f222daaf62821eb664061e98dd21bcfa.ppt

- Количество слайдов: 41

Chapter 3 - Market Structures

Chapter 3 - Market Structures

This Lecture Ü Financial Systems Ü Markets Ü Intermediaries 2

This Lecture Ü Financial Systems Ü Markets Ü Intermediaries 2

This Lecture Ü options of financial demand supply Ü regional differences in financial structures Ü how people save and invest Ü criteria of financial market classifications Ü the trade-off between risk and return Ü the international dimension Ü the interconnectedness of markets 3

This Lecture Ü options of financial demand supply Ü regional differences in financial structures Ü how people save and invest Ü criteria of financial market classifications Ü the trade-off between risk and return Ü the international dimension Ü the interconnectedness of markets 3

Options Which options has a private household in western Europe • looking to finance the purchase of a new car, a house, or other consumer durables? • looking for an opportunity to save? 4

Options Which options has a private household in western Europe • looking to finance the purchase of a new car, a house, or other consumer durables? • looking for an opportunity to save? 4

Options a private household in western Europe looking to finance the purchase of consumer durables can • take a bank loan • look for special finance (mortgage, consumer loan offered by a car producer. . . ) • use a credit card • spend own savings. . . in most cases a financial intermediary is needed 5

Options a private household in western Europe looking to finance the purchase of consumer durables can • take a bank loan • look for special finance (mortgage, consumer loan offered by a car producer. . . ) • use a credit card • spend own savings. . . in most cases a financial intermediary is needed 5

Options a private household in western Europe looking for an opportunity to save can • open a savings account • buy bonds or shares • speculate in foreign exchange • invest in derivatives • buy insurance • keep the money under the mattress in most cases a financial intermediary is needed 6

Options a private household in western Europe looking for an opportunity to save can • open a savings account • buy bonds or shares • speculate in foreign exchange • invest in derivatives • buy insurance • keep the money under the mattress in most cases a financial intermediary is needed 6

Financial intermediaries • take the money from one party and give it to another in exchange for a small fee or other form of compensation, or • arrange for capital demand supply to meet in organised markets. 7

Financial intermediaries • take the money from one party and give it to another in exchange for a small fee or other form of compensation, or • arrange for capital demand supply to meet in organised markets. 7

Providers of financial services include • banks • investment funds • insurance companies • credit card companies • non-bank financial firms (GE Capital, Ford Motor Credit Company). . . 8

Providers of financial services include • banks • investment funds • insurance companies • credit card companies • non-bank financial firms (GE Capital, Ford Motor Credit Company). . . 8

Options Which options has a business firm in western Europe looking to • finance an investment or • its daily expenses or • actively manage financial risks? 9

Options Which options has a business firm in western Europe looking to • finance an investment or • its daily expenses or • actively manage financial risks? 9

Options A business firm can • take a bank loan • issue securities • buy and sell short-term papers, bonds and shares • engage in money market and foreign exchange transactions • engage in derivatives trading 10

Options A business firm can • take a bank loan • issue securities • buy and sell short-term papers, bonds and shares • engage in money market and foreign exchange transactions • engage in derivatives trading 10

Options Firms’ financial options depend on size: In financial markets, larger customers • get better conditions both as borrower and investor; • face a wider spectrum of financial instruments and • have better market access than smaller ones. 11

Options Firms’ financial options depend on size: In financial markets, larger customers • get better conditions both as borrower and investor; • face a wider spectrum of financial instruments and • have better market access than smaller ones. 11

Options Discuss: In which way do business firms and households differ with respect to • transparency • creditworthiness • overall economic performance? 12

Options Discuss: In which way do business firms and households differ with respect to • transparency • creditworthiness • overall economic performance? 12

Business firms Special case: Institutional Investors • mutual funds • life insurance companies • pension funds 13

Business firms Special case: Institutional Investors • mutual funds • life insurance companies • pension funds 13

Business firms Institutional Investors are characterised by • financial strength • professional management of collective portfolios • strict prudential rules for asset allocation • long-term engagements, buy-and-hold strategy • strong preference for stable markets and smooth trading • high risk of reverse price movements, strong focus on traditional debt instruments and equity. 14

Business firms Institutional Investors are characterised by • financial strength • professional management of collective portfolios • strict prudential rules for asset allocation • long-term engagements, buy-and-hold strategy • strong preference for stable markets and smooth trading • high risk of reverse price movements, strong focus on traditional debt instruments and equity. 14

Business firms Institutional Investors are: • large and reliable sources of finance; • enhancing market stability; • contributing to financial development • and economic growth. 15

Business firms Institutional Investors are: • large and reliable sources of finance; • enhancing market stability; • contributing to financial development • and economic growth. 15

16

16

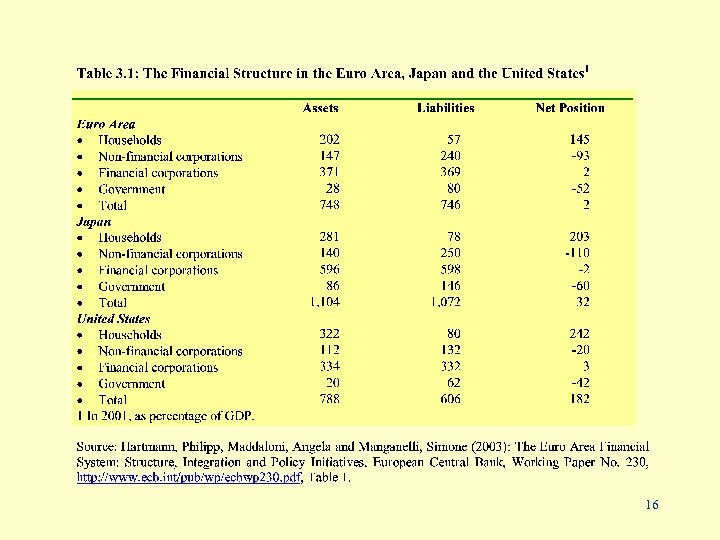

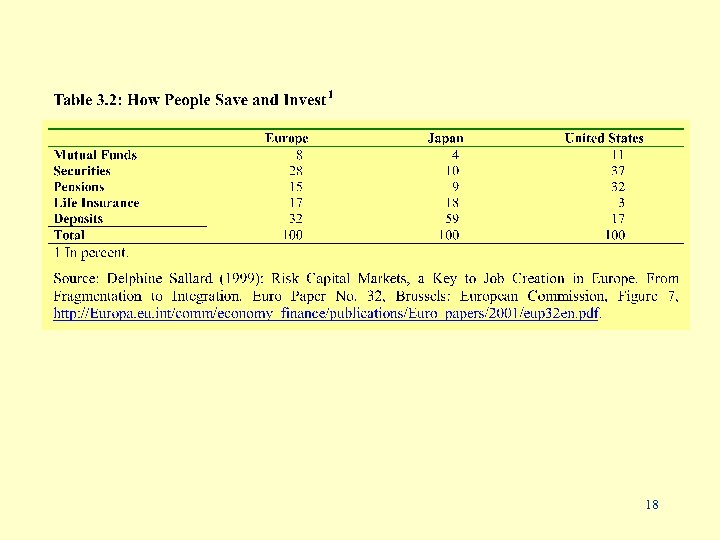

In Europe, as in the United States and Japan, households are the ultimate providers of funds for non-financial corporations and governments. Financial corporations merely function as intermediaries. 17

In Europe, as in the United States and Japan, households are the ultimate providers of funds for non-financial corporations and governments. Financial corporations merely function as intermediaries. 17

18

18

Europeans appear more risk averse than US Americans. They spend more on life insurance and less on securities and mutual funds. 19

Europeans appear more risk averse than US Americans. They spend more on life insurance and less on securities and mutual funds. 19

20

20

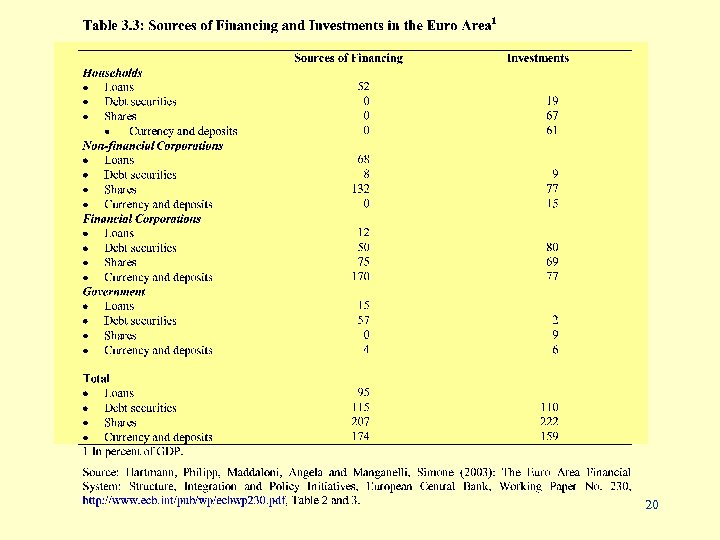

European households • rely on loans for external funding and • invest their money above all in shares and bank accounts. For companies in Europe • the stock markets are the most important source of external finance • followed by bank loans. • Debt securities play a minor role. 21

European households • rely on loans for external funding and • invest their money above all in shares and bank accounts. For companies in Europe • the stock markets are the most important source of external finance • followed by bank loans. • Debt securities play a minor role. 21

Other European characteristics are: • the importance of internal funding • the role of private equity Both can be explained in parts by the comparably high share of small and medium-sized firms in Europe. 22

Other European characteristics are: • the importance of internal funding • the role of private equity Both can be explained in parts by the comparably high share of small and medium-sized firms in Europe. 22

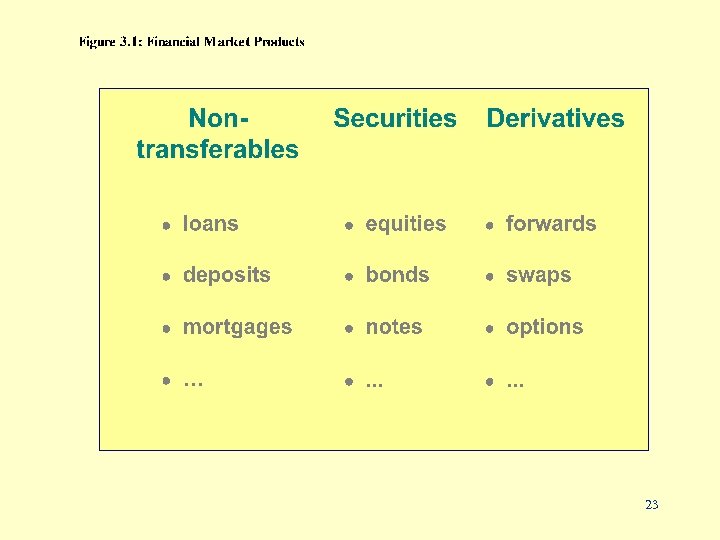

23

23

Financial market diversity reflects the variety of needs and preferences. . . and the inherent dangers and limitations. 24

Financial market diversity reflects the variety of needs and preferences. . . and the inherent dangers and limitations. 24

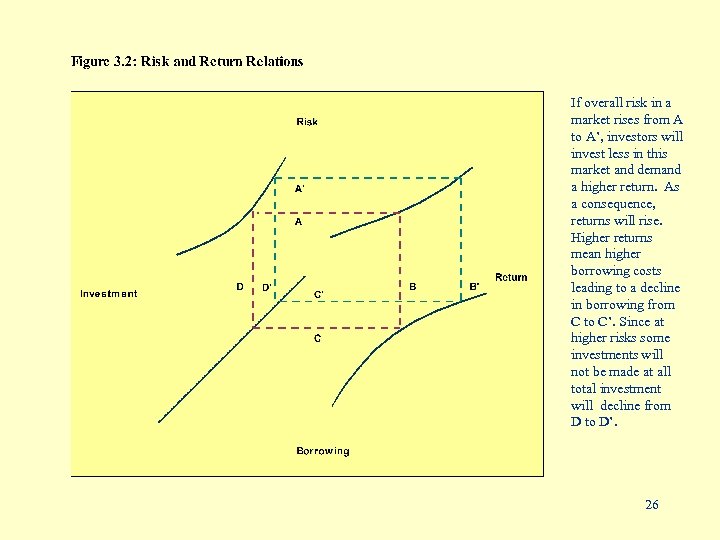

There is a constant trade-off between risk and return underlying all financial transactions: 25

There is a constant trade-off between risk and return underlying all financial transactions: 25

If overall risk in a market rises from A to A’, investors will invest less in this market and demand a higher return. As a consequence, returns will rise. Higher returns mean higher borrowing costs leading to a decline in borrowing from C to C’. Since at higher risks some investments will not be made at all total investment will decline from D to D’. 26

If overall risk in a market rises from A to A’, investors will invest less in this market and demand a higher return. As a consequence, returns will rise. Higher returns mean higher borrowing costs leading to a decline in borrowing from C to C’. Since at higher risks some investments will not be made at all total investment will decline from D to D’. 26

Discuss: In which way do the positions of shareholders and bond holders differ with respect to • flexibility • overall risk • return of their investment? Distinguish between institutional investors and private households. 27

Discuss: In which way do the positions of shareholders and bond holders differ with respect to • flexibility • overall risk • return of their investment? Distinguish between institutional investors and private households. 27

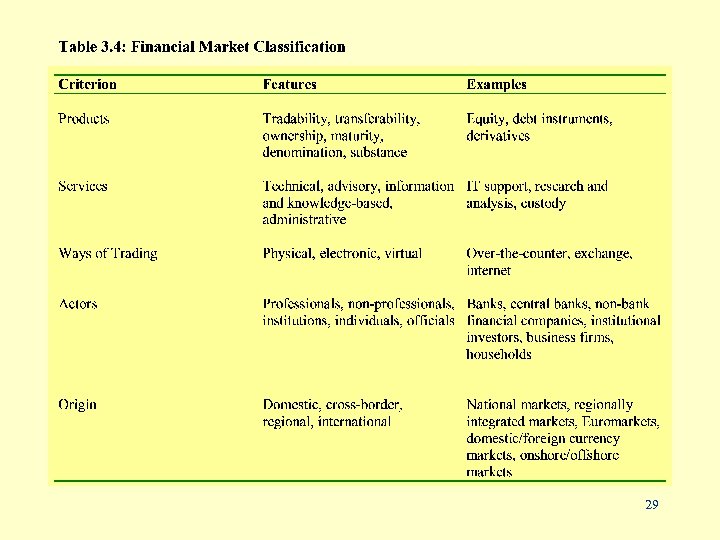

Products are only one way to classify markets. . . 28

Products are only one way to classify markets. . . 28

29

29

Financial Market Classification Services • technical • advisory • information and knowledge based • administrative 30

Financial Market Classification Services • technical • advisory • information and knowledge based • administrative 30

Financial Market Classification Ways of Trading • physical • electronic • virtual 31

Financial Market Classification Ways of Trading • physical • electronic • virtual 31

Financial Market Classification Actors • professionals • non-professionals • institutions • individuals • officials 32

Financial Market Classification Actors • professionals • non-professionals • institutions • individuals • officials 32

Financial Market Classification Origin • domestic • cross-border • regional • international 33

Financial Market Classification Origin • domestic • cross-border • regional • international 33

Internationalisation and globalisation of financial services have widened the range of opportunities: • borrowing and investing are not restricted to domestic markets; • borrowing and investing are not restricted to the domestic currency; • borrowing and investing are not restricted to domestic suppliers of financial services. 34

Internationalisation and globalisation of financial services have widened the range of opportunities: • borrowing and investing are not restricted to domestic markets; • borrowing and investing are not restricted to the domestic currency; • borrowing and investing are not restricted to domestic suppliers of financial services. 34

Why do financial institutions, borrowers and investors go abroad? • market access: actors may be excluded from sources in one place that are available to them in others; • risk and return considerations: conditions in international markets may be more favourable; risk monitoring and managing simpler and more reliable; diversification opportunities more numerous. • cost and efficiency considerations: financial institutions may realise additional economies of scale. 35

Why do financial institutions, borrowers and investors go abroad? • market access: actors may be excluded from sources in one place that are available to them in others; • risk and return considerations: conditions in international markets may be more favourable; risk monitoring and managing simpler and more reliable; diversification opportunities more numerous. • cost and efficiency considerations: financial institutions may realise additional economies of scale. 35

Domestic, foreign and international financial markets offer a wide range of risk and return combinations. Actors usually engage in a variety of borrowing and lending activities. As a consequence, markets are highly interconnected: 36

Domestic, foreign and international financial markets offer a wide range of risk and return combinations. Actors usually engage in a variety of borrowing and lending activities. As a consequence, markets are highly interconnected: 36

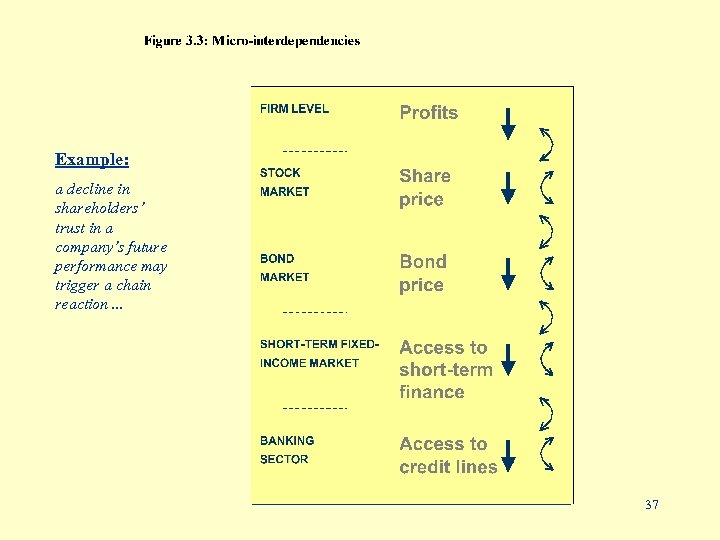

Example: a decline in shareholders’ trust in a company’s future performance may trigger a chain reaction. . . 37

Example: a decline in shareholders’ trust in a company’s future performance may trigger a chain reaction. . . 37

Links exist • across markets • within industries • between industries 38

Links exist • across markets • within industries • between industries 38

Summary • Europe’s financial landscapes are characterised by diversity. • Compared to the US, Europeans appear more risk averse. • Internal funding and private equity play an important role. • The diversity of financial products reflects the variety of needs and preferences. • Financial market participants face a constant trade-off between risks and returns. • As a consequence of internationalisation and globalisation financial opportunities are not restricted to domestic markets. • Financial markets for different products are highly interconnected. 39

Summary • Europe’s financial landscapes are characterised by diversity. • Compared to the US, Europeans appear more risk averse. • Internal funding and private equity play an important role. • The diversity of financial products reflects the variety of needs and preferences. • Financial market participants face a constant trade-off between risks and returns. • As a consequence of internationalisation and globalisation financial opportunities are not restricted to domestic markets. • Financial markets for different products are highly interconnected. 39

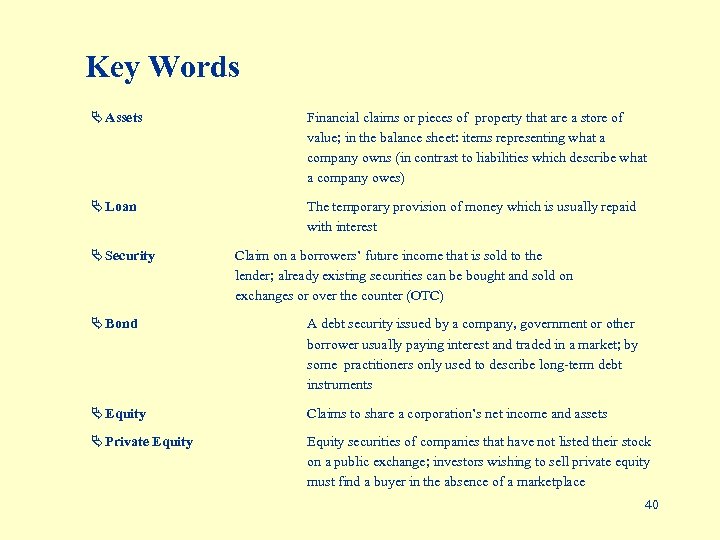

Key Words Ä Assets Financial claims or pieces of property that are a store of value; in the balance sheet: items representing what a company owns (in contrast to liabilities which describe what a company owes) Ä Loan The temporary provision of money which is usually repaid with interest Ä Security Claim on a borrowers’ future income that is sold to the lender; already existing securities can be bought and sold on exchanges or over the counter (OTC) Ä Bond A debt security issued by a company, government or other borrower usually paying interest and traded in a market; by some practitioners only used to describe long-term debt instruments Ä Equity Claims to share a corporation’s net income and assets Ä Private Equity securities of companies that have not listed their stock on a public exchange; investors wishing to sell private equity must find a buyer in the absence of a marketplace 40

Key Words Ä Assets Financial claims or pieces of property that are a store of value; in the balance sheet: items representing what a company owns (in contrast to liabilities which describe what a company owes) Ä Loan The temporary provision of money which is usually repaid with interest Ä Security Claim on a borrowers’ future income that is sold to the lender; already existing securities can be bought and sold on exchanges or over the counter (OTC) Ä Bond A debt security issued by a company, government or other borrower usually paying interest and traded in a market; by some practitioners only used to describe long-term debt instruments Ä Equity Claims to share a corporation’s net income and assets Ä Private Equity securities of companies that have not listed their stock on a public exchange; investors wishing to sell private equity must find a buyer in the absence of a marketplace 40

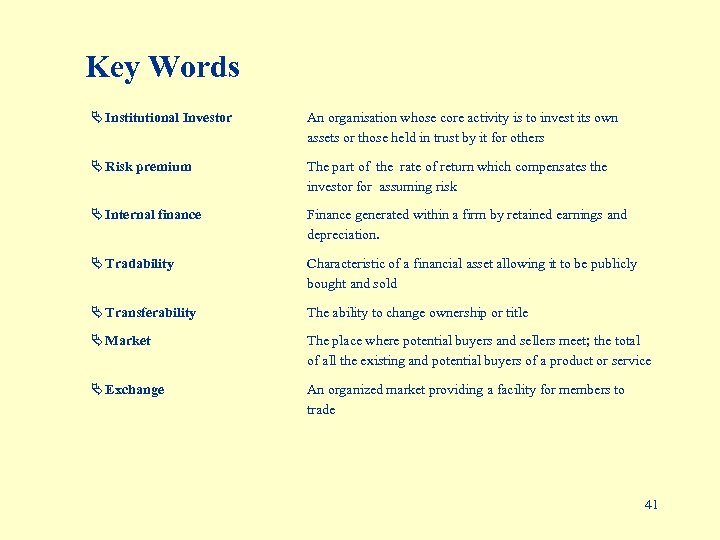

Key Words Ä Institutional Investor An organisation whose core activity is to invest its own assets or those held in trust by it for others Ä Risk premium The part of the rate of return which compensates the investor for assuming risk Ä Internal finance Finance generated within a firm by retained earnings and depreciation. Ä Tradability Characteristic of a financial asset allowing it to be publicly bought and sold Ä Transferability The ability to change ownership or title Ä Market The place where potential buyers and sellers meet; the total of all the existing and potential buyers of a product or service Ä Exchange An organized market providing a facility for members to trade 41

Key Words Ä Institutional Investor An organisation whose core activity is to invest its own assets or those held in trust by it for others Ä Risk premium The part of the rate of return which compensates the investor for assuming risk Ä Internal finance Finance generated within a firm by retained earnings and depreciation. Ä Tradability Characteristic of a financial asset allowing it to be publicly bought and sold Ä Transferability The ability to change ownership or title Ä Market The place where potential buyers and sellers meet; the total of all the existing and potential buyers of a product or service Ä Exchange An organized market providing a facility for members to trade 41