f76bd0da0a9c0950663d17e1e1701eb8.ppt

- Количество слайдов: 18

Chapter 19 The Foreign Exchange Market

Chapter 19 The Foreign Exchange Market

Exchange Rate • An exchange rate can be quoted in two ways: • Direct (price quotation system): The price of the foreign currency in terms of domestic currency. – Quotes in American terms (goes up, domestic currency depreciation) • Indirect (quantity quotation system): The price of domestic currency in terms of the foreign currency. – Quotes in European terms (goes up, domestic currency appreciation) © 2004 Pearson Addison-Wesley. All rights reserved 2

Exchange Rate • An exchange rate can be quoted in two ways: • Direct (price quotation system): The price of the foreign currency in terms of domestic currency. – Quotes in American terms (goes up, domestic currency depreciation) • Indirect (quantity quotation system): The price of domestic currency in terms of the foreign currency. – Quotes in European terms (goes up, domestic currency appreciation) © 2004 Pearson Addison-Wesley. All rights reserved 2

1. International Financial Market • The Bank for International Settlements estimated the trading value reached more than $2 trillion per day. • Vehicle currency: determined primarily by transactions costs. • Whenever the indirect exchange costs through the vehicle are less than direct exchange costs between two nonvehicle currencies. Example: Peso-USD and USD-Won vs. Peso-Won. © 2004 Pearson Addison-Wesley. All rights reserved 3

1. International Financial Market • The Bank for International Settlements estimated the trading value reached more than $2 trillion per day. • Vehicle currency: determined primarily by transactions costs. • Whenever the indirect exchange costs through the vehicle are less than direct exchange costs between two nonvehicle currencies. Example: Peso-USD and USD-Won vs. Peso-Won. © 2004 Pearson Addison-Wesley. All rights reserved 3

Types of Transaction: – Spot: Apply to exchange currencies “on the spot” – Forward: Apply to exchange currencies on some future date at a prenegotiated exchange rate – Future: The buyer buys a promise that a specified amount of foreign currency will be delivered on a specified date in the future. – Option: The owner has the right to buy or sell a specified amount of foreign currency at a specified price at any time up to a specified expiration date. – Swap: Spot sales of a currency combined with a forward repurchase of the currency. Swap makes up a significant proportion of all foreign exchange trading. © 2004 Pearson Addison-Wesley. All rights reserved 4

Types of Transaction: – Spot: Apply to exchange currencies “on the spot” – Forward: Apply to exchange currencies on some future date at a prenegotiated exchange rate – Future: The buyer buys a promise that a specified amount of foreign currency will be delivered on a specified date in the future. – Option: The owner has the right to buy or sell a specified amount of foreign currency at a specified price at any time up to a specified expiration date. – Swap: Spot sales of a currency combined with a forward repurchase of the currency. Swap makes up a significant proportion of all foreign exchange trading. © 2004 Pearson Addison-Wesley. All rights reserved 4

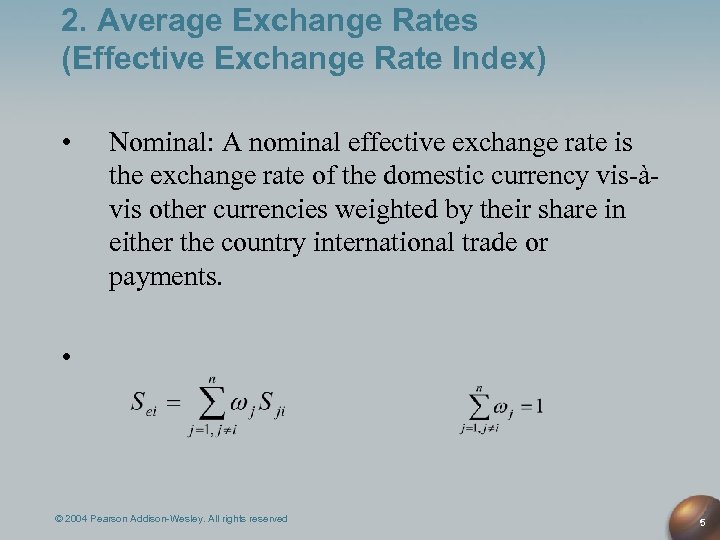

2. Average Exchange Rates (Effective Exchange Rate Index) • Nominal: A nominal effective exchange rate is the exchange rate of the domestic currency vis-àvis other currencies weighted by their share in either the country international trade or payments. • © 2004 Pearson Addison-Wesley. All rights reserved 5

2. Average Exchange Rates (Effective Exchange Rate Index) • Nominal: A nominal effective exchange rate is the exchange rate of the domestic currency vis-àvis other currencies weighted by their share in either the country international trade or payments. • © 2004 Pearson Addison-Wesley. All rights reserved 5

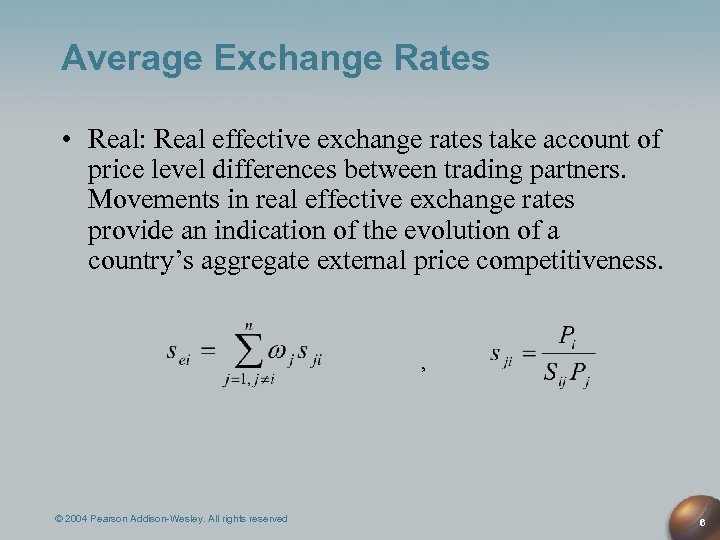

Average Exchange Rates • Real: Real effective exchange rates take account of price level differences between trading partners. Movements in real effective exchange rates provide an indication of the evolution of a country’s aggregate external price competitiveness. , © 2004 Pearson Addison-Wesley. All rights reserved 6

Average Exchange Rates • Real: Real effective exchange rates take account of price level differences between trading partners. Movements in real effective exchange rates provide an indication of the evolution of a country’s aggregate external price competitiveness. , © 2004 Pearson Addison-Wesley. All rights reserved 6

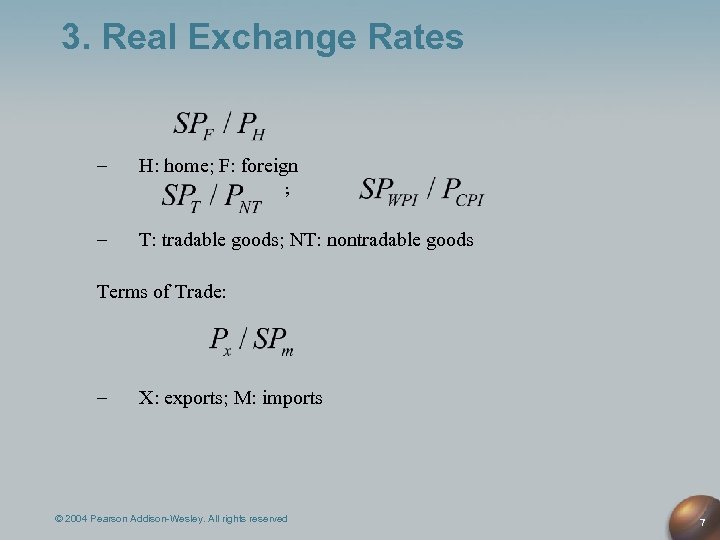

3. Real Exchange Rates – H: home; F: foreign ; – T: tradable goods; NT: nontradable goods Terms of Trade: – X: exports; M: imports © 2004 Pearson Addison-Wesley. All rights reserved 7

3. Real Exchange Rates – H: home; F: foreign ; – T: tradable goods; NT: nontradable goods Terms of Trade: – X: exports; M: imports © 2004 Pearson Addison-Wesley. All rights reserved 7

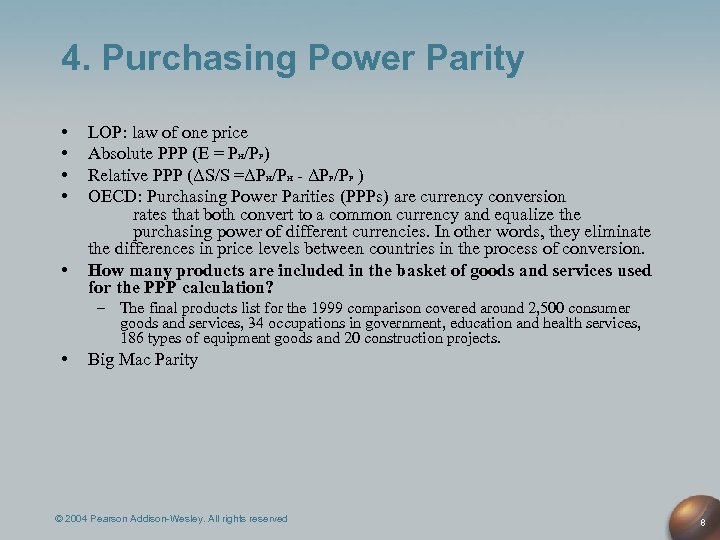

4. Purchasing Power Parity • • • LOP: law of one price Absolute PPP (E = PH/PF) Relative PPP (ΔS/S =ΔPH/PH - ΔPF/PF ) OECD: Purchasing Power Parities (PPPs) are currency conversion rates that both convert to a common currency and equalize the purchasing power of different currencies. In other words, they eliminate the differences in price levels between countries in the process of conversion. How many products are included in the basket of goods and services used for the PPP calculation? – The final products list for the 1999 comparison covered around 2, 500 consumer goods and services, 34 occupations in government, education and health services, 186 types of equipment goods and 20 construction projects. • Big Mac Parity © 2004 Pearson Addison-Wesley. All rights reserved 8

4. Purchasing Power Parity • • • LOP: law of one price Absolute PPP (E = PH/PF) Relative PPP (ΔS/S =ΔPH/PH - ΔPF/PF ) OECD: Purchasing Power Parities (PPPs) are currency conversion rates that both convert to a common currency and equalize the purchasing power of different currencies. In other words, they eliminate the differences in price levels between countries in the process of conversion. How many products are included in the basket of goods and services used for the PPP calculation? – The final products list for the 1999 comparison covered around 2, 500 consumer goods and services, 34 occupations in government, education and health services, 186 types of equipment goods and 20 construction projects. • Big Mac Parity © 2004 Pearson Addison-Wesley. All rights reserved 8

Problems with PPP • Trade Barriers and Nontradables – Transport costs and governmental trade restrictions make trade expensive and in some cases create nontradable goods. • The greater the transport costs, the greater the range over which the exchange rate can move. • Departures from Free Competition – When trade barriers and imperfectly competitive market structures occur together, linkages between national price levels are weakened further. (pricing to the market) • International Differences in Price Level Measurement – Government measures of the price level differ from country to country because people living in different counties spend their income in different ways. • PPP in the Short Run and in the Long Run – Departures from PPP may be even greater in the short- run than in the long run. © 2004 Pearson Addison-Wesley. All rights reserved 9

Problems with PPP • Trade Barriers and Nontradables – Transport costs and governmental trade restrictions make trade expensive and in some cases create nontradable goods. • The greater the transport costs, the greater the range over which the exchange rate can move. • Departures from Free Competition – When trade barriers and imperfectly competitive market structures occur together, linkages between national price levels are weakened further. (pricing to the market) • International Differences in Price Level Measurement – Government measures of the price level differ from country to country because people living in different counties spend their income in different ways. • PPP in the Short Run and in the Long Run – Departures from PPP may be even greater in the short- run than in the long run. © 2004 Pearson Addison-Wesley. All rights reserved 9

5. PPP and Non-Traded Goods • Balassa-Samuelson Effect – Balassa (1964) and Samuelson (1964) • The observation that consumer price levels in wealthier countries are systematically higher than in poorer ones. • An economic model predicting the above, based on the assumption that productivity or productivity growth-rates vary more by country in the traded goods' sectors than in other sectors. © 2004 Pearson Addison-Wesley. All rights reserved 10

5. PPP and Non-Traded Goods • Balassa-Samuelson Effect – Balassa (1964) and Samuelson (1964) • The observation that consumer price levels in wealthier countries are systematically higher than in poorer ones. • An economic model predicting the above, based on the assumption that productivity or productivity growth-rates vary more by country in the traded goods' sectors than in other sectors. © 2004 Pearson Addison-Wesley. All rights reserved 10

6. Interest Parity • Covered Interest Parity • Example: 1 + 0. 0678 > (1 + 0. 0422) = 1. 0178 There is arbitrage profit • Logarithmic approximation, Forward premium (discount) on domestic (foreign) currency against foreign (domestic) currency © 2004 Pearson Addison-Wesley. All rights reserved 11

6. Interest Parity • Covered Interest Parity • Example: 1 + 0. 0678 > (1 + 0. 0422) = 1. 0178 There is arbitrage profit • Logarithmic approximation, Forward premium (discount) on domestic (foreign) currency against foreign (domestic) currency © 2004 Pearson Addison-Wesley. All rights reserved 11

Interest Parity • Uncovered Interest Parity • Using interest parity to think about: – What is the relationship between spot exchange rate and interest rate? – What to do with a currency crisis? © 2004 Pearson Addison-Wesley. All rights reserved 12

Interest Parity • Uncovered Interest Parity • Using interest parity to think about: – What is the relationship between spot exchange rate and interest rate? – What to do with a currency crisis? © 2004 Pearson Addison-Wesley. All rights reserved 12

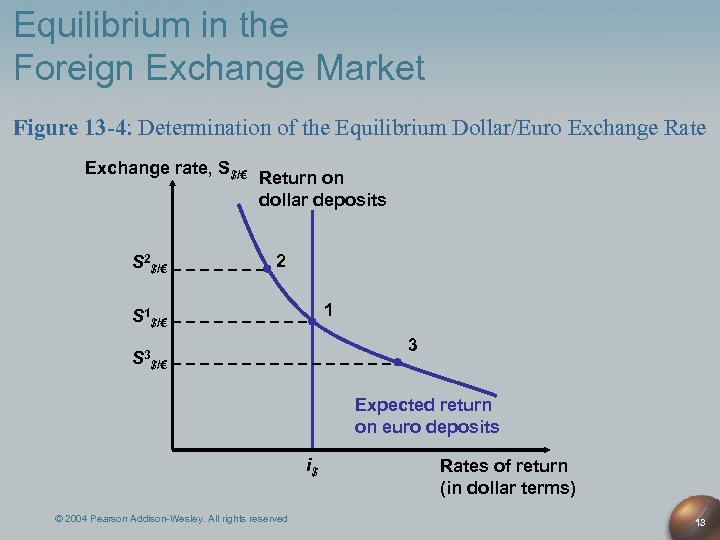

Equilibrium in the Foreign Exchange Market Figure 13 -4: Determination of the Equilibrium Dollar/Euro Exchange Rate Exchange rate, S$/€ S 2$/€ Return on dollar deposits 2 1 S 1$/€ S 3 3 $/€ Expected return on euro deposits i$ © 2004 Pearson Addison-Wesley. All rights reserved Rates of return (in dollar terms) 13

Equilibrium in the Foreign Exchange Market Figure 13 -4: Determination of the Equilibrium Dollar/Euro Exchange Rate Exchange rate, S$/€ S 2$/€ Return on dollar deposits 2 1 S 1$/€ S 3 3 $/€ Expected return on euro deposits i$ © 2004 Pearson Addison-Wesley. All rights reserved Rates of return (in dollar terms) 13

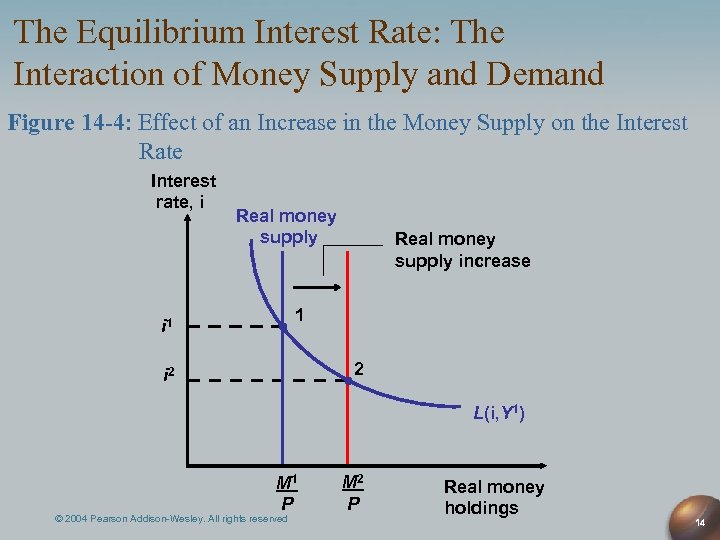

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -4: Effect of an Increase in the Money Supply on the Interest Rate Interest rate, i Real money supply increase 1 i 1 2 i 2 L(i, Y 1) M 1 P © 2004 Pearson Addison-Wesley. All rights reserved M 2 P Real money holdings 14

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -4: Effect of an Increase in the Money Supply on the Interest Rate Interest rate, i Real money supply increase 1 i 1 2 i 2 L(i, Y 1) M 1 P © 2004 Pearson Addison-Wesley. All rights reserved M 2 P Real money holdings 14

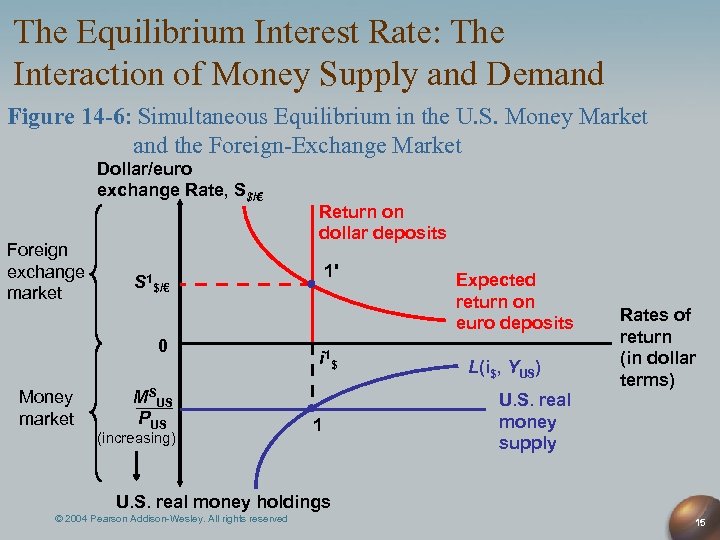

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -6: Simultaneous Equilibrium in the U. S. Money Market and the Foreign-Exchange Market Dollar/euro exchange Rate, S$/€ Foreign exchange market 1' S 1$/€ 0 Money market Return on dollar deposits MSUS PUS (increasing) i 1 $ 1 Expected return on euro deposits L(i$, YUS) Rates of return (in dollar terms) U. S. real money supply U. S. real money holdings © 2004 Pearson Addison-Wesley. All rights reserved 15

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -6: Simultaneous Equilibrium in the U. S. Money Market and the Foreign-Exchange Market Dollar/euro exchange Rate, S$/€ Foreign exchange market 1' S 1$/€ 0 Money market Return on dollar deposits MSUS PUS (increasing) i 1 $ 1 Expected return on euro deposits L(i$, YUS) Rates of return (in dollar terms) U. S. real money supply U. S. real money holdings © 2004 Pearson Addison-Wesley. All rights reserved 15

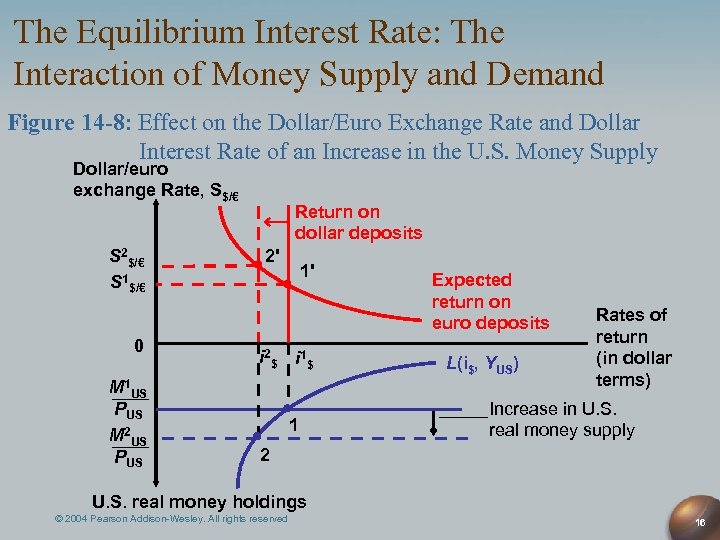

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -8: Effect on the Dollar/Euro Exchange Rate and Dollar Interest Rate of an Increase in the U. S. Money Supply Dollar/euro exchange Rate, S$/€ S 2$/€ S 1$/€ 0 M 1 US PUS M 2 US PUS Return on dollar deposits 2' 1' i 2 $ i 1 $ 1 Expected return on euro deposits L(i$, YUS) Rates of return (in dollar terms) Increase in U. S. real money supply 2 U. S. real money holdings © 2004 Pearson Addison-Wesley. All rights reserved 16

The Equilibrium Interest Rate: The Interaction of Money Supply and Demand Figure 14 -8: Effect on the Dollar/Euro Exchange Rate and Dollar Interest Rate of an Increase in the U. S. Money Supply Dollar/euro exchange Rate, S$/€ S 2$/€ S 1$/€ 0 M 1 US PUS M 2 US PUS Return on dollar deposits 2' 1' i 2 $ i 1 $ 1 Expected return on euro deposits L(i$, YUS) Rates of return (in dollar terms) Increase in U. S. real money supply 2 U. S. real money holdings © 2004 Pearson Addison-Wesley. All rights reserved 16

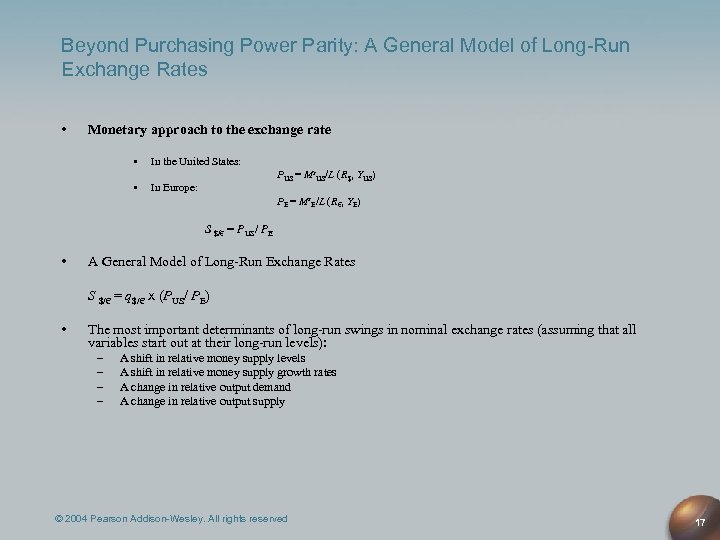

Beyond Purchasing Power Parity: A General Model of Long-Run Exchange Rates • Monetary approach to the exchange rate • • In the United States: PUS = Ms. US/L (R$, YUS) In Europe: PE = Ms. E/L (R€, YE) S $/€ = PUS/ PE • A General Model of Long-Run Exchange Rates S $/€ = q$/€ x (PUS/ PE) • The most important determinants of long-run swings in nominal exchange rates (assuming that all variables start out at their long-run levels): – – A shift in relative money supply levels A shift in relative money supply growth rates A change in relative output demand A change in relative output supply © 2004 Pearson Addison-Wesley. All rights reserved 17

Beyond Purchasing Power Parity: A General Model of Long-Run Exchange Rates • Monetary approach to the exchange rate • • In the United States: PUS = Ms. US/L (R$, YUS) In Europe: PE = Ms. E/L (R€, YE) S $/€ = PUS/ PE • A General Model of Long-Run Exchange Rates S $/€ = q$/€ x (PUS/ PE) • The most important determinants of long-run swings in nominal exchange rates (assuming that all variables start out at their long-run levels): – – A shift in relative money supply levels A shift in relative money supply growth rates A change in relative output demand A change in relative output supply © 2004 Pearson Addison-Wesley. All rights reserved 17

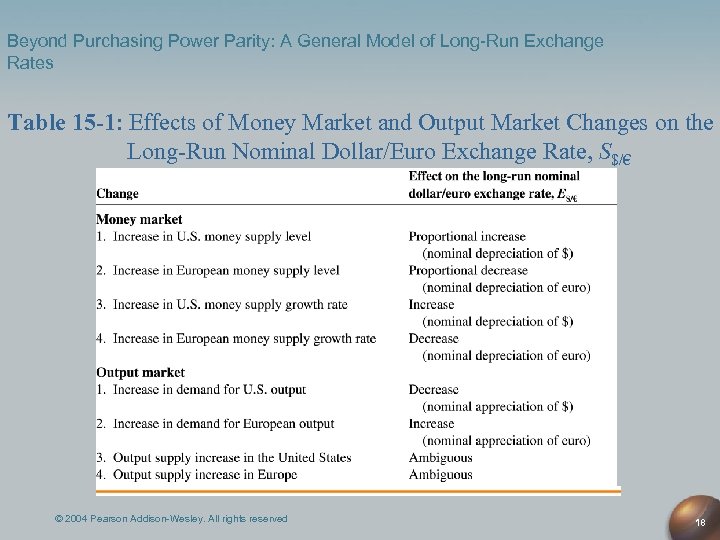

Beyond Purchasing Power Parity: A General Model of Long-Run Exchange Rates Table 15 -1: Effects of Money Market and Output Market Changes on the Long-Run Nominal Dollar/Euro Exchange Rate, S$/€ © 2004 Pearson Addison-Wesley. All rights reserved 18

Beyond Purchasing Power Parity: A General Model of Long-Run Exchange Rates Table 15 -1: Effects of Money Market and Output Market Changes on the Long-Run Nominal Dollar/Euro Exchange Rate, S$/€ © 2004 Pearson Addison-Wesley. All rights reserved 18