e658a0a9d1ea528519e09d039785bdca.ppt

- Количество слайдов: 30

Chapter 3 Buying and Selling Securities • Getting started • Brokerage accounts • Short sales • Investor objectives, constraints, and strategies © 2009 Mc. Graw-Hill Ryerson Limited 3 -1

Getting Started (a) Open a brokerage or trading account (b) Deposit $10, 000 into account (d) Pay Commission, Say $50 (c) Buy 100 Shares of Disney at $60 per share (e) $3, 950 Cash in Account $6, 000 Stock In Account © 2009 Mc. Graw-Hill Ryerson Limited 3 - 2

Choosing a Broker n n n Brokers are traditionally divided into three groups: 1. full-service brokers 2. discount brokers 3. deep-discount brokers These three groups can be distinguished by the level of service provided, as well as the level of commissions charged. As the brokerage industry becomes more competitive, the differences among broker types continues to blur. Another important change is the rapid growth of online brokers, also known as e-brokers or cyberbrokers. Online investing has really changed the brokerage industry. n slashing brokerage commissions n providing investment information n Customers place buy and sell orders over the Internet © 2009 Mc. Graw-Hill Ryerson Limited 3 - 3

Choosing a Broker © 2009 Mc. Graw-Hill Ryerson Limited 3 - 4

Canadian Investor Protection Fund n n Canadian Investor Protection Fund (CIPF): Insurance fund covering investors’ brokerage accounts with member firms. Most brokerage firms belong to the CIPF, which insures each account for up to $1, 000 for losses of securities, commodity and futures contracts. Important: The CIPF does not guarantee the value of any security (unlike CDIC coverage). Rather, CIPF protects whatever amount of cash and securities that were in your account, in the event of fraud or other failure. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 5

Broker-Customer Relations n There are several important things to remember when you deal with a broker: n Any advice you receive is not guaranteed. n Your broker works as your agent and has a legal duty to act in your best interest. n However, brokerage firms make profits from brokerage commissions. n Your account agreement will probably specify that any disputes will be settled by arbitration and that the arbitration is final and binding. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 6

Brokerage Accounts n n A Cash account is a brokerage account in which securities are paid for in full. A Margin account is a brokerage account in which, subject to limits, securities can be bought and sold short on credit. (more on selling short later) © 2009 Mc. Graw-Hill Ryerson Limited 3 - 7

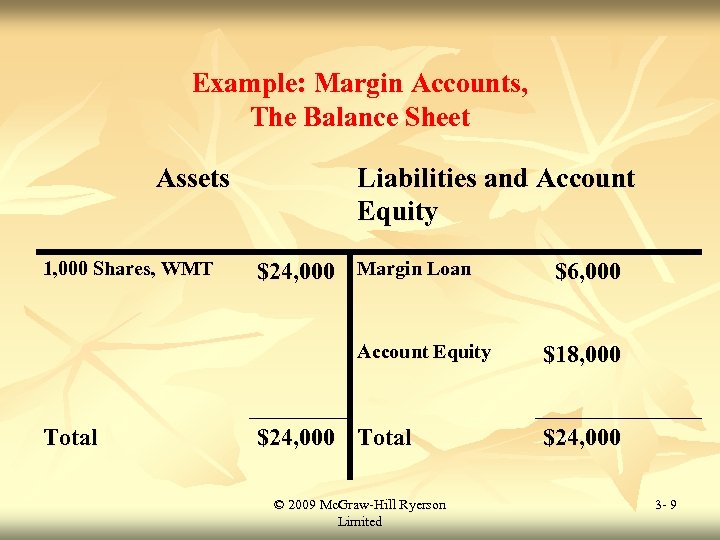

Margin Accounts n In a margin purchase, the portion of the value of an investment that is not borrowed is called the margin. Of course, the portion that is borrowed incurs an interest charge. n This interest is based on the broker’s call money rate. n The call money rate is the rate brokers pay to borrow money to lend to customers in their margin accounts. n Example: Margin Accounts, The Balance Sheet n You buy 1, 000 Wal-Mart shares at $24 per share. n You put up $18, 000 and borrow the rest. n Amount borrowed = $24, 000 – $18, 000 = $6, 000 n Margin = $18, 000 / $24, 000 = 75% © 2009 Mc. Graw-Hill Ryerson Limited 3 - 8

Example: Margin Accounts, The Balance Sheet Assets 1, 000 Shares, WMT Liabilities and Account Equity $24, 000 Margin Loan Account Equity Total $24, 000 Total © 2009 Mc. Graw-Hill Ryerson Limited $6, 000 $18, 000 $24, 000 3 - 9

Margin Accounts n n n In a margin purchase, the minimum margin that must be supplied is called the initial margin. The maintenance margin is the margin amount that must be present at all times in a margin account. When the margin drops below the maintenance margin, the broker can demand more funds. This is known as a margin call. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 10

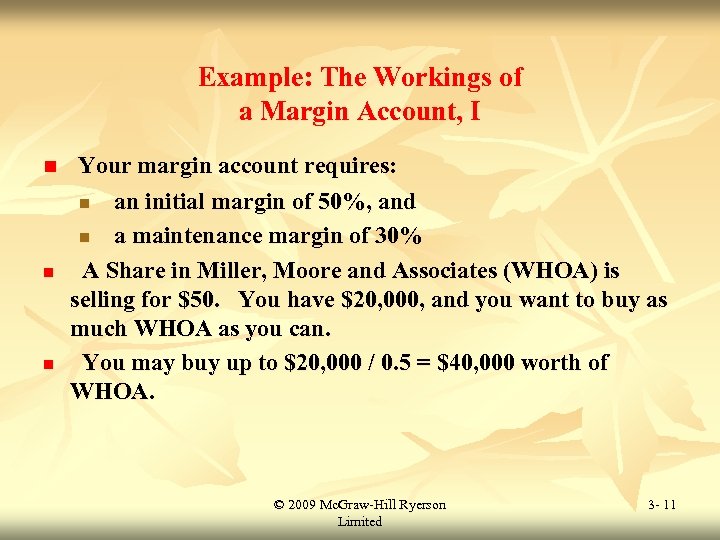

Example: The Workings of a Margin Account, I n n n Your margin account requires: n an initial margin of 50%, and n a maintenance margin of 30% A Share in Miller, Moore and Associates (WHOA) is selling for $50. You have $20, 000, and you want to buy as much WHOA as you can. You may buy up to $20, 000 / 0. 5 = $40, 000 worth of WHOA. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 11

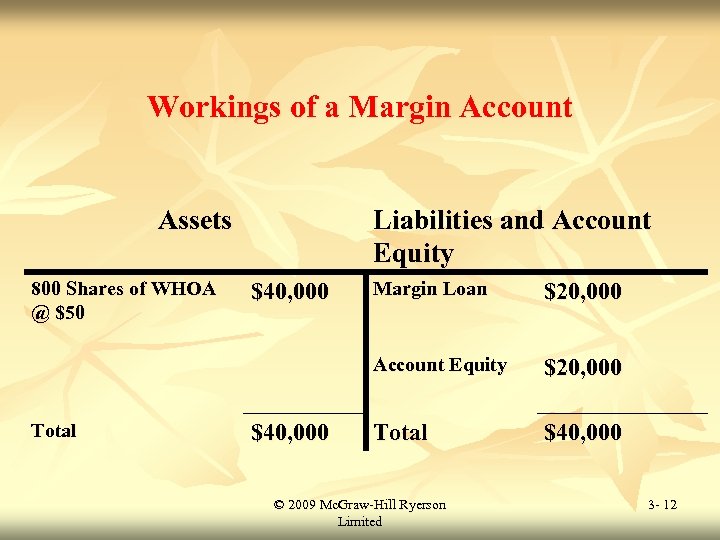

Workings of a Margin Account Assets 800 Shares of WHOA @ $50 Liabilities and Account Equity Total $40, 000 Margin Loan $20, 000 Account Equity $40, 000 $20, 000 Total $40, 000 © 2009 Mc. Graw-Hill Ryerson Limited 3 - 12

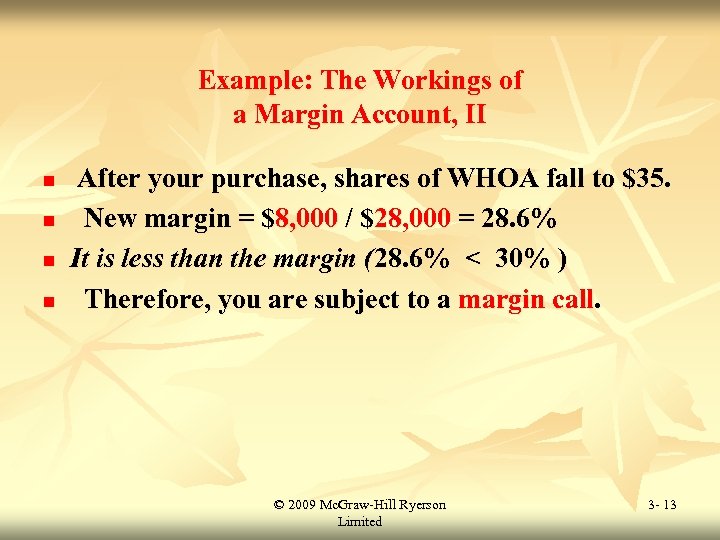

Example: The Workings of a Margin Account, II n n After your purchase, shares of WHOA fall to $35. New margin = $8, 000 / $28, 000 = 28. 6% It is less than the margin (28. 6% < 30% ) Therefore, you are subject to a margin call. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 13

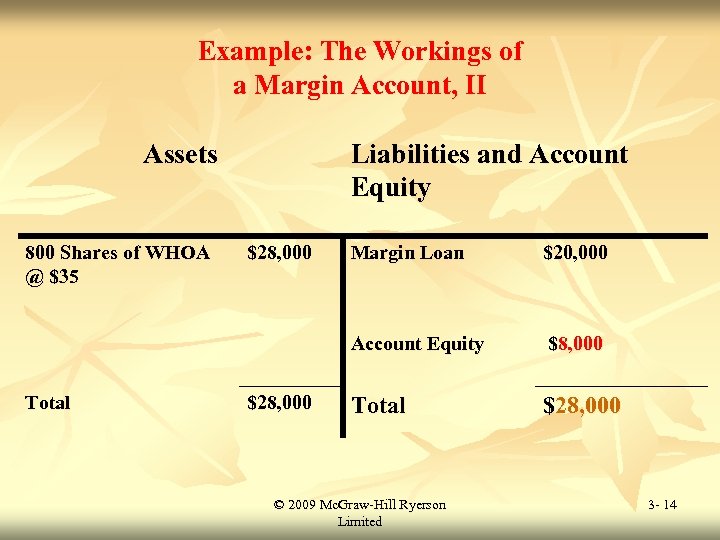

Example: The Workings of a Margin Account, II Assets 800 Shares of WHOA @ $35 Liabilities and Account Equity $28, 000 Margin Loan $20, 000 Account Equity Total $28, 000 $8, 000 Total $28, 000 © 2009 Mc. Graw-Hill Ryerson Limited 3 - 14

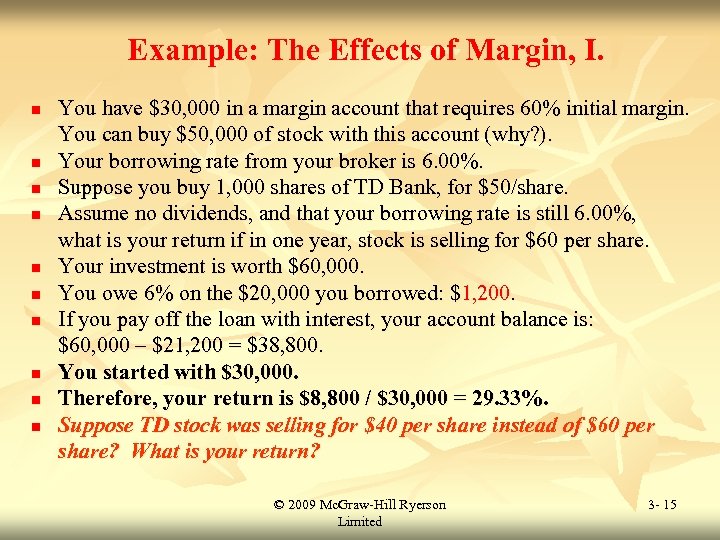

Example: The Effects of Margin, I. n n n n n You have $30, 000 in a margin account that requires 60% initial margin. You can buy $50, 000 of stock with this account (why? ). Your borrowing rate from your broker is 6. 00%. Suppose you buy 1, 000 shares of TD Bank, for $50/share. Assume no dividends, and that your borrowing rate is still 6. 00%, what is your return if in one year, stock is selling for $60 per share. Your investment is worth $60, 000. You owe 6% on the $20, 000 you borrowed: $1, 200. If you pay off the loan with interest, your account balance is: $60, 000 – $21, 200 = $38, 800. You started with $30, 000. Therefore, your return is $8, 800 / $30, 000 = 29. 33%. Suppose TD stock was selling for $40 per share instead of $60 per share? What is your return? © 2009 Mc. Graw-Hill Ryerson Limited 3 - 15

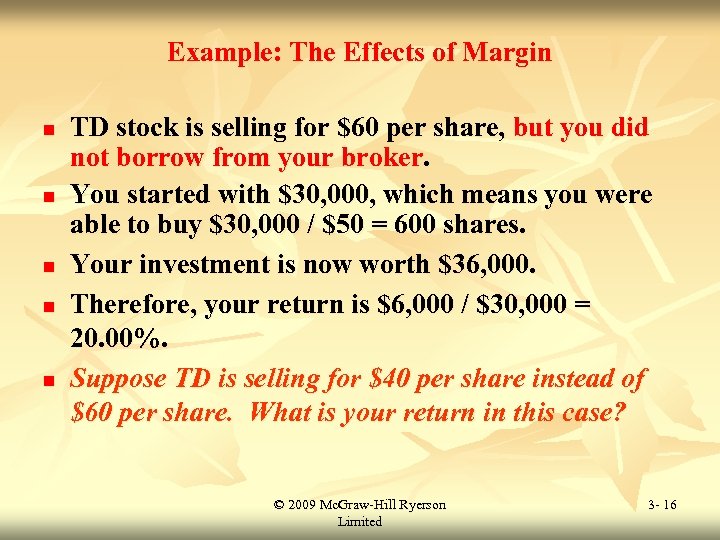

Example: The Effects of Margin n n TD stock is selling for $60 per share, but you did not borrow from your broker. You started with $30, 000, which means you were able to buy $30, 000 / $50 = 600 shares. Your investment is now worth $36, 000. Therefore, your return is $6, 000 / $30, 000 = 20. 00%. Suppose TD is selling for $40 per share instead of $60 per share. What is your return in this case? © 2009 Mc. Graw-Hill Ryerson Limited 3 - 16

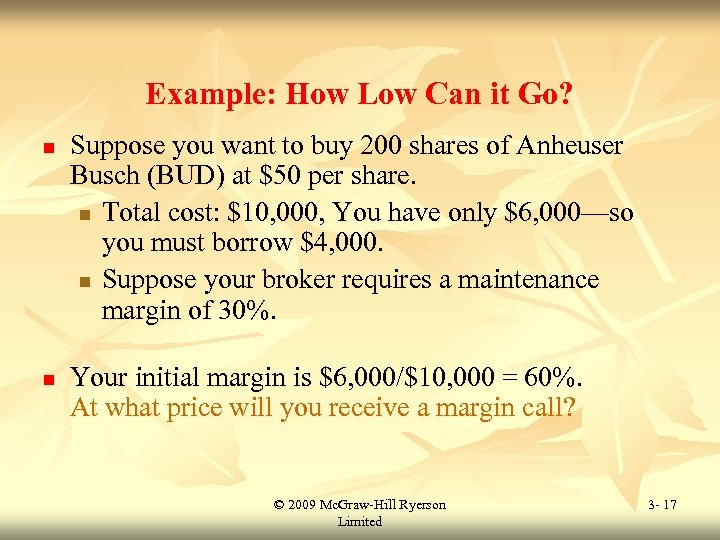

Example: How Low Can it Go? n n Suppose you want to buy 200 shares of Anheuser Busch (BUD) at $50 per share. n Total cost: $10, 000, You have only $6, 000—so you must borrow $4, 000. n Suppose your broker requires a maintenance margin of 30%. Your initial margin is $6, 000/$10, 000 = 60%. At what price will you receive a margin call? © 2009 Mc. Graw-Hill Ryerson Limited 3 - 17

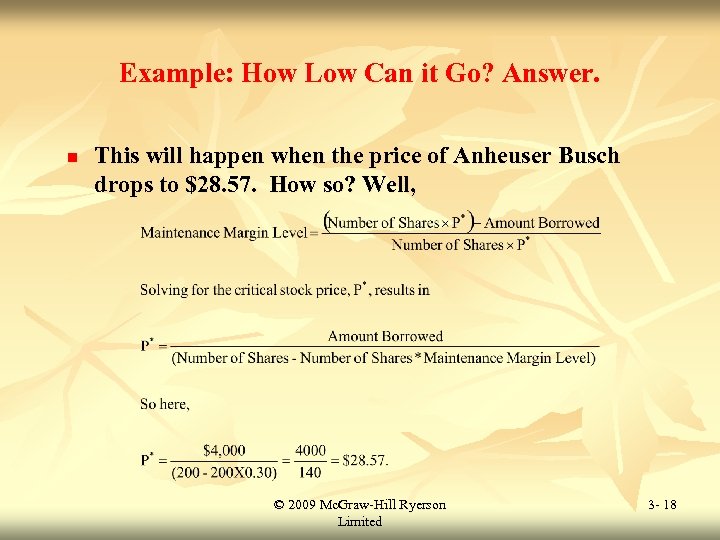

Example: How Low Can it Go? Answer. n This will happen when the price of Anheuser Busch drops to $28. 57. How so? Well, © 2009 Mc. Graw-Hill Ryerson Limited 3 - 18

Hypothecation and Street Name Registration n Hypothecation is the act of pledging securities as a collateral against a loan. This pledge is needed so that the securities can be sold by the broker if the customer is unwilling or unable to meet a margin call. Street name registration is an arrangement under which a broker is the registered owner of a security. (You, as the account holder are the “beneficial owner. ”) © 2009 Mc. Graw-Hill Ryerson Limited 3 - 19

Other Account Issues, I. n n Trading accounts can also be differentiated by the ways they are managed. n Advisory account - You pay someone else to make buy and sell decisions on your behalf. n Wrap account - All the expenses associated with your account are “wrapped” into a single fee. n Discretionary account - You authorize your broker to trade for you. n Asset management account - Provide for complete money management, including check-writing privileges, credit cards, and margin loans. To invest in financial securities, you do not need an account with a broker. One alternative is to buy securities directly from the issuer. Another alternative is to invest in mutual funds. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 20

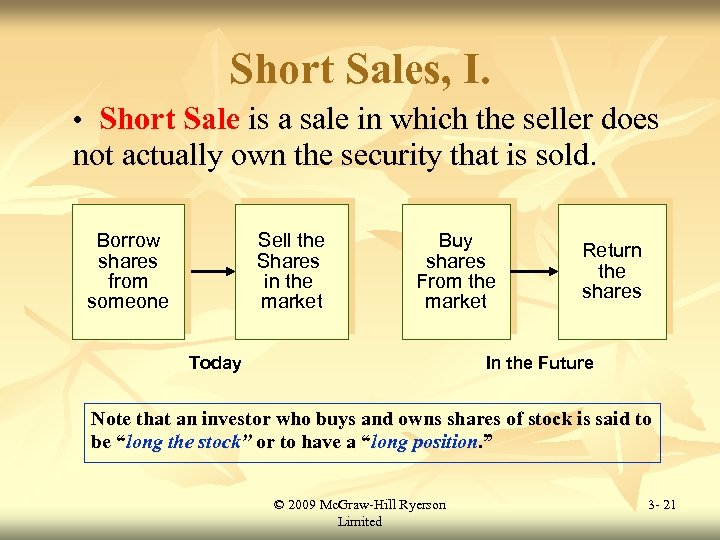

Short Sales, I. • Short Sale is a sale in which the seller does not actually own the security that is sold. Borrow shares from someone Sell the Shares in the market Buy shares From the market Today Return the shares In the Future Note that an investor who buys and owns shares of stock is said to be “long the stock” or to have a “long position. ” © 2009 Mc. Graw-Hill Ryerson Limited 3 - 21

Short Sales, II. n n An investor with a long position benefits from price increases. n Easy to understand n You buy today at $34, and sell later at $57, you profit! n Buy low, sell high An investor with a short position benefits from price decreases. n Also easy to understand n You sell today at $83, and buy later at $27, you profit. n Sell high, buy low © 2009 Mc. Graw-Hill Ryerson Limited 3 - 22

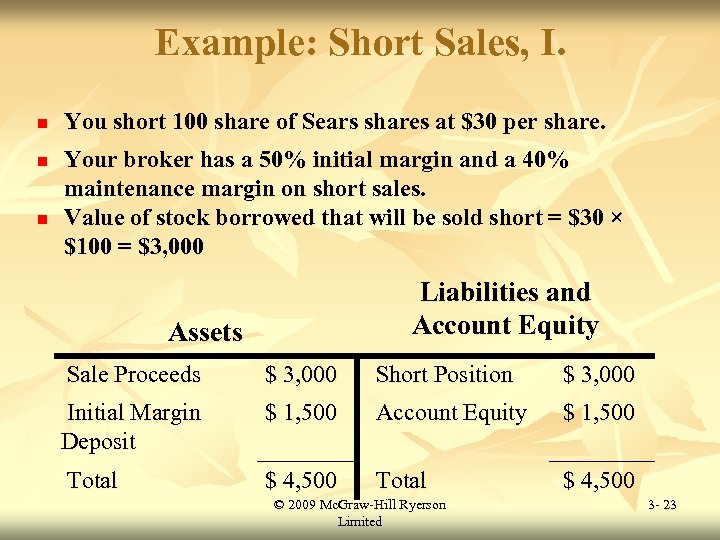

Example: Short Sales, I. n n n You short 100 share of Sears shares at $30 per share. Your broker has a 50% initial margin and a 40% maintenance margin on short sales. Value of stock borrowed that will be sold short = $30 × $100 = $3, 000 Liabilities and Account Equity Assets Sale Proceeds $ 3, 000 Short Position $ 3, 000 Initial Margin Deposit $ 1, 500 Account Equity $ 1, 500 Total $ 4, 500 © 2009 Mc. Graw-Hill Ryerson Limited 3 - 23

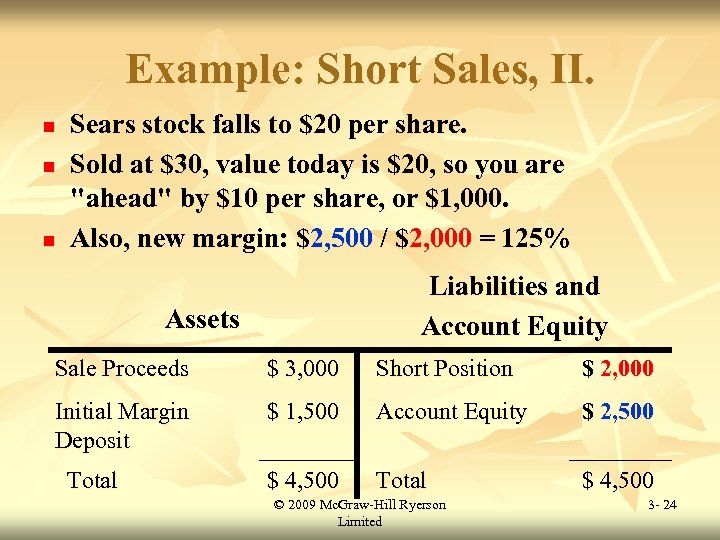

Example: Short Sales, II. n n n Sears stock falls to $20 per share. Sold at $30, value today is $20, so you are "ahead" by $10 per share, or $1, 000. Also, new margin: $2, 500 / $2, 000 = 125% Liabilities and Account Equity Assets Sale Proceeds $ 3, 000 Short Position $ 2, 000 Initial Margin Deposit $ 1, 500 Account Equity $ 2, 500 $ 4, 500 Total © 2009 Mc. Graw-Hill Ryerson Limited 3 - 24

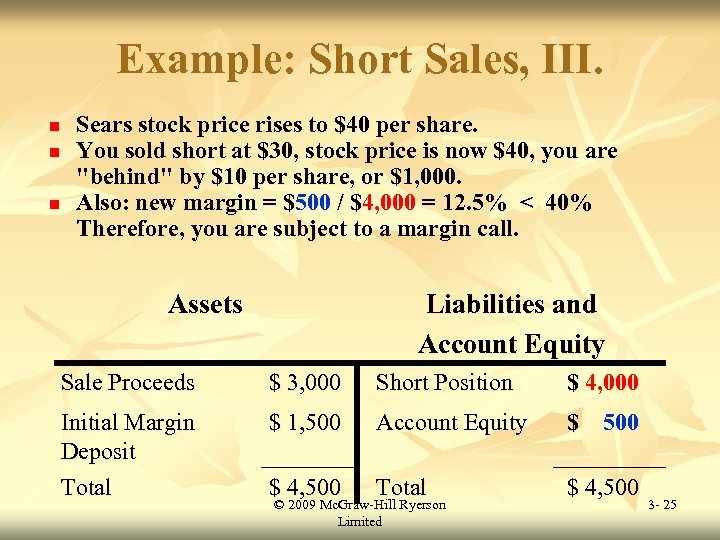

Example: Short Sales, III. n n n Sears stock price rises to $40 per share. You sold short at $30, stock price is now $40, you are "behind" by $10 per share, or $1, 000. Also: new margin = $500 / $4, 000 = 12. 5% < 40% Therefore, you are subject to a margin call. Assets Liabilities and Account Equity Sale Proceeds $ 3, 000 Short Position $ 4, 000 Initial Margin Deposit Total $ 1, 500 Account Equity $ 500 $ 4, 500 Total $ 4, 500 © 2009 Mc. Graw-Hill Ryerson Limited 3 - 25

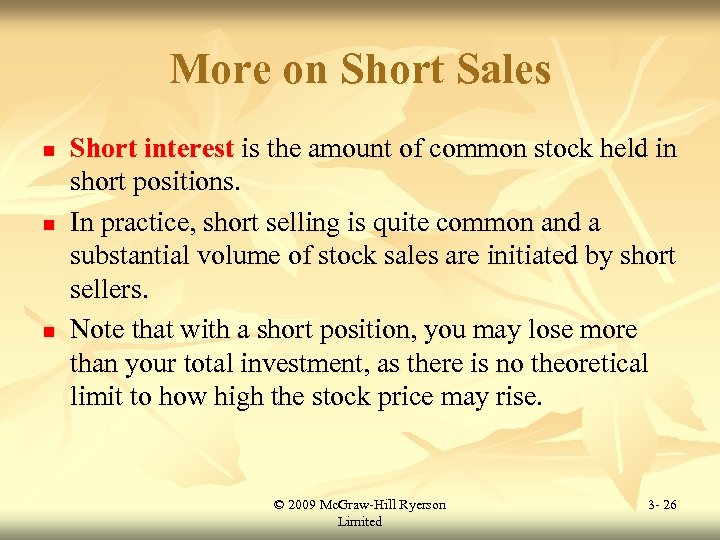

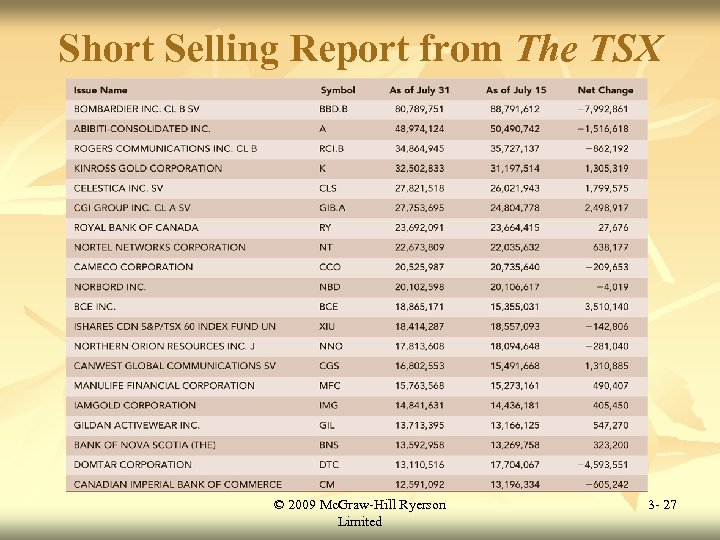

More on Short Sales n n n Short interest is the amount of common stock held in short positions. In practice, short selling is quite common and a substantial volume of stock sales are initiated by short sellers. Note that with a short position, you may lose more than your total investment, as there is no theoretical limit to how high the stock price may rise. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 26

Short Selling Report from The TSX © 2009 Mc. Graw-Hill Ryerson Limited 3 - 27

Investment Objectives n Fundamental Question: Why invest at all? n n We invest today to have more tomorrow. Investment is simply deferred consumption. We choose to wait because we want more to spend later. In formulating investment objectives, the individual must balance return objectives with risk tolerance. n n Investors must think about risk and return. Investors must think about how much risk they can handle. © 2009 Mc. Graw-Hill Ryerson Limited 3 - 28

Investor Constraints n n n Resources What is the minimum sum needed? What are the associated costs? Horizon. When do you need the money? Liquidity. How high is the possibility that you need to sell the asset quickly? Taxes Which tax bracket are you in? Special circumstances. Does your company provide any incentive? What are your regulatory and legal restrictions? Investment Strategies and Policies • Investment management. Should you manage your investments yourself? • Market timing. Should you try to buy and sell in anticipation of the future direction of the market? • Asset allocation. How should you distribute your investment funds across the different classes of assets? • Security selection. Within each class, which specific securities should you buy? © 2009 Mc. Graw-Hill Ryerson Limited 3 - 29

Useful Internet Sites n n n www. bearmarketcentral. com (a reference for short selling) www. moneycentral. msn. com (a reference for risk aversion) www. sharebuilder. com (a reference for opening a brokerage account) www. individual. ml. com (a risk tolerance questionnaire from Merrill Lynch) www. money-rates. com (a reference for current broker call money rate) © 2009 Mc. Graw-Hill Ryerson Limited 3 - 30

e658a0a9d1ea528519e09d039785bdca.ppt