5a27e98203c8a1a8a62734777e0a1ae3.ppt

- Количество слайдов: 16

Chapter 23: Liquidity Management Corporate Finance, 3 e Graham, Smart, and Megginson © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

Chapter 23: Liquidity Management Corporate Finance, 3 e Graham, Smart, and Megginson © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

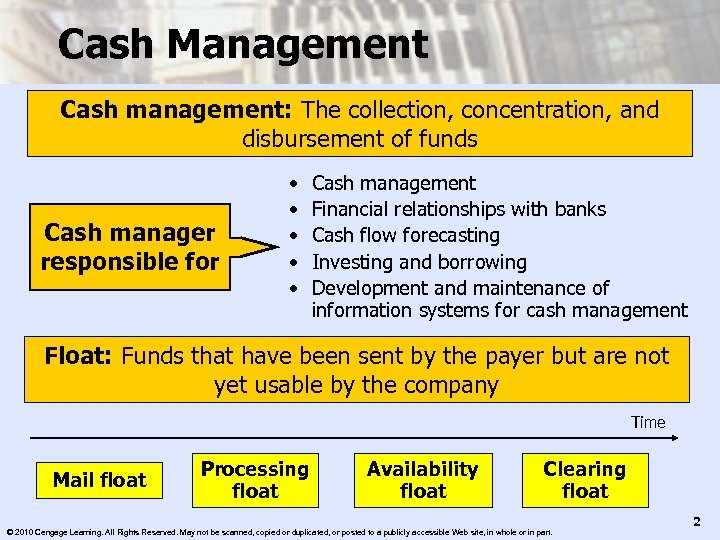

Cash Management Cash management: The collection, concentration, and disbursement of funds Cash manager responsible for • • • Cash management Financial relationships with banks Cash flow forecasting Investing and borrowing Development and maintenance of information systems for cash management Float: Funds that have been sent by the payer but are not yet usable by the company Time Mail float Processing float Availability float Clearing float © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 2

Cash Management Cash management: The collection, concentration, and disbursement of funds Cash manager responsible for • • • Cash management Financial relationships with banks Cash flow forecasting Investing and borrowing Development and maintenance of information systems for cash management Float: Funds that have been sent by the payer but are not yet usable by the company Time Mail float Processing float Availability float Clearing float © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 2

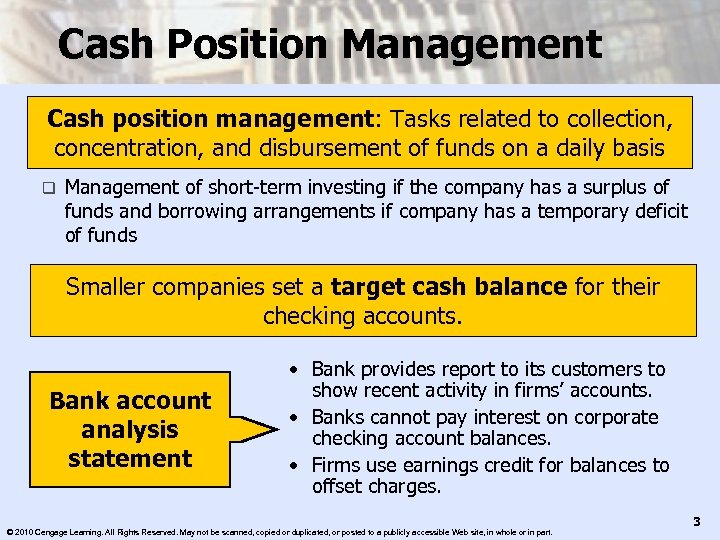

Cash Position Management Cash position management: Tasks related to collection, concentration, and disbursement of funds on a daily basis q Management of short-term investing if the company has a surplus of funds and borrowing arrangements if company has a temporary deficit of funds Smaller companies set a target cash balance for their checking accounts. Bank account analysis statement • Bank provides report to its customers to show recent activity in firms’ accounts. • Banks cannot pay interest on corporate checking account balances. • Firms use earnings credit for balances to offset charges. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 3

Cash Position Management Cash position management: Tasks related to collection, concentration, and disbursement of funds on a daily basis q Management of short-term investing if the company has a surplus of funds and borrowing arrangements if company has a temporary deficit of funds Smaller companies set a target cash balance for their checking accounts. Bank account analysis statement • Bank provides report to its customers to show recent activity in firms’ accounts. • Banks cannot pay interest on corporate checking account balances. • Firms use earnings credit for balances to offset charges. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 3

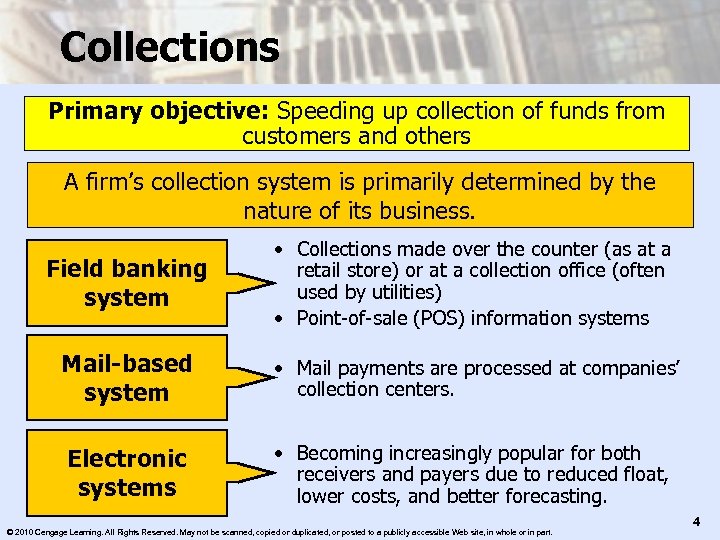

Collections Primary objective: Speeding up collection of funds from customers and others A firm’s collection system is primarily determined by the nature of its business. Field banking system • Collections made over the counter (as at a retail store) or at a collection office (often used by utilities) • Point-of-sale (POS) information systems Mail-based system • Mail payments are processed at companies’ collection centers. Electronic systems • Becoming increasingly popular for both receivers and payers due to reduced float, lower costs, and better forecasting. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 4

Collections Primary objective: Speeding up collection of funds from customers and others A firm’s collection system is primarily determined by the nature of its business. Field banking system • Collections made over the counter (as at a retail store) or at a collection office (often used by utilities) • Point-of-sale (POS) information systems Mail-based system • Mail payments are processed at companies’ collection centers. Electronic systems • Becoming increasingly popular for both receivers and payers due to reduced float, lower costs, and better forecasting. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 4

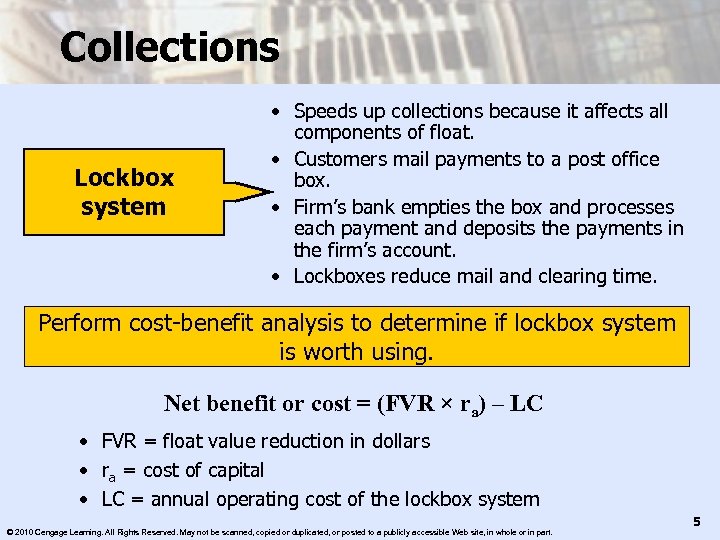

Collections Lockbox system • Speeds up collections because it affects all components of float. • Customers mail payments to a post office box. • Firm’s bank empties the box and processes each payment and deposits the payments in the firm’s account. • Lockboxes reduce mail and clearing time. Perform cost-benefit analysis to determine if lockbox system is worth using. Net benefit or cost = (FVR × ra) – LC • FVR = float value reduction in dollars • ra = cost of capital • LC = annual operating cost of the lockbox system © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 5

Collections Lockbox system • Speeds up collections because it affects all components of float. • Customers mail payments to a post office box. • Firm’s bank empties the box and processes each payment and deposits the payments in the firm’s account. • Lockboxes reduce mail and clearing time. Perform cost-benefit analysis to determine if lockbox system is worth using. Net benefit or cost = (FVR × ra) – LC • FVR = float value reduction in dollars • ra = cost of capital • LC = annual operating cost of the lockbox system © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 5

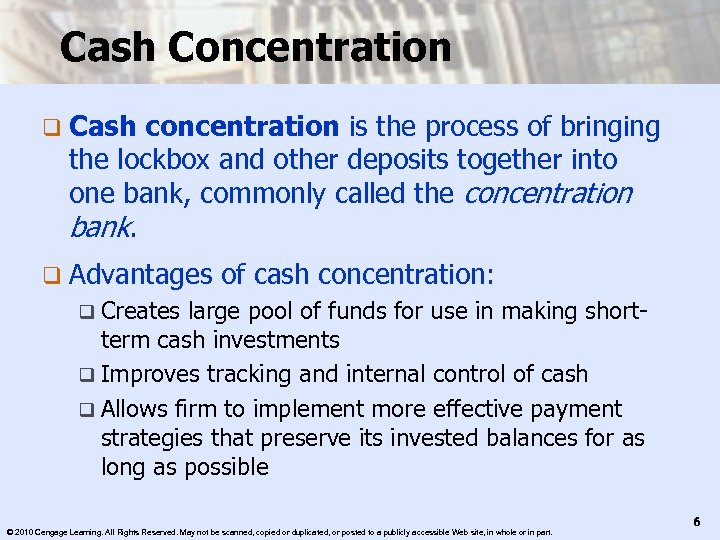

Cash Concentration q Cash concentration is the process of bringing the lockbox and other deposits together into one bank, commonly called the concentration bank. q Advantages of cash concentration: q Creates large pool of funds for use in making shortterm cash investments q Improves tracking and internal control of cash q Allows firm to implement more effective payment strategies that preserve its invested balances for as long as possible © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 6

Cash Concentration q Cash concentration is the process of bringing the lockbox and other deposits together into one bank, commonly called the concentration bank. q Advantages of cash concentration: q Creates large pool of funds for use in making shortterm cash investments q Improves tracking and internal control of cash q Allows firm to implement more effective payment strategies that preserve its invested balances for as long as possible © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 6

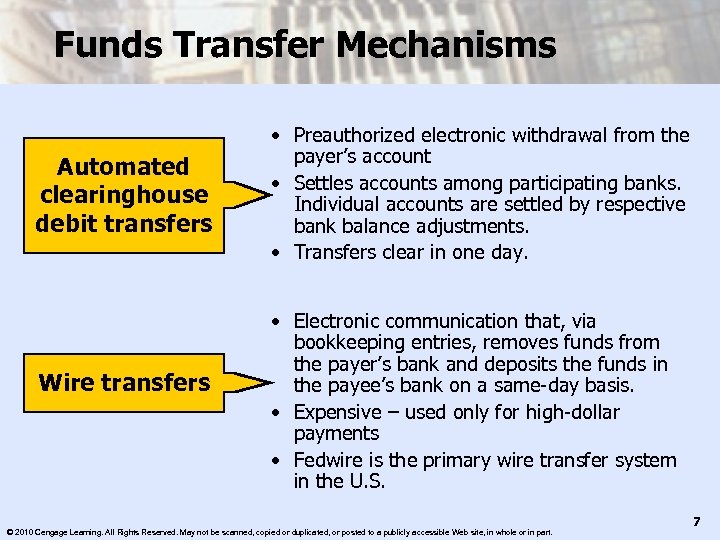

Funds Transfer Mechanisms Automated clearinghouse debit transfers Wire transfers • Preauthorized electronic withdrawal from the payer’s account • Settles accounts among participating banks. Individual accounts are settled by respective bank balance adjustments. • Transfers clear in one day. • Electronic communication that, via bookkeeping entries, removes funds from the payer’s bank and deposits the funds in the payee’s bank on a same-day basis. • Expensive – used only for high-dollar payments • Fedwire is the primary wire transfer system in the U. S. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 7

Funds Transfer Mechanisms Automated clearinghouse debit transfers Wire transfers • Preauthorized electronic withdrawal from the payer’s account • Settles accounts among participating banks. Individual accounts are settled by respective bank balance adjustments. • Transfers clear in one day. • Electronic communication that, via bookkeeping entries, removes funds from the payer’s bank and deposits the funds in the payee’s bank on a same-day basis. • Expensive – used only for high-dollar payments • Fedwire is the primary wire transfer system in the U. S. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 7

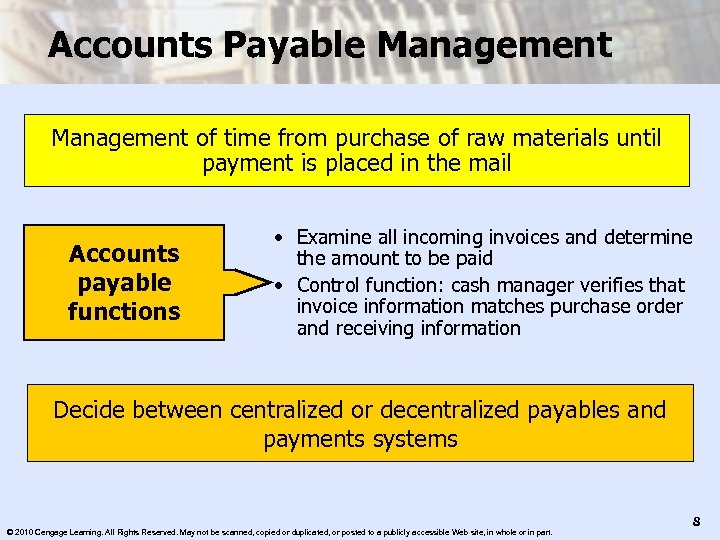

Accounts Payable Management of time from purchase of raw materials until payment is placed in the mail Accounts payable functions • Examine all incoming invoices and determine the amount to be paid • Control function: cash manager verifies that invoice information matches purchase order and receiving information Decide between centralized or decentralized payables and payments systems © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 8

Accounts Payable Management of time from purchase of raw materials until payment is placed in the mail Accounts payable functions • Examine all incoming invoices and determine the amount to be paid • Control function: cash manager verifies that invoice information matches purchase order and receiving information Decide between centralized or decentralized payables and payments systems © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 8

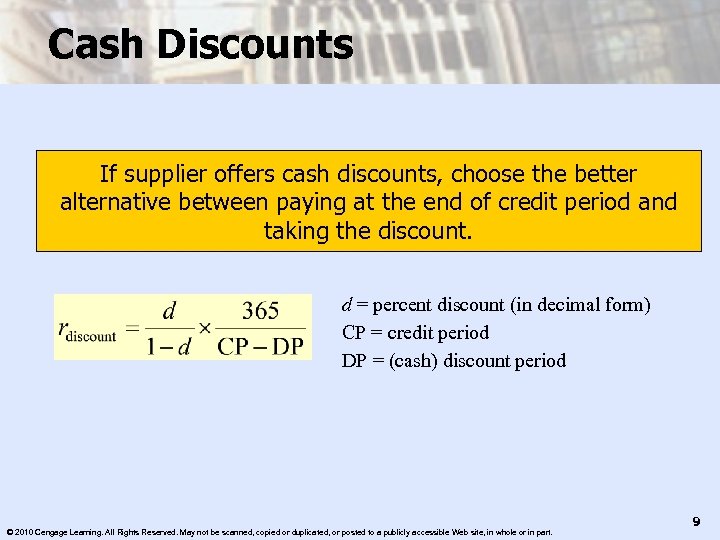

Cash Discounts If supplier offers cash discounts, choose the better alternative between paying at the end of credit period and taking the discount. d = percent discount (in decimal form) CP = credit period DP = (cash) discount period © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 9

Cash Discounts If supplier offers cash discounts, choose the better alternative between paying at the end of credit period and taking the discount. d = percent discount (in decimal form) CP = credit period DP = (cash) discount period © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 9

Disbursements Products and Methods q Zero-balance accounts (ZBAs): Disbursements accounts that always have end-of-day balance of zero q Controlled disbursement: Bank provides early notification of checks presented against a company’s account every day. q Positive pay: Company transmits to the bank a checkissued file to the bank when checks are issued. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 10

Disbursements Products and Methods q Zero-balance accounts (ZBAs): Disbursements accounts that always have end-of-day balance of zero q Controlled disbursement: Bank provides early notification of checks presented against a company’s account every day. q Positive pay: Company transmits to the bank a checkissued file to the bank when checks are issued. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 10

Developments in Accounts Payable and Disbursements q Integrated (comprehensive) accounts payable: Outsourcing of accounts payable or disbursements operations q Purchasing/procurement cards: Increased use of credit cards for low-dollar indirect purchases q Imaging services: Both sides of the check, as well as remittance information, are converted into digital images. q Especially useful when incorporated with positive-pay services © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 11

Developments in Accounts Payable and Disbursements q Integrated (comprehensive) accounts payable: Outsourcing of accounts payable or disbursements operations q Purchasing/procurement cards: Increased use of credit cards for low-dollar indirect purchases q Imaging services: Both sides of the check, as well as remittance information, are converted into digital images. q Especially useful when incorporated with positive-pay services © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 11

Developments in Accounts Payable and Disbursements q Fraud prevention measures in disbursements q Written policies and procedures for creating and disbursing checks q Separating check-issuance duties (approval, signing, reconciliation) q Using safety features on checks (microprinting, watermarks, tamper resistance) q Setting maximum dollar limits and/or requiring multiple signatures q Using positive-pay services q Increasing the use of electronic pay methods © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 12

Developments in Accounts Payable and Disbursements q Fraud prevention measures in disbursements q Written policies and procedures for creating and disbursing checks q Separating check-issuance duties (approval, signing, reconciliation) q Using safety features on checks (microprinting, watermarks, tamper resistance) q Setting maximum dollar limits and/or requiring multiple signatures q Using positive-pay services q Increasing the use of electronic pay methods © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 12

Short-Term Investing q Instead of keeping excess balances in non -interest-bearing accounts, a company will hold some “near-cash” assets in the form of short-term investments, often labeled marketable securities. q Primary concerns are providing liquidity and preserving principal © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 13

Short-Term Investing q Instead of keeping excess balances in non -interest-bearing accounts, a company will hold some “near-cash” assets in the form of short-term investments, often labeled marketable securities. q Primary concerns are providing liquidity and preserving principal © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 13

Short-Term Investing q Marketable securities: q Money market mutual funds q Money market financial instruments q. U. S. Treasuries q. Federal agency issues q. Bank financial instruments (CDs, time deposits, banker’s acceptances) q. Corporate obligations (commercial paper, adjustable rate preferred stock) © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 14

Short-Term Investing q Marketable securities: q Money market mutual funds q Money market financial instruments q. U. S. Treasuries q. Federal agency issues q. Bank financial instruments (CDs, time deposits, banker’s acceptances) q. Corporate obligations (commercial paper, adjustable rate preferred stock) © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 14

Yield Calculations for Discount Instruments q Yield for short-term discount investments such as T-bills and commercial paper are typically calculated using algebraic approximations rather than precise present value methods. q In a discount investment, investor pays less than face value at time of purchase, and receives face value at its maturity date. q Generally no interim interest or coupon payments during the course of holding such an investment. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 15

Yield Calculations for Discount Instruments q Yield for short-term discount investments such as T-bills and commercial paper are typically calculated using algebraic approximations rather than precise present value methods. q In a discount investment, investor pays less than face value at time of purchase, and receives face value at its maturity date. q Generally no interim interest or coupon payments during the course of holding such an investment. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 15

Short-Term Borrowing q Variable-rate basis q Base rate + spread = all-in-rate q Typical base rates include the prime rate and LIBOR q For lines of credit, banks often require commitment fees and/or compensating balances. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 16

Short-Term Borrowing q Variable-rate basis q Base rate + spread = all-in-rate q Typical base rates include the prime rate and LIBOR q For lines of credit, banks often require commitment fees and/or compensating balances. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part. 16