b0004e748ef78ff0b056ffff9aa35ed9.ppt

- Количество слайдов: 32

CHAPTER 2 Asset Classes and Financial Instruments Investments, 8 th edition Bodie, Kane and Marcus Slides by Susan Hine Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

CHAPTER 2 Asset Classes and Financial Instruments Investments, 8 th edition Bodie, Kane and Marcus Slides by Susan Hine Mc. Graw-Hill/Irwin Copyright © 2009 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Major Classes of Financial Assets or Securities • • • Money market Bond market Equity Securities Indexes Derivative markets 2 -2

Major Classes of Financial Assets or Securities • • • Money market Bond market Equity Securities Indexes Derivative markets 2 -2

The Money Market • Treasury bills – Bid and asked price – Bank discount method • Certificates of Deposits • Commercial Paper • Bankers Acceptances 2 -3

The Money Market • Treasury bills – Bid and asked price – Bank discount method • Certificates of Deposits • Commercial Paper • Bankers Acceptances 2 -3

The Money Market Continued • Eurodollars • Repurchase Agreements (RPs) and Reverse RPs • Brokers’ Calls • Federal Funds • LIBOR Market 2 -4

The Money Market Continued • Eurodollars • Repurchase Agreements (RPs) and Reverse RPs • Brokers’ Calls • Federal Funds • LIBOR Market 2 -4

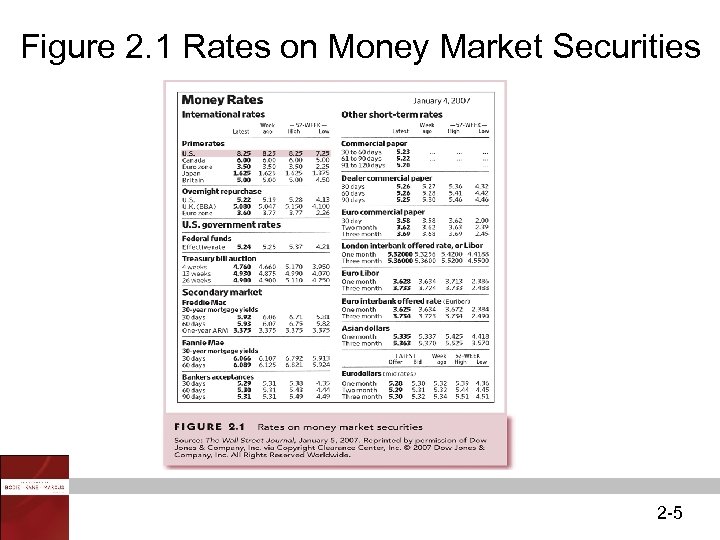

Figure 2. 1 Rates on Money Market Securities 2 -5

Figure 2. 1 Rates on Money Market Securities 2 -5

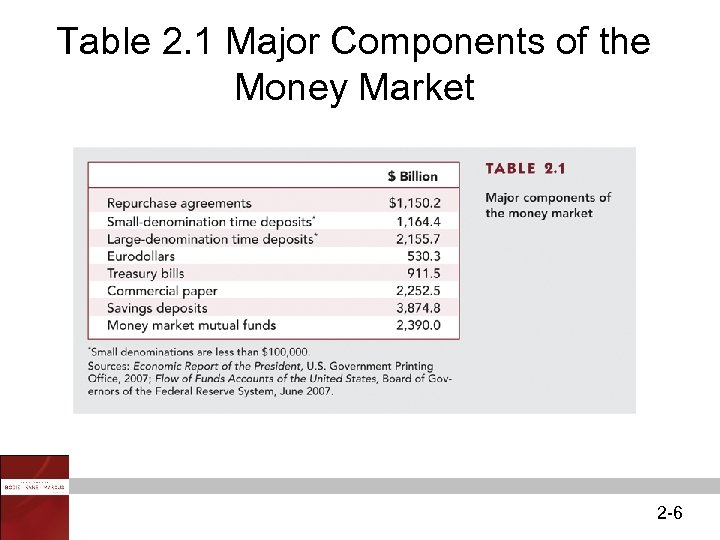

Table 2. 1 Major Components of the Money Market 2 -6

Table 2. 1 Major Components of the Money Market 2 -6

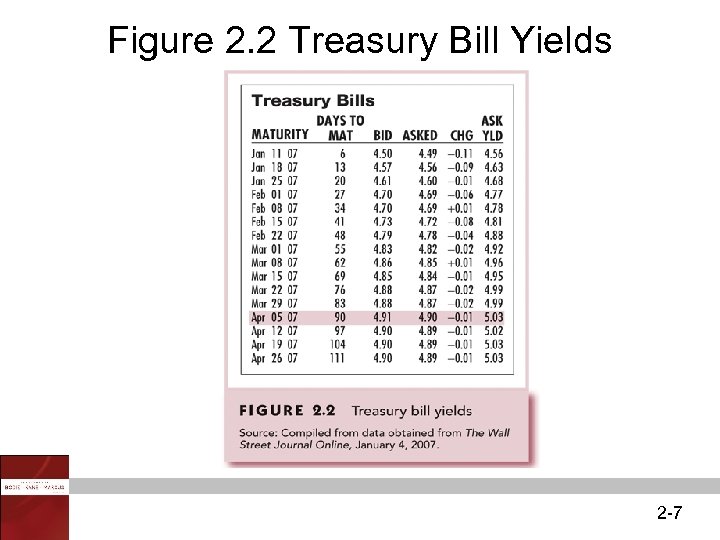

Figure 2. 2 Treasury Bill Yields 2 -7

Figure 2. 2 Treasury Bill Yields 2 -7

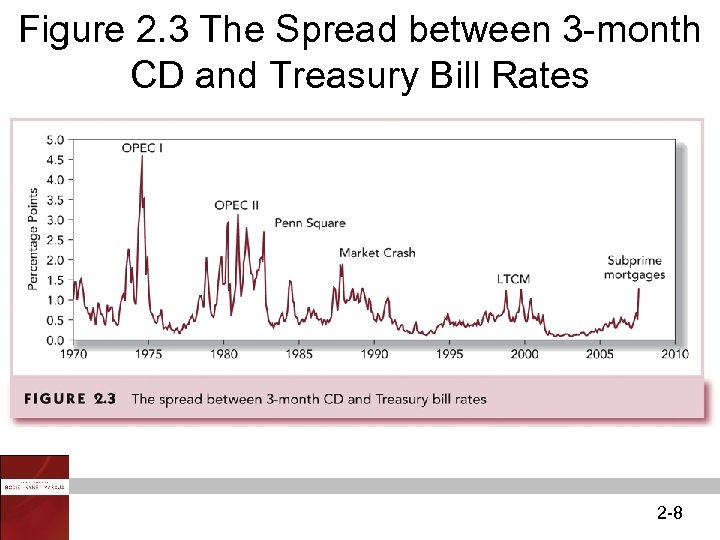

Figure 2. 3 The Spread between 3 -month CD and Treasury Bill Rates 2 -8

Figure 2. 3 The Spread between 3 -month CD and Treasury Bill Rates 2 -8

The Bond Market • • Treasury Notes and Bonds Inflation-Protected Treasury Bonds Federal Agency Debt International Bonds Municipal Bonds Corporate Bonds Mortgages and Mortgage-Backed Securities 2 -9

The Bond Market • • Treasury Notes and Bonds Inflation-Protected Treasury Bonds Federal Agency Debt International Bonds Municipal Bonds Corporate Bonds Mortgages and Mortgage-Backed Securities 2 -9

Treasury Notes and Bonds • Maturities – Notes – maturities up to 10 years – Bonds – maturities in excess of 10 years – 30 -year bond • Par Value - $1, 000 • Quotes – percentage of par 2 -10

Treasury Notes and Bonds • Maturities – Notes – maturities up to 10 years – Bonds – maturities in excess of 10 years – 30 -year bond • Par Value - $1, 000 • Quotes – percentage of par 2 -10

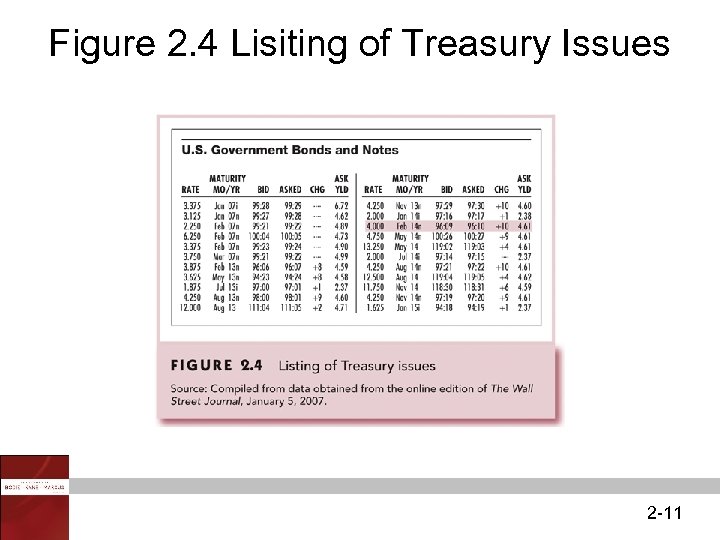

Figure 2. 4 Lisiting of Treasury Issues 2 -11

Figure 2. 4 Lisiting of Treasury Issues 2 -11

Federal Agency Debt • Major issuers – Federal Home Loan Bank – Federal National Mortgage Association – Government National Mortgage Association – Federal Home Loan Mortgage Corporation 2 -12

Federal Agency Debt • Major issuers – Federal Home Loan Bank – Federal National Mortgage Association – Government National Mortgage Association – Federal Home Loan Mortgage Corporation 2 -12

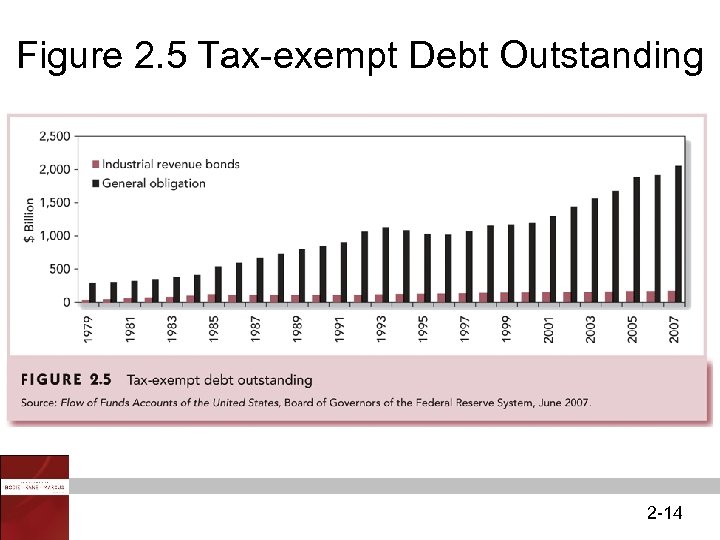

Municipal Bonds • Issued by state and local governments • Types – General obligation bonds – Revenue bonds • Industrial revenue bonds • Maturities – range up to 30 years 2 -13

Municipal Bonds • Issued by state and local governments • Types – General obligation bonds – Revenue bonds • Industrial revenue bonds • Maturities – range up to 30 years 2 -13

Figure 2. 5 Tax-exempt Debt Outstanding 2 -14

Figure 2. 5 Tax-exempt Debt Outstanding 2 -14

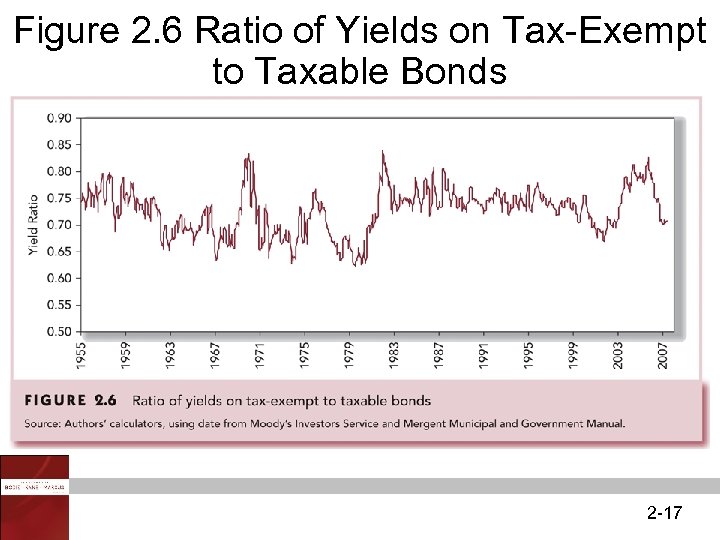

Municipal Bond Yields • Interest income on municipal bonds is not subject to federal and sometimes not to state and local tax • To compare yields on taxable securities a Taxable Equivalent Yield is constructed 2 -15

Municipal Bond Yields • Interest income on municipal bonds is not subject to federal and sometimes not to state and local tax • To compare yields on taxable securities a Taxable Equivalent Yield is constructed 2 -15

Table 2. 2 Equivalent Taxable Yields Corresponding to Various Tax-Exempt Yields 2 -16

Table 2. 2 Equivalent Taxable Yields Corresponding to Various Tax-Exempt Yields 2 -16

Figure 2. 6 Ratio of Yields on Tax-Exempt to Taxable Bonds 2 -17

Figure 2. 6 Ratio of Yields on Tax-Exempt to Taxable Bonds 2 -17

Corporate Bonds • Issued by private firms • Semi-annual interest payments • Subject to larger default risk than government securities • Options in corporate bonds – Callable – Convertible 2 -18

Corporate Bonds • Issued by private firms • Semi-annual interest payments • Subject to larger default risk than government securities • Options in corporate bonds – Callable – Convertible 2 -18

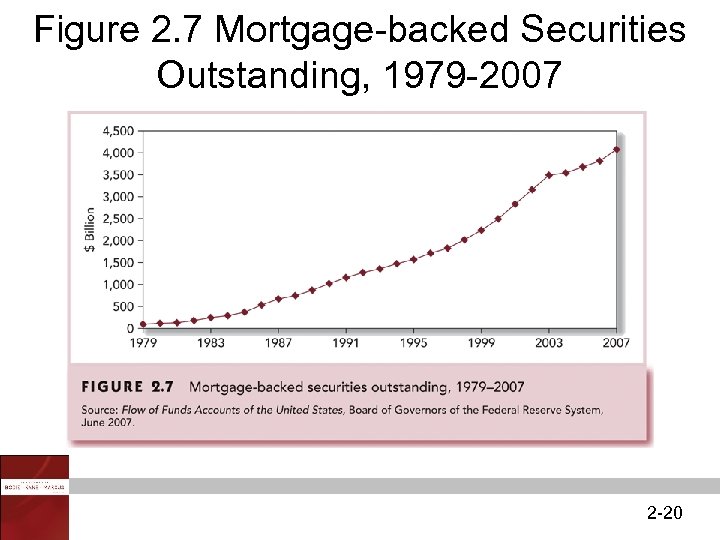

Mortgages and Mortgage-Backed Securities • Developed in the 1970 s to help liquidity of financial institutions • Proportional ownership of a pool or a specified obligation secured by a pool • Market has experienced very high rates of growth 2 -19

Mortgages and Mortgage-Backed Securities • Developed in the 1970 s to help liquidity of financial institutions • Proportional ownership of a pool or a specified obligation secured by a pool • Market has experienced very high rates of growth 2 -19

Figure 2. 7 Mortgage-backed Securities Outstanding, 1979 -2007 2 -20

Figure 2. 7 Mortgage-backed Securities Outstanding, 1979 -2007 2 -20

Equity Securities • Common stock – Residual claim – Limited liability • Preferred stock – Fixed dividends -limited – Priority over common – Tax treatment • Depository receipts 2 -21

Equity Securities • Common stock – Residual claim – Limited liability • Preferred stock – Fixed dividends -limited – Priority over common – Tax treatment • Depository receipts 2 -21

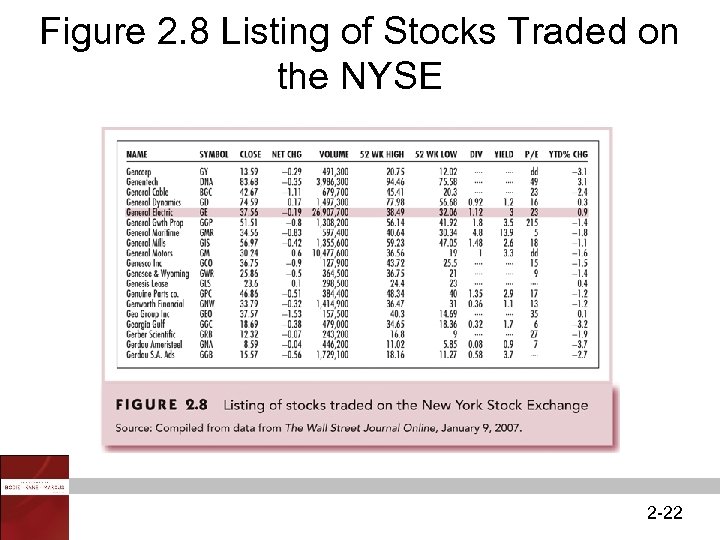

Figure 2. 8 Listing of Stocks Traded on the NYSE 2 -22

Figure 2. 8 Listing of Stocks Traded on the NYSE 2 -22

Stock Market Indexes • There are several broadly based indexes computed and published daily • There are several indexes of bond market performance • Others include: – Nikkei Average – Financial Times Index 2 -23

Stock Market Indexes • There are several broadly based indexes computed and published daily • There are several indexes of bond market performance • Others include: – Nikkei Average – Financial Times Index 2 -23

Dow Jones Industrial Average • Includes 30 large blue-chip corporations • Computed since 1896 • Price-weighted average 2 -24

Dow Jones Industrial Average • Includes 30 large blue-chip corporations • Computed since 1896 • Price-weighted average 2 -24

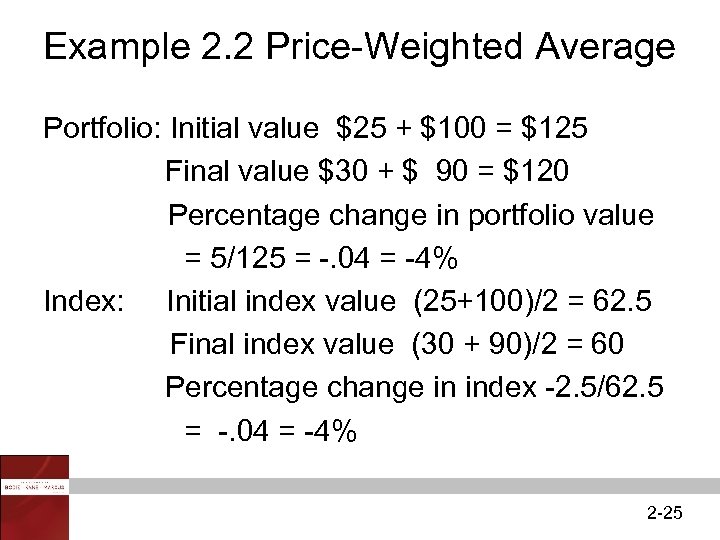

Example 2. 2 Price-Weighted Average Portfolio: Initial value $25 + $100 = $125 Final value $30 + $ 90 = $120 Percentage change in portfolio value = 5/125 = -. 04 = -4% Index: Initial index value (25+100)/2 = 62. 5 Final index value (30 + 90)/2 = 60 Percentage change in index -2. 5/62. 5 = -. 04 = -4% 2 -25

Example 2. 2 Price-Weighted Average Portfolio: Initial value $25 + $100 = $125 Final value $30 + $ 90 = $120 Percentage change in portfolio value = 5/125 = -. 04 = -4% Index: Initial index value (25+100)/2 = 62. 5 Final index value (30 + 90)/2 = 60 Percentage change in index -2. 5/62. 5 = -. 04 = -4% 2 -25

Standard & Poor’s Indexes • Broadly based index of 500 firms • Market-value-weighted index • Index funds • Exchange Traded Funds (ETFs) 2 -26

Standard & Poor’s Indexes • Broadly based index of 500 firms • Market-value-weighted index • Index funds • Exchange Traded Funds (ETFs) 2 -26

Other U. S. Market-Value Indexes • NASDAQ Composite • NYSE Composite • Wilshire 5000 2 -27

Other U. S. Market-Value Indexes • NASDAQ Composite • NYSE Composite • Wilshire 5000 2 -27

Figure 2. 9 Comparative Performance of Several Stock Indexes, 2001 -2006 2 -28

Figure 2. 9 Comparative Performance of Several Stock Indexes, 2001 -2006 2 -28

Foreign and International Stock Market Indexes • Nikkei (Japan) • FTSE (Financial Times of London) • Dax (Germany) • MSCI (Morgan Stanley Capital International) • Hang Seng (Hong Kong) • TSX (Canada) 2 -29

Foreign and International Stock Market Indexes • Nikkei (Japan) • FTSE (Financial Times of London) • Dax (Germany) • MSCI (Morgan Stanley Capital International) • Hang Seng (Hong Kong) • TSX (Canada) 2 -29

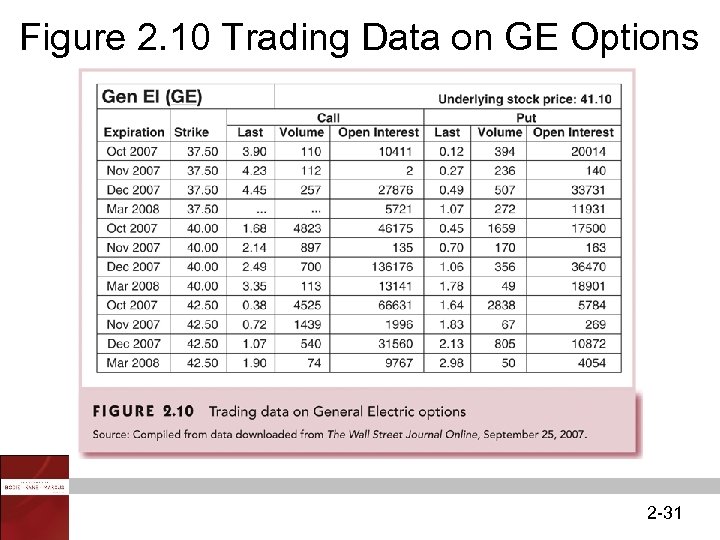

Derivatives Markets Options • Basic Positions – Call (Buy) – Put (Sell) • Terms – Exercise Price – Expiration Date – Assets Futures • Basic Positions – Long (Buy) – Short (Sell) • Terms – Delivery Date – Assets 2 -30

Derivatives Markets Options • Basic Positions – Call (Buy) – Put (Sell) • Terms – Exercise Price – Expiration Date – Assets Futures • Basic Positions – Long (Buy) – Short (Sell) • Terms – Delivery Date – Assets 2 -30

Figure 2. 10 Trading Data on GE Options 2 -31

Figure 2. 10 Trading Data on GE Options 2 -31

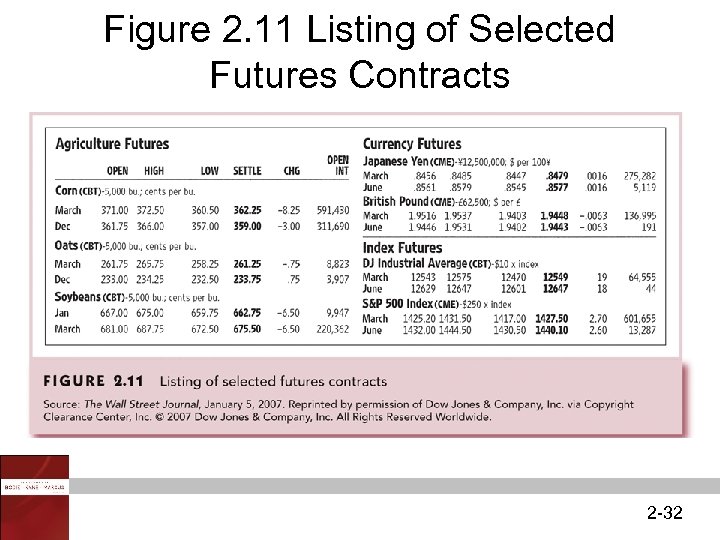

Figure 2. 11 Listing of Selected Futures Contracts 2 -32

Figure 2. 11 Listing of Selected Futures Contracts 2 -32