c409bb64c9ebe71038d52e8e40f9a3c2.ppt

- Количество слайдов: 18

Chapter 4 Analysis of Financial Statements 1

Chapter 4 Analysis of Financial Statements 1

Learning Objectives Measure and interpret financial ratios. Analyze trends in financial ratios. Manipulate financial ratios to find another ratio. 2

Learning Objectives Measure and interpret financial ratios. Analyze trends in financial ratios. Manipulate financial ratios to find another ratio. 2

Ratio Analysis Examines firm’s management of various facets of the company’s business through its financial statements. Scales balance sheet and income statement information for easy comparison across time or to other companies. 3

Ratio Analysis Examines firm’s management of various facets of the company’s business through its financial statements. Scales balance sheet and income statement information for easy comparison across time or to other companies. 3

Two common approaches Trend Analysis - looks at changes in one company’s ratios over time. Benchmarking: Comparison or Industry Analysis compares company’s ratios against a similar company or against industry-wide ratios. To illustrate trend analysis, we will compare Best Buy’s Feb. 2006 and Feb. 2005 ratios. To illustrate benchmarking, we will calculate Best Buy’s Feb. 2006 ratios and will compare to Circuit City’s Feb. 2006 ratios. 4

Two common approaches Trend Analysis - looks at changes in one company’s ratios over time. Benchmarking: Comparison or Industry Analysis compares company’s ratios against a similar company or against industry-wide ratios. To illustrate trend analysis, we will compare Best Buy’s Feb. 2006 and Feb. 2005 ratios. To illustrate benchmarking, we will calculate Best Buy’s Feb. 2006 ratios and will compare to Circuit City’s Feb. 2006 ratios. 4

Areas Examined by Ratio Analysis Liquidity - measures the ability to meet short-term obligations Asset Management - measures the ability to contain the growth of assets, and the ability to effectively utilize assets Debt Management - measures the use of financial leverage (debt) and its impact Profitability - measures the profitability of various segments of a company 5

Areas Examined by Ratio Analysis Liquidity - measures the ability to meet short-term obligations Asset Management - measures the ability to contain the growth of assets, and the ability to effectively utilize assets Debt Management - measures the use of financial leverage (debt) and its impact Profitability - measures the profitability of various segments of a company 5

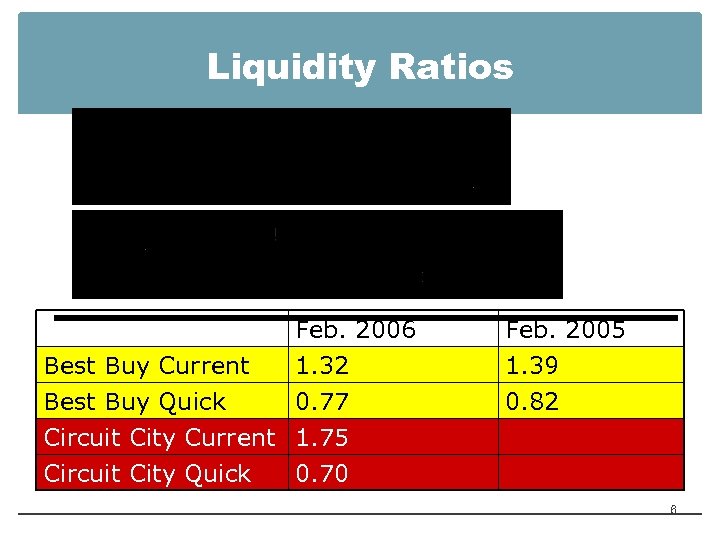

Liquidity Ratios Feb. 2006 Best Buy Current 1. 32 Best Buy Quick 0. 77 Circuit City Current 1. 75 Circuit City Quick Feb. 2005 1. 39 0. 82 0. 70 6

Liquidity Ratios Feb. 2006 Best Buy Current 1. 32 Best Buy Quick 0. 77 Circuit City Current 1. 75 Circuit City Quick Feb. 2005 1. 39 0. 82 0. 70 6

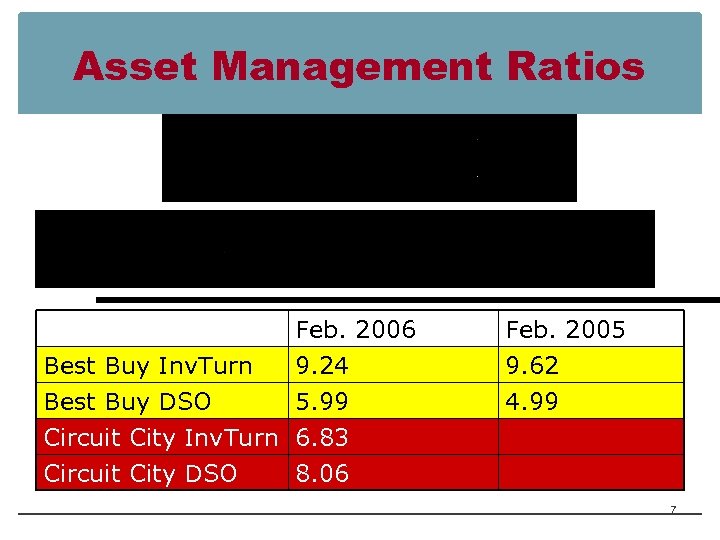

Asset Management Ratios Feb. 2006 Best Buy Inv. Turn 9. 24 Best Buy DSO 5. 99 Circuit City Inv. Turn 6. 83 Circuit City DSO Feb. 2005 9. 62 4. 99 8. 06 7

Asset Management Ratios Feb. 2006 Best Buy Inv. Turn 9. 24 Best Buy DSO 5. 99 Circuit City Inv. Turn 6. 83 Circuit City DSO Feb. 2005 9. 62 4. 99 8. 06 7

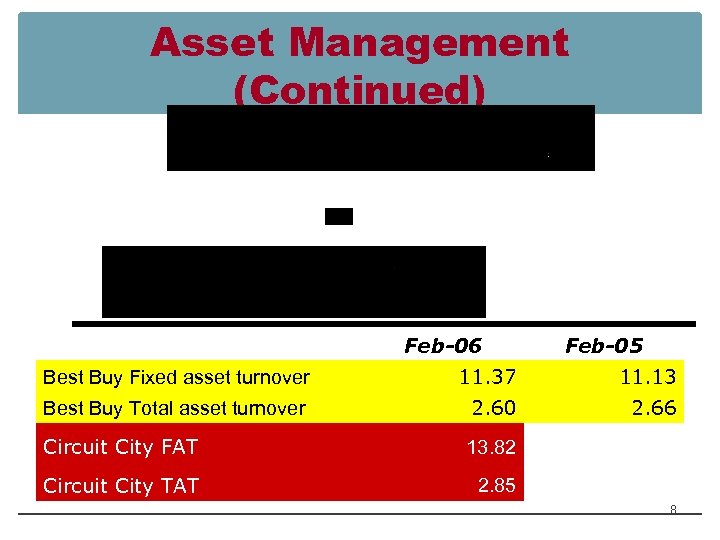

Asset Management (Continued) Feb-06 Feb-05 Best Buy Fixed asset turnover 11. 37 11. 13 Best Buy Total asset turnover 2. 60 2. 66 Circuit City FAT 13. 82 Circuit City TAT 2. 85 8

Asset Management (Continued) Feb-06 Feb-05 Best Buy Fixed asset turnover 11. 37 11. 13 Best Buy Total asset turnover 2. 60 2. 66 Circuit City FAT 13. 82 Circuit City TAT 2. 85 8

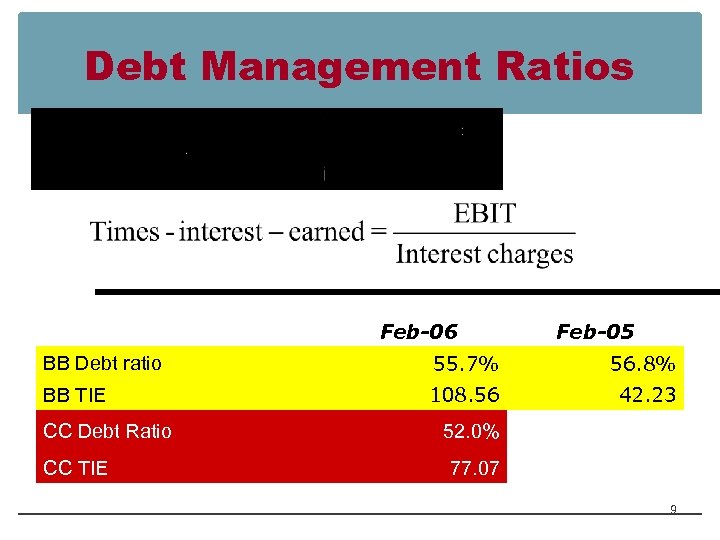

Debt Management Ratios Feb-06 Feb-05 BB Debt ratio 55. 7% 56. 8% BB TIE 108. 56 42. 23 CC Debt Ratio CC TIE 52. 0% 77. 07 9

Debt Management Ratios Feb-06 Feb-05 BB Debt ratio 55. 7% 56. 8% BB TIE 108. 56 42. 23 CC Debt Ratio CC TIE 52. 0% 77. 07 9

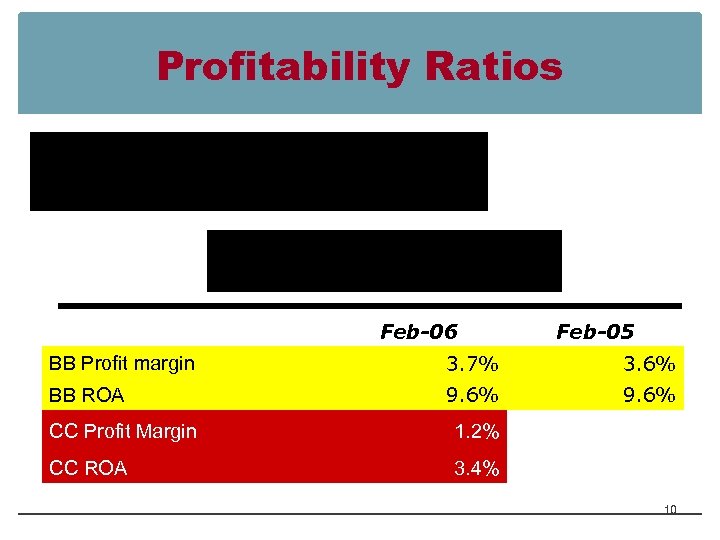

Profitability Ratios Feb-06 Feb-05 BB Profit margin 3. 7% 3. 6% BB ROA 9. 6% CC Profit Margin 1. 2% CC ROA 3. 4% 10

Profitability Ratios Feb-06 Feb-05 BB Profit margin 3. 7% 3. 6% BB ROA 9. 6% CC Profit Margin 1. 2% CC ROA 3. 4% 10

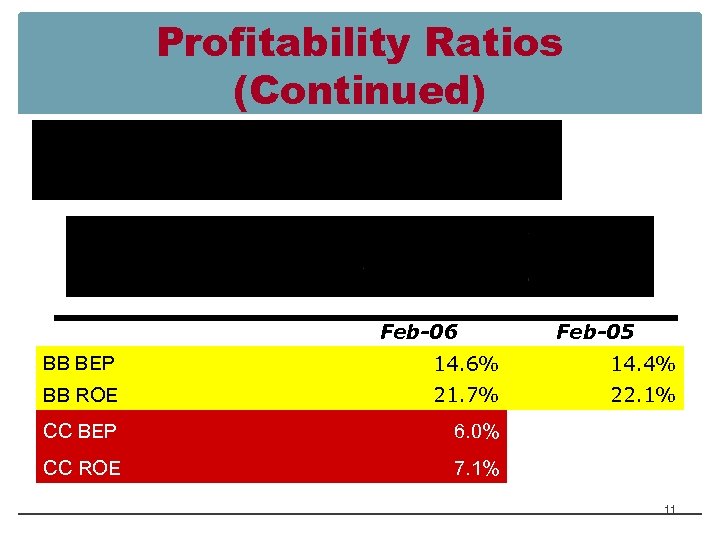

Profitability Ratios (Continued) Feb-06 Feb-05 BB BEP 14. 6% 14. 4% BB ROE 21. 7% 22. 1% CC BEP 6. 0% CC ROE 7. 1% 11

Profitability Ratios (Continued) Feb-06 Feb-05 BB BEP 14. 6% 14. 4% BB ROE 21. 7% 22. 1% CC BEP 6. 0% CC ROE 7. 1% 11

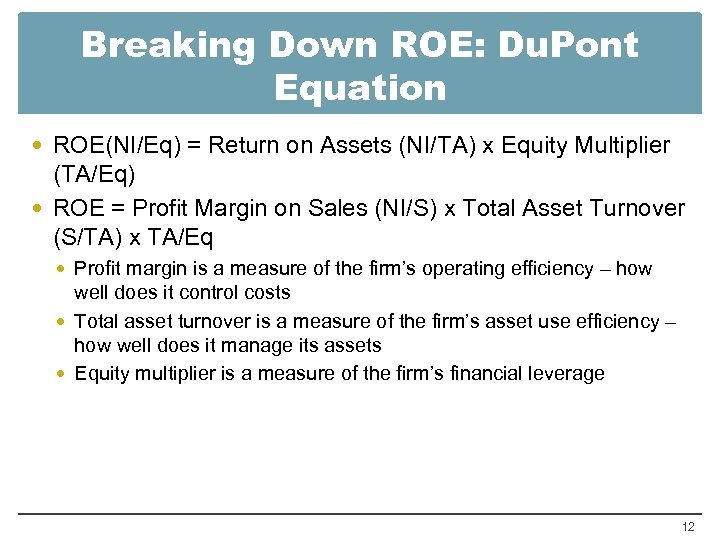

Breaking Down ROE: Du. Pont Equation ROE(NI/Eq) = Return on Assets (NI/TA) x Equity Multiplier (TA/Eq) ROE = Profit Margin on Sales (NI/S) x Total Asset Turnover (S/TA) x TA/Eq Profit margin is a measure of the firm’s operating efficiency – how well does it control costs Total asset turnover is a measure of the firm’s asset use efficiency – how well does it manage its assets Equity multiplier is a measure of the firm’s financial leverage 12

Breaking Down ROE: Du. Pont Equation ROE(NI/Eq) = Return on Assets (NI/TA) x Equity Multiplier (TA/Eq) ROE = Profit Margin on Sales (NI/S) x Total Asset Turnover (S/TA) x TA/Eq Profit margin is a measure of the firm’s operating efficiency – how well does it control costs Total asset turnover is a measure of the firm’s asset use efficiency – how well does it manage its assets Equity multiplier is a measure of the firm’s financial leverage 12

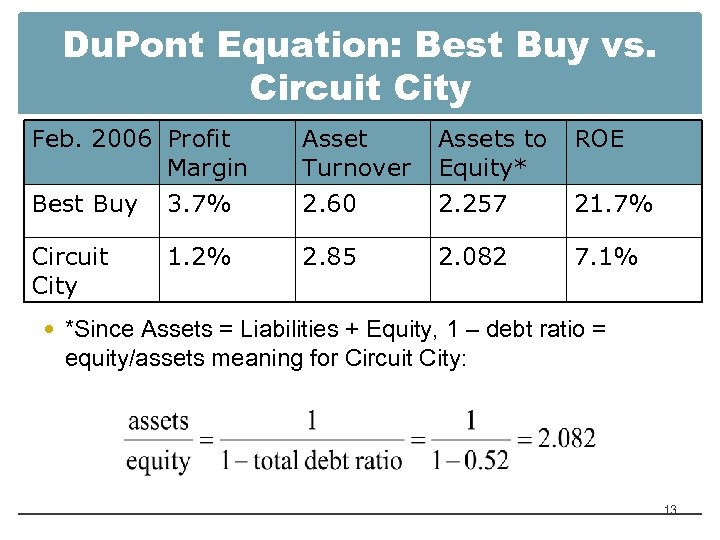

Du. Pont Equation: Best Buy vs. Circuit City Feb. 2006 Profit Margin Best Buy 3. 7% Asset Turnover 2. 60 Assets to Equity* 2. 257 ROE Circuit City 2. 85 2. 082 7. 1% 1. 2% 21. 7% *Since Assets = Liabilities + Equity, 1 – debt ratio = equity/assets meaning for Circuit City: 13

Du. Pont Equation: Best Buy vs. Circuit City Feb. 2006 Profit Margin Best Buy 3. 7% Asset Turnover 2. 60 Assets to Equity* 2. 257 ROE Circuit City 2. 85 2. 082 7. 1% 1. 2% 21. 7% *Since Assets = Liabilities + Equity, 1 – debt ratio = equity/assets meaning for Circuit City: 13

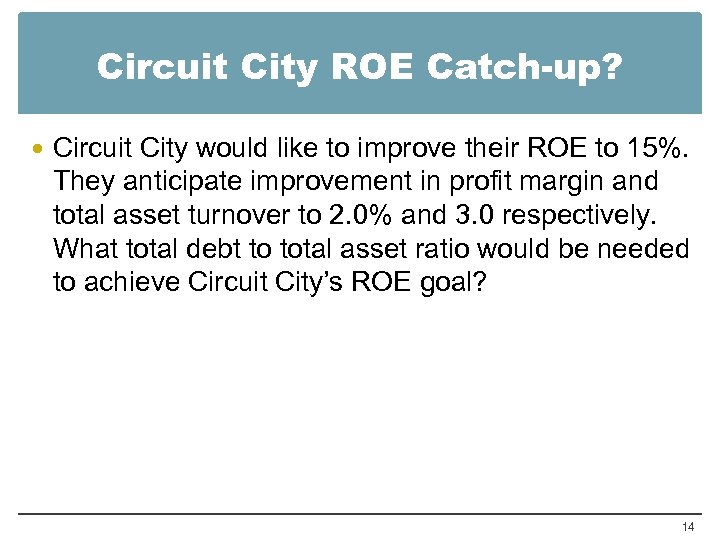

Circuit City ROE Catch-up? Circuit City would like to improve their ROE to 15%. They anticipate improvement in profit margin and total asset turnover to 2. 0% and 3. 0 respectively. What total debt to total asset ratio would be needed to achieve Circuit City’s ROE goal? 14

Circuit City ROE Catch-up? Circuit City would like to improve their ROE to 15%. They anticipate improvement in profit margin and total asset turnover to 2. 0% and 3. 0 respectively. What total debt to total asset ratio would be needed to achieve Circuit City’s ROE goal? 14

15

15

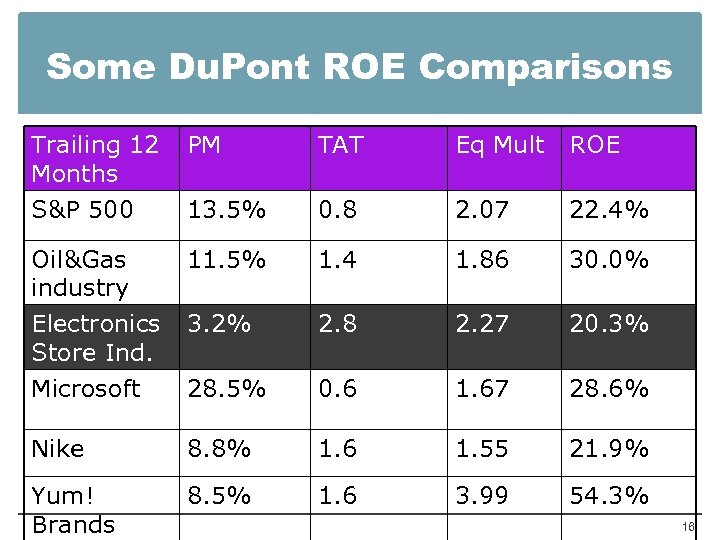

Some Du. Pont ROE Comparisons Trailing 12 Months PM TAT Eq Mult ROE S&P 500 13. 5% 0. 8 2. 07 22. 4% Oil&Gas industry 11. 5% 1. 4 1. 86 30. 0% Electronics Store Ind. 3. 2% 2. 8 2. 27 20. 3% Microsoft 28. 5% 0. 6 1. 67 28. 6% Nike 8. 8% 1. 6 1. 55 21. 9% Yum! Brands 8. 5% 1. 6 3. 99 54. 3% 16

Some Du. Pont ROE Comparisons Trailing 12 Months PM TAT Eq Mult ROE S&P 500 13. 5% 0. 8 2. 07 22. 4% Oil&Gas industry 11. 5% 1. 4 1. 86 30. 0% Electronics Store Ind. 3. 2% 2. 8 2. 27 20. 3% Microsoft 28. 5% 0. 6 1. 67 28. 6% Nike 8. 8% 1. 6 1. 55 21. 9% Yum! Brands 8. 5% 1. 6 3. 99 54. 3% 16

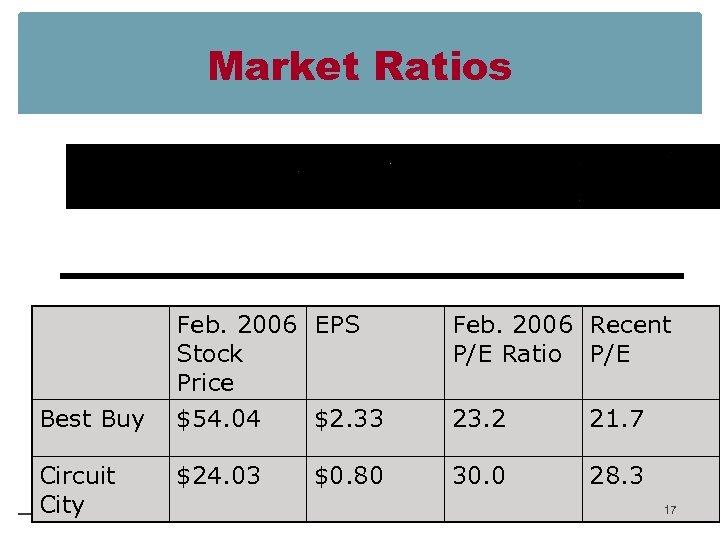

Market Ratios Feb. 2006 EPS Stock Price Feb. 2006 Recent P/E Ratio P/E Best Buy $54. 04 $2. 33 23. 2 21. 7 Circuit City $24. 03 $0. 80 30. 0 28. 3 17

Market Ratios Feb. 2006 EPS Stock Price Feb. 2006 Recent P/E Ratio P/E Best Buy $54. 04 $2. 33 23. 2 21. 7 Circuit City $24. 03 $0. 80 30. 0 28. 3 17

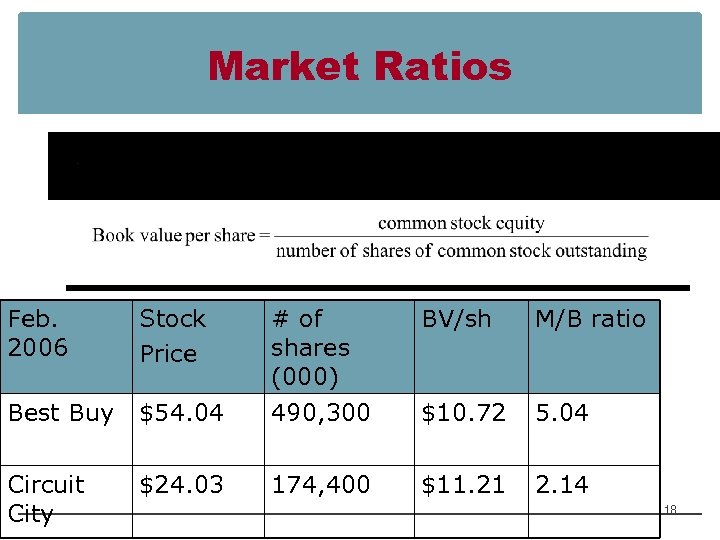

Market Ratios Feb. 2006 Stock Price # of shares (000) BV/sh M/B ratio Best Buy $54. 04 490, 300 $10. 72 5. 04 Circuit City $24. 03 174, 400 $11. 21 2. 14 18

Market Ratios Feb. 2006 Stock Price # of shares (000) BV/sh M/B ratio Best Buy $54. 04 490, 300 $10. 72 5. 04 Circuit City $24. 03 174, 400 $11. 21 2. 14 18