d9132cda903648f5acbe1bd134410d94.ppt

- Количество слайдов: 86

Chapter 2 -1 Asset Classes and Financial Instruments Mc. Graw-Hill/Irwin Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

Chapter 2 -1 Asset Classes and Financial Instruments Mc. Graw-Hill/Irwin Copyright © 2010 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

2. 1 Money Market Instruments • • Treasury Bills: Fed Certificates of Deposit: Banks Commercial Paper: Corp & banks Bankers’ Acceptances : Bank Eurodollars: bank & Corp Repos and Reverses Federal Funds: Deposit in Fed LIBOR (London Interbank Offer Rate): Banks 2 -2

2. 1 Money Market Instruments • • Treasury Bills: Fed Certificates of Deposit: Banks Commercial Paper: Corp & banks Bankers’ Acceptances : Bank Eurodollars: bank & Corp Repos and Reverses Federal Funds: Deposit in Fed LIBOR (London Interbank Offer Rate): Banks 2 -2

Treasury Bills • Treasury bills – – – – Issued by Denomination Maturity Liquidity Default risk Interest type Taxation Federal Government $100, commonly $10, 000 4, 13, 26, or 52 weeks Highly liquid None, why? Discount-(later on this) Federal taxes owed, exempt from state and local taxes 2 -3

Treasury Bills • Treasury bills – – – – Issued by Denomination Maturity Liquidity Default risk Interest type Taxation Federal Government $100, commonly $10, 000 4, 13, 26, or 52 weeks Highly liquid None, why? Discount-(later on this) Federal taxes owed, exempt from state and local taxes 2 -3

Certificates of Deposit (CD) – Issued by Depository Institutions – Denomination Any, $100, 000 or more are marketable Varies, typically 14 day minimum – Maturity – – Liquidity Default risk Interest type Taxation 3 months or less are liquid ( marketable) First $100, 000 ($250, 000) is insured Add on ( you get the deposit + interset) Interest income is fully taxable 2 -4

Certificates of Deposit (CD) – Issued by Depository Institutions – Denomination Any, $100, 000 or more are marketable Varies, typically 14 day minimum – Maturity – – Liquidity Default risk Interest type Taxation 3 months or less are liquid ( marketable) First $100, 000 ($250, 000) is insured Add on ( you get the deposit + interset) Interest income is fully taxable 2 -4

Commercial Paper • Commercial Paper Large creditworthy corporations and financial institutions Maximum 270 days, usually 1 to 2 months – Maturity – Denomination Minimum $100, 000 3 months or less are liquid if marketable – Liquidity Unsecured, Rated, Mostly high quality – Default risk – Interest type Discount Interest income is fully taxable – Taxation – Issued by 2 -5

Commercial Paper • Commercial Paper Large creditworthy corporations and financial institutions Maximum 270 days, usually 1 to 2 months – Maturity – Denomination Minimum $100, 000 3 months or less are liquid if marketable – Liquidity Unsecured, Rated, Mostly high quality – Default risk – Interest type Discount Interest income is fully taxable – Taxation – Issued by 2 -5

Bankers Acceptances & Eurodollars • Bankers Acceptances – Originates when a purchaser of goods authorizes its bank to pay the seller for the goods at a date in the future (time draft). – When the purchaser’s bank ‘accepts’ the draft it becomes a contingent liability of the bank and becomes a marketable security. • Eurodollars – Dollar denominated (time) deposits held outside the U. S. – Pay a higher interest rate than U. S. deposits. 2 -6

Bankers Acceptances & Eurodollars • Bankers Acceptances – Originates when a purchaser of goods authorizes its bank to pay the seller for the goods at a date in the future (time draft). – When the purchaser’s bank ‘accepts’ the draft it becomes a contingent liability of the bank and becomes a marketable security. • Eurodollars – Dollar denominated (time) deposits held outside the U. S. – Pay a higher interest rate than U. S. deposits. 2 -6

Federal Funds and LIBOR • Federal Funds – Depository institutions must maintain deposits with the Federal Reserve Bank. – Federal funds represents trading in reserves held on deposit at the Federal Reserve. – Key interest rate for the economy • LIBOR (London Interbank Offer Rate) – Rate at which large banks in London (and elsewhere) lend to each other. – Base rate for many loans and derivatives. 2 -7

Federal Funds and LIBOR • Federal Funds – Depository institutions must maintain deposits with the Federal Reserve Bank. – Federal funds represents trading in reserves held on deposit at the Federal Reserve. – Key interest rate for the economy • LIBOR (London Interbank Offer Rate) – Rate at which large banks in London (and elsewhere) lend to each other. – Base rate for many loans and derivatives. 2 -7

Repurchase Agreements and Reverses • Repurchase Agreements (RPs or repos) and Reverse RPs – Short term sales of securities arranged with an agreement to repurchase the securities a set higher price. – A RP is a collateralized loan, many are overnight, although “Term” RPs may have a one month maturity. – A Reverse Repo is lending money and obtaining security title as collateral. – “Haircuts” may be required depending on collateral quality 2 -8

Repurchase Agreements and Reverses • Repurchase Agreements (RPs or repos) and Reverse RPs – Short term sales of securities arranged with an agreement to repurchase the securities a set higher price. – A RP is a collateralized loan, many are overnight, although “Term” RPs may have a one month maturity. – A Reverse Repo is lending money and obtaining security title as collateral. – “Haircuts” may be required depending on collateral quality 2 -8

2 -9

2 -9

Haircut • The buyer assumes the collateral as repayment should the seller default. If the collateral has a volatile price history the buyer is at risk. • To reduce this risk, a haircut is imposed. The haircut is some percentage of the market value the buyer holds back from the cash payment to account for the price volatility as well as counterparty risk. • Ex. If the haircut is 10% on 10 mm market value bonds, the buyer receives 10 mm in bonds and the seller receives 9 mm in cash. At the end of the repo term, the seller pays the 9 mm cash back plus interest and receives the same 10 mm bonds back 2 -10

Haircut • The buyer assumes the collateral as repayment should the seller default. If the collateral has a volatile price history the buyer is at risk. • To reduce this risk, a haircut is imposed. The haircut is some percentage of the market value the buyer holds back from the cash payment to account for the price volatility as well as counterparty risk. • Ex. If the haircut is 10% on 10 mm market value bonds, the buyer receives 10 mm in bonds and the seller receives 9 mm in cash. At the end of the repo term, the seller pays the 9 mm cash back plus interest and receives the same 10 mm bonds back 2 -10

Money Market Instruments • Call Money Rate (later ch 3) – Investors who buy stock on margin borrow money from their brokers to purchase stock. The borrowing rate is the call money rate. – The loan may be ‘called in’ by the broker. 2 -11

Money Market Instruments • Call Money Rate (later ch 3) – Investors who buy stock on margin borrow money from their brokers to purchase stock. The borrowing rate is the call money rate. – The loan may be ‘called in’ by the broker. 2 -11

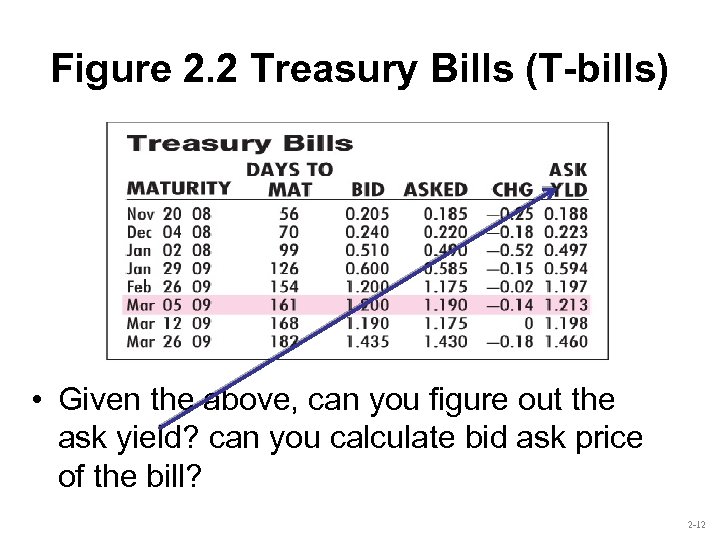

Figure 2. 2 Treasury Bills (T-bills) • Given the above, can you figure out the ask yield? can you calculate bid ask price of the bill? 2 -12

Figure 2. 2 Treasury Bills (T-bills) • Given the above, can you figure out the ask yield? can you calculate bid ask price of the bill? 2 -12

![Price = $10, 000 x [ 1 – T-bill rate x (N/360)] BID: $10, Price = $10, 000 x [ 1 – T-bill rate x (N/360)] BID: $10,](https://present5.com/presentation/d9132cda903648f5acbe1bd134410d94/image-13.jpg) Price = $10, 000 x [ 1 – T-bill rate x (N/360)] BID: $10, 000 X [1 -. 0120 X (161/360)] = $9, 946. 33 ASK: $10, 000 X (1 -. 01190 x(161/360) = $9, 946. 80. 2 -13

Price = $10, 000 x [ 1 – T-bill rate x (N/360)] BID: $10, 000 X [1 -. 0120 X (161/360)] = $9, 946. 33 ASK: $10, 000 X (1 -. 01190 x(161/360) = $9, 946. 80. 2 -13

BEY: Bond-Equivalent Yield • An investor who buys the bill for the asked price and holds it until maturity will see her investment grow over 161 days by a multiple of • $10, 000/$9, 946. 80 = 1. 00535, or. 535%. But this is the return for 161 days only. • Annualizing this return using a 365 -day year results in a yield of. 535% X 365/161 = 1. 213%. • In short: 2 -14

BEY: Bond-Equivalent Yield • An investor who buys the bill for the asked price and holds it until maturity will see her investment grow over 161 days by a multiple of • $10, 000/$9, 946. 80 = 1. 00535, or. 535%. But this is the return for 161 days only. • Annualizing this return using a 365 -day year results in a yield of. 535% X 365/161 = 1. 213%. • In short: 2 -14

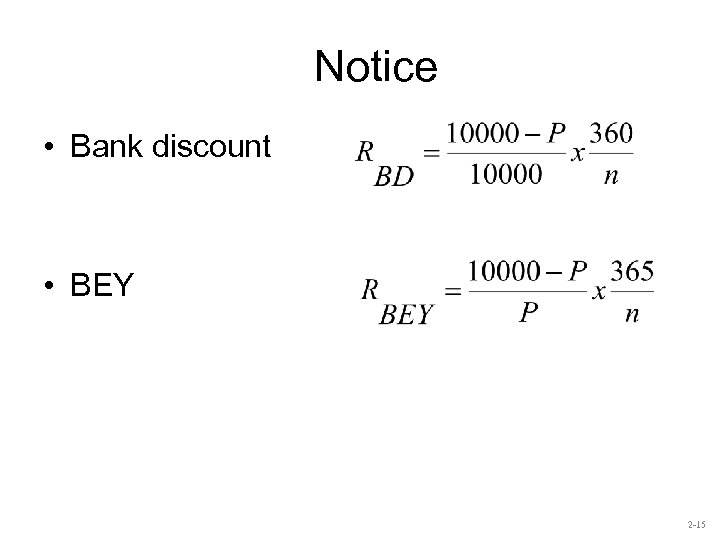

Notice • Bank discount • BEY 2 -15

Notice • Bank discount • BEY 2 -15

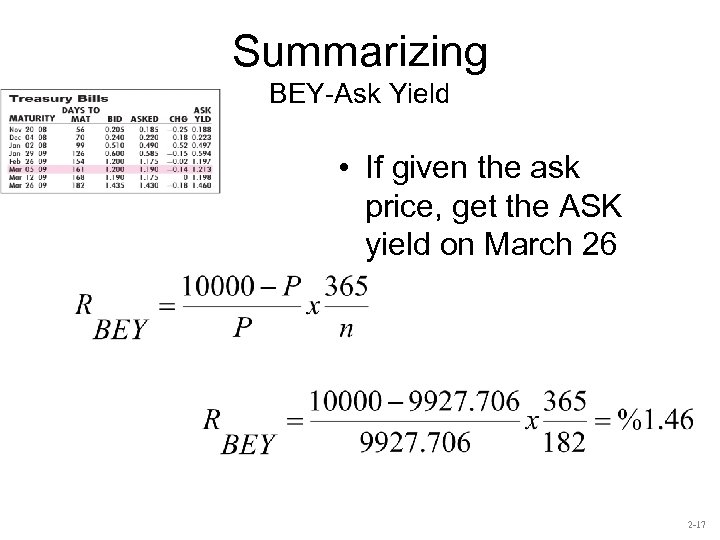

• Exercise • Do the same for • Jan 29 BID 9979 ASK 9979. 525 bond-equivalent yield 0. 594% • March 26 BID 9927. 453 ASK 9927. 706 bond-equivalent yield 1. 46% 2 -16

• Exercise • Do the same for • Jan 29 BID 9979 ASK 9979. 525 bond-equivalent yield 0. 594% • March 26 BID 9927. 453 ASK 9927. 706 bond-equivalent yield 1. 46% 2 -16

Summarizing BEY-Ask Yield • If given the ask price, get the ASK yield on March 26 2 -17

Summarizing BEY-Ask Yield • If given the ask price, get the ASK yield on March 26 2 -17

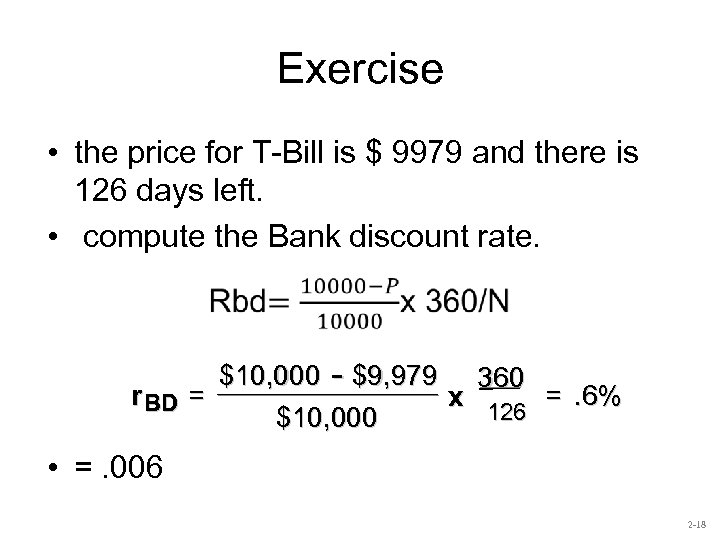

Exercise • the price for T-Bill is $ 9979 and there is 126 days left. • compute the Bank discount rate. $10, 000 - $9, 979 360 r BD = =. 6% x 126 $10, 000 • =. 006 2 -18

Exercise • the price for T-Bill is $ 9979 and there is 126 days left. • compute the Bank discount rate. $10, 000 - $9, 979 360 r BD = =. 6% x 126 $10, 000 • =. 006 2 -18

Example: Bank Discount Rate Given T-Bill price • r. BD • P • n = bank discount rate = market price of the T-bill = number of days to maturity 90 -day T-bill, P = $9, 875 $10, 000 - $9, 875 360 r BD = = 5% x $10, 000 90 2 -19

Example: Bank Discount Rate Given T-Bill price • r. BD • P • n = bank discount rate = market price of the T-bill = number of days to maturity 90 -day T-bill, P = $9, 875 $10, 000 - $9, 875 360 r BD = = 5% x $10, 000 90 2 -19

Bond Equivalent Yield r BEY 10, 000 - P 365 = x n P r. BD=5% P = price of the T-bill n = number of days to maturity Example Using Sample T-Bill 10, 000 - 9, 875 365 r BEY = x 9, 875 90 r. BEY =. 0127 x 4. 0556 =. 0513 = 5. 13% 2 -20

Bond Equivalent Yield r BEY 10, 000 - P 365 = x n P r. BD=5% P = price of the T-bill n = number of days to maturity Example Using Sample T-Bill 10, 000 - 9, 875 365 r BEY = x 9, 875 90 r. BEY =. 0127 x 4. 0556 =. 0513 = 5. 13% 2 -20

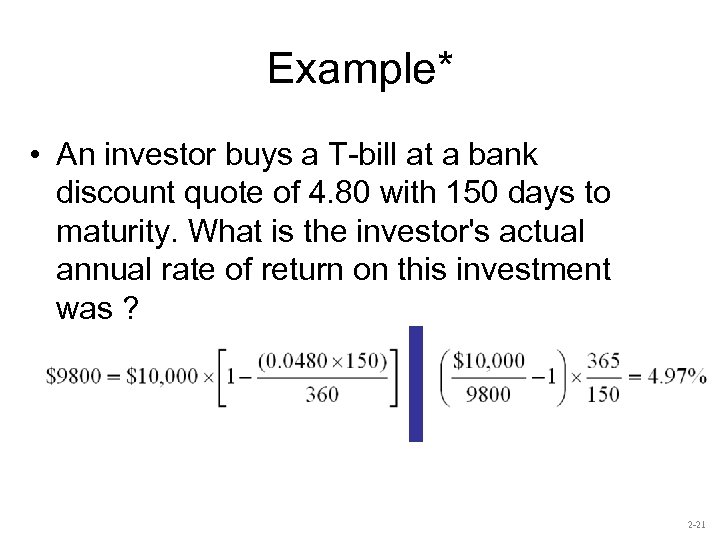

Example* • An investor buys a T-bill at a bank discount quote of 4. 80 with 150 days to maturity. What is the investor's actual annual rate of return on this investment was ? 2 -21

Example* • An investor buys a T-bill at a bank discount quote of 4. 80 with 150 days to maturity. What is the investor's actual annual rate of return on this investment was ? 2 -21

Money Market Instrument Yields • Yields on money market instruments are not always directly comparable Factors influencing “quoted” yields • Par value vs. investment value • 360 vs. 365 days assumed in a year (366 leap year) • Simple vs. Compound Interest 2 -22

Money Market Instrument Yields • Yields on money market instruments are not always directly comparable Factors influencing “quoted” yields • Par value vs. investment value • 360 vs. 365 days assumed in a year (366 leap year) • Simple vs. Compound Interest 2 -22

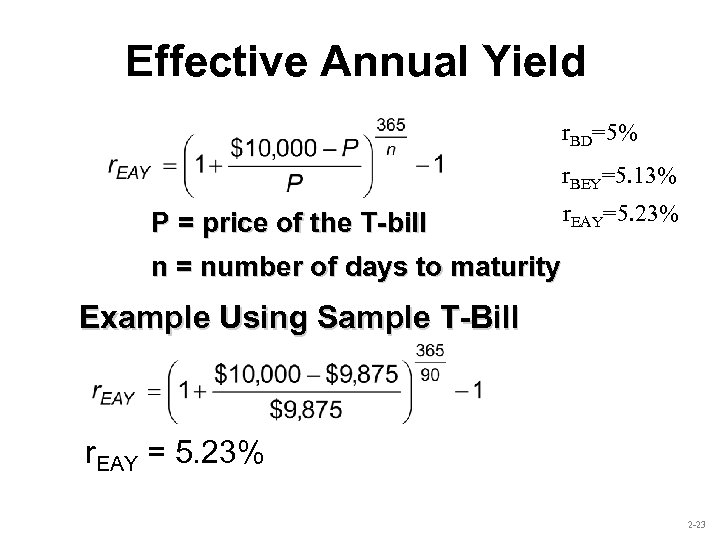

Effective Annual Yield r. BD=5% r. BEY=5. 13% P = price of the T-bill r. EAY=5. 23% n = number of days to maturity Example Using Sample T-Bill r. EAY = 5. 23% 2 -23

Effective Annual Yield r. BD=5% r. BEY=5. 13% P = price of the T-bill r. EAY=5. 23% n = number of days to maturity Example Using Sample T-Bill r. EAY = 5. 23% 2 -23

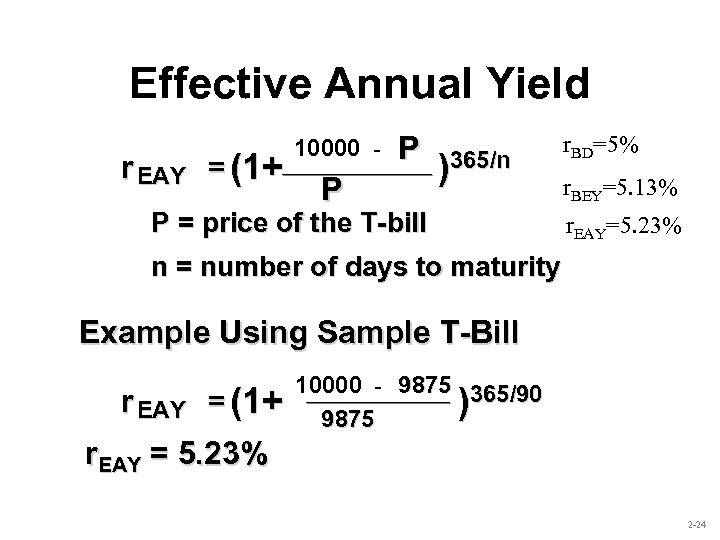

Effective Annual Yield r EAY = (1+ 10000 - P P )365/n P = price of the T-bill r. BD=5% r. BEY=5. 13% r. EAY=5. 23% n = number of days to maturity Example Using Sample T-Bill r EAY = (1+ 10000 - 9875 365/90 ) 9875 r. EAY = 5. 23% 2 -24

Effective Annual Yield r EAY = (1+ 10000 - P P )365/n P = price of the T-bill r. BD=5% r. BEY=5. 13% r. EAY=5. 23% n = number of days to maturity Example Using Sample T-Bill r EAY = (1+ 10000 - 9875 365/90 ) 9875 r. EAY = 5. 23% 2 -24

Money Market Instruments • • Treasury bills Discount Certificates of deposit BEY* Commercial Paper Discount Bankers Acceptances Discount Eurodollars BEY* Federal Funds BEY* Repurchase Agreements (RPs) and Reverse RPs Discount 2 -25

Money Market Instruments • • Treasury bills Discount Certificates of deposit BEY* Commercial Paper Discount Bankers Acceptances Discount Eurodollars BEY* Federal Funds BEY* Repurchase Agreements (RPs) and Reverse RPs Discount 2 -25

2. 2 The Bond Market 2 -26

2. 2 The Bond Market 2 -26

Capital Market - Fixed Income Instruments Government Issues • US Treasury Bonds and Notes – Bonds (10 -30 years) versus Notes ( up to 10 years) – Denomination ($100, mostly $1000) – Interest type ( semi-annual) – Risk? Taxation? Variation: Treasury Inflation Protected Securities (TIPS) • Tips have principal adjusted for increases in the Consumer Price Index 2 -27

Capital Market - Fixed Income Instruments Government Issues • US Treasury Bonds and Notes – Bonds (10 -30 years) versus Notes ( up to 10 years) – Denomination ($100, mostly $1000) – Interest type ( semi-annual) – Risk? Taxation? Variation: Treasury Inflation Protected Securities (TIPS) • Tips have principal adjusted for increases in the Consumer Price Index 2 -27

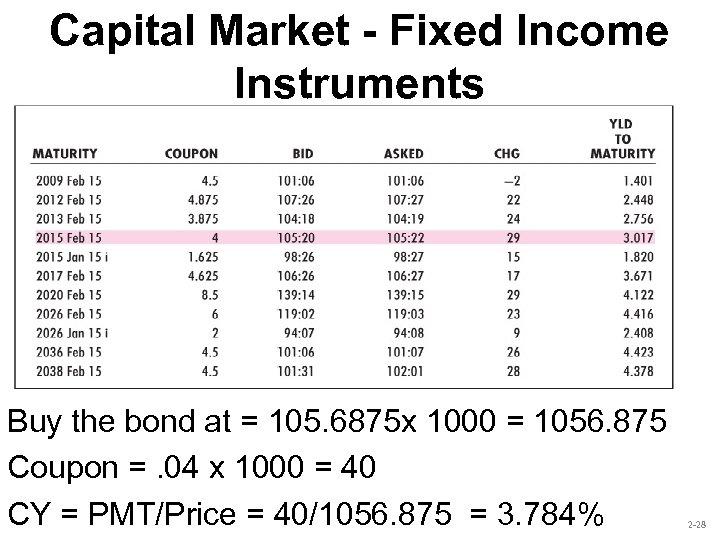

Capital Market - Fixed Income Instruments Buy the bond at = 105. 6875 x 1000 = 1056. 875 Coupon =. 04 x 1000 = 40 CY = PMT/Price = 40/1056. 875 = 3. 784% 2 -28

Capital Market - Fixed Income Instruments Buy the bond at = 105. 6875 x 1000 = 1056. 875 Coupon =. 04 x 1000 = 40 CY = PMT/Price = 40/1056. 875 = 3. 784% 2 -28

Capital Market - Fixed Income Instruments Government Issues • Agency Issues (Fed Gov) – Most are home mortgage related • Issuers: FNMA, FHLMC, GNMA, Federal Home Loan Banks – Risk of these securities? • Implied backing by the government • In September 2008, Federal government took over FNMA and FHLMC. (sup-prime) 2 -29

Capital Market - Fixed Income Instruments Government Issues • Agency Issues (Fed Gov) – Most are home mortgage related • Issuers: FNMA, FHLMC, GNMA, Federal Home Loan Banks – Risk of these securities? • Implied backing by the government • In September 2008, Federal government took over FNMA and FHLMC. (sup-prime) 2 -29

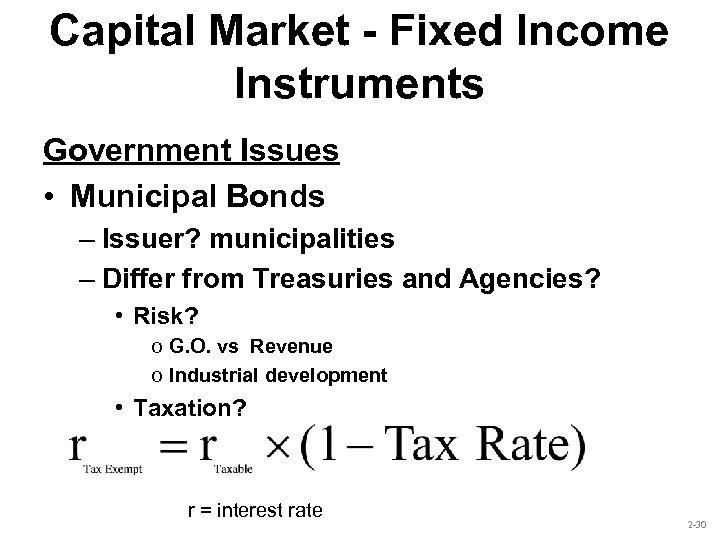

Capital Market - Fixed Income Instruments Government Issues • Municipal Bonds – Issuer? municipalities – Differ from Treasuries and Agencies? • Risk? o G. O. vs Revenue o Industrial development • Taxation? r = interest rate 2 -30

Capital Market - Fixed Income Instruments Government Issues • Municipal Bonds – Issuer? municipalities – Differ from Treasuries and Agencies? • Risk? o G. O. vs Revenue o Industrial development • Taxation? r = interest rate 2 -30

Table 2. 3 Equivalent Taxable Yields 2 -31

Table 2. 3 Equivalent Taxable Yields 2 -31

Example • A municipal bond carries a coupon rate of 6% and is trading at par. What would be the equivalent taxable yield of this bond to a taxpayer in a 35% tax bracket? • Taxable equivalent yield =. 06 / (1 -. 35) =. 0923 2 -32

Example • A municipal bond carries a coupon rate of 6% and is trading at par. What would be the equivalent taxable yield of this bond to a taxpayer in a 35% tax bracket? • Taxable equivalent yield =. 06 / (1 -. 35) =. 0923 2 -32

Example An investor is in a 30% combined federal plus state tax bracket. If corporate bonds offer 9% yields, what must municipals offer for the investor to prefer them to corporate bonds? [0. 09 x (1 – 0. 30)] = 0. 0630 = 6. 30%. Therefore, the municipals must offer at least 6. 30% yields. 2 -33

Example An investor is in a 30% combined federal plus state tax bracket. If corporate bonds offer 9% yields, what must municipals offer for the investor to prefer them to corporate bonds? [0. 09 x (1 – 0. 30)] = 0. 0630 = 6. 30%. Therefore, the municipals must offer at least 6. 30% yields. 2 -33

Example • Suppose that short-term municipal bonds (M) currently offer yields of 4%, while comparable taxable bonds (B) pay 5%. Which gives you the higher after-tax yield if your tax bracket is: • a. Zero B • b. 10% B • c. 20% equal • d. 30% M 2 -34

Example • Suppose that short-term municipal bonds (M) currently offer yields of 4%, while comparable taxable bonds (B) pay 5%. Which gives you the higher after-tax yield if your tax bracket is: • a. Zero B • b. 10% B • c. 20% equal • d. 30% M 2 -34

Continue from previous Find the equivalent taxable yield of the municipal bond in the pervious slide for tax brackets of zero, 10%, 20%, and 30%. – 4. 00% – 4. 44% – 5. 00% – 5. 71% 2 -35

Continue from previous Find the equivalent taxable yield of the municipal bond in the pervious slide for tax brackets of zero, 10%, 20%, and 30%. – 4. 00% – 4. 44% – 5. 00% – 5. 71% 2 -35

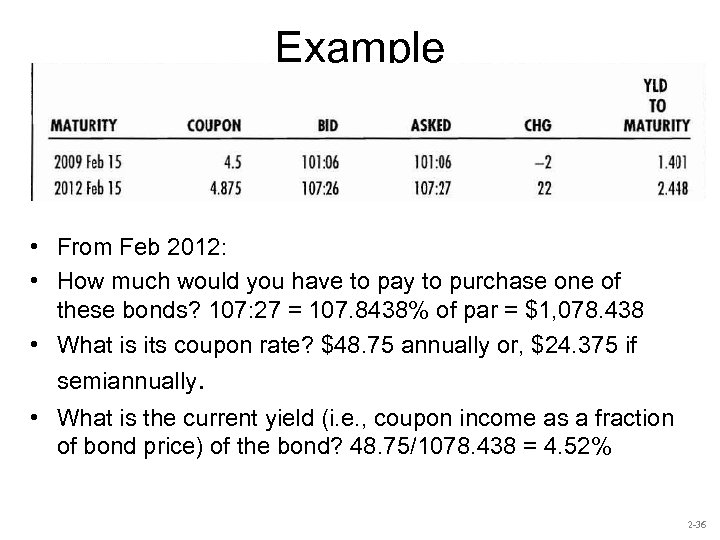

Example • From Feb 2012: • How much would you have to pay to purchase one of these bonds? 107: 27 = 107. 8438% of par = $1, 078. 438 • What is its coupon rate? $48. 75 annually or, $24. 375 if semiannually. • What is the current yield (i. e. , coupon income as a fraction of bond price) of the bond? 48. 75/1078. 438 = 4. 52% 2 -36

Example • From Feb 2012: • How much would you have to pay to purchase one of these bonds? 107: 27 = 107. 8438% of par = $1, 078. 438 • What is its coupon rate? $48. 75 annually or, $24. 375 if semiannually. • What is the current yield (i. e. , coupon income as a fraction of bond price) of the bond? 48. 75/1078. 438 = 4. 52% 2 -36

Capital Market - Fixed Income Instruments Private Issues • Corporate Bonds – Investment grade vs speculative grade – Risker than Gov bond – Coupon : semi – Callable 2 -37

Capital Market - Fixed Income Instruments Private Issues • Corporate Bonds – Investment grade vs speculative grade – Risker than Gov bond – Coupon : semi – Callable 2 -37

Capital Market - Fixed Income Instruments • Mortgage-Backed Securities (read book 34 -36) – Pass-through • A security backed by a pool of mortgages. The pool backer ‘passes through’ monthly mortgage payments made by homeowners and covers payments from any homeowners that default. • Collateral: – Traditionally all mortgages were conforming mortgages but since 2006, Alt-A and subprime mortgages were included in pools 2 -38

Capital Market - Fixed Income Instruments • Mortgage-Backed Securities (read book 34 -36) – Pass-through • A security backed by a pool of mortgages. The pool backer ‘passes through’ monthly mortgage payments made by homeowners and covers payments from any homeowners that default. • Collateral: – Traditionally all mortgages were conforming mortgages but since 2006, Alt-A and subprime mortgages were included in pools 2 -38

Capital Market - Fixed Income Instruments • Mortgage-Backed Securities • Political encouragement to spur affordable housing led to increase in subprime lending • Private banks began to purchase and sell pools of subprime mortgages • Pool issuers assumed housing prices would continue to rise, but they began to fall as far back as 2006 with disastrous results for the markets. 2 -39

Capital Market - Fixed Income Instruments • Mortgage-Backed Securities • Political encouragement to spur affordable housing led to increase in subprime lending • Private banks began to purchase and sell pools of subprime mortgages • Pool issuers assumed housing prices would continue to rise, but they began to fall as far back as 2006 with disastrous results for the markets. 2 -39

The U. S. Bond Market 2 -40

The U. S. Bond Market 2 -40

2. 3 Equity Securities 2 -41

2. 3 Equity Securities 2 -41

Capital Market - Equity • Common stock (p 36 -37) – Residual claim • Cash flows to common stock? • In the event of bankruptcy, what will stockholders receive? – Limited liability • What is the maximum loss on a stock purchase? 2 -42

Capital Market - Equity • Common stock (p 36 -37) – Residual claim • Cash flows to common stock? • In the event of bankruptcy, what will stockholders receive? – Limited liability • What is the maximum loss on a stock purchase? 2 -42

Capital Market - Equity • Preferred stock – Fixed dividends: limited gains, non-voting – Priority over common – Tax treatment • Preferred & common dividends are not tax deductible to the issuing firm • Corporate tax exclusion on 70% dividends earned 2 -43

Capital Market - Equity • Preferred stock – Fixed dividends: limited gains, non-voting – Priority over common – Tax treatment • Preferred & common dividends are not tax deductible to the issuing firm • Corporate tax exclusion on 70% dividends earned 2 -43

Capital Market - Equity • Depository Receipts – American Depository Receipts (ADRs) also called American Depository Shares (ADSs) are certificates traded in the U. S. that represent ownership in a foreign security. 2 -44

Capital Market - Equity • Depository Receipts – American Depository Receipts (ADRs) also called American Depository Shares (ADSs) are certificates traded in the U. S. that represent ownership in a foreign security. 2 -44

Capital Market - Equity • Capital Gains and Dividend Yields – You buy a share of stock for $50, hold it for one year, collect a $1. 00 dividend and sell the stock for $54. What were your dividend yield, capital gain yield and total return? (Ignore taxes) – Dividend yield: = Dividend / Pbuy $1. 00 / $50 = 2% – Capital gain yield: = (Psell – Pbuy)/ Pbuy ($54 - $50) / $50 = 8% – Total return: = Dividend yield + Capital gain yield 2% + 8% = 10% 2 -45

Capital Market - Equity • Capital Gains and Dividend Yields – You buy a share of stock for $50, hold it for one year, collect a $1. 00 dividend and sell the stock for $54. What were your dividend yield, capital gain yield and total return? (Ignore taxes) – Dividend yield: = Dividend / Pbuy $1. 00 / $50 = 2% – Capital gain yield: = (Psell – Pbuy)/ Pbuy ($54 - $50) / $50 = 8% – Total return: = Dividend yield + Capital gain yield 2% + 8% = 10% 2 -45

2. 4 Stock and Bond Indexes Uses • Track average returns • Comparing performance of managers • Base of derivatives Factors in constructing or using an index • Representative? • Broad or narrow? • How is it constructed? 2 -46

2. 4 Stock and Bond Indexes Uses • Track average returns • Comparing performance of managers • Base of derivatives Factors in constructing or using an index • Representative? • Broad or narrow? • How is it constructed? 2 -46

Construction of Indexes • How are stocks weighted? – Price weighted (DJIA) How much money do you put in each stock in the index? – Market-value weighted (S&P 500, NASDAQ) – Equally weighted (Value Line Index) 2 -47

Construction of Indexes • How are stocks weighted? – Price weighted (DJIA) How much money do you put in each stock in the index? – Market-value weighted (S&P 500, NASDAQ) – Equally weighted (Value Line Index) 2 -47

Constructing market indices • Indexes can be distinguished in four ways: – The market covered, – The types of stocks included, – How many stocks are included, and – How the index is calculated (price-weighted, e. g. DJIA, versus value-weighted, e. g. S&P 500). 2 -48

Constructing market indices • Indexes can be distinguished in four ways: – The market covered, – The types of stocks included, – How many stocks are included, and – How the index is calculated (price-weighted, e. g. DJIA, versus value-weighted, e. g. S&P 500). 2 -48

Constructing market indices • Price weighted average assumes buy 1 share each stock and invest cash and stock dividends proportionately. • For a price-weighted index (i. e. , the DJIA), higher priced stocks receive higher weights. • Value weighted: considers not only price but also # shares : – $ invested in each stock are proportional to market value of each stock – For a value-weighted index (i. e. , the S&P 500), companies with larger market values have higher weights. • Equal weighted: considers not only price but also # shares: – invest same amount of $ in each stock regardless of market value of stock 2 -49

Constructing market indices • Price weighted average assumes buy 1 share each stock and invest cash and stock dividends proportionately. • For a price-weighted index (i. e. , the DJIA), higher priced stocks receive higher weights. • Value weighted: considers not only price but also # shares : – $ invested in each stock are proportional to market value of each stock – For a value-weighted index (i. e. , the S&P 500), companies with larger market values have higher weights. • Equal weighted: considers not only price but also # shares: – invest same amount of $ in each stock regardless of market value of stock 2 -49

Example Price weighted • Three stocks have share prices of $12, $75, and $30 with total market values of $400 million, $350 million and $150 million respectively. If you were to construct a price-weighted index of the three stocks what would be the index value? • Index = (12 + 75 + 30)/3 = 39 2 -50

Example Price weighted • Three stocks have share prices of $12, $75, and $30 with total market values of $400 million, $350 million and $150 million respectively. If you were to construct a price-weighted index of the three stocks what would be the index value? • Index = (12 + 75 + 30)/3 = 39 2 -50

Price weighted Day 1 Stock NBK Zain Kipico Index Price (KD) 1. 2 2. 1 0. 8 1. 37 2 -51

Price weighted Day 1 Stock NBK Zain Kipico Index Price (KD) 1. 2 2. 1 0. 8 1. 37 2 -51

Day 2 Stock Price (KD) NBK 1. 3 Zain 2. 2 Kipico 1 Index 1. 50 2 -52

Day 2 Stock Price (KD) NBK 1. 3 Zain 2. 2 Kipico 1 Index 1. 50 2 -52

Change in index • 150 -137 / 1. 37 = 9. 76% 2 -53

Change in index • 150 -137 / 1. 37 = 9. 76% 2 -53

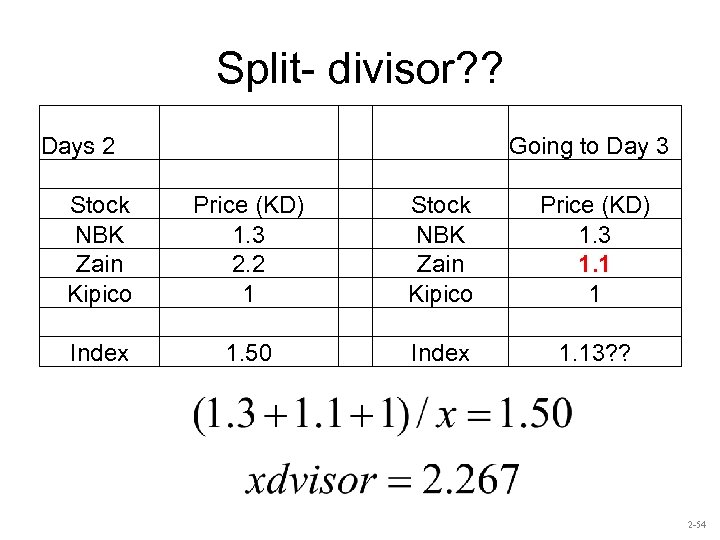

Split- divisor? ? Days 2 Going to Day 3 Stock NBK Zain Kipico Price (KD) 1. 3 2. 2 1 Stock NBK Zain Kipico Price (KD) 1. 3 1. 1 1 Index 1. 50 Index 1. 13? ? 2 -54

Split- divisor? ? Days 2 Going to Day 3 Stock NBK Zain Kipico Price (KD) 1. 3 2. 2 1 Stock NBK Zain Kipico Price (KD) 1. 3 1. 1 1 Index 1. 50 Index 1. 13? ? 2 -54

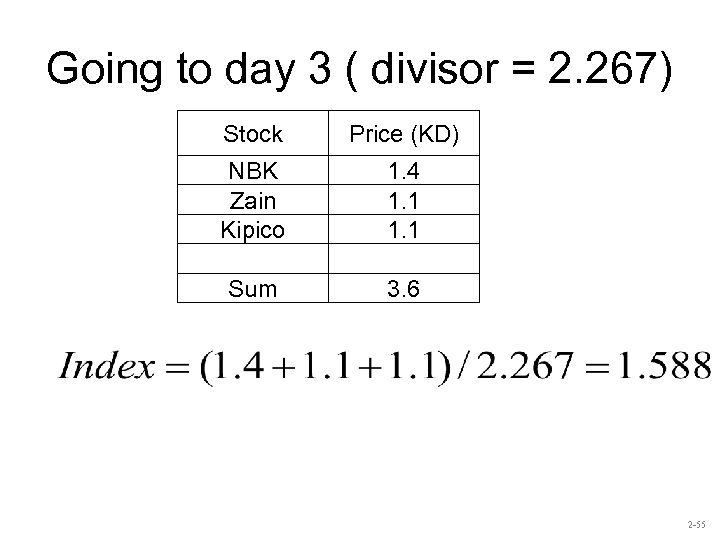

Going to day 3 ( divisor = 2. 267) Stock Price (KD) NBK Zain Kipico 1. 4 1. 1 Sum 3. 6 2 -55

Going to day 3 ( divisor = 2. 267) Stock Price (KD) NBK Zain Kipico 1. 4 1. 1 Sum 3. 6 2 -55

Summary index change Day 1 1. 37 Day 2 1. 50 9. 76% Day 3 1. 588 5. 88% 2 -56

Summary index change Day 1 1. 37 Day 2 1. 50 9. 76% Day 3 1. 588 5. 88% 2 -56

a) Price weighted series (10+50+140)/3 = 200/3 = Time 0 index value is Time 1 index value = 190/3 = 63. 33 Problem? split Refigure denominator (10+25+140) / Denom = 66. 67 Denominator ( divisor) = 2. 624869 Time 1 index value = (15+25+150) / 2. 624869 = 72. 38 66. 67 Other problems – similar % change movements in higher price stocks cause proportionately larger changes in the index 2 -57

a) Price weighted series (10+50+140)/3 = 200/3 = Time 0 index value is Time 1 index value = 190/3 = 63. 33 Problem? split Refigure denominator (10+25+140) / Denom = 66. 67 Denominator ( divisor) = 2. 624869 Time 1 index value = (15+25+150) / 2. 624869 = 72. 38 66. 67 Other problems – similar % change movements in higher price stocks cause proportionately larger changes in the index 2 -57

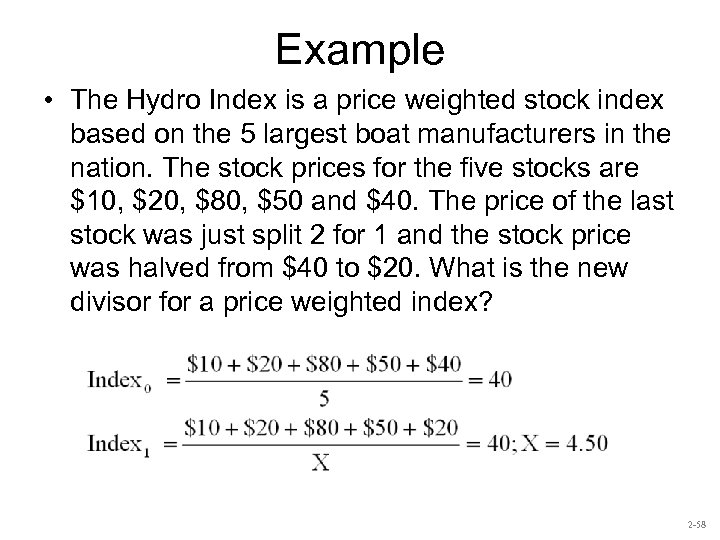

Example • The Hydro Index is a price weighted stock index based on the 5 largest boat manufacturers in the nation. The stock prices for the five stocks are $10, $20, $80, $50 and $40. The price of the last stock was just split 2 for 1 and the stock price was halved from $40 to $20. What is the new divisor for a price weighted index? 2 -58

Example • The Hydro Index is a price weighted stock index based on the 5 largest boat manufacturers in the nation. The stock prices for the five stocks are $10, $20, $80, $50 and $40. The price of the last stock was just split 2 for 1 and the stock price was halved from $40 to $20. What is the new divisor for a price weighted index? 2 -58

2 -3 handout Price-Weighted Portfolio Example I: $1, 000 to Invest, Price 67. 50 41. 93 21. 70 131. 130 Company Boeing Nordstrom Lowe's Price Weight 0. 5148 0. 3198 0. 1655 1. 000 Note: Shares = $1, 000 / 131. 130 = 7, 626 2 -59

2 -3 handout Price-Weighted Portfolio Example I: $1, 000 to Invest, Price 67. 50 41. 93 21. 70 131. 130 Company Boeing Nordstrom Lowe's Price Weight 0. 5148 0. 3198 0. 1655 1. 000 Note: Shares = $1, 000 / 131. 130 = 7, 626 2 -59

Example II: Changing the Divisor What would have happened to the divisor if Home Depot shares were selling at $65. 72 per share instead of $32. 90? 2 -60

Example II: Changing the Divisor What would have happened to the divisor if Home Depot shares were selling at $65. 72 per share instead of $32. 90? 2 -60

What would have happened to the divisor if Home Depot shares were selling at $65. 72 per share instead of $32. 90? To keep the value of the Index the same, i. e. , 43. 71: Boeing Nordstrom Home Depot Sum: 175. 15 / Divisor = 43. 71, if Divisor is: 67. 50 41. 93 65. 72 175. 15 4. 00709 2 -61

What would have happened to the divisor if Home Depot shares were selling at $65. 72 per share instead of $32. 90? To keep the value of the Index the same, i. e. , 43. 71: Boeing Nordstrom Home Depot Sum: 175. 15 / Divisor = 43. 71, if Divisor is: 67. 50 41. 93 65. 72 175. 15 4. 00709 2 -61

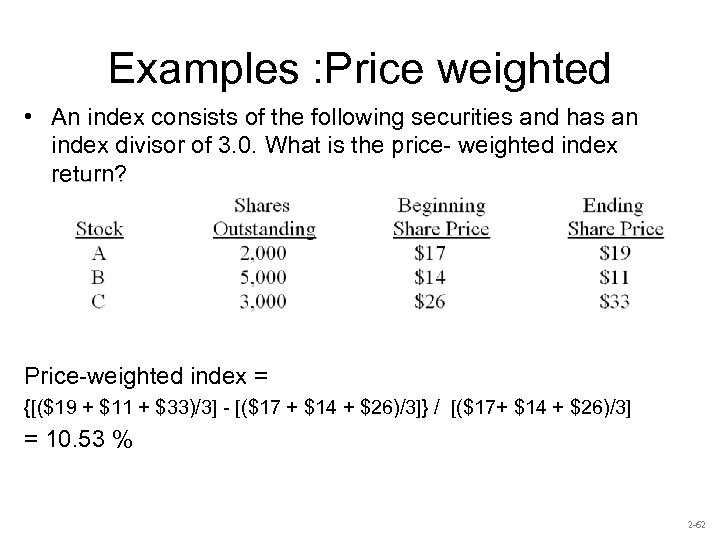

Examples : Price weighted • An index consists of the following securities and has an index divisor of 3. 0. What is the price- weighted index return? Price-weighted index = {[($19 + $11 + $33)/3] - [($17 + $14 + $26)/3]} / [($17+ $14 + $26)/3] = 10. 53 % 2 -62

Examples : Price weighted • An index consists of the following securities and has an index divisor of 3. 0. What is the price- weighted index return? Price-weighted index = {[($19 + $11 + $33)/3] - [($17 + $14 + $26)/3]} / [($17+ $14 + $26)/3] = 10. 53 % 2 -62

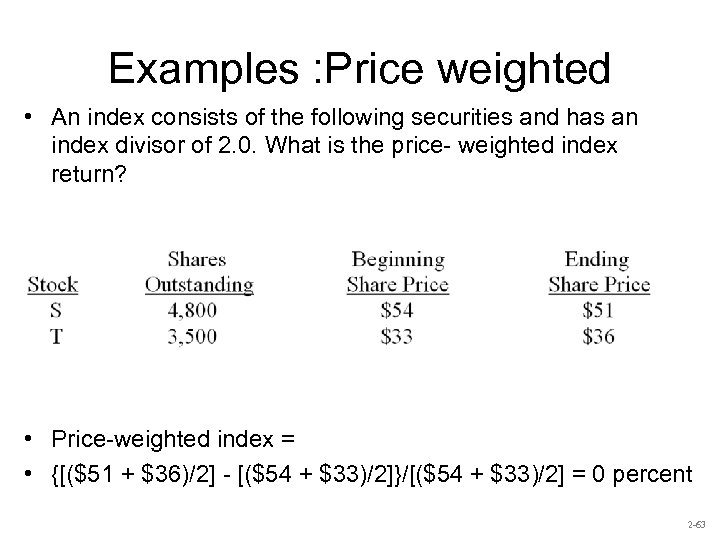

Examples : Price weighted • An index consists of the following securities and has an index divisor of 2. 0. What is the price- weighted index return? • Price-weighted index = • {[($51 + $36)/2] - [($54 + $33)/2]}/[($54 + $33)/2] = 0 percent 2 -63

Examples : Price weighted • An index consists of the following securities and has an index divisor of 2. 0. What is the price- weighted index return? • Price-weighted index = • {[($51 + $36)/2] - [($54 + $33)/2]}/[($54 + $33)/2] = 0 percent 2 -63

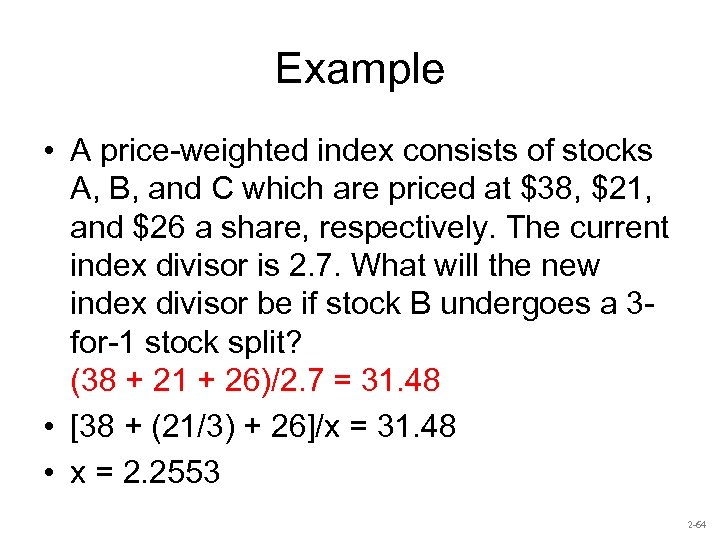

Example • A price-weighted index consists of stocks A, B, and C which are priced at $38, $21, and $26 a share, respectively. The current index divisor is 2. 7. What will the new index divisor be if stock B undergoes a 3 for-1 stock split? (38 + 21 + 26)/2. 7 = 31. 48 • [38 + (21/3) + 26]/x = 31. 48 • x = 2. 2553 2 -64

Example • A price-weighted index consists of stocks A, B, and C which are priced at $38, $21, and $26 a share, respectively. The current index divisor is 2. 7. What will the new index divisor be if stock B undergoes a 3 for-1 stock split? (38 + 21 + 26)/2. 7 = 31. 48 • [38 + (21/3) + 26]/x = 31. 48 • x = 2. 2553 2 -64

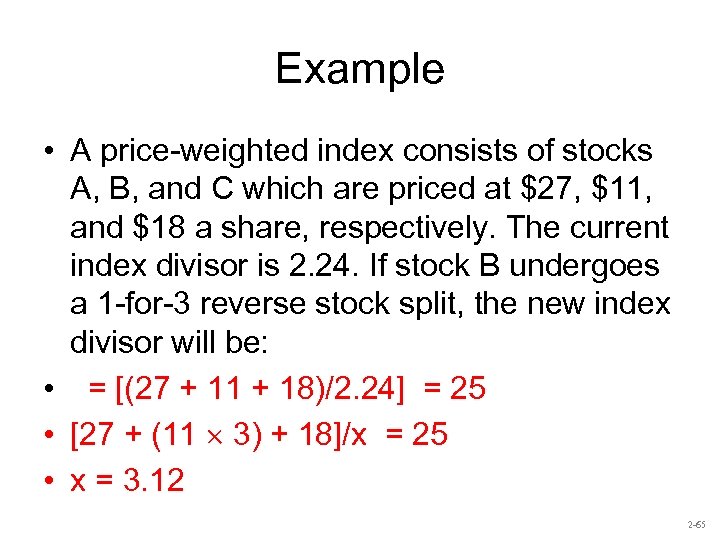

Example • A price-weighted index consists of stocks A, B, and C which are priced at $27, $11, and $18 a share, respectively. The current index divisor is 2. 24. If stock B undergoes a 1 -for-3 reverse stock split, the new index divisor will be: • = [(27 + 11 + 18)/2. 24] = 25 • [27 + (11 3) + 18]/x = 25 • x = 3. 12 2 -65

Example • A price-weighted index consists of stocks A, B, and C which are priced at $27, $11, and $18 a share, respectively. The current index divisor is 2. 24. If stock B undergoes a 1 -for-3 reverse stock split, the new index divisor will be: • = [(27 + 11 + 18)/2. 24] = 25 • [27 + (11 3) + 18]/x = 25 • x = 3. 12 2 -65

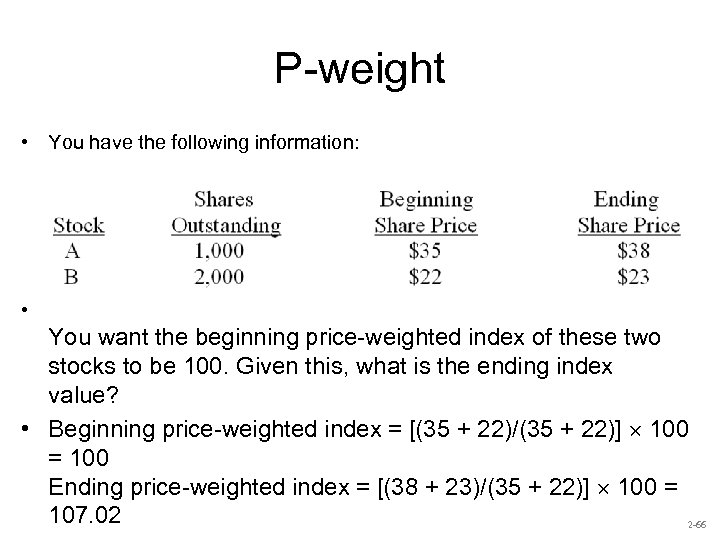

P-weight • You have the following information: • You want the beginning price-weighted index of these two stocks to be 100. Given this, what is the ending index value? • Beginning price-weighted index = [(35 + 22)/(35 + 22)] 100 = 100 Ending price-weighted index = [(38 + 23)/(35 + 22)] 100 = 107. 02 2 -66

P-weight • You have the following information: • You want the beginning price-weighted index of these two stocks to be 100. Given this, what is the ending index value? • Beginning price-weighted index = [(35 + 22)/(35 + 22)] 100 = 100 Ending price-weighted index = [(38 + 23)/(35 + 22)] 100 = 107. 02 2 -66

Value weighted Computed by calculating a weighted average of the returns of each security in the index, with weights proportional to outstanding market value. 2 -67

Value weighted Computed by calculating a weighted average of the returns of each security in the index, with weights proportional to outstanding market value. 2 -67

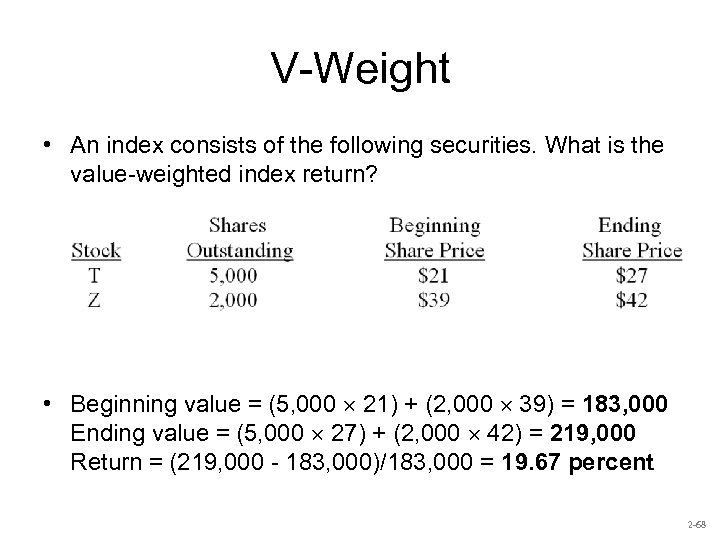

V-Weight • An index consists of the following securities. What is the value-weighted index return? • Beginning value = (5, 000 21) + (2, 000 39) = 183, 000 Ending value = (5, 000 27) + (2, 000 42) = 219, 000 Return = (219, 000 - 183, 000)/183, 000 = 19. 67 percent 2 -68

V-Weight • An index consists of the following securities. What is the value-weighted index return? • Beginning value = (5, 000 21) + (2, 000 39) = 183, 000 Ending value = (5, 000 27) + (2, 000 42) = 219, 000 Return = (219, 000 - 183, 000)/183, 000 = 19. 67 percent 2 -68

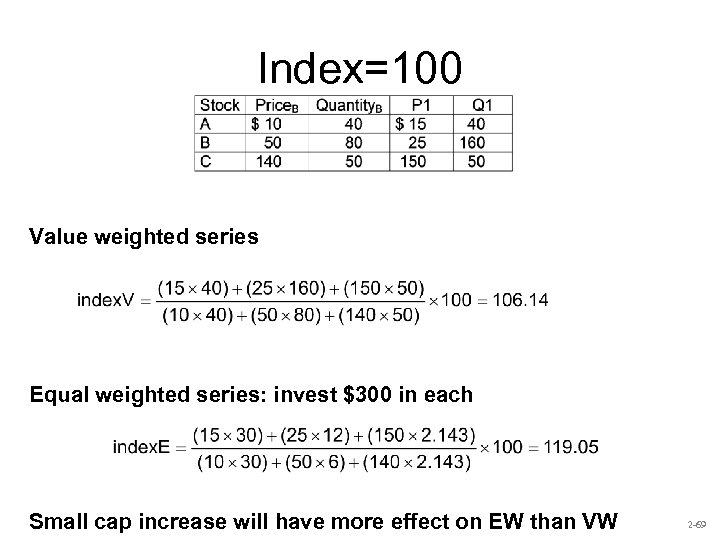

Index=100 Value weighted series Equal weighted series: invest $300 in each Small cap increase will have more effect on EW than VW 2 -69

Index=100 Value weighted series Equal weighted series: invest $300 in each Small cap increase will have more effect on EW than VW 2 -69

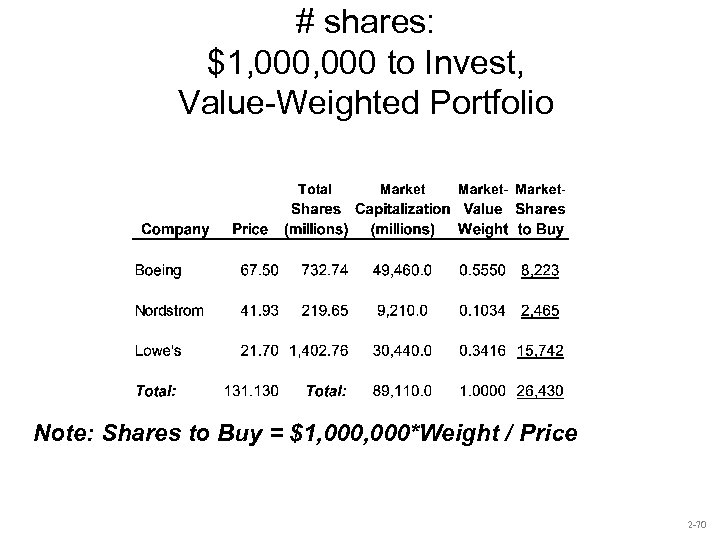

# shares: $1, 000 to Invest, Value-Weighted Portfolio Note: Shares to Buy = $1, 000*Weight / Price 2 -70

# shares: $1, 000 to Invest, Value-Weighted Portfolio Note: Shares to Buy = $1, 000*Weight / Price 2 -70

Example IV: How Does the Value-Weighted Index Change? Using the Portfolio from Example III: 2 -71

Example IV: How Does the Value-Weighted Index Change? Using the Portfolio from Example III: 2 -71

The Day 3 Index Can be Calculated in Two Ways: 2 -72

The Day 3 Index Can be Calculated in Two Ways: 2 -72

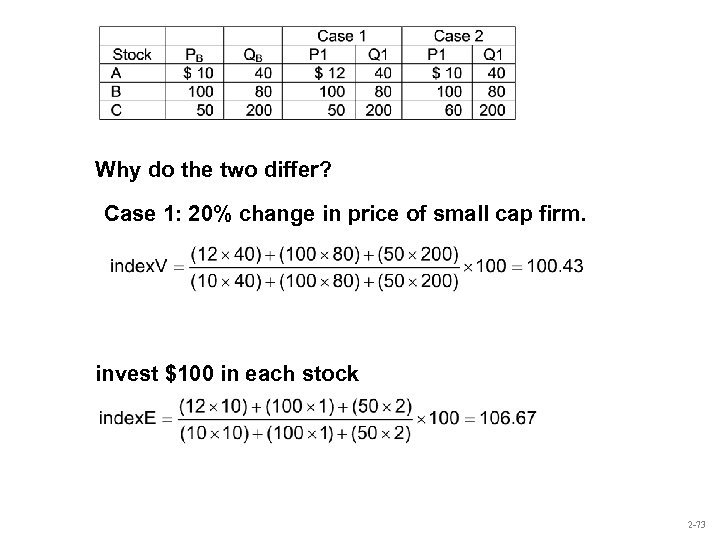

Why do the two differ? Case 1: 20% change in price of small cap firm. invest $100 in each stock 2 -73

Why do the two differ? Case 1: 20% change in price of small cap firm. invest $100 in each stock 2 -73

Case 1 VW = 100. 43 Case 1 EW = 106. 67 Why do the two differ? Case 2: 20% change in price of large cap firm. Assume that we invest $100 in each stock Large cap increase will have more effect on v. W than e. W 2 -74

Case 1 VW = 100. 43 Case 1 EW = 106. 67 Why do the two differ? Case 2: 20% change in price of large cap firm. Assume that we invest $100 in each stock Large cap increase will have more effect on v. W than e. W 2 -74

2. 5 Derivative Markets Read the book (P 45) • Listed Call Option: – Holder the right to buy 100 shares of the underlying stock at a predetermined price on or before some specified expiration date. • Listed Put Option: – Holder the right to sell 100 shares of the underlying stock at a predetermined price on or before some specified expiration date. 2 -75

2. 5 Derivative Markets Read the book (P 45) • Listed Call Option: – Holder the right to buy 100 shares of the underlying stock at a predetermined price on or before some specified expiration date. • Listed Put Option: – Holder the right to sell 100 shares of the underlying stock at a predetermined price on or before some specified expiration date. 2 -75

Figure 2. 10 Stock Options on Apple What does the term ‘strike’ or exercise price refer to? What is an option premium? 2 -76

Figure 2. 10 Stock Options on Apple What does the term ‘strike’ or exercise price refer to? What is an option premium? 2 -76

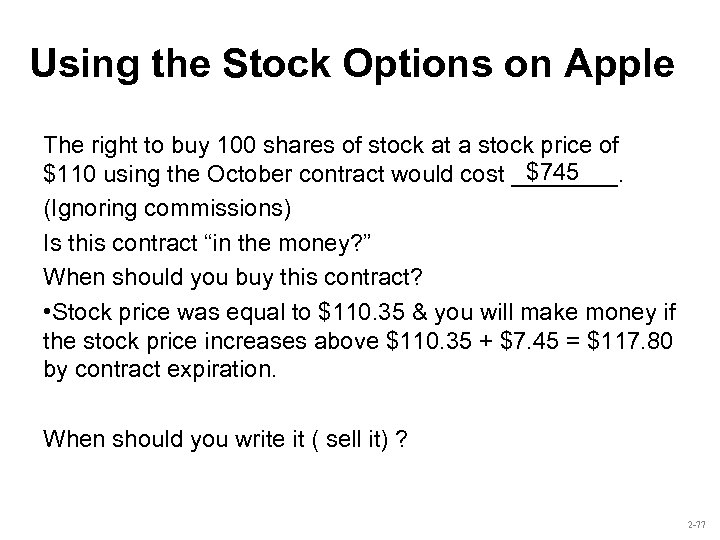

Using the Stock Options on Apple The right to buy 100 shares of stock at a stock price of $745 $110 using the October contract would cost ____. (Ignoring commissions) Is this contract “in the money? ” When should you buy this contract? • Stock price was equal to $110. 35 & you will make money if the stock price increases above $110. 35 + $7. 45 = $117. 80 by contract expiration. When should you write it ( sell it) ? 2 -77

Using the Stock Options on Apple The right to buy 100 shares of stock at a stock price of $745 $110 using the October contract would cost ____. (Ignoring commissions) Is this contract “in the money? ” When should you buy this contract? • Stock price was equal to $110. 35 & you will make money if the stock price increases above $110. 35 + $7. 45 = $117. 80 by contract expiration. When should you write it ( sell it) ? 2 -77

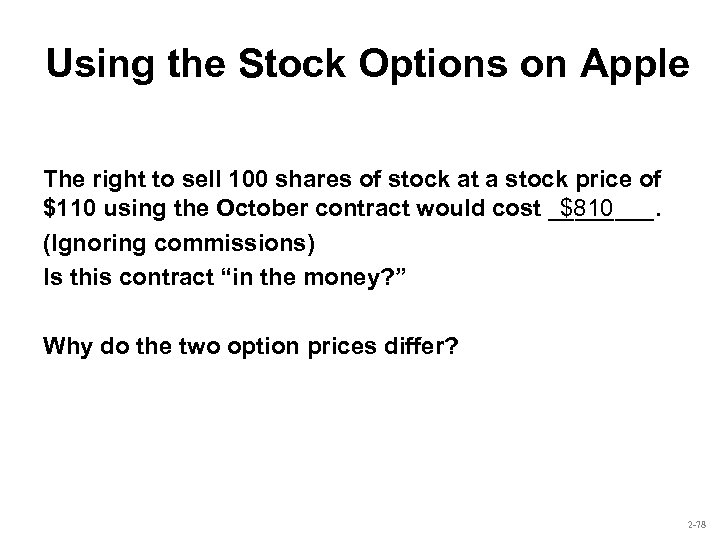

Using the Stock Options on Apple The right to sell 100 shares of stock at a stock price of $110 using the October contract would cost ____. $810 (Ignoring commissions) Is this contract “in the money? ” Why do the two option prices differ? 2 -78

Using the Stock Options on Apple The right to sell 100 shares of stock at a stock price of $110 using the October contract would cost ____. $810 (Ignoring commissions) Is this contract “in the money? ” Why do the two option prices differ? 2 -78

Using the Stock Options on Apple Look at Figure 2. 10 to answer the following questions: 1. How does the exercise or strike price affect the value of a call option? A put option? Why? The higher Strike price for a Call (Put), the lower ( Higher) the option value for the call (PUT) 2. How does a greater time to contract expiration affect the value of a call option? A put option? Why? The longer expiration date for the option, the higher option value. 3. How is ‘volume’ different from ‘open interest? ’ Volume is what is traded on a day. Open interest: The total number of buy options that are not closed on a particular day 2 -79

Using the Stock Options on Apple Look at Figure 2. 10 to answer the following questions: 1. How does the exercise or strike price affect the value of a call option? A put option? Why? The higher Strike price for a Call (Put), the lower ( Higher) the option value for the call (PUT) 2. How does a greater time to contract expiration affect the value of a call option? A put option? Why? The longer expiration date for the option, the higher option value. 3. How is ‘volume’ different from ‘open interest? ’ Volume is what is traded on a day. Open interest: The total number of buy options that are not closed on a particular day 2 -79

2 -80

2 -80

Example • Suppose you buy an April expiration call option with exercise price 105. • a. If the stock price in April is $111, will you exercise your call? What are the profit and rate of return on your position? As long as the stock price at expiration exceeds the exercise price, it makes sense to exercise the call. Gross profit is: $111 - $ 105 = $6 Net profit = $6 – $ 22. 40 = $16. 40 loss Rate of return = -16. 40 / 22. 40 = -. 7321 or 73. 21% loss • c. What if you had bought an April put with exercise price 105? 2 -81

Example • Suppose you buy an April expiration call option with exercise price 105. • a. If the stock price in April is $111, will you exercise your call? What are the profit and rate of return on your position? As long as the stock price at expiration exceeds the exercise price, it makes sense to exercise the call. Gross profit is: $111 - $ 105 = $6 Net profit = $6 – $ 22. 40 = $16. 40 loss Rate of return = -16. 40 / 22. 40 = -. 7321 or 73. 21% loss • c. What if you had bought an April put with exercise price 105? 2 -81

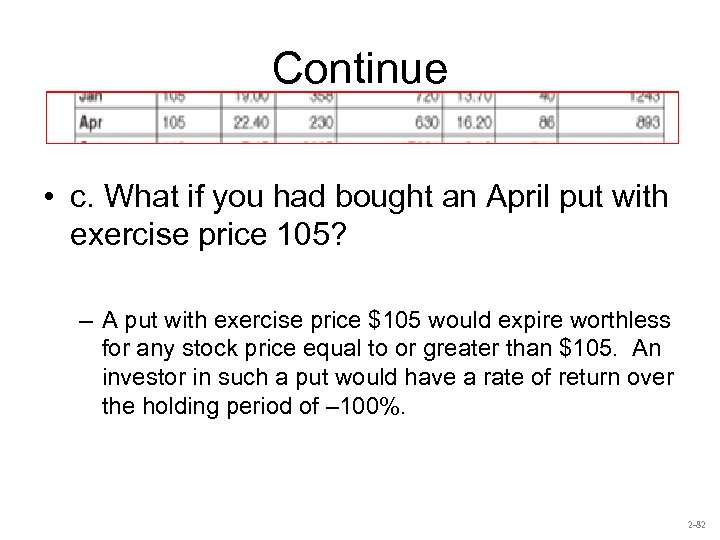

Continue • c. What if you had bought an April put with exercise price 105? – A put with exercise price $105 would expire worthless for any stock price equal to or greater than $105. An investor in such a put would have a rate of return over the holding period of – 100%. 2 -82

Continue • c. What if you had bought an April put with exercise price 105? – A put with exercise price $105 would expire worthless for any stock price equal to or greater than $105. An investor in such a put would have a rate of return over the holding period of – 100%. 2 -82

Continue • b. What if you had bought the April call with exercise price 100? – Yes, exercise. • Gross profit is: $111 - $ 100 = $11 • Net profit = $11 – $ 25. 10 = $14. 10 loss • Rate of return = -14. 10 / 25. 10 = 0. 5618 or 56. 18 % loss 2 -83

Continue • b. What if you had bought the April call with exercise price 100? – Yes, exercise. • Gross profit is: $111 - $ 100 = $11 • Net profit = $11 – $ 25. 10 = $14. 10 loss • Rate of return = -14. 10 / 25. 10 = 0. 5618 or 56. 18 % loss 2 -83

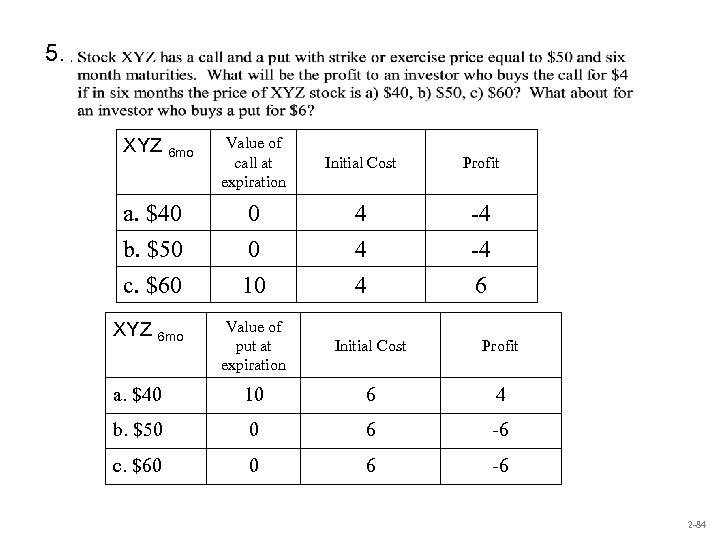

5. XYZ 6 mo a. $40 b. $50 c. $60 Value of call at expiration Initial Cost Profit 0 0 10 4 4 4 -4 -4 6 Value of put at expiration Initial Cost Profit a. $40 10 6 4 b. $50 0 6 -6 c. $60 0 6 -6 XYZ 6 mo 2 -84

5. XYZ 6 mo a. $40 b. $50 c. $60 Value of call at expiration Initial Cost Profit 0 0 10 4 4 4 -4 -4 6 Value of put at expiration Initial Cost Profit a. $40 10 6 4 b. $50 0 6 -6 c. $60 0 6 -6 XYZ 6 mo 2 -84

Selected Problems 1. Find the after tax rate of return to a corporation that buys preferred stock at $40, holds it one year and sells it at $40 after collecting a $4 dividend. The firm’s tax rate is 30%. $4 / $40 = 10% • (Pretax rate or return = ______ ) • The total before-tax income is $4. After the 70% exclusion, taxable income is: • 0. 30 $4 = $1. 20 taxable income • Therefore Taxes owed are Tax rate taxable income • Taxes = 0. 30 $1. 20 = $0. 36 • After-tax income = $4 – $0. 36 = $3. 64 • After-tax rate of return = $3. 64 / $40 = 9. 10% 2 -85

Selected Problems 1. Find the after tax rate of return to a corporation that buys preferred stock at $40, holds it one year and sells it at $40 after collecting a $4 dividend. The firm’s tax rate is 30%. $4 / $40 = 10% • (Pretax rate or return = ______ ) • The total before-tax income is $4. After the 70% exclusion, taxable income is: • 0. 30 $4 = $1. 20 taxable income • Therefore Taxes owed are Tax rate taxable income • Taxes = 0. 30 $1. 20 = $0. 36 • After-tax income = $4 – $0. 36 = $3. 64 • After-tax rate of return = $3. 64 / $40 = 9. 10% 2 -85

2. a) Using the quote find GD’s closing price the day before the quote appeared The closing price is $94. 80, which is $1. 14 higher than yesterday’s price. Therefore, yesterday’s closing price was: $94. 80 – $1. 14 = $93. 66 b) How many shares could you buy for $5000? You could buy: $5, 000/$94. 80 = 52. 74 shares c) Total annual dividend income from the __ shares? 52 $1. 44 * 52 = $74. 88 d) What are EPS? (Approximate) P / (P/E) = EPS = $94. 80 / 18 = $5. 27 2 -86

2. a) Using the quote find GD’s closing price the day before the quote appeared The closing price is $94. 80, which is $1. 14 higher than yesterday’s price. Therefore, yesterday’s closing price was: $94. 80 – $1. 14 = $93. 66 b) How many shares could you buy for $5000? You could buy: $5, 000/$94. 80 = 52. 74 shares c) Total annual dividend income from the __ shares? 52 $1. 44 * 52 = $74. 88 d) What are EPS? (Approximate) P / (P/E) = EPS = $94. 80 / 18 = $5. 27 2 -86