95beb364d9e1cedfcacd7d51f5caac5d.ppt

- Количество слайдов: 30

Chapter 28 Secured Transactions

Chapter 28 Secured Transactions

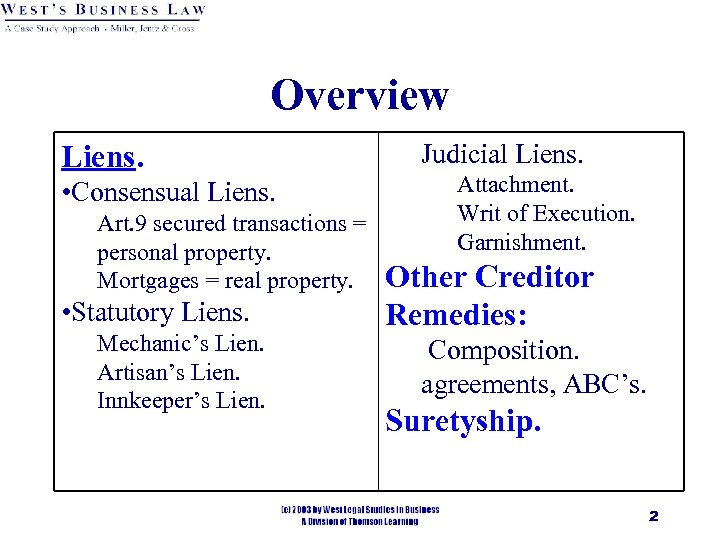

Overview Liens. • Consensual Liens. Art. 9 secured transactions = personal property. Mortgages = real property. • Statutory Liens. Mechanic’s Lien. Artisan’s Lien. Innkeeper’s Lien. Judicial Liens. Attachment. Writ of Execution. Garnishment. Other Creditor Remedies: Composition. agreements, ABC’s. Suretyship. 2

Overview Liens. • Consensual Liens. Art. 9 secured transactions = personal property. Mortgages = real property. • Statutory Liens. Mechanic’s Lien. Artisan’s Lien. Innkeeper’s Lien. Judicial Liens. Attachment. Writ of Execution. Garnishment. Other Creditor Remedies: Composition. agreements, ABC’s. Suretyship. 2

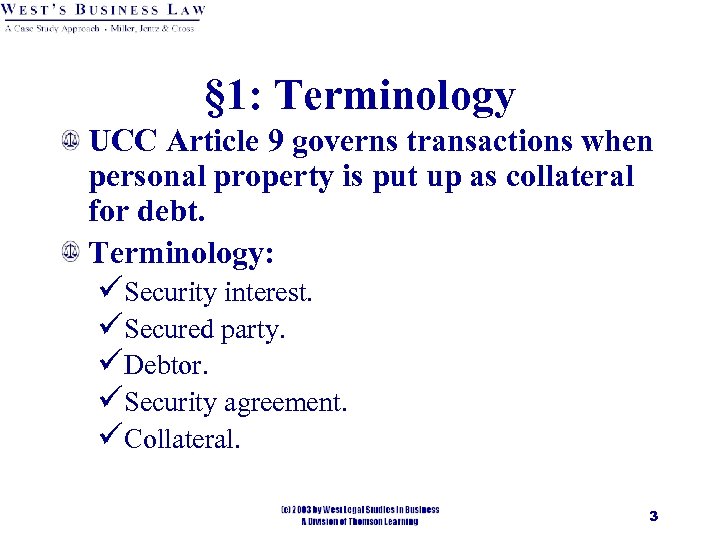

§ 1: Terminology UCC Article 9 governs transactions when personal property is put up as collateral for debt. Terminology: üSecurity interest. üSecured party. üDebtor. üSecurity agreement. üCollateral. 3

§ 1: Terminology UCC Article 9 governs transactions when personal property is put up as collateral for debt. Terminology: üSecurity interest. üSecured party. üDebtor. üSecurity agreement. üCollateral. 3

Tangible Collateral Real Property. Tangible Personal Property. üConsumer goods. üEquipment. üFarm Products. üInventory. üFixtures. 4

Tangible Collateral Real Property. Tangible Personal Property. üConsumer goods. üEquipment. üFarm Products. üInventory. üFixtures. 4

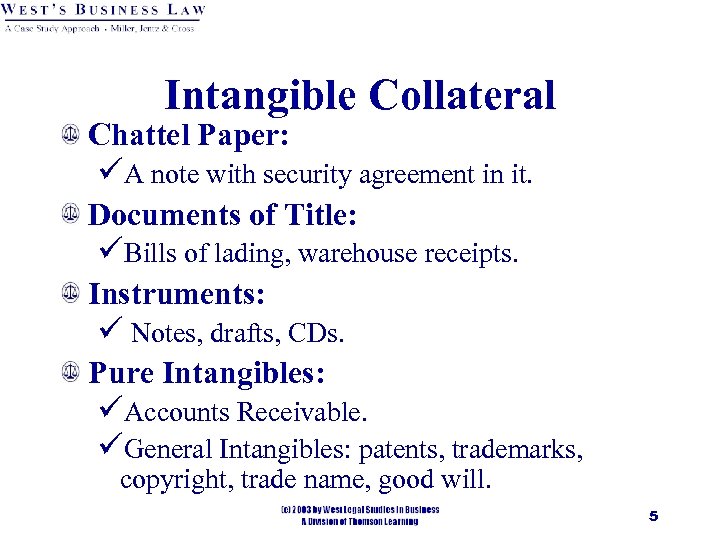

Intangible Collateral Chattel Paper: üA note with security agreement in it. Documents of Title: üBills of lading, warehouse receipts. Instruments: ü Notes, drafts, CDs. Pure Intangibles: üAccounts Receivable. üGeneral Intangibles: patents, trademarks, copyright, trade name, good will. 5

Intangible Collateral Chattel Paper: üA note with security agreement in it. Documents of Title: üBills of lading, warehouse receipts. Instruments: ü Notes, drafts, CDs. Pure Intangibles: üAccounts Receivable. üGeneral Intangibles: patents, trademarks, copyright, trade name, good will. 5

§ 2: Creating & Perfecting a Security Interest A valid security interest makes a creditor “secured” and her rights “attach” to the collateral. Attachment gives creditor enforceable security interest. Three requirements: ü 1. Either: oral agreement and possession or a written agreement. ü 2. Secured creditor give debtor value. ü 3. Debtor has rights in the collateral. 6

§ 2: Creating & Perfecting a Security Interest A valid security interest makes a creditor “secured” and her rights “attach” to the collateral. Attachment gives creditor enforceable security interest. Three requirements: ü 1. Either: oral agreement and possession or a written agreement. ü 2. Secured creditor give debtor value. ü 3. Debtor has rights in the collateral. 6

Security Interest: Agreement An oral agreement wherein the debtor puts the personal property up as collateral and gives possession of the collateral to the secured party; or A written agreement wherein the debtor puts the personal property up as collateral, describes the collateral reasonably identifying it, and signs the agreement. 7

Security Interest: Agreement An oral agreement wherein the debtor puts the personal property up as collateral and gives possession of the collateral to the secured party; or A written agreement wherein the debtor puts the personal property up as collateral, describes the collateral reasonably identifying it, and signs the agreement. 7

Security Interest: Value Creditor gives any consideration that would support a simple contract. Creditor already gave consideration (antecedent debt). 8

Security Interest: Value Creditor gives any consideration that would support a simple contract. Creditor already gave consideration (antecedent debt). 8

Security Interest: Debtor’s Rights in Collateral Debtor must have some interest (but not necessarily ownership) in the collateral, or right to obtain possession. Rights can either be future or current legal interests. 9

Security Interest: Debtor’s Rights in Collateral Debtor must have some interest (but not necessarily ownership) in the collateral, or right to obtain possession. Rights can either be future or current legal interests. 9

§ 3: The Scope of a Security Interest Proceeds: whatever Creditor received when collateral sold or disposed of. Automatically perfected in proceeds of collateral for 10 days after receipt of the proceeds by the Debtor. 10

§ 3: The Scope of a Security Interest Proceeds: whatever Creditor received when collateral sold or disposed of. Automatically perfected in proceeds of collateral for 10 days after receipt of the proceeds by the Debtor. 10

To Perfect Proceeds Beyond 10 provides for extended days Filed financing statement coverage. Financing statement would be filed in same place. When financing statement would be filed in same place for property bought by the debtor with cash proceeds. Financing statement covers original collateral and proceeds are identifiable cash proceeds. Perfected before the 10 days in a different place as called for by the kind of property proceeds. 11

To Perfect Proceeds Beyond 10 provides for extended days Filed financing statement coverage. Financing statement would be filed in same place. When financing statement would be filed in same place for property bought by the debtor with cash proceeds. Financing statement covers original collateral and proceeds are identifiable cash proceeds. Perfected before the 10 days in a different place as called for by the kind of property proceeds. 11

After Acquired Property Clauses Creditor wants to have a security interest in property acquired after the security interest is signed. üInventory as collateral: will be sold, and more inventory brought in - Creditor wants a security interest in the new inventory. 12

After Acquired Property Clauses Creditor wants to have a security interest in property acquired after the security interest is signed. üInventory as collateral: will be sold, and more inventory brought in - Creditor wants a security interest in the new inventory. 12

“Future Advances” Used in establishing a “line of credit. ” Creditor wants to lend money in the future that will be secured by the same collateral as debtor puts up for first loan. Creditor and Debtor do not want to execute a new security agreement every time the debtor needs to borrow money - the first security agreement covers future advances. 13

“Future Advances” Used in establishing a “line of credit. ” Creditor wants to lend money in the future that will be secured by the same collateral as debtor puts up for first loan. Creditor and Debtor do not want to execute a new security agreement every time the debtor needs to borrow money - the first security agreement covers future advances. 13

“Floating-Liens” Commonly used in the financing of inventory - the lien “floats” over the changing inventory. üAfter-acquired property clause will cover new inventory as it comes in. üFuture advances clause will enable debtor to borrow money again and again without putting up new collateral or entering into a new agreement. 14

“Floating-Liens” Commonly used in the financing of inventory - the lien “floats” over the changing inventory. üAfter-acquired property clause will cover new inventory as it comes in. üFuture advances clause will enable debtor to borrow money again and again without putting up new collateral or entering into a new agreement. 14

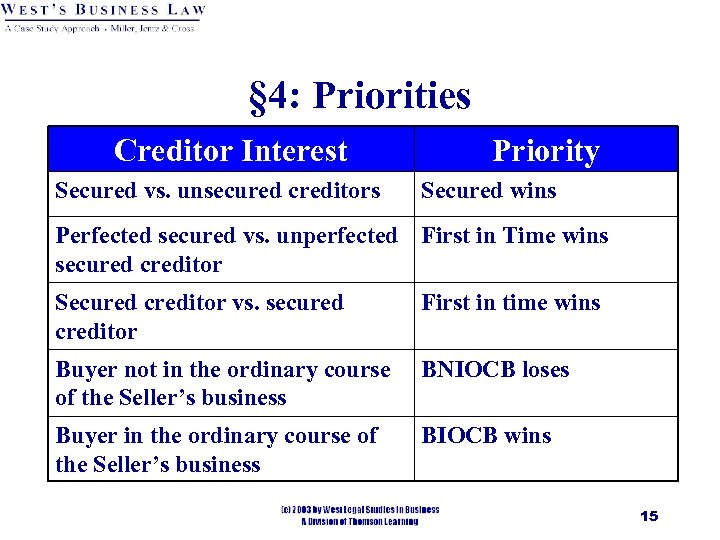

§ 4: Priorities Creditor Interest Secured vs. unsecured creditors Priority Secured wins Perfected secured vs. unperfected First in Time wins secured creditor Secured creditor vs. secured creditor First in time wins Buyer not in the ordinary course of the Seller’s business BNIOCB loses Buyer in the ordinary course of the Seller’s business BIOCB wins 15

§ 4: Priorities Creditor Interest Secured vs. unsecured creditors Priority Secured wins Perfected secured vs. unperfected First in Time wins secured creditor Secured creditor vs. secured creditor First in time wins Buyer not in the ordinary course of the Seller’s business BNIOCB loses Buyer in the ordinary course of the Seller’s business BIOCB wins 15

![Rules of Priority [2] Secured Party vs. Lien Creditor: first in time has priority. Rules of Priority [2] Secured Party vs. Lien Creditor: first in time has priority.](https://present5.com/presentation/95beb364d9e1cedfcacd7d51f5caac5d/image-16.jpg) Rules of Priority [2] Secured Party vs. Lien Creditor: first in time has priority. Exceptions: üPMSI creditor has an extra 10 days to file which is then retroactive. 16

Rules of Priority [2] Secured Party vs. Lien Creditor: first in time has priority. Exceptions: üPMSI creditor has an extra 10 days to file which is then retroactive. 16

![Rules of Priority [3] When More Than One Party has security in same Collateral: Rules of Priority [3] When More Than One Party has security in same Collateral:](https://present5.com/presentation/95beb364d9e1cedfcacd7d51f5caac5d/image-17.jpg) Rules of Priority [3] When More Than One Party has security in same Collateral: first in time wins. Exceptions: üPMSI creditor in inventory. üPMSI creditor in equipment. 17

Rules of Priority [3] When More Than One Party has security in same Collateral: first in time wins. Exceptions: üPMSI creditor in inventory. üPMSI creditor in equipment. 17

![Rules of Priority [4] Secured vs. Buyer: üBuyer not in the ordinary course of Rules of Priority [4] Secured vs. Buyer: üBuyer not in the ordinary course of](https://present5.com/presentation/95beb364d9e1cedfcacd7d51f5caac5d/image-18.jpg) Rules of Priority [4] Secured vs. Buyer: üBuyer not in the ordinary course of the Seller’s business loses. üExceptions: • “Garage sale” Buyer. • Buyer of chattel paper in the ordinary course of the Buyer’s business. üBuyer in the ordinary course of the Seller’s business wins even if she knows of the security interest. 18

Rules of Priority [4] Secured vs. Buyer: üBuyer not in the ordinary course of the Seller’s business loses. üExceptions: • “Garage sale” Buyer. • Buyer of chattel paper in the ordinary course of the Buyer’s business. üBuyer in the ordinary course of the Seller’s business wins even if she knows of the security interest. 18

§ 5: Rights and Duties of Debtors and Creditors Information Request By Creditors. Assignment – record. Amendment - signed by both parties. Release. Reasonable Care of Collateral. 19

§ 5: Rights and Duties of Debtors and Creditors Information Request By Creditors. Assignment – record. Amendment - signed by both parties. Release. Reasonable Care of Collateral. 19

The Status of the Debt Creditor must approve or correct within two weeks. Request every 6 months is free, more often - charge for it. 20

The Status of the Debt Creditor must approve or correct within two weeks. Request every 6 months is free, more often - charge for it. 20

Termination Statement All creditors must file. For consumer debts, must file within one month or when request in writing, must file within 10 days of receipt of request, whichever is earliest. For all other written requests - within 10 days of receipt. 21

Termination Statement All creditors must file. For consumer debts, must file within one month or when request in writing, must file within 10 days of receipt of request, whichever is earliest. For all other written requests - within 10 days of receipt. 21

§ 6: Default Basic Remedies: üCreditor can give up security interest and sue to get judgment, then execute. üTake possession and keep or sell. Secured Party’s Right to Take Possession, but no breach of peace. 22

§ 6: Default Basic Remedies: üCreditor can give up security interest and sue to get judgment, then execute. üTake possession and keep or sell. Secured Party’s Right to Take Possession, but no breach of peace. 22

Disposition of Collateral After taking possession, Creditor must give notice of plans for the collateral: üNotice. üWit 21 days for objection. üConsumer Goods exception. Sale of Collateral By Secured Party. üNotice. üCommercially reasonable manner. 23

Disposition of Collateral After taking possession, Creditor must give notice of plans for the collateral: üNotice. üWit 21 days for objection. üConsumer Goods exception. Sale of Collateral By Secured Party. üNotice. üCommercially reasonable manner. 23

Case 28. 1: In Re Cantu (Written Security Agreement) FACTS: üCantu is a Hormel employee. Under the Hormel Employees Credit Union’s loan program, an employee who fills out and signs a general loan agreement is eligible to draw funds. The agreement does not describe the collateral but refers to a second document called a “funds advance voucher” which includes a description of the collateral. The voucher provides that its terms are incorporated into the loan agreement. The debtor is not required to sign the voucher. üJesus Cantu bought a truck with financing through this program and later filed bankruptcy. Did HECU have an enforceable security interest in the truck? 24

Case 28. 1: In Re Cantu (Written Security Agreement) FACTS: üCantu is a Hormel employee. Under the Hormel Employees Credit Union’s loan program, an employee who fills out and signs a general loan agreement is eligible to draw funds. The agreement does not describe the collateral but refers to a second document called a “funds advance voucher” which includes a description of the collateral. The voucher provides that its terms are incorporated into the loan agreement. The debtor is not required to sign the voucher. üJesus Cantu bought a truck with financing through this program and later filed bankruptcy. Did HECU have an enforceable security interest in the truck? 24

Case 28. 1: In Re Cantu (Written Security Agreement) HELD: FOR CREDIT UNION. üThe loan agreement and voucher, read together, created an enforceable security interest. üThe funds advance voucher, when issued thereafter, contains a full description of the collateral and provides that its terms are made part of the loan agreement. 25

Case 28. 1: In Re Cantu (Written Security Agreement) HELD: FOR CREDIT UNION. üThe loan agreement and voucher, read together, created an enforceable security interest. üThe funds advance voucher, when issued thereafter, contains a full description of the collateral and provides that its terms are made part of the loan agreement. 25

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) FACTS: üThe Donovans owned Donovan Floors borrowed $245, 000 from Bank One. üThe companies gave Bank One security interests in their assets, and a mortgage on their home. üIn 1991, Donovan Floors defaulted on the debt and Bank One sued the debtors. üDonovans agreed to surrender to Bank One some of the firms’ assets and agreed to a foreclosure on the home. 26

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) FACTS: üThe Donovans owned Donovan Floors borrowed $245, 000 from Bank One. üThe companies gave Bank One security interests in their assets, and a mortgage on their home. üIn 1991, Donovan Floors defaulted on the debt and Bank One sued the debtors. üDonovans agreed to surrender to Bank One some of the firms’ assets and agreed to a foreclosure on the home. 26

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) FACTS (cont’d) üBank One promised not to act on the agreement immediately to give the Donovans a chance to revitalize their business. üIn 1993, Bank One assigned the debt and its security interest to Banks Brothers Corporation. üBanks, the Donovans, and Donovan Floors signed an agreement under which, among other things, Banks was given some of the firms’ assets. A payment schedule was set up, but none of the payments were made. üSix years later, Banks scheduled a sale of the house. Donovans sued to keep the house. 27

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) FACTS (cont’d) üBank One promised not to act on the agreement immediately to give the Donovans a chance to revitalize their business. üIn 1993, Bank One assigned the debt and its security interest to Banks Brothers Corporation. üBanks, the Donovans, and Donovan Floors signed an agreement under which, among other things, Banks was given some of the firms’ assets. A payment schedule was set up, but none of the payments were made. üSix years later, Banks scheduled a sale of the house. Donovans sued to keep the house. 27

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) HELD: FOR BANKS BROS. üThe court noted, “Understandably, the Donovans and Donovan Floors would love to have their cake (the chance to save their business given to them by Banks’s agreement to hold off on its right to claim the assets pledged for the debt) and eat it also (keep those assets). üBanks had a right * * * to immediate strict foreclosure of all the pledged assets. It gave up that right in consideration for a partial payment on the debt and the concomitant [accompanying] partial satisfaction. üThe Donovans have no legal or moral ground to 28 complain.

Case 28. 2: Banks Bros v. Donovan Floors (Retention of Collateral) HELD: FOR BANKS BROS. üThe court noted, “Understandably, the Donovans and Donovan Floors would love to have their cake (the chance to save their business given to them by Banks’s agreement to hold off on its right to claim the assets pledged for the debt) and eat it also (keep those assets). üBanks had a right * * * to immediate strict foreclosure of all the pledged assets. It gave up that right in consideration for a partial payment on the debt and the concomitant [accompanying] partial satisfaction. üThe Donovans have no legal or moral ground to 28 complain.

Case 28. 3: Fielder v. Credit Acceptance (Notice to the Debtor) FACTS: üFielder signed a contract with Northeast Auto Credit to buy used cars. üNAC assigned the contracts to Credit Acceptance (CAC) which had supplied the contract forms to the sellers. üWhen Fielder defaulted, CAC repossessed the cars and sent notices that they would be sold. The notices contained errors and Fielder sued, charging in part that the notices violated UCC 9– 504(3). 29

Case 28. 3: Fielder v. Credit Acceptance (Notice to the Debtor) FACTS: üFielder signed a contract with Northeast Auto Credit to buy used cars. üNAC assigned the contracts to Credit Acceptance (CAC) which had supplied the contract forms to the sellers. üWhen Fielder defaulted, CAC repossessed the cars and sent notices that they would be sold. The notices contained errors and Fielder sued, charging in part that the notices violated UCC 9– 504(3). 29

Case 28. 3: Fielder v. Credit Acceptance (Notice to the Debtor) HELD: FOR FIELDER. üThe court issued a summary judgment in the plaintiffs’ favor. The notices were “unreasonably misleading” as to the amounts owed and did not tell the debtors that the figures might be inaccurate. üThis was not “reasonable notification of the sale because such notice is designed to ensure the debtors are aware of their rights which include redemption. ” ü The other notices similarly violated UCC 9– 504. 30

Case 28. 3: Fielder v. Credit Acceptance (Notice to the Debtor) HELD: FOR FIELDER. üThe court issued a summary judgment in the plaintiffs’ favor. The notices were “unreasonably misleading” as to the amounts owed and did not tell the debtors that the figures might be inaccurate. üThis was not “reasonable notification of the sale because such notice is designed to ensure the debtors are aware of their rights which include redemption. ” ü The other notices similarly violated UCC 9– 504. 30