Chapter 3.PPT

- Количество слайдов: 35

Chapter 3 -- External Analysis: The Identification of Industry Opportunities and Threats 3 -1 Text by Charles W. L. Hill Gareth R. Jones Multimedia Slides by Milton M. Pressley Univ. of New Orleans Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Chapter 3 -- External Analysis: The Identification of Industry Opportunities and Threats 3 -1 Text by Charles W. L. Hill Gareth R. Jones Multimedia Slides by Milton M. Pressley Univ. of New Orleans Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -2 Preview 4 Five Forces Model 4 Strategic Groups Within Industries 4 Limitations of the Five Forces and Strategic Group Models 4 Competitive Changes During Industry Revolution 4 Globalization and Industry Structure 4 The National State and Competitive Advantage Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -2 Preview 4 Five Forces Model 4 Strategic Groups Within Industries 4 Limitations of the Five Forces and Strategic Group Models 4 Competitive Changes During Industry Revolution 4 Globalization and Industry Structure 4 The National State and Competitive Advantage Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

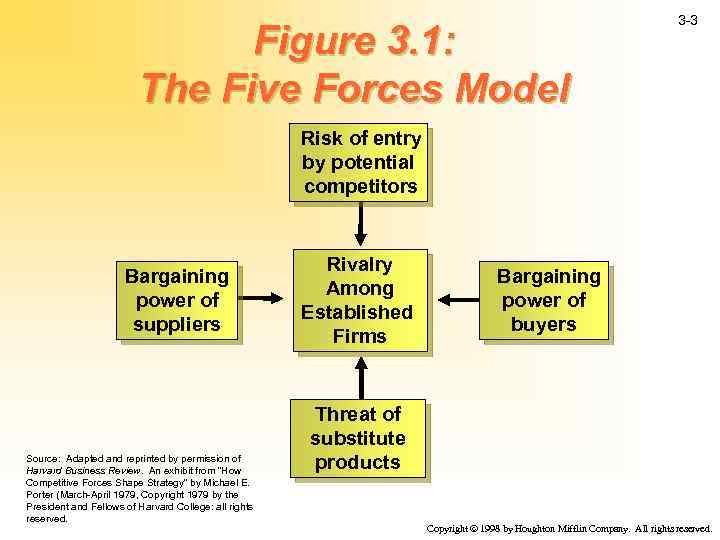

Figure 3. 1: The Five Forces Model 3 -3 Risk of entry by potential competitors Bargaining power of suppliers Source: Adapted and reprinted by permission of Harvard Business Review. An exhibit from “How Competitive Forces Shape Strategy” by Michael E. Porter (March-April 1979, Copyright 1979 by the President and Fellows of Harvard College: all rights reserved. Rivalry Among Established Firms Bargaining power of buyers Threat of substitute products Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 1: The Five Forces Model 3 -3 Risk of entry by potential competitors Bargaining power of suppliers Source: Adapted and reprinted by permission of Harvard Business Review. An exhibit from “How Competitive Forces Shape Strategy” by Michael E. Porter (March-April 1979, Copyright 1979 by the President and Fellows of Harvard College: all rights reserved. Rivalry Among Established Firms Bargaining power of buyers Threat of substitute products Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -4 Potential Competitors • Defined • Incumbent Companies • Barriers to Entry – Brand Loyalty – Absolute Cost Advantages – Economies of Scale – Government Regulation • Entry Barriers and Competition Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -4 Potential Competitors • Defined • Incumbent Companies • Barriers to Entry – Brand Loyalty – Absolute Cost Advantages – Economies of Scale – Government Regulation • Entry Barriers and Competition Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

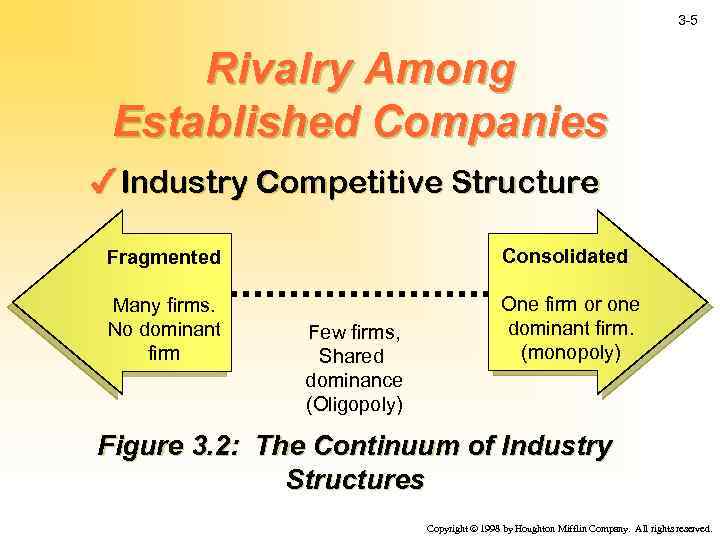

3 -5 Rivalry Among Established Companies 4 Industry Competitive Structure Fragmented Consolidated Many firms. No dominant firm One firm or one dominant firm. (monopoly) Few firms, Shared dominance (Oligopoly) Figure 3. 2: The Continuum of Industry Structures Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -5 Rivalry Among Established Companies 4 Industry Competitive Structure Fragmented Consolidated Many firms. No dominant firm One firm or one dominant firm. (monopoly) Few firms, Shared dominance (Oligopoly) Figure 3. 2: The Continuum of Industry Structures Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -6 Rivalry Among Established Companies (Continued) 4 Demand Conditions vs. Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -6 Rivalry Among Established Companies (Continued) 4 Demand Conditions vs. Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -7 Rivalry Among Established Companies (Continued) 4 Height of Exit Barriers in the Industry Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -7 Rivalry Among Established Companies (Continued) 4 Height of Exit Barriers in the Industry Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -8 The Bargaining Power of Buyers Is Highest When: • • • Many Small Sellers - Few Large Buyers Purchase in Large Quantities Buyer Accounts for Large Percentage of Sellers’ Total Orders Buyers Can Switch Suppliers at Low Cost Buyers Purchase from Several Sellers at Once Buyers Can Vertically Integrate Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -8 The Bargaining Power of Buyers Is Highest When: • • • Many Small Sellers - Few Large Buyers Purchase in Large Quantities Buyer Accounts for Large Percentage of Sellers’ Total Orders Buyers Can Switch Suppliers at Low Cost Buyers Purchase from Several Sellers at Once Buyers Can Vertically Integrate Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

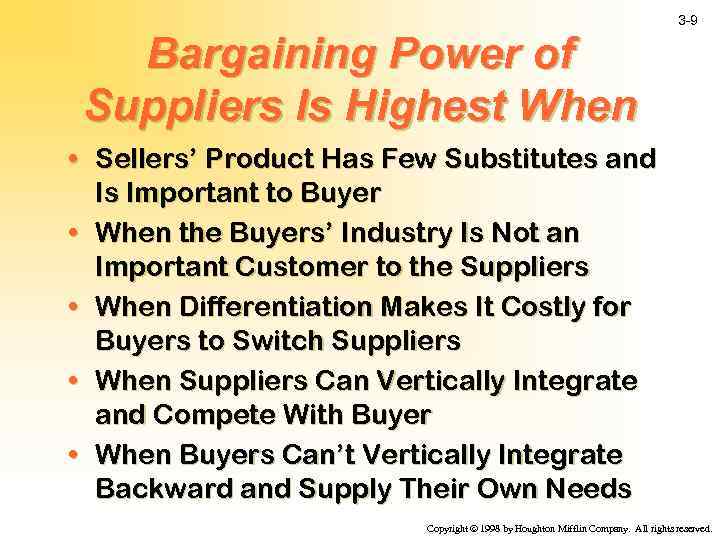

Bargaining Power of Suppliers Is Highest When 3 -9 • Sellers’ Product Has Few Substitutes and Is Important to Buyer • When the Buyers’ Industry Is Not an Important Customer to the Suppliers • When Differentiation Makes It Costly for Buyers to Switch Suppliers • When Suppliers Can Vertically Integrate and Compete With Buyer • When Buyers Can’t Vertically Integrate Backward and Supply Their Own Needs Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Bargaining Power of Suppliers Is Highest When 3 -9 • Sellers’ Product Has Few Substitutes and Is Important to Buyer • When the Buyers’ Industry Is Not an Important Customer to the Suppliers • When Differentiation Makes It Costly for Buyers to Switch Suppliers • When Suppliers Can Vertically Integrate and Compete With Buyer • When Buyers Can’t Vertically Integrate Backward and Supply Their Own Needs Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -10 The Threat of Substitute Products MILK Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -10 The Threat of Substitute Products MILK Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

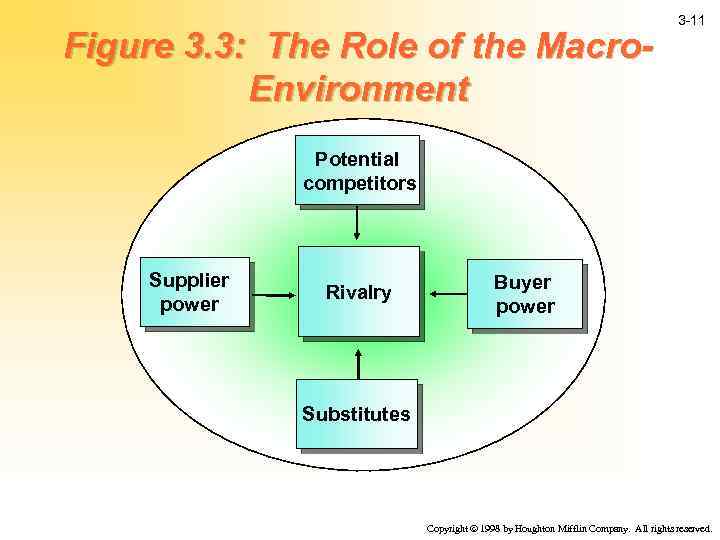

Figure 3. 3: The Role of the Macro. Environment 3 -11 Potential competitors Supplier power Rivalry Buyer power Substitutes Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment 3 -11 Potential competitors Supplier power Rivalry Buyer power Substitutes Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

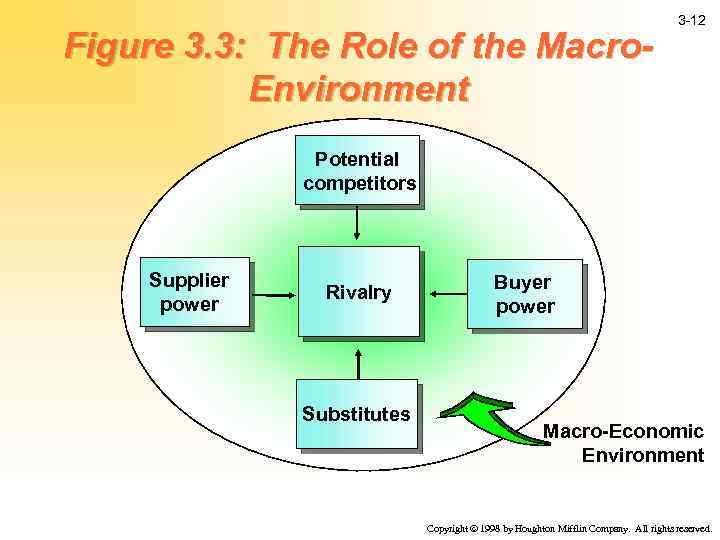

Figure 3. 3: The Role of the Macro. Environment 3 -12 Potential competitors Supplier power Rivalry Substitutes Buyer power Macro-Economic Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment 3 -12 Potential competitors Supplier power Rivalry Substitutes Buyer power Macro-Economic Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

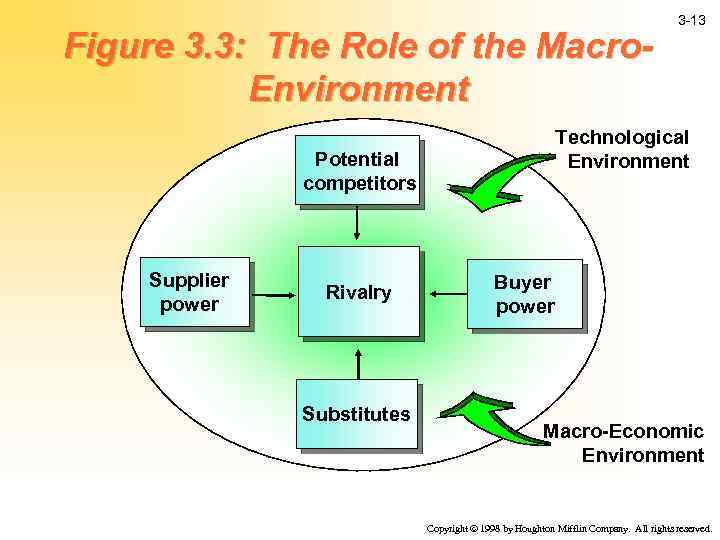

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Rivalry Substitutes 3 -13 Buyer power Macro-Economic Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Rivalry Substitutes 3 -13 Buyer power Macro-Economic Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

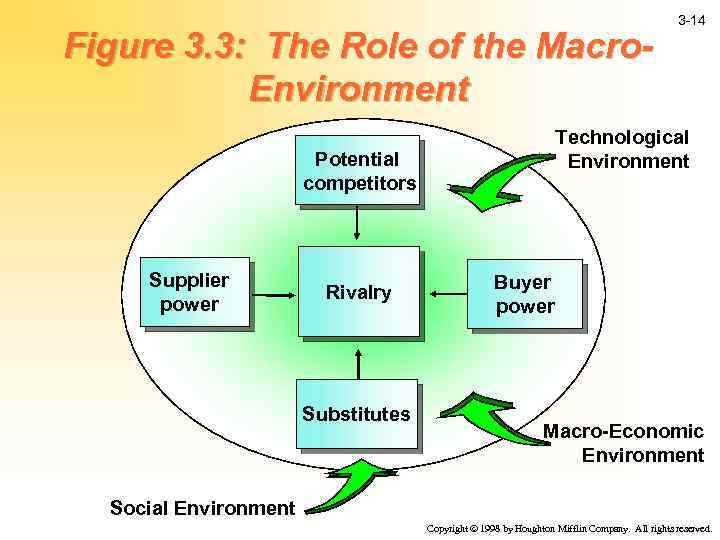

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Rivalry Substitutes 3 -14 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Rivalry Substitutes 3 -14 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

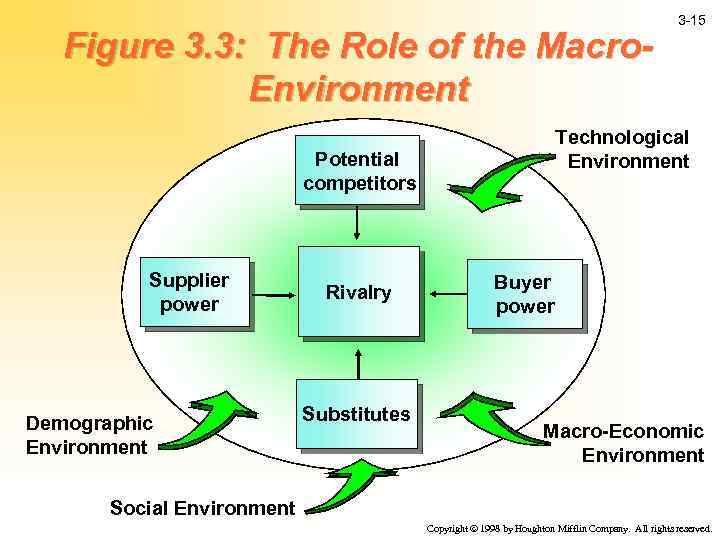

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Demographic Environment Rivalry Substitutes 3 -15 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment Technological Environment Potential competitors Supplier power Demographic Environment Rivalry Substitutes 3 -15 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

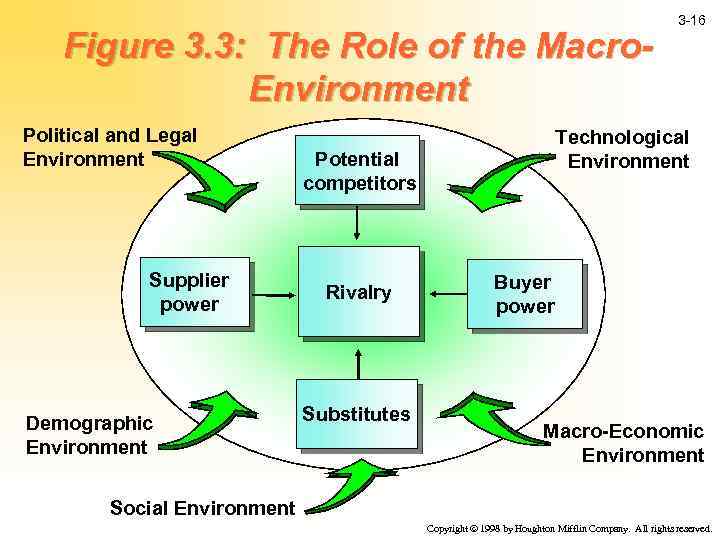

Figure 3. 3: The Role of the Macro. Environment Political and Legal Environment Supplier power Demographic Environment Technological Environment Potential competitors Rivalry Substitutes 3 -16 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 3: The Role of the Macro. Environment Political and Legal Environment Supplier power Demographic Environment Technological Environment Potential competitors Rivalry Substitutes 3 -16 Buyer power Macro-Economic Environment Social Environment Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -17 Strategic Groups Within Industries • The Concept of Strategic Groups Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -17 Strategic Groups Within Industries • The Concept of Strategic Groups Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

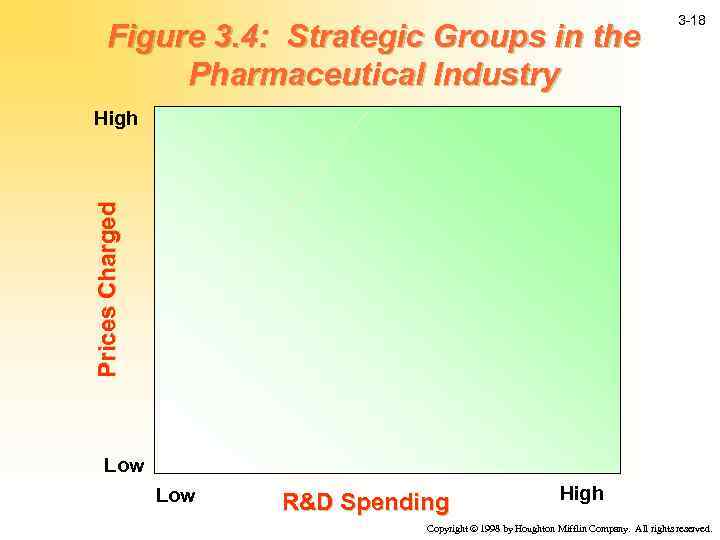

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry 3 -18 Prices Charged High Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry 3 -18 Prices Charged High Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

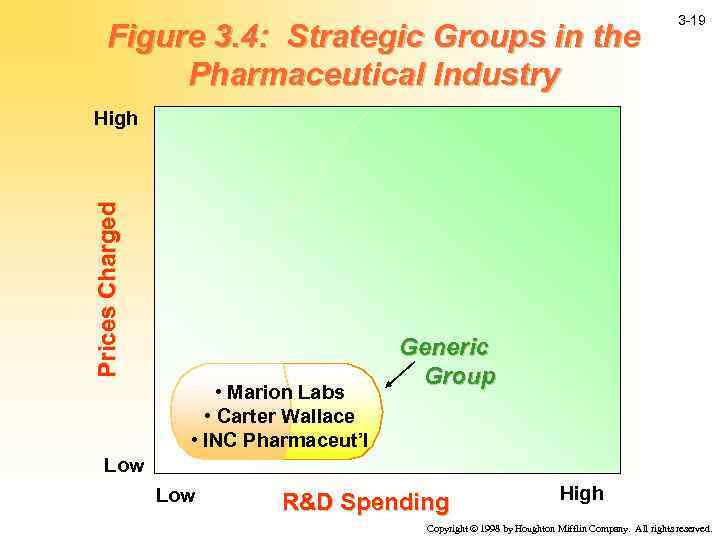

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry 3 -19 Prices Charged High • Marion Labs • Carter Wallace • INC Pharmaceut’l Generic Group Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry 3 -19 Prices Charged High • Marion Labs • Carter Wallace • INC Pharmaceut’l Generic Group Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

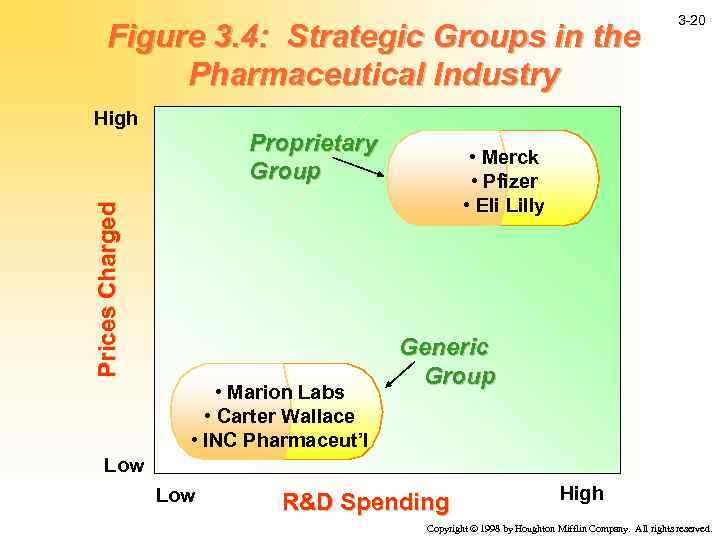

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry High Prices Charged Proprietary Group • Marion Labs • Carter Wallace • INC Pharmaceut’l 3 -20 • Merck • Pfizer • Eli Lilly Generic Group Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 4: Strategic Groups in the Pharmaceutical Industry High Prices Charged Proprietary Group • Marion Labs • Carter Wallace • INC Pharmaceut’l 3 -20 • Merck • Pfizer • Eli Lilly Generic Group Low R&D Spending High Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -21 Strategic Groups Within Industries (Continued) • The Concept of Strategic Groups • Implications of Strategic Groups • Mobility Barriers Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -21 Strategic Groups Within Industries (Continued) • The Concept of Strategic Groups • Implications of Strategic Groups • Mobility Barriers Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -22 Limitations of the Five Forces and Strategic Group Models • Innovation and Industry Structure Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -22 Limitations of the Five Forces and Strategic Group Models • Innovation and Industry Structure Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

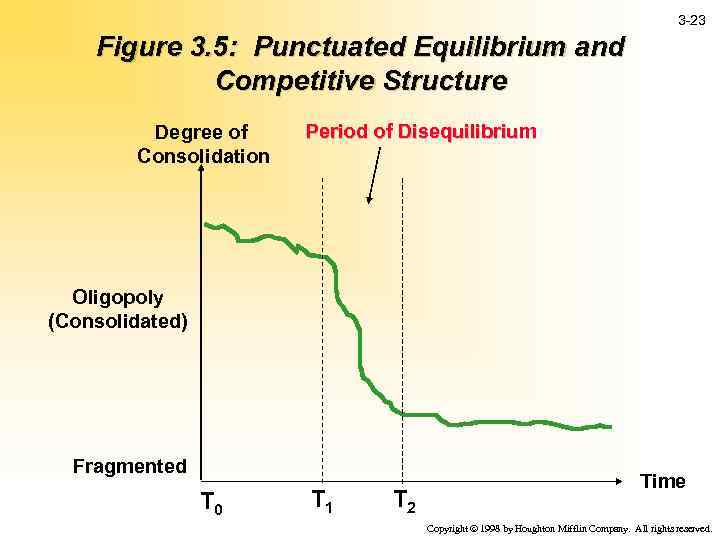

3 -23 Figure 3. 5: Punctuated Equilibrium and Competitive Structure Degree of Consolidation Period of Disequilibrium Oligopoly (Consolidated) Fragmented T 0 T 1 T 2 Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -23 Figure 3. 5: Punctuated Equilibrium and Competitive Structure Degree of Consolidation Period of Disequilibrium Oligopoly (Consolidated) Fragmented T 0 T 1 T 2 Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -24 Limitations of the Five Forces and Strategic Group Models (Continued) • Innovation and Industry Structure • Industry Structure and Company Differences Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -24 Limitations of the Five Forces and Strategic Group Models (Continued) • Innovation and Industry Structure • Industry Structure and Company Differences Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

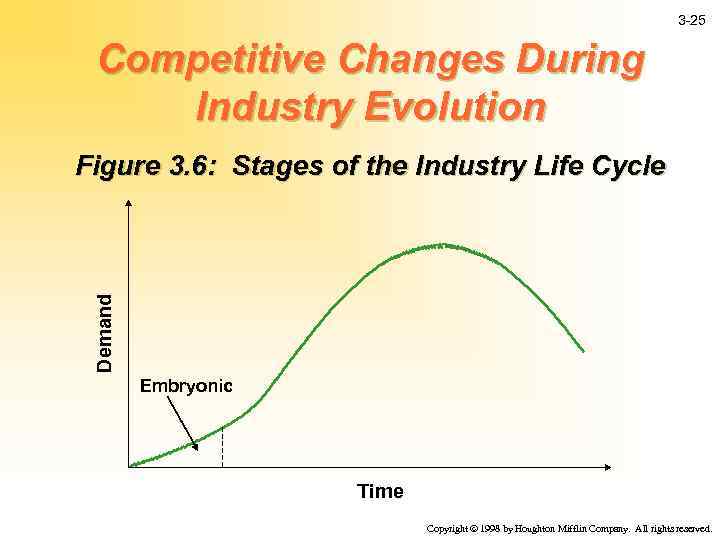

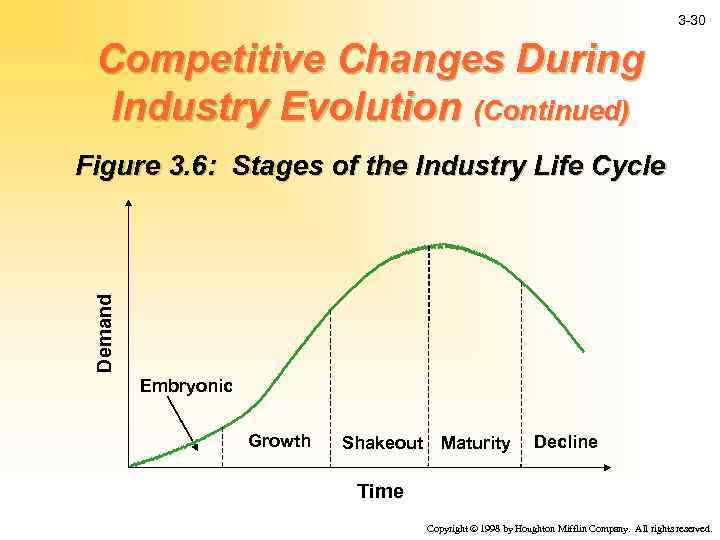

3 -25 Competitive Changes During Industry Evolution Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -25 Competitive Changes During Industry Evolution Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

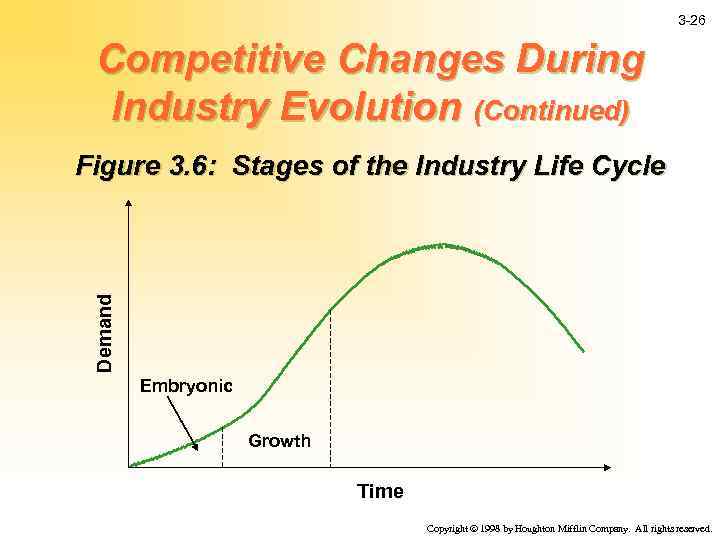

3 -26 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -26 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

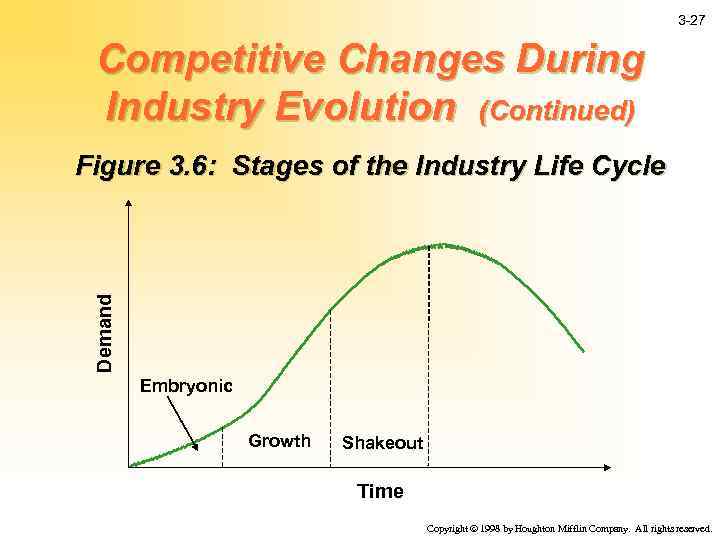

3 -27 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -27 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

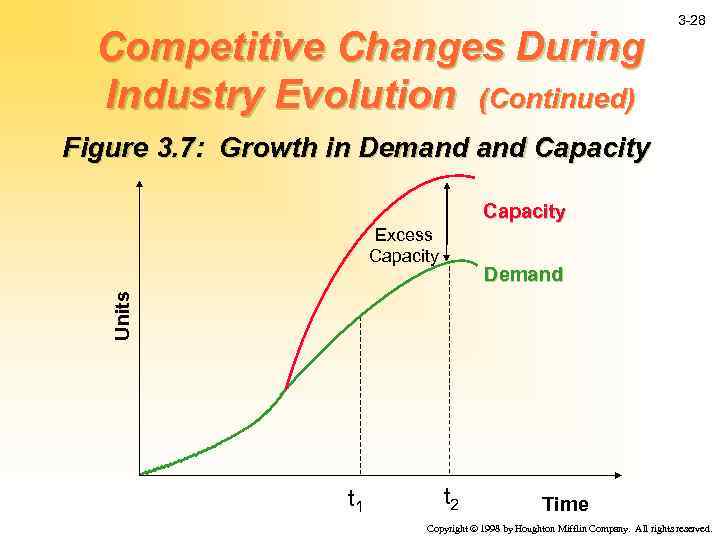

Competitive Changes During Industry Evolution (Continued) 3 -28 Figure 3. 7: Growth in Demand Capacity Excess Capacity Units Demand t 1 t 2 Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Competitive Changes During Industry Evolution (Continued) 3 -28 Figure 3. 7: Growth in Demand Capacity Excess Capacity Units Demand t 1 t 2 Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

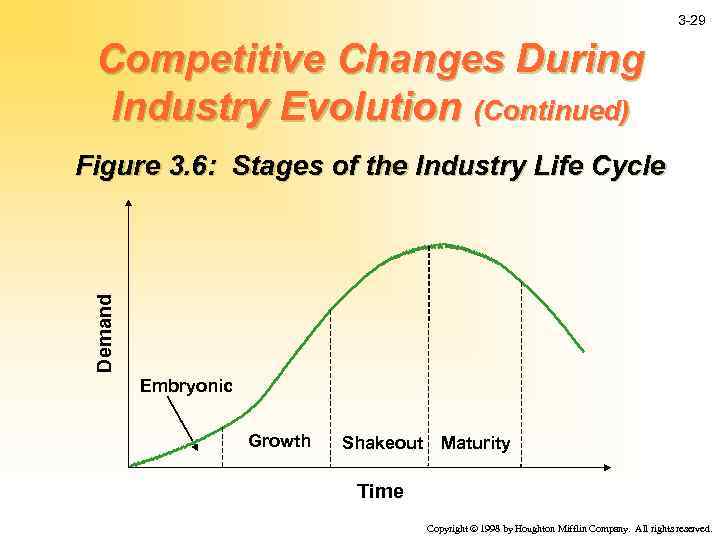

3 -29 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Maturity Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -29 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Maturity Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -30 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Maturity Decline Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -30 Competitive Changes During Industry Evolution (Continued) Demand Figure 3. 6: Stages of the Industry Life Cycle Embryonic Growth Shakeout Maturity Decline Time Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -31 Limitations of the Five Forces and Strategic Group Models (Continued) • Innovation and Industry Structure • Industry Structure and Company Differences • Variations in the Theme Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -31 Limitations of the Five Forces and Strategic Group Models (Continued) • Innovation and Industry Structure • Industry Structure and Company Differences • Variations in the Theme Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -32 Globalization and Industry Structure 4 Globalization of Markets Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -32 Globalization and Industry Structure 4 Globalization of Markets Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

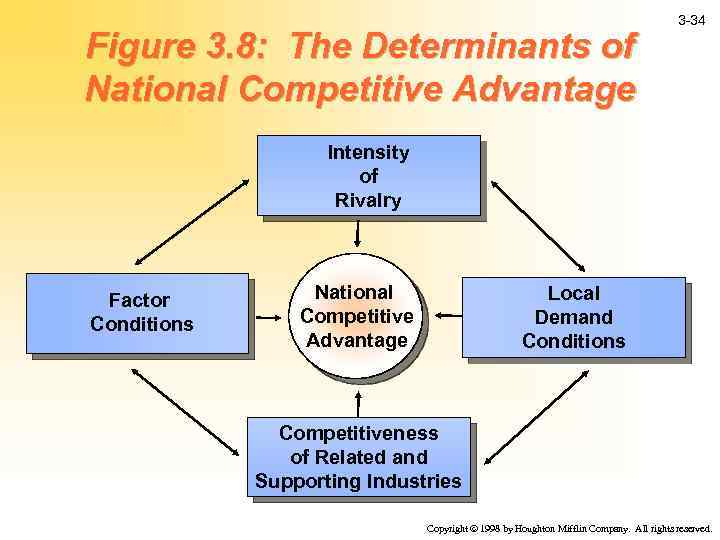

3 -33 The National State and Competitive Advantage 4 Four Attributes That Impact a Firm’s Global Competitiveness – Factor Endowments – Demand Conditions – Relating and Supporting Industries – Firm Strategy, Structure, and Rivalry Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

3 -33 The National State and Competitive Advantage 4 Four Attributes That Impact a Firm’s Global Competitiveness – Factor Endowments – Demand Conditions – Relating and Supporting Industries – Firm Strategy, Structure, and Rivalry Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 8: The Determinants of National Competitive Advantage 3 -34 Intensity of Rivalry Factor Conditions National Competitive Advantage Local Demand Conditions Competitiveness of Related and Supporting Industries Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Figure 3. 8: The Determinants of National Competitive Advantage 3 -34 Intensity of Rivalry Factor Conditions National Competitive Advantage Local Demand Conditions Competitiveness of Related and Supporting Industries Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Chapter Summary 3 -35 4 FIVE FORCES MODEL IN 4 STRATEGIC GROUPS WITH INDUSTRIES AND IONS OF THE FIVE FORCES 4 LIMITAT STRATEGIC GROUP MODELS STRY IVE CHANGES DURING INDU 4 COMPETIT REVOLUTION ND INDUSTRY s. TRUCTURE 4 GLOBALIZATION A L STATE AND COMPETITIVE 4 THE NATIONA ADVANTAGE Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.

Chapter Summary 3 -35 4 FIVE FORCES MODEL IN 4 STRATEGIC GROUPS WITH INDUSTRIES AND IONS OF THE FIVE FORCES 4 LIMITAT STRATEGIC GROUP MODELS STRY IVE CHANGES DURING INDU 4 COMPETIT REVOLUTION ND INDUSTRY s. TRUCTURE 4 GLOBALIZATION A L STATE AND COMPETITIVE 4 THE NATIONA ADVANTAGE Copyright ã 1998 by Houghton Mifflin Company. All rights reserved.