2e29ede5e8998b2f0e850078a712ae4e.ppt

- Количество слайдов: 39

Chapter 3 • Working With Financial Statements Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 3 • Working With Financial Statements Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Key Concepts and Skills • Understand sources and uses of cash and the Statement of Cash Flows • Know how to standardize financial statements for comparison purposes • Know how to compute and interpret important financial ratios • Be able to compute and interpret the Du. Pont Identity • Understand the problems and pitfalls in financial statement analysis 1

Key Concepts and Skills • Understand sources and uses of cash and the Statement of Cash Flows • Know how to standardize financial statements for comparison purposes • Know how to compute and interpret important financial ratios • Be able to compute and interpret the Du. Pont Identity • Understand the problems and pitfalls in financial statement analysis 1

Chapter Outline • Cash Flow and Financial Statements: A Closer Look • Standardized Financial Statements • Ratio Analysis • The Du. Pont Identity • Using Financial Statement Information 2

Chapter Outline • Cash Flow and Financial Statements: A Closer Look • Standardized Financial Statements • Ratio Analysis • The Du. Pont Identity • Using Financial Statement Information 2

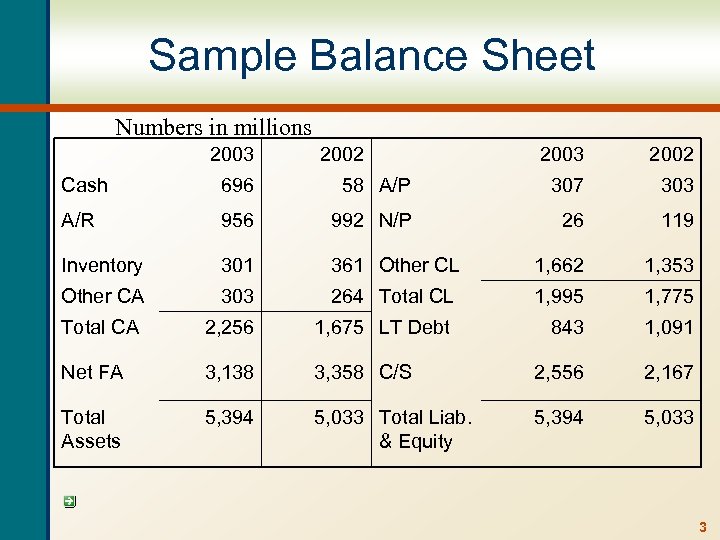

Sample Balance Sheet Numbers in millions 2003 2002 Cash 696 58 A/P 307 303 A/R 956 992 N/P 26 119 Inventory 301 361 Other CL 1, 662 1, 353 Other CA 303 264 Total CL 1, 995 1, 775 Total CA 2, 256 1, 675 LT Debt 843 1, 091 Net FA 3, 138 3, 358 C/S 2, 556 2, 167 Total Assets 5, 394 5, 033 Total Liab. & Equity 5, 394 5, 033 3

Sample Balance Sheet Numbers in millions 2003 2002 Cash 696 58 A/P 307 303 A/R 956 992 N/P 26 119 Inventory 301 361 Other CL 1, 662 1, 353 Other CA 303 264 Total CL 1, 995 1, 775 Total CA 2, 256 1, 675 LT Debt 843 1, 091 Net FA 3, 138 3, 358 C/S 2, 556 2, 167 Total Assets 5, 394 5, 033 Total Liab. & Equity 5, 394 5, 033 3

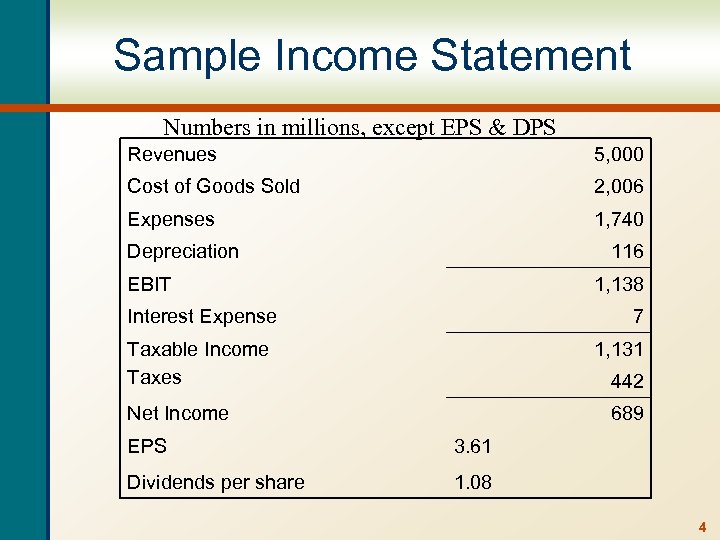

Sample Income Statement Numbers in millions, except EPS & DPS Revenues 5, 000 Cost of Goods Sold 2, 006 Expenses 1, 740 Depreciation 116 EBIT 1, 138 Interest Expense 7 Taxable Income Taxes 1, 131 442 Net Income 689 EPS 3. 61 Dividends per share 1. 08 4

Sample Income Statement Numbers in millions, except EPS & DPS Revenues 5, 000 Cost of Goods Sold 2, 006 Expenses 1, 740 Depreciation 116 EBIT 1, 138 Interest Expense 7 Taxable Income Taxes 1, 131 442 Net Income 689 EPS 3. 61 Dividends per share 1. 08 4

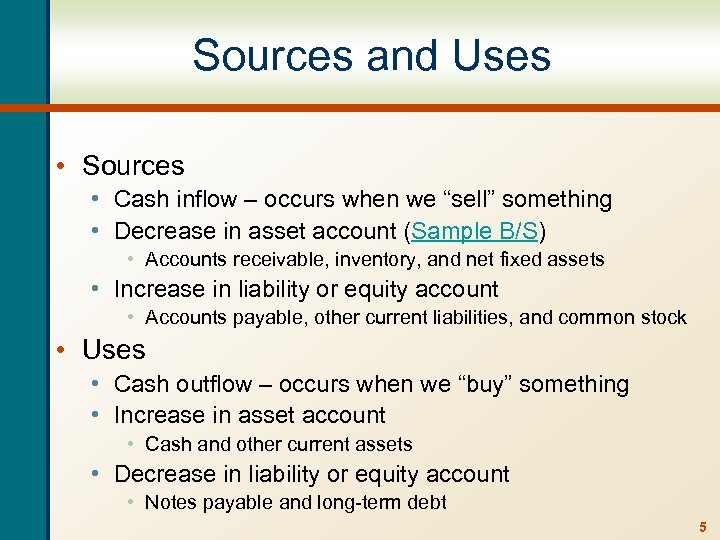

Sources and Uses • Sources • Cash inflow – occurs when we “sell” something • Decrease in asset account (Sample B/S) • Accounts receivable, inventory, and net fixed assets • Increase in liability or equity account • Accounts payable, other current liabilities, and common stock • Uses • Cash outflow – occurs when we “buy” something • Increase in asset account • Cash and other current assets • Decrease in liability or equity account • Notes payable and long-term debt 5

Sources and Uses • Sources • Cash inflow – occurs when we “sell” something • Decrease in asset account (Sample B/S) • Accounts receivable, inventory, and net fixed assets • Increase in liability or equity account • Accounts payable, other current liabilities, and common stock • Uses • Cash outflow – occurs when we “buy” something • Increase in asset account • Cash and other current assets • Decrease in liability or equity account • Notes payable and long-term debt 5

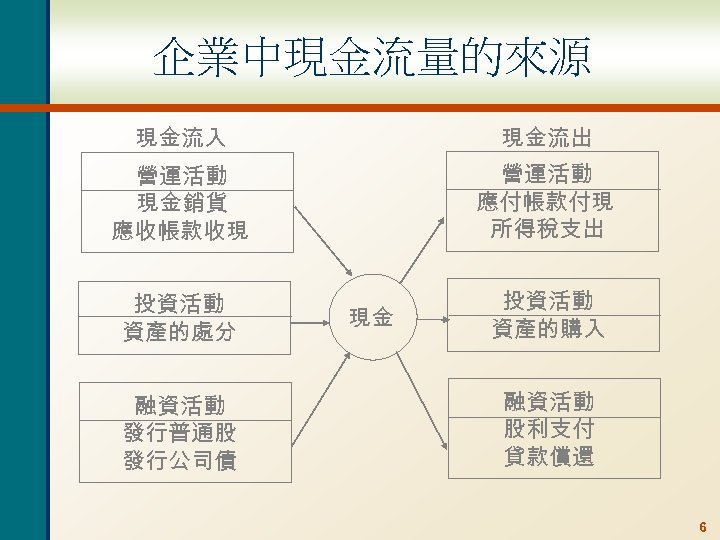

企業中現金流量的來源 現金流入 現金流出 營運活動 現金銷貨 應收帳款收現 營運活動 應付帳款付現 所得稅支出 投資活動 資產的處分 投資活動 資產的購入 融資活動 發行普通股 發行公司債 現金 融資活動 股利支付 貸款償還 6

企業中現金流量的來源 現金流入 現金流出 營運活動 現金銷貨 應收帳款收現 營運活動 應付帳款付現 所得稅支出 投資活動 資產的處分 投資活動 資產的購入 融資活動 發行普通股 發行公司債 現金 融資活動 股利支付 貸款償還 6

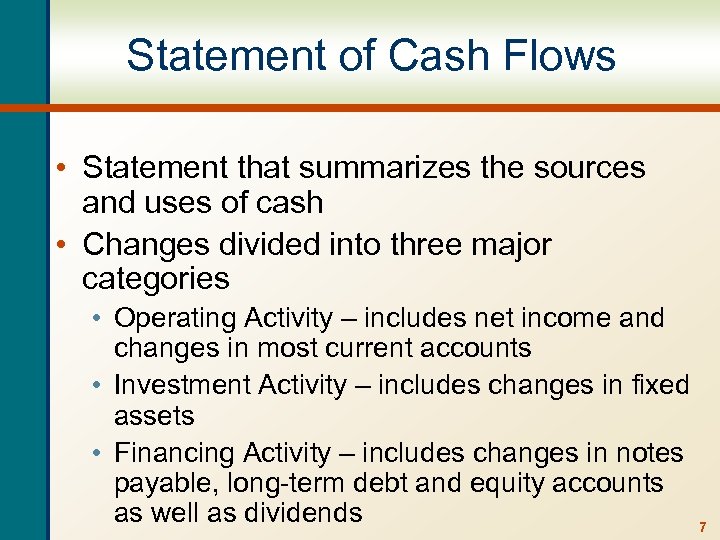

Statement of Cash Flows • Statement that summarizes the sources and uses of cash • Changes divided into three major categories • Operating Activity – includes net income and changes in most current accounts • Investment Activity – includes changes in fixed assets • Financing Activity – includes changes in notes payable, long-term debt and equity accounts as well as dividends 7

Statement of Cash Flows • Statement that summarizes the sources and uses of cash • Changes divided into three major categories • Operating Activity – includes net income and changes in most current accounts • Investment Activity – includes changes in fixed assets • Financing Activity – includes changes in notes payable, long-term debt and equity accounts as well as dividends 7

Sample Statement of Cash Flows Numbers in millions Cash, beginning of year 58 Operating Activity Financing Activity Decrease in Notes Payable Net Income 689 Decrease in LT Debt Plus: Depreciation 116 Decrease in C/S (minus RE) Decrease in A/R 36 Decrease in Inventory 60 Increase in A/P Increase in Other CL Less: Increase in CA Net Cash from Operations 4 309 Dividends Paid Net Cash from Financing -93 -248 -94 -206 -641 Net Increase in Cash 638 Cash End of Year 696 -39 1, 175 Investment Activity Sale of Fixed Assets Net Cash from Investments 104 8

Sample Statement of Cash Flows Numbers in millions Cash, beginning of year 58 Operating Activity Financing Activity Decrease in Notes Payable Net Income 689 Decrease in LT Debt Plus: Depreciation 116 Decrease in C/S (minus RE) Decrease in A/R 36 Decrease in Inventory 60 Increase in A/P Increase in Other CL Less: Increase in CA Net Cash from Operations 4 309 Dividends Paid Net Cash from Financing -93 -248 -94 -206 -641 Net Increase in Cash 638 Cash End of Year 696 -39 1, 175 Investment Activity Sale of Fixed Assets Net Cash from Investments 104 8

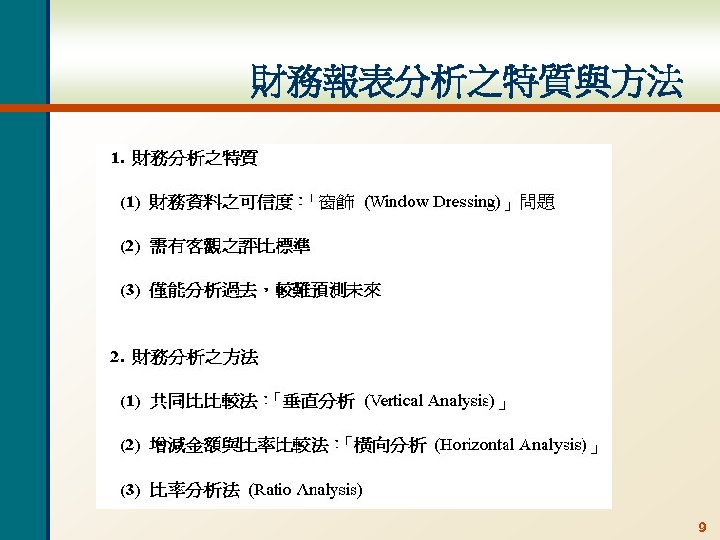

財務報表分析之特質與方法 9

財務報表分析之特質與方法 9

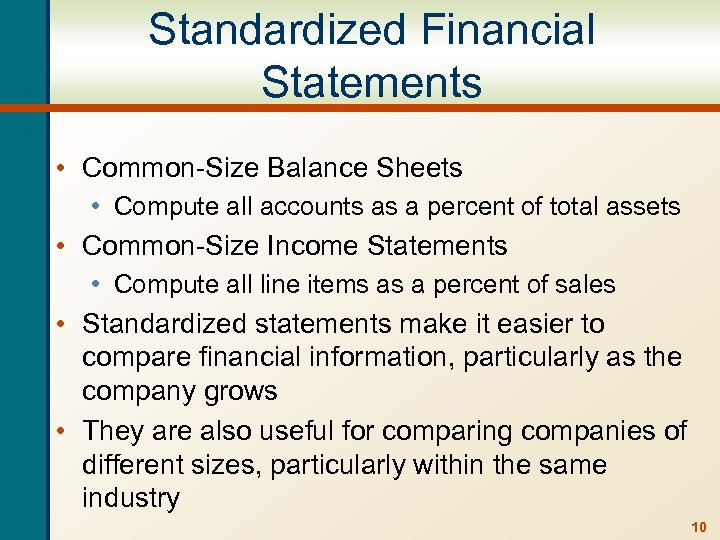

Standardized Financial Statements • Common-Size Balance Sheets • Compute all accounts as a percent of total assets • Common-Size Income Statements • Compute all line items as a percent of sales • Standardized statements make it easier to compare financial information, particularly as the company grows • They are also useful for comparing companies of different sizes, particularly within the same industry 10

Standardized Financial Statements • Common-Size Balance Sheets • Compute all accounts as a percent of total assets • Common-Size Income Statements • Compute all line items as a percent of sales • Standardized statements make it easier to compare financial information, particularly as the company grows • They are also useful for comparing companies of different sizes, particularly within the same industry 10

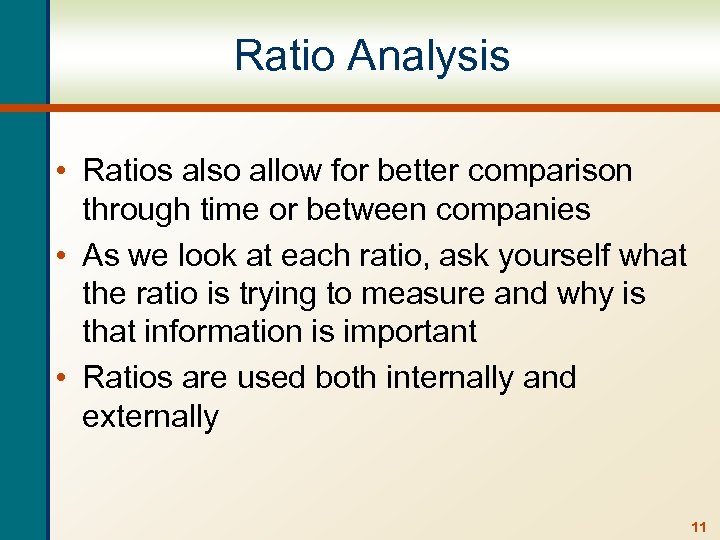

Ratio Analysis • Ratios also allow for better comparison through time or between companies • As we look at each ratio, ask yourself what the ratio is trying to measure and why is that information is important • Ratios are used both internally and externally 11

Ratio Analysis • Ratios also allow for better comparison through time or between companies • As we look at each ratio, ask yourself what the ratio is trying to measure and why is that information is important • Ratios are used both internally and externally 11

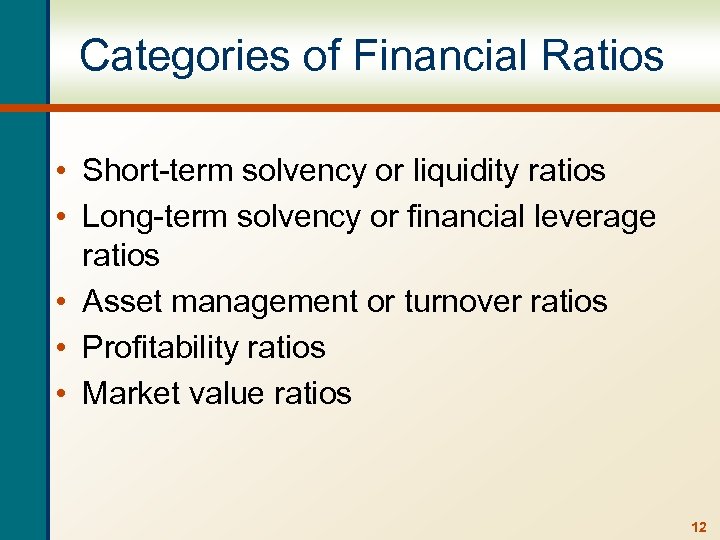

Categories of Financial Ratios • Short-term solvency or liquidity ratios • Long-term solvency or financial leverage ratios • Asset management or turnover ratios • Profitability ratios • Market value ratios 12

Categories of Financial Ratios • Short-term solvency or liquidity ratios • Long-term solvency or financial leverage ratios • Asset management or turnover ratios • Profitability ratios • Market value ratios 12

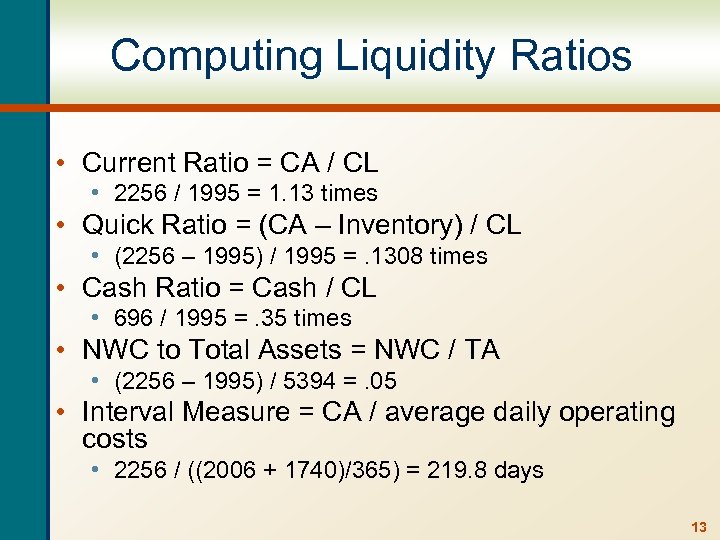

Computing Liquidity Ratios • Current Ratio = CA / CL • 2256 / 1995 = 1. 13 times • Quick Ratio = (CA – Inventory) / CL • (2256 – 1995) / 1995 =. 1308 times • Cash Ratio = Cash / CL • 696 / 1995 =. 35 times • NWC to Total Assets = NWC / TA • (2256 – 1995) / 5394 =. 05 • Interval Measure = CA / average daily operating costs • 2256 / ((2006 + 1740)/365) = 219. 8 days 13

Computing Liquidity Ratios • Current Ratio = CA / CL • 2256 / 1995 = 1. 13 times • Quick Ratio = (CA – Inventory) / CL • (2256 – 1995) / 1995 =. 1308 times • Cash Ratio = Cash / CL • 696 / 1995 =. 35 times • NWC to Total Assets = NWC / TA • (2256 – 1995) / 5394 =. 05 • Interval Measure = CA / average daily operating costs • 2256 / ((2006 + 1740)/365) = 219. 8 days 13

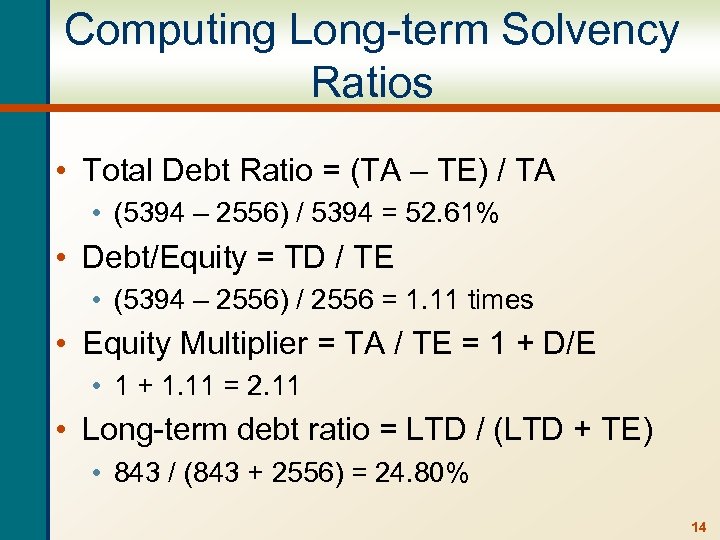

Computing Long-term Solvency Ratios • Total Debt Ratio = (TA – TE) / TA • (5394 – 2556) / 5394 = 52. 61% • Debt/Equity = TD / TE • (5394 – 2556) / 2556 = 1. 11 times • Equity Multiplier = TA / TE = 1 + D/E • 1 + 1. 11 = 2. 11 • Long-term debt ratio = LTD / (LTD + TE) • 843 / (843 + 2556) = 24. 80% 14

Computing Long-term Solvency Ratios • Total Debt Ratio = (TA – TE) / TA • (5394 – 2556) / 5394 = 52. 61% • Debt/Equity = TD / TE • (5394 – 2556) / 2556 = 1. 11 times • Equity Multiplier = TA / TE = 1 + D/E • 1 + 1. 11 = 2. 11 • Long-term debt ratio = LTD / (LTD + TE) • 843 / (843 + 2556) = 24. 80% 14

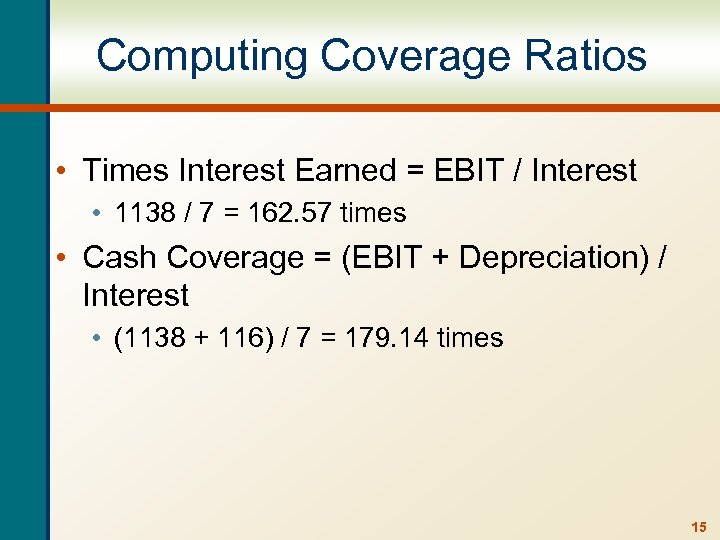

Computing Coverage Ratios • Times Interest Earned = EBIT / Interest • 1138 / 7 = 162. 57 times • Cash Coverage = (EBIT + Depreciation) / Interest • (1138 + 116) / 7 = 179. 14 times 15

Computing Coverage Ratios • Times Interest Earned = EBIT / Interest • 1138 / 7 = 162. 57 times • Cash Coverage = (EBIT + Depreciation) / Interest • (1138 + 116) / 7 = 179. 14 times 15

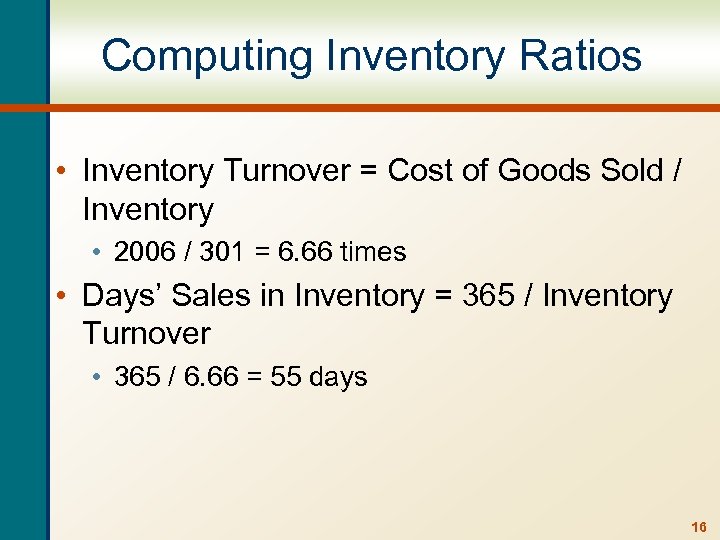

Computing Inventory Ratios • Inventory Turnover = Cost of Goods Sold / Inventory • 2006 / 301 = 6. 66 times • Days’ Sales in Inventory = 365 / Inventory Turnover • 365 / 6. 66 = 55 days 16

Computing Inventory Ratios • Inventory Turnover = Cost of Goods Sold / Inventory • 2006 / 301 = 6. 66 times • Days’ Sales in Inventory = 365 / Inventory Turnover • 365 / 6. 66 = 55 days 16

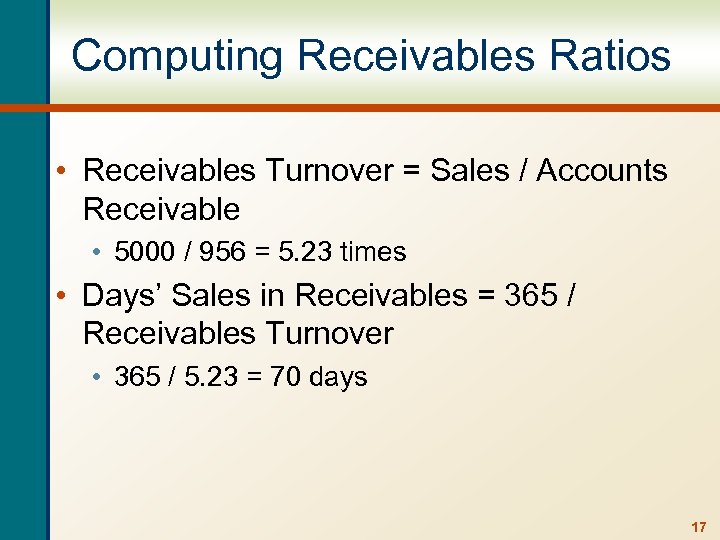

Computing Receivables Ratios • Receivables Turnover = Sales / Accounts Receivable • 5000 / 956 = 5. 23 times • Days’ Sales in Receivables = 365 / Receivables Turnover • 365 / 5. 23 = 70 days 17

Computing Receivables Ratios • Receivables Turnover = Sales / Accounts Receivable • 5000 / 956 = 5. 23 times • Days’ Sales in Receivables = 365 / Receivables Turnover • 365 / 5. 23 = 70 days 17

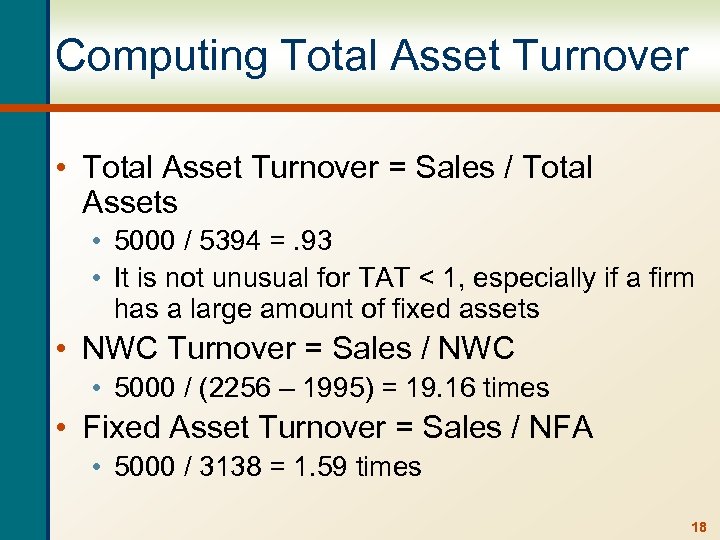

Computing Total Asset Turnover • Total Asset Turnover = Sales / Total Assets • 5000 / 5394 =. 93 • It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets • NWC Turnover = Sales / NWC • 5000 / (2256 – 1995) = 19. 16 times • Fixed Asset Turnover = Sales / NFA • 5000 / 3138 = 1. 59 times 18

Computing Total Asset Turnover • Total Asset Turnover = Sales / Total Assets • 5000 / 5394 =. 93 • It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets • NWC Turnover = Sales / NWC • 5000 / (2256 – 1995) = 19. 16 times • Fixed Asset Turnover = Sales / NFA • 5000 / 3138 = 1. 59 times 18

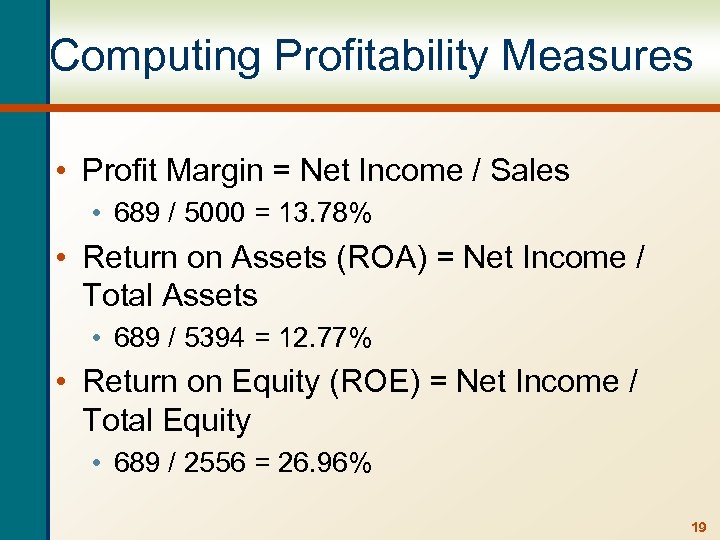

Computing Profitability Measures • Profit Margin = Net Income / Sales • 689 / 5000 = 13. 78% • Return on Assets (ROA) = Net Income / Total Assets • 689 / 5394 = 12. 77% • Return on Equity (ROE) = Net Income / Total Equity • 689 / 2556 = 26. 96% 19

Computing Profitability Measures • Profit Margin = Net Income / Sales • 689 / 5000 = 13. 78% • Return on Assets (ROA) = Net Income / Total Assets • 689 / 5394 = 12. 77% • Return on Equity (ROE) = Net Income / Total Equity • 689 / 2556 = 26. 96% 19

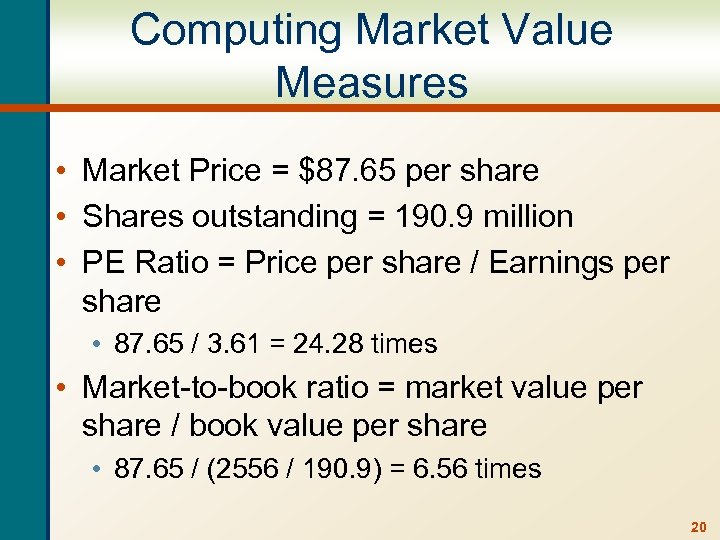

Computing Market Value Measures • Market Price = $87. 65 per share • Shares outstanding = 190. 9 million • PE Ratio = Price per share / Earnings per share • 87. 65 / 3. 61 = 24. 28 times • Market-to-book ratio = market value per share / book value per share • 87. 65 / (2556 / 190. 9) = 6. 56 times 20

Computing Market Value Measures • Market Price = $87. 65 per share • Shares outstanding = 190. 9 million • PE Ratio = Price per share / Earnings per share • 87. 65 / 3. 61 = 24. 28 times • Market-to-book ratio = market value per share / book value per share • 87. 65 / (2556 / 190. 9) = 6. 56 times 20

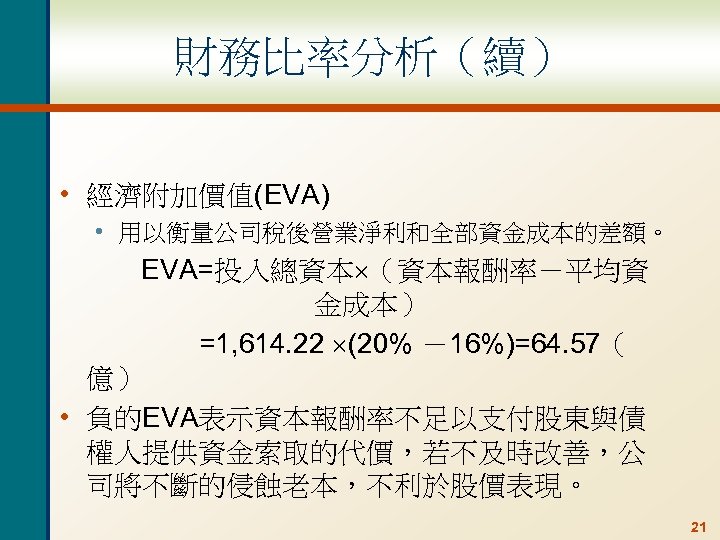

財務比率分析(續) • 經濟附加價值(EVA) • 用以衡量公司稅後營業淨利和全部資金成本的差額。 EVA=投入總資本 (資本報酬率-平均資 金成本) =1, 614. 22 (20% -16%)=64. 57( 億) • 負的EVA表示資本報酬率不足以支付股東與債 權人提供資金索取的代價,若不及時改善,公 司將不斷的侵蝕老本,不利於股價表現。 21

財務比率分析(續) • 經濟附加價值(EVA) • 用以衡量公司稅後營業淨利和全部資金成本的差額。 EVA=投入總資本 (資本報酬率-平均資 金成本) =1, 614. 22 (20% -16%)=64. 57( 億) • 負的EVA表示資本報酬率不足以支付股東與債 權人提供資金索取的代價,若不及時改善,公 司將不斷的侵蝕老本,不利於股價表現。 21

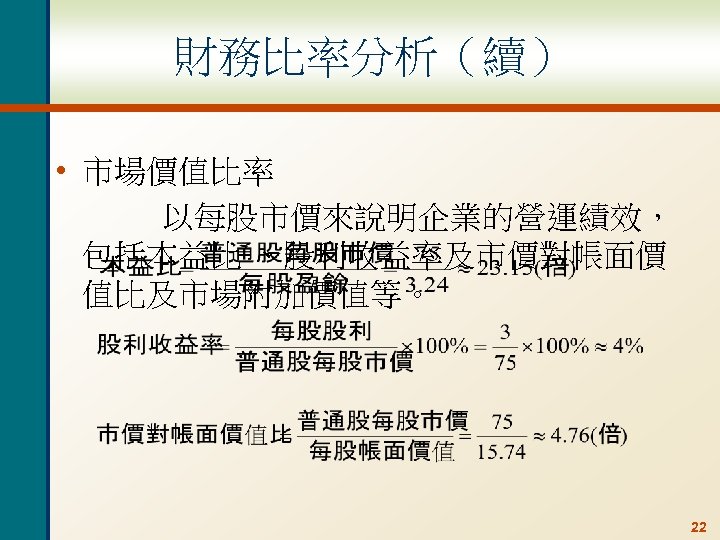

財務比率分析(續) • 市場價值比率 以每股市價來說明企業的營運績效, 包括本益比 、股利收益率及市價對帳面價 值比及市場附加價值等。 22

財務比率分析(續) • 市場價值比率 以每股市價來說明企業的營運績效, 包括本益比 、股利收益率及市價對帳面價 值比及市場附加價值等。 22

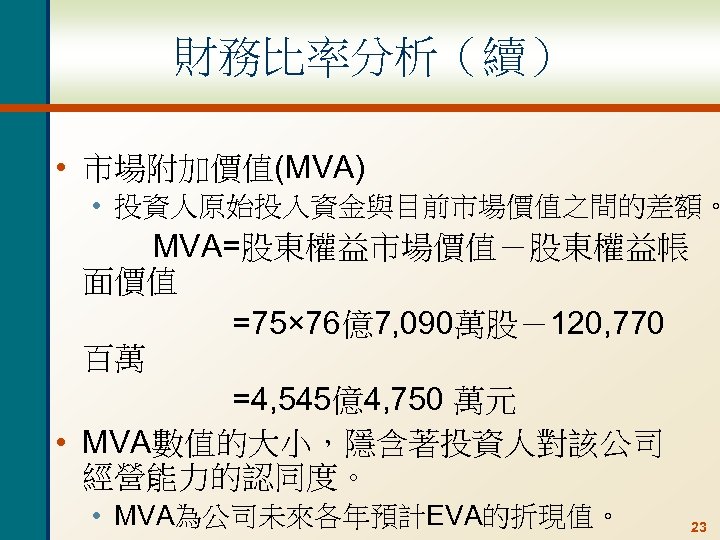

財務比率分析(續) • 市場附加價值(MVA) • 投資人原始投入資金與目前市場價值之間的差額。 MVA=股東權益市場價值-股東權益帳 面價值 =75× 76億7, 090萬股-120, 770 百萬 =4, 545億4, 750 萬元 • MVA數值的大小,隱含著投資人對該公司 經營能力的認同度。 • MVA為公司未來各年預計EVA的折現值。 23

財務比率分析(續) • 市場附加價值(MVA) • 投資人原始投入資金與目前市場價值之間的差額。 MVA=股東權益市場價值-股東權益帳 面價值 =75× 76億7, 090萬股-120, 770 百萬 =4, 545億4, 750 萬元 • MVA數值的大小,隱含著投資人對該公司 經營能力的認同度。 • MVA為公司未來各年預計EVA的折現值。 23

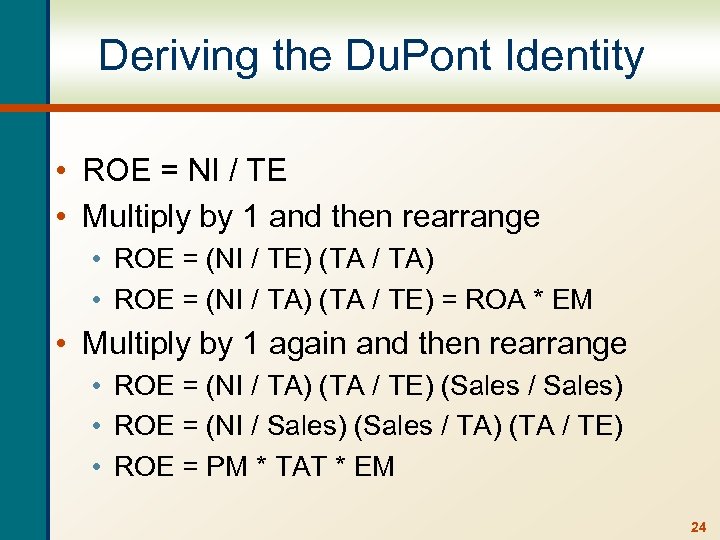

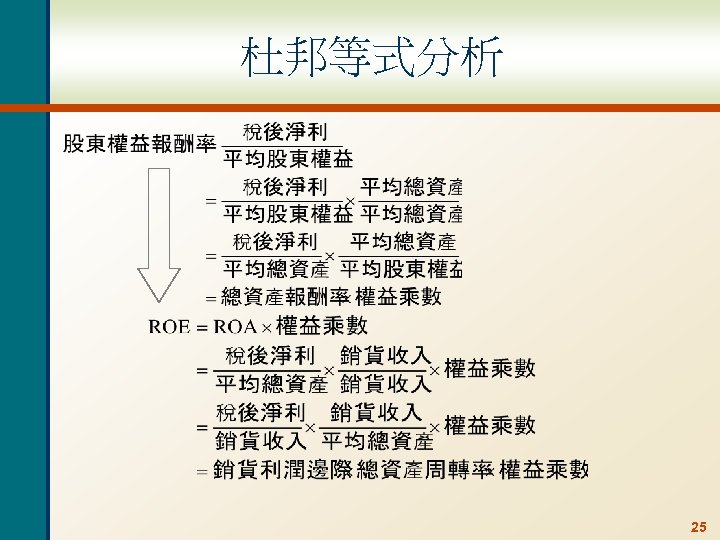

Deriving the Du. Pont Identity • ROE = NI / TE • Multiply by 1 and then rearrange • ROE = (NI / TE) (TA / TA) • ROE = (NI / TA) (TA / TE) = ROA * EM • Multiply by 1 again and then rearrange • ROE = (NI / TA) (TA / TE) (Sales / Sales) • ROE = (NI / Sales) (Sales / TA) (TA / TE) • ROE = PM * TAT * EM 24

Deriving the Du. Pont Identity • ROE = NI / TE • Multiply by 1 and then rearrange • ROE = (NI / TE) (TA / TA) • ROE = (NI / TA) (TA / TE) = ROA * EM • Multiply by 1 again and then rearrange • ROE = (NI / TA) (TA / TE) (Sales / Sales) • ROE = (NI / Sales) (Sales / TA) (TA / TE) • ROE = PM * TAT * EM 24

杜邦等式分析 25

杜邦等式分析 25

Using the Du. Pont Identity • ROE = PM * TAT * EM • Profit margin is a measure of the firm’s operating efficiency – how well does it control costs • Total asset turnover is a measure of the firm’s asset use efficiency – how well does it manage its assets • Equity multiplier is a measure of the firm’s financial leverage 26

Using the Du. Pont Identity • ROE = PM * TAT * EM • Profit margin is a measure of the firm’s operating efficiency – how well does it control costs • Total asset turnover is a measure of the firm’s asset use efficiency – how well does it manage its assets • Equity multiplier is a measure of the firm’s financial leverage 26

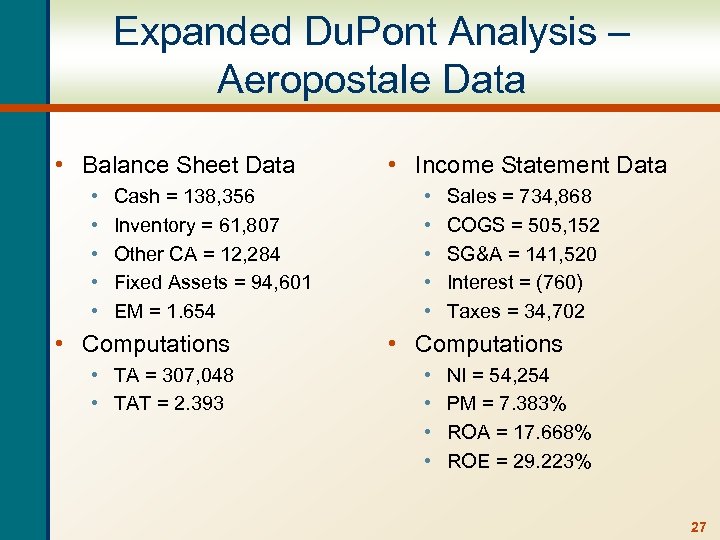

Expanded Du. Pont Analysis – Aeropostale Data • Balance Sheet Data • • • Cash = 138, 356 Inventory = 61, 807 Other CA = 12, 284 Fixed Assets = 94, 601 EM = 1. 654 • Computations • TA = 307, 048 • TAT = 2. 393 • Income Statement Data • • • Sales = 734, 868 COGS = 505, 152 SG&A = 141, 520 Interest = (760) Taxes = 34, 702 • Computations • • NI = 54, 254 PM = 7. 383% ROA = 17. 668% ROE = 29. 223% 27

Expanded Du. Pont Analysis – Aeropostale Data • Balance Sheet Data • • • Cash = 138, 356 Inventory = 61, 807 Other CA = 12, 284 Fixed Assets = 94, 601 EM = 1. 654 • Computations • TA = 307, 048 • TAT = 2. 393 • Income Statement Data • • • Sales = 734, 868 COGS = 505, 152 SG&A = 141, 520 Interest = (760) Taxes = 34, 702 • Computations • • NI = 54, 254 PM = 7. 383% ROA = 17. 668% ROE = 29. 223% 27

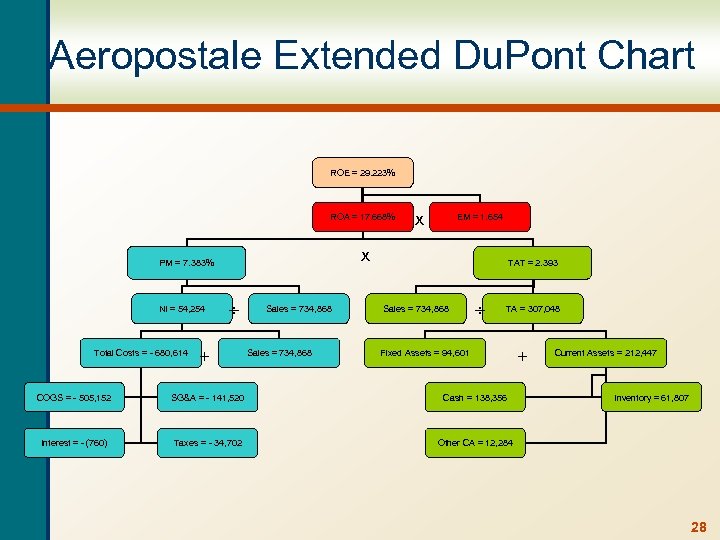

Aeropostale Extended Du. Pont Chart ROE = 29. 223% ROA = 17. 668% Total Costs = - 680, 614 EM = 1. 654 x PM = 7. 383% NI = 54, 254 x + Sales = 734, 868 TAT = 2. 393 Sales = 734, 868 TA = 307, 048 Fixed Assets = 94, 601 COGS = - 505, 152 SG&A = - 141, 520 Cash = 138, 356 Interest = - (760) Taxes = - 34, 702 + Current Assets = 212, 447 Inventory = 61, 807 Other CA = 12, 284 28

Aeropostale Extended Du. Pont Chart ROE = 29. 223% ROA = 17. 668% Total Costs = - 680, 614 EM = 1. 654 x PM = 7. 383% NI = 54, 254 x + Sales = 734, 868 TAT = 2. 393 Sales = 734, 868 TA = 307, 048 Fixed Assets = 94, 601 COGS = - 505, 152 SG&A = - 141, 520 Cash = 138, 356 Interest = - (760) Taxes = - 34, 702 + Current Assets = 212, 447 Inventory = 61, 807 Other CA = 12, 284 28

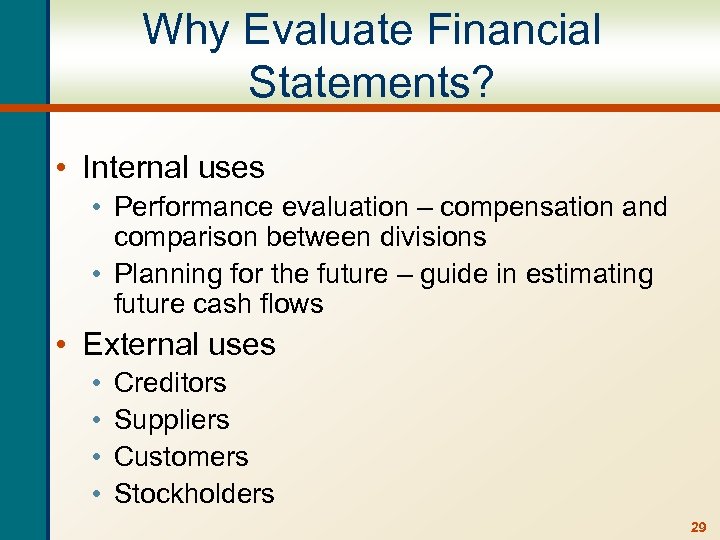

Why Evaluate Financial Statements? • Internal uses • Performance evaluation – compensation and comparison between divisions • Planning for the future – guide in estimating future cash flows • External uses • • Creditors Suppliers Customers Stockholders 29

Why Evaluate Financial Statements? • Internal uses • Performance evaluation – compensation and comparison between divisions • Planning for the future – guide in estimating future cash flows • External uses • • Creditors Suppliers Customers Stockholders 29

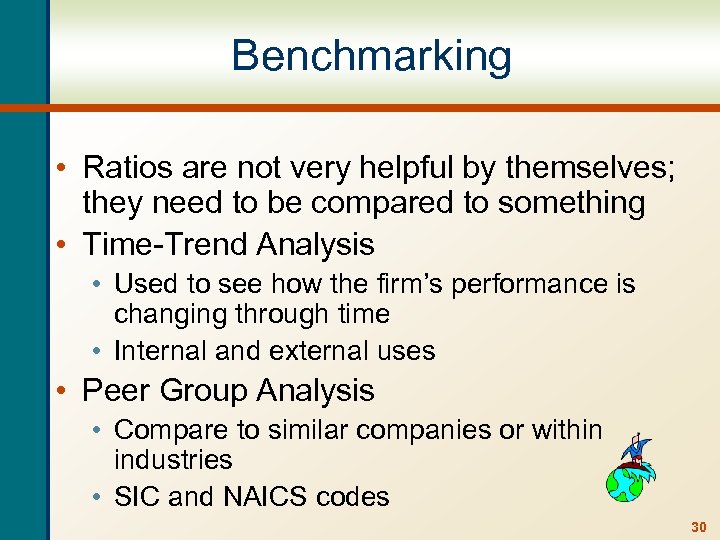

Benchmarking • Ratios are not very helpful by themselves; they need to be compared to something • Time-Trend Analysis • Used to see how the firm’s performance is changing through time • Internal and external uses • Peer Group Analysis • Compare to similar companies or within industries • SIC and NAICS codes 30

Benchmarking • Ratios are not very helpful by themselves; they need to be compared to something • Time-Trend Analysis • Used to see how the firm’s performance is changing through time • Internal and external uses • Peer Group Analysis • Compare to similar companies or within industries • SIC and NAICS codes 30

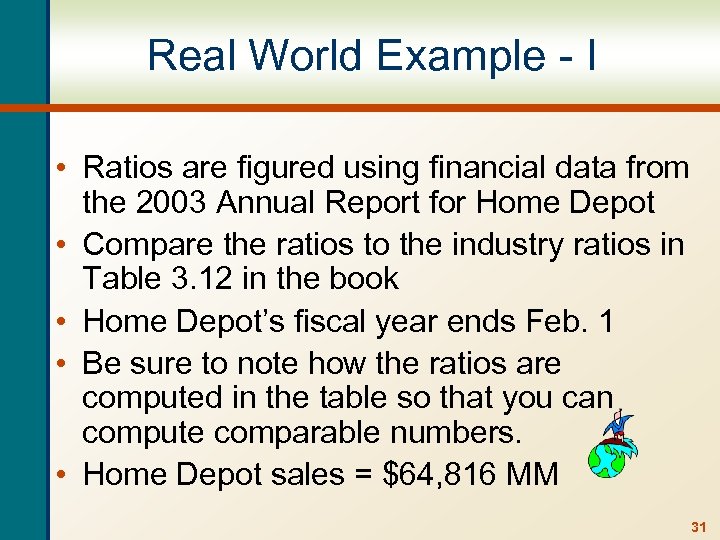

Real World Example - I • Ratios are figured using financial data from the 2003 Annual Report for Home Depot • Compare the ratios to the industry ratios in Table 3. 12 in the book • Home Depot’s fiscal year ends Feb. 1 • Be sure to note how the ratios are computed in the table so that you can compute comparable numbers. • Home Depot sales = $64, 816 MM 31

Real World Example - I • Ratios are figured using financial data from the 2003 Annual Report for Home Depot • Compare the ratios to the industry ratios in Table 3. 12 in the book • Home Depot’s fiscal year ends Feb. 1 • Be sure to note how the ratios are computed in the table so that you can compute comparable numbers. • Home Depot sales = $64, 816 MM 31

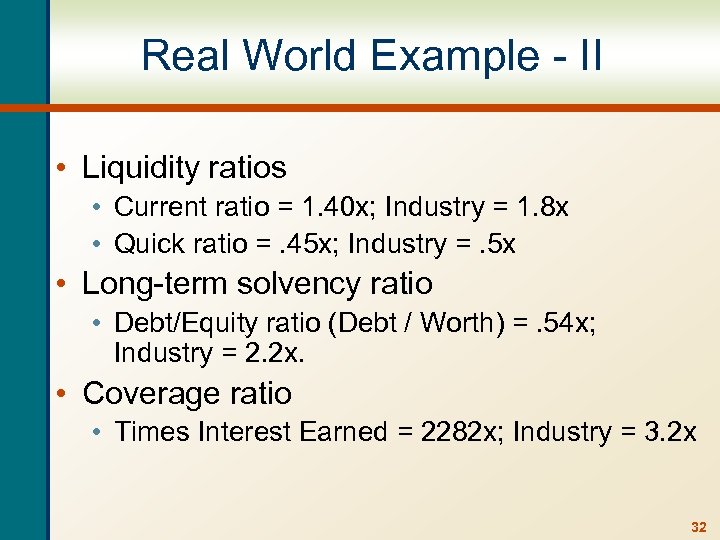

Real World Example - II • Liquidity ratios • Current ratio = 1. 40 x; Industry = 1. 8 x • Quick ratio =. 45 x; Industry =. 5 x • Long-term solvency ratio • Debt/Equity ratio (Debt / Worth) =. 54 x; Industry = 2. 2 x. • Coverage ratio • Times Interest Earned = 2282 x; Industry = 3. 2 x 32

Real World Example - II • Liquidity ratios • Current ratio = 1. 40 x; Industry = 1. 8 x • Quick ratio =. 45 x; Industry =. 5 x • Long-term solvency ratio • Debt/Equity ratio (Debt / Worth) =. 54 x; Industry = 2. 2 x. • Coverage ratio • Times Interest Earned = 2282 x; Industry = 3. 2 x 32

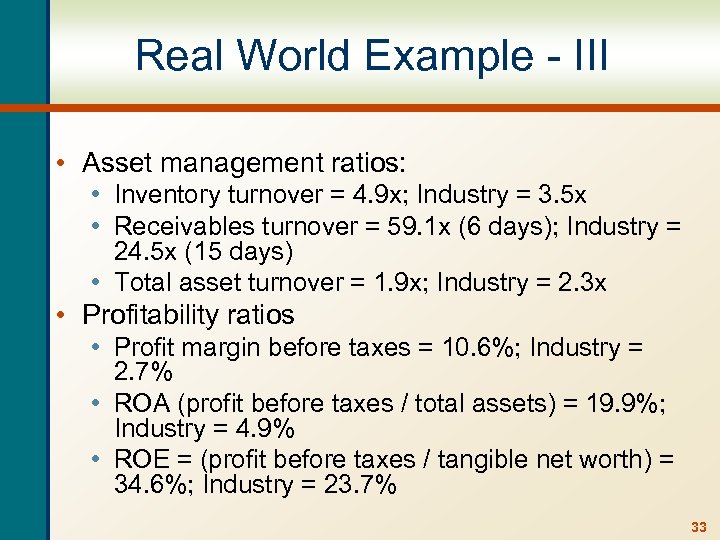

Real World Example - III • Asset management ratios: • Inventory turnover = 4. 9 x; Industry = 3. 5 x • Receivables turnover = 59. 1 x (6 days); Industry = 24. 5 x (15 days) • Total asset turnover = 1. 9 x; Industry = 2. 3 x • Profitability ratios • Profit margin before taxes = 10. 6%; Industry = 2. 7% • ROA (profit before taxes / total assets) = 19. 9%; Industry = 4. 9% • ROE = (profit before taxes / tangible net worth) = 34. 6%; Industry = 23. 7% 33

Real World Example - III • Asset management ratios: • Inventory turnover = 4. 9 x; Industry = 3. 5 x • Receivables turnover = 59. 1 x (6 days); Industry = 24. 5 x (15 days) • Total asset turnover = 1. 9 x; Industry = 2. 3 x • Profitability ratios • Profit margin before taxes = 10. 6%; Industry = 2. 7% • ROA (profit before taxes / total assets) = 19. 9%; Industry = 4. 9% • ROE = (profit before taxes / tangible net worth) = 34. 6%; Industry = 23. 7% 33

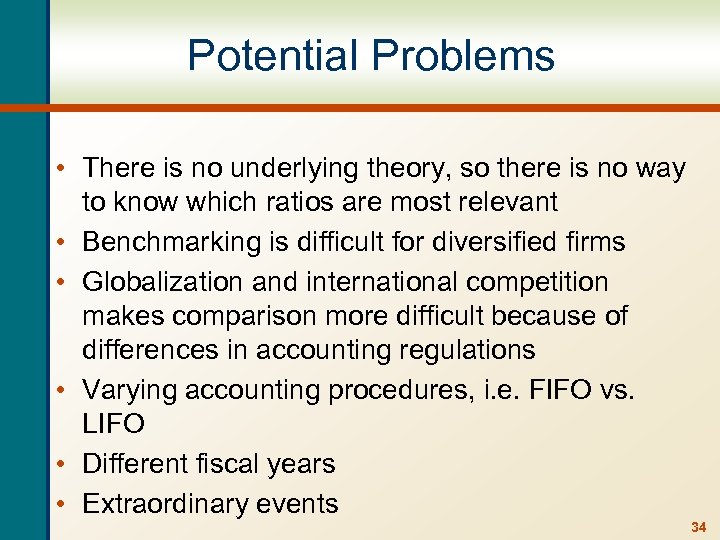

Potential Problems • There is no underlying theory, so there is no way to know which ratios are most relevant • Benchmarking is difficult for diversified firms • Globalization and international competition makes comparison more difficult because of differences in accounting regulations • Varying accounting procedures, i. e. FIFO vs. LIFO • Different fiscal years • Extraordinary events 34

Potential Problems • There is no underlying theory, so there is no way to know which ratios are most relevant • Benchmarking is difficult for diversified firms • Globalization and international competition makes comparison more difficult because of differences in accounting regulations • Varying accounting procedures, i. e. FIFO vs. LIFO • Different fiscal years • Extraordinary events 34

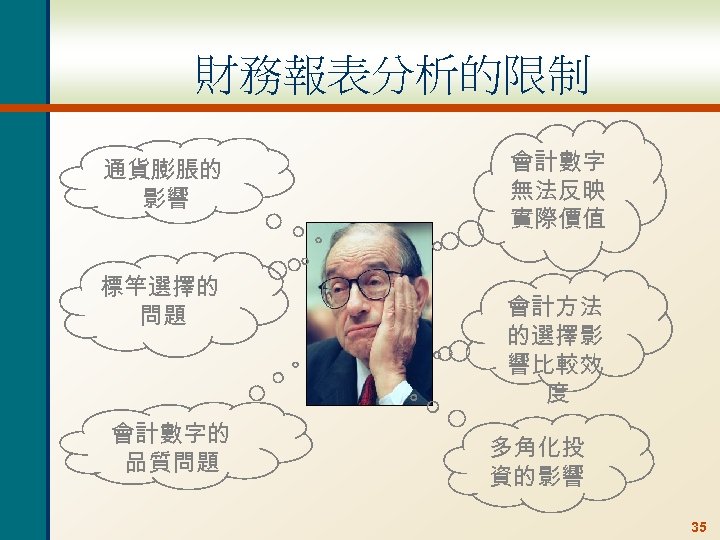

財務報表分析的限制 通貨膨脹的 影響 標竿選擇的 問題 會計數字的 品質問題 會計數字 無法反映 實際價值 會計方法 的選擇影 響比較效 度 多角化投 資的影響 35

財務報表分析的限制 通貨膨脹的 影響 標竿選擇的 問題 會計數字的 品質問題 會計數字 無法反映 實際價值 會計方法 的選擇影 響比較效 度 多角化投 資的影響 35

Work the Web Example • The Internet makes ratio analysis much easier than it has been in the past • Click on the web surfer to go to www. investor. reuters. com • Choose a company and enter its ticker symbol • Click on Ratios and then Financial Condition and see what information is available 36

Work the Web Example • The Internet makes ratio analysis much easier than it has been in the past • Click on the web surfer to go to www. investor. reuters. com • Choose a company and enter its ticker symbol • Click on Ratios and then Financial Condition and see what information is available 36

Quick Quiz • What is the Statement of Cash Flows and how do you determine sources and uses of cash? • How do you standardize balance sheets and income statements and why is standardization useful? • What are the major categories of ratios and how do you compute specific ratios within each category? • What are some of the problems associated with financial statement analysis? 37

Quick Quiz • What is the Statement of Cash Flows and how do you determine sources and uses of cash? • How do you standardize balance sheets and income statements and why is standardization useful? • What are the major categories of ratios and how do you compute specific ratios within each category? • What are some of the problems associated with financial statement analysis? 37

Chapter 3 • End of Chapter Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 3 • End of Chapter Mc. Graw-Hill/Irwin Copyright © 2006 by The Mc. Graw-Hill Companies, Inc. All rights reserved.