0e14071156b27daf31683d6aeb4b8da8.ppt

- Количество слайдов: 22

Chapter 3

Chapter 3

Understanding Financial Statements and Cash Flows

Understanding Financial Statements and Cash Flows

Basic Financial Statements l Income Statement l Balance Sheet l Statement of Cash Flows

Basic Financial Statements l Income Statement l Balance Sheet l Statement of Cash Flows

Income Statement l Profit/Loss Statement l Indicates the amount of profits generated by a firm over a given period of time l Sales – Expenses = Profit

Income Statement l Profit/Loss Statement l Indicates the amount of profits generated by a firm over a given period of time l Sales – Expenses = Profit

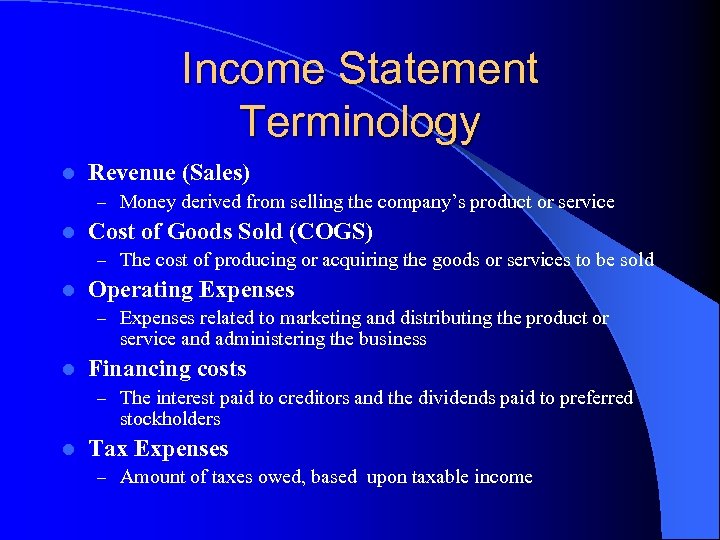

Income Statement Terminology l Revenue (Sales) – Money derived from selling the company’s product or service l Cost of Goods Sold (COGS) – The cost of producing or acquiring the goods or services to be sold l Operating Expenses – Expenses related to marketing and distributing the product or service and administering the business l Financing costs – The interest paid to creditors and the dividends paid to preferred stockholders l Tax Expenses – Amount of taxes owed, based upon taxable income

Income Statement Terminology l Revenue (Sales) – Money derived from selling the company’s product or service l Cost of Goods Sold (COGS) – The cost of producing or acquiring the goods or services to be sold l Operating Expenses – Expenses related to marketing and distributing the product or service and administering the business l Financing costs – The interest paid to creditors and the dividends paid to preferred stockholders l Tax Expenses – Amount of taxes owed, based upon taxable income

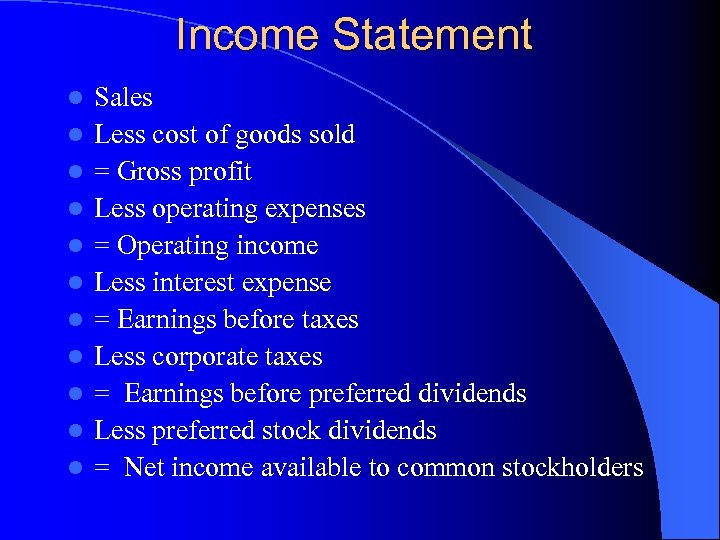

Income Statement l l l Sales Less cost of goods sold = Gross profit Less operating expenses = Operating income Less interest expense = Earnings before taxes Less corporate taxes = Earnings before preferred dividends Less preferred stock dividends = Net income available to common stockholders

Income Statement l l l Sales Less cost of goods sold = Gross profit Less operating expenses = Operating income Less interest expense = Earnings before taxes Less corporate taxes = Earnings before preferred dividends Less preferred stock dividends = Net income available to common stockholders

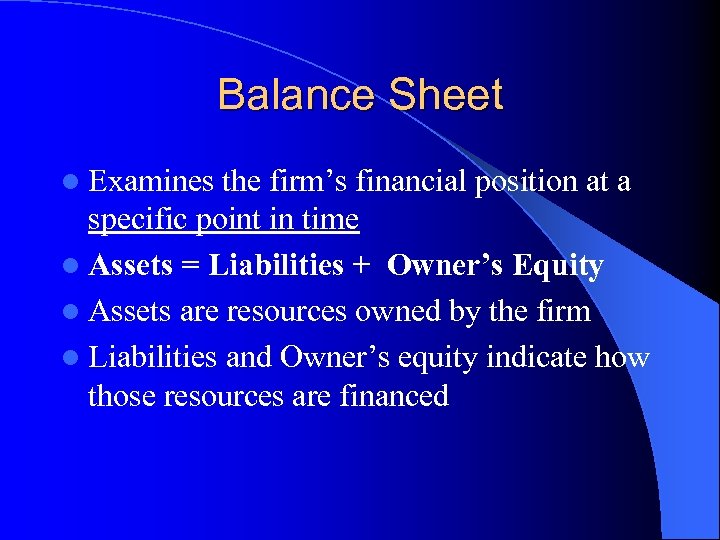

Balance Sheet l Examines the firm’s financial position at a specific point in time l Assets = Liabilities + Owner’s Equity l Assets are resources owned by the firm l Liabilities and Owner’s equity indicate how those resources are financed

Balance Sheet l Examines the firm’s financial position at a specific point in time l Assets = Liabilities + Owner’s Equity l Assets are resources owned by the firm l Liabilities and Owner’s equity indicate how those resources are financed

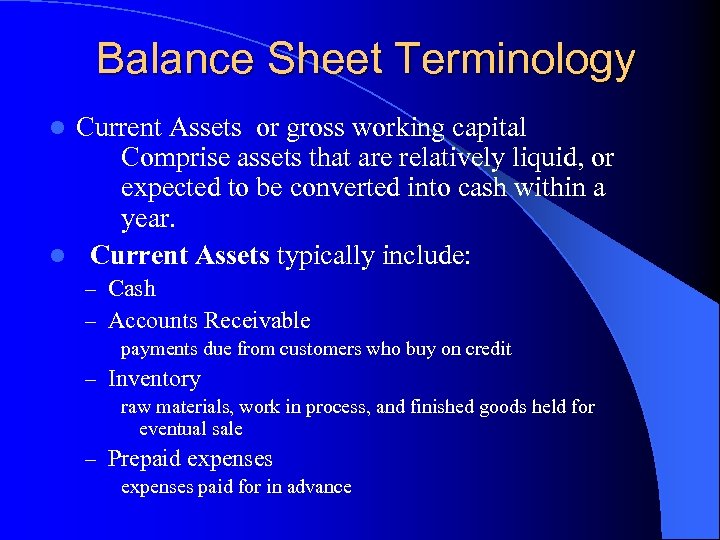

Balance Sheet Terminology Current Assets or gross working capital Comprise assets that are relatively liquid, or expected to be converted into cash within a year. l Current Assets typically include: l – Cash – Accounts Receivable payments due from customers who buy on credit – Inventory raw materials, work in process, and finished goods held for eventual sale – Prepaid expenses paid for in advance

Balance Sheet Terminology Current Assets or gross working capital Comprise assets that are relatively liquid, or expected to be converted into cash within a year. l Current Assets typically include: l – Cash – Accounts Receivable payments due from customers who buy on credit – Inventory raw materials, work in process, and finished goods held for eventual sale – Prepaid expenses paid for in advance

l Fixed Assets held for more than one year. Typically Include: – Machinery – Equipment – Land Buildings l Other Assets that are not current assets or fixed assets – Patents – Copyrights – Goodwill

l Fixed Assets held for more than one year. Typically Include: – Machinery – Equipment – Land Buildings l Other Assets that are not current assets or fixed assets – Patents – Copyrights – Goodwill

l Debt or Liabilities – Money that has been borrowed and must be repaid at some predetermined date – Debt Capital financing provided by a creditor l Current, short-term and long-term l Current or short-term must be repaid within the next 12 months l

l Debt or Liabilities – Money that has been borrowed and must be repaid at some predetermined date – Debt Capital financing provided by a creditor l Current, short-term and long-term l Current or short-term must be repaid within the next 12 months l

l Current Liabilities: – Accounts Payable l Credit extended by suppliers – Other Payables l Interest and taxes that are owed – Accrued expenses l Liabilities incurred, but not yet paid – Short-term Notes l Borrowings from a bank or lending institution due and payable within 12 months l Long-Term Debt – Loans from banks or other institutions for longer than 12 months

l Current Liabilities: – Accounts Payable l Credit extended by suppliers – Other Payables l Interest and taxes that are owed – Accrued expenses l Liabilities incurred, but not yet paid – Short-term Notes l Borrowings from a bank or lending institution due and payable within 12 months l Long-Term Debt – Loans from banks or other institutions for longer than 12 months

l Equity l Includes the shareholder’s investment – Preferred stock – Common stock l Retained Earnings – cumulative total of all the net income over the life of the firm, less common stock dividends that have been paid out l Treasury Stock – stock that was once outstanding and has been re -purchased by the company

l Equity l Includes the shareholder’s investment – Preferred stock – Common stock l Retained Earnings – cumulative total of all the net income over the life of the firm, less common stock dividends that have been paid out l Treasury Stock – stock that was once outstanding and has been re -purchased by the company

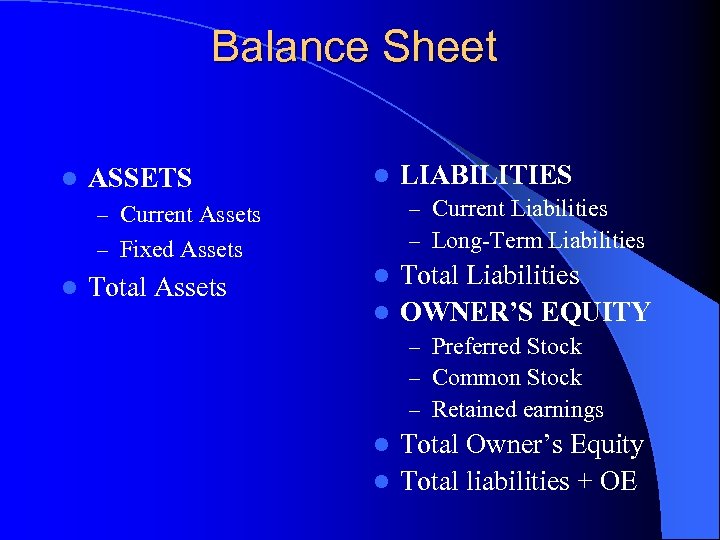

Balance Sheet l ASSETS l – Current Liabilities – Long-Term Liabilities – Current Assets – Fixed Assets l Total Assets LIABILITIES Total Liabilities l OWNER’S EQUITY l – Preferred Stock – Common Stock – Retained earnings Total Owner’s Equity l Total liabilities + OE l

Balance Sheet l ASSETS l – Current Liabilities – Long-Term Liabilities – Current Assets – Fixed Assets l Total Assets LIABILITIES Total Liabilities l OWNER’S EQUITY l – Preferred Stock – Common Stock – Retained earnings Total Owner’s Equity l Total liabilities + OE l

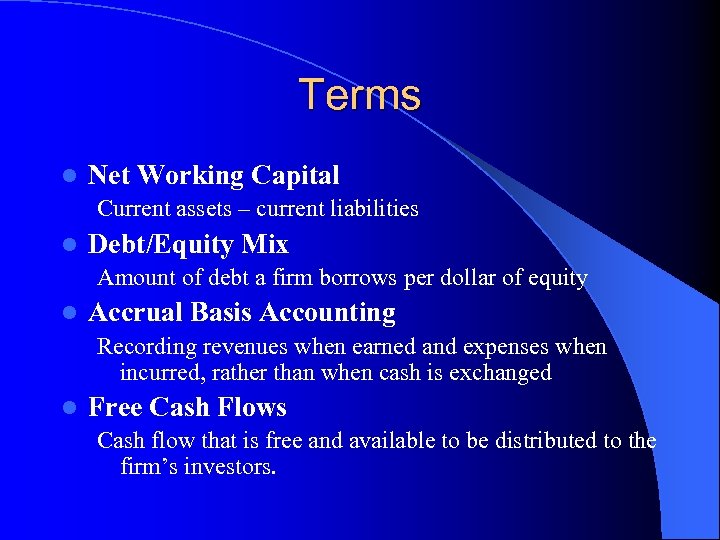

Terms l Net Working Capital Current assets – current liabilities l Debt/Equity Mix Amount of debt a firm borrows per dollar of equity l Accrual Basis Accounting Recording revenues when earned and expenses when incurred, rather than when cash is exchanged l Free Cash Flows Cash flow that is free and available to be distributed to the firm’s investors.

Terms l Net Working Capital Current assets – current liabilities l Debt/Equity Mix Amount of debt a firm borrows per dollar of equity l Accrual Basis Accounting Recording revenues when earned and expenses when incurred, rather than when cash is exchanged l Free Cash Flows Cash flow that is free and available to be distributed to the firm’s investors.

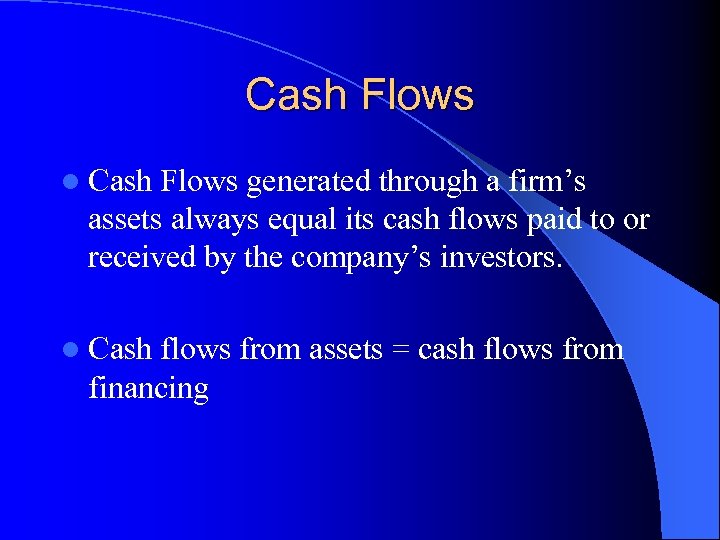

Cash Flows l Cash Flows generated through a firm’s assets always equal its cash flows paid to or received by the company’s investors. l Cash flows from assets = cash flows from financing

Cash Flows l Cash Flows generated through a firm’s assets always equal its cash flows paid to or received by the company’s investors. l Cash flows from assets = cash flows from financing

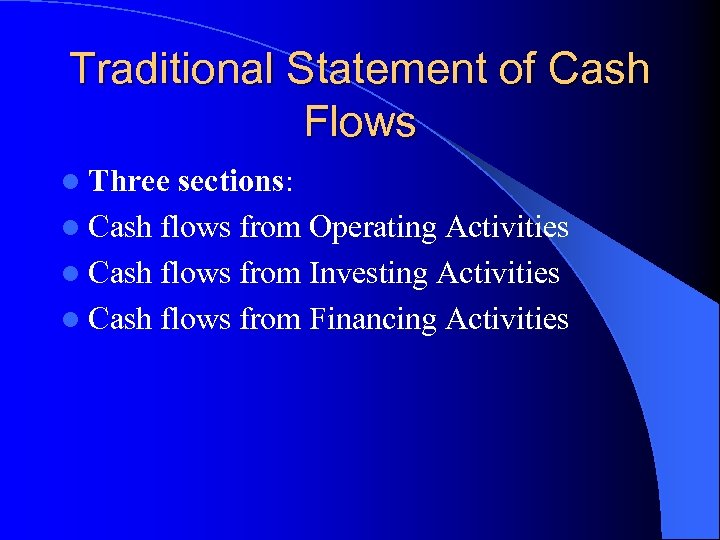

Traditional Statement of Cash Flows l Three sections: l Cash flows from Operating Activities l Cash flows from Investing Activities l Cash flows from Financing Activities

Traditional Statement of Cash Flows l Three sections: l Cash flows from Operating Activities l Cash flows from Investing Activities l Cash flows from Financing Activities

Modified Cash Flow Calculations l Cash Flows from Assets = Cash flows from Financing l Cash flows from Assets = After-tax cash flows from operations less investment in operating working capital less investments in fixed assets and other assets.

Modified Cash Flow Calculations l Cash Flows from Assets = Cash flows from Financing l Cash flows from Assets = After-tax cash flows from operations less investment in operating working capital less investments in fixed assets and other assets.

Cash Flows from Assets l After-tax cash flow from operations -- less-l Investment in operating working capital -- less -l Investment in fixed assets and other assets

Cash Flows from Assets l After-tax cash flow from operations -- less-l Investment in operating working capital -- less -l Investment in fixed assets and other assets

After-Tax Cash Flows From Operations l Operating Income l + Depreciation l = Earnings before interest, taxes , depreciation, and amortization l - Income taxes l = After-tax cash flows from operations

After-Tax Cash Flows From Operations l Operating Income l + Depreciation l = Earnings before interest, taxes , depreciation, and amortization l - Income taxes l = After-tax cash flows from operations

Change in Operating Working Capital l Change in operating working capital = l Change in current assets l - (change in accounts payable + change in accrued expenses)

Change in Operating Working Capital l Change in operating working capital = l Change in current assets l - (change in accounts payable + change in accrued expenses)

Investment in Fixed Assets l. A decrease in long-term assets indicates that the firm is selling assets, which is a source of cash or increases cash l An increase in long-term assets indicates that the firm is purchasing assets, which is a “use” of cash or causes cash to go down

Investment in Fixed Assets l. A decrease in long-term assets indicates that the firm is selling assets, which is a source of cash or increases cash l An increase in long-term assets indicates that the firm is purchasing assets, which is a “use” of cash or causes cash to go down

Cash Flows from Financing l l l l Financing Activities which generate cash include: An increase in debt (a source of cash) Issuing new stock Financing Activities which decrease cash include: Payment of interest Payment of dividends A decrease in debt (indicates payment of principal) A decrease in equity (indicates the re-purchase of outstanding stock

Cash Flows from Financing l l l l Financing Activities which generate cash include: An increase in debt (a source of cash) Issuing new stock Financing Activities which decrease cash include: Payment of interest Payment of dividends A decrease in debt (indicates payment of principal) A decrease in equity (indicates the re-purchase of outstanding stock