08072cb429dade8cf60fe36b01a62da2.ppt

- Количество слайдов: 56

Chapter 20 Options Websites: www. asx. com. au Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -1

Learning objectives • Understand the structure and operation of option contracts and the types available • Explain the profit and loss payoff profiles of call and put option contracts • Describe the structure and organisation of international and Australian options markets • Explain the factors affecting the price of options • Develop options strategies for hedging price risk • Discuss the advantages and disadvantages of option contracts in managing risk Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -2

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -3

20. 1 The nature of options • Options differ from futures because they provide asymmetric cover against price movements • Options limit the effects of adverse price movements without reducing profits from favourable price movements • Options involve the payment of a premium by the buyer to the seller (writer) (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -4

20. 1 The nature of options (cont. ) • An option gives the buyer the right, but not the obligation, to buy or sell a specified commodity or financial instrument at a predetermined price (exercise or strike price), on or before a specified date (expiration date) • An option will be exercised only if it is in the buyer’s best interests (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -5

20. 1 The nature of options (cont. ) • Types of options – Call options § Give the option buyer the right to buy the commodity or instrument at the exercise price – Put options § Give the buyer the right to sell the commodity or instrument at the exercise price • Options can be exercised either: – only on expiration date (European); or – any time up to expiration date (American) (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -6

20. 1 The nature of options (cont. ) • Premium – The price paid by an option buyer to the writer (seller) of the option • Exercise price or strike price – The price specified in an options contract at which the option buyer can buy or sell Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -7

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -8

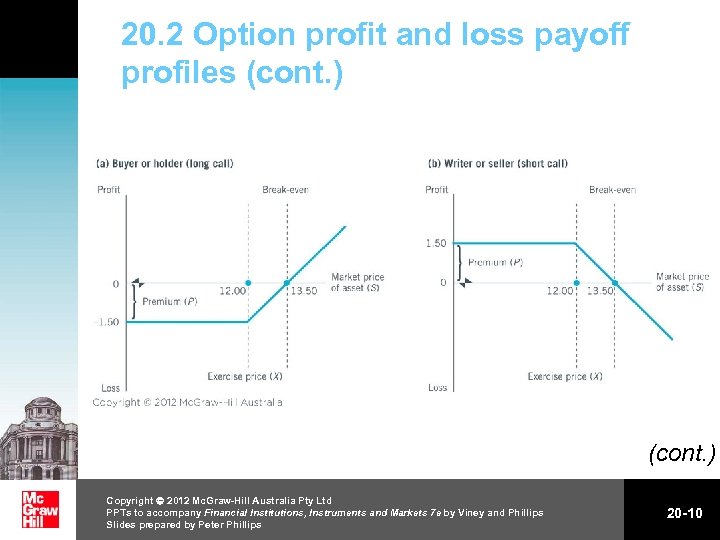

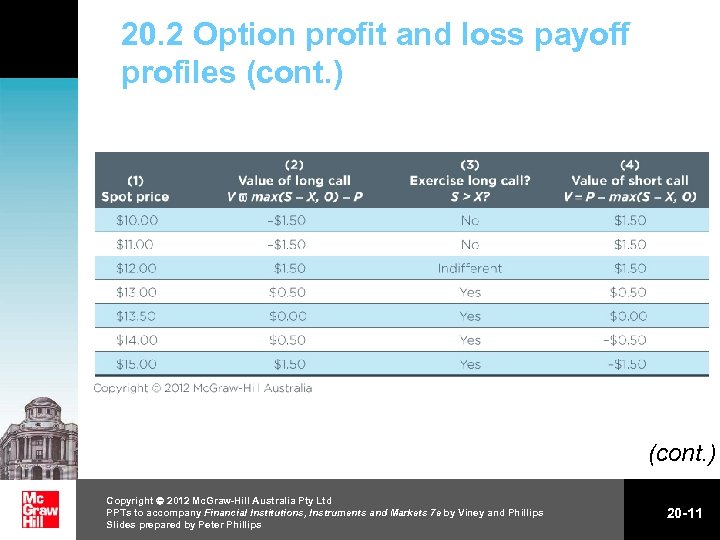

20. 2 Option profit and loss payoff profiles • Call option profit and loss payoff profiles – Example: a call option for shares in a listed company at a strike or exercise price (X) of $12, and a premium (P) of $1. 50 § Figure 20. 1 indicates the profit and loss profiles of a call option for (a) the buyer or holder (long call) and (b) the writer or seller (short call) § The critical break points of the market price of the share (S) at expiration date are <$12, $12 to $13. 50 and >$13. 50 § If S (market price of asset) > X (i. e. > $12) , option is ‘in the money’ (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -9

20. 2 Option profit and loss payoff profiles (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -10

20. 2 Option profit and loss payoff profiles (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -11

20. 2 Option profit and loss payoff profiles (cont. ) • Call option profit and loss payoff profiles (cont. ) – The value of the option to the buyer or holder (long call party) is: – V = max(S - X, 0) - P – The value of the option to the writer (short call party) is: V = P - max(S - X, 0) (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -12

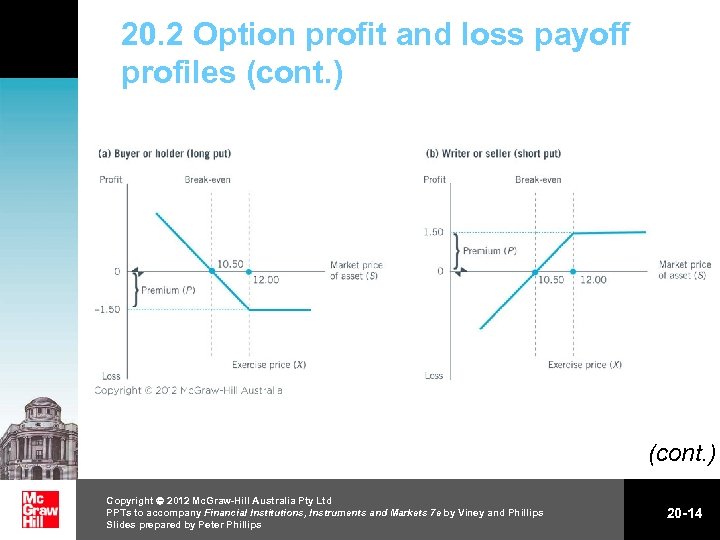

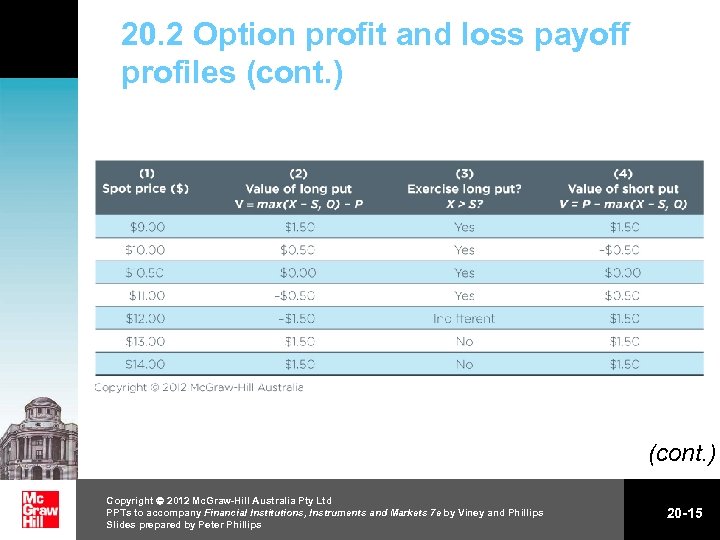

20. 2 Option profit and loss payoff profiles (cont. ) • Put option profit and loss payoff profiles – Example: a put option for shares in a listed company at a strike or exercise price (X) of $12, and premium (P) of $1. 50 § Figure 20. 2 indicates the profit and loss profiles of a put option for (a) the buyer or holder (long put) and (b) the writer or seller (short put) § The critical break points of the market price of the share (S) at expiration date are <$10. 50, $10. 50 to $12 and >$12 § Buyer exercises option if S < X (i. e. < $12) (cont. ) Copyright 2009 Mc. Graw-Hill Australia Pty Ltd Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Financial Institutions, Instruments and Markets 6 e by Viney PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Anthonyprepared by Peter Phillips Slides Stanger 2013 20 -13

20. 2 Option profit and loss payoff profiles (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -14

20. 2 Option profit and loss payoff profiles (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -15

20. 2 Option profit and loss payoff profiles (cont. ) • Put option profit and loss payoff profiles (cont. ) – The value of the option to the buyer or holder (long put party) is: – V = max(X - S, 0) - P – The value of the option to the writer (or short put party) is: – V = P - max(X - S, 0) (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -16

20. 2 Option profit and loss payoff profiles (cont. ) • Covered and naked options – Unlike the case with futures, the risk of loss for a buyer of an option contract is limited to the premium – However, sellers (writers) of options have potentially unlimited risk and may be subject to margin requirements unless they write a covered option § I. e. the writer of an option holds the underlying asset or provides a financial guarantee (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -17

20. 2 Option profit and loss payoff profiles (cont. ) • Covered and naked options (cont. ) – The writer of a call option has written a covered option if the writer either: § owns sufficient of the underlying asset to satisfy the option contract if exercised; or § is also the holder of a call option on the same asset, but with a lower exercise price – The writer of a put option has written a covered option if the writer is also the holder of a put option on the same asset, but with a higher exercise price Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -18

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -19

20. 3 Organisation of the market • Option markets are categorised as: – Over the counter – Exchange-traded § These are recorded through a clearing house § Clearing house acts as counterparty to buyer and seller, thus creating two options contracts through the process of ‘novation’ § The clearing house allows buyers and sellers to close out (i. e. reverse) their contracts (cont. ) Copyright 2009 Mc. Graw-Hill Australia Pty Ltd Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Financial Institutions, Instruments and Markets 6 e by Viney PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Anthonyprepared by Peter Phillips Slides Stanger 2020 20 -20

20. 3 Organisation of the market (cont. ) • International options markets – An exchange in a particular country will usually specialise in option contracts that are directly related to physical or futures market products also traded in that particular country – Trading on international exchanges varies § The largest exchanges, the Chicago Board of Trade (CBOT) and Chicago Mercantile Exchange (CME), retain open-outcry trading on the floor involving 4000 to 5000 people – International links between exchanges allow 24 -hour trading (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -21

20. 3 Organisation of the market (cont. ) • The Australian options markets – Types of options traded § § § Options on futures contracts Share options Low-exercise-price options Warrants Over-the-counter options (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -22

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Options on futures contracts § Traded on the ASX § Buyer of options contract has the right to buy (call) or sell (put) a futures contract § Options on futures available for: • • 90 -day bank-accepted bills SPI 200 index futures contract three-year and 10 -year Commonwealth Treasury bonds overnight options on the above Treasury bonds and share price index futures contracts (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -23

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Share options § Traded on the ASX § Based on ordinary shares of specified listed companies § Usually three or more options contracts for each company, each with identical expiration dates but different exercise prices § The options clearing house maintains a system of deposits, maintenance margins and a share scrip depository (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -24

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Low exercise price options (LEPOs) § Traded on the ASX since 2005 § A highly leveraged option on individual stocks, with an exercise price between 1 and 10 cents, and a premium similar to the price of the underlying stock § Exercisable only at expiration date (i. e. European) § Available over a range of high-liquidity stocks listed on the ASX (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -25

20. 3 Organisation of the market (cont. ) • Australian options market (cont. ) – Warrants § An options contract (i. e. contractual right but not obligation to buy or sell an underlying asset) § Two classes of warrants • Equity warrants attached to debt issues made by companies raising funds through primary market debt issues – Option to convert debt to ordinary shares of the issuing company (discussed in Chapter 5) (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -26

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Warrants (cont. ) § Two classes of warrants (cont. ) • Warrants issued as financial products for investment and to manage risk exposure to price movements in the market – – Issued by financial institutions American- or European-type contracts Traded on ASX Trade, the ASX’s electronic trading system Settlement of contracts through ASX Trade (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -27

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Warrants (cont. ) § Warrants issued as financial products • Fractional warrants – Cover only a part or a fraction of a listed share – So may require two or more fractional warrants to be exercised to buy a share • Fully covered warrants – Underlying shares lodged in trust by issuer as guarantee – Shares held as a guarantee of the issuer’s capacity to deliver the stock if the holder exercises warrant – Price involves initial specified instalment and second instalment based on market value of share (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -28

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Warrants (cont. ) § Warrants issued as financial products (cont. ) • Index warrants – Issued on a share price index (e. g. S&P/ASX 200, S&P 500 index) • • • Basket warrants Capped warrants Instalment warrants Capital plus warrants Endowment warrants (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -29

20. 3 Organisation of the market (cont. ) • The Australian options market (cont. ) – Over-the-counter markets § Used to trade options not traded on the exchanges, e. g. semigovernment securities and other money-market instruments or securities with unusual maturities § Allows flexibility in terms of: • • amount term interest rate price § Used to set interest rate caps, floors and collars Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -30

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -31

20. 4 Factors affecting an option contract premium • Option price (or premium) is influenced by four key factors 1. 2. 3. 4. Intrinsic value Time value Price volatility Interest rates (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -32

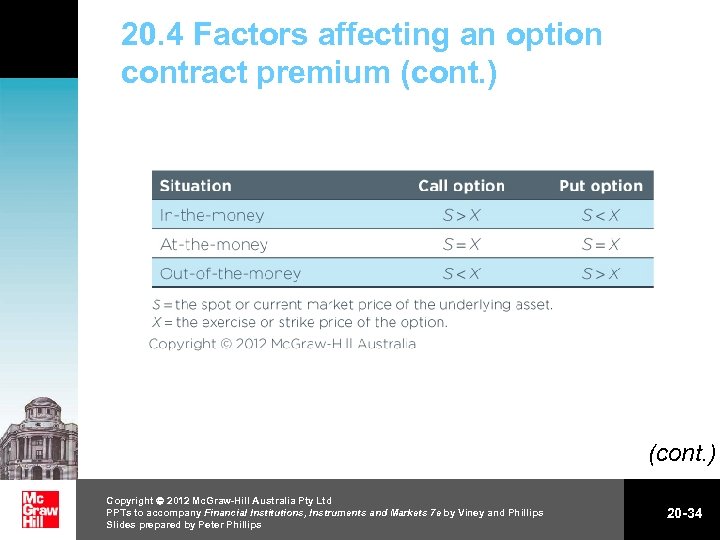

20. 4 Factors affecting an option contract premium (cont. ) 1. Intrinsic value – The market price of the underlying asset relative to the exercise price – The greater the intrinsic value, the greater the premium, i. e. positive relationship – Options with an intrinsic value § Positive are ‘in the money’ and the buyer is able to exercise contract at a profit § Negative are ‘out of the money’ and the buyer will not exercise § Zero are ‘at the money’ (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -33

20. 4 Factors affecting an option contract premium (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -34

20. 4 Factors affecting an option contract premium (cont. ) 2. Time value – The longer the time to expiry, the greater the possibility that the option will be able to be exercised for a profit (‘in the money’); i. e. positive relationship – If the spot price moves adversely, the loss is limited to the premium (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -35

20. 4 Factors affecting an option contract premium (cont. ) 3. Price volatility – The greater the volatility of the spot price, the greater the chance of exercising the option for a profit, or a loss – The option will be exercised only if the price moves favourably – The greater the spot price volatility, the greater the option premium; i. e. positive relationship (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -36

20. 4 Factors affecting an option contract premium (cont. ) 4. Interest rates – Interest rates have opposite impacts on put and call options § Positive relationship between interest rates and the price of a call • Benefit of present value of deferred payment if exercised > lower present value of profit if exercised § Negative relationship between interest rates and the price of a put • Opportunity cost of holding asset • Lower present value of the profit if exercised Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -37

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -38

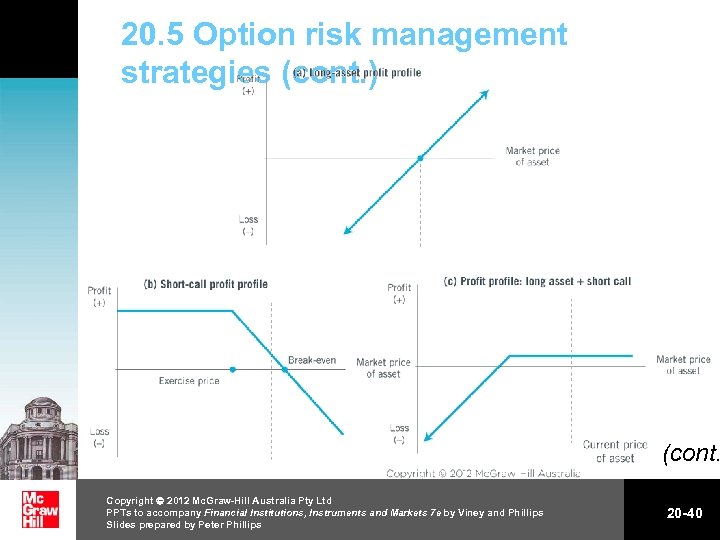

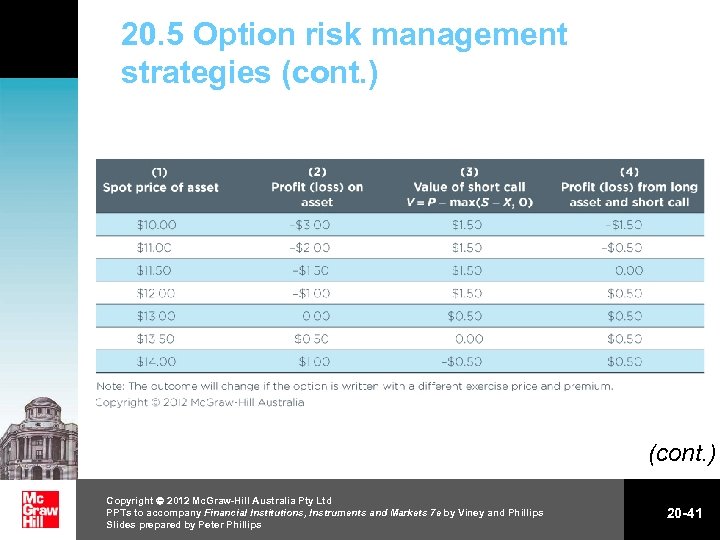

20. 5 Option risk management strategies • Single-option strategies – Example: long asset (i. e. bought) and bearish (negative) about future asset price § Strategy • Limit downside risk by writing (selling) a call option, i. e. short call • Figure 20. 5 and Table 20. 4 in the textbook illustrate the profit profile of this strategy (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -39

20. 5 Option risk management strategies (cont. ) (cont. Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -40

20. 5 Option risk management strategies (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -41

20. 5 Option risk management strategies (cont. ) • Single-option strategies (cont. ) – Example: short asset (i. e. sold) and bullish (positive) about future asset price § Strategy • Buy a call in the underlying asset (i. e. take a long-call position) • Figure 20. 6 and Table 20. 5 in the textbook illustrate the profit profile of this strategy (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -42

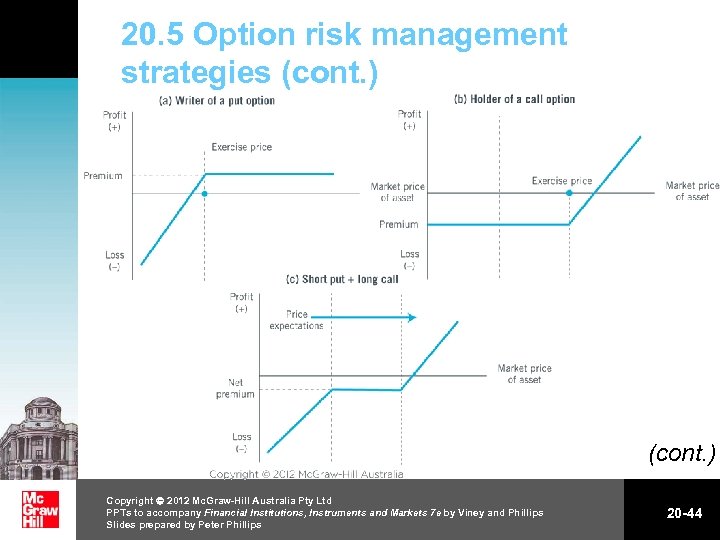

20. 5 Option risk management strategies (cont. ) • Combined-options strategies – Example: very bullish about future price of the asset § Strategy: ‘vertical bull spread’—contracts with same expiration dates, different exercise prices • Write (sell) a put option and earn a premium to benefit from fall in spot price • Hold (buy) a call option with exercise price greater than written put • Effect: Offsets high premium associated with call • Figure 20. 7 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -43

20. 5 Option risk management strategies (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -44

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: quite bullish, but with some risk of a price fall § Strategy • Hold (buy) a call option to benefit from fall in spot price • Write (sell) a call option with a higher exercise price than the long call • This ‘call bull spread’ limits the potential loss • Figure 20. 8 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -45

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: very bearish about the future price of the asset § Strategy • Hold (buy) put option to benefit from fall in spot price • Write (sell) a call option with a higher exercise price than the long put • This ‘vertical bear spread’ limits the potential gain but exposes the writer to unlimited losses • Figure 20. 9 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -46

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: quite bearish, but with some risk of a price rise § Strategy • Hold (buy) put option to benefit from fall in spot price • Write (sell) a put option with a lower exercise price than the long put • This ‘put bear spread’ limits the potential loss if the price rises • Figure 20. 10 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -47

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: expectation of increased price volatility, with no trend § Strategy • Hold (buy) a put option • Hold (buy) a call option with common exercise price • ‘Long straddle’ provides positive pay-off for both large upward and downward price movements • If prices remain unchanged, individual makes loss equal to sum of premiums • Figure 20. 11 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -48

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: expectation of increased volatility, without trend, with stagnation § Strategy • Hold (buy) call option with out-of-the-money exercise price • Hold (buy) put option with out-of-the-money exercise price • With ‘long strangle’ loss is decreased if price remains unchanged, compared with ‘long straddle’ • Figure 20. 12 in the textbook illustrates the profit profile (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -49

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Example: expectation of asset price stability § Strategy • Take opposite position to long straddle and long strangle • Strategy I: Short straddle – Sell call and put options with same exercise price • Strategy II: Short strangle – Sell call and put options, both out of the money • Figure 20. 13 in the textbook illustrates the profit profiles (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -50

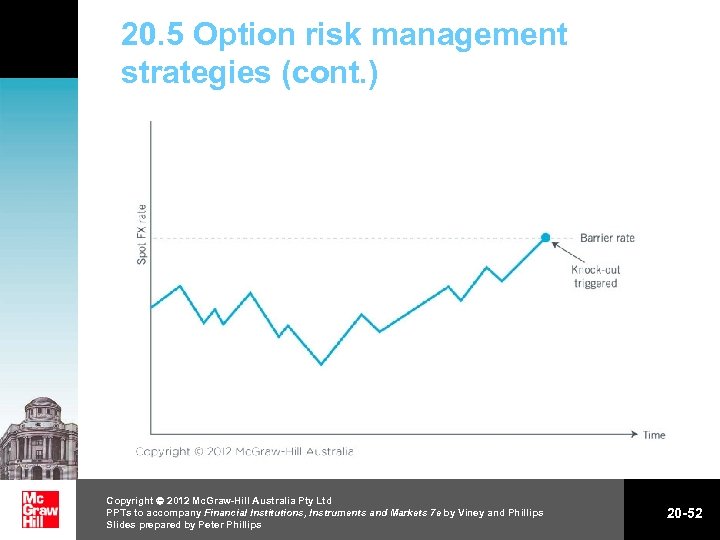

20. 5 Option risk management strategies (cont. ) • Combined-options strategies (cont. ) – Barrier options: knock-out and knock-in options § Another form of option strategy suited to the management of FX risk exposures § Knock-out option: • is extinguished if a specified spot exchange rate barrier is breached § Knock-in option: • is created if a specified spot exchange rate is achieved § The barrier rate can be set above or below the current spot FX rate § As the barrier limits the exposure of the writer, the premium is not as high as it is with a straight option (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -51

20. 5 Option risk management strategies (cont. ) Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -52

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -53

20. 6 Conclusion • The potential gains and losses to buyers and sellers of futures contracts are different from those of options – Options provide one-sided price protection that is not available through futures – The option buyer limits losses and allows profits to accumulate § However, the premium may be quite high Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -54

Chapter organisation 20. 1 20. 2 20. 3 20. 4 20. 5 20. 6 20. 7 The nature of options Option profit and loss payoff profiles Organisation of the market Factors affecting an option contract premium Option risk management strategies Conclusion Summary Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -55

20. 7 Summary • The holder of an option (long party) has the right to buy (call) or sell (put) the commodity at a specified exercise price • The writer (seller) is the short party • ASX trades standardised options, unlike over-thecounter market • The premium paid to buy an option is affected by its intrinsic value, time value, price volatility, and interest rates • A broad array of option strategies may be adopted by hedgers and speculators Copyright 2012 Mc. Graw-Hill Australia Pty Ltd PPTs to accompany Financial Institutions, Instruments and Markets 7 e by Viney and Phillips Slides prepared by Peter Phillips 20 -56

08072cb429dade8cf60fe36b01a62da2.ppt