7c42dd2dee690e6df8894598df98b046.ppt

- Количество слайдов: 10

Chapter 34 Exchange rate regimes David Begg, Stanley Fischer and Rudiger Dornbusch, Economics, 7 th Edition, Mc. Graw-Hill, 2003 Power Point presentation by Alex Tackie ©The Mc. Graw-Hill Companies, 2002

Key issues • Exchange rate regimes and their implications for the world economy • International policy co-ordination • Policy co-ordination in Europe 1 ©The Mc. Graw-Hill Companies, 2002

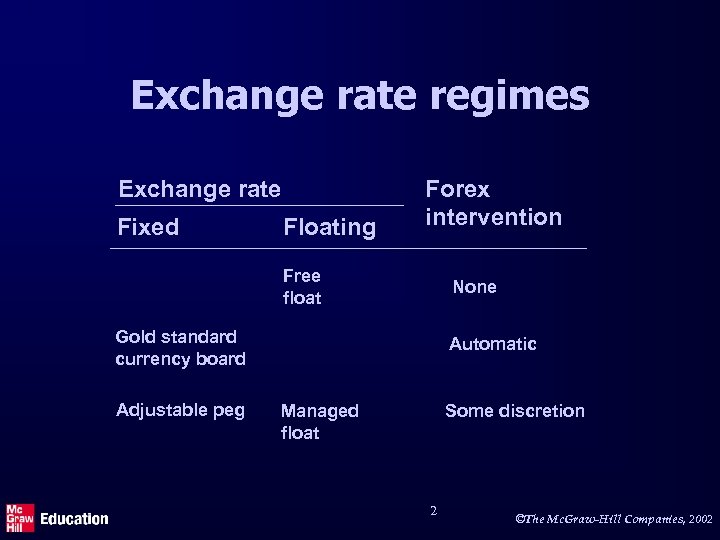

Exchange rate regimes Exchange rate Fixed Floating Forex intervention Free float None Gold standard currency board Adjustable peg Automatic Managed float Some discretion 2 ©The Mc. Graw-Hill Companies, 2002

The gold standard • Characteristics of the gold standard: – The government of each country fixes the price of gold in terms of its domestic currency. – The government maintains convertibility of domestic currency into gold. – Domestic money creation is tied to the government's holding of gold. • Adjustment to full employment is via domestic wages and prices – creating vulnerability to long and deep recessions. 3 ©The Mc. Graw-Hill Companies, 2002

The adjustable peg and the dollar standard • In an adjustable peg regime, exchange rates are normally fixed, but countries are occasionally allowed to alter their exchange rate. • Under the Bretton Woods system, each country announced a par value for their currency in terms of US dollars – the dollar standard. 4 ©The Mc. Graw-Hill Companies, 2002

The dollar standard • Faced with a balance of payments deficit under the dollar standard • countries could try to avoid monetary contraction by running down foreign exchange reserves • but devaluation could not be postponed for ever, given finite reserves • expansion of US money supply began to spread inflation world-wide 5 ©The Mc. Graw-Hill Companies, 2002

Floating exchange rates • Under pure/clean floating, forex markets are in continuous equilibrium • the exchange rate adjusts to maintain competitiveness • but in the short run, the level of floating exchange rates is determined by speculation – given that capital flows respond to interest rate differentials. 6 ©The Mc. Graw-Hill Companies, 2002

Fixed versus floating exchange rates • Robustness – Bretton Woods system was abandoned because it could not cope with real and nominal strains – a flexible rate system is probably more robust • Volatility – fixed rate system offers fundamental stability – flexible rate system is potentially volatile – but instability must be accommodated in other ways under a fixed rate system • Financial discipline – fixed rate system imposes discipline and policy harmonization. 7 ©The Mc. Graw-Hill Companies, 2002

International policy co-ordination • Can a concerted attempt by a group of countries to co-ordinate their policy bring benefits to the group? • Externality argument: – non-co-operative policy can impose costs that can be avoided by agreement between governments • Reputation argument – co-ordination may allow individual governments to pre-commit to policies that would otherwise not be credible 8 ©The Mc. Graw-Hill Companies, 2002

The European Monetary System • Established by members of the European Community (including the UK) in 1979 • A system of monetary and exchange rate cooperation. • Included the Exchange Rate Mechanism (ERM) – which the UK did not join until 1990 – and it left again in 1992. • The system had some success in reducing exchange rate volatility – through co-ordination of monetary policy – plus exchange rate controls – even if it did not work for the UK. 9 ©The Mc. Graw-Hill Companies, 2002

7c42dd2dee690e6df8894598df98b046.ppt