e5d0447d726a6a6c2eaa87377f9c39dc.ppt

- Количество слайдов: 38

CHAPTER 20 Options Markets: Introduction Investments, 8 th edition Bodie, Kane and Marcus Slides by Susan Hine Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

CHAPTER 20 Options Markets: Introduction Investments, 8 th edition Bodie, Kane and Marcus Slides by Susan Hine Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Option Terminology • • • Buy - Long Sell - Short Call Put Key Elements – Exercise or Strike Price – Premium or Price – Maturity or Expiration 20 -2

Option Terminology • • • Buy - Long Sell - Short Call Put Key Elements – Exercise or Strike Price – Premium or Price – Maturity or Expiration 20 -2

Market and Exercise Price Relationships In the Money - exercise of the option would be profitable Call: market price>exercise price Put: exercise price>market price Out of the Money - exercise of the option would not be profitable Call: market price

Market and Exercise Price Relationships In the Money - exercise of the option would be profitable Call: market price>exercise price Put: exercise price>market price Out of the Money - exercise of the option would not be profitable Call: market price

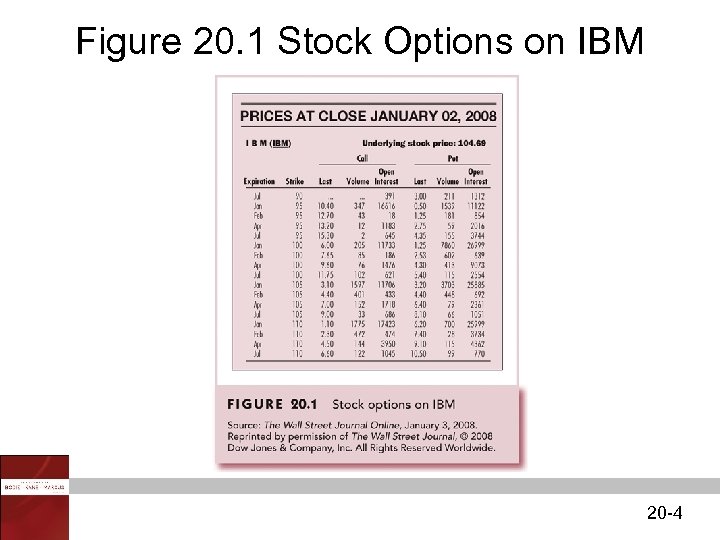

Figure 20. 1 Stock Options on IBM 20 -4

Figure 20. 1 Stock Options on IBM 20 -4

American vs. European Options American - the option can be exercised at any time before expiration or maturity European - the option can only be exercised on the expiration or maturity date 20 -5

American vs. European Options American - the option can be exercised at any time before expiration or maturity European - the option can only be exercised on the expiration or maturity date 20 -5

Different Types of Options • • • Stock Options Index Options Futures Options Foreign Currency Options Interest Rate Options 20 -6

Different Types of Options • • • Stock Options Index Options Futures Options Foreign Currency Options Interest Rate Options 20 -6

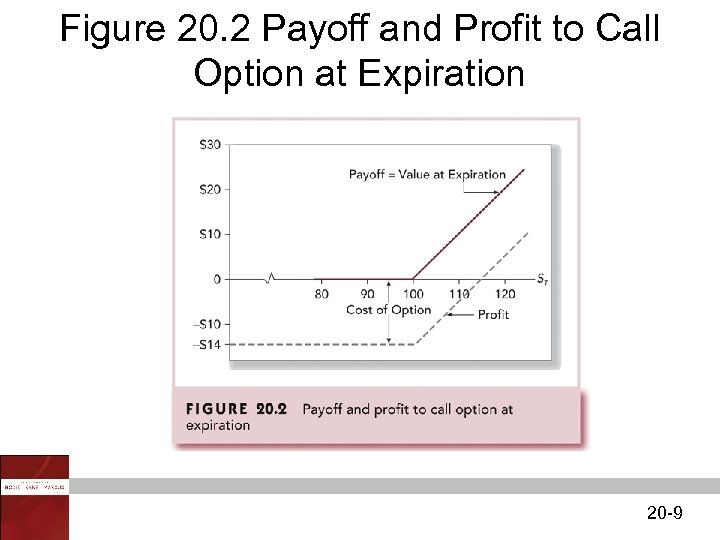

Payoffs and Profits at Expiration - Calls Notation Stock Price = ST Exercise Price = X Payoff to Call Holder (ST - X) if ST >X 0 if ST < X Profit to Call Holder Payoff - Purchase Price 20 -7

Payoffs and Profits at Expiration - Calls Notation Stock Price = ST Exercise Price = X Payoff to Call Holder (ST - X) if ST >X 0 if ST < X Profit to Call Holder Payoff - Purchase Price 20 -7

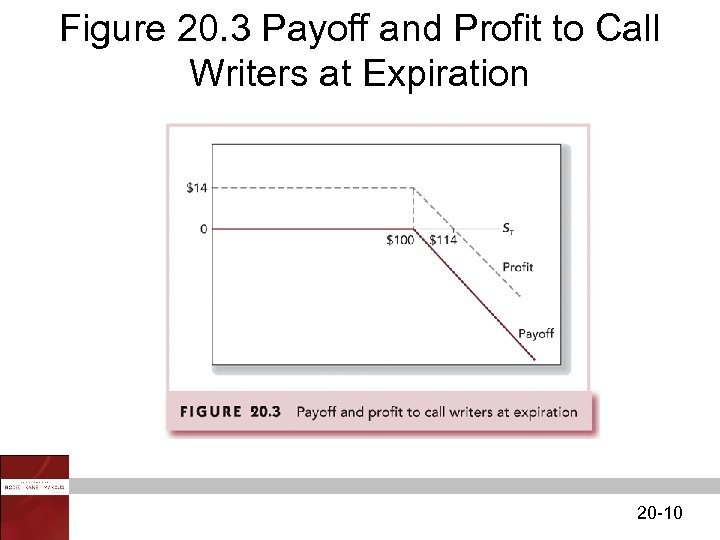

Payoffs and Profits at Expiration - Calls Payoff to Call Writer - (ST - X) if ST >X 0 if ST < X Profit to Call Writer Payoff + Premium 20 -8

Payoffs and Profits at Expiration - Calls Payoff to Call Writer - (ST - X) if ST >X 0 if ST < X Profit to Call Writer Payoff + Premium 20 -8

Figure 20. 2 Payoff and Profit to Call Option at Expiration 20 -9

Figure 20. 2 Payoff and Profit to Call Option at Expiration 20 -9

Figure 20. 3 Payoff and Profit to Call Writers at Expiration 20 -10

Figure 20. 3 Payoff and Profit to Call Writers at Expiration 20 -10

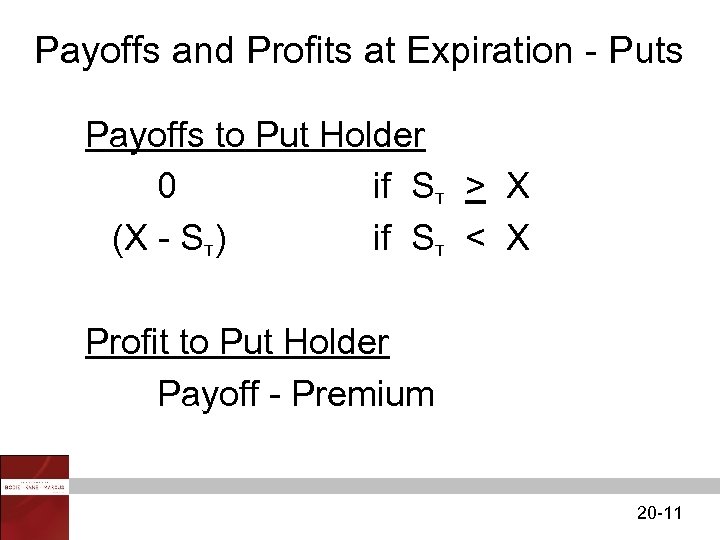

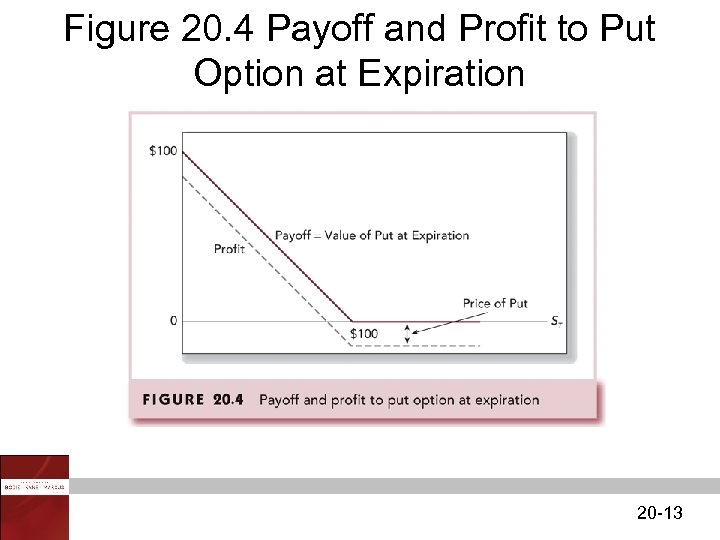

Payoffs and Profits at Expiration - Puts Payoffs to Put Holder 0 if ST > X (X - ST) if ST < X Profit to Put Holder Payoff - Premium 20 -11

Payoffs and Profits at Expiration - Puts Payoffs to Put Holder 0 if ST > X (X - ST) if ST < X Profit to Put Holder Payoff - Premium 20 -11

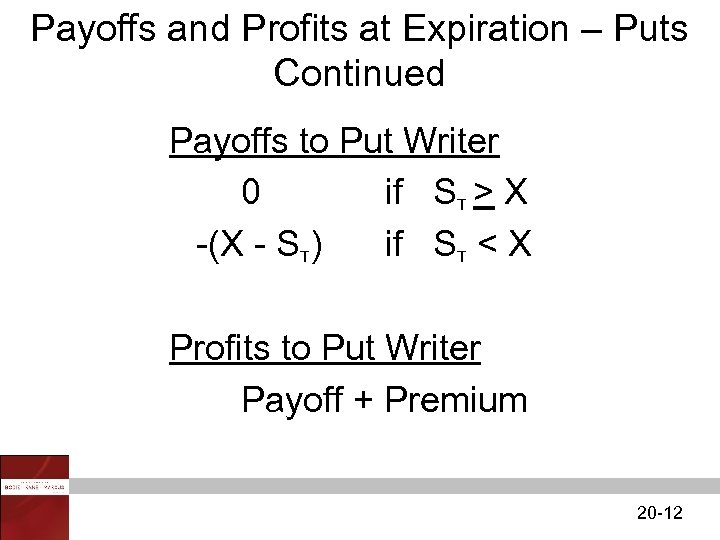

Payoffs and Profits at Expiration – Puts Continued Payoffs to Put Writer 0 if ST > X -(X - ST) if ST < X Profits to Put Writer Payoff + Premium 20 -12

Payoffs and Profits at Expiration – Puts Continued Payoffs to Put Writer 0 if ST > X -(X - ST) if ST < X Profits to Put Writer Payoff + Premium 20 -12

Figure 20. 4 Payoff and Profit to Put Option at Expiration 20 -13

Figure 20. 4 Payoff and Profit to Put Option at Expiration 20 -13

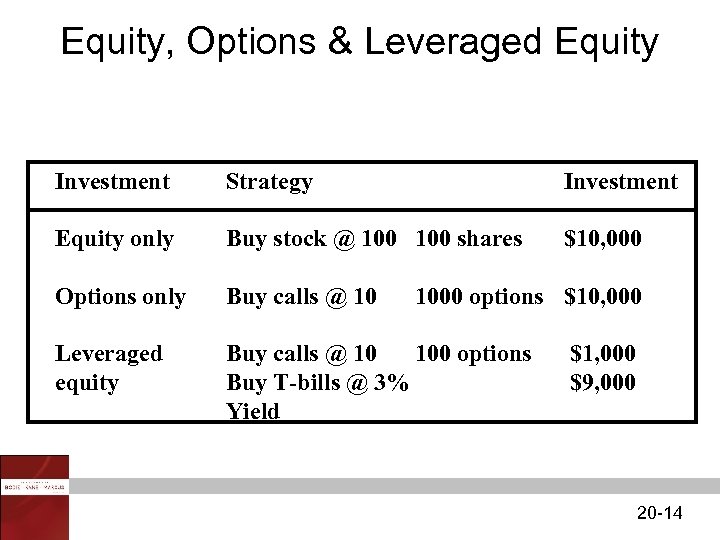

Equity, Options & Leveraged Equity Investment Strategy Investment Equity only Buy stock @ 100 shares $10, 000 Options only Buy calls @ 10 Leveraged equity Buy calls @ 10 100 options Buy T-bills @ 3% Yield 1000 options $10, 000 $1, 000 $9, 000 20 -14

Equity, Options & Leveraged Equity Investment Strategy Investment Equity only Buy stock @ 100 shares $10, 000 Options only Buy calls @ 10 Leveraged equity Buy calls @ 10 100 options Buy T-bills @ 3% Yield 1000 options $10, 000 $1, 000 $9, 000 20 -14

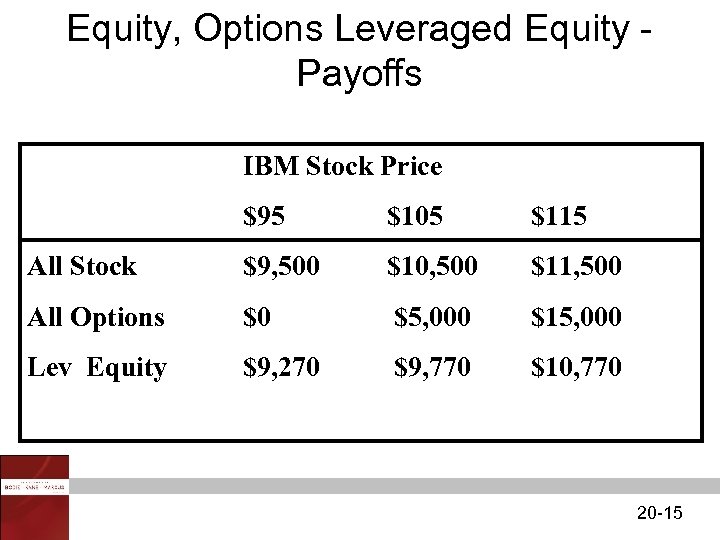

Equity, Options Leveraged Equity Payoffs IBM Stock Price $95 $105 $115 All Stock $9, 500 $10, 500 $11, 500 All Options $0 $5, 000 $15, 000 Lev Equity $9, 270 $9, 770 $10, 770 20 -15

Equity, Options Leveraged Equity Payoffs IBM Stock Price $95 $105 $115 All Stock $9, 500 $10, 500 $11, 500 All Options $0 $5, 000 $15, 000 Lev Equity $9, 270 $9, 770 $10, 770 20 -15

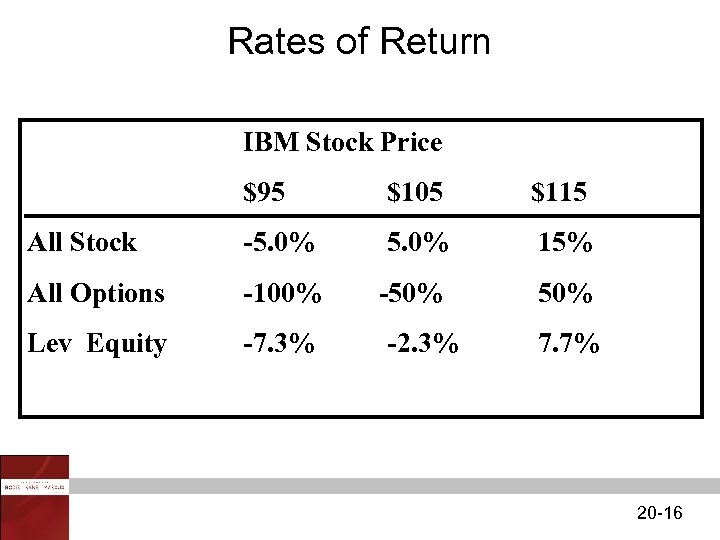

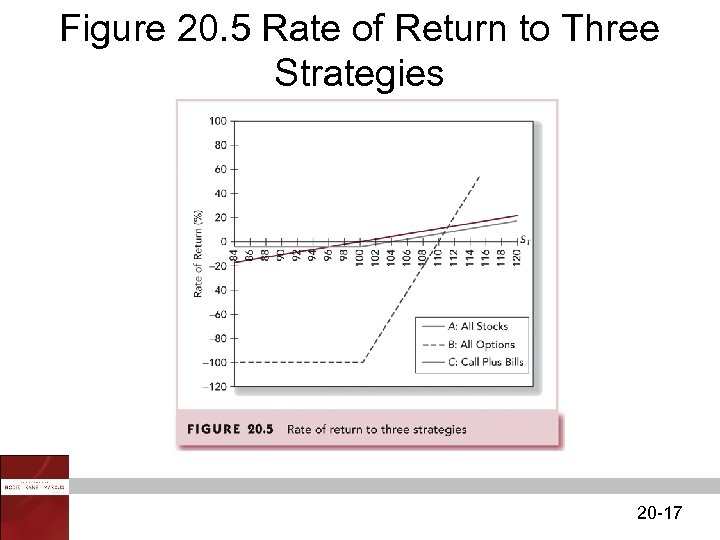

Rates of Return IBM Stock Price $95 $105 $115 All Stock -5. 0% 15% All Options -100% -50% Lev Equity -7. 3% -2. 3% 7. 7% 20 -16

Rates of Return IBM Stock Price $95 $105 $115 All Stock -5. 0% 15% All Options -100% -50% Lev Equity -7. 3% -2. 3% 7. 7% 20 -16

Figure 20. 5 Rate of Return to Three Strategies 20 -17

Figure 20. 5 Rate of Return to Three Strategies 20 -17

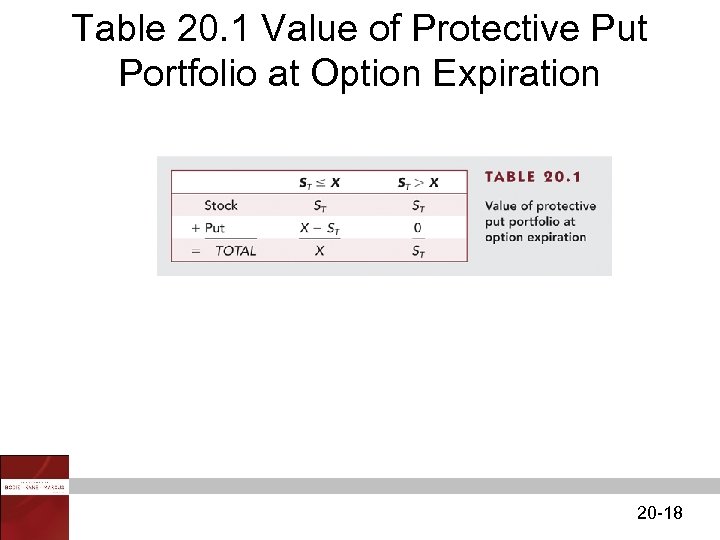

Table 20. 1 Value of Protective Put Portfolio at Option Expiration 20 -18

Table 20. 1 Value of Protective Put Portfolio at Option Expiration 20 -18

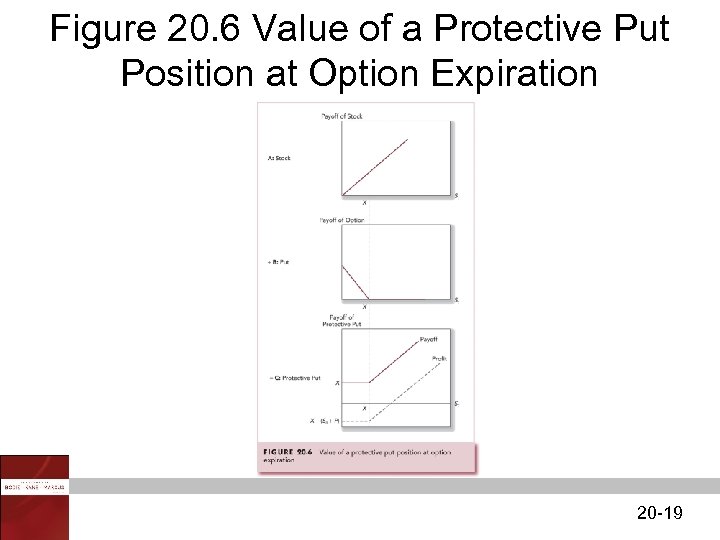

Figure 20. 6 Value of a Protective Put Position at Option Expiration 20 -19

Figure 20. 6 Value of a Protective Put Position at Option Expiration 20 -19

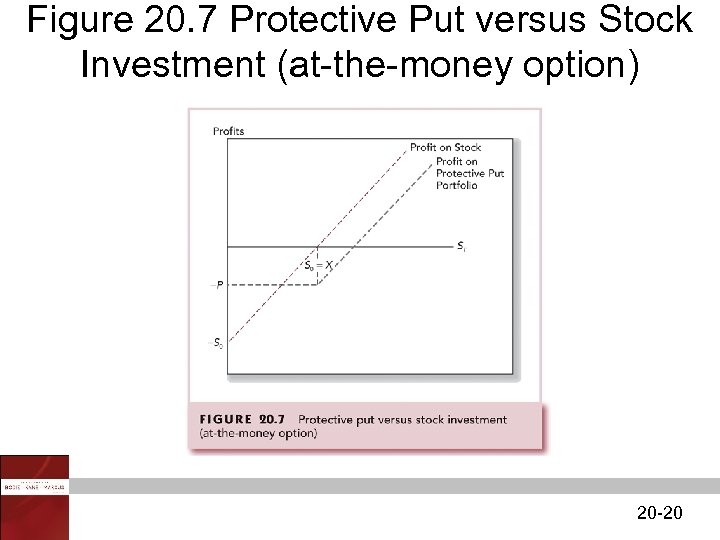

Figure 20. 7 Protective Put versus Stock Investment (at-the-money option) 20 -20

Figure 20. 7 Protective Put versus Stock Investment (at-the-money option) 20 -20

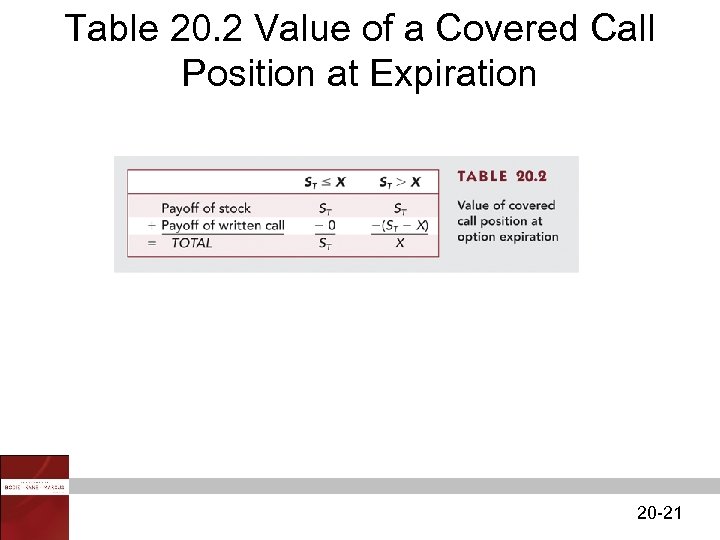

Table 20. 2 Value of a Covered Call Position at Expiration 20 -21

Table 20. 2 Value of a Covered Call Position at Expiration 20 -21

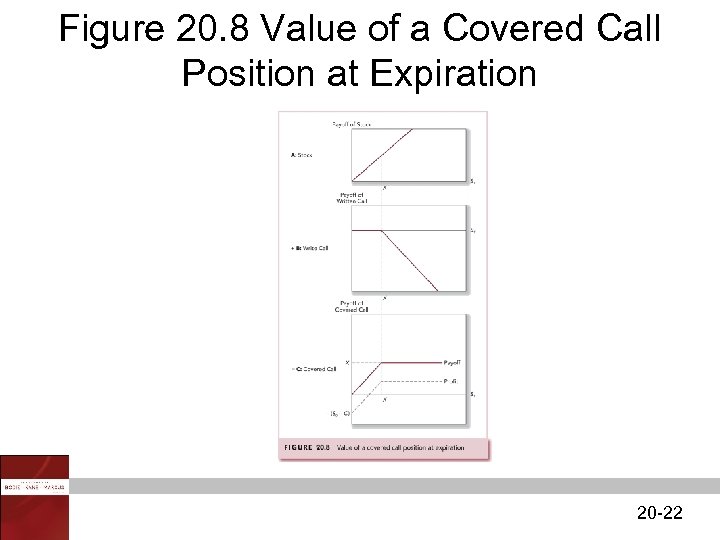

Figure 20. 8 Value of a Covered Call Position at Expiration 20 -22

Figure 20. 8 Value of a Covered Call Position at Expiration 20 -22

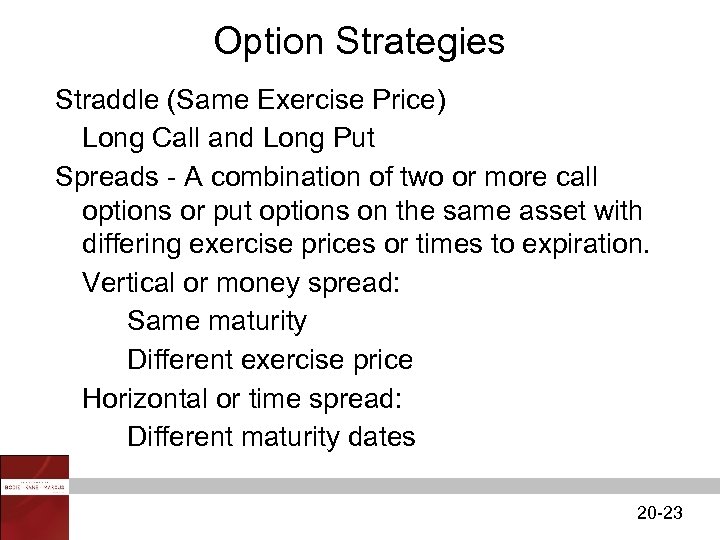

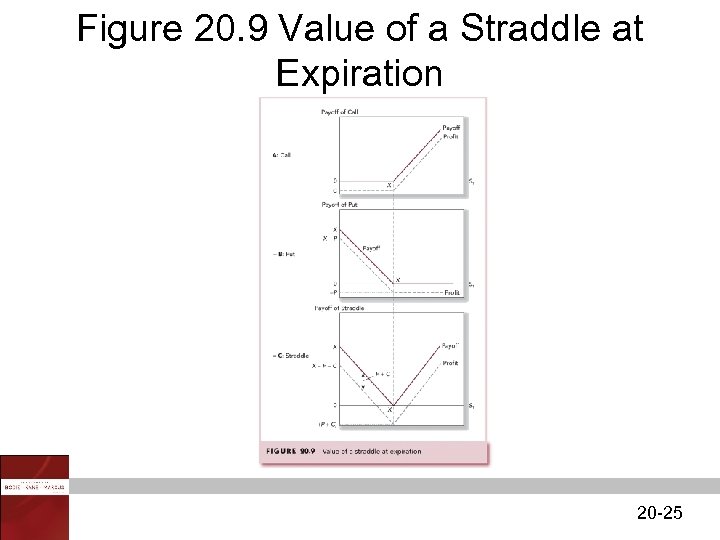

Option Strategies Straddle (Same Exercise Price) Long Call and Long Put Spreads - A combination of two or more call options or put options on the same asset with differing exercise prices or times to expiration. Vertical or money spread: Same maturity Different exercise price Horizontal or time spread: Different maturity dates 20 -23

Option Strategies Straddle (Same Exercise Price) Long Call and Long Put Spreads - A combination of two or more call options or put options on the same asset with differing exercise prices or times to expiration. Vertical or money spread: Same maturity Different exercise price Horizontal or time spread: Different maturity dates 20 -23

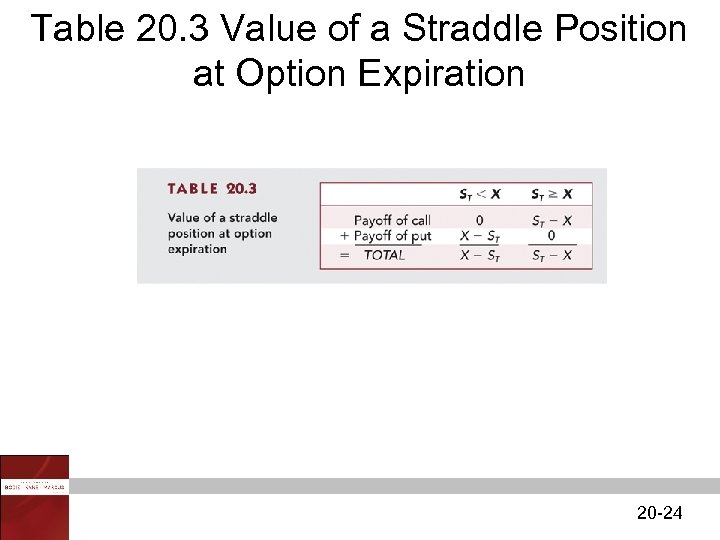

Table 20. 3 Value of a Straddle Position at Option Expiration 20 -24

Table 20. 3 Value of a Straddle Position at Option Expiration 20 -24

Figure 20. 9 Value of a Straddle at Expiration 20 -25

Figure 20. 9 Value of a Straddle at Expiration 20 -25

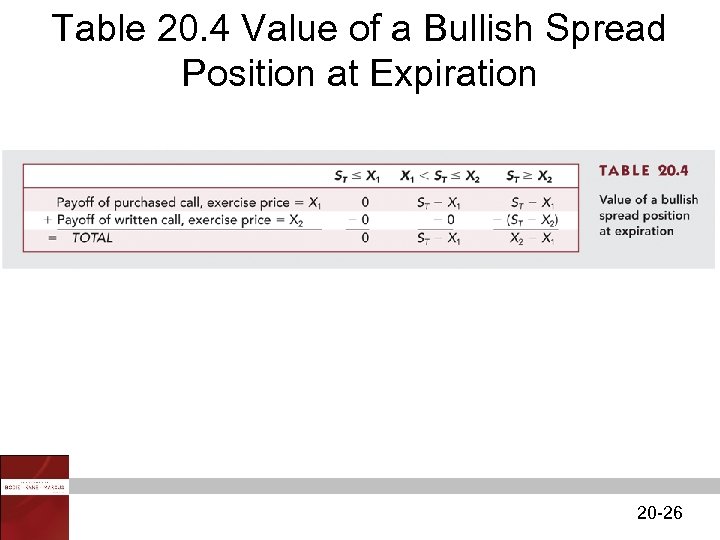

Table 20. 4 Value of a Bullish Spread Position at Expiration 20 -26

Table 20. 4 Value of a Bullish Spread Position at Expiration 20 -26

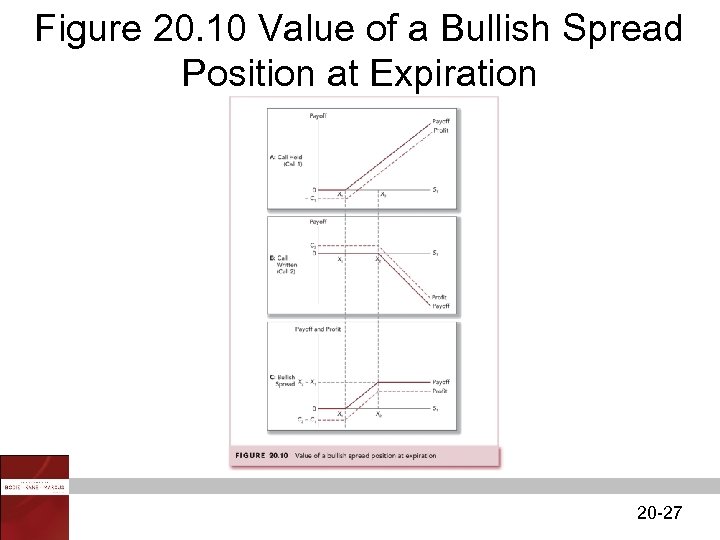

Figure 20. 10 Value of a Bullish Spread Position at Expiration 20 -27

Figure 20. 10 Value of a Bullish Spread Position at Expiration 20 -27

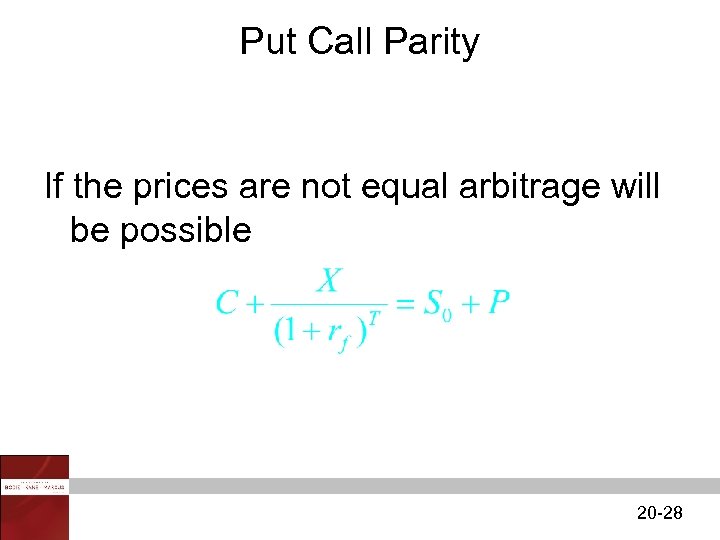

Put Call Parity If the prices are not equal arbitrage will be possible 20 -28

Put Call Parity If the prices are not equal arbitrage will be possible 20 -28

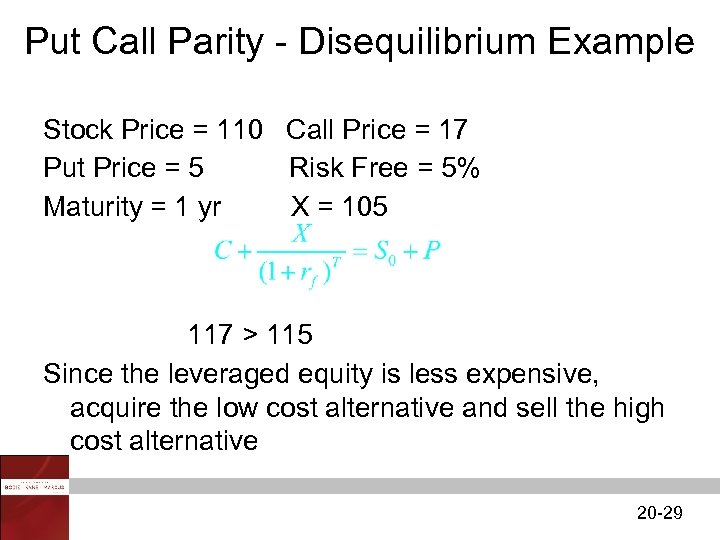

Put Call Parity - Disequilibrium Example Stock Price = 110 Call Price = 17 Put Price = 5 Risk Free = 5% Maturity = 1 yr X = 105 117 > 115 Since the leveraged equity is less expensive, acquire the low cost alternative and sell the high cost alternative 20 -29

Put Call Parity - Disequilibrium Example Stock Price = 110 Call Price = 17 Put Price = 5 Risk Free = 5% Maturity = 1 yr X = 105 117 > 115 Since the leveraged equity is less expensive, acquire the low cost alternative and sell the high cost alternative 20 -29

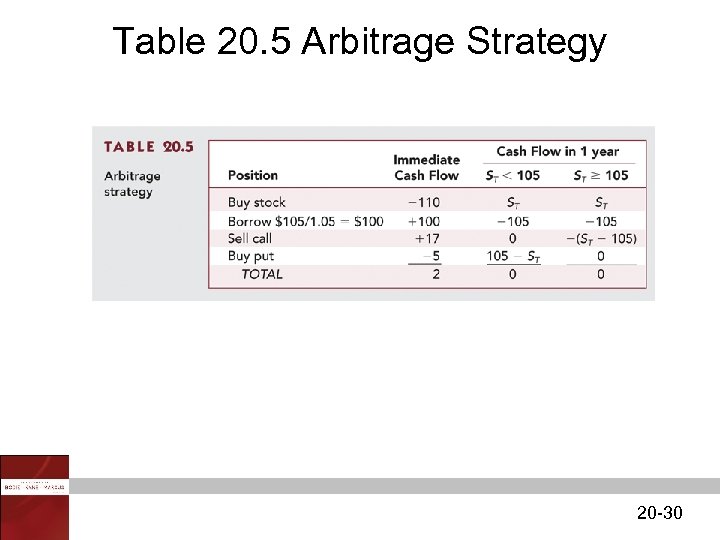

Table 20. 5 Arbitrage Strategy 20 -30

Table 20. 5 Arbitrage Strategy 20 -30

Optionlike Securities • • Callable Bonds Convertible Securities Warrants Collateralized Loans 20 -31

Optionlike Securities • • Callable Bonds Convertible Securities Warrants Collateralized Loans 20 -31

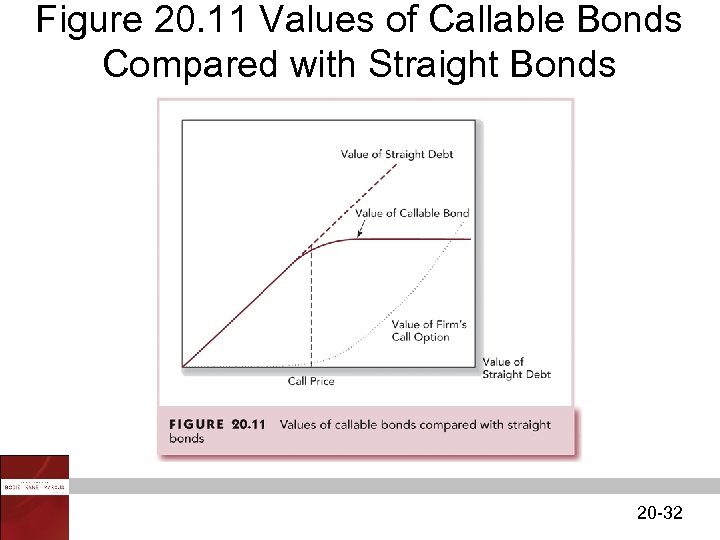

Figure 20. 11 Values of Callable Bonds Compared with Straight Bonds 20 -32

Figure 20. 11 Values of Callable Bonds Compared with Straight Bonds 20 -32

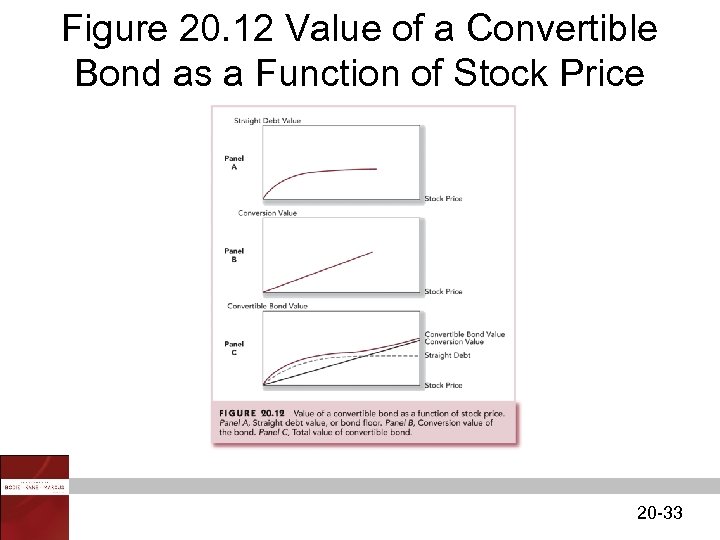

Figure 20. 12 Value of a Convertible Bond as a Function of Stock Price 20 -33

Figure 20. 12 Value of a Convertible Bond as a Function of Stock Price 20 -33

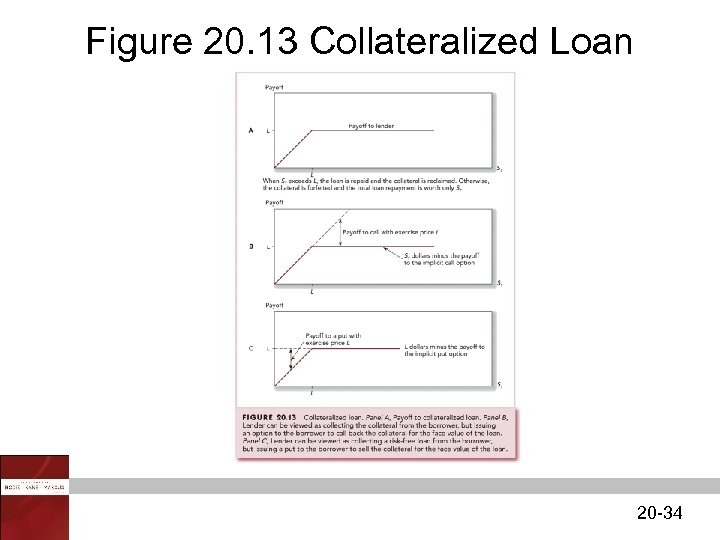

Figure 20. 13 Collateralized Loan 20 -34

Figure 20. 13 Collateralized Loan 20 -34

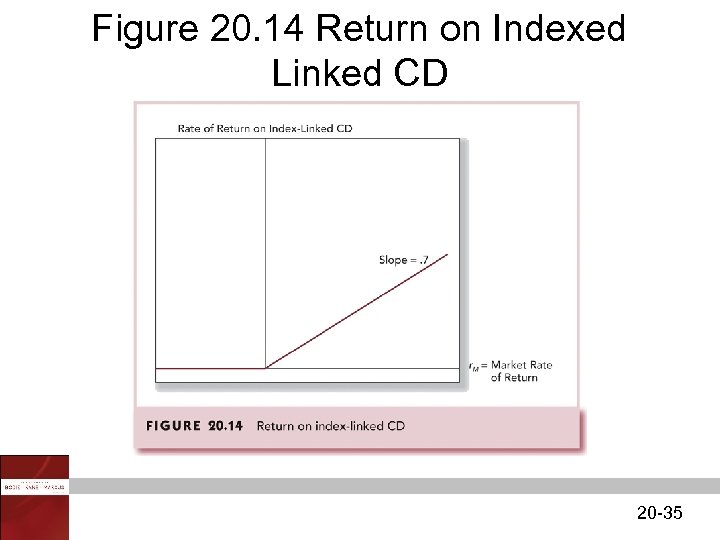

Figure 20. 14 Return on Indexed Linked CD 20 -35

Figure 20. 14 Return on Indexed Linked CD 20 -35

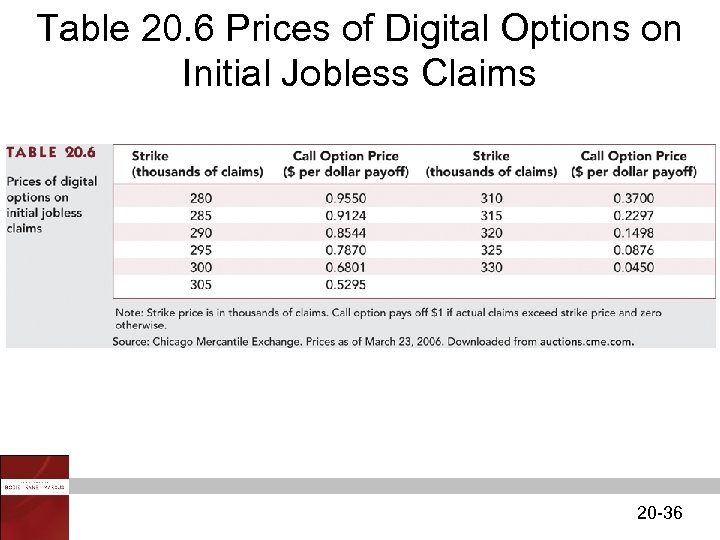

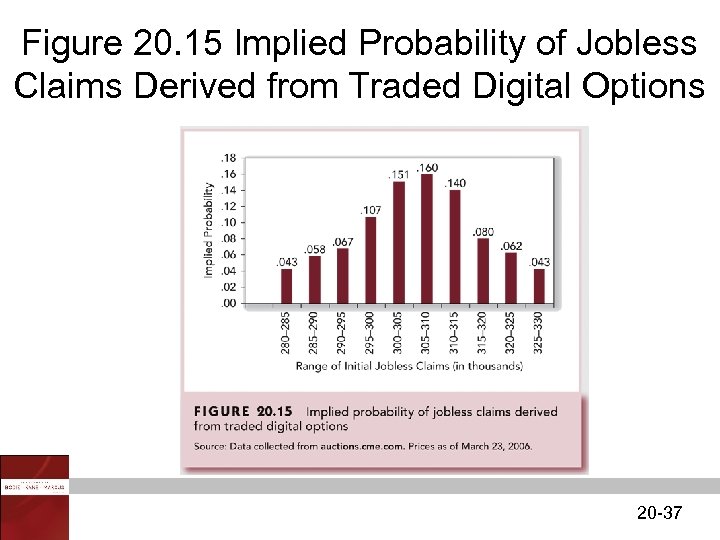

Table 20. 6 Prices of Digital Options on Initial Jobless Claims 20 -36

Table 20. 6 Prices of Digital Options on Initial Jobless Claims 20 -36

Figure 20. 15 Implied Probability of Jobless Claims Derived from Traded Digital Options 20 -37

Figure 20. 15 Implied Probability of Jobless Claims Derived from Traded Digital Options 20 -37

Exotic Options • • • Asian Options Barrier Options Lookback Options Currency Translated Options Digital Options 20 -38

Exotic Options • • • Asian Options Barrier Options Lookback Options Currency Translated Options Digital Options 20 -38