01a93611aba2ab9fcd06096ca3236f15.ppt

- Количество слайдов: 13

Chapter 22: Cash Conversion, Inventory, and Receivables Management Corporate Finance, 3 e Graham, Smart, and Megginson © 2010 South-Western, Rights of Cengage Learning © 2010 Cengage Learning. All a part. Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

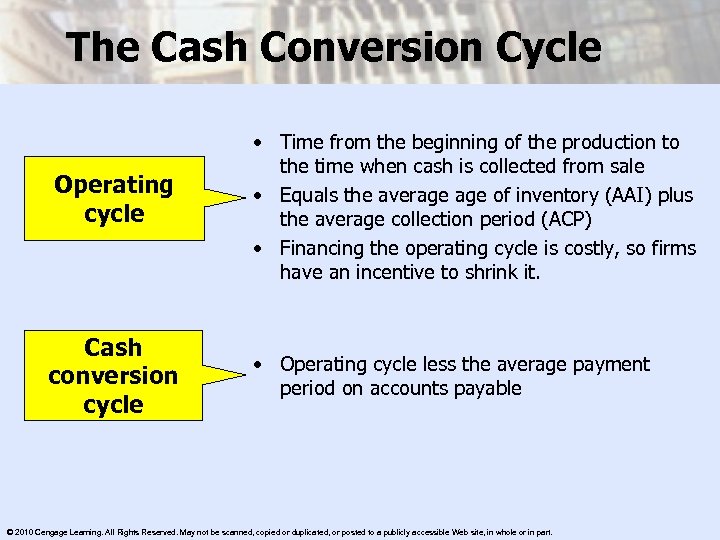

The Cash Conversion Cycle Operating cycle Cash conversion cycle • Time from the beginning of the production to the time when cash is collected from sale • Equals the average of inventory (AAI) plus the average collection period (ACP) • Financing the operating cycle is costly, so firms have an incentive to shrink it. • Operating cycle less the average payment period on accounts payable © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

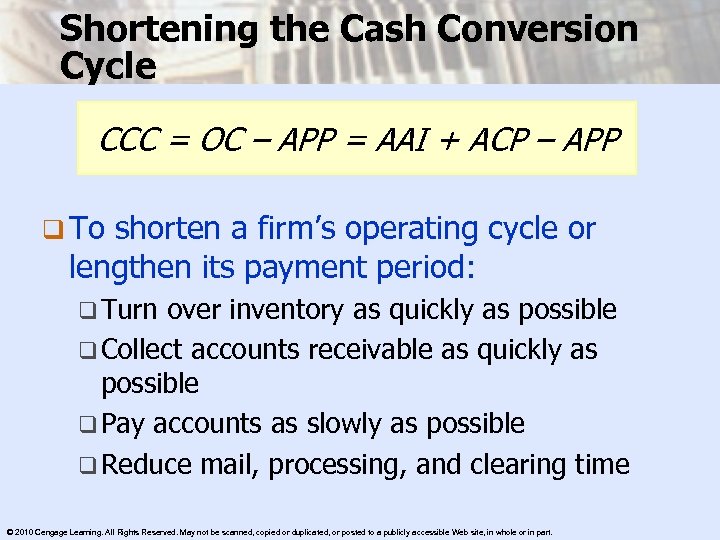

Shortening the Cash Conversion Cycle CCC = OC – APP = AAI + ACP – APP q To shorten a firm’s operating cycle or lengthen its payment period: q Turn over inventory as quickly as possible q Collect accounts receivable as quickly as possible q Pay accounts as slowly as possible q Reduce mail, processing, and clearing time © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

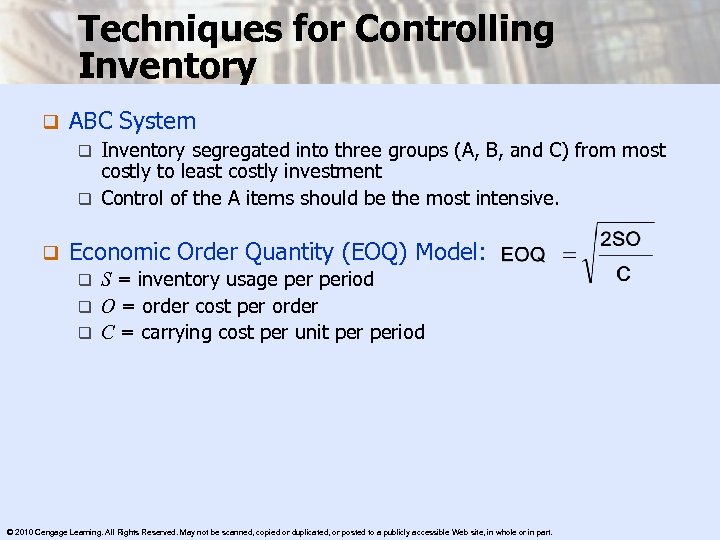

Techniques for Controlling Inventory q ABC System Inventory segregated into three groups (A, B, and C) from most costly to least costly investment q Control of the A items should be the most intensive. q q Economic Order Quantity (EOQ) Model: S = inventory usage period q O = order cost per order q C = carrying cost per unit period q © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

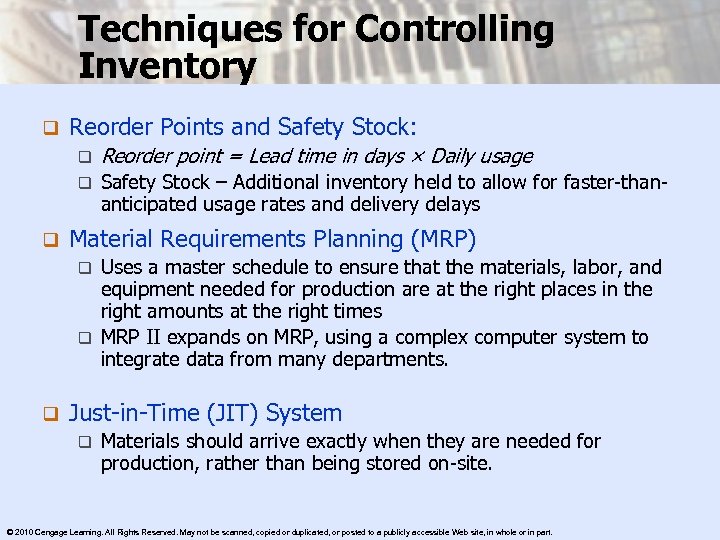

Techniques for Controlling Inventory q Reorder Points and Safety Stock: q q q Reorder point = Lead time in days × Daily usage Safety Stock – Additional inventory held to allow for faster-thananticipated usage rates and delivery delays Material Requirements Planning (MRP) Uses a master schedule to ensure that the materials, labor, and equipment needed for production are at the right places in the right amounts at the right times q MRP II expands on MRP, using a complex computer system to integrate data from many departments. q q Just-in-Time (JIT) System q Materials should arrive exactly when they are needed for production, rather than being stored on-site. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

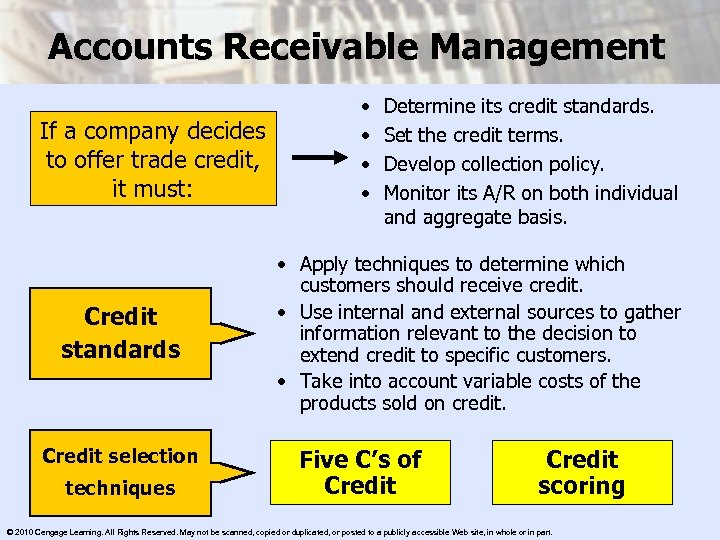

Accounts Receivable Management If a company decides to offer trade credit, it must: Credit standards Credit selection techniques • • Determine its credit standards. Set the credit terms. Develop collection policy. Monitor its A/R on both individual and aggregate basis. • Apply techniques to determine which customers should receive credit. • Use internal and external sources to gather information relevant to the decision to extend credit to specific customers. • Take into account variable costs of the products sold on credit. Five C’s of Credit scoring © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

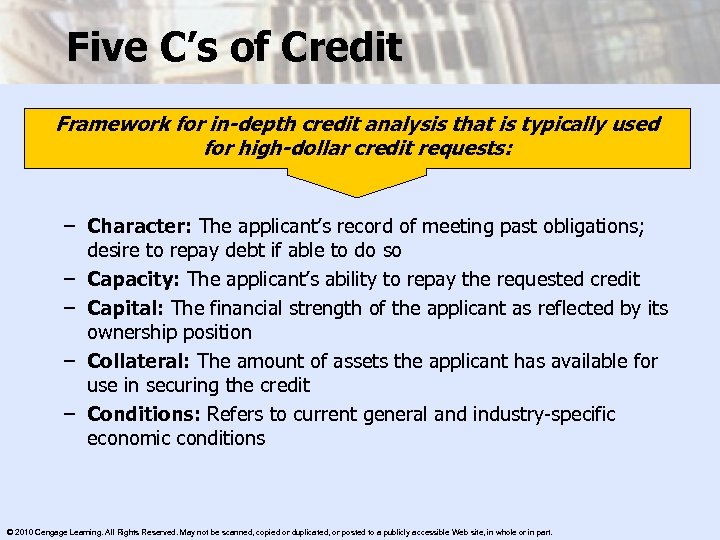

Five C’s of Credit Framework for in-depth credit analysis that is typically used for high-dollar credit requests: – Character: The applicant’s record of meeting past obligations; desire to repay debt if able to do so – Capacity: The applicant’s ability to repay the requested credit – Capital: The financial strength of the applicant as reflected by its ownership position – Collateral: The amount of assets the applicant has available for use in securing the credit – Conditions: Refers to current general and industry-specific economic conditions © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

Credit Scoring Uses statistically-derived weights for key credit characteristics to predict whether a credit applicant will pay the requested credit in a timely fashion. Used with high volume/small dollar credit requests q Most commonly used by large credit card operations, such as banks, oil companies, and department stores q © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

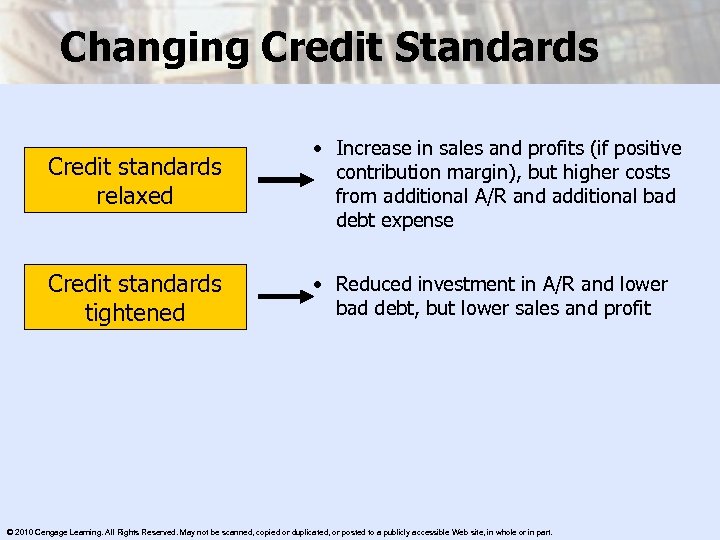

Changing Credit Standards Credit standards relaxed • Increase in sales and profits (if positive contribution margin), but higher costs from additional A/R and additional bad debt expense Credit standards tightened • Reduced investment in A/R and lower bad debt, but lower sales and profit © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

Credit Terms q Terms of sale for customers q. Net 30: Payment in full due in 30 days q. Cash discounts q. Example: q 2% 2/10 net 30 discount if payment made within 10 -day cash discount period q Otherwise, full payment due within 30 -day credit period © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

Collection Policy q Reminders, form letters, telephone calls, or personal visits may initiate customer payment. q At a minimum, the company should generally suspend further sales to the customer until the delinquent account is brought current. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

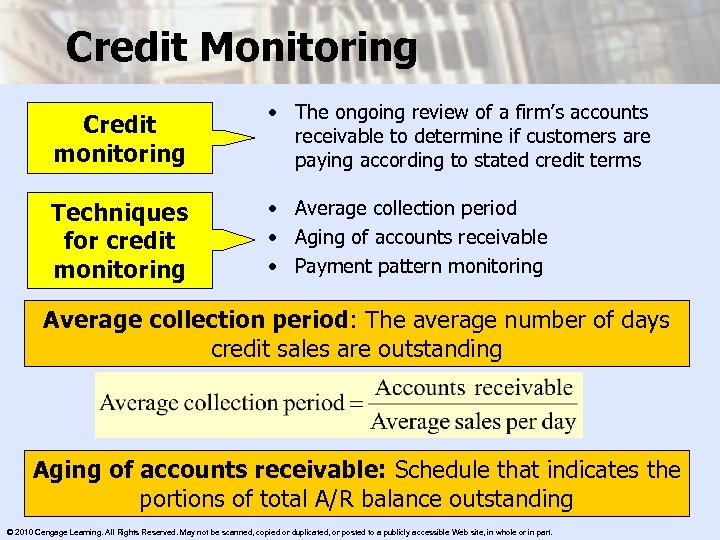

Credit Monitoring Credit monitoring • The ongoing review of a firm’s accounts receivable to determine if customers are paying according to stated credit terms Techniques for credit monitoring • Average collection period • Aging of accounts receivable • Payment pattern monitoring Average collection period: The average number of days credit sales are outstanding Aging of accounts receivable: Schedule that indicates the portions of total A/R balance outstanding © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

Credit Monitoring Payment pattern: The normal timing within which a firm’s customers pay their accounts • Percentage of monthly sales collected the following month • Should be constant over time; if payment pattern changes, the firm should review its credit policies. © 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible Web site, in whole or in part.

01a93611aba2ab9fcd06096ca3236f15.ppt