7dcd754dc1f1a4aa9dd00947aafd18e4.ppt

- Количество слайдов: 35

Chapter 24 Outgoing Payment Processing is the final step in the Procurement Cycle. The system employs an automated Payment Program which provides full functionality for processing Vendor payments. Chapter Objectives – Describe the input data needed to configure the Payment Program. – Discuss cash discount strategies. – Execute the Payment Program. 4. 6 fi_24. 1 Outgoing Payment Processing

Chapter 24 Outgoing Payment Processing is the final step in the Procurement Cycle. The system employs an automated Payment Program which provides full functionality for processing Vendor payments. Chapter Objectives – Describe the input data needed to configure the Payment Program. – Discuss cash discount strategies. – Execute the Payment Program. 4. 6 fi_24. 1 Outgoing Payment Processing

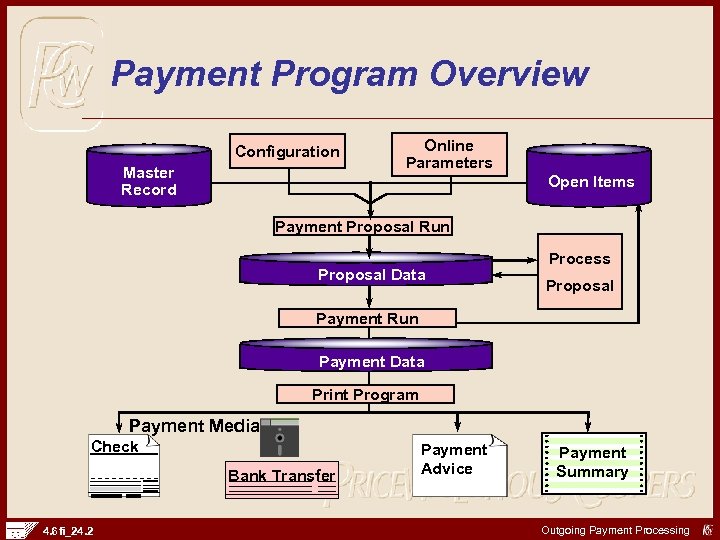

Payment Program Overview Configuration Master Record Online Parameters Open Items Payment Proposal Run Proposal Data Process Proposal Payment Run Payment Data Print Program Payment Media Check Bank Transfer 4. 6 fi_24. 2 Payment Advice Payment Summary Outgoing Payment Processing

Payment Program Overview Configuration Master Record Online Parameters Open Items Payment Proposal Run Proposal Data Process Proposal Payment Run Payment Data Print Program Payment Media Check Bank Transfer 4. 6 fi_24. 2 Payment Advice Payment Summary Outgoing Payment Processing

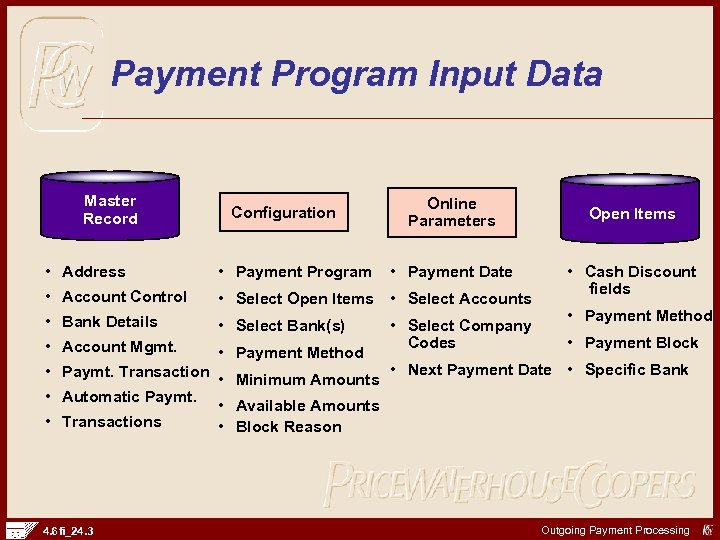

Payment Program Input Data Master Record Configuration Online Parameters • Address • Payment Program • Payment Date • Account Control • Select Open Items • Select Accounts • Bank Details • Select Bank(s) • Account Mgmt. • Payment Method • Select Company Codes Open Items • Cash Discount fields • Payment Method • Payment Block • Paymt. Transaction • Minimum Amounts • Next Payment Date • Specific Bank • Automatic Paymt. • Available Amounts • Transactions • Block Reason 4. 6 fi_24. 3 Outgoing Payment Processing

Payment Program Input Data Master Record Configuration Online Parameters • Address • Payment Program • Payment Date • Account Control • Select Open Items • Select Accounts • Bank Details • Select Bank(s) • Account Mgmt. • Payment Method • Select Company Codes Open Items • Cash Discount fields • Payment Method • Payment Block • Paymt. Transaction • Minimum Amounts • Next Payment Date • Specific Bank • Automatic Paymt. • Available Amounts • Transactions • Block Reason 4. 6 fi_24. 3 Outgoing Payment Processing

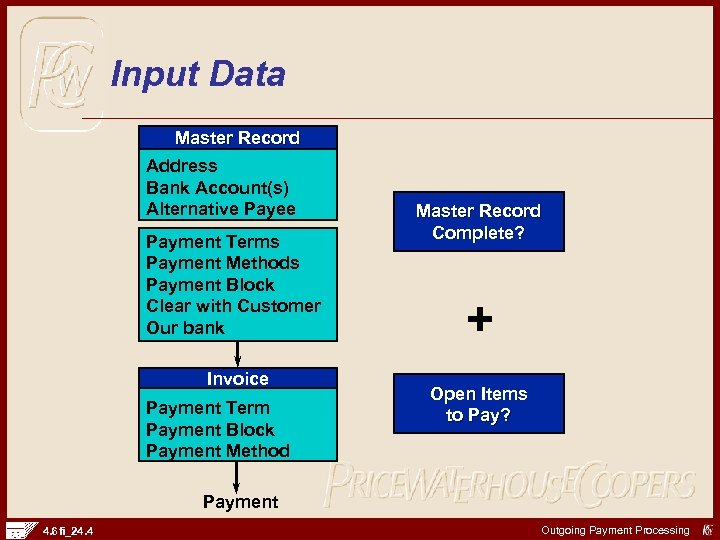

Input Data Master Record Address Bank Account(s) Alternative Payee Payment Terms Payment Methods Payment Block Clear with Customer Our bank Invoice Payment Term Payment Block Payment Method Master Record Complete? + Open Items to Pay? Payment 4. 6 fi_24. 4 Outgoing Payment Processing

Input Data Master Record Address Bank Account(s) Alternative Payee Payment Terms Payment Methods Payment Block Clear with Customer Our bank Invoice Payment Term Payment Block Payment Method Master Record Complete? + Open Items to Pay? Payment 4. 6 fi_24. 4 Outgoing Payment Processing

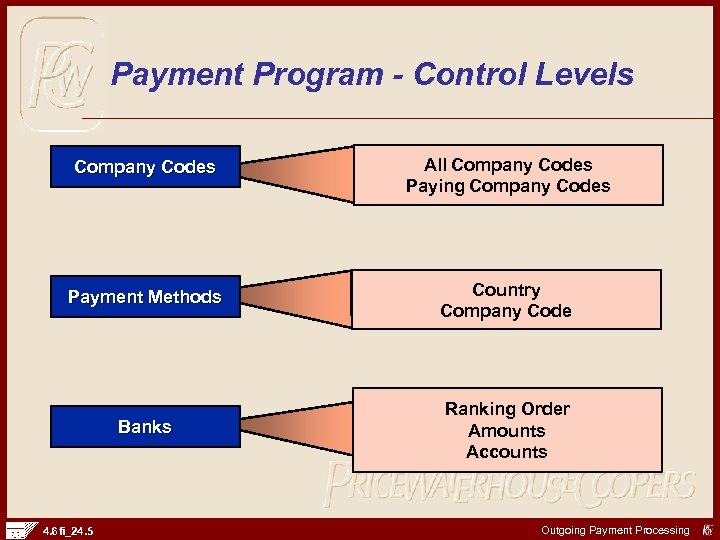

Payment Program - Control Levels Company Codes All Company Codes Paying Company Codes Payment Methods Country Company Code Banks Ranking Order Amounts Accounts 4. 6 fi_24. 5 Outgoing Payment Processing

Payment Program - Control Levels Company Codes All Company Codes Paying Company Codes Payment Methods Country Company Code Banks Ranking Order Amounts Accounts 4. 6 fi_24. 5 Outgoing Payment Processing

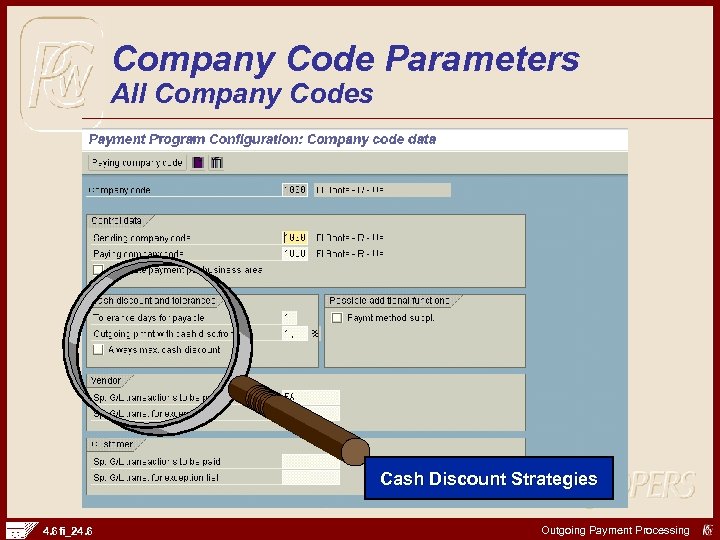

Company Code Parameters All Company Codes Cash Discount Strategies 4. 6 fi_24. 6 Outgoing Payment Processing

Company Code Parameters All Company Codes Cash Discount Strategies 4. 6 fi_24. 6 Outgoing Payment Processing

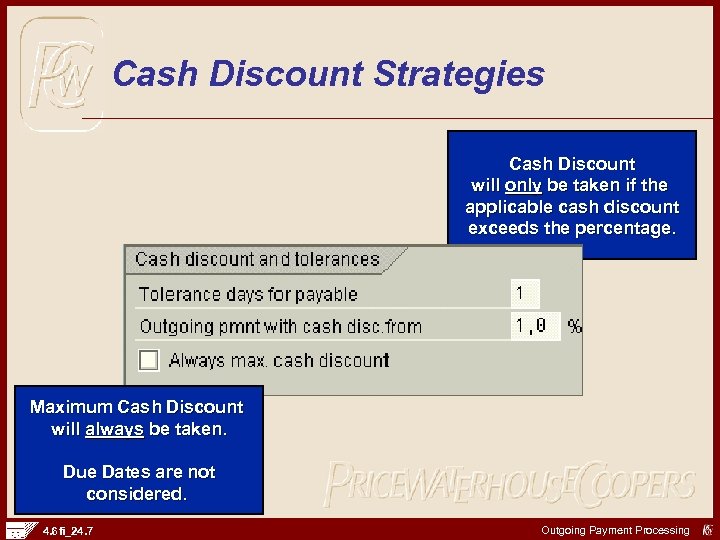

Cash Discount Strategies Cash Discount will only be taken if the applicable cash discount exceeds the percentage. Maximum Cash Discount will always be taken. Due Dates are not considered. 4. 6 fi_24. 7 Outgoing Payment Processing

Cash Discount Strategies Cash Discount will only be taken if the applicable cash discount exceeds the percentage. Maximum Cash Discount will always be taken. Due Dates are not considered. 4. 6 fi_24. 7 Outgoing Payment Processing

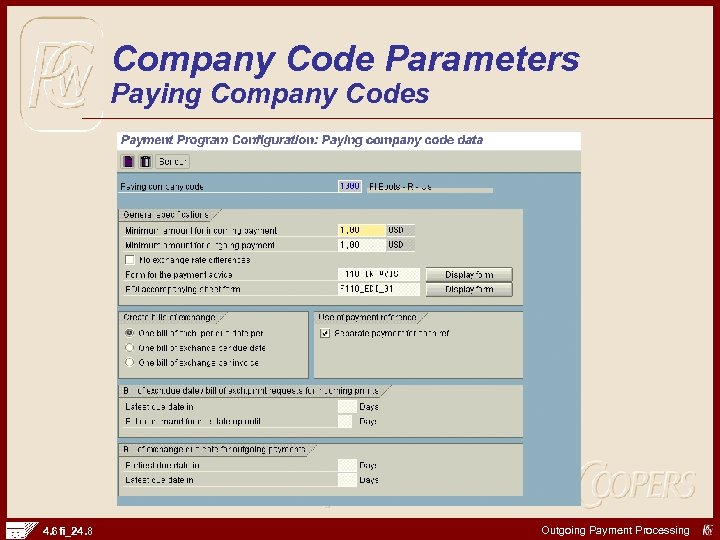

Company Code Parameters Paying Company Codes 4. 6 fi_24. 8 Outgoing Payment Processing

Company Code Parameters Paying Company Codes 4. 6 fi_24. 8 Outgoing Payment Processing

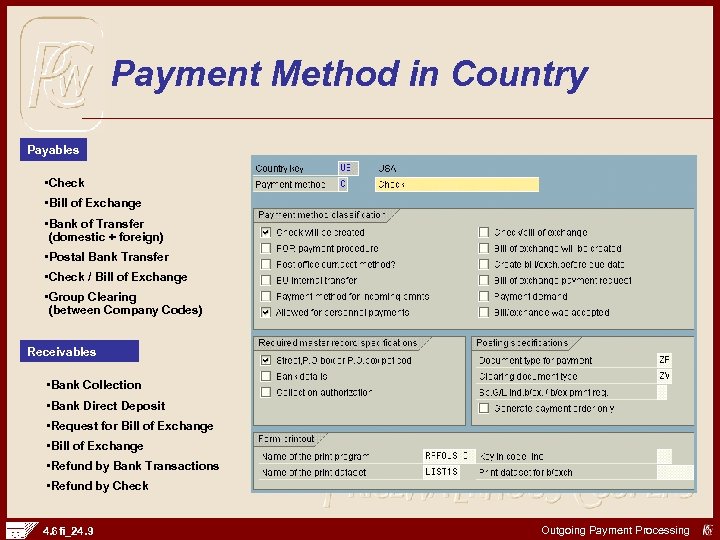

Payment Method in Country Payables • Check • Bill of Exchange • Bank of Transfer (domestic + foreign) • Postal Bank Transfer • Check / Bill of Exchange • Group Clearing (between Company Codes) Receivables • Bank Collection • Bank Direct Deposit • Request for Bill of Exchange • Refund by Bank Transactions • Refund by Check 4. 6 fi_24. 9 Outgoing Payment Processing

Payment Method in Country Payables • Check • Bill of Exchange • Bank of Transfer (domestic + foreign) • Postal Bank Transfer • Check / Bill of Exchange • Group Clearing (between Company Codes) Receivables • Bank Collection • Bank Direct Deposit • Request for Bill of Exchange • Refund by Bank Transactions • Refund by Check 4. 6 fi_24. 9 Outgoing Payment Processing

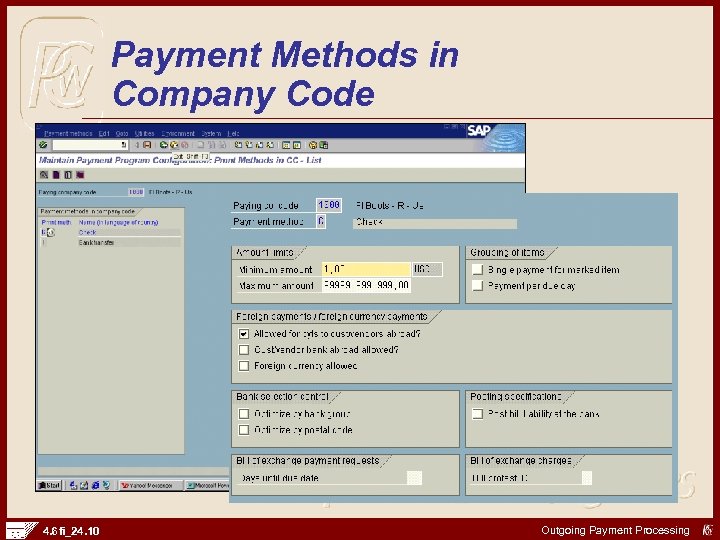

Payment Methods in Company Code 4. 6 fi_24. 10 Outgoing Payment Processing

Payment Methods in Company Code 4. 6 fi_24. 10 Outgoing Payment Processing

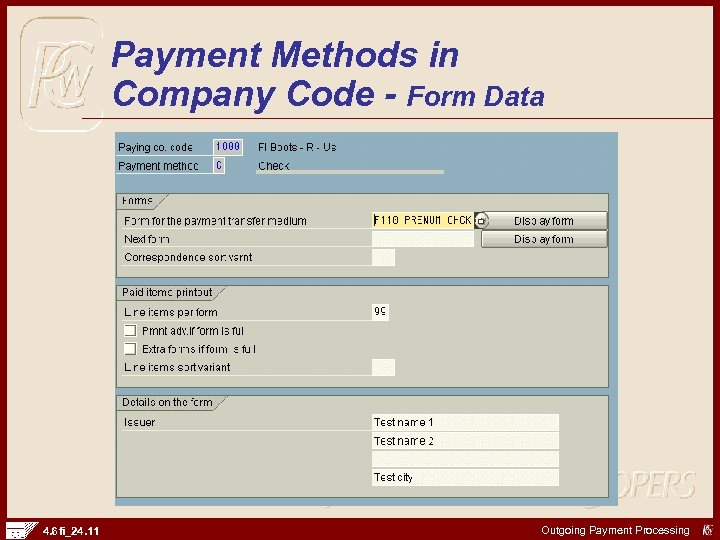

Payment Methods in Company Code - Form Data 4. 6 fi_24. 11 Outgoing Payment Processing

Payment Methods in Company Code - Form Data 4. 6 fi_24. 11 Outgoing Payment Processing

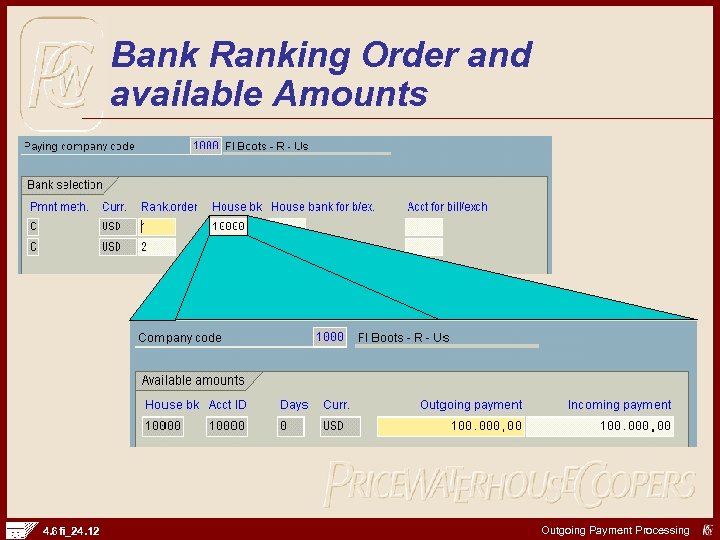

Bank Ranking Order and available Amounts 4. 6 fi_24. 12 Outgoing Payment Processing

Bank Ranking Order and available Amounts 4. 6 fi_24. 12 Outgoing Payment Processing

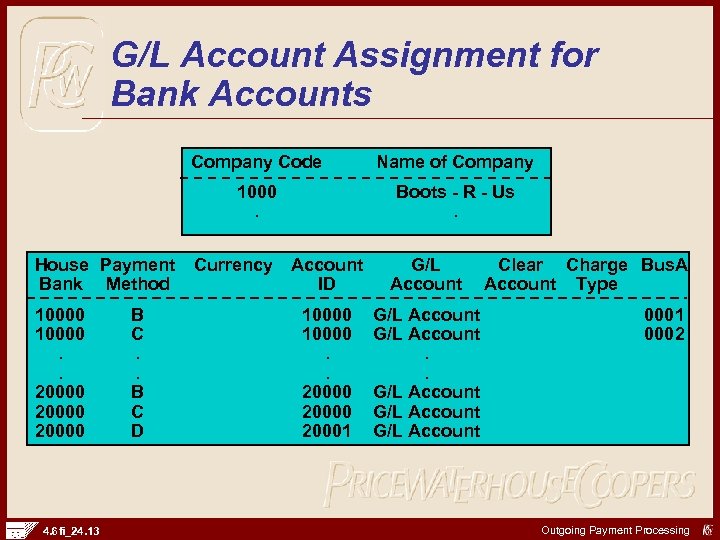

G/L Account Assignment for Bank Accounts Company Code 1000. House Payment Bank Method 10000. . 20000 4. 6 fi_24. 13 B C. . B C D Name of Company Boots - R - Us. Currency Account ID G/L Account 10000. . 20000 20001 G/L Account. . G/L Account Clear Charge Bus. A Account Type 0001 0002 Outgoing Payment Processing

G/L Account Assignment for Bank Accounts Company Code 1000. House Payment Bank Method 10000. . 20000 4. 6 fi_24. 13 B C. . B C D Name of Company Boots - R - Us. Currency Account ID G/L Account 10000. . 20000 20001 G/L Account. . G/L Account Clear Charge Bus. A Account Type 0001 0002 Outgoing Payment Processing

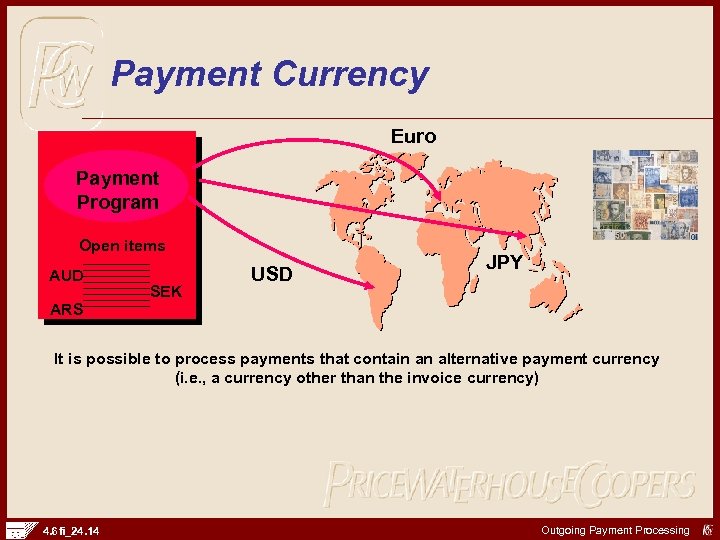

Payment Currency Euro Payment Program Open items AUD ARS SEK USD JPY It is possible to process payments that contain an alternative payment currency (i. e. , a currency other than the invoice currency) 4. 6 fi_24. 14 Outgoing Payment Processing

Payment Currency Euro Payment Program Open items AUD ARS SEK USD JPY It is possible to process payments that contain an alternative payment currency (i. e. , a currency other than the invoice currency) 4. 6 fi_24. 14 Outgoing Payment Processing

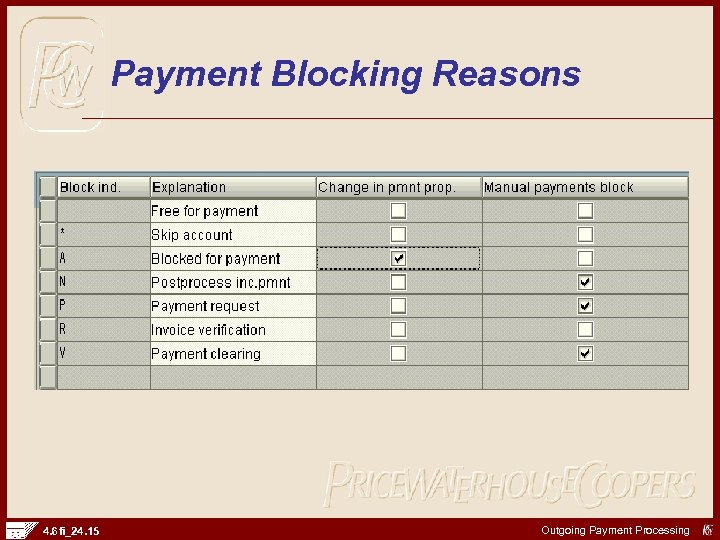

Payment Blocking Reasons 4. 6 fi_24. 15 Outgoing Payment Processing

Payment Blocking Reasons 4. 6 fi_24. 15 Outgoing Payment Processing

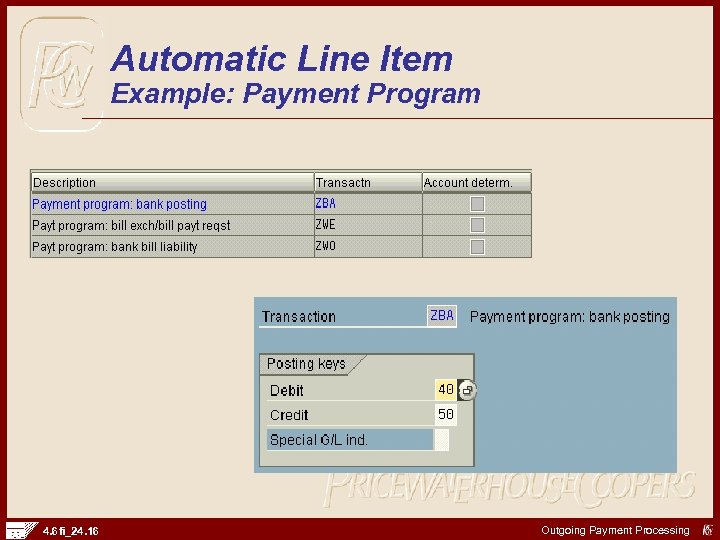

Automatic Line Item Example: Payment Program 4. 6 fi_24. 16 Outgoing Payment Processing

Automatic Line Item Example: Payment Program 4. 6 fi_24. 16 Outgoing Payment Processing

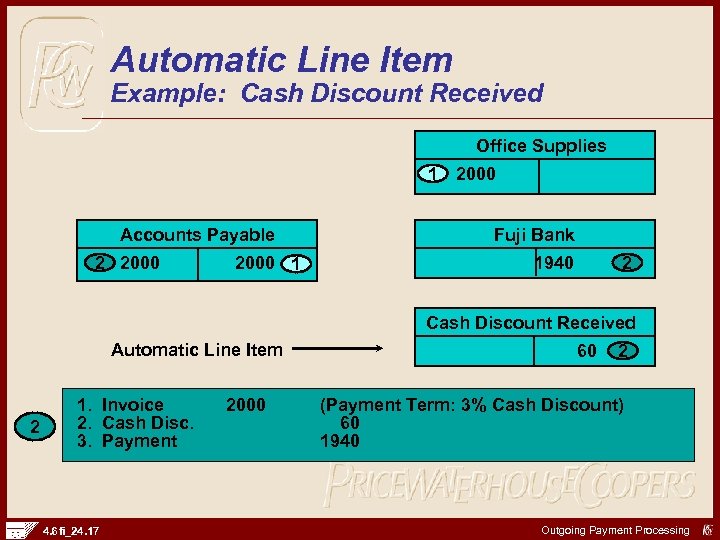

Automatic Line Item Example: Cash Discount Received Office Supplies 1 2000 Accounts Payable 2 2000 1 Fuji Bank 1940 2 Cash Discount Received Automatic Line Item 2 1. Invoice 2. Cash Disc. 3. Payment 4. 6 fi_24. 17 2000 60 2 (Payment Term: 3% Cash Discount) 60 1940 Outgoing Payment Processing

Automatic Line Item Example: Cash Discount Received Office Supplies 1 2000 Accounts Payable 2 2000 1 Fuji Bank 1940 2 Cash Discount Received Automatic Line Item 2 1. Invoice 2. Cash Disc. 3. Payment 4. 6 fi_24. 17 2000 60 2 (Payment Term: 3% Cash Discount) 60 1940 Outgoing Payment Processing

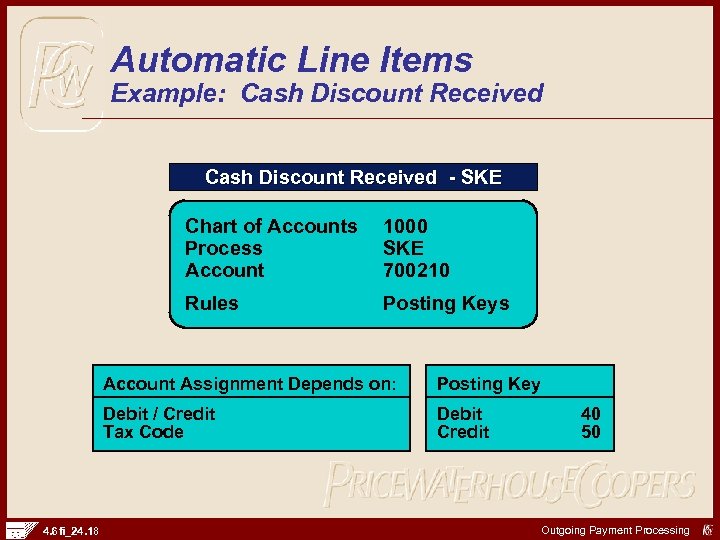

Automatic Line Items Example: Cash Discount Received - SKE Chart of Accounts Process Account 1000 SKE 700210 Rules Posting Keys Account Assignment Depends on: Debit / Credit Tax Code 4. 6 fi_24. 18 Posting Key Debit Credit 40 50 Outgoing Payment Processing

Automatic Line Items Example: Cash Discount Received - SKE Chart of Accounts Process Account 1000 SKE 700210 Rules Posting Keys Account Assignment Depends on: Debit / Credit Tax Code 4. 6 fi_24. 18 Posting Key Debit Credit 40 50 Outgoing Payment Processing

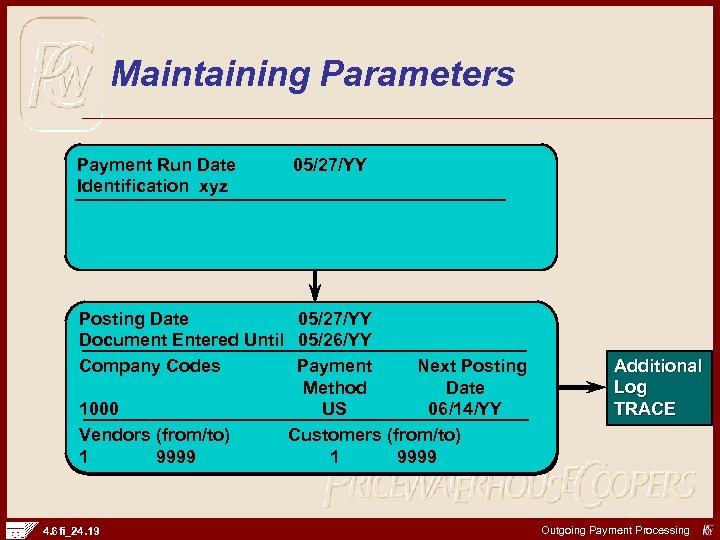

Maintaining Parameters Payment Run Date Identification xyz 05/27/YY Posting Date 05/27/YY Document Entered Until 05/26/YY Company Codes Payment Next Posting Method Date 1000 US 06/14/YY Vendors (from/to) Customers (from/to) 1 9999 4. 6 fi_24. 19 Additional Log TRACE Outgoing Payment Processing

Maintaining Parameters Payment Run Date Identification xyz 05/27/YY Posting Date 05/27/YY Document Entered Until 05/26/YY Company Codes Payment Next Posting Method Date 1000 US 06/14/YY Vendors (from/to) Customers (from/to) 1 9999 4. 6 fi_24. 19 Additional Log TRACE Outgoing Payment Processing

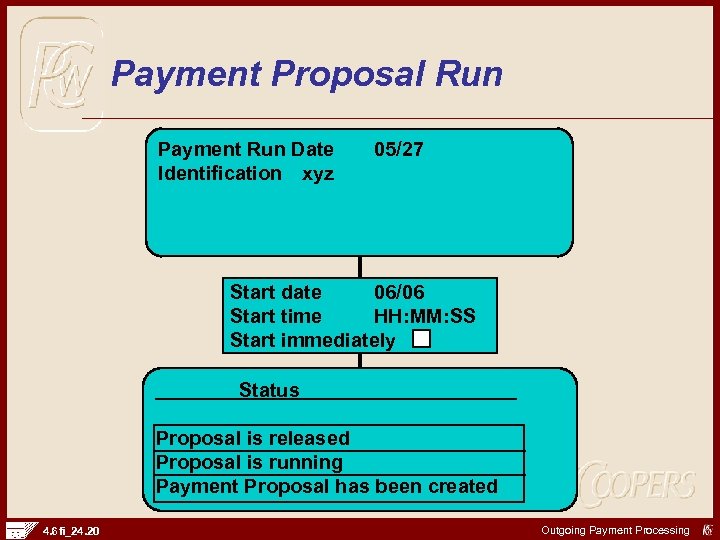

Payment Proposal Run Payment Run Date Identification xyz 05/27 Start date 06/06 Start time HH: MM: SS Start immediately Status Proposal is released Proposal is running Payment Proposal has been created 4. 6 fi_24. 20 Outgoing Payment Processing

Payment Proposal Run Payment Run Date Identification xyz 05/27 Start date 06/06 Start time HH: MM: SS Start immediately Status Proposal is released Proposal is running Payment Proposal has been created 4. 6 fi_24. 20 Outgoing Payment Processing

Intermediary Banks: Solution Own Bank Intermediary Bank(s) Vendor Bank Payment Program • Companies have the option to specify not only the banks at the start and at the end of the payment cycle (House bank and the business partner bank) but also the banks via which the payment should be made in between. • The payment program can determine a predefined combination of intermediary banks for each payment 4. 6 fi_24. 21 Outgoing Payment Processing

Intermediary Banks: Solution Own Bank Intermediary Bank(s) Vendor Bank Payment Program • Companies have the option to specify not only the banks at the start and at the end of the payment cycle (House bank and the business partner bank) but also the banks via which the payment should be made in between. • The payment program can determine a predefined combination of intermediary banks for each payment 4. 6 fi_24. 21 Outgoing Payment Processing

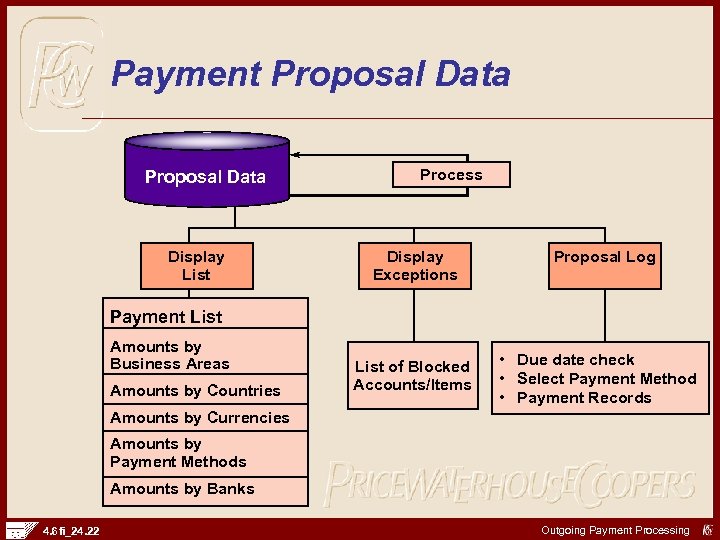

Payment Proposal Data Display List Process Display Exceptions Proposal Log Payment List Amounts by Business Areas Amounts by Countries List of Blocked Accounts/Items • Due date check • Select Payment Method • Payment Records Amounts by Currencies Amounts by Payment Methods Amounts by Banks 4. 6 fi_24. 22 Outgoing Payment Processing

Payment Proposal Data Display List Process Display Exceptions Proposal Log Payment List Amounts by Business Areas Amounts by Countries List of Blocked Accounts/Items • Due date check • Select Payment Method • Payment Records Amounts by Currencies Amounts by Payment Methods Amounts by Banks 4. 6 fi_24. 22 Outgoing Payment Processing

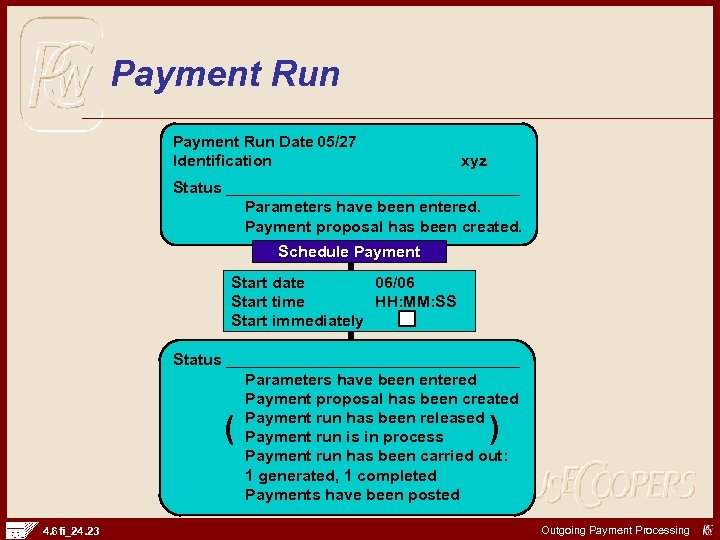

Payment Run Date 05/27 Identification xyz Status _________________ Parameters have been entered. Payment proposal has been created. Schedule Payment Start date 06/06 Start time HH: MM: SS Start immediately Status _________________ Parameters have been entered Payment proposal has been created Payment run has been released Payment run is in process Payment run has been carried out: 1 generated, 1 completed Payments have been posted ( 4. 6 fi_24. 23 ) Outgoing Payment Processing

Payment Run Date 05/27 Identification xyz Status _________________ Parameters have been entered. Payment proposal has been created. Schedule Payment Start date 06/06 Start time HH: MM: SS Start immediately Status _________________ Parameters have been entered Payment proposal has been created Payment run has been released Payment run is in process Payment run has been carried out: 1 generated, 1 completed Payments have been posted ( 4. 6 fi_24. 23 ) Outgoing Payment Processing

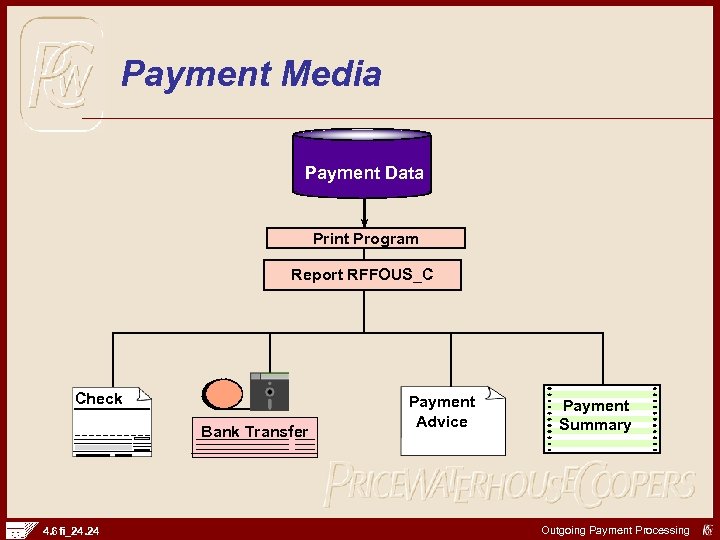

Payment Media Payment Data Print Program Report RFFOUS_C Check Bank Transfer 4. 6 fi_24. 24 Payment Advice Payment Summary Outgoing Payment Processing

Payment Media Payment Data Print Program Report RFFOUS_C Check Bank Transfer 4. 6 fi_24. 24 Payment Advice Payment Summary Outgoing Payment Processing

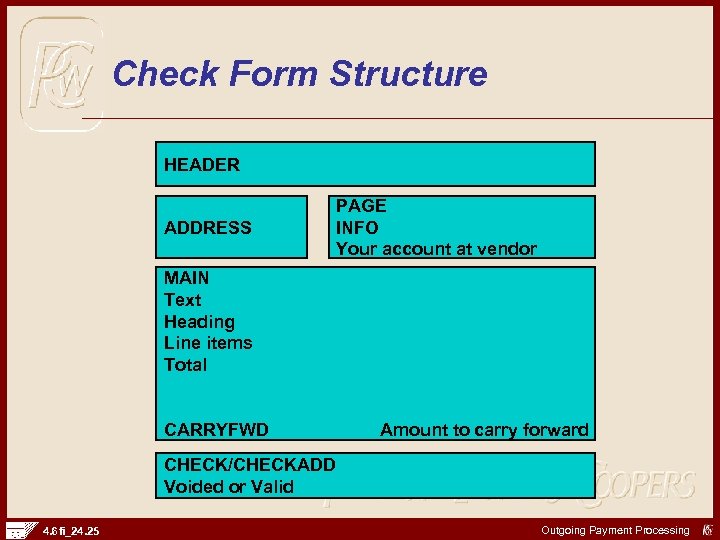

Check Form Structure HEADER ADDRESS PAGE INFO Your account at vendor MAIN Text Heading Line items Total CARRYFWD Amount to carry forward CHECK/CHECKADD Voided or Valid 4. 6 fi_24. 25 Outgoing Payment Processing

Check Form Structure HEADER ADDRESS PAGE INFO Your account at vendor MAIN Text Heading Line items Total CARRYFWD Amount to carry forward CHECK/CHECKADD Voided or Valid 4. 6 fi_24. 25 Outgoing Payment Processing

Outgoing Payment Program Chapter Summary • Key Terms – Outgoing Payment Program – Payment Method – Payment Block – Paying Company Code – Sending Company Code – Optimization by Bank Group – Optimization by Postal Code – Variant 4. 6 fi_24. 26 Outgoing Payment Processing

Outgoing Payment Program Chapter Summary • Key Terms – Outgoing Payment Program – Payment Method – Payment Block – Paying Company Code – Sending Company Code – Optimization by Bank Group – Optimization by Postal Code – Variant 4. 6 fi_24. 26 Outgoing Payment Processing

Outgoing Payment Program Chapter Summary • Key Terms – Payment Currency – Intermediary Bank – Bank Chain 4. 6 fi_24. 27 Outgoing Payment Processing

Outgoing Payment Program Chapter Summary • Key Terms – Payment Currency – Intermediary Bank – Bank Chain 4. 6 fi_24. 27 Outgoing Payment Processing

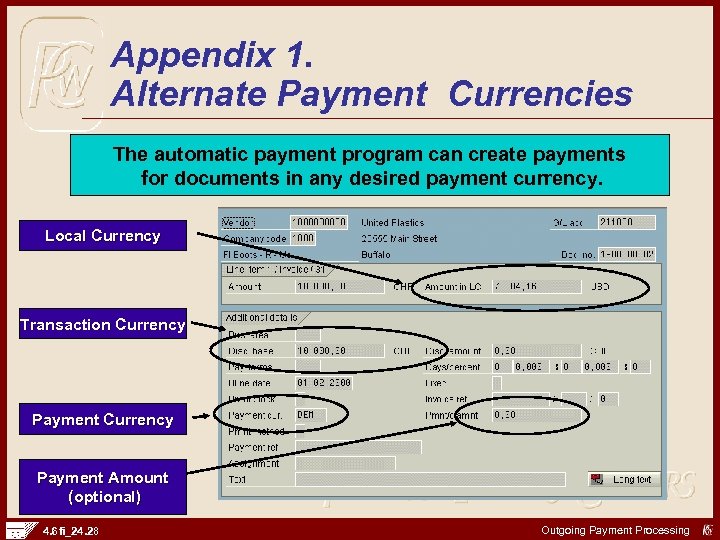

Appendix 1. Alternate Payment Currencies The automatic payment program can create payments for documents in any desired payment currency. Local Currency Transaction Currency Payment Amount (optional) 4. 6 fi_24. 28 Outgoing Payment Processing

Appendix 1. Alternate Payment Currencies The automatic payment program can create payments for documents in any desired payment currency. Local Currency Transaction Currency Payment Amount (optional) 4. 6 fi_24. 28 Outgoing Payment Processing

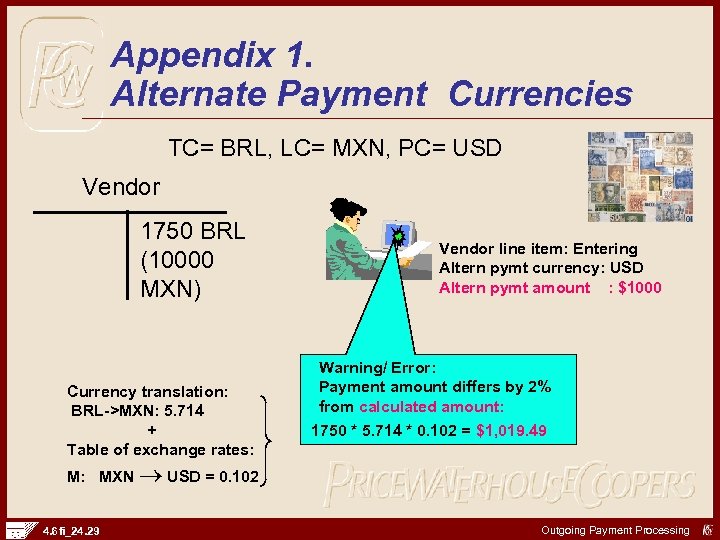

Appendix 1. Alternate Payment Currencies TC= BRL, LC= MXN, PC= USD Vendor 1750 BRL (10000 MXN) Currency translation: BRL->MXN: 5. 714 + Table of exchange rates: Vendor line item: Entering Altern pymt currency: USD Altern pymt amount : $1000 Warning/ Error: Payment amount differs by 2% from calculated amount: 1750 * 5. 714 * 0. 102 = $1, 019. 49 M: MXN USD = 0. 102 4. 6 fi_24. 29 Outgoing Payment Processing

Appendix 1. Alternate Payment Currencies TC= BRL, LC= MXN, PC= USD Vendor 1750 BRL (10000 MXN) Currency translation: BRL->MXN: 5. 714 + Table of exchange rates: Vendor line item: Entering Altern pymt currency: USD Altern pymt amount : $1000 Warning/ Error: Payment amount differs by 2% from calculated amount: 1750 * 5. 714 * 0. 102 = $1, 019. 49 M: MXN USD = 0. 102 4. 6 fi_24. 29 Outgoing Payment Processing

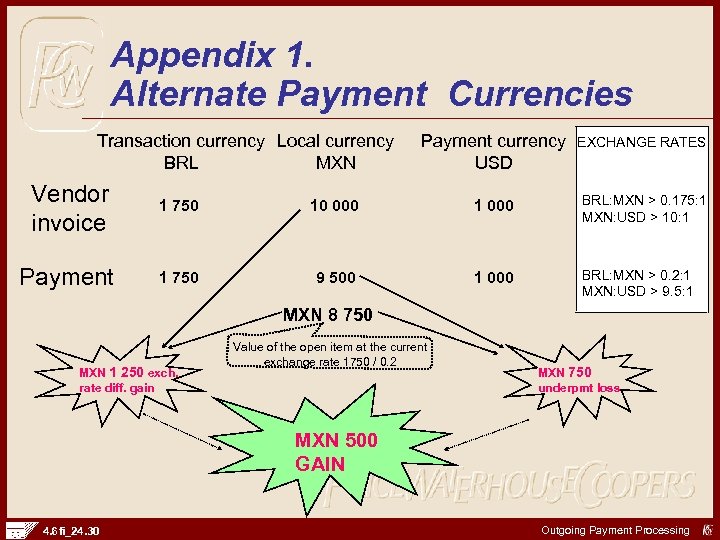

Appendix 1. Alternate Payment Currencies Transaction currency Local currency BRL MXN Payment currency USD EXCHANGE RATES Vendor invoice 1 750 10 000 1 000 BRL: MXN > 0. 175: 1 MXN: USD > 10: 1 Payment 1 750 9 500 1 000 BRL: MXN > 0. 2: 1 MXN: USD > 9. 5: 1 MXN 8 750 MXN 1 250 exch. rate diff. gain Value of the open item at the current exchange rate 1750 / 0. 2 MXN 750 underpmt loss MXN 500 GAIN 4. 6 fi_24. 30 Outgoing Payment Processing

Appendix 1. Alternate Payment Currencies Transaction currency Local currency BRL MXN Payment currency USD EXCHANGE RATES Vendor invoice 1 750 10 000 1 000 BRL: MXN > 0. 175: 1 MXN: USD > 10: 1 Payment 1 750 9 500 1 000 BRL: MXN > 0. 2: 1 MXN: USD > 9. 5: 1 MXN 8 750 MXN 1 250 exch. rate diff. gain Value of the open item at the current exchange rate 1750 / 0. 2 MXN 750 underpmt loss MXN 500 GAIN 4. 6 fi_24. 30 Outgoing Payment Processing

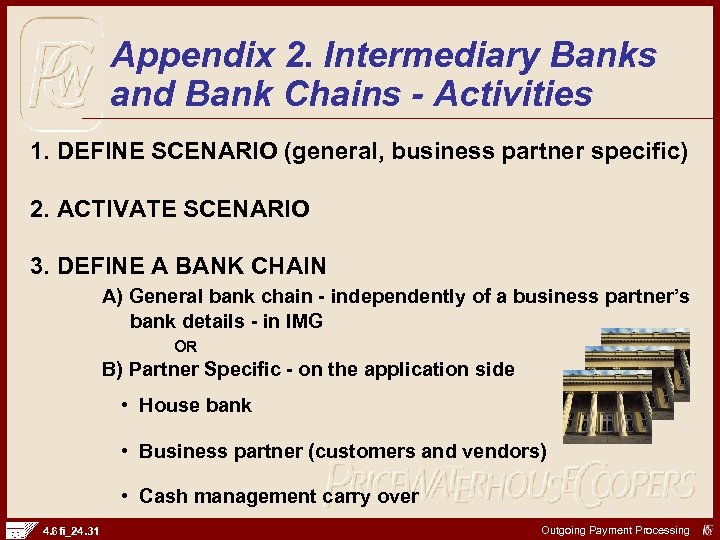

Appendix 2. Intermediary Banks and Bank Chains - Activities 1. DEFINE SCENARIO (general, business partner specific) 2. ACTIVATE SCENARIO 3. DEFINE A BANK CHAIN A) General bank chain - independently of a business partner’s bank details - in IMG OR B) Partner Specific - on the application side • House bank • Business partner (customers and vendors) • Cash management carry over 4. 6 fi_24. 31 Outgoing Payment Processing

Appendix 2. Intermediary Banks and Bank Chains - Activities 1. DEFINE SCENARIO (general, business partner specific) 2. ACTIVATE SCENARIO 3. DEFINE A BANK CHAIN A) General bank chain - independently of a business partner’s bank details - in IMG OR B) Partner Specific - on the application side • House bank • Business partner (customers and vendors) • Cash management carry over 4. 6 fi_24. 31 Outgoing Payment Processing

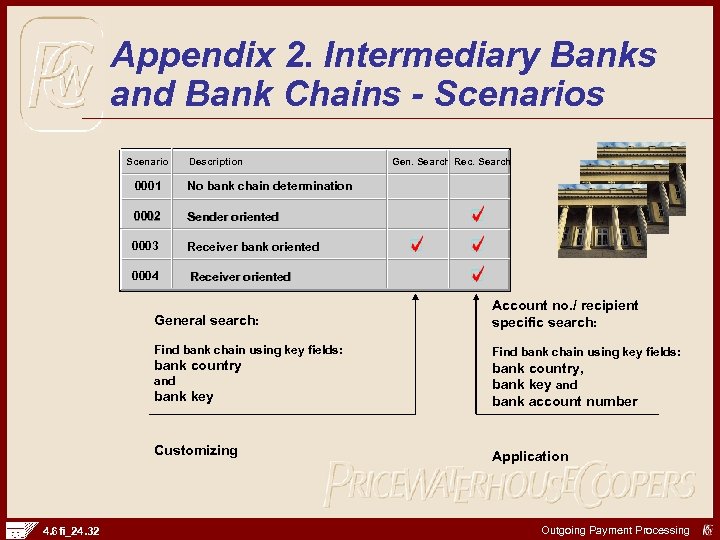

Appendix 2. Intermediary Banks and Bank Chains - Scenarios Scenario Description 0001 No bank chain determination 0002 Sender oriented 0003 Receiver bank oriented 0004 Gen. Search Receiver oriented General search: Account no. / recipient specific search: Find bank chain using key fields: bank country bank key bank country, bank key and bank account number Customizing Application and 4. 6 fi_24. 32 Outgoing Payment Processing

Appendix 2. Intermediary Banks and Bank Chains - Scenarios Scenario Description 0001 No bank chain determination 0002 Sender oriented 0003 Receiver bank oriented 0004 Gen. Search Receiver oriented General search: Account no. / recipient specific search: Find bank chain using key fields: bank country bank key bank country, bank key and bank account number Customizing Application and 4. 6 fi_24. 32 Outgoing Payment Processing

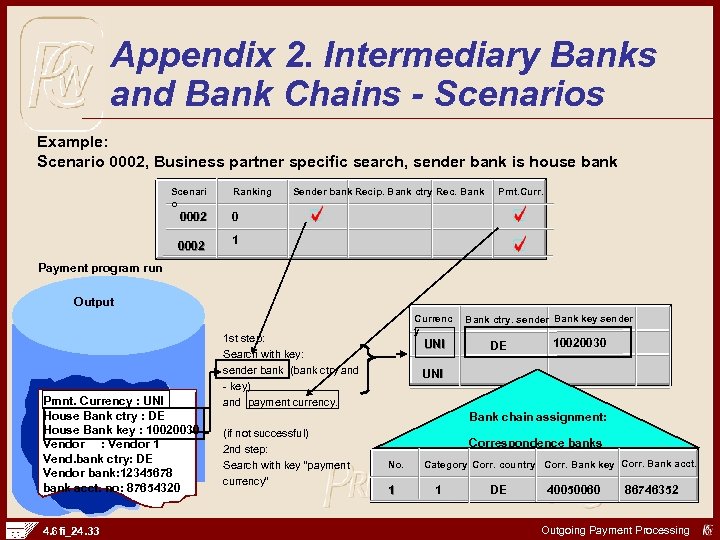

Appendix 2. Intermediary Banks and Bank Chains - Scenarios Example: Scenario 0002, Business partner specific search, sender bank is house bank Scenari o Ranking 0002 Pmt. Curr. 0 0002 Sender bank Recip. Bank ctry Rec. Bank 1 Payment program run Output Pmnt. Currency : UNI House Bank ctry : DE House Bank key : 10020030 Vendor : Vendor 1 Vend. bank ctry: DE Vendor bank: 12345678 bank acct. no: 87654320 4. 6 fi_24. 33 Currenc y 1 st step: Search with key: sender bank (bank ctry and - key) and payment currency. UNI Bank ctry. sender Bank key sender DE 10020030 UNI Bank chain assignment: (if not successful) 2 nd step: Search with key “payment currency” Correspondence banks No. 1 Category Corr. country Corr. Bank key Corr. Bank acct. 1 DE 40050060 86746352 Outgoing Payment Processing

Appendix 2. Intermediary Banks and Bank Chains - Scenarios Example: Scenario 0002, Business partner specific search, sender bank is house bank Scenari o Ranking 0002 Pmt. Curr. 0 0002 Sender bank Recip. Bank ctry Rec. Bank 1 Payment program run Output Pmnt. Currency : UNI House Bank ctry : DE House Bank key : 10020030 Vendor : Vendor 1 Vend. bank ctry: DE Vendor bank: 12345678 bank acct. no: 87654320 4. 6 fi_24. 33 Currenc y 1 st step: Search with key: sender bank (bank ctry and - key) and payment currency. UNI Bank ctry. sender Bank key sender DE 10020030 UNI Bank chain assignment: (if not successful) 2 nd step: Search with key “payment currency” Correspondence banks No. 1 Category Corr. country Corr. Bank key Corr. Bank acct. 1 DE 40050060 86746352 Outgoing Payment Processing

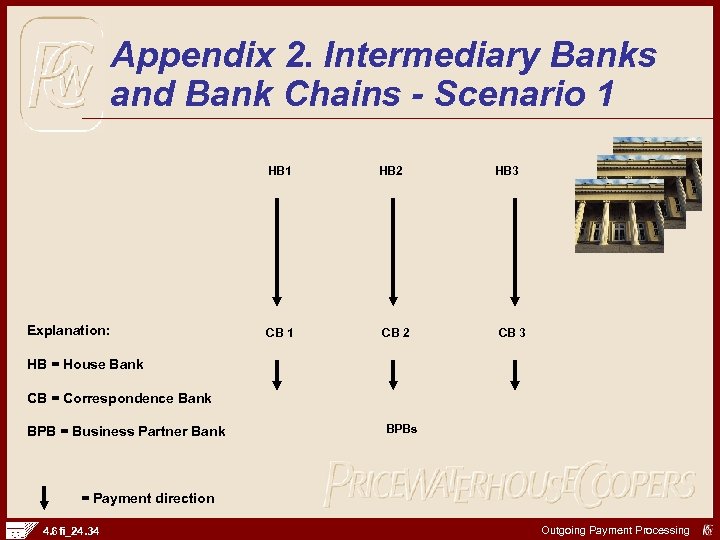

Appendix 2. Intermediary Banks and Bank Chains - Scenario 1 HB 1 Explanation: CB 1 HB 2 CB 2 HB 3 CB 3 HB = House Bank CB = Correspondence Bank BPB = Business Partner Bank BPBs = Payment direction 4. 6 fi_24. 34 Outgoing Payment Processing

Appendix 2. Intermediary Banks and Bank Chains - Scenario 1 HB 1 Explanation: CB 1 HB 2 CB 2 HB 3 CB 3 HB = House Bank CB = Correspondence Bank BPB = Business Partner Bank BPBs = Payment direction 4. 6 fi_24. 34 Outgoing Payment Processing

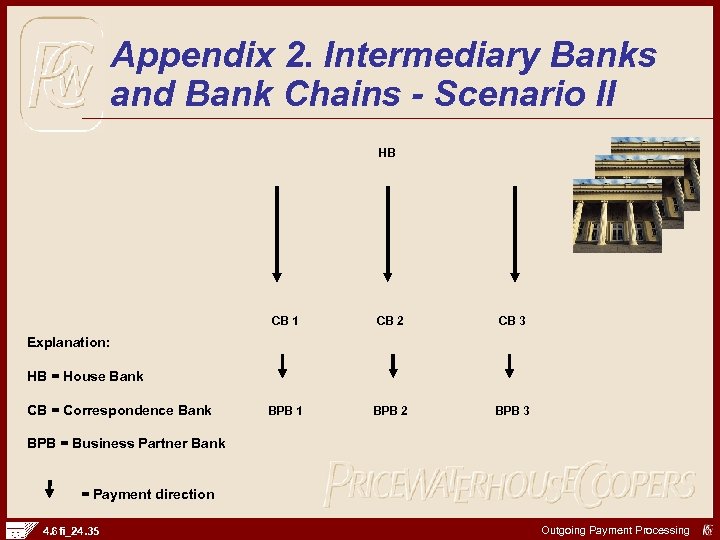

Appendix 2. Intermediary Banks and Bank Chains - Scenario II HB CB 1 CB 2 CB 3 BPB 1 BPB 2 BPB 3 Explanation: HB = House Bank CB = Correspondence Bank BPB = Business Partner Bank = Payment direction 4. 6 fi_24. 35 Outgoing Payment Processing

Appendix 2. Intermediary Banks and Bank Chains - Scenario II HB CB 1 CB 2 CB 3 BPB 1 BPB 2 BPB 3 Explanation: HB = House Bank CB = Correspondence Bank BPB = Business Partner Bank = Payment direction 4. 6 fi_24. 35 Outgoing Payment Processing