8fa05e305bbcbefb61527be4578202bb.ppt

- Количество слайдов: 22

Chapter 19 Credit Management • Credit Management is the process of establishing customer credit limits, establishing credit checking policies and monitoring Customers against those criteria. It is configured in both the Financial Accounting (FI) and Sales & Distribution (SD) modules. • Chapter Objectives – Provide an understanding of how credit limits are set and maintained for customers. – Provide an understanding of the hierarchical relationships between Credit Control Area, Company Code, and Customer. – Identify and understand the functionality of monitoring credit limits for Customers using Automated Credit Checking in FI and SD. 4. 6 fi_19. 1 Credit Management

Chapter 19 Credit Management • Credit Management is the process of establishing customer credit limits, establishing credit checking policies and monitoring Customers against those criteria. It is configured in both the Financial Accounting (FI) and Sales & Distribution (SD) modules. • Chapter Objectives – Provide an understanding of how credit limits are set and maintained for customers. – Provide an understanding of the hierarchical relationships between Credit Control Area, Company Code, and Customer. – Identify and understand the functionality of monitoring credit limits for Customers using Automated Credit Checking in FI and SD. 4. 6 fi_19. 1 Credit Management

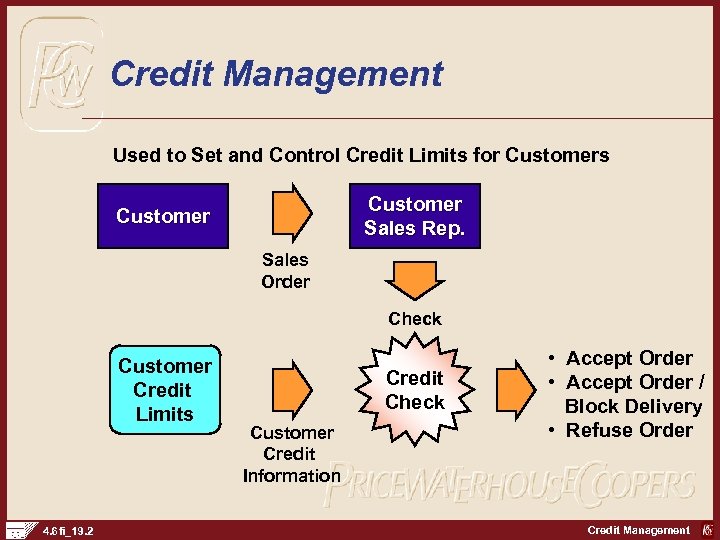

Credit Management Used to Set and Control Credit Limits for Customers Customer Sales Rep. Customer Sales Order Check Customer Credit Limits 4. 6 fi_19. 2 Credit Check Customer Credit Information • Accept Order / Block Delivery • Refuse Order Credit Management

Credit Management Used to Set and Control Credit Limits for Customers Customer Sales Rep. Customer Sales Order Check Customer Credit Limits 4. 6 fi_19. 2 Credit Check Customer Credit Information • Accept Order / Block Delivery • Refuse Order Credit Management

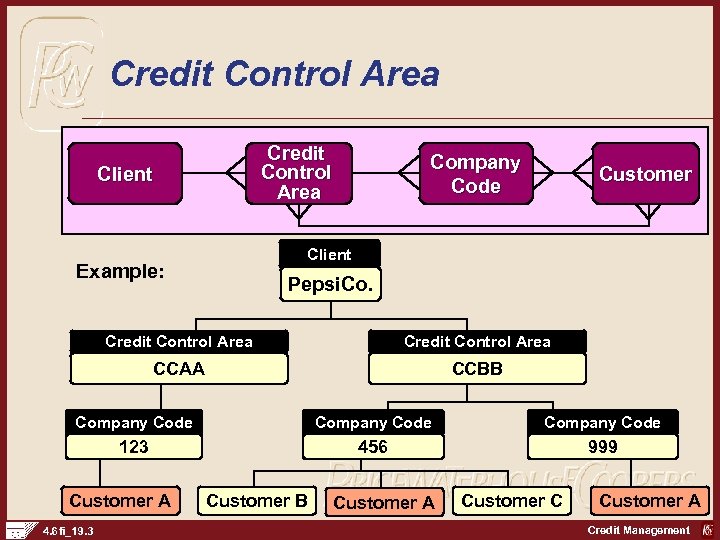

Credit Control Area Client Company Code Customer Client Example: Pepsi. Co. Credit Control Area CCAA CCBB Company Code 123 456 999 Customer A 4. 6 fi_19. 3 Customer B Customer A Customer C Customer A Credit Management

Credit Control Area Client Company Code Customer Client Example: Pepsi. Co. Credit Control Area CCAA CCBB Company Code 123 456 999 Customer A 4. 6 fi_19. 3 Customer B Customer A Customer C Customer A Credit Management

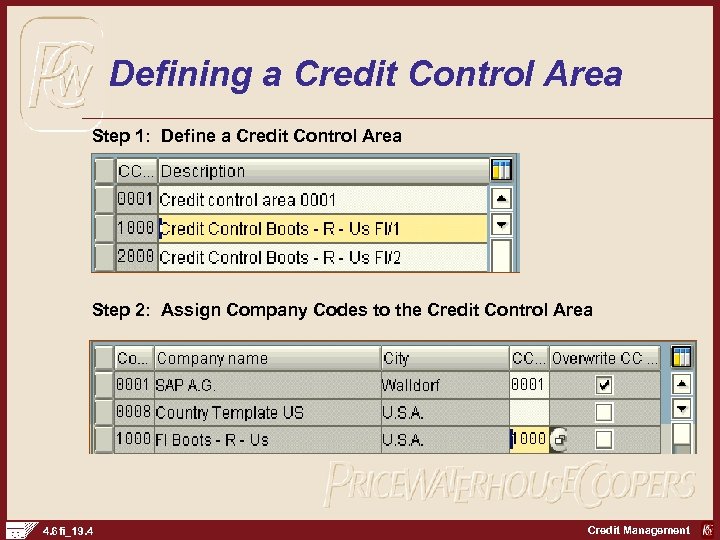

Defining a Credit Control Area Step 1: Define a Credit Control Area Step 2: Assign Company Codes to the Credit Control Area 4. 6 fi_19. 4 Credit Management

Defining a Credit Control Area Step 1: Define a Credit Control Area Step 2: Assign Company Codes to the Credit Control Area 4. 6 fi_19. 4 Credit Management

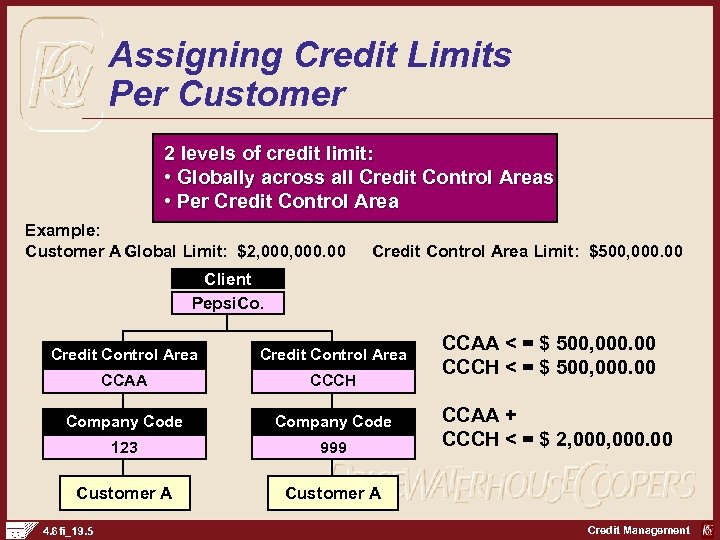

Assigning Credit Limits Per Customer 2 levels of credit limit: • Globally across all Credit Control Areas • Per Credit Control Area Example: Customer A Global Limit: $2, 000. 00 Credit Control Area Limit: $500, 000. 00 Client Pepsi. Co. Credit Control Area CCAA CCCH Company Code 123 999 Customer A CCAA < = $ 500, 000. 00 CCCH < = $ 500, 000. 00 Customer A 4. 6 fi_19. 5 CCAA + CCCH < = $ 2, 000. 00 Credit Management

Assigning Credit Limits Per Customer 2 levels of credit limit: • Globally across all Credit Control Areas • Per Credit Control Area Example: Customer A Global Limit: $2, 000. 00 Credit Control Area Limit: $500, 000. 00 Client Pepsi. Co. Credit Control Area CCAA CCCH Company Code 123 999 Customer A CCAA < = $ 500, 000. 00 CCCH < = $ 500, 000. 00 Customer A 4. 6 fi_19. 5 CCAA + CCCH < = $ 2, 000. 00 Credit Management

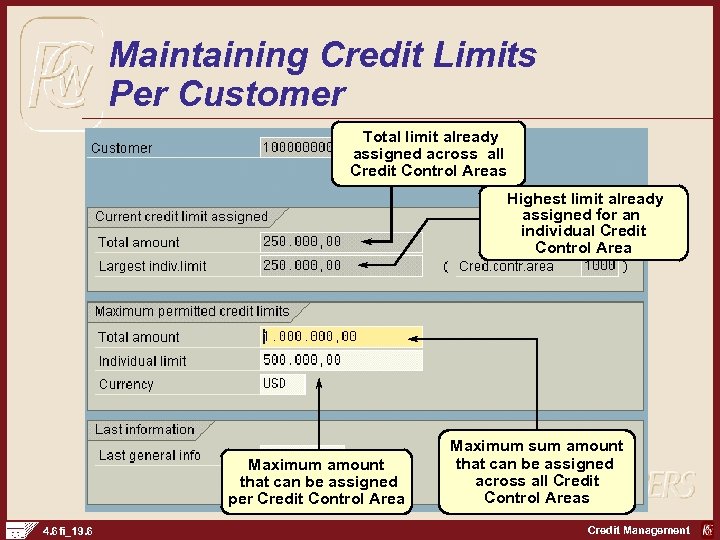

Maintaining Credit Limits Per Customer Total limit already assigned across all Credit Control Areas Highest limit already assigned for an individual Credit Control Area Maximum amount that can be assigned per Credit Control Area 4. 6 fi_19. 6 Maximum sum amount that can be assigned across all Credit Control Areas Credit Management

Maintaining Credit Limits Per Customer Total limit already assigned across all Credit Control Areas Highest limit already assigned for an individual Credit Control Area Maximum amount that can be assigned per Credit Control Area 4. 6 fi_19. 6 Maximum sum amount that can be assigned across all Credit Control Areas Credit Management

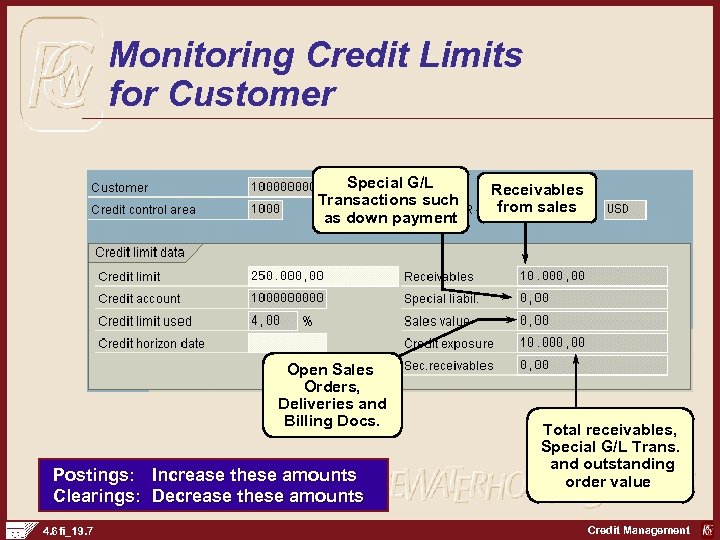

Monitoring Credit Limits for Customer Special G/L Transactions such as down payment Open Sales Orders, Deliveries and Billing Docs. Postings: Increase these amounts Clearings: Decrease these amounts 4. 6 fi_19. 7 Receivables from sales Total receivables, Special G/L Trans. and outstanding order value Credit Management

Monitoring Credit Limits for Customer Special G/L Transactions such as down payment Open Sales Orders, Deliveries and Billing Docs. Postings: Increase these amounts Clearings: Decrease these amounts 4. 6 fi_19. 7 Receivables from sales Total receivables, Special G/L Trans. and outstanding order value Credit Management

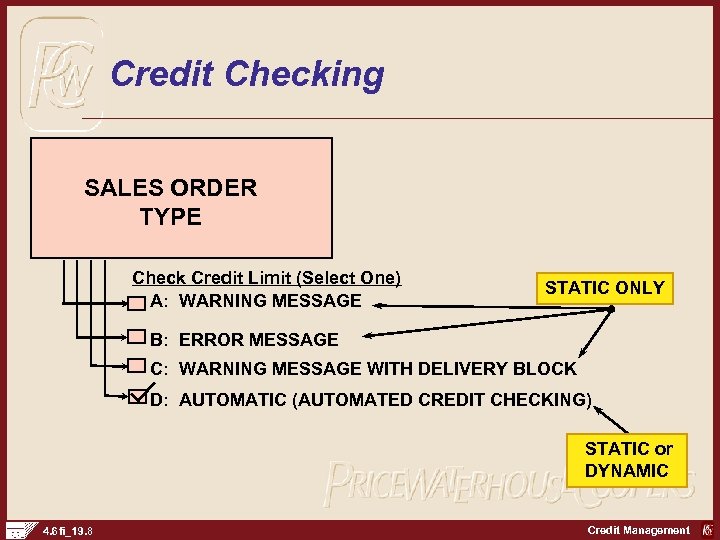

Credit Checking SALES ORDER TYPE Check Credit Limit (Select One) A: WARNING MESSAGE STATIC ONLY B: ERROR MESSAGE C: WARNING MESSAGE WITH DELIVERY BLOCK D: AUTOMATIC (AUTOMATED CREDIT CHECKING) STATIC or DYNAMIC 4. 6 fi_19. 8 Credit Management

Credit Checking SALES ORDER TYPE Check Credit Limit (Select One) A: WARNING MESSAGE STATIC ONLY B: ERROR MESSAGE C: WARNING MESSAGE WITH DELIVERY BLOCK D: AUTOMATIC (AUTOMATED CREDIT CHECKING) STATIC or DYNAMIC 4. 6 fi_19. 8 Credit Management

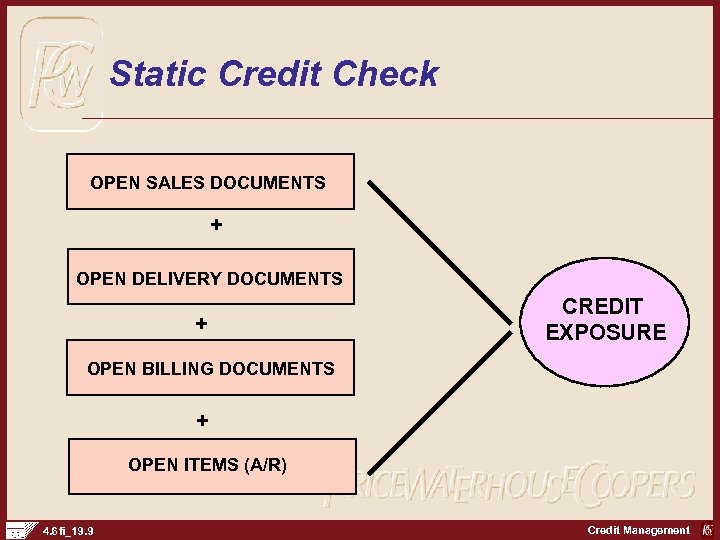

Static Credit Check OPEN SALES DOCUMENTS + OPEN DELIVERY DOCUMENTS + CREDIT EXPOSURE OPEN BILLING DOCUMENTS + OPEN ITEMS (A/R) 4. 6 fi_19. 9 Credit Management

Static Credit Check OPEN SALES DOCUMENTS + OPEN DELIVERY DOCUMENTS + CREDIT EXPOSURE OPEN BILLING DOCUMENTS + OPEN ITEMS (A/R) 4. 6 fi_19. 9 Credit Management

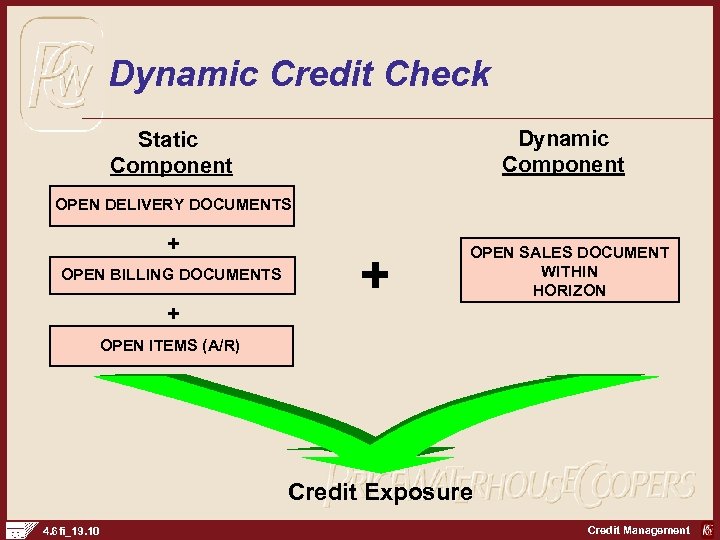

Dynamic Credit Check Dynamic Component Static Component OPEN DELIVERY DOCUMENTS + OPEN BILLING DOCUMENTS + + OPEN SALES DOCUMENT WITHIN HORIZON OPEN ITEMS (A/R) Credit Exposure 4. 6 fi_19. 10 Credit Management

Dynamic Credit Check Dynamic Component Static Component OPEN DELIVERY DOCUMENTS + OPEN BILLING DOCUMENTS + + OPEN SALES DOCUMENT WITHIN HORIZON OPEN ITEMS (A/R) Credit Exposure 4. 6 fi_19. 10 Credit Management

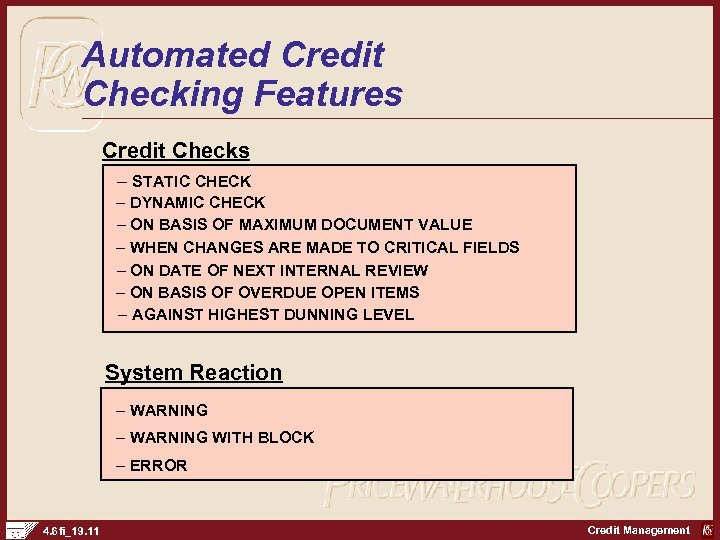

Automated Credit Checking Features Credit Checks – STATIC CHECK – DYNAMIC CHECK – ON BASIS OF MAXIMUM DOCUMENT VALUE – WHEN CHANGES ARE MADE TO CRITICAL FIELDS – ON DATE OF NEXT INTERNAL REVIEW – ON BASIS OF OVERDUE OPEN ITEMS – AGAINST HIGHEST DUNNING LEVEL System Reaction – WARNING WITH BLOCK – ERROR 4. 6 fi_19. 11 Credit Management

Automated Credit Checking Features Credit Checks – STATIC CHECK – DYNAMIC CHECK – ON BASIS OF MAXIMUM DOCUMENT VALUE – WHEN CHANGES ARE MADE TO CRITICAL FIELDS – ON DATE OF NEXT INTERNAL REVIEW – ON BASIS OF OVERDUE OPEN ITEMS – AGAINST HIGHEST DUNNING LEVEL System Reaction – WARNING WITH BLOCK – ERROR 4. 6 fi_19. 11 Credit Management

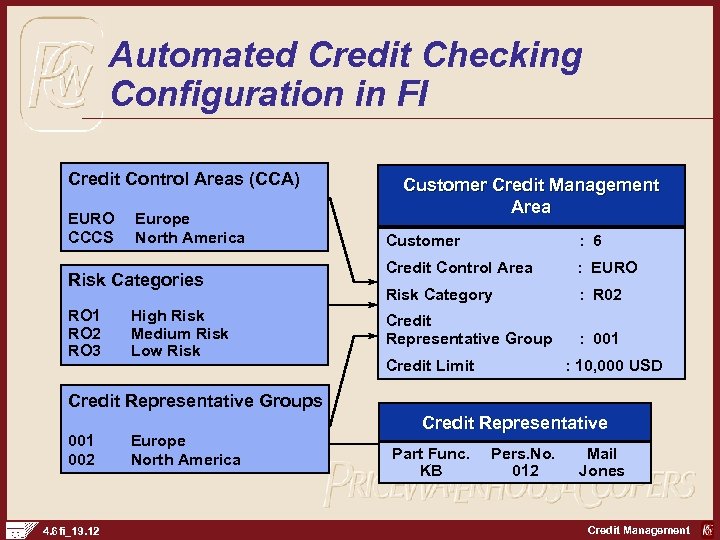

Automated Credit Checking Configuration in FI Credit Control Areas (CCA) EURO CCCS Europe North America Risk Categories RO 1 RO 2 RO 3 High Risk Medium Risk Low Risk Customer Credit Management Area Customer : 6 Credit Control Area : EURO Risk Category : R 02 Credit Representative Group : 001 Credit Limit : 10, 000 USD Credit Representative Groups 001 002 4. 6 fi_19. 12 Europe North America Credit Representative Part Func. KB Pers. No. 012 Mail Jones Credit Management

Automated Credit Checking Configuration in FI Credit Control Areas (CCA) EURO CCCS Europe North America Risk Categories RO 1 RO 2 RO 3 High Risk Medium Risk Low Risk Customer Credit Management Area Customer : 6 Credit Control Area : EURO Risk Category : R 02 Credit Representative Group : 001 Credit Limit : 10, 000 USD Credit Representative Groups 001 002 4. 6 fi_19. 12 Europe North America Credit Representative Part Func. KB Pers. No. 012 Mail Jones Credit Management

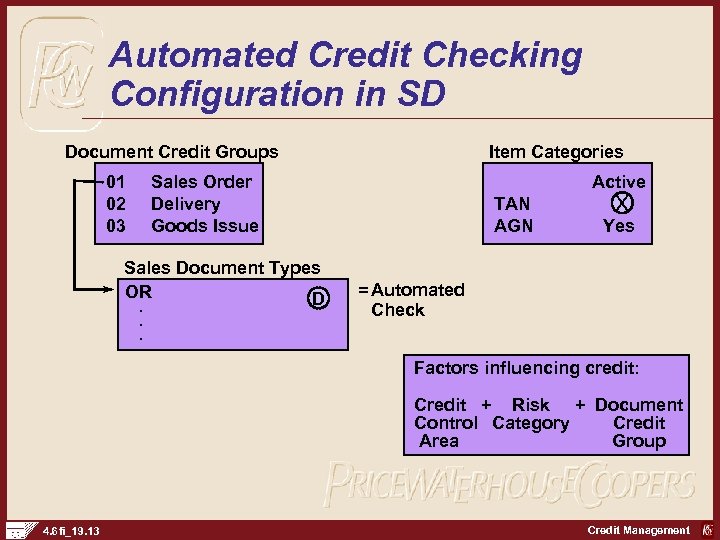

Automated Credit Checking Configuration in SD Document Credit Groups 01 02 03 Item Categories Sales Order Delivery Goods Issue Sales Document Types OR D. . . Active TAN AGN X Yes = Automated Check Factors influencing credit: Credit + Risk + Document Control Category Credit Area Group 4. 6 fi_19. 13 Credit Management

Automated Credit Checking Configuration in SD Document Credit Groups 01 02 03 Item Categories Sales Order Delivery Goods Issue Sales Document Types OR D. . . Active TAN AGN X Yes = Automated Check Factors influencing credit: Credit + Risk + Document Control Category Credit Area Group 4. 6 fi_19. 13 Credit Management

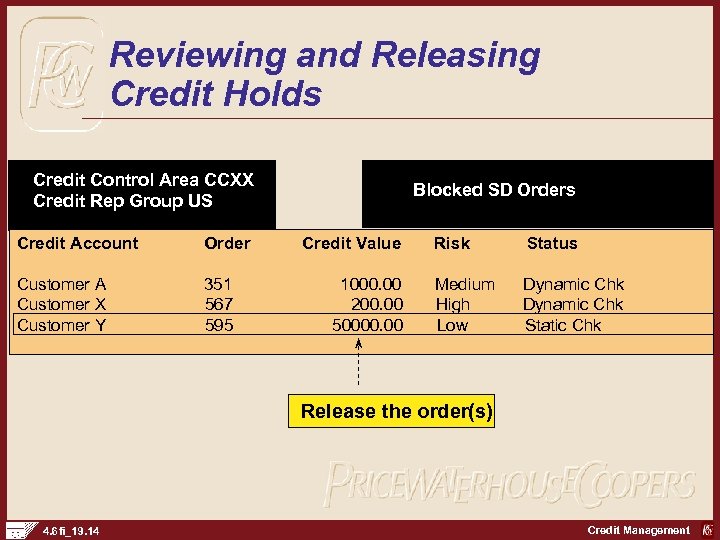

Reviewing and Releasing Credit Holds Credit Control Area CCXX Credit Rep Group US Credit Account Order Customer A Customer X Customer Y 351 567 595 Blocked SD Orders Credit Value 1000. 00 200. 00 50000. 00 Risk Status Medium High Low Dynamic Chk Static Chk Release the order(s) 4. 6 fi_19. 14 Credit Management

Reviewing and Releasing Credit Holds Credit Control Area CCXX Credit Rep Group US Credit Account Order Customer A Customer X Customer Y 351 567 595 Blocked SD Orders Credit Value 1000. 00 200. 00 50000. 00 Risk Status Medium High Low Dynamic Chk Static Chk Release the order(s) 4. 6 fi_19. 14 Credit Management

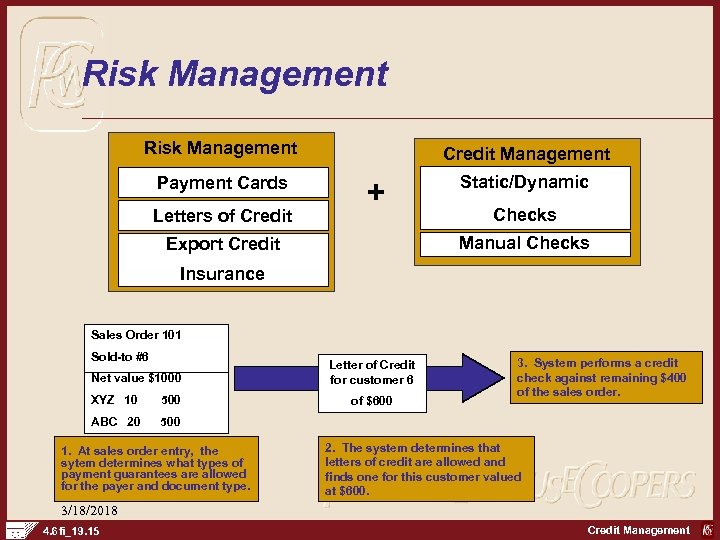

Risk Management Payment Cards Letters of Credit Management + Static/Dynamic Checks Manual Checks Export Credit Insurance Sales Order 101 Sold-to #6 Net value $1000 XYZ 10 500 ABC 20 Letter of Credit for customer 6 3. System performs a credit check against remaining $400 of the sales order. 500 1. At sales order entry, the sytem determines what types of payment guarantees are allowed for the payer and document type. of $600 2. The system determines that letters of credit are allowed and finds one for this customer valued at $600. 3/18/2018 4. 6 fi_19. 15 Credit Management

Risk Management Payment Cards Letters of Credit Management + Static/Dynamic Checks Manual Checks Export Credit Insurance Sales Order 101 Sold-to #6 Net value $1000 XYZ 10 500 ABC 20 Letter of Credit for customer 6 3. System performs a credit check against remaining $400 of the sales order. 500 1. At sales order entry, the sytem determines what types of payment guarantees are allowed for the payer and document type. of $600 2. The system determines that letters of credit are allowed and finds one for this customer valued at $600. 3/18/2018 4. 6 fi_19. 15 Credit Management

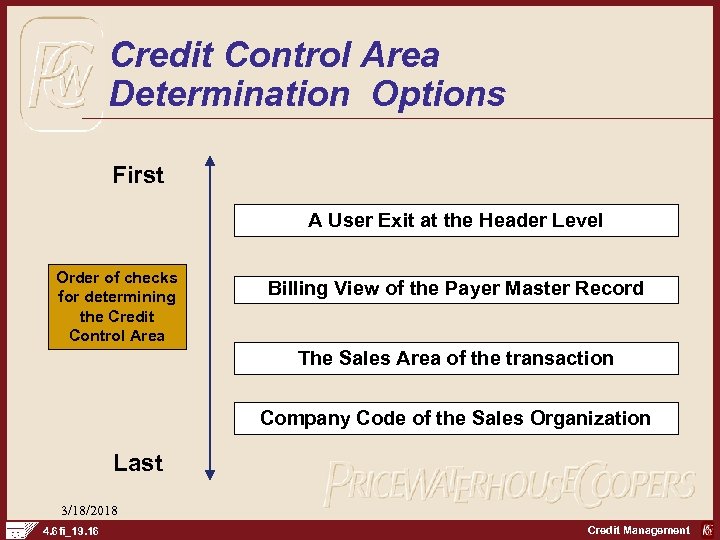

Credit Control Area Determination Options First A User Exit at the Header Level Order of checks for determining the Credit Control Area Billing View of the Payer Master Record The Sales Area of the transaction Company Code of the Sales Organization Last 3/18/2018 4. 6 fi_19. 16 Credit Management

Credit Control Area Determination Options First A User Exit at the Header Level Order of checks for determining the Credit Control Area Billing View of the Payer Master Record The Sales Area of the transaction Company Code of the Sales Organization Last 3/18/2018 4. 6 fi_19. 16 Credit Management

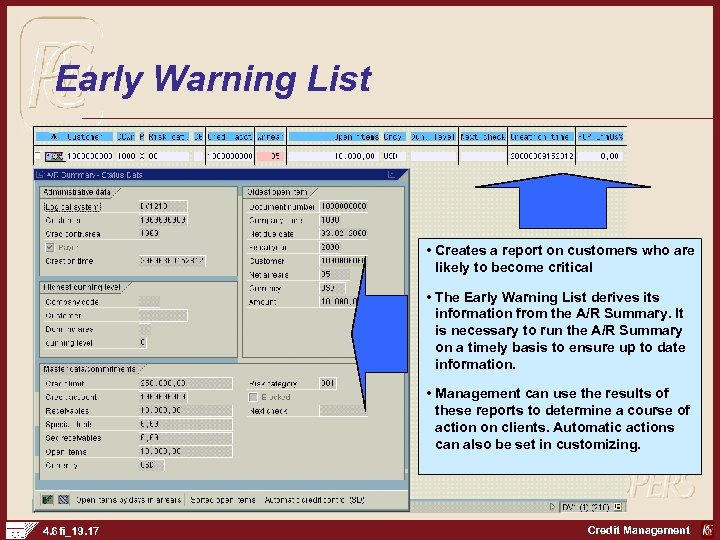

Early Warning List • Creates a report on customers who are likely to become critical • The Early Warning List derives its information from the A/R Summary. It is necessary to run the A/R Summary on a timely basis to ensure up to date information. • Management can use the results of these reports to determine a course of action on clients. Automatic actions can also be set in customizing. 4. 6 fi_19. 17 Credit Management

Early Warning List • Creates a report on customers who are likely to become critical • The Early Warning List derives its information from the A/R Summary. It is necessary to run the A/R Summary on a timely basis to ensure up to date information. • Management can use the results of these reports to determine a course of action on clients. Automatic actions can also be set in customizing. 4. 6 fi_19. 17 Credit Management

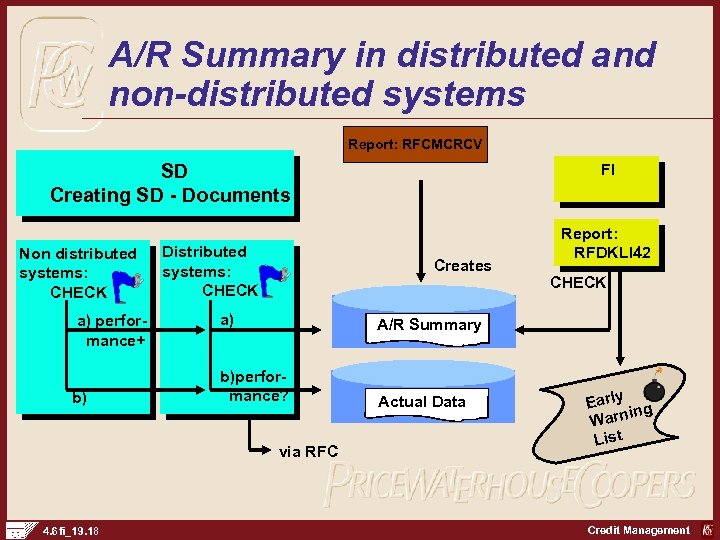

A/R Summary in distributed and non-distributed systems Report: RFCMCRCV SD Creating SD - Documents Non distributed systems: CHECK a) performance+ b) Distributed systems: CHECK Creates a) b)performance? Actual Data Report: RFDKLI 42 CHECK A/R Summary via RFC 4. 6 fi_19. 18 FI Early g in Warn List Credit Management

A/R Summary in distributed and non-distributed systems Report: RFCMCRCV SD Creating SD - Documents Non distributed systems: CHECK a) performance+ b) Distributed systems: CHECK Creates a) b)performance? Actual Data Report: RFDKLI 42 CHECK A/R Summary via RFC 4. 6 fi_19. 18 FI Early g in Warn List Credit Management

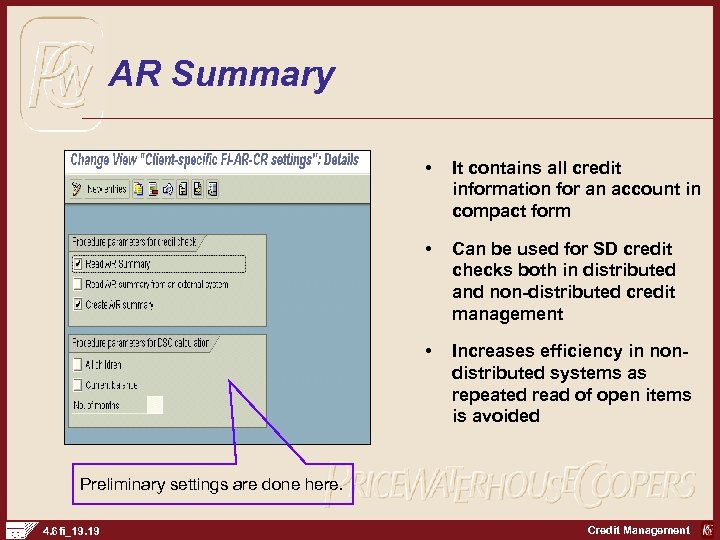

AR Summary • It contains all credit information for an account in compact form • Can be used for SD credit checks both in distributed and non-distributed credit management • Increases efficiency in nondistributed systems as repeated read of open items is avoided Preliminary settings are done here. 4. 6 fi_19. 19 Credit Management

AR Summary • It contains all credit information for an account in compact form • Can be used for SD credit checks both in distributed and non-distributed credit management • Increases efficiency in nondistributed systems as repeated read of open items is avoided Preliminary settings are done here. 4. 6 fi_19. 19 Credit Management

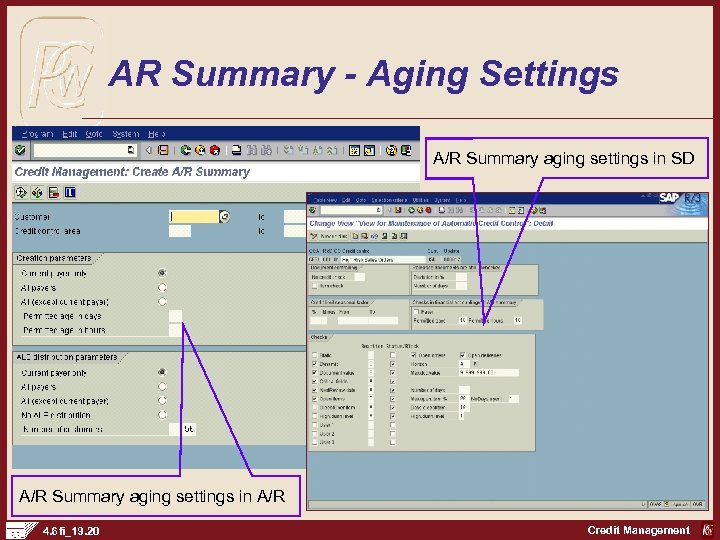

AR Summary - Aging Settings A/R Summary aging settings in SD A/R Summary aging settings in A/R 4. 6 fi_19. 20 Credit Management

AR Summary - Aging Settings A/R Summary aging settings in SD A/R Summary aging settings in A/R 4. 6 fi_19. 20 Credit Management

Credit Management Chapter Summary • Key Terms – Credit Management – Credit Control Area – Credit Limit – Automated Credit Checking – Static Credit Checking – Dynamic Credit Checking – Risk Category 4. 6 fi_19. 21 Credit Management

Credit Management Chapter Summary • Key Terms – Credit Management – Credit Control Area – Credit Limit – Automated Credit Checking – Static Credit Checking – Dynamic Credit Checking – Risk Category 4. 6 fi_19. 21 Credit Management

Credit Management Chapter Summary • Key Terms – Document Credit Group – Risk Management – Early Warning List – A/R Summary 4. 6 fi_19. 22 Credit Management

Credit Management Chapter Summary • Key Terms – Document Credit Group – Risk Management – Early Warning List – A/R Summary 4. 6 fi_19. 22 Credit Management