f05b169c3aaea79400b07fb4c9fb1a36.ppt

- Количество слайдов: 17

Chapter 23 Liquidity Professor XXX Course Name/Number © 2007 Thomson South-Western

Cash Management q. Float – funds sent by payer but not yet available to payee q. Mail Float q. Processing Float q. Availability Float q. Clearing Float 2

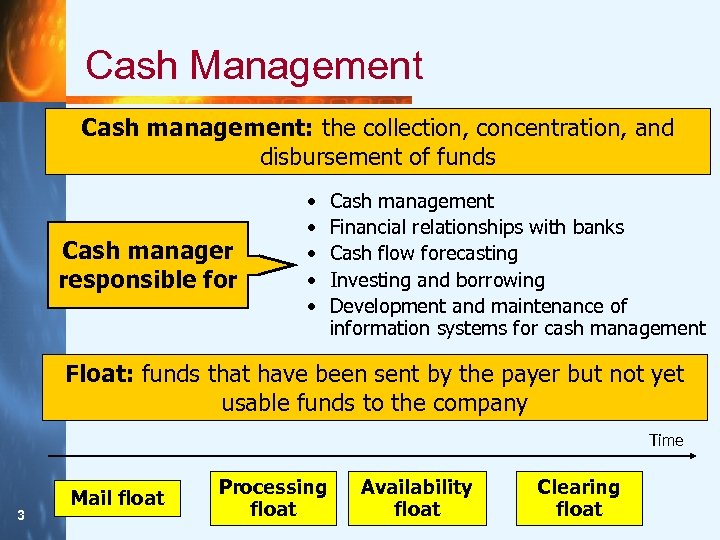

Cash Management Cash management: the collection, concentration, and disbursement of funds Cash manager responsible for • • • Cash management Financial relationships with banks Cash flow forecasting Investing and borrowing Development and maintenance of information systems for cash management Float: funds that have been sent by the payer but not yet usable funds to the company Time 3 Mail float Processing float Availability float Clearing float

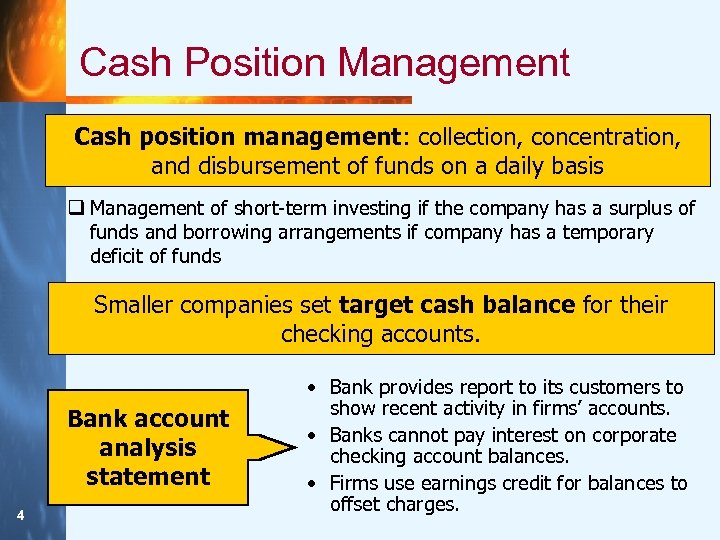

Cash Position Management Cash position management: collection, concentration, and disbursement of funds on a daily basis q Management of short-term investing if the company has a surplus of funds and borrowing arrangements if company has a temporary deficit of funds Smaller companies set target cash balance for their checking accounts. Bank account analysis statement 4 • Bank provides report to its customers to show recent activity in firms’ accounts. • Banks cannot pay interest on corporate checking account balances. • Firms use earnings credit for balances to offset charges.

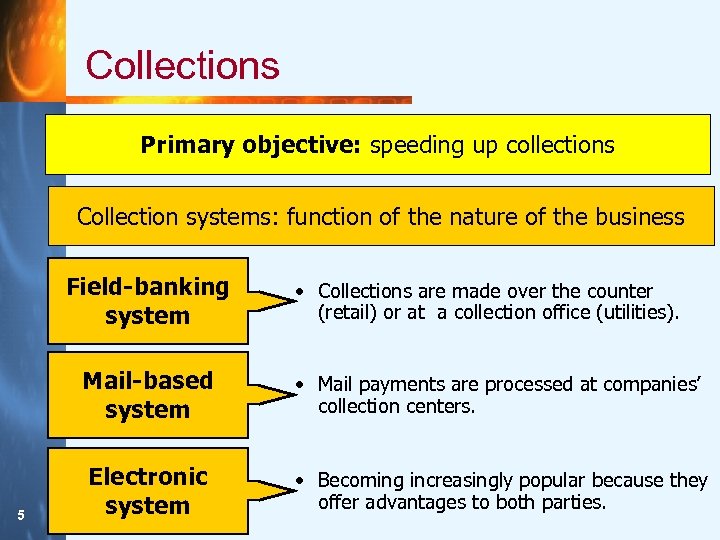

Collections Primary objective: speeding up collections Collection systems: function of the nature of the business Field-banking system • Collections are made over the counter (retail) or at a collection office (utilities). Mail-based system 5 • Mail payments are processed at companies’ collection centers. Electronic system • Becoming increasingly popular because they offer advantages to both parties.

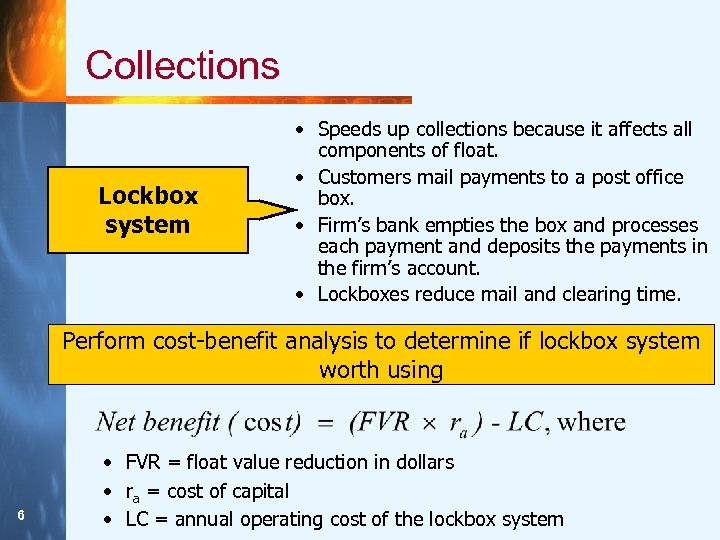

Collections Lockbox system • Speeds up collections because it affects all components of float. • Customers mail payments to a post office box. • Firm’s bank empties the box and processes each payment and deposits the payments in the firm’s account. • Lockboxes reduce mail and clearing time. Perform cost-benefit analysis to determine if lockbox system worth using 6 • FVR = float value reduction in dollars • ra = cost of capital • LC = annual operating cost of the lockbox system

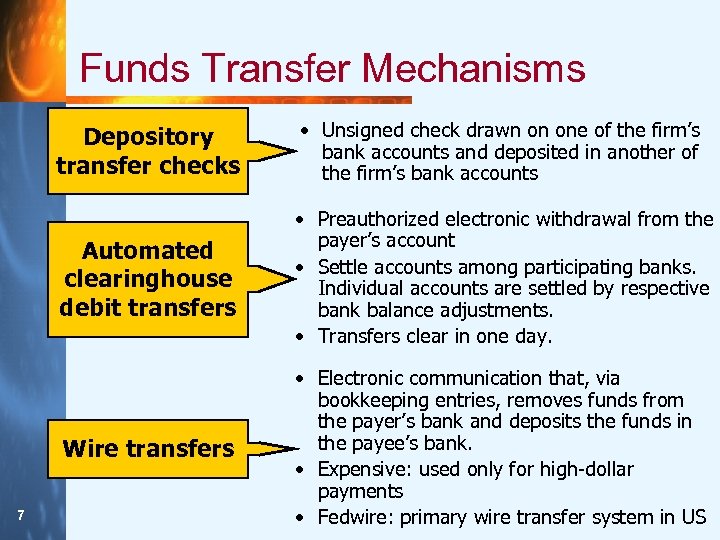

Funds Transfer Mechanisms Depository transfer checks Automated clearinghouse debit transfers • Preauthorized electronic withdrawal from the payer’s account • Settle accounts among participating banks. Individual accounts are settled by respective bank balance adjustments. • Transfers clear in one day. Wire transfers 7 • Unsigned check drawn on one of the firm’s bank accounts and deposited in another of the firm’s bank accounts • Electronic communication that, via bookkeeping entries, removes funds from the payer’s bank and deposits the funds in the payee’s bank. • Expensive: used only for high-dollar payments • Fedwire: primary wire transfer system in US

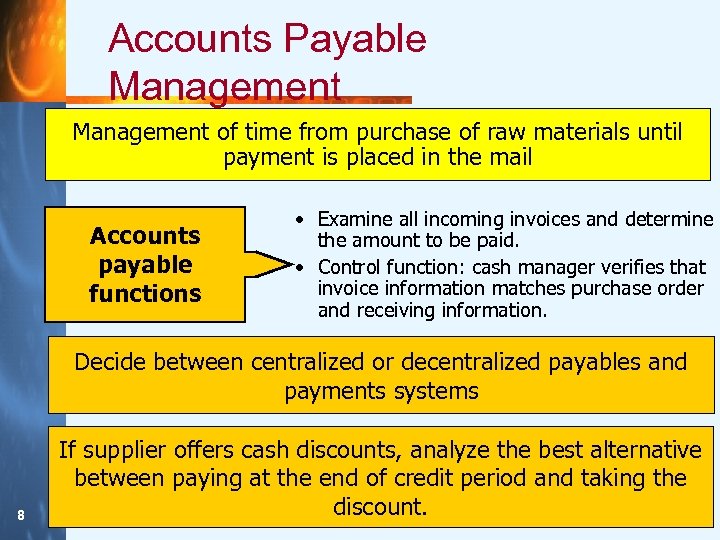

Accounts Payable Management of time from purchase of raw materials until payment is placed in the mail Accounts payable functions • Examine all incoming invoices and determine the amount to be paid. • Control function: cash manager verifies that invoice information matches purchase order and receiving information. Decide between centralized or decentralized payables and payments systems 8 If supplier offers cash discounts, analyze the best alternative between paying at the end of credit period and taking the discount.

Disbursements Products and Methods q Zero-balance accounts (ZBAs): disbursements accounts that always have end-of-day balance of zero q Allows the firm to maximize the use of float on each check, without altering the float time of its suppliers q Keeps all cash in interest-bearing accounts q Controlled disbursement: Bank provides early notification of checks presented against a company’s account every day. q Federal Reserve Bank makes two presentments of checks to be cleared each day for most large cash management banks. q Positive pay: Company transmits to the bank a checkissued file to the bank when checks are issued. 9 q Check-issued file includes check number and amount of each item. q Used for fraud prevention

Developments in Accounts Payable and Disbursements q Integrated (comprehensive) accounts payable: outsourcing of accounts payable or disbursements operations q Purchasing/procurement cards: increased use of credit cards for low-dollar indirect purchases q Imaging services: Both sides of the check, as well as remittance information, is converted into digital images. q Useful when incorporated with positive pay services q Fraud prevention in disbursements: fraud prevention measures: q Written policies and procedures for creating and disbursing checks; separating duties (approval, signing, reconciliation) q Using safety features on checks; setting maximum dollar limits and/or requiring multiple signatures 10

Short-Term Investing q. Essentially a substitute for cash, primary concerns should be q. Providing liquidity q. Preserving principal q. Not intended to generate profits 11

Short-Term Investing q. Marketable securities: q. Money market mutual funds q. Money market financial instruments q. U. S. Treasuries q. Federal agency issues q. Bank financial instruments q. Corporate obligations q. Others (MMF, asset-backed securities, international money market, repos 12

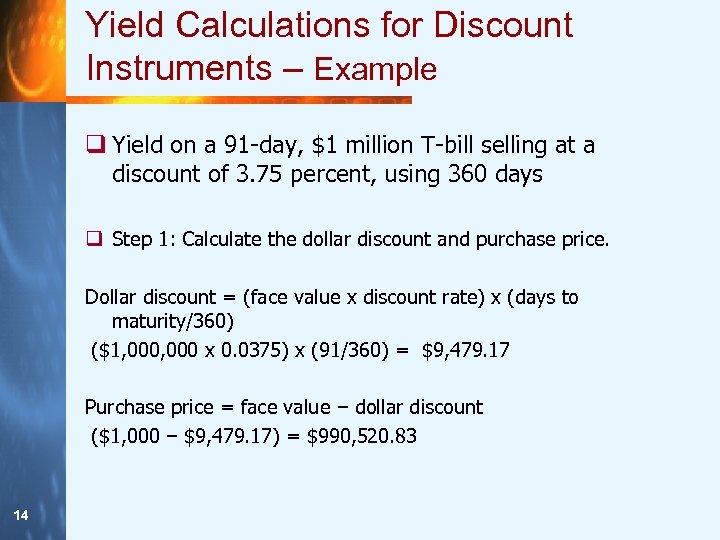

Yield Calculations for Discount Instruments q Yield for short-term discount investments such as T-bills and commercial paper typically calculated using algebraic approximations rather than precise present value methods q In a discount investment, investor pays less than face value at time of purchase, and receives face value at its maturity date. q Generally no interim interest or coupon payments during the course of holdings uch an investment. 13

Yield Calculations for Discount Instruments – Example q Yield on a 91 -day, $1 million T-bill selling at a discount of 3. 75 percent, using 360 days q Step 1: Calculate the dollar discount and purchase price. Dollar discount = (face value x discount rate) x (days to maturity/360) ($1, 000 x 0. 0375) x (91/360) = $9, 479. 17 Purchase price = face value − dollar discount ($1, 000 − $9, 479. 17) = $990, 520. 83 14

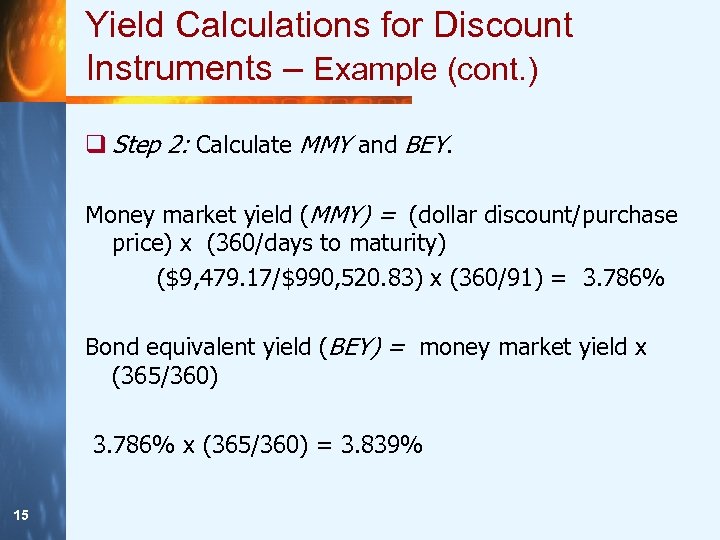

Yield Calculations for Discount Instruments – Example (cont. ) q Step 2: Calculate MMY and BEY. Money market yield (MMY) = (dollar discount/purchase price) x (360/days to maturity) ($9, 479. 17/$990, 520. 83) x (360/91) = 3. 786% Bond equivalent yield (BEY) = money market yield x (365/360) 3. 786% x (365/360) = 3. 839% 15

Short-Term Borrowing q Variable-rate basis q. Base rate + spread = all-in-rate q. Prime rate q. LIBOR q. Effective borrowing rate 16

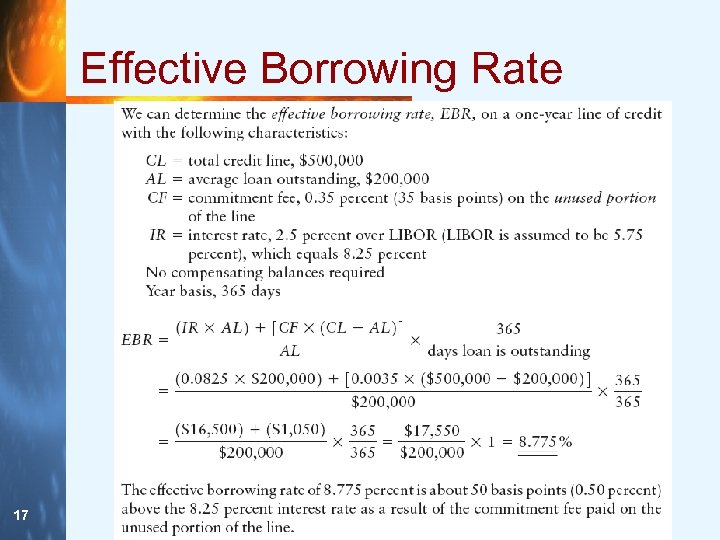

Effective Borrowing Rate 17

f05b169c3aaea79400b07fb4c9fb1a36.ppt