3180e8b46e6277e4ab6ba9a9a9942f6f.ppt

- Количество слайдов: 22

Chapter 27 Closing • Closing is the periodic process of reviewing system reports and executing system programs in preparing the legal financial statements of the organization. • 4. 6 fi_27. 1 Chapter Objectives – Provide an understanding of the closing process as it is supported by the system. – Provide an understanding of the system and business requirements involved in period-end and year-end closing. – Explain the purpose of executing the various reports and programs used to support the closing process. Closing

Chapter 27 Closing • Closing is the periodic process of reviewing system reports and executing system programs in preparing the legal financial statements of the organization. • 4. 6 fi_27. 1 Chapter Objectives – Provide an understanding of the closing process as it is supported by the system. – Provide an understanding of the system and business requirements involved in period-end and year-end closing. – Explain the purpose of executing the various reports and programs used to support the closing process. Closing

System Requirements for Closing • Close Prior Posting Period • Open New Posting Period 4. 6 fi_27. 2 Closing

System Requirements for Closing • Close Prior Posting Period • Open New Posting Period 4. 6 fi_27. 2 Closing

Period Closing • Pre-closing activities Where do I start? ? • Financial closing • Managerial closing 4. 6 fi_27. 3 Closing

Period Closing • Pre-closing activities Where do I start? ? • Financial closing • Managerial closing 4. 6 fi_27. 3 Closing

Pre-Closing Activities • Post journal entries to record recurring entries and accruals. • Make sure all entries have been included from the entire system (depreciation, material valuations, salaries, invoicing complete, etc. ) • Make sure all external programs affecting the trial balance have been interfaced. 4. 6 fi_27. 4 Closing

Pre-Closing Activities • Post journal entries to record recurring entries and accruals. • Make sure all entries have been included from the entire system (depreciation, material valuations, salaries, invoicing complete, etc. ) • Make sure all external programs affecting the trial balance have been interfaced. 4. 6 fi_27. 4 Closing

Financial Closing • Foreign Currency Valuation • Execute the Financial Accounting Comparative Analysis. • Create financial statements for review and analysis. • Post final adjustment entries 4. 6 fi_27. 5 Closing

Financial Closing • Foreign Currency Valuation • Execute the Financial Accounting Comparative Analysis. • Create financial statements for review and analysis. • Post final adjustment entries 4. 6 fi_27. 5 Closing

Foreign Currency Valuation • 4. 6 fi_27. 6 Types – Receivables & Payables (when clearing) – Balance Sheet Accounts Maintained in Foreign Currency (RFSBEWOO) – Open Item Accounts (SAPF 100) Closing

Foreign Currency Valuation • 4. 6 fi_27. 6 Types – Receivables & Payables (when clearing) – Balance Sheet Accounts Maintained in Foreign Currency (RFSBEWOO) – Open Item Accounts (SAPF 100) Closing

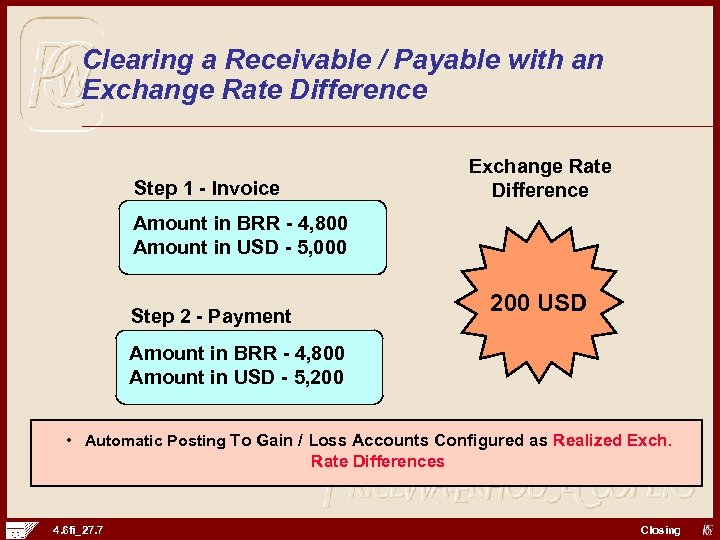

Clearing a Receivable / Payable with an Exchange Rate Difference Step 1 - Invoice Exchange Rate Difference Amount in BRR - 4, 800 Amount in USD - 5, 000 Step 2 - Payment 200 USD Amount in BRR - 4, 800 Amount in USD - 5, 200 • Automatic Posting To Gain / Loss Accounts Configured as Realized Exch. Rate Differences 4. 6 fi_27. 7 Closing

Clearing a Receivable / Payable with an Exchange Rate Difference Step 1 - Invoice Exchange Rate Difference Amount in BRR - 4, 800 Amount in USD - 5, 000 Step 2 - Payment 200 USD Amount in BRR - 4, 800 Amount in USD - 5, 200 • Automatic Posting To Gain / Loss Accounts Configured as Realized Exch. Rate Differences 4. 6 fi_27. 7 Closing

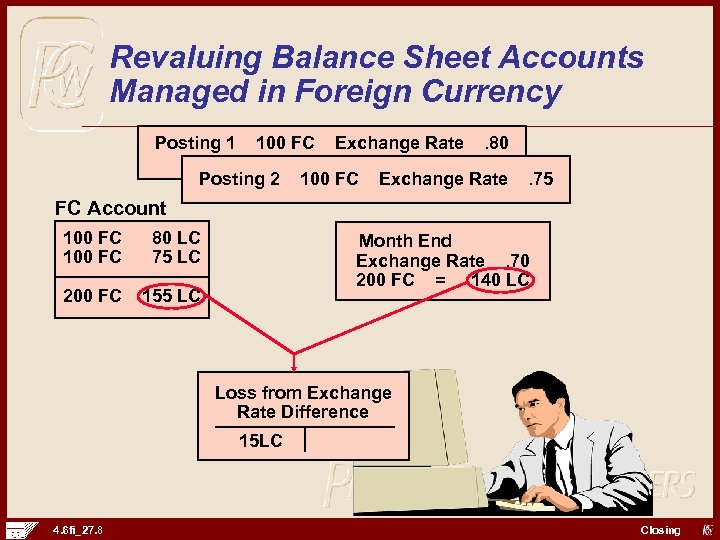

Revaluing Balance Sheet Accounts Managed in Foreign Currency Posting 1 100 FC Posting 2 Exchange Rate 100 FC . 80 Exchange Rate . 75 FC Account 100 FC 80 LC 75 LC 200 FC 155 LC Month End Exchange Rate. 70 200 FC = 140 LC Loss from Exchange Rate Difference 15 LC 4. 6 fi_27. 8 Closing

Revaluing Balance Sheet Accounts Managed in Foreign Currency Posting 1 100 FC Posting 2 Exchange Rate 100 FC . 80 Exchange Rate . 75 FC Account 100 FC 80 LC 75 LC 200 FC 155 LC Month End Exchange Rate. 70 200 FC = 140 LC Loss from Exchange Rate Difference 15 LC 4. 6 fi_27. 8 Closing

Valuation Method Used when running automated valuation programs • Combines Specifications – Exchange Rate Type – Document Types 4. 6 fi_27. 9 Closing

Valuation Method Used when running automated valuation programs • Combines Specifications – Exchange Rate Type – Document Types 4. 6 fi_27. 9 Closing

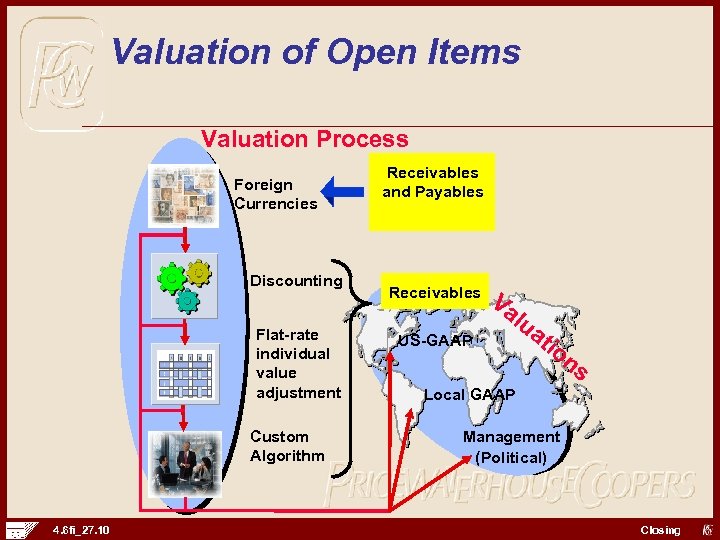

Valuation of Open Items Valuation Process Foreign Currencies Discounting Flat-rate individual value adjustment Custom Algorithm 4. 6 fi_27. 10 Receivables and Payables Receivables US-GAAP Va lu at io ns Local GAAP Management (Political) Closing

Valuation of Open Items Valuation Process Foreign Currencies Discounting Flat-rate individual value adjustment Custom Algorithm 4. 6 fi_27. 10 Receivables and Payables Receivables US-GAAP Va lu at io ns Local GAAP Management (Political) Closing

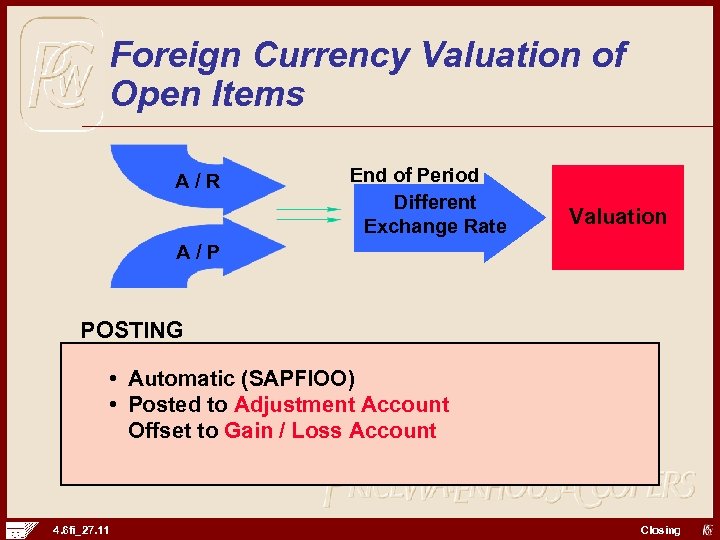

Foreign Currency Valuation of Open Items A/R End of Period Different Exchange Rate Valuation A/P POSTING • Automatic (SAPFIOO) • Posted to Adjustment Account Offset to Gain / Loss Account 4. 6 fi_27. 11 Closing

Foreign Currency Valuation of Open Items A/R End of Period Different Exchange Rate Valuation A/P POSTING • Automatic (SAPFIOO) • Posted to Adjustment Account Offset to Gain / Loss Account 4. 6 fi_27. 11 Closing

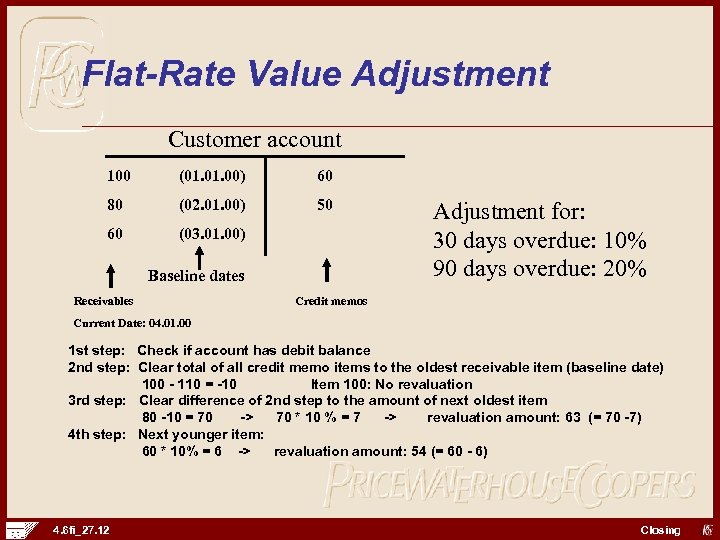

Flat-Rate Value Adjustment Customer account 100 (01. 00) 60 80 (02. 01. 00) 50 60 (03. 01. 00) Baseline dates Receivables Adjustment for: 30 days overdue: 10% 90 days overdue: 20% Credit memos Current Date: 04. 01. 00 1 st step: Check if account has debit balance 2 nd step: Clear total of all credit memo items to the oldest receivable item (baseline date) 100 - 110 = -10 Item 100: No revaluation 3 rd step: Clear difference of 2 nd step to the amount of next oldest item 80 -10 = 70 -> 70 * 10 % = 7 -> revaluation amount: 63 (= 70 -7) 4 th step: Next younger item: 60 * 10% = 6 -> revaluation amount: 54 (= 60 - 6) 4. 6 fi_27. 12 Closing

Flat-Rate Value Adjustment Customer account 100 (01. 00) 60 80 (02. 01. 00) 50 60 (03. 01. 00) Baseline dates Receivables Adjustment for: 30 days overdue: 10% 90 days overdue: 20% Credit memos Current Date: 04. 01. 00 1 st step: Check if account has debit balance 2 nd step: Clear total of all credit memo items to the oldest receivable item (baseline date) 100 - 110 = -10 Item 100: No revaluation 3 rd step: Clear difference of 2 nd step to the amount of next oldest item 80 -10 = 70 -> 70 * 10 % = 7 -> revaluation amount: 63 (= 70 -7) 4 th step: Next younger item: 60 * 10% = 6 -> revaluation amount: 54 (= 60 - 6) 4. 6 fi_27. 12 Closing

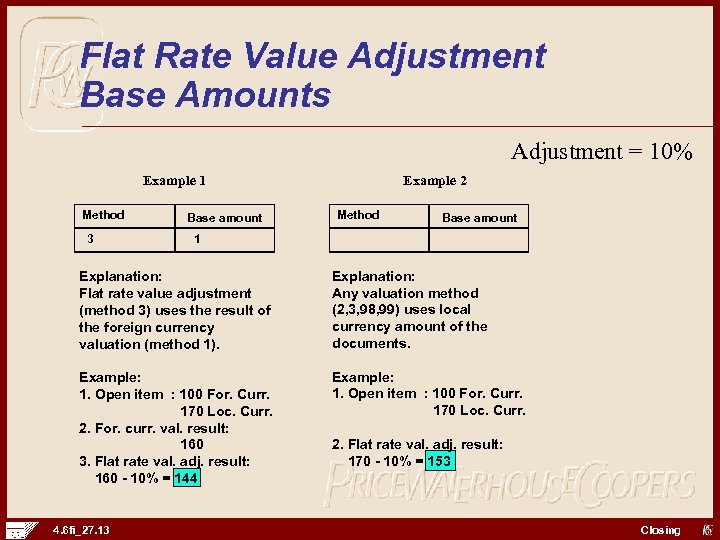

Flat Rate Value Adjustment Base Amounts Adjustment = 10% Example 1 Method 3 Base amount Example 2 Method Base amount 1 Explanation: Flat rate value adjustment (method 3) uses the result of the foreign currency valuation (method 1). Explanation: Any valuation method (2, 3, 98, 99) uses local currency amount of the documents. Example: 1. Open item : 100 For. Curr. 170 Loc. Curr. 2. For. curr. val. result: 160 3. Flat rate val. adj. result: 160 - 10% = 144 Example: 1. Open item : 100 For. Curr. 170 Loc. Curr. 4. 6 fi_27. 13 2. Flat rate val. adj. result: 170 - 10% = 153 Closing

Flat Rate Value Adjustment Base Amounts Adjustment = 10% Example 1 Method 3 Base amount Example 2 Method Base amount 1 Explanation: Flat rate value adjustment (method 3) uses the result of the foreign currency valuation (method 1). Explanation: Any valuation method (2, 3, 98, 99) uses local currency amount of the documents. Example: 1. Open item : 100 For. Curr. 170 Loc. Curr. 2. For. curr. val. result: 160 3. Flat rate val. adj. result: 160 - 10% = 144 Example: 1. Open item : 100 For. Curr. 170 Loc. Curr. 4. 6 fi_27. 13 2. Flat rate val. adj. result: 170 - 10% = 153 Closing

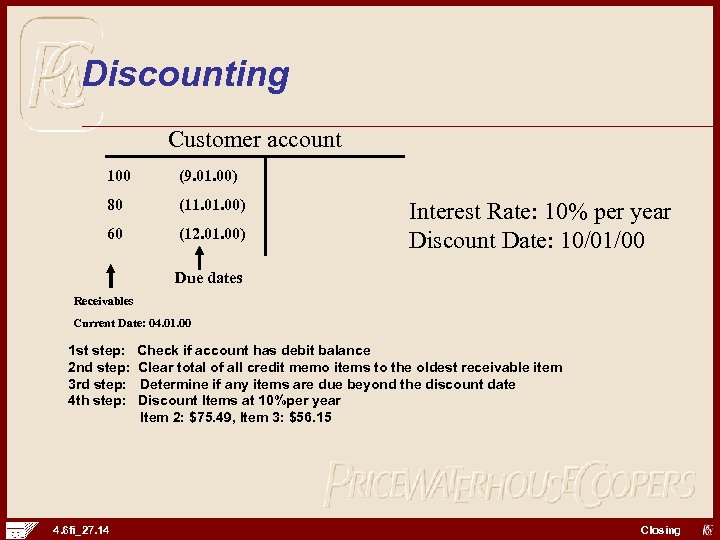

Discounting Customer account 100 (9. 01. 00) 80 (11. 00) 60 (12. 01. 00) Interest Rate: 10% per year Discount Date: 10/01/00 Due dates Receivables Current Date: 04. 01. 00 1 st step: 2 nd step: 3 rd step: 4 th step: 4. 6 fi_27. 14 Check if account has debit balance Clear total of all credit memo items to the oldest receivable item Determine if any items are due beyond the discount date Discount Items at 10%per year Item 2: $75. 49, Item 3: $56. 15 Closing

Discounting Customer account 100 (9. 01. 00) 80 (11. 00) 60 (12. 01. 00) Interest Rate: 10% per year Discount Date: 10/01/00 Due dates Receivables Current Date: 04. 01. 00 1 st step: 2 nd step: 3 rd step: 4 th step: 4. 6 fi_27. 14 Check if account has debit balance Clear total of all credit memo items to the oldest receivable item Determine if any items are due beyond the discount date Discount Items at 10%per year Item 2: $75. 49, Item 3: $56. 15 Closing

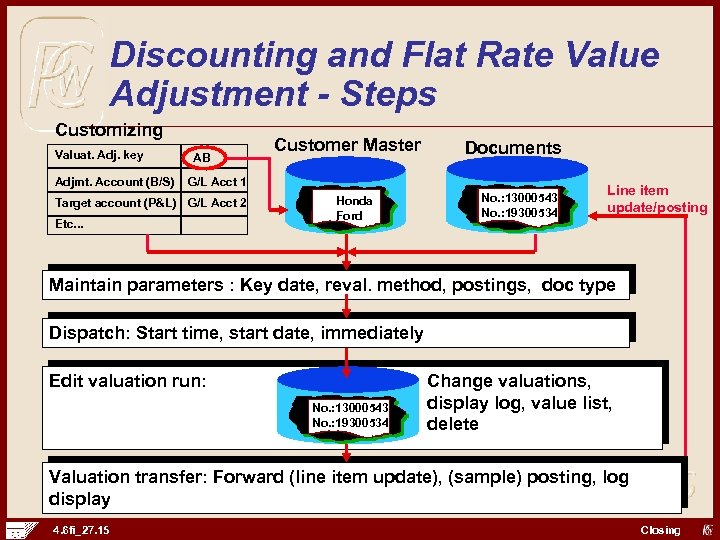

Discounting and Flat Rate Value Adjustment - Steps Customizing Valuat. Adj. key Adjmt. Account (B/S) AB Customer Master Documents G/L Acct 1 Target account (P&L) G/L Acct 2 Etc. . . Honda Ford No. : 13000543 No. : 19300534 Line item update/posting Maintain parameters : Key date, reval. method, postings, doc type Dispatch: Start time, start date, immediately Edit valuation run: No. : 13000543 No. : 19300534 Change valuations, display log, value list, delete Valuation transfer: Forward (line item update), (sample) posting, log display 4. 6 fi_27. 15 Closing

Discounting and Flat Rate Value Adjustment - Steps Customizing Valuat. Adj. key Adjmt. Account (B/S) AB Customer Master Documents G/L Acct 1 Target account (P&L) G/L Acct 2 Etc. . . Honda Ford No. : 13000543 No. : 19300534 Line item update/posting Maintain parameters : Key date, reval. method, postings, doc type Dispatch: Start time, start date, immediately Edit valuation run: No. : 13000543 No. : 19300534 Change valuations, display log, value list, delete Valuation transfer: Forward (line item update), (sample) posting, log display 4. 6 fi_27. 15 Closing

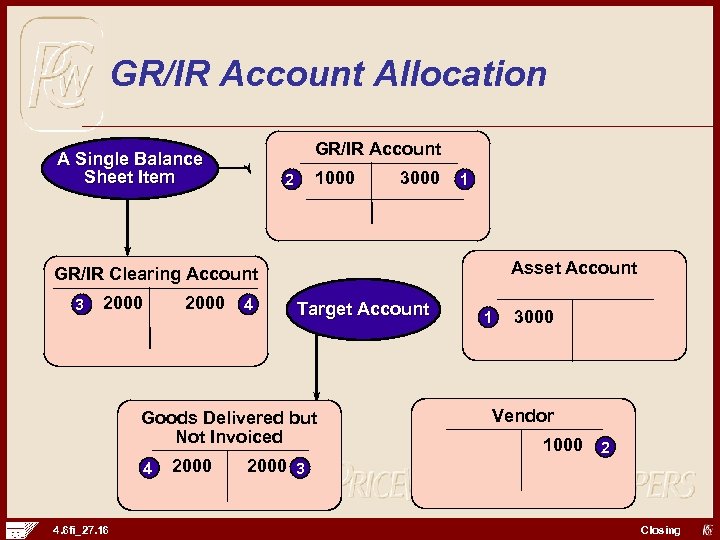

GR/IR Account Allocation GR/IR Account A Single Balance Sheet Item 1000 2 3000 1 Asset Account GR/IR Clearing Account 3 2000 4 Target Account Goods Delivered but Not Invoiced 4 4. 6 fi_27. 16 2000 3 1 3000 Vendor 1000 2 Closing

GR/IR Account Allocation GR/IR Account A Single Balance Sheet Item 1000 2 3000 1 Asset Account GR/IR Clearing Account 3 2000 4 Target Account Goods Delivered but Not Invoiced 4 4. 6 fi_27. 16 2000 3 1 3000 Vendor 1000 2 Closing

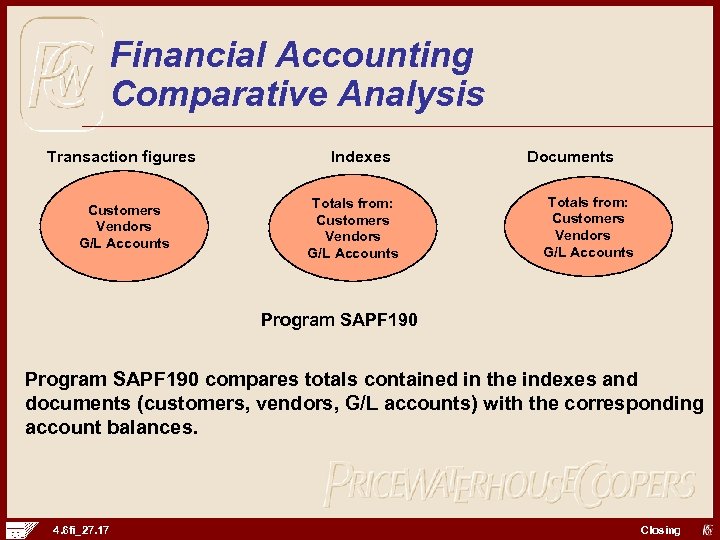

Financial Accounting Comparative Analysis Transaction figures Customers Vendors G/L Accounts Indexes Totals from: Customers Vendors G/L Accounts Documents Totals from: Customers Vendors G/L Accounts Program SAPF 190 compares totals contained in the indexes and documents (customers, vendors, G/L accounts) with the corresponding account balances. 4. 6 fi_27. 17 Closing

Financial Accounting Comparative Analysis Transaction figures Customers Vendors G/L Accounts Indexes Totals from: Customers Vendors G/L Accounts Documents Totals from: Customers Vendors G/L Accounts Program SAPF 190 compares totals contained in the indexes and documents (customers, vendors, G/L accounts) with the corresponding account balances. 4. 6 fi_27. 17 Closing

End of Period Reporting • Balance Sheet / Profit and Loss Statement • General Ledger Account Information System – Financial Statement Versions – Key Figure / Ratio Reports • Special Purpose Ledger - for reports with more customized format. 4. 6 fi_27. 18 Closing

End of Period Reporting • Balance Sheet / Profit and Loss Statement • General Ledger Account Information System – Financial Statement Versions – Key Figure / Ratio Reports • Special Purpose Ledger - for reports with more customized format. 4. 6 fi_27. 18 Closing

Year-End Closing Account Carry Forward: Customer / Vendor Balance Carried Forward General Ledger Account Balance Carried Forward 4. 6 fi_27. 19 Closing

Year-End Closing Account Carry Forward: Customer / Vendor Balance Carried Forward General Ledger Account Balance Carried Forward 4. 6 fi_27. 19 Closing

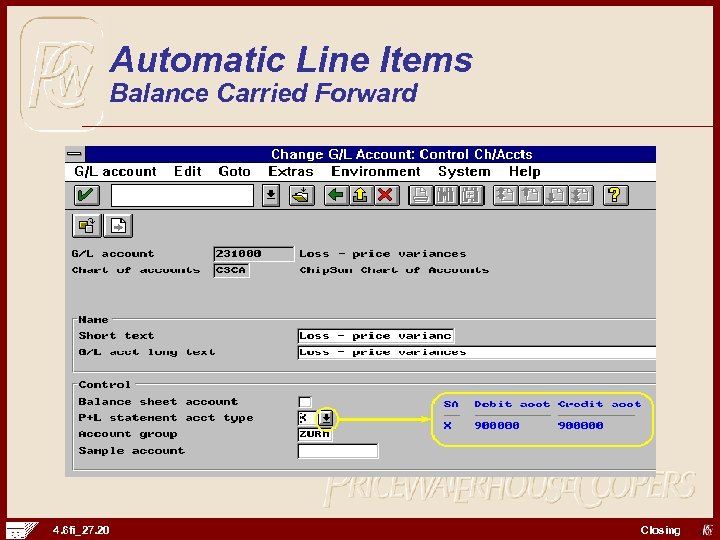

Automatic Line Items Balance Carried Forward 4. 6 fi_27. 20 Closing

Automatic Line Items Balance Carried Forward 4. 6 fi_27. 20 Closing

Managerial Closing • Preliminary close of controlling accounting period. • Reallocation and settlement of costs throughout the entire organization. • Review and analysis of internal reports. • Re-opening of the controlling accounting period to correct and adjust accounting data. • Run FI-CO Reconciliation ledger • Execute readjustment programs to ensure Business Areas and Profit Centers are in balance 4. 6 fi_27. 21 Closing

Managerial Closing • Preliminary close of controlling accounting period. • Reallocation and settlement of costs throughout the entire organization. • Review and analysis of internal reports. • Re-opening of the controlling accounting period to correct and adjust accounting data. • Run FI-CO Reconciliation ledger • Execute readjustment programs to ensure Business Areas and Profit Centers are in balance 4. 6 fi_27. 21 Closing

Closing Chapter Summary • Key Terms: – Closing – Valuation Method – Flat Rate Adjustments – Discounting – GR/IR Account – Balance Carry Forward 4. 6 fi_27. 22 Closing

Closing Chapter Summary • Key Terms: – Closing – Valuation Method – Flat Rate Adjustments – Discounting – GR/IR Account – Balance Carry Forward 4. 6 fi_27. 22 Closing