1c8dcfcbfd864ca7251d132b87b969f4.ppt

- Количество слайдов: 44

CHAPTER 31 Open-Economy Macroeconomics: Basic Concepts Economics PRINCIPLES OF N. Gregory Mankiw Premium Power. Point Slides by Ron Cronovich © 2009 South-Western, a part of Cengage Learning, all rights reserved

In this chapter, look for the answers to these questions: § How are international flows of goods and assets related? 재화와 자산의 국제적 흐름은 어떻게 관련 되어 있나? § What’s the difference between the real and nominal exchange rate? 실질환율과 명목환율의 차이 § What is “purchasing-power parity, ” and how does it explain nominal exchange rates? “구매력평가설”이 란 무엇이며 그것은 어떻게 명목환율을 설명해주나? OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 1

Introduction § One of the Ten Principles of Economics from Chapter 1: Trade can make everyone better off. § This chapter introduces basic concepts of international macroeconomics: 이 장에서는 국제 거시경제학의 기본개념을 소개 § The trade balance (trade deficits, surpluses) § International flows of assets § Exchange rates OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 2

Closed vs. Open Economies § A closed economy does not interact with other economies in the world. 폐쇄경제란 세계의 다른 경제들과 교류하지 않는 경제 § An open economy interacts freely with other economies around the world. 개방경제란 전세계 다른 경제들과 자유롭게 교류하는 경제 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 3

The Flow of Goods & Services § Exports: domestically-produced g&s sold abroad 국내에서 생산되어 해외에서 팔린 재화와 서비스 § Imports: foreign-produced g&s sold domestically 해외에서 생산되어 국내에서 팔린 재화와 서비스 § Net exports (NX), aka the trade balance = value of exports – value of imports 무역수 지라고도 불리는 순수출 = 수출액-수입액 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 4

ACTIVE LEARNING 1 Variables that affect NX What do you think would happen to U. S. net exports if: A. Canada experiences a recession (falling incomes, rising unemployment) B. U. S. consumers decide to be patriotic and buy more products “Made in the U. S. A. ” C. Prices of goods produced in Mexico rise faster than prices of goods produced in the U. S. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 5

ACTIVE LEARNING Answers 1 A. Canada experiences a recession (falling incomes, rising unemployment) U. S. net exports would fall due to a fall in Canadian consumers’ purchases of U. S. exports B. U. S. consumers decide to be patriotic and buy more products “Made in the U. S. A. ” U. S. net exports would rise due to a fall in imports OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 6

ACTIVE LEARNING Answers 1 C. Prices of Mexican goods rise faster than prices of U. S. goods This makes U. S. goods more attractive relative to Mexico’s goods. Exports to Mexico increase, imports from Mexico decrease, so U. S. net exports increase. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 7

Variables that Influence Net Exports 순수출에 영향을 미치는 변수들 § Consumers’ preferences foreign and domestic goods 해외 및 국내산 재화에 대한 소비자의 선호 § Prices of goods at home and abroad 국내외 가격 § Incomes of consumers at home and abroad 소득 § The exchange rates at which foreign currency trades for domestic currency 외화가 국내 통화와 거래되는 환율 § Transportation costs 운송비용 § Govt policies 정부정책 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 8

Trade Surpluses & Deficits무역수지 흑자와 적자 NX measures the imbalance in a country’s trade in goods and services. 순수출은 어떤 나라의 재화와 서비스 무역에서의 불균형을 측정한다. § Trade deficit: 무역수지 적자 an excess of imports over exports § Trade surplus: 무역수지 흑자 an excess of exports over imports § Balanced trade: 무역수지 균형 when exports = imports OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 9

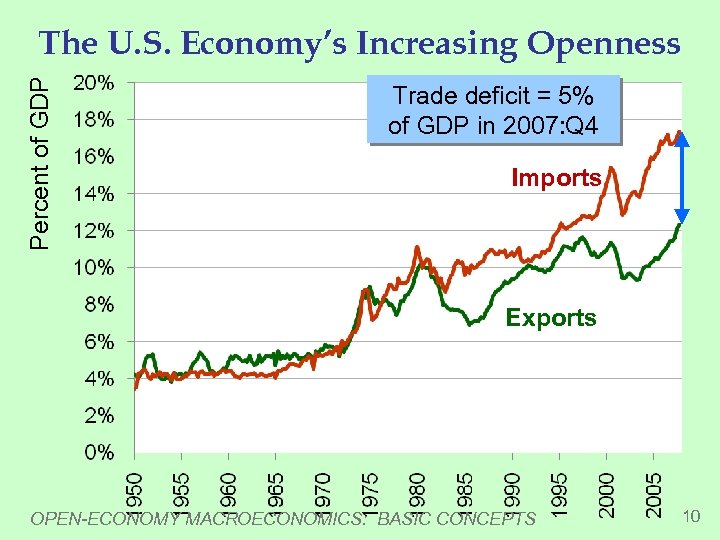

Percent of GDP The U. S. Economy’s Increasing Openness Trade deficit = 5% of GDP in 2007: Q 4 Imports Exports OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 10

The Flow of Capital 자본의 이동 § Net capital outflow (NCO): 순자본유출 domestic residents’ purchases of foreign assets minus foreigners’ purchases of domestic assets 내국인의 해외자산 취득액 –외국인의 국내자산 취득액 § NCO is also called net foreign investment. NCO는 순해외투자라고도 부른다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 11

The Flow of Capital The flow of capital abroad takes two forms: 자본의 해외이동은 두가지 형태를 띤다. § Foreign direct investment: 해외직접투자 Domestic residents actively manage the foreign investment, e. g. , Mc. Donalds opens a fast-food outlet in Moscow. 내국인이 해외 투자자산을 직접 경영하는 경우 § Foreign portfolio investment: 해외포트폴리오투자 Domestic residents purchase foreign stocks or bonds, supplying “loanable funds” to a foreign firm. 내국인이 해외의 주식이나 채권을 취득 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 12

The Flow of Capital NCO measures the imbalance in a country’s trade in assets: 순자본유출은 한 나라의 자산거래의 불균형을 측정한다. § When NCO > 0, “capital outflow”자본유출 Domestic purchases of foreign assets exceed foreign purchases of domestic assets. 내국인이 취득 한 해외자산이 외국인이 취득한 국내자산을 초과 § When NCO < 0, “capital inflow”자본유입 Foreign purchases of domestic assets exceed domestic purchases of foreign assets. 외국인이 취득 한 국내자산이 내국인이 취득한 해외자산을 초과 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 13

Variables that Influence NCO 순자본유출에 영향을 미치는 변수들 § Real interest rates paid on foreign assets 해외자산 에 지불되는 실질이자율 § Real interest rates paid on domestic assets 국내자 산에 지불되는 실질이자율 § Perceived risks of holding foreign assets 해외자산 을 보유함에 따른 위험에 대한 인식 § Govt policies affecting foreign ownership of domestic assets 국내 자산의 외국인 소유에 영향을 미치는 정부 정 책 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 14

The Equality of NX and NCO순수출과 순자본유출의 일치 § An accounting identity: NCO = NX 회계적 항등식 § arises because every transaction that affects NX also affects NCO by the same amount (and vice versa) 순수 출에 영향을 미치는 모든 거래는 동일한 액수만큼 순자본유출에 영향을 미친다( 역도 성립) § When a foreigner purchases a good from the U. S. , 외국인이 미국으로부터 재화를 구매할 때 § U. S. exports and NX increase 미국의 수출과 순수출 증가 § the foreigner pays with currency or assets, so the U. S. acquires some foreign assets, causing NCO to rise. 외 국인은 현금이나 자산으로 가격을 지불하므로 미국은 해외 자산을 취득 하게 되어 순자본유출이 증가 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 15

The Equality of NX and NCO § An accounting identity: NCO = NX § arises because every transaction that affects NX also affects NCO by the same amount (and vice versa) § When a U. S. citizen buys foreign goods, 미국시민 이 외국 재화를 살 때 § U. S. imports rise, NX falls 수입이 증가하므로 순수출이 감소하고 § the U. S. buyer pays with U. S. dollars or assets, so the other country acquires U. S. assets, causing U. S. NCO to fall. 미국 구매자가 미국 달러나 자산으로 지불하므로 나른 나라가 미 국의 자산을 취득하는 것이므로 미국의 순자본유출이 감소 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 16

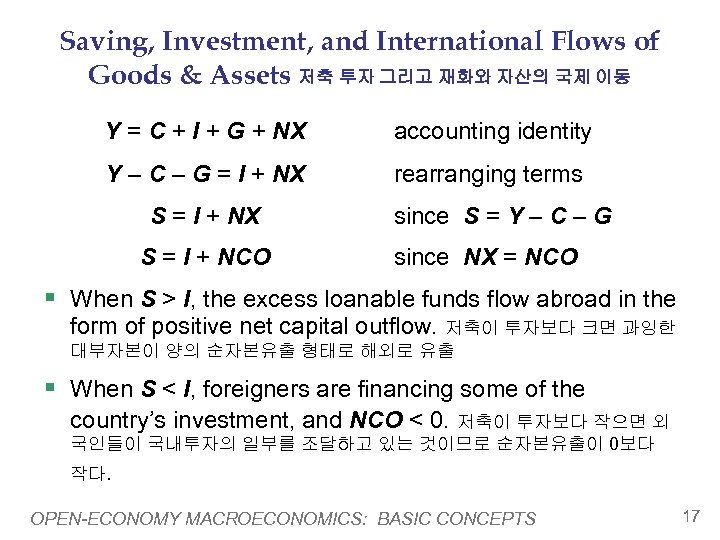

Saving, Investment, and International Flows of Goods & Assets 저축 투자 그리고 재화와 자산의 국제 이동 Y = C + I + G + NX accounting identity Y – C – G = I + NX rearranging terms S = I + NX S = I + NCO since S = Y – C – G since NX = NCO § When S > I, the excess loanable funds flow abroad in the form of positive net capital outflow. 저축이 투자보다 크면 과잉한 대부자본이 양의 순자본유출 형태로 해외로 유출 § When S < I, foreigners are financing some of the country’s investment, and NCO < 0. 저축이 투자보다 작으면 외 국인들이 국내투자의 일부를 조달하고 있는 것이므로 순자본유출이 0보다 작다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 17

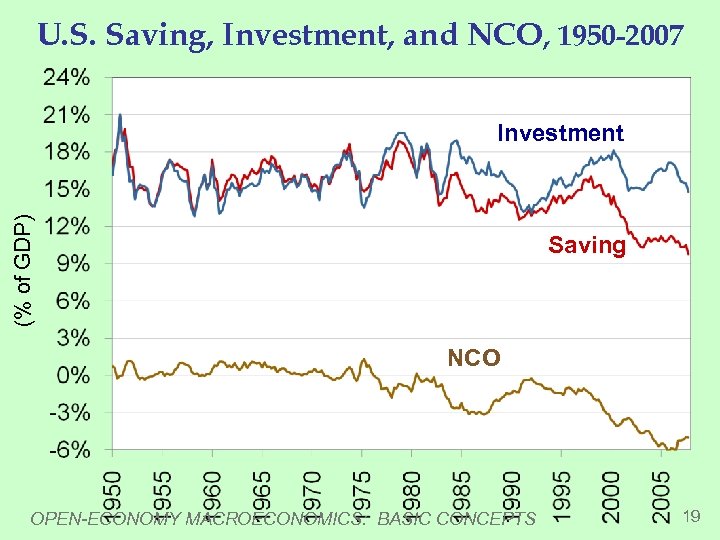

Case Study: The U. S. Trade Deficit § The U. S. trade deficit reached record levels in 2006 and remained high in 2007 -2008. 미국의 무역수지 적자는 2006년에 최 고에 달하였고, 2007 -2008년에도 높은 수준에 머물러 있다. § Recall, NX = S – I = NCO. A trade deficit means I > S, so the nation borrows the difference from foreigners. 그러 므로 미국경제는 투자와 저축의 차액을 외국인들로 부터 차입하고 있는 것이 다. § In 2007, foreign purchases of U. S. assets exceeded U. S. purchases of foreign assets by $775 million. 2007년에 미국 이 해외자산을 취득한 것보다 외국인들이 미국자산을 775 밀리언 달러만큼 더 많이 취득했다. § Such deficits have been the norm since 1980…이러한 적자 는 1980년 이래 전형이 되어 왔다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 18

U. S. Saving, Investment, and NCO, 1950 -2007 (% of GDP) Investment Saving NCO OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 19

Case Study: The U. S. Trade Deficit Why U. S. saving has been less than investment: § In the 1980 s and early 2000 s, huge budget deficits and low private saving depressed national saving. 1980년대와 2000년대 초, 대규모 재정적자와 낮은 민간저축으로 국민저축이 줄어들었다. § In the 1990 s, national saving increased as the economy grew, but domestic investment increased even faster due to the information technology boom. 1990년대에는 경제성장과 함께 국민저축이 증가하였다. 그러나 정보기술산업 붐 때무에 국내투자가 더 빨리 증가하였다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 20

Case Study: The U. S. Trade Deficit § Is the U. S. trade deficit a problem? 미국의 무역수지적자는 문제인 가? § The extra capital stock from the ’ 90 s investment boom may well yield large returns. 90년대 투자 붐으로 형성된 추가적인 자본스톡은 큰 수익을 가져올 것이다. § The fall in saving of the ’ 80 s and ’ 00 s, while not desirable, at least did not depress domestic investment, as firms could borrow from abroad. 80년대 와 2000년대의 저축 감소는기업들이 해외로부터 차입할 수 있었기 때문 에 최소한 국내 투자를 위축시키지는 않았다. § A country, like a person, can go into debt for good reasons or bad ones. A trade deficit is not necessarily a problem, but might be a symptom of a problem. 사람처럼 나라도 좋은 이유에서 빚을 질 수도 있고, 나쁜 이유에서도 빚을 질 수도 있다. 무역수지적자가 반드시 문제는 아니지만 문제의 징후일 수는 있다. (notice: Seigniorage의 이득) OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 21

Case Study: The U. S. Trade Deficit as of 12 -31 -2007 People abroad owned $20. 1 trillion in U. S. assets. U. S. residents owned $17. 6 trillion in foreign assets. U. S. ’ net indebtedness to other countries = $2. 5 trillion. Higher than every other country’s net indebtedness. So, U. S. is “the world’s biggest debtor nation. ” § So far, the U. S. earns higher interest rates on foreign assets than it pays on its debts to foreigners. 지금까지는 미국이 외국인에 대한 채무에 지불하는 이자율보다 해외자산에서 벌어들이는 이자율이 더 높았다. § But if U. S. debt continues to grow, foreigners may demand higher interest rates, and servicing the debt would become a drain on U. S. income. 그러나 미국의 채무가 지속적으로 커지면 외국 인들이 더 높은 이자율을 요구하게 되고 그 결과 채무에 대한 이자지급으로 미국 소득이 누출될 수 있다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 22

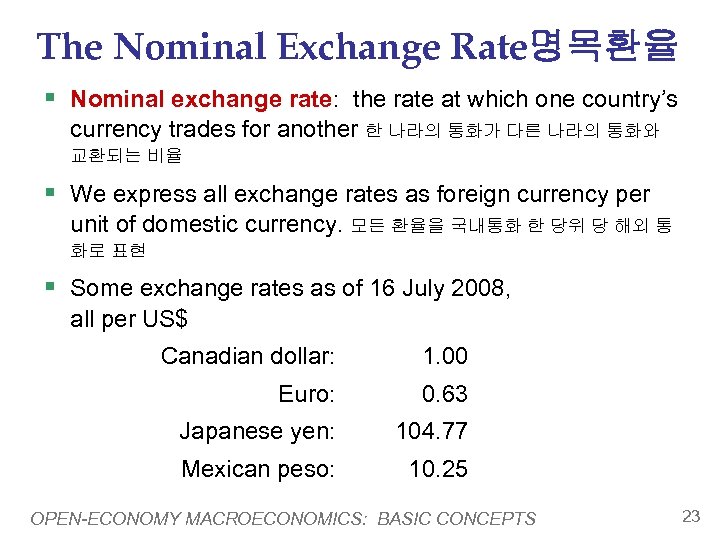

The Nominal Exchange Rate명목환율 § Nominal exchange rate: the rate at which one country’s currency trades for another 한 나라의 통화가 다른 나라의 통화와 교환되는 비율 § We express all exchange rates as foreign currency per unit of domestic currency. 모든 환율을 국내통화 한 당위 당 해외 통 화로 표현 § Some exchange rates as of 16 July 2008, all per US$ Canadian dollar: 1. 00 Euro: 0. 63 Japanese yen: 104. 77 Mexican peso: 10. 25 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 23

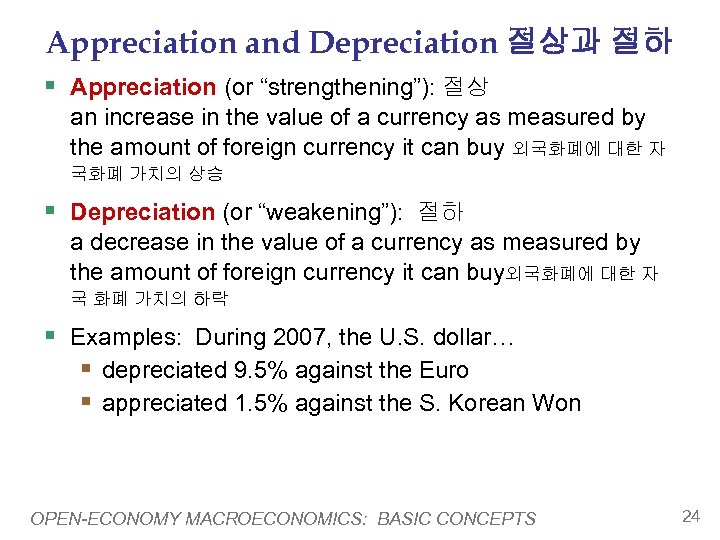

Appreciation and Depreciation 절상과 절하 § Appreciation (or “strengthening”): 절상 an increase in the value of a currency as measured by the amount of foreign currency it can buy 외국화폐에 대한 자 국화폐 가치의 상승 § Depreciation (or “weakening”): 절하 a decrease in the value of a currency as measured by the amount of foreign currency it can buy외국화폐에 대한 자 국 화폐 가치의 하락 § Examples: During 2007, the U. S. dollar… § depreciated 9. 5% against the Euro § appreciated 1. 5% against the S. Korean Won OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 24

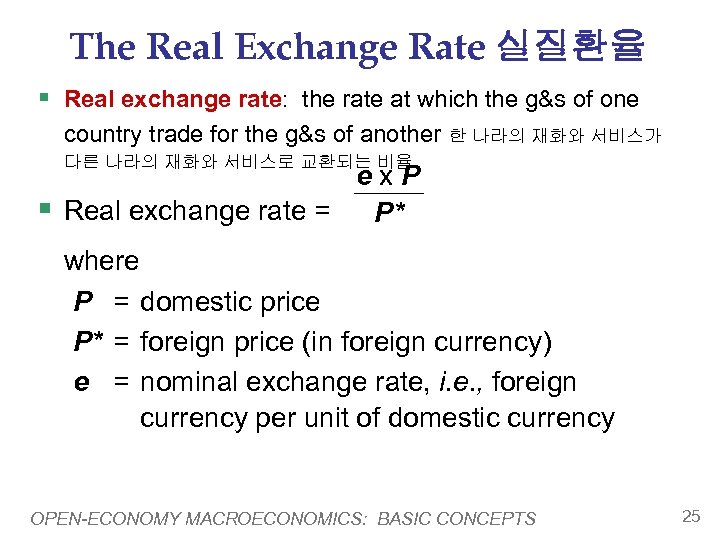

The Real Exchange Rate 실질환율 § Real exchange rate: the rate at which the g&s of one country trade for the g&s of another 한 나라의 재화와 서비스가 다른 나라의 재화와 서비스로 교환되는 비율 § ex. P Real exchange rate = P* where P = domestic price P* = foreign price (in foreign currency) e = nominal exchange rate, i. e. , foreign currency per unit of domestic currency OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 25

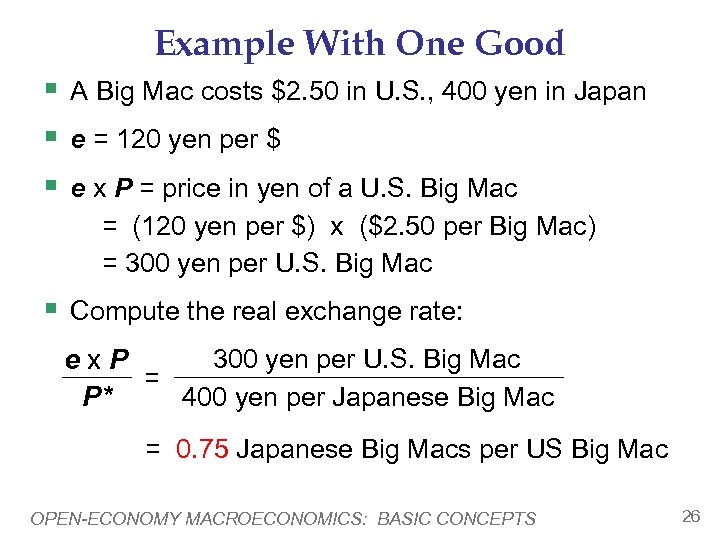

Example With One Good § A Big Mac costs $2. 50 in U. S. , 400 yen in Japan § e = 120 yen per $ § e x P = price in yen of a U. S. Big Mac = (120 yen per $) x ($2. 50 per Big Mac) = 300 yen per U. S. Big Mac § Compute the real exchange rate: 300 yen per U. S. Big Mac ex. P = P* 400 yen per Japanese Big Mac = 0. 75 Japanese Big Macs per US Big Mac OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 26

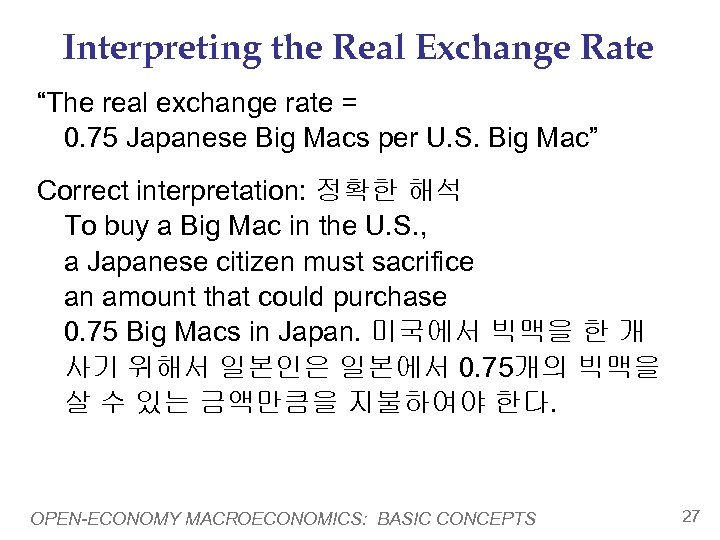

Interpreting the Real Exchange Rate “The real exchange rate = 0. 75 Japanese Big Macs per U. S. Big Mac” Correct interpretation: 정확한 해석 To buy a Big Mac in the U. S. , a Japanese citizen must sacrifice an amount that could purchase 0. 75 Big Macs in Japan. 미국에서 빅맥을 한 개 사기 위해서 일본인은 일본에서 0. 75개의 빅맥을 살 수 있는 금액만큼을 지불하여야 한다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 27

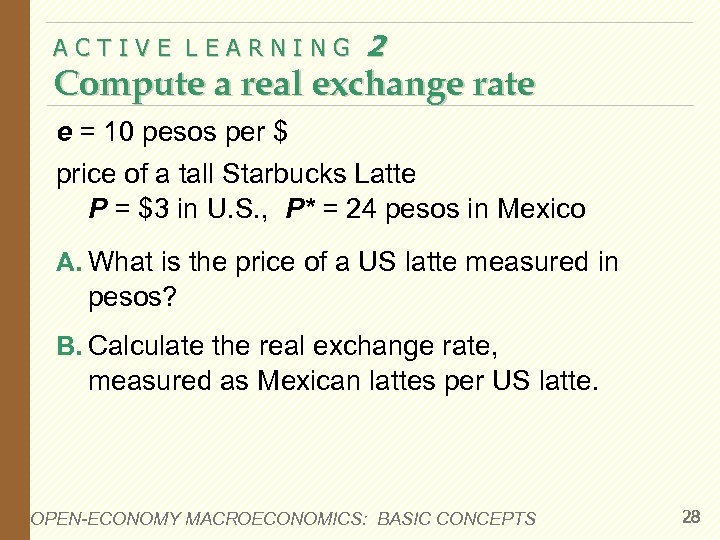

ACTIVE LEARNING 2 Compute a real exchange rate e = 10 pesos per $ price of a tall Starbucks Latte P = $3 in U. S. , P* = 24 pesos in Mexico A. What is the price of a US latte measured in pesos? B. Calculate the real exchange rate, measured as Mexican lattes per US latte. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 28

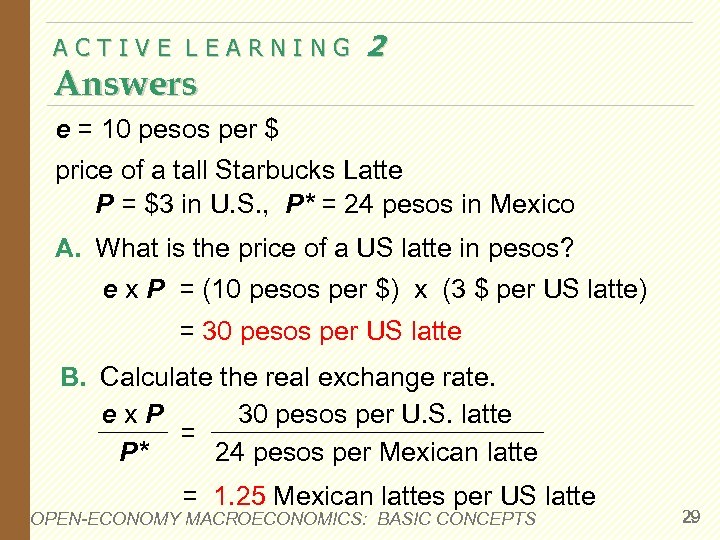

ACTIVE LEARNING Answers 2 e = 10 pesos per $ price of a tall Starbucks Latte P = $3 in U. S. , P* = 24 pesos in Mexico A. What is the price of a US latte in pesos? e x P = (10 pesos per $) x (3 $ per US latte) = 30 pesos per US latte B. Calculate the real exchange rate. ex. P 30 pesos per U. S. latte = P* 24 pesos per Mexican latte = 1. 25 Mexican lattes per US latte OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 29

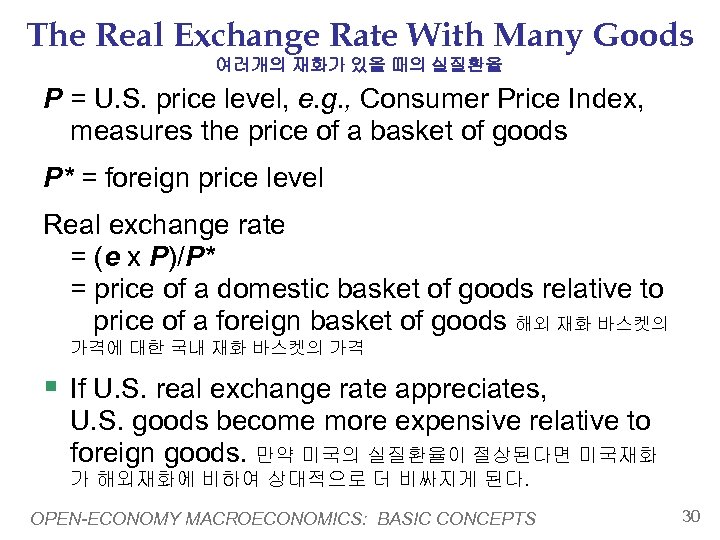

The Real Exchange Rate With Many Goods 여러개의 재화가 있을 때의 실질환율 P = U. S. price level, e. g. , Consumer Price Index, measures the price of a basket of goods P* = foreign price level Real exchange rate = (e x P)/P* = price of a domestic basket of goods relative to price of a foreign basket of goods 해외 재화 바스켓의 가격에 대한 국내 재화 바스켓의 가격 § If U. S. real exchange rate appreciates, U. S. goods become more expensive relative to foreign goods. 만약 미국의 실질환율이 절상된다면 미국재화 가 해외재화에 비하여 상대적으로 더 비싸지게 된다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 30

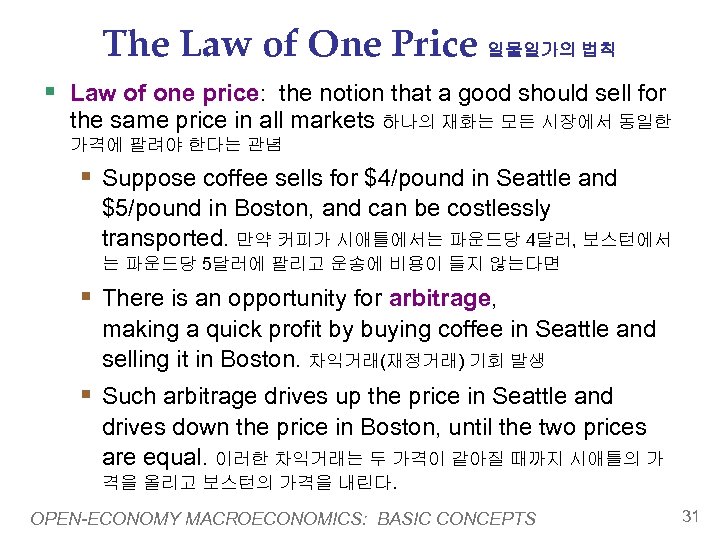

The Law of One Price 일물일가의 법칙 § Law of one price: the notion that a good should sell for the same price in all markets 하나의 재화는 모든 시장에서 동일한 가격에 팔려야 한다는 관념 § Suppose coffee sells for $4/pound in Seattle and $5/pound in Boston, and can be costlessly transported. 만약 커피가 시애틀에서는 파운드당 4달러, 보스턴에서 는 파운드당 5달러에 팔리고 운송에 비용이 들지 않는다면 § There is an opportunity for arbitrage, making a quick profit by buying coffee in Seattle and selling it in Boston. 차익거래(재정거래) 기회 발생 § Such arbitrage drives up the price in Seattle and drives down the price in Boston, until the two prices are equal. 이러한 차익거래는 두 가격이 같아질 때까지 시애틀의 가 격을 올리고 보스턴의 가격을 내린다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 31

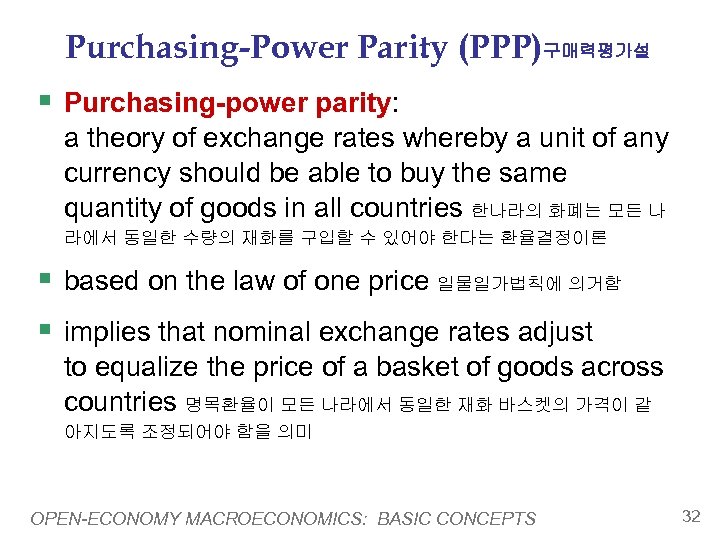

Purchasing-Power Parity (PPP)구매력평가설 § Purchasing-power parity: a theory of exchange rates whereby a unit of any currency should be able to buy the same quantity of goods in all countries 한나라의 화폐는 모든 나 라에서 동일한 수량의 재화를 구입할 수 있어야 한다는 환율결정이론 § based on the law of one price 일물일가법칙에 의거함 § implies that nominal exchange rates adjust to equalize the price of a basket of goods across countries 명목환율이 모든 나라에서 동일한 재화 바스켓의 가격이 같 아지도록 조정되어야 함을 의미 OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 32

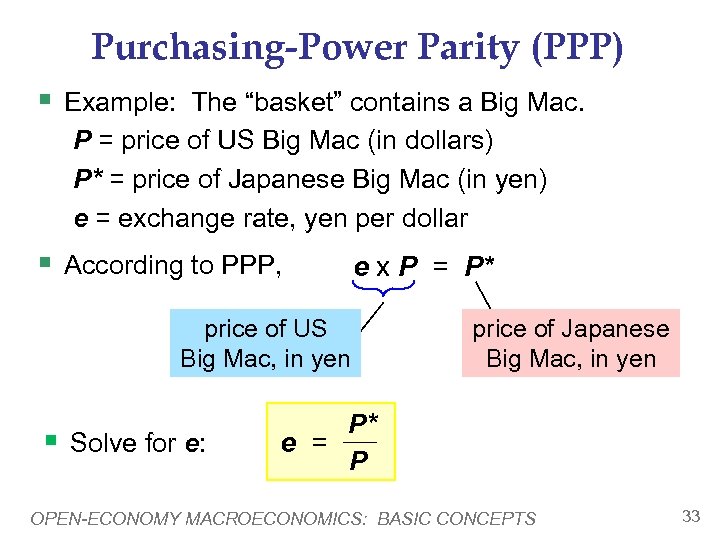

Purchasing-Power Parity (PPP) § Example: The “basket” contains a Big Mac. P = price of US Big Mac (in dollars) P* = price of Japanese Big Mac (in yen) e = exchange rate, yen per dollar § According to PPP, e x P = P* price of US Big Mac, in yen § Solve for e: price of Japanese Big Mac, in yen P* e = P OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 33

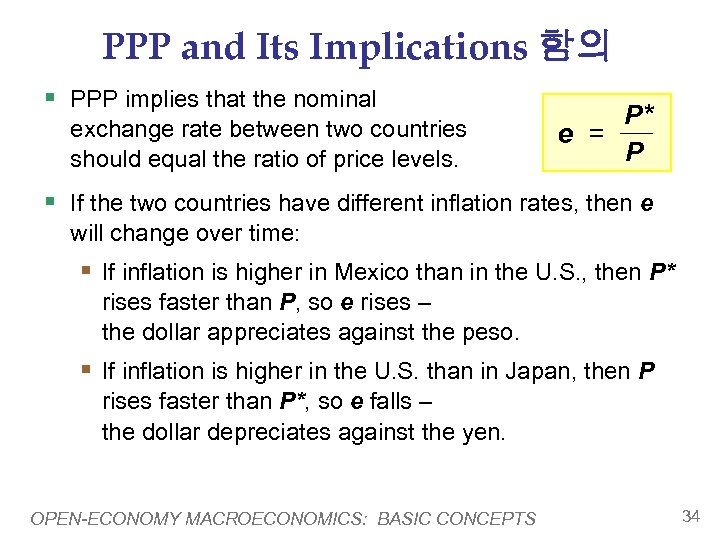

PPP and Its Implications 함의 § PPP implies that the nominal exchange rate between two countries should equal the ratio of price levels. P* e = P § If the two countries have different inflation rates, then e will change over time: § If inflation is higher in Mexico than in the U. S. , then P* rises faster than P, so e rises – the dollar appreciates against the peso. § If inflation is higher in the U. S. than in Japan, then P rises faster than P*, so e falls – the dollar depreciates against the yen. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 34

Limitations of PPP Theory 한계 Two reasons why exchange rates do not always adjust to equalize prices across countries: 환율이 항상 모든 나라에서 가격 을 일치시키는 방향으로 조정되지는 않는 두 가지 이유 § Many goods cannot easily be traded 쉽게 거래되지 못하는 재화 들이 많이 있다. § Examples: haircuts, going to the movies § Price differences on such goods cannot be arbitraged away 이러한 재화의 가격 차이는 차액거래를 통해 해소되지 못한다. § Foreign, domestic goods not perfect substitutes 해외 재화와 국내재화가 완전 대체적이지 않다. § E. g. , some U. S. consumers prefer Toyotas over § Chevys, or vice versa Price differences reflect taste differences OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 35

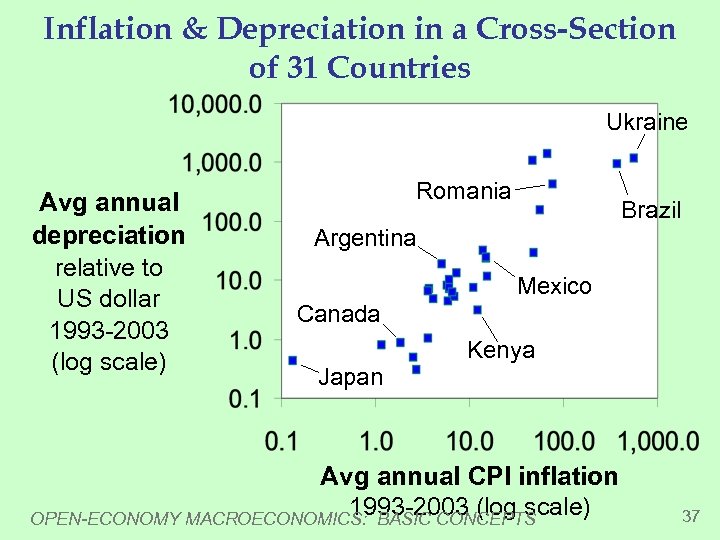

Limitations of PPP Theory § Nonetheless, PPP works well in many cases, especially as an explanation of long-run trends. 그럼에도 불구하고 구매력 평가설은 많은 경우에 작동하고 있으며 특히 장기 추세의 설명으로 유용하다. § For example, PPP implies: the greater a country’s inflation rate, the faster its currency should depreciate (relative to a low-inflation country like the US). 한 나라의 인 플레율이 더 클수록 그 통화는 더 빨리 절하된다 § The data support this prediction… 데이터는 이러한 예측을 지지 한다. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 36

Inflation & Depreciation in a Cross-Section of 31 Countries Ukraine Avg annual depreciation relative to US dollar 1993 -2003 (log scale) Romania Brazil Argentina Mexico Canada Kenya Japan Avg annual CPI inflation 1993 -2003 (log scale) OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 37

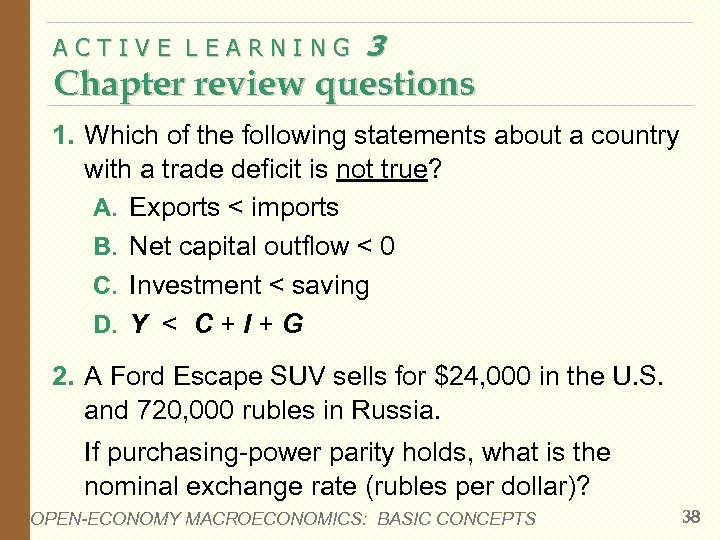

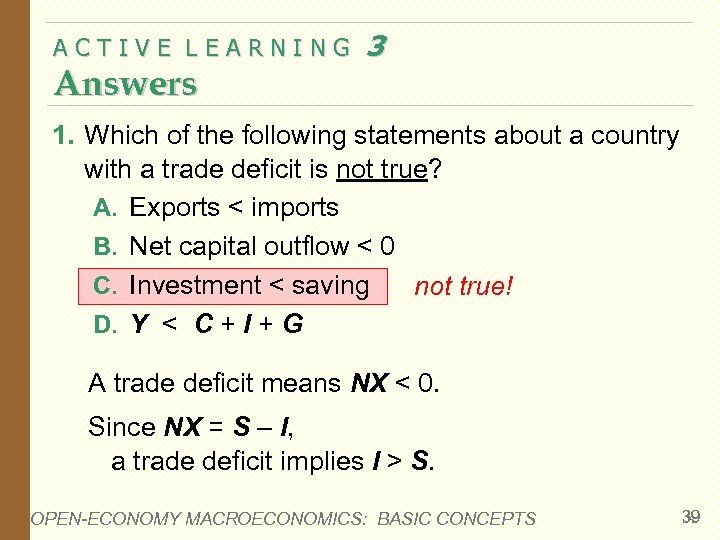

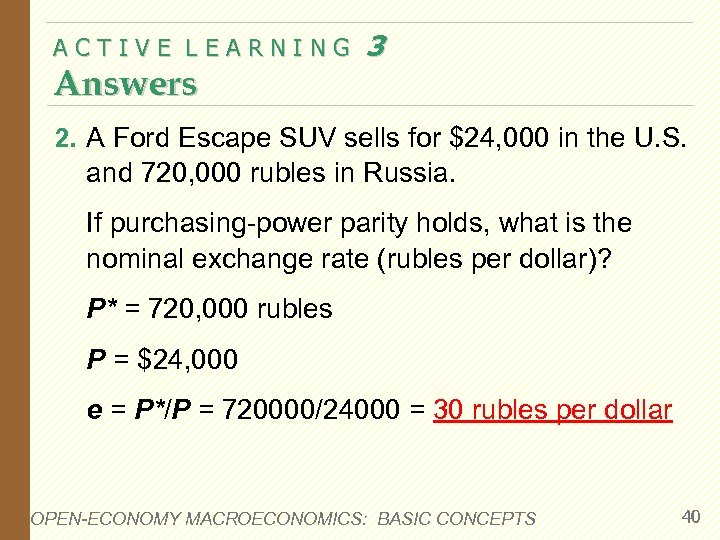

ACTIVE LEARNING 3 Chapter review questions 1. Which of the following statements about a country with a trade deficit is not true? A. Exports < imports B. Net capital outflow < 0 C. Investment < saving D. Y < C + I + G 2. A Ford Escape SUV sells for $24, 000 in the U. S. and 720, 000 rubles in Russia. If purchasing-power parity holds, what is the nominal exchange rate (rubles per dollar)? OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 38

ACTIVE LEARNING Answers 3 1. Which of the following statements about a country with a trade deficit is not true? A. Exports < imports B. Net capital outflow < 0 C. Investment < saving not true! D. Y < C + I + G A trade deficit means NX < 0. Since NX = S – I, a trade deficit implies I > S. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 39

ACTIVE LEARNING Answers 3 2. A Ford Escape SUV sells for $24, 000 in the U. S. and 720, 000 rubles in Russia. If purchasing-power parity holds, what is the nominal exchange rate (rubles per dollar)? P* = 720, 000 rubles P = $24, 000 e = P*/P = 720000/24000 = 30 rubles per dollar OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 40

CHAPTER SUMMARY § Net exports equal exports minus imports. Net capital outflow equals domestic residents’ purchases of foreign assets minus foreigners’ purchases of domestic assets. § Every international transaction involves the exchange of an asset for a good or service, so net exports equal net capital outflow. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 41

CHAPTER SUMMARY § Saving can be used to finance domestic investment or to buy assets abroad. Thus, saving equals domestic investment plus net capital outflow. § The nominal exchange rate is the relative price of the currency of two countries. § The real exchange rate is the relative price of the goods and services of the two countries. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 42

CHAPTER SUMMARY § According to theory of purchasing-power parity, a unit of any country’s currency should be able to buy the same quantity of goods in all countries. § This theory implies that the nominal exchange rate between two countries should equal the ratio of the price levels in the two countries. § It also implies that countries with high inflation should have depreciating currencies. OPEN-ECONOMY MACROECONOMICS: BASIC CONCEPTS 43

1c8dcfcbfd864ca7251d132b87b969f4.ppt