716a637e3ef93d52177c3994734552f0.ppt

- Количество слайдов: 35

CHAPTER 24 Hedging with Financial Derivatives Copyright © 2012 Pearson Prentice Hall. All rights reserved.

CHAPTER 24 Hedging with Financial Derivatives Copyright © 2012 Pearson Prentice Hall. All rights reserved.

MINI-CASE: Program Trading and the Market Crash of 1987 § In the aftermath of the Black Monday crash on October 19, 1987, stock price index futures markets have been accused of being culprits in the market collapse. § Program trading between futures and stock prices creates a downward spiral. Other experts blame portfolio insurance, which can have the same affect. § Limits on program trading have been implements to reduce this problem in the future. © 2012 Pearson Prentice Hall. All rights reserved. 24 -1

MINI-CASE: Program Trading and the Market Crash of 1987 § In the aftermath of the Black Monday crash on October 19, 1987, stock price index futures markets have been accused of being culprits in the market collapse. § Program trading between futures and stock prices creates a downward spiral. Other experts blame portfolio insurance, which can have the same affect. § Limits on program trading have been implements to reduce this problem in the future. © 2012 Pearson Prentice Hall. All rights reserved. 24 -1

Options § Options Contract ─ Right to buy (call option) or sell (put option) an instrument at the exercise (strike) price up until expiration date (American) or on expiration date (European). § Options are available on a number of financial instruments, including individual stocks, stock indexes, etc. © 2012 Pearson Prentice Hall. All rights reserved. 24 -2

Options § Options Contract ─ Right to buy (call option) or sell (put option) an instrument at the exercise (strike) price up until expiration date (American) or on expiration date (European). § Options are available on a number of financial instruments, including individual stocks, stock indexes, etc. © 2012 Pearson Prentice Hall. All rights reserved. 24 -2

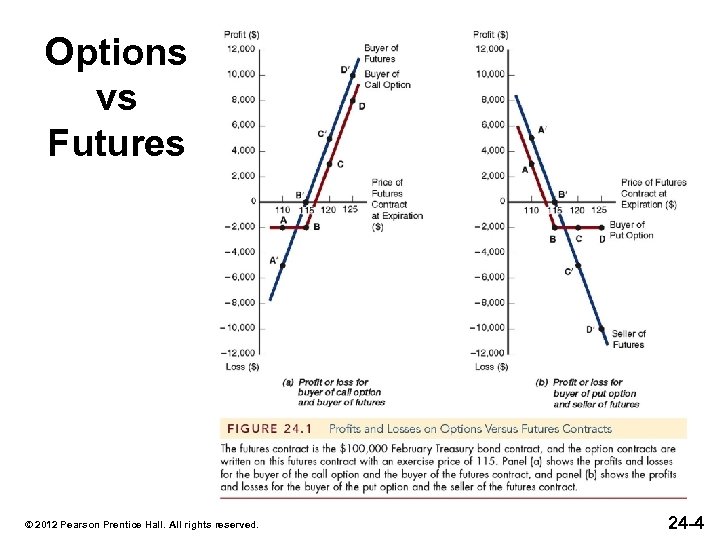

Options § Hedging with Options ─ Buy same number of put option contracts as would sell of futures ─ Disadvantage: pay premium ─ Advantage: protected if i increases, gain on contract ─ if i falls, additional advantage if macro hedge: avoids accounting problems, no losses on option § The next slide highlights these differences between futures and options © 2012 Pearson Prentice Hall. All rights reserved. 24 -3

Options § Hedging with Options ─ Buy same number of put option contracts as would sell of futures ─ Disadvantage: pay premium ─ Advantage: protected if i increases, gain on contract ─ if i falls, additional advantage if macro hedge: avoids accounting problems, no losses on option § The next slide highlights these differences between futures and options © 2012 Pearson Prentice Hall. All rights reserved. 24 -3

Options vs Futures © 2012 Pearson Prentice Hall. All rights reserved. 24 -4

Options vs Futures © 2012 Pearson Prentice Hall. All rights reserved. 24 -4

Factors Affecting Premium 1. Higher strike price, lower premium on call options and higher premium on put options. 2. Greater term to expiration, higher premiums for both call and put options. 3. Greater price volatility of underlying instrument, higher premiums for both call and put options. © 2012 Pearson Prentice Hall. All rights reserved. 24 -5

Factors Affecting Premium 1. Higher strike price, lower premium on call options and higher premium on put options. 2. Greater term to expiration, higher premiums for both call and put options. 3. Greater price volatility of underlying instrument, higher premiums for both call and put options. © 2012 Pearson Prentice Hall. All rights reserved. 24 -5

Hedging with Options § Example: Rock Solid has a stock portfolio worth $100 million, which tracks closely with the S&P 500. The portfolio manager fears that a decline is coming and what to completely hedge the value of the portfolio against any downside risk. If the S&P is currently at 1, 000, how is this accomplished? © 2012 Pearson Prentice Hall. All rights reserved. 24 -6

Hedging with Options § Example: Rock Solid has a stock portfolio worth $100 million, which tracks closely with the S&P 500. The portfolio manager fears that a decline is coming and what to completely hedge the value of the portfolio against any downside risk. If the S&P is currently at 1, 000, how is this accomplished? © 2012 Pearson Prentice Hall. All rights reserved. 24 -6

Hedging with Options § Value of the S&P 500 Option Contract = 100 index ─ currently 100 1, 000 = $100, 000 § To hedge $100 million of stocks that move 1 for 1 (perfect correlation) with S&P currently selling at 1000, you would: ─ buy $100 million of S&P put options = 1, 000 contracts © 2012 Pearson Prentice Hall. All rights reserved. 24 -7

Hedging with Options § Value of the S&P 500 Option Contract = 100 index ─ currently 100 1, 000 = $100, 000 § To hedge $100 million of stocks that move 1 for 1 (perfect correlation) with S&P currently selling at 1000, you would: ─ buy $100 million of S&P put options = 1, 000 contracts © 2012 Pearson Prentice Hall. All rights reserved. 24 -7

Hedging with Options § The premium would depend on the strike price. For example, a strike price of 950 might have a premium of $200 / contract, while a strike price of 900 might have a strike price of only $100. § Let’s assume Rock Solid chooses a strike price of 950. Then Rock Solid must pay $200, 000 for the position. This is non-refundable and comes out of the portfolio value (now only $99. 8 million). © 2012 Pearson Prentice Hall. All rights reserved. 24 -8

Hedging with Options § The premium would depend on the strike price. For example, a strike price of 950 might have a premium of $200 / contract, while a strike price of 900 might have a strike price of only $100. § Let’s assume Rock Solid chooses a strike price of 950. Then Rock Solid must pay $200, 000 for the position. This is non-refundable and comes out of the portfolio value (now only $99. 8 million). © 2012 Pearson Prentice Hall. All rights reserved. 24 -8

Hedging with Options § Suppose after the year, the S&P 500 is at 900 and the portfolio is worth $89. 8 million. ─ options position is up $5 million (since 950 strike price) ─ in net, portfolio is worth $94. 8 million § If instead, the S&P 500 is at 1100 and the portfolio is worth $109. 8 million. ─ options position expires worthless, and portfolio is worth $109. 8 million © 2012 Pearson Prentice Hall. All rights reserved. 24 -9

Hedging with Options § Suppose after the year, the S&P 500 is at 900 and the portfolio is worth $89. 8 million. ─ options position is up $5 million (since 950 strike price) ─ in net, portfolio is worth $94. 8 million § If instead, the S&P 500 is at 1100 and the portfolio is worth $109. 8 million. ─ options position expires worthless, and portfolio is worth $109. 8 million © 2012 Pearson Prentice Hall. All rights reserved. 24 -9

Hedging with Options § Note that the portfolio is protected from any downside risk (the risk that the value in the portfolio will fall ) in excess of $5 million. However, to accomplish this, the manager has to pay a premium upfront of $200, 000. © 2012 Pearson Prentice Hall. All rights reserved. 24 -10

Hedging with Options § Note that the portfolio is protected from any downside risk (the risk that the value in the portfolio will fall ) in excess of $5 million. However, to accomplish this, the manager has to pay a premium upfront of $200, 000. © 2012 Pearson Prentice Hall. All rights reserved. 24 -10

Interest-Rate Swaps § Interest-rate swaps involve the exchange of one set of interest payments for another set of interest payments, all denominated in the same currency. § Simplest type, called a plain vanilla swap, specifies (1) the rates being exchanged, (2) type of payments, and (3) notional amount. © 2012 Pearson Prentice Hall. All rights reserved. 24 -11

Interest-Rate Swaps § Interest-rate swaps involve the exchange of one set of interest payments for another set of interest payments, all denominated in the same currency. § Simplest type, called a plain vanilla swap, specifies (1) the rates being exchanged, (2) type of payments, and (3) notional amount. © 2012 Pearson Prentice Hall. All rights reserved. 24 -11

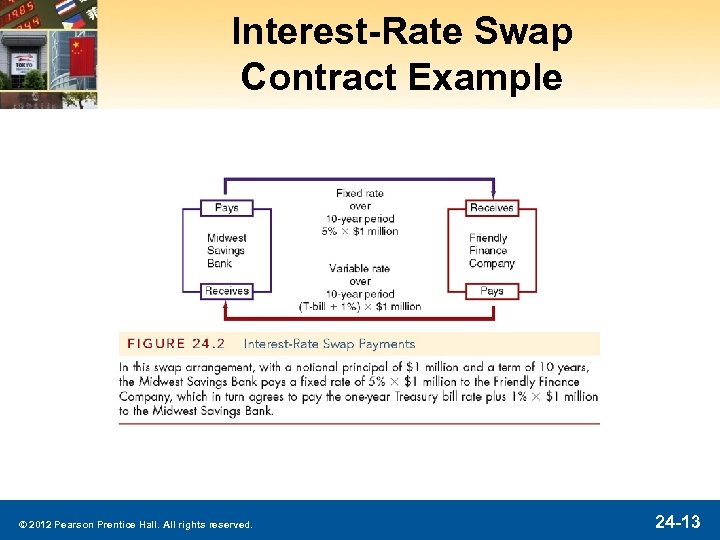

Interest-Rate Swap Contract Example § Midwest Savings Bank wishes to hedge rate changes by entering into variable-rate contracts. § Friendly Finance Company wishes to hedge some of its variable-rate debt with some fixed-rate debt. § Notional principle of $1 million § Term of 10 years § Midwest SB swaps 7% payment for T-bill + 1% from Friendly Finance Company. © 2012 Pearson Prentice Hall. All rights reserved. 24 -12

Interest-Rate Swap Contract Example § Midwest Savings Bank wishes to hedge rate changes by entering into variable-rate contracts. § Friendly Finance Company wishes to hedge some of its variable-rate debt with some fixed-rate debt. § Notional principle of $1 million § Term of 10 years § Midwest SB swaps 7% payment for T-bill + 1% from Friendly Finance Company. © 2012 Pearson Prentice Hall. All rights reserved. 24 -12

Interest-Rate Swap Contract Example © 2012 Pearson Prentice Hall. All rights reserved. 24 -13

Interest-Rate Swap Contract Example © 2012 Pearson Prentice Hall. All rights reserved. 24 -13

Hedging with Interest-Rate Swaps § Reduce interest-rate risk for both parties 1. Midwest converts $1 m of fixed rate assets to rate-sensitive assets, RSA, lowers GAP 2. Friendly Finance RSA, lowers GAP © 2012 Pearson Prentice Hall. All rights reserved. 24 -14

Hedging with Interest-Rate Swaps § Reduce interest-rate risk for both parties 1. Midwest converts $1 m of fixed rate assets to rate-sensitive assets, RSA, lowers GAP 2. Friendly Finance RSA, lowers GAP © 2012 Pearson Prentice Hall. All rights reserved. 24 -14

Hedging with Interest-Rate Swaps § Advantages of swaps 1. Reduce risk, no change in balance-sheet 2. Longer term than futures or options § Disadvantages of swaps 1. Lack of liquidity 2. Subject to default risk § Financial intermediaries help reduce disadvantages of swaps (but at a cost!) © 2012 Pearson Prentice Hall. All rights reserved. 24 -15

Hedging with Interest-Rate Swaps § Advantages of swaps 1. Reduce risk, no change in balance-sheet 2. Longer term than futures or options § Disadvantages of swaps 1. Lack of liquidity 2. Subject to default risk § Financial intermediaries help reduce disadvantages of swaps (but at a cost!) © 2012 Pearson Prentice Hall. All rights reserved. 24 -15

Credit Derivatives § Credit derivatives are a relatively new derivative offering payoffs based on changes in credit conditions along a variety of dimensions. Almost nonexistent twenty years ago, the notional amount of credit derivatives today is in the trillions. © 2012 Pearson Prentice Hall. All rights reserved. 24 -16

Credit Derivatives § Credit derivatives are a relatively new derivative offering payoffs based on changes in credit conditions along a variety of dimensions. Almost nonexistent twenty years ago, the notional amount of credit derivatives today is in the trillions. © 2012 Pearson Prentice Hall. All rights reserved. 24 -16

Credit Derivatives § Credit derivatives can be generally categorized as credit options, credit swaps, and credit-linked notes. We will look at each of these in turn. © 2012 Pearson Prentice Hall. All rights reserved. 24 -17

Credit Derivatives § Credit derivatives can be generally categorized as credit options, credit swaps, and credit-linked notes. We will look at each of these in turn. © 2012 Pearson Prentice Hall. All rights reserved. 24 -17

Credit Derivatives § Credit options are like other options, but payoffs are tied to changes in credit conditions. ─ Credit options on debt are tied to changes in credit ratings. ─ Credit options can also be tied to credit spreads. For example, the strike price can be a predetermined spread between AAA-rated and BBB-rated corporate debt. © 2012 Pearson Prentice Hall. All rights reserved. 24 -18

Credit Derivatives § Credit options are like other options, but payoffs are tied to changes in credit conditions. ─ Credit options on debt are tied to changes in credit ratings. ─ Credit options can also be tied to credit spreads. For example, the strike price can be a predetermined spread between AAA-rated and BBB-rated corporate debt. © 2012 Pearson Prentice Hall. All rights reserved. 24 -18

Credit Derivatives § Credit options are like other options, but payoffs are tied to changes in credit conditions. ─ Credit options on debt are tied to changes in credit ratings. ─ Credit options can also be tied to credit spreads. For example, the strike price can be a predetermined spread between BBB-rated corporate debt and T-bonds. © 2012 Pearson Prentice Hall. All rights reserved. 24 -19

Credit Derivatives § Credit options are like other options, but payoffs are tied to changes in credit conditions. ─ Credit options on debt are tied to changes in credit ratings. ─ Credit options can also be tied to credit spreads. For example, the strike price can be a predetermined spread between BBB-rated corporate debt and T-bonds. © 2012 Pearson Prentice Hall. All rights reserved. 24 -19

Credit Derivatives § For example, suppose you wanted to issue $100, 000 in debt in six months, and your debt is expected to be rated single-A. Currently, A-rated debt is trading at 100 basis points above the Treasury. You could enter into a credit option on the spread, with a strike price of 100 basis points. © 2012 Pearson Prentice Hall. All rights reserved. 24 -20

Credit Derivatives § For example, suppose you wanted to issue $100, 000 in debt in six months, and your debt is expected to be rated single-A. Currently, A-rated debt is trading at 100 basis points above the Treasury. You could enter into a credit option on the spread, with a strike price of 100 basis points. © 2012 Pearson Prentice Hall. All rights reserved. 24 -20

Credit Derivatives § If the spread widens, you will, of course, have to issue the debt at a higher-thanexpected interest rate. But the additional cost will be offset by the payoff from the option. Like any option, you will have to pay a premium upfront for this protection. © 2012 Pearson Prentice Hall. All rights reserved. 24 -21

Credit Derivatives § If the spread widens, you will, of course, have to issue the debt at a higher-thanexpected interest rate. But the additional cost will be offset by the payoff from the option. Like any option, you will have to pay a premium upfront for this protection. © 2012 Pearson Prentice Hall. All rights reserved. 24 -21

Credit Derivatives § Credit swaps involve, for example, swapping actual payments on similar-sized loan portfolios. This allows financial institutions to diversify portfolios while still allowing the lenders to specialize in local markets or particular industries. © 2012 Pearson Prentice Hall. All rights reserved. 24 -22

Credit Derivatives § Credit swaps involve, for example, swapping actual payments on similar-sized loan portfolios. This allows financial institutions to diversify portfolios while still allowing the lenders to specialize in local markets or particular industries. © 2012 Pearson Prentice Hall. All rights reserved. 24 -22

Credit Derivatives § Another form of a credit swap, called a credit default swap, involves option-like payoffs when a basket of loans defaults. For example, the swap may payoff only after the 5 th bond in a bond portfolio defaults (or has some other bad credit event). © 2012 Pearson Prentice Hall. All rights reserved. 24 -23

Credit Derivatives § Another form of a credit swap, called a credit default swap, involves option-like payoffs when a basket of loans defaults. For example, the swap may payoff only after the 5 th bond in a bond portfolio defaults (or has some other bad credit event). © 2012 Pearson Prentice Hall. All rights reserved. 24 -23

Credit Derivatives § Credit-linked notes combine a bond a credit option. Like any bond, it makes regular interest payments and a final payment including the face value. But the issuer has an option tied to a key variable. © 2012 Pearson Prentice Hall. All rights reserved. 24 -24

Credit Derivatives § Credit-linked notes combine a bond a credit option. Like any bond, it makes regular interest payments and a final payment including the face value. But the issuer has an option tied to a key variable. © 2012 Pearson Prentice Hall. All rights reserved. 24 -24

Credit Derivatives § For example, GM might issue a bond with a 5% coupon rate. However, the covenants would stipulate that if an index of SUV sales falls by more than 10%, the coupon rate drops to 3%. This would be especially useful if GM was using the bond proceeds to build a new SUV plant. © 2012 Pearson Prentice Hall. All rights reserved. 24 -25

Credit Derivatives § For example, GM might issue a bond with a 5% coupon rate. However, the covenants would stipulate that if an index of SUV sales falls by more than 10%, the coupon rate drops to 3%. This would be especially useful if GM was using the bond proceeds to build a new SUV plant. © 2012 Pearson Prentice Hall. All rights reserved. 24 -25

Are derivatives a time bomb? § In the 2002 annual report for Berkshire Hathaway, Warren Buffett referred to derivatives (bought for speculation) as “…weapons of mass destruction. ” (although also noting that Berkshire uses derivatives). Is he right? © 2012 Pearson Prentice Hall. All rights reserved. 24 -26

Are derivatives a time bomb? § In the 2002 annual report for Berkshire Hathaway, Warren Buffett referred to derivatives (bought for speculation) as “…weapons of mass destruction. ” (although also noting that Berkshire uses derivatives). Is he right? © 2012 Pearson Prentice Hall. All rights reserved. 24 -26

Are derivatives a time bomb? § There are three major concerns with the use of financial derivatives: ─ Derivatives allow financial institutions to increase their leverage (effectively changing their capital), possibly to take on more risk ─ Derivatives are too complicated ─ The derivative positions of some banks exceed their capital—the probability of failure has greatly increased © 2012 Pearson Prentice Hall. All rights reserved. 24 -27

Are derivatives a time bomb? § There are three major concerns with the use of financial derivatives: ─ Derivatives allow financial institutions to increase their leverage (effectively changing their capital), possibly to take on more risk ─ Derivatives are too complicated ─ The derivative positions of some banks exceed their capital—the probability of failure has greatly increased © 2012 Pearson Prentice Hall. All rights reserved. 24 -27

Are derivatives a time bomb? § As usual, the blanket comments are usually not accurate. For example, although the notional amount of derivatives exceeds capital, often these are offsetting positions on behalf of clients—the bank has no exposure. In other words, you have to look at each situation individually. Further, actual derivative losses by banks is small, despite a few news-worthy exceptions. © 2012 Pearson Prentice Hall. All rights reserved. 24 -28

Are derivatives a time bomb? § As usual, the blanket comments are usually not accurate. For example, although the notional amount of derivatives exceeds capital, often these are offsetting positions on behalf of clients—the bank has no exposure. In other words, you have to look at each situation individually. Further, actual derivative losses by banks is small, despite a few news-worthy exceptions. © 2012 Pearson Prentice Hall. All rights reserved. 24 -28

Are derivatives a time bomb? § Of course, the 2007 -2009 financial crisis only further illustrates the problem of speculative derivatives. AIG, for example, sought fee revenue from taking the short side of credit default swaps. Unfortunately, when housing prices collapsed, they have to payout on those positions, resulting in billions in losses (to you me in the end!). © 2012 Pearson Prentice Hall. All rights reserved. 24 -29

Are derivatives a time bomb? § Of course, the 2007 -2009 financial crisis only further illustrates the problem of speculative derivatives. AIG, for example, sought fee revenue from taking the short side of credit default swaps. Unfortunately, when housing prices collapsed, they have to payout on those positions, resulting in billions in losses (to you me in the end!). © 2012 Pearson Prentice Hall. All rights reserved. 24 -29

Are derivatives a time bomb? § In the end, derivatives do have their dangers. But so does hiring crooks to run a bank (Lincoln S&L ring a bell). But derivatives have changed the sophistication needed by both managers and regulators to understand the whole picture. © 2012 Pearson Prentice Hall. All rights reserved. 24 -30

Are derivatives a time bomb? § In the end, derivatives do have their dangers. But so does hiring crooks to run a bank (Lincoln S&L ring a bell). But derivatives have changed the sophistication needed by both managers and regulators to understand the whole picture. © 2012 Pearson Prentice Hall. All rights reserved. 24 -30

Chapter Summary § Hedging: the basic idea of entering into an offsetting contract to reduce or eliminate some type of risk was presented. § Forward Markets: the basic idea of contracts in this highly specialized market, as well as a simple example of eliminating risk was presented. © 2012 Pearson Prentice Hall. All rights reserved. 24 -31

Chapter Summary § Hedging: the basic idea of entering into an offsetting contract to reduce or eliminate some type of risk was presented. § Forward Markets: the basic idea of contracts in this highly specialized market, as well as a simple example of eliminating risk was presented. © 2012 Pearson Prentice Hall. All rights reserved. 24 -31

Chapter Summary (cont. ) § Financial Futures Markets: these exchange traded markets were presented, as well as their advantages over forward contacts. § Stock Index Futures: the specific application of stock index futures was presented, exploring their ability to reduce or eliminate risk for equity portfolios. © 2012 Pearson Prentice Hall. All rights reserved. 24 -32

Chapter Summary (cont. ) § Financial Futures Markets: these exchange traded markets were presented, as well as their advantages over forward contacts. § Stock Index Futures: the specific application of stock index futures was presented, exploring their ability to reduce or eliminate risk for equity portfolios. © 2012 Pearson Prentice Hall. All rights reserved. 24 -32

Chapter Summary (cont. ) § Options: these contracts, which give the buyer the right but not the obligation to act, were presented, as well as an example showing their costs. § Interest-Rate Swaps: the idea of trading fixed-rate interest payments for floating-rate payments was presented, as well as the pros and cons of such contracts. © 2012 Pearson Prentice Hall. All rights reserved. 24 -33

Chapter Summary (cont. ) § Options: these contracts, which give the buyer the right but not the obligation to act, were presented, as well as an example showing their costs. § Interest-Rate Swaps: the idea of trading fixed-rate interest payments for floating-rate payments was presented, as well as the pros and cons of such contracts. © 2012 Pearson Prentice Hall. All rights reserved. 24 -33

Chapter Summary (cont. ) § Credit Derivatives: we examine this relatively new market for hedging the credit risk of portfolios and the dangers involved. © 2012 Pearson Prentice Hall. All rights reserved. 24 -34

Chapter Summary (cont. ) § Credit Derivatives: we examine this relatively new market for hedging the credit risk of portfolios and the dangers involved. © 2012 Pearson Prentice Hall. All rights reserved. 24 -34