cc035a376169f27d30e54f2720d4a4a2.ppt

- Количество слайдов: 45

Chapter 2 -1

Chapter 2 -1

CHAPTER 2 THE RECORDING PROCESS Accounting Principles, Eighth Edition Chapter 2 -2

CHAPTER 2 THE RECORDING PROCESS Accounting Principles, Eighth Edition Chapter 2 -2

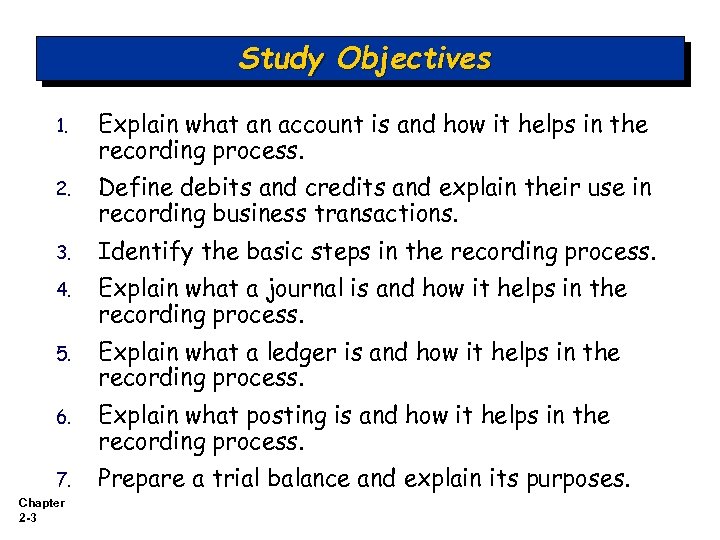

Study Objectives 1. Explain what an account is and how it helps in the recording process. 2. Define debits and credits and explain their use in recording business transactions. 3. Identify the basic steps in the recording process. 4. Explain what a journal is and how it helps in the recording process. 5. Explain what a ledger is and how it helps in the recording process. 6. Explain what posting is and how it helps in the recording process. 7. Prepare a trial balance and explain its purposes. Chapter 2 -3

Study Objectives 1. Explain what an account is and how it helps in the recording process. 2. Define debits and credits and explain their use in recording business transactions. 3. Identify the basic steps in the recording process. 4. Explain what a journal is and how it helps in the recording process. 5. Explain what a ledger is and how it helps in the recording process. 6. Explain what posting is and how it helps in the recording process. 7. Prepare a trial balance and explain its purposes. Chapter 2 -3

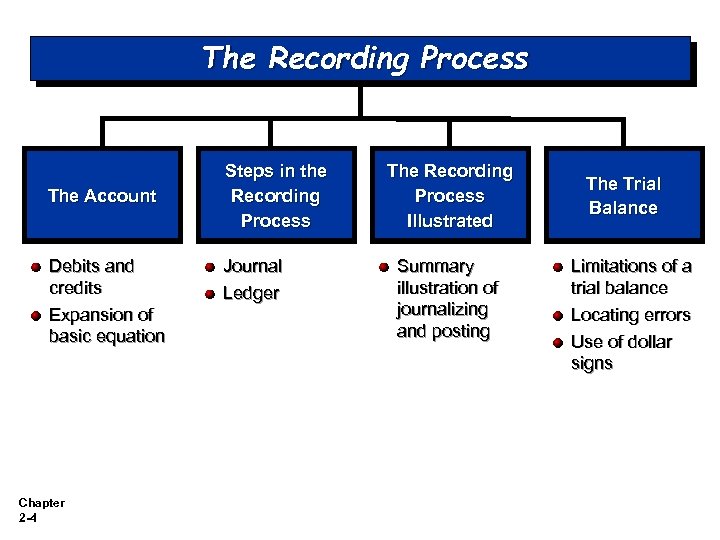

The Recording Process The Account Debits and credits Expansion of basic equation Chapter 2 -4 Steps in the Recording Process Journal Ledger The Recording Process Illustrated Summary illustration of journalizing and posting The Trial Balance Limitations of a trial balance Locating errors Use of dollar signs

The Recording Process The Account Debits and credits Expansion of basic equation Chapter 2 -4 Steps in the Recording Process Journal Ledger The Recording Process Illustrated Summary illustration of journalizing and posting The Trial Balance Limitations of a trial balance Locating errors Use of dollar signs

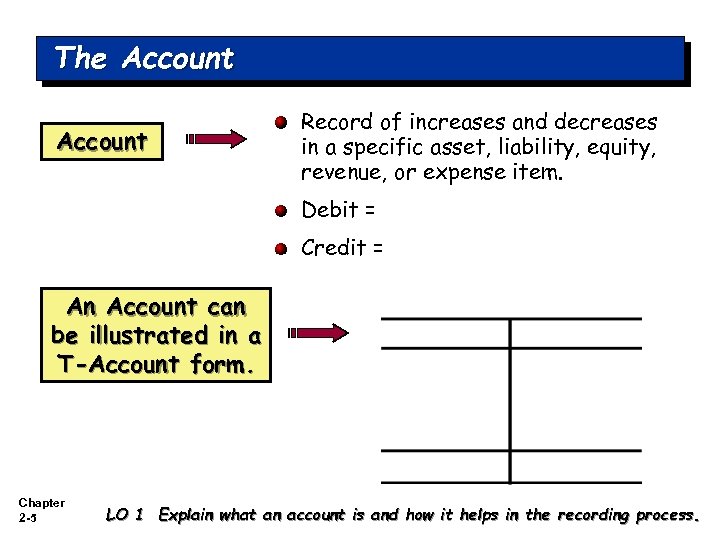

The Account Record of increases and decreases in a specific asset, liability, equity, revenue, or expense item. Debit = Credit = An Account can be illustrated in a T-Account form. Chapter 2 -5 LO 1 Explain what an account is and how it helps in the recording process.

The Account Record of increases and decreases in a specific asset, liability, equity, revenue, or expense item. Debit = Credit = An Account can be illustrated in a T-Account form. Chapter 2 -5 LO 1 Explain what an account is and how it helps in the recording process.

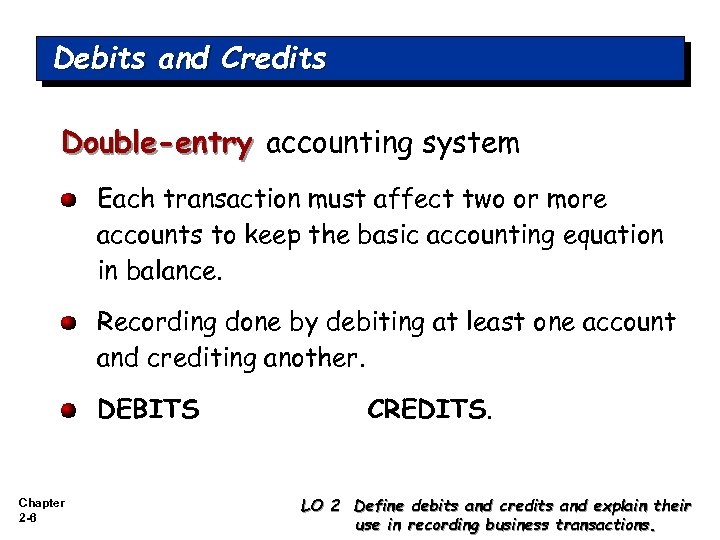

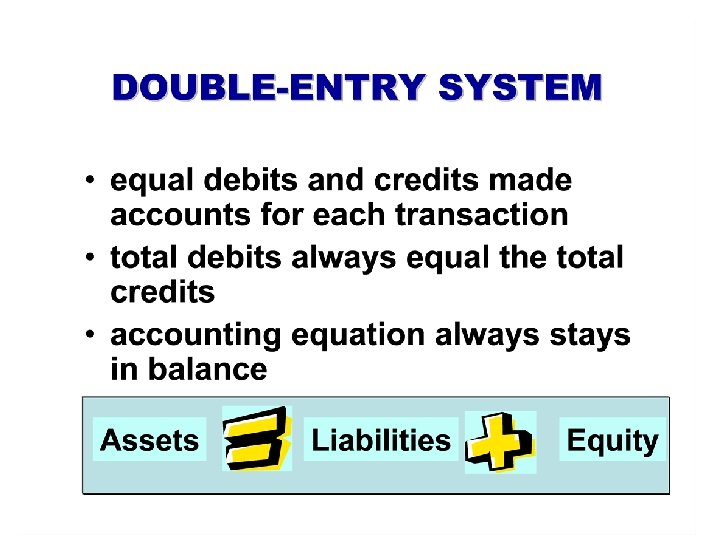

Debits and Credits Double-entry accounting system Each transaction must affect two or more accounts to keep the basic accounting equation in balance. Recording done by debiting at least one account and crediting another. DEBITS Chapter 2 -6 CREDITS. LO 2 Define debits and credits and explain their use in recording business transactions.

Debits and Credits Double-entry accounting system Each transaction must affect two or more accounts to keep the basic accounting equation in balance. Recording done by debiting at least one account and crediting another. DEBITS Chapter 2 -6 CREDITS. LO 2 Define debits and credits and explain their use in recording business transactions.

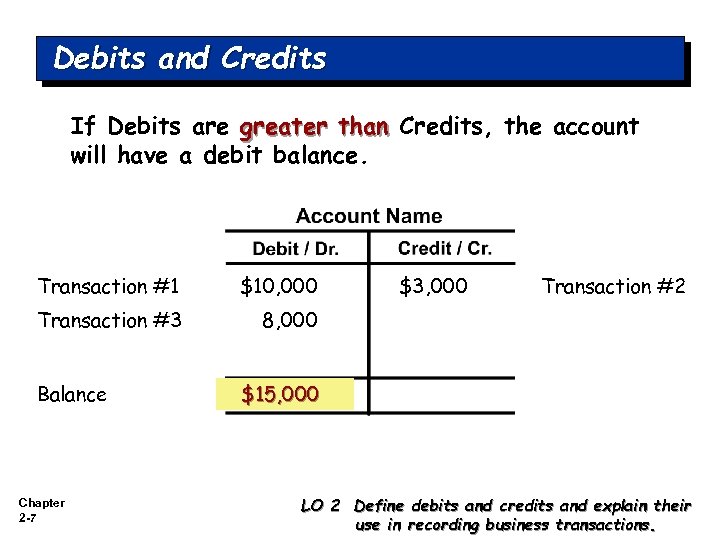

Debits and Credits If Debits are greater than Credits, the account will have a debit balance. Transaction #1 $10, 000 Transaction #3 8, 000 Balance Chapter 2 -7 $3, 000 Transaction #2 $15, 000 LO 2 Define debits and credits and explain their use in recording business transactions.

Debits and Credits If Debits are greater than Credits, the account will have a debit balance. Transaction #1 $10, 000 Transaction #3 8, 000 Balance Chapter 2 -7 $3, 000 Transaction #2 $15, 000 LO 2 Define debits and credits and explain their use in recording business transactions.

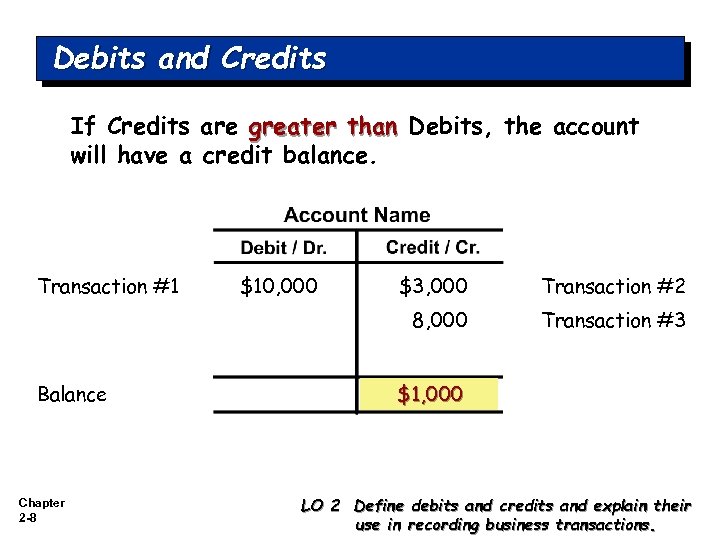

Debits and Credits If Credits are greater than Debits, the account will have a credit balance. Transaction #1 Chapter 2 -8 $3, 000 Transaction #2 8, 000 Balance $10, 000 Transaction #3 $1, 000 LO 2 Define debits and credits and explain their use in recording business transactions.

Debits and Credits If Credits are greater than Debits, the account will have a credit balance. Transaction #1 Chapter 2 -8 $3, 000 Transaction #2 8, 000 Balance $10, 000 Transaction #3 $1, 000 LO 2 Define debits and credits and explain their use in recording business transactions.

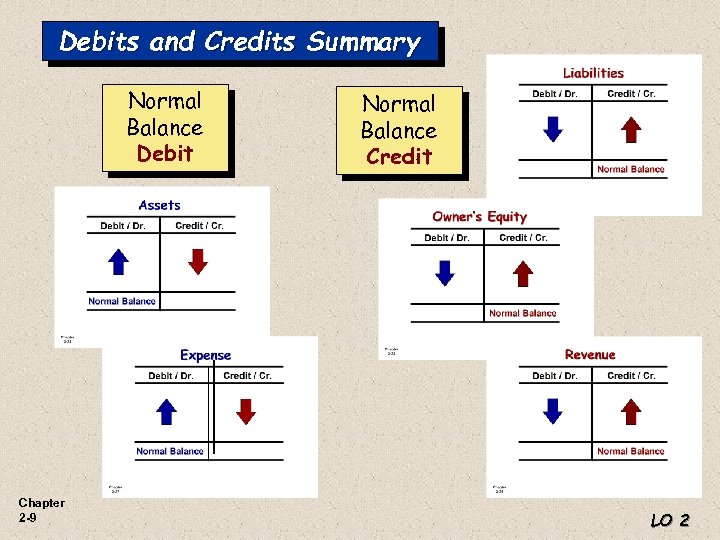

Debits and Credits Summary Normal Balance Debit Chapter 2 -9 Normal Balance Credit LO 2

Debits and Credits Summary Normal Balance Debit Chapter 2 -9 Normal Balance Credit LO 2

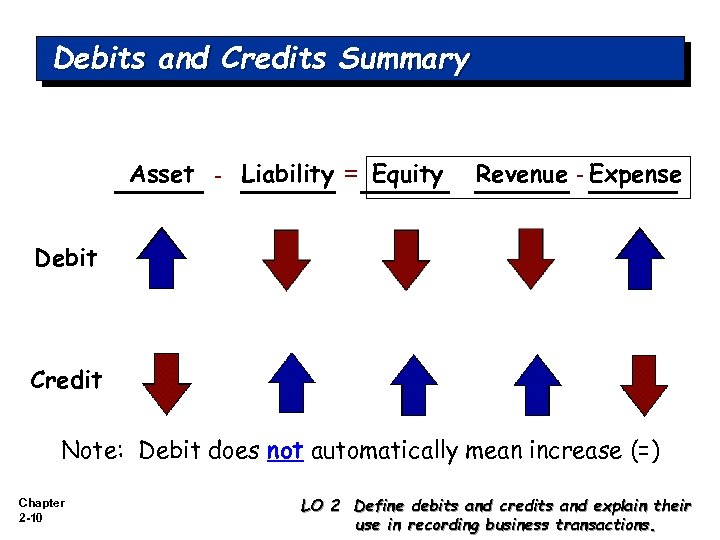

Debits and Credits Summary Asset - Liability = Equity Revenue - Expense Debit Credit Note: Debit does not automatically mean increase (=) Chapter 2 -10 LO 2 Define debits and credits and explain their use in recording business transactions.

Debits and Credits Summary Asset - Liability = Equity Revenue - Expense Debit Credit Note: Debit does not automatically mean increase (=) Chapter 2 -10 LO 2 Define debits and credits and explain their use in recording business transactions.

Chapter 1 Chapter 2 -11 Chapter 2

Chapter 1 Chapter 2 -11 Chapter 2

Chapter 2 -12

Chapter 2 -12

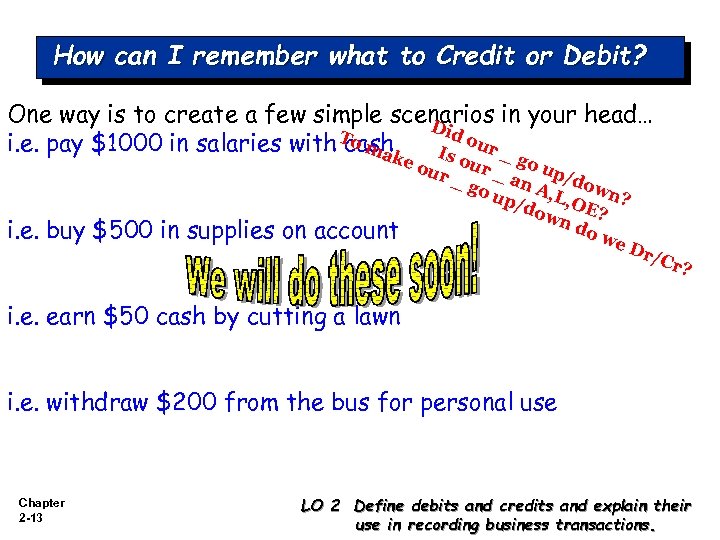

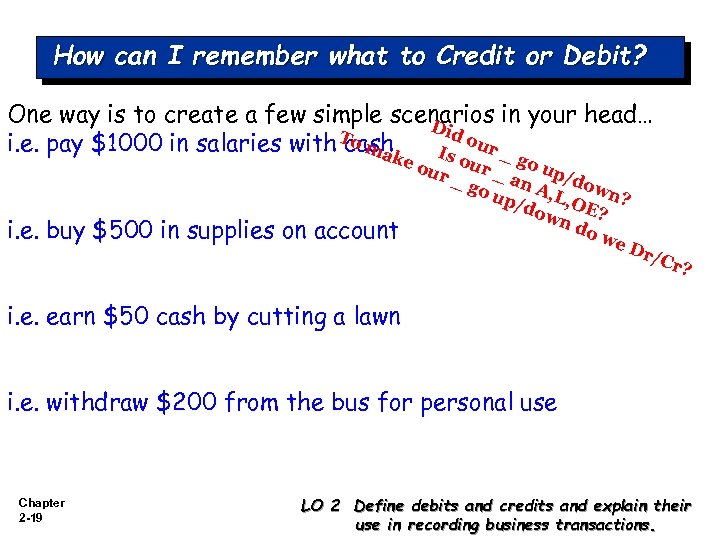

How can I remember what to Credit or Debit? One way is to create a few simple scenarios in your head… Did To i. e. pay $1000 in salaries with cashk Is our _ ma eo ur i. e. buy $500 in supplies on account go our _ a up/d _g o u n A, L own? p/d , ow OE? nd ow e Dr/ Cr? i. e. earn $50 cash by cutting a lawn i. e. withdraw $200 from the bus for personal use Chapter 2 -13 LO 2 Define debits and credits and explain their use in recording business transactions.

How can I remember what to Credit or Debit? One way is to create a few simple scenarios in your head… Did To i. e. pay $1000 in salaries with cashk Is our _ ma eo ur i. e. buy $500 in supplies on account go our _ a up/d _g o u n A, L own? p/d , ow OE? nd ow e Dr/ Cr? i. e. earn $50 cash by cutting a lawn i. e. withdraw $200 from the bus for personal use Chapter 2 -13 LO 2 Define debits and credits and explain their use in recording business transactions.

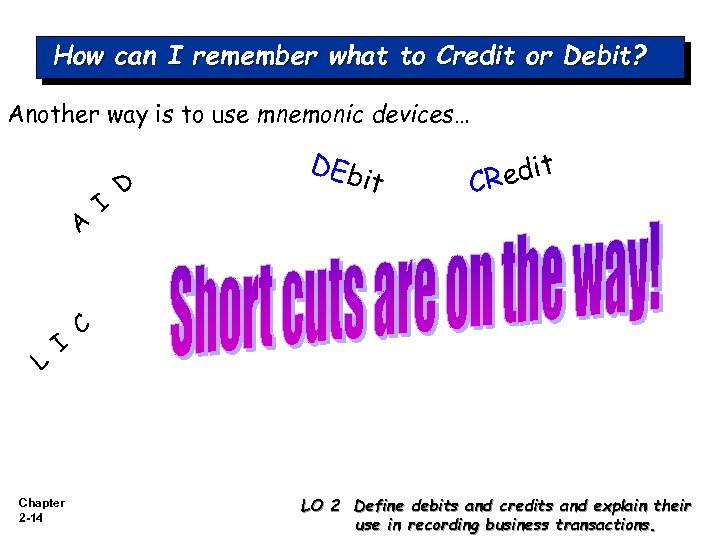

How can I remember what to Credit or Debit? Another way is to use mnemonic devices… A L I Chapter 2 -14 I D DE b it edit CR C LO 2 Define debits and credits and explain their use in recording business transactions.

How can I remember what to Credit or Debit? Another way is to use mnemonic devices… A L I Chapter 2 -14 I D DE b it edit CR C LO 2 Define debits and credits and explain their use in recording business transactions.

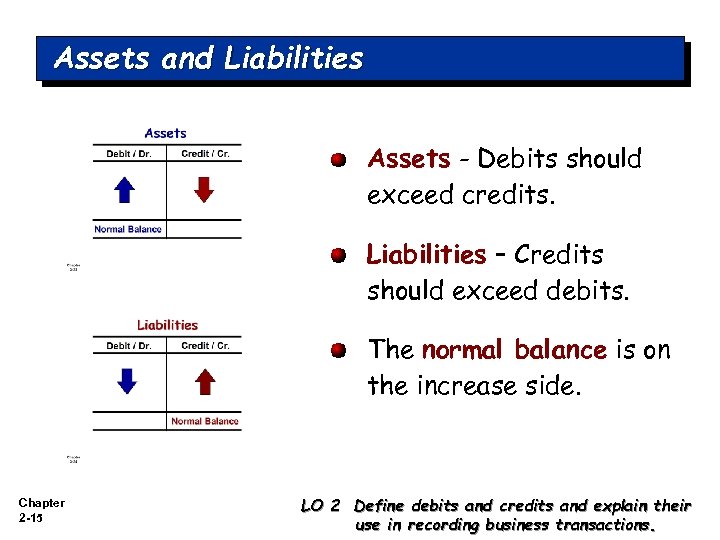

Assets and Liabilities Assets - Debits should exceed credits. Liabilities – Credits should exceed debits. The normal balance is on the increase side. Chapter 2 -15 LO 2 Define debits and credits and explain their use in recording business transactions.

Assets and Liabilities Assets - Debits should exceed credits. Liabilities – Credits should exceed debits. The normal balance is on the increase side. Chapter 2 -15 LO 2 Define debits and credits and explain their use in recording business transactions.

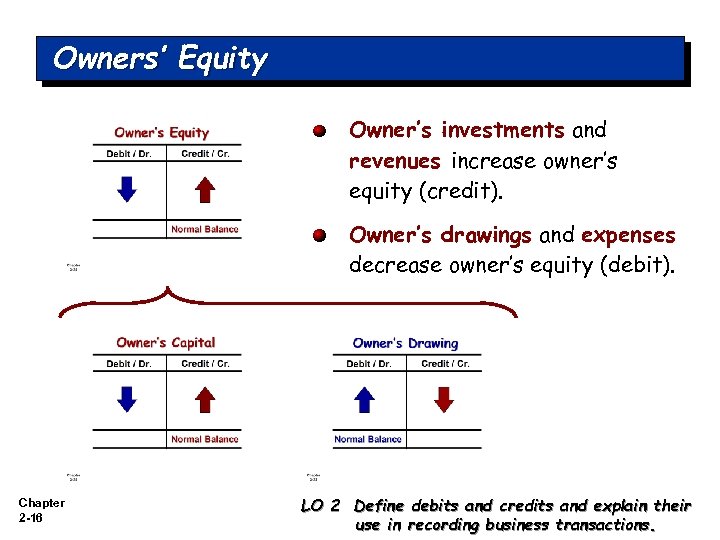

Owners’ Equity Owner’s investments and revenues increase owner’s equity (credit). Owner’s drawings and expenses decrease owner’s equity (debit). Chapter 2 -16 LO 2 Define debits and credits and explain their use in recording business transactions.

Owners’ Equity Owner’s investments and revenues increase owner’s equity (credit). Owner’s drawings and expenses decrease owner’s equity (debit). Chapter 2 -16 LO 2 Define debits and credits and explain their use in recording business transactions.

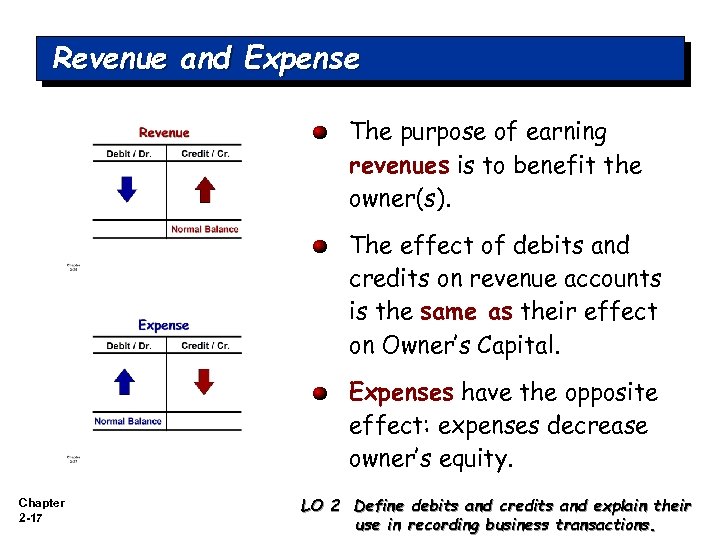

Revenue and Expense The purpose of earning revenues is to benefit the owner(s). The effect of debits and credits on revenue accounts is the same as their effect on Owner’s Capital. Expenses have the opposite effect: expenses decrease owner’s equity. Chapter 2 -17 LO 2 Define debits and credits and explain their use in recording business transactions.

Revenue and Expense The purpose of earning revenues is to benefit the owner(s). The effect of debits and credits on revenue accounts is the same as their effect on Owner’s Capital. Expenses have the opposite effect: expenses decrease owner’s equity. Chapter 2 -17 LO 2 Define debits and credits and explain their use in recording business transactions.

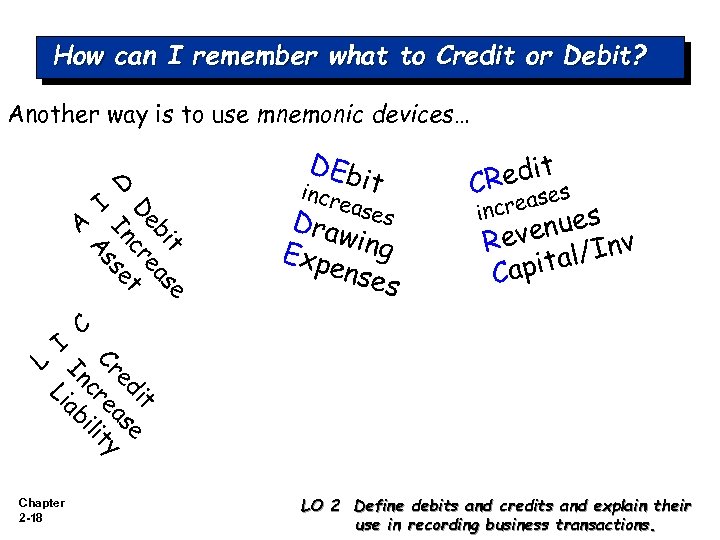

How can I remember what to Credit or Debit? Another way is to use mnemonic devices… e t bi as De cre t In se As I D A incr it ease s Dra wing Exp ense s edit CR s rease inc nues Reve l/Inv apita C C it ed ase Cr e y cr ilit In ab Li L I DE b Chapter 2 -18 LO 2 Define debits and credits and explain their use in recording business transactions.

How can I remember what to Credit or Debit? Another way is to use mnemonic devices… e t bi as De cre t In se As I D A incr it ease s Dra wing Exp ense s edit CR s rease inc nues Reve l/Inv apita C C it ed ase Cr e y cr ilit In ab Li L I DE b Chapter 2 -18 LO 2 Define debits and credits and explain their use in recording business transactions.

How can I remember what to Credit or Debit? One way is to create a few simple scenarios in your head… Did To i. e. pay $1000 in salaries with cashk Is our _ ma eo ur i. e. buy $500 in supplies on account go our _ a up/d _g o u n A, L own? p/d , ow OE? nd ow e Dr/ Cr? i. e. earn $50 cash by cutting a lawn i. e. withdraw $200 from the bus for personal use Chapter 2 -19 LO 2 Define debits and credits and explain their use in recording business transactions.

How can I remember what to Credit or Debit? One way is to create a few simple scenarios in your head… Did To i. e. pay $1000 in salaries with cashk Is our _ ma eo ur i. e. buy $500 in supplies on account go our _ a up/d _g o u n A, L own? p/d , ow OE? nd ow e Dr/ Cr? i. e. earn $50 cash by cutting a lawn i. e. withdraw $200 from the bus for personal use Chapter 2 -19 LO 2 Define debits and credits and explain their use in recording business transactions.

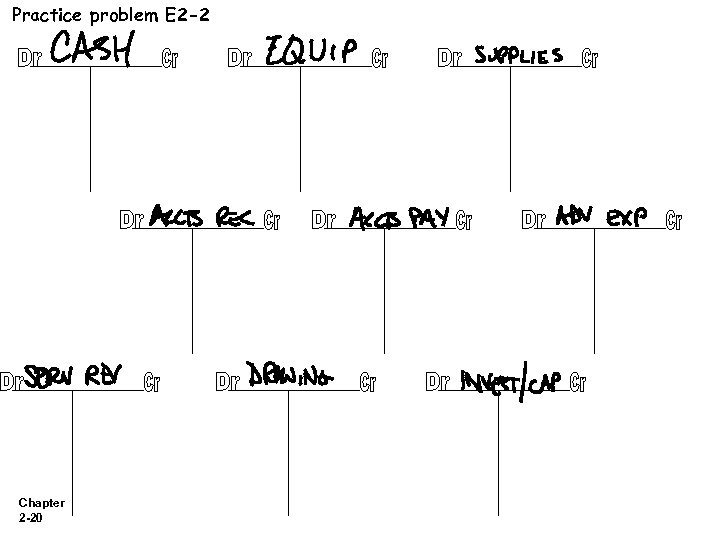

Practice problem E 2 -2 Chapter 2 -20

Practice problem E 2 -2 Chapter 2 -20

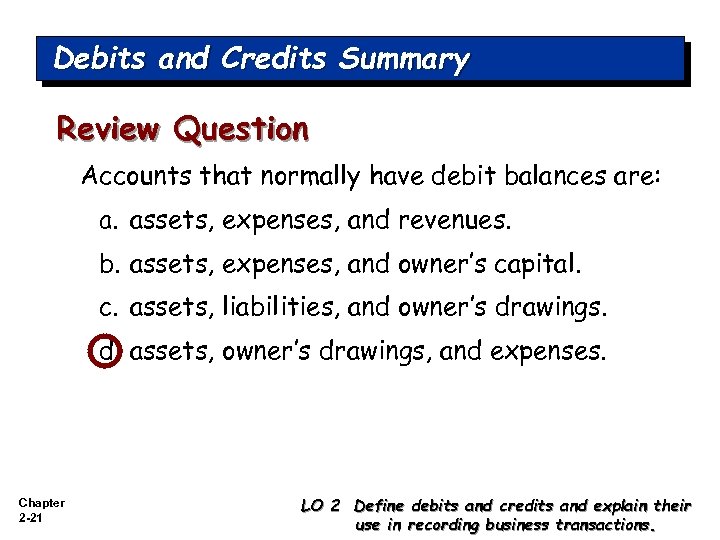

Debits and Credits Summary Review Question Accounts that normally have debit balances are: a. assets, expenses, and revenues. b. assets, expenses, and owner’s capital. c. assets, liabilities, and owner’s drawings. d. assets, owner’s drawings, and expenses. Chapter 2 -21 LO 2 Define debits and credits and explain their use in recording business transactions.

Debits and Credits Summary Review Question Accounts that normally have debit balances are: a. assets, expenses, and revenues. b. assets, expenses, and owner’s capital. c. assets, liabilities, and owner’s drawings. d. assets, owner’s drawings, and expenses. Chapter 2 -21 LO 2 Define debits and credits and explain their use in recording business transactions.

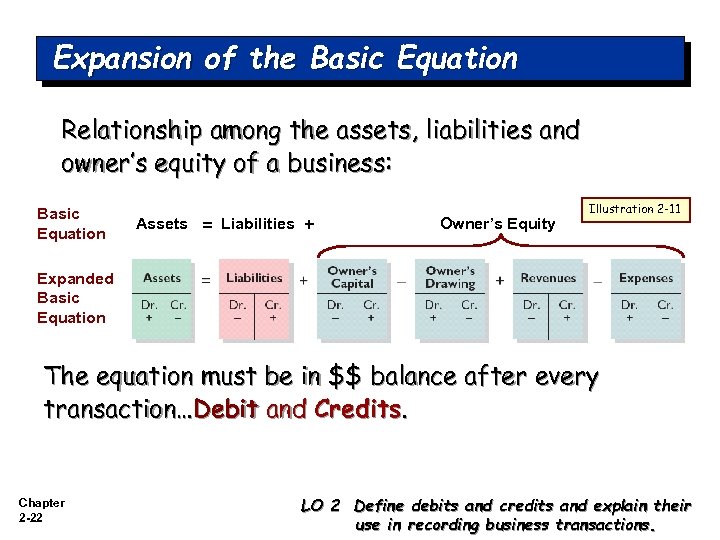

Expansion of the Basic Equation Relationship among the assets, liabilities and owner’s equity of a business: Basic Equation Assets = Liabilities + Owner’s Equity Illustration 2 -11 Expanded Basic Equation The equation must be in $$ balance after every transaction…Debit and Credits. Chapter 2 -22 LO 2 Define debits and credits and explain their use in recording business transactions.

Expansion of the Basic Equation Relationship among the assets, liabilities and owner’s equity of a business: Basic Equation Assets = Liabilities + Owner’s Equity Illustration 2 -11 Expanded Basic Equation The equation must be in $$ balance after every transaction…Debit and Credits. Chapter 2 -22 LO 2 Define debits and credits and explain their use in recording business transactions.

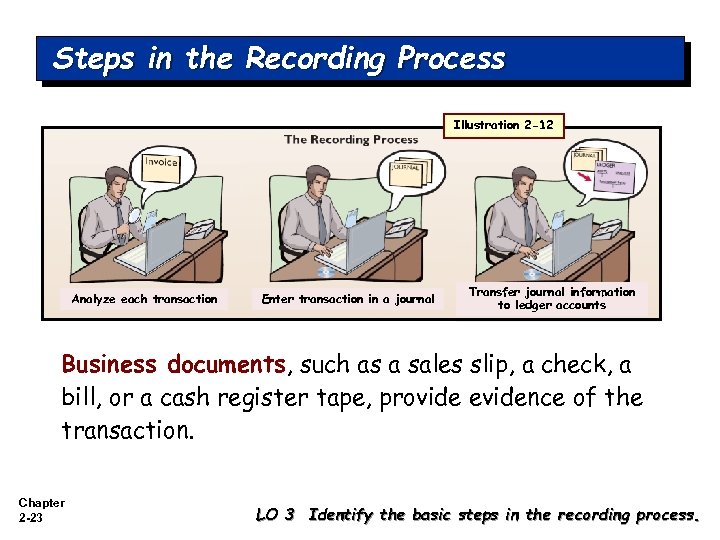

Steps in the Recording Process Illustration 2 -12 Analyze each transaction Enter transaction in a journal Transfer journal information to ledger accounts Business documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. Chapter 2 -23 LO 3 Identify the basic steps in the recording process.

Steps in the Recording Process Illustration 2 -12 Analyze each transaction Enter transaction in a journal Transfer journal information to ledger accounts Business documents, such as a sales slip, a check, a bill, or a cash register tape, provide evidence of the transaction. Chapter 2 -23 LO 3 Identify the basic steps in the recording process.

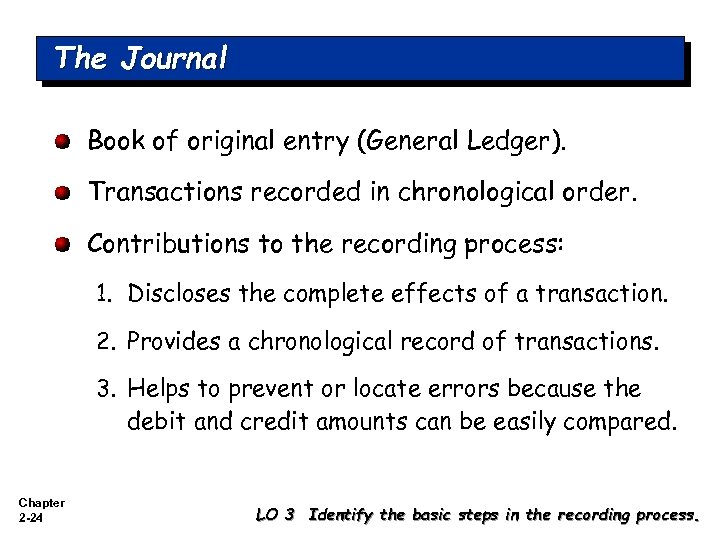

The Journal Book of original entry (General Ledger). Transactions recorded in chronological order. Contributions to the recording process: 1. Discloses the complete effects of a transaction. 2. Provides a chronological record of transactions. 3. Helps to prevent or locate errors because the debit and credit amounts can be easily compared. Chapter 2 -24 LO 3 Identify the basic steps in the recording process.

The Journal Book of original entry (General Ledger). Transactions recorded in chronological order. Contributions to the recording process: 1. Discloses the complete effects of a transaction. 2. Provides a chronological record of transactions. 3. Helps to prevent or locate errors because the debit and credit amounts can be easily compared. Chapter 2 -24 LO 3 Identify the basic steps in the recording process.

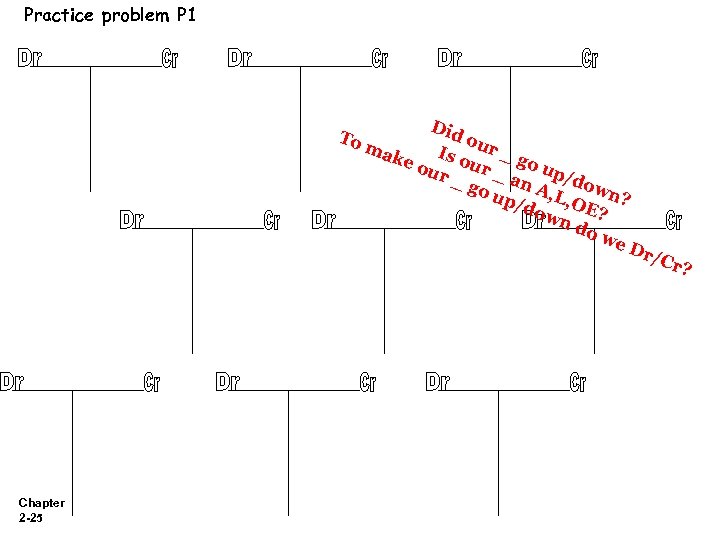

Practice problem P 1 To Did o ma Is o ur _ g ke our ur _ o up /d a _g o u n A, L own? p/d , ow OE? nd ow e. D r/C Chapter 2 -25 r?

Practice problem P 1 To Did o ma Is o ur _ g ke our ur _ o up /d a _g o u n A, L own? p/d , ow OE? nd ow e. D r/C Chapter 2 -25 r?

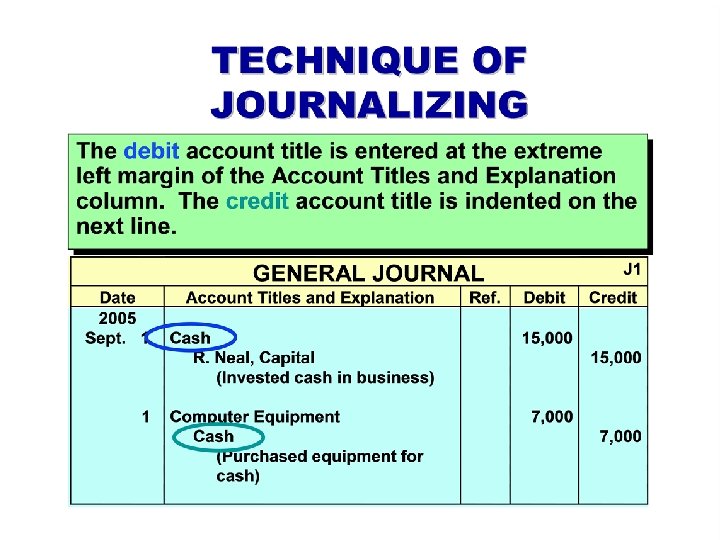

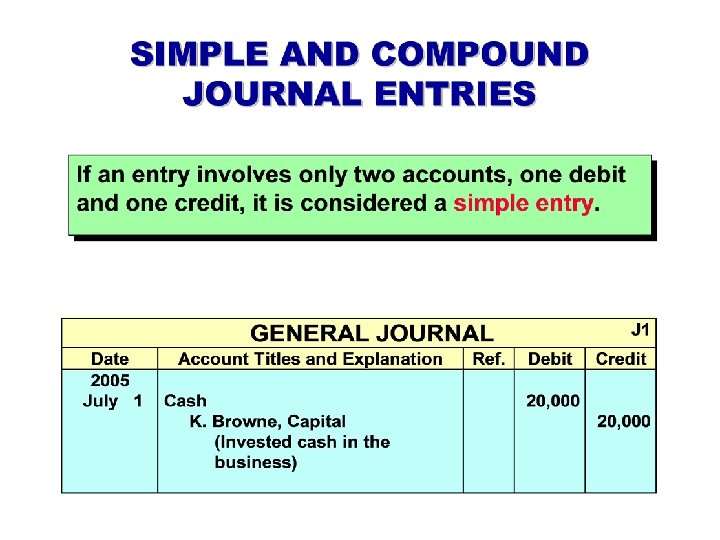

Journalizing - Entering transaction data in the journal. THE JOURNAL • Transactions are initially recorded in chronological order (as they occur) before they are transferred to the ledger accounts. • (This is like recording your own journal… you write everything down as it happens) Chapter 2 -26

Journalizing - Entering transaction data in the journal. THE JOURNAL • Transactions are initially recorded in chronological order (as they occur) before they are transferred to the ledger accounts. • (This is like recording your own journal… you write everything down as it happens) Chapter 2 -26

Journalizing - Entering transaction data in the journal. A journal makes several contributions to recording process: • • • Chapter 2 -27 discloses in one place the complete effect of a transaction provides a chronological record of transactions helps to prevent or locate errors as debit and credit amounts for each entry can be compared

Journalizing - Entering transaction data in the journal. A journal makes several contributions to recording process: • • • Chapter 2 -27 discloses in one place the complete effect of a transaction provides a chronological record of transactions helps to prevent or locate errors as debit and credit amounts for each entry can be compared

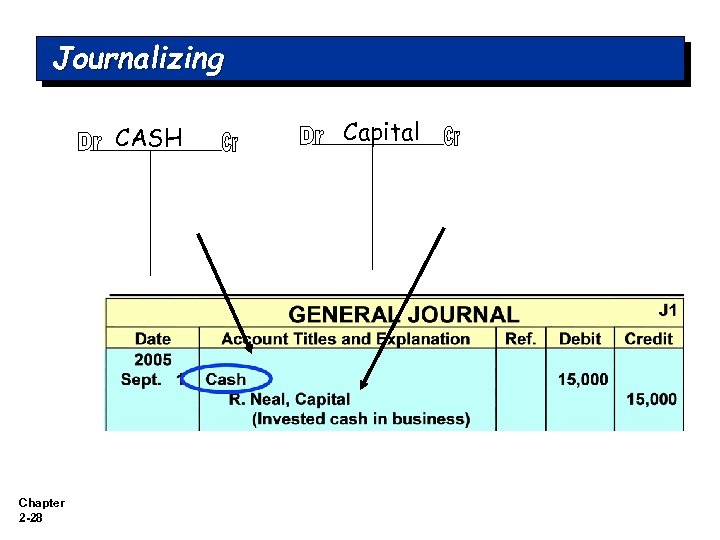

Journalizing CASH Chapter 2 -28 Capital

Journalizing CASH Chapter 2 -28 Capital

Journalizing Chapter 2 -29

Journalizing Chapter 2 -29

Journalizing - Entering transaction data in the journal. Chapter 2 -30

Journalizing - Entering transaction data in the journal. Chapter 2 -30

Journalizing - Entering transaction data in the journal. Chapter 2 -31

Journalizing - Entering transaction data in the journal. Chapter 2 -31

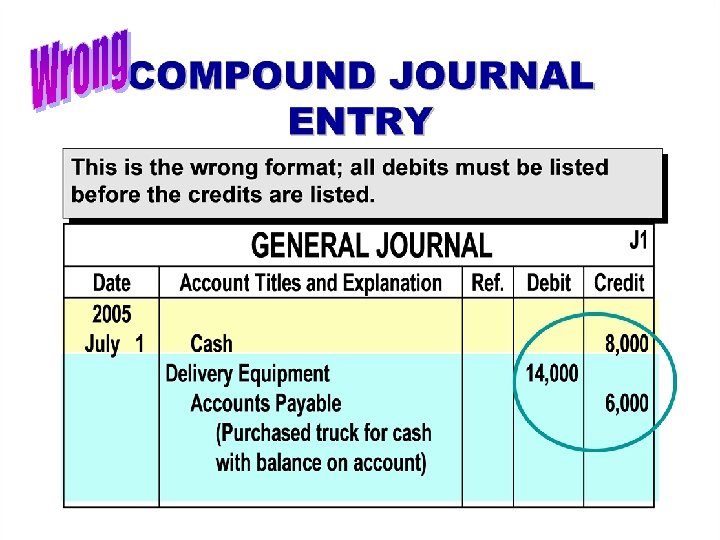

Creating a Compound Entry l Chapter 2 -32 We buy __ for $__. We have only $__ to put down. And must finance the rest.

Creating a Compound Entry l Chapter 2 -32 We buy __ for $__. We have only $__ to put down. And must finance the rest.

Journalizing - Entering transaction data in the journal. Chapter 2 -33

Journalizing - Entering transaction data in the journal. Chapter 2 -33

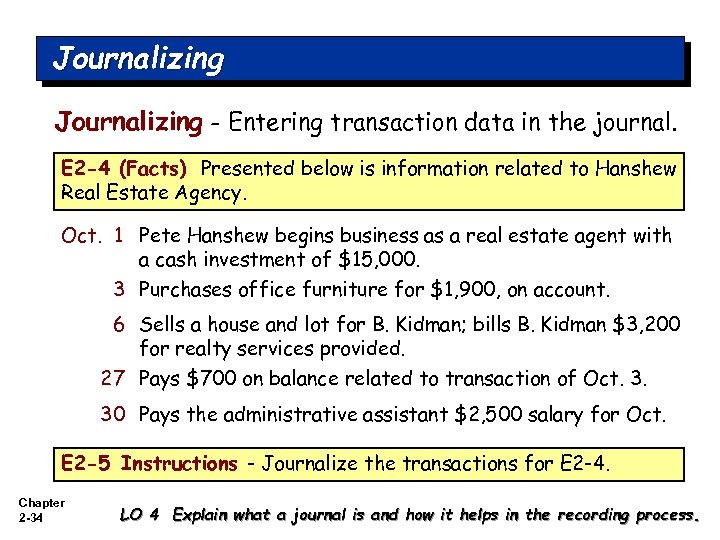

Journalizing - Entering transaction data in the journal. E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 1 Pete Hanshew begins business as a real estate agent with a cash investment of $15, 000. 3 Purchases office furniture for $1, 900, on account. 6 Sells a house and lot for B. Kidman; bills B. Kidman $3, 200 for realty services provided. 27 Pays $700 on balance related to transaction of Oct. 3. 30 Pays the administrative assistant $2, 500 salary for Oct. E 2 -5 Instructions - Journalize the transactions for E 2 -4. Chapter 2 -34 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing - Entering transaction data in the journal. E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 1 Pete Hanshew begins business as a real estate agent with a cash investment of $15, 000. 3 Purchases office furniture for $1, 900, on account. 6 Sells a house and lot for B. Kidman; bills B. Kidman $3, 200 for realty services provided. 27 Pays $700 on balance related to transaction of Oct. 3. 30 Pays the administrative assistant $2, 500 salary for Oct. E 2 -5 Instructions - Journalize the transactions for E 2 -4. Chapter 2 -34 LO 4 Explain what a journal is and how it helps in the recording process.

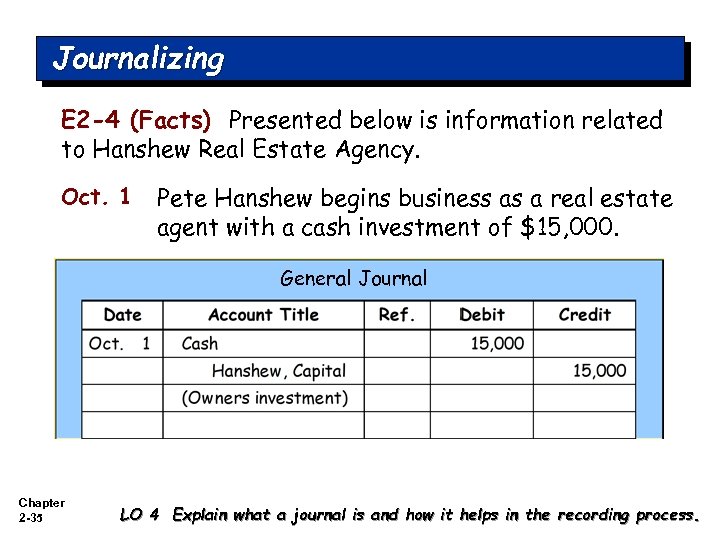

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 1 Pete Hanshew begins business as a real estate agent with a cash investment of $15, 000. General Journal Chapter 2 -35 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 1 Pete Hanshew begins business as a real estate agent with a cash investment of $15, 000. General Journal Chapter 2 -35 LO 4 Explain what a journal is and how it helps in the recording process.

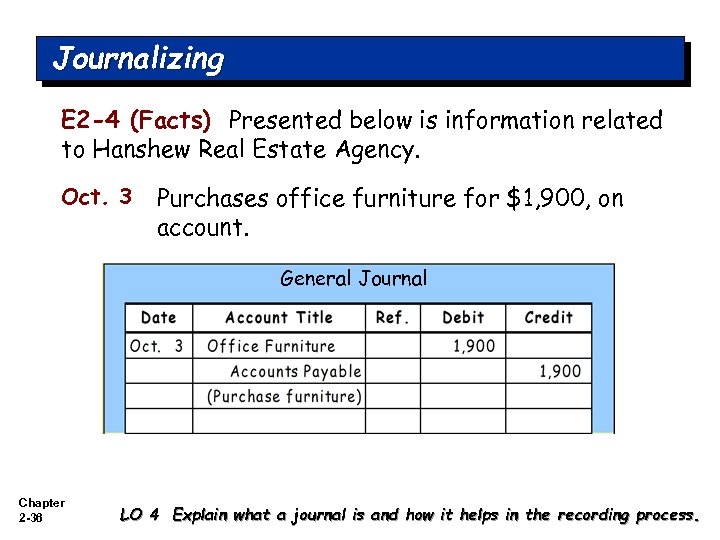

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 3 Purchases office furniture for $1, 900, on account. General Journal Chapter 2 -36 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 3 Purchases office furniture for $1, 900, on account. General Journal Chapter 2 -36 LO 4 Explain what a journal is and how it helps in the recording process.

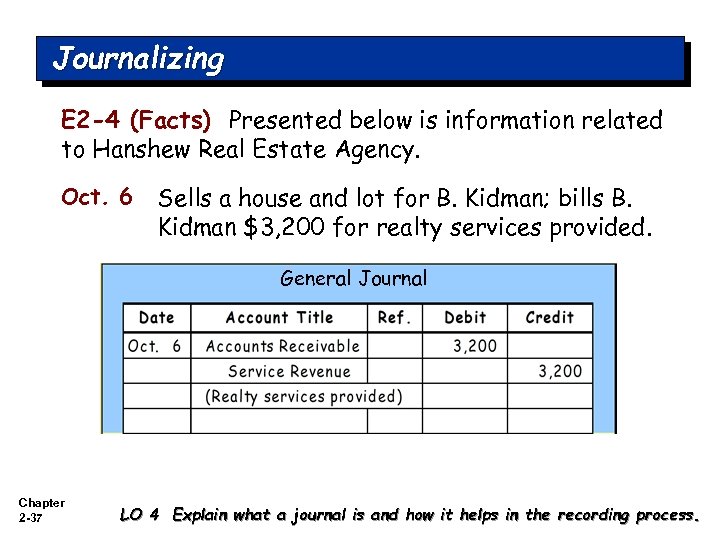

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 6 Sells a house and lot for B. Kidman; bills B. Kidman $3, 200 for realty services provided. General Journal Chapter 2 -37 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 6 Sells a house and lot for B. Kidman; bills B. Kidman $3, 200 for realty services provided. General Journal Chapter 2 -37 LO 4 Explain what a journal is and how it helps in the recording process.

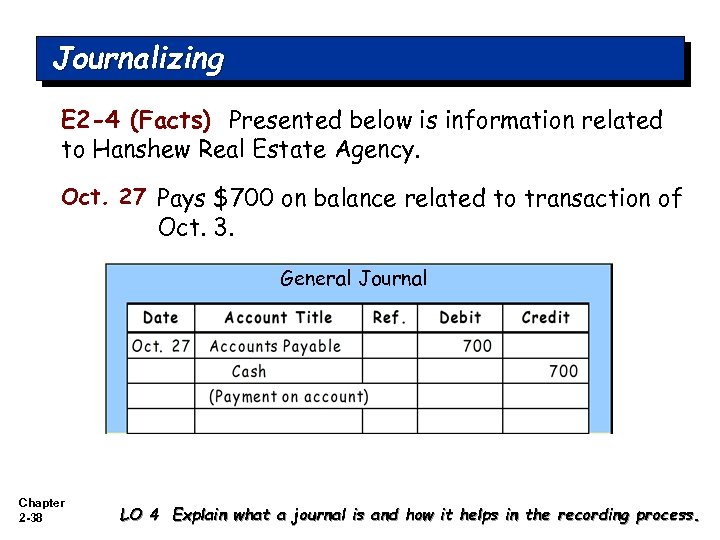

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 27 Pays $700 on balance related to transaction of Oct. 3. General Journal Chapter 2 -38 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 27 Pays $700 on balance related to transaction of Oct. 3. General Journal Chapter 2 -38 LO 4 Explain what a journal is and how it helps in the recording process.

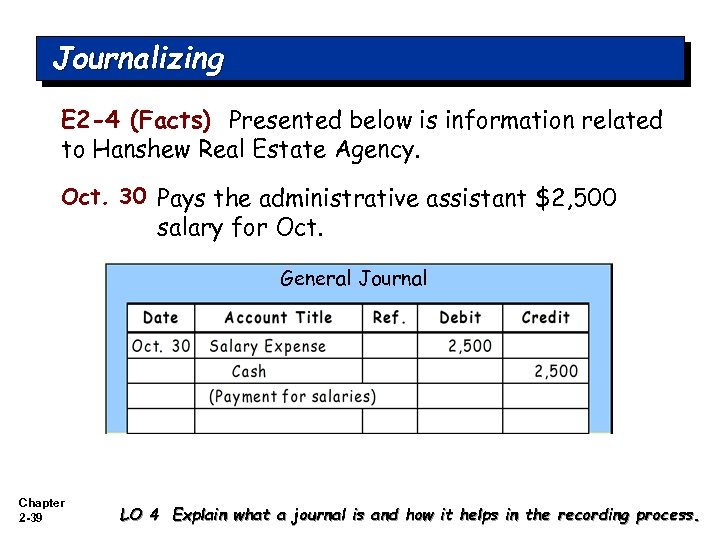

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 30 Pays the administrative assistant $2, 500 salary for Oct. General Journal Chapter 2 -39 LO 4 Explain what a journal is and how it helps in the recording process.

Journalizing E 2 -4 (Facts) Presented below is information related to Hanshew Real Estate Agency. Oct. 30 Pays the administrative assistant $2, 500 salary for Oct. General Journal Chapter 2 -39 LO 4 Explain what a journal is and how it helps in the recording process.

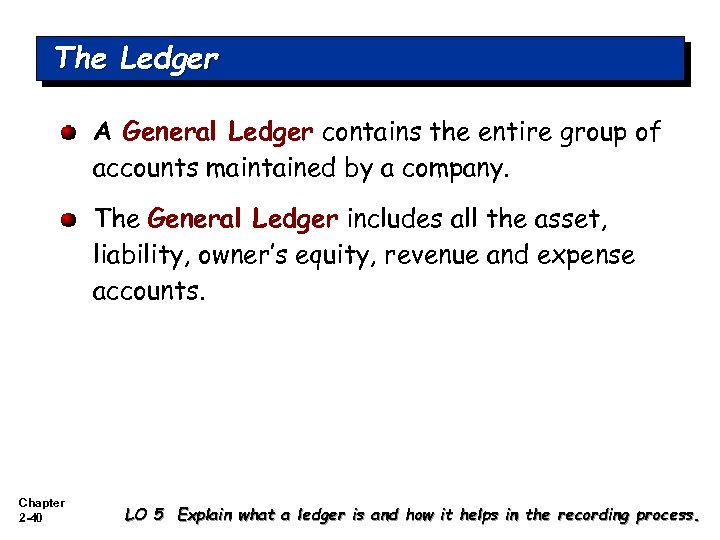

The Ledger A General Ledger contains the entire group of accounts maintained by a company. The General Ledger includes all the asset, liability, owner’s equity, revenue and expense accounts. Chapter 2 -40 LO 5 Explain what a ledger is and how it helps in the recording process.

The Ledger A General Ledger contains the entire group of accounts maintained by a company. The General Ledger includes all the asset, liability, owner’s equity, revenue and expense accounts. Chapter 2 -40 LO 5 Explain what a ledger is and how it helps in the recording process.

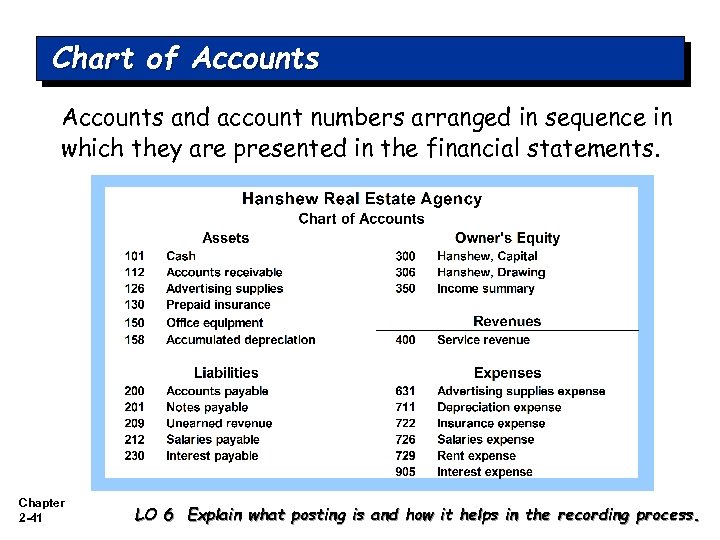

Chart of Accounts and account numbers arranged in sequence in which they are presented in the financial statements. Chapter 2 -41 LO 6 Explain what posting is and how it helps in the recording process.

Chart of Accounts and account numbers arranged in sequence in which they are presented in the financial statements. Chapter 2 -41 LO 6 Explain what posting is and how it helps in the recording process.

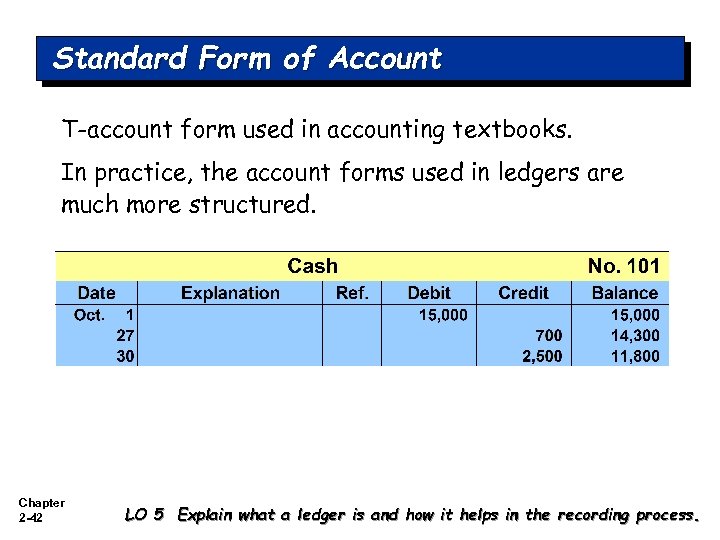

Standard Form of Account T-account form used in accounting textbooks. In practice, the account forms used in ledgers are much more structured. Chapter 2 -42 LO 5 Explain what a ledger is and how it helps in the recording process.

Standard Form of Account T-account form used in accounting textbooks. In practice, the account forms used in ledgers are much more structured. Chapter 2 -42 LO 5 Explain what a ledger is and how it helps in the recording process.

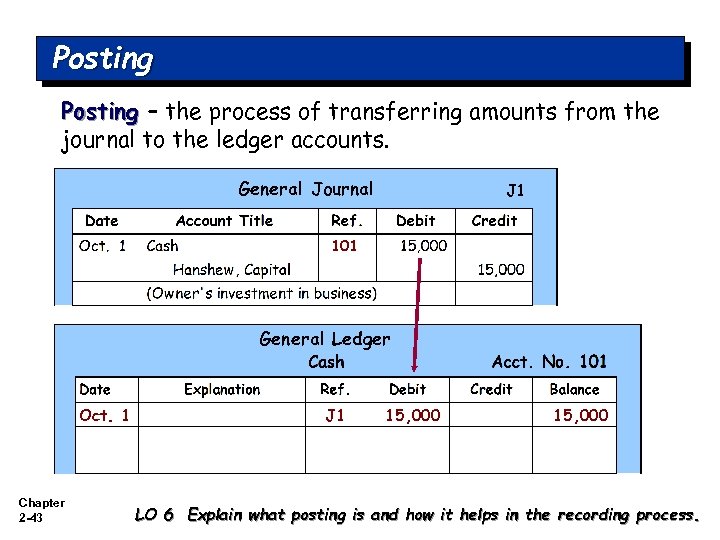

Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal J 1 101 General Ledger Oct. 1 Chapter 2 -43 J 1 15, 000 LO 6 Explain what posting is and how it helps in the recording process.

Posting – the process of transferring amounts from the journal to the ledger accounts. General Journal J 1 101 General Ledger Oct. 1 Chapter 2 -43 J 1 15, 000 LO 6 Explain what posting is and how it helps in the recording process.

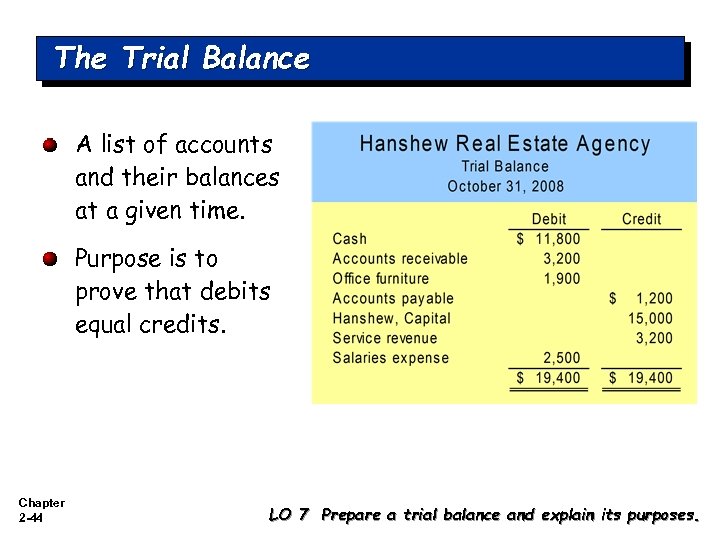

The Trial Balance A list of accounts and their balances at a given time. Purpose is to prove that debits equal credits. Chapter 2 -44 LO 7 Prepare a trial balance and explain its purposes.

The Trial Balance A list of accounts and their balances at a given time. Purpose is to prove that debits equal credits. Chapter 2 -44 LO 7 Prepare a trial balance and explain its purposes.

The Trial Balance Limitations of a Trial Balance The trial balance may balance even when 1. a transaction is not journalized, 2. a correct journal entry is not posted, 3. a journal entry is posted twice, 4. incorrect accounts are used in journalizing or posting, or 5. offsetting errors are made in recording the amount of a transaction. Chapter 2 -45 LO 7 Prepare a trial balance and explain its purposes.

The Trial Balance Limitations of a Trial Balance The trial balance may balance even when 1. a transaction is not journalized, 2. a correct journal entry is not posted, 3. a journal entry is posted twice, 4. incorrect accounts are used in journalizing or posting, or 5. offsetting errors are made in recording the amount of a transaction. Chapter 2 -45 LO 7 Prepare a trial balance and explain its purposes.