f844c0f38b4ad966485ead6b26d9df2b.ppt

- Количество слайдов: 52

Chapter 2 The Foreign Exchange Market

Objectives • • To describe the FX market To identify participants and currencies To describe the Australian FX market To describe the mechanics and technology of FX trading (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -2

Objectives (cont. ) • To introduce some exchange rate concepts • To illustrate FX position keeping • To introduce some FX jargon Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -3

Definition • The FX market is the market where national currencies are bought and sold against one another. Foreign exchange consists mainly of bank deposits. Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -4

Characteristics • It is the largest and most perfect market • It is needed because every international transaction requires a foreign exchange transaction • It is an over-the-counter (OTC) market Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -5

Market participants • Foreign exchange traders buy and sell currencies directly or indirectly • Arbitragers exploit exchange rate anomalies; hedgers cover open positions; speculators take open positions Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -6

Categories of participants • • • Customers Commercial banks Other financial institutions Brokers Central banks Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -7

Interbank operations • The FX market is dominated by interbank operations • Participants in the interbank market are market makers, other major dealers and second-tier banks Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -8

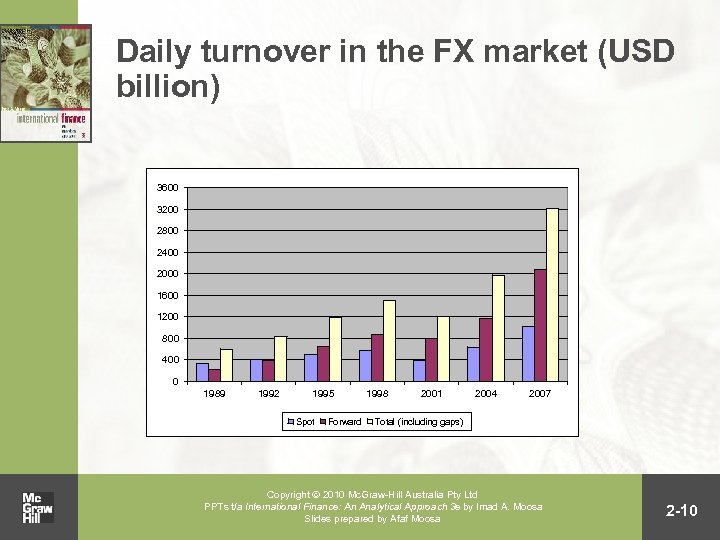

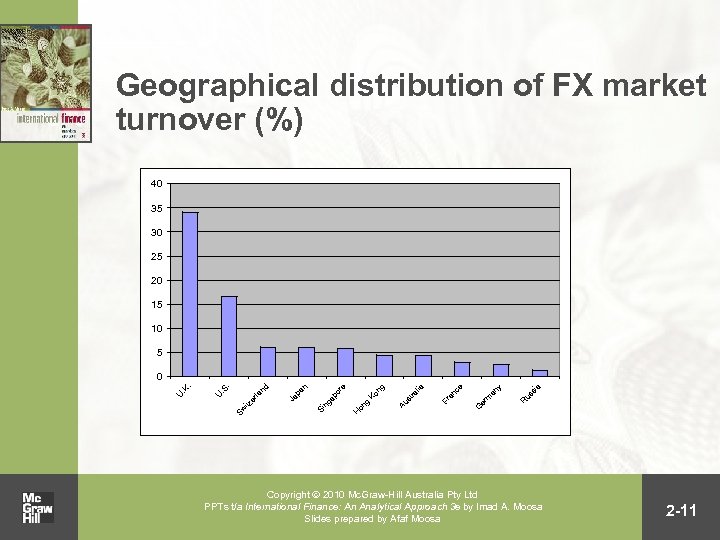

Size and composition • The size of the global FX market is measured by the sum of daily turnover in FX centres • A survey is coordinated by the BIS every three years for this purpose Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -9

Daily turnover in the FX market (USD billion) 3600 3200 2800 2400 2000 1600 1200 800 400 0 1989 1992 1995 Spot Forward 1998 2001 2004 2007 Total (including gaps) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -10

Geographical distribution of FX market turnover (%) 40 35 30 25 20 15 10 5 a si us R G er m an y ce Fr an lia ra st Au ng Ko g H on or e ng ap Ja pa n Si Sw itz er la nd . . S U U . K . 0 Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -11

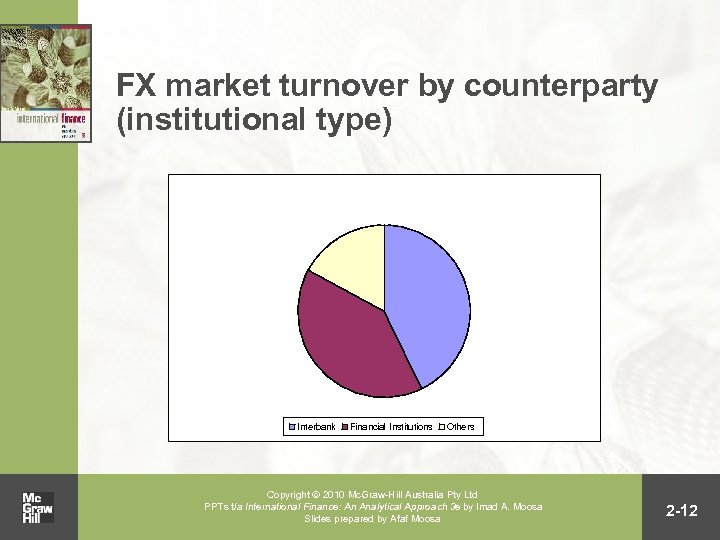

FX market turnover by counterparty (institutional type) Interbank Financial Institutions Others Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -12

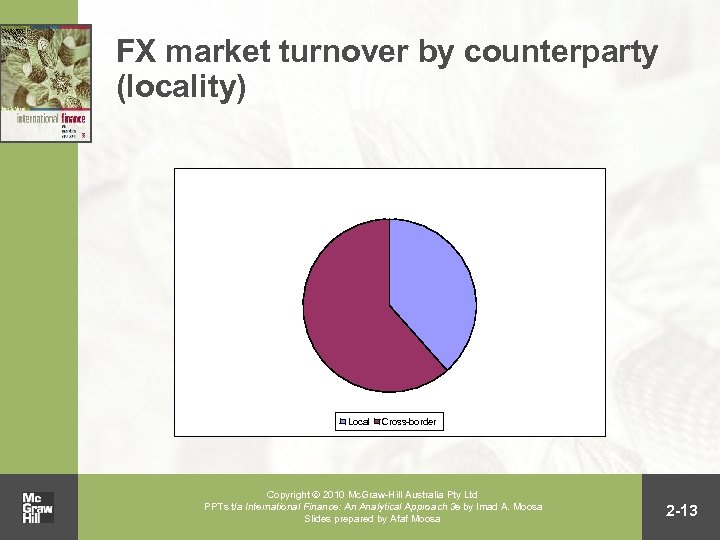

FX market turnover by counterparty (locality) Local Cross-border Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -13

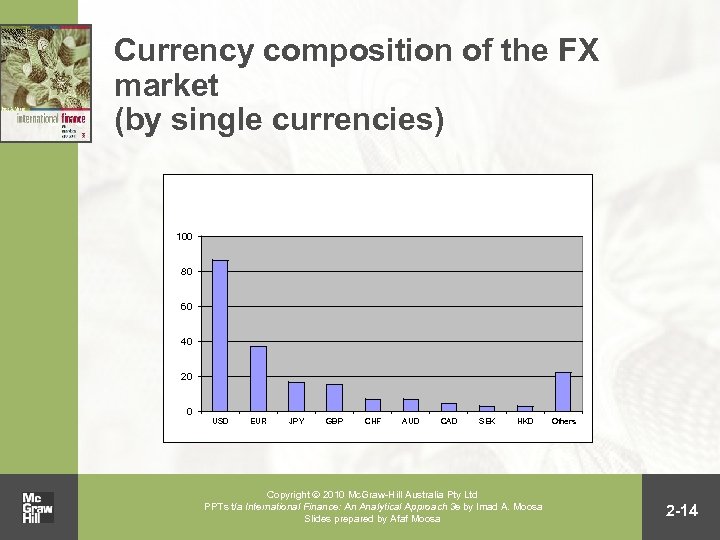

Currency composition of the FX market (by single currencies) 100 80 60 40 20 0 USD EUR JPY GBP CHF AUD CAD SEK HKD Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa Others 2 -14

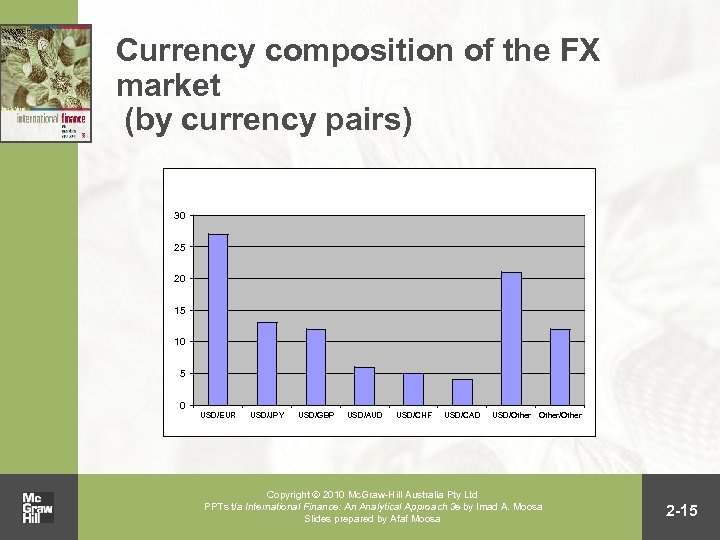

Currency composition of the FX market (by currency pairs) 30 25 20 15 10 5 0 USD/EUR USD/JPY USD/GBP USD/AUD USD/CHF USD/CAD USD/Other/Other Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -15

Traded currencies • The US dollar is the most heavily traded currency • The euro and the yen are heavily traded because of the importance of Europe and Japan in the world economy (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -16

Traded currencies (cont. ) • The pound is heavily traded for historical reasons • Currencies that are heavily traded in certain financial centres and lack liquidity in others: CHF, CAD (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -17

Traded currencies (cont. ) • Currencies that are traded locally, but internationally are traded for international trade purposes: AUD, NZD, HKD • Third world currencies: soft or exotic currencies Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -18

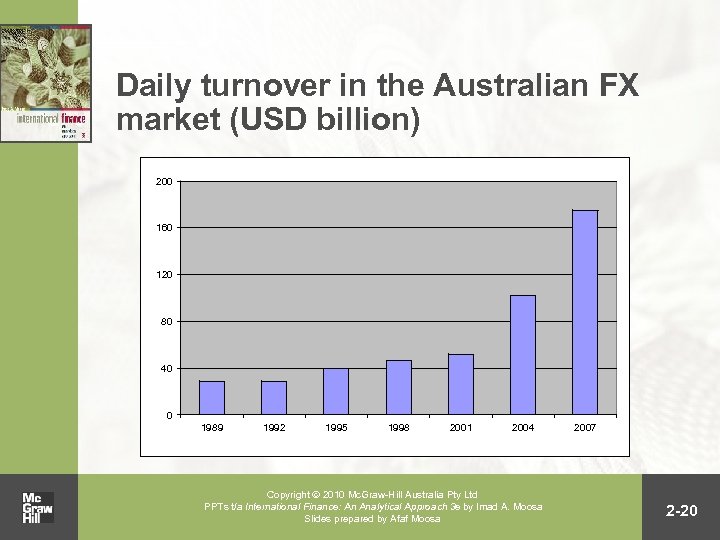

The AUD FX market • The market consists of the banking system and non -bank dealers authorised by the Reserve Bank of Australia (RBA) • The market has grown since the flotation of the AUD in 1983 Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -19

Daily turnover in the Australian FX market (USD billion) 200 160 120 80 40 0 1989 1992 1995 1998 2001 2004 Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2007 2 -20

Reasons for the growth of the AUD market • • Deregulation High interest rates in the 1980 s Australia’s time zone Exchange rate volatility Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -21

Components of an FX transaction • • Price discovery Decision making Settlement Position keeping Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -22

FX market technology • • The telegraph The telephone The telex The fax (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -23

FX market technology (cont. ) • • Screen-based information systems Screen-based automated dealing systems Automatic order matching systems Online FX trading Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -24

The bilateral spot exchange rate • The exchange rate between two currencies for immediate delivery Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -25

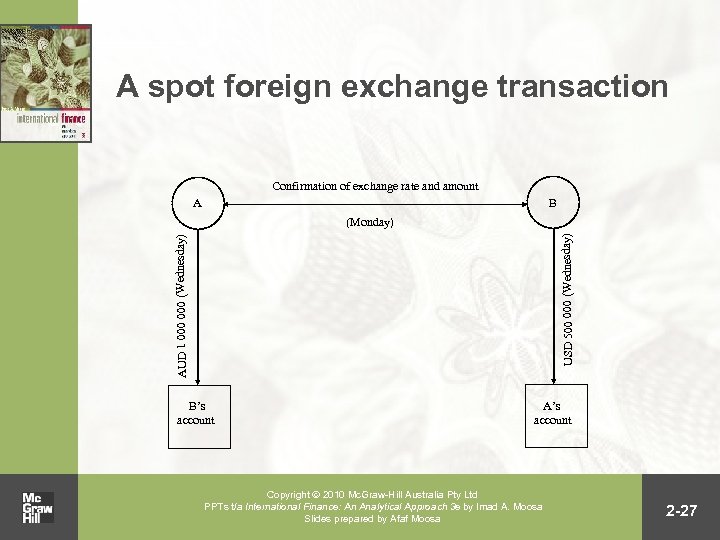

Transaction dates • The date on which the transaction is agreed upon is called the contract date, dealing date, done date or trade date • The date on which currencies are exchanged is the value date or the delivery date Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -26

A spot foreign exchange transaction Confirmation of exchange rate and amount A B AUD 1 000 (Wednesday) USD 500 000 (Wednesday) (Monday) B’s account A’s account Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -27

The delivery date • Typically, the delivery date is two business days after the contract date • In a value-today or same-day transaction the delivery date is the same as the contract date • In a value-tomorrow or next-day transaction the delivery date is one day after the contract date Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -28

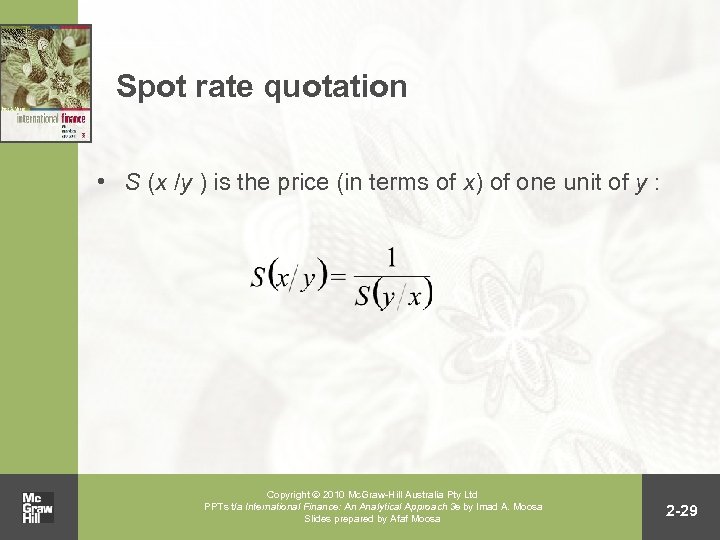

Spot rate quotation • S (x /y ) is the price (in terms of x) of one unit of y : Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -29

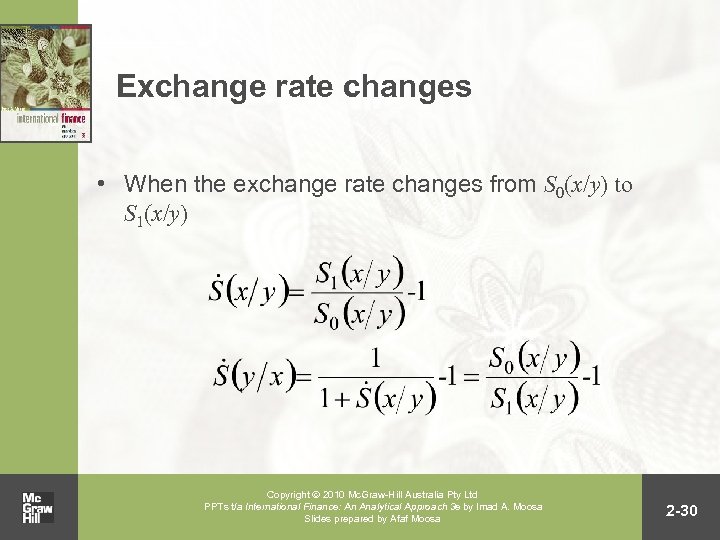

Exchange rate changes • When the exchange rate changes from S 0(x/y) to S 1(x/y) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -30

Currency conversion • To convert from y to x, multiply by the exchange rate • To convert from x to y, divide by the exchange rate Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -31

Exchange rate quotation in practice • Direct quotation refers to the domestic currency price of one unit of the foreign currency • Indirect quotation refers to the foreign currency price of the domestic currency • What is a direct quotation from the perspective of one country is an indirect quotation from the perspective of the other country, and vice versa Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -32

The bid and offer rates • The bid rate is the rate at which the quoting dealer is willing to buy. The offer rate is the rate at which the quoting dealer is willing to sell. • The spread is Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -33

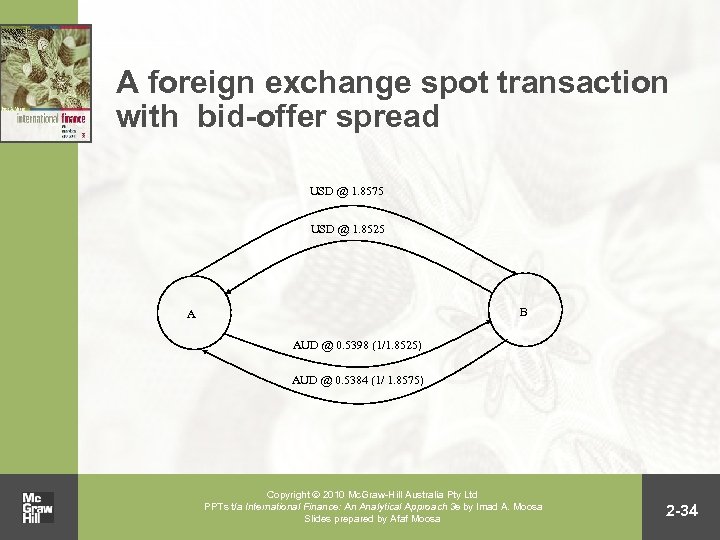

A foreign exchange spot transaction with bid-offer spread USD @ 1. 8575 USD @ 1. 8525 B A AUD @ 0. 5398 (1/1. 8525) AUD @ 0. 5384 (1/ 1. 8575) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -34

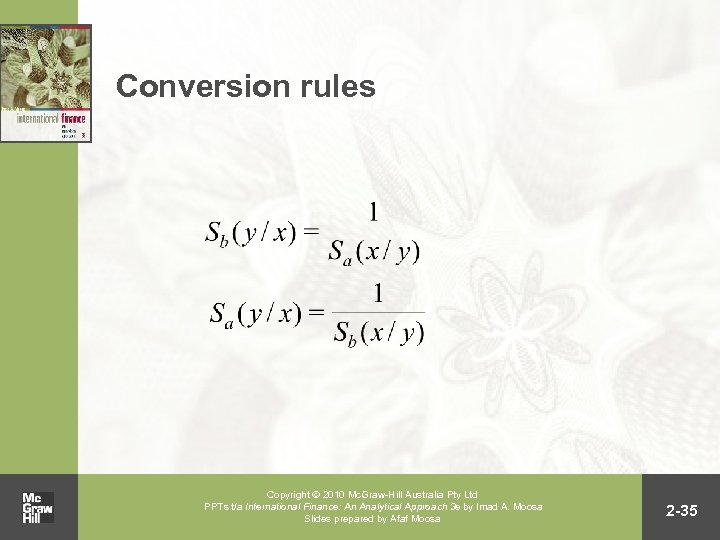

Conversion rules Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -35

Points and pips • A point is one-hundredth of a cent, a penny, etc. • A pip is one-tenth of a point • If the exchange rate is 1. 2545 -1. 2585, this can be expressed as 45 -85 and 1. 25 is called the “big number” Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -36

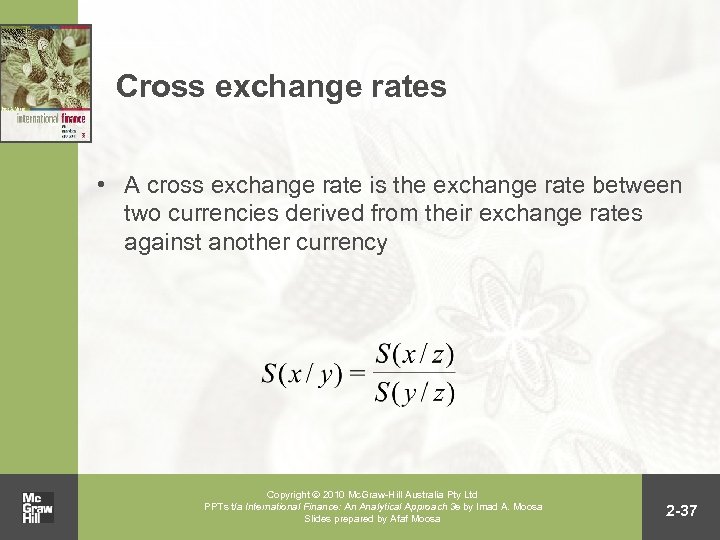

Cross exchange rates • A cross exchange rate is the exchange rate between two currencies derived from their exchange rates against another currency Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -37

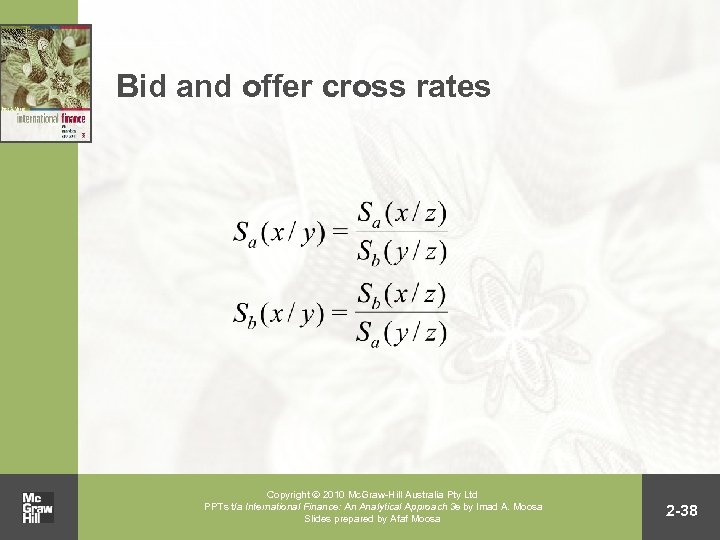

Bid and offer cross rates Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -38

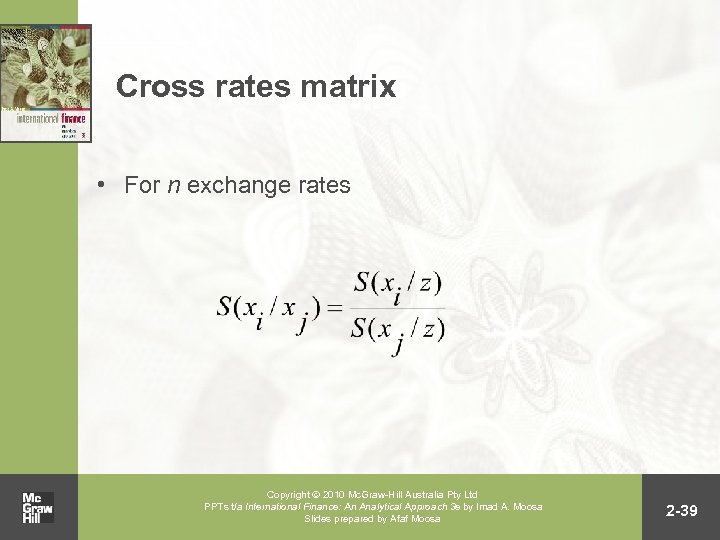

Cross rates matrix • For n exchange rates Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -39

FX position keeping • A nostro account is held by a dealer at a correspondent bank • A vostro account is held by a bank on behalf of a foreign dealer • The words “nostro” and “vostro” are Latin for “ours” and “yours” (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -40

FX position keeping (cont. ) • A short position is created when a dealer borrows a currency and sells it • A long position is created when a currency is bought because it is expected to appreciate (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -41

FX position keeping (cont. ) • Position keeping is the monitoring of positions in each currency • A position is the net cumulative total of a currency holding arising from deals • A blotter is a schedule used to record the details of transactions (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -42

FX position keeping (cont. ) • Position squaring is realising profit/loss by buying the short-position currency and selling the long-position currency • Valuation is the calculation of unrealised profit/loss using the average rate Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -43

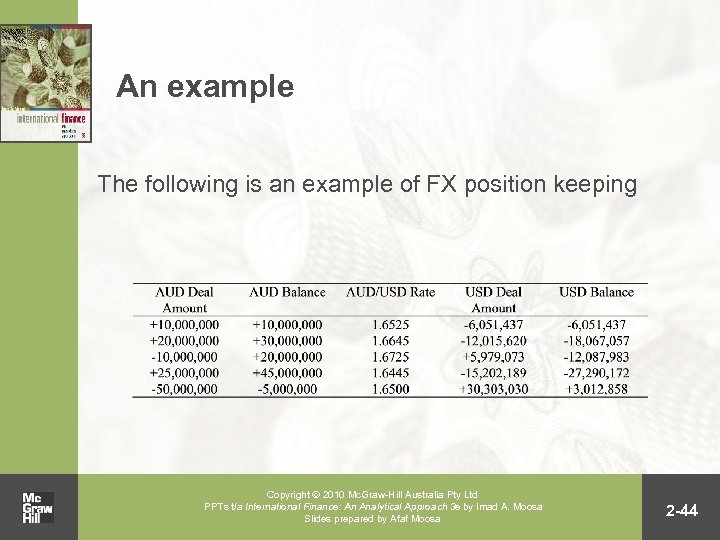

An example The following is an example of FX position keeping Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -44

The forward exchange rate • The rate contracted today for the delivery of a currency at a specified date in the future Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -45

Forward value date • The date on which currencies involved in a forward transaction are exchanged • The forward value date must be more than two business days after the contract date, otherwise it will be a spot transaction • The period preceding the forward value date is calculated from the spot value date Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -46

Forward value date (cont) • A short date means a maturity of one month or less • A round date means a maturity of a whole number of months • A broken date means a maturity of less than round dates (cont. ) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -47

Outright and swap forward transactions • An outright contract involves the sale or purchase of a currency for delivery more than two days into the future • A swap transaction involves a spot purchase against a matching outright sale (or vice versa) Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -48

Kinds of FX swaps • • Forward swaps Forward-forward swaps Overnight swaps Tom/next swaps Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -49

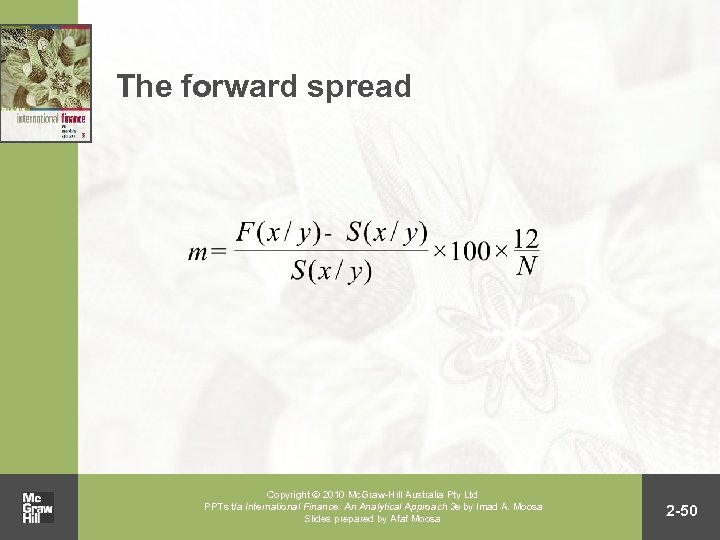

The forward spread Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -50

Premium and discount • If F (x /y ) > S (x /y ), then y sells at a premium • If F (x /y ) < S (x /y ), then y sells at a discount • If F (x /y ) = S (x /y ), both currencies are flat Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -51

Outright and swap rates • An outright forward rate is quoted as bid and offer rates • A swap rate is quoted in terms of the points representing the forward premium or discount Copyright 2010 Mc. Graw-Hill Australia Pty Ltd PPTs t/a International Finance: An Analytical Approach 3 e by Imad A. Moosa Slides prepared by Afaf Moosa 2 -52

f844c0f38b4ad966485ead6b26d9df2b.ppt