640539a9301709b03abc7ac4284f9285.ppt

- Количество слайдов: 33

Chapter 27: All Forms of Partnership © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1

Chapter 27: All Forms of Partnership © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1

Learning Objectives • What are three essential elements of a partnership? • What are the rights and duties of partners in an ordinary partnership? • What is meant by joint and several liability? Why is this often considered to be disadvantage of the partnership form of business? © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 2

Learning Objectives • What are three essential elements of a partnership? • What are the rights and duties of partners in an ordinary partnership? • What is meant by joint and several liability? Why is this often considered to be disadvantage of the partnership form of business? © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 2

Learning Objectives • What advantages do limited liability partnerships offer to businesspersons that are not offered by general partnerships? • What are the key differences between the rights and liabilities of general partners and those of limited partners? © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 3

Learning Objectives • What advantages do limited liability partnerships offer to businesspersons that are not offered by general partnerships? • What are the key differences between the rights and liabilities of general partners and those of limited partners? © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 3

Agency Concepts and Partnership Law • Partnership arises from agreement, express or implied, between two or more persons to carry on a business together for profit. • Partners are agents and fiduciaries of one another, but differ from agents in that they are also co-owners and have equal rights to manage and share in the profits and losses. • If a commercial enterprise shares profits and losses, a partnership will be inferred. • Law: Uniform Partnership Act. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 4

Agency Concepts and Partnership Law • Partnership arises from agreement, express or implied, between two or more persons to carry on a business together for profit. • Partners are agents and fiduciaries of one another, but differ from agents in that they are also co-owners and have equal rights to manage and share in the profits and losses. • If a commercial enterprise shares profits and losses, a partnership will be inferred. • Law: Uniform Partnership Act. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 4

Uniform Partnership Act • In the absence of an express partnership agreement (oral or written) most states have enacted the UPA to govern the rights among partners: – Management: equal, each one vote, majority wins; need unanimous consent for some actions. – Partnership Interest: equal profits, losses shared as profits shared. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 5

Uniform Partnership Act • In the absence of an express partnership agreement (oral or written) most states have enacted the UPA to govern the rights among partners: – Management: equal, each one vote, majority wins; need unanimous consent for some actions. – Partnership Interest: equal profits, losses shared as profits shared. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 5

When Does a Partnership Exist? • Intent to associate is a key element of a partnership, and all “partners” must consent. • Three key elements: – A sharing of profits and losses, AND – A joint ownership of the business, AND – An equal right to be involved in the management of the business. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 6

When Does a Partnership Exist? • Intent to associate is a key element of a partnership, and all “partners” must consent. • Three key elements: – A sharing of profits and losses, AND – A joint ownership of the business, AND – An equal right to be involved in the management of the business. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 6

When Does A Partnership Exist? • No inference of partnership if merely: – Debt. – Wages. – Rent. – Annuity. – Sale of goodwill. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 7

When Does A Partnership Exist? • No inference of partnership if merely: – Debt. – Wages. – Rent. – Annuity. – Sale of goodwill. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 7

Entity versus Aggregate Theory of Partnerships • At common law, partnerships were treated as an aggregate—not separate legal entities. – So, a suit at common law could never be brought by, or against, the firm in its own name; each individual partner had to sue or be sued. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 8

Entity versus Aggregate Theory of Partnerships • At common law, partnerships were treated as an aggregate—not separate legal entities. – So, a suit at common law could never be brought by, or against, the firm in its own name; each individual partner had to sue or be sued. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 8

Entity versus Aggregate Theory of Partnerships • Today, many states recognize the partnership as a separate legal entity for the following purposes: – To sue and be sued (for federal questions, yes; for state questions, differs). – To have judgments collected against it’s assets, and individual partners’ assets. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 9

Entity versus Aggregate Theory of Partnerships • Today, many states recognize the partnership as a separate legal entity for the following purposes: – To sue and be sued (for federal questions, yes; for state questions, differs). – To have judgments collected against it’s assets, and individual partners’ assets. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 9

Entity versus Aggregate Theory of Partnerships • Partnerships are recognized as separate legal entities (cont’d): – To own partnership property. – To convey partnership property. • At common law -- property owned in tenancy in partnership, all partners had to be named and sign the conveyance. • Under UPA partnership property can be held and sold in firm name. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 10

Entity versus Aggregate Theory of Partnerships • Partnerships are recognized as separate legal entities (cont’d): – To own partnership property. – To convey partnership property. • At common law -- property owned in tenancy in partnership, all partners had to be named and sign the conveyance. • Under UPA partnership property can be held and sold in firm name. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 10

Partnership Formation • Generally, agreements to form a partnership can be: – Oral. – Written, or – Implied by Conduct. • Duration. – Partnership agreement can specify duration. – If limited, called “Partnership for a Term. ” © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 11

Partnership Formation • Generally, agreements to form a partnership can be: – Oral. – Written, or – Implied by Conduct. • Duration. – Partnership agreement can specify duration. – If limited, called “Partnership for a Term. ” © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 11

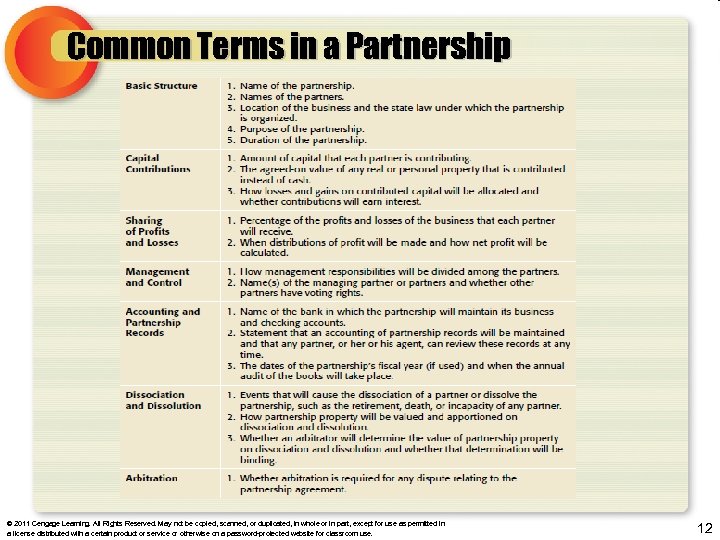

Common Terms in a Partnership © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 12

Common Terms in a Partnership © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 12

Partnership Formation • Partnership agreements (Articles of Partnership) should be written. • Partners must have legal capacity. UPA permits corporations to be a partner. • Partnership By Estoppel: parties who are not partners hold themselves out to 3 rd Parties and 3 rd Party relies to her detriment. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 13

Partnership Formation • Partnership agreements (Articles of Partnership) should be written. • Partners must have legal capacity. UPA permits corporations to be a partner. • Partnership By Estoppel: parties who are not partners hold themselves out to 3 rd Parties and 3 rd Party relies to her detriment. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 13

Rights of Partners • Management: equal, each one vote, majority wins; need unanimous consent for some actions. • Partnership Interest: equal profits, losses shared as profits shared. • Compensation: generally, none. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 14

Rights of Partners • Management: equal, each one vote, majority wins; need unanimous consent for some actions. • Partnership Interest: equal profits, losses shared as profits shared. • Compensation: generally, none. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 14

Rights of Partners • Inspection of the Books: always and also by rep. of deceased partner. • Accounting: when other partner(s) committing fraud, embezzlement, wrongful exclusion, or anytime it is just and reasonable. • Property Rights © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 15

Rights of Partners • Inspection of the Books: always and also by rep. of deceased partner. • Accounting: when other partner(s) committing fraud, embezzlement, wrongful exclusion, or anytime it is just and reasonable. • Property Rights © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 15

Rights of Partners • Each partner has a property right, which includes: – An interest in the partnership. – A right in specific partnership property. – A right to participate in the management of the partnership, as mentioned above. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 16

Rights of Partners • Each partner has a property right, which includes: – An interest in the partnership. – A right in specific partnership property. – A right to participate in the management of the partnership, as mentioned above. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 16

Duties and Liabilities of Partners • Fiduciary Duties: Partners are fiduciaries and general agents of one another and the partnership. • Authority of Partners: Partners have implied authority to conduct ordinary partnership business but need unanimous consent to sell assets or donate to charity. – Scope of Implied Powers. – Authorized vs. Unauthorized Actions. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 17

Duties and Liabilities of Partners • Fiduciary Duties: Partners are fiduciaries and general agents of one another and the partnership. • Authority of Partners: Partners have implied authority to conduct ordinary partnership business but need unanimous consent to sell assets or donate to charity. – Scope of Implied Powers. – Authorized vs. Unauthorized Actions. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 17

Liabilities of Partners • Joint Liability for Contracts. If Partner is sued for Partnership debt, Partner has right to insist that other partners be sued with her. • Joint and Several Liability for Torts: 3 rd party can sue either one or all partners. 3 rd party may collect against personal assets of all partners. • Liability of Incoming Partner. Newly admitted partner has no personal liability for existing partnership debts and obligations. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 18

Liabilities of Partners • Joint Liability for Contracts. If Partner is sued for Partnership debt, Partner has right to insist that other partners be sued with her. • Joint and Several Liability for Torts: 3 rd party can sue either one or all partners. 3 rd party may collect against personal assets of all partners. • Liability of Incoming Partner. Newly admitted partner has no personal liability for existing partnership debts and obligations. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 18

Partner’s Dissociation • Dissociation occurs when a partner ceases to be associated with the carrying on of partnership business. • Events which can cause dissociation: – Partners giving notice of withdrawal. – Occurrence of event in partnership agreement. – Unanimous vote of partners. – Order of court or arbitrator for wrongful conduct – Bankruptcy, Assignment to Creditors, Incapacity or Death. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 19

Partner’s Dissociation • Dissociation occurs when a partner ceases to be associated with the carrying on of partnership business. • Events which can cause dissociation: – Partners giving notice of withdrawal. – Occurrence of event in partnership agreement. – Unanimous vote of partners. – Order of court or arbitrator for wrongful conduct – Bankruptcy, Assignment to Creditors, Incapacity or Death. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 19

Partner’s Dissociation • Wrongful Dissociation occurs: – If partner lacks right to dissociate, or – When partner’s withdrawal is in breach of partnership agreement. • Effects of Dissociation. – Terminates rights of partner, requires “buyout” of partnership interest, and alters liability to third parties. Case 27. 1 Warnick v. Warnick. Proper calculation of buyout price of a dissociated partner do not include purely hypothetical costs of sale. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 20

Partner’s Dissociation • Wrongful Dissociation occurs: – If partner lacks right to dissociate, or – When partner’s withdrawal is in breach of partnership agreement. • Effects of Dissociation. – Terminates rights of partner, requires “buyout” of partnership interest, and alters liability to third parties. Case 27. 1 Warnick v. Warnick. Proper calculation of buyout price of a dissociated partner do not include purely hypothetical costs of sale. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 20

Partner’s Dissociation • Liability to Third Parties. – Under UPA, partnership is liable to third parties for two years by acts of dissociated partner, IF third party reasonably believes dissociated partner was still a partner. – Also, dissociated partner may be personally liable to third parties for his wrongful acts. • Partnership should notify all creditors, customers, and clients of a dissociation. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 21

Partner’s Dissociation • Liability to Third Parties. – Under UPA, partnership is liable to third parties for two years by acts of dissociated partner, IF third party reasonably believes dissociated partner was still a partner. – Also, dissociated partner may be personally liable to third parties for his wrongful acts. • Partnership should notify all creditors, customers, and clients of a dissociation. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 21

Partnership Termination: Dissolution • By Acts of the Partners: – Partners can agree to Agreement. – Partner’s Withdrawal. • Partnership for term – breach. • No term -- no breach. – Admission of a new partner. – Not a transfer of a partner’s interest. • By assignment or attachment by creditor. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 22

Partnership Termination: Dissolution • By Acts of the Partners: – Partners can agree to Agreement. – Partner’s Withdrawal. • Partnership for term – breach. • No term -- no breach. – Admission of a new partner. – Not a transfer of a partner’s interest. • By assignment or attachment by creditor. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 22

Dissolution • By Operation of Law: – Death of a partner. – Bankruptcy of partnership. – Illegality. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 23

Dissolution • By Operation of Law: – Death of a partner. – Bankruptcy of partnership. – Illegality. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 23

Winding Up • Partners have no authority after dissolution occurs except to: – Complete transactions already begun. – Wind up by collecting and preserving partnership assets, discharging liabilities, and accounting to each partner for the value of his share. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 24

Winding Up • Partners have no authority after dissolution occurs except to: – Complete transactions already begun. – Wind up by collecting and preserving partnership assets, discharging liabilities, and accounting to each partner for the value of his share. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 24

Winding Up • Partnership obligations are paid in the following order: – First, 3 rd party creditors. – Second, partner loans to partnership. – Third, return of capital contributions. – Fourth, distribution of the balance, if any to partners. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 25

Winding Up • Partnership obligations are paid in the following order: – First, 3 rd party creditors. – Second, partner loans to partnership. – Third, return of capital contributions. – Fourth, distribution of the balance, if any to partners. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 25

Limited Liability Partnerships • LLP: hybrid form of business that allows for ‘pass-through’ for tax purposes, but limits personal liability from malpractice of other partners. • LLP is formed under state law. • Family LLP is a limited liability partnership in which the majority of the partners are related to each other. – Used frequently for agriculture. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 26

Limited Liability Partnerships • LLP: hybrid form of business that allows for ‘pass-through’ for tax purposes, but limits personal liability from malpractice of other partners. • LLP is formed under state law. • Family LLP is a limited liability partnership in which the majority of the partners are related to each other. – Used frequently for agriculture. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 26

Limited Partnerships • Agreement of two or more persons to carry on a business for profit with at least one general partner and one limited partner. • Limits the liability of the limited partners to their investment. • An LP is a creature of state statute so filing a certificate with the Secretary of State is required. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 27

Limited Partnerships • Agreement of two or more persons to carry on a business for profit with at least one general partner and one limited partner. • Limits the liability of the limited partners to their investment. • An LP is a creature of state statute so filing a certificate with the Secretary of State is required. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 27

LP - Rights and Liabilities • The General partner assumes all management and personal liability. • Both general and limited partners have a fiduciary duty to each other. Case 27. 2 1515 North Wells, LP v. 1513 North Wells, LLC. An LP agreement cannot contract away the fiduciary duties. So a general partner is liable for breach of fiduciary duty to limited partners. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 28

LP - Rights and Liabilities • The General partner assumes all management and personal liability. • Both general and limited partners have a fiduciary duty to each other. Case 27. 2 1515 North Wells, LP v. 1513 North Wells, LLC. An LP agreement cannot contract away the fiduciary duties. So a general partner is liable for breach of fiduciary duty to limited partners. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 28

LP - Rights and Liabilities • General partners are personally liable to 3 rd parties for breach of contract and tort liability. A corporation (or an LLC) can be a general partner and with limited liability. • Limited Partner contributes cash but has no management rights. – Liability is limited to the amount of investment. – A limited partner can forfeit this “veil” of immunity by taking part in the management of the LP. • Limited partners have the right to inspect the LP’s books. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 29

LP - Rights and Liabilities • General partners are personally liable to 3 rd parties for breach of contract and tort liability. A corporation (or an LLC) can be a general partner and with limited liability. • Limited Partner contributes cash but has no management rights. – Liability is limited to the amount of investment. – A limited partner can forfeit this “veil” of immunity by taking part in the management of the LP. • Limited partners have the right to inspect the LP’s books. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 29

LP-Dissociation and Dissolution • General partner has right to withdraw, but can lead to dissolution. • On dissolution, the limited partner is entitled to return of capital contributions. • LP interests are considered securities and regulated by both federal and state securities laws. • Limited partners’ liability is limited to the capital investment. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 30

LP-Dissociation and Dissolution • General partner has right to withdraw, but can lead to dissolution. • On dissolution, the limited partner is entitled to return of capital contributions. • LP interests are considered securities and regulated by both federal and state securities laws. • Limited partners’ liability is limited to the capital investment. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 30

LP-Dissolution • Dissolved in much the same way as a general partnership. – Retirement, withdrawal, death bankruptcy or mental incompetence of a general partner will trigger dissolution unless the remaining GP’s consent to continue. • Creditors are paid first then partners. Case 27. 3 In re Dissolution of Midnight Star Enterprises, LP. A partner cannot force the sale of a limited partnership on the open market if the other partners want to continue the business. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 31

LP-Dissolution • Dissolved in much the same way as a general partnership. – Retirement, withdrawal, death bankruptcy or mental incompetence of a general partner will trigger dissolution unless the remaining GP’s consent to continue. • Creditors are paid first then partners. Case 27. 3 In re Dissolution of Midnight Star Enterprises, LP. A partner cannot force the sale of a limited partnership on the open market if the other partners want to continue the business. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 31

Limited Liability Limited Partnerships • Limited Liability Limited Partnership is a type of limited partnership. • Difference between LP and LLLP is that the general partner has limited liability, like a limited partner, up to the amount of investment. • Most states do not allow for LLLP’s. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 32

Limited Liability Limited Partnerships • Limited Liability Limited Partnership is a type of limited partnership. • Difference between LP and LLLP is that the general partner has limited liability, like a limited partner, up to the amount of investment. • Most states do not allow for LLLP’s. © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 32

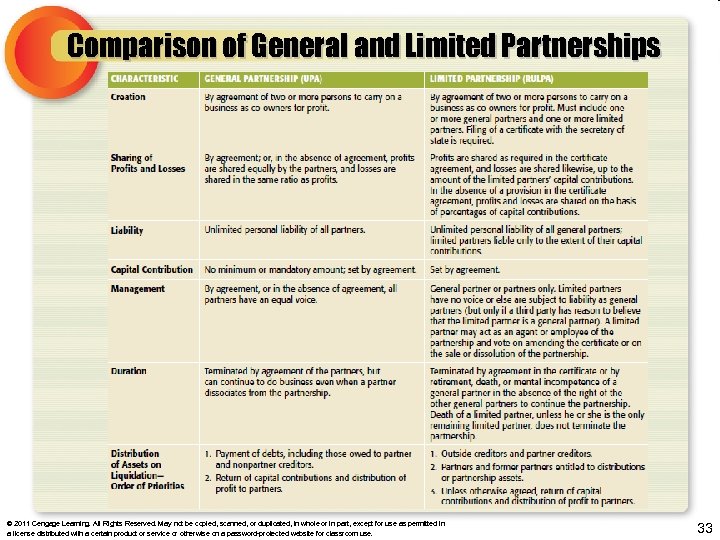

Comparison of General and Limited Partnerships © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 33

Comparison of General and Limited Partnerships © 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 33