019c6fa00cf41e298ae8237b1bb853ba.ppt

- Количество слайдов: 30

Chapter 28 Exchange rates and the balance of payments David Begg, Stanley Fischer and Rudiger Dornbusch, Economics, 9 th Edition, Mc. Graw-Hill, 2008 Power. Point presentation by Alex Tackie and Damian Ward ©The Mc. Graw-Hill Companies, 2008

Nominal Exchange Rates • The nominal exchange rate is the rate at which a person can trade the currency of one country for the currency of another. ©The Mc. Graw-Hill Companies, 2008

Nominal Exchange Rates • The nominal exchange rate is expressed in two ways: – In units of foreign currency per one U. S. dollar. – And in units of U. S. dollars per one unit of the foreign currency. ©The Mc. Graw-Hill Companies, 2008

Nominal Exchange Rates • Assume the exchange rate between the Japanese yen and U. S. dollar is 80 yen to one dollar. – One U. S. dollar trades for 80 yen. – One yen trades for 1/80 (= 0. 0125) of a dollar. ©The Mc. Graw-Hill Companies, 2008

Nominal Exchange Rates • Appreciation refers to an increase in the value of a currency as measured by the amount of foreign currency it can buy. • Depreciation refers to a decrease in the value of a currency as measured by the amount of foreign currency it can buy. ©The Mc. Graw-Hill Companies, 2008

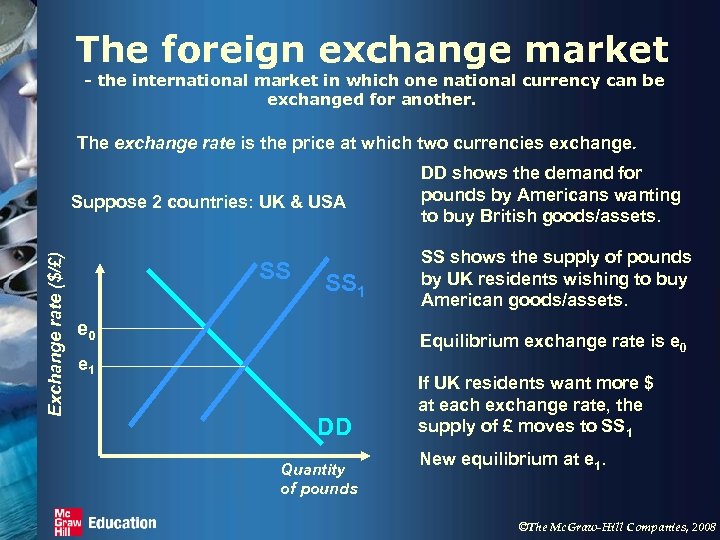

The foreign exchange market - the international market in which one national currency can be exchanged for another. The exchange rate is the price at which two currencies exchange. Exchange rate ($/£) Suppose 2 countries: UK & USA SS SS 1 e 0 DD shows the demand for pounds by Americans wanting to buy British goods/assets. SS shows the supply of pounds by UK residents wishing to buy American goods/assets. Equilibrium exchange rate is e 0 e 1 DD Quantity of pounds If UK residents want more $ at each exchange rate, the supply of £ moves to SS 1 New equilibrium at e 1. ©The Mc. Graw-Hill Companies, 2008

Exchange rate regimes • In a fixed exchange rate regime – the national governments agree to maintain the convertibility of their currency at a fixed exchange rate. • In a flexible exchange rate regime – the exchange rate is allowed to attain its free market equilibrium level without any government intervention using exchange reserves. ©The Mc. Graw-Hill Companies, 2008

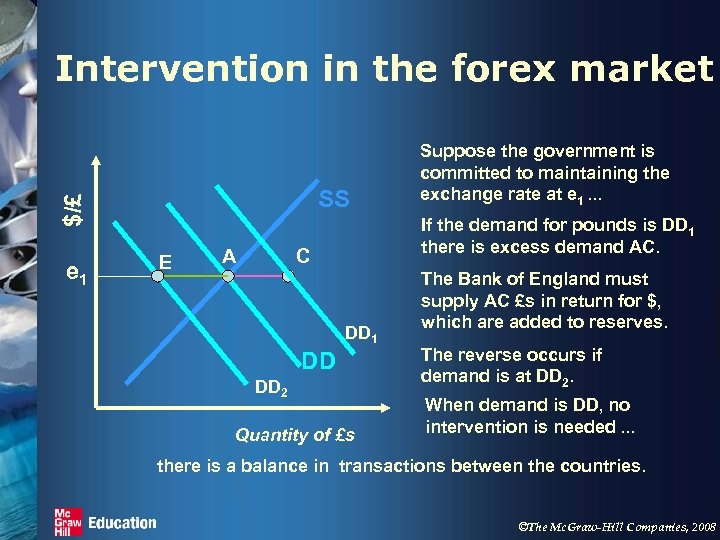

Intervention in the forex market $/£ SS e 1 E A Suppose the government is committed to maintaining the exchange rate at e 1. . . If the demand for pounds is DD 1 there is excess demand AC. C DD 1 DD DD 2 Quantity of £s The Bank of England must supply AC £s in return for $, which are added to reserves. The reverse occurs if demand is at DD 2. When demand is DD, no intervention is needed. . . there is a balance in transactions between the countries. ©The Mc. Graw-Hill Companies, 2008

The balance of payments • … a systematic record of all transactions between residents of one country and the rest of the world • Current account – records international flows of goods, services, income and transfer payments • Capital account – records transactions involving fixed assets • Financial account – records transactions in financial assets ©The Mc. Graw-Hill Companies, 2008

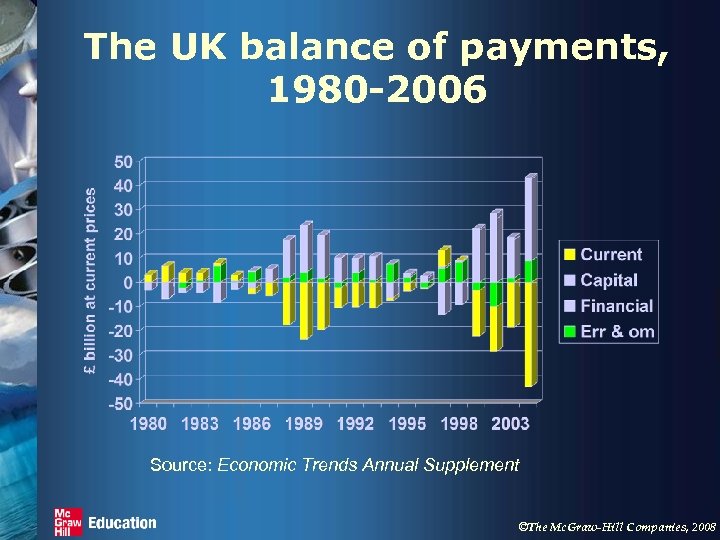

The UK balance of payments, 1980 -2006 Source: Economic Trends Annual Supplement ©The Mc. Graw-Hill Companies, 2008

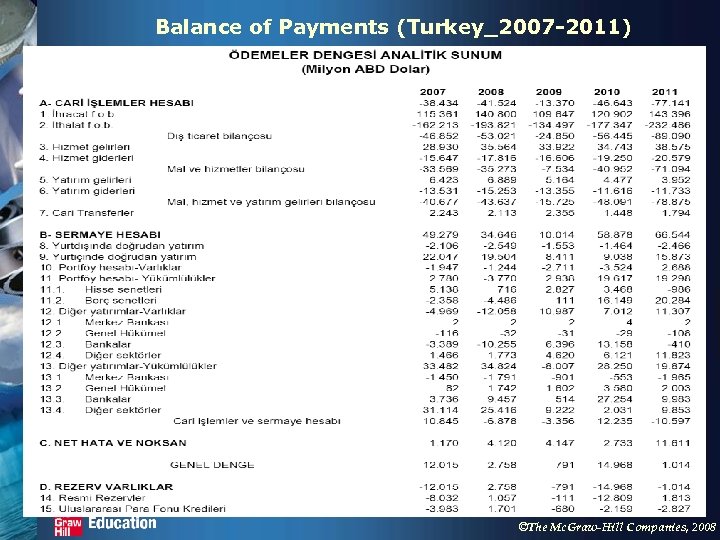

Balance of Payment • The interaction between the domestic agents with the foreign agents. • 1. Current Account: Exports (+), Imports(), Take aid (+), Give aid (-), income coming from abroad (+), income going to abroad (-). • 2. Capital Account: Foreigners buying stocks (+), domestic buying foreign stocks (-), capital investment to abroad (-), foreign investment to Turkey (+). ©The Mc. Graw-Hill Companies, 2008

Balance of Payment • Current Account + Capital Account =0. ©The Mc. Graw-Hill Companies, 2008

Components of the balance of payments • The current account is influenced by: – competitiveness – domestic and foreign income • The capital & financial accounts are influenced by: – relative interest rates • which affect international capital flows. • Perfect capital mobility – occurs when there are no barriers to capital flows, and investors equate expected total returns on assets in different countries ©The Mc. Graw-Hill Companies, 2008

Balance of Payments (Turkey_2007 -2011) ©The Mc. Graw-Hill Companies, 2008

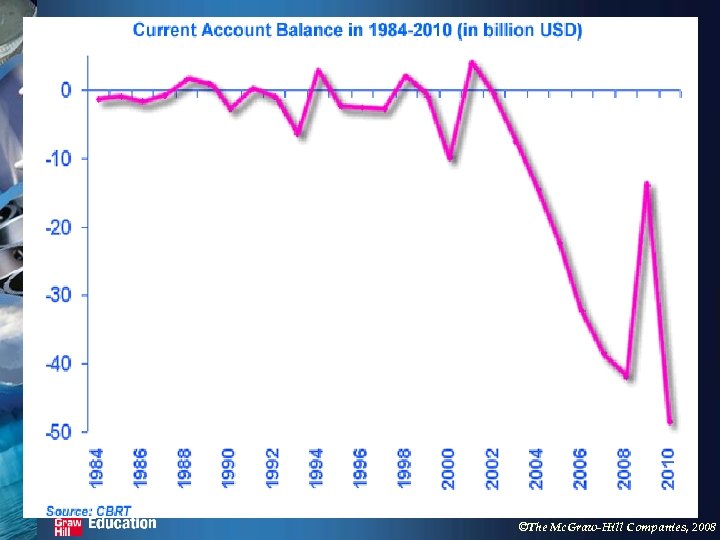

©The Mc. Graw-Hill Companies, 2008

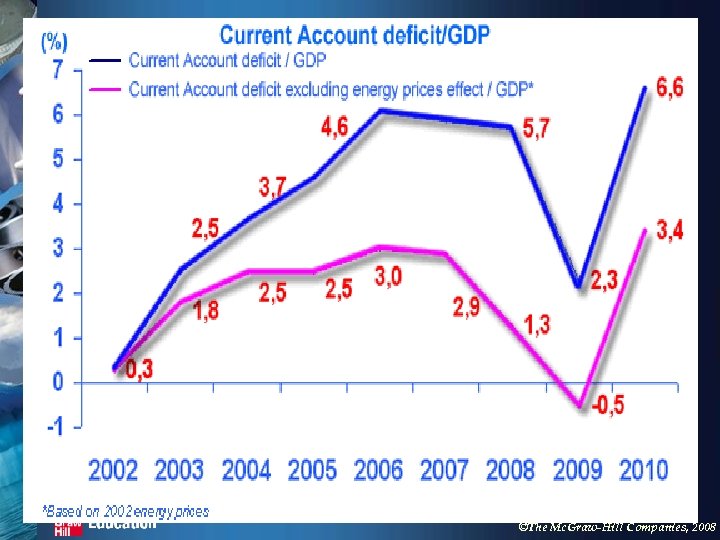

©The Mc. Graw-Hill Companies, 2008

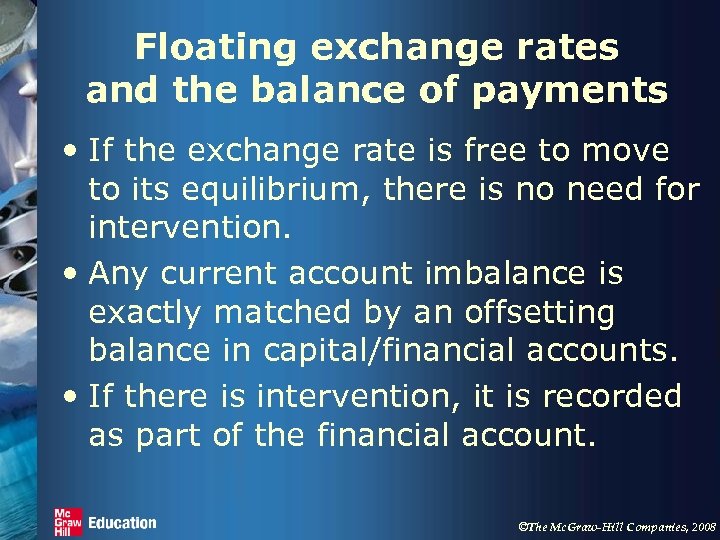

Floating exchange rates and the balance of payments • If the exchange rate is free to move to its equilibrium, there is no need for intervention. • Any current account imbalance is exactly matched by an offsetting balance in capital/financial accounts. • If there is intervention, it is recorded as part of the financial account. ©The Mc. Graw-Hill Companies, 2008

Fixed Exhange Rate and Balance of Payments • The central bank promises to keep the nominal exchange rate at a specified level. • E. g. if exports<imports : need foreign currency. Foreign currency become more valuable, central bank should increase the dollar supply by using its reserves. ©The Mc. Graw-Hill Companies, 2008

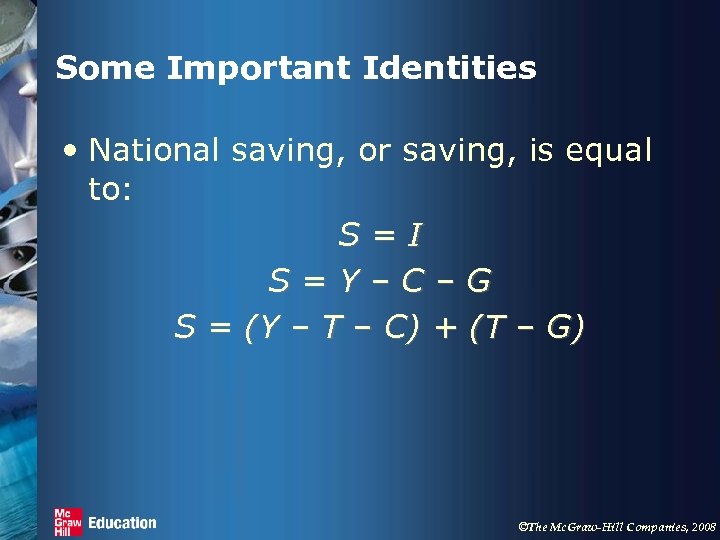

Some Important Identities • Assume a closed economy – one that does not engage in international trade: Y=C+I+G ©The Mc. Graw-Hill Companies, 2008

Some Important Identities • Now, subtract C and G from both sides of the equation: Y – C – G =I • The left side of the equation is the total income in the economy after paying for consumption and government purchases and is called national saving, or just saving (S). ©The Mc. Graw-Hill Companies, 2008

Some Important Identities • Substituting S for Y - C - G, the equation can be written as: S=I ©The Mc. Graw-Hill Companies, 2008

Some Important Identities • National saving, or saving, is equal to: S=I S=Y–C–G S = (Y – T – C) + (T – G) ©The Mc. Graw-Hill Companies, 2008

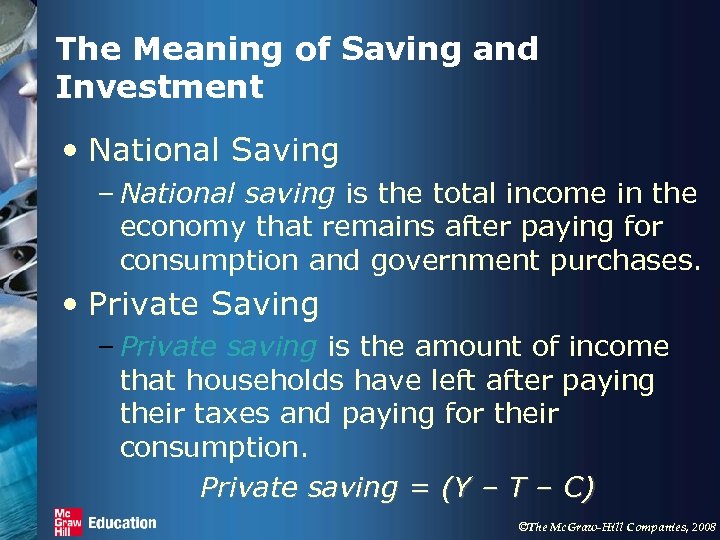

The Meaning of Saving and Investment • National Saving – National saving is the total income in the economy that remains after paying for consumption and government purchases. • Private Saving – Private saving is the amount of income that households have left after paying their taxes and paying for their consumption. Private saving = (Y – T – C) ©The Mc. Graw-Hill Companies, 2008

The Meaning of Saving and Investment • Public Saving – Public saving is the amount of tax revenue that the government has left after paying for its spending. Public saving = (T – G) ©The Mc. Graw-Hill Companies, 2008

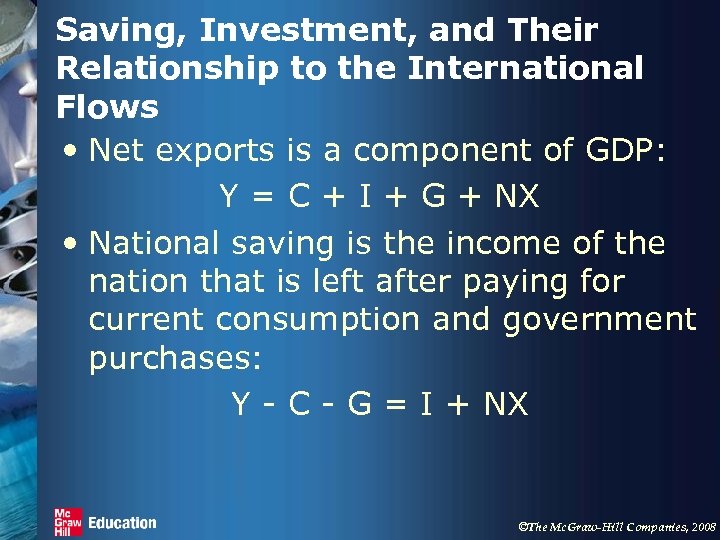

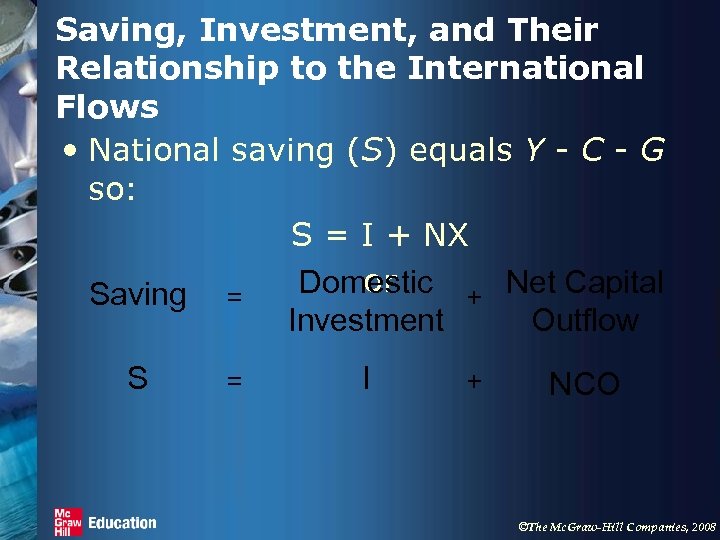

Saving, Investment, and Their Relationship to the International Flows • Net exports is a component of GDP: Y = C + I + G + NX • National saving is the income of the nation that is left after paying for current consumption and government purchases: Y - C - G = I + NX ©The Mc. Graw-Hill Companies, 2008

Saving, Investment, and Their Relationship to the International Flows • National saving (S) equals Y - C - G so: S = I + NX or Domestic + Net Capital Saving = Investment Outflow S = I + NCO ©The Mc. Graw-Hill Companies, 2008

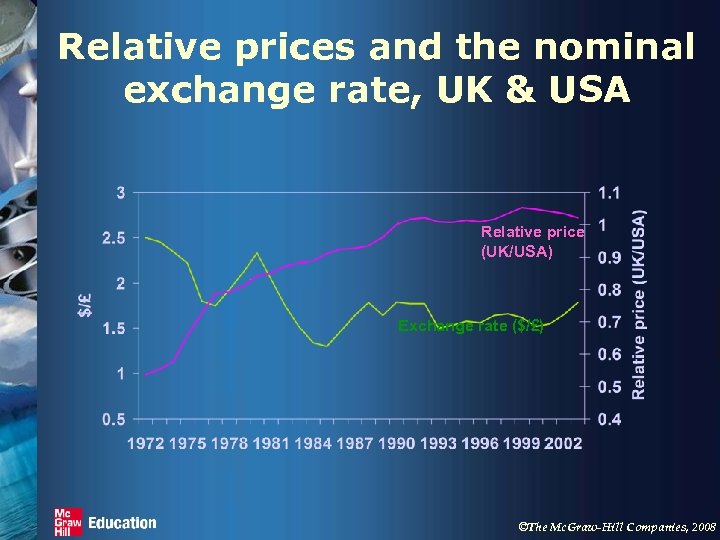

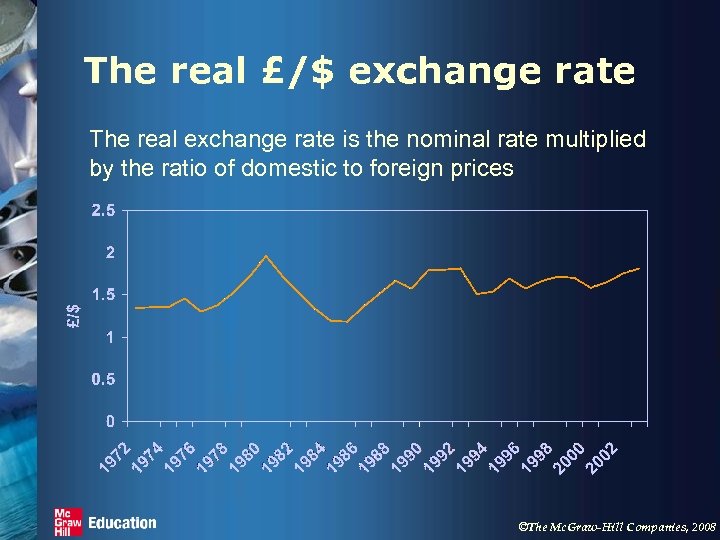

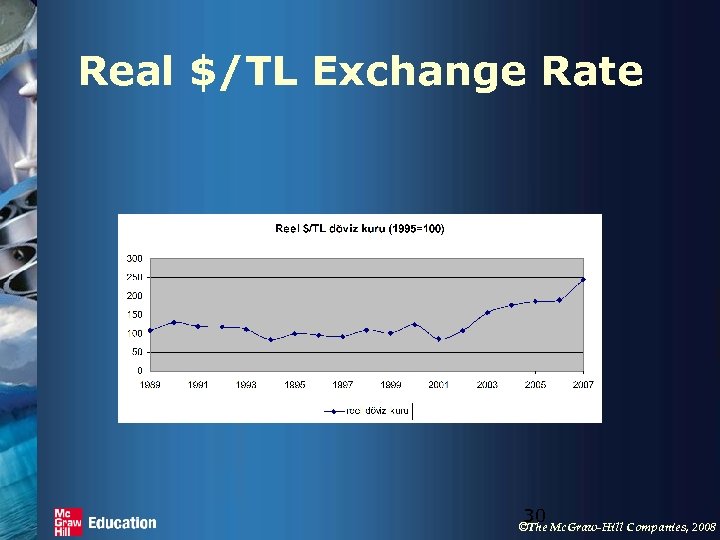

International competitiveness • The competitiveness of UK goods in international markets depends upon: – the nominal exchange rate – relative inflation rates. • Overall competitiveness is measured by the real exchange rate – which measures the relative price of goods from different countries when measured in a common currency. – $/YTL Reel döviz kuru= e$/YTL *Ptr /Pabd ©The Mc. Graw-Hill Companies, 2008

Relative prices and the nominal exchange rate, UK & USA Relative price (UK/USA) Exchange rate ($/£) ©The Mc. Graw-Hill Companies, 2008

The real £/$ exchange rate The real exchange rate is the nominal rate multiplied by the ratio of domestic to foreign prices ©The Mc. Graw-Hill Companies, 2008

Real $/TL Exchange Rate 30 ©The Mc. Graw-Hill Companies, 2008

019c6fa00cf41e298ae8237b1bb853ba.ppt