52ce50af3490b0ea24ee94598a986b35.ppt

- Количество слайдов: 44

Chapter 24 International Financial Management 24 -1 © 2001 Prentice-Hall, Inc. Fundamentals of Financial Management, 11/e Created by: Gregory A. Kuhlemeyer, Ph. D. Carroll College, Waukesha, WI

Chapter 24 International Financial Management 24 -1 © 2001 Prentice-Hall, Inc. Fundamentals of Financial Management, 11/e Created by: Gregory A. Kuhlemeyer, Ph. D. Carroll College, Waukesha, WI

International Financial Management Some Background u Types of Exchange-Rate Risk Exposure u Management of Exchange-Rate Risk Exposure u Structuring International Trade Transactions u 24 -2

International Financial Management Some Background u Types of Exchange-Rate Risk Exposure u Management of Exchange-Rate Risk Exposure u Structuring International Trade Transactions u 24 -2

Some Background What is a company’s motivation to invest capital abroad? u u To produce products in foreign markets more efficiently than domestically. u 24 -3 Fill product gaps in foreign markets where excess returns can be earned. To secure the necessary raw materials required for production.

Some Background What is a company’s motivation to invest capital abroad? u u To produce products in foreign markets more efficiently than domestically. u 24 -3 Fill product gaps in foreign markets where excess returns can be earned. To secure the necessary raw materials required for production.

International Capital Budgeting How does a firm make an international capital budgeting decision? 1. 2. Compute their U. S. -dollar equivalents at the expected exchange rate. 3. 24 -4 Estimate expected cash flows in the foreign currency. Determine the NPV of the project using the U. S. required rate of return, with the rate adjusted upward or downward for any risk premium effect associated with the foreign investment.

International Capital Budgeting How does a firm make an international capital budgeting decision? 1. 2. Compute their U. S. -dollar equivalents at the expected exchange rate. 3. 24 -4 Estimate expected cash flows in the foreign currency. Determine the NPV of the project using the U. S. required rate of return, with the rate adjusted upward or downward for any risk premium effect associated with the foreign investment.

International Capital Budgeting u Only consider those cash flows that can be “repatriated” (returned) to the homecountry parent. u The exchange rate is the number of units of one currency that may be purchased with one unit of another currency. u For example, the current exchange rate might be 2. 50 Freedonian marks per one U. S. dollar. 24 -5

International Capital Budgeting u Only consider those cash flows that can be “repatriated” (returned) to the homecountry parent. u The exchange rate is the number of units of one currency that may be purchased with one unit of another currency. u For example, the current exchange rate might be 2. 50 Freedonian marks per one U. S. dollar. 24 -5

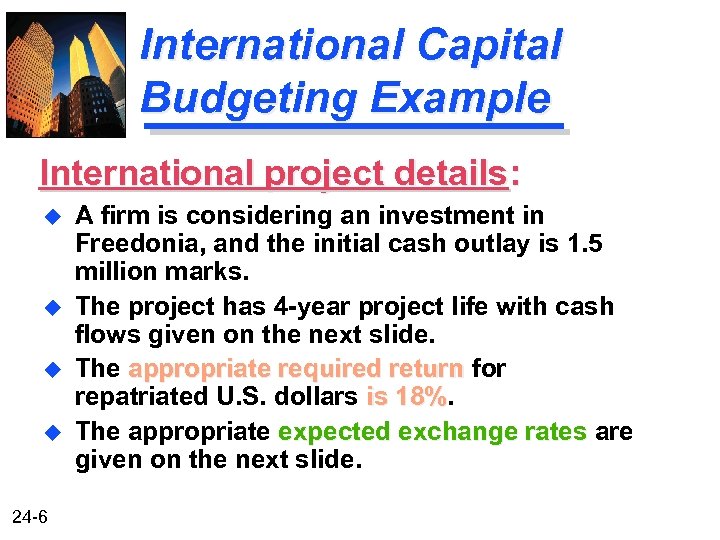

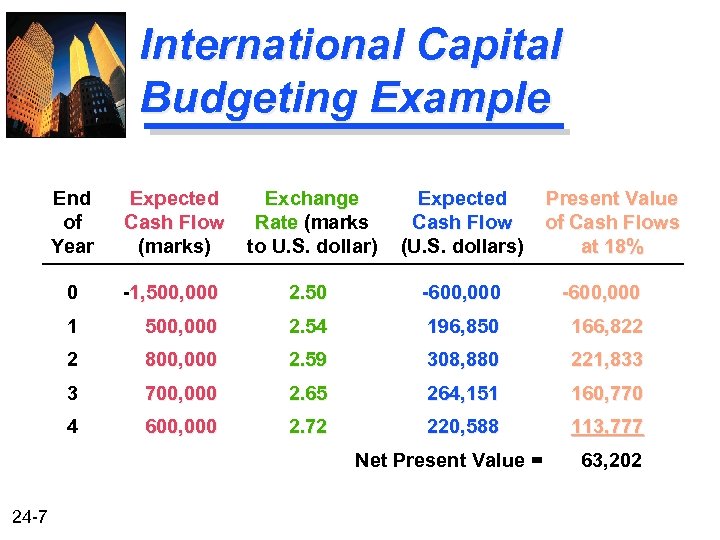

International Capital Budgeting Example International project details: u u 24 -6 A firm is considering an investment in Freedonia, and the initial cash outlay is 1. 5 million marks. The project has 4 -year project life with cash flows given on the next slide. The appropriate required return for repatriated U. S. dollars is 18% The appropriate expected exchange rates are given on the next slide.

International Capital Budgeting Example International project details: u u 24 -6 A firm is considering an investment in Freedonia, and the initial cash outlay is 1. 5 million marks. The project has 4 -year project life with cash flows given on the next slide. The appropriate required return for repatriated U. S. dollars is 18% The appropriate expected exchange rates are given on the next slide.

International Capital Budgeting Example End of Year Expected Cash Flow (marks) Exchange Rate (marks to U. S. dollar) Expected Cash Flow (U. S. dollars) 0 -1, 500, 000 2. 50 -600, 000 1 500, 000 2. 54 196, 850 166, 822 2 800, 000 2. 59 308, 880 221, 833 3 700, 000 2. 65 264, 151 160, 770 4 600, 000 2. 72 220, 588 113, 777 Net Present Value = 24 -7 Present Value of Cash Flows at 18% 63, 202

International Capital Budgeting Example End of Year Expected Cash Flow (marks) Exchange Rate (marks to U. S. dollar) Expected Cash Flow (U. S. dollars) 0 -1, 500, 000 2. 50 -600, 000 1 500, 000 2. 54 196, 850 166, 822 2 800, 000 2. 59 308, 880 221, 833 3 700, 000 2. 65 264, 151 160, 770 4 600, 000 2. 72 220, 588 113, 777 Net Present Value = 24 -7 Present Value of Cash Flows at 18% 63, 202

International Capital Budgeting Related issues of concern: u u International diversification and risk reduction U. S. Government taxation u u 24 -8 Taxable income derived from non-domestic operations through a branch or division is taxed under U. S. code. Foreign subsidiaries are taxed under foreign tax codes until dividends are received by the U. S. parent from the foreign subsidiary.

International Capital Budgeting Related issues of concern: u u International diversification and risk reduction U. S. Government taxation u u 24 -8 Taxable income derived from non-domestic operations through a branch or division is taxed under U. S. code. Foreign subsidiaries are taxed under foreign tax codes until dividends are received by the U. S. parent from the foreign subsidiary.

International Capital Budgeting u Foreign Taxation u Tax codes and policies differ from country to country, but all countries impose income taxes on foreign companies. u The U. S. government provides a tax credit to companies to avoid the double taxation problem. u. A credit is provided up to the amount of the foreign tax, but not to exceed the same proportion of taxable earnings from the foreign country. u Excess 24 -9 tax credits can be carried forward.

International Capital Budgeting u Foreign Taxation u Tax codes and policies differ from country to country, but all countries impose income taxes on foreign companies. u The U. S. government provides a tax credit to companies to avoid the double taxation problem. u. A credit is provided up to the amount of the foreign tax, but not to exceed the same proportion of taxable earnings from the foreign country. u Excess 24 -9 tax credits can be carried forward.

International Capital Budgeting u Political Risk u u Developing countries may provide financial incentives to enhance foreign investment. u Bottom line: Forecasting political instability u 24 -10 Expropriation is the ultimate political risk. Protect the firm by hiring local nationals, acting responsibly in the eyes of the host government, entering joint ventures, making the subsidiary reliant on the parent company, and/or purchasing political risk insurance

International Capital Budgeting u Political Risk u u Developing countries may provide financial incentives to enhance foreign investment. u Bottom line: Forecasting political instability u 24 -10 Expropriation is the ultimate political risk. Protect the firm by hiring local nationals, acting responsibly in the eyes of the host government, entering joint ventures, making the subsidiary reliant on the parent company, and/or purchasing political risk insurance

Important Exchange-Rate Terms Spot Exchange Rate -- The rate today for exchanging one currency for another for immediate delivery Forward Exchange Rate -- The rate today for exchanging one currency for another at a specific future date u 24 -11 Currency risk can be thought of as the volatility of the exchange rate of one currency for another (say British pounds per U. S. dollar).

Important Exchange-Rate Terms Spot Exchange Rate -- The rate today for exchanging one currency for another for immediate delivery Forward Exchange Rate -- The rate today for exchanging one currency for another at a specific future date u 24 -11 Currency risk can be thought of as the volatility of the exchange rate of one currency for another (say British pounds per U. S. dollar).

Types of Exchange. Rate Risk Exposure u Translation Exposure -- Relates to the change in accounting income and balance sheet statements caused by changes in exchange rates. u Transactions Exposure -- Relates to settling a particular transaction at one exchange rate when the obligation was originally recorded at another. u Economic Exposure -- Involves changes in expected future cash flows, and hence economic value, caused by a change in exchange rates. 24 -12

Types of Exchange. Rate Risk Exposure u Translation Exposure -- Relates to the change in accounting income and balance sheet statements caused by changes in exchange rates. u Transactions Exposure -- Relates to settling a particular transaction at one exchange rate when the obligation was originally recorded at another. u Economic Exposure -- Involves changes in expected future cash flows, and hence economic value, caused by a change in exchange rates. 24 -12

Management of Exchange. Rate Risk Exposure Natural hedges u Cash management u Adjusting of intracompany accounts u International financing hedges u Currency market hedges u 24 -13

Management of Exchange. Rate Risk Exposure Natural hedges u Cash management u Adjusting of intracompany accounts u International financing hedges u Currency market hedges u 24 -13

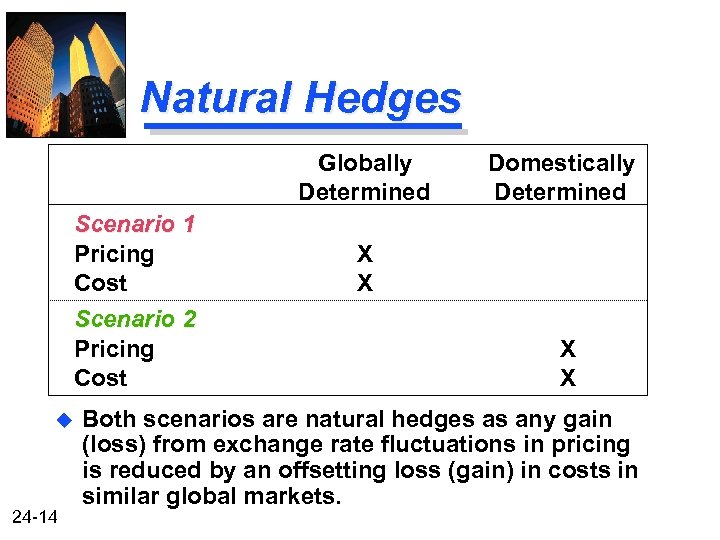

Natural Hedges Globally Determined Scenario 1 Pricing Cost Scenario 2 Pricing Cost u 24 -14 Domestically Determined X X Both scenarios are natural hedges as any gain (loss) from exchange rate fluctuations in pricing is reduced by an offsetting loss (gain) in costs in similar global markets.

Natural Hedges Globally Determined Scenario 1 Pricing Cost Scenario 2 Pricing Cost u 24 -14 Domestically Determined X X Both scenarios are natural hedges as any gain (loss) from exchange rate fluctuations in pricing is reduced by an offsetting loss (gain) in costs in similar global markets.

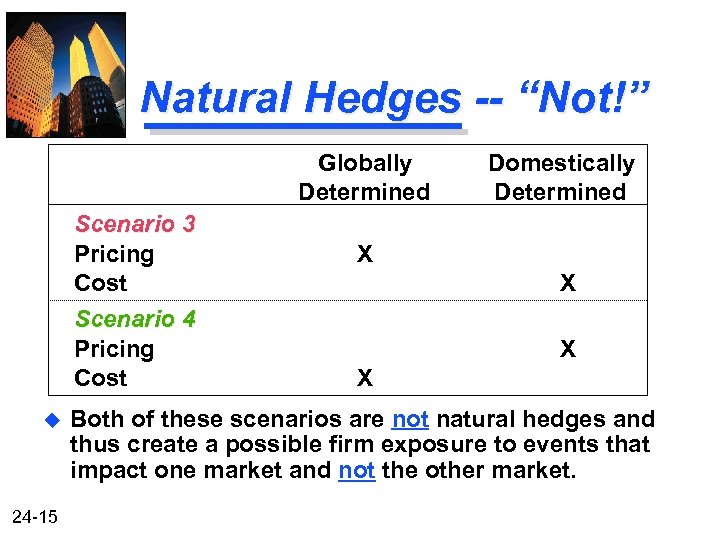

Natural Hedges -- “Not!” Globally Determined Scenario 3 Pricing Cost Scenario 4 Pricing Cost u 24 -15 Domestically Determined X X Both of these scenarios are not natural hedges and thus create a possible firm exposure to events that impact one market and not the other market.

Natural Hedges -- “Not!” Globally Determined Scenario 3 Pricing Cost Scenario 4 Pricing Cost u 24 -15 Domestically Determined X X Both of these scenarios are not natural hedges and thus create a possible firm exposure to events that impact one market and not the other market.

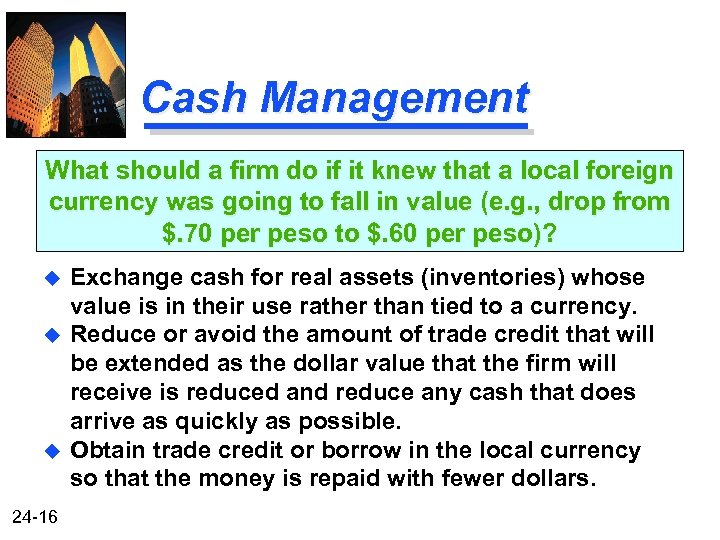

Cash Management What should a firm do if it knew that a local foreign currency was going to fall in value (e. g. , drop from $. 70 per peso to $. 60 per peso)? u u u 24 -16 Exchange cash for real assets (inventories) whose value is in their use rather than tied to a currency. Reduce or avoid the amount of trade credit that will be extended as the dollar value that the firm will receive is reduced and reduce any cash that does arrive as quickly as possible. Obtain trade credit or borrow in the local currency so that the money is repaid with fewer dollars.

Cash Management What should a firm do if it knew that a local foreign currency was going to fall in value (e. g. , drop from $. 70 per peso to $. 60 per peso)? u u u 24 -16 Exchange cash for real assets (inventories) whose value is in their use rather than tied to a currency. Reduce or avoid the amount of trade credit that will be extended as the dollar value that the firm will receive is reduced and reduce any cash that does arrive as quickly as possible. Obtain trade credit or borrow in the local currency so that the money is repaid with fewer dollars.

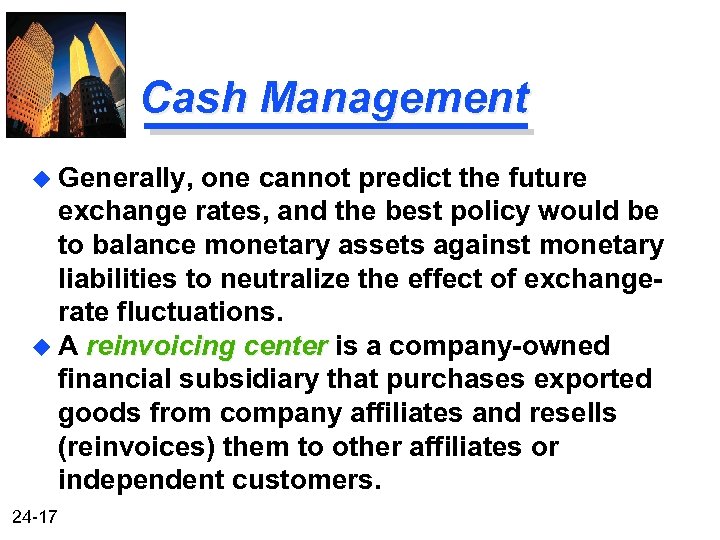

Cash Management u Generally, one cannot predict the future exchange rates, and the best policy would be to balance monetary assets against monetary liabilities to neutralize the effect of exchangerate fluctuations. u A reinvoicing center is a company-owned financial subsidiary that purchases exported goods from company affiliates and resells (reinvoices) them to other affiliates or independent customers. 24 -17

Cash Management u Generally, one cannot predict the future exchange rates, and the best policy would be to balance monetary assets against monetary liabilities to neutralize the effect of exchangerate fluctuations. u A reinvoicing center is a company-owned financial subsidiary that purchases exported goods from company affiliates and resells (reinvoices) them to other affiliates or independent customers. 24 -17

Cash Management Netting -- A system in which cross-border purchases among participating subsidiaries of the same company are netted so that each participant pays or receives only the net amount of its intracompany purchases and sales. u u 24 -18 Generally, the reinvoicing center is billed in the selling unit’s home currency and bills the purchasing unit in that unit’s home currency. Allows better management of intracompany transactions.

Cash Management Netting -- A system in which cross-border purchases among participating subsidiaries of the same company are netted so that each participant pays or receives only the net amount of its intracompany purchases and sales. u u 24 -18 Generally, the reinvoicing center is billed in the selling unit’s home currency and bills the purchasing unit in that unit’s home currency. Allows better management of intracompany transactions.

International Financing Hedges 1. Commercial Bank Loans and Trade Bills u Foreign commercial banks perform essentially the same financing functions as domestic banks except: u They allow longer term loans. u u u 24 -19 Loans are generally made on an overdraft basis Nearly all major commercial cities have U. S. bank branches or offices available for customers. The use of “discounting” trade bills is widely utilized in Europe versus minimal usage in the United States.

International Financing Hedges 1. Commercial Bank Loans and Trade Bills u Foreign commercial banks perform essentially the same financing functions as domestic banks except: u They allow longer term loans. u u u 24 -19 Loans are generally made on an overdraft basis Nearly all major commercial cities have U. S. bank branches or offices available for customers. The use of “discounting” trade bills is widely utilized in Europe versus minimal usage in the United States.

International Financing Hedges 2. Eurodollar Financing u u 24 -20 Eurodollars are bank deposits denominated in U. S. dollars but not subject to U. S. banking regulations. This market is unregulated. Therefore, the differential between the rate paid on deposits and that charged on loans varies according to the risk of the borrower and current supply and demand forces. Rates are typically quoted in terms of the LIBOR. It is a major source of short-term financing for the working capital requirements of the multinational company.

International Financing Hedges 2. Eurodollar Financing u u 24 -20 Eurodollars are bank deposits denominated in U. S. dollars but not subject to U. S. banking regulations. This market is unregulated. Therefore, the differential between the rate paid on deposits and that charged on loans varies according to the risk of the borrower and current supply and demand forces. Rates are typically quoted in terms of the LIBOR. It is a major source of short-term financing for the working capital requirements of the multinational company.

International Financing Hedges 3. International Bond Financing u u 24 -21 A Eurobond is a bond issued internationally outside of the country in whose currency the bond is denominated. The Eurobond is issued in a single currency, but is placed in multiple countries. A foreign bond is issued by a foreign government or corporation in a local market. For example, Yankee bonds, Samurai bonds, and Rembrandt bonds. Many international debt issues are floating rate notes that carry a variable interest rate.

International Financing Hedges 3. International Bond Financing u u 24 -21 A Eurobond is a bond issued internationally outside of the country in whose currency the bond is denominated. The Eurobond is issued in a single currency, but is placed in multiple countries. A foreign bond is issued by a foreign government or corporation in a local market. For example, Yankee bonds, Samurai bonds, and Rembrandt bonds. Many international debt issues are floating rate notes that carry a variable interest rate.

International Financing Hedges 4. Currency-Option and Multiple-Currency bonds u u u 24 -22 Currency-option bonds provide the holder with the option to choose the currency in which payment is received. For example, a bond might allow you to choose between yen and U. S. dollars. Currency cocktail bonds provide a degree of exchangerate stability by having principal and interest payments being a weighted average of a “basket” of currencies. Dual-currency bonds have their purchase price and coupon payments denominated in one currency, while a different currency is used to make principal payments.

International Financing Hedges 4. Currency-Option and Multiple-Currency bonds u u u 24 -22 Currency-option bonds provide the holder with the option to choose the currency in which payment is received. For example, a bond might allow you to choose between yen and U. S. dollars. Currency cocktail bonds provide a degree of exchangerate stability by having principal and interest payments being a weighted average of a “basket” of currencies. Dual-currency bonds have their purchase price and coupon payments denominated in one currency, while a different currency is used to make principal payments.

Currencies and the Euro – The name given to the single European currency. Symbol is € (much like the dollar, $). u u 24 -23 Each country has a representative currency like the $ in the United States or the ₤ in Britain. On January 1, 1999, the “euro” started trading. European Monetary Union (EMU) includes Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain. Agreed to issue a common currency, the euro, but can continue to use their national currencies until 2002 when each national currency is retired.

Currencies and the Euro – The name given to the single European currency. Symbol is € (much like the dollar, $). u u 24 -23 Each country has a representative currency like the $ in the United States or the ₤ in Britain. On January 1, 1999, the “euro” started trading. European Monetary Union (EMU) includes Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain. Agreed to issue a common currency, the euro, but can continue to use their national currencies until 2002 when each national currency is retired.

Currency Market Hedges 1. Forward Exchange Market u u u A forward contract is a contract for the delivery of a commodity, foreign currency, or financial instrument at a price specified now, with delivery and settlement at a specified future date. Spot rate $. 168 per EFr 90 -day forward rate. 166 per EFr As shown, the Elbonian franc (EFr) is said to sell at a forward discount as the forward price is less than the spot rate. If the forward rate is $. 171, the EFr is said to sell at a forward premium 24 -24

Currency Market Hedges 1. Forward Exchange Market u u u A forward contract is a contract for the delivery of a commodity, foreign currency, or financial instrument at a price specified now, with delivery and settlement at a specified future date. Spot rate $. 168 per EFr 90 -day forward rate. 166 per EFr As shown, the Elbonian franc (EFr) is said to sell at a forward discount as the forward price is less than the spot rate. If the forward rate is $. 171, the EFr is said to sell at a forward premium 24 -24

Currency Market Hedges Fillups Electronics has just sold equipment worth 1 million Elbonian francs with credit terms of “net 90. ” How can the firm hedge the currency risk? u u u 24 -25 The firm has the option of selling 1 million Elbonian francs forward 90 days. The firm will receive $166, 000 in 90 days (1 million Elbonian francs x $. 166). Therefore, if the actual spot price in 90 days is less than. 166, the firm benefited from entering into this transaction. If the rate is greater than. 166, the firm would have benefited from not entering into the transaction.

Currency Market Hedges Fillups Electronics has just sold equipment worth 1 million Elbonian francs with credit terms of “net 90. ” How can the firm hedge the currency risk? u u u 24 -25 The firm has the option of selling 1 million Elbonian francs forward 90 days. The firm will receive $166, 000 in 90 days (1 million Elbonian francs x $. 166). Therefore, if the actual spot price in 90 days is less than. 166, the firm benefited from entering into this transaction. If the rate is greater than. 166, the firm would have benefited from not entering into the transaction.

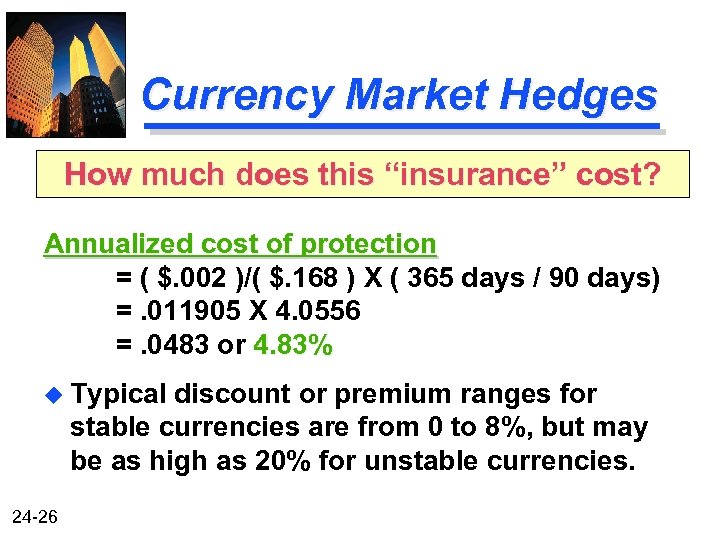

Currency Market Hedges How much does this “insurance” cost? Annualized cost of protection = ( $. 002 )/( $. 168 ) X ( 365 days / 90 days) =. 011905 X 4. 0556 =. 0483 or 4. 83% u Typical discount or premium ranges for stable currencies are from 0 to 8%, but may be as high as 20% for unstable currencies. 24 -26

Currency Market Hedges How much does this “insurance” cost? Annualized cost of protection = ( $. 002 )/( $. 168 ) X ( 365 days / 90 days) =. 011905 X 4. 0556 =. 0483 or 4. 83% u Typical discount or premium ranges for stable currencies are from 0 to 8%, but may be as high as 20% for unstable currencies. 24 -26

Currency Market Hedges 2. Currency Futures u A futures contract is a contract for the delivery of a commodity, foreign currency, or financial instrument at a specified price on a stipulated future date. u A currency futures market exists for the major currencies of the world. u Futures contracts are traded on organized exchanges. u The clearinghouse of the exchange interposes itself between the buyer and the seller. Therefore, transactions are not made directly between two parties. u Very 24 -27 few contracts involve actual delivery at expiration.

Currency Market Hedges 2. Currency Futures u A futures contract is a contract for the delivery of a commodity, foreign currency, or financial instrument at a specified price on a stipulated future date. u A currency futures market exists for the major currencies of the world. u Futures contracts are traded on organized exchanges. u The clearinghouse of the exchange interposes itself between the buyer and the seller. Therefore, transactions are not made directly between two parties. u Very 24 -27 few contracts involve actual delivery at expiration.

Currency Market Hedges 2. Currency Futures (continued) u Sellers (buyers) cancel a contract by purchasing (selling) another contract. This is an offsetting position that closes out the original contract with the clearinghouse. u Futures contracts are marked-to-market daily. This is different than forward contracts that are settled only at maturity. u Contracts come in only standard-size contracts (e. g. , 12. 5 million yen per contract). 24 -28

Currency Market Hedges 2. Currency Futures (continued) u Sellers (buyers) cancel a contract by purchasing (selling) another contract. This is an offsetting position that closes out the original contract with the clearinghouse. u Futures contracts are marked-to-market daily. This is different than forward contracts that are settled only at maturity. u Contracts come in only standard-size contracts (e. g. , 12. 5 million yen per contract). 24 -28

Currency Market Hedges 3. Currency Options u A currency option is a contract that gives the holder the right to buy (call) or sell (put) a specific amount of a foreign currency at some specified price until a certain (expiration) date. u Currency options hedge only adverse currency movements (“one-sided” risk). For example, a put option can hedge only downside movements in the currency exchange rate. u Options exist in both the spot and futures markets. u The 24 -29 value depends on exchange rate volatility.

Currency Market Hedges 3. Currency Options u A currency option is a contract that gives the holder the right to buy (call) or sell (put) a specific amount of a foreign currency at some specified price until a certain (expiration) date. u Currency options hedge only adverse currency movements (“one-sided” risk). For example, a put option can hedge only downside movements in the currency exchange rate. u Options exist in both the spot and futures markets. u The 24 -29 value depends on exchange rate volatility.

Currency Market Hedges 4. Currency Swaps u In a currency swap two parties exchange debt obligations denominated in different currencies. Each party agrees to pay the other’s interest obligation. At maturity, principal amounts are exchanged, usually at a rate of exchange agreed to in advance. u The exchange is notional -- only the cash flow difference is paid. u Swaps are typically arranged through a financial intermediary, such as a commercial bank. u A 24 -30 variety of (complex) arrangements are available.

Currency Market Hedges 4. Currency Swaps u In a currency swap two parties exchange debt obligations denominated in different currencies. Each party agrees to pay the other’s interest obligation. At maturity, principal amounts are exchanged, usually at a rate of exchange agreed to in advance. u The exchange is notional -- only the cash flow difference is paid. u Swaps are typically arranged through a financial intermediary, such as a commercial bank. u A 24 -30 variety of (complex) arrangements are available.

Macro Factors Governing Exchange-Rate Behavior Purchasing-Power Parity (PPP) u The idea that a basket of goods should sell for the same price in two countries, after exchange rates are taken into account. u For example, the price of wheat in Canadian and U. S. markets should trade at the same price (after adjusting for the exchange rate). If the price of wheat is lower in Canada, then purchasers will buy wheat in Canada as long as the price is cheaper (after accounting for transportation costs). 24 -31

Macro Factors Governing Exchange-Rate Behavior Purchasing-Power Parity (PPP) u The idea that a basket of goods should sell for the same price in two countries, after exchange rates are taken into account. u For example, the price of wheat in Canadian and U. S. markets should trade at the same price (after adjusting for the exchange rate). If the price of wheat is lower in Canada, then purchasers will buy wheat in Canada as long as the price is cheaper (after accounting for transportation costs). 24 -31

Macro Factors Governing Exchange-Rate Behavior Purchasing-Power Parity (PPP continued) u Thus, demand will fall in the U. S. and increase in Canada to bring prices back into equilibrium. u The price elasticity of exports and imports influences the relationship between a country’s exchange rate and its purchasing-power parity. u u 24 -32 Commodity items and products in mature industries are more likely to conform to PPP. Frictions such as government intervention and trade barriers cause PPP not to hold.

Macro Factors Governing Exchange-Rate Behavior Purchasing-Power Parity (PPP continued) u Thus, demand will fall in the U. S. and increase in Canada to bring prices back into equilibrium. u The price elasticity of exports and imports influences the relationship between a country’s exchange rate and its purchasing-power parity. u u 24 -32 Commodity items and products in mature industries are more likely to conform to PPP. Frictions such as government intervention and trade barriers cause PPP not to hold.

Macro Factors Governing Exchange-Rate Behavior Interest-Rate Parity u It suggests that if interest rates are higher in one country than they are in another, the former’s currency will sell at a discount in the forward market. u Remember that the Fisher effect implies that the nominal rate of interest equals the real rate of interest plus the expected rate of inflation. u The international Fisher effect suggests that differences in interest rates between two countries serve as a proxy for differences in expected inflation. 24 -33

Macro Factors Governing Exchange-Rate Behavior Interest-Rate Parity u It suggests that if interest rates are higher in one country than they are in another, the former’s currency will sell at a discount in the forward market. u Remember that the Fisher effect implies that the nominal rate of interest equals the real rate of interest plus the expected rate of inflation. u The international Fisher effect suggests that differences in interest rates between two countries serve as a proxy for differences in expected inflation. 24 -33

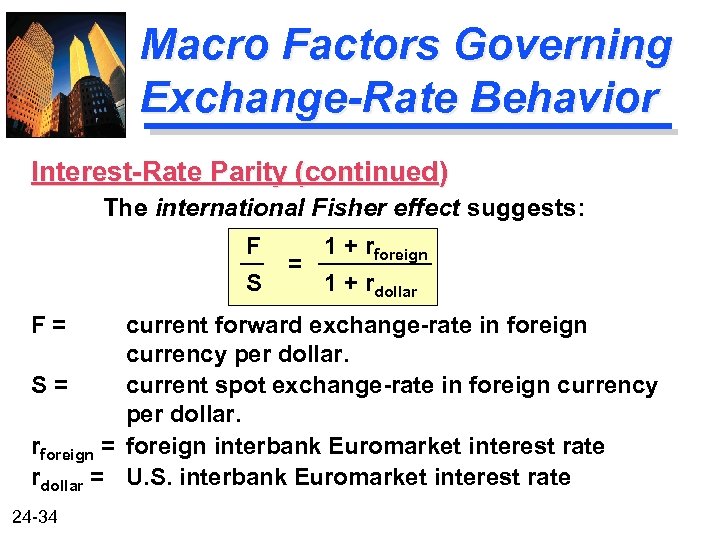

Macro Factors Governing Exchange-Rate Behavior Interest-Rate Parity (continued) The international Fisher effect suggests: F S F= = 1 + rforeign 1 + rdollar current forward exchange-rate in foreign currency per dollar. S= current spot exchange-rate in foreign currency per dollar. rforeign = foreign interbank Euromarket interest rate rdollar = U. S. interbank Euromarket interest rate 24 -34

Macro Factors Governing Exchange-Rate Behavior Interest-Rate Parity (continued) The international Fisher effect suggests: F S F= = 1 + rforeign 1 + rdollar current forward exchange-rate in foreign currency per dollar. S= current spot exchange-rate in foreign currency per dollar. rforeign = foreign interbank Euromarket interest rate rdollar = U. S. interbank Euromarket interest rate 24 -34

Interest-Rate Parity Example u The current German 90 -day interest rate is 4%. u The current U. S. 90 -day interest rate is 2%. u The current spot rate is. 706 Freedonian marks per U. S. dollar ($1. 416 per mark). What is the implied 90 -day forward rate? 24 -35

Interest-Rate Parity Example u The current German 90 -day interest rate is 4%. u The current U. S. 90 -day interest rate is 2%. u The current spot rate is. 706 Freedonian marks per U. S. dollar ($1. 416 per mark). What is the implied 90 -day forward rate? 24 -35

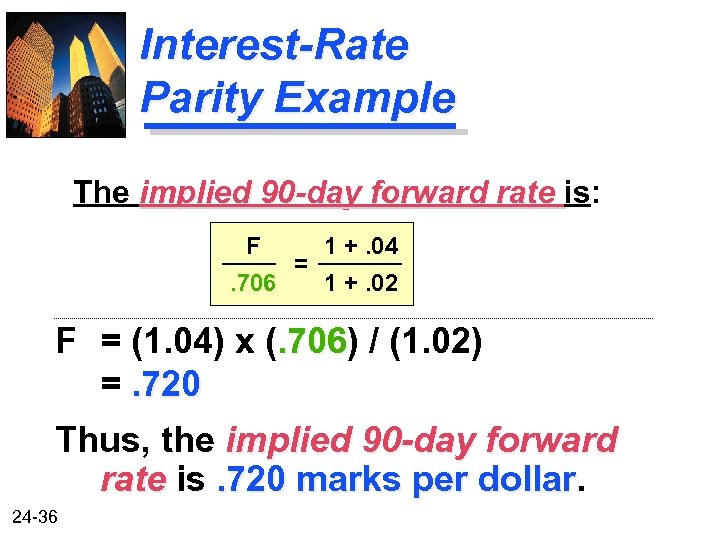

Interest-Rate Parity Example The implied 90 -day forward rate is: F. 706 = 1 +. 04 1 +. 02 F = (1. 04) x (. 706) / (1. 02). 706 =. 720 Thus, the implied 90 -day forward rate is. 720 marks per dollar 24 -36

Interest-Rate Parity Example The implied 90 -day forward rate is: F. 706 = 1 +. 04 1 +. 02 F = (1. 04) x (. 706) / (1. 02). 706 =. 720 Thus, the implied 90 -day forward rate is. 720 marks per dollar 24 -36

Structuring International Trade Transactions u In international trade, sellers often have difficulty obtaining thorough and accurate credit information on potential buyers. u Channels for legal settlement in cases of default are more complicated and costly to pursue. u Key documents are (1) an order to pay (international trade draft), (2) a bill of lading, and (3) a letter of credit. 24 -37

Structuring International Trade Transactions u In international trade, sellers often have difficulty obtaining thorough and accurate credit information on potential buyers. u Channels for legal settlement in cases of default are more complicated and costly to pursue. u Key documents are (1) an order to pay (international trade draft), (2) a bill of lading, and (3) a letter of credit. 24 -37

International Trade Draft u The international trade draft (bill of exchange) is a written statement by the exporter ordering the importer to pay a specific amount of money at a specified time. u u 24 -38 Sight draft is payable on presentation to the party (drawee) to whom the draft is addressed. Time draft is payable at a specified future date after sight to the party (drawee) to whom the draft is addressed.

International Trade Draft u The international trade draft (bill of exchange) is a written statement by the exporter ordering the importer to pay a specific amount of money at a specified time. u u 24 -38 Sight draft is payable on presentation to the party (drawee) to whom the draft is addressed. Time draft is payable at a specified future date after sight to the party (drawee) to whom the draft is addressed.

Time Draft Features u An unconditional order in writing signed by the drawer, the exporter. u It specifies an exact amount of money that the drawee, the importer, must pay. u It specifies the future date when this amount must be paid. u Upon presentation to the drawee, it is accepted 24 -39

Time Draft Features u An unconditional order in writing signed by the drawer, the exporter. u It specifies an exact amount of money that the drawee, the importer, must pay. u It specifies the future date when this amount must be paid. u Upon presentation to the drawee, it is accepted 24 -39

Time Draft Features u The acceptance can be by either the drawee or a bank u If the drawee accepts the draft, it is acknowledged in writing on the back of the draft the obligation to pay the amount so many specified days hence. u It is then known as a trade draft (banker’s acceptance if a bank accepts the draft). 24 -40

Time Draft Features u The acceptance can be by either the drawee or a bank u If the drawee accepts the draft, it is acknowledged in writing on the back of the draft the obligation to pay the amount so many specified days hence. u It is then known as a trade draft (banker’s acceptance if a bank accepts the draft). 24 -40

Bill of Lading -- A shipping document indicating the details of the shipment and delivery of goods and their ownership. u u u 24 -41 It serves as a receipt from the transportation company to the exporter, showing that specified goods have been received. It serves as a contract between the transportation company and the exporter to ship goods and deliver them to a specific party at a specific destination. It serves as a document of title.

Bill of Lading -- A shipping document indicating the details of the shipment and delivery of goods and their ownership. u u u 24 -41 It serves as a receipt from the transportation company to the exporter, showing that specified goods have been received. It serves as a contract between the transportation company and the exporter to ship goods and deliver them to a specific party at a specific destination. It serves as a document of title.

Letter of Credit u. A letter of credit is issued by a bank on behalf of the importer. u The bank agrees to honor a draft drawn on the importer, provided the bill of lading and other details are in order. u The bank is essentially substituting its credit for that of the importer. 24 -42

Letter of Credit u. A letter of credit is issued by a bank on behalf of the importer. u The bank agrees to honor a draft drawn on the importer, provided the bill of lading and other details are in order. u The bank is essentially substituting its credit for that of the importer. 24 -42

Countertrade -- Generic term for barter and other forms of trade that involve the international sale of goods or services that are paid for -- in whole or in part -- by the transfer of goods or services from a foreign country. u u 24 -43 Used effectively when exchange restrictions exist or other difficulties prevent payment in hard currencies. Quality, standardization of goods, and resale of goods that are delivered are risks that arise with countertrade.

Countertrade -- Generic term for barter and other forms of trade that involve the international sale of goods or services that are paid for -- in whole or in part -- by the transfer of goods or services from a foreign country. u u 24 -43 Used effectively when exchange restrictions exist or other difficulties prevent payment in hard currencies. Quality, standardization of goods, and resale of goods that are delivered are risks that arise with countertrade.

Forfaiting -- The selling “without recourse” of medium- to long-term export receivables to a financial institution, the forfaiter. A third party, usually a bank or governmental unit, guarantees the financing. u u 24 -44 The forfaiter assumes the credit risk and collects the amount owed from the importer. Most useful when the importer is in a lessdeveloped country or in an Eastern European nation.

Forfaiting -- The selling “without recourse” of medium- to long-term export receivables to a financial institution, the forfaiter. A third party, usually a bank or governmental unit, guarantees the financing. u u 24 -44 The forfaiter assumes the credit risk and collects the amount owed from the importer. Most useful when the importer is in a lessdeveloped country or in an Eastern European nation.