09c9586e339396795b7c59601197a95d.ppt

- Количество слайдов: 19

Chapter 2 The Measurement of Income, Prices, and Unemployment Copyright © 2006 Pearson Addison-Wesley. All rights reserved.

Chapter 2 The Measurement of Income, Prices, and Unemployment Copyright © 2006 Pearson Addison-Wesley. All rights reserved.

We assume a simple economy with households and business firms. • Firms sell goods and services. Households sell their work(labor). • These are purchased by households for their own use. • We call this action consumption expenditures. • In order to purchase some good or service the households need to have an income. • They generate this income by working for the firms. • So there are flows between households and firms. • The green flows from the firms to households represent what the firms pay to them so that is an income for them(households). • The red flows from the households to firsm represent what they spend on consumption so that is a source of income for the firms. In this example every party spend exactly what they get from each. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

We assume a simple economy with households and business firms. • Firms sell goods and services. Households sell their work(labor). • These are purchased by households for their own use. • We call this action consumption expenditures. • In order to purchase some good or service the households need to have an income. • They generate this income by working for the firms. • So there are flows between households and firms. • The green flows from the firms to households represent what the firms pay to them so that is an income for them(households). • The red flows from the households to firsm represent what they spend on consumption so that is a source of income for the firms. In this example every party spend exactly what they get from each. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 2

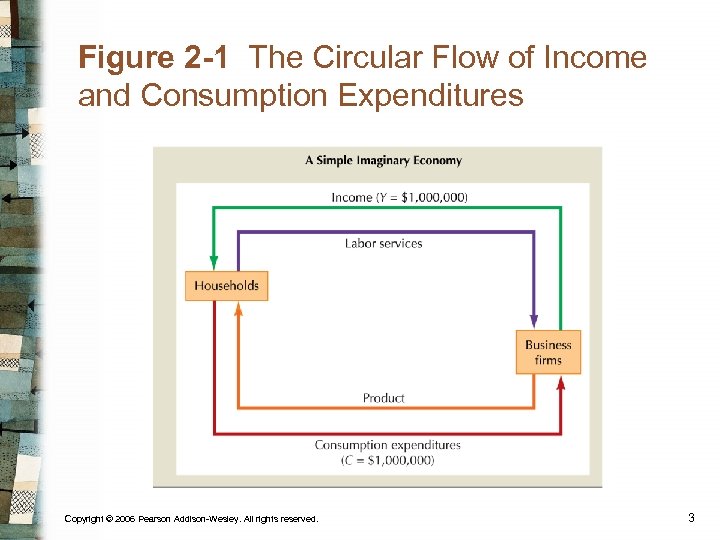

Figure 2 -1 The Circular Flow of Income and Consumption Expenditures Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 3

Figure 2 -1 The Circular Flow of Income and Consumption Expenditures Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 3

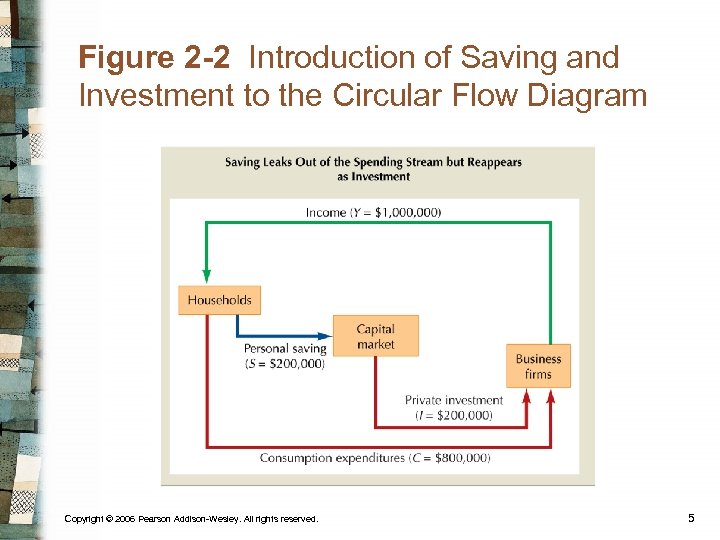

In the next slide things get a little complicated. . • Now households do not spend all of their income on consumption. • They save the part of their income they do NOT spend. • This saving may occur in the form of buying the shares (stocks) of the firms. • Or this saving may be in the form of money deposited in a bank. • In the first case, the households pay money- for each share they buy – to firms. • In the second case, the bank lend the money deposited to the firms. • The firms use the money they obtain to buy investment goods. • Households spend the rest of their income on consumption goods that they buy from the firms. • Now you see that in addition to household and firm sectors there is a capital market sector. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

In the next slide things get a little complicated. . • Now households do not spend all of their income on consumption. • They save the part of their income they do NOT spend. • This saving may occur in the form of buying the shares (stocks) of the firms. • Or this saving may be in the form of money deposited in a bank. • In the first case, the households pay money- for each share they buy – to firms. • In the second case, the bank lend the money deposited to the firms. • The firms use the money they obtain to buy investment goods. • Households spend the rest of their income on consumption goods that they buy from the firms. • Now you see that in addition to household and firm sectors there is a capital market sector. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 4

Figure 2 -2 Introduction of Saving and Investment to the Circular Flow Diagram Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 5

Figure 2 -2 Introduction of Saving and Investment to the Circular Flow Diagram Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 5

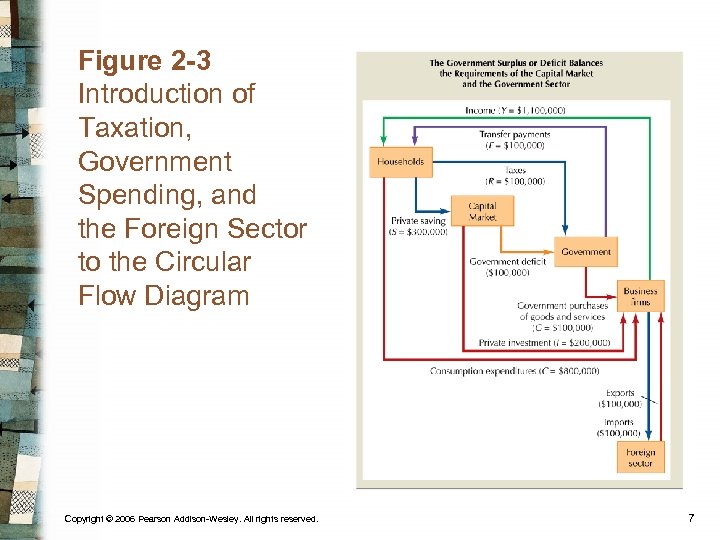

In the next slide things get even more complicated. . because now we put the government in the picture. . . • Now, in addition to HH, firms, capital market we introduce the government. • Government will now take the part of the income that goes to the HH in the form of taxes. • Taxes-we may not like to pay them- are a source of revenue for the government. • But, government is not that bad, sometimes government may make payments to the HH. . such as social security, unemployment , pension etc. . . • These payments are called transfer payments. • Government also makes spending on purchases of goods and services. . . such as schools, highways, defence. . . • Now, let us see the new flows. . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

In the next slide things get even more complicated. . because now we put the government in the picture. . . • Now, in addition to HH, firms, capital market we introduce the government. • Government will now take the part of the income that goes to the HH in the form of taxes. • Taxes-we may not like to pay them- are a source of revenue for the government. • But, government is not that bad, sometimes government may make payments to the HH. . such as social security, unemployment , pension etc. . . • These payments are called transfer payments. • Government also makes spending on purchases of goods and services. . . such as schools, highways, defence. . . • Now, let us see the new flows. . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 6

Figure 2 -3 Introduction of Taxation, Government Spending, and the Foreign Sector to the Circular Flow Diagram Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

Figure 2 -3 Introduction of Taxation, Government Spending, and the Foreign Sector to the Circular Flow Diagram Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 7

Moreover, we have the foreign sector added now. . • When government purchases exceed its income (taxes collected) , it is in deficit. • Government can finance this deficit by borrowing in the capital market. Example: what do you think the treasury bills are for? • By the way, let us remember that HH are not ONLY composed of people who work for firms, the OWNERS of the firms are also part of households. So. . . HH = People who work for salary + people who are the owners of the firms which hire workers. • The income the owners make is called. . . PROFIT. • The income the salaried people make is called wages(salaries). • Let us go back to government. . . now that $100. 000 is borrowed it can be used to finance its purchses (same amount). • When you add up C + I + G what do you find it is equal to ? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

Moreover, we have the foreign sector added now. . • When government purchases exceed its income (taxes collected) , it is in deficit. • Government can finance this deficit by borrowing in the capital market. Example: what do you think the treasury bills are for? • By the way, let us remember that HH are not ONLY composed of people who work for firms, the OWNERS of the firms are also part of households. So. . . HH = People who work for salary + people who are the owners of the firms which hire workers. • The income the owners make is called. . . PROFIT. • The income the salaried people make is called wages(salaries). • Let us go back to government. . . now that $100. 000 is borrowed it can be used to finance its purchses (same amount). • When you add up C + I + G what do you find it is equal to ? Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 8

Important issues to remember. . • Distinguish the flows from the stocks; a flow magnitude is any money payment, physical good or service that flows from one economic unit to another per unit of time. • For example, consumption, investment, government purchases are flows. • On the other hand, money, debt or depreciation are stock type of variables. We say Money stock, debt stock etc. . . • In calculating GDP, we use only final goods, that is, goods that are NOT used as inputs in the production goods. • For instance, bread is a FINAL good, but flour is an INTERMEDIATE good. • We use flour as input in the production of bread. . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

Important issues to remember. . • Distinguish the flows from the stocks; a flow magnitude is any money payment, physical good or service that flows from one economic unit to another per unit of time. • For example, consumption, investment, government purchases are flows. • On the other hand, money, debt or depreciation are stock type of variables. We say Money stock, debt stock etc. . . • In calculating GDP, we use only final goods, that is, goods that are NOT used as inputs in the production goods. • For instance, bread is a FINAL good, but flour is an INTERMEDIATE good. • We use flour as input in the production of bread. . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 9

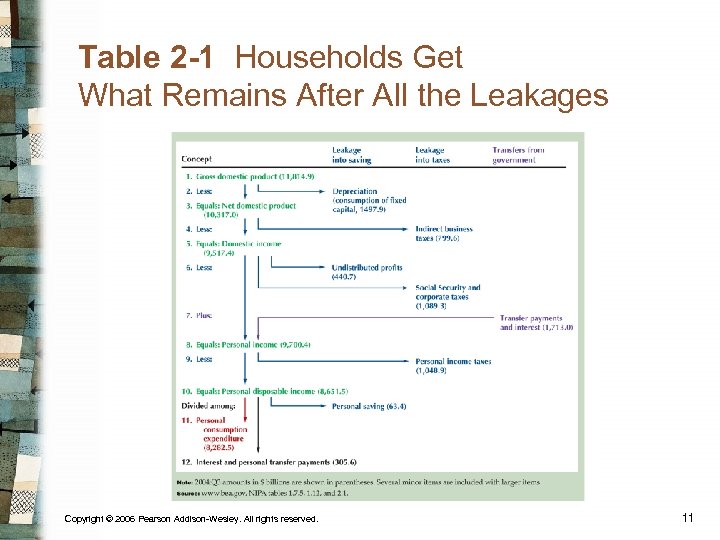

In the next slide, we see how we can find some aggregates such disposable income, personal income from GDP. • To find Net domestic product (NDP) we subtract depreciation from the GDP. • Depreciation expenditures are the part of the investment made for the replacement of old buildings and equipment. • Subtract indirect business taxes from NDP, and we find domestic income. • Subtract undistributed profits and social security payments from domestic income add transfer payments and we find personal income. • But personal income is still not usable (disposable) income. To find this latter we subtract personal income taxes. • The amounts we subtract are called leakages because we take them out to find what is left as available for households. • Now take a look at the following. . . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 10

In the next slide, we see how we can find some aggregates such disposable income, personal income from GDP. • To find Net domestic product (NDP) we subtract depreciation from the GDP. • Depreciation expenditures are the part of the investment made for the replacement of old buildings and equipment. • Subtract indirect business taxes from NDP, and we find domestic income. • Subtract undistributed profits and social security payments from domestic income add transfer payments and we find personal income. • But personal income is still not usable (disposable) income. To find this latter we subtract personal income taxes. • The amounts we subtract are called leakages because we take them out to find what is left as available for households. • Now take a look at the following. . . Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 10

Table 2 -1 Households Get What Remains After All the Leakages Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

Table 2 -1 Households Get What Remains After All the Leakages Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 11

Leakages can be of different type. . . • For example, depreciation, undistributed profits and personal savings can ALL be considered as leakages into SAVING. • When companies decide not to distribute their profits these are retained, (not given to company shareholders) so this is a LEAKAGE from the expenditure system into a kind of saving. • The income is the source of the expenditure remember? • When the people are deprived of their extra income in the form of undistributed profits, they also have to arrange their spending accordingly. • All types of taxes, whether income taxes or personal taxes are LEAKAGES into taxes. That is these amounts are taken away from people’s incomes, so LESS is available for SPENDING. • ALL the money spent, enters into economic system. Remember the golden rule: Someone’s spending (expenditures) is also somebody else’s income. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

Leakages can be of different type. . . • For example, depreciation, undistributed profits and personal savings can ALL be considered as leakages into SAVING. • When companies decide not to distribute their profits these are retained, (not given to company shareholders) so this is a LEAKAGE from the expenditure system into a kind of saving. • The income is the source of the expenditure remember? • When the people are deprived of their extra income in the form of undistributed profits, they also have to arrange their spending accordingly. • All types of taxes, whether income taxes or personal taxes are LEAKAGES into taxes. That is these amounts are taken away from people’s incomes, so LESS is available for SPENDING. • ALL the money spent, enters into economic system. Remember the golden rule: Someone’s spending (expenditures) is also somebody else’s income. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 12

So, anything that is not spend and witheld is a LEAKAGE • All taxes are leakages, beacuse they are taken away from the income which is the main source of our expenditures. • If we pay more taxes, less is left for sepnding. • Same for savings, these are the amounts not spent but puıt aside for later use. • Transfer payments are INJECTIONS into economic system. • Beacuse these are the amount that the government transfer to the people. • Example: Pensions, tax rebates, subsidies. • All these ADD to people’s income. Even when transfer payment is made to the firms, it is still an addition to the income, because people(households) are the OWNERS of the firms as well. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13

So, anything that is not spend and witheld is a LEAKAGE • All taxes are leakages, beacuse they are taken away from the income which is the main source of our expenditures. • If we pay more taxes, less is left for sepnding. • Same for savings, these are the amounts not spent but puıt aside for later use. • Transfer payments are INJECTIONS into economic system. • Beacuse these are the amount that the government transfer to the people. • Example: Pensions, tax rebates, subsidies. • All these ADD to people’s income. Even when transfer payment is made to the firms, it is still an addition to the income, because people(households) are the OWNERS of the firms as well. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 13

Equality between income and expenditure • Y = E (İncome equals expenditures) • E =C+I+G+NX (Expenditures may be of different types) • Y +F = C+S+R (Income plus transfer payments are split between different USES: these are consumption, saving and tax payments, after you pay out your taxes out of your income, the rest is split between consumption and saving). • Carry the F to right hand side, since F can be seen as negative taxes. Now define R –F as net taxes (T) so: • Y = C +S +T • C+S+T = C+I+G+NX and subtract C from both sides: • S+T = I+G+NX (leakages must be balanced by injections) • If there is a deficit: T-G<0, then I+NX-S <0 ---> I+NX

Equality between income and expenditure • Y = E (İncome equals expenditures) • E =C+I+G+NX (Expenditures may be of different types) • Y +F = C+S+R (Income plus transfer payments are split between different USES: these are consumption, saving and tax payments, after you pay out your taxes out of your income, the rest is split between consumption and saving). • Carry the F to right hand side, since F can be seen as negative taxes. Now define R –F as net taxes (T) so: • Y = C +S +T • C+S+T = C+I+G+NX and subtract C from both sides: • S+T = I+G+NX (leakages must be balanced by injections) • If there is a deficit: T-G<0, then I+NX-S <0 ---> I+NX

The Magic Equation • The magic equation shows how the funds resulting from a budget surplus are used. • 1993 : T-G = -1. 8 and I=17. 6, NX=-1. 0, S=18. 4. • Saving is larger than investment (excess saving) and net exports are negative that is imports are greater the exports so the difference between them can only be financed by foreign borrowing. • So: -1. 8 = (17. 6 -1. 0)-18. 4 • 1994: T-G = 4. 4 (now there is a surplus), I=20. 8, NX=-4. 0, S=12. 4. • The surplus over expenditures and STILL foreign borrowing (a minus net exports greater than before)help to finance a bigger amount of investment now. • So: 4. 4 =(20. 8 -4. 0)-12. 4. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 15

The Magic Equation • The magic equation shows how the funds resulting from a budget surplus are used. • 1993 : T-G = -1. 8 and I=17. 6, NX=-1. 0, S=18. 4. • Saving is larger than investment (excess saving) and net exports are negative that is imports are greater the exports so the difference between them can only be financed by foreign borrowing. • So: -1. 8 = (17. 6 -1. 0)-18. 4 • 1994: T-G = 4. 4 (now there is a surplus), I=20. 8, NX=-4. 0, S=12. 4. • The surplus over expenditures and STILL foreign borrowing (a minus net exports greater than before)help to finance a bigger amount of investment now. • So: 4. 4 =(20. 8 -4. 0)-12. 4. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 15

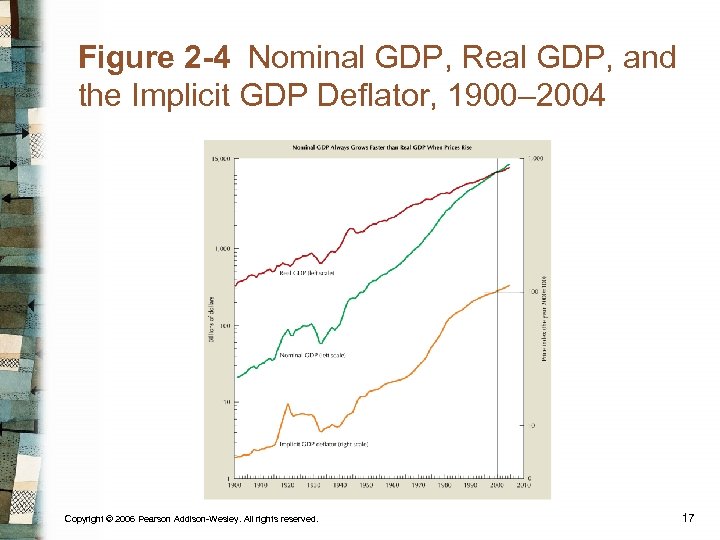

Now let us look at the difference between Nominal and Real GDP • Real GDP is the GDP expressed in constant prices. • We are concerned with the physical volumes and not the price effects if we consider the Real GDP. • If in a country the GDP say, last year was $100 million and the this year $110 million, this does not mean the economy has grown. • Because there may have been price increases of the goods and services. So the nominal values may not tell whether the increase is due to price increase or quantity increases. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 16

Now let us look at the difference between Nominal and Real GDP • Real GDP is the GDP expressed in constant prices. • We are concerned with the physical volumes and not the price effects if we consider the Real GDP. • If in a country the GDP say, last year was $100 million and the this year $110 million, this does not mean the economy has grown. • Because there may have been price increases of the goods and services. So the nominal values may not tell whether the increase is due to price increase or quantity increases. Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 16

Figure 2 -4 Nominal GDP, Real GDP, and the Implicit GDP Deflator, 1900– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 17

Figure 2 -4 Nominal GDP, Real GDP, and the Implicit GDP Deflator, 1900– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 17

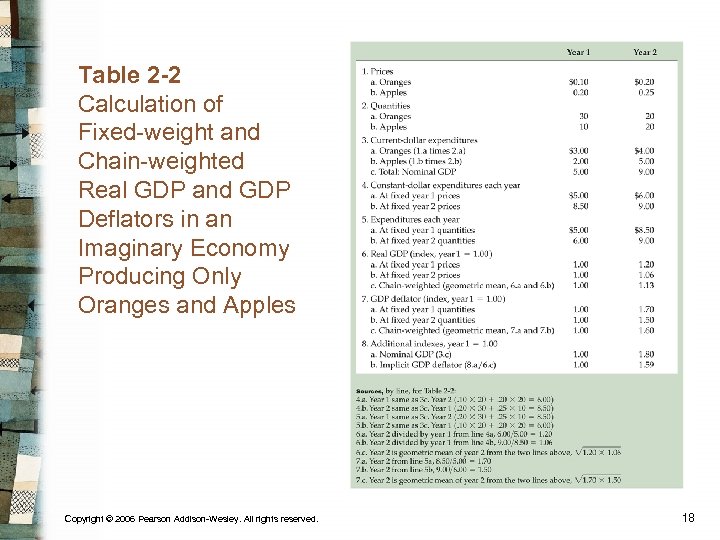

Table 2 -2 Calculation of Fixed-weight and Chain-weighted Real GDP and GDP Deflators in an Imaginary Economy Producing Only Oranges and Apples Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 18

Table 2 -2 Calculation of Fixed-weight and Chain-weighted Real GDP and GDP Deflators in an Imaginary Economy Producing Only Oranges and Apples Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 18

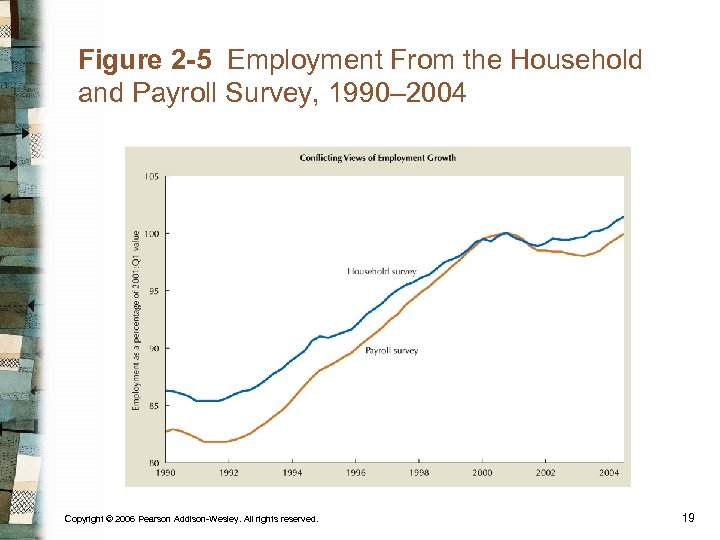

Figure 2 -5 Employment From the Household and Payroll Survey, 1990– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 19

Figure 2 -5 Employment From the Household and Payroll Survey, 1990– 2004 Copyright © 2006 Pearson Addison-Wesley. All rights reserved. 19