2fcd17c5af9039126add6741b8aa4390.ppt

- Количество слайдов: 25

Chapter 2 Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Markets and Instruments Slide 2 -1 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Chapter Summary w Objective: To introduce the features of various security types, necessary for the understanding of the coming material n n Slide 2 -2 Money markets and how yields are measured Fixed Income Stocks and Indexes Derivative Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Major Classes of Financial Assets or Securities w Debt n n Money market instruments Bonds w Common stock w Preferred stock w Derivative securities Slide 2 -3 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Markets and Instruments w Money Market n n Debt Instruments Derivatives w Capital Market n n n Slide 2 -4 Bonds Equity Derivatives Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: To introduce the features of various security types, necessary for the understanding of the coming material n n Slide 2 -5 Money markets and how yields are measured Fixed Income Stocks and Indexes Derivative Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Money Market Instruments w Treasury bills w Certificates of Deposit and Bearer Deposit Notes (BDNs) w Commercial Paper w Bankers Acceptances w Eurodollars w Repurchase Agreements (REPOs) and Reverse REPOs Slide 2 -6 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Money Market Instrument Yields w Yields on Money Market Instruments are not always directly comparable w Factors influencing yields n n n Slide 2 -7 Par value vs. investment value 360 vs. 365 days assumed in a year (366 leap year) Bond equivalent yield Copyright © Mc. Graw-Hill Ryerson Limited, 2003

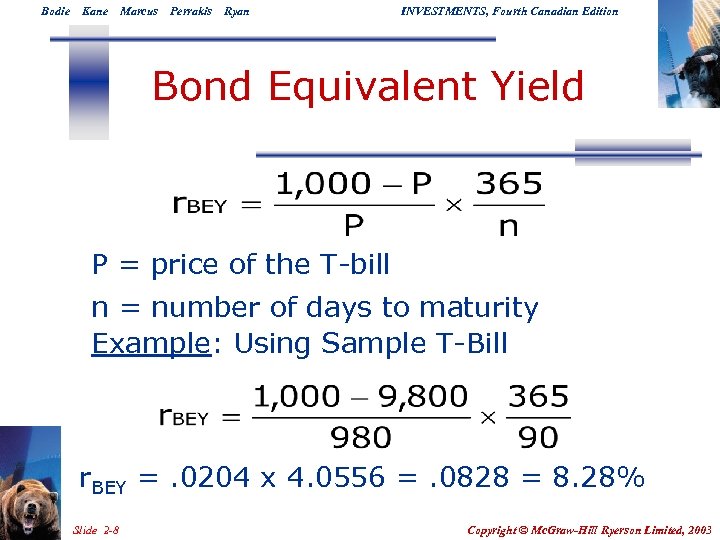

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Bond Equivalent Yield P = price of the T-bill n = number of days to maturity Example: Using Sample T-Bill r. BEY =. 0204 x 4. 0556 =. 0828 = 8. 28% Slide 2 -8 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

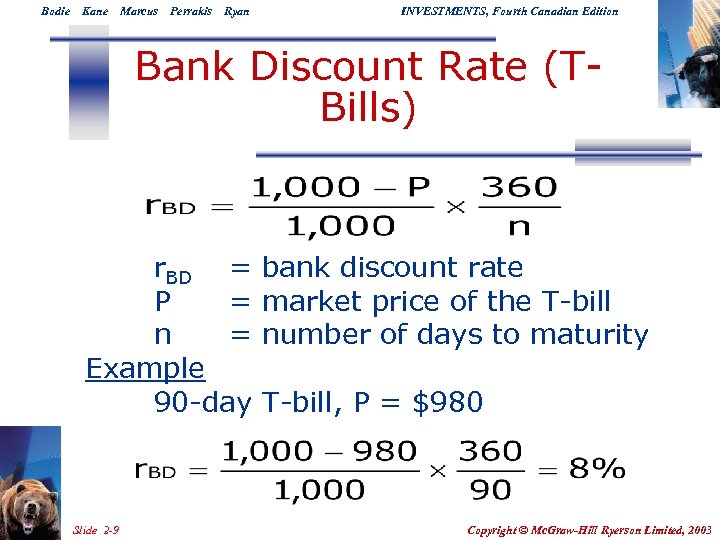

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Bank Discount Rate (TBills) r. BD = P = n = Example 90 -day Slide 2 -9 bank discount rate market price of the T-bill number of days to maturity T-bill, P = $980 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Bond Equivalent Yield w Impossible to compare T-bill directly to bond n n 360 vs 365 days Return is figured on par vs. price paid w Adjust the bank discount rate to make it comparable Slide 2 -10 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

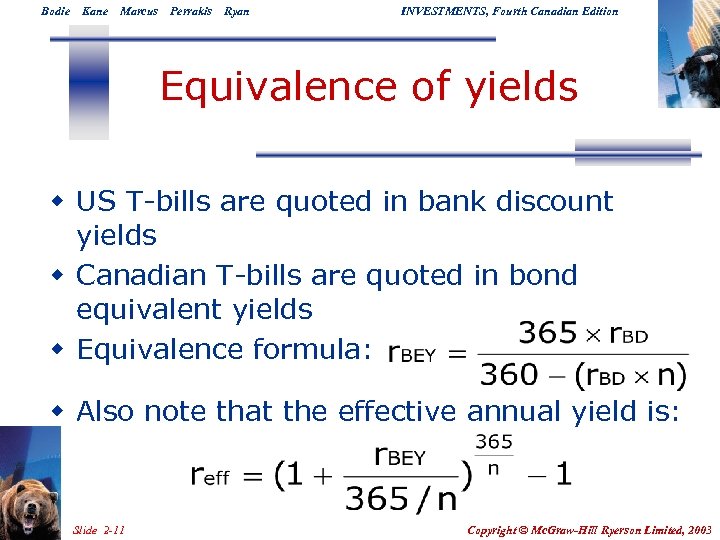

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Equivalence of yields w US T-bills are quoted in bank discount yields w Canadian T-bills are quoted in bond equivalent yields w Equivalence formula: w Also note that the effective annual yield is: Slide 2 -11 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: To introduce the features of various security types, necessary for the understanding of the coming material n n Slide 2 -12 Money markets and how yields are measured Fixed Income Stocks and Indexes Derivative Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Capital Market Fixed Income Instruments w Publicly Issued Instruments n n n Canada Bonds Provincial Government Bonds Municipal Bonds w Privately Issued Instruments n n Slide 2 -13 Corporate Bonds Mortgage-Backed Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: To introduce the features of various security types, necessary for the understanding of the coming material n n Slide 2 -14 Money markets and how yields are measured Fixed Income Stocks and Indexes Derivative Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Capital Market - Equity w Common stock n n n Residual claim Limited liability Corporate governance and restricted shares w Preferred stock n n n Slide 2 -15 Fixed dividends - limited Priority over common Tax treatment Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Stock Indexes w Uses n n n Track average returns Comparing performance of managers Base of derivatives w Factors in constructing or using an Index n n n Slide 2 -16 Representative? Broad or narrow? How is it constructed? Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Examples of Indexes – Canadian w TSE 300 Composite Index w TSE 35 (also known as Toronto 35 or T 35) w TSE 100 w S&P/TSE 60 Slide 2 -17 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Examples of Indexes US w w w Dow Jones Industrial Average (30 Stocks) Standard & Poor’s 500 Composite NASDAQ Composite NYSE Composite Wilshire 5000 Slide 2 -18 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Examples of Indexes International w w TSE (Tokyo) - Nikkei 225 & Nikkei 300 FTSE (Financial Times of London) Dax Region and Country Indexes n n n Slide 2 -19 EAFE Far East United Kingdom Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Construction of Indexes w How are stocks weighted? n n n Price weighted (DJIA) Market-value weighted (S&P 500, NASDAQ, TSE 300) Equally weighted (Value Line Index) w How returns are averaged? n n Slide 2 -20 Arithmetic (DJIA and S&P 500) Geometric (Value Line Index) Copyright © Mc. Graw-Hill Ryerson Limited, 2003

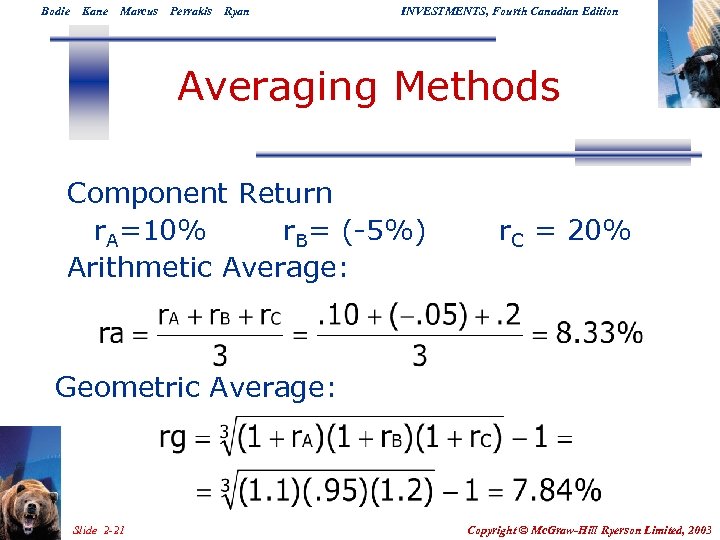

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Averaging Methods Component Return r. A=10% r. B= (-5%) Arithmetic Average: r. C = 20% Geometric Average: Slide 2 -21 Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Bond Indexes w w w Lehman Brothers Merrill Lynch Salomon Brothers Scotia Capital (Canada) Specialized Indexes n Slide 2 -22 Merrill Lynch Mortgage Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Summary Reminder w Objective: To introduce the features of various security types, necessary for the understanding of the coming material n n Slide 2 -23 Money markets and how yields are measured Fixed Income Stocks and Indexes Derivative Securities Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Derivatives Securities Options w Basic Positions n n Call (Buy) Put (Sell) w Terms n n n Slide 2 -24 Exercise Price Expiration Date Underlying Assets Futures w Basic Positions n n Long (Buy) Short (Sell) w Terms n n Delivery Date Underlying Assets Copyright © Mc. Graw-Hill Ryerson Limited, 2003

Bodie Kane Marcus Perrakis Ryan INVESTMENTS, Fourth Canadian Edition Derivative Securities. Quotes Options w Bid price w Ask price w Last price w Open interest w Underlying asset price w Cash settlement w Physical delivery Slide 2 -25 Futures w Settlement price w Change w Open interest w Underlying asset price w Cash settlement w Physical delivery Copyright © Mc. Graw-Hill Ryerson Limited, 2003

2fcd17c5af9039126add6741b8aa4390.ppt