dbea2d0563cd046b427fcb5c1da47e44.ppt

- Количество слайдов: 33

Chapter 3: National Income: Where it Comes From and Where it Goes § Continued CHAPTER 3 National Income slide 0

Chapter 3: National Income: Where it Comes From and Where it Goes § Continued CHAPTER 3 National Income slide 0

Outline of model A closed economy, market-clearing model Supply side DONE q factor markets (supply, demand, price) DONE q determination of output/income Demand side Next q determinants of C, I, and G Equilibrium q goods market q loanable funds market CHAPTER 3 National Income slide 1

Outline of model A closed economy, market-clearing model Supply side DONE q factor markets (supply, demand, price) DONE q determination of output/income Demand side Next q determinants of C, I, and G Equilibrium q goods market q loanable funds market CHAPTER 3 National Income slide 1

Demand for goods & services Components of aggregate demand: C = consumer demand for goods and services I = demand for investment goods G = government demand for goods and services (closed economy: no NX ) CHAPTER 3 National Income slide 2

Demand for goods & services Components of aggregate demand: C = consumer demand for goods and services I = demand for investment goods G = government demand for goods and services (closed economy: no NX ) CHAPTER 3 National Income slide 2

Consumption, C § We have seen earlier that consumption has the largest share of GDP (about 2/3) § What are the determinants of consumption? § We assume that the level of consumption depends on your “disposable income” CHAPTER 3 National Income slide 3

Consumption, C § We have seen earlier that consumption has the largest share of GDP (about 2/3) § What are the determinants of consumption? § We assume that the level of consumption depends on your “disposable income” CHAPTER 3 National Income slide 3

Consumption, C § def: Disposable income is total income minus total taxes: Y – T. § Consumption function: C = C (Y – T ) CHAPTER 3 National Income C slide 4

Consumption, C § def: Disposable income is total income minus total taxes: Y – T. § Consumption function: C = C (Y – T ) CHAPTER 3 National Income C slide 4

§ In addition to disposable income (Yd ), consumption depends on one’s tendency to consume § def: Marginal propensity to consume (MPC) is the increase in C caused by a one-unit increase in disposable income: mpc=∆C/∆Yd § 0 ≤ mpc ≤ 1: If Yd increases by $1, your consumption may increase at most by $1. § Normally, it will increase by ~ 70 cents mpc = 0. 7 § mps (marginal propensity to save) = 1 -mpc = 0. 3 CHAPTER 3 National Income slide 5

§ In addition to disposable income (Yd ), consumption depends on one’s tendency to consume § def: Marginal propensity to consume (MPC) is the increase in C caused by a one-unit increase in disposable income: mpc=∆C/∆Yd § 0 ≤ mpc ≤ 1: If Yd increases by $1, your consumption may increase at most by $1. § Normally, it will increase by ~ 70 cents mpc = 0. 7 § mps (marginal propensity to save) = 1 -mpc = 0. 3 CHAPTER 3 National Income slide 5

The consumption function § C = a + b(Y-T) § a: autonomous consumption (The component of consumption that’s independent from your income) § b: mpc CHAPTER 3 National Income slide 6

The consumption function § C = a + b(Y-T) § a: autonomous consumption (The component of consumption that’s independent from your income) § b: mpc CHAPTER 3 National Income slide 6

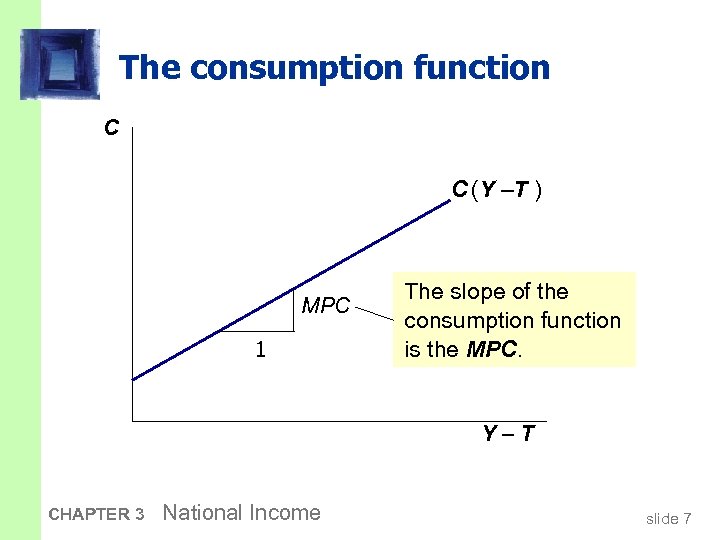

The consumption function C C (Y –T ) MPC 1 The slope of the consumption function is the MPC. Y–T CHAPTER 3 National Income slide 7

The consumption function C C (Y –T ) MPC 1 The slope of the consumption function is the MPC. Y–T CHAPTER 3 National Income slide 7

Investment, I § The investment function is I = I (r ), where r denotes the real interest rate § Real vs. Nominal Interest Rate: Nominal interest rate is the interest rate that is reported: e. g. interest rate that the bank charges when you get a loan, interest rate on your credit card, etc. § Real Interest Rate = Nominal Interest Rate – Inflation Rate CHAPTER 3 National Income slide 8

Investment, I § The investment function is I = I (r ), where r denotes the real interest rate § Real vs. Nominal Interest Rate: Nominal interest rate is the interest rate that is reported: e. g. interest rate that the bank charges when you get a loan, interest rate on your credit card, etc. § Real Interest Rate = Nominal Interest Rate – Inflation Rate CHAPTER 3 National Income slide 8

§ The real interest rate is § the cost of borrowing § the opportunity cost of using one’s own funds to finance investment spending. § A negative relationship between Investment demanded and interest rate So, r CHAPTER 3 National Income I slide 9

§ The real interest rate is § the cost of borrowing § the opportunity cost of using one’s own funds to finance investment spending. § A negative relationship between Investment demanded and interest rate So, r CHAPTER 3 National Income I slide 9

Examples § Ex: If a firm is trying to decide whether or not it should invest in a small $1 million factory, it compares the interest rate paid on the loan with the rate of return on investment. § As interest rates increase, the chances of undertaking the investment ____. § Ex: If the interest rate on your mortgage increases, the likelihood of buying a new house ____. CHAPTER 3 National Income slide 10

Examples § Ex: If a firm is trying to decide whether or not it should invest in a small $1 million factory, it compares the interest rate paid on the loan with the rate of return on investment. § As interest rates increase, the chances of undertaking the investment ____. § Ex: If the interest rate on your mortgage increases, the likelihood of buying a new house ____. CHAPTER 3 National Income slide 10

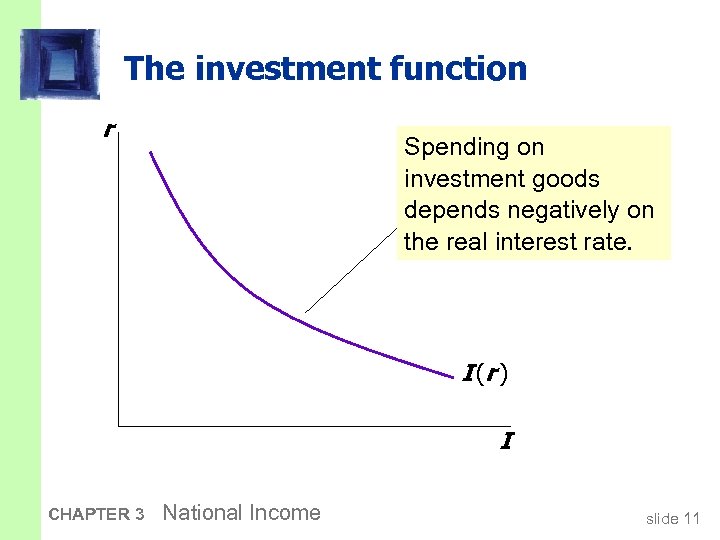

The investment function r Spending on investment goods depends negatively on the real interest rate. I (r ) I CHAPTER 3 National Income slide 11

The investment function r Spending on investment goods depends negatively on the real interest rate. I (r ) I CHAPTER 3 National Income slide 11

Government spending, G § G = govt spending on goods and services. § G excludes transfer payments (e. g. , social security benefits, unemployment insurance benefits). CHAPTER 3 National Income slide 12

Government spending, G § G = govt spending on goods and services. § G excludes transfer payments (e. g. , social security benefits, unemployment insurance benefits). CHAPTER 3 National Income slide 12

Notes § Even though transfer payments are not part of GDP (because the government does not spend that money to buy goods and services) they have an indirect effect on GDP through consumption: § Transfer payments Yd § If the transfer payments are financed by taxes no effect on Yd CHAPTER 3 National Income slide 13

Notes § Even though transfer payments are not part of GDP (because the government does not spend that money to buy goods and services) they have an indirect effect on GDP through consumption: § Transfer payments Yd § If the transfer payments are financed by taxes no effect on Yd CHAPTER 3 National Income slide 13

§ Redefine disposable income as: § Yd = Y – (T- transfer payments) § From now on, “T-transfer payments” will be denoted by T. § Assume government spending and total taxes are exogenous: CHAPTER 3 National Income slide 14

§ Redefine disposable income as: § Yd = Y – (T- transfer payments) § From now on, “T-transfer payments” will be denoted by T. § Assume government spending and total taxes are exogenous: CHAPTER 3 National Income slide 14

§ If G = T: balanced budget § G > T: budget deficit (financed by borrowing from financial markets) § G < T: budget surplus (can be used to pay existing debt) CHAPTER 3 National Income slide 15

§ If G = T: balanced budget § G > T: budget deficit (financed by borrowing from financial markets) § G < T: budget surplus (can be used to pay existing debt) CHAPTER 3 National Income slide 15

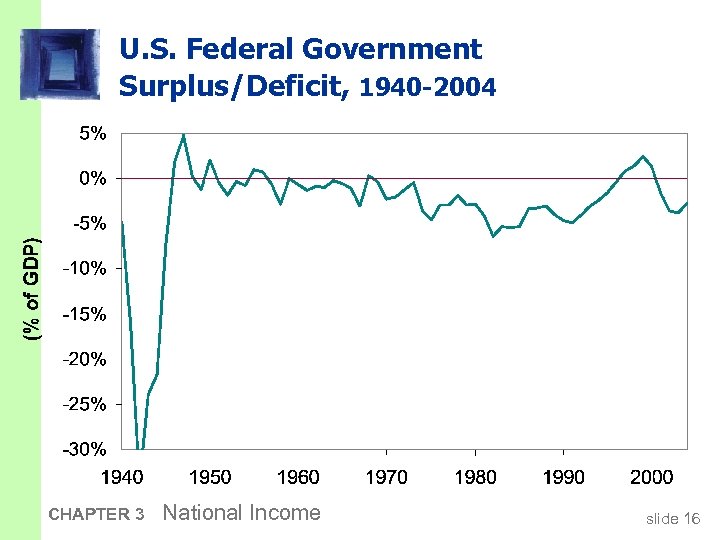

U. S. Federal Government Surplus/Deficit, 1940 -2004 CHAPTER 3 National Income slide 16

U. S. Federal Government Surplus/Deficit, 1940 -2004 CHAPTER 3 National Income slide 16

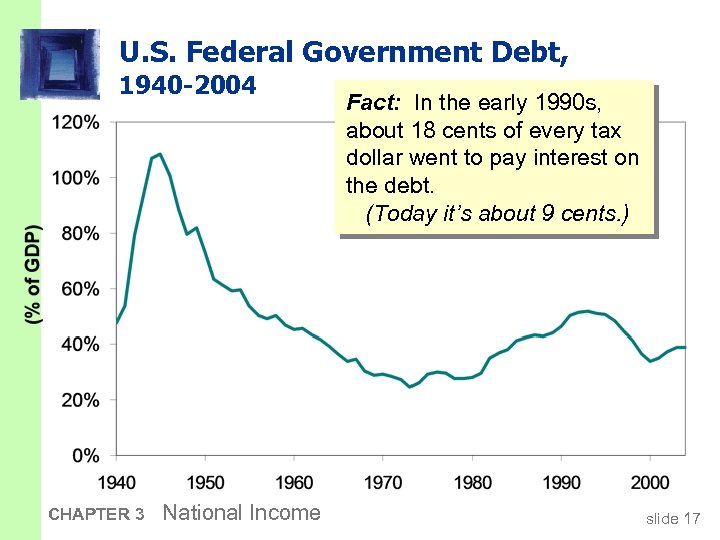

U. S. Federal Government Debt, 1940 -2004 CHAPTER 3 National Income Fact: In the early 1990 s, about 18 cents of every tax dollar went to pay interest on the debt. (Today it’s about 9 cents. ) slide 17

U. S. Federal Government Debt, 1940 -2004 CHAPTER 3 National Income Fact: In the early 1990 s, about 18 cents of every tax dollar went to pay interest on the debt. (Today it’s about 9 cents. ) slide 17

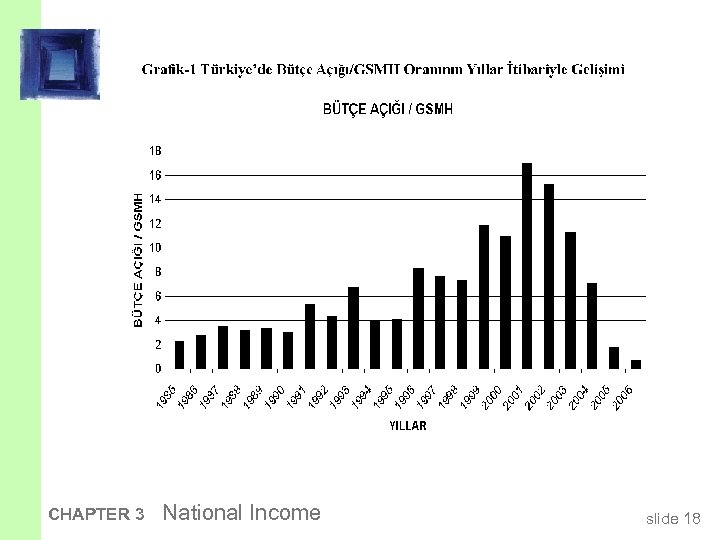

CHAPTER 3 National Income slide 18

CHAPTER 3 National Income slide 18

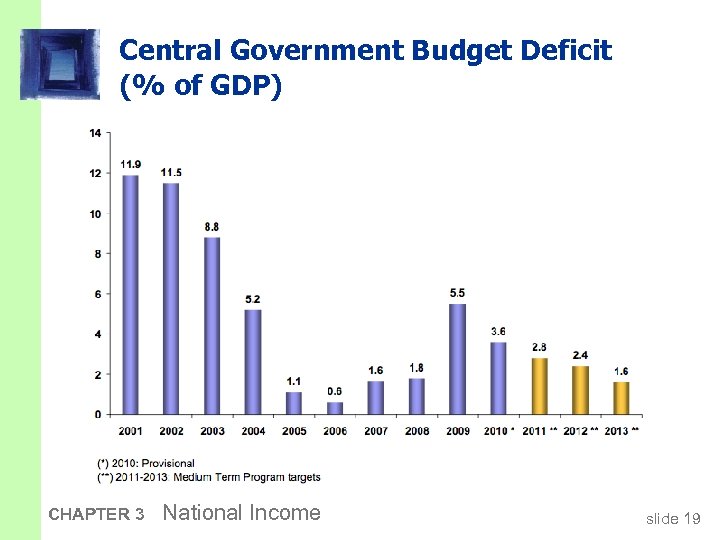

Central Government Budget Deficit (% of GDP) CHAPTER 3 National Income slide 19

Central Government Budget Deficit (% of GDP) CHAPTER 3 National Income slide 19

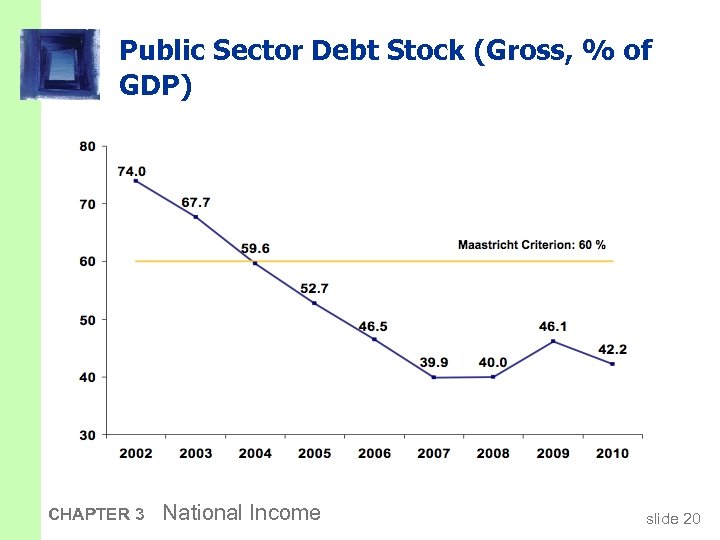

Public Sector Debt Stock (Gross, % of GDP) CHAPTER 3 National Income slide 20

Public Sector Debt Stock (Gross, % of GDP) CHAPTER 3 National Income slide 20

Aside § Fiscal policy: The government’s policy to adjust its spending G and taxation T to manipulate the level of output. Note: § G or T Y : expansionary policy § G or T Y : contractionary policy § In this chapter we don’t try to explain fiscal policy. We take G and T as given (exogenous variables). We want to see the impact of these variables on C, I, r (endogenous variables). CHAPTER 3 National Income slide 21

Aside § Fiscal policy: The government’s policy to adjust its spending G and taxation T to manipulate the level of output. Note: § G or T Y : expansionary policy § G or T Y : contractionary policy § In this chapter we don’t try to explain fiscal policy. We take G and T as given (exogenous variables). We want to see the impact of these variables on C, I, r (endogenous variables). CHAPTER 3 National Income slide 21

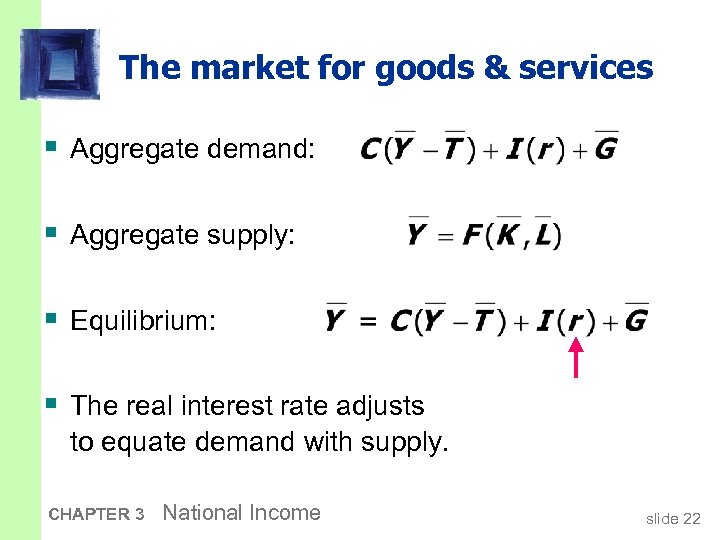

The market for goods & services § Aggregate demand: § Aggregate supply: § Equilibrium: § The real interest rate adjusts to equate demand with supply. CHAPTER 3 National Income slide 22

The market for goods & services § Aggregate demand: § Aggregate supply: § Equilibrium: § The real interest rate adjusts to equate demand with supply. CHAPTER 3 National Income slide 22

The loanable funds market § A simple supply-demand model of the financial system. § One asset: “loanable funds” § Loanable funds are funds available for borrowing/lending § demand for funds: investment § supply of funds: saving § “price” of funds: real interest rate CHAPTER 3 National Income slide 23

The loanable funds market § A simple supply-demand model of the financial system. § One asset: “loanable funds” § Loanable funds are funds available for borrowing/lending § demand for funds: investment § supply of funds: saving § “price” of funds: real interest rate CHAPTER 3 National Income slide 23

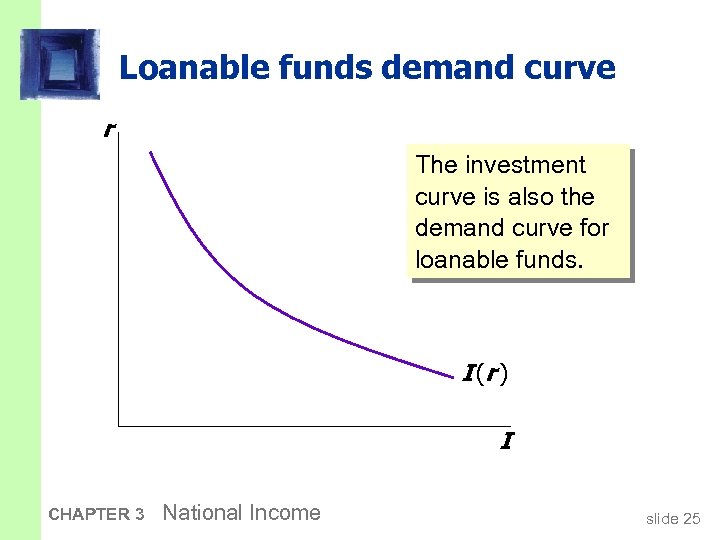

Demand for funds: Investment The demand for loanable funds… § comes from investment: Firms borrow to finance spending on plant & equipment, new office buildings, etc. Consumers borrow to buy new houses. § depends negatively on r, the “price” of loanable funds (cost of borrowing). CHAPTER 3 National Income slide 24

Demand for funds: Investment The demand for loanable funds… § comes from investment: Firms borrow to finance spending on plant & equipment, new office buildings, etc. Consumers borrow to buy new houses. § depends negatively on r, the “price” of loanable funds (cost of borrowing). CHAPTER 3 National Income slide 24

Loanable funds demand curve r The investment curve is also the demand curve for loanable funds. I (r ) I CHAPTER 3 National Income slide 25

Loanable funds demand curve r The investment curve is also the demand curve for loanable funds. I (r ) I CHAPTER 3 National Income slide 25

Supply of funds: Saving § The supply of loanable funds comes from savings: § Households use their saving to make bank deposits, purchase bonds and other assets. These funds become available to firms to borrow to finance investment spending. § The government may also contribute to saving if it does not spend all the tax revenue it receives. CHAPTER 3 National Income slide 26

Supply of funds: Saving § The supply of loanable funds comes from savings: § Households use their saving to make bank deposits, purchase bonds and other assets. These funds become available to firms to borrow to finance investment spending. § The government may also contribute to saving if it does not spend all the tax revenue it receives. CHAPTER 3 National Income slide 26

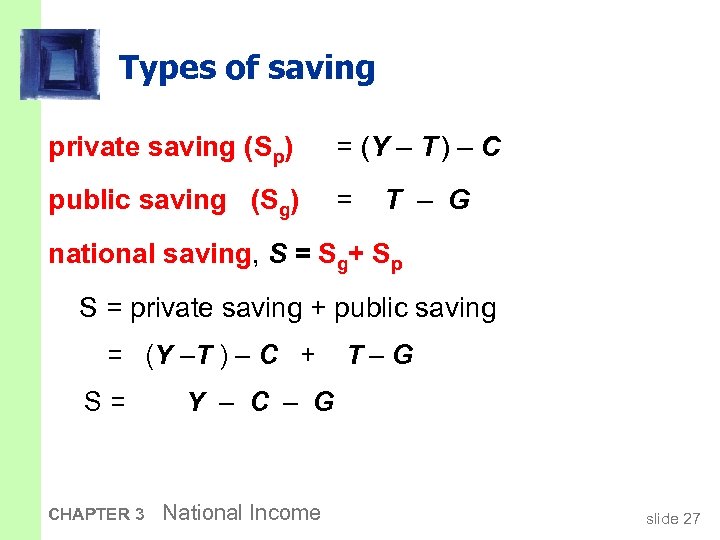

Types of saving private saving (Sp) = (Y – T ) – C public saving (Sg) = T – G national saving, S = Sg+ Sp S = private saving + public saving = (Y –T ) – C + S= CHAPTER 3 T–G Y – C – G National Income slide 27

Types of saving private saving (Sp) = (Y – T ) – C public saving (Sg) = T – G national saving, S = Sg+ Sp S = private saving + public saving = (Y –T ) – C + S= CHAPTER 3 T–G Y – C – G National Income slide 27

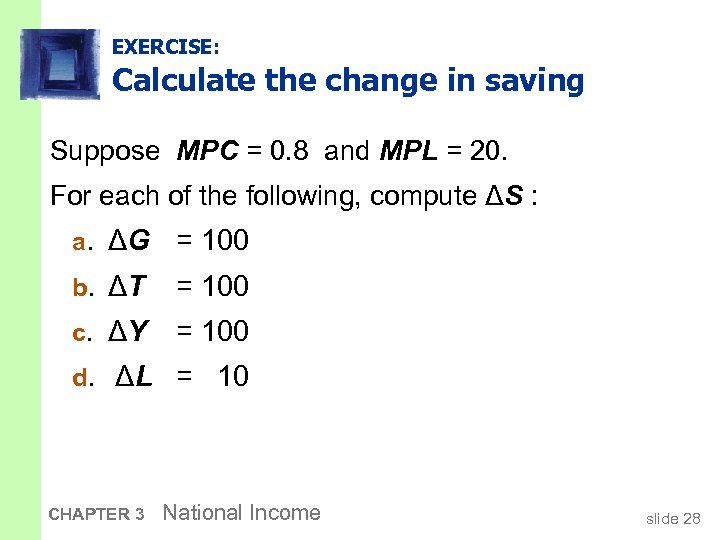

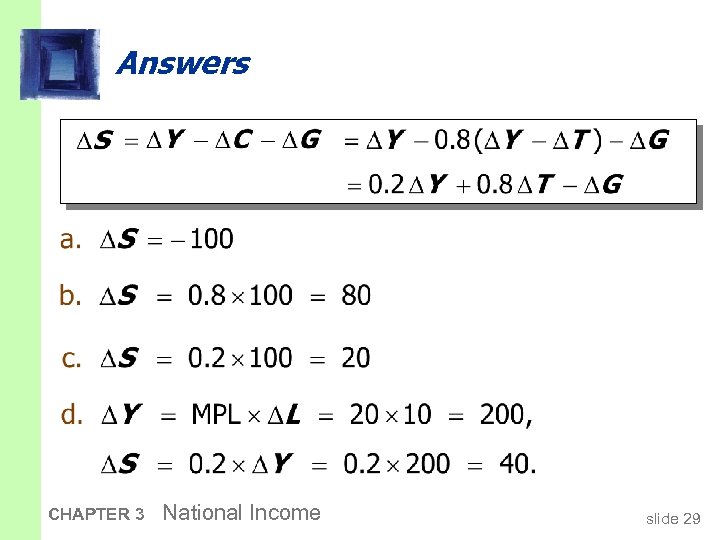

EXERCISE: Calculate the change in saving Suppose MPC = 0. 8 and MPL = 20. For each of the following, compute ΔS : a. ΔG = 100 b. ΔT = 100 c. ΔY = 100 d. ΔL = 10 CHAPTER 3 National Income slide 28

EXERCISE: Calculate the change in saving Suppose MPC = 0. 8 and MPL = 20. For each of the following, compute ΔS : a. ΔG = 100 b. ΔT = 100 c. ΔY = 100 d. ΔL = 10 CHAPTER 3 National Income slide 28

Answers CHAPTER 3 National Income slide 29

Answers CHAPTER 3 National Income slide 29

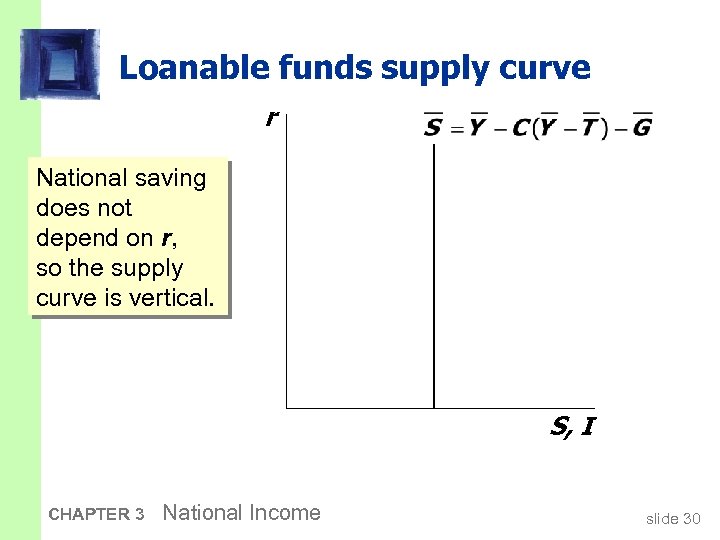

Loanable funds supply curve r National saving does not depend on r, so the supply curve is vertical. S, I CHAPTER 3 National Income slide 30

Loanable funds supply curve r National saving does not depend on r, so the supply curve is vertical. S, I CHAPTER 3 National Income slide 30

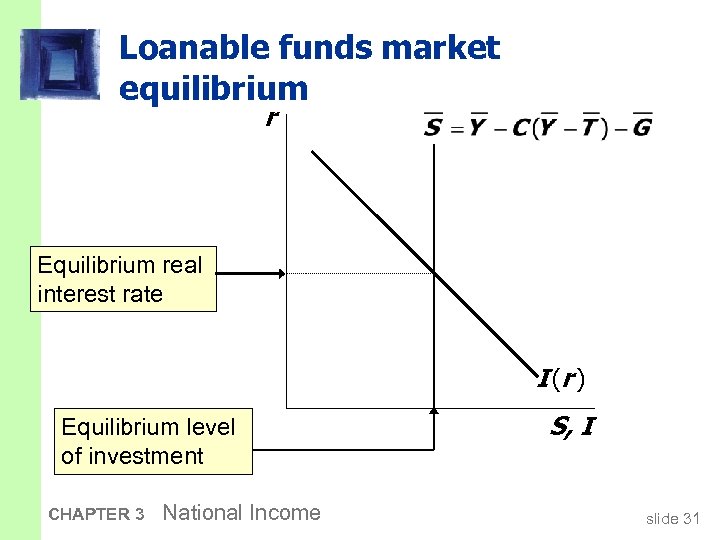

Loanable funds market equilibrium r Equilibrium real interest rate I (r ) Equilibrium level of investment CHAPTER 3 National Income S, I slide 31

Loanable funds market equilibrium r Equilibrium real interest rate I (r ) Equilibrium level of investment CHAPTER 3 National Income S, I slide 31

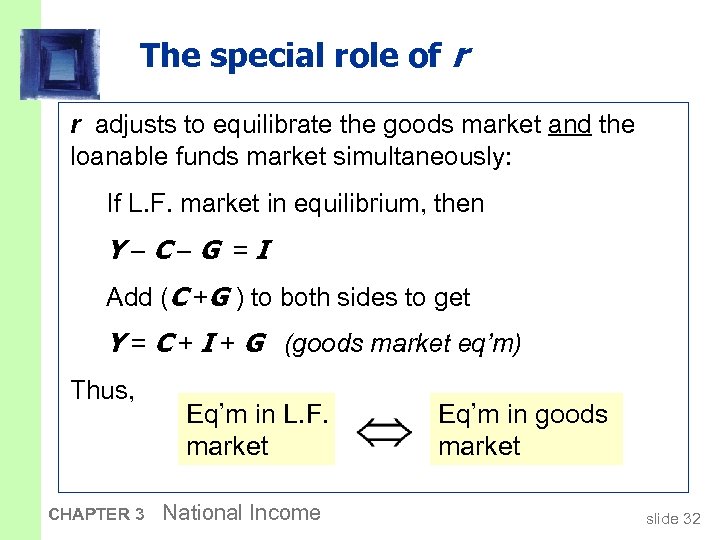

The special role of r r adjusts to equilibrate the goods market and the loanable funds market simultaneously: If L. F. market in equilibrium, then Y–C–G =I Add (C +G ) to both sides to get Y = C + I + G (goods market eq’m) Thus, CHAPTER 3 Eq’m in L. F. market National Income Eq’m in goods market slide 32

The special role of r r adjusts to equilibrate the goods market and the loanable funds market simultaneously: If L. F. market in equilibrium, then Y–C–G =I Add (C +G ) to both sides to get Y = C + I + G (goods market eq’m) Thus, CHAPTER 3 Eq’m in L. F. market National Income Eq’m in goods market slide 32