81791f8d398d600385635d07840d2b2b.ppt

- Количество слайдов: 53

Chapter 20 Monetary Policy Lecture Slides Survey of Economics Irvin B. Tucker 1 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Chapter 20 Monetary Policy Lecture Slides Survey of Economics Irvin B. Tucker 1 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What will I learn in this chapter? • How monetary policy affects the economy through the money market and what are differences between Keynesian and monetarist policies 2 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What will I learn in this chapter? • How monetary policy affects the economy through the money market and what are differences between Keynesian and monetarist policies 2 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the transactions demand for money? • The stock of money people hold to pay everyday predictable expenses 3 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the transactions demand for money? • The stock of money people hold to pay everyday predictable expenses 3 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the precautionary demand for money? • The stock of money people hold to pay unpredictable expenses 4 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the precautionary demand for money? • The stock of money people hold to pay unpredictable expenses 4 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the speculative demand for money? • The stock of money people hold to take advantage of expected future changes in the price of bonds, stocks, or other nonmoney assets 5 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the speculative demand for money? • The stock of money people hold to take advantage of expected future changes in the price of bonds, stocks, or other nonmoney assets 5 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How does a change in interest rates affect speculative demand? • As the interest rate falls, the opportunity cost of holding money falls, and people increase their speculative balances 6 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How does a change in interest rates affect speculative demand? • As the interest rate falls, the opportunity cost of holding money falls, and people increase their speculative balances 6 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the demand for money curve? • A curve representing the quantity of money that people hold at different interest rates, ceteris paribus 7 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the demand for money curve? • A curve representing the quantity of money that people hold at different interest rates, ceteris paribus 7 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How do interest rates affect the demand for money? • There is an inverse relationship between the quantity of money demanded and the interest rate 8 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How do interest rates affect the demand for money? • There is an inverse relationship between the quantity of money demanded and the interest rate 8 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What gives the demand for money a downward slope? • The speculative demand for money at possible interest rates 9 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What gives the demand for money a downward slope? • The speculative demand for money at possible interest rates 9 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Increase in the quantity of money demanded Decrease in the interest rate Increase in the interest rate 10 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Increase in the quantity of money demanded Decrease in the interest rate Increase in the interest rate 10 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

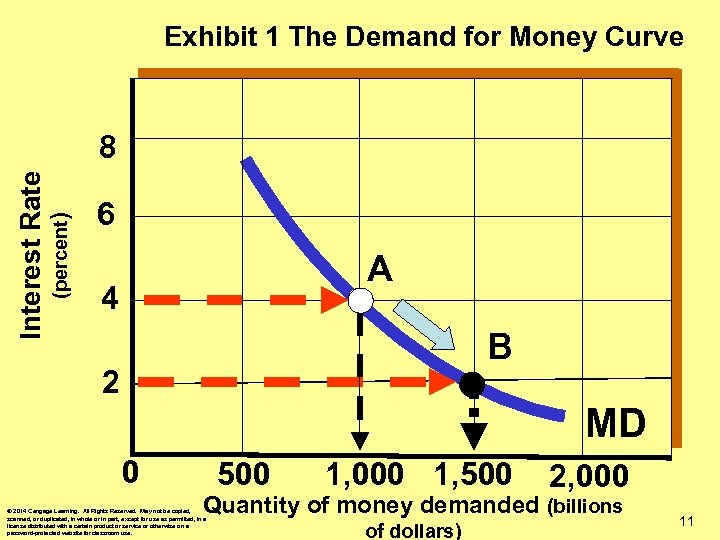

Exhibit 1 The Demand for Money Curve (percent) Interest Rate 8 6 A 4 B 2 MD 0 500 1, 000 1, 500 2, 000 Quantity of money demanded (billions © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. of dollars) 11

Exhibit 1 The Demand for Money Curve (percent) Interest Rate 8 6 A 4 B 2 MD 0 500 1, 000 1, 500 2, 000 Quantity of money demanded (billions © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. of dollars) 11

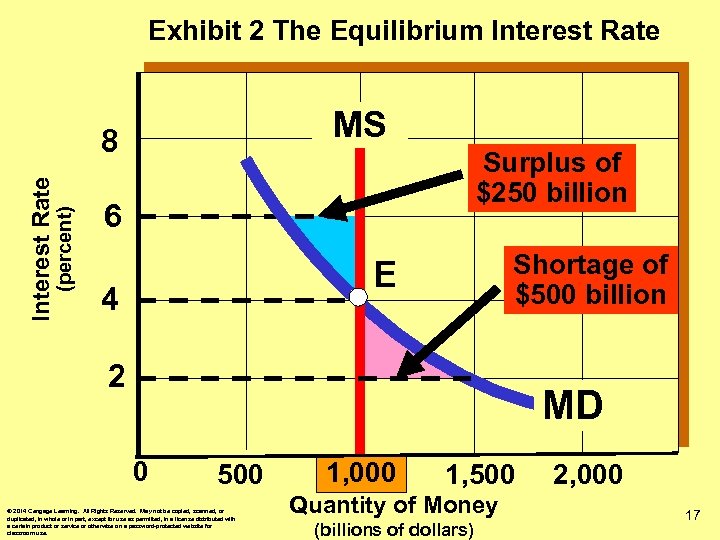

What determines interest rates in the money market? • The demand supply of money in the money market determine the equilibrium interest rate 12 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What determines interest rates in the money market? • The demand supply of money in the money market determine the equilibrium interest rate 12 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

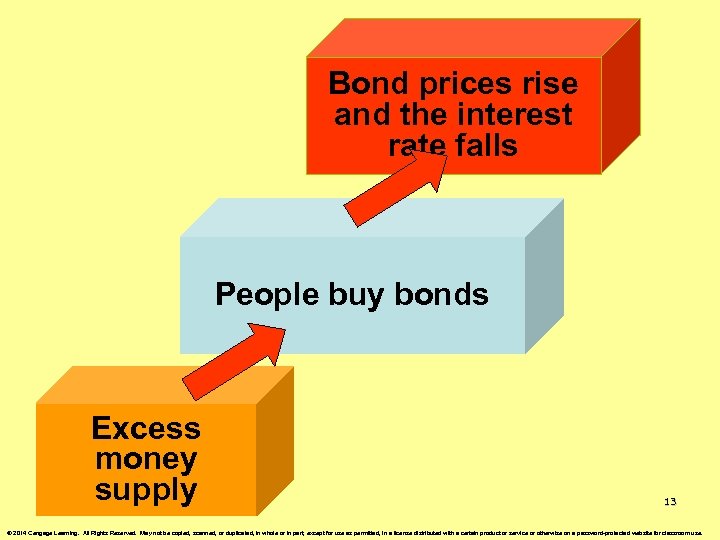

Bond prices rise and the interest rate falls People buy bonds Excess money supply 13 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Bond prices rise and the interest rate falls People buy bonds Excess money supply 13 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

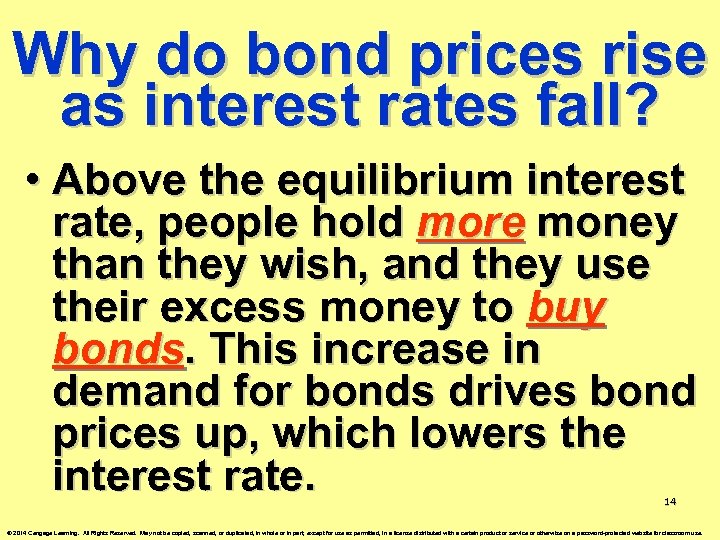

Why do bond prices rise as interest rates fall? • Above the equilibrium interest rate, people hold more money than they wish, and they use their excess money to buy bonds. This increase in demand for bonds drives bond prices up, which lowers the interest rate. 14 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Why do bond prices rise as interest rates fall? • Above the equilibrium interest rate, people hold more money than they wish, and they use their excess money to buy bonds. This increase in demand for bonds drives bond prices up, which lowers the interest rate. 14 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

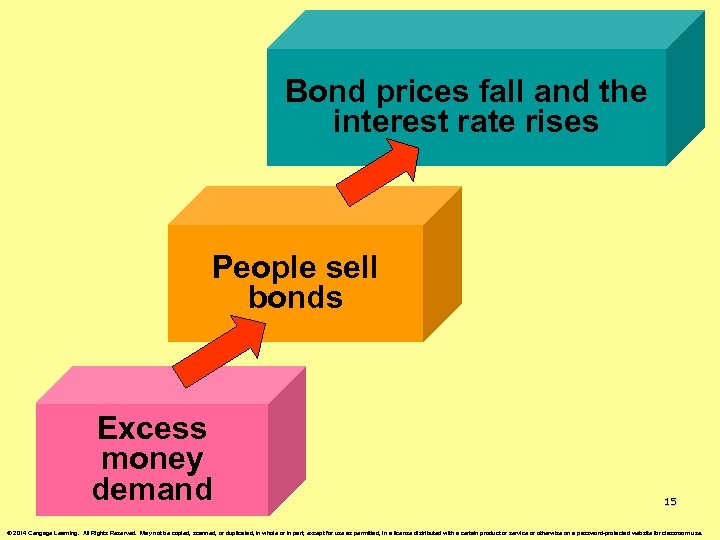

Bond prices fall and the interest rate rises People sell bonds Excess money demand 15 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Bond prices fall and the interest rate rises People sell bonds Excess money demand 15 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

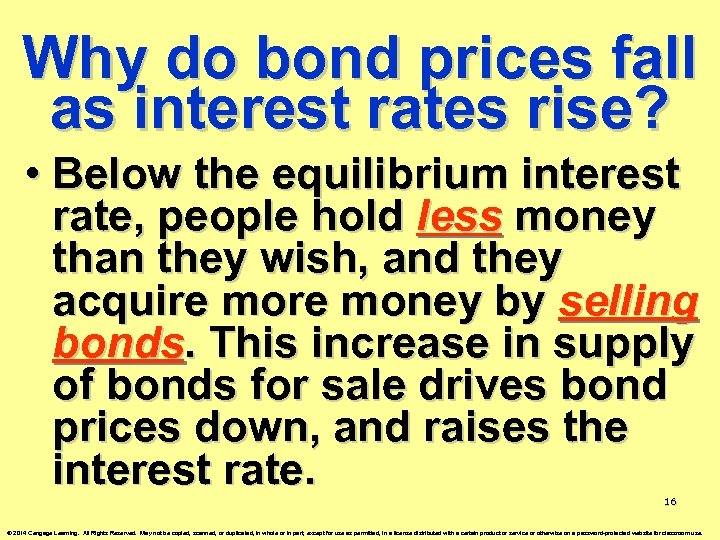

Why do bond prices fall as interest rates rise? • Below the equilibrium interest rate, people hold less money than they wish, and they acquire money by selling bonds. This increase in supply of bonds for sale drives bond prices down, and raises the interest rate. 16 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Why do bond prices fall as interest rates rise? • Below the equilibrium interest rate, people hold less money than they wish, and they acquire money by selling bonds. This increase in supply of bonds for sale drives bond prices down, and raises the interest rate. 16 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 2 The Equilibrium Interest Rate MS (percent) Interest Rate 8 Surplus of $250 billion 6 Shortage of $500 billion E 4 2 MD 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 17

Exhibit 2 The Equilibrium Interest Rate MS (percent) Interest Rate 8 Surplus of $250 billion 6 Shortage of $500 billion E 4 2 MD 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 17

How can the Fed influence the equilibrium interest rate? • It can increase or decrease the supply of money 18 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How can the Fed influence the equilibrium interest rate? • It can increase or decrease the supply of money 18 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

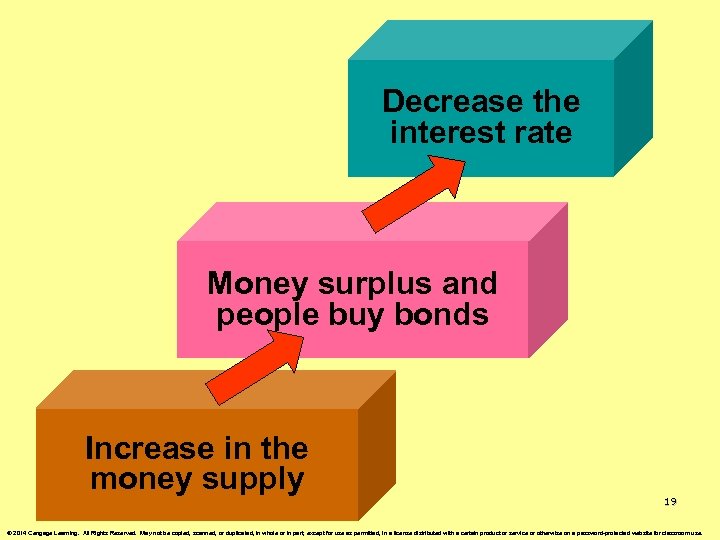

Decrease the interest rate Money surplus and people buy bonds Increase in the money supply © 2014 South-Western, a part of Cengage Learning 19 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Decrease the interest rate Money surplus and people buy bonds Increase in the money supply © 2014 South-Western, a part of Cengage Learning 19 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

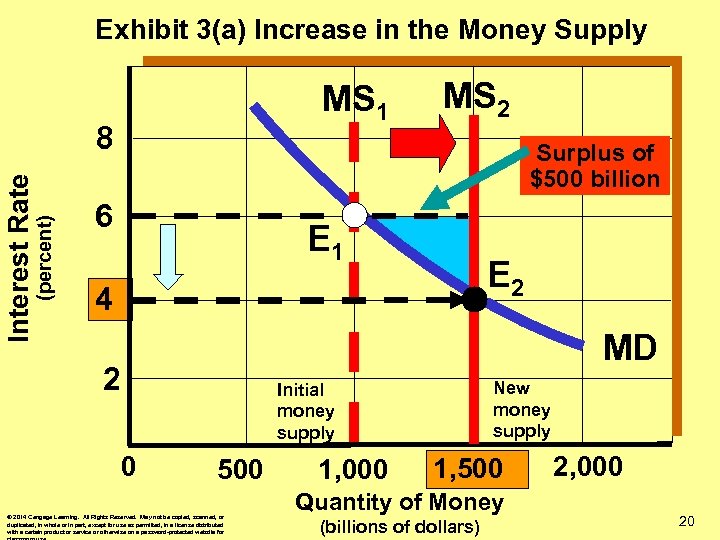

Exhibit 3(a) Increase in the Money Supply MS 1 (percent) Interest Rate 8 MS 2 Surplus of $500 billion 6 E 1 E 2 4 MD 2 New money supply Initial money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 20

Exhibit 3(a) Increase in the Money Supply MS 1 (percent) Interest Rate 8 MS 2 Surplus of $500 billion 6 E 1 E 2 4 MD 2 New money supply Initial money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 20

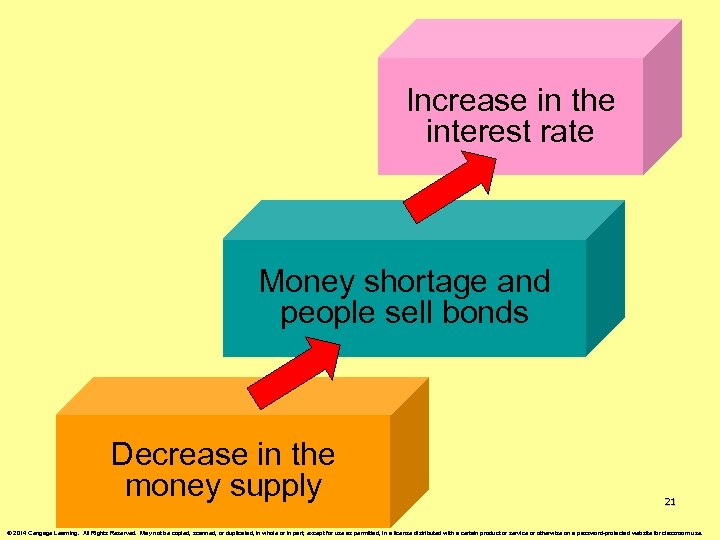

Increase in the interest rate Money shortage and people sell bonds Decrease in the money supply © 2014 South-Western, a part of Cengage Learning 21 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Increase in the interest rate Money shortage and people sell bonds Decrease in the money supply © 2014 South-Western, a part of Cengage Learning 21 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

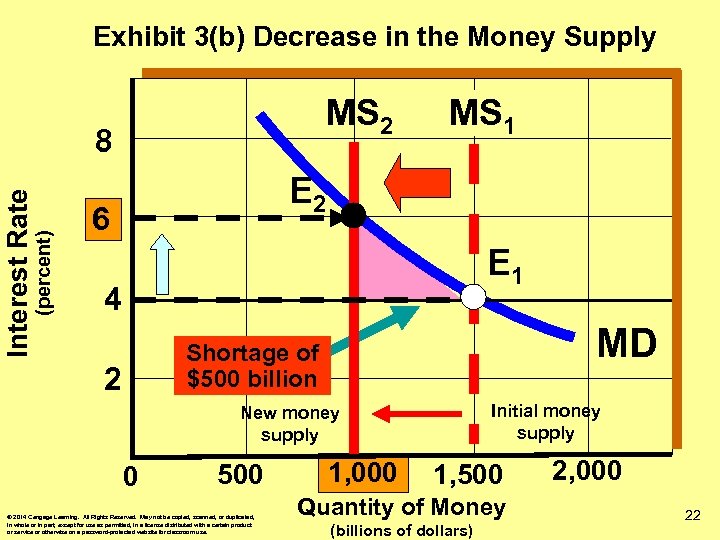

Exhibit 3(b) Decrease in the Money Supply MS 2 (percent) Interest Rate 8 MS 1 E 2 6 E 1 4 MD Shortage of $500 billion 2 Initial money supply New money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 22

Exhibit 3(b) Decrease in the Money Supply MS 2 (percent) Interest Rate 8 MS 1 E 2 6 E 1 4 MD Shortage of $500 billion 2 Initial money supply New money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 1, 500 Quantity of Money (billions of dollars) 2, 000 22

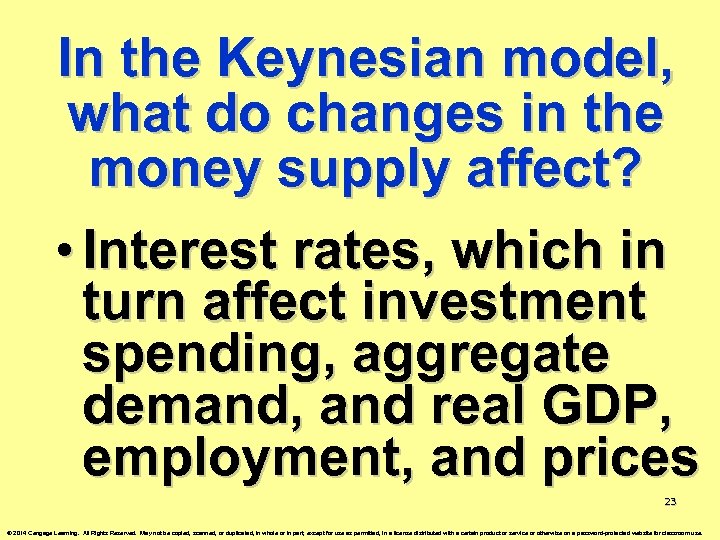

In the Keynesian model, what do changes in the money supply affect? • Interest rates, which in turn affect investment spending, aggregate demand, and real GDP, employment, and prices 23 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

In the Keynesian model, what do changes in the money supply affect? • Interest rates, which in turn affect investment spending, aggregate demand, and real GDP, employment, and prices 23 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

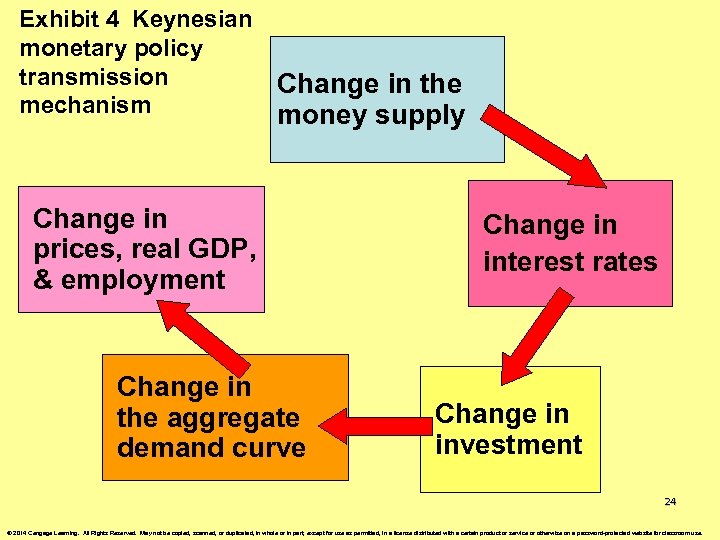

Exhibit 4 Keynesian monetary policy transmission mechanism Change in the money supply Change in prices, real GDP, & employment Change in the aggregate demand curve Change in interest rates Change in investment 24 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 4 Keynesian monetary policy transmission mechanism Change in the money supply Change in prices, real GDP, & employment Change in the aggregate demand curve Change in interest rates Change in investment 24 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

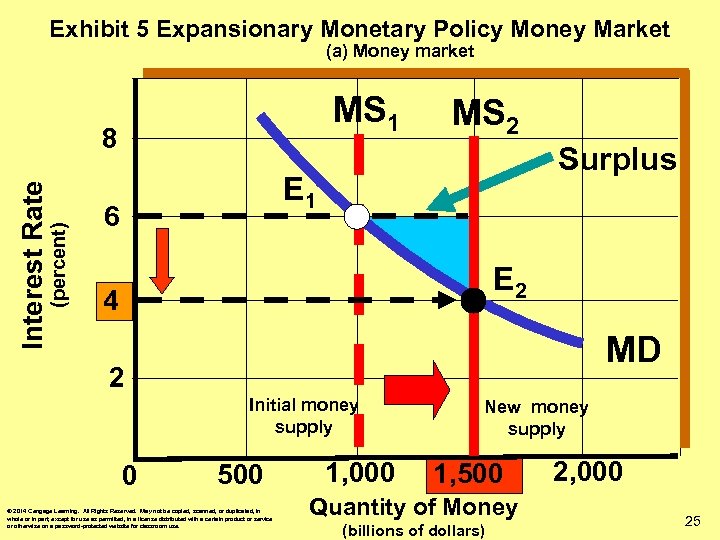

Exhibit 5 Expansionary Monetary Policy Money Market (a) Money market MS 1 (percent) Interest Rate 8 MS 2 Surplus E 1 6 E 2 4 MD 2 Initial money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 New money supply 1, 500 Quantity of Money (billions of dollars) 2, 000 25

Exhibit 5 Expansionary Monetary Policy Money Market (a) Money market MS 1 (percent) Interest Rate 8 MS 2 Surplus E 1 6 E 2 4 MD 2 Initial money supply 0 500 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. 1, 000 New money supply 1, 500 Quantity of Money (billions of dollars) 2, 000 25

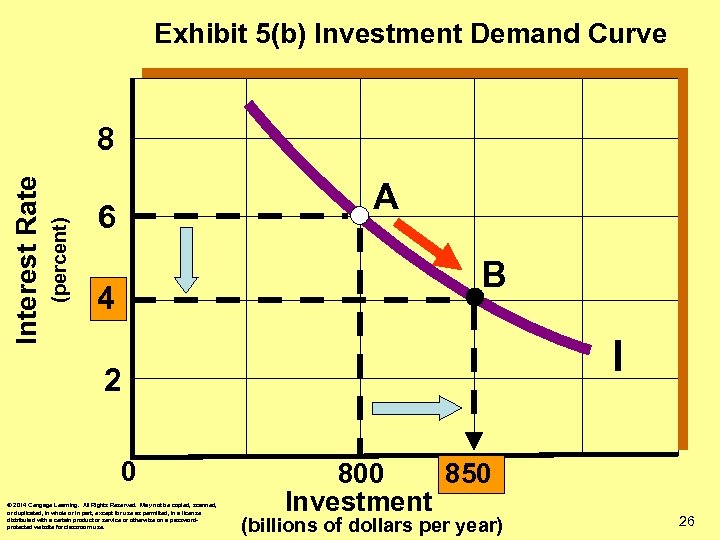

Exhibit 5(b) Investment Demand Curve (percent) Interest Rate 8 A 6 B 4 I 2 0 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a passwordprotected website for classroom use. 800 850 Investment (billions of dollars per year) 26

Exhibit 5(b) Investment Demand Curve (percent) Interest Rate 8 A 6 B 4 I 2 0 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a passwordprotected website for classroom use. 800 850 Investment (billions of dollars per year) 26

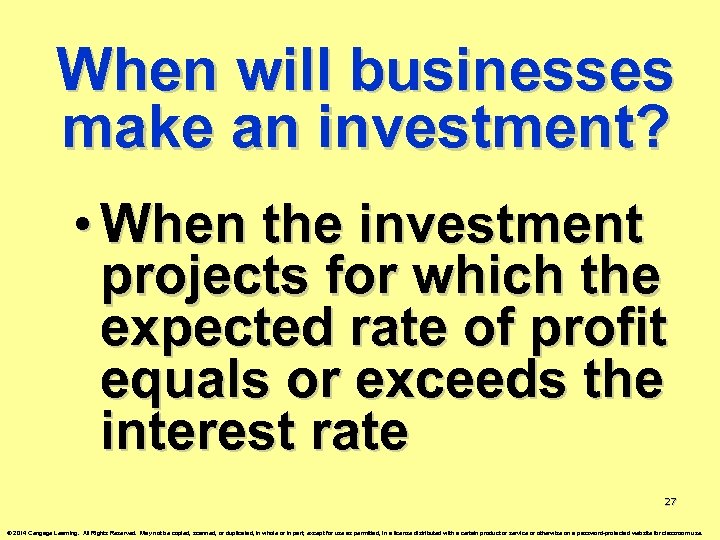

When will businesses make an investment? • When the investment projects for which the expected rate of profit equals or exceeds the interest rate 27 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

When will businesses make an investment? • When the investment projects for which the expected rate of profit equals or exceeds the interest rate 27 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

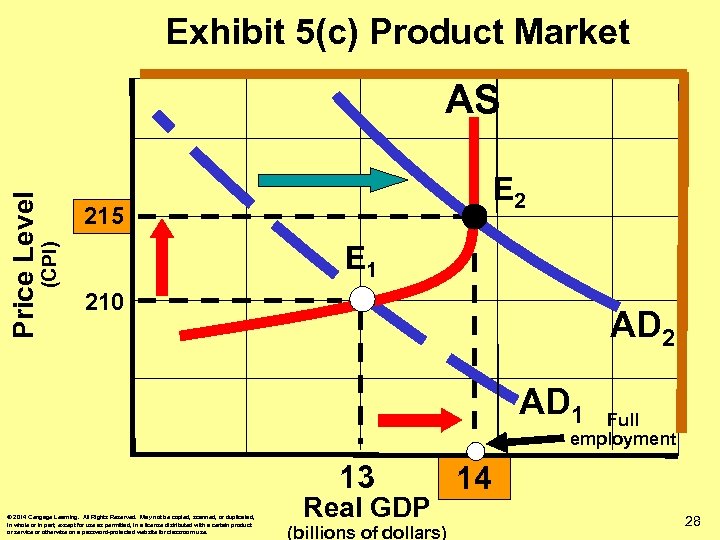

Exhibit 5(c) Product Market E 2 215 E 1 (CPI) Price Level AS 210 AD 2 AD 1 Full employment 13 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Real GDP (billions of dollars) 14 28

Exhibit 5(c) Product Market E 2 215 E 1 (CPI) Price Level AS 210 AD 2 AD 1 Full employment 13 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use. Real GDP (billions of dollars) 14 28

What is monetarism? • The theory that changes in the money supply directly determine changes in prices, real GDP, and employment 29 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is monetarism? • The theory that changes in the money supply directly determine changes in prices, real GDP, and employment 29 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

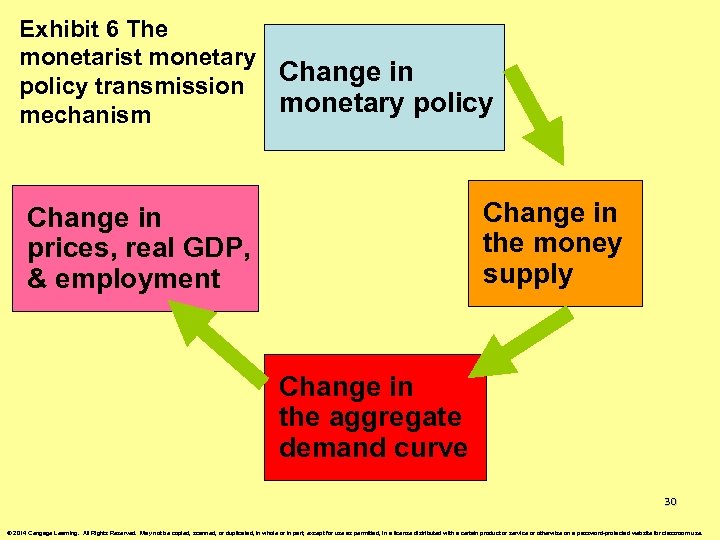

Exhibit 6 The monetarist monetary Change in policy transmission monetary policy mechanism Change in the money supply Change in prices, real GDP, & employment Change in the aggregate demand curve 30 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 6 The monetarist monetary Change in policy transmission monetary policy mechanism Change in the money supply Change in prices, real GDP, & employment Change in the aggregate demand curve 30 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the equation of exchange? • An accounting identity that states the money supply times the velocity of money equals total spending 31 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the equation of exchange? • An accounting identity that states the money supply times the velocity of money equals total spending 31 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

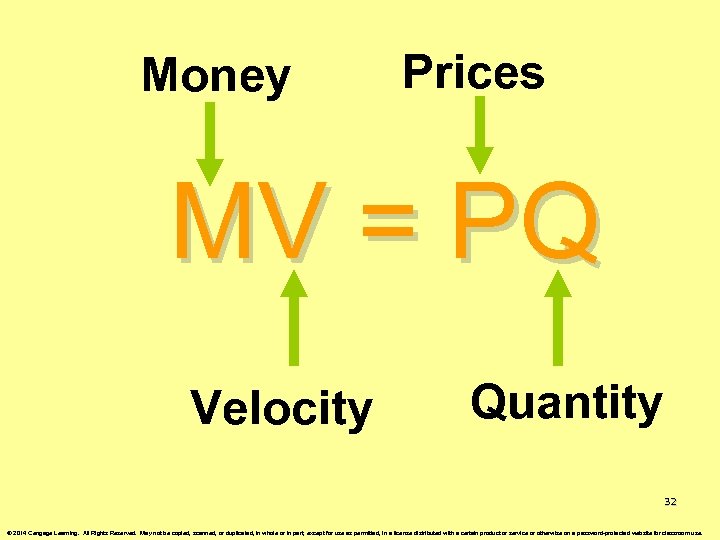

Money Prices MV = PQ Velocity Quantity 32 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Money Prices MV = PQ Velocity Quantity 32 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the velocity of money? • The average number of times per year a dollar of the money supply is spent on final goods and services 33 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the velocity of money? • The average number of times per year a dollar of the money supply is spent on final goods and services 33 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the quantity theory of money? • The theory that changes in the money supply are directly related to changes in the price level 34 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the quantity theory of money? • The theory that changes in the money supply are directly related to changes in the price level 34 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the conclusion of the quantity theory of money? • Any change in the money supply (M) must lead to a proportional change in the price level (P) because classical economists argue that the velocity of money (V) and real output (Q) remain constant 35 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the conclusion of the quantity theory of money? • Any change in the money supply (M) must lead to a proportional change in the price level (P) because classical economists argue that the velocity of money (V) and real output (Q) remain constant 35 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the modern monetarism view of the classical quantity theory of money? • Although velocity is not unchanging, it is predictable, the Fed should increase the money supply at a constant percentage to avoid inflation or recession. 36 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the modern monetarism view of the classical quantity theory of money? • Although velocity is not unchanging, it is predictable, the Fed should increase the money supply at a constant percentage to avoid inflation or recession. 36 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Who was Milton Friedman? • In the 1950’s and 1960’s, he was a leader in putting forth the ideas of the modern-day monetarists 37 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Who was Milton Friedman? • In the 1950’s and 1960’s, he was a leader in putting forth the ideas of the modern-day monetarists 37 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What did Milton Friedman advocate? • The Federal Reserve should follow a fixed money target and increase the money supply by a constant percentage each year to enhance full employment and stable prices 38 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What did Milton Friedman advocate? • The Federal Reserve should follow a fixed money target and increase the money supply by a constant percentage each year to enhance full employment and stable prices 38 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How do the Keynesians view the velocity of money? • Velocity of money is not stable or predictable 39 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

How do the Keynesians view the velocity of money? • Velocity of money is not stable or predictable 39 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

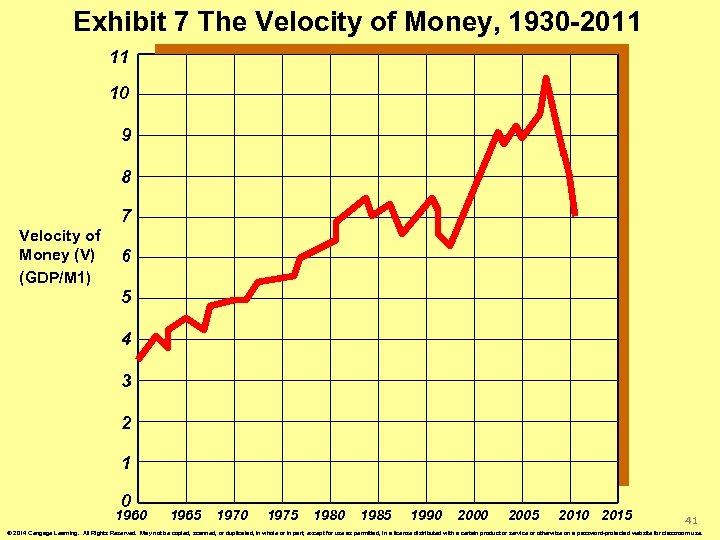

What does the data on velocity of money show in Exhibit 7? • During the 1980 s and early 1990 s, and after 2001, velocity was unpredictable – supporting the Keynesians • Between 1946 and 1981 and 1993 and 2000, velocity rose at a predictable or constant rate – supporting the monetarists 40 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What does the data on velocity of money show in Exhibit 7? • During the 1980 s and early 1990 s, and after 2001, velocity was unpredictable – supporting the Keynesians • Between 1946 and 1981 and 1993 and 2000, velocity rose at a predictable or constant rate – supporting the monetarists 40 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 7 The Velocity of Money, 1930 -2011 11 10 9 8 7 Velocity of Money (V) (GDP/M 1) 6 5 4 3 2 1 0 1965 1970 1975 1980 1985 1990 2005 2010 2015 41 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 7 The Velocity of Money, 1930 -2011 11 10 9 8 7 Velocity of Money (V) (GDP/M 1) 6 5 4 3 2 1 0 1965 1970 1975 1980 1985 1990 2005 2010 2015 41 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

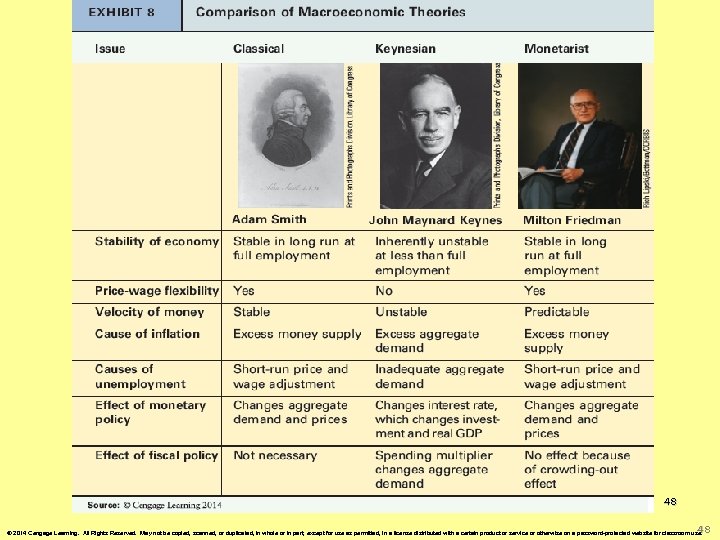

A Comparison of Macroeconomic Views 42 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

A Comparison of Macroeconomic Views 42 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Classical Economics • Classical theory argues that the economy automatically self corrects to full employment in the long run because of flexible prices and wages. Therefore there is no need for fiscal policy. • Classical economists believe in the quantity theory of money and that increases in the money supply cause inflation. 43 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Classical Economics • Classical theory argues that the economy automatically self corrects to full employment in the long run because of flexible prices and wages. Therefore there is no need for fiscal policy. • Classical economists believe in the quantity theory of money and that increases in the money supply cause inflation. 43 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Keynesian Economics • Keynesian theory argues that the economy does not automatically self corrects to full employment in the long run and prices and wages are inflexible downward during a severe recession. Therefore there is a need for fiscal policy. • Keynesian economists believe that the velocity of money is unstable and that changes in the money supply affect interest rates and investment. 44 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Keynesian Economics • Keynesian theory argues that the economy does not automatically self corrects to full employment in the long run and prices and wages are inflexible downward during a severe recession. Therefore there is a need for fiscal policy. • Keynesian economists believe that the velocity of money is unstable and that changes in the money supply affect interest rates and investment. 44 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the crowding-out effect? • Too much government borrowing can raise interest rates, which reduces consumption and investment. As a result, the increase in the AD curve from fiscal policy is diminished or “crowded out. ” 45 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the crowding-out effect? • Too much government borrowing can raise interest rates, which reduces consumption and investment. As a result, the increase in the AD curve from fiscal policy is diminished or “crowded out. ” 45 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the Keynesian view of the crowding-out effect? • The investment demand curve is rather steep or vertical, so the crowdingout effect is insignificant 46 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

What is the Keynesian view of the crowding-out effect? • The investment demand curve is rather steep or vertical, so the crowdingout effect is insignificant 46 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Monetarism • The investment demand curve is relatively flat or more horizontal, so the crowding-out effect is significant and fiscal policy is ineffective. • The Fed can not be trusted to control the money supply. Monetarists believe in the quantity theory of money and they advocate using a fixed money supply target. 47 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Monetarism • The investment demand curve is relatively flat or more horizontal, so the crowding-out effect is significant and fiscal policy is ineffective. • The Fed can not be trusted to control the money supply. Monetarists believe in the quantity theory of money and they advocate using a fixed money supply target. 47 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

48 48 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

48 48 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 9 The Great Depression Economic Data, 1929 -1934 Compared to the Great Recession of 2007 (additional graphs not in text included) 49 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Exhibit 9 The Great Depression Economic Data, 1929 -1934 Compared to the Great Recession of 2007 (additional graphs not in text included) 49 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

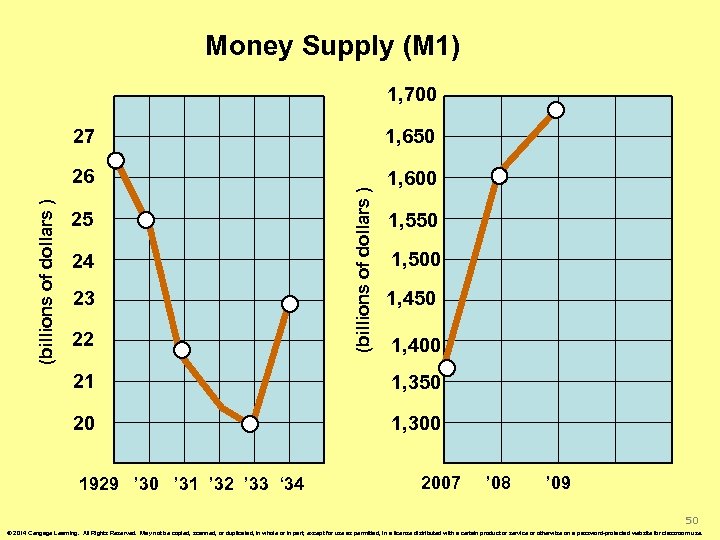

Money Supply (M 1) 1, 700 1, 600 25 24 23 22 (billions of dollars ) 1, 650 26 (billions of dollars ) 27 1, 550 1, 500 1, 450 1, 400 21 1, 350 20 1, 300 1929 ’ 30 ’ 31 ’ 32 ’ 33 ‘ 34 2007 ’ 08 ’ 09 50 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Money Supply (M 1) 1, 700 1, 600 25 24 23 22 (billions of dollars ) 1, 650 26 (billions of dollars ) 27 1, 550 1, 500 1, 450 1, 400 21 1, 350 20 1, 300 1929 ’ 30 ’ 31 ’ 32 ’ 33 ‘ 34 2007 ’ 08 ’ 09 50 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

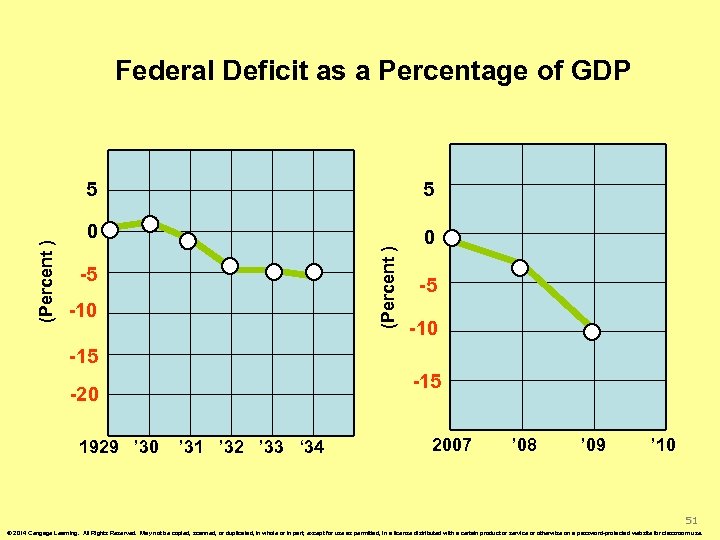

Federal Deficit as a Percentage of GDP 5 0 0 (Percent ) 5 -5 -10 -15 -20 1929 ’ 30 ’ 31 ’ 32 ’ 33 ‘ 34 2007 ’ 08 ’ 09 ’ 10 51 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Federal Deficit as a Percentage of GDP 5 0 0 (Percent ) 5 -5 -10 -15 -20 1929 ’ 30 ’ 31 ’ 32 ’ 33 ‘ 34 2007 ’ 08 ’ 09 ’ 10 51 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

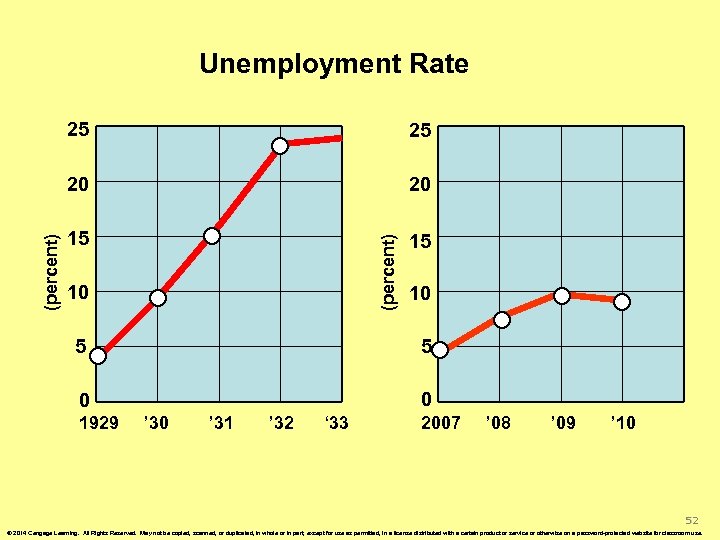

Unemployment Rate 20 15 15 (percent) 25 20 (percent) 25 10 10 5 5 0 0 1929 ’ 30 ’ 31 ’ 32 ‘ 33 2007 ’ 08 ’ 09 ’ 10 52 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

Unemployment Rate 20 15 15 (percent) 25 20 (percent) 25 10 10 5 5 0 0 1929 ’ 30 ’ 31 ’ 32 ‘ 33 2007 ’ 08 ’ 09 ’ 10 52 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

END 53 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.

END 53 © 2014 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part, except for use as permitted, in a license distributed with a certain product or service or otherwise on a password-protected website for classroom use.