f3ee2c44866d75739f515d72b03b607c.ppt

- Количество слайдов: 41

Chapter 3: DECISION ANALYSIS Part 2 1

Chapter 3: DECISION ANALYSIS Part 2 1

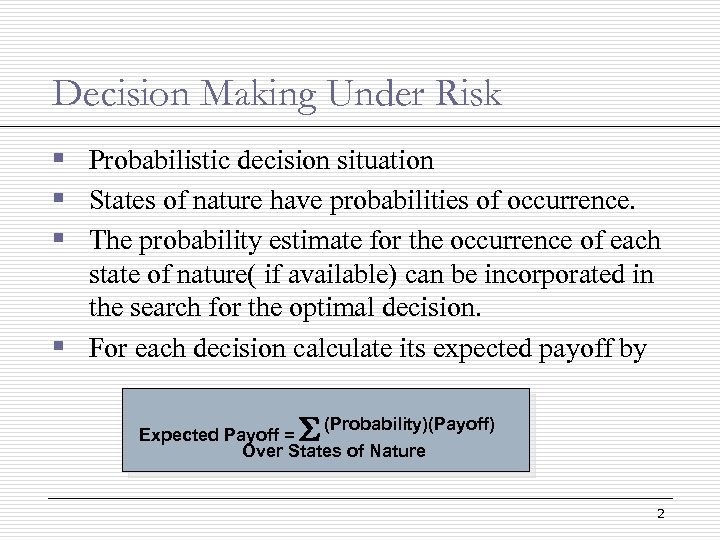

Decision Making Under Risk § Probabilistic decision situation § States of nature have probabilities of occurrence. § The probability estimate for the occurrence of each state of nature( if available) can be incorporated in the search for the optimal decision. § For each decision calculate its expected payoff by S (Probability)(Payoff) Expected Payoff = Over States of Nature 2

Decision Making Under Risk § Probabilistic decision situation § States of nature have probabilities of occurrence. § The probability estimate for the occurrence of each state of nature( if available) can be incorporated in the search for the optimal decision. § For each decision calculate its expected payoff by S (Probability)(Payoff) Expected Payoff = Over States of Nature 2

Decision Making Under Risk (cont. ) § Select the decision with the best expected payoff 3

Decision Making Under Risk (cont. ) § Select the decision with the best expected payoff 3

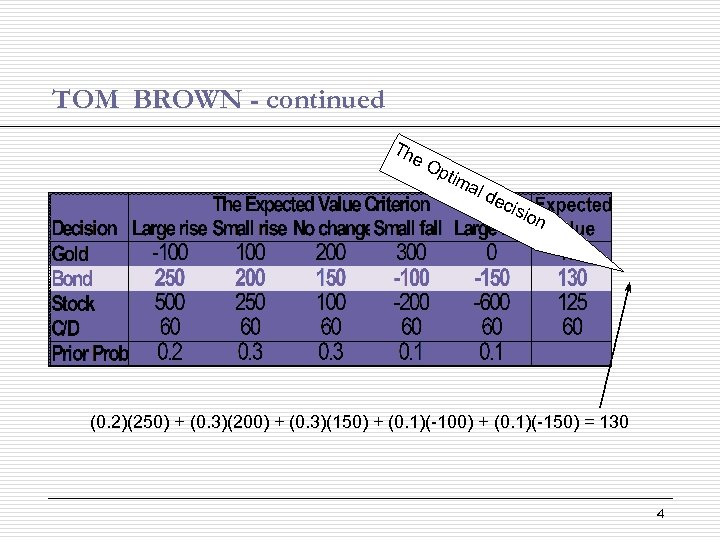

TOM BROWN - continued Th e. O ptim al d e cis io n (0. 2)(250) + (0. 3)(200) + (0. 3)(150) + (0. 1)(-100) + (0. 1)(-150) = 130 4

TOM BROWN - continued Th e. O ptim al d e cis io n (0. 2)(250) + (0. 3)(200) + (0. 3)(150) + (0. 1)(-100) + (0. 1)(-150) = 130 4

Decision Making Criteria (cont. ) § When to Use the Expected Value Approach § The Expected Value Criterion is useful in cases where long run planning is appropriate, and decision situations repeat themselves. § One problem with this criterion is that it does not consider attitude toward possible losses. 5

Decision Making Criteria (cont. ) § When to Use the Expected Value Approach § The Expected Value Criterion is useful in cases where long run planning is appropriate, and decision situations repeat themselves. § One problem with this criterion is that it does not consider attitude toward possible losses. 5

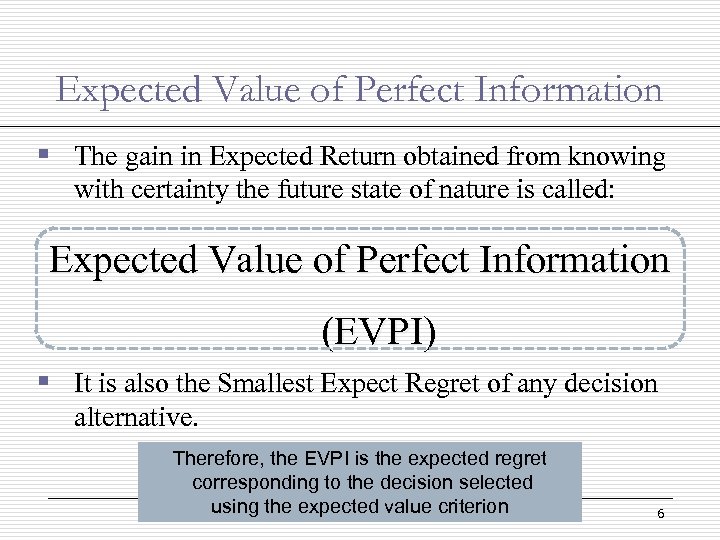

Expected Value of Perfect Information § The gain in Expected Return obtained from knowing with certainty the future state of nature is called: Expected Value of Perfect Information (EVPI) § It is also the Smallest Expect Regret of any decision alternative. Therefore, the EVPI is the expected regret corresponding to the decision selected using the expected value criterion 6

Expected Value of Perfect Information § The gain in Expected Return obtained from knowing with certainty the future state of nature is called: Expected Value of Perfect Information (EVPI) § It is also the Smallest Expect Regret of any decision alternative. Therefore, the EVPI is the expected regret corresponding to the decision selected using the expected value criterion 6

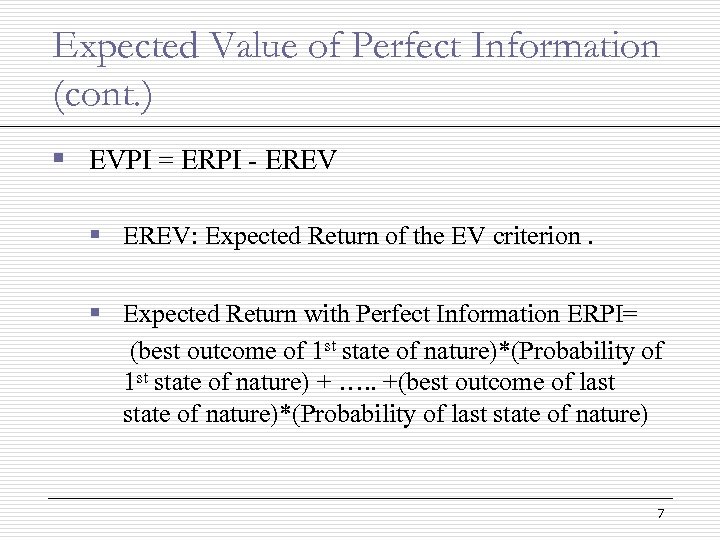

Expected Value of Perfect Information (cont. ) § EVPI = ERPI - EREV § EREV: Expected Return of the EV criterion. § Expected Return with Perfect Information ERPI= (best outcome of 1 st state of nature)*(Probability of 1 st state of nature) + …. . +(best outcome of last state of nature)*(Probability of last state of nature) 7

Expected Value of Perfect Information (cont. ) § EVPI = ERPI - EREV § EREV: Expected Return of the EV criterion. § Expected Return with Perfect Information ERPI= (best outcome of 1 st state of nature)*(Probability of 1 st state of nature) + …. . +(best outcome of last state of nature)*(Probability of last state of nature) 7

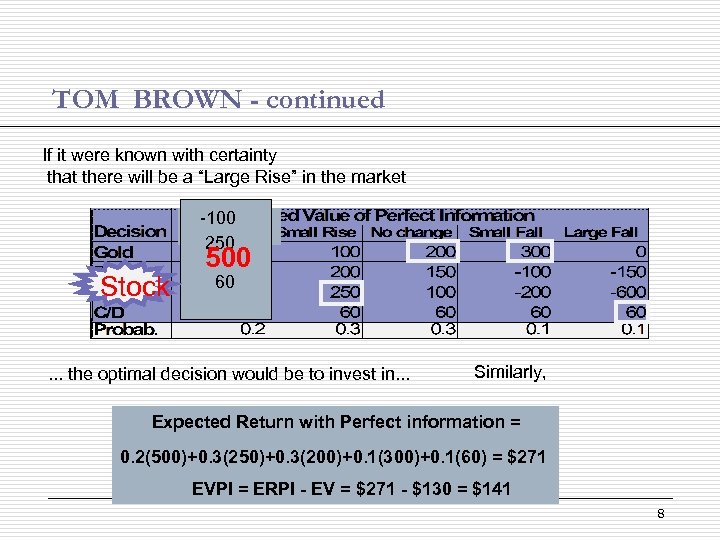

TOM BROWN - continued If it were known with certainty that there will be a “Large Rise” in the market -100 Large rise 250 Stock 500 60 . . . the optimal decision would be to invest in. . . Similarly, Expected Return with Perfect information = 0. 2(500)+0. 3(250)+0. 3(200)+0. 1(300)+0. 1(60) = $271 EVPI = ERPI - EV = $271 - $130 = $141 8

TOM BROWN - continued If it were known with certainty that there will be a “Large Rise” in the market -100 Large rise 250 Stock 500 60 . . . the optimal decision would be to invest in. . . Similarly, Expected Return with Perfect information = 0. 2(500)+0. 3(250)+0. 3(200)+0. 1(300)+0. 1(60) = $271 EVPI = ERPI - EV = $271 - $130 = $141 8

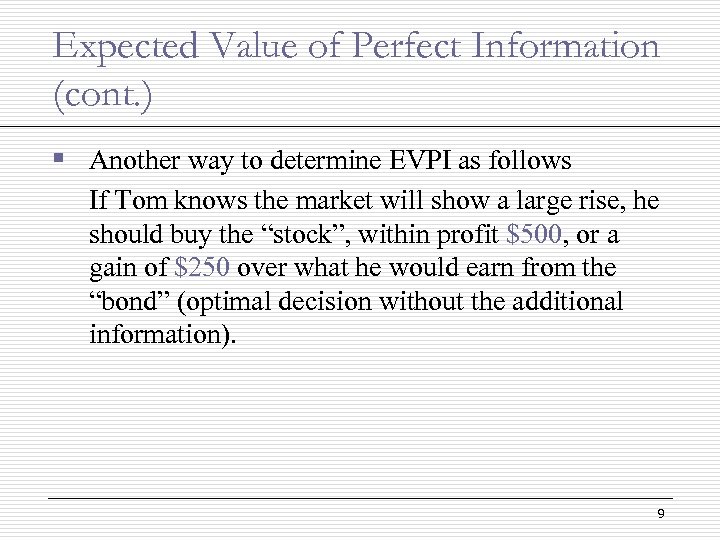

Expected Value of Perfect Information (cont. ) § Another way to determine EVPI as follows If Tom knows the market will show a large rise, he should buy the “stock”, within profit $500, or a gain of $250 over what he would earn from the “bond” (optimal decision without the additional information). 9

Expected Value of Perfect Information (cont. ) § Another way to determine EVPI as follows If Tom knows the market will show a large rise, he should buy the “stock”, within profit $500, or a gain of $250 over what he would earn from the “bond” (optimal decision without the additional information). 9

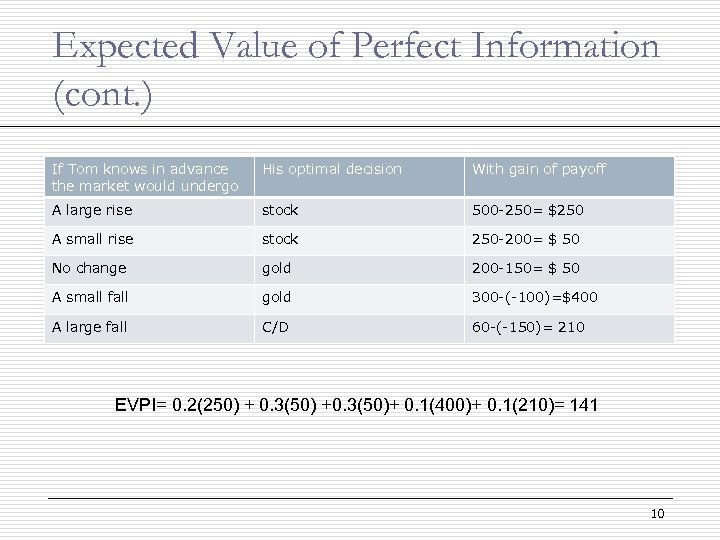

Expected Value of Perfect Information (cont. ) If Tom knows in advance the market would undergo His optimal decision With gain of payoff A large rise stock 500 -250= $250 A small rise stock 250 -200= $ 50 No change gold 200 -150= $ 50 A small fall gold 300 -(-100)=$400 A large fall C/D 60 -(-150)= 210 EVPI= 0. 2(250) + 0. 3(50) +0. 3(50)+ 0. 1(400)+ 0. 1(210)= 141 10

Expected Value of Perfect Information (cont. ) If Tom knows in advance the market would undergo His optimal decision With gain of payoff A large rise stock 500 -250= $250 A small rise stock 250 -200= $ 50 No change gold 200 -150= $ 50 A small fall gold 300 -(-100)=$400 A large fall C/D 60 -(-150)= 210 EVPI= 0. 2(250) + 0. 3(50) +0. 3(50)+ 0. 1(400)+ 0. 1(210)= 141 10

Baysian Analysis - Decision Making with Imperfect Information § Baysian Statistic play a role in assessing additional information obtained from various sources. § This additional information may assist in refining original probability estimates, and help improve decision making. 11

Baysian Analysis - Decision Making with Imperfect Information § Baysian Statistic play a role in assessing additional information obtained from various sources. § This additional information may assist in refining original probability estimates, and help improve decision making. 11

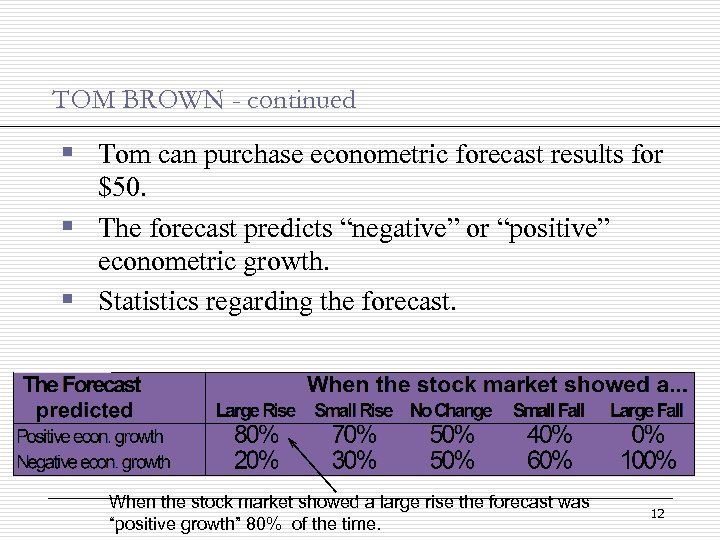

TOM BROWN - continued § Tom can purchase econometric forecast results for $50. § The forecast predicts “negative” or “positive” econometric growth. § Statistics regarding the forecast. When the stock market showed a large rise the forecast was “positive growth” 80% of the time. 12

TOM BROWN - continued § Tom can purchase econometric forecast results for $50. § The forecast predicts “negative” or “positive” econometric growth. § Statistics regarding the forecast. When the stock market showed a large rise the forecast was “positive growth” 80% of the time. 12

TOM BROWN - continued § P(forecast predicts “positive” | small rise in market) = 0. 7 § P(forecast predicts “ negative” | small rise in market) = 0. 3 Should Tom purchase the Forecast ? 13

TOM BROWN - continued § P(forecast predicts “positive” | small rise in market) = 0. 7 § P(forecast predicts “ negative” | small rise in market) = 0. 3 Should Tom purchase the Forecast ? 13

SOLUTION § Tom should determine his optimal decisions when the forecast is “positive” and “negative”. § If his decisions change because of the forecast, he should compare the expected payoff with and without the forecast. § If the expected gain resulting from the decisions made with the forecast exceeds $50, he should purchase the forecast. 14

SOLUTION § Tom should determine his optimal decisions when the forecast is “positive” and “negative”. § If his decisions change because of the forecast, he should compare the expected payoff with and without the forecast. § If the expected gain resulting from the decisions made with the forecast exceeds $50, he should purchase the forecast. 14

SOLUTION § To find Expected payoff with forecast Tom should determine what to do when: § The forecast is “positive growth” § The forecast is “negative growth” 15

SOLUTION § To find Expected payoff with forecast Tom should determine what to do when: § The forecast is “positive growth” § The forecast is “negative growth” 15

SOLUTION § Tom needs to know the following probabilities § § § P(Large rise | The forecast predicted “Positive”) P(Small rise | The forecast predicted “Positive”) P(No change | The forecast predicted “Positive ”) P(Small fall | The forecast predicted “Positive”) P(Large Fall | The forecast predicted “Positive”) 16

SOLUTION § Tom needs to know the following probabilities § § § P(Large rise | The forecast predicted “Positive”) P(Small rise | The forecast predicted “Positive”) P(No change | The forecast predicted “Positive ”) P(Small fall | The forecast predicted “Positive”) P(Large Fall | The forecast predicted “Positive”) 16

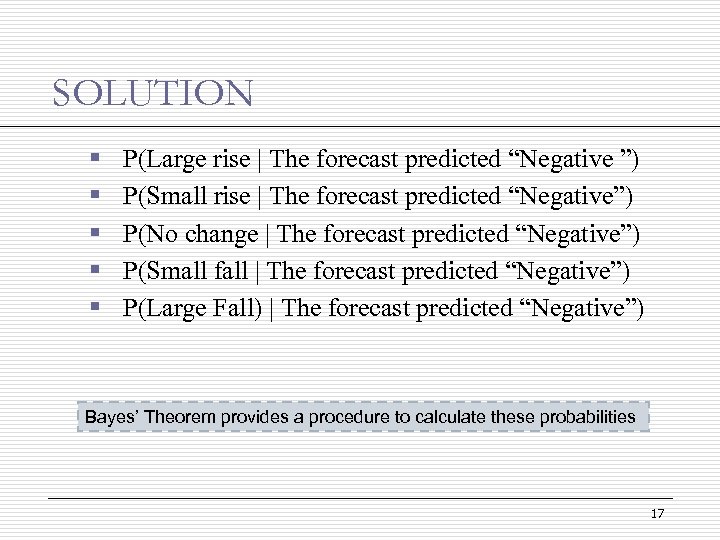

SOLUTION § § § P(Large rise | The forecast predicted “Negative ”) P(Small rise | The forecast predicted “Negative”) P(No change | The forecast predicted “Negative”) P(Small fall | The forecast predicted “Negative”) P(Large Fall) | The forecast predicted “Negative”) Bayes’ Theorem provides a procedure to calculate these probabilities 17

SOLUTION § § § P(Large rise | The forecast predicted “Negative ”) P(Small rise | The forecast predicted “Negative”) P(No change | The forecast predicted “Negative”) P(Small fall | The forecast predicted “Negative”) P(Large Fall) | The forecast predicted “Negative”) Bayes’ Theorem provides a procedure to calculate these probabilities 17

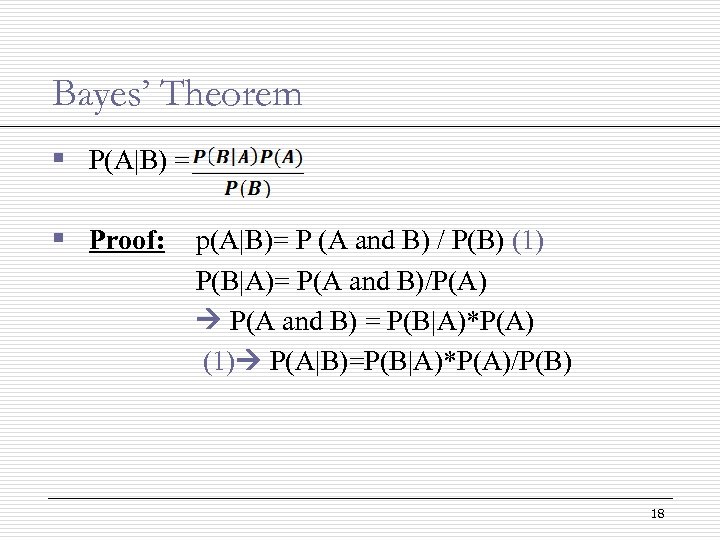

Bayes’ Theorem § P(A|B) = § Proof: p(A|B)= P (A and B) / P(B) (1) P(B|A)= P(A and B)/P(A) P(A and B) = P(B|A)*P(A) (1) P(A|B)=P(B|A)*P(A)/P(B) 18

Bayes’ Theorem § P(A|B) = § Proof: p(A|B)= P (A and B) / P(B) (1) P(B|A)= P(A and B)/P(A) P(A and B) = P(B|A)*P(A) (1) P(A|B)=P(B|A)*P(A)/P(B) 18

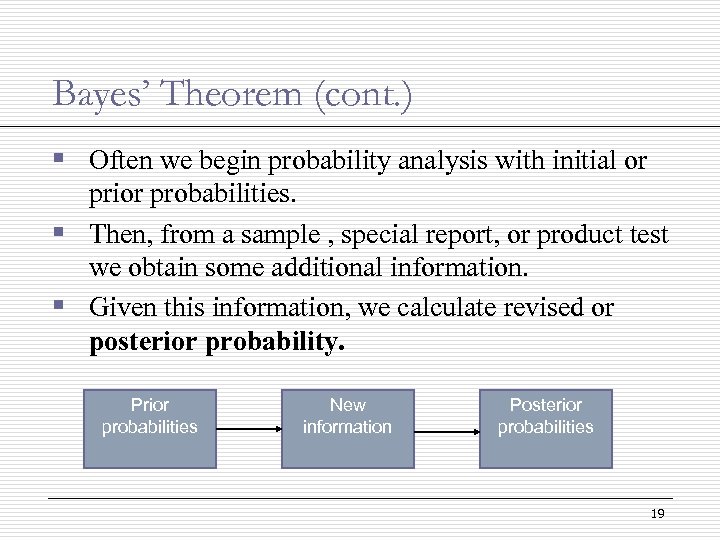

Bayes’ Theorem (cont. ) § Often we begin probability analysis with initial or prior probabilities. § Then, from a sample , special report, or product test we obtain some additional information. § Given this information, we calculate revised or posterior probability. Prior probabilities New information Posterior probabilities 19

Bayes’ Theorem (cont. ) § Often we begin probability analysis with initial or prior probabilities. § Then, from a sample , special report, or product test we obtain some additional information. § Given this information, we calculate revised or posterior probability. Prior probabilities New information Posterior probabilities 19

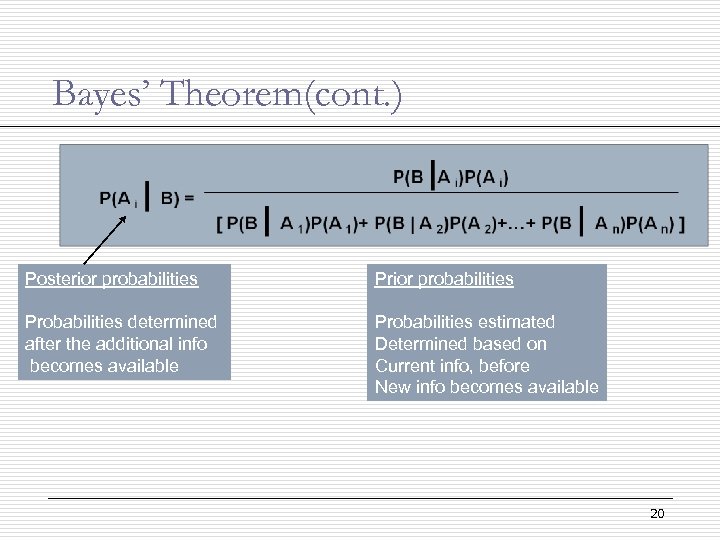

Bayes’ Theorem(cont. ) Posterior probabilities Probabilities determined after the additional info becomes available Probabilities estimated Determined based on Current info, before New info becomes available 20

Bayes’ Theorem(cont. ) Posterior probabilities Probabilities determined after the additional info becomes available Probabilities estimated Determined based on Current info, before New info becomes available 20

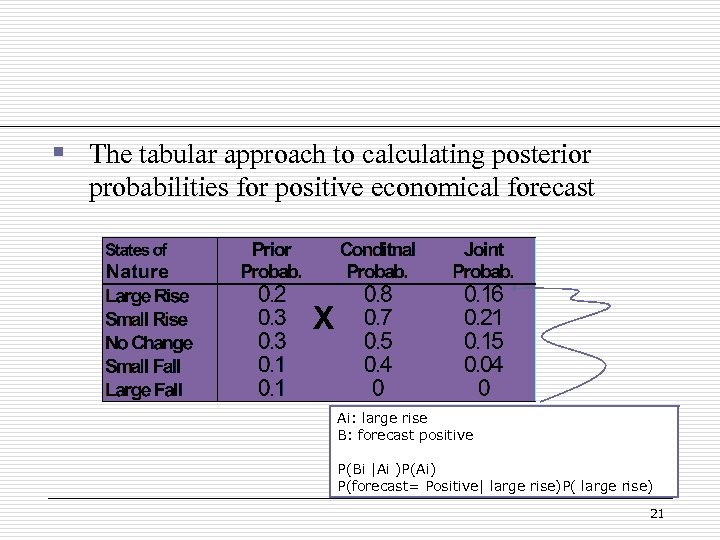

§ The tabular approach to calculating posterior probabilities for positive economical forecast X Ai: large rise B: forecast positive P(Bi |Ai )P(Ai) P(forecast= Positive| large rise)P( large rise) 21

§ The tabular approach to calculating posterior probabilities for positive economical forecast X Ai: large rise B: forecast positive P(Bi |Ai )P(Ai) P(forecast= Positive| large rise)P( large rise) 21

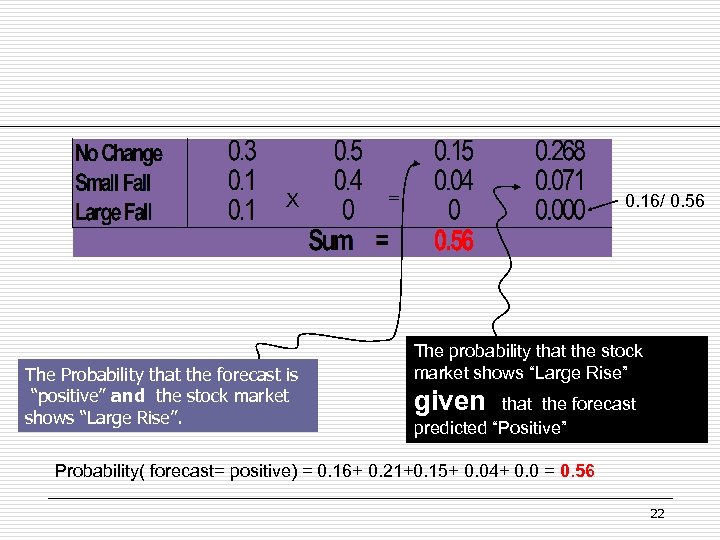

X The Probability that the forecast is “positive” and the stock market shows “Large Rise”. = 0. 16/ 0. 56 The probability that the stock market shows “Large Rise” given that the forecast predicted “Positive” Probability( forecast= positive) = 0. 16+ 0. 21+0. 15+ 0. 04+ 0. 0 = 0. 56 22

X The Probability that the forecast is “positive” and the stock market shows “Large Rise”. = 0. 16/ 0. 56 The probability that the stock market shows “Large Rise” given that the forecast predicted “Positive” Probability( forecast= positive) = 0. 16+ 0. 21+0. 15+ 0. 04+ 0. 0 = 0. 56 22

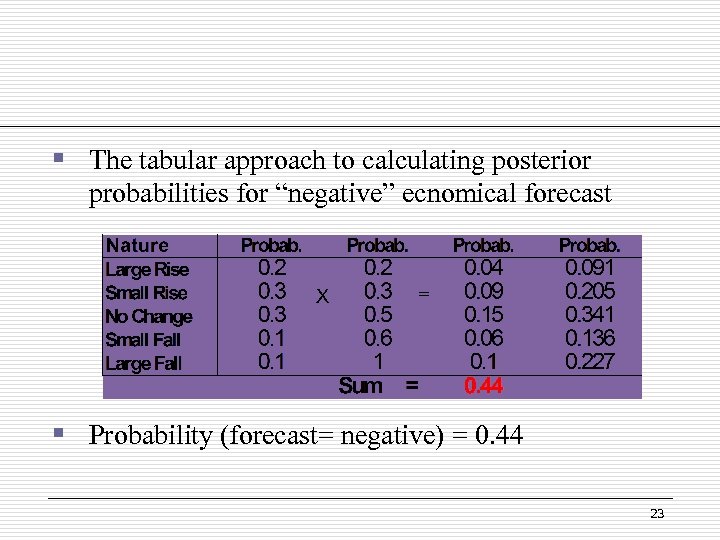

§ The tabular approach to calculating posterior probabilities for “negative” ecnomical forecast X = § Probability (forecast= negative) = 0. 44 23

§ The tabular approach to calculating posterior probabilities for “negative” ecnomical forecast X = § Probability (forecast= negative) = 0. 44 23

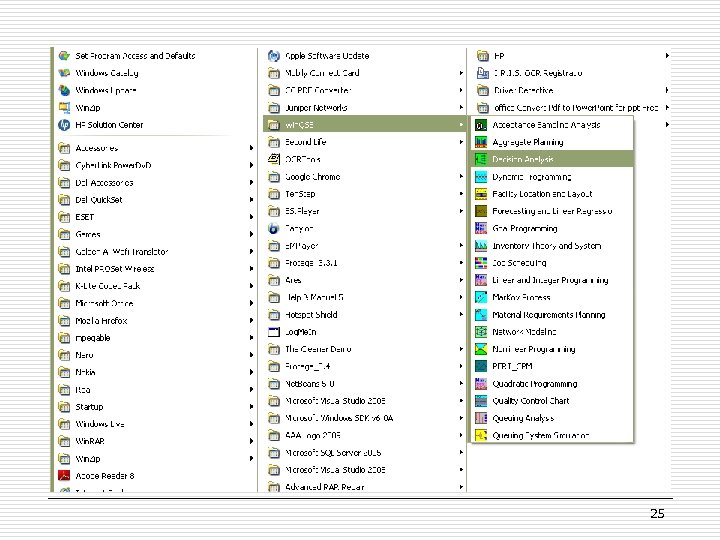

WINQSB printout for the calculation of the Posterior probabilities 24

WINQSB printout for the calculation of the Posterior probabilities 24

25

25

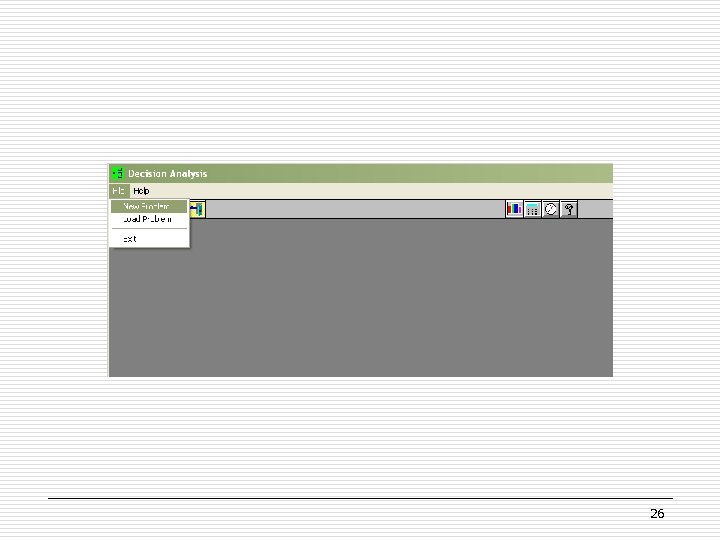

26

26

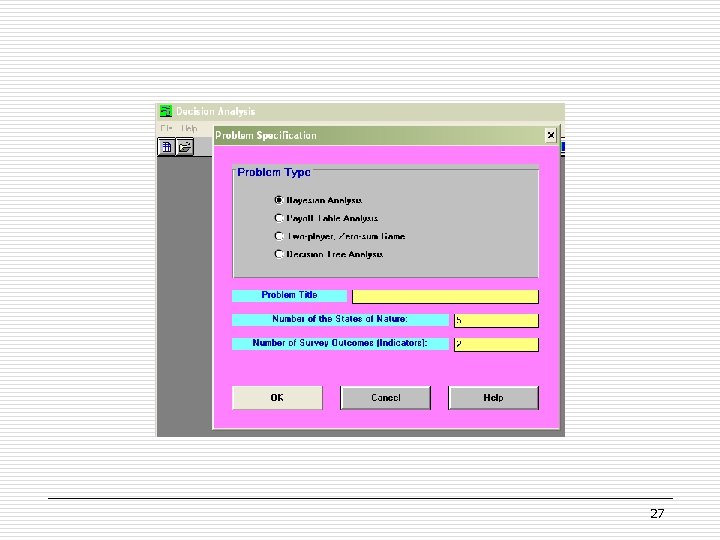

27

27

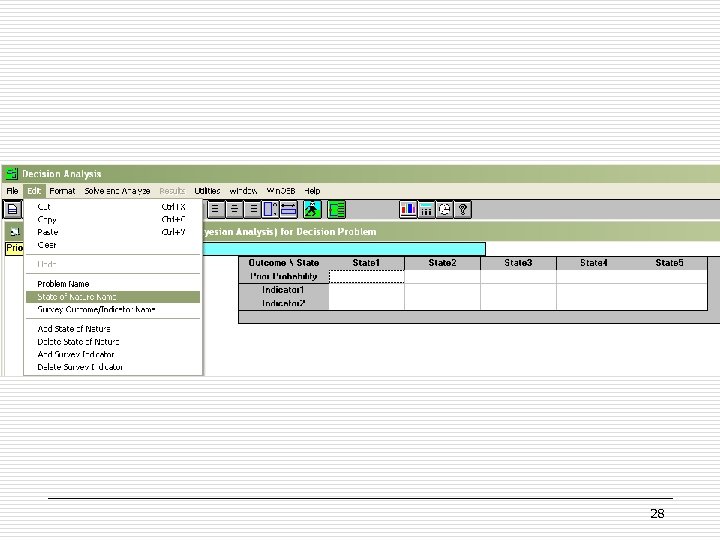

28

28

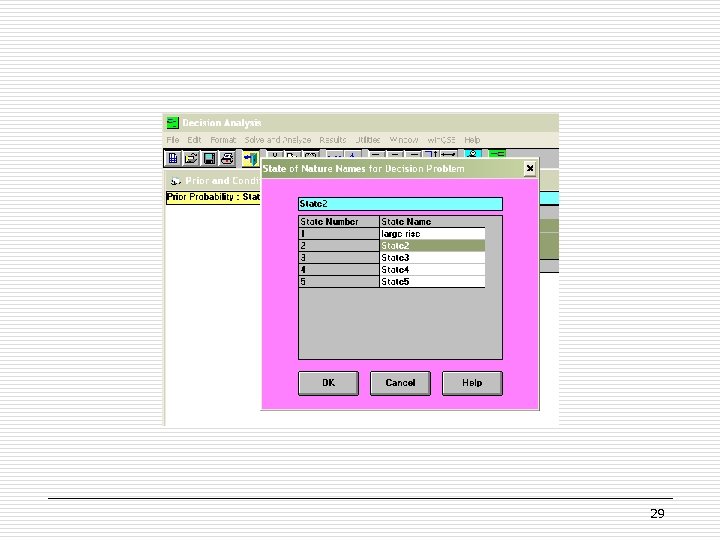

29

29

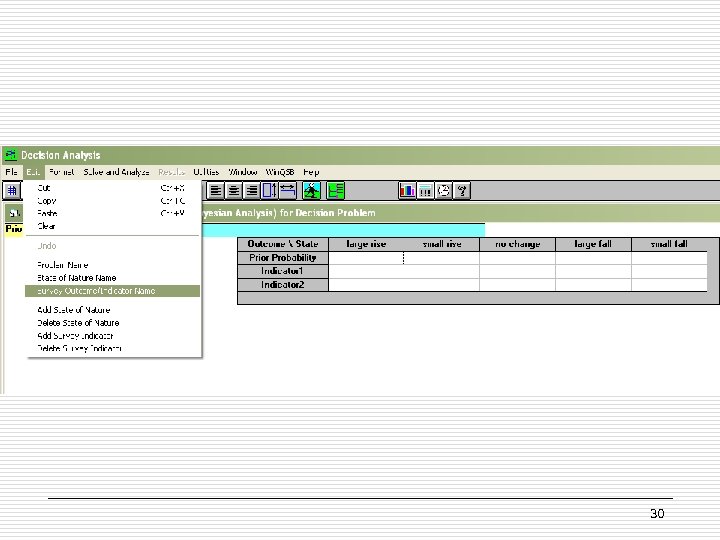

30

30

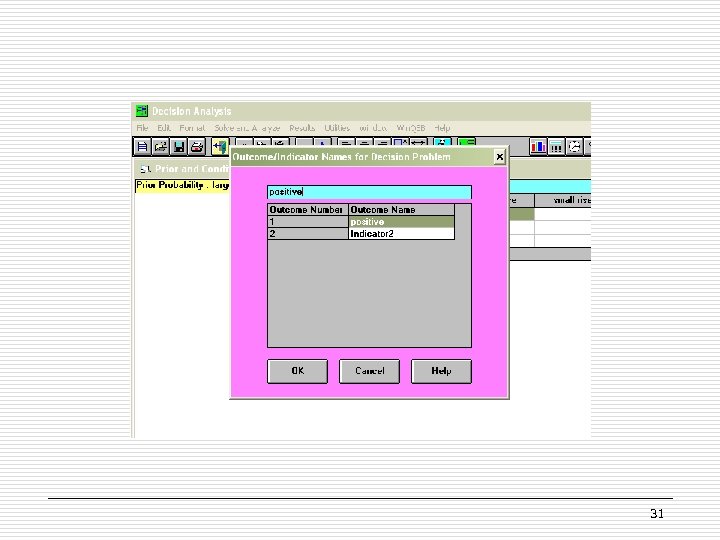

31

31

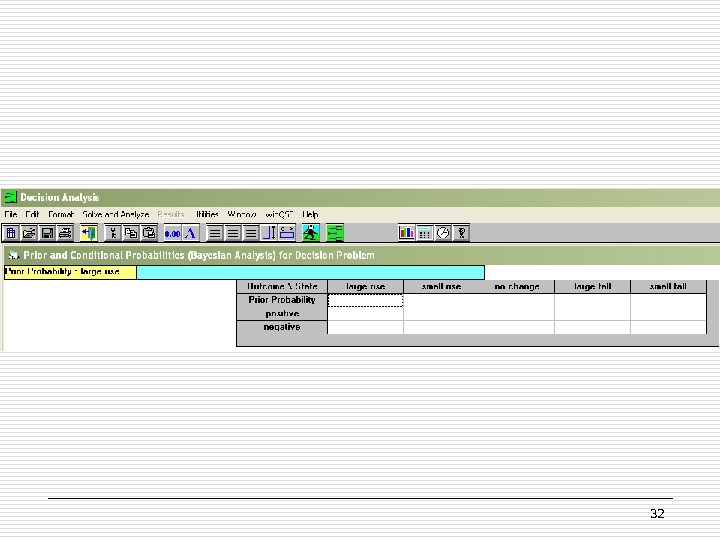

32

32

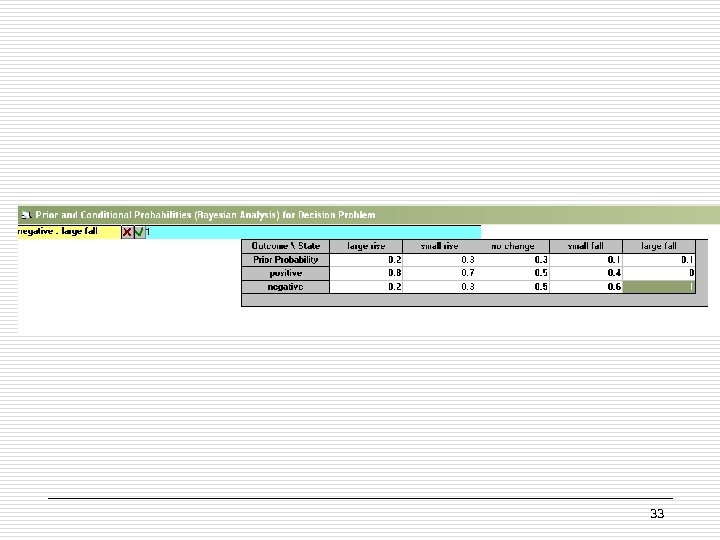

33

33

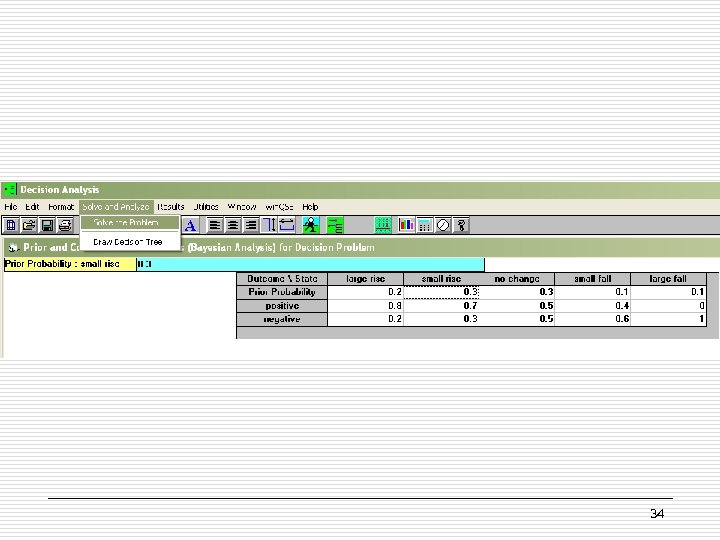

34

34

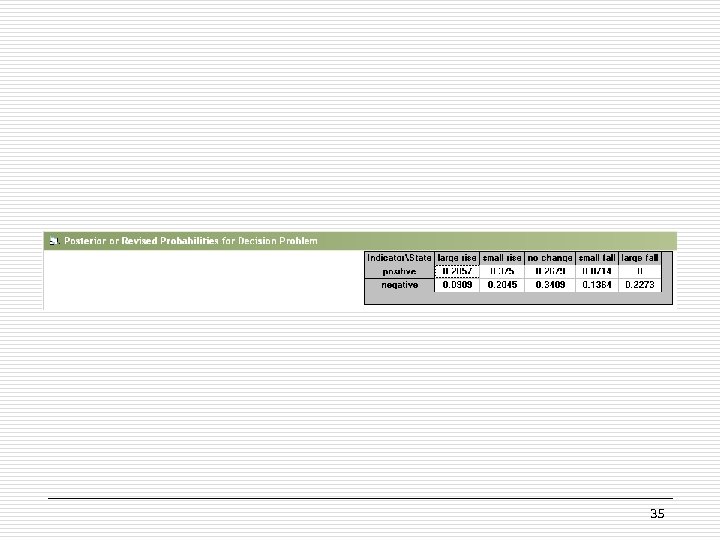

35

35

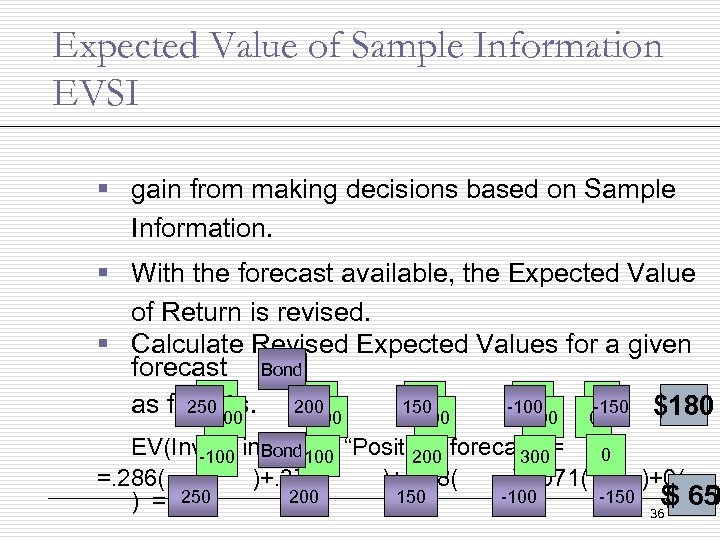

Expected Value of Sample Information EVSI § gain from making decisions based on Sample Information. § With the forecast available, the Expected Value of Return is revised. § Calculate Revised Expected Values for a given Gold forecast Bond -100 200 300 00 -100 250 200 150 200 -100 300 -150 $180 as follows. 100 $84 -100 200 300 0 EV(Invest in……. |“Positive” forecast) = Gold -100 Bond 100 200 300 =. 286( )+. 375( )+. 268( )+. 071( 250 100 200 150 -100 300 ) = -100 0 -150 0 )+0( $120 $ 65 36

Expected Value of Sample Information EVSI § gain from making decisions based on Sample Information. § With the forecast available, the Expected Value of Return is revised. § Calculate Revised Expected Values for a given Gold forecast Bond -100 200 300 00 -100 250 200 150 200 -100 300 -150 $180 as follows. 100 $84 -100 200 300 0 EV(Invest in……. |“Positive” forecast) = Gold -100 Bond 100 200 300 =. 286( )+. 375( )+. 268( )+. 071( 250 100 200 150 -100 300 ) = -100 0 -150 0 )+0( $120 $ 65 36

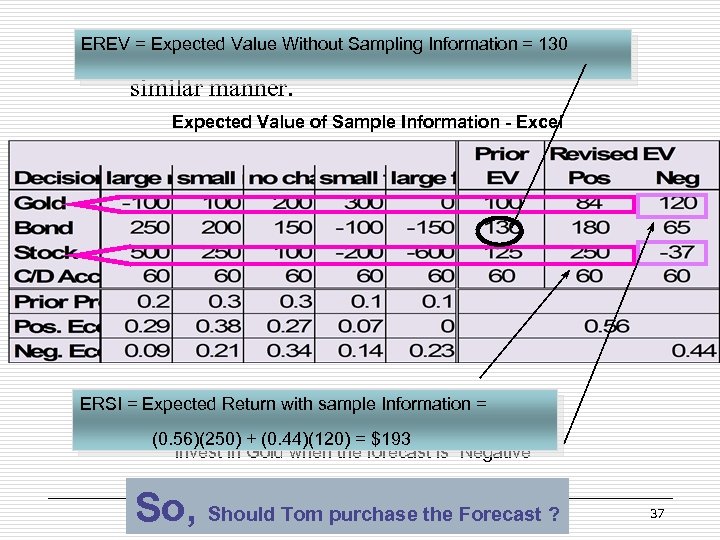

EREV = Expected of the revised EV s. Information = 130 § The rest Value Without Sampling are calculated in a similar manner. Expected Value of Sample Information - Excel Invest Expected Return Forecast is Information ERSI =in Stock when the with sample “Positive” = (0. 56)(250) + (0. 44)(120) = $193 Invest in Gold when the forecast is “Negative” So, Should Tom purchase the Forecast ? 37

EREV = Expected of the revised EV s. Information = 130 § The rest Value Without Sampling are calculated in a similar manner. Expected Value of Sample Information - Excel Invest Expected Return Forecast is Information ERSI =in Stock when the with sample “Positive” = (0. 56)(250) + (0. 44)(120) = $193 Invest in Gold when the forecast is “Negative” So, Should Tom purchase the Forecast ? 37

§ EVSI = Expected Value of Sampling Information = ERSI - EREV = 193 - 130 = $63. Yes, Tom should purchase the Forecast. His expected return is greater than the Forecast cost. § Efficiency = EVSI / EVPI = 63 / 141 = 0. 45 38

§ EVSI = Expected Value of Sampling Information = ERSI - EREV = 193 - 130 = $63. Yes, Tom should purchase the Forecast. His expected return is greater than the Forecast cost. § Efficiency = EVSI / EVPI = 63 / 141 = 0. 45 38

Game Theory § Game theory can be used to determine optimal decision in face of other decision making players. § All the players are seeking to maximize their return. § The payoff is based on the actions taken by all the decision making players. 39

Game Theory § Game theory can be used to determine optimal decision in face of other decision making players. § All the players are seeking to maximize their return. § The payoff is based on the actions taken by all the decision making players. 39

Game Theory (cont. ) § Classification of Games § Number of Players § Two players - Chess § Multiplayer - More than two competitors (Poker) § Total return § Zero Sum - The amount won and amount lost by all competitors are equal (Poker among friends) § Nonzero Sum -The amount won and the amount lost by all competitors are not equal (Poker In A Casino) 40

Game Theory (cont. ) § Classification of Games § Number of Players § Two players - Chess § Multiplayer - More than two competitors (Poker) § Total return § Zero Sum - The amount won and amount lost by all competitors are equal (Poker among friends) § Nonzero Sum -The amount won and the amount lost by all competitors are not equal (Poker In A Casino) 40

Game Theory (cont. ) § Sequence of Moves § Sequential - Each player gets a play in a given sequence. § Simultaneous - All players play simultaneously. 41

Game Theory (cont. ) § Sequence of Moves § Sequential - Each player gets a play in a given sequence. § Simultaneous - All players play simultaneously. 41