a08149bd6397cf0e75e119691d9f2c2d.ppt

- Количество слайдов: 56

Chapter 20 Saving, Capital Formation, and Financial Markets National Chi Nan University 2012/04/24

Chapter 20 Saving, Capital Formation, and Financial Markets National Chi Nan University 2012/04/24

Cover Story: n Aesop’s fable (伊索寓言 ): Ant: all summer worked hard laying up food for the winter. Grasshopper: mocked the ant’s efforts. When winter came: the grasshopper starved. the ant was well-fed. Moral: When times are good, the wise put aside something for the future.

Cover Story: n Aesop’s fable (伊索寓言 ): Ant: all summer worked hard laying up food for the winter. Grasshopper: mocked the ant’s efforts. When winter came: the grasshopper starved. the ant was well-fed. Moral: When times are good, the wise put aside something for the future.

Learning Objectives: 1. Explain the relationship between savings and wealth. 2. Recognize and work with the components of national saving (瞭解國民儲蓄的內涵 ). 3. Understand the reasons people save (為何要儲蓄 ? ). 4. Discuss the reasons firms choose to invest in capital rather than financial assets (為何要投資資本而非金 融資產 ? ). 5. Analyze financial markets using the tools of supply and demand (用供需模型了解金融市場 ).

Learning Objectives: 1. Explain the relationship between savings and wealth. 2. Recognize and work with the components of national saving (瞭解國民儲蓄的內涵 ). 3. Understand the reasons people save (為何要儲蓄 ? ). 4. Discuss the reasons firms choose to invest in capital rather than financial assets (為何要投資資本而非金 融資產 ? ). 5. Analyze financial markets using the tools of supply and demand (用供需模型了解金融市場 ).

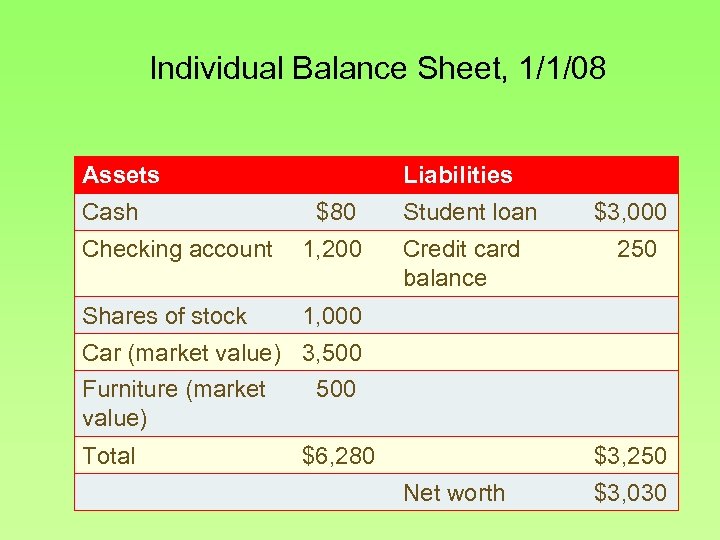

Individual Balance Sheet, 1/1/08 Assets Cash Liabilities $80 Checking account 1, 200 Shares of stock Student loan Credit card balance $3, 000 250 1, 000 Car (market value) 3, 500 Furniture (market value) Total 500 $6, 280 $3, 250 Net worth $3, 030

Individual Balance Sheet, 1/1/08 Assets Cash Liabilities $80 Checking account 1, 200 Shares of stock Student loan Credit card balance $3, 000 250 1, 000 Car (market value) 3, 500 Furniture (market value) Total 500 $6, 280 $3, 250 Net worth $3, 030

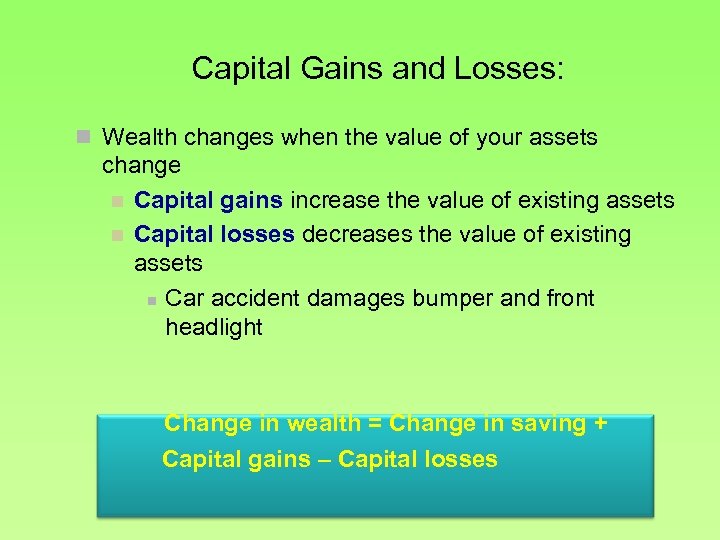

Capital Gains and Losses: n Wealth changes when the value of your assets change n Capital gains increase the value of existing assets n Capital losses decreases the value of existing assets n Car accident damages bumper and front headlight Change in wealth = Change in saving + Capital gains – Capital losses

Capital Gains and Losses: n Wealth changes when the value of your assets change n Capital gains increase the value of existing assets n Capital losses decreases the value of existing assets n Car accident damages bumper and front headlight Change in wealth = Change in saving + Capital gains – Capital losses

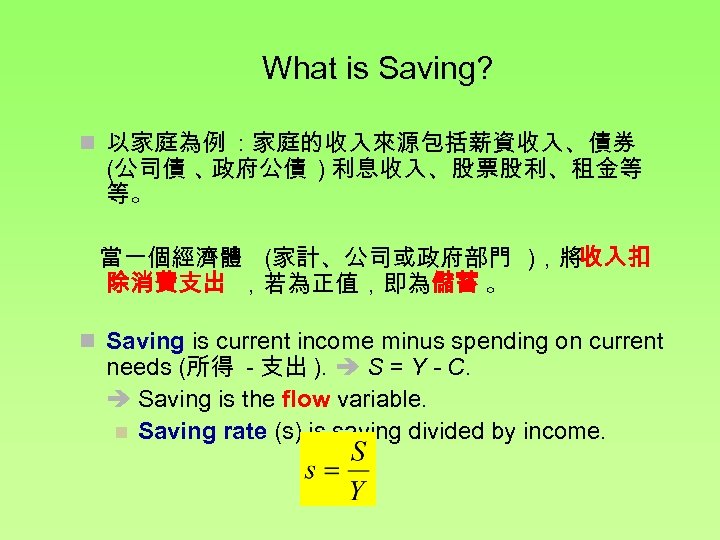

What is Saving? n 以家庭為例 : 家庭的收入來源包括薪資收入、債券 (公司債 、 政府公債 ) 利息收入、股票股利、租金等 等。 當一個經濟體 (家計、公司或政府部門 ),將收入扣 除消費支出 ,若為正值,即為儲蓄 。 n Saving is current income minus spending on current needs (所得 - 支出 ). S = Y - C. Saving is the flow variable. n Saving rate (s) is saving divided by income.

What is Saving? n 以家庭為例 : 家庭的收入來源包括薪資收入、債券 (公司債 、 政府公債 ) 利息收入、股票股利、租金等 等。 當一個經濟體 (家計、公司或政府部門 ),將收入扣 除消費支出 ,若為正值,即為儲蓄 。 n Saving is current income minus spending on current needs (所得 - 支出 ). S = Y - C. Saving is the flow variable. n Saving rate (s) is saving divided by income.

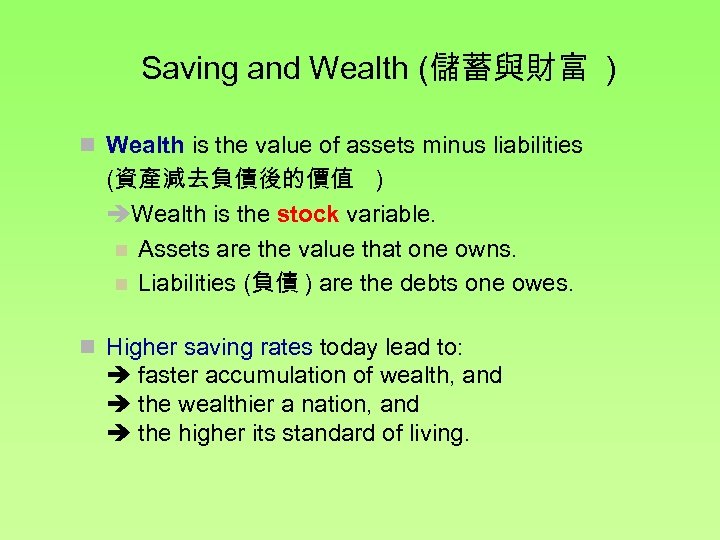

Saving and Wealth (儲蓄與財富 ) n Wealth is the value of assets minus liabilities (資產減去負債後的價值 ) Wealth is the stock variable. n Assets are the value that one owns. n Liabilities (負債 ) are the debts one owes. n Higher saving rates today lead to: faster accumulation of wealth, and the wealthier a nation, and the higher its standard of living.

Saving and Wealth (儲蓄與財富 ) n Wealth is the value of assets minus liabilities (資產減去負債後的價值 ) Wealth is the stock variable. n Assets are the value that one owns. n Liabilities (負債 ) are the debts one owes. n Higher saving rates today lead to: faster accumulation of wealth, and the wealthier a nation, and the higher its standard of living.

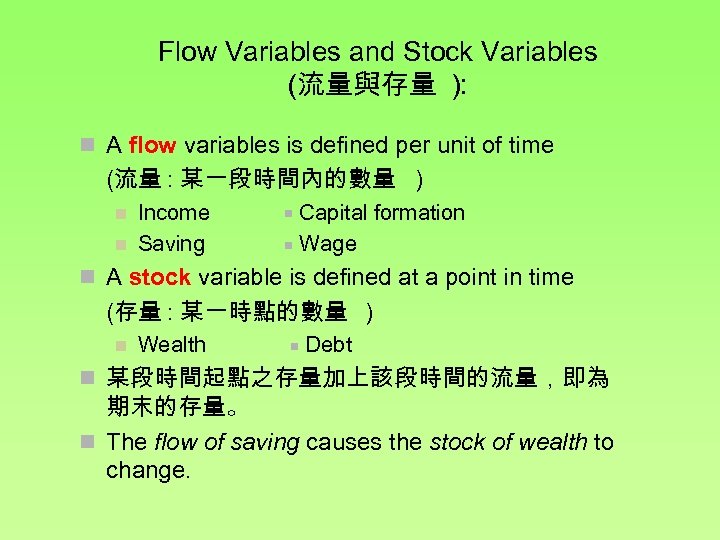

Flow Variables and Stock Variables (流量與存量 ): n A flow variables is defined per unit of time (流量 : 某一段時間內的數量 ) n n Income Saving Capital formation ■ Wage ■ n A stock variable is defined at a point in time (存量 : 某一時點的數量 ) n Wealth ■ Debt n 某段時間起點之存量加上該段時間的流量,即為 期末的存量。 n The flow of saving causes the stock of wealth to change.

Flow Variables and Stock Variables (流量與存量 ): n A flow variables is defined per unit of time (流量 : 某一段時間內的數量 ) n n Income Saving Capital formation ■ Wage ■ n A stock variable is defined at a point in time (存量 : 某一時點的數量 ) n Wealth ■ Debt n 某段時間起點之存量加上該段時間的流量,即為 期末的存量。 n The flow of saving causes the stock of wealth to change.

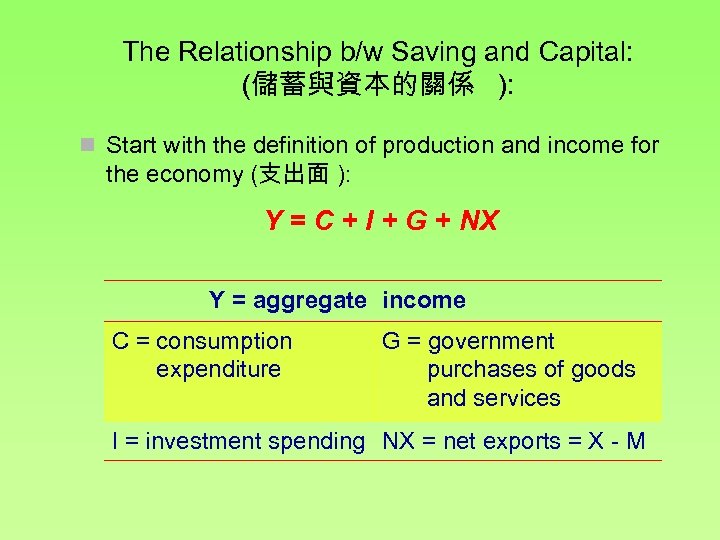

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n Start with the definition of production and income for the economy (支出面 ): Y = C + I + G + NX Y = aggregate income C = consumption expenditure G = government purchases of goods and services I = investment spending NX = net exports = X - M

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n Start with the definition of production and income for the economy (支出面 ): Y = C + I + G + NX Y = aggregate income C = consumption expenditure G = government purchases of goods and services I = investment spending NX = net exports = X - M

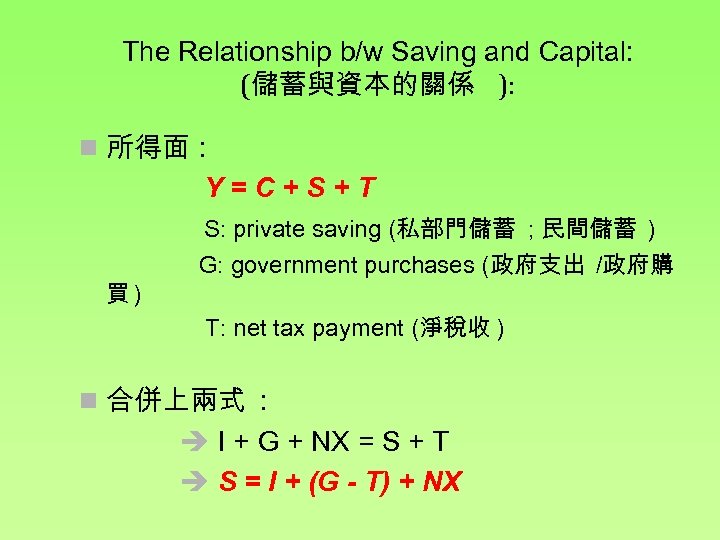

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 所得面 : Y=C+S+T 買) S: private saving (私部門儲蓄 ; 民間儲蓄 ) G: government purchases (政府支出 /政府購 T: net tax payment (淨稅收 ) n 合併上兩式 : I + G + NX = S + T S = I + (G - T) + NX

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 所得面 : Y=C+S+T 買) S: private saving (私部門儲蓄 ; 民間儲蓄 ) G: government purchases (政府支出 /政府購 T: net tax payment (淨稅收 ) n 合併上兩式 : I + G + NX = S + T S = I + (G - T) + NX

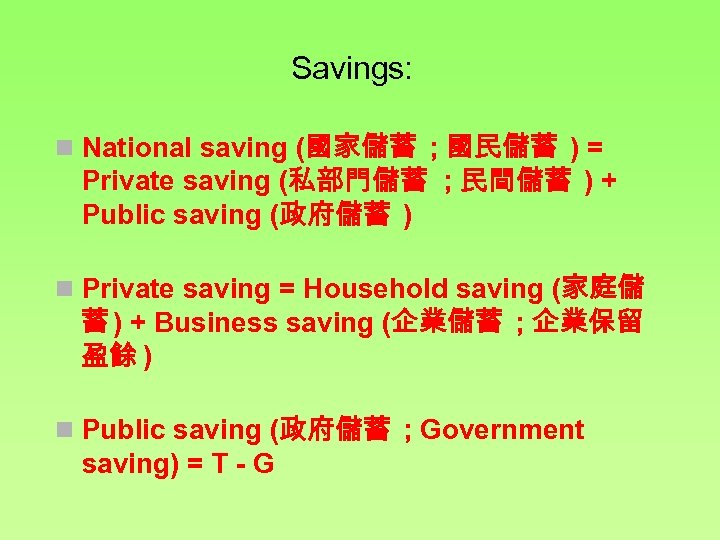

Savings: n National saving (國家儲蓄 ; 國民儲蓄 ) = Private saving (私部門儲蓄 ; 民間儲蓄 ) + Public saving (政府儲蓄 ) n Private saving = Household saving (家庭儲 蓄 ) + Business saving (企業儲蓄 ; 企業保留 盈餘 ) n Public saving (政府儲蓄 ; Government saving) = T - G

Savings: n National saving (國家儲蓄 ; 國民儲蓄 ) = Private saving (私部門儲蓄 ; 民間儲蓄 ) + Public saving (政府儲蓄 ) n Private saving = Household saving (家庭儲 蓄 ) + Business saving (企業儲蓄 ; 企業保留 盈餘 ) n Public saving (政府儲蓄 ; Government saving) = T - G

US National Saving, 1960 - 2006

US National Saving, 1960 - 2006

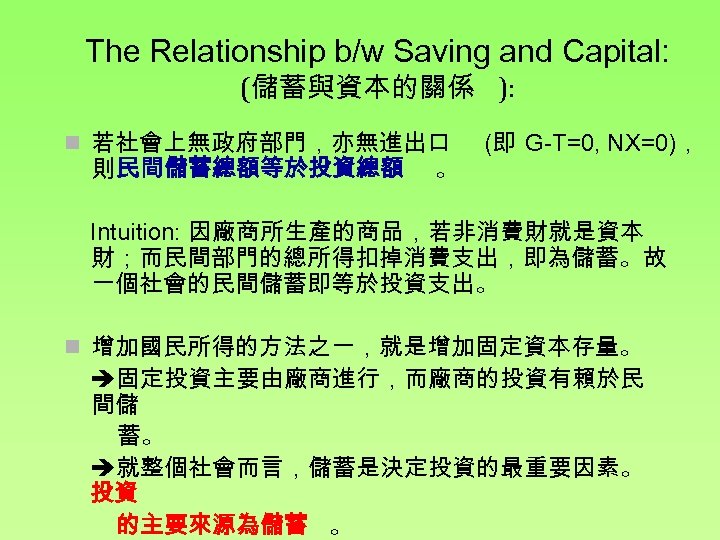

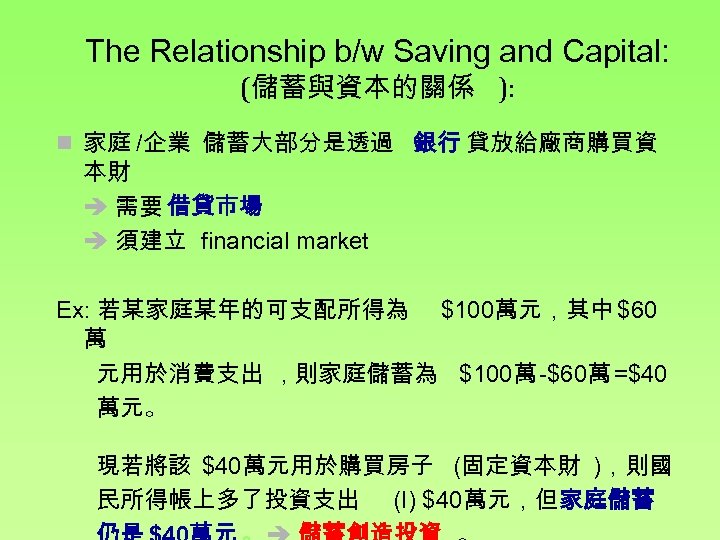

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 若社會上無政府部門,亦無進出口 則 民間儲蓄總額等於投資總額 。 (即 G-T=0, NX=0), Intuition: 因廠商所生產的商品,若非消費財就是資本 財;而民間部門的總所得扣掉消費支出,即為儲蓄。故 一個社會的民間儲蓄即等於投資支出。 n 增加國民所得的方法之一,就是增加固定資本存量。 固定投資主要由廠商進行,而廠商的投資有賴於民 間儲 蓄。 就整個社會而言,儲蓄是決定投資的最重要因素。 投資 的主要來源為儲蓄 。

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 若社會上無政府部門,亦無進出口 則 民間儲蓄總額等於投資總額 。 (即 G-T=0, NX=0), Intuition: 因廠商所生產的商品,若非消費財就是資本 財;而民間部門的總所得扣掉消費支出,即為儲蓄。故 一個社會的民間儲蓄即等於投資支出。 n 增加國民所得的方法之一,就是增加固定資本存量。 固定投資主要由廠商進行,而廠商的投資有賴於民 間儲 蓄。 就整個社會而言,儲蓄是決定投資的最重要因素。 投資 的主要來源為儲蓄 。

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 家庭 /企業 儲蓄大部分是透過 銀行 貸放給廠商購買資 本財 需要 借貸市場 須建立 financial market Ex: 若某家庭某年的可支配所得為 $100萬元,其中 $60 萬 元用於消費支出 , 則家庭儲蓄為 $100萬 -$60萬 =$40 萬元。 現若將該 $40萬元用於購買房子 (固定資本財 ),則國 民所得帳上多了投資支出 (I) $40萬元,但家庭儲蓄

The Relationship b/w Saving and Capital: (儲蓄與資本的關係 ): n 家庭 /企業 儲蓄大部分是透過 銀行 貸放給廠商購買資 本財 需要 借貸市場 須建立 financial market Ex: 若某家庭某年的可支配所得為 $100萬元,其中 $60 萬 元用於消費支出 , 則家庭儲蓄為 $100萬 -$60萬 =$40 萬元。 現若將該 $40萬元用於購買房子 (固定資本財 ),則國 民所得帳上多了投資支出 (I) $40萬元,但家庭儲蓄

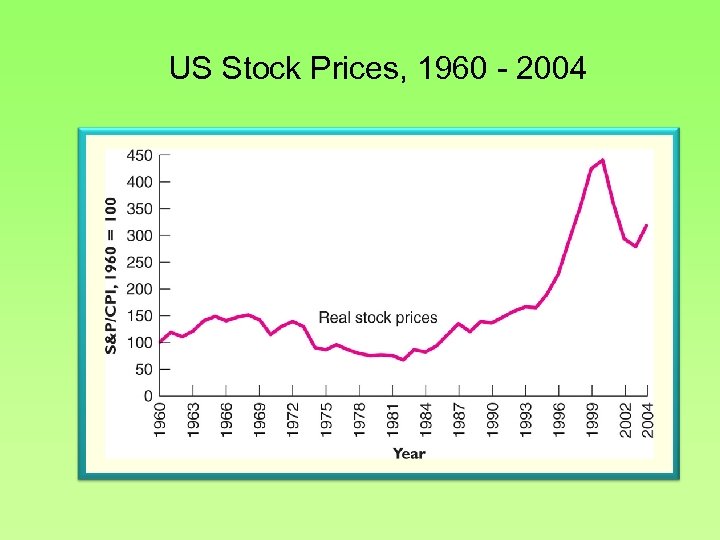

US Stock Prices, 1960 - 2004

US Stock Prices, 1960 - 2004

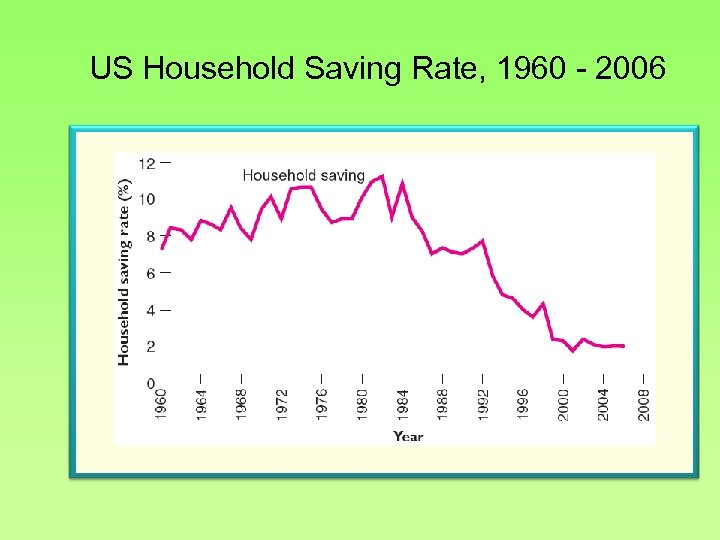

US Household Saving Rate, 1960 - 2006

US Household Saving Rate, 1960 - 2006

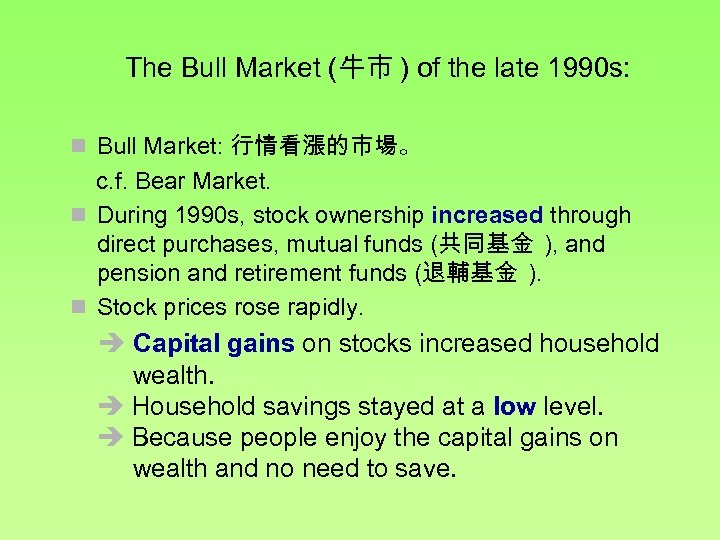

The Bull Market (牛市 ) of the late 1990 s: n Bull Market: 行情看漲的市場。 c. f. Bear Market. n During 1990 s, stock ownership increased through direct purchases, mutual funds (共同基金 ), and pension and retirement funds (退輔基金 ). n Stock prices rose rapidly. Capital gains on stocks increased household wealth. Household savings stayed at a low level. Because people enjoy the capital gains on wealth and no need to save.

The Bull Market (牛市 ) of the late 1990 s: n Bull Market: 行情看漲的市場。 c. f. Bear Market. n During 1990 s, stock ownership increased through direct purchases, mutual funds (共同基金 ), and pension and retirement funds (退輔基金 ). n Stock prices rose rapidly. Capital gains on stocks increased household wealth. Household savings stayed at a low level. Because people enjoy the capital gains on wealth and no need to save.

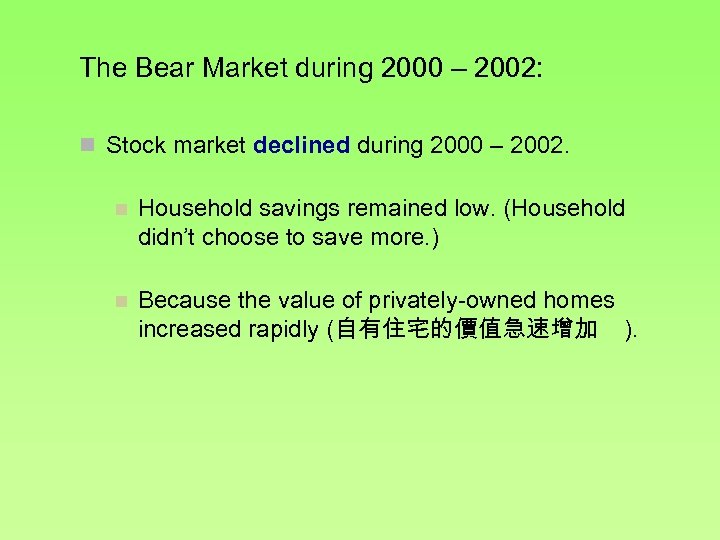

The Bear Market during 2000 – 2002: n Stock market declined during 2000 – 2002. n Household savings remained low. (Household didn’t choose to save more. ) n Because the value of privately-owned homes increased rapidly (自有住宅的價值急速增加 ).

The Bear Market during 2000 – 2002: n Stock market declined during 2000 – 2002. n Household savings remained low. (Household didn’t choose to save more. ) n Because the value of privately-owned homes increased rapidly (自有住宅的價值急速增加 ).

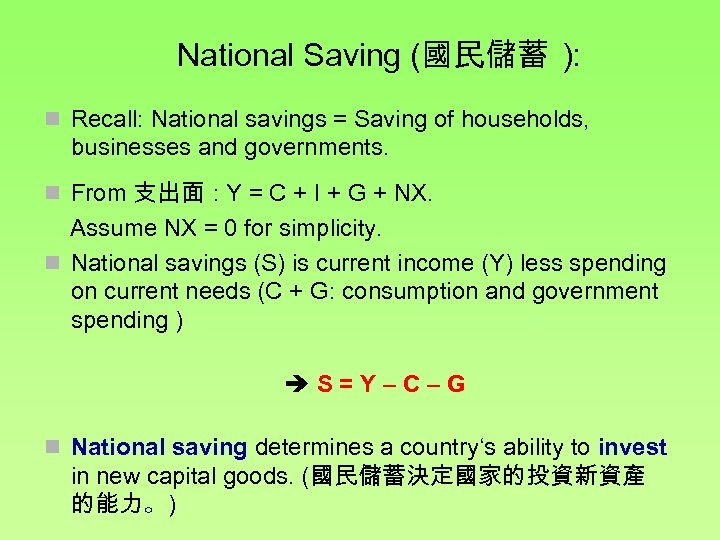

National Saving (國民儲蓄 ): n Recall: National savings = Saving of households, businesses and governments. n From 支出面 : Y = C + I + G + NX. Assume NX = 0 for simplicity. n National savings (S) is current income (Y) less spending on current needs (C + G: consumption and government spending ) S=Y–C–G n National saving determines a country‘s ability to invest in new capital goods. (國民儲蓄決定國家的投資新資產 的能力。)

National Saving (國民儲蓄 ): n Recall: National savings = Saving of households, businesses and governments. n From 支出面 : Y = C + I + G + NX. Assume NX = 0 for simplicity. n National savings (S) is current income (Y) less spending on current needs (C + G: consumption and government spending ) S=Y–C–G n National saving determines a country‘s ability to invest in new capital goods. (國民儲蓄決定國家的投資新資產 的能力。)

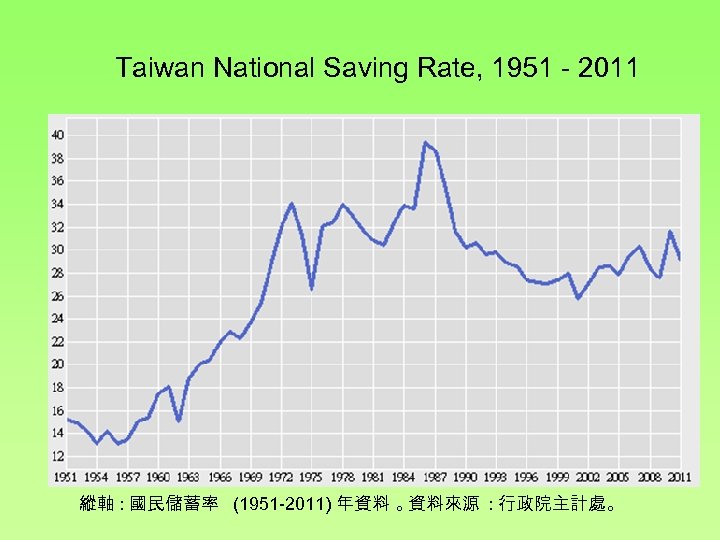

Taiwan National Saving Rate, 1951 - 2011 縱軸 : 國民儲蓄率 (1951 -2011) 年資料 。 資料來源 : 行政院主計處。

Taiwan National Saving Rate, 1951 - 2011 縱軸 : 國民儲蓄率 (1951 -2011) 年資料 。 資料來源 : 行政院主計處。

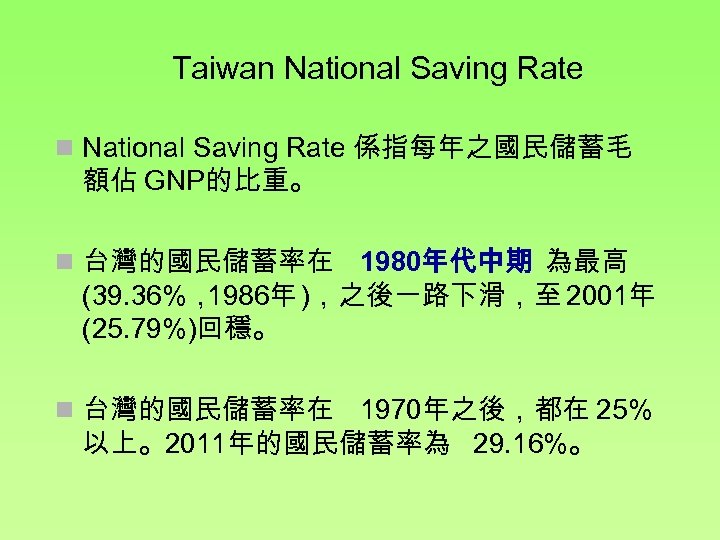

Taiwan National Saving Rate 係指每年之國民儲蓄毛 額佔 GNP的比重。 n 台灣的國民儲蓄率在 1980年代中期 為最高 (39. 36%, 1986年 ),之後一路下滑,至 2001年 (25. 79%)回穩。 n 台灣的國民儲蓄率在 1970年之後,都在 25% 以上。2011年的國民儲蓄率為 29. 16%。

Taiwan National Saving Rate 係指每年之國民儲蓄毛 額佔 GNP的比重。 n 台灣的國民儲蓄率在 1980年代中期 為最高 (39. 36%, 1986年 ),之後一路下滑,至 2001年 (25. 79%)回穩。 n 台灣的國民儲蓄率在 1970年之後,都在 25% 以上。2011年的國民儲蓄率為 29. 16%。

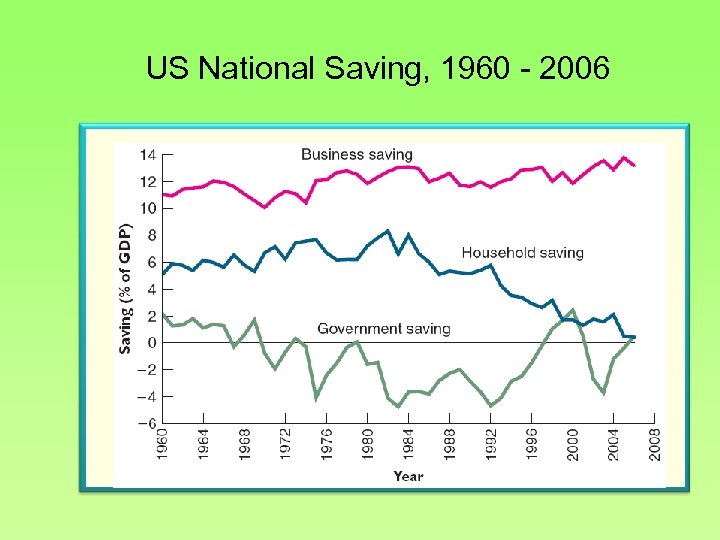

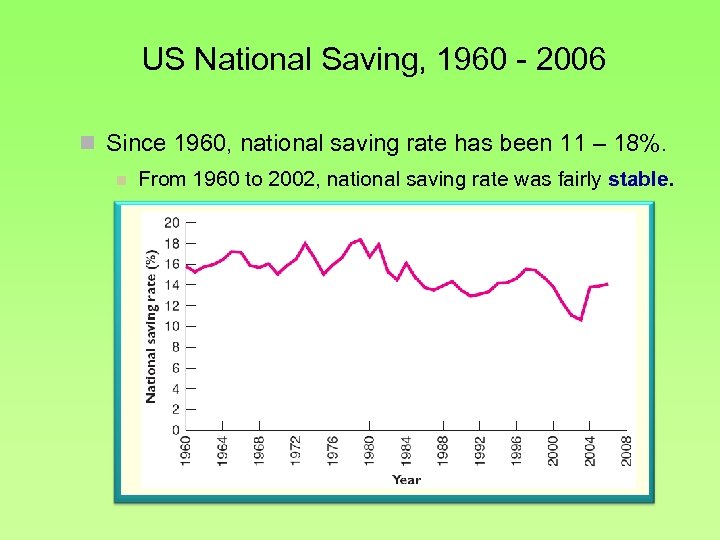

US National Saving, 1960 - 2006 n Since 1960, national saving rate has been 11 – 18%. n From 1960 to 2002, national saving rate was fairly stable.

US National Saving, 1960 - 2006 n Since 1960, national saving rate has been 11 – 18%. n From 1960 to 2002, national saving rate was fairly stable.

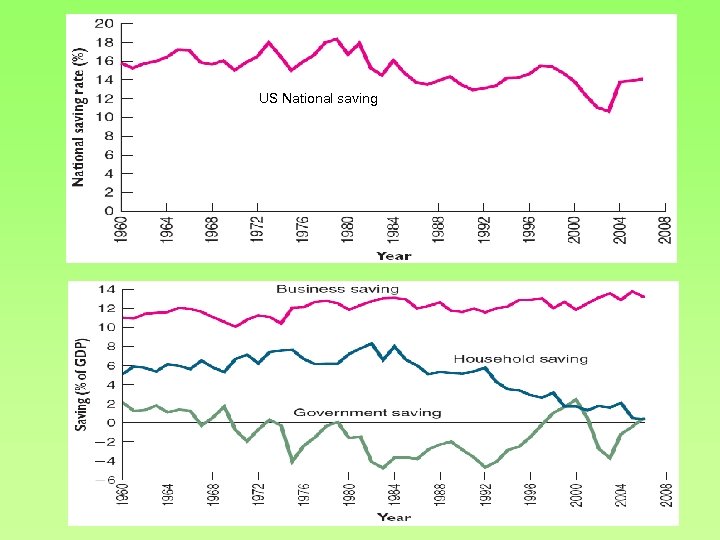

US National saving

US National saving

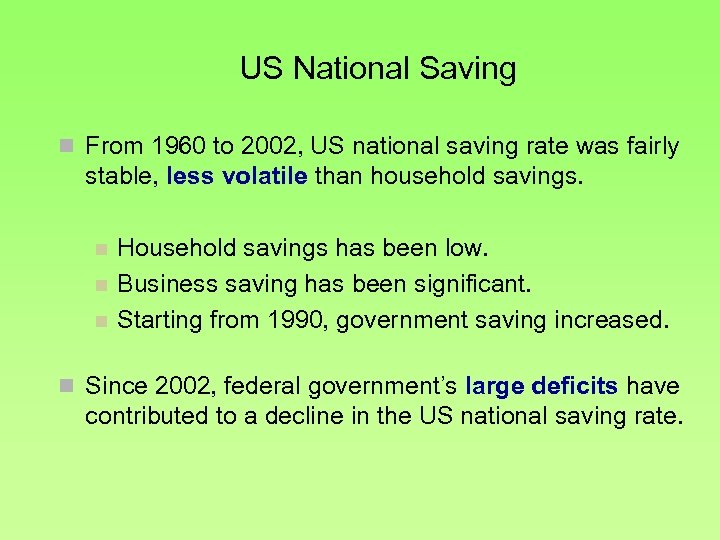

US National Saving n From 1960 to 2002, US national saving rate was fairly stable, less volatile than household savings. n n n Household savings has been low. Business saving has been significant. Starting from 1990, government saving increased. n Since 2002, federal government’s large deficits have contributed to a decline in the US national saving rate.

US National Saving n From 1960 to 2002, US national saving rate was fairly stable, less volatile than household savings. n n n Household savings has been low. Business saving has been significant. Starting from 1990, government saving increased. n Since 2002, federal government’s large deficits have contributed to a decline in the US national saving rate.

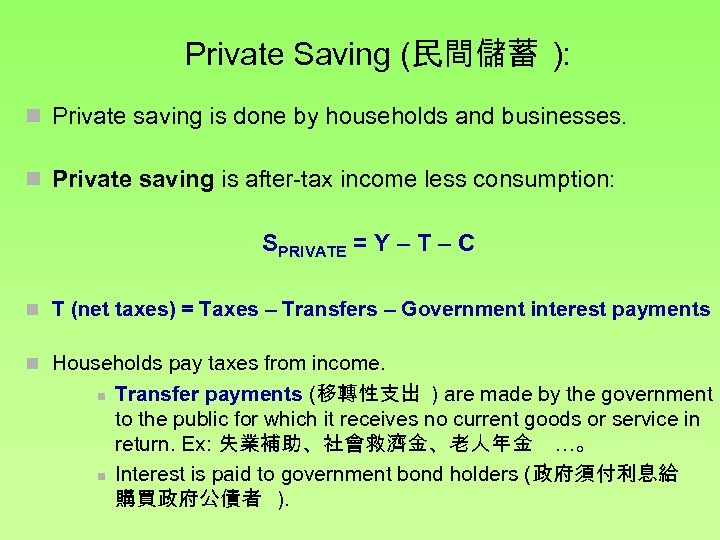

Private Saving (民間儲蓄 ): n Private saving is done by households and businesses. n Private saving is after-tax income less consumption: SPRIVATE = Y – T – C n T (net taxes) = Taxes – Transfers – Government interest payments n Households pay taxes from income. n n Transfer payments (移轉性支出 ) are made by the government to the public for which it receives no current goods or service in return. Ex: 失業補助、社會救濟金、老人年金 …。 Interest is paid to government bond holders (政府須付利息給 購買政府公債者 ).

Private Saving (民間儲蓄 ): n Private saving is done by households and businesses. n Private saving is after-tax income less consumption: SPRIVATE = Y – T – C n T (net taxes) = Taxes – Transfers – Government interest payments n Households pay taxes from income. n n Transfer payments (移轉性支出 ) are made by the government to the public for which it receives no current goods or service in return. Ex: 失業補助、社會救濟金、老人年金 …。 Interest is paid to government bond holders (政府須付利息給 購買政府公債者 ).

Business saving n Business saving is revenues less operating costs less dividends to shareholders. n Business saving can purchase new capital equipment.

Business saving n Business saving is revenues less operating costs less dividends to shareholders. n Business saving can purchase new capital equipment.

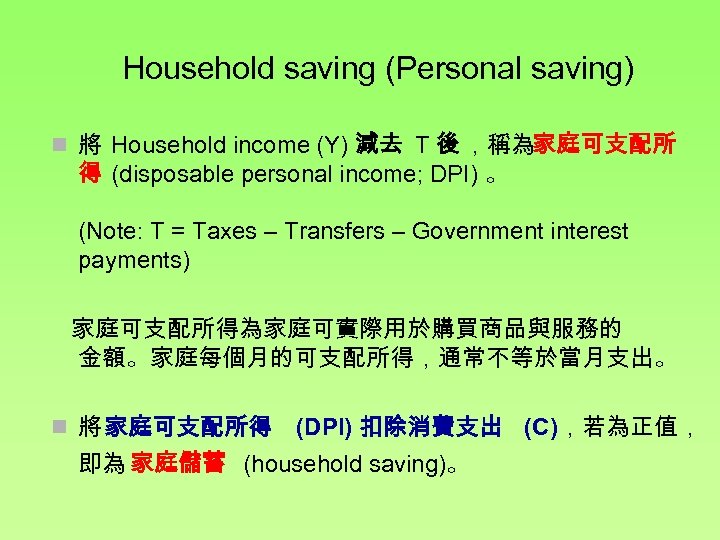

Household saving (Personal saving) n 將 Household income (Y) 減去 T 後 ,稱為家庭可支配所 得 (disposable personal income; DPI) 。 (Note: T = Taxes – Transfers – Government interest payments) 家庭可支配所得為家庭可實際用於購買商品與服務的 金額。家庭每個月的可支配所得,通常不等於當月支出。 n 將 家庭可支配所得 (DPI) 扣除消費支出 (C),若為正值, 即為 家庭儲蓄 (household saving)。

Household saving (Personal saving) n 將 Household income (Y) 減去 T 後 ,稱為家庭可支配所 得 (disposable personal income; DPI) 。 (Note: T = Taxes – Transfers – Government interest payments) 家庭可支配所得為家庭可實際用於購買商品與服務的 金額。家庭每個月的可支配所得,通常不等於當月支出。 n 將 家庭可支配所得 (DPI) 扣除消費支出 (C),若為正值, 即為 家庭儲蓄 (household saving)。

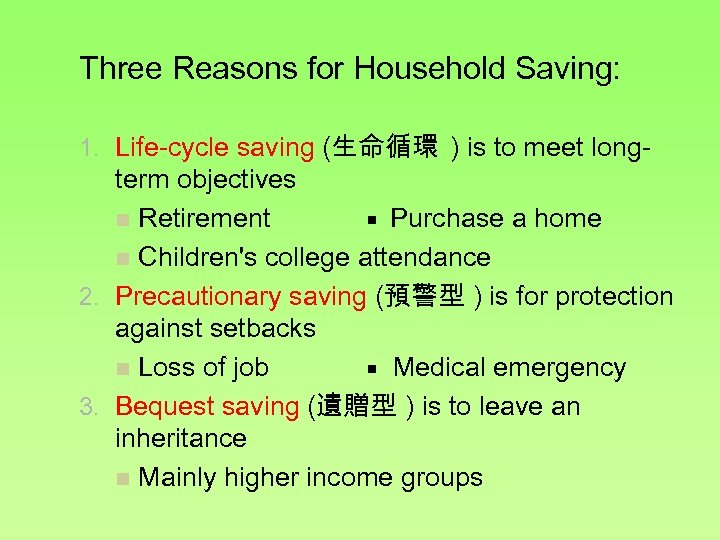

Three Reasons for Household Saving: 1. Life-cycle saving (生命循環 ) is to meet long- term objectives ■ Purchase a home n Retirement n Children's college attendance 2. Precautionary saving (預警型 ) is for protection against setbacks ■ Medical emergency n Loss of job 3. Bequest saving (遺贈型 ) is to leave an inheritance n Mainly higher income groups

Three Reasons for Household Saving: 1. Life-cycle saving (生命循環 ) is to meet long- term objectives ■ Purchase a home n Retirement n Children's college attendance 2. Precautionary saving (預警型 ) is for protection against setbacks ■ Medical emergency n Loss of job 3. Bequest saving (遺贈型 ) is to leave an inheritance n Mainly higher income groups

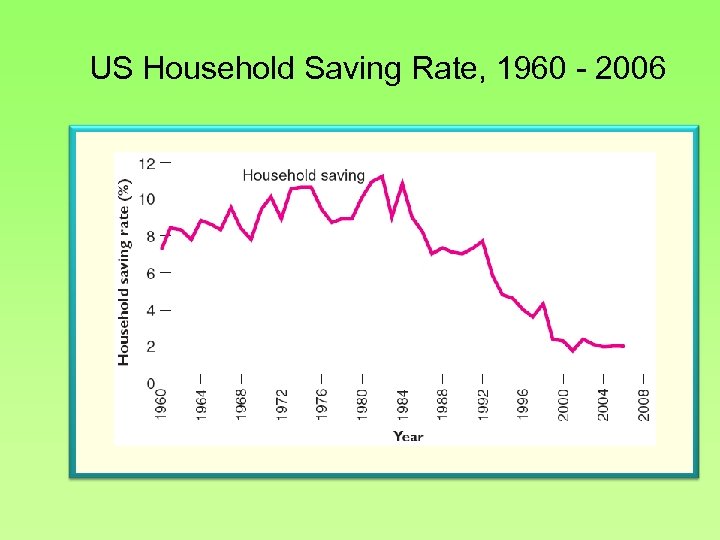

US Household Saving Rate, 1960 - 2006

US Household Saving Rate, 1960 - 2006

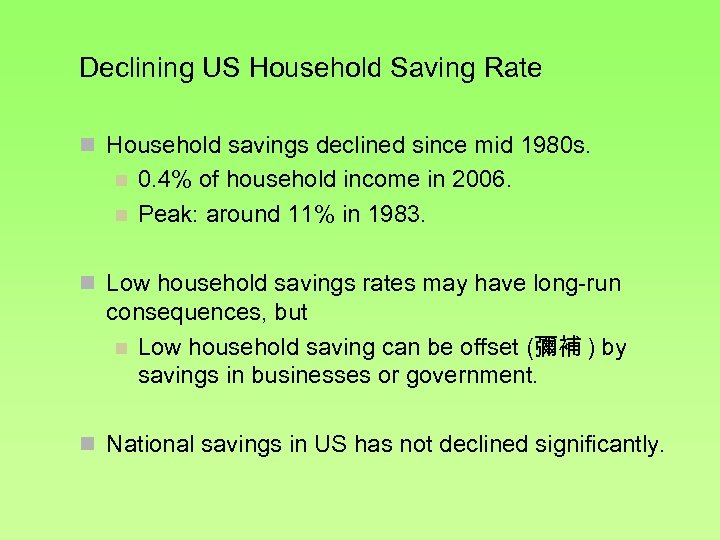

Declining US Household Saving Rate n Household savings declined since mid 1980 s. n n 0. 4% of household income in 2006. Peak: around 11% in 1983. n Low household savings rates may have long-run consequences, but n Low household saving can be offset (彌補 ) by savings in businesses or government. n National savings in US has not declined significantly.

Declining US Household Saving Rate n Household savings declined since mid 1980 s. n n 0. 4% of household income in 2006. Peak: around 11% in 1983. n Low household savings rates may have long-run consequences, but n Low household saving can be offset (彌補 ) by savings in businesses or government. n National savings in US has not declined significantly.

Explaining US Household Savings Rate n Savings rate may be depressed by n n n Social Security, Medicare, and other government programs for the elderly Mortgages with small or no down payment Confidence in a prosperous future Increasing value of stocks and growing home values Demonstration effects (示範效果 )

Explaining US Household Savings Rate n Savings rate may be depressed by n n n Social Security, Medicare, and other government programs for the elderly Mortgages with small or no down payment Confidence in a prosperous future Increasing value of stocks and growing home values Demonstration effects (示範效果 )

Household Saving in Japan: n After World War II, household saving rates were 15 – 25% n Declined after 1990 n Life-cycle motives are important n Long life expectancy n Retire relatively early; long retirement period n Housing prices and down-payment (頭期款 ) requirements were very high n Bequest saving matters; precautionary saving is low.

Household Saving in Japan: n After World War II, household saving rates were 15 – 25% n Declined after 1990 n Life-cycle motives are important n Long life expectancy n Retire relatively early; long retirement period n Housing prices and down-payment (頭期款 ) requirements were very high n Bequest saving matters; precautionary saving is low.

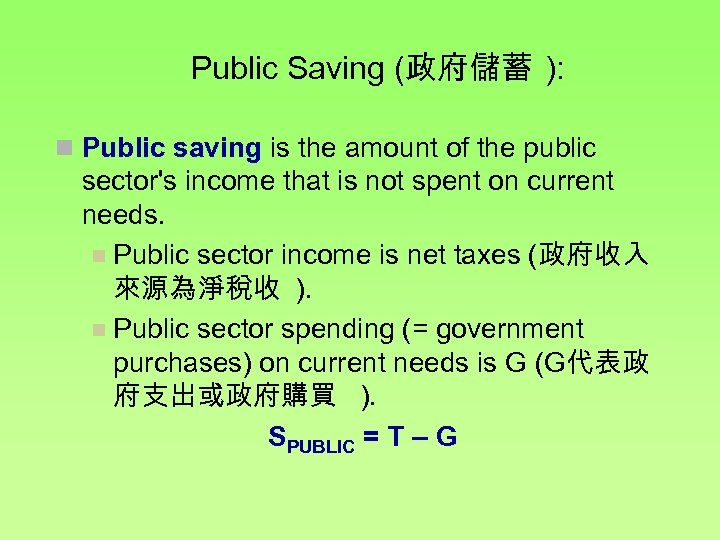

Public Saving (政府儲蓄 ): n Public saving is the amount of the public sector's income that is not spent on current needs. n Public sector income is net taxes (政府收入 來源為淨稅收 ). n Public sector spending (= government purchases) on current needs is G (G代表政 府支出或政府購買 ). SPUBLIC = T – G

Public Saving (政府儲蓄 ): n Public saving is the amount of the public sector's income that is not spent on current needs. n Public sector income is net taxes (政府收入 來源為淨稅收 ). n Public sector spending (= government purchases) on current needs is G (G代表政 府支出或政府購買 ). SPUBLIC = T – G

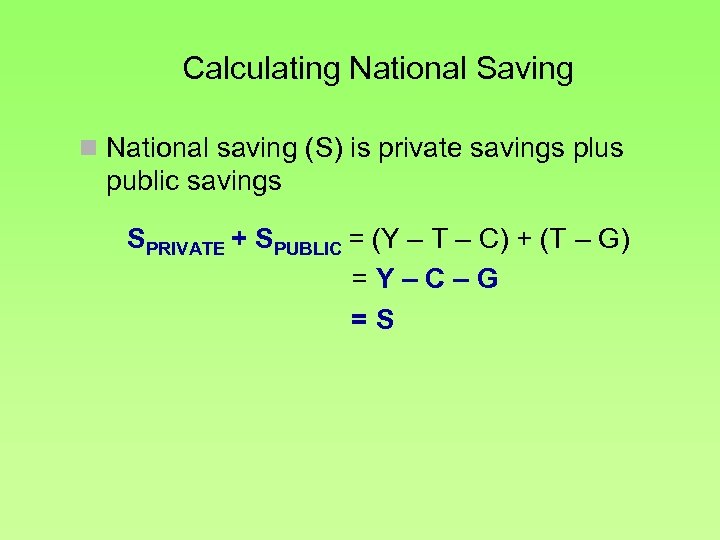

Calculating National Saving n National saving (S) is private savings plus public savings SPRIVATE + SPUBLIC = (Y – T – C) + (T – G) =Y–C–G =S

Calculating National Saving n National saving (S) is private savings plus public savings SPRIVATE + SPUBLIC = (Y – T – C) + (T – G) =Y–C–G =S

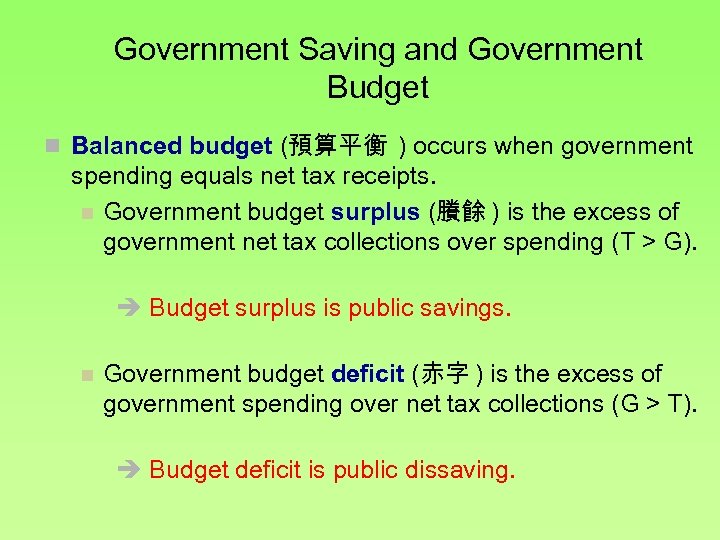

Government Saving and Government Budget n Balanced budget (預算平衡 ) occurs when government spending equals net tax receipts. n Government budget surplus (賸餘 ) is the excess of government net tax collections over spending (T > G). Budget surplus is public savings. n Government budget deficit (赤字 ) is the excess of government spending over net tax collections (G > T). Budget deficit is public dissaving.

Government Saving and Government Budget n Balanced budget (預算平衡 ) occurs when government spending equals net tax receipts. n Government budget surplus (賸餘 ) is the excess of government net tax collections over spending (T > G). Budget surplus is public savings. n Government budget deficit (赤字 ) is the excess of government spending over net tax collections (G > T). Budget deficit is public dissaving.

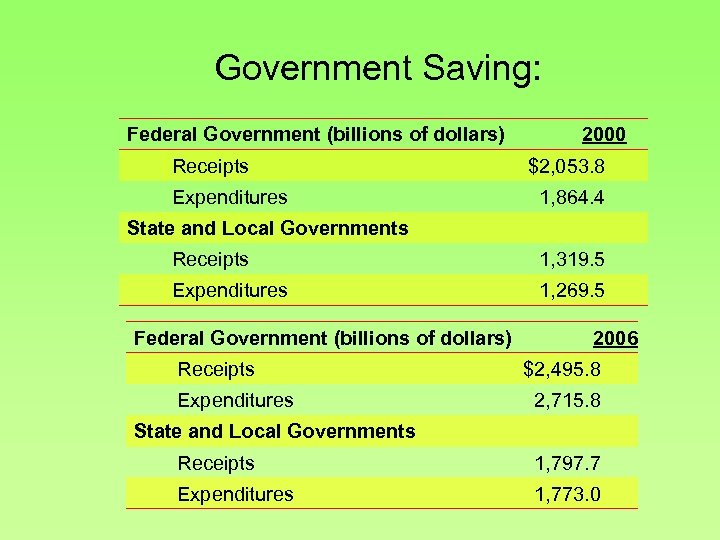

Government Saving: Federal Government (billions of dollars) Receipts Expenditures 2000 $2, 053. 8 1, 864. 4 State and Local Governments Receipts 1, 319. 5 Expenditures 1, 269. 5 Federal Government (billions of dollars) Receipts Expenditures 2006 $2, 495. 8 2, 715. 8 State and Local Governments Receipts 1, 797. 7 Expenditures 1, 773. 0

Government Saving: Federal Government (billions of dollars) Receipts Expenditures 2000 $2, 053. 8 1, 864. 4 State and Local Governments Receipts 1, 319. 5 Expenditures 1, 269. 5 Federal Government (billions of dollars) Receipts Expenditures 2006 $2, 495. 8 2, 715. 8 State and Local Governments Receipts 1, 797. 7 Expenditures 1, 773. 0

From Surplus to Deficit n Three reasons for change in the US government budget: n Government receipts (T) decreased during the 2001 recession n Lower income during recession means lower taxes n Tax (T) reductions during the first Bush term n Government spending (G) increased n Wars in Iraq and Afghanistan n Homeland Security

From Surplus to Deficit n Three reasons for change in the US government budget: n Government receipts (T) decreased during the 2001 recession n Lower income during recession means lower taxes n Tax (T) reductions during the first Bush term n Government spending (G) increased n Wars in Iraq and Afghanistan n Homeland Security

Saving and the Real Interest Rate n Savings often take the form of financial assets that pay a return n Interest-bearing checking Savings Mutual funds ■ ■ ■ Bonds CDs Stocks n The real interest rate (r) is the nominal interest rate (i) minus the rate of inflation ( ) I=r+ The real interest rate is the reward for saving.

Saving and the Real Interest Rate n Savings often take the form of financial assets that pay a return n Interest-bearing checking Savings Mutual funds ■ ■ ■ Bonds CDs Stocks n The real interest rate (r) is the nominal interest rate (i) minus the rate of inflation ( ) I=r+ The real interest rate is the reward for saving.

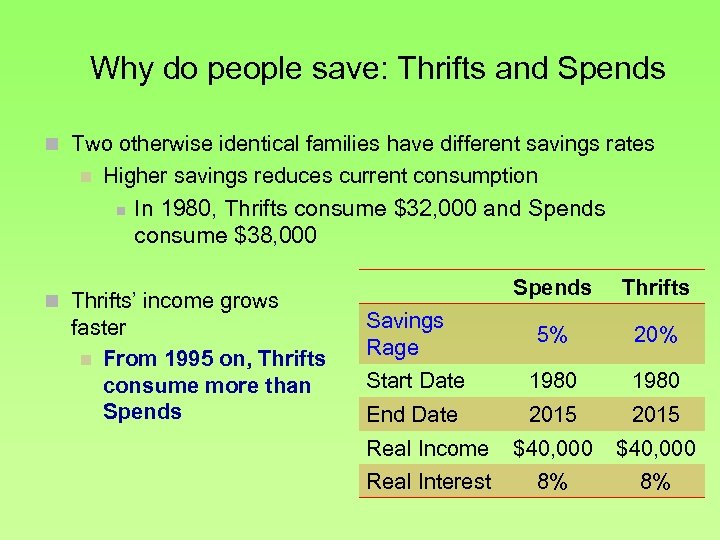

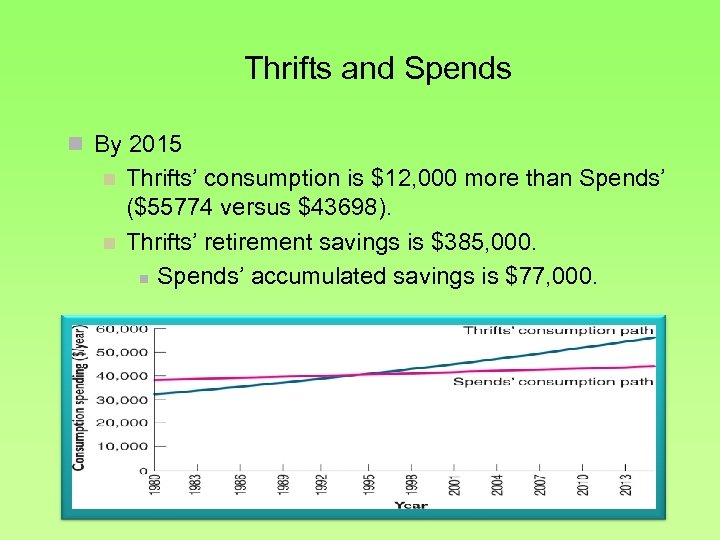

Why do people save: Thrifts and Spends n Two otherwise identical families have different savings rates n Higher savings reduces current consumption n In 1980, Thrifts consume $32, 000 and Spends consume $38, 000 n Thrifts’ income grows faster n From 1995 on, Thrifts consume more than Spends Thrifts 5% 20% Start Date 1980 End Date 2015 Real Income $40, 000 Real Interest 8% 8% Savings Rage

Why do people save: Thrifts and Spends n Two otherwise identical families have different savings rates n Higher savings reduces current consumption n In 1980, Thrifts consume $32, 000 and Spends consume $38, 000 n Thrifts’ income grows faster n From 1995 on, Thrifts consume more than Spends Thrifts 5% 20% Start Date 1980 End Date 2015 Real Income $40, 000 Real Interest 8% 8% Savings Rage

Thrifts and Spends n By 2015 n n Thrifts’ consumption is $12, 000 more than Spends’ ($55774 versus $43698). Thrifts’ retirement savings is $385, 000. n Spends’ accumulated savings is $77, 000.

Thrifts and Spends n By 2015 n n Thrifts’ consumption is $12, 000 more than Spends’ ($55774 versus $43698). Thrifts’ retirement savings is $385, 000. n Spends’ accumulated savings is $77, 000.

Saving and Self-Control n Psychologists suggest individual self-control may be too weak to produce rational outcomes n Smoking, obesity, gambling, and spending n Easy borrowing supports high levels of current spending n Credit cards n Home equity loans

Saving and Self-Control n Psychologists suggest individual self-control may be too weak to produce rational outcomes n Smoking, obesity, gambling, and spending n Easy borrowing supports high levels of current spending n Credit cards n Home equity loans

http: //www. bankofamerica. com/deposits/checksave/index. cfm? template=save_overview

http: //www. bankofamerica. com/deposits/checksave/index. cfm? template=save_overview

n Deposit interest rates: 2010 Q 3 (Source: IMF) Euro Area Austria Belgium Cyprus Finland France Germany Greece Ireland Italy Luxembourg Netherlands Portugal Australia Canada Hong Kong Israel Japan Korea New Zealand Singapore United States 2. 26 1. 03 0. 79 3. 94 1. 56 1. 68 1. 06 3. 65 2. 85 1. 42 0. 70 2. 42 1. 82 4. 32 0. 05 0. 01 1. 65 0. 44 3. 83 4. 66 0. 20 0. 34

n Deposit interest rates: 2010 Q 3 (Source: IMF) Euro Area Austria Belgium Cyprus Finland France Germany Greece Ireland Italy Luxembourg Netherlands Portugal Australia Canada Hong Kong Israel Japan Korea New Zealand Singapore United States 2. 26 1. 03 0. 79 3. 94 1. 56 1. 68 1. 06 3. 65 2. 85 1. 42 0. 70 2. 42 1. 82 4. 32 0. 05 0. 01 1. 65 0. 44 3. 83 4. 66 0. 20 0. 34

Investment and Capital Formation n Investment is the creation of new capital goods and housing n Firms buy new capital to increase profits n n n Cost – Benefit Principle (成本效益法則 ) Cost is the spending of using the machine or other capital Benefit is the value of the marginal product of the capital (MPC)

Investment and Capital Formation n Investment is the creation of new capital goods and housing n Firms buy new capital to increase profits n n n Cost – Benefit Principle (成本效益法則 ) Cost is the spending of using the machine or other capital Benefit is the value of the marginal product of the capital (MPC)

Larry and the Lawn Mower n Larry's lawn care business plan Cost of lawn mower = $4, 000 n Interest on loan = 6% n Assume the mower can be resold for $4, 000 n Net revenue = $6, 000 per summer n Taxes = 20% n Larry could earn $4, 400 per summer after tax working elsewhere n Cost – Benefit Principle help us to check whether Larry should start the business n

Larry and the Lawn Mower n Larry's lawn care business plan Cost of lawn mower = $4, 000 n Interest on loan = 6% n Assume the mower can be resold for $4, 000 n Net revenue = $6, 000 per summer n Taxes = 20% n Larry could earn $4, 400 per summer after tax working elsewhere n Cost – Benefit Principle help us to check whether Larry should start the business n

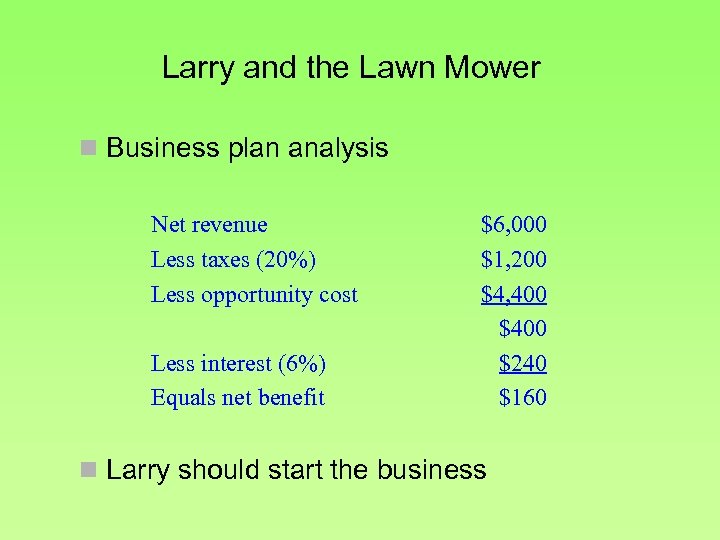

Larry and the Lawn Mower n Business plan analysis Net revenue Less taxes (20%) Less opportunity cost Less interest (6%) Equals net benefit $6, 000 $1, 200 $4, 400 $240 $160 n Larry should start the business

Larry and the Lawn Mower n Business plan analysis Net revenue Less taxes (20%) Less opportunity cost Less interest (6%) Equals net benefit $6, 000 $1, 200 $4, 400 $240 $160 n Larry should start the business

The Investment Decision n Factors that increase the willingness to invest: n n n A decline in the price of the capital goods A decline in the real interest rates n Opportunity cost of the investment Technical innovation that increases the value of the marginal product of the capital (MPC) Lower taxes Higher price of the goods

The Investment Decision n Factors that increase the willingness to invest: n n n A decline in the price of the capital goods A decline in the real interest rates n Opportunity cost of the investment Technical innovation that increases the value of the marginal product of the capital (MPC) Lower taxes Higher price of the goods

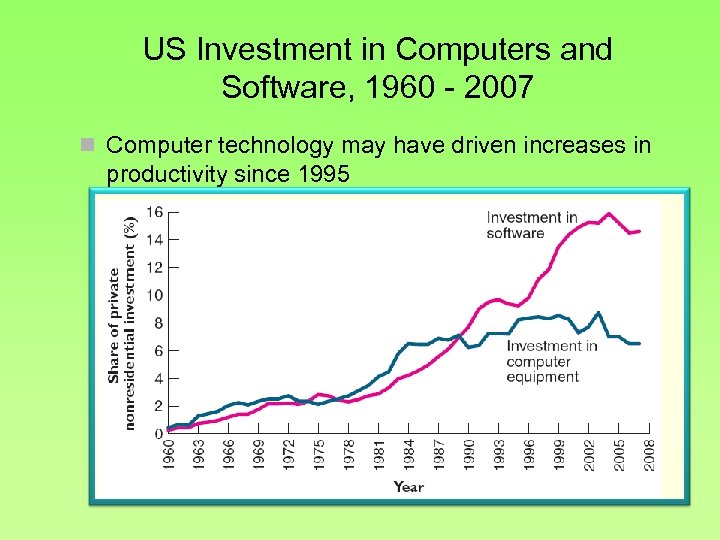

US Investment in Computers and Software, 1960 - 2007 n Computer technology may have driven increases in productivity since 1995

US Investment in Computers and Software, 1960 - 2007 n Computer technology may have driven increases in productivity since 1995

Saving, Investment, and Financial Markets n Saving is supplied by households, firms, and the government. n Saving is demanded by borrowers wishing to invest. n Supply of saving (S) increases as the real interest rate (r) increases because increases in interest rates stimulate saving. n The supply of saving curve is upward-sloping. n Demand for investment (I) decreases as the real interest rate (r) increases because higher real interest rate raise the cost of borrowing, and reduce firms’ willingness to invest. n The demand for investment curve is downward-sloping.

Saving, Investment, and Financial Markets n Saving is supplied by households, firms, and the government. n Saving is demanded by borrowers wishing to invest. n Supply of saving (S) increases as the real interest rate (r) increases because increases in interest rates stimulate saving. n The supply of saving curve is upward-sloping. n Demand for investment (I) decreases as the real interest rate (r) increases because higher real interest rate raise the cost of borrowing, and reduce firms’ willingness to invest. n The demand for investment curve is downward-sloping.

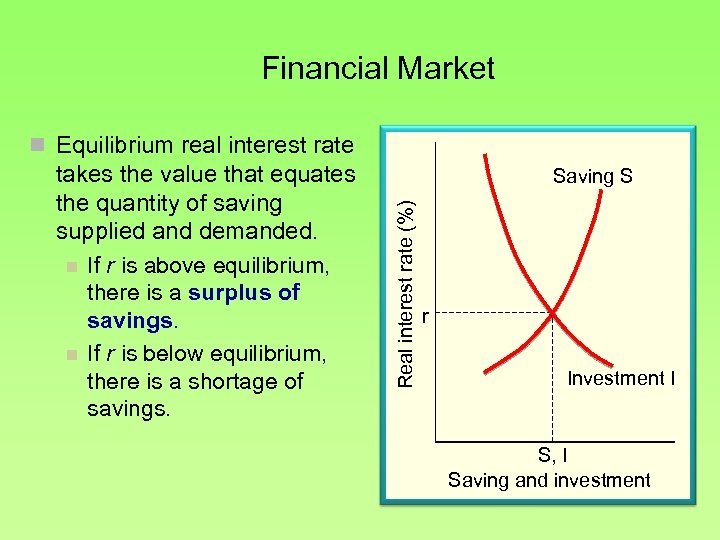

Financial Market n Equilibrium real interest rate Saving S Real interest rate (%) takes the value that equates the quantity of saving supplied and demanded. n If r is above equilibrium, there is a surplus of savings. n If r is below equilibrium, there is a shortage of savings. r Investment I S, I Saving and investment

Financial Market n Equilibrium real interest rate Saving S Real interest rate (%) takes the value that equates the quantity of saving supplied and demanded. n If r is above equilibrium, there is a surplus of savings. n If r is below equilibrium, there is a shortage of savings. r Investment I S, I Saving and investment

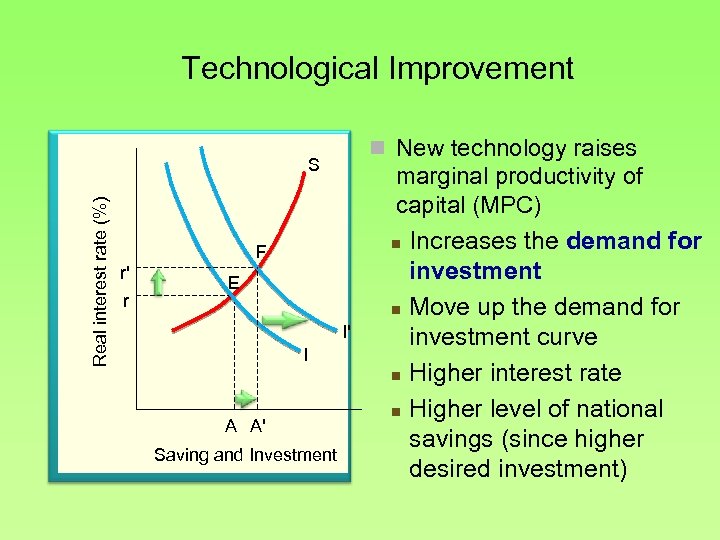

Technological Improvement n New technology raises Real interest rate (%) S F r' r E I' I A A' Saving and Investment marginal productivity of capital (MPC) n Increases the demand for investment n Move up the demand for investment curve n Higher interest rate n Higher level of national savings (since higher desired investment)

Technological Improvement n New technology raises Real interest rate (%) S F r' r E I' I A A' Saving and Investment marginal productivity of capital (MPC) n Increases the demand for investment n Move up the demand for investment curve n Higher interest rate n Higher level of national savings (since higher desired investment)

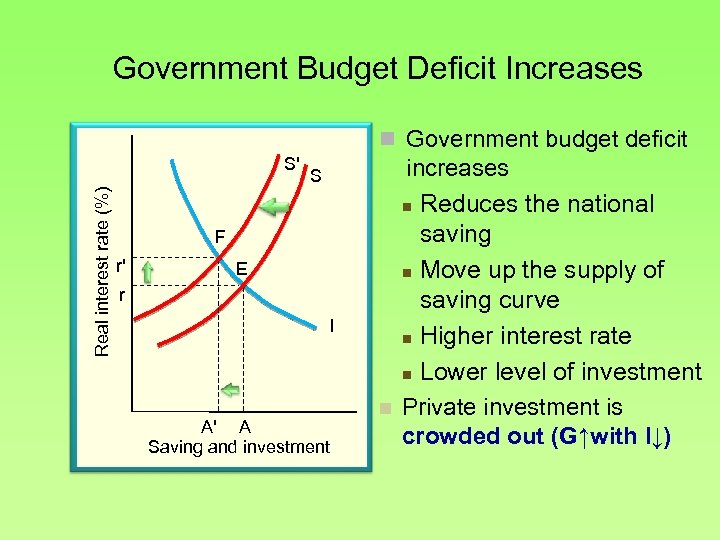

Government Budget Deficit Increases n Government budget deficit Real interest rate (%) S' S F r' E r I A' A Saving and investment n increases n Reduces the national saving n Move up the supply of saving curve n Higher interest rate n Lower level of investment Private investment is crowded out (G↑with I↓)

Government Budget Deficit Increases n Government budget deficit Real interest rate (%) S' S F r' E r I A' A Saving and investment n increases n Reduces the national saving n Move up the supply of saving curve n Higher interest rate n Lower level of investment Private investment is crowded out (G↑with I↓)

How to Increase National Saving n Policymakers know the benefits of increased national saving rates. n Reducing government budget deficit would increase national saving. n Increase saving incentives for households. n Reduce Federal consumption tax. n Reduce taxes on dividends and investment income. n Higher national saving rate leads to greater investment in new capital goods and a higher standard of living.

How to Increase National Saving n Policymakers know the benefits of increased national saving rates. n Reducing government budget deficit would increase national saving. n Increase saving incentives for households. n Reduce Federal consumption tax. n Reduce taxes on dividends and investment income. n Higher national saving rate leads to greater investment in new capital goods and a higher standard of living.

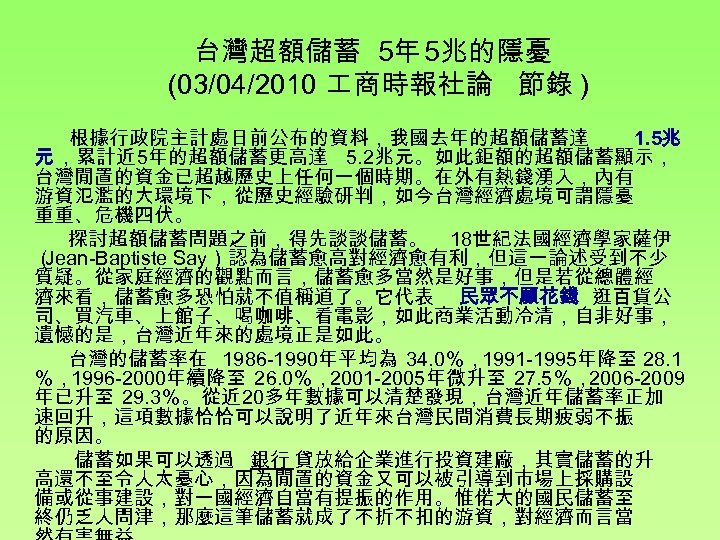

台灣超額儲蓄 5年 5兆的隱憂 (03/04/2010 商時報社論 節錄 ) 根據行政院主計處日前公布的資料,我國去年的超額儲蓄達 1. 5兆 元 ,累計近 5年的超額儲蓄更高達 5. 2兆元。如此鉅額的超額儲蓄顯示, 台灣閒置的資金已超越歷史上任何一個時期。在外有熱錢湧入,內有 游資氾濫的大環境下,從歷史經驗研判,如今台灣經濟處境可謂隱憂 重重、危機四伏。 探討超額儲蓄問題之前,得先談談儲蓄。 18世紀法國經濟學家薩伊 ( Jean-Baptiste Say)認為儲蓄愈高對經濟愈有利,但這一論述受到不少 質疑。從家庭經濟的觀點而言,儲蓄愈多當然是好事,但是若從總體經 濟來看,儲蓄愈多恐怕就不值稱道了。它代表 民眾不願花錢 逛百貨公 司、買汽車、上館子、喝咖啡、看電影,如此商業活動冷清,自非好事, 遺憾的是,台灣近年來的處境正是如此。 台灣的儲蓄率在 1986 -1990年平均為 34. 0%,1991 -1995年降至 28. 1 %,1996 -2000年續降至 26. 0%,2001 -2005年微升至 27. 5%,2006 -2009 年已升至 29. 3%。從近 20多年數據可以清楚發現,台灣近年儲蓄率正加 速回升,這項數據恰恰可以說明了近年來台灣民間消費長期疲弱不振 的原因。 儲蓄如果可以透過 銀行 貸放給企業進行投資建廠,其實儲蓄的升 高還不至令人太憂心,因為閒置的資金又可以被引導到市場上採購設 備或從事建設,對一國經濟自當有提振的作用。惟偌大的國民儲蓄至 終仍乏人問津,那麼這筆儲蓄就成了不折不扣的游資,對經濟而言當

台灣超額儲蓄 5年 5兆的隱憂 (03/04/2010 商時報社論 節錄 ) 根據行政院主計處日前公布的資料,我國去年的超額儲蓄達 1. 5兆 元 ,累計近 5年的超額儲蓄更高達 5. 2兆元。如此鉅額的超額儲蓄顯示, 台灣閒置的資金已超越歷史上任何一個時期。在外有熱錢湧入,內有 游資氾濫的大環境下,從歷史經驗研判,如今台灣經濟處境可謂隱憂 重重、危機四伏。 探討超額儲蓄問題之前,得先談談儲蓄。 18世紀法國經濟學家薩伊 ( Jean-Baptiste Say)認為儲蓄愈高對經濟愈有利,但這一論述受到不少 質疑。從家庭經濟的觀點而言,儲蓄愈多當然是好事,但是若從總體經 濟來看,儲蓄愈多恐怕就不值稱道了。它代表 民眾不願花錢 逛百貨公 司、買汽車、上館子、喝咖啡、看電影,如此商業活動冷清,自非好事, 遺憾的是,台灣近年來的處境正是如此。 台灣的儲蓄率在 1986 -1990年平均為 34. 0%,1991 -1995年降至 28. 1 %,1996 -2000年續降至 26. 0%,2001 -2005年微升至 27. 5%,2006 -2009 年已升至 29. 3%。從近 20多年數據可以清楚發現,台灣近年儲蓄率正加 速回升,這項數據恰恰可以說明了近年來台灣民間消費長期疲弱不振 的原因。 儲蓄如果可以透過 銀行 貸放給企業進行投資建廠,其實儲蓄的升 高還不至令人太憂心,因為閒置的資金又可以被引導到市場上採購設 備或從事建設,對一國經濟自當有提振的作用。惟偌大的國民儲蓄至 終仍乏人問津,那麼這筆儲蓄就成了不折不扣的游資,對經濟而言當

為檢驗一國游資到底有多少,因此國民所得統計會以 儲蓄毛額減去投 資毛額 加以衡量,所得到的數據即稱為「 超額儲蓄 」。超額儲蓄為零,就表 示儲蓄被充份運用,社會上沒有閒置的游資;若超額儲蓄升高,就代表一 國的資金沒有被有效使用,是嚴重的警訊。 … … 如今台灣連年超額儲蓄狂升。超額儲蓄在去年升至 1. 5兆元,超額儲蓄 率升至 11. 5%,創下近 22年以來最高,並且近 5年的超額儲蓄累計已逾 5兆 元。以此觀察,今天台灣「超額儲蓄率」升高的情況與 1984 -1987年極為雷同, 這麼龐大的閒置資金,無疑對台灣經濟社會同樣將帶來嚴重的經濟風險, 政府決策高層,不能不防。 台灣超額儲蓄這麼多,到底是什麼原因造成的,是景氣因素?或是來 自結構性的因素?我們認為, 結構性因素 才是導致台灣超額儲蓄升高的根 本原因。雖然有幾年確實是因為景氣低迷導致消費、投資不振,從而使得 超額儲蓄升高,但是這並非根本原因。造成超額儲蓄升高的根本原因,在 於台灣 貧富差距 近年來急速擴大。 台灣的儲蓄率升高,其實只是 富有家庭儲蓄升高 所致,龐大的中產家 庭儲蓄這些年反而持續下滑。以五等分位家庭儲蓄情況觀察,最有錢的第 五等分位在 2008年的平均每戶儲蓄(當年可支配所得扣除消費支出後的餘 額)達 68萬元,儲蓄率高達 36. 9%,而最低所得家庭 10年前每年仍可儲蓄 2 萬元,如今已入不敷出,需舉債才能生活。其餘中產家庭的儲蓄也都比 10 年前少了 2成到 5成。總體儲蓄的分配如此不均,占經濟消費份額最高的中 產家庭自然難以如 10年前一般盡情的消費,如此民間消費自然低迷,儲蓄 及超額儲蓄又豈能不升高? 台灣這些年來財富集中,所得分配不均的情況日趨嚴重,這不但是一 個社會正義的問題,更是攸關台灣經濟能否穩定成長的問題。如今全球熱 錢虎視眈眈於外,而超額儲蓄氾濫於內,內憂外患不容小覷。決策當局應

為檢驗一國游資到底有多少,因此國民所得統計會以 儲蓄毛額減去投 資毛額 加以衡量,所得到的數據即稱為「 超額儲蓄 」。超額儲蓄為零,就表 示儲蓄被充份運用,社會上沒有閒置的游資;若超額儲蓄升高,就代表一 國的資金沒有被有效使用,是嚴重的警訊。 … … 如今台灣連年超額儲蓄狂升。超額儲蓄在去年升至 1. 5兆元,超額儲蓄 率升至 11. 5%,創下近 22年以來最高,並且近 5年的超額儲蓄累計已逾 5兆 元。以此觀察,今天台灣「超額儲蓄率」升高的情況與 1984 -1987年極為雷同, 這麼龐大的閒置資金,無疑對台灣經濟社會同樣將帶來嚴重的經濟風險, 政府決策高層,不能不防。 台灣超額儲蓄這麼多,到底是什麼原因造成的,是景氣因素?或是來 自結構性的因素?我們認為, 結構性因素 才是導致台灣超額儲蓄升高的根 本原因。雖然有幾年確實是因為景氣低迷導致消費、投資不振,從而使得 超額儲蓄升高,但是這並非根本原因。造成超額儲蓄升高的根本原因,在 於台灣 貧富差距 近年來急速擴大。 台灣的儲蓄率升高,其實只是 富有家庭儲蓄升高 所致,龐大的中產家 庭儲蓄這些年反而持續下滑。以五等分位家庭儲蓄情況觀察,最有錢的第 五等分位在 2008年的平均每戶儲蓄(當年可支配所得扣除消費支出後的餘 額)達 68萬元,儲蓄率高達 36. 9%,而最低所得家庭 10年前每年仍可儲蓄 2 萬元,如今已入不敷出,需舉債才能生活。其餘中產家庭的儲蓄也都比 10 年前少了 2成到 5成。總體儲蓄的分配如此不均,占經濟消費份額最高的中 產家庭自然難以如 10年前一般盡情的消費,如此民間消費自然低迷,儲蓄 及超額儲蓄又豈能不升高? 台灣這些年來財富集中,所得分配不均的情況日趨嚴重,這不但是一 個社會正義的問題,更是攸關台灣經濟能否穩定成長的問題。如今全球熱 錢虎視眈眈於外,而超額儲蓄氾濫於內,內憂外患不容小覷。決策當局應

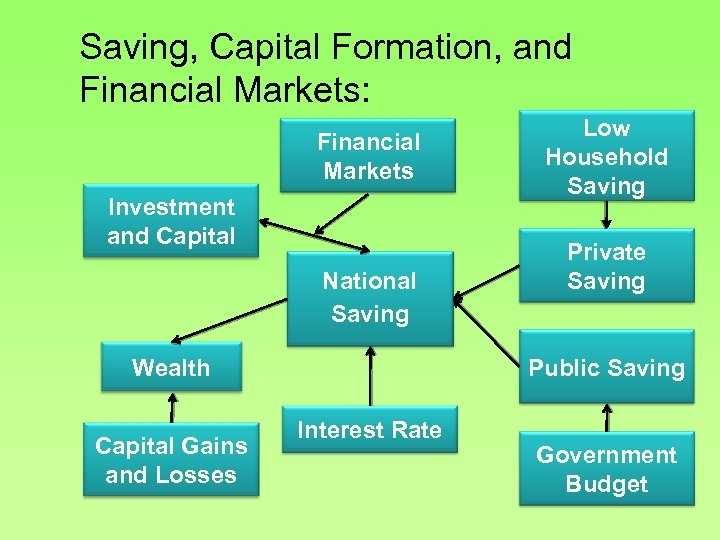

Saving, Capital Formation, and Financial Markets: Financial Markets Investment and Capital National Saving Private Saving Public Saving Wealth Capital Gains and Losses Low Household Saving Interest Rate Government Budget

Saving, Capital Formation, and Financial Markets: Financial Markets Investment and Capital National Saving Private Saving Public Saving Wealth Capital Gains and Losses Low Household Saving Interest Rate Government Budget