55da60fcf486ad17516b8db6037c2d20.ppt

- Количество слайдов: 76

Chapter 19 The Equity Implications of Taxation: Tax Incidence Jonathan Gruber Public Finance and Public Policy Aaron S. Yelowitz - Copyright 2005 © Worth Publishers

Chapter 19 The Equity Implications of Taxation: Tax Incidence Jonathan Gruber Public Finance and Public Policy Aaron S. Yelowitz - Copyright 2005 © Worth Publishers

Introduction n A central question of tax incidence is who bears the burden of a tax? n Tax incidenceassessing which party (consumers or is producers) bear the true burden of a tax. n When New Jersey raised the corporate income tax, companies claimed that the tax would just hurt their employees, while the governor claimed the tax would affect the wealth owners of the company.

Introduction n A central question of tax incidence is who bears the burden of a tax? n Tax incidenceassessing which party (consumers or is producers) bear the true burden of a tax. n When New Jersey raised the corporate income tax, companies claimed that the tax would just hurt their employees, while the governor claimed the tax would affect the wealth owners of the company.

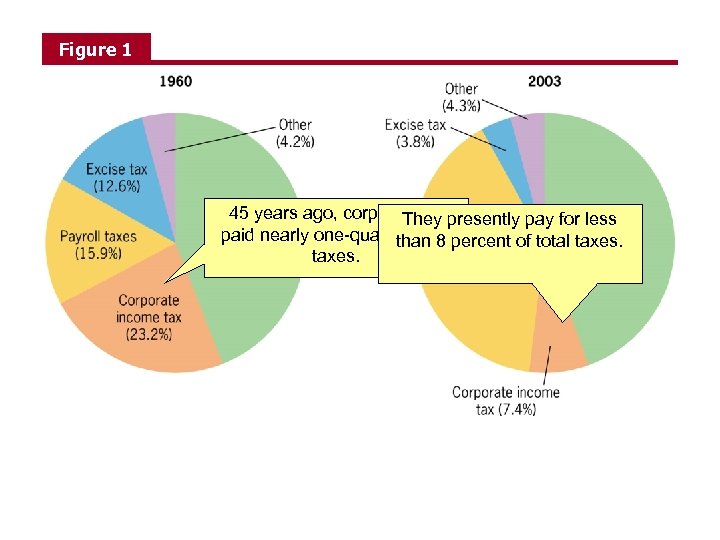

Introduction n Although the legal incidence of a tax is pretty obvious, markets do respond to taxes, so that the ultimate burden is not nearly so clear. n As Figure 1 illustrates, the share of taxes paid by corporations has fallen by roughly two-thirds.

Introduction n Although the legal incidence of a tax is pretty obvious, markets do respond to taxes, so that the ultimate burden is not nearly so clear. n As Figure 1 illustrates, the share of taxes paid by corporations has fallen by roughly two-thirds.

Figure 1 45 years ago, corporations presently pay for less They paid nearly one-quarter of all percent of total taxes. than 8 taxes.

Figure 1 45 years ago, corporations presently pay for less They paid nearly one-quarter of all percent of total taxes. than 8 taxes.

Introduction n Although this change in the share of taxes paid by corporations may be viewed as unfair, it is important to recall that corporate taxes are paid by the individuals who own, work for, and buy from corporations.

Introduction n Although this change in the share of taxes paid by corporations may be viewed as unfair, it is important to recall that corporate taxes are paid by the individuals who own, work for, and buy from corporations.

Introduction n The goal of this lesson is to examine the equity implications of taxation. Three rules of tax incidence n General equilibrium tax incidence n Empirical evidence n

Introduction n The goal of this lesson is to examine the equity implications of taxation. Three rules of tax incidence n General equilibrium tax incidence n Empirical evidence n

THE THREE RULES OF TAX INCIDENCE n There are three basic rules for figuring out who ultimately bears the burden of paying a tax. The statutory burden of a tax does not describe who really bears the tax. n The side of the market on which the tax is imposed is irrelevant to the distribution of tax burdens. n Parties with inelastic supply or demand bear the burden of a tax. n

THE THREE RULES OF TAX INCIDENCE n There are three basic rules for figuring out who ultimately bears the burden of paying a tax. The statutory burden of a tax does not describe who really bears the tax. n The side of the market on which the tax is imposed is irrelevant to the distribution of tax burdens. n Parties with inelastic supply or demand bear the burden of a tax. n

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n Statutory incidence burden of the tax borne by is the party that sends the check to the government. n For example, the government could impose a 50¢ per gallon tax on suppliers of gasoline. n Economic incidence burden of taxation measured is the by the change in resources available to any economic agent as a result of taxation. n If gas stations raise gasoline prices by 25¢ per gallon as a result, then consumers are bearing half of the tax.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n Statutory incidence burden of the tax borne by is the party that sends the check to the government. n For example, the government could impose a 50¢ per gallon tax on suppliers of gasoline. n Economic incidence burden of taxation measured is the by the change in resources available to any economic agent as a result of taxation. n If gas stations raise gasoline prices by 25¢ per gallon as a result, then consumers are bearing half of the tax.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n When a tax is imposed on producers, they will raise prices to some extent to offset this tax burden. n Producer tax burden = (pretax price – posttax price) + tax payments of producers n When a tax is imposed on consumers, they are not willing to pay as much for a good, so prices fall. The tax burden for consumers is: n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n When a tax is imposed on producers, they will raise prices to some extent to offset this tax burden. n Producer tax burden = (pretax price – posttax price) + tax payments of producers n When a tax is imposed on consumers, they are not willing to pay as much for a good, so prices fall. The tax burden for consumers is: n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers

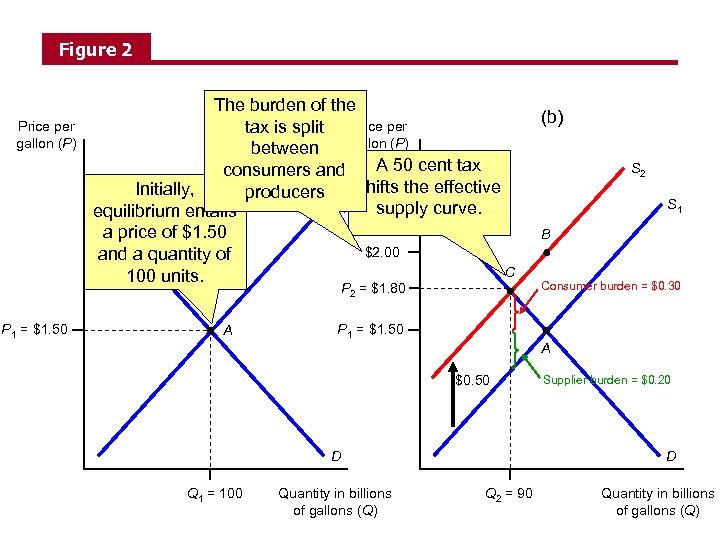

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n Figure 2 illustrates the impact of a 50¢ per gallon tax on suppliers of gasoline.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n Figure 2 illustrates the impact of a 50¢ per gallon tax on suppliers of gasoline.

Figure 2 Price per gallon (P) The burden of the (a) tax is split Price per gallon (P) between A 50 cent tax consumers and shifts the effective Initially, producers S 1 supply curve. equilibrium entails a price of $1. 50 $2. 00 and a quantity of C 100 units. P 2 = $1. 80 P 1 = $1. 50 A (b) S 2 S 1 B Consumer burden = $0. 30 P 1 = $1. 50 A $0. 50 D Q 1 = 100 Quantity in billions of gallons (Q) Supplier burden = $0. 20 D Q 2 = 90 Quantity in billions of gallons (Q)

Figure 2 Price per gallon (P) The burden of the (a) tax is split Price per gallon (P) between A 50 cent tax consumers and shifts the effective Initially, producers S 1 supply curve. equilibrium entails a price of $1. 50 $2. 00 and a quantity of C 100 units. P 2 = $1. 80 P 1 = $1. 50 A (b) S 2 S 1 B Consumer burden = $0. 30 P 1 = $1. 50 A $0. 50 D Q 1 = 100 Quantity in billions of gallons (Q) Supplier burden = $0. 20 D Q 2 = 90 Quantity in billions of gallons (Q)

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The initial market equilibrium is 100 billion gallons sold at $1. 50 per gallon. n The 50¢ tax raises the marginal costs of production for the firm, shifting the supply curve up to S 2. n At the original market price, there is now excess demand of 20 billion gallons; the price is bid up to $1. 80, where there is neither a shortage nor a surplus.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The initial market equilibrium is 100 billion gallons sold at $1. 50 per gallon. n The 50¢ tax raises the marginal costs of production for the firm, shifting the supply curve up to S 2. n At the original market price, there is now excess demand of 20 billion gallons; the price is bid up to $1. 80, where there is neither a shortage nor a surplus.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The gasoline tax has two effects: n It changes the market price n Producers must now pay a tax to the government n Recall that n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 80 - $1. 50) + 0 = 30¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 80) + $0. 50 = 20¢

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The gasoline tax has two effects: n It changes the market price n Producers must now pay a tax to the government n Recall that n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 80 - $1. 50) + 0 = 30¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 80) + $0. 50 = 20¢

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n This analysis reveals that the true burden on producers is not 50¢, but some smaller number, because part of the burden is borne by consumers in the form of a higher price. n The tax wedge the difference between what is consumers pay and what producers receive from a transaction. n The wedge in this case is the difference between the $1. 80 consumers pay and the $1. 30 producers receive.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n This analysis reveals that the true burden on producers is not 50¢, but some smaller number, because part of the burden is borne by consumers in the form of a higher price. n The tax wedge the difference between what is consumers pay and what producers receive from a transaction. n The wedge in this case is the difference between the $1. 80 consumers pay and the $1. 30 producers receive.

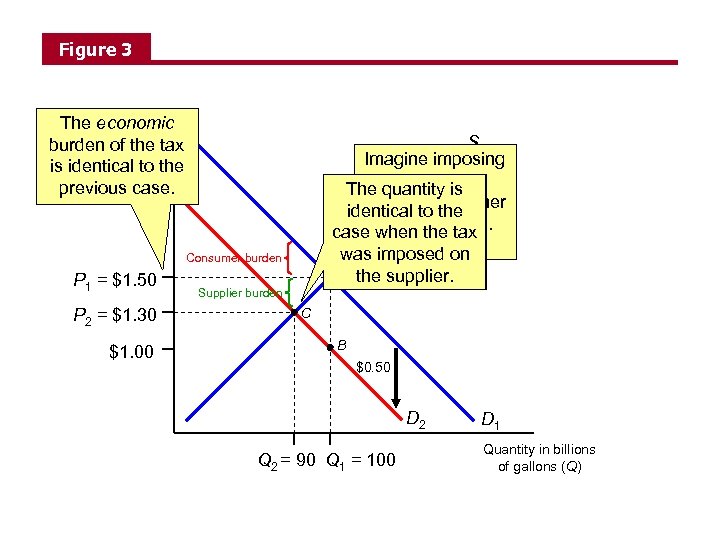

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The second question to examine is whether imposing the tax on the consumers, rather than producers, will change the analysis. n Figure 3 illustrates the impact of a 50¢ per gallon tax on demanders of gasoline.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The second question to examine is whether imposing the tax on the consumers, rather than producers, will change the analysis. n Figure 3 illustrates the impact of a 50¢ per gallon tax on demanders of gasoline.

Figure 3 The economic Price per gallon (P) burden of the tax is identical to the previous case. S Imagine imposing the tax The new on The quantity is demanders rather equilibrium price identical to the than the tax is $1. 30, and the case whensuppliers. quantity is 90. was imposed on A the supplier. Consumer burden P 1 = $1. 50 P 2 = $1. 30 $1. 00 Supplier burden C B $0. 50 D 2 Q 2 = 90 Q 1 = 100 D 1 Quantity in billions of gallons (Q)

Figure 3 The economic Price per gallon (P) burden of the tax is identical to the previous case. S Imagine imposing the tax The new on The quantity is demanders rather equilibrium price identical to the than the tax is $1. 30, and the case whensuppliers. quantity is 90. was imposed on A the supplier. Consumer burden P 1 = $1. 50 P 2 = $1. 30 $1. 00 Supplier burden C B $0. 50 D 2 Q 2 = 90 Q 1 = 100 D 1 Quantity in billions of gallons (Q)

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The initial market equilibrium is 100 billion gallons sold at $1. 50 per gallon. n Although the overall willingness to pay for a unit of gasoline is unchanged, the 50¢ tax lowers the consumers’ willingness to pay producers by 50¢ (since consumers must pay the government). Thus, the demand curve shifts to D 2. n At the original market price, there is now excess supply of gasoline; producers lower their price until $1. 30, where there is neither a shortage nor a surplus.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n The initial market equilibrium is 100 billion gallons sold at $1. 50 per gallon. n Although the overall willingness to pay for a unit of gasoline is unchanged, the 50¢ tax lowers the consumers’ willingness to pay producers by 50¢ (since consumers must pay the government). Thus, the demand curve shifts to D 2. n At the original market price, there is now excess supply of gasoline; producers lower their price until $1. 30, where there is neither a shortage nor a surplus.

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n As before, the new gasoline tax has two effects: n It changes the market price n Consumers must now pay a tax to the government n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 30 - $1. 50) + $0. 50 = 30¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 30) + 0 = 20¢

The three rules of tax incidence: The statutory burden does not describe who really bears the tax n As before, the new gasoline tax has two effects: n It changes the market price n Consumers must now pay a tax to the government n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 30 - $1. 50) + $0. 50 = 30¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 30) + 0 = 20¢

The three rules of tax incidence: The side of the market on which the tax is imposed is irrelevant n Note that these tax burdens are identical to the burdens when the tax was levied on producers. n This illustrates an important lesson – the side on which the tax is imposed is irrelevant for the distribution of tax burdens.

The three rules of tax incidence: The side of the market on which the tax is imposed is irrelevant n Note that these tax burdens are identical to the burdens when the tax was levied on producers. n This illustrates an important lesson – the side on which the tax is imposed is irrelevant for the distribution of tax burdens.

The three rules of tax incidence: The side of the market on which the tax is imposed is irrelevant n While there is only one market price when a tax is imposed, there are two different prices that economists track. n The gross pricethe price in the market. is n The after-tax price the gross price minus the is amount of the tax (if producers pay the tax) or plus the amount of the tax (if consumers pay the tax).

The three rules of tax incidence: The side of the market on which the tax is imposed is irrelevant n While there is only one market price when a tax is imposed, there are two different prices that economists track. n The gross pricethe price in the market. is n The after-tax price the gross price minus the is amount of the tax (if producers pay the tax) or plus the amount of the tax (if consumers pay the tax).

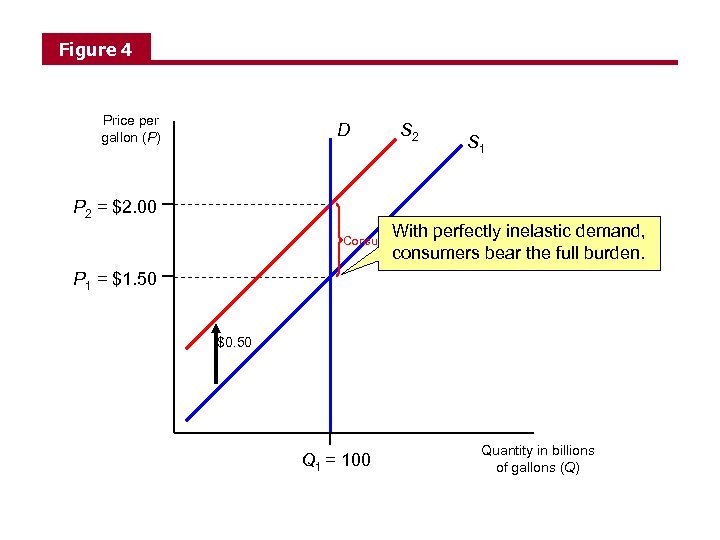

The three rules of tax incidence: Inelastic versus elastic supply and demand n The third question to examine is how the tax burden varies with the elasticities of supply and demand. n In all cases, elastic parties avoid taxes and inelastic parties bear them. n Consider Figure 4, with perfectly inelastic demand 4 for gasoline.

The three rules of tax incidence: Inelastic versus elastic supply and demand n The third question to examine is how the tax burden varies with the elasticities of supply and demand. n In all cases, elastic parties avoid taxes and inelastic parties bear them. n Consider Figure 4, with perfectly inelastic demand 4 for gasoline.

Figure 4 Price per gallon (P) D S 2 S 1 P 2 = $2. 00 With perfectly inelastic demand, consumers bear the full burden. Consumer burden P 1 = $1. 50 $0. 50 Q 1 = 100 Quantity in billions of gallons (Q)

Figure 4 Price per gallon (P) D S 2 S 1 P 2 = $2. 00 With perfectly inelastic demand, consumers bear the full burden. Consumer burden P 1 = $1. 50 $0. 50 Q 1 = 100 Quantity in billions of gallons (Q)

The three rules of tax incidence: Inelastic versus elastic supply and demand n The new equilibrium market price is $2. 00, a full 50¢ higher than the original price. n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($2. 00 - $1. 50) + 0 = 50¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $2. 00) + 50¢ = 0

The three rules of tax incidence: Inelastic versus elastic supply and demand n The new equilibrium market price is $2. 00, a full 50¢ higher than the original price. n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($2. 00 - $1. 50) + 0 = 50¢ n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $2. 00) + 50¢ = 0

The three rules of tax incidence: Inelastic versus elastic supply and demand n Note that even though the tax was legally imposed on the producer, the full burden of the tax is borne by the consumer. n Full shifting when one party in a transaction bears is all of the tax burden. n With perfectly inelastic demand, consumers bear all of the tax burden.

The three rules of tax incidence: Inelastic versus elastic supply and demand n Note that even though the tax was legally imposed on the producer, the full burden of the tax is borne by the consumer. n Full shifting when one party in a transaction bears is all of the tax burden. n With perfectly inelastic demand, consumers bear all of the tax burden.

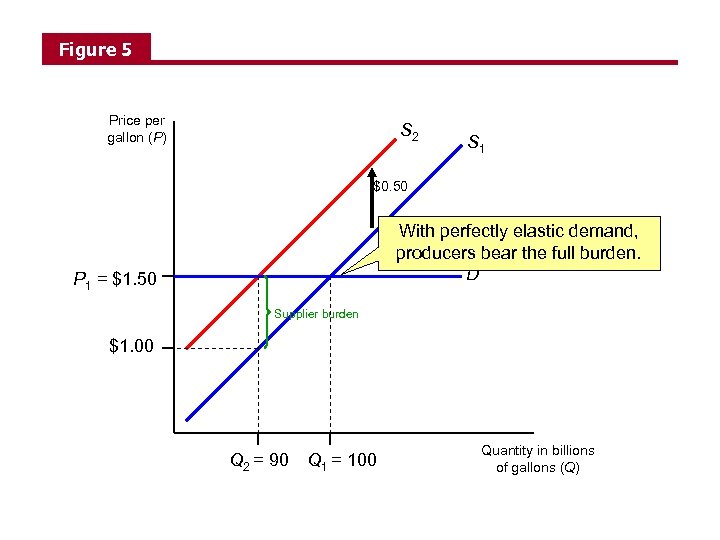

The three rules of tax incidence: Inelastic versus elastic supply and demand n Now consider Figure 5, with perfectly elastic 5 demand for gasoline.

The three rules of tax incidence: Inelastic versus elastic supply and demand n Now consider Figure 5, with perfectly elastic 5 demand for gasoline.

Figure 5 Price per gallon (P) S 2 S 1 $0. 50 With perfectly elastic demand, producers bear the full burden. D P 1 = $1. 50 Supplier burden $1. 00 Q 2 = 90 Q 1 = 100 Quantity in billions of gallons (Q)

Figure 5 Price per gallon (P) S 2 S 1 $0. 50 With perfectly elastic demand, producers bear the full burden. D P 1 = $1. 50 Supplier burden $1. 00 Q 2 = 90 Q 1 = 100 Quantity in billions of gallons (Q)

The three rules of tax incidence: Inelastic versus elastic supply and demand n The new equilibrium market price is $1. 50, the same as the original price. n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 50 - $1. 50) + 0 = 0 n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 50) + 50¢ = 50¢

The three rules of tax incidence: Inelastic versus elastic supply and demand n The new equilibrium market price is $1. 50, the same as the original price. n Consumer tax burden = (posttax price – pretax price) + tax payments of consumers n Consumer tax burden = ($1. 50 - $1. 50) + 0 = 0 n Producer tax burden = (pretax price – posttax price) + tax payments of producers n Producer tax burden = ($1. 50 - $1. 50) + 50¢ = 50¢

The three rules of tax incidence: Inelastic versus elastic supply and demand n In this case, the producer bears the full burden of the tax, because consumers will simply stop purchasing the product if prices are raised. n These extreme cases illustrate a general point: n n n Parties with inelastic supply or demand bear taxes; parties with elastic supply or demand avoid them. Demand is more elastic when there are many good substitutes (for example, fast food at restaurants). Demand is less elastic when there are few substitutes (for example, insulin medication). Supply is more elastic when suppliers have more alternative uses to which their resources can be put.

The three rules of tax incidence: Inelastic versus elastic supply and demand n In this case, the producer bears the full burden of the tax, because consumers will simply stop purchasing the product if prices are raised. n These extreme cases illustrate a general point: n n n Parties with inelastic supply or demand bear taxes; parties with elastic supply or demand avoid them. Demand is more elastic when there are many good substitutes (for example, fast food at restaurants). Demand is less elastic when there are few substitutes (for example, insulin medication). Supply is more elastic when suppliers have more alternative uses to which their resources can be put.

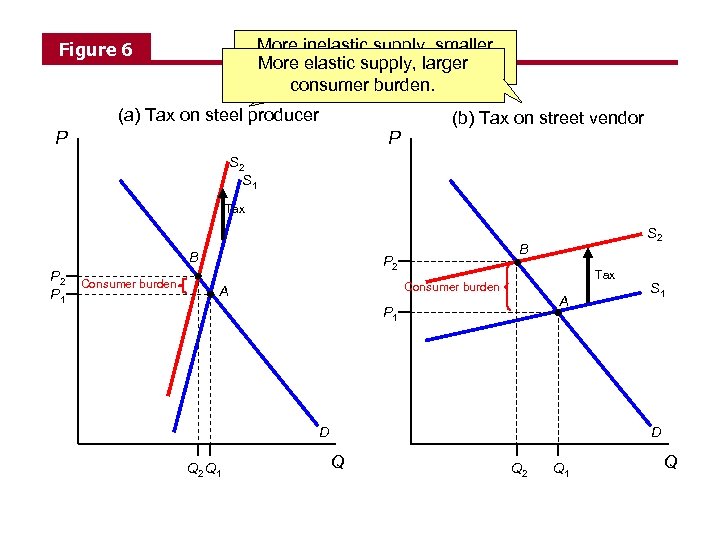

The three rules of tax incidence: Inelastic versus elastic supply and demand n Figure 6 illustrates these cases – holding demand constant, more inelastic supply leads to a greater tax burden on producers.

The three rules of tax incidence: Inelastic versus elastic supply and demand n Figure 6 illustrates these cases – holding demand constant, more inelastic supply leads to a greater tax burden on producers.

More inelastic supply, smaller More consumer burden. elastic supply, larger consumer burden. Figure 6 (a) Tax on steel producer (b) Tax on street vendor P P S 2 S 1 Tax B P 2 P 1 Consumer burden B P 2 Tax Consumer burden A S 2 A P 1 D Q 2 Q 1 S 1 D Q Q 2 Q 1 Q

More inelastic supply, smaller More consumer burden. elastic supply, larger consumer burden. Figure 6 (a) Tax on steel producer (b) Tax on street vendor P P S 2 S 1 Tax B P 2 P 1 Consumer burden B P 2 Tax Consumer burden A S 2 A P 1 D Q 2 Q 1 S 1 D Q Q 2 Q 1 Q

The three rules of tax incidence: Inelastic versus elastic supply and demand n As illustrated in Figure 6 a, when a tax is levied on 6 a an inelastic supplier – the steel firm that is committed to a level of production by its fixed capital investment – the consumer pays very little of the tax, and the producer almost all of it. n In the second panel, with elastic supply, the consumer bears almost all of the tax.

The three rules of tax incidence: Inelastic versus elastic supply and demand n As illustrated in Figure 6 a, when a tax is levied on 6 a an inelastic supplier – the steel firm that is committed to a level of production by its fixed capital investment – the consumer pays very little of the tax, and the producer almost all of it. n In the second panel, with elastic supply, the consumer bears almost all of the tax.

The three rules of tax incidence: Tax incidence is about prices, not quantities n Finally, it is important to note that even though quantities change dramatically with perfectly elastic demand, the focus of tax incidence is on prices, not quantities. n We ignore quantities because at both the old and new equilibria, consumers are indifferent between buying the taxed good and spending the money elsewhere.

The three rules of tax incidence: Tax incidence is about prices, not quantities n Finally, it is important to note that even though quantities change dramatically with perfectly elastic demand, the focus of tax incidence is on prices, not quantities. n We ignore quantities because at both the old and new equilibria, consumers are indifferent between buying the taxed good and spending the money elsewhere.

TAX INCIDENCE EXTENSIONS n We extend the analysis by examining: n Factors of production n Imperfectly competitive markets n Accounting for the expenditure side

TAX INCIDENCE EXTENSIONS n We extend the analysis by examining: n Factors of production n Imperfectly competitive markets n Accounting for the expenditure side

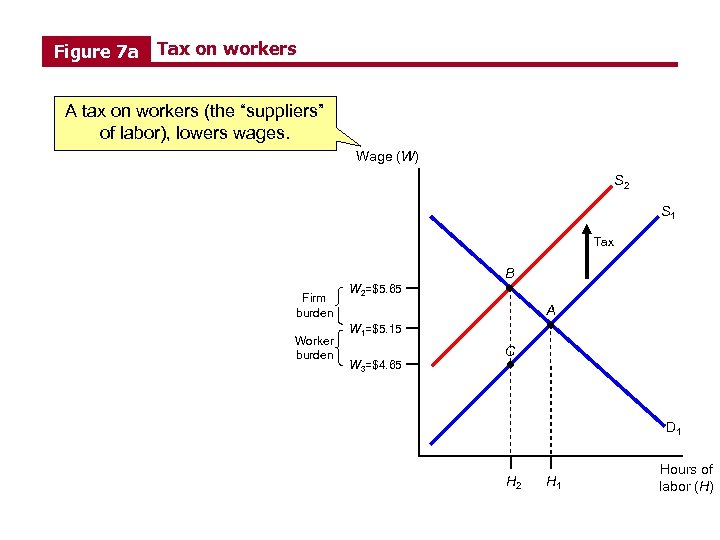

Tax incidence extensions Tax incidence in factor markets n Many taxes are levied on the factors of production, such as labor. n Consider the labor market illustrated in Figure 7 a, 7 a before and after a tax on workers (the suppliers of labor) is imposed.

Tax incidence extensions Tax incidence in factor markets n Many taxes are levied on the factors of production, such as labor. n Consider the labor market illustrated in Figure 7 a, 7 a before and after a tax on workers (the suppliers of labor) is imposed.

Figure 7 a Tax on workers A tax on workers (the “suppliers” of labor), lowers wages. Wage (W) S 2 S 1 Tax B Firm burden Worker burden W 2=$5. 65 A W 1=$5. 15 W 3=$4. 65 C D 1 H 2 H 1 Hours of labor (H)

Figure 7 a Tax on workers A tax on workers (the “suppliers” of labor), lowers wages. Wage (W) S 2 S 1 Tax B Firm burden Worker burden W 2=$5. 65 A W 1=$5. 15 W 3=$4. 65 C D 1 H 2 H 1 Hours of labor (H)

Tax incidence extensions Tax incidence in factor markets n The $1 per hour tax lowers the return to work at every amount of labor. n Thus, individuals require a $1 rise in their wages to supply any amount of labor, and the supply curve shifts upward. n With labor demand unchanged, the new equilibrium wage is $5. 65. In this case, the tax is borne equally by workers and firms.

Tax incidence extensions Tax incidence in factor markets n The $1 per hour tax lowers the return to work at every amount of labor. n Thus, individuals require a $1 rise in their wages to supply any amount of labor, and the supply curve shifts upward. n With labor demand unchanged, the new equilibrium wage is $5. 65. In this case, the tax is borne equally by workers and firms.

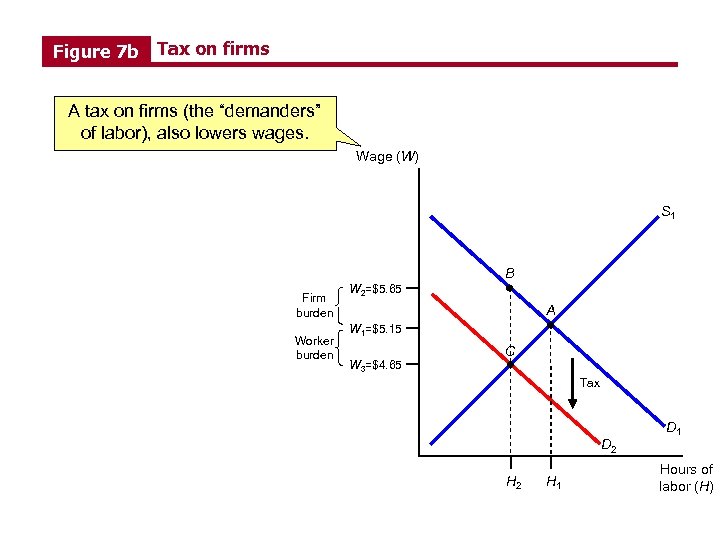

Tax incidence extensions Tax incidence in factor markets n Now consider the labor market illustrated in Figure 7 b, where a tax on firms (the demanders of labor) is 7 b imposed.

Tax incidence extensions Tax incidence in factor markets n Now consider the labor market illustrated in Figure 7 b, where a tax on firms (the demanders of labor) is 7 b imposed.

Figure 7 b Tax on firms A tax on firms (the “demanders” of labor), also lowers wages. Wage (W) S 1 B Firm burden Worker burden W 2=$5. 65 A W 1=$5. 15 W 3=$4. 65 C Tax D 2 H 1 D 1 Hours of labor (H)

Figure 7 b Tax on firms A tax on firms (the “demanders” of labor), also lowers wages. Wage (W) S 1 B Firm burden Worker burden W 2=$5. 65 A W 1=$5. 15 W 3=$4. 65 C Tax D 2 H 1 D 1 Hours of labor (H)

Tax incidence extensions Tax incidence in factor markets n With the tax on firms, the demand curve shifts downward to D 2, and market wages fall to $4. 65. n The firm pays workers 50¢ less than the original $5. 15, but must send $1 to the government. In effect, they are paying a wage of $5. 65. n As in output markets, the tax incidence of a payroll tax shows that it makes no difference on which side of the market it is levied, and the economic burden can differ from the statutory burden.

Tax incidence extensions Tax incidence in factor markets n With the tax on firms, the demand curve shifts downward to D 2, and market wages fall to $4. 65. n The firm pays workers 50¢ less than the original $5. 15, but must send $1 to the government. In effect, they are paying a wage of $5. 65. n As in output markets, the tax incidence of a payroll tax shows that it makes no difference on which side of the market it is levied, and the economic burden can differ from the statutory burden.

Tax incidence extensions Tax incidence in factor markets n This analysis will not be correct if there are impediments to wage adjustments, however. n The minimum wage legally mandated minimum is a amount that workers must be paid for each hour of work. n The current federal minimum wage is $5. 15 per hour.

Tax incidence extensions Tax incidence in factor markets n This analysis will not be correct if there are impediments to wage adjustments, however. n The minimum wage legally mandated minimum is a amount that workers must be paid for each hour of work. n The current federal minimum wage is $5. 15 per hour.

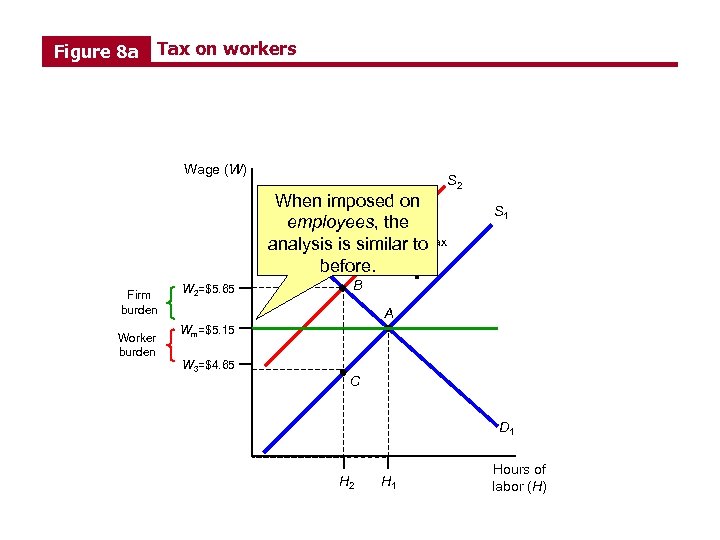

Tax incidence extensions Tax incidence in factor markets n With a minimum wage, wages cannot fully adjust, so the incidence will be different. n Consider, first, Figure 8 a, which imposes the tax on 8 a workers.

Tax incidence extensions Tax incidence in factor markets n With a minimum wage, wages cannot fully adjust, so the incidence will be different. n Consider, first, Figure 8 a, which imposes the tax on 8 a workers.

Figure 8 a Tax on workers Wage (W) A binding minimum When imposed on wage changes the employees, the analysis ishowever. Tax analysis, similar to before. Firm burden Worker burden W 2=$5. 65 S 2 S 1 B A Wm=$5. 15 W 3=$4. 65 C D 1 H 2 H 1 Hours of labor (H)

Figure 8 a Tax on workers Wage (W) A binding minimum When imposed on wage changes the employees, the analysis ishowever. Tax analysis, similar to before. Firm burden Worker burden W 2=$5. 65 S 2 S 1 B A Wm=$5. 15 W 3=$4. 65 C D 1 H 2 H 1 Hours of labor (H)

Tax incidence extensions Tax incidence in factor markets n With a tax on workers, the labor supply curve shifts upward as before. Workers are paid $5. 65 per hour, but are forced to pay $1 of that to the government for taxes. n The incidence is borne in the same manner as when there was no minimum wage.

Tax incidence extensions Tax incidence in factor markets n With a tax on workers, the labor supply curve shifts upward as before. Workers are paid $5. 65 per hour, but are forced to pay $1 of that to the government for taxes. n The incidence is borne in the same manner as when there was no minimum wage.

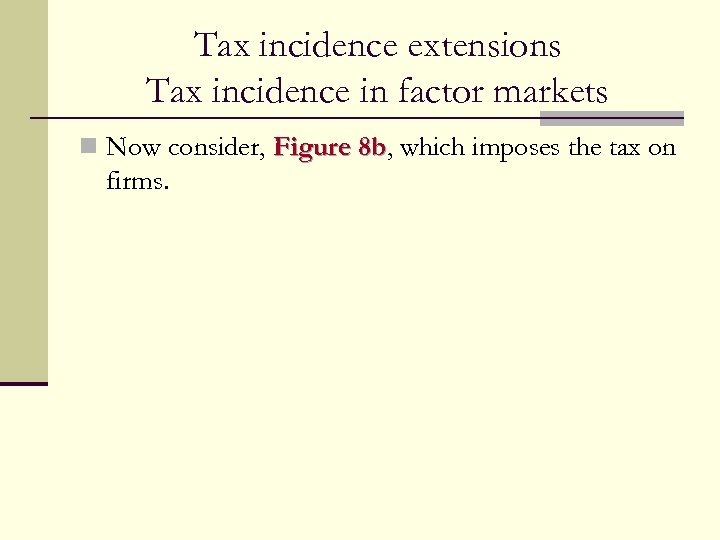

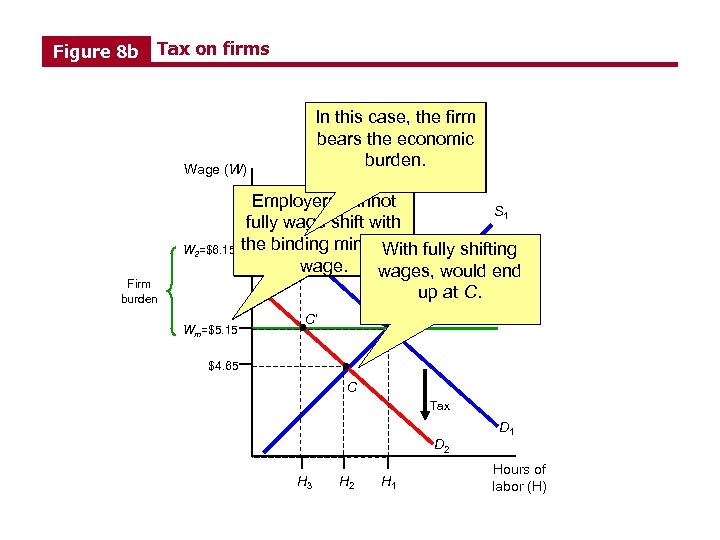

Tax incidence extensions Tax incidence in factor markets n Now consider, Figure 8 b, which imposes the tax on 8 b firms.

Tax incidence extensions Tax incidence in factor markets n Now consider, Figure 8 b, which imposes the tax on 8 b firms.

Figure 8 b Tax on firms Without wage In this case, the firm shifting, would end bears the economic up at C’. burden. Wage (W) Firm burden Employers cannot When imposed on S 1 fully wage shift with employers, the B incidence differs! W 2=$6. 15 the binding minimum fully shifting With wages, would end up at C. Wm=$5. 15 A C’ $4. 65 C Tax D 2 H 3 H 2 H 1 D 1 Hours of labor (H)

Figure 8 b Tax on firms Without wage In this case, the firm shifting, would end bears the economic up at C’. burden. Wage (W) Firm burden Employers cannot When imposed on S 1 fully wage shift with employers, the B incidence differs! W 2=$6. 15 the binding minimum fully shifting With wages, would end up at C. Wm=$5. 15 A C’ $4. 65 C Tax D 2 H 3 H 2 H 1 D 1 Hours of labor (H)

Tax incidence extensions Tax incidence in factor markets n With a tax on firms, the labor demand curve shifts downward. Without wage impediments, the market wage would fall from $5. 15 to $4. 65, and the firm would also pay $1 to the government. Hours of work would be H 2. n With the minimum wage, wages cannot adjust downward, so the firm instead demands H 3

Tax incidence extensions Tax incidence in factor markets n With a tax on firms, the labor demand curve shifts downward. Without wage impediments, the market wage would fall from $5. 15 to $4. 65, and the firm would also pay $1 to the government. Hours of work would be H 2. n With the minimum wage, wages cannot adjust downward, so the firm instead demands H 3

Tax incidence extensions Tax incidence in factor markets n When there are barriers to reaching the competitive market equilibrium, the side of the market on which the tax is levied can matter. Minimum wages n Workplace norms n Union rules n n There are more frequent in input markets than output markets.

Tax incidence extensions Tax incidence in factor markets n When there are barriers to reaching the competitive market equilibrium, the side of the market on which the tax is levied can matter. Minimum wages n Workplace norms n Union rules n n There are more frequent in input markets than output markets.

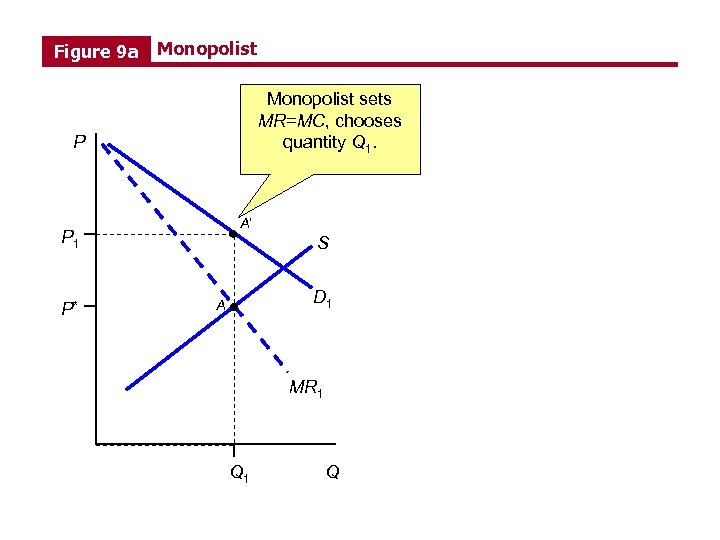

Tax incidence extensions Tax incidence in imperfectly competitive markets n The analysis has so far focused on competitive markets. n Monopoly markets in which there is only are one supplier of a good. n Monopolists are price makers, not price takers. n Figure 9 a shows the determination of equilibrium in monopoly markets.

Tax incidence extensions Tax incidence in imperfectly competitive markets n The analysis has so far focused on competitive markets. n Monopoly markets in which there is only are one supplier of a good. n Monopolists are price makers, not price takers. n Figure 9 a shows the determination of equilibrium in monopoly markets.

Figure 9 a Monopolist sets MR=MC, chooses quantity Q 1. P A’ P 1 P* S D 1 A MR 1 Q

Figure 9 a Monopolist sets MR=MC, chooses quantity Q 1. P A’ P 1 P* S D 1 A MR 1 Q

Tax incidence extensions Tax incidence in imperfectly competitive markets n Unlike a perfect competitor, the monopolist faces a downward sloping marginal revenue curve, because it must lower its price on all units to sell another unit. n The marginal revenue curve, MR 1, is therefore everywhere below the demand curve. Setting MR 1=MC, the quantity Q 1 initially maximizes profits. n Now consider a tax on consumers, illustrated in Figure 9 b. 9 b

Tax incidence extensions Tax incidence in imperfectly competitive markets n Unlike a perfect competitor, the monopolist faces a downward sloping marginal revenue curve, because it must lower its price on all units to sell another unit. n The marginal revenue curve, MR 1, is therefore everywhere below the demand curve. Setting MR 1=MC, the quantity Q 1 initially maximizes profits. n Now consider a tax on consumers, illustrated in Figure 9 b. 9 b

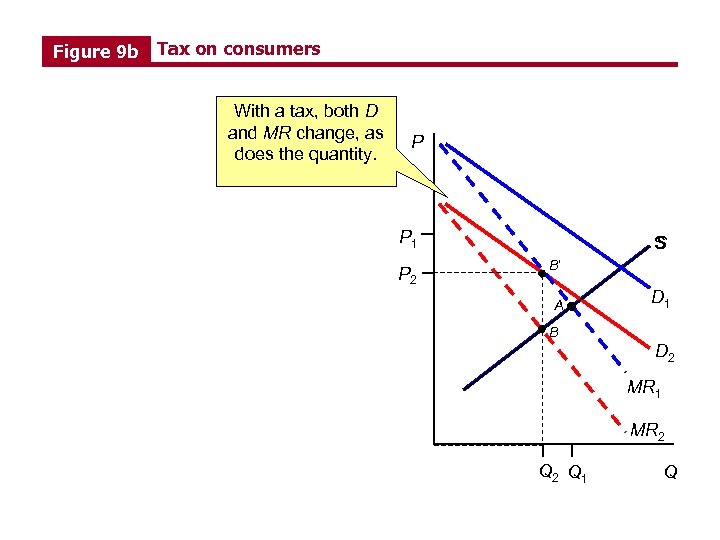

Figure 9 b Tax on consumers With a tax, both D and MR change, as does the quantity. P P 1 P 2 S B’ A D 1 B D 2 MR 1 MR 2 Q 1 Q

Figure 9 b Tax on consumers With a tax, both D and MR change, as does the quantity. P P 1 P 2 S B’ A D 1 B D 2 MR 1 MR 2 Q 1 Q

Tax incidence extensions Tax incidence in imperfectly competitive markets n The tax on consumers shifts the demand curve downward to D 2, and the associated marginal revenue curve to MR 2. n Setting MR 2=MC, the quantity Q 2 now maximizes profits. n The monopolist’s price falls from P 1 to P 2, so it bears some of the tax, just as a competitive firm does. n The three rules of tax incidence continue to apply for a monopolist.

Tax incidence extensions Tax incidence in imperfectly competitive markets n The tax on consumers shifts the demand curve downward to D 2, and the associated marginal revenue curve to MR 2. n Setting MR 2=MC, the quantity Q 2 now maximizes profits. n The monopolist’s price falls from P 1 to P 2, so it bears some of the tax, just as a competitive firm does. n The three rules of tax incidence continue to apply for a monopolist.

Tax incidence extensions Tax incidence in imperfectly competitive markets n Most markets fall somewhere between perfect competition and monopoly. n Oligopoly markets in which firms have are some market power in setting prices, but not as much as a monopolist. There is less consensus on how to model these markets. n Economists tend to assume the tax incidence results apply in these markets as well. n

Tax incidence extensions Tax incidence in imperfectly competitive markets n Most markets fall somewhere between perfect competition and monopoly. n Oligopoly markets in which firms have are some market power in setting prices, but not as much as a monopolist. There is less consensus on how to model these markets. n Economists tend to assume the tax incidence results apply in these markets as well. n

Tax incidence extensions Balanced budget tax incidence n One final extension asks how the money that is raised will be spent. n Balanced budget incidence analysis that is tax account for both the tax and the benefits it brings. n It is inconvenient, however, to worry about both the taxation and expenditure side at the same time.

Tax incidence extensions Balanced budget tax incidence n One final extension asks how the money that is raised will be spent. n Balanced budget incidence analysis that is tax account for both the tax and the benefits it brings. n It is inconvenient, however, to worry about both the taxation and expenditure side at the same time.

GENERAL EQUILIBRIUM TAX INCIDENCE n Our models so far have focused on partial equilibrium. n Partial equilibrium tax incidence is analysis that considers the impact of a tax on a market in isolation. n To study the effects on related markets, we use general equilibrium analysis. n General equilibrium tax incidence is analysis that considers the effects on related markets of a tax imposed on one market.

GENERAL EQUILIBRIUM TAX INCIDENCE n Our models so far have focused on partial equilibrium. n Partial equilibrium tax incidence is analysis that considers the impact of a tax on a market in isolation. n To study the effects on related markets, we use general equilibrium analysis. n General equilibrium tax incidence is analysis that considers the effects on related markets of a tax imposed on one market.

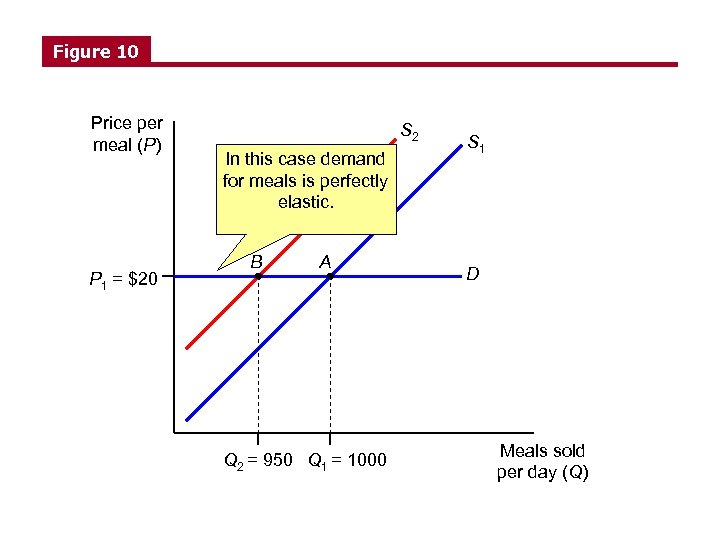

General equilibrium tax incidence Effects of a restaurant tax: A GE example n Consider the demand for restaurant meals in a single town, as illustrated in Figure 10. 10 n The demand for such meals is likely to be highly elastic.

General equilibrium tax incidence Effects of a restaurant tax: A GE example n Consider the demand for restaurant meals in a single town, as illustrated in Figure 10. 10 n The demand for such meals is likely to be highly elastic.

Figure 10 Price per meal (P) P 1 = $20 S 2 In this case demand for meals is perfectly $1 elastic. B A Q 2 = 950 Q 1 = 1000 S 1 D Meals sold per day (Q)

Figure 10 Price per meal (P) P 1 = $20 S 2 In this case demand for meals is perfectly $1 elastic. B A Q 2 = 950 Q 1 = 1000 S 1 D Meals sold per day (Q)

General equilibrium tax incidence Effects of a restaurant tax: A GE example n In such a case, a $1 tax on firms shifts the supply curve, and the firm bears the full burden of the tax. n But in reality, firms are not self-functioning entities, but are a technology for combining capital and labor to produce an output. n With a restaurant, capital is best viewed as financial capital – the money that buys physical capital inputs like the building, the ovens, tables, etc.

General equilibrium tax incidence Effects of a restaurant tax: A GE example n In such a case, a $1 tax on firms shifts the supply curve, and the firm bears the full burden of the tax. n But in reality, firms are not self-functioning entities, but are a technology for combining capital and labor to produce an output. n With a restaurant, capital is best viewed as financial capital – the money that buys physical capital inputs like the building, the ovens, tables, etc.

General equilibrium tax incidence Effects of a restaurant tax: A GE example n The $1 tax on meals is borne by the firm, meaning that it is borne by the factors of production (labor and capital). n We move back to the input market in Figure 11. 11

General equilibrium tax incidence Effects of a restaurant tax: A GE example n The $1 tax on meals is borne by the firm, meaning that it is borne by the factors of production (labor and capital). n We move back to the input market in Figure 11. 11

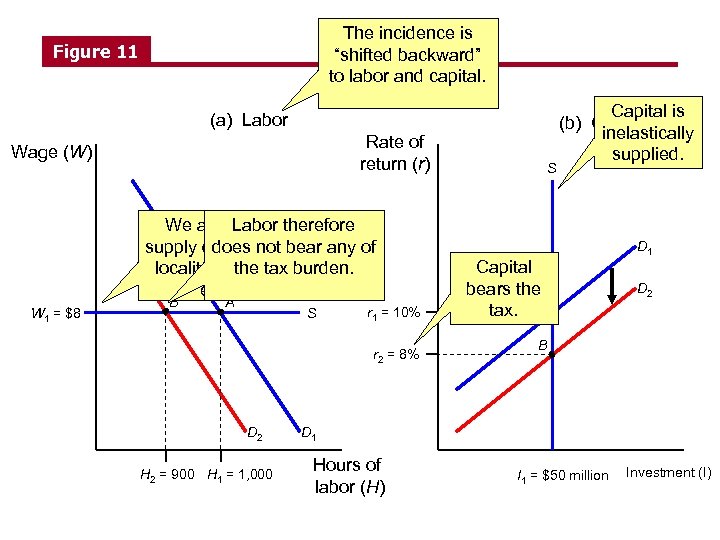

The incidence is “shifted backward” to labor and capital. Figure 11 (a) Labor Rate of return (r) Wage (W) We assume the Labor therefore supply of labor in the any of does not bear locality is perfectly the tax burden. elastic. W 1 = $8 B A S r 1 = 10% r 2 = 8% D 2 H 2 = 900 H 1 = 1, 000 S Capital is (b) Capital inelastically supplied. D 1 Capital bears the tax. A D 2 B D 1 Hours of labor (H) I 1 = $50 million Investment (I)

The incidence is “shifted backward” to labor and capital. Figure 11 (a) Labor Rate of return (r) Wage (W) We assume the Labor therefore supply of labor in the any of does not bear locality is perfectly the tax burden. elastic. W 1 = $8 B A S r 1 = 10% r 2 = 8% D 2 H 2 = 900 H 1 = 1, 000 S Capital is (b) Capital inelastically supplied. D 1 Capital bears the tax. A D 2 B D 1 Hours of labor (H) I 1 = $50 million Investment (I)

General equilibrium tax incidence Issues to consider in GE incidence analysis n As illustrated, the supply of labor (restaurant workers) is perfectly elastic, because those workers can easily find a job in another locality. n The tax on output, restaurant meals, would reduce the firm’s demand for labor, reducing the number of workers hired, but not their wage rate. n On the other hand, in the short-run, the supply of capital is likely to be fixed. The firm’s demand for capital shifts in, lowering the rate of return on capital. n In the short run, the owners of capital bear the tax in the form of a lower return on their investment.

General equilibrium tax incidence Issues to consider in GE incidence analysis n As illustrated, the supply of labor (restaurant workers) is perfectly elastic, because those workers can easily find a job in another locality. n The tax on output, restaurant meals, would reduce the firm’s demand for labor, reducing the number of workers hired, but not their wage rate. n On the other hand, in the short-run, the supply of capital is likely to be fixed. The firm’s demand for capital shifts in, lowering the rate of return on capital. n In the short run, the owners of capital bear the tax in the form of a lower return on their investment.

General equilibrium tax incidence Issues to consider in GE incidence analysis n In the longer-run, the supply of capital is not inelastic. Investors can close or sell the restaurant, take their money, and invest it elsewhere. n In the long-run, capital is likely to be perfectly elastic as there are many good substitutes for investing in a particular restaurant in a particular town. n

General equilibrium tax incidence Issues to consider in GE incidence analysis n In the longer-run, the supply of capital is not inelastic. Investors can close or sell the restaurant, take their money, and invest it elsewhere. n In the long-run, capital is likely to be perfectly elastic as there are many good substitutes for investing in a particular restaurant in a particular town. n

General equilibrium tax incidence Issues to consider in GE incidence analysis n If both labor and capital are highly elastic in the long run, who bears the tax? n The one additional inelastic factor in the restaurant production process is land. The supply is clearly fixed. n When both labor and capital can avoid the tax, the only way restaurants can stay open is if they pay a lower rent on their land. n

General equilibrium tax incidence Issues to consider in GE incidence analysis n If both labor and capital are highly elastic in the long run, who bears the tax? n The one additional inelastic factor in the restaurant production process is land. The supply is clearly fixed. n When both labor and capital can avoid the tax, the only way restaurants can stay open is if they pay a lower rent on their land. n

General equilibrium tax incidence Issues to consider in GE incidence analysis n The scope of a tax matters for tax incidence as well. Consider imposing a restaurant tax on the entire state rather than just a city. n Demand in the output market is less elastic; consumers bear some of the burden. n Labor supply is less elastic as well. n The scope of the tax matters to incidence analysis because it determines which elasticities are relevant to the analysis: taxes that are broader based are harder to avoid than taxes that are narrower, so the response of producers and consumers to the tax will be smaller and more inelastic.

General equilibrium tax incidence Issues to consider in GE incidence analysis n The scope of a tax matters for tax incidence as well. Consider imposing a restaurant tax on the entire state rather than just a city. n Demand in the output market is less elastic; consumers bear some of the burden. n Labor supply is less elastic as well. n The scope of the tax matters to incidence analysis because it determines which elasticities are relevant to the analysis: taxes that are broader based are harder to avoid than taxes that are narrower, so the response of producers and consumers to the tax will be smaller and more inelastic.

General equilibrium tax incidence Issues to consider in GE incidence analysis n There also potentially spillovers into other output markets from the restaurant tax, not just input markets. n Consider the statewide restaurant tax that raises the price of meals: n n n It has an income effect for consumers. It increases consumption of goods that are substitutes for restaurant meals, such as meals at home. It decreases consumption of goods that are complements for restaurant meals, such as valets. n A complete general equilibrium analysis must account for the effects in these other markets.

General equilibrium tax incidence Issues to consider in GE incidence analysis n There also potentially spillovers into other output markets from the restaurant tax, not just input markets. n Consider the statewide restaurant tax that raises the price of meals: n n n It has an income effect for consumers. It increases consumption of goods that are substitutes for restaurant meals, such as meals at home. It decreases consumption of goods that are complements for restaurant meals, such as valets. n A complete general equilibrium analysis must account for the effects in these other markets.

THE INCIDENCE OF TAXATION IN THE UNITED STATES CBO incidence assumptions n The Congressional Budget Office (CBO) has examined the incidence of taxation in the U. S. n The CBO assumes: Income taxes are fully borne by the households that pay them. n Payroll taxes are fully borne by workers, regardless of the statutory incidence. n Excise taxes are fully shifted forward to prices. n Corporate taxes are fully shifted forward to the owners of capital. n

THE INCIDENCE OF TAXATION IN THE UNITED STATES CBO incidence assumptions n The Congressional Budget Office (CBO) has examined the incidence of taxation in the U. S. n The CBO assumes: Income taxes are fully borne by the households that pay them. n Payroll taxes are fully borne by workers, regardless of the statutory incidence. n Excise taxes are fully shifted forward to prices. n Corporate taxes are fully shifted forward to the owners of capital. n

The incidence of taxation in the United States CBO incidence assumptions n These assumptions are generally consistent with empirical evidence. n For example, Poterba (1996) shows full shifting to prices from increases in the sales tax. n The most questionable assumption relates to the corporate income tax. It is likely that consumers and workers bear some of the tax. The corporate tax will be discussed in detail in Chapter 24.

The incidence of taxation in the United States CBO incidence assumptions n These assumptions are generally consistent with empirical evidence. n For example, Poterba (1996) shows full shifting to prices from increases in the sales tax. n The most questionable assumption relates to the corporate income tax. It is likely that consumers and workers bear some of the tax. The corporate tax will be discussed in detail in Chapter 24.

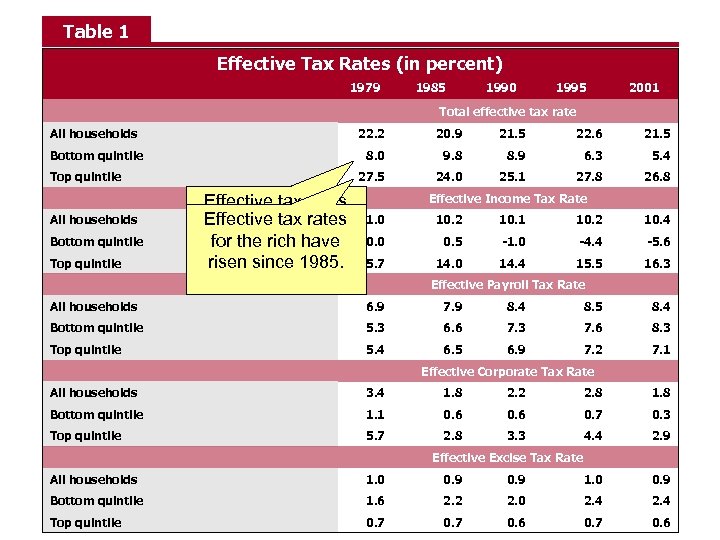

The incidence of taxation in the United States Results of CBO incidence analysis n Table 1 shows the effective tax rates over time, by income quintile. n The effective tax rate is taxes paid relative to total income.

The incidence of taxation in the United States Results of CBO incidence analysis n Table 1 shows the effective tax rates over time, by income quintile. n The effective tax rate is taxes paid relative to total income.

Table 1 Effective Tax Rates (in percent) 1979 1985 1990 1995 2001 Total effective tax rate All households 22. 2 All households Bottom quintile Top quintile Effective tax rates Effective tax have for the poor rates for theover time. fallen rich have risen since 1985. 22. 6 21. 5 9. 8 8. 9 6. 3 5. 4 27. 5 Top quintile 21. 5 8. 0 Bottom quintile 20. 9 24. 0 25. 1 27. 8 26. 8 Effective Income Tax Rate 11. 0 10. 2 10. 1 10. 2 10. 4 0. 0 0. 5 -1. 0 -4. 4 -5. 6 15. 7 14. 0 14. 4 15. 5 16. 3 Effective Payroll Tax Rate All households 6. 9 7. 9 8. 4 8. 5 8. 4 Bottom quintile 5. 3 6. 6 7. 3 7. 6 8. 3 Top quintile 5. 4 6. 5 6. 9 7. 2 7. 1 Effective Corporate Tax Rate All households 3. 4 1. 8 2. 2 2. 8 1. 8 Bottom quintile 1. 1 0. 6 0. 7 0. 3 Top quintile 5. 7 2. 8 3. 3 4. 4 2. 9 Effective Excise Tax Rate All households 1. 0 0. 9 Bottom quintile 1. 6 2. 2 2. 0 2. 4 Top quintile 0. 7 0. 6

Table 1 Effective Tax Rates (in percent) 1979 1985 1990 1995 2001 Total effective tax rate All households 22. 2 All households Bottom quintile Top quintile Effective tax rates Effective tax have for the poor rates for theover time. fallen rich have risen since 1985. 22. 6 21. 5 9. 8 8. 9 6. 3 5. 4 27. 5 Top quintile 21. 5 8. 0 Bottom quintile 20. 9 24. 0 25. 1 27. 8 26. 8 Effective Income Tax Rate 11. 0 10. 2 10. 1 10. 2 10. 4 0. 0 0. 5 -1. 0 -4. 4 -5. 6 15. 7 14. 0 14. 4 15. 5 16. 3 Effective Payroll Tax Rate All households 6. 9 7. 9 8. 4 8. 5 8. 4 Bottom quintile 5. 3 6. 6 7. 3 7. 6 8. 3 Top quintile 5. 4 6. 5 6. 9 7. 2 7. 1 Effective Corporate Tax Rate All households 3. 4 1. 8 2. 2 2. 8 1. 8 Bottom quintile 1. 1 0. 6 0. 7 0. 3 Top quintile 5. 7 2. 8 3. 3 4. 4 2. 9 Effective Excise Tax Rate All households 1. 0 0. 9 Bottom quintile 1. 6 2. 2 2. 0 2. 4 Top quintile 0. 7 0. 6

The incidence of taxation in the United States Results of CBO incidence analysis n The table shows that effective tax rates for the poor have fallen since 1985, while the effective rate for the rich have risen. n The distribution of various components of the tax system varies, however. n The payroll tax, for example, is regressive. n Effective corporate tax rates are small relative to income and payroll tax rates, and have fallen at both the top and bottom of the income distribution.

The incidence of taxation in the United States Results of CBO incidence analysis n The table shows that effective tax rates for the poor have fallen since 1985, while the effective rate for the rich have risen. n The distribution of various components of the tax system varies, however. n The payroll tax, for example, is regressive. n Effective corporate tax rates are small relative to income and payroll tax rates, and have fallen at both the top and bottom of the income distribution.

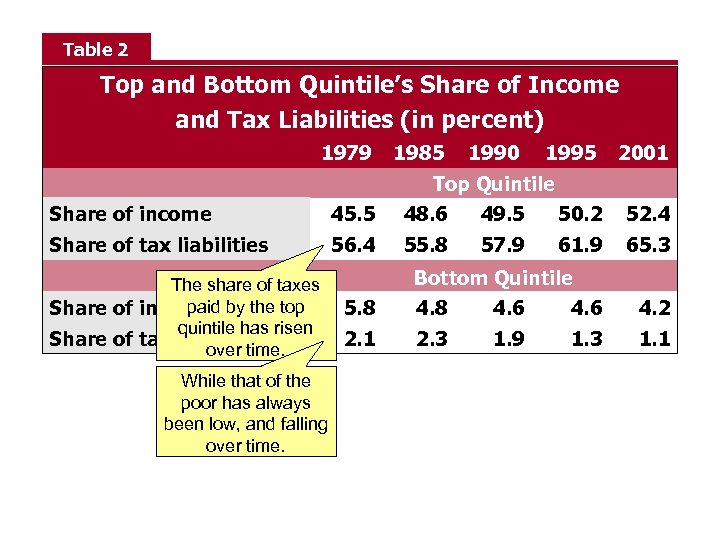

The incidence of taxation in the United States Results of CBO incidence analysis n Table 2 shows the top and bottom quintile’s share of income and tax liabilities.

The incidence of taxation in the United States Results of CBO incidence analysis n Table 2 shows the top and bottom quintile’s share of income and tax liabilities.

Table 2 Top and Bottom Quintile’s Share of Income and Tax Liabilities (in percent) 1979 1985 1990 1995 2001 52. 4 61. 9 65. 3 5. 8 Bottom Quintile 4. 8 4. 6 4. 2 2. 1 2. 3 1. 1 Share of income 45. 5 Top Quintile 48. 6 49. 5 50. 2 Share of tax liabilities 56. 4 55. 8 The share of taxes paid Share of income by the top quintile has risen Share of tax liabilities over time. While that of the poor has always been low, and falling over time. 57. 9 1. 3

Table 2 Top and Bottom Quintile’s Share of Income and Tax Liabilities (in percent) 1979 1985 1990 1995 2001 52. 4 61. 9 65. 3 5. 8 Bottom Quintile 4. 8 4. 6 4. 2 2. 1 2. 3 1. 1 Share of income 45. 5 Top Quintile 48. 6 49. 5 50. 2 Share of tax liabilities 56. 4 55. 8 The share of taxes paid Share of income by the top quintile has risen Share of tax liabilities over time. While that of the poor has always been low, and falling over time. 57. 9 1. 3

The incidence of taxation in the United States Results of CBO incidence analysis n The bottom quintile of taxpayers has always paid a very small share of taxes, and that share has fallen over time. n The top quintile has always paid the majority of taxes, and that share has risen over time. n The top 20% earn more than half of all income, and pay almost two-thirds of the taxes.

The incidence of taxation in the United States Results of CBO incidence analysis n The bottom quintile of taxpayers has always paid a very small share of taxes, and that share has fallen over time. n The top quintile has always paid the majority of taxes, and that share has risen over time. n The top 20% earn more than half of all income, and pay almost two-thirds of the taxes.

The incidence of taxation in the United States Current versus lifetime income incidence n Tax incidence can be based on current or lifetime income, and the results can differ greatly for some types of taxes. n Current tax incidence of a tax in is the relation to an individual’s current resources. n Lifetime tax incidence of a tax in is the relation to an individual’s lifetime resources. n Recent estimates show that 60% of Americans change income quintiles within a decade.

The incidence of taxation in the United States Current versus lifetime income incidence n Tax incidence can be based on current or lifetime income, and the results can differ greatly for some types of taxes. n Current tax incidence of a tax in is the relation to an individual’s current resources. n Lifetime tax incidence of a tax in is the relation to an individual’s lifetime resources. n Recent estimates show that 60% of Americans change income quintiles within a decade.

The incidence of taxation in the United States Current versus lifetime income incidence n This income mobility, and the use of lifetime incidence, has a number of implications for tax policy. Imagine that there was a tax on college textbooks. On the surface, this seems extremely regressive using current income, since college students have very low incomes. n On a lifetime basis, however, college graduates have income twice as those who did not attend college. On a lifetime basis, the tax incidence is progressive. n

The incidence of taxation in the United States Current versus lifetime income incidence n This income mobility, and the use of lifetime incidence, has a number of implications for tax policy. Imagine that there was a tax on college textbooks. On the surface, this seems extremely regressive using current income, since college students have very low incomes. n On a lifetime basis, however, college graduates have income twice as those who did not attend college. On a lifetime basis, the tax incidence is progressive. n

Recap of The Equity Implications of Taxation: Tax Incidence n The Three Rules of Tax Incidence n Tax Incidence Extensions n General Equilibrium Tax Incidence n The Incidence of Taxation in the United States

Recap of The Equity Implications of Taxation: Tax Incidence n The Three Rules of Tax Incidence n Tax Incidence Extensions n General Equilibrium Tax Incidence n The Incidence of Taxation in the United States