1cf5f4ce3611bd289d83e2c37fbda6d2.ppt

- Количество слайдов: 67

Chapter 2 International Monetary Systems l l l l Silver used in Mesopotamia in 2, 500 BC First true coins, in Lydia (NE Greece) of electrum (a mixture of Gold & Silver) King Croesus of Lydia (560 -546 BC) made first standardized gold coins Trade flourished. “As rich as Croesus” Greeks and then Romans minted coinage Incentives for Roman rules to debase currency minted with alloys or lower weight. First paper money: Ts’ai Lun 1 st Century China 1

Chapter 2 International Monetary Systems l l l l Silver used in Mesopotamia in 2, 500 BC First true coins, in Lydia (NE Greece) of electrum (a mixture of Gold & Silver) King Croesus of Lydia (560 -546 BC) made first standardized gold coins Trade flourished. “As rich as Croesus” Greeks and then Romans minted coinage Incentives for Roman rules to debase currency minted with alloys or lower weight. First paper money: Ts’ai Lun 1 st Century China 1

Usury Laws & International Finance Leviticus 25: 36 -37 “Take thou no usury…” l Ezekiel 18: 37 “He that. . . hath given forth usury…he shall surely die. ” SOLUTION: Bills of Exchange l Knights Templar (1095 - 1310) l » Temple Banks in London, Paris, and Jerusalem l Italian Merchant Bankers » Houses of Peruzzi & Bardi collectors of money for the Pope in 1317, after demise of the Templars » the Medici (Florins in Florence & Ducats in Venice) 2

Usury Laws & International Finance Leviticus 25: 36 -37 “Take thou no usury…” l Ezekiel 18: 37 “He that. . . hath given forth usury…he shall surely die. ” SOLUTION: Bills of Exchange l Knights Templar (1095 - 1310) l » Temple Banks in London, Paris, and Jerusalem l Italian Merchant Bankers » Houses of Peruzzi & Bardi collectors of money for the Pope in 1317, after demise of the Templars » the Medici (Florins in Florence & Ducats in Venice) 2

A SHORT DIGRESSION ON THE GOLD STANDARD THE USE OF GOLD and SILVER Desirable properties In short run: – High production costs – Limits short-run changes. In long run: – Commodity money insures stability. Class 2 in 456: International Monetary Systems and Balance of Payments 3

A SHORT DIGRESSION ON THE GOLD STANDARD THE USE OF GOLD and SILVER Desirable properties In short run: – High production costs – Limits short-run changes. In long run: – Commodity money insures stability. Class 2 in 456: International Monetary Systems and Balance of Payments 3

l The Classical Gold Standard (1821 - 1914 with interruptions) l Involved commitment by nations to fix the price of domestic currency in terms of a specific amount of gold. l Maintenance involved the buying and selling of gold at that price. l Disturbances in Price Levels would be offset by the price-specie-flow mechanism. » specie refers to gold (or silver) coins » Exports bring in gold that tends to inflate the economy and thereby reduce future exports 4

l The Classical Gold Standard (1821 - 1914 with interruptions) l Involved commitment by nations to fix the price of domestic currency in terms of a specific amount of gold. l Maintenance involved the buying and selling of gold at that price. l Disturbances in Price Levels would be offset by the price-specie-flow mechanism. » specie refers to gold (or silver) coins » Exports bring in gold that tends to inflate the economy and thereby reduce future exports 4

Price-specie-flow mechanism in economic theory AUTOMATIC international adjustments: 1. ) A balance of payments surplus leads 2. ) 3). 4). 5). 6). to a gold inflow Gold inflows lead to higher prices Higher prices reduces exports Higher prices increase imports Hence, a trade surplus disappears automatically The reverse is true for a trade deficit. Class 2 in 456: International Monetary Systems and Balance of Payments 5

Price-specie-flow mechanism in economic theory AUTOMATIC international adjustments: 1. ) A balance of payments surplus leads 2. ) 3). 4). 5). 6). to a gold inflow Gold inflows lead to higher prices Higher prices reduces exports Higher prices increase imports Hence, a trade surplus disappears automatically The reverse is true for a trade deficit. Class 2 in 456: International Monetary Systems and Balance of Payments 5

Post Civil War America (1865 -1900) l Mostly on a Gold Standard » 1848 Gold Rush was over after 1865. l l Population growth and growth of goods But steady 1% deflation » » l Debtors hurt (Farmers) Creditors helped (Bankers) Populist uprising for easy money William Jennings Bryan - 3 times candidate for President Cross of Gold Speech in 1896 » http: //historymatters. gmu. edu/d/5354/ l The Wizard of Oz as a monetary allegory » http: //www. micheloud. com/FXM/MH/Crime/WWIZOZ. htm Class 2 in 456: International Monetary Systems and Balance of Payments 6

Post Civil War America (1865 -1900) l Mostly on a Gold Standard » 1848 Gold Rush was over after 1865. l l Population growth and growth of goods But steady 1% deflation » » l Debtors hurt (Farmers) Creditors helped (Bankers) Populist uprising for easy money William Jennings Bryan - 3 times candidate for President Cross of Gold Speech in 1896 » http: //historymatters. gmu. edu/d/5354/ l The Wizard of Oz as a monetary allegory » http: //www. micheloud. com/FXM/MH/Crime/WWIZOZ. htm Class 2 in 456: International Monetary Systems and Balance of Payments 6

The Gold Exchange Standard (1925 -1931) Only U. S. and Britain allowed to hold gold reserves. Others could hold both gold, dollars or pound reserves. Currencies devalued in 1931 - led to increased trade wars. Bretton Woods Conference 1944 - called in order to avoid future protectionist and destructive economic policies Class 2 in 456: International Monetary Systems and Balance of Payments Conference at Bretton Woods, New Hampshire July 1 - 22, 1944 7

The Gold Exchange Standard (1925 -1931) Only U. S. and Britain allowed to hold gold reserves. Others could hold both gold, dollars or pound reserves. Currencies devalued in 1931 - led to increased trade wars. Bretton Woods Conference 1944 - called in order to avoid future protectionist and destructive economic policies Class 2 in 456: International Monetary Systems and Balance of Payments Conference at Bretton Woods, New Hampshire July 1 - 22, 1944 7

Conference at Bretton Woods, NH l The United Nations Monetary and Financial Conference was held in July 1944 to discuss postwar international payments problems. l Agreements reached on financial assistance and measures to stabilize exchange rates l Creation of the International Bank for Reconstruction and Development 1945 (now World Bank) and the International Monetary Fund (IMF). l There were 44 nations represented at the conference, which considered proposals by the USA, UK, and Canadian governments. Class 2 in 456: International Monetary Systems and Balance of Payments 8

Conference at Bretton Woods, NH l The United Nations Monetary and Financial Conference was held in July 1944 to discuss postwar international payments problems. l Agreements reached on financial assistance and measures to stabilize exchange rates l Creation of the International Bank for Reconstruction and Development 1945 (now World Bank) and the International Monetary Fund (IMF). l There were 44 nations represented at the conference, which considered proposals by the USA, UK, and Canadian governments. Class 2 in 456: International Monetary Systems and Balance of Payments 8

The Bretton Woods System (1946 -1971) l The U. S. $ was key currency » valued at $1 = 1/35 oz. of gold. All currencies linked to that price in a fixed rate system. l Exchange rates allowed to fluctuate by 1% above or below initially set rates. l Collapse, 1971 because l » U. S. high inflation rate » U. S. $ depreciated sharply. Class 2 in 456: International Monetary Systems and Balance of Payments Nixon 9

The Bretton Woods System (1946 -1971) l The U. S. $ was key currency » valued at $1 = 1/35 oz. of gold. All currencies linked to that price in a fixed rate system. l Exchange rates allowed to fluctuate by 1% above or below initially set rates. l Collapse, 1971 because l » U. S. high inflation rate » U. S. $ depreciated sharply. Class 2 in 456: International Monetary Systems and Balance of Payments Nixon 9

Post-Bretton Woods System (1971 -Present) Smithsonian Agreement, 1971 l US$ devalued to 1/38 oz. of gold. By 1973: World on a freely floating exchange rate system. Surprisingly, free floating exchange rates have worked Class 2 in 456: International Monetary Systems and Balance of Payments 10

Post-Bretton Woods System (1971 -Present) Smithsonian Agreement, 1971 l US$ devalued to 1/38 oz. of gold. By 1973: World on a freely floating exchange rate system. Surprisingly, free floating exchange rates have worked Class 2 in 456: International Monetary Systems and Balance of Payments 10

OPEC and the Oil Crisis (1973 -1974) l OPEC raised oil prices four fold; l Exchange rate turmoil resulted; l Caused OPEC nations to earn large surplus B-O-P. l Surpluses recycled to debtor nations which set up debt crisis of 1980’s. 11

OPEC and the Oil Crisis (1973 -1974) l OPEC raised oil prices four fold; l Exchange rate turmoil resulted; l Caused OPEC nations to earn large surplus B-O-P. l Surpluses recycled to debtor nations which set up debt crisis of 1980’s. 11

Dollar Crisis (1977 -78) l U. S. B-O-P difficulties l Result of inconsistent monetary policy in U. S. l Dollar value falls as confidence shrinks. Fed Chair Miller ousted in ‘ 79 l Volcker new Fed Chair -- monetarist The Rising Dollar (1980 -85) U. S. inflation declines as the Fed targets slow money growth and raises interest rates l Rising rates attracts global capital to U. S. l Result: Dollar value rises. l 12

Dollar Crisis (1977 -78) l U. S. B-O-P difficulties l Result of inconsistent monetary policy in U. S. l Dollar value falls as confidence shrinks. Fed Chair Miller ousted in ‘ 79 l Volcker new Fed Chair -- monetarist The Rising Dollar (1980 -85) U. S. inflation declines as the Fed targets slow money growth and raises interest rates l Rising rates attracts global capital to U. S. l Result: Dollar value rises. l 12

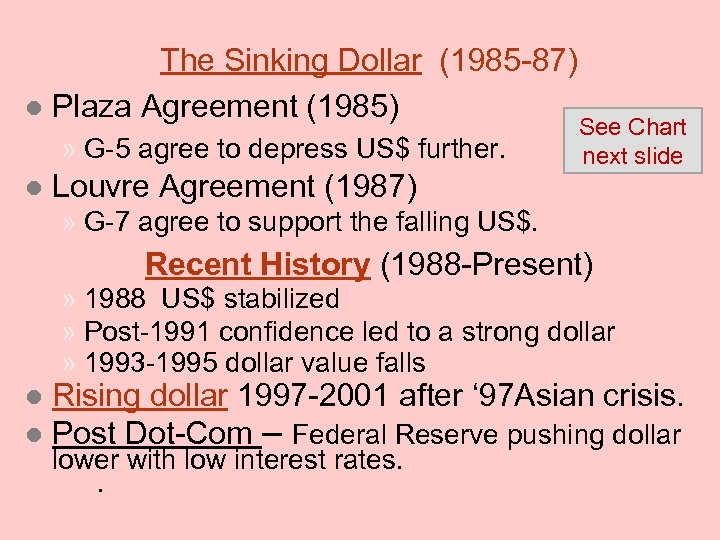

The Sinking Dollar (1985 -87) l Plaza Agreement (1985) » G-5 agree to depress US$ further. l Louvre Agreement (1987) See Chart next slide » G-7 agree to support the falling US$. Recent History (1988 -Present) » 1988 US$ stabilized » Post-1991 confidence led to a strong dollar » 1993 -1995 dollar value falls Rising dollar 1997 -2001 after ‘ 97 Asian crisis. l Post Dot-Com – Federal Reserve pushing dollar l lower with low interest rates. .

The Sinking Dollar (1985 -87) l Plaza Agreement (1985) » G-5 agree to depress US$ further. l Louvre Agreement (1987) See Chart next slide » G-7 agree to support the falling US$. Recent History (1988 -Present) » 1988 US$ stabilized » Post-1991 confidence led to a strong dollar » 1993 -1995 dollar value falls Rising dollar 1997 -2001 after ‘ 97 Asian crisis. l Post Dot-Com – Federal Reserve pushing dollar l lower with low interest rates. .

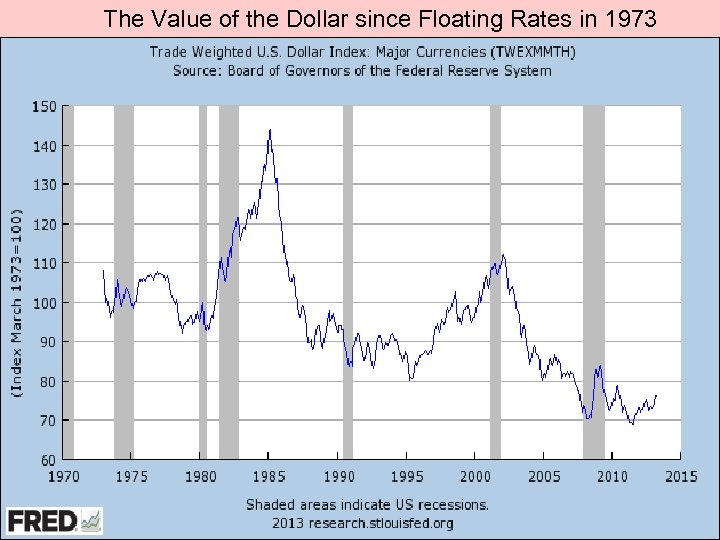

The Value of the Dollar since Floating Rates in 1973

The Value of the Dollar since Floating Rates in 1973

Motives for Using International Financial Markets l There are still barriers to the complete integration of the markets for real and financial assets. l Examples » tax differentials » tariffs and quotas » labor immobility » cultural differences » financial reporting differences » costs of communication. l Yet barriers also create opportunities for specific geographic markets that will attract foreign creditors and investors. Barriers are imperfections in the market Class 2 in 456: International Monetary Systems and Balance of Payments 15

Motives for Using International Financial Markets l There are still barriers to the complete integration of the markets for real and financial assets. l Examples » tax differentials » tariffs and quotas » labor immobility » cultural differences » financial reporting differences » costs of communication. l Yet barriers also create opportunities for specific geographic markets that will attract foreign creditors and investors. Barriers are imperfections in the market Class 2 in 456: International Monetary Systems and Balance of Payments 15

Foreign Exchange Market l. There is no specific location or time where traders exchange currencies. l. The market for immediate exchange is known as the spot market. l. Trading between banks makes up what is often referred to as the interbank market. l. The forward market for currencies enables an MNC to lock in the exchange rate (called a forward rate) at which it will buy or sell a currency. Class 2 in 456: International Monetary Systems and Balance of Payments 16

Foreign Exchange Market l. There is no specific location or time where traders exchange currencies. l. The market for immediate exchange is known as the spot market. l. Trading between banks makes up what is often referred to as the interbank market. l. The forward market for currencies enables an MNC to lock in the exchange rate (called a forward rate) at which it will buy or sell a currency. Class 2 in 456: International Monetary Systems and Balance of Payments 16

Foreign Exchange Market l. Attributes of banks important to customers in need of foreign exchange: competitiveness of quote l special relationship with the bank l speed of execution l advice about current market conditions l forecasting advice l l. Banks provide foreign exchange transactions for a fee: the bid (buy) quote for a foreign currency will be less than its ask (sell) quote. Class 2 in 456: International Monetary Systems and Balance of Payments 17

Foreign Exchange Market l. Attributes of banks important to customers in need of foreign exchange: competitiveness of quote l special relationship with the bank l speed of execution l advice about current market conditions l forecasting advice l l. Banks provide foreign exchange transactions for a fee: the bid (buy) quote for a foreign currency will be less than its ask (sell) quote. Class 2 in 456: International Monetary Systems and Balance of Payments 17

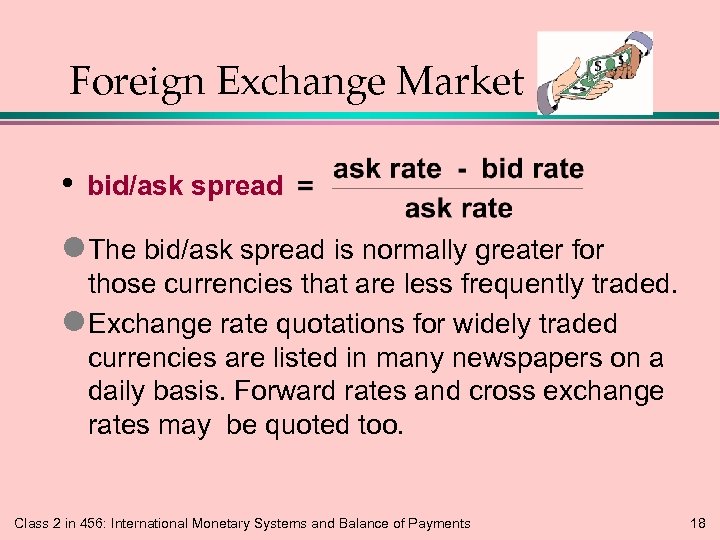

Foreign Exchange Market • bid/ask spread l The bid/ask spread is normally greater for those currencies that are less frequently traded. l Exchange rate quotations for widely traded currencies are listed in many newspapers on a daily basis. Forward rates and cross exchange rates may be quoted too. Class 2 in 456: International Monetary Systems and Balance of Payments 18

Foreign Exchange Market • bid/ask spread l The bid/ask spread is normally greater for those currencies that are less frequently traded. l Exchange rate quotations for widely traded currencies are listed in many newspapers on a daily basis. Forward rates and cross exchange rates may be quoted too. Class 2 in 456: International Monetary Systems and Balance of Payments 18

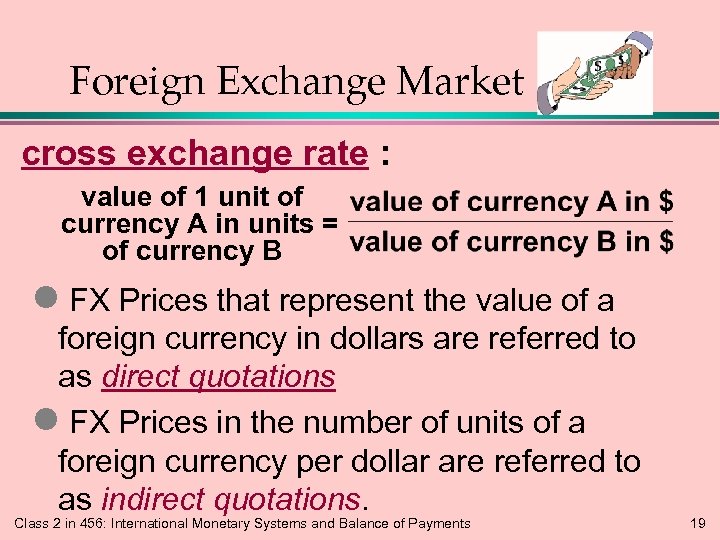

Foreign Exchange Market cross exchange rate : value of 1 unit of currency A in units = of currency B l FX Prices that represent the value of a foreign currency in dollars are referred to as direct quotations l FX Prices in the number of units of a foreign currency per dollar are referred to as indirect quotations. Class 2 in 456: International Monetary Systems and Balance of Payments 19

Foreign Exchange Market cross exchange rate : value of 1 unit of currency A in units = of currency B l FX Prices that represent the value of a foreign currency in dollars are referred to as direct quotations l FX Prices in the number of units of a foreign currency per dollar are referred to as indirect quotations. Class 2 in 456: International Monetary Systems and Balance of Payments 19

Foreign Exchange Market l. Some MNCs involved in international trade use the currency futures and options markets to hedge their positions. l. Futures are similar to forward contracts, except that they are sold on an exchange while forward contracts are offered by banks. l. Currency options are classified as either calls or puts. They can be purchased on an exchange too. Class 2 in 456: International Monetary Systems and Balance of Payments 20

Foreign Exchange Market l. Some MNCs involved in international trade use the currency futures and options markets to hedge their positions. l. Futures are similar to forward contracts, except that they are sold on an exchange while forward contracts are offered by banks. l. Currency options are classified as either calls or puts. They can be purchased on an exchange too. Class 2 in 456: International Monetary Systems and Balance of Payments 20

Eurocurrency Market $ l. U. S. dollar deposits placed in banks in Europe and other continents are Eurodollars and are not subject to U. S. regulations. l. In the 1960 s & 70 s, the Eurodollar market, or what is now called the Eurocurrency market, grew to accommodate increasing international business. l. The market is made up of several large banks called Eurobanks that accept deposits and provide loans in various currencies. Class 2 in 456: International Monetary Systems and Balance of Payments 21

Eurocurrency Market $ l. U. S. dollar deposits placed in banks in Europe and other continents are Eurodollars and are not subject to U. S. regulations. l. In the 1960 s & 70 s, the Eurodollar market, or what is now called the Eurocurrency market, grew to accommodate increasing international business. l. The market is made up of several large banks called Eurobanks that accept deposits and provide loans in various currencies. Class 2 in 456: International Monetary Systems and Balance of Payments 21

Eurocurrency Market $ l. Although the market focuses on large-volume transactions, at times no single bank is willing to lend the needed amount. A syndicate of Eurobanks may then be composed. l. Two regulatory events allow for a more competitive global playing field: The Single European Act opens up the European banking industry and calls for similar regulations. » The Basel Accord includes standardized guidelines on the classification of capital. » Class 2 in 456: International Monetary Systems and Balance of Payments 22

Eurocurrency Market $ l. Although the market focuses on large-volume transactions, at times no single bank is willing to lend the needed amount. A syndicate of Eurobanks may then be composed. l. Two regulatory events allow for a more competitive global playing field: The Single European Act opens up the European banking industry and calls for similar regulations. » The Basel Accord includes standardized guidelines on the classification of capital. » Class 2 in 456: International Monetary Systems and Balance of Payments 22

Eurocurrency Market $ l. The Eurocurrency market in Asia is sometimes referred to separately as the Asian dollar market. l. The primary function of banks in the Asian dollar market is to channel funds from depositors to borrowers. l. Another function is interbank lending and borrowing. Class 2 in 456: International Monetary Systems and Balance of Payments 23

Eurocurrency Market $ l. The Eurocurrency market in Asia is sometimes referred to separately as the Asian dollar market. l. The primary function of banks in the Asian dollar market is to channel funds from depositors to borrowers. l. Another function is interbank lending and borrowing. Class 2 in 456: International Monetary Systems and Balance of Payments 23

Eurocredit Market LOANS l. Loans of one year or longer extended by Eurobanks to MNCs or government agencies are called Eurocredit loans. » These loans are provided in the Eurocredit market. l. Eurocredit loans often have a floating rate, to lessen the risk resulting from a mismatch in the banks’ asset and liability maturities. l. Syndicated Eurocredit loans are popular among big borrowers too. Class 2 in 456: International Monetary Systems and Balance of Payments 24

Eurocredit Market LOANS l. Loans of one year or longer extended by Eurobanks to MNCs or government agencies are called Eurocredit loans. » These loans are provided in the Eurocredit market. l. Eurocredit loans often have a floating rate, to lessen the risk resulting from a mismatch in the banks’ asset and liability maturities. l. Syndicated Eurocredit loans are popular among big borrowers too. Class 2 in 456: International Monetary Systems and Balance of Payments 24

Eurobond Market BONDS l. There are two types of international bonds: A foreign bond is issued by a borrower foreign to the country where the bond is placed. » Eurobonds are sold in countries other than the country represented by the currency denominating them. » l. Eurobonds are underwritten by a multinational syndicate of investment banks and simultaneously placed in many countries. They are usually issued in bearer form. Class 2 in 456: International Monetary Systems and Balance of Payments 25

Eurobond Market BONDS l. There are two types of international bonds: A foreign bond is issued by a borrower foreign to the country where the bond is placed. » Eurobonds are sold in countries other than the country represented by the currency denominating them. » l. Eurobonds are underwritten by a multinational syndicate of investment banks and simultaneously placed in many countries. They are usually issued in bearer form. Class 2 in 456: International Monetary Systems and Balance of Payments 25

Eurobond Market BONDS l. Eurobonds increased rapidly in volume when in 1984, the withholding tax was abolished in the U. S. and corporations were allowed to issue bonds directly to non-U. S. investors. l. Interest rates for each currency and credit conditions change constantly, causing the market’s popularity to vary among currencies. l. In recent years, governments and corporations from emerging markets have frequently utilized the Eurobond market. Class 2 in 456: International Monetary Systems and Balance of Payments 26

Eurobond Market BONDS l. Eurobonds increased rapidly in volume when in 1984, the withholding tax was abolished in the U. S. and corporations were allowed to issue bonds directly to non-U. S. investors. l. Interest rates for each currency and credit conditions change constantly, causing the market’s popularity to vary among currencies. l. In recent years, governments and corporations from emerging markets have frequently utilized the Eurobond market. Class 2 in 456: International Monetary Systems and Balance of Payments 26

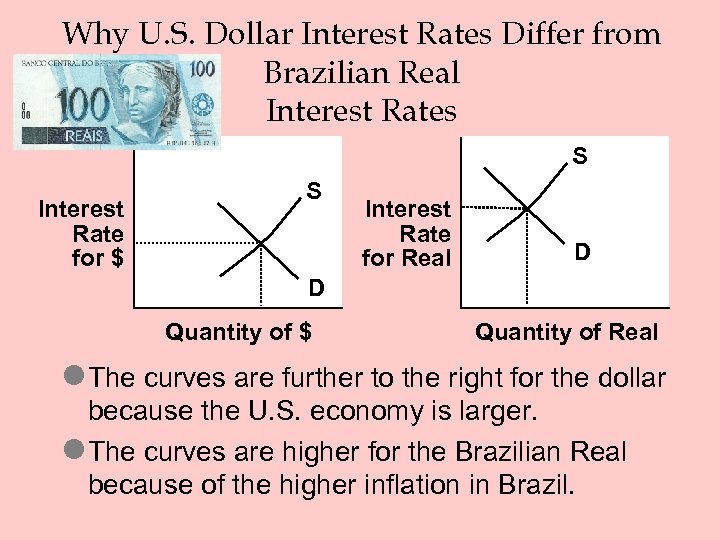

Why Interest Rates Vary Among Currencies l. Interest rates, which can vary substantially for different currencies, affect the MNC’s cost of financing. l. The interest rate for a specific currency is determined by the demand for and supply of funds in that currency. l. As the demand supply schedules change over time for a currency, the interest rate for that currency will also change. Class 2 in 456: International Monetary Systems and Balance of Payments 27

Why Interest Rates Vary Among Currencies l. Interest rates, which can vary substantially for different currencies, affect the MNC’s cost of financing. l. The interest rate for a specific currency is determined by the demand for and supply of funds in that currency. l. As the demand supply schedules change over time for a currency, the interest rate for that currency will also change. Class 2 in 456: International Monetary Systems and Balance of Payments 27

Why U. S. Dollar Interest Rates Differ from Brazilian Real Interest Rates S Interest Rate for $ S Interest Rate for Real D D Quantity of $ Quantity of Real l The curves are further to the right for the dollar because the U. S. economy is larger. l The curves are higher for the Brazilian Real because of the higher inflation in Brazil.

Why U. S. Dollar Interest Rates Differ from Brazilian Real Interest Rates S Interest Rate for $ S Interest Rate for Real D D Quantity of $ Quantity of Real l The curves are further to the right for the dollar because the U. S. economy is larger. l The curves are higher for the Brazilian Real because of the higher inflation in Brazil.

Global Integration of Interest Rates l. Many investors shift their savings around currencies to take advantage of higher interest rates. l. Borrowers sometimes also borrow a currency different from what they need to take advantage of a lower interest rate. l. Ultimately, the freedom to transfer funds across countries causes the demand supply conditions for funds to be integrated » this causes interest rates to be integrated. Class 2 in 456: International Monetary Systems and Balance of Payments 29

Global Integration of Interest Rates l. Many investors shift their savings around currencies to take advantage of higher interest rates. l. Borrowers sometimes also borrow a currency different from what they need to take advantage of a lower interest rate. l. Ultimately, the freedom to transfer funds across countries causes the demand supply conditions for funds to be integrated » this causes interest rates to be integrated. Class 2 in 456: International Monetary Systems and Balance of Payments 29

International Stock Markets l. MNCs can obtain funds by issuing stock in international markets, in addition to the local market. l. By having access to various markets, the stocks may be more easily digested, the image of the MNC may be enhanced, and the shareholder base may be diversified. l. The proportion of individual versus institutional ownership of shares varies across stock markets. The regulations are different too. Class 2 in 456: International Monetary Systems and Balance of Payments 30

International Stock Markets l. MNCs can obtain funds by issuing stock in international markets, in addition to the local market. l. By having access to various markets, the stocks may be more easily digested, the image of the MNC may be enhanced, and the shareholder base may be diversified. l. The proportion of individual versus institutional ownership of shares varies across stock markets. The regulations are different too. Class 2 in 456: International Monetary Systems and Balance of Payments 30

International Stock Markets l. The locations of the MNC’s operations may affect the decision about where to place stock, in view of the cash flows needed to cover dividend payments in the future. l. Stock issued in the U. S. by non-U. S. firms or governments are called Yankee stock offerings. l. Non-U. S. firms can also issue American depository receipts (ADRs), which are certificates representing bundles of stock. The use of ADRs circumvents some disclosure requirements.

International Stock Markets l. The locations of the MNC’s operations may affect the decision about where to place stock, in view of the cash flows needed to cover dividend payments in the future. l. Stock issued in the U. S. by non-U. S. firms or governments are called Yankee stock offerings. l. Non-U. S. firms can also issue American depository receipts (ADRs), which are certificates representing bundles of stock. The use of ADRs circumvents some disclosure requirements.

THE NEW EURO COINS & BILLS -- No People!!!

THE NEW EURO COINS & BILLS -- No People!!!

Maastricht Treaty Called for Monetary Union by Jan. 1, 1999 with 2002 as when currency will be in complete circulation l Established a single currency: the euro, €. l Called for creation of a single central EU bank l Adopts tough fiscal standards l » Convergent Criteria Class 2 in 456: International Monetary Systems and Balance of Payments 33

Maastricht Treaty Called for Monetary Union by Jan. 1, 1999 with 2002 as when currency will be in complete circulation l Established a single currency: the euro, €. l Called for creation of a single central EU bank l Adopts tough fiscal standards l » Convergent Criteria Class 2 in 456: International Monetary Systems and Balance of Payments 33

Is Europe an Optimum Currency Area? A tradition of monetary unions within Europe. l Is the size of this union is too small or too large? l The Euro will create greater unity, lower transaction costs in trade and travel, and harmonized fiscal and monetary policies. l An internationalist’s dream. l Class 2 in 456: International Monetary Systems and Balance of Payments 34

Is Europe an Optimum Currency Area? A tradition of monetary unions within Europe. l Is the size of this union is too small or too large? l The Euro will create greater unity, lower transaction costs in trade and travel, and harmonized fiscal and monetary policies. l An internationalist’s dream. l Class 2 in 456: International Monetary Systems and Balance of Payments 34

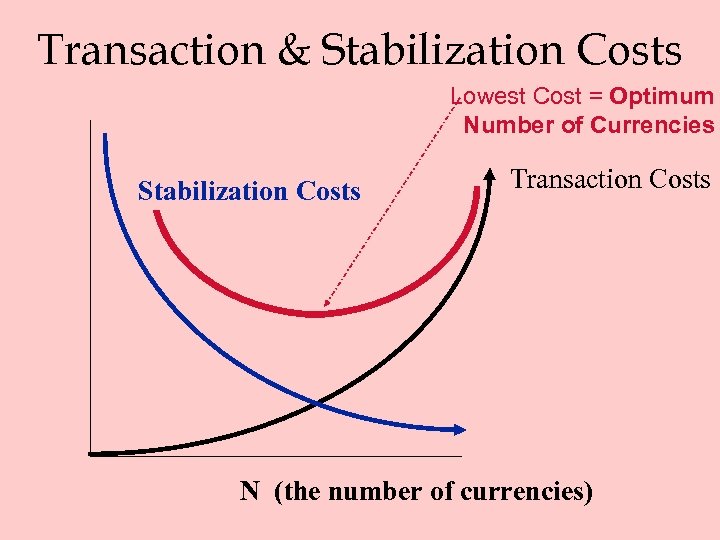

Search for an Optimum Currency Area l In a world of N regions have N(N-1)/2 exchange rates pairs. l As the number of regions grows ð markets for these currencies become thinner ð more subject to speculator attacks l transaction costs grow exponentially in N, the number of regional currency areas. Class 2 in 456: International Monetary Systems and Balance of Payments 35

Search for an Optimum Currency Area l In a world of N regions have N(N-1)/2 exchange rates pairs. l As the number of regions grows ð markets for these currencies become thinner ð more subject to speculator attacks l transaction costs grow exponentially in N, the number of regional currency areas. Class 2 in 456: International Monetary Systems and Balance of Payments 35

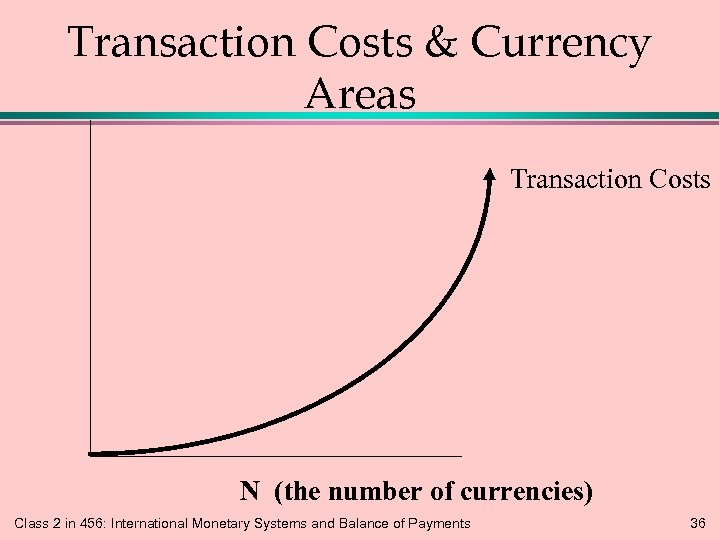

Transaction Costs & Currency Areas Transaction Costs N (the number of currencies) Class 2 in 456: International Monetary Systems and Balance of Payments 36

Transaction Costs & Currency Areas Transaction Costs N (the number of currencies) Class 2 in 456: International Monetary Systems and Balance of Payments 36

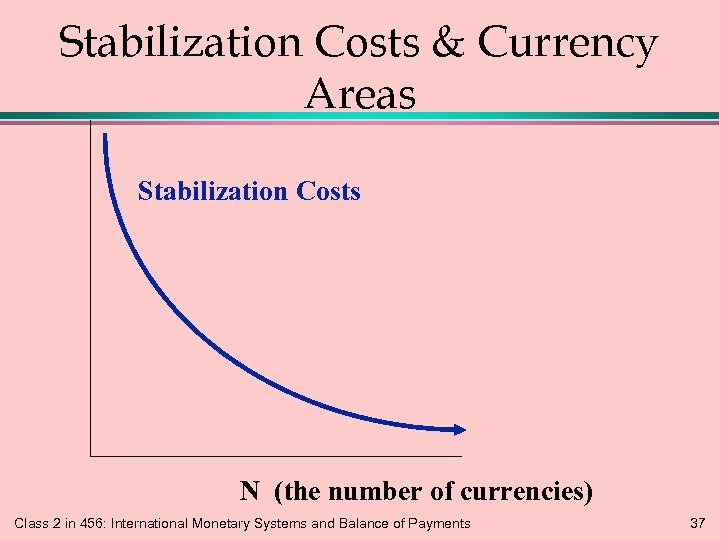

Stabilization Costs & Currency Areas Stabilization Costs N (the number of currencies) Class 2 in 456: International Monetary Systems and Balance of Payments 37

Stabilization Costs & Currency Areas Stabilization Costs N (the number of currencies) Class 2 in 456: International Monetary Systems and Balance of Payments 37

Transaction & Stabilization Costs Lowest Cost = Optimum Number of Currencies Stabilization Costs Transaction Costs N (the number of currencies)

Transaction & Stabilization Costs Lowest Cost = Optimum Number of Currencies Stabilization Costs Transaction Costs N (the number of currencies)

Arguments for Euroland as an Optimal Currency Area 1. 2. 3. 4. 5. 6. Positive public sentiment (17 members) The Euro promotes growth Greater fiscal discipline Smooth launch of the Euro Added Greece (2000), Slovenia (2007), Cyprus (2008), Malta (2008), Slovakia (2009), and Estonia (2011). European Union interested in furthering integration Class 2 in 456: International Monetary Systems and Balance of Payments 39

Arguments for Euroland as an Optimal Currency Area 1. 2. 3. 4. 5. 6. Positive public sentiment (17 members) The Euro promotes growth Greater fiscal discipline Smooth launch of the Euro Added Greece (2000), Slovenia (2007), Cyprus (2008), Malta (2008), Slovakia (2009), and Estonia (2011). European Union interested in furthering integration Class 2 in 456: International Monetary Systems and Balance of Payments 39

Arguments Against Euroland as an Optimal Currency Area 1. 2. 3. 4. 5. Political instability Labor immobility Loss of independent domestic fiscal and monetary policy Heterogeneity of regions England, Denmark, and Sweden select independence. Greece could drop out. Class 2 in 456: International Monetary Systems and Balance of Payments 40

Arguments Against Euroland as an Optimal Currency Area 1. 2. 3. 4. 5. Political instability Labor immobility Loss of independent domestic fiscal and monetary policy Heterogeneity of regions England, Denmark, and Sweden select independence. Greece could drop out. Class 2 in 456: International Monetary Systems and Balance of Payments 40

Chapter 3 The Balance of Payments l. The balance of payments (BOP ) measures all transactions between domestic and foreign residents over a period of time. l. The recording of transactions uses doubleentry bookkeeping. l. The balance-of-payments statement can be broken down into various components, the chief ones being the current account and the capital account.

Chapter 3 The Balance of Payments l. The balance of payments (BOP ) measures all transactions between domestic and foreign residents over a period of time. l. The recording of transactions uses doubleentry bookkeeping. l. The balance-of-payments statement can be broken down into various components, the chief ones being the current account and the capital account.

Current Account l. The current account summarizes the flow of funds between one specified country and all other countries » purchases of goods and services » provision of income on financial assets, over a specified period of time. l. The current account assesses the balance of trade, which is the difference between merchandise exports and merchandise imports. Class 2 in 456: International Monetary Systems and Balance of Payments 42

Current Account l. The current account summarizes the flow of funds between one specified country and all other countries » purchases of goods and services » provision of income on financial assets, over a specified period of time. l. The current account assesses the balance of trade, which is the difference between merchandise exports and merchandise imports. Class 2 in 456: International Monetary Systems and Balance of Payments 42

Capital Account l. The capital account is a summary of the flow of funds resulting from the sale of assets between one specified country and all other countries over a specified period of time. l. Assets include: » direct foreign investments (DFI) » portfolio investments » and other capital investments. Class 2 in 456: International Monetary Systems and Balance of Payments 43

Capital Account l. The capital account is a summary of the flow of funds resulting from the sale of assets between one specified country and all other countries over a specified period of time. l. Assets include: » direct foreign investments (DFI) » portfolio investments » and other capital investments. Class 2 in 456: International Monetary Systems and Balance of Payments 43

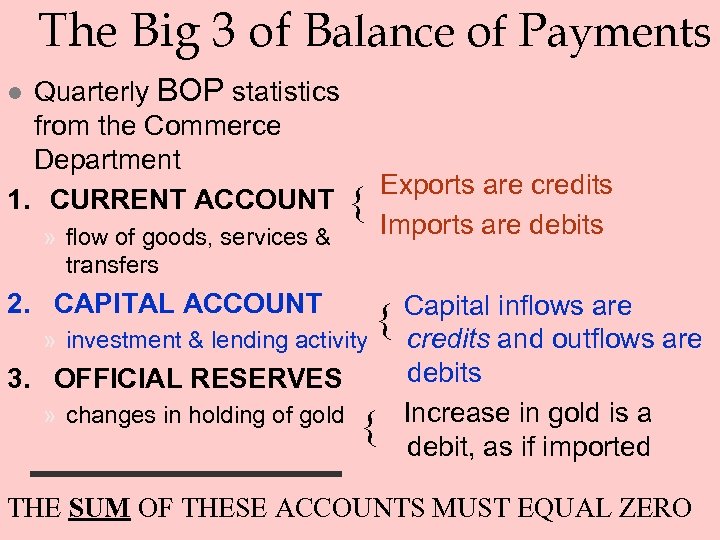

The Big 3 of Balance of Payments Quarterly BOP statistics from the Commerce Department Exports are credits 1. CURRENT ACCOUNT { Imports are debits » flow of goods, services & l transfers 2. CAPITAL ACCOUNT { » investment & lending activity 3. OFFICIAL RESERVES » changes in holding of gold { Capital inflows are credits and outflows are debits Increase in gold is a debit, as if imported THE SUM OF THESE ACCOUNTS MUST EQUAL ZERO

The Big 3 of Balance of Payments Quarterly BOP statistics from the Commerce Department Exports are credits 1. CURRENT ACCOUNT { Imports are debits » flow of goods, services & l transfers 2. CAPITAL ACCOUNT { » investment & lending activity 3. OFFICIAL RESERVES » changes in holding of gold { Capital inflows are credits and outflows are debits Increase in gold is a debit, as if imported THE SUM OF THESE ACCOUNTS MUST EQUAL ZERO

Three Major Accounts: Current , Capital, and Official Reserves Current Account records net flow of goods, services, and unilateral transfers. Capital Account Function: records public and private investment and lending. Inflows = credits a Outflows = debits a Transactions classified as 1. ) portfolio 2. ) direct & a 3. ) short term

Three Major Accounts: Current , Capital, and Official Reserves Current Account records net flow of goods, services, and unilateral transfers. Capital Account Function: records public and private investment and lending. Inflows = credits a Outflows = debits a Transactions classified as 1. ) portfolio 2. ) direct & a 3. ) short term

® Official Reserves Account » Function: 1. ) measures changes in international reserves owned by central banks. 2. ) reflects surplus/deficit of a. ) current account b. ) capital account » Reserves consist of 1. ) gold 2. ) convertible securities gold

® Official Reserves Account » Function: 1. ) measures changes in international reserves owned by central banks. 2. ) reflects surplus/deficit of a. ) current account b. ) capital account » Reserves consist of 1. ) gold 2. ) convertible securities gold

International Trade Flows l Since the 1970 s, international trade has generally grown for most countries. l However, times the 2008 recession push back the amount of trade. l Since 1976, the value of U. S. imports has exceeded the value of U. S. exports, causing a balance of trade deficit. Class 2 in 456: International Monetary Systems and Balance of Payments 47

International Trade Flows l Since the 1970 s, international trade has generally grown for most countries. l However, times the 2008 recession push back the amount of trade. l Since 1976, the value of U. S. imports has exceeded the value of U. S. exports, causing a balance of trade deficit. Class 2 in 456: International Monetary Systems and Balance of Payments 47

International Trade Flows l Changes in North American Trade » A free trade pact between U. S. and Canada was initiated in 1989 and completely phased in by 1998. » In 1993, the North American Free Trade Agreement (NAFTA), which removed numerous trade restrictions among Canada, Mexico, and the U. S. , was passed. Class 2 in 456: International Monetary Systems and Balance of Payments 48

International Trade Flows l Changes in North American Trade » A free trade pact between U. S. and Canada was initiated in 1989 and completely phased in by 1998. » In 1993, the North American Free Trade Agreement (NAFTA), which removed numerous trade restrictions among Canada, Mexico, and the U. S. , was passed. Class 2 in 456: International Monetary Systems and Balance of Payments 48

International Trade Flows l. Recent Changes in European Trade Single European Act of 1987 » Momentum for free enterprise in Eastern Europe » Single currency system in 1999 » l. Trade Agreements Around the World » In 1993, a General Agreement on Tariffs and Trade (GATT) accord calling for lower tariffs was made among 117 countries. Class 2 in 456: International Monetary Systems and Balance of Payments 49

International Trade Flows l. Recent Changes in European Trade Single European Act of 1987 » Momentum for free enterprise in Eastern Europe » Single currency system in 1999 » l. Trade Agreements Around the World » In 1993, a General Agreement on Tariffs and Trade (GATT) accord calling for lower tariffs was made among 117 countries. Class 2 in 456: International Monetary Systems and Balance of Payments 49

International Trade Flows l But there is also friction surrounding Trade Agreements » Dumping refers to the exporting of products by one country to other countries at prices below cost. » Another situation that can break a trade agreement is copyright piracy. Class 2 in 456: International Monetary Systems and Balance of Payments 50

International Trade Flows l But there is also friction surrounding Trade Agreements » Dumping refers to the exporting of products by one country to other countries at prices below cost. » Another situation that can break a trade agreement is copyright piracy. Class 2 in 456: International Monetary Systems and Balance of Payments 50

Factors Affecting International Trade Flows l Inflation » A relative increase in a country’s inflation rate will decrease its current account. l International Preferences l l War National Income growth rates » A relative increase in a country’s income level will decrease its current account. Class 2 in 456: International Monetary Systems and Balance of Payments 51

Factors Affecting International Trade Flows l Inflation » A relative increase in a country’s inflation rate will decrease its current account. l International Preferences l l War National Income growth rates » A relative increase in a country’s income level will decrease its current account. Class 2 in 456: International Monetary Systems and Balance of Payments 51

Factors Affecting International Trade Flows l Government Restrictions An increase in the tariffs on imported goods will increase the country’s current account. » A government can also reduce its country’s imports by enforcing a quota. » l Exchange Rates » If a country’s currency begins to rise in value, its current account balance will decrease. Note that the factors are interactive, such that their simultaneous influence is complex. Class 2 in 456: International Monetary Systems and Balance of Payments 52

Factors Affecting International Trade Flows l Government Restrictions An increase in the tariffs on imported goods will increase the country’s current account. » A government can also reduce its country’s imports by enforcing a quota. » l Exchange Rates » If a country’s currency begins to rise in value, its current account balance will decrease. Note that the factors are interactive, such that their simultaneous influence is complex. Class 2 in 456: International Monetary Systems and Balance of Payments 52

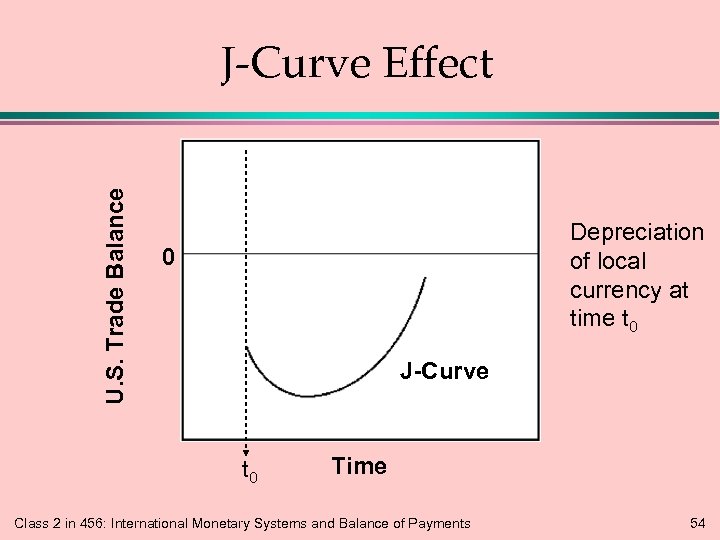

Correcting a Balance of Trade Deficit l. By reconsidering the factors that affect the balance of trade, some common correction methods can be developed. l. However, a weak home currency may not necessarily improve a trade deficit due to: revised pricing policy by foreign competition, » weakening of some other currencies, » trade prearrangements (J-curve effect), and » intra-company trade. » Class 2 in 456: International Monetary Systems and Balance of Payments 53

Correcting a Balance of Trade Deficit l. By reconsidering the factors that affect the balance of trade, some common correction methods can be developed. l. However, a weak home currency may not necessarily improve a trade deficit due to: revised pricing policy by foreign competition, » weakening of some other currencies, » trade prearrangements (J-curve effect), and » intra-company trade. » Class 2 in 456: International Monetary Systems and Balance of Payments 53

U. S. Trade Balance J-Curve Effect Depreciation of local currency at time t 0 0 J-Curve t 0 Time Class 2 in 456: International Monetary Systems and Balance of Payments 54

U. S. Trade Balance J-Curve Effect Depreciation of local currency at time t 0 0 J-Curve t 0 Time Class 2 in 456: International Monetary Systems and Balance of Payments 54

International Capital Flows l. Capital flows represent direct foreign investment (DFI) and portfolio investments. l. The DFIs in the U. S. and outside the U. S. have risen over time, indicating increasing globalization. » DFI by U. S. firms are mainly targeted at the United Kingdom and Canada » DFI in the U. S. comes from the United Kingdom, Japan, the Netherlands, Germany, and Canada. Class 2 in 456: International Monetary Systems and Balance of Payments 55

International Capital Flows l. Capital flows represent direct foreign investment (DFI) and portfolio investments. l. The DFIs in the U. S. and outside the U. S. have risen over time, indicating increasing globalization. » DFI by U. S. firms are mainly targeted at the United Kingdom and Canada » DFI in the U. S. comes from the United Kingdom, Japan, the Netherlands, Germany, and Canada. Class 2 in 456: International Monetary Systems and Balance of Payments 55

Factors Affecting DFI l. Changes in Restrictions » New opportunities may arise from the removal of government barriers. l. Privatization » DFI has also been stimulated by the movement toward free enterprise. l. Potential Economic Growth » Countries that have more potential economic growth are more likely to attract DFI. Class 2 in 456: International Monetary Systems and Balance of Payments 56

Factors Affecting DFI l. Changes in Restrictions » New opportunities may arise from the removal of government barriers. l. Privatization » DFI has also been stimulated by the movement toward free enterprise. l. Potential Economic Growth » Countries that have more potential economic growth are more likely to attract DFI. Class 2 in 456: International Monetary Systems and Balance of Payments 56

Factors Affecting DFI l. Tax Rates Countries that impose relatively low tax rates on corporate earnings are more likely to attract DFI. » Canada reduced corporate taxes from over 22% to 2011 to 15%. http: //www. deloitte. com/assets/Dcom» Canada/Local%20 Assets/Documents/Tax/EN/2010/ca_en_tax_2010_Corporate. Income. Tax Rates_%20310110. pdf l. Exchange Rates » Firms will typically prefer DFI in countries where the local currency strengthens against their own. Class 2 in 456: International Monetary Systems and Balance of Payments 57

Factors Affecting DFI l. Tax Rates Countries that impose relatively low tax rates on corporate earnings are more likely to attract DFI. » Canada reduced corporate taxes from over 22% to 2011 to 15%. http: //www. deloitte. com/assets/Dcom» Canada/Local%20 Assets/Documents/Tax/EN/2010/ca_en_tax_2010_Corporate. Income. Tax Rates_%20310110. pdf l. Exchange Rates » Firms will typically prefer DFI in countries where the local currency strengthens against their own. Class 2 in 456: International Monetary Systems and Balance of Payments 57

Factors Affecting International Portfolio Investment l. Tax Rates on Interest or Dividends » Investors assess their potential after-tax earnings from investments in foreign securities. l. Interest Rates » Money tends to flow to countries with high interest rates. l. Exchange Rates » If a country’s home currency is expected to strengthen, foreign investors may be attracted. Class 2 in 456: International Monetary Systems and Balance of Payments 58

Factors Affecting International Portfolio Investment l. Tax Rates on Interest or Dividends » Investors assess their potential after-tax earnings from investments in foreign securities. l. Interest Rates » Money tends to flow to countries with high interest rates. l. Exchange Rates » If a country’s home currency is expected to strengthen, foreign investors may be attracted. Class 2 in 456: International Monetary Systems and Balance of Payments 58

Agencies that Facilitate International Flows l International Monetary Fund (IMF) IMF goals encourage increased internationalization of business. » Its compensatory financing facility attempts to reduce the impact of export instability on country economies. » Financing by the IMF is measured in special drawing rights (SDRs). » Class 2 in 456: International Monetary Systems and Balance of Payments 59

Agencies that Facilitate International Flows l International Monetary Fund (IMF) IMF goals encourage increased internationalization of business. » Its compensatory financing facility attempts to reduce the impact of export instability on country economies. » Financing by the IMF is measured in special drawing rights (SDRs). » Class 2 in 456: International Monetary Systems and Balance of Payments 59

Agencies that Facilitate International Flows l. World Bank The primary objective of the profit-oriented bank is to make loans to countries in order to enhance economic development. » The World Bank may spread its funds by entering into cofinancing agreements. » A recently established agency offers various forms of political risk insurance. » Class 2 in 456: International Monetary Systems and Balance of Payments 60

Agencies that Facilitate International Flows l. World Bank The primary objective of the profit-oriented bank is to make loans to countries in order to enhance economic development. » The World Bank may spread its funds by entering into cofinancing agreements. » A recently established agency offers various forms of political risk insurance. » Class 2 in 456: International Monetary Systems and Balance of Payments 60

Agencies that Facilitate International Flows l World Trade Organization (the WTO) Established to provide a forum for multilateral trade negotiations and to settle trade disputes related to the GATT accord. » International Financial Corporation (IFC) promotes private enterprise within countries through loans and stock purchases. » l International Development Association (IDA) » The “World Bank” for less prosperous nations. Class 2 in 456: International Monetary Systems and Balance of Payments 61

Agencies that Facilitate International Flows l World Trade Organization (the WTO) Established to provide a forum for multilateral trade negotiations and to settle trade disputes related to the GATT accord. » International Financial Corporation (IFC) promotes private enterprise within countries through loans and stock purchases. » l International Development Association (IDA) » The “World Bank” for less prosperous nations. Class 2 in 456: International Monetary Systems and Balance of Payments 61

Agencies that Facilitate International Flows l. Bank for International Settlements (BIS) The BIS facilitates international transactions among countries. It is the “central banks’ central bank” and the “lender of last resort. ” » Regional Development Agencies » These agencies, such as the Inter-American Development Bank and the Asian Development Bank, have regional objectives relating to economic development. » Class 2 in 456: International Monetary Systems and Balance of Payments 62

Agencies that Facilitate International Flows l. Bank for International Settlements (BIS) The BIS facilitates international transactions among countries. It is the “central banks’ central bank” and the “lender of last resort. ” » Regional Development Agencies » These agencies, such as the Inter-American Development Bank and the Asian Development Bank, have regional objectives relating to economic development. » Class 2 in 456: International Monetary Systems and Balance of Payments 62

COPING WITH A CURRENT ACCOUNT DEFICIT POSSIBLE SOLUTIONS UNLIKELY TOWORK: þ Currency Depreciation þ & Protectionism CURRENCY DEPRECIATION U. S. Experience: Does not improve the trade deficit! Ineffective because (1) it takes time to affect trade; and (2) J-Curve Effect = a decline in currency value will initially worsen the deficit before improvement. Class 2 in 456: International Monetary Systems and Balance of Payments 63

COPING WITH A CURRENT ACCOUNT DEFICIT POSSIBLE SOLUTIONS UNLIKELY TOWORK: þ Currency Depreciation þ & Protectionism CURRENCY DEPRECIATION U. S. Experience: Does not improve the trade deficit! Ineffective because (1) it takes time to affect trade; and (2) J-Curve Effect = a decline in currency value will initially worsen the deficit before improvement. Class 2 in 456: International Monetary Systems and Balance of Payments 63

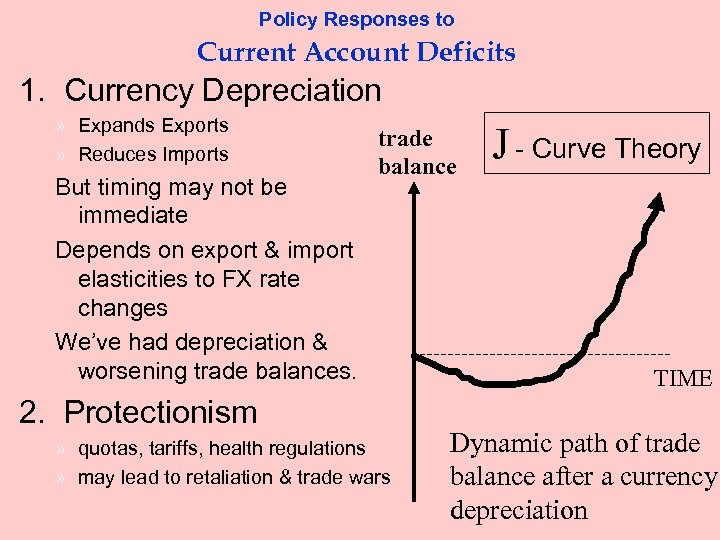

Policy Responses to Current Account Deficits 1. Currency Depreciation » Expands Exports » Reduces Imports But timing may not be immediate Depends on export & import elasticities to FX rate changes We’ve had depreciation & worsening trade balances. trade balance 2. Protectionism » quotas, tariffs, health regulations » may lead to retaliation & trade wars J - Curve Theory TIME Dynamic path of trade balance after a currency depreciation

Policy Responses to Current Account Deficits 1. Currency Depreciation » Expands Exports » Reduces Imports But timing may not be immediate Depends on export & import elasticities to FX rate changes We’ve had depreciation & worsening trade balances. trade balance 2. Protectionism » quotas, tariffs, health regulations » may lead to retaliation & trade wars J - Curve Theory TIME Dynamic path of trade balance after a currency depreciation

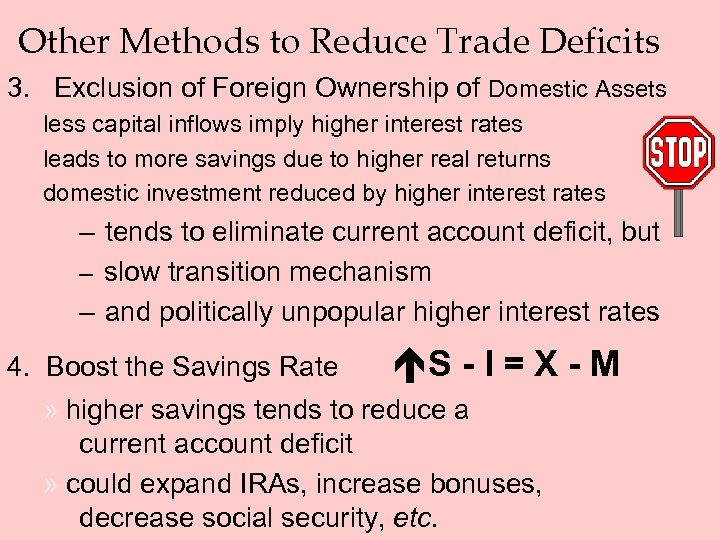

Other Methods to Reduce Trade Deficits 3. Exclusion of Foreign Ownership of Domestic Assets less capital inflows imply higher interest rates leads to more savings due to higher real returns domestic investment reduced by higher interest rates – tends to eliminate current account deficit, but – slow transition mechanism – and politically unpopular higher interest rates 4. Boost the Savings Rate S - I = X - M » higher savings tends to reduce a current account deficit » could expand IRAs, increase bonuses, decrease social security, etc.

Other Methods to Reduce Trade Deficits 3. Exclusion of Foreign Ownership of Domestic Assets less capital inflows imply higher interest rates leads to more savings due to higher real returns domestic investment reduced by higher interest rates – tends to eliminate current account deficit, but – slow transition mechanism – and politically unpopular higher interest rates 4. Boost the Savings Rate S - I = X - M » higher savings tends to reduce a current account deficit » could expand IRAs, increase bonuses, decrease social security, etc.

PROTECTIONISM l TRADE BARRIERS then to use: 1. Tariffs or 2. Quotas Results: Most likely will reduce both X and M. l FOREIGN OWNERSHIP one protectionist-style solution would place limits on or eliminate foreign ownership leading to capital inflows. l STIMULATE NATIONAL SAVING change the tax regulations and rates.

PROTECTIONISM l TRADE BARRIERS then to use: 1. Tariffs or 2. Quotas Results: Most likely will reduce both X and M. l FOREIGN OWNERSHIP one protectionist-style solution would place limits on or eliminate foreign ownership leading to capital inflows. l STIMULATE NATIONAL SAVING change the tax regulations and rates.

SUMMARY: CURRENT-ACCOUNT DEFICITS are neither inherently good nor bad 1. Since one country’s exports are another’s imports, it is not possible for all to run a surplus 2. Deficits may be a solution to the problem of different national propensities to save and invest.

SUMMARY: CURRENT-ACCOUNT DEFICITS are neither inherently good nor bad 1. Since one country’s exports are another’s imports, it is not possible for all to run a surplus 2. Deficits may be a solution to the problem of different national propensities to save and invest.