9c343d37a880b444326b08308aca0a11.ppt

- Количество слайдов: 35

Chapter 2: The Financial System Objective Understanding the workings of the financial system Determining rates of return Copyright © Prentice Hall Inc. 2000. Author: Nick Bagley, bdella. Soft, Inc. 1

Chapter 2 Contents 1. 2. 3. 4. 5. 6. What is a Financial System The Flow of Funds The Functional Perspective Financial Innovation & the “Invisible Hand” Financial Markets Financial Market Rates 7. 8. 9. Financial Intermediaries Financial Infrastructure and Regulation Governmental & Quasi. Governmental Organizations 2

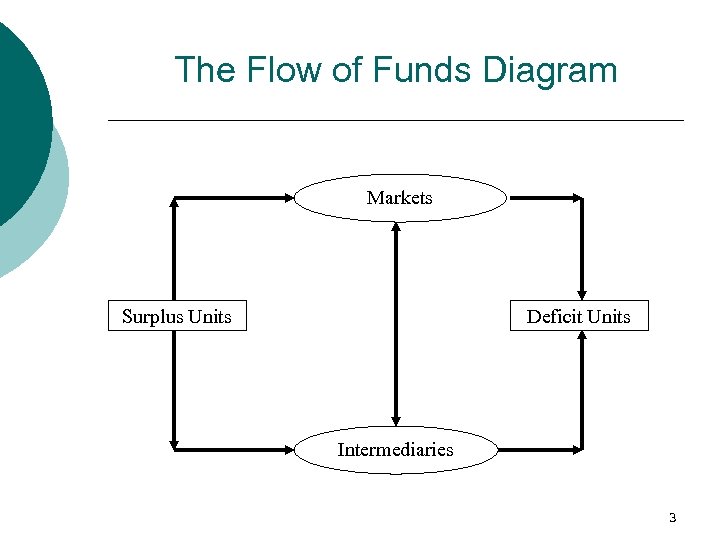

The Flow of Funds Diagram Markets Surplus Units Deficit Units Intermediaries 3

Fund Flows via Markets Surplus Units Deficit Units Intermediaries 4

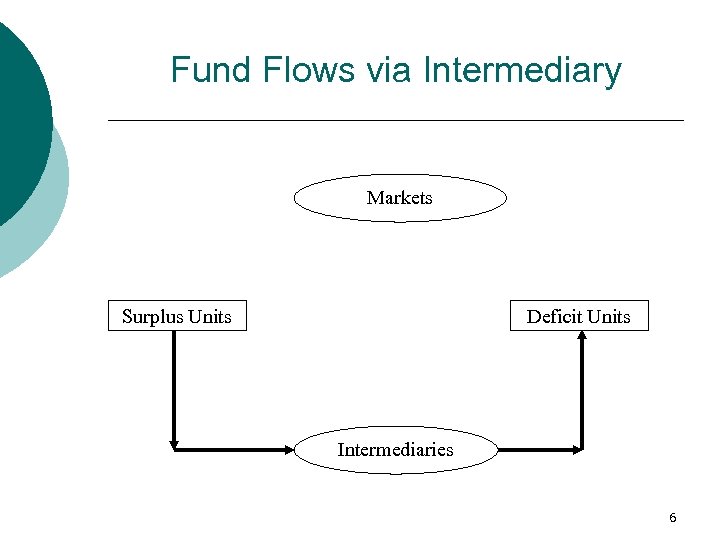

Fund Flows via Intermediary Markets Surplus Units Deficit Units Intermediaries 6

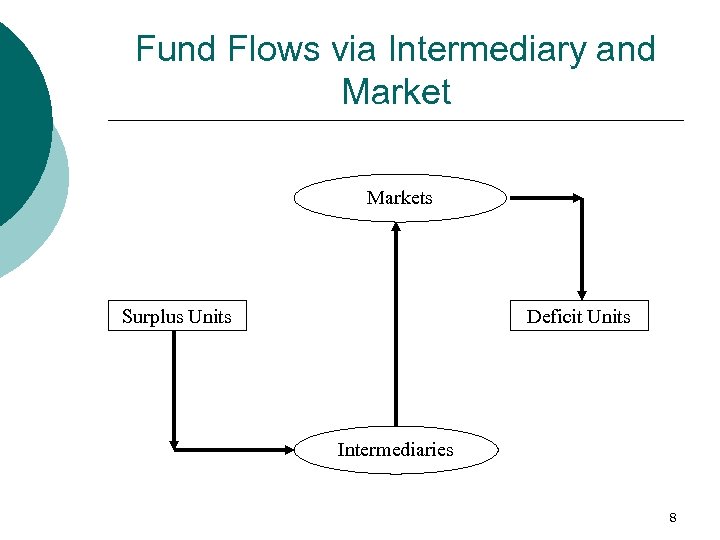

Fund Flows via Intermediary and Markets Surplus Units Deficit Units Intermediaries 8

Funds Flow via Markets and Intermediaries Markets Surplus Units Deficit Units Intermediaries 10

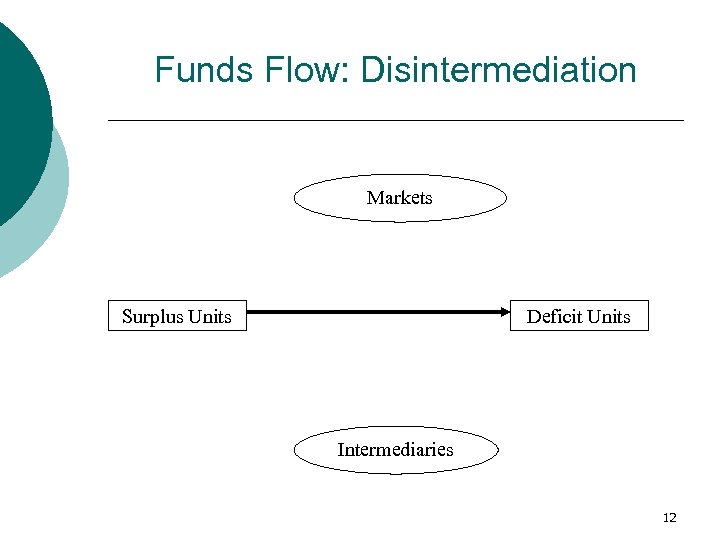

Funds Flow: Disintermediation Markets Surplus Units Deficit Units Intermediaries 12

Six Key Financial Functions: l l l Transferring Resources Across Time & Space Managing Risk Clearing and Settling Payments Pooling Resources and Subdividing Shares Providing Information Dealing with Incentive Problems 13

Incentive Problems Moral Hazard ¡ Adverse Selection ¡ Principal-Agent Problem ¡ 19

Moral Hazard When having insurance against some risk causes the insured party to greater risk or to take less care. ¡ Example: If a warehouse owner buys fire insurance, his incentive to spend money to prevent a fire is reduced. ¡ 20

Adverse Selection Those who purchase insurance against risk are more likely than the general population to be at risk. ¡ Example: A firm selling life annuities cannot assume that the people who buy them will have the same expected length of life as the general population. ¡ 21

Principal-Agent Problem ¡ Agents may not make the same decisions that the principals would have made if the principals knew what the agents know and were making the decisions themselves. 22

Financial Assets Debt: Bonds ¡ Equity: Stocks ¡ Derivatives: Options, Forward Contracts ¡ 26

Debt Corporate bonds, government bonds, residential and commercial mortgages, consumer loans. ¡ Fixed-income instruments ¡ 27

Debt Money Market: Short-term Debt ¡ Capital Market: Long-term Debt ¡ Money market instruments are mostly interest-earning securities. Money markets are globally integrated and liquid. ¡ 28

Equity The claim of the owners of a firm. Common stocks or shares are bought and sold in the stock market. ¡ Common stock represents a residual claim on the assets of a corporation. Has the feature of limited liability. ¡ 29

Derivatives Financial instruments that derive their value from the prices of one or more other assets such as equity securities, fixed-income securities, foreign currencies, or commodities. ¡ They serve as tools for managing exposures to the risks associated with the underlying assets. ¡ 30

Derivatives Options: call options, put options o Call option: gives its holder the right to buy some asset at a specified price on or before some specified expiration date. o Put option: the right to sell. ¡ Forward contracts: oblige one party to the contract to buy, and the other party to sell. ¡ 31

Financial Market Rates 1. 2. Interest Rates of Return on Risky Assets 32

Interest Rates A promised rate of return. ¡ Mortgage rate: the interest rate that home buyers pay on the loans they take to finance their homes. ¡ Commercial loan rate: the rate charged by banks on loans made to businesses. ¡ 33

Interest Rates Depend on: ¡ Unit of account: the medium in which payments are denominated. A currency, a commodity such as gold, or some standard “basket” of goods and services. ¡ Maturity: the length of time until repayment of the entire amount borrowed. 34

Interest Rates Depend on: ¡ Default risk: the possibility that some portion of the interest or principal on a fixed-income instrument will not be repaid in full. 35

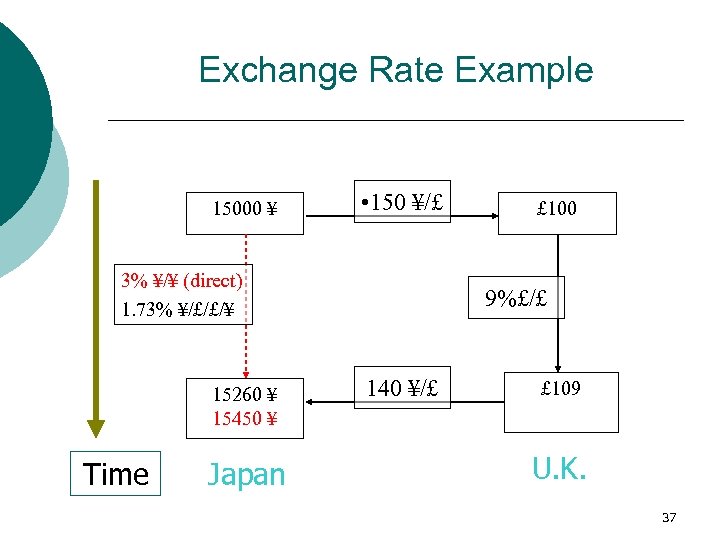

Exchange Rate Example 15000 ¥ • 150 ¥/£ 3% ¥/¥ (direct) 1. 73% ¥/£/£/¥ 15260 ¥ 15450 ¥ Time Japan £ 100 9%£/£ 140 ¥/£ £ 109 U. K. 37

Exchange Rate Example 15000 ¥ 150 ¥/£ 3% ¥/¥ (direct) 8. 27% ¥/£/£/¥ 16241 ¥ 15450 ¥ Time Japan £ 100 9%£/£ 149 ¥/£ £ 109 U. K. 38

Effect of Maturity 40

Effect of Default Risk 41

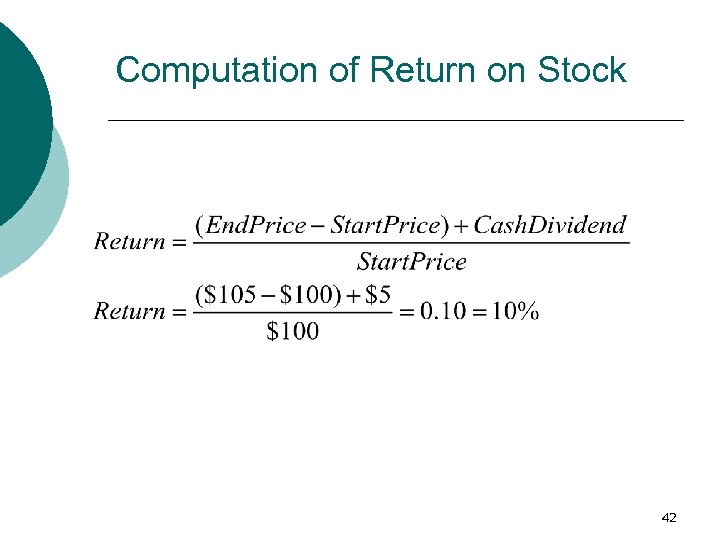

Computation of Return on Stock 42

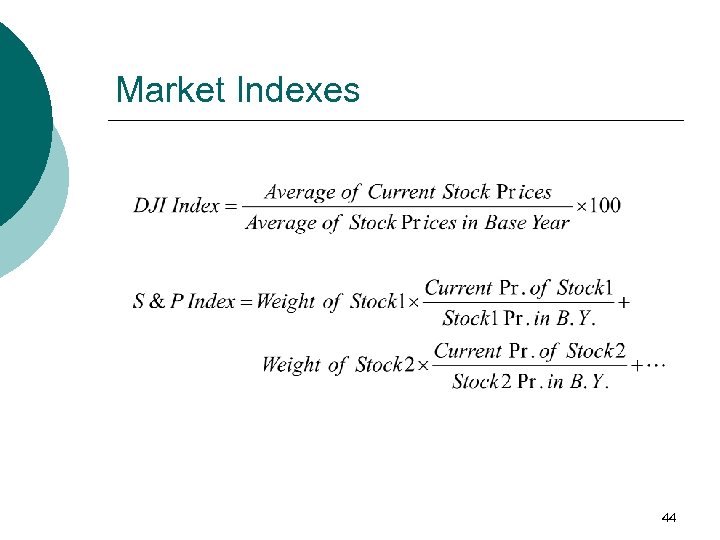

Market Indexes Dow Jones Industrial Index (DJI) ¡ Standard and Poor’s 500 (S&P 500) ¡ DJI: Prices of 30 Stocks of Major Industrial Corporations S&P 500: 500 Stocks of the largest public corporations 43

Market Indexes 44

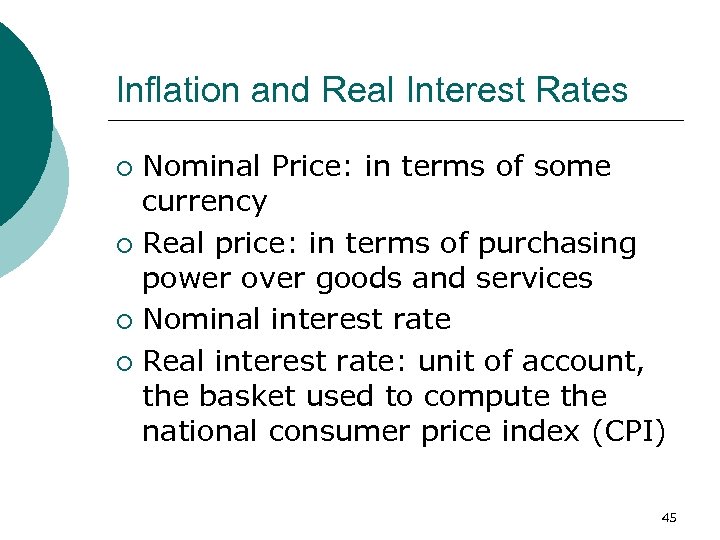

Inflation and Real Interest Rates Nominal Price: in terms of some currency ¡ Real price: in terms of purchasing power over goods and services ¡ Nominal interest rate ¡ Real interest rate: unit of account, the basket used to compute the national consumer price index (CPI) ¡ 45

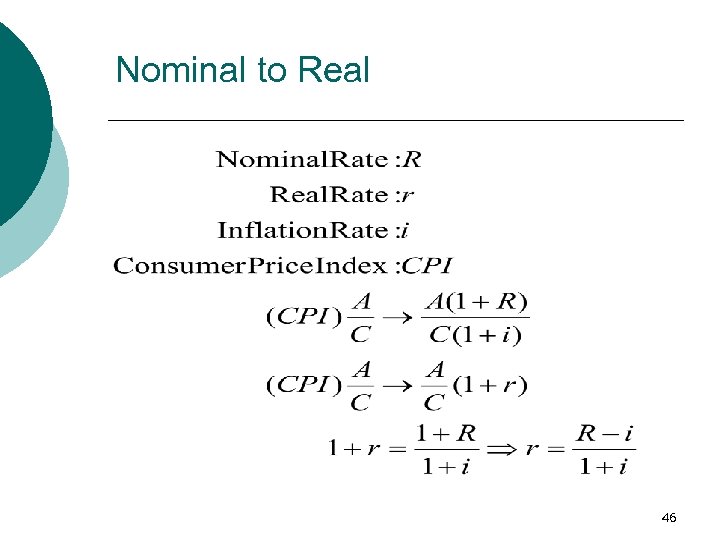

Nominal to Real 46

Determinants of Rates of Return Productivity of Capital Goods ¡ Degree of Uncertainty about productivity ¡ Time Preferences of People ¡ Risk Aversion ¡ 47

Financial Intermediaries Banks: Commercial, Investment ¡ Insurance Companies ¡ Pension and Retirement Funds ¡ Mutual Funds ¡ Venture Capital Firms ¡ Asset Management Firms ¡ Information Services ¡ 48

Regional and World Organizations Bank for International Settlements (BIS) ¡ International Monetary Fund (IMF) ¡ International Bank for Reconstruction and Development (World Bank) ¡ 49

9c343d37a880b444326b08308aca0a11.ppt