3478001a24bf628f2bfefbb88e03ce61.ppt

- Количество слайдов: 28

Chapter 4 APPLICATIONS OF MONEY -TIME RELATIONSHIPS 1

Chapter 4 APPLICATIONS OF MONEY -TIME RELATIONSHIPS 1

Learning Objectives • To evaluate the economic profitability and liquidity of a single project • Equivalent measures of a project’s profitability – – Present Worth (PW) Future Worth (FW) Annual Worth (AW) Internal Rate of Return • Measures of liquidity – Simple Payback Method – Discounted Payback Method 2

Learning Objectives • To evaluate the economic profitability and liquidity of a single project • Equivalent measures of a project’s profitability – – Present Worth (PW) Future Worth (FW) Annual Worth (AW) Internal Rate of Return • Measures of liquidity – Simple Payback Method – Discounted Payback Method 2

Minimum Attractive Rate of Return • Firms will set a minimum interest rate that all projects should earn it in order to be considered for funding • Once established by the firm is termed the Minimum Attractive Rate of Return (MARR) • Numerous models exist to aid engineering managers in estimating what this rate should be in a given time period • Personal Example: • Assume you want to purchase a new computer • Assume you have a charge card that carries a 18% per year interest rate. • If you charge the purchase, YOUR cost of capital is the 18% 3 interest rate

Minimum Attractive Rate of Return • Firms will set a minimum interest rate that all projects should earn it in order to be considered for funding • Once established by the firm is termed the Minimum Attractive Rate of Return (MARR) • Numerous models exist to aid engineering managers in estimating what this rate should be in a given time period • Personal Example: • Assume you want to purchase a new computer • Assume you have a charge card that carries a 18% per year interest rate. • If you charge the purchase, YOUR cost of capital is the 18% 3 interest rate

Cost to a Firm • Firm’s raise capital from the following sources • Equity – using the owner’s funds (retained earnings, cash on hand) belongs to the owners • Debt – the firm borrows from outside the firm and pays an interest rate on the borrowed funds • Once this “cost” is approximated, then, new project MUST return at least the cost of the funds used in the project PLUS some additional percent return 4

Cost to a Firm • Firm’s raise capital from the following sources • Equity – using the owner’s funds (retained earnings, cash on hand) belongs to the owners • Debt – the firm borrows from outside the firm and pays an interest rate on the borrowed funds • Once this “cost” is approximated, then, new project MUST return at least the cost of the funds used in the project PLUS some additional percent return 4

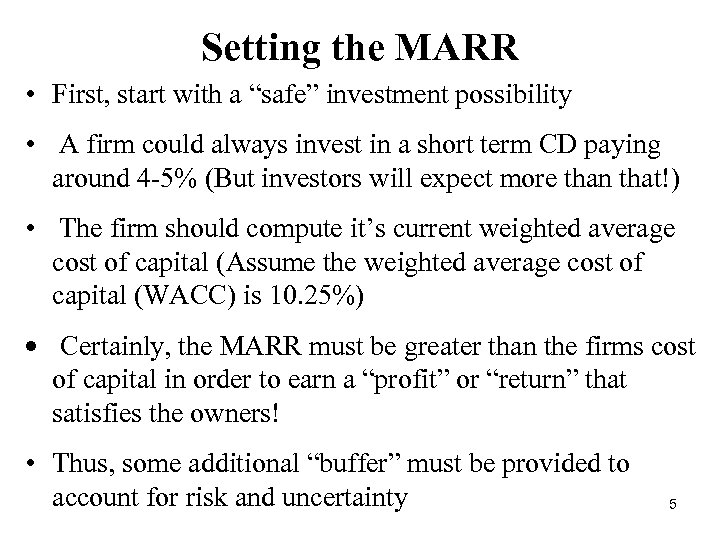

Setting the MARR • First, start with a “safe” investment possibility • A firm could always invest in a short term CD paying around 4 -5% (But investors will expect more than that!) • The firm should compute it’s current weighted average cost of capital (Assume the weighted average cost of capital (WACC) is 10. 25%) • Certainly, the MARR must be greater than the firms cost of capital in order to earn a “profit” or “return” that satisfies the owners! • Thus, some additional “buffer” must be provided to account for risk and uncertainty 5

Setting the MARR • First, start with a “safe” investment possibility • A firm could always invest in a short term CD paying around 4 -5% (But investors will expect more than that!) • The firm should compute it’s current weighted average cost of capital (Assume the weighted average cost of capital (WACC) is 10. 25%) • Certainly, the MARR must be greater than the firms cost of capital in order to earn a “profit” or “return” that satisfies the owners! • Thus, some additional “buffer” must be provided to account for risk and uncertainty 5

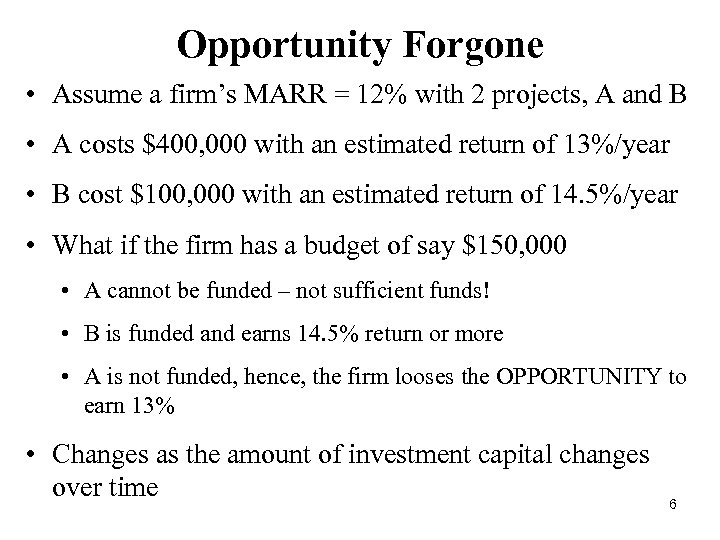

Opportunity Forgone • Assume a firm’s MARR = 12% with 2 projects, A and B • A costs $400, 000 with an estimated return of 13%/year • B cost $100, 000 with an estimated return of 14. 5%/year • What if the firm has a budget of say $150, 000 • A cannot be funded – not sufficient funds! • B is funded and earns 14. 5% return or more • A is not funded, hence, the firm looses the OPPORTUNITY to earn 13% • Changes as the amount of investment capital changes over time 6

Opportunity Forgone • Assume a firm’s MARR = 12% with 2 projects, A and B • A costs $400, 000 with an estimated return of 13%/year • B cost $100, 000 with an estimated return of 14. 5%/year • What if the firm has a budget of say $150, 000 • A cannot be funded – not sufficient funds! • B is funded and earns 14. 5% return or more • A is not funded, hence, the firm looses the OPPORTUNITY to earn 13% • Changes as the amount of investment capital changes over time 6

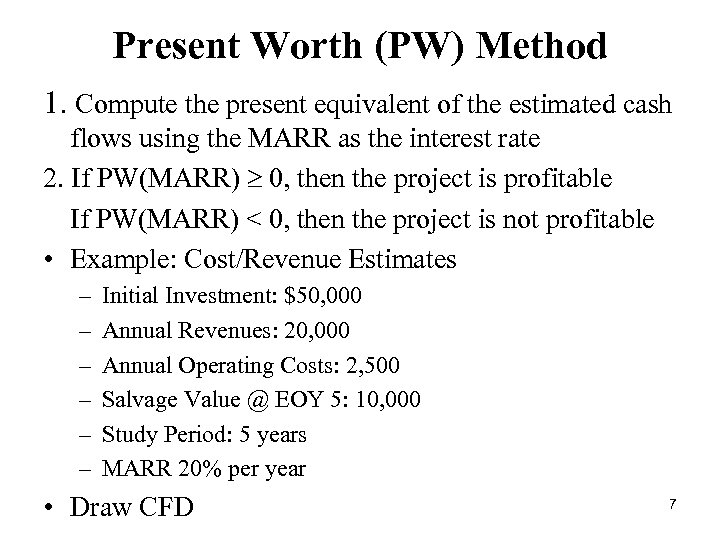

Present Worth (PW) Method 1. Compute the present equivalent of the estimated cash flows using the MARR as the interest rate 2. If PW(MARR) ³ 0, then the project is profitable If PW(MARR) < 0, then the project is not profitable • Example: Cost/Revenue Estimates – – – Initial Investment: $50, 000 Annual Revenues: 20, 000 Annual Operating Costs: 2, 500 Salvage Value @ EOY 5: 10, 000 Study Period: 5 years MARR 20% per year • Draw CFD 7

Present Worth (PW) Method 1. Compute the present equivalent of the estimated cash flows using the MARR as the interest rate 2. If PW(MARR) ³ 0, then the project is profitable If PW(MARR) < 0, then the project is not profitable • Example: Cost/Revenue Estimates – – – Initial Investment: $50, 000 Annual Revenues: 20, 000 Annual Operating Costs: 2, 500 Salvage Value @ EOY 5: 10, 000 Study Period: 5 years MARR 20% per year • Draw CFD 7

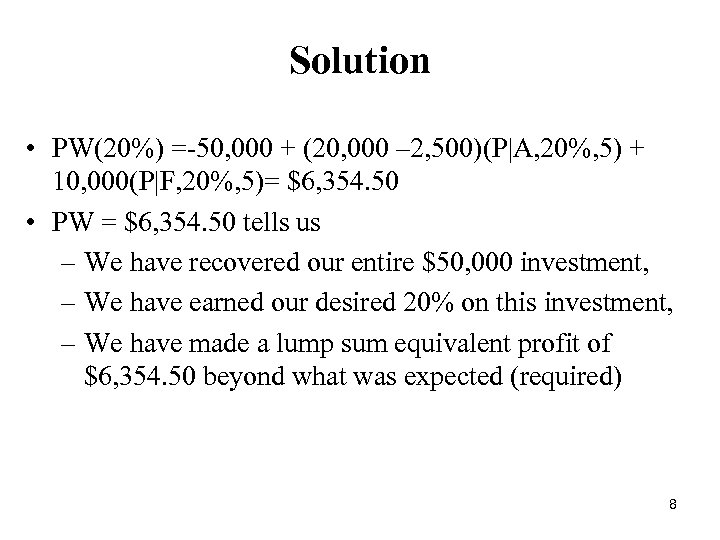

Solution • PW(20%) =-50, 000 + (20, 000 – 2, 500)(P|A, 20%, 5) + 10, 000(P|F, 20%, 5)= $6, 354. 50 • PW = $6, 354. 50 tells us – We have recovered our entire $50, 000 investment, – We have earned our desired 20% on this investment, – We have made a lump sum equivalent profit of $6, 354. 50 beyond what was expected (required) 8

Solution • PW(20%) =-50, 000 + (20, 000 – 2, 500)(P|A, 20%, 5) + 10, 000(P|F, 20%, 5)= $6, 354. 50 • PW = $6, 354. 50 tells us – We have recovered our entire $50, 000 investment, – We have earned our desired 20% on this investment, – We have made a lump sum equivalent profit of $6, 354. 50 beyond what was expected (required) 8

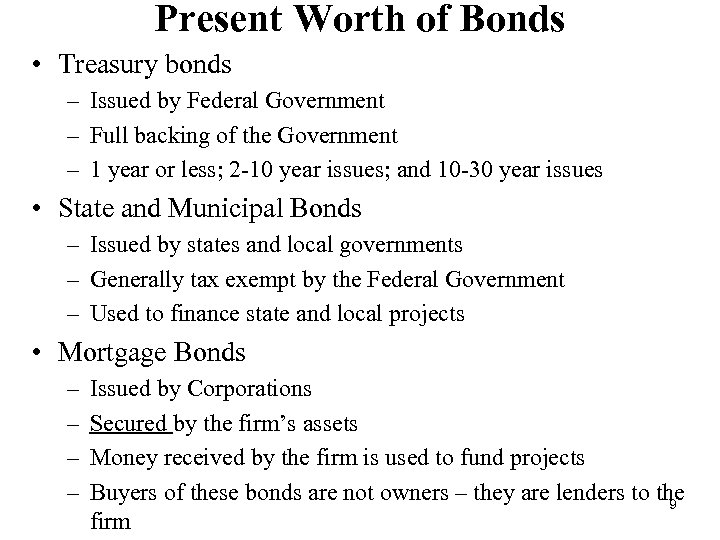

Present Worth of Bonds • Treasury bonds – Issued by Federal Government – Full backing of the Government – 1 year or less; 2 -10 year issues; and 10 -30 year issues • State and Municipal Bonds – Issued by states and local governments – Generally tax exempt by the Federal Government – Used to finance state and local projects • Mortgage Bonds – – Issued by Corporations Secured by the firm’s assets Money received by the firm is used to fund projects Buyers of these bonds are not owners – they are lenders to the 9 firm

Present Worth of Bonds • Treasury bonds – Issued by Federal Government – Full backing of the Government – 1 year or less; 2 -10 year issues; and 10 -30 year issues • State and Municipal Bonds – Issued by states and local governments – Generally tax exempt by the Federal Government – Used to finance state and local projects • Mortgage Bonds – – Issued by Corporations Secured by the firm’s assets Money received by the firm is used to fund projects Buyers of these bonds are not owners – they are lenders to the 9 firm

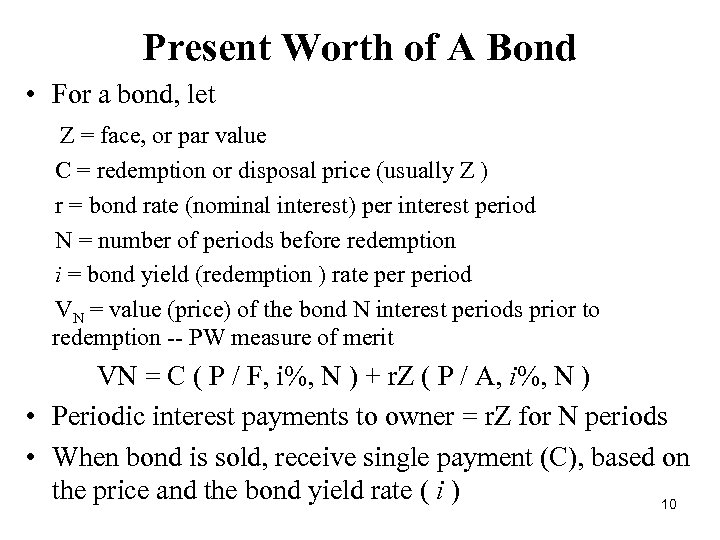

Present Worth of A Bond • For a bond, let Z = face, or par value C = redemption or disposal price (usually Z ) r = bond rate (nominal interest) per interest period N = number of periods before redemption i = bond yield (redemption ) rate period VN = value (price) of the bond N interest periods prior to redemption -- PW measure of merit VN = C ( P / F, i%, N ) + r. Z ( P / A, i%, N ) • Periodic interest payments to owner = r. Z for N periods • When bond is sold, receive single payment (C), based on the price and the bond yield rate ( i ) 10

Present Worth of A Bond • For a bond, let Z = face, or par value C = redemption or disposal price (usually Z ) r = bond rate (nominal interest) per interest period N = number of periods before redemption i = bond yield (redemption ) rate period VN = value (price) of the bond N interest periods prior to redemption -- PW measure of merit VN = C ( P / F, i%, N ) + r. Z ( P / A, i%, N ) • Periodic interest payments to owner = r. Z for N periods • When bond is sold, receive single payment (C), based on the price and the bond yield rate ( i ) 10

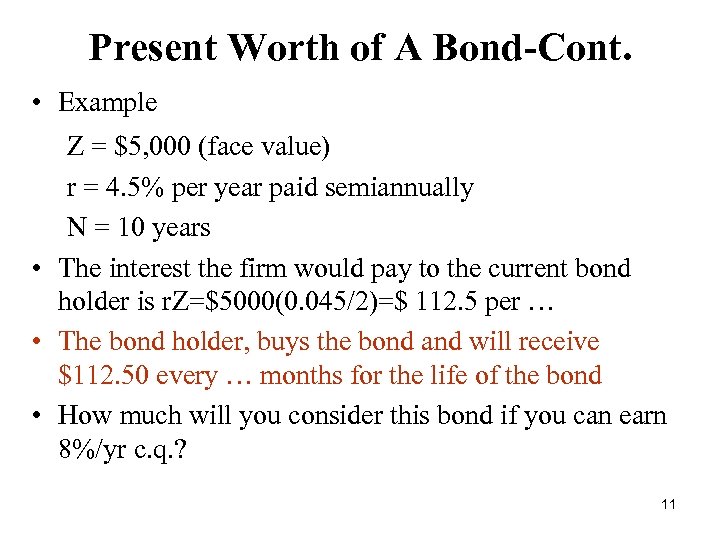

Present Worth of A Bond-Cont. • Example Z = $5, 000 (face value) r = 4. 5% per year paid semiannually N = 10 years • The interest the firm would pay to the current bond holder is r. Z=$5000(0. 045/2)=$ 112. 5 per … • The bond holder, buys the bond and will receive $112. 50 every … months for the life of the bond • How much will you consider this bond if you can earn 8%/yr c. q. ? 11

Present Worth of A Bond-Cont. • Example Z = $5, 000 (face value) r = 4. 5% per year paid semiannually N = 10 years • The interest the firm would pay to the current bond holder is r. Z=$5000(0. 045/2)=$ 112. 5 per … • The bond holder, buys the bond and will receive $112. 50 every … months for the life of the bond • How much will you consider this bond if you can earn 8%/yr c. q. ? 11

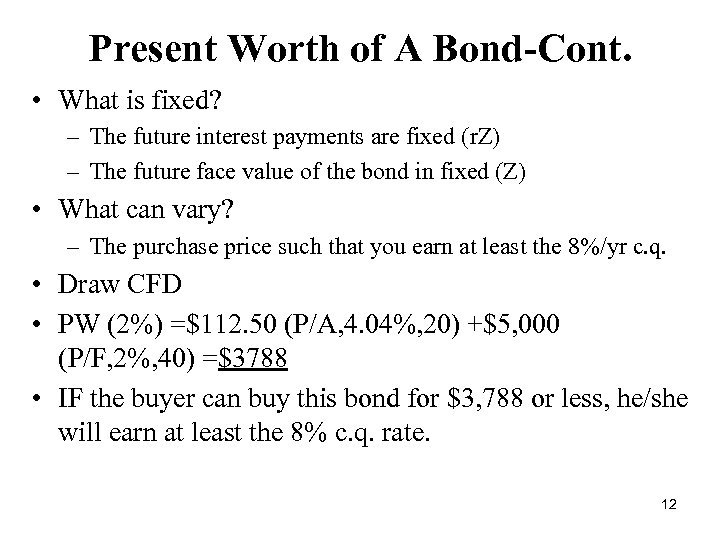

Present Worth of A Bond-Cont. • What is fixed? – The future interest payments are fixed (r. Z) – The future face value of the bond in fixed (Z) • What can vary? – The purchase price such that you earn at least the 8%/yr c. q. • Draw CFD • PW (2%) =$112. 50 (P/A, 4. 04%, 20) +$5, 000 (P/F, 2%, 40) =$3788 • IF the buyer can buy this bond for $3, 788 or less, he/she will earn at least the 8% c. q. rate. 12

Present Worth of A Bond-Cont. • What is fixed? – The future interest payments are fixed (r. Z) – The future face value of the bond in fixed (Z) • What can vary? – The purchase price such that you earn at least the 8%/yr c. q. • Draw CFD • PW (2%) =$112. 50 (P/A, 4. 04%, 20) +$5, 000 (P/F, 2%, 40) =$3788 • IF the buyer can buy this bond for $3, 788 or less, he/she will earn at least the 8% c. q. rate. 12

Future Worth (FW) Method • Compute the future equivalent of the estimated cash flows using the MARR as the interest rate • If FW(MARR) >0, then the project is profitable • If FW(MARR)<0, then the project is not profitable • Previous Example – FW Method • FW(20%) =-50, 000(F|P, 20%, 5)+(20, 0002, 500)(F|A, 20%, 5)+10, 000= $15, 813 • Since FW(20%)>0, the project is profitable 13

Future Worth (FW) Method • Compute the future equivalent of the estimated cash flows using the MARR as the interest rate • If FW(MARR) >0, then the project is profitable • If FW(MARR)<0, then the project is not profitable • Previous Example – FW Method • FW(20%) =-50, 000(F|P, 20%, 5)+(20, 0002, 500)(F|A, 20%, 5)+10, 000= $15, 813 • Since FW(20%)>0, the project is profitable 13

Section 4. 5 Annual Worth (AW) Method • Popular with some managers who tend to thing in terms of “$/year, $/months, etc. • Easily understood-results are reported in $/time period • AW(i%) = R - E - CR(i%) (Eqn. 4. 4) R = annual equivalent revenues E = annual equivalent expenses CR = annual equivalent capital recovery cost • CR is the equivalent uniform annual cost of capital invested • CR(i%) = I (A/P, i%, N) - S (A/F, i%, N) (Eqn. 4 -5) – CR(20%) = $50, 000(A|P, 20%, 5) - $10, 000(A|F, 20%, 5)= $15, 376 – AW(20%) = R – E – CR(20%), or – AW(20%) = $20, 000 - $2, 500 - $15, 376 = $2, 124 • Since AW(20%) ³ 0, project is profitable 14

Section 4. 5 Annual Worth (AW) Method • Popular with some managers who tend to thing in terms of “$/year, $/months, etc. • Easily understood-results are reported in $/time period • AW(i%) = R - E - CR(i%) (Eqn. 4. 4) R = annual equivalent revenues E = annual equivalent expenses CR = annual equivalent capital recovery cost • CR is the equivalent uniform annual cost of capital invested • CR(i%) = I (A/P, i%, N) - S (A/F, i%, N) (Eqn. 4 -5) – CR(20%) = $50, 000(A|P, 20%, 5) - $10, 000(A|F, 20%, 5)= $15, 376 – AW(20%) = R – E – CR(20%), or – AW(20%) = $20, 000 - $2, 500 - $15, 376 = $2, 124 • Since AW(20%) ³ 0, project is profitable 14

Equivalent Worth Methods • Note: PW, FW, and AW are equivalent measures of profitability • If PW>0, then FW>0 and AW>0 • From our example, PW = $6, 354. 50 therefore, FW = 6, 354. 50(F|P, 20%, 5) = $15, 812 and AW = 6, 354. 50(A|P, 20%, 5) = $2125 15

Equivalent Worth Methods • Note: PW, FW, and AW are equivalent measures of profitability • If PW>0, then FW>0 and AW>0 • From our example, PW = $6, 354. 50 therefore, FW = 6, 354. 50(F|P, 20%, 5) = $15, 812 and AW = 6, 354. 50(A|P, 20%, 5) = $2125 15

Section 4. 6 Effect of Compounding • Benjamin Franklin, according to the American Bankers Association, left $5, 000 to the residents of Boston in 1791, with the understanding that it should be allowed to accumulate for a hundred years. By 1891 the $5, 000 had grown to $322, 000. A school was built, and $92, 000 was set aside for a second hundred years of growth. In 1960, this second century fund had reached $1, 400, 000. As Franklin put it, in anticipation: "Money makes money and the money that money makes, makes more money. " • Question: What average interest rate per year was earned from 1791 to 1891? • Given: P = $5, 000, n = 100, F = $322, 000 , Find: i'% per year • F = P(F|P, i'%, 100) or $322, 000 = $5000(F|P, i'%, 100) • F = P(1+i')n or 64. 4 = (1+i')100 or i' = 4. 25% per year 16

Section 4. 6 Effect of Compounding • Benjamin Franklin, according to the American Bankers Association, left $5, 000 to the residents of Boston in 1791, with the understanding that it should be allowed to accumulate for a hundred years. By 1891 the $5, 000 had grown to $322, 000. A school was built, and $92, 000 was set aside for a second hundred years of growth. In 1960, this second century fund had reached $1, 400, 000. As Franklin put it, in anticipation: "Money makes money and the money that money makes, makes more money. " • Question: What average interest rate per year was earned from 1791 to 1891? • Given: P = $5, 000, n = 100, F = $322, 000 , Find: i'% per year • F = P(F|P, i'%, 100) or $322, 000 = $5000(F|P, i'%, 100) • F = P(1+i')n or 64. 4 = (1+i')100 or i' = 4. 25% per year 16

Section 4. 6 IRR Method • The Internal Rate of Return (IRR) method solves for the interest rate that equates the equivalent worth of a project's cash outflows (expenditures) to the equivalent worth of cash inflows (receipts or savings) • In other words, the IRR is the interest rate that makes the PW, AW, and FW of a project's estimated cash flows equal to zero, or PW(i') of cash inflow = PW(i') of cash outflow • We commonly denote the IRR by i’, and use PW(i' %) = 0, AW(i' %) = 0, or FW(i' %) = 0 • In general, we must solve for i' by trial and error (unless 17 we use an equation solver)

Section 4. 6 IRR Method • The Internal Rate of Return (IRR) method solves for the interest rate that equates the equivalent worth of a project's cash outflows (expenditures) to the equivalent worth of cash inflows (receipts or savings) • In other words, the IRR is the interest rate that makes the PW, AW, and FW of a project's estimated cash flows equal to zero, or PW(i') of cash inflow = PW(i') of cash outflow • We commonly denote the IRR by i’, and use PW(i' %) = 0, AW(i' %) = 0, or FW(i' %) = 0 • In general, we must solve for i' by trial and error (unless 17 we use an equation solver)

Evaluating Projects with the IRR • Once we know the value of the IRR for a project, we compare it to the MARR to determine whether or not the project is acceptable with respect to profitability IRR = i' ³ MARR project is acceptable IRR = i' < MARR project is unacceptable (reject) • Difficulties with the IRR Method: – The IRR Method assumes that recovered funds are reinvested at the IRR rather than the MARR – Possible multiple IRRs • Why should you learn the IRR Method? • The majority of U. S. companies favor the IRR method for evaluating capital investment projects 18

Evaluating Projects with the IRR • Once we know the value of the IRR for a project, we compare it to the MARR to determine whether or not the project is acceptable with respect to profitability IRR = i' ³ MARR project is acceptable IRR = i' < MARR project is unacceptable (reject) • Difficulties with the IRR Method: – The IRR Method assumes that recovered funds are reinvested at the IRR rather than the MARR – Possible multiple IRRs • Why should you learn the IRR Method? • The majority of U. S. companies favor the IRR method for evaluating capital investment projects 18

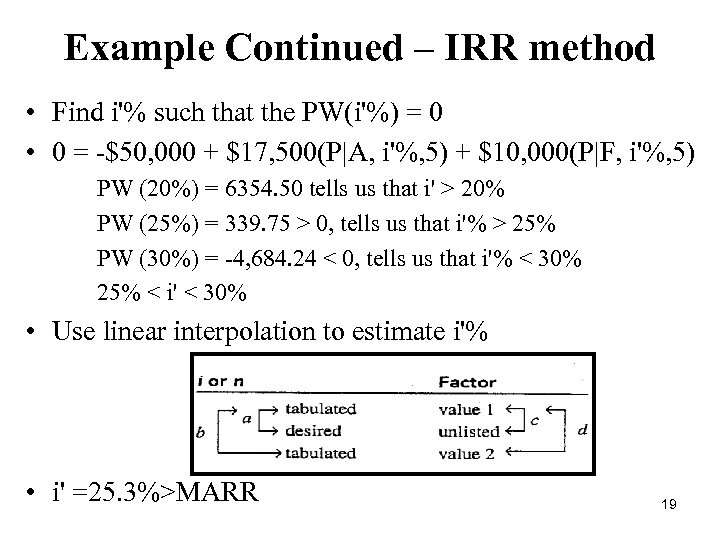

Example Continued – IRR method • Find i'% such that the PW(i'%) = 0 • 0 = -$50, 000 + $17, 500(P|A, i'%, 5) + $10, 000(P|F, i'%, 5) PW (20%) = 6354. 50 tells us that i' > 20% PW (25%) = 339. 75 > 0, tells us that i'% > 25% PW (30%) = -4, 684. 24 < 0, tells us that i'% < 30% 25% < i' < 30% • Use linear interpolation to estimate i'% • i' =25. 3%>MARR 19

Example Continued – IRR method • Find i'% such that the PW(i'%) = 0 • 0 = -$50, 000 + $17, 500(P|A, i'%, 5) + $10, 000(P|F, i'%, 5) PW (20%) = 6354. 50 tells us that i' > 20% PW (25%) = 339. 75 > 0, tells us that i'% > 25% PW (30%) = -4, 684. 24 < 0, tells us that i'% < 30% 25% < i' < 30% • Use linear interpolation to estimate i'% • i' =25. 3%>MARR 19

IRR – Installment Financing Example • An individual approaches the Loan Shark Agency for $1, 000 to be repaid in 24 monthly installments. The agency advertises an interest rate of 1. 5% per month. They proceed to calculate a monthly payment in the following manner: Amount you leave with $1, 000 Credit investigation 25 Credit risk insurance 5 Total $1, 030 Interest: ($1, 030)(24)(0. 015) = $371 Total owed: $1, 030 +. . . =. . . Payment: $1, 401/24 = $58. 50 per month • What effective annual interest rate is the individual paying? 20

IRR – Installment Financing Example • An individual approaches the Loan Shark Agency for $1, 000 to be repaid in 24 monthly installments. The agency advertises an interest rate of 1. 5% per month. They proceed to calculate a monthly payment in the following manner: Amount you leave with $1, 000 Credit investigation 25 Credit risk insurance 5 Total $1, 030 Interest: ($1, 030)(24)(0. 015) = $371 Total owed: $1, 030 +. . . =. . . Payment: $1, 401/24 = $58. 50 per month • What effective annual interest rate is the individual paying? 20

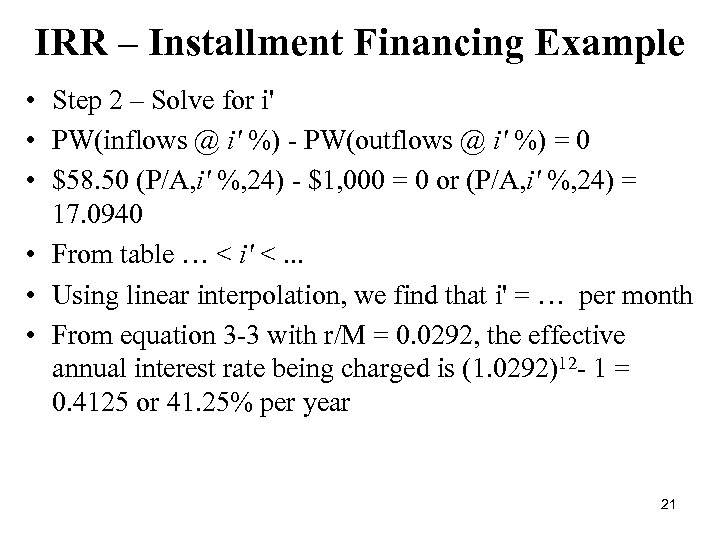

IRR – Installment Financing Example • Step 2 – Solve for i' • PW(inflows @ i' %) - PW(outflows @ i' %) = 0 • $58. 50 (P/A, i' %, 24) - $1, 000 = 0 or (P/A, i' %, 24) = 17. 0940 • From table … < i' <. . . • Using linear interpolation, we find that i' = … per month • From equation 3 -3 with r/M = 0. 0292, the effective annual interest rate being charged is (1. 0292)12 - 1 = 0. 4125 or 41. 25% per year 21

IRR – Installment Financing Example • Step 2 – Solve for i' • PW(inflows @ i' %) - PW(outflows @ i' %) = 0 • $58. 50 (P/A, i' %, 24) - $1, 000 = 0 or (P/A, i' %, 24) = 17. 0940 • From table … < i' <. . . • Using linear interpolation, we find that i' = … per month • From equation 3 -3 with r/M = 0. 0292, the effective annual interest rate being charged is (1. 0292)12 - 1 = 0. 4125 or 41. 25% per year 21

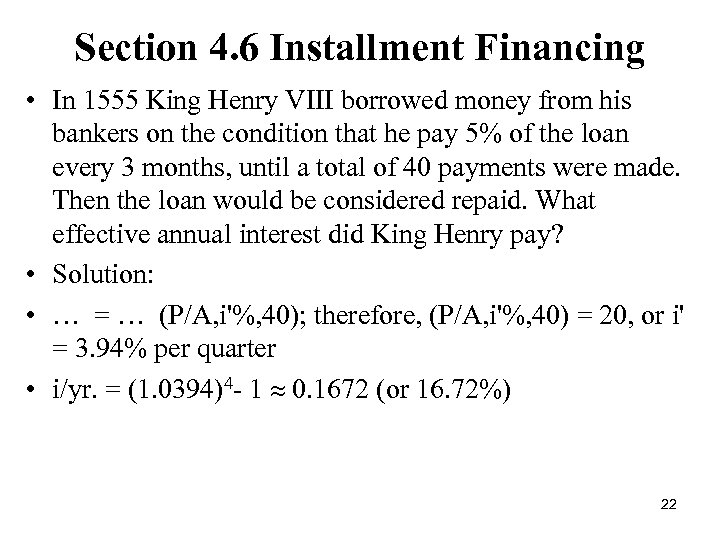

Section 4. 6 Installment Financing • In 1555 King Henry VIII borrowed money from his bankers on the condition that he pay 5% of the loan every 3 months, until a total of 40 payments were made. Then the loan would be considered repaid. What effective annual interest did King Henry pay? • Solution: • … = … (P/A, i'%, 40); therefore, (P/A, i'%, 40) = 20, or i' = 3. 94% per quarter • i/yr. = (1. 0394)4 - 1 » 0. 1672 (or 16. 72%) 22

Section 4. 6 Installment Financing • In 1555 King Henry VIII borrowed money from his bankers on the condition that he pay 5% of the loan every 3 months, until a total of 40 payments were made. Then the loan would be considered repaid. What effective annual interest did King Henry pay? • Solution: • … = … (P/A, i'%, 40); therefore, (P/A, i'%, 40) = 20, or i' = 3. 94% per quarter • i/yr. = (1. 0394)4 - 1 » 0. 1672 (or 16. 72%) 22

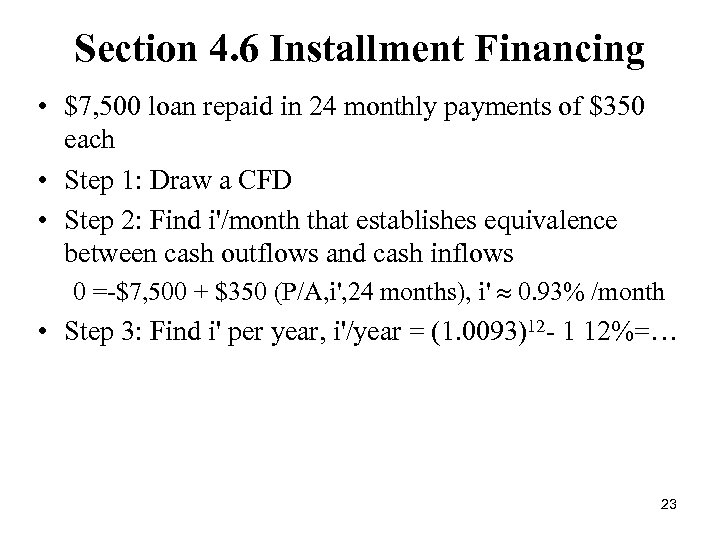

Section 4. 6 Installment Financing • $7, 500 loan repaid in 24 monthly payments of $350 each • Step 1: Draw a CFD • Step 2: Find i'/month that establishes equivalence between cash outflows and cash inflows 0 =-$7, 500 + $350 (P/A, i', 24 months), i' » 0. 93% /month • Step 3: Find i' per year, i'/year = (1. 0093)12 - 1 12%=… 23

Section 4. 6 Installment Financing • $7, 500 loan repaid in 24 monthly payments of $350 each • Step 1: Draw a CFD • Step 2: Find i'/month that establishes equivalence between cash outflows and cash inflows 0 =-$7, 500 + $350 (P/A, i', 24 months), i' » 0. 93% /month • Step 3: Find i' per year, i'/year = (1. 0093)12 - 1 12%=… 23

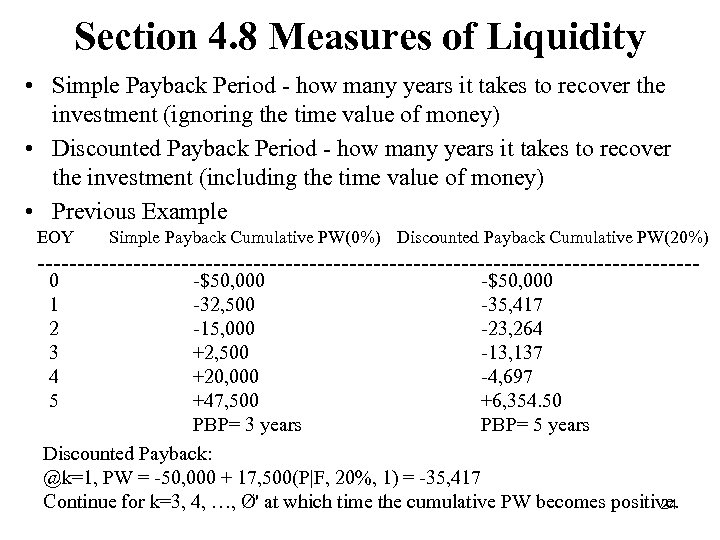

Section 4. 8 Measures of Liquidity • Simple Payback Period - how many years it takes to recover the investment (ignoring the time value of money) • Discounted Payback Period - how many years it takes to recover the investment (including the time value of money) • Previous Example EOY Simple Payback Cumulative PW(0%) Discounted Payback Cumulative PW(20%) -----------------------------------------0 1 2 3 4 5 -$50, 000 -32, 500 -35, 417 -15, 000 -23, 264 +2, 500 -13, 137 +20, 000 -4, 697 +47, 500 +6, 354. 50 PBP= 3 years PBP= 5 years Discounted Payback: @k=1, PW = -50, 000 + 17, 500(P|F, 20%, 1) = -35, 417 Continue for k=3, 4, …, Ø' at which time the cumulative PW becomes positive. 24

Section 4. 8 Measures of Liquidity • Simple Payback Period - how many years it takes to recover the investment (ignoring the time value of money) • Discounted Payback Period - how many years it takes to recover the investment (including the time value of money) • Previous Example EOY Simple Payback Cumulative PW(0%) Discounted Payback Cumulative PW(20%) -----------------------------------------0 1 2 3 4 5 -$50, 000 -32, 500 -35, 417 -15, 000 -23, 264 +2, 500 -13, 137 +20, 000 -4, 697 +47, 500 +6, 354. 50 PBP= 3 years PBP= 5 years Discounted Payback: @k=1, PW = -50, 000 + 17, 500(P|F, 20%, 1) = -35, 417 Continue for k=3, 4, …, Ø' at which time the cumulative PW becomes positive. 24

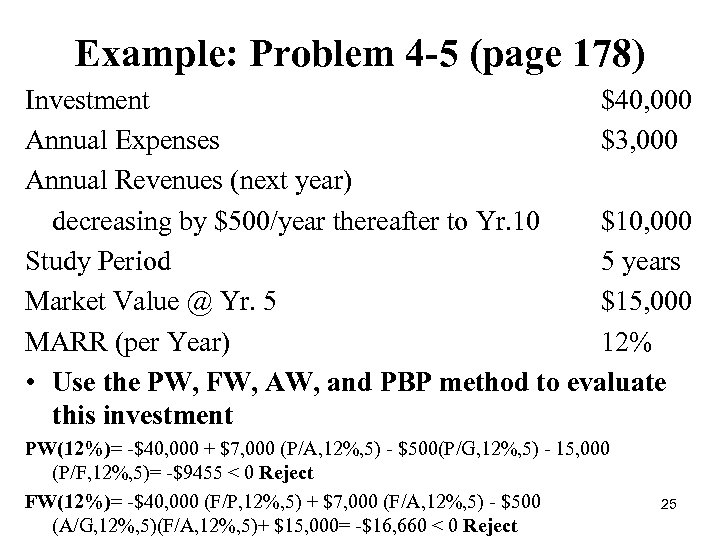

Example: Problem 4 -5 (page 178) Investment $40, 000 Annual Expenses $3, 000 Annual Revenues (next year) decreasing by $500/year thereafter to Yr. 10 $10, 000 Study Period 5 years Market Value @ Yr. 5 $15, 000 MARR (per Year) 12% • Use the PW, FW, AW, and PBP method to evaluate this investment PW(12%)= -$40, 000 + $7, 000 (P/A, 12%, 5) - $500(P/G, 12%, 5) - 15, 000 (P/F, 12%, 5)= -$9455 < 0 Reject FW(12%)= -$40, 000 (F/P, 12%, 5) + $7, 000 (F/A, 12%, 5) - $500 (A/G, 12%, 5)(F/A, 12%, 5)+ $15, 000= -$16, 660 < 0 Reject 25

Example: Problem 4 -5 (page 178) Investment $40, 000 Annual Expenses $3, 000 Annual Revenues (next year) decreasing by $500/year thereafter to Yr. 10 $10, 000 Study Period 5 years Market Value @ Yr. 5 $15, 000 MARR (per Year) 12% • Use the PW, FW, AW, and PBP method to evaluate this investment PW(12%)= -$40, 000 + $7, 000 (P/A, 12%, 5) - $500(P/G, 12%, 5) - 15, 000 (P/F, 12%, 5)= -$9455 < 0 Reject FW(12%)= -$40, 000 (F/P, 12%, 5) + $7, 000 (F/A, 12%, 5) - $500 (A/G, 12%, 5)(F/A, 12%, 5)+ $15, 000= -$16, 660 < 0 Reject 25

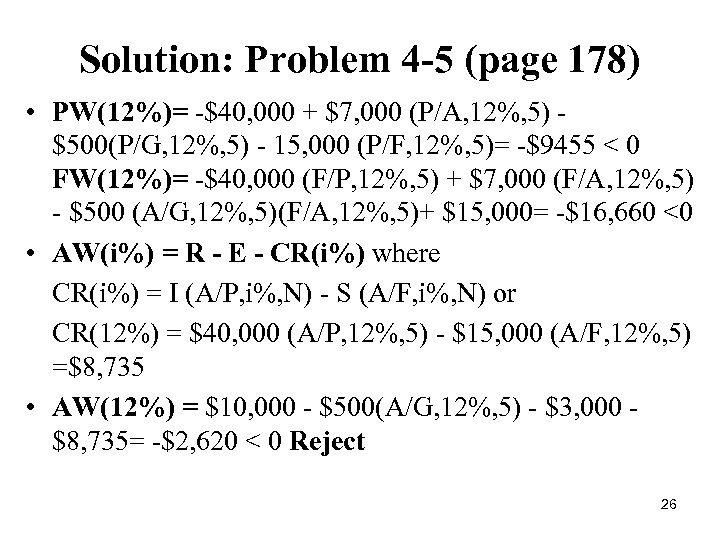

Solution: Problem 4 -5 (page 178) • PW(12%)= -$40, 000 + $7, 000 (P/A, 12%, 5) $500(P/G, 12%, 5) - 15, 000 (P/F, 12%, 5)= -$9455 < 0 FW(12%)= -$40, 000 (F/P, 12%, 5) + $7, 000 (F/A, 12%, 5) - $500 (A/G, 12%, 5)(F/A, 12%, 5)+ $15, 000= -$16, 660 <0 • AW(i%) = R - E - CR(i%) where CR(i%) = I (A/P, i%, N) - S (A/F, i%, N) or CR(12%) = $40, 000 (A/P, 12%, 5) - $15, 000 (A/F, 12%, 5) =$8, 735 • AW(12%) = $10, 000 - $500(A/G, 12%, 5) - $3, 000 $8, 735= -$2, 620 < 0 Reject 26

Solution: Problem 4 -5 (page 178) • PW(12%)= -$40, 000 + $7, 000 (P/A, 12%, 5) $500(P/G, 12%, 5) - 15, 000 (P/F, 12%, 5)= -$9455 < 0 FW(12%)= -$40, 000 (F/P, 12%, 5) + $7, 000 (F/A, 12%, 5) - $500 (A/G, 12%, 5)(F/A, 12%, 5)+ $15, 000= -$16, 660 <0 • AW(i%) = R - E - CR(i%) where CR(i%) = I (A/P, i%, N) - S (A/F, i%, N) or CR(12%) = $40, 000 (A/P, 12%, 5) - $15, 000 (A/F, 12%, 5) =$8, 735 • AW(12%) = $10, 000 - $500(A/G, 12%, 5) - $3, 000 $8, 735= -$2, 620 < 0 Reject 26

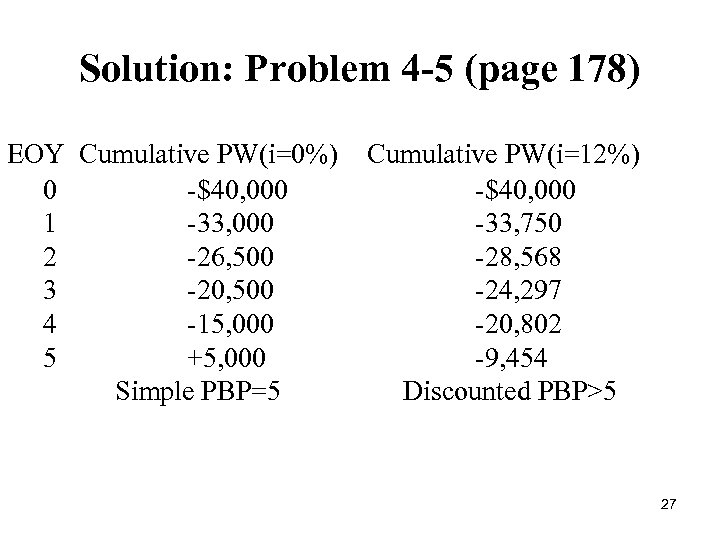

Solution: Problem 4 -5 (page 178) EOY Cumulative PW(i=0%) 0 -$40, 000 1 -33, 000 2 -26, 500 3 -20, 500 4 -15, 000 5 +5, 000 Simple PBP=5 Cumulative PW(i=12%) -$40, 000 -33, 750 -28, 568 -24, 297 -20, 802 -9, 454 Discounted PBP>5 27

Solution: Problem 4 -5 (page 178) EOY Cumulative PW(i=0%) 0 -$40, 000 1 -33, 000 2 -26, 500 3 -20, 500 4 -15, 000 5 +5, 000 Simple PBP=5 Cumulative PW(i=12%) -$40, 000 -33, 750 -28, 568 -24, 297 -20, 802 -9, 454 Discounted PBP>5 27

Payback Method • Avoid using this method as a primary analysis technique for selection projects • Does not employ the time value of money (simple) • If used, can lead to conflicting selections when compared to more technically correct methods like present worth! • Disregards all cash flows past the payback time period 28

Payback Method • Avoid using this method as a primary analysis technique for selection projects • Does not employ the time value of money (simple) • If used, can lead to conflicting selections when compared to more technically correct methods like present worth! • Disregards all cash flows past the payback time period 28