Chapter 2: Cost Terms, Concepts, and Classifications Introduction.

16844-cost_acc_chapter_2.ppt

- Количество слайдов: 23

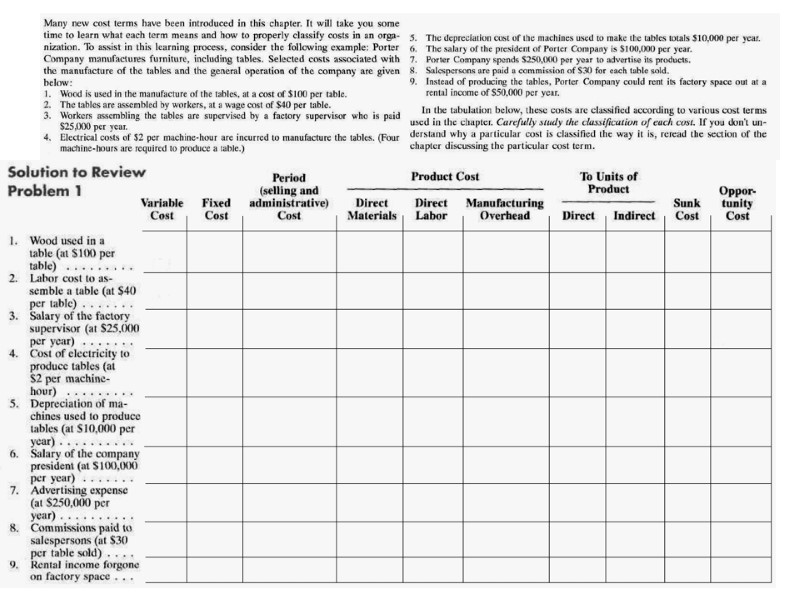

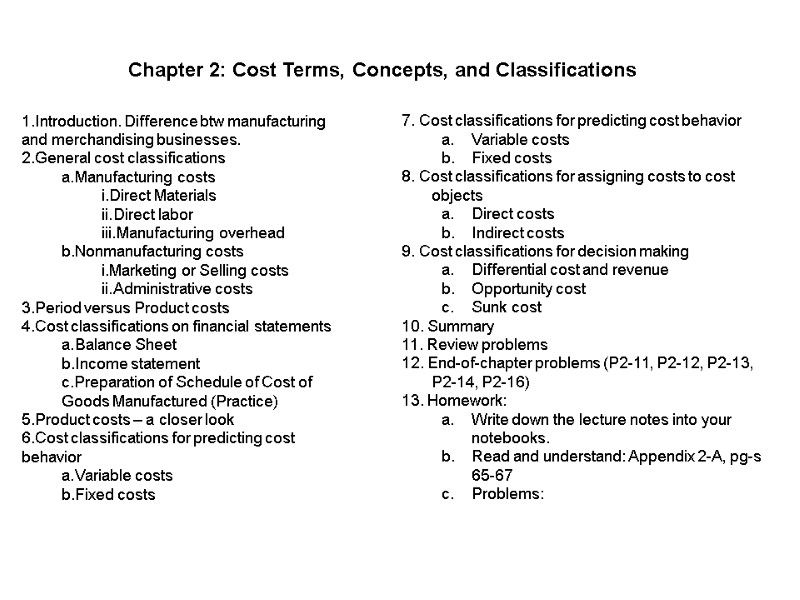

Chapter 2: Cost Terms, Concepts, and Classifications Introduction. Difference btw manufacturing and merchandising businesses. General cost classifications Manufacturing costs Direct Materials Direct labor Manufacturing overhead Nonmanufacturing costs Marketing or Selling costs Administrative costs Period versus Product costs Cost classifications on financial statements Balance Sheet Income statement Preparation of Schedule of Cost of Goods Manufactured (Practice) Product costs – a closer look Cost classifications for predicting cost behavior Variable costs Fixed costs 7. Cost classifications for predicting cost behavior Variable costs Fixed costs 8. Cost classifications for assigning costs to cost objects Direct costs Indirect costs 9. Cost classifications for decision making Differential cost and revenue Opportunity cost Sunk cost 10. Summary 11. Review problems 12. End-of-chapter problems (P2-11, P2-12, P2-13, P2-14, P2-16) 13. Homework: Write down the lecture notes into your notebooks. Read and understand: Appendix 2-A, pg-s 65-67 Problems:

Chapter 2: Cost Terms, Concepts, and Classifications Introduction. Difference btw manufacturing and merchandising businesses. General cost classifications Manufacturing costs Direct Materials Direct labor Manufacturing overhead Nonmanufacturing costs Marketing or Selling costs Administrative costs Period versus Product costs Cost classifications on financial statements Balance Sheet Income statement Preparation of Schedule of Cost of Goods Manufactured (Practice) Product costs – a closer look Cost classifications for predicting cost behavior Variable costs Fixed costs 7. Cost classifications for predicting cost behavior Variable costs Fixed costs 8. Cost classifications for assigning costs to cost objects Direct costs Indirect costs 9. Cost classifications for decision making Differential cost and revenue Opportunity cost Sunk cost 10. Summary 11. Review problems 12. End-of-chapter problems (P2-11, P2-12, P2-13, P2-14, P2-16) 13. Homework: Write down the lecture notes into your notebooks. Read and understand: Appendix 2-A, pg-s 65-67 Problems:

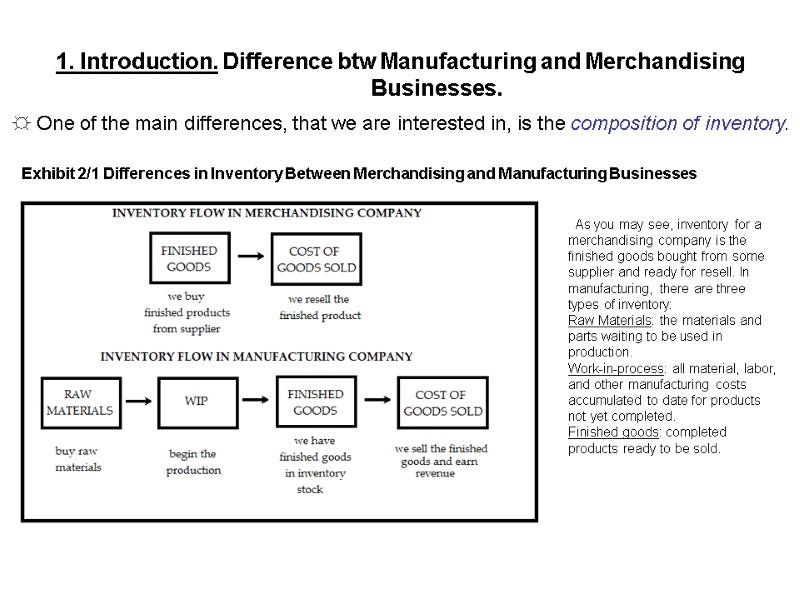

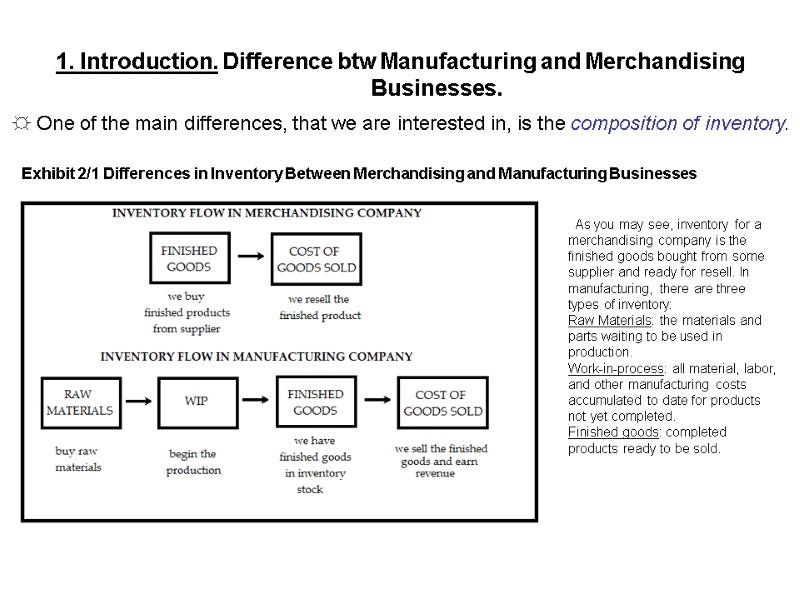

1. Introduction. Difference btw Manufacturing and Merchandising Businesses. ☼ One of the main differences, that we are interested in, is the composition of inventory. Exhibit 2/1 Differences in Inventory Between Merchandising and Manufacturing Businesses As you may see, inventory for a merchandising company is the finished goods bought from some supplier and ready for resell. In manufacturing, there are three types of inventory: Raw Materials: the materials and parts waiting to be used in production. Work-in-process: all material, labor, and other manufacturing costs accumulated to date for products not yet completed. Finished goods: completed products ready to be sold.

1. Introduction. Difference btw Manufacturing and Merchandising Businesses. ☼ One of the main differences, that we are interested in, is the composition of inventory. Exhibit 2/1 Differences in Inventory Between Merchandising and Manufacturing Businesses As you may see, inventory for a merchandising company is the finished goods bought from some supplier and ready for resell. In manufacturing, there are three types of inventory: Raw Materials: the materials and parts waiting to be used in production. Work-in-process: all material, labor, and other manufacturing costs accumulated to date for products not yet completed. Finished goods: completed products ready to be sold.

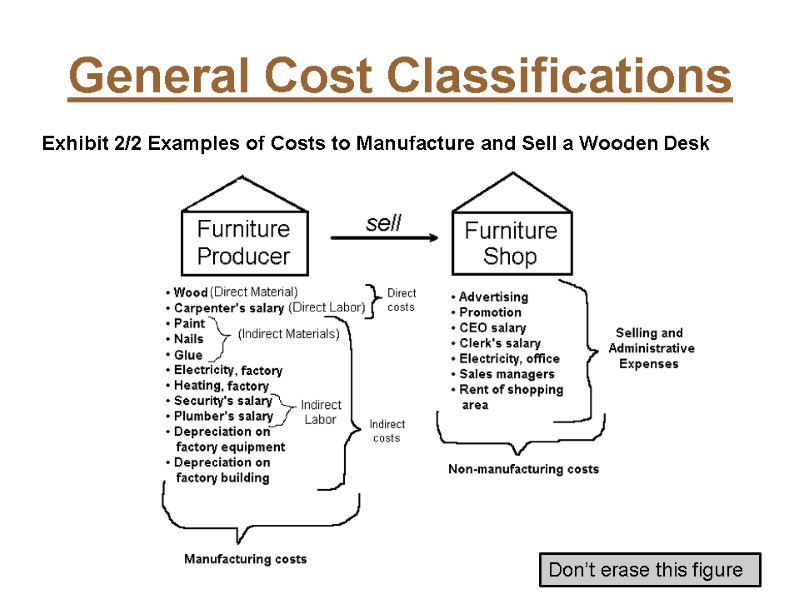

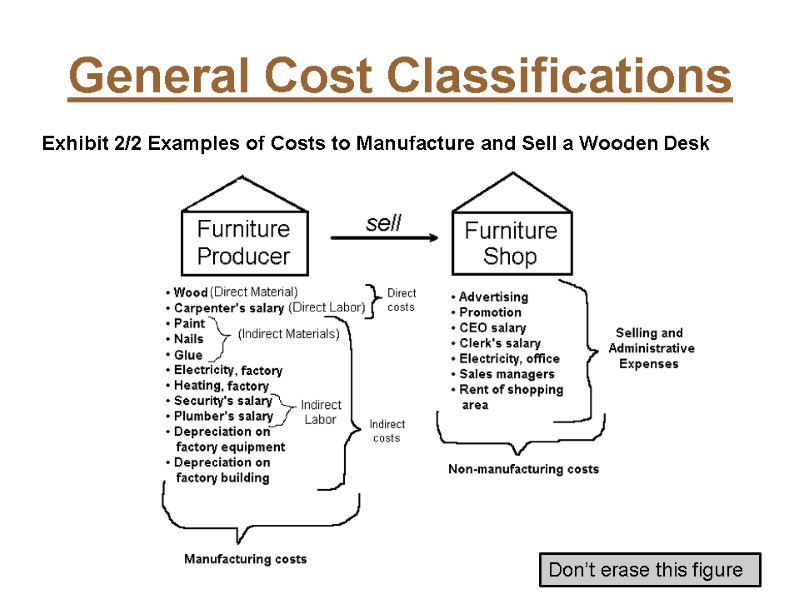

General Cost Classifications Exhibit 2/2 Examples of Costs to Manufacture and Sell a Wooden Desk Don’t erase this figure

General Cost Classifications Exhibit 2/2 Examples of Costs to Manufacture and Sell a Wooden Desk Don’t erase this figure

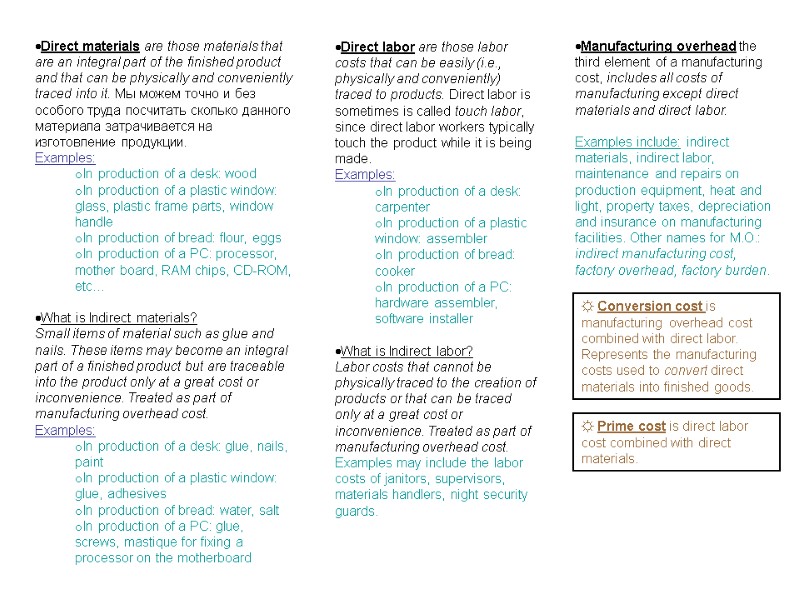

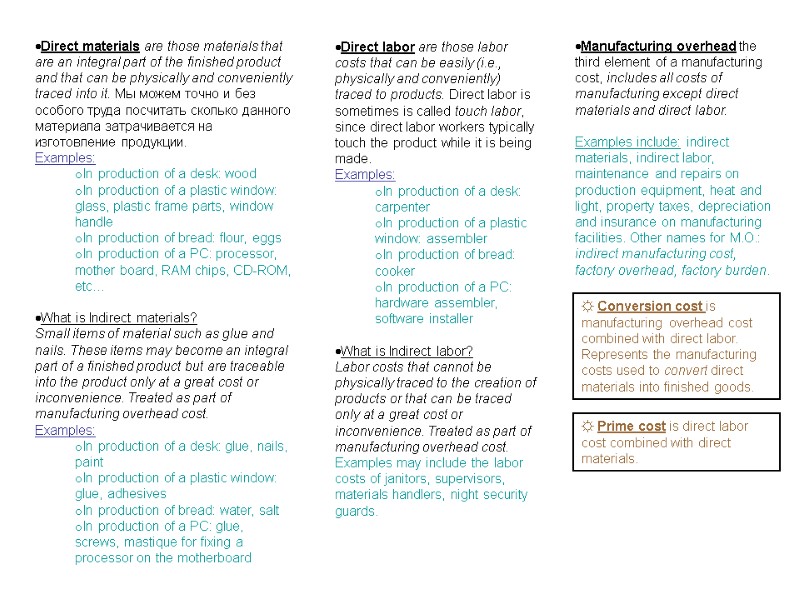

Direct materials are those materials that are an integral part of the finished product and that can be physically and conveniently traced into it. Мы можем точно и без особого труда посчитать сколько данного материала затрачивается на изготовление продукции. Examples: In production of a desk: wood In production of a plastic window: glass, plastic frame parts, window handle In production of bread: flour, eggs In production of a PC: processor, mother board, RAM chips, CD-ROM, etc… What is Indirect materials? Small items of material such as glue and nails. These items may become an integral part of a finished product but are traceable into the product only at a great cost or inconvenience. Treated as part of manufacturing overhead cost. Examples: In production of a desk: glue, nails, paint In production of a plastic window: glue, adhesives In production of bread: water, salt In production of a PC: glue, screws, mastique for fixing a processor on the motherboard Direct labor are those labor costs that can be easily (i.e., physically and conveniently) traced to products. Direct labor is sometimes is called touch labor, since direct labor workers typically touch the product while it is being made. Examples: In production of a desk: carpenter In production of a plastic window: assembler In production of bread: cooker In production of a PC: hardware assembler, software installer What is Indirect labor? Labor costs that cannot be physically traced to the creation of products or that can be traced only at a great cost or inconvenience. Treated as part of manufacturing overhead cost. Examples may include the labor costs of janitors, supervisors, materials handlers, night security guards. Manufacturing overhead the third element of a manufacturing cost, includes all costs of manufacturing except direct materials and direct labor. Examples include: indirect materials, indirect labor, maintenance and repairs on production equipment, heat and light, property taxes, depreciation and insurance on manufacturing facilities. Other names for M.O.: indirect manufacturing cost, factory overhead, factory burden. ☼ Conversion cost is manufacturing overhead cost combined with direct labor. Represents the manufacturing costs used to convert direct materials into finished goods. ☼ Prime cost is direct labor cost combined with direct materials.

Direct materials are those materials that are an integral part of the finished product and that can be physically and conveniently traced into it. Мы можем точно и без особого труда посчитать сколько данного материала затрачивается на изготовление продукции. Examples: In production of a desk: wood In production of a plastic window: glass, plastic frame parts, window handle In production of bread: flour, eggs In production of a PC: processor, mother board, RAM chips, CD-ROM, etc… What is Indirect materials? Small items of material such as glue and nails. These items may become an integral part of a finished product but are traceable into the product only at a great cost or inconvenience. Treated as part of manufacturing overhead cost. Examples: In production of a desk: glue, nails, paint In production of a plastic window: glue, adhesives In production of bread: water, salt In production of a PC: glue, screws, mastique for fixing a processor on the motherboard Direct labor are those labor costs that can be easily (i.e., physically and conveniently) traced to products. Direct labor is sometimes is called touch labor, since direct labor workers typically touch the product while it is being made. Examples: In production of a desk: carpenter In production of a plastic window: assembler In production of bread: cooker In production of a PC: hardware assembler, software installer What is Indirect labor? Labor costs that cannot be physically traced to the creation of products or that can be traced only at a great cost or inconvenience. Treated as part of manufacturing overhead cost. Examples may include the labor costs of janitors, supervisors, materials handlers, night security guards. Manufacturing overhead the third element of a manufacturing cost, includes all costs of manufacturing except direct materials and direct labor. Examples include: indirect materials, indirect labor, maintenance and repairs on production equipment, heat and light, property taxes, depreciation and insurance on manufacturing facilities. Other names for M.O.: indirect manufacturing cost, factory overhead, factory burden. ☼ Conversion cost is manufacturing overhead cost combined with direct labor. Represents the manufacturing costs used to convert direct materials into finished goods. ☼ Prime cost is direct labor cost combined with direct materials.

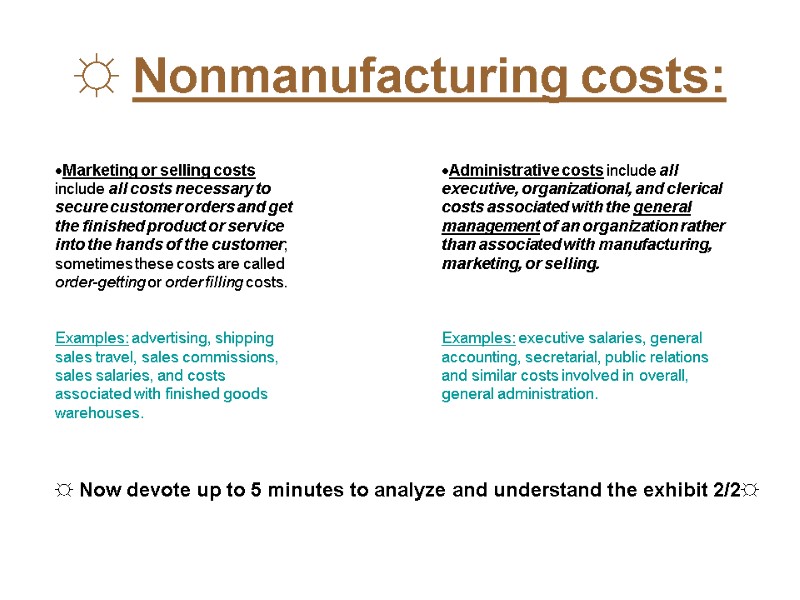

☼ Nonmanufacturing costs: Marketing or selling costs include all costs necessary to secure customer orders and get the finished product or service into the hands of the customer; sometimes these costs are called order-getting or order filling costs. Examples: advertising, shipping sales travel, sales commissions, sales salaries, and costs associated with finished goods warehouses. Administrative costs include all executive, organizational, and clerical costs associated with the general management of an organization rather than associated with manufacturing, marketing, or selling. Examples: executive salaries, general accounting, secretarial, public relations and similar costs involved in overall, general administration. ☼ Now devote up to 5 minutes to analyze and understand the exhibit 2/2☼

☼ Nonmanufacturing costs: Marketing or selling costs include all costs necessary to secure customer orders and get the finished product or service into the hands of the customer; sometimes these costs are called order-getting or order filling costs. Examples: advertising, shipping sales travel, sales commissions, sales salaries, and costs associated with finished goods warehouses. Administrative costs include all executive, organizational, and clerical costs associated with the general management of an organization rather than associated with manufacturing, marketing, or selling. Examples: executive salaries, general accounting, secretarial, public relations and similar costs involved in overall, general administration. ☼ Now devote up to 5 minutes to analyze and understand the exhibit 2/2☼

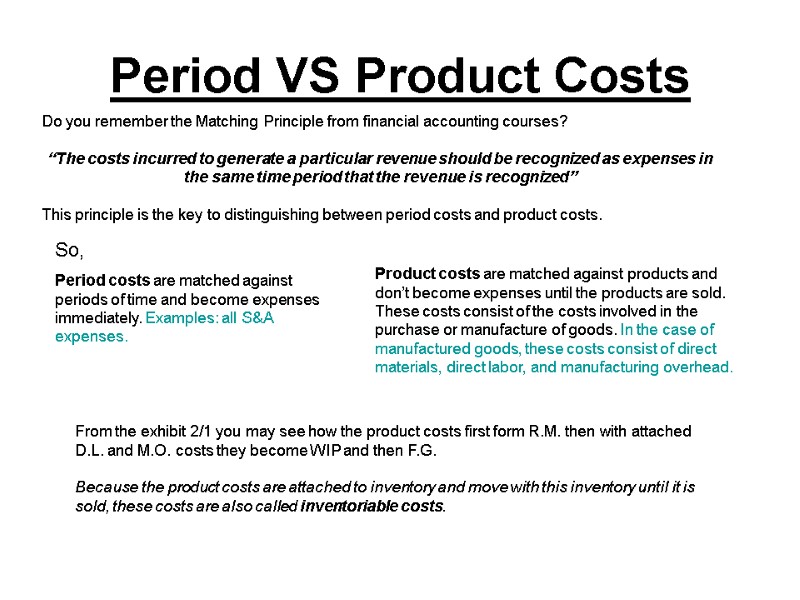

Period VS Product Costs Do you remember the Matching Principle from financial accounting courses? “The costs incurred to generate a particular revenue should be recognized as expenses in the same time period that the revenue is recognized” This principle is the key to distinguishing between period costs and product costs. So, Period costs are matched against periods of time and become expenses immediately. Examples: all S&A expenses. Product costs are matched against products and don’t become expenses until the products are sold. These costs consist of the costs involved in the purchase or manufacture of goods. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. From the exhibit 2/1 you may see how the product costs first form R.M. then with attached D.L. and M.O. costs they become WIP and then F.G. Because the product costs are attached to inventory and move with this inventory until it is sold, these costs are also called inventoriable costs.

Period VS Product Costs Do you remember the Matching Principle from financial accounting courses? “The costs incurred to generate a particular revenue should be recognized as expenses in the same time period that the revenue is recognized” This principle is the key to distinguishing between period costs and product costs. So, Period costs are matched against periods of time and become expenses immediately. Examples: all S&A expenses. Product costs are matched against products and don’t become expenses until the products are sold. These costs consist of the costs involved in the purchase or manufacture of goods. In the case of manufactured goods, these costs consist of direct materials, direct labor, and manufacturing overhead. From the exhibit 2/1 you may see how the product costs first form R.M. then with attached D.L. and M.O. costs they become WIP and then F.G. Because the product costs are attached to inventory and move with this inventory until it is sold, these costs are also called inventoriable costs.

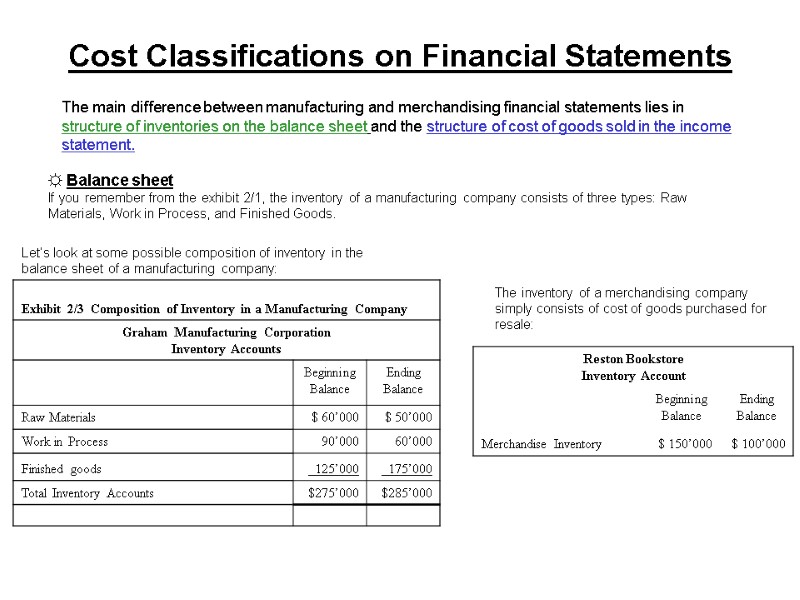

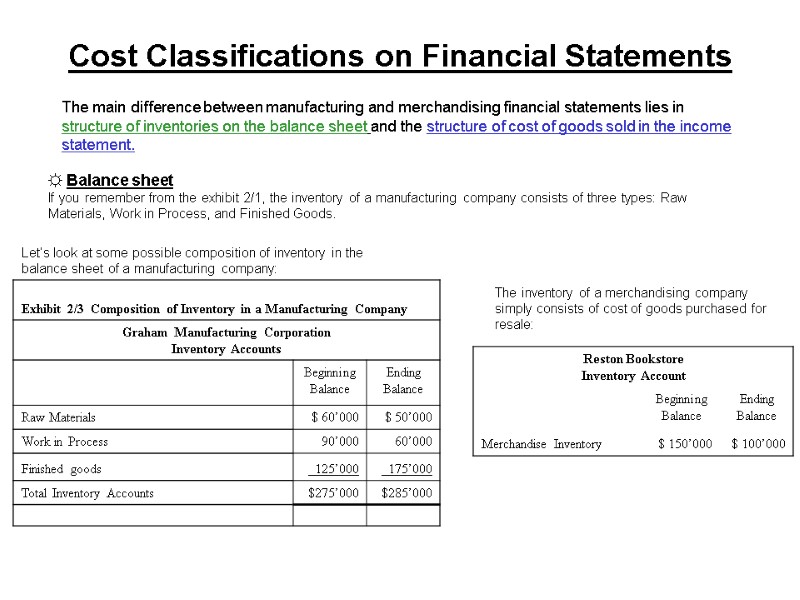

Cost Classifications on Financial Statements The main difference between manufacturing and merchandising financial statements lies in structure of inventories on the balance sheet and the structure of cost of goods sold in the income statement. ☼ Balance sheet If you remember from the exhibit 2/1, the inventory of a manufacturing company consists of three types: Raw Materials, Work in Process, and Finished Goods. Let’s look at some possible composition of inventory in the balance sheet of a manufacturing company: The inventory of a merchandising company simply consists of cost of goods purchased for resale:

Cost Classifications on Financial Statements The main difference between manufacturing and merchandising financial statements lies in structure of inventories on the balance sheet and the structure of cost of goods sold in the income statement. ☼ Balance sheet If you remember from the exhibit 2/1, the inventory of a manufacturing company consists of three types: Raw Materials, Work in Process, and Finished Goods. Let’s look at some possible composition of inventory in the balance sheet of a manufacturing company: The inventory of a merchandising company simply consists of cost of goods purchased for resale:

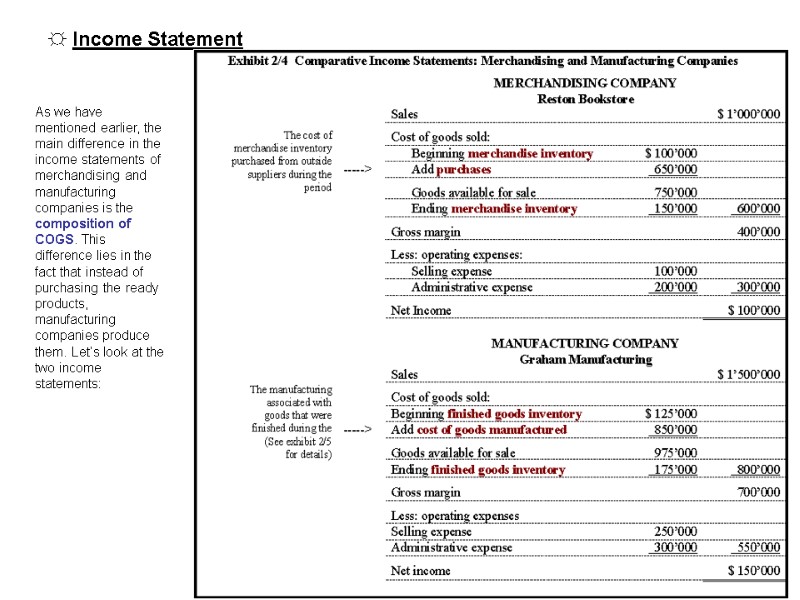

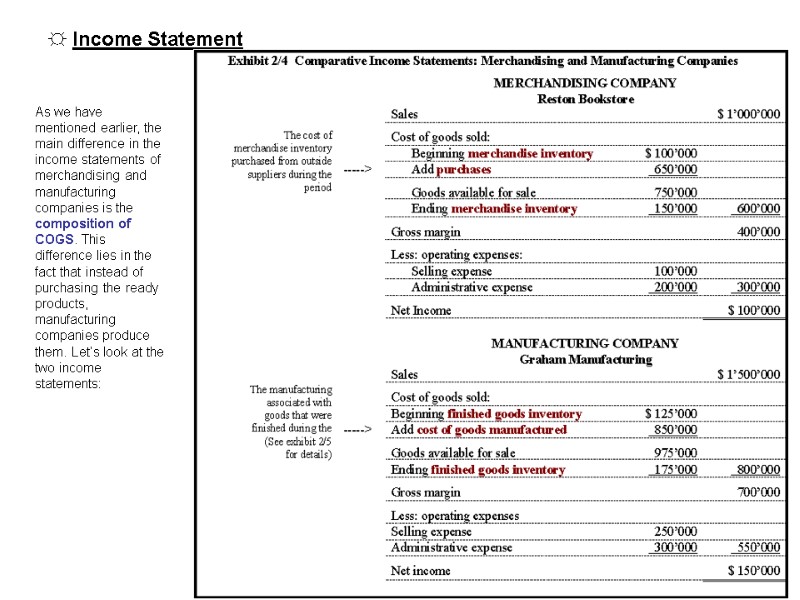

☼ Income Statement As we have mentioned earlier, the main difference in the income statements of merchandising and manufacturing companies is the composition of COGS. This difference lies in the fact that instead of purchasing the ready products, manufacturing companies produce them. Let’s look at the two income statements:

☼ Income Statement As we have mentioned earlier, the main difference in the income statements of merchandising and manufacturing companies is the composition of COGS. This difference lies in the fact that instead of purchasing the ready products, manufacturing companies produce them. Let’s look at the two income statements:

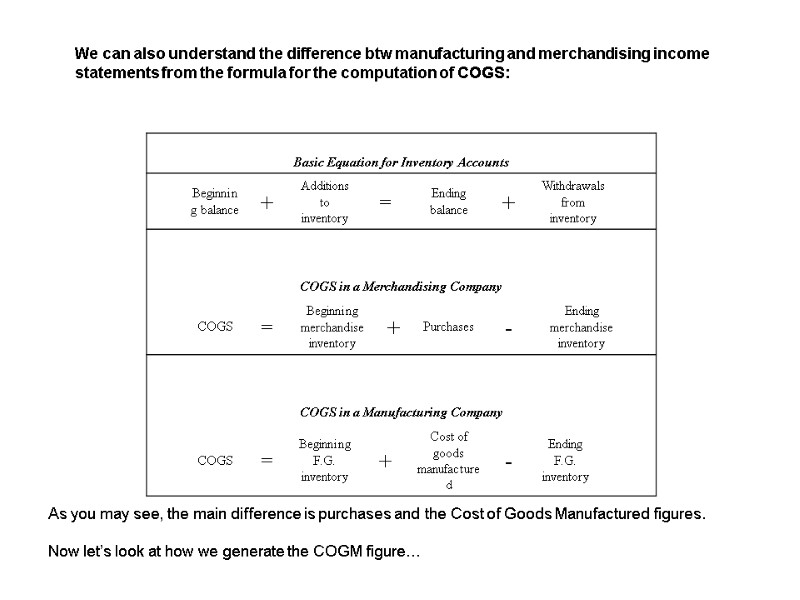

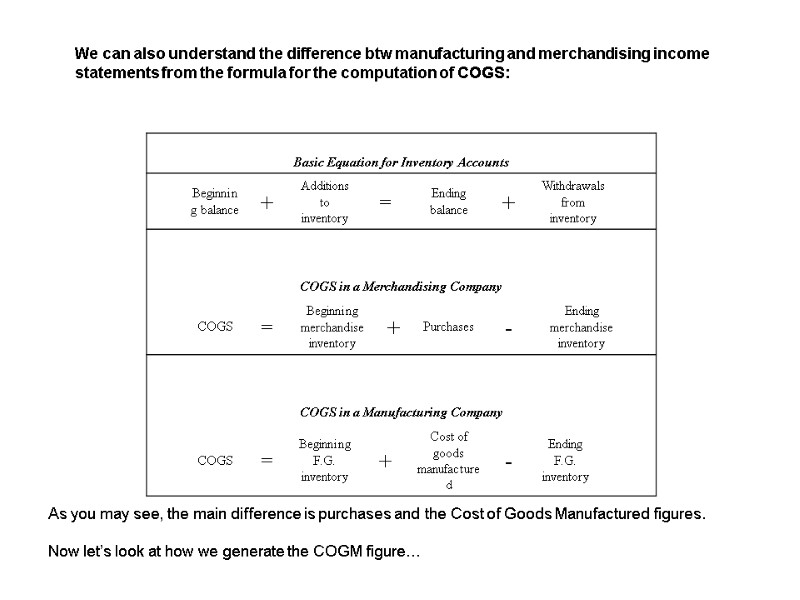

We can also understand the difference btw manufacturing and merchandising income statements from the formula for the computation of COGS: As you may see, the main difference is purchases and the Cost of Goods Manufactured figures. Now let’s look at how we generate the COGM figure…

We can also understand the difference btw manufacturing and merchandising income statements from the formula for the computation of COGS: As you may see, the main difference is purchases and the Cost of Goods Manufactured figures. Now let’s look at how we generate the COGM figure…

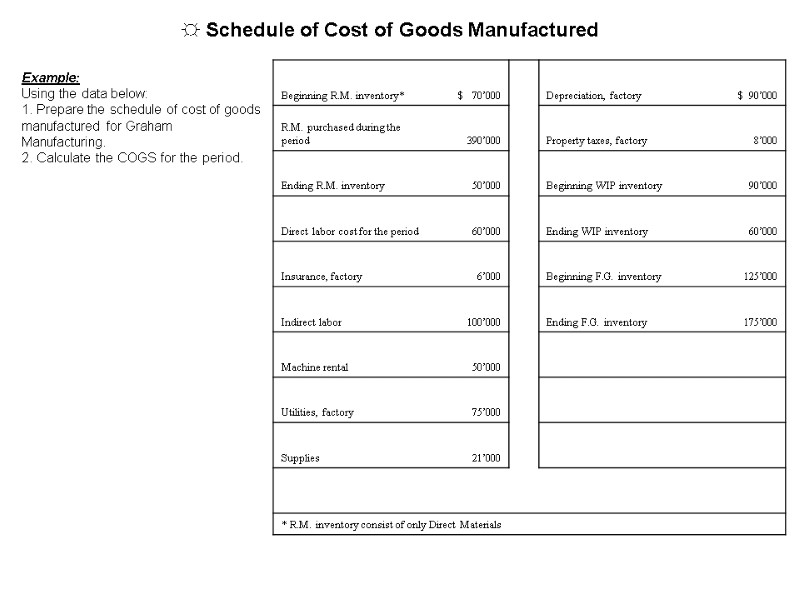

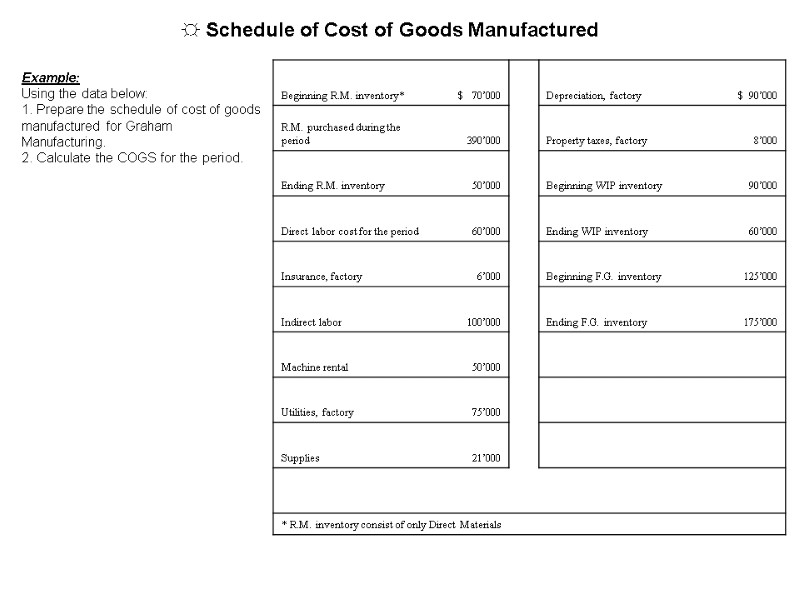

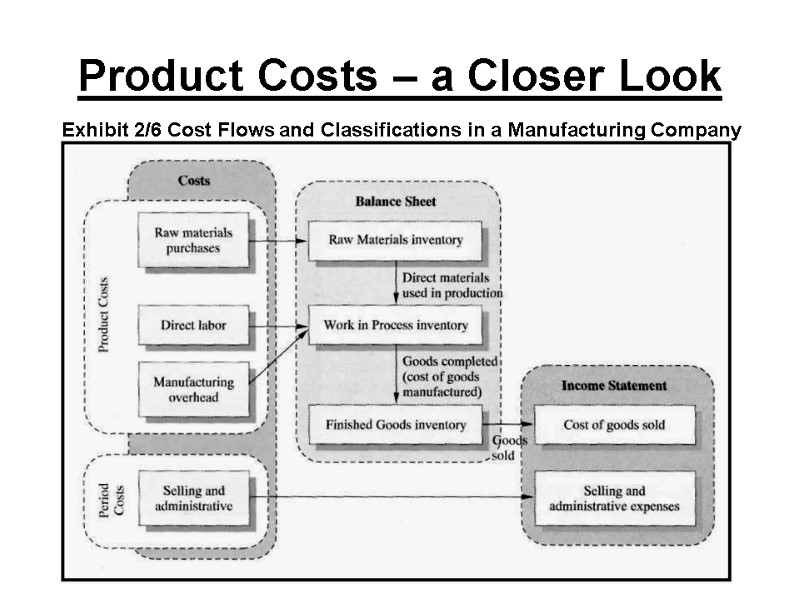

Example: Using the data below: 1. Prepare the schedule of cost of goods manufactured for Graham Manufacturing. 2. Calculate the COGS for the period. ☼ Schedule of Cost of Goods Manufactured

Example: Using the data below: 1. Prepare the schedule of cost of goods manufactured for Graham Manufacturing. 2. Calculate the COGS for the period. ☼ Schedule of Cost of Goods Manufactured

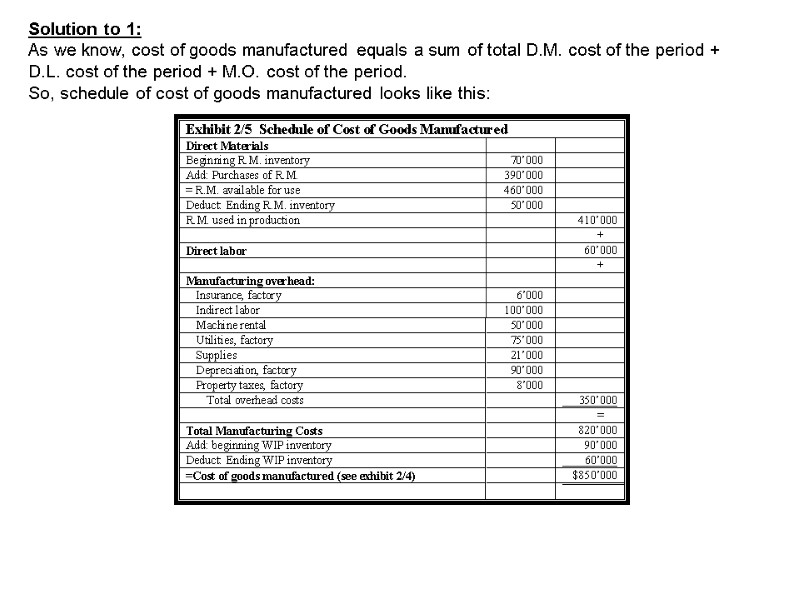

Solution to 1: As we know, cost of goods manufactured equals a sum of total D.M. cost of the period + D.L. cost of the period + M.O. cost of the period. So, schedule of cost of goods manufactured looks like this:

Solution to 1: As we know, cost of goods manufactured equals a sum of total D.M. cost of the period + D.L. cost of the period + M.O. cost of the period. So, schedule of cost of goods manufactured looks like this:

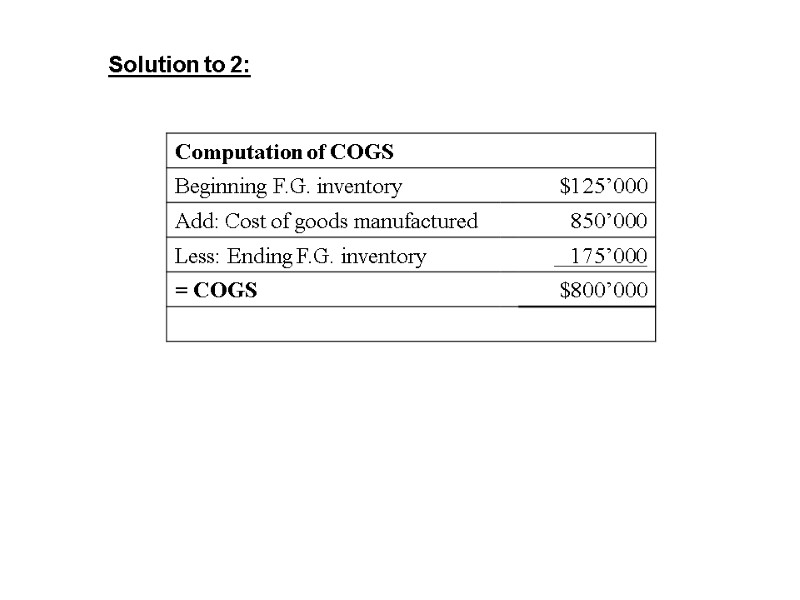

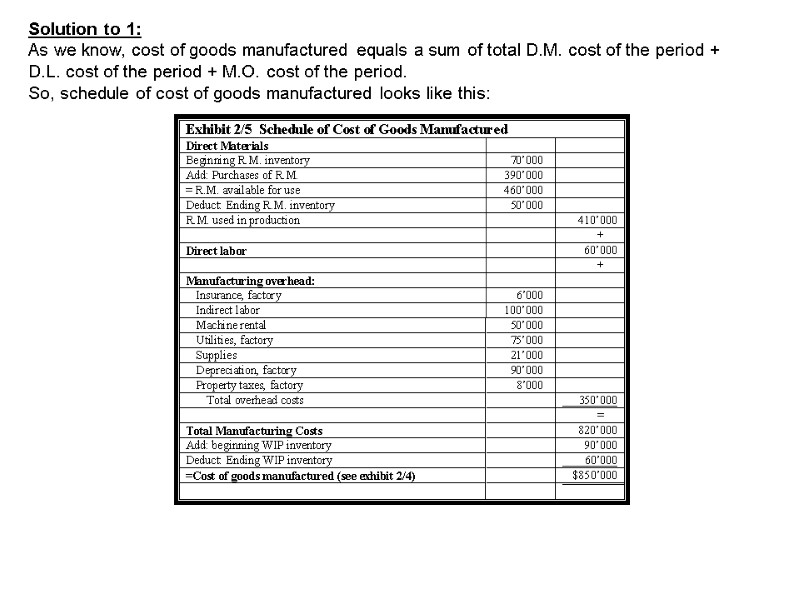

Solution to 2:

Solution to 2:

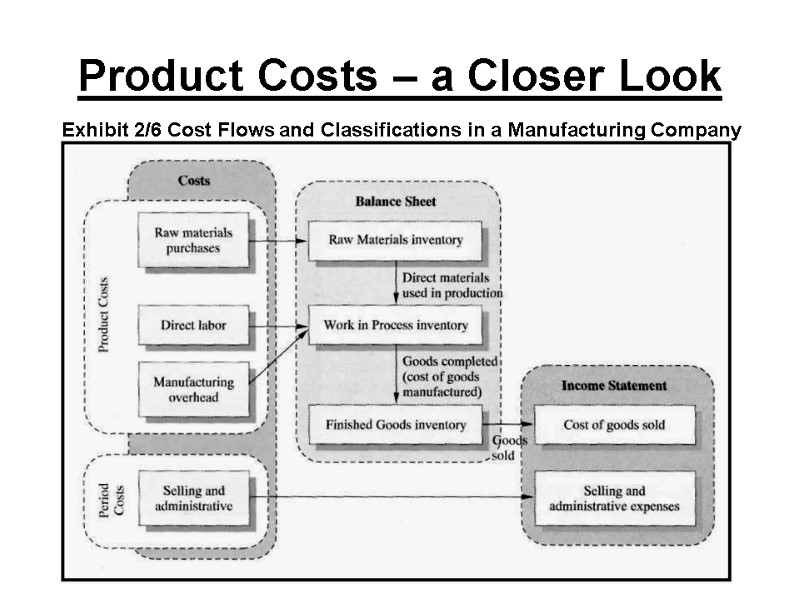

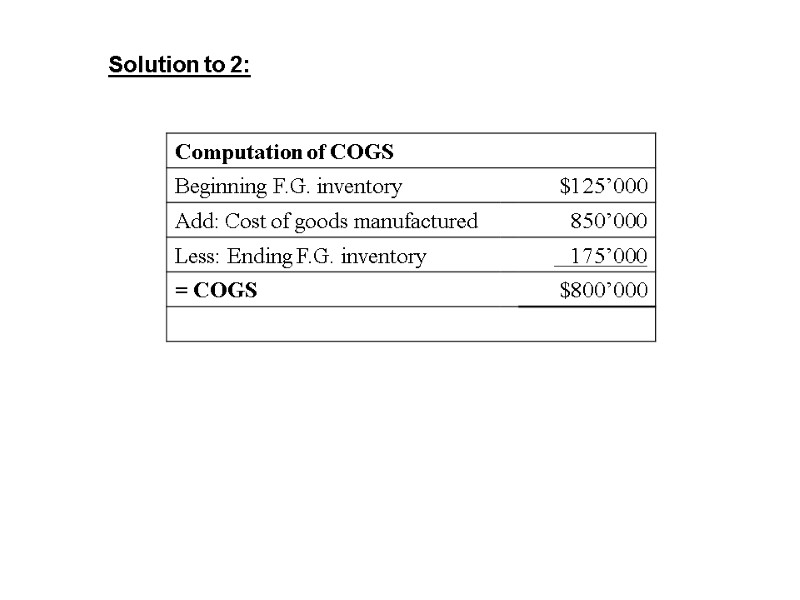

Product Costs – a Closer Look Exhibit 2/6 Cost Flows and Classifications in a Manufacturing Company

Product Costs – a Closer Look Exhibit 2/6 Cost Flows and Classifications in a Manufacturing Company

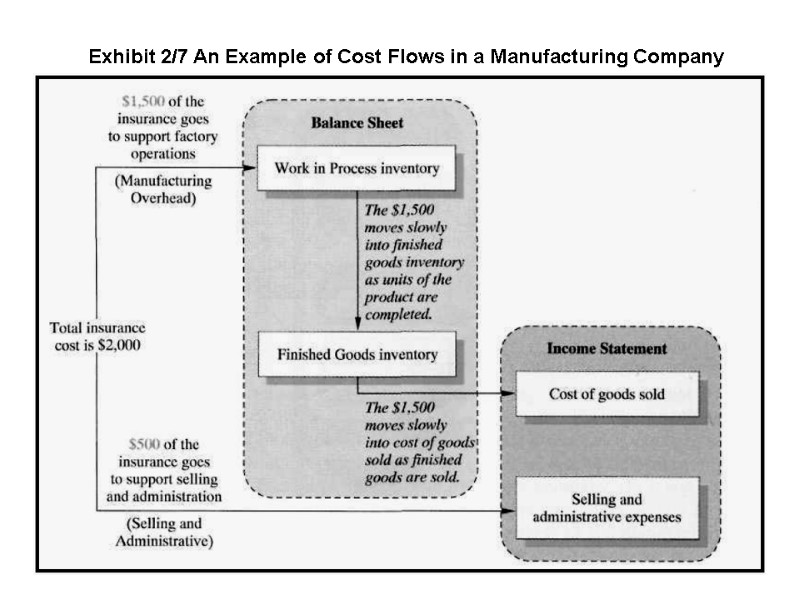

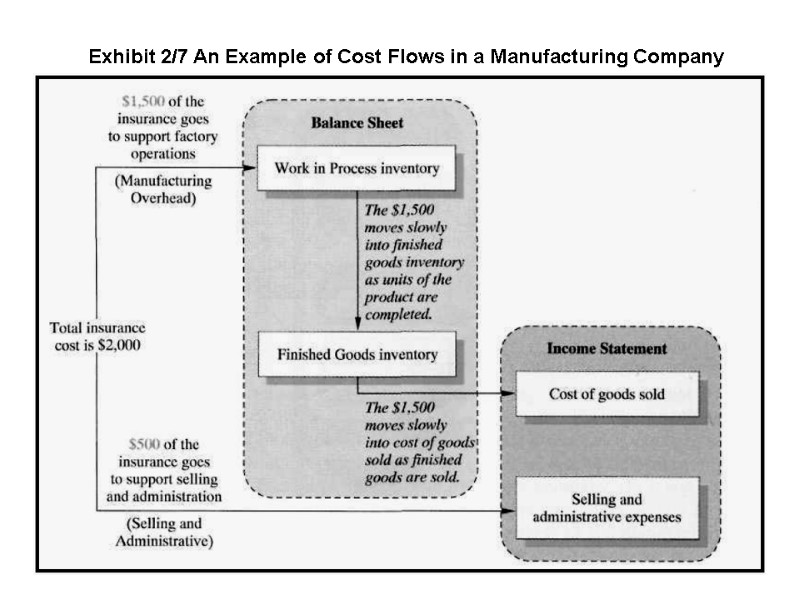

Exhibit 2/7 An Example of Cost Flows in a Manufacturing Company

Exhibit 2/7 An Example of Cost Flows in a Manufacturing Company

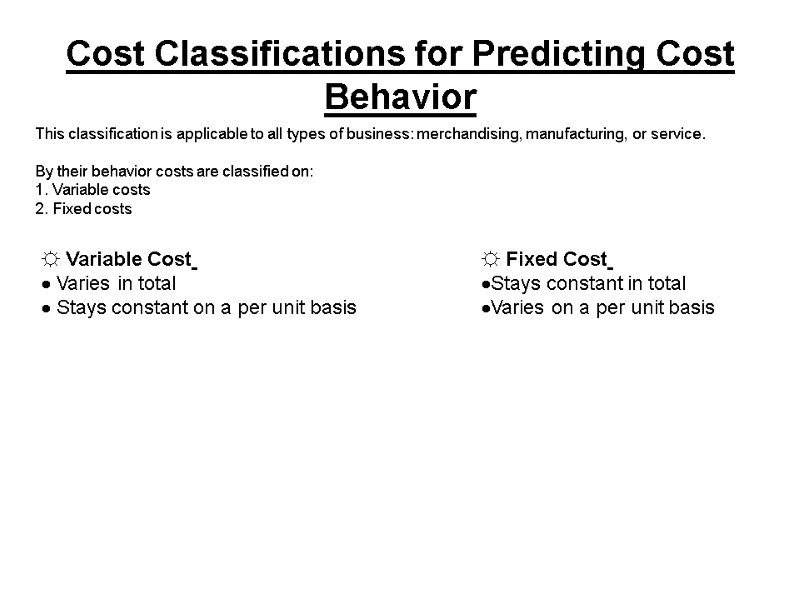

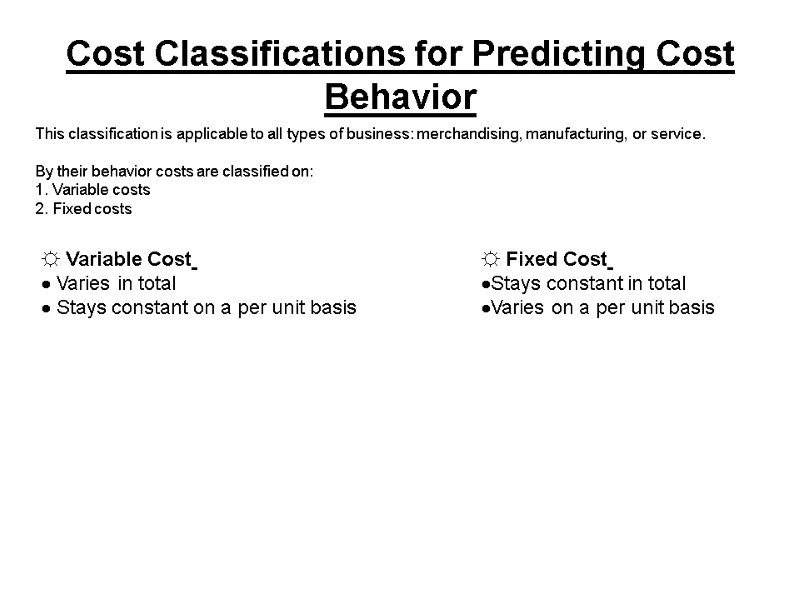

Cost Classifications for Predicting Cost Behavior This classification is applicable to all types of business: merchandising, manufacturing, or service. By their behavior costs are classified on: 1. Variable costs 2. Fixed costs ☼ Variable Cost Varies in total Stays constant on a per unit basis ☼ Fixed Cost Stays constant in total Varies on a per unit basis

Cost Classifications for Predicting Cost Behavior This classification is applicable to all types of business: merchandising, manufacturing, or service. By their behavior costs are classified on: 1. Variable costs 2. Fixed costs ☼ Variable Cost Varies in total Stays constant on a per unit basis ☼ Fixed Cost Stays constant in total Varies on a per unit basis

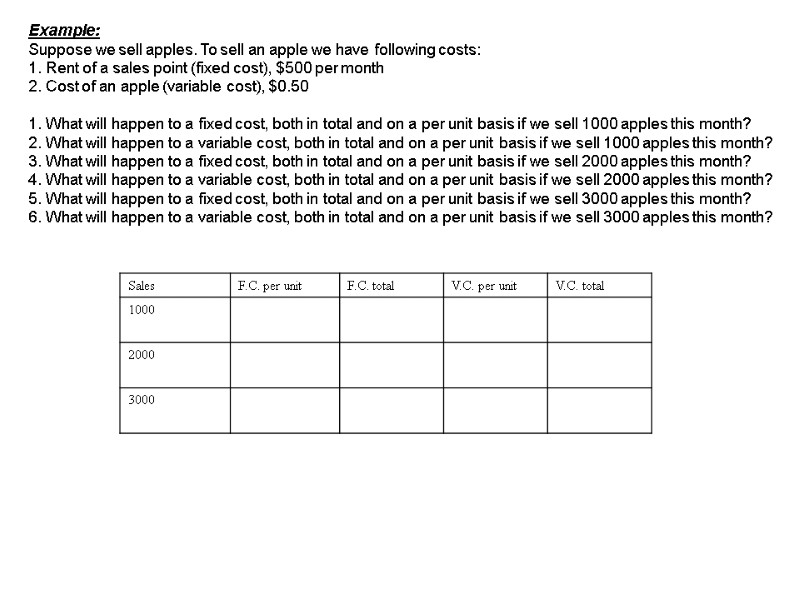

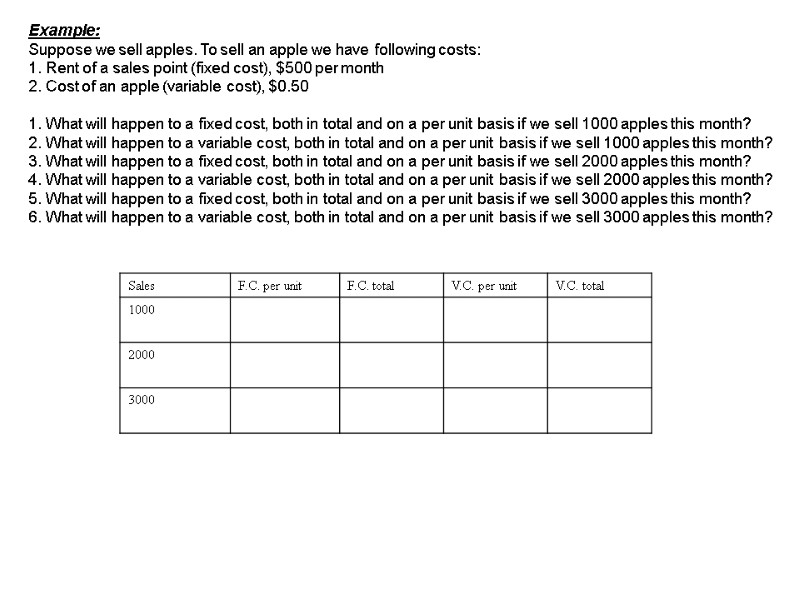

Example: Suppose we sell apples. To sell an apple we have following costs: 1. Rent of a sales point (fixed cost), $500 per month 2. Cost of an apple (variable cost), $0.50 1. What will happen to a fixed cost, both in total and on a per unit basis if we sell 1000 apples this month? 2. What will happen to a variable cost, both in total and on a per unit basis if we sell 1000 apples this month? 3. What will happen to a fixed cost, both in total and on a per unit basis if we sell 2000 apples this month? 4. What will happen to a variable cost, both in total and on a per unit basis if we sell 2000 apples this month? 5. What will happen to a fixed cost, both in total and on a per unit basis if we sell 3000 apples this month? 6. What will happen to a variable cost, both in total and on a per unit basis if we sell 3000 apples this month?

Example: Suppose we sell apples. To sell an apple we have following costs: 1. Rent of a sales point (fixed cost), $500 per month 2. Cost of an apple (variable cost), $0.50 1. What will happen to a fixed cost, both in total and on a per unit basis if we sell 1000 apples this month? 2. What will happen to a variable cost, both in total and on a per unit basis if we sell 1000 apples this month? 3. What will happen to a fixed cost, both in total and on a per unit basis if we sell 2000 apples this month? 4. What will happen to a variable cost, both in total and on a per unit basis if we sell 2000 apples this month? 5. What will happen to a fixed cost, both in total and on a per unit basis if we sell 3000 apples this month? 6. What will happen to a variable cost, both in total and on a per unit basis if we sell 3000 apples this month?

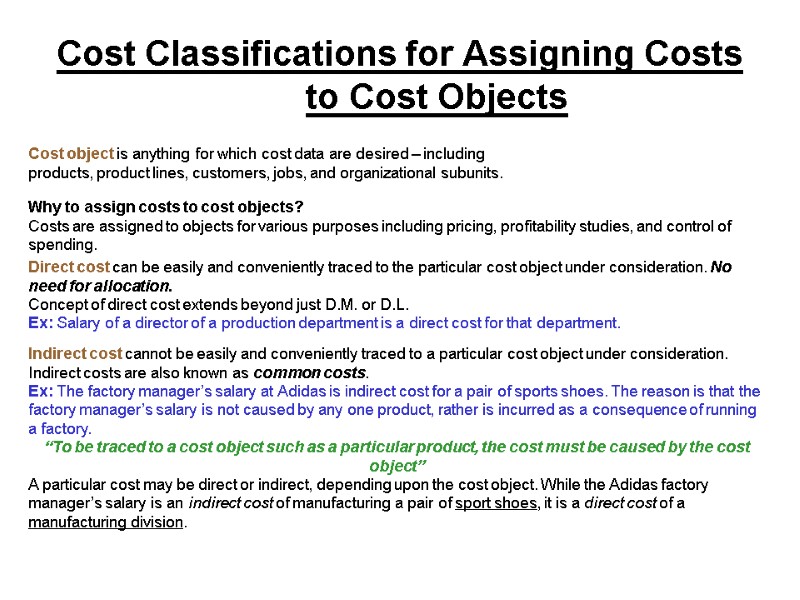

Cost Classifications for Assigning Costs to Cost Objects Cost object is anything for which cost data are desired – including products, product lines, customers, jobs, and organizational subunits. Why to assign costs to cost objects? Costs are assigned to objects for various purposes including pricing, profitability studies, and control of spending. Direct cost can be easily and conveniently traced to the particular cost object under consideration. No need for allocation. Concept of direct cost extends beyond just D.M. or D.L. Ex: Salary of a director of a production department is a direct cost for that department. Indirect cost cannot be easily and conveniently traced to a particular cost object under consideration. Indirect costs are also known as common costs. Ex: The factory manager’s salary at Adidas is indirect cost for a pair of sports shoes. The reason is that the factory manager’s salary is not caused by any one product, rather is incurred as a consequence of running a factory. “To be traced to a cost object such as a particular product, the cost must be caused by the cost object” A particular cost may be direct or indirect, depending upon the cost object. While the Adidas factory manager’s salary is an indirect cost of manufacturing a pair of sport shoes, it is a direct cost of a manufacturing division.

Cost Classifications for Assigning Costs to Cost Objects Cost object is anything for which cost data are desired – including products, product lines, customers, jobs, and organizational subunits. Why to assign costs to cost objects? Costs are assigned to objects for various purposes including pricing, profitability studies, and control of spending. Direct cost can be easily and conveniently traced to the particular cost object under consideration. No need for allocation. Concept of direct cost extends beyond just D.M. or D.L. Ex: Salary of a director of a production department is a direct cost for that department. Indirect cost cannot be easily and conveniently traced to a particular cost object under consideration. Indirect costs are also known as common costs. Ex: The factory manager’s salary at Adidas is indirect cost for a pair of sports shoes. The reason is that the factory manager’s salary is not caused by any one product, rather is incurred as a consequence of running a factory. “To be traced to a cost object such as a particular product, the cost must be caused by the cost object” A particular cost may be direct or indirect, depending upon the cost object. While the Adidas factory manager’s salary is an indirect cost of manufacturing a pair of sport shoes, it is a direct cost of a manufacturing division.

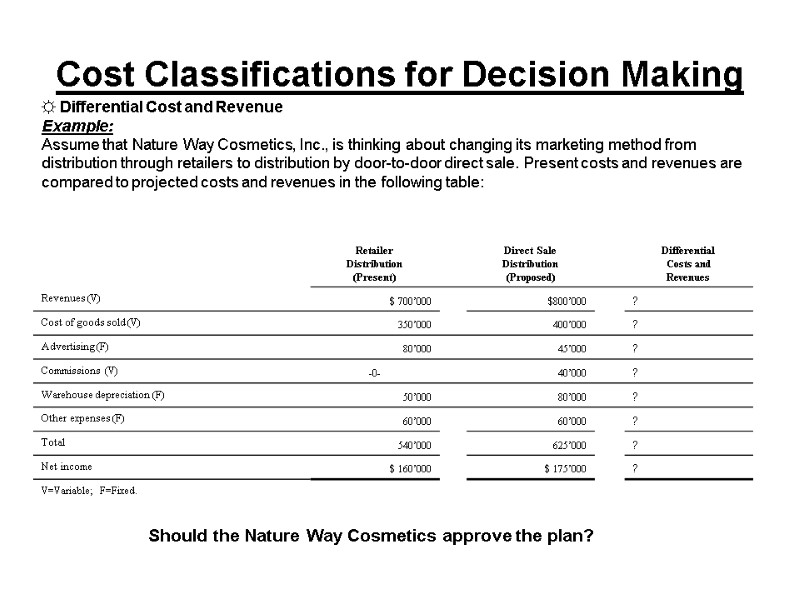

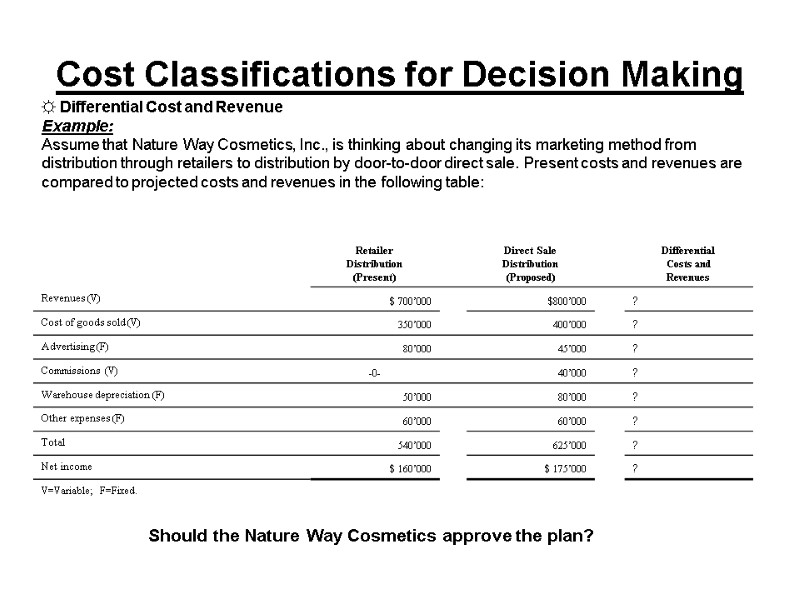

Cost Classifications for Decision Making ☼ Differential Cost and Revenue Example: Assume that Nature Way Cosmetics, Inc., is thinking about changing its marketing method from distribution through retailers to distribution by door-to-door direct sale. Present costs and revenues are compared to projected costs and revenues in the following table: Should the Nature Way Cosmetics approve the plan?

Cost Classifications for Decision Making ☼ Differential Cost and Revenue Example: Assume that Nature Way Cosmetics, Inc., is thinking about changing its marketing method from distribution through retailers to distribution by door-to-door direct sale. Present costs and revenues are compared to projected costs and revenues in the following table: Should the Nature Way Cosmetics approve the plan?

Cost Classifications for Decision Making ☼ Opportunity cost Although the opportunity cost is not usually entered in accounting records of an organization, this cost must be explicitly considered in every decision a manager makes. ☼ Sunk cost Since sunk cost cannot be changed by any present or future decision, they are not differential costs, and therefore they can, and should, be ignored when analyzing future courses of action.

Cost Classifications for Decision Making ☼ Opportunity cost Although the opportunity cost is not usually entered in accounting records of an organization, this cost must be explicitly considered in every decision a manager makes. ☼ Sunk cost Since sunk cost cannot be changed by any present or future decision, they are not differential costs, and therefore they can, and should, be ignored when analyzing future courses of action.

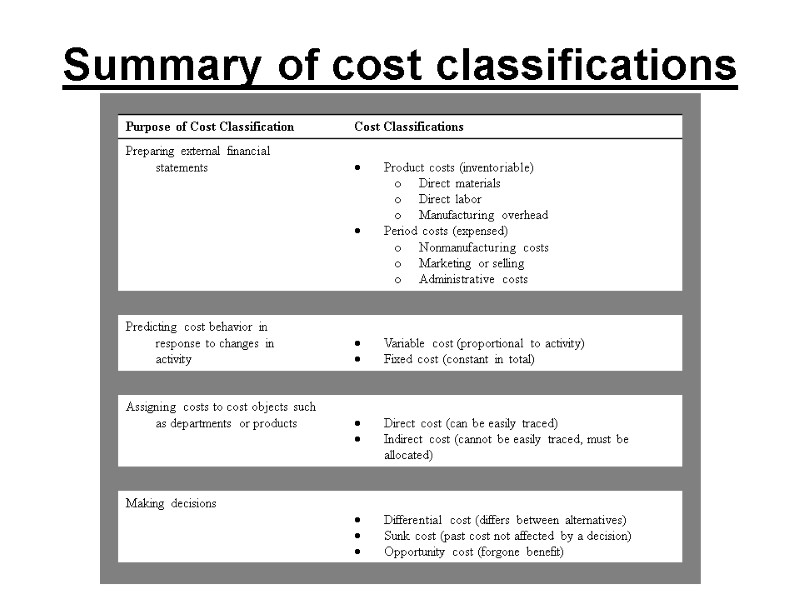

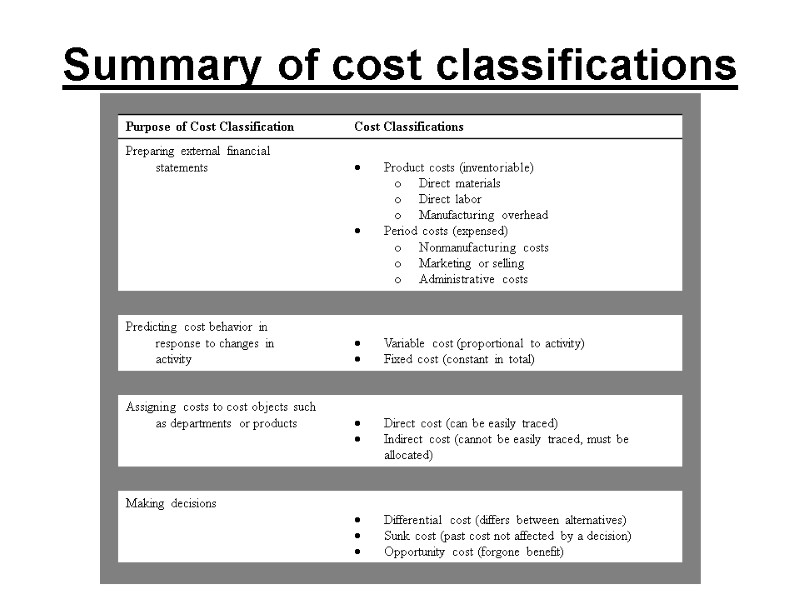

Summary of cost classifications

Summary of cost classifications

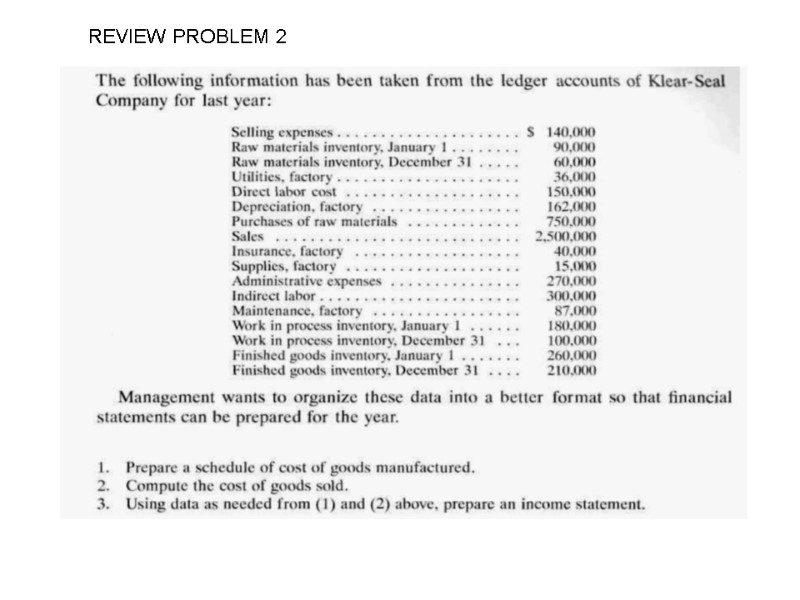

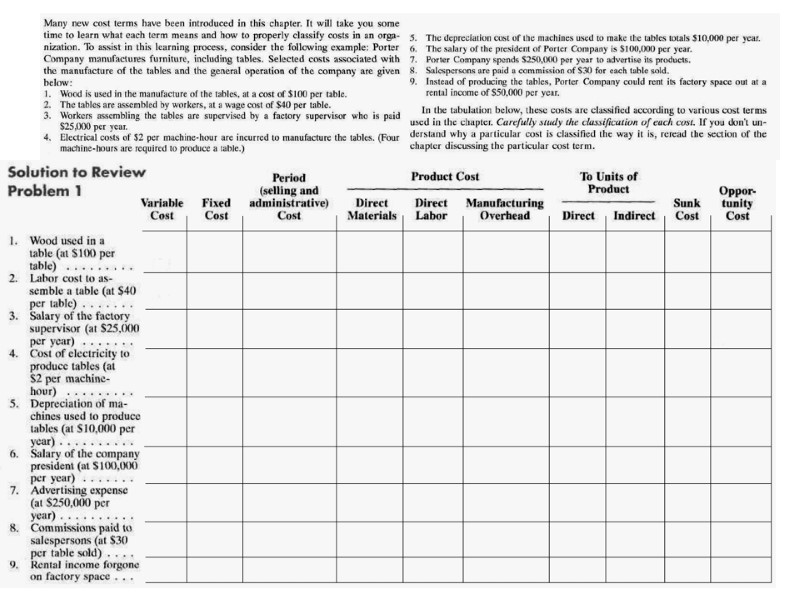

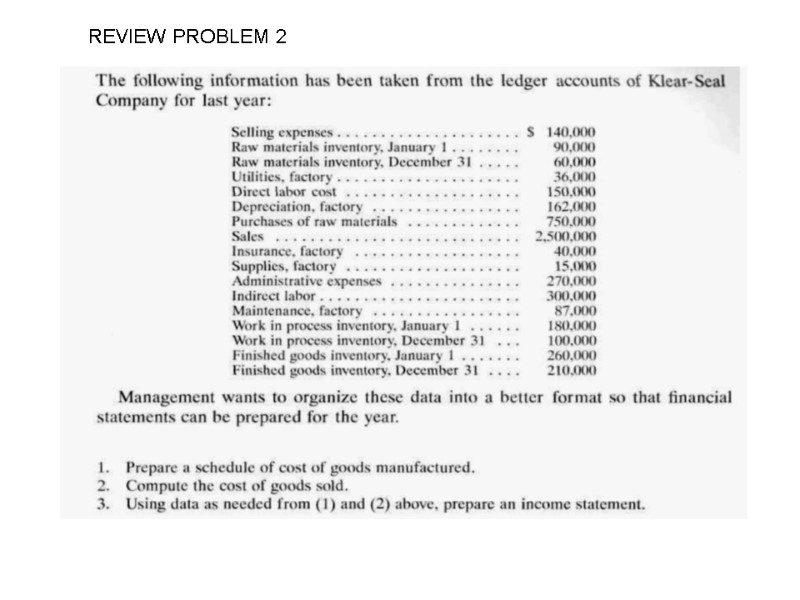

REVIEW PROBLEM 2

REVIEW PROBLEM 2

Homework: Read and understand: Appendix 2-A, pg-s 65-67 All End-of-chapter exercises End-of-chapter problems, all. TILL NEXT LESSON:

Homework: Read and understand: Appendix 2-A, pg-s 65-67 All End-of-chapter exercises End-of-chapter problems, all. TILL NEXT LESSON: