0c85fa8a47e0b97af8b8dbb4d7007332.ppt

- Количество слайдов: 102

Chapter 2 Accounting for Partnerships: Organization and Operation All examples are from textbook by Larsen ACCT 501

Chapter 2 Accounting for Partnerships: Organization and Operation All examples are from textbook by Larsen ACCT 501

Objectives of the Chapter To learn the accounting and reporting for limited liability partnerships (LLPs) including: a. the organization, b. the income-sharing plans, c. the financial statements, and d. the changes in ownership. n To learn the accounting for limited partnerships n Partnerships: Organization and Operation 2

Objectives of the Chapter To learn the accounting and reporting for limited liability partnerships (LLPs) including: a. the organization, b. the income-sharing plans, c. the financial statements, and d. the changes in ownership. n To learn the accounting for limited partnerships n Partnerships: Organization and Operation 2

Partnerships n The Uniform Partnership Act defines a partnership as: "an association of two or more persons to carry on, as coowners, a business for profit". n Partnerships generally are associated with the practice of law, medicine, public accounting and other professions, and also with small business enterprises. Partnerships: Organization and Operation 3

Partnerships n The Uniform Partnership Act defines a partnership as: "an association of two or more persons to carry on, as coowners, a business for profit". n Partnerships generally are associated with the practice of law, medicine, public accounting and other professions, and also with small business enterprises. Partnerships: Organization and Operation 3

Partnerships (contd. ) n n General partnership: in which all partners have unlimited personal liability for debts of the partnership. Limited liability partnerships (LLPs): individual partners of LLPs are personally responsible for their own actions and for the actions of employees under their supervision. Partnerships: Organization and Operation 4

Partnerships (contd. ) n n General partnership: in which all partners have unlimited personal liability for debts of the partnership. Limited liability partnerships (LLPs): individual partners of LLPs are personally responsible for their own actions and for the actions of employees under their supervision. Partnerships: Organization and Operation 4

Partnerships (contd. ) n n The LLPs as a whole, like a general partnership, is responsible for the actions of all partners and employees. Since the LLPs are the prevalent form of partnerships and the issues of organization, income-sharing plans and changes in ownership of LLPs are similar to those of general partnerships, LLPs are discussed in this chapter. Partnerships: Organization and Operation 5

Partnerships (contd. ) n n The LLPs as a whole, like a general partnership, is responsible for the actions of all partners and employees. Since the LLPs are the prevalent form of partnerships and the issues of organization, income-sharing plans and changes in ownership of LLPs are similar to those of general partnerships, LLPs are discussed in this chapter. Partnerships: Organization and Operation 5

Organization of a Limited Liability Partnership (LLP) § Basic Characteristics of the LLP: 1. Ease of Formation. 2. Limited Life. 3. Mutual Agency. 4. Co-Ownership of Partnership Assets and Earnings. Partnerships: Organization and Operation 6

Organization of a Limited Liability Partnership (LLP) § Basic Characteristics of the LLP: 1. Ease of Formation. 2. Limited Life. 3. Mutual Agency. 4. Co-Ownership of Partnership Assets and Earnings. Partnerships: Organization and Operation 6

Major Differences between an LLP and a Corporation Characteristics of a corporation: 1. Separated legal entity from its owners: it can buy, sell and own properties. 2. Limited liability for stockholders. 3. Continuous existence. 4. Ease of transfer of ownership. 5. Ease of capital generation. Partnerships: Organization and Operation 7

Major Differences between an LLP and a Corporation Characteristics of a corporation: 1. Separated legal entity from its owners: it can buy, sell and own properties. 2. Limited liability for stockholders. 3. Continuous existence. 4. Ease of transfer of ownership. 5. Ease of capital generation. Partnerships: Organization and Operation 7

Major Differences between an LLP and a Corporation (contd. ) 6. Centralized authority and responsibility-to the President, not to numerous owners. 7. Professional management 8. Corporation taxes (double taxation). 9. Separation of ownership and management: principal & agent conflicts. 10. Government regulations. Partnerships: Organization and Operation 8

Major Differences between an LLP and a Corporation (contd. ) 6. Centralized authority and responsibility-to the President, not to numerous owners. 7. Professional management 8. Corporation taxes (double taxation). 9. Separation of ownership and management: principal & agent conflicts. 10. Government regulations. Partnerships: Organization and Operation 8

Taxation of LLP n n An LLP pays no income tax. LLP is only required to file an annual information return showing its revenue and expenses, the amount of its net income and the division of the net income among the partners. Partnerships: Organization and Operation 9

Taxation of LLP n n An LLP pays no income tax. LLP is only required to file an annual information return showing its revenue and expenses, the amount of its net income and the division of the net income among the partners. Partnerships: Organization and Operation 9

Taxation of LLP n The partners of LLP report their shares of the ordinary net income from the partnership and dividends and charitable contributions in their individual income tax returns, regardless of whether they received more of less than this amount of cash from the LLP. Partnerships: Organization and Operation 10

Taxation of LLP n The partners of LLP report their shares of the ordinary net income from the partnership and dividends and charitable contributions in their individual income tax returns, regardless of whether they received more of less than this amount of cash from the LLP. Partnerships: Organization and Operation 10

Is the LLP a Separate Entity ? n n Legal status: a partnership is an "association of persons" and is not a separate entity while a corporation is a separate entity from its owners. Economic substance: in terms of managerial policy and business objectives, LLPs are as much business and accounting entities as are corporations. Partnerships: Organization and Operation 11

Is the LLP a Separate Entity ? n n Legal status: a partnership is an "association of persons" and is not a separate entity while a corporation is a separate entity from its owners. Economic substance: in terms of managerial policy and business objectives, LLPs are as much business and accounting entities as are corporations. Partnerships: Organization and Operation 11

Is the LLP a Separate Entity ? (contd). n n LLPs typically are guided by longrange plans not likely to be affected by the admission or departure of a single partner. The accounting policies of LLPs should reflect the fact that the partnership is an accounting entity apart from its owners. Partnerships: Organization and Operation 12

Is the LLP a Separate Entity ? (contd). n n LLPs typically are guided by longrange plans not likely to be affected by the admission or departure of a single partner. The accounting policies of LLPs should reflect the fact that the partnership is an accounting entity apart from its owners. Partnerships: Organization and Operation 12

The Partnership Contract n n A good business practice requires the partnership contract in writing. The followings are a few important points to be covered in a written contract for a LLP: Partnerships: Organization and Operation 13

The Partnership Contract n n A good business practice requires the partnership contract in writing. The followings are a few important points to be covered in a written contract for a LLP: Partnerships: Organization and Operation 13

The Partnership Contract (contd. ) 1. The formation date and the planned duration of the partnership; the names of the partners, and the name and business activities of the partnership. 2. The assets to be invested by each partner, the procedure for valuing noncash investments, and the penalties for a partner's failure to invest and maintain the agreed amount of capital. Partnerships: Organization and Operation 14

The Partnership Contract (contd. ) 1. The formation date and the planned duration of the partnership; the names of the partners, and the name and business activities of the partnership. 2. The assets to be invested by each partner, the procedure for valuing noncash investments, and the penalties for a partner's failure to invest and maintain the agreed amount of capital. Partnerships: Organization and Operation 14

The Partnership Contract (contd. ) 3. The authority, the rights and the duties of each partner. 4. The accounting period to be used, the nature of accounting records, financial statements and audits by independent public accountants. 5. The net income (loss) sharing plans. Partnerships: Organization and Operation 15

The Partnership Contract (contd. ) 3. The authority, the rights and the duties of each partner. 4. The accounting period to be used, the nature of accounting records, financial statements and audits by independent public accountants. 5. The net income (loss) sharing plans. Partnerships: Organization and Operation 15

The Partnership Contract (contd. ) 6. The drawings allowed to each partner. 7. Insurance on the lives of partners 8. Provision for arbitration of disputes. 9. Provision for liquidation of the partnership at the end of the term specified in the contract or at the death or retirement of a partner. Partnerships: Organization and Operation 16

The Partnership Contract (contd. ) 6. The drawings allowed to each partner. 7. Insurance on the lives of partners 8. Provision for arbitration of disputes. 9. Provision for liquidation of the partnership at the end of the term specified in the contract or at the death or retirement of a partner. Partnerships: Organization and Operation 16

Ledger Accounts for Partners The following three types of accounts are used in LLPs for each partner: 1. Capital accounts. 2. Drawing accounts. 3. Accounts for loans to and from partners. n Partnerships: Organization and Operation 17

Ledger Accounts for Partners The following three types of accounts are used in LLPs for each partner: 1. Capital accounts. 2. Drawing accounts. 3. Accounts for loans to and from partners. n Partnerships: Organization and Operation 17

Ledger Accounts for Partners (contd. ) The original investment from partner is recorded as: n Assets (based on current fair value) $$$ Liabilities $$$ Capital-Partner A $$$ n Drawings from Partners are recorded as: Drawing –Partner A Cash $$$ Partnerships: Organization and Operation 18

Ledger Accounts for Partners (contd. ) The original investment from partner is recorded as: n Assets (based on current fair value) $$$ Liabilities $$$ Capital-Partner A $$$ n Drawings from Partners are recorded as: Drawing –Partner A Cash $$$ Partnerships: Organization and Operation 18

Ledger Accounts for Partners (contd. ) At the end of each accounting period, the income summary ledger account is transferred to the capital accounts in accordance with income sharing plan specified in the contract. n Also, the debit balances in the drawing accounts are closed to the partner's capital account. n Partnerships: Organization and Operation 19

Ledger Accounts for Partners (contd. ) At the end of each accounting period, the income summary ledger account is transferred to the capital accounts in accordance with income sharing plan specified in the contract. n Also, the debit balances in the drawing accounts are closed to the partner's capital account. n Partnerships: Organization and Operation 19

Ledger Accounts for Partners (contd. ) Loans Receivable from Partners: this account is debited when a partner receives cash from the LLP with the intention to repay this amount. n Loans Payable to Partners: this account is credited when a partner makes a cash payment to the LLP that is considered a loan rather than an investment. n Partnerships: Organization and Operation 20

Ledger Accounts for Partners (contd. ) Loans Receivable from Partners: this account is debited when a partner receives cash from the LLP with the intention to repay this amount. n Loans Payable to Partners: this account is credited when a partner makes a cash payment to the LLP that is considered a loan rather than an investment. n Partnerships: Organization and Operation 20

Ledger Accounts for Partners (contd. ) If a substantial unsecured loan has been made to a partner and repayment appears doubtful, it is appropriate to offset the receivable against the partner's capital account. n Partnerships: Organization and Operation 21

Ledger Accounts for Partners (contd. ) If a substantial unsecured loan has been made to a partner and repayment appears doubtful, it is appropriate to offset the receivable against the partner's capital account. n Partnerships: Organization and Operation 21

Valuation of Investments by Partners Gains or losses from disposal of noncash assets invested by the partners is measured as: n. The disposal price – the current fair value of the assets when invested n adjusted for any depreciation or amortization to the date of disposal. These gains (losses) are divided based on the income sharing plan of the LLP. n Partnerships: Organization and Operation 22

Valuation of Investments by Partners Gains or losses from disposal of noncash assets invested by the partners is measured as: n. The disposal price – the current fair value of the assets when invested n adjusted for any depreciation or amortization to the date of disposal. These gains (losses) are divided based on the income sharing plan of the LLP. n Partnerships: Organization and Operation 22

Income-Sharing Plans for LLP Partners can agree on any type of income sharing plan regardless of the amount of their respective capital investment. n The Uniform Partnership Act states that if partners fail to specify a plan for sharing net income/loss, it is assumed that they intend to share equally. n Partnerships: Organization and Operation 23

Income-Sharing Plans for LLP Partners can agree on any type of income sharing plan regardless of the amount of their respective capital investment. n The Uniform Partnership Act states that if partners fail to specify a plan for sharing net income/loss, it is assumed that they intend to share equally. n Partnerships: Organization and Operation 23

Income-Sharing Plans for LLP (contd. ) The following are a few possible plans of income-sharing: 1. Equally. 2. In the ratio of partners' capital account balance on a specific date or in the ratio of average capital account balance in the year. 3. Allowing interest on partner's capital account balances and dividing the remaining net income/loss in a specified ratio. n Partnerships: Organization and Operation 24

Income-Sharing Plans for LLP (contd. ) The following are a few possible plans of income-sharing: 1. Equally. 2. In the ratio of partners' capital account balance on a specific date or in the ratio of average capital account balance in the year. 3. Allowing interest on partner's capital account balances and dividing the remaining net income/loss in a specified ratio. n Partnerships: Organization and Operation 24

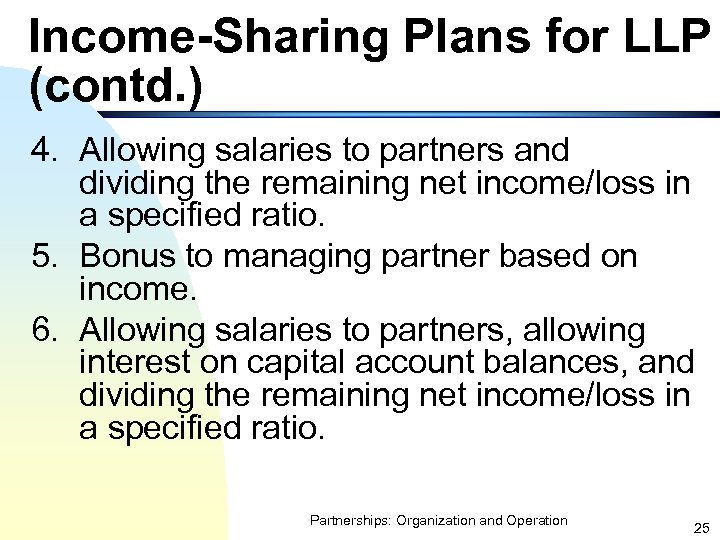

Income-Sharing Plans for LLP (contd. ) 4. Allowing salaries to partners and dividing the remaining net income/loss in a specified ratio. 5. Bonus to managing partner based on income. 6. Allowing salaries to partners, allowing interest on capital account balances, and dividing the remaining net income/loss in a specified ratio. Partnerships: Organization and Operation 25

Income-Sharing Plans for LLP (contd. ) 4. Allowing salaries to partners and dividing the remaining net income/loss in a specified ratio. 5. Bonus to managing partner based on income. 6. Allowing salaries to partners, allowing interest on capital account balances, and dividing the remaining net income/loss in a specified ratio. Partnerships: Organization and Operation 25

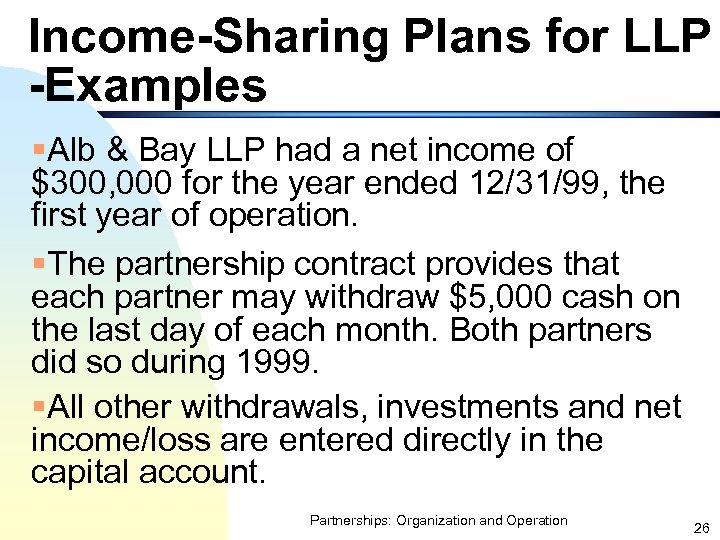

Income-Sharing Plans for LLP -Examples §Alb & Bay LLP had a net income of $300, 000 for the year ended 12/31/99, the first year of operation. §The partnership contract provides that each partner may withdraw $5, 000 cash on the last day of each month. Both partners did so during 1999. §All other withdrawals, investments and net income/loss are entered directly in the capital account. Partnerships: Organization and Operation 26

Income-Sharing Plans for LLP -Examples §Alb & Bay LLP had a net income of $300, 000 for the year ended 12/31/99, the first year of operation. §The partnership contract provides that each partner may withdraw $5, 000 cash on the last day of each month. Both partners did so during 1999. §All other withdrawals, investments and net income/loss are entered directly in the capital account. Partnerships: Organization and Operation 26

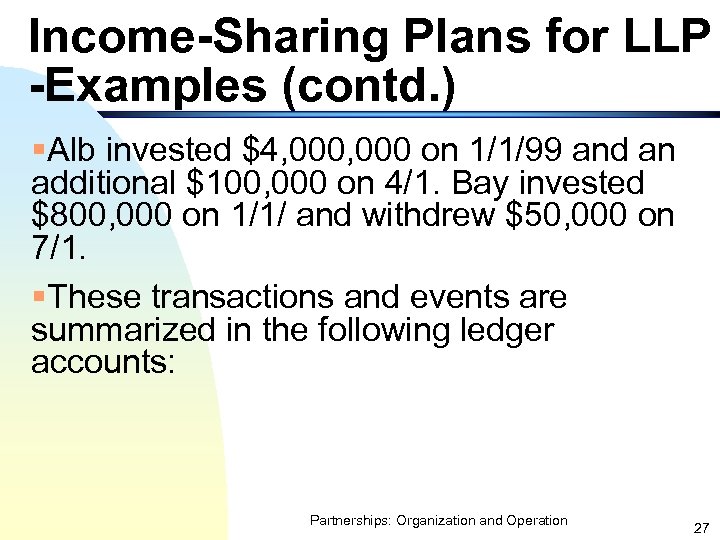

Income-Sharing Plans for LLP -Examples (contd. ) §Alb invested $4, 000 on 1/1/99 and an additional $100, 000 on 4/1. Bay invested $800, 000 on 1/1/ and withdrew $50, 000 on 7/1. §These transactions and events are summarized in the following ledger accounts: Partnerships: Organization and Operation 27

Income-Sharing Plans for LLP -Examples (contd. ) §Alb invested $4, 000 on 1/1/99 and an additional $100, 000 on 4/1. Bay invested $800, 000 on 1/1/ and withdrew $50, 000 on 7/1. §These transactions and events are summarized in the following ledger accounts: Partnerships: Organization and Operation 27

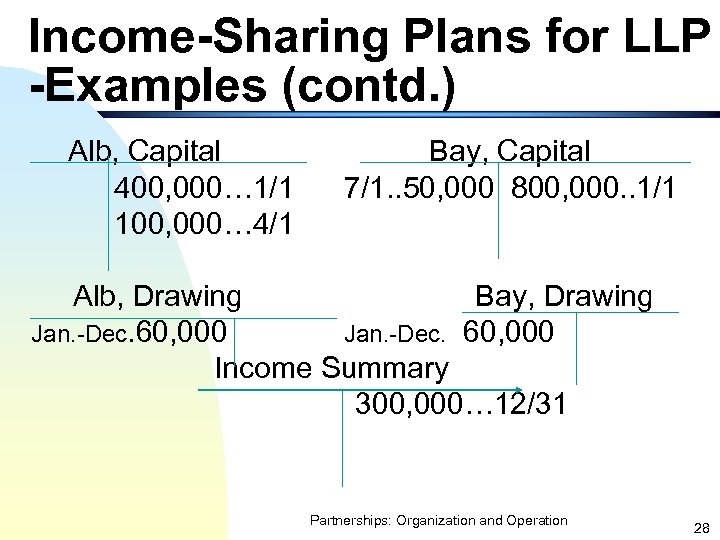

Income-Sharing Plans for LLP -Examples (contd. ) Alb, Capital 400, 000… 1/1 100, 000… 4/1 Bay, Capital 7/1. . 50, 000 800, 000. . 1/1 Alb, Drawing Bay, Drawing Jan. -Dec. 60, 000 Income Summary 300, 000… 12/31 Partnerships: Organization and Operation 28

Income-Sharing Plans for LLP -Examples (contd. ) Alb, Capital 400, 000… 1/1 100, 000… 4/1 Bay, Capital 7/1. . 50, 000 800, 000. . 1/1 Alb, Drawing Bay, Drawing Jan. -Dec. 60, 000 Income Summary 300, 000… 12/31 Partnerships: Organization and Operation 28

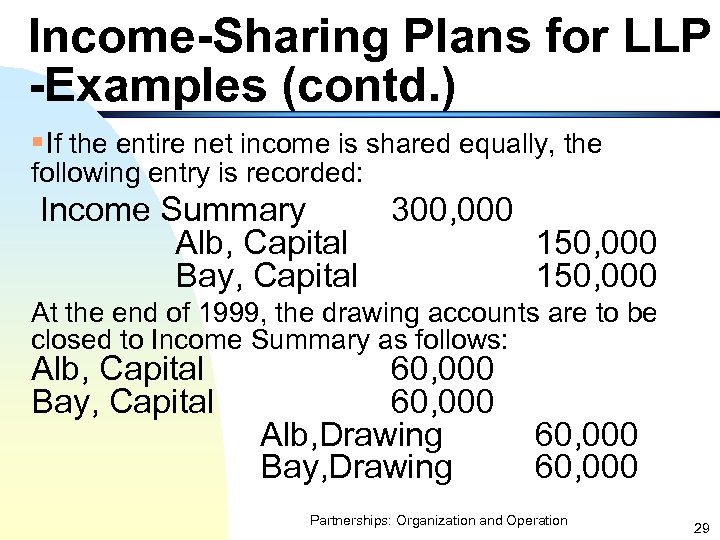

Income-Sharing Plans for LLP -Examples (contd. ) §If the entire net income is shared equally, the following entry is recorded: Income Summary 300, 000 Alb, Capital 150, 000 Bay, Capital 150, 000 At the end of 1999, the drawing accounts are to be closed to Income Summary as follows: Alb, Capital Bay, Capital 60, 000 Alb, Drawing Bay, Drawing 60, 000 Partnerships: Organization and Operation 29

Income-Sharing Plans for LLP -Examples (contd. ) §If the entire net income is shared equally, the following entry is recorded: Income Summary 300, 000 Alb, Capital 150, 000 Bay, Capital 150, 000 At the end of 1999, the drawing accounts are to be closed to Income Summary as follows: Alb, Capital Bay, Capital 60, 000 Alb, Drawing Bay, Drawing 60, 000 Partnerships: Organization and Operation 29

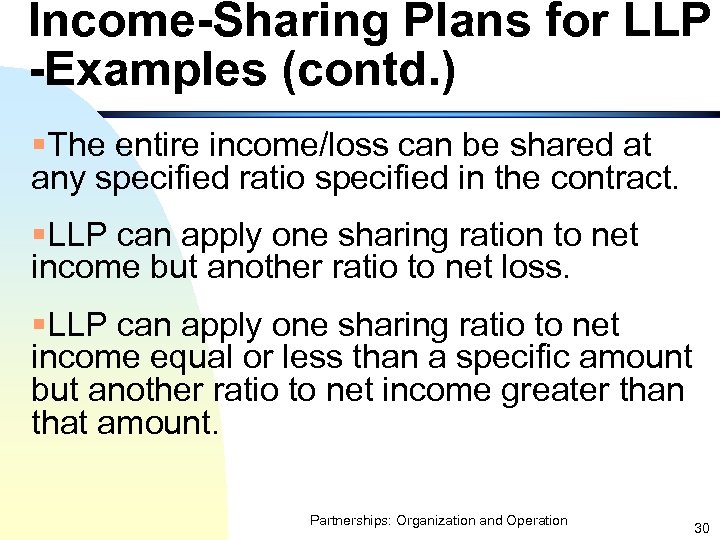

Income-Sharing Plans for LLP -Examples (contd. ) §The entire income/loss can be shared at any specified ratio specified in the contract. §LLP can apply one sharing ration to net income but another ratio to net loss. §LLP can apply one sharing ratio to net income equal or less than a specific amount but another ratio to net income greater than that amount. Partnerships: Organization and Operation 30

Income-Sharing Plans for LLP -Examples (contd. ) §The entire income/loss can be shared at any specified ratio specified in the contract. §LLP can apply one sharing ration to net income but another ratio to net loss. §LLP can apply one sharing ratio to net income equal or less than a specific amount but another ratio to net income greater than that amount. Partnerships: Organization and Operation 30

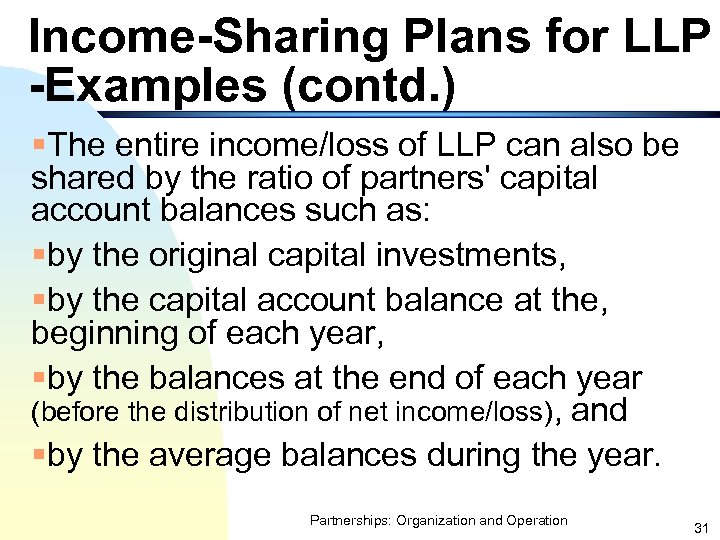

Income-Sharing Plans for LLP -Examples (contd. ) §The entire income/loss of LLP can also be shared by the ratio of partners' capital account balances such as: §by the original capital investments, §by the capital account balance at the, beginning of each year, §by the balances at the end of each year (before the distribution of net income/loss), and §by the average balances during the year. Partnerships: Organization and Operation 31

Income-Sharing Plans for LLP -Examples (contd. ) §The entire income/loss of LLP can also be shared by the ratio of partners' capital account balances such as: §by the original capital investments, §by the capital account balance at the, beginning of each year, §by the balances at the end of each year (before the distribution of net income/loss), and §by the average balances during the year. Partnerships: Organization and Operation 31

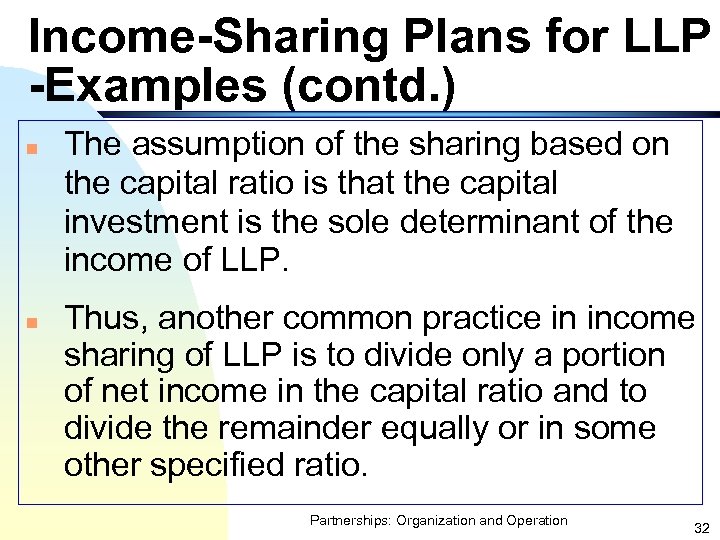

Income-Sharing Plans for LLP -Examples (contd. ) n n The assumption of the sharing based on the capital ratio is that the capital investment is the sole determinant of the income of LLP. Thus, another common practice in income sharing of LLP is to divide only a portion of net income in the capital ratio and to divide the remainder equally or in some other specified ratio. Partnerships: Organization and Operation 32

Income-Sharing Plans for LLP -Examples (contd. ) n n The assumption of the sharing based on the capital ratio is that the capital investment is the sole determinant of the income of LLP. Thus, another common practice in income sharing of LLP is to divide only a portion of net income in the capital ratio and to divide the remainder equally or in some other specified ratio. Partnerships: Organization and Operation 32

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio §A method to carry out the above sharing scheme is to allow interest on partners' capital balance at 15%, for example, and dividing the remainder at a specified ratio. §This method is the same as dividing only a portion of net income in the ratio of partners' capital balances. §If this income sharing scheme is used, LLP needs to specify the interest rate and the capital account balances to be used. Partnerships: Organization and Operation 33

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio §A method to carry out the above sharing scheme is to allow interest on partners' capital balance at 15%, for example, and dividing the remainder at a specified ratio. §This method is the same as dividing only a portion of net income in the ratio of partners' capital balances. §If this income sharing scheme is used, LLP needs to specify the interest rate and the capital account balances to be used. Partnerships: Organization and Operation 33

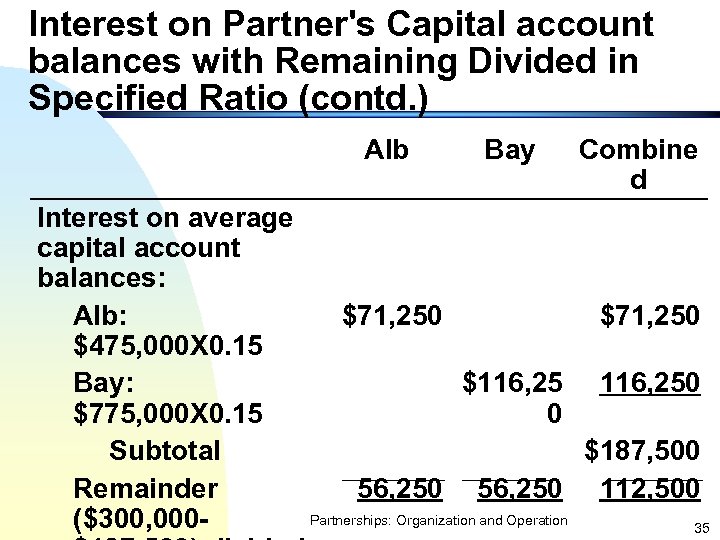

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio §Example: Assume that the partnership contract allows interest on partners' average capital account balances at 15% with remainder to be divided equally. §The net income of $300, 000 for 1999 is divided as follows: §Note: the average capital balances for Alb and Bay are $475, 000 and $775, 000, respectively. Partnerships: Organization and Operation 34

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio §Example: Assume that the partnership contract allows interest on partners' average capital account balances at 15% with remainder to be divided equally. §The net income of $300, 000 for 1999 is divided as follows: §Note: the average capital balances for Alb and Bay are $475, 000 and $775, 000, respectively. Partnerships: Organization and Operation 34

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (contd. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Subtotal Remainder ($300, 000 - Bay $71, 250 $116, 25 0 56, 250 Combine d 116, 250 $187, 500 56, 250 112, 500 Partnerships: Organization and Operation 35

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (contd. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Subtotal Remainder ($300, 000 - Bay $71, 250 $116, 25 0 56, 250 Combine d 116, 250 $187, 500 56, 250 112, 500 Partnerships: Organization and Operation 35

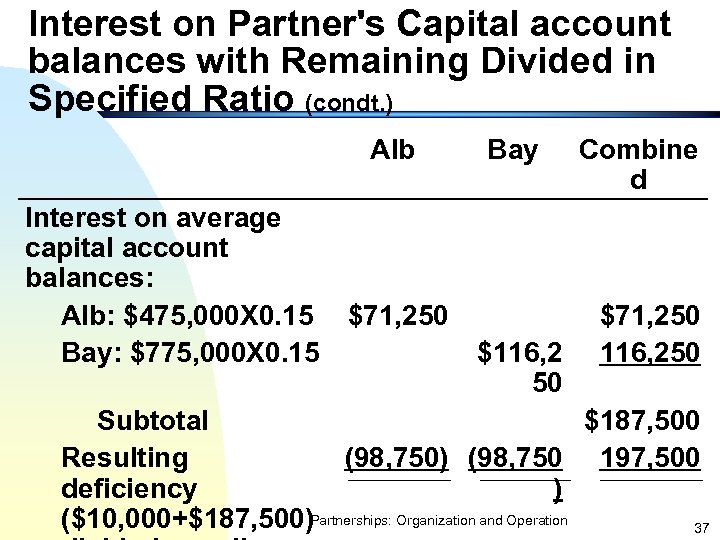

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) n n The provision of allowing interest on capital balance should be carried out even in the case of net loss unless otherwise indicated in the contract. Example (with net loss): assume that $10, 000 net loss incurred for the year of 1999, the following table presents the division of the net loss for the year of 1999: Partnerships: Organization and Operation 36

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) n n The provision of allowing interest on capital balance should be carried out even in the case of net loss unless otherwise indicated in the contract. Example (with net loss): assume that $10, 000 net loss incurred for the year of 1999, the following table presents the division of the net loss for the year of 1999: Partnerships: Organization and Operation 36

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Bay $71, 250 $116, 2 50 Combine d $71, 250 116, 250 Subtotal $187, 500 Resulting (98, 750) (98, 750 197, 500 deficiency ) ($10, 000+$187, 500)Partnerships: Organization and Operation 37

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Bay $71, 250 $116, 2 50 Combine d $71, 250 116, 250 Subtotal $187, 500 Resulting (98, 750) (98, 750 197, 500 deficiency ) ($10, 000+$187, 500)Partnerships: Organization and Operation 37

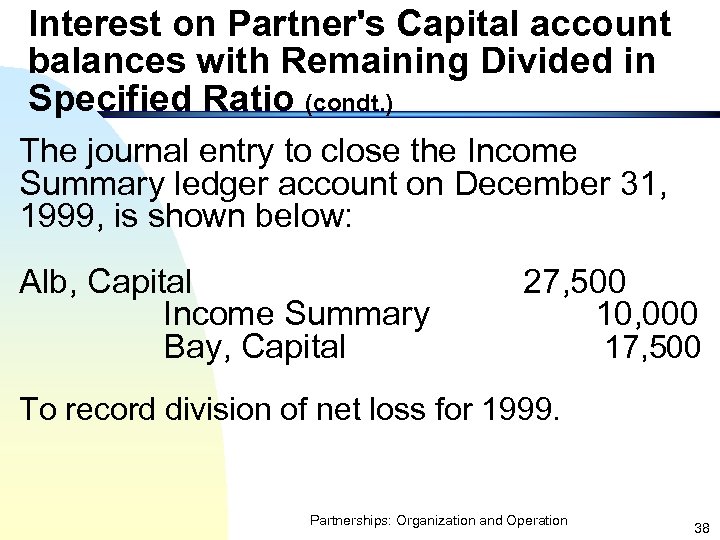

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) The journal entry to close the Income Summary ledger account on December 31, 1999, is shown below: Alb, Capital Income Summary Bay, Capital 27, 500 10, 000 17, 500 To record division of net loss for 1999. Partnerships: Organization and Operation 38

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) The journal entry to close the Income Summary ledger account on December 31, 1999, is shown below: Alb, Capital Income Summary Bay, Capital 27, 500 10, 000 17, 500 To record division of net loss for 1999. Partnerships: Organization and Operation 38

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) n The rational underlies the above allocation: n The above income sharing scheme assumes that capital is NOT the only factor to cause the net loss; therefore, the net loss should not be allocated solely on the capital ratio. Partnerships: Organization and Operation 39

Interest on Partner's Capital account balances with Remaining Divided in Specified Ratio (condt. ) n The rational underlies the above allocation: n The above income sharing scheme assumes that capital is NOT the only factor to cause the net loss; therefore, the net loss should not be allocated solely on the capital ratio. Partnerships: Organization and Operation 39

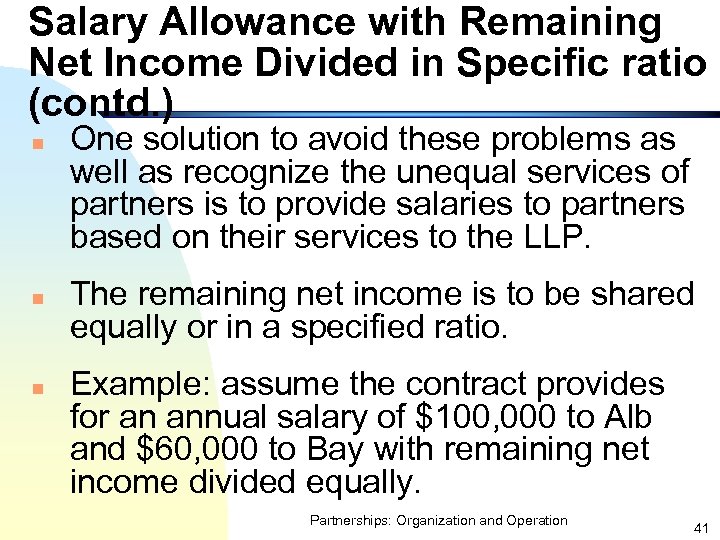

Salary Allowance with Remaining Net Income Divided in Specific ratio n n One partner may contribute more services to the LLP than the other. If the income-sharing is based solely on the amount of services provided by each partner, the following problems arise: 1) the success of a LLP is not determined solely by the services provided by partners. 2) in the case of net loss, the partner renders more services will absorb a larger portion of the loss. Partnerships: Organization and Operation 40

Salary Allowance with Remaining Net Income Divided in Specific ratio n n One partner may contribute more services to the LLP than the other. If the income-sharing is based solely on the amount of services provided by each partner, the following problems arise: 1) the success of a LLP is not determined solely by the services provided by partners. 2) in the case of net loss, the partner renders more services will absorb a larger portion of the loss. Partnerships: Organization and Operation 40

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) n n n One solution to avoid these problems as well as recognize the unequal services of partners is to provide salaries to partners based on their services to the LLP. The remaining net income is to be shared equally or in a specified ratio. Example: assume the contract provides for an annual salary of $100, 000 to Alb and $60, 000 to Bay with remaining net income divided equally. Partnerships: Organization and Operation 41

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) n n n One solution to avoid these problems as well as recognize the unequal services of partners is to provide salaries to partners based on their services to the LLP. The remaining net income is to be shared equally or in a specified ratio. Example: assume the contract provides for an annual salary of $100, 000 to Alb and $60, 000 to Bay with remaining net income divided equally. Partnerships: Organization and Operation 41

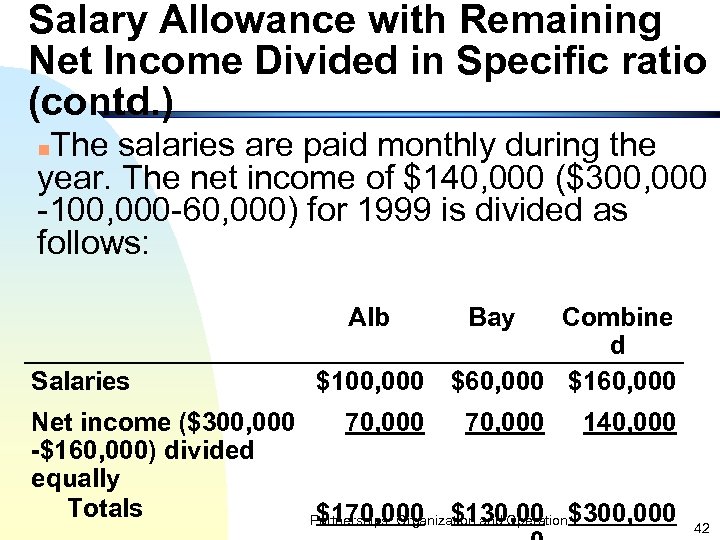

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) The salaries are paid monthly during the year. The net income of $140, 000 ($300, 000 -100, 000 -60, 000) for 1999 is divided as follows: n Alb Salaries $100, 000 Bay Combine d $60, 000 $160, 000 Net income ($300, 000 70, 000 140, 000 -$160, 000) divided equally Totals $170, 000 $130, 00 Partnerships: Organization and Operation$300, 000 42

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) The salaries are paid monthly during the year. The net income of $140, 000 ($300, 000 -100, 000 -60, 000) for 1999 is divided as follows: n Alb Salaries $100, 000 Bay Combine d $60, 000 $160, 000 Net income ($300, 000 70, 000 140, 000 -$160, 000) divided equally Totals $170, 000 $130, 00 Partnerships: Organization and Operation$300, 000 42

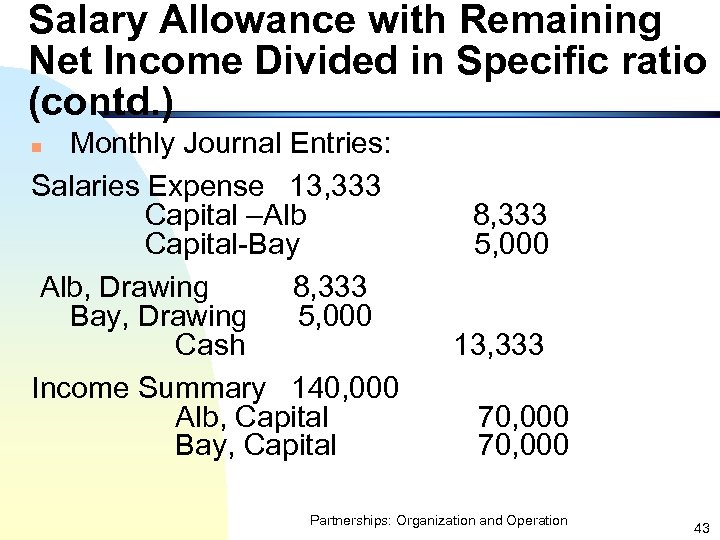

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) Monthly Journal Entries: Salaries Expense 13, 333 Capital –Alb Capital-Bay Alb, Drawing 8, 333 Bay, Drawing 5, 000 Cash Income Summary 140, 000 Alb, Capital Bay, Capital n 8, 333 5, 000 13, 333 70, 000 Partnerships: Organization and Operation 43

Salary Allowance with Remaining Net Income Divided in Specific ratio (contd. ) Monthly Journal Entries: Salaries Expense 13, 333 Capital –Alb Capital-Bay Alb, Drawing 8, 333 Bay, Drawing 5, 000 Cash Income Summary 140, 000 Alb, Capital Bay, Capital n 8, 333 5, 000 13, 333 70, 000 Partnerships: Organization and Operation 43

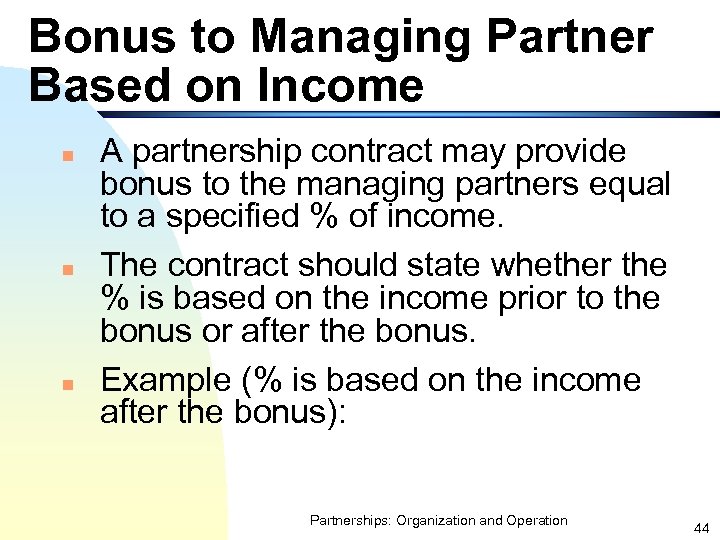

Bonus to Managing Partner Based on Income n n n A partnership contract may provide bonus to the managing partners equal to a specified % of income. The contract should state whether the % is based on the income prior to the bonus or after the bonus. Example (% is based on the income after the bonus): Partnerships: Organization and Operation 44

Bonus to Managing Partner Based on Income n n n A partnership contract may provide bonus to the managing partners equal to a specified % of income. The contract should state whether the % is based on the income prior to the bonus or after the bonus. Example (% is based on the income after the bonus): Partnerships: Organization and Operation 44

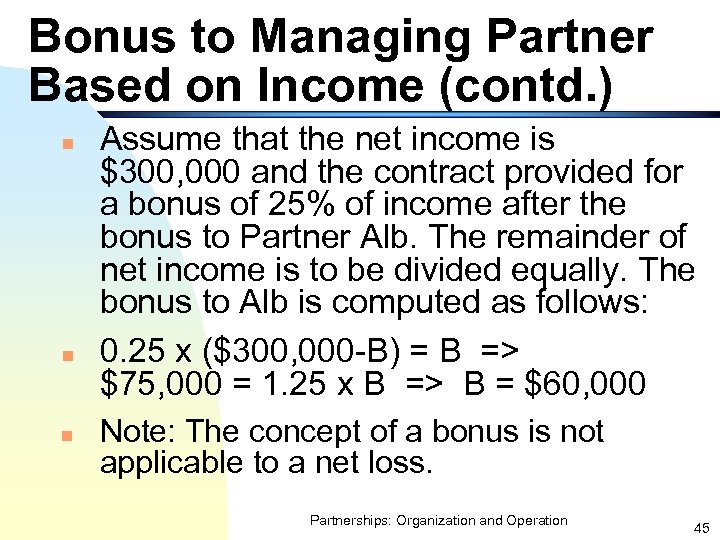

Bonus to Managing Partner Based on Income (contd. ) n n n Assume that the net income is $300, 000 and the contract provided for a bonus of 25% of income after the bonus to Partner Alb. The remainder of net income is to be divided equally. The bonus to Alb is computed as follows: 0. 25 x ($300, 000 -B) = B => $75, 000 = 1. 25 x B => B = $60, 000 Note: The concept of a bonus is not applicable to a net loss. Partnerships: Organization and Operation 45

Bonus to Managing Partner Based on Income (contd. ) n n n Assume that the net income is $300, 000 and the contract provided for a bonus of 25% of income after the bonus to Partner Alb. The remainder of net income is to be divided equally. The bonus to Alb is computed as follows: 0. 25 x ($300, 000 -B) = B => $75, 000 = 1. 25 x B => B = $60, 000 Note: The concept of a bonus is not applicable to a net loss. Partnerships: Organization and Operation 45

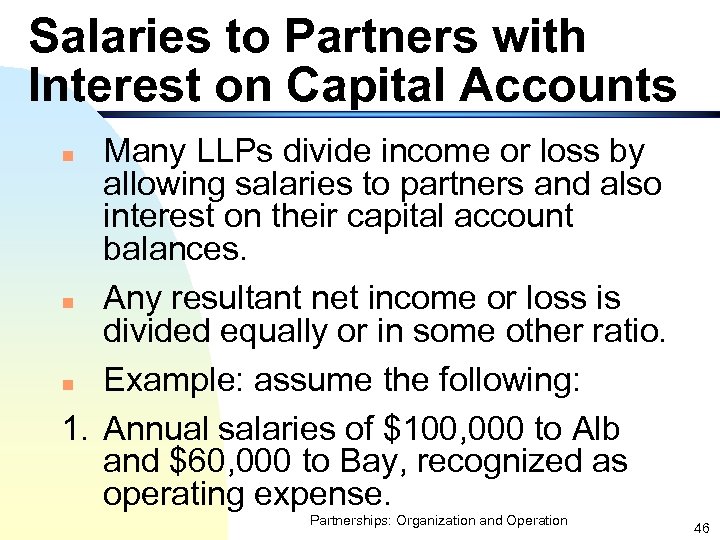

Salaries to Partners with Interest on Capital Accounts Many LLPs divide income or loss by allowing salaries to partners and also interest on their capital account balances. n Any resultant net income or loss is divided equally or in some other ratio. n Example: assume the following: 1. Annual salaries of $100, 000 to Alb and $60, 000 to Bay, recognized as operating expense. n Partnerships: Organization and Operation 46

Salaries to Partners with Interest on Capital Accounts Many LLPs divide income or loss by allowing salaries to partners and also interest on their capital account balances. n Any resultant net income or loss is divided equally or in some other ratio. n Example: assume the following: 1. Annual salaries of $100, 000 to Alb and $60, 000 to Bay, recognized as operating expense. n Partnerships: Organization and Operation 46

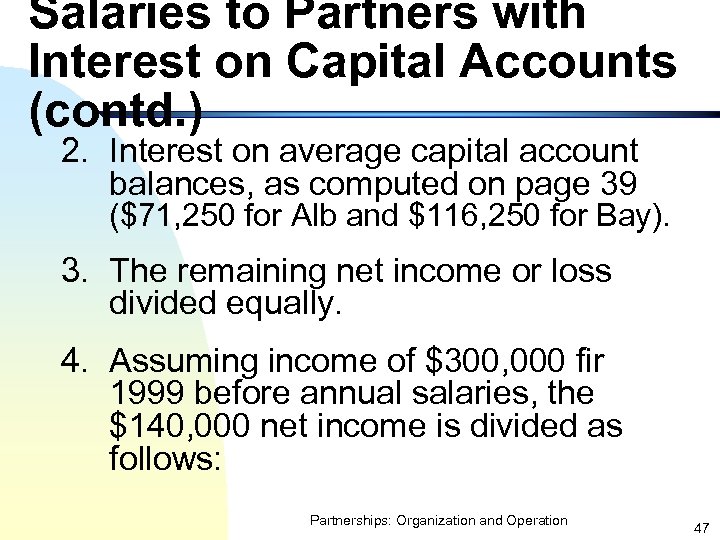

Salaries to Partners with Interest on Capital Accounts (contd. ) 2. Interest on average capital account balances, as computed on page 39 ($71, 250 for Alb and $116, 250 for Bay). 3. The remaining net income or loss divided equally. 4. Assuming income of $300, 000 fir 1999 before annual salaries, the $140, 000 net income is divided as follows: Partnerships: Organization and Operation 47

Salaries to Partners with Interest on Capital Accounts (contd. ) 2. Interest on average capital account balances, as computed on page 39 ($71, 250 for Alb and $116, 250 for Bay). 3. The remaining net income or loss divided equally. 4. Assuming income of $300, 000 fir 1999 before annual salaries, the $140, 000 net income is divided as follows: Partnerships: Organization and Operation 47

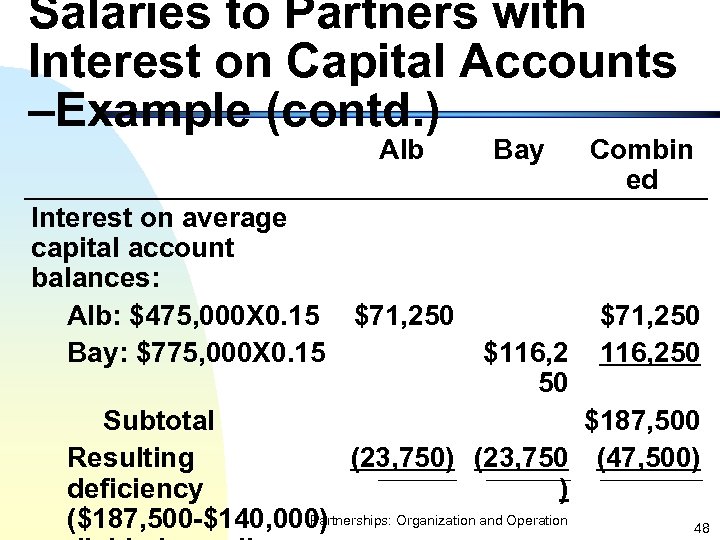

Salaries to Partners with Interest on Capital Accounts –Example (contd. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Bay $71, 250 $116, 2 50 Combin ed $71, 250 116, 250 Subtotal $187, 500 Resulting (23, 750) (23, 750 (47, 500) deficiency ) Partnerships: Organization and Operation ($187, 500 -$140, 000) 48

Salaries to Partners with Interest on Capital Accounts –Example (contd. ) Alb Interest on average capital account balances: Alb: $475, 000 X 0. 15 Bay: $775, 000 X 0. 15 Bay $71, 250 $116, 2 50 Combin ed $71, 250 116, 250 Subtotal $187, 500 Resulting (23, 750) (23, 750 (47, 500) deficiency ) Partnerships: Organization and Operation ($187, 500 -$140, 000) 48

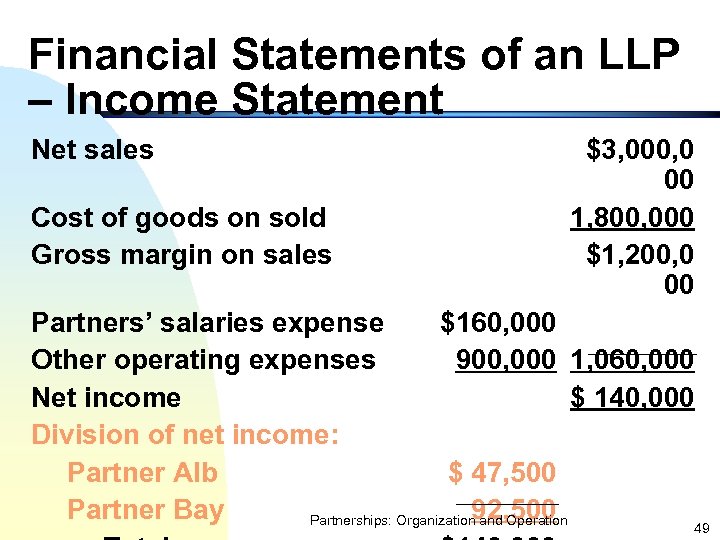

Financial Statements of an LLP – Income Statement Net sales Cost of goods on sold Gross margin on sales $3, 000, 0 00 1, 800, 000 $1, 200, 0 00 Partners’ salaries expense $160, 000 Other operating expenses 900, 000 1, 060, 000 Net income $ 140, 000 Division of net income: Partner Alb $ 47, 500 Partner Bay 92, 500 Partnerships: Organization and Operation 49

Financial Statements of an LLP – Income Statement Net sales Cost of goods on sold Gross margin on sales $3, 000, 0 00 1, 800, 000 $1, 200, 0 00 Partners’ salaries expense $160, 000 Other operating expenses 900, 000 1, 060, 000 Net income $ 140, 000 Division of net income: Partner Alb $ 47, 500 Partner Bay 92, 500 Partnerships: Organization and Operation 49

Financial Statements of an LLP – Income Statement (contd. ) n Notes to the I/S: 1. Explanations of the division of net income may be included in the partnership's income statement or in a note to the financial statements. 2. A partnership in not subject to income taxes. Partnerships: Organization and Operation 50

Financial Statements of an LLP – Income Statement (contd. ) n Notes to the I/S: 1. Explanations of the division of net income may be included in the partnership's income statement or in a note to the financial statements. 2. A partnership in not subject to income taxes. Partnerships: Organization and Operation 50

Financial Statements of an LLP – Income Statement (contd. ) § Notes to the I/S (contd. ) 3. The partners are taxed for their shares of partnership income, including their salaries (this information can be disclosed). Partnerships: Organization and Operation 51

Financial Statements of an LLP – Income Statement (contd. ) § Notes to the I/S (contd. ) 3. The partners are taxed for their shares of partnership income, including their salaries (this information can be disclosed). Partnerships: Organization and Operation 51

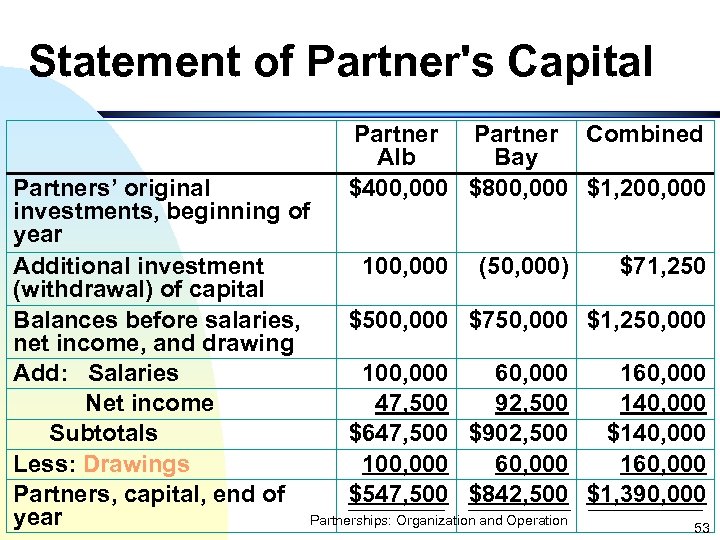

Statement of Partner's Capital 1. A statement of partner's capital provides a complete explanation of the changes in the partners' capital accounts each year. 2. The following statement o partners' capital for Alb& Bay LLP is based on the capital accounts presented on p 30 and includes the income division of net income illustrated in the foregoing income statement: Partnerships: Organization and Operation 52

Statement of Partner's Capital 1. A statement of partner's capital provides a complete explanation of the changes in the partners' capital accounts each year. 2. The following statement o partners' capital for Alb& Bay LLP is based on the capital accounts presented on p 30 and includes the income division of net income illustrated in the foregoing income statement: Partnerships: Organization and Operation 52

Statement of Partner's Capital Partner Combined Alb Bay $400, 000 $800, 000 $1, 200, 000 Partners’ original investments, beginning of year Additional investment 100, 000 (50, 000) $71, 250 (withdrawal) of capital Balances before salaries, $500, 000 $750, 000 $1, 250, 000 net income, and drawing Add: Salaries 100, 000 60, 000 160, 000 Net income 47, 500 92, 500 140, 000 Subtotals $647, 500 $902, 500 $140, 000 Less: Drawings 100, 000 60, 000 160, 000 Partners, capital, end of $547, 500 $842, 500 $1, 390, 000 year Partnerships: Organization and Operation 53

Statement of Partner's Capital Partner Combined Alb Bay $400, 000 $800, 000 $1, 200, 000 Partners’ original investments, beginning of year Additional investment 100, 000 (50, 000) $71, 250 (withdrawal) of capital Balances before salaries, $500, 000 $750, 000 $1, 250, 000 net income, and drawing Add: Salaries 100, 000 60, 000 160, 000 Net income 47, 500 92, 500 140, 000 Subtotals $647, 500 $902, 500 $140, 000 Less: Drawings 100, 000 60, 000 160, 000 Partners, capital, end of $547, 500 $842, 500 $1, 390, 000 year Partnerships: Organization and Operation 53

Statement of Partner's Capital (contd. ) § Note: § Partners' capital at end of year is reported as owners' equity in the 12/31/1999, balance sheet of the partnership as illustrated on page 57. Partnerships: Organization and Operation 54

Statement of Partner's Capital (contd. ) § Note: § Partners' capital at end of year is reported as owners' equity in the 12/31/1999, balance sheet of the partnership as illustrated on page 57. Partnerships: Organization and Operation 54

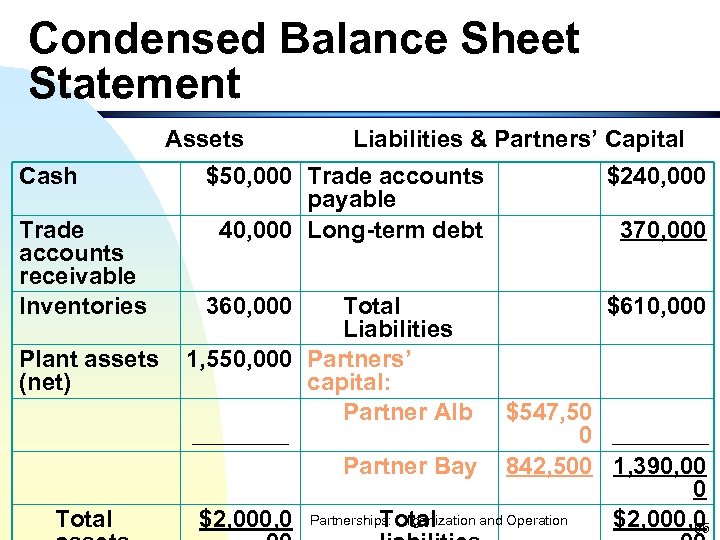

Condensed Balance Sheet Statement Assets Cash Trade accounts receivable Inventories Plant assets (net) Total Liabilities & Partners’ Capital $50, 000 Trade accounts payable 40, 000 Long-term debt $240, 000 360, 000 $610, 000 Total Liabilities 1, 550, 000 Partners’ capital: Partner Alb 370, 000 $547, 50 0 Partner Bay 842, 500 1, 390, 00 0 $2, 000, 0 Partnerships: Organization and Operation Total $2, 000, 0 55

Condensed Balance Sheet Statement Assets Cash Trade accounts receivable Inventories Plant assets (net) Total Liabilities & Partners’ Capital $50, 000 Trade accounts payable 40, 000 Long-term debt $240, 000 360, 000 $610, 000 Total Liabilities 1, 550, 000 Partners’ capital: Partner Alb 370, 000 $547, 50 0 Partner Bay 842, 500 1, 390, 00 0 $2, 000, 0 Partnerships: Organization and Operation Total $2, 000, 0 55

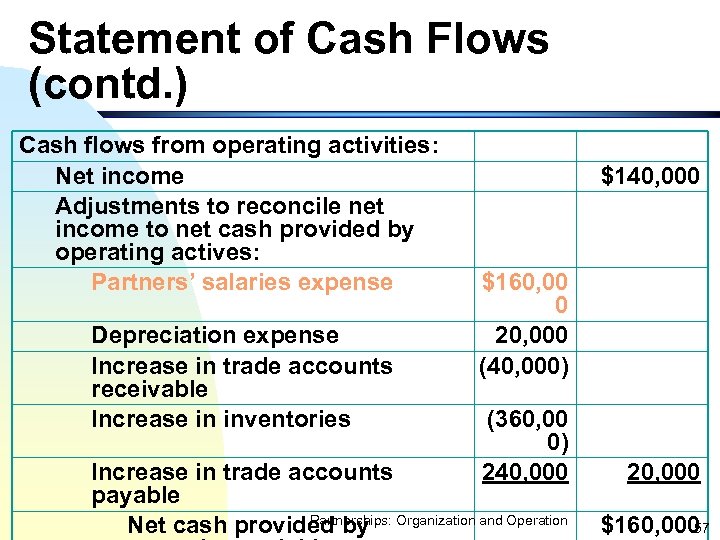

Statement of Cash Flows § A statement of cash flows is prepared for a partnership as it is for a corporation. § A statement of cash flows for Alb & Bay LLP under the indirect method is as follows: Partnerships: Organization and Operation 56

Statement of Cash Flows § A statement of cash flows is prepared for a partnership as it is for a corporation. § A statement of cash flows for Alb & Bay LLP under the indirect method is as follows: Partnerships: Organization and Operation 56

Statement of Cash Flows (contd. ) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating actives: Partners’ salaries expense Depreciation expense Increase in trade accounts receivable Increase in inventories $140, 000 $160, 00 0 20, 000 (40, 000) (360, 00 0) 240, 000 Increase in trade accounts payable Partnerships: Net cash provided by Organization and Operation 20, 000 $160, 000 57

Statement of Cash Flows (contd. ) Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating actives: Partners’ salaries expense Depreciation expense Increase in trade accounts receivable Increase in inventories $140, 000 $160, 00 0 20, 000 (40, 000) (360, 00 0) 240, 000 Increase in trade accounts payable Partnerships: Net cash provided by Organization and Operation 20, 000 $160, 000 57

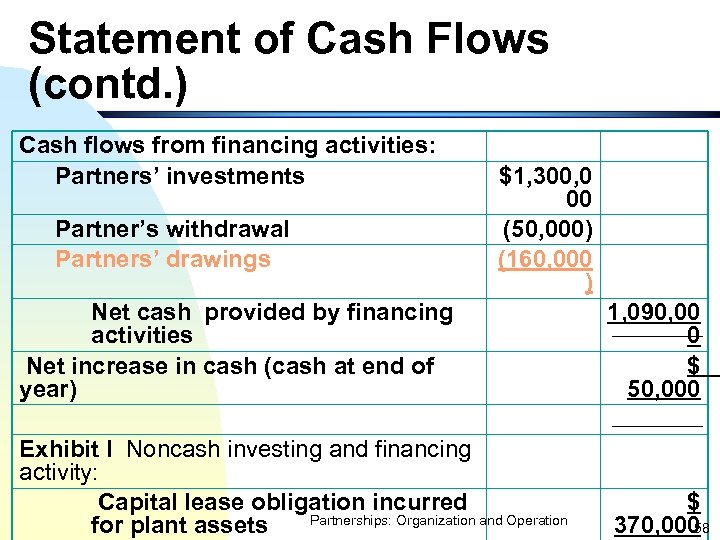

Statement of Cash Flows (contd. ) Cash flows from financing activities: Partners’ investments Partner’s withdrawal Partners’ drawings $1, 300, 0 00 (50, 000) (160, 000 ) Net cash provided by financing activities Net increase in cash (cash at end of year) 1, 090, 00 0 $ 50, 000 Exhibit I Noncash investing and financing activity: Capital lease obligation incurred Partnerships: Organization and Operation for plant assets $ 370, 000 58

Statement of Cash Flows (contd. ) Cash flows from financing activities: Partners’ investments Partner’s withdrawal Partners’ drawings $1, 300, 0 00 (50, 000) (160, 000 ) Net cash provided by financing activities Net increase in cash (cash at end of year) 1, 090, 00 0 $ 50, 000 Exhibit I Noncash investing and financing activity: Capital lease obligation incurred Partnerships: Organization and Operation for plant assets $ 370, 000 58

Correction of Partnership Net Income of Prior Period – Changes in Income Sharing Plan 1. When prior period adjustments occurred, the change in the prior period income/loss should be divided based on the income sharing plan of the year in which the error occurred, not the current years'. 2. This principle applies to the appreciation in assets when income sharing plan changes. Partnerships: Organization and Operation 59

Correction of Partnership Net Income of Prior Period – Changes in Income Sharing Plan 1. When prior period adjustments occurred, the change in the prior period income/loss should be divided based on the income sharing plan of the year in which the error occurred, not the current years'. 2. This principle applies to the appreciation in assets when income sharing plan changes. Partnerships: Organization and Operation 59

Changes in Ownership of LLPs 1. From a legal point of view, a LLP is dissolved when: 2. Admit a new partner, 3. the retirement or death of a partner, 4. the bankruptcy of the firm or of any partner, 5. the expiration of a time period stated in the contract, or 6. the mutual agreement of the partners to end their association. Partnerships: Organization and Operation 60

Changes in Ownership of LLPs 1. From a legal point of view, a LLP is dissolved when: 2. Admit a new partner, 3. the retirement or death of a partner, 4. the bankruptcy of the firm or of any partner, 5. the expiration of a time period stated in the contract, or 6. the mutual agreement of the partners to end their association. Partnerships: Organization and Operation 60

Changes in Ownership of LLPs (contd. ) § Thus, the term dissolution is used for events ranging from a minor change of ownership not affecting operations of the LLP to a decision by the partners to terminate the LLP. Partnerships: Organization and Operation 61

Changes in Ownership of LLPs (contd. ) § Thus, the term dissolution is used for events ranging from a minor change of ownership not affecting operations of the LLP to a decision by the partners to terminate the LLP. Partnerships: Organization and Operation 61

Changes in Ownership of LLPs (contd. ) § Accountants are more concerned with the economic substance of an event than with the legal form of an event. § The change in partnership should be recorded after evaluate all the circumstances of the individual case. Partnerships: Organization and Operation 62

Changes in Ownership of LLPs (contd. ) § Accountants are more concerned with the economic substance of an event than with the legal form of an event. § The change in partnership should be recorded after evaluate all the circumstances of the individual case. Partnerships: Organization and Operation 62

Admission of a New Partner – General Principles to Follow 1. When a new partner is admitted to a LLP, the existing assets should be revalued and the excess should increase the capital of the existing partners. 2. This excess can be allocated based on the income sharing plan. Partnerships: Organization and Operation 63

Admission of a New Partner – General Principles to Follow 1. When a new partner is admitted to a LLP, the existing assets should be revalued and the excess should increase the capital of the existing partners. 2. This excess can be allocated based on the income sharing plan. Partnerships: Organization and Operation 63

Admission of a New Partner – General Principles to Follow (contd. ) 1. When the investment amount of a new partner is greater than the capital credited to the new partner, the excess is bonus to the existing partners. 2. Journal entry: 3. Asset 70, 000 4. Capital, new 60, 000 5. Capital, existing 10, 000 6. (also see example on p 72) Partnerships: Organization and Operation 64

Admission of a New Partner – General Principles to Follow (contd. ) 1. When the investment amount of a new partner is greater than the capital credited to the new partner, the excess is bonus to the existing partners. 2. Journal entry: 3. Asset 70, 000 4. Capital, new 60, 000 5. Capital, existing 10, 000 6. (also see example on p 72) Partnerships: Organization and Operation 64

Admission of a New Partner. General Principles to Follow (contd. ) § When the investment amount of a new partner is less than the capital credited to the new partner, the excess is bonus to the new partner or goodwill to the partnership § Journal entry (the excess is bonus to the new partner) (also see p 77 for example) : Assets (invested by the new partner) 70, 000 Capital, existing 10, 000 Capital, new 80, 000 Partnerships: Organization and Operation 65

Admission of a New Partner. General Principles to Follow (contd. ) § When the investment amount of a new partner is less than the capital credited to the new partner, the excess is bonus to the new partner or goodwill to the partnership § Journal entry (the excess is bonus to the new partner) (also see p 77 for example) : Assets (invested by the new partner) 70, 000 Capital, existing 10, 000 Capital, new 80, 000 Partnerships: Organization and Operation 65

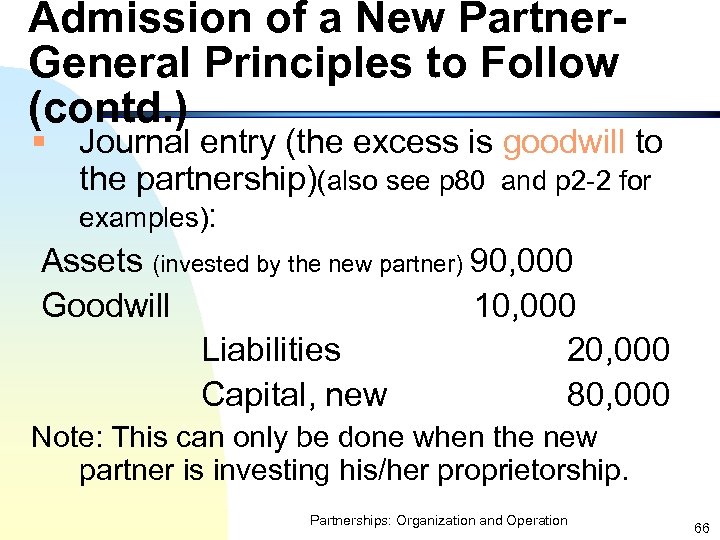

Admission of a New Partner. General Principles to Follow (contd. ) § Journal entry (the excess is goodwill to the partnership)(also see p 80 and p 2 -2 for examples): Assets (invested by the new partner) 90, 000 Goodwill 10, 000 Liabilities 20, 000 Capital, new 80, 000 Note: This can only be done when the new partner is investing his/her proprietorship. Partnerships: Organization and Operation 66

Admission of a New Partner. General Principles to Follow (contd. ) § Journal entry (the excess is goodwill to the partnership)(also see p 80 and p 2 -2 for examples): Assets (invested by the new partner) 90, 000 Goodwill 10, 000 Liabilities 20, 000 Capital, new 80, 000 Note: This can only be done when the new partner is investing his/her proprietorship. Partnerships: Organization and Operation 66

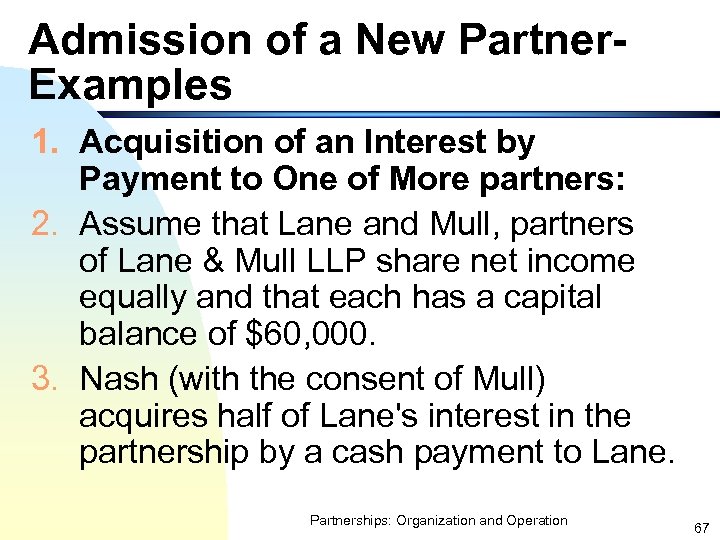

Admission of a New Partner. Examples 1. Acquisition of an Interest by Payment to One of More partners: 2. Assume that Lane and Mull, partners of Lane & Mull LLP share net income equally and that each has a capital balance of $60, 000. 3. Nash (with the consent of Mull) acquires half of Lane's interest in the partnership by a cash payment to Lane. Partnerships: Organization and Operation 67

Admission of a New Partner. Examples 1. Acquisition of an Interest by Payment to One of More partners: 2. Assume that Lane and Mull, partners of Lane & Mull LLP share net income equally and that each has a capital balance of $60, 000. 3. Nash (with the consent of Mull) acquires half of Lane's interest in the partnership by a cash payment to Lane. Partnerships: Organization and Operation 67

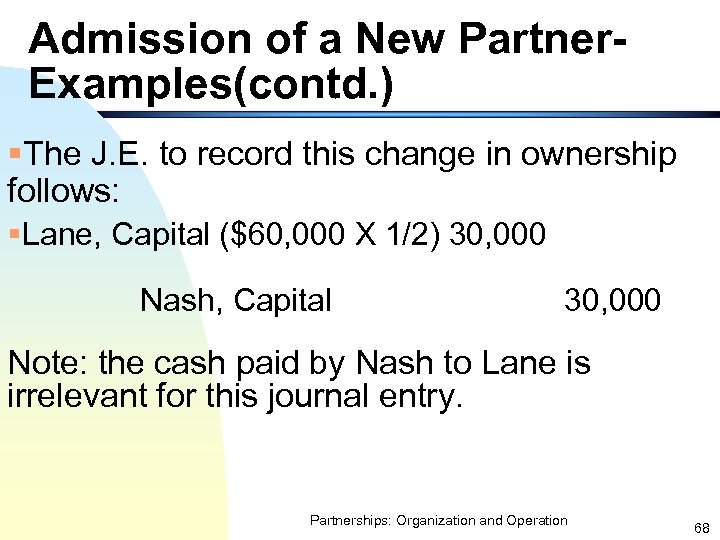

Admission of a New Partner. Examples(contd. ) §The J. E. to record this change in ownership follows: §Lane, Capital ($60, 000 X 1/2) 30, 000 Nash, Capital 30, 000 Note: the cash paid by Nash to Lane is irrelevant for this journal entry. Partnerships: Organization and Operation 68

Admission of a New Partner. Examples(contd. ) §The J. E. to record this change in ownership follows: §Lane, Capital ($60, 000 X 1/2) 30, 000 Nash, Capital 30, 000 Note: the cash paid by Nash to Lane is irrelevant for this journal entry. Partnerships: Organization and Operation 68

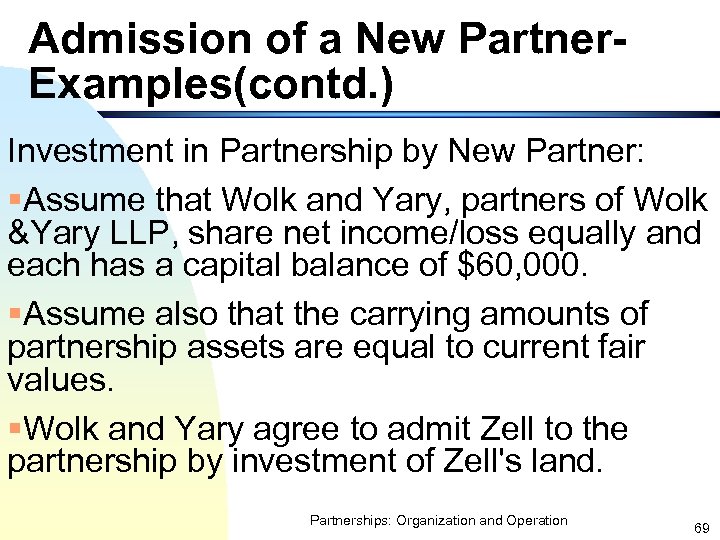

Admission of a New Partner. Examples(contd. ) Investment in Partnership by New Partner: §Assume that Wolk and Yary, partners of Wolk &Yary LLP, share net income/loss equally and each has a capital balance of $60, 000. §Assume also that the carrying amounts of partnership assets are equal to current fair values. §Wolk and Yary agree to admit Zell to the partnership by investment of Zell's land. Partnerships: Organization and Operation 69

Admission of a New Partner. Examples(contd. ) Investment in Partnership by New Partner: §Assume that Wolk and Yary, partners of Wolk &Yary LLP, share net income/loss equally and each has a capital balance of $60, 000. §Assume also that the carrying amounts of partnership assets are equal to current fair values. §Wolk and Yary agree to admit Zell to the partnership by investment of Zell's land. Partnerships: Organization and Operation 69

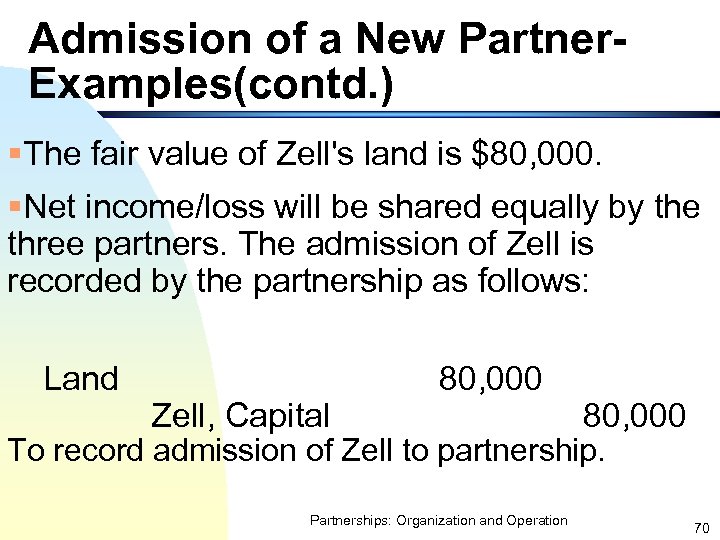

Admission of a New Partner. Examples(contd. ) §The fair value of Zell's land is $80, 000. §Net income/loss will be shared equally by the three partners. The admission of Zell is recorded by the partnership as follows: Land Zell, Capital 80, 000 To record admission of Zell to partnership. Partnerships: Organization and Operation 70

Admission of a New Partner. Examples(contd. ) §The fair value of Zell's land is $80, 000. §Net income/loss will be shared equally by the three partners. The admission of Zell is recorded by the partnership as follows: Land Zell, Capital 80, 000 To record admission of Zell to partnership. Partnerships: Organization and Operation 70

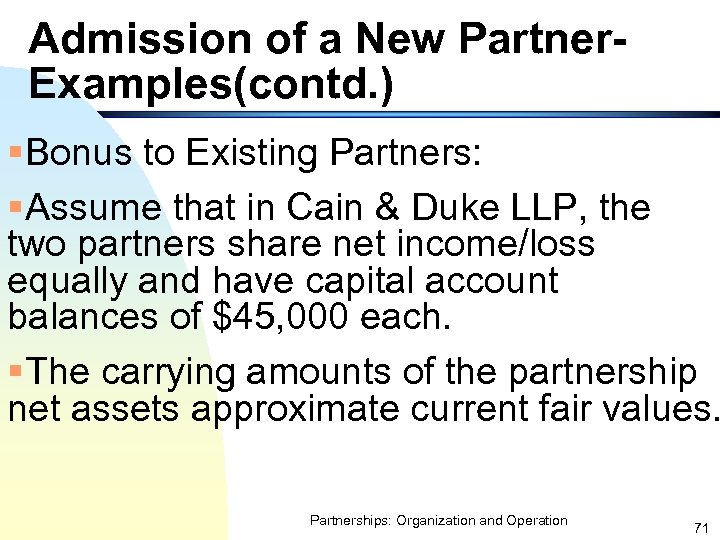

Admission of a New Partner. Examples(contd. ) §Bonus to Existing Partners: §Assume that in Cain & Duke LLP, the two partners share net income/loss equally and have capital account balances of $45, 000 each. §The carrying amounts of the partnership net assets approximate current fair values. Partnerships: Organization and Operation 71

Admission of a New Partner. Examples(contd. ) §Bonus to Existing Partners: §Assume that in Cain & Duke LLP, the two partners share net income/loss equally and have capital account balances of $45, 000 each. §The carrying amounts of the partnership net assets approximate current fair values. Partnerships: Organization and Operation 71

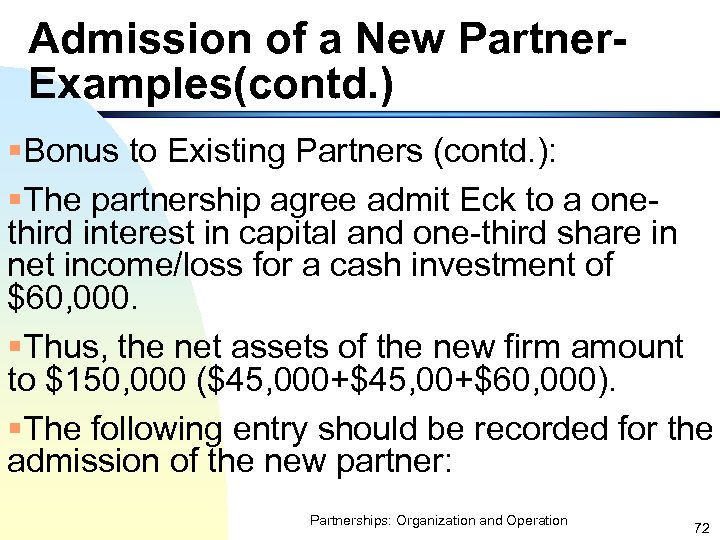

Admission of a New Partner. Examples(contd. ) §Bonus to Existing Partners (contd. ): §The partnership agree admit Eck to a onethird interest in capital and one-third share in net income/loss for a cash investment of $60, 000. §Thus, the net assets of the new firm amount to $150, 000 ($45, 000+$45, 00+$60, 000). §The following entry should be recorded for the admission of the new partner: Partnerships: Organization and Operation 72

Admission of a New Partner. Examples(contd. ) §Bonus to Existing Partners (contd. ): §The partnership agree admit Eck to a onethird interest in capital and one-third share in net income/loss for a cash investment of $60, 000. §Thus, the net assets of the new firm amount to $150, 000 ($45, 000+$45, 00+$60, 000). §The following entry should be recorded for the admission of the new partner: Partnerships: Organization and Operation 72

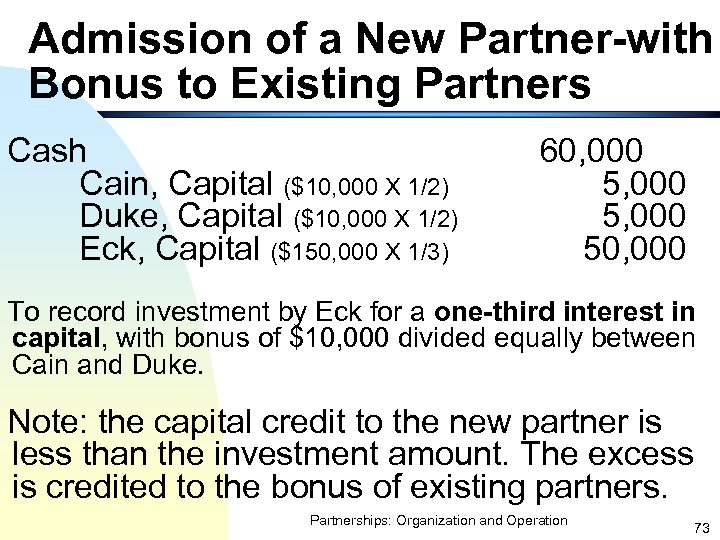

Admission of a New Partner-with Bonus to Existing Partners Cash Cain, Capital ($10, 000 X 1/2) Duke, Capital ($10, 000 X 1/2) Eck, Capital ($150, 000 X 1/3) 60, 000 5, 000 50, 000 To record investment by Eck for a one-third interest in capital, with bonus of $10, 000 divided equally between Cain and Duke. Note: the capital credit to the new partner is less than the investment amount. The excess is credited to the bonus of existing partners. Partnerships: Organization and Operation 73

Admission of a New Partner-with Bonus to Existing Partners Cash Cain, Capital ($10, 000 X 1/2) Duke, Capital ($10, 000 X 1/2) Eck, Capital ($150, 000 X 1/3) 60, 000 5, 000 50, 000 To record investment by Eck for a one-third interest in capital, with bonus of $10, 000 divided equally between Cain and Duke. Note: the capital credit to the new partner is less than the investment amount. The excess is credited to the bonus of existing partners. Partnerships: Organization and Operation 73

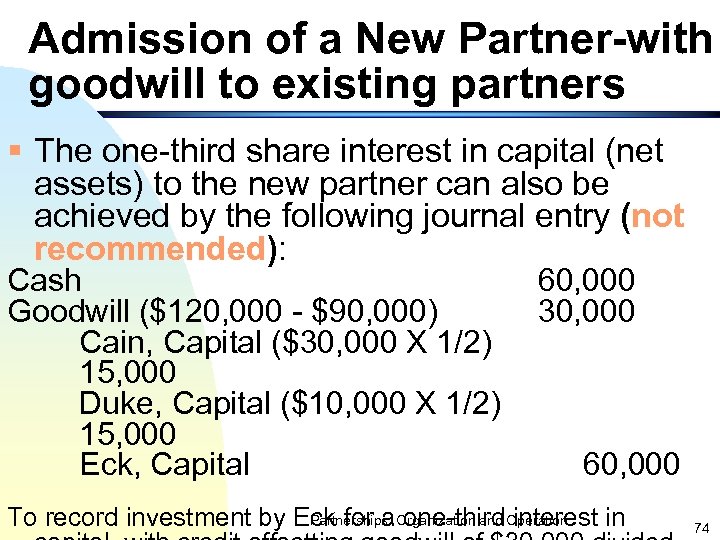

Admission of a New Partner-with goodwill to existing partners § The one-third share interest in capital (net assets) to the new partner can also be achieved by the following journal entry (not recommended): Cash Goodwill ($120, 000 - $90, 000) Cain, Capital ($30, 000 X 1/2) 15, 000 Duke, Capital ($10, 000 X 1/2) 15, 000 Eck, Capital 60, 000 30, 000 60, 000 Partnerships: one-third interest To record investment by Eck for a. Organization and Operation in 74

Admission of a New Partner-with goodwill to existing partners § The one-third share interest in capital (net assets) to the new partner can also be achieved by the following journal entry (not recommended): Cash Goodwill ($120, 000 - $90, 000) Cain, Capital ($30, 000 X 1/2) 15, 000 Duke, Capital ($10, 000 X 1/2) 15, 000 Eck, Capital 60, 000 30, 000 60, 000 Partnerships: one-third interest To record investment by Eck for a. Organization and Operation in 74

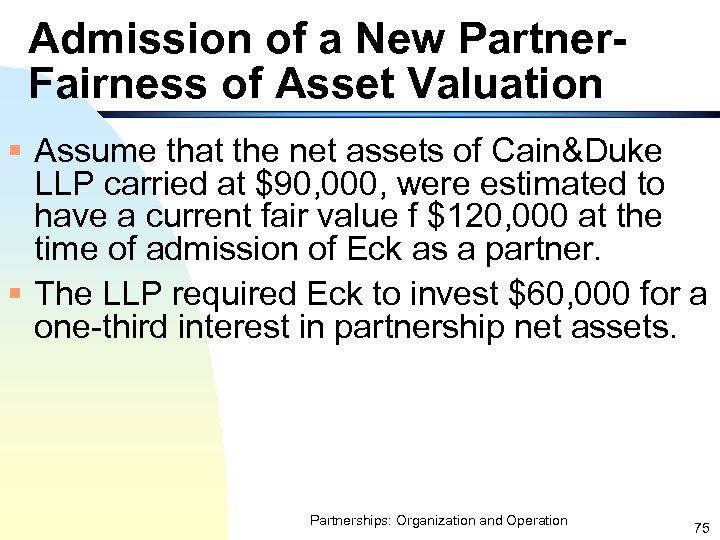

Admission of a New Partner. Fairness of Asset Valuation § Assume that the net assets of Cain&Duke LLP carried at $90, 000, were estimated to have a current fair value f $120, 000 at the time of admission of Eck as a partner. § The LLP required Eck to invest $60, 000 for a one-third interest in partnership net assets. Partnerships: Organization and Operation 75

Admission of a New Partner. Fairness of Asset Valuation § Assume that the net assets of Cain&Duke LLP carried at $90, 000, were estimated to have a current fair value f $120, 000 at the time of admission of Eck as a partner. § The LLP required Eck to invest $60, 000 for a one-third interest in partnership net assets. Partnerships: Organization and Operation 75

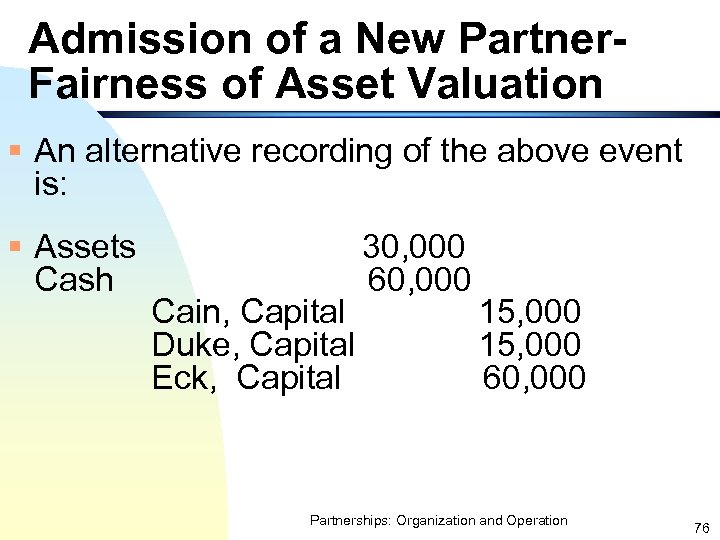

Admission of a New Partner. Fairness of Asset Valuation § An alternative recording of the above event is: § Assets Cash Cain, Capital Duke, Capital Eck, Capital 30, 000 60, 000 15, 000 60, 000 Partnerships: Organization and Operation 76

Admission of a New Partner. Fairness of Asset Valuation § An alternative recording of the above event is: § Assets Cash Cain, Capital Duke, Capital Eck, Capital 30, 000 60, 000 15, 000 60, 000 Partnerships: Organization and Operation 76

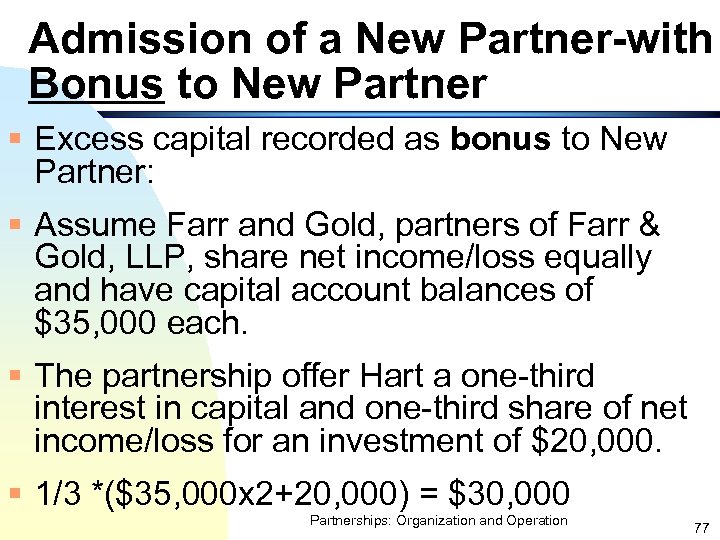

Admission of a New Partner-with Bonus to New Partner § Excess capital recorded as bonus to New Partner: § Assume Farr and Gold, partners of Farr & Gold, LLP, share net income/loss equally and have capital account balances of $35, 000 each. § The partnership offer Hart a one-third interest in capital and one-third share of net income/loss for an investment of $20, 000. § 1/3 *($35, 000 x 2+20, 000) = $30, 000 Partnerships: Organization and Operation 77

Admission of a New Partner-with Bonus to New Partner § Excess capital recorded as bonus to New Partner: § Assume Farr and Gold, partners of Farr & Gold, LLP, share net income/loss equally and have capital account balances of $35, 000 each. § The partnership offer Hart a one-third interest in capital and one-third share of net income/loss for an investment of $20, 000. § 1/3 *($35, 000 x 2+20, 000) = $30, 000 Partnerships: Organization and Operation 77

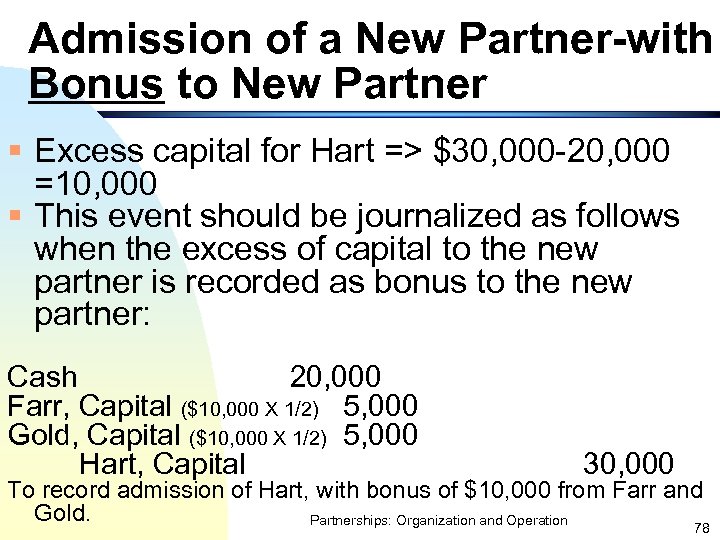

Admission of a New Partner-with Bonus to New Partner § Excess capital for Hart => $30, 000 -20, 000 =10, 000 § This event should be journalized as follows when the excess of capital to the new partner is recorded as bonus to the new partner: Cash 20, 000 Farr, Capital ($10, 000 X 1/2) 5, 000 Gold, Capital ($10, 000 X 1/2) 5, 000 Hart, Capital 30, 000 To record admission of Hart, with bonus of $10, 000 from Farr and Gold. Partnerships: Organization and Operation 78

Admission of a New Partner-with Bonus to New Partner § Excess capital for Hart => $30, 000 -20, 000 =10, 000 § This event should be journalized as follows when the excess of capital to the new partner is recorded as bonus to the new partner: Cash 20, 000 Farr, Capital ($10, 000 X 1/2) 5, 000 Gold, Capital ($10, 000 X 1/2) 5, 000 Hart, Capital 30, 000 To record admission of Hart, with bonus of $10, 000 from Farr and Gold. Partnerships: Organization and Operation 78

Admission of a New Partner-with Bonus to New Partner § The above treatment assumes that the net assets of the LLP were valued properly prior to the admission of Hart. § If not, the net assets should be written down (debit the capital accounts) to the fair value prior to the above journal entry. Partnerships: Organization and Operation 79

Admission of a New Partner-with Bonus to New Partner § The above treatment assumes that the net assets of the LLP were valued properly prior to the admission of Hart. § If not, the net assets should be written down (debit the capital accounts) to the fair value prior to the above journal entry. Partnerships: Organization and Operation 79

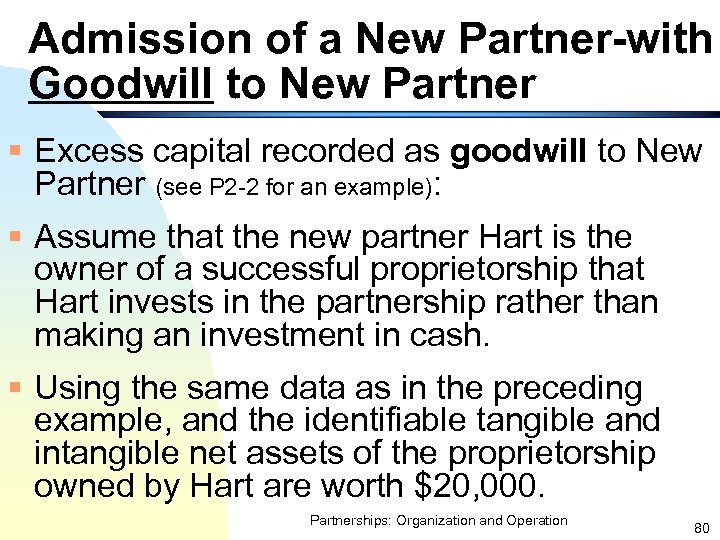

Admission of a New Partner-with Goodwill to New Partner § Excess capital recorded as goodwill to New Partner (see P 2 -2 for an example): § Assume that the new partner Hart is the owner of a successful proprietorship that Hart invests in the partnership rather than making an investment in cash. § Using the same data as in the preceding example, and the identifiable tangible and intangible net assets of the proprietorship owned by Hart are worth $20, 000. Partnerships: Organization and Operation 80

Admission of a New Partner-with Goodwill to New Partner § Excess capital recorded as goodwill to New Partner (see P 2 -2 for an example): § Assume that the new partner Hart is the owner of a successful proprietorship that Hart invests in the partnership rather than making an investment in cash. § Using the same data as in the preceding example, and the identifiable tangible and intangible net assets of the proprietorship owned by Hart are worth $20, 000. Partnerships: Organization and Operation 80

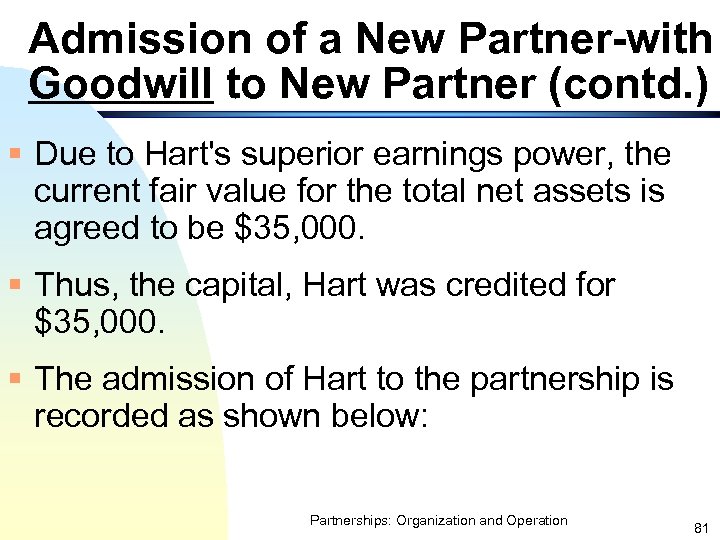

Admission of a New Partner-with Goodwill to New Partner (contd. ) § Due to Hart's superior earnings power, the current fair value for the total net assets is agreed to be $35, 000. § Thus, the capital, Hart was credited for $35, 000. § The admission of Hart to the partnership is recorded as shown below: Partnerships: Organization and Operation 81

Admission of a New Partner-with Goodwill to New Partner (contd. ) § Due to Hart's superior earnings power, the current fair value for the total net assets is agreed to be $35, 000. § Thus, the capital, Hart was credited for $35, 000. § The admission of Hart to the partnership is recorded as shown below: Partnerships: Organization and Operation 81

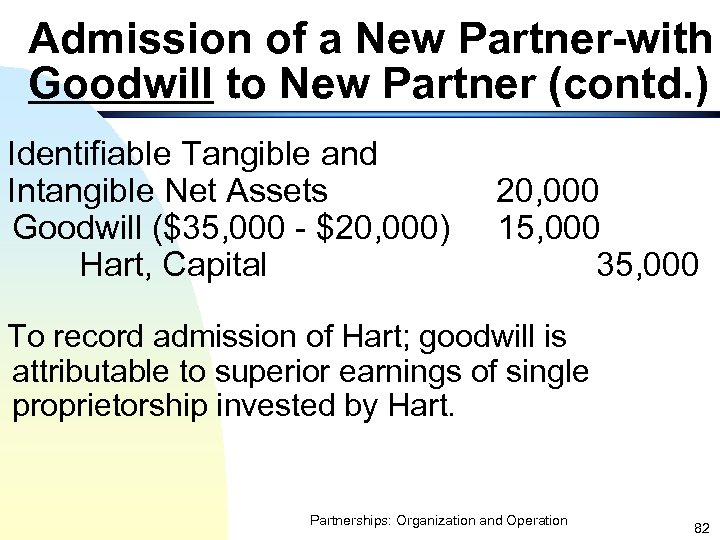

Admission of a New Partner-with Goodwill to New Partner (contd. ) Identifiable Tangible and Intangible Net Assets Goodwill ($35, 000 - $20, 000) Hart, Capital 20, 000 15, 000 35, 000 To record admission of Hart; goodwill is attributable to superior earnings of single proprietorship invested by Hart. Partnerships: Organization and Operation 82

Admission of a New Partner-with Goodwill to New Partner (contd. ) Identifiable Tangible and Intangible Net Assets Goodwill ($35, 000 - $20, 000) Hart, Capital 20, 000 15, 000 35, 000 To record admission of Hart; goodwill is attributable to superior earnings of single proprietorship invested by Hart. Partnerships: Organization and Operation 82

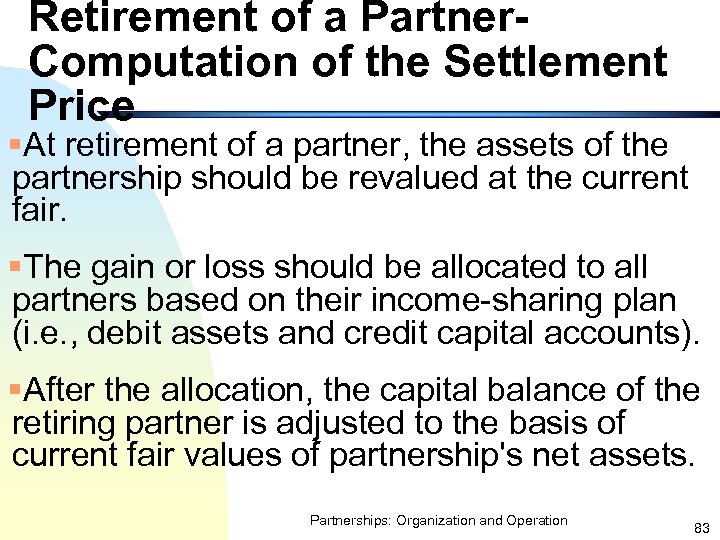

Retirement of a Partner. Computation of the Settlement Price §At retirement of a partner, the assets of the partnership should be revalued at the current fair. §The gain or loss should be allocated to all partners based on their income-sharing plan (i. e. , debit assets and credit capital accounts). §After the allocation, the capital balance of the retiring partner is adjusted to the basis of current fair values of partnership's net assets. Partnerships: Organization and Operation 83

Retirement of a Partner. Computation of the Settlement Price §At retirement of a partner, the assets of the partnership should be revalued at the current fair. §The gain or loss should be allocated to all partners based on their income-sharing plan (i. e. , debit assets and credit capital accounts). §After the allocation, the capital balance of the retiring partner is adjusted to the basis of current fair values of partnership's net assets. Partnerships: Organization and Operation 83

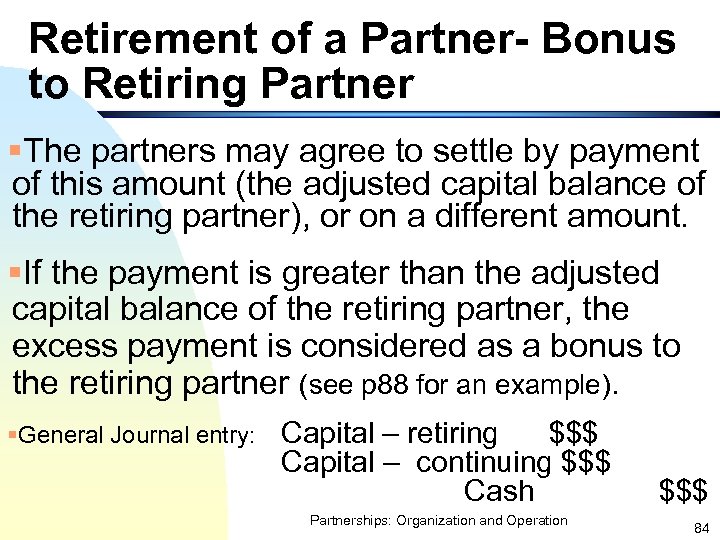

Retirement of a Partner- Bonus to Retiring Partner §The partners may agree to settle by payment of this amount (the adjusted capital balance of the retiring partner), or on a different amount. §If the payment is greater than the adjusted capital balance of the retiring partner, the excess payment is considered as a bonus to the retiring partner (see p 88 for an example). §General Journal entry: Capital – retiring $$$ Capital – continuing $$$ Cash Partnerships: Organization and Operation $$$ 84

Retirement of a Partner- Bonus to Retiring Partner §The partners may agree to settle by payment of this amount (the adjusted capital balance of the retiring partner), or on a different amount. §If the payment is greater than the adjusted capital balance of the retiring partner, the excess payment is considered as a bonus to the retiring partner (see p 88 for an example). §General Journal entry: Capital – retiring $$$ Capital – continuing $$$ Cash Partnerships: Organization and Operation $$$ 84

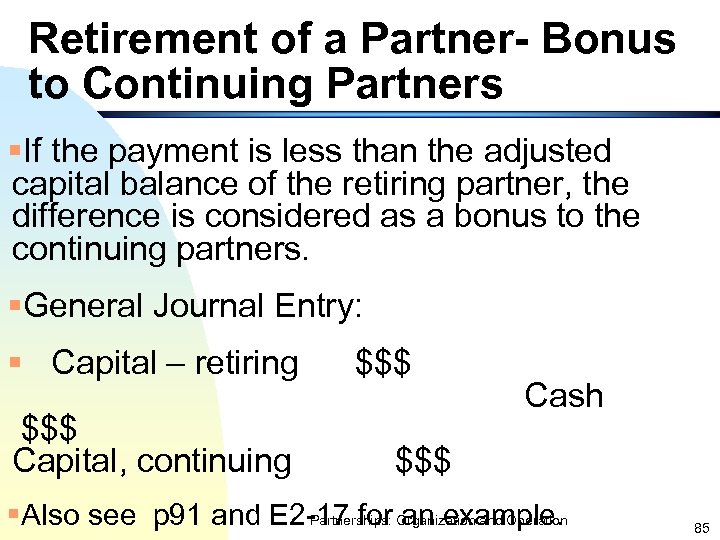

Retirement of a Partner- Bonus to Continuing Partners §If the payment is less than the adjusted capital balance of the retiring partner, the difference is considered as a bonus to the continuing partners. §General Journal Entry: § Capital – retiring $$$ Capital, continuing $$$ Cash $$$ §Also see p 91 and E 2 -17 for Organization and Operation Partnerships: an example. 85

Retirement of a Partner- Bonus to Continuing Partners §If the payment is less than the adjusted capital balance of the retiring partner, the difference is considered as a bonus to the continuing partners. §General Journal Entry: § Capital – retiring $$$ Capital, continuing $$$ Cash $$$ §Also see p 91 and E 2 -17 for Organization and Operation Partnerships: an example. 85

Retirement of a Partner- Bonus to Retiring Partner (example) § Assume that partner Lund is to retire from Jorb, Kent & Lund LLP. Each partner has a capital balance of $60, 000, and net income and losses are shared equally. § The contract provides that a retiring partner is to receive the balance of the retiring partner capital account plus a share of any internally generated goodwill. Partnerships: Organization and Operation 86

Retirement of a Partner- Bonus to Retiring Partner (example) § Assume that partner Lund is to retire from Jorb, Kent & Lund LLP. Each partner has a capital balance of $60, 000, and net income and losses are shared equally. § The contract provides that a retiring partner is to receive the balance of the retiring partner capital account plus a share of any internally generated goodwill. Partnerships: Organization and Operation 86

Retirement of a Partner- Bonus to Retiring Partner (example) § At the time of Lund's retirement, goodwill in the amount of $30, 000 is computed. § The appropriate treatment is to record the amount paid to Lund for goodwill as a $10, 000 bonus. § The journal entry is as follows: Partnerships: Organization and Operation 87

Retirement of a Partner- Bonus to Retiring Partner (example) § At the time of Lund's retirement, goodwill in the amount of $30, 000 is computed. § The appropriate treatment is to record the amount paid to Lund for goodwill as a $10, 000 bonus. § The journal entry is as follows: Partnerships: Organization and Operation 87

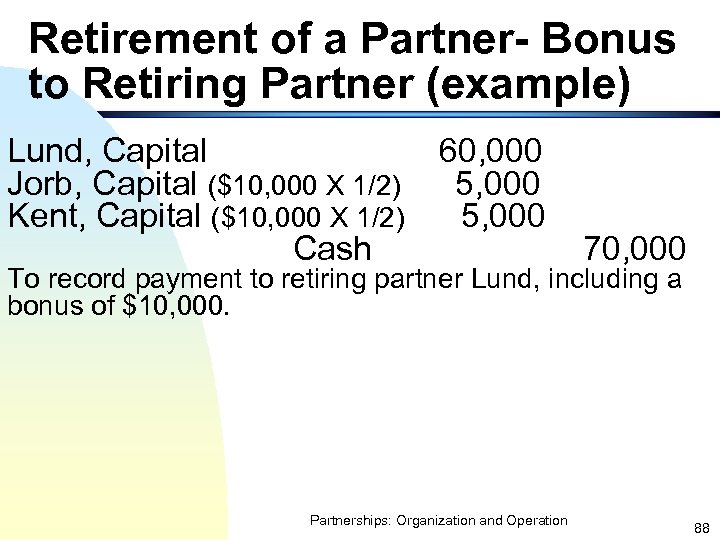

Retirement of a Partner- Bonus to Retiring Partner (example) Lund, Capital Jorb, Capital ($10, 000 X 1/2) Kent, Capital ($10, 000 X 1/2) Cash 60, 000 5, 000 70, 000 To record payment to retiring partner Lund, including a bonus of $10, 000. Partnerships: Organization and Operation 88

Retirement of a Partner- Bonus to Retiring Partner (example) Lund, Capital Jorb, Capital ($10, 000 X 1/2) Kent, Capital ($10, 000 X 1/2) Cash 60, 000 5, 000 70, 000 To record payment to retiring partner Lund, including a bonus of $10, 000. Partnerships: Organization and Operation 88

Retirement of a Partner- Bonus to Retiring Partner (example) §This bonus method illustrated above is appropriate whenever the settlement exceeds the capital account balance of the retiring partner. §The agreement for settlement may not use the term goodwill. Partnerships: Organization and Operation 89

Retirement of a Partner- Bonus to Retiring Partner (example) §This bonus method illustrated above is appropriate whenever the settlement exceeds the capital account balance of the retiring partner. §The agreement for settlement may not use the term goodwill. Partnerships: Organization and Operation 89

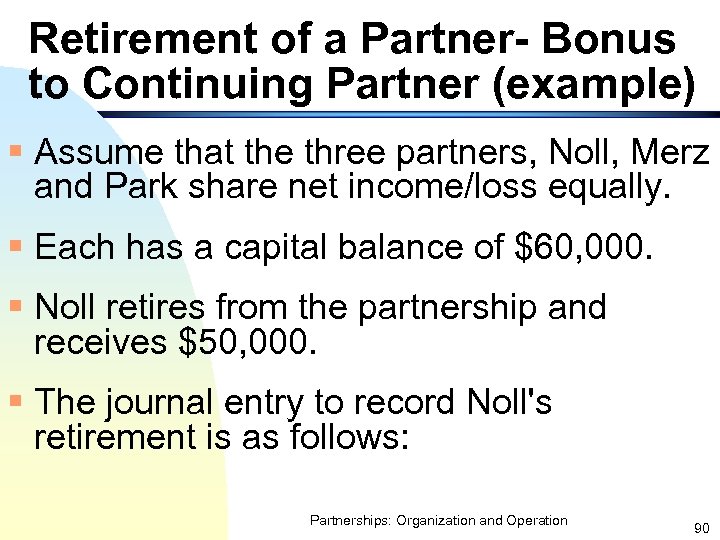

Retirement of a Partner- Bonus to Continuing Partner (example) § Assume that the three partners, Noll, Merz and Park share net income/loss equally. § Each has a capital balance of $60, 000. § Noll retires from the partnership and receives $50, 000. § The journal entry to record Noll's retirement is as follows: Partnerships: Organization and Operation 90

Retirement of a Partner- Bonus to Continuing Partner (example) § Assume that the three partners, Noll, Merz and Park share net income/loss equally. § Each has a capital balance of $60, 000. § Noll retires from the partnership and receives $50, 000. § The journal entry to record Noll's retirement is as follows: Partnerships: Organization and Operation 90

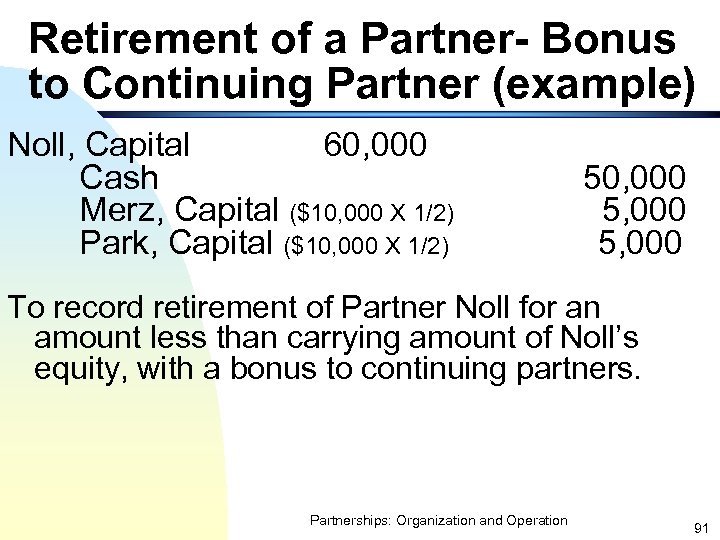

Retirement of a Partner- Bonus to Continuing Partner (example) Noll, Capital 60, 000 Cash Merz, Capital ($10, 000 X 1/2) Park, Capital ($10, 000 X 1/2) 50, 000 5, 000 To record retirement of Partner Noll for an amount less than carrying amount of Noll’s equity, with a bonus to continuing partners. Partnerships: Organization and Operation 91

Retirement of a Partner- Bonus to Continuing Partner (example) Noll, Capital 60, 000 Cash Merz, Capital ($10, 000 X 1/2) Park, Capital ($10, 000 X 1/2) 50, 000 5, 000 To record retirement of Partner Noll for an amount less than carrying amount of Noll’s equity, with a bonus to continuing partners. Partnerships: Organization and Operation 91

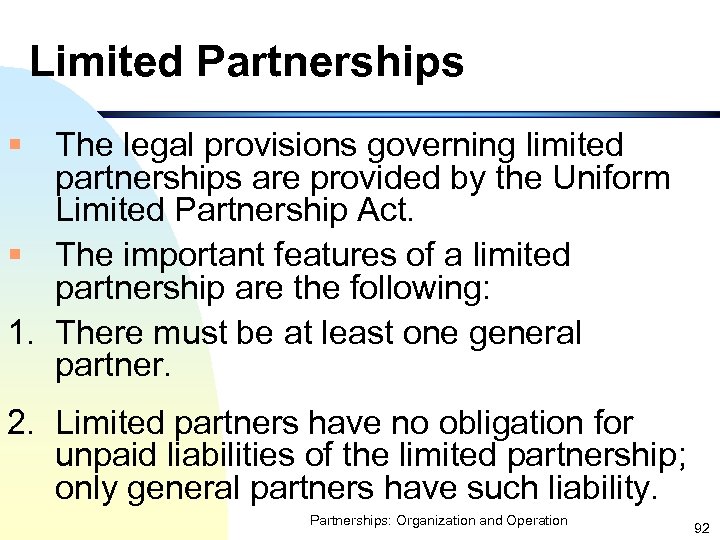

Limited Partnerships § The legal provisions governing limited partnerships are provided by the Uniform Limited Partnership Act. § The important features of a limited partnership are the following: 1. There must be at least one general partner. 2. Limited partners have no obligation for unpaid liabilities of the limited partnership; only general partners have such liability. Partnerships: Organization and Operation 92

Limited Partnerships § The legal provisions governing limited partnerships are provided by the Uniform Limited Partnership Act. § The important features of a limited partnership are the following: 1. There must be at least one general partner. 2. Limited partners have no obligation for unpaid liabilities of the limited partnership; only general partners have such liability. Partnerships: Organization and Operation 92

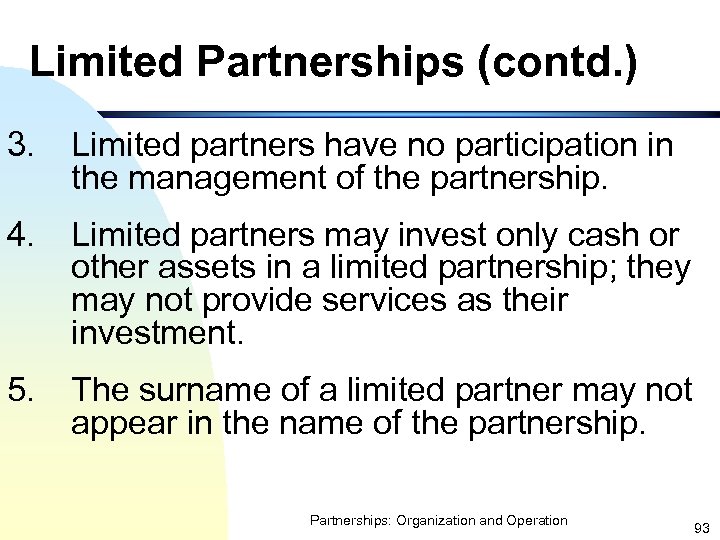

Limited Partnerships (contd. ) 3. Limited partners have no participation in the management of the partnership. 4. Limited partners may invest only cash or other assets in a limited partnership; they may not provide services as their investment. 5. The surname of a limited partner may not appear in the name of the partnership. Partnerships: Organization and Operation 93

Limited Partnerships (contd. ) 3. Limited partners have no participation in the management of the partnership. 4. Limited partners may invest only cash or other assets in a limited partnership; they may not provide services as their investment. 5. The surname of a limited partner may not appear in the name of the partnership. Partnerships: Organization and Operation 93

Limited Partnerships (contd. ) 6. The formation of a limited partnership is evidenced by a certificate filed with the county recorder of the principal place of business of the limited partnership. Partnerships: Organization and Operation 94

Limited Partnerships (contd. ) 6. The formation of a limited partnership is evidenced by a certificate filed with the county recorder of the principal place of business of the limited partnership. Partnerships: Organization and Operation 94

Limited Partnerships (contd. ) 1. Membership in a limited partnership is offered to limited partners in units subject to the Securities Act of 1933. 2. Thus, unless exempt by the provisions of that Act, a limited partnership must file a registration statement for the offered units with the SEC and file reports with the SEC. Partnerships: Organization and Operation 95

Limited Partnerships (contd. ) 1. Membership in a limited partnership is offered to limited partners in units subject to the Securities Act of 1933. 2. Thus, unless exempt by the provisions of that Act, a limited partnership must file a registration statement for the offered units with the SEC and file reports with the SEC. Partnerships: Organization and Operation 95

Accounting for Limited Partnerships 1. The accounting for limited partnerships parallels that accounting for LLPs. 2. However, limited partners do not have periodic drawings debited to Drawing ledger account. 3. In Staff Accounting Bulletin 40, the SEC requires the equity section of a limited partnership balance sheet specify amounts for each ownership class (i. e. , the general partner versus the limited partners). Partnerships: Organization and Operation 96

Accounting for Limited Partnerships 1. The accounting for limited partnerships parallels that accounting for LLPs. 2. However, limited partners do not have periodic drawings debited to Drawing ledger account. 3. In Staff Accounting Bulletin 40, the SEC requires the equity section of a limited partnership balance sheet specify amounts for each ownership class (i. e. , the general partner versus the limited partners). Partnerships: Organization and Operation 96

Financial Statements for Limited Partnerships 1. Assume that Wesley Randall formed Randall Company, a limited partnership that was exempt from the registration requirements of the Securities Act of 1933 on 1/2/1999. 2. Wesley Randall, the general partner, acquired 30 units at $1, 000 a unit, and 30 limited partners acquired a total of 570 units at $1, 000. 3. The certificate for Randall Company Partnerships: Organization and Operation provided 97

Financial Statements for Limited Partnerships 1. Assume that Wesley Randall formed Randall Company, a limited partnership that was exempt from the registration requirements of the Securities Act of 1933 on 1/2/1999. 2. Wesley Randall, the general partner, acquired 30 units at $1, 000 a unit, and 30 limited partners acquired a total of 570 units at $1, 000. 3. The certificate for Randall Company Partnerships: Organization and Operation provided 97

Financial Statements for Limited Partnerships (contd. ) § The certificate for Randall Company provided that limited partners might withdraw their net equity only on 12/31 of each year. § Randall was authorized to withdrew $500 a month at his discretion, but he had no drawings during 1999. Partnerships: Organization and Operation 98

Financial Statements for Limited Partnerships (contd. ) § The certificate for Randall Company provided that limited partners might withdraw their net equity only on 12/31 of each year. § Randall was authorized to withdrew $500 a month at his discretion, but he had no drawings during 1999. Partnerships: Organization and Operation 98

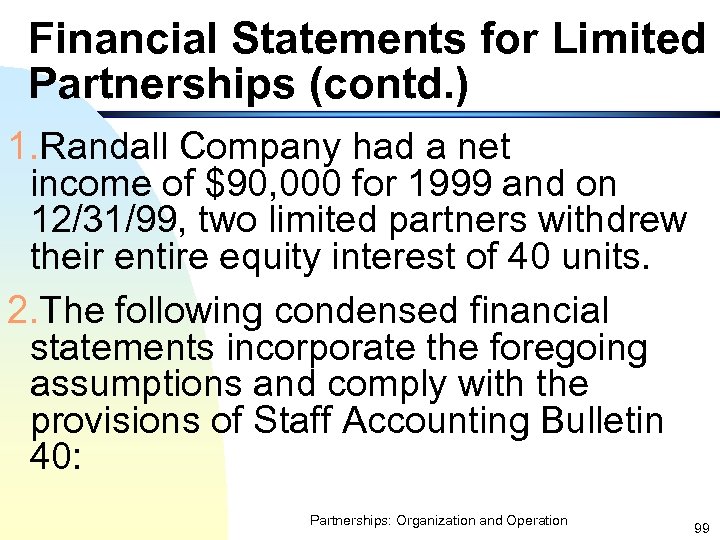

Financial Statements for Limited Partnerships (contd. ) 1. Randall Company had a net income of $90, 000 for 1999 and on 12/31/99, two limited partners withdrew their entire equity interest of 40 units. 2. The following condensed financial statements incorporate the foregoing assumptions and comply with the provisions of Staff Accounting Bulletin 40: Partnerships: Organization and Operation 99

Financial Statements for Limited Partnerships (contd. ) 1. Randall Company had a net income of $90, 000 for 1999 and on 12/31/99, two limited partners withdrew their entire equity interest of 40 units. 2. The following condensed financial statements incorporate the foregoing assumptions and comply with the provisions of Staff Accounting Bulletin 40: Partnerships: Organization and Operation 99

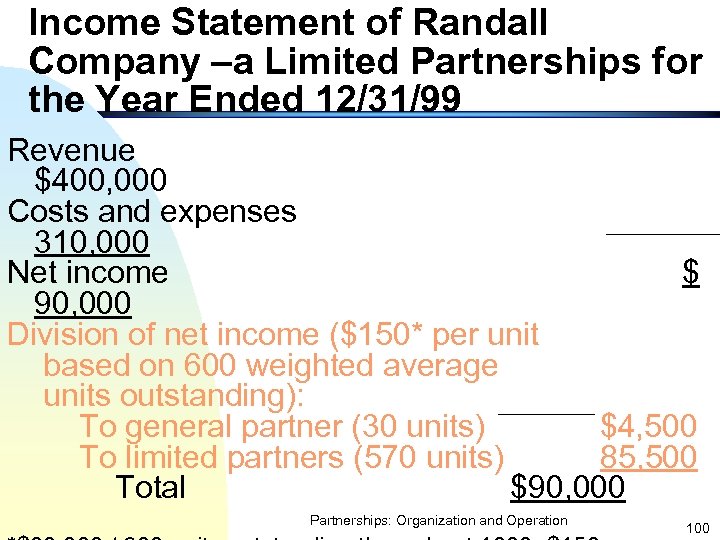

Income Statement of Randall Company –a Limited Partnerships for the Year Ended 12/31/99 Revenue $400, 000 Costs and expenses 310, 000 Net income $ 90, 000 Division of net income ($150* per unit based on 600 weighted average units outstanding): To general partner (30 units) $4, 500 To limited partners (570 units) 85, 500 Total $90, 000 Partnerships: Organization and Operation 100

Income Statement of Randall Company –a Limited Partnerships for the Year Ended 12/31/99 Revenue $400, 000 Costs and expenses 310, 000 Net income $ 90, 000 Division of net income ($150* per unit based on 600 weighted average units outstanding): To general partner (30 units) $4, 500 To limited partners (570 units) 85, 500 Total $90, 000 Partnerships: Organization and Operation 100

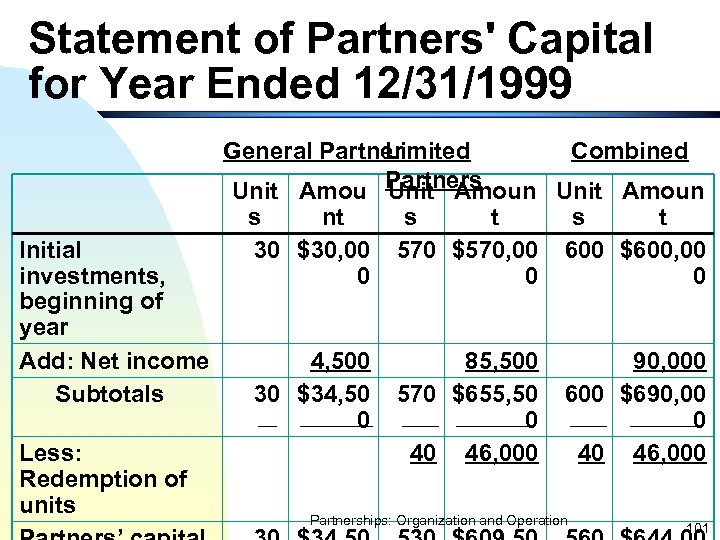

Statement of Partners' Capital for Year Ended 12/31/1999 Initial investments, beginning of year Add: Net income Subtotals Less: Redemption of units General Partner Limited Combined Unit Amou Partners Unit Amoun s nt s t 30 $30, 00 570 $570, 00 600 $600, 00 0 4, 500 30 $34, 50 0 85, 500 570 $655, 50 0 40 46, 000 90, 000 600 $690, 00 0 40 46, 000 Partnerships: Organization and Operation 101

Statement of Partners' Capital for Year Ended 12/31/1999 Initial investments, beginning of year Add: Net income Subtotals Less: Redemption of units General Partner Limited Combined Unit Amou Partners Unit Amoun s nt s t 30 $30, 00 570 $570, 00 600 $600, 00 0 4, 500 30 $34, 50 0 85, 500 570 $655, 50 0 40 46, 000 90, 000 600 $690, 00 0 40 46, 000 Partnerships: Organization and Operation 101

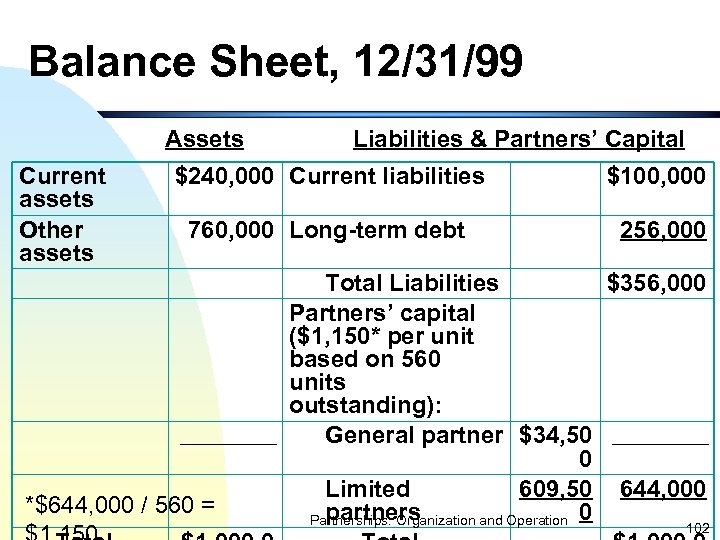

Balance Sheet, 12/31/99 Assets Current assets Other assets Liabilities & Partners’ Capital $240, 000 Current liabilities $100, 000 760, 000 Long-term debt 256, 000 *$644, 000 / 560 = Total Liabilities $356, 000 Partners’ capital ($1, 150* per unit based on 560 units outstanding): General partner $34, 50 0 Limited 609, 50 644, 000 partners Partnerships: Organization and Operation 0 102

Balance Sheet, 12/31/99 Assets Current assets Other assets Liabilities & Partners’ Capital $240, 000 Current liabilities $100, 000 760, 000 Long-term debt 256, 000 *$644, 000 / 560 = Total Liabilities $356, 000 Partners’ capital ($1, 150* per unit based on 560 units outstanding): General partner $34, 50 0 Limited 609, 50 644, 000 partners Partnerships: Organization and Operation 0 102