4f73335af784df0b11bde3f5c4de394b.ppt

- Количество слайдов: 41

Chapter 19 Alternative International Monetary Standards

Chapter 19 Alternative International Monetary Standards

Topics to be Covered • The Gold Standard 1880– 1914 • The Interwar Period 1918– 1939 • The Gold Exchange Standard 1944– 1970 • The Transition Years 1971– 1973 • Floating Exchange Rates Since 1973 • Types of Exchange Rate Arrangements • Choosing an Exchange Rate System • Optimum Currency Area Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 2

Topics to be Covered • The Gold Standard 1880– 1914 • The Interwar Period 1918– 1939 • The Gold Exchange Standard 1944– 1970 • The Transition Years 1971– 1973 • Floating Exchange Rates Since 1973 • Types of Exchange Rate Arrangements • Choosing an Exchange Rate System • Optimum Currency Area Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 2

Topics to be Covered (cont. ) • European Monetary System and the Euro • Target Zones • Currency Boards • International Reserve Currencies • Multiple Exchange Rates Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 3

Topics to be Covered (cont. ) • European Monetary System and the Euro • Target Zones • Currency Boards • International Reserve Currencies • Multiple Exchange Rates Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 3

History of International Monetary Systems • The Gold Standard: 1880– 1914 • The Interwar Period: 1918– 1939 • The Gold Exchange Standard: 1944– 1970 • Transition to Floating Exchange Rates: 1971– 1973 • Floating Exchange Rates: Since 1973 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 4

History of International Monetary Systems • The Gold Standard: 1880– 1914 • The Interwar Period: 1918– 1939 • The Gold Exchange Standard: 1944– 1970 • Transition to Floating Exchange Rates: 1971– 1973 • Floating Exchange Rates: Since 1973 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 4

The Gold Standard: 1880– 1914 • Under a gold standard, currencies are valued in terms of a gold equivalent, or mint parity price. An ounce of gold was worth $20. 67. • Since each currency is defined in terms of its gold value, all currencies are linked in a fixed exchange rate system. • Each participating country must be willing and ready to buy and sell gold to anyone at the fixed price. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 5

The Gold Standard: 1880– 1914 • Under a gold standard, currencies are valued in terms of a gold equivalent, or mint parity price. An ounce of gold was worth $20. 67. • Since each currency is defined in terms of its gold value, all currencies are linked in a fixed exchange rate system. • Each participating country must be willing and ready to buy and sell gold to anyone at the fixed price. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 5

Gold Standard (cont. ) • Gold is used as a monetary standard because it is a homogenous good, easily storable, portable, and divisible into standardized units, such as ounces. Another important feature of gold is that governments cannot easily increase its supply. • A gold standard is a commodity money standard. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 6

Gold Standard (cont. ) • Gold is used as a monetary standard because it is a homogenous good, easily storable, portable, and divisible into standardized units, such as ounces. Another important feature of gold is that governments cannot easily increase its supply. • A gold standard is a commodity money standard. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 6

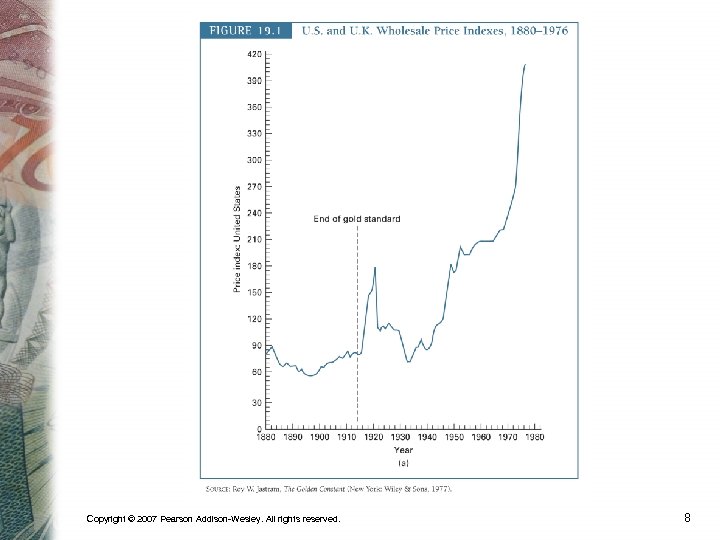

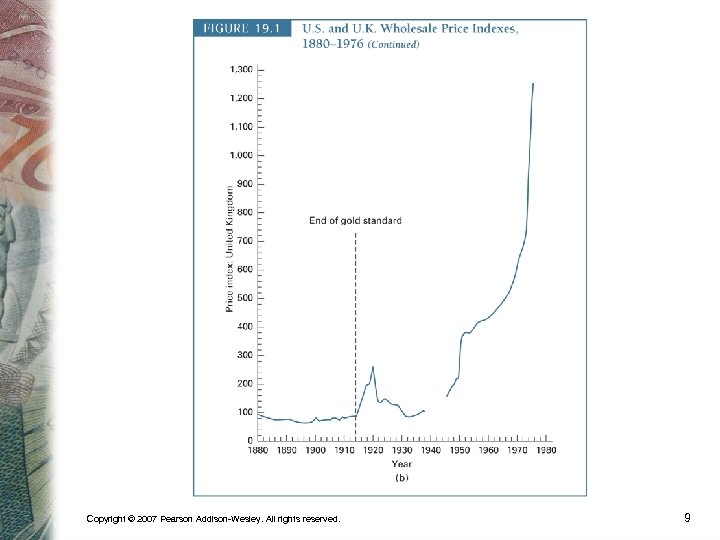

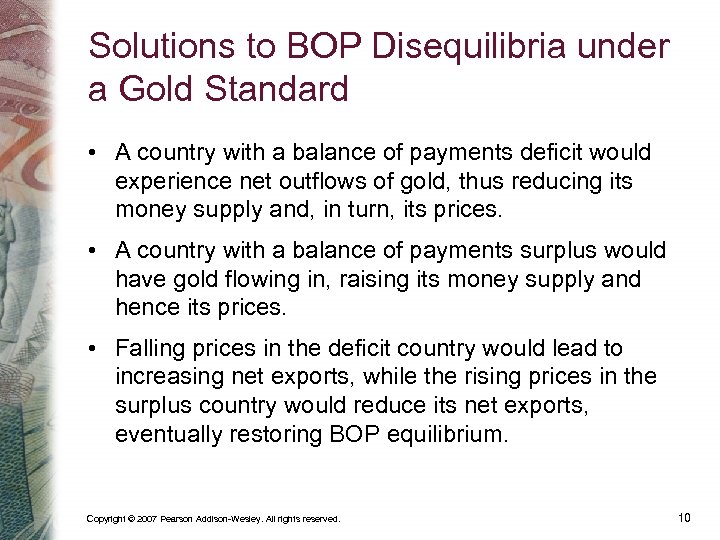

Gold Standard (cont. ) • A money standard based on a commodity such as gold with a relatively fixed supply will lead to long run price stability. This is because a country’s supply of money is limited by its supply of gold. • Refer to Figure 19. 1 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 7

Gold Standard (cont. ) • A money standard based on a commodity such as gold with a relatively fixed supply will lead to long run price stability. This is because a country’s supply of money is limited by its supply of gold. • Refer to Figure 19. 1 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 7

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 8

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 8

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 9

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 9

Solutions to BOP Disequilibria under a Gold Standard • A country with a balance of payments deficit would experience net outflows of gold, thus reducing its money supply and, in turn, its prices. • A country with a balance of payments surplus would have gold flowing in, raising its money supply and hence its prices. • Falling prices in the deficit country would lead to increasing net exports, while the rising prices in the surplus country would reduce its net exports, eventually restoring BOP equilibrium. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 10

Solutions to BOP Disequilibria under a Gold Standard • A country with a balance of payments deficit would experience net outflows of gold, thus reducing its money supply and, in turn, its prices. • A country with a balance of payments surplus would have gold flowing in, raising its money supply and hence its prices. • Falling prices in the deficit country would lead to increasing net exports, while the rising prices in the surplus country would reduce its net exports, eventually restoring BOP equilibrium. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 10

Interwar Period: 1918– 1939 • World War I effectively ended the gold standard. • Europe experienced inflation during and after the war so restoration of the gold standard at the old exchange values was not possible. • The U. S. experienced little inflation and returned to the gold standard in 1919 at the old parity. • In 1925, England returned to the gold standard despite inflation. Money supply fell as gold purchases soared, and by 1931 the British pound was declared inconvertible. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 11

Interwar Period: 1918– 1939 • World War I effectively ended the gold standard. • Europe experienced inflation during and after the war so restoration of the gold standard at the old exchange values was not possible. • The U. S. experienced little inflation and returned to the gold standard in 1919 at the old parity. • In 1925, England returned to the gold standard despite inflation. Money supply fell as gold purchases soared, and by 1931 the British pound was declared inconvertible. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 11

Interwar Period (cont. ) • Demand for gold focused on the U. S. market. A “run” on U. S. gold lead to the U. S. raising the official gold price to $35 an ounce. • The depression years of the 1930 s were characterized by international monetary warfare in the form of competitive devaluations and foreign exchange controls. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 12

Interwar Period (cont. ) • Demand for gold focused on the U. S. market. A “run” on U. S. gold lead to the U. S. raising the official gold price to $35 an ounce. • The depression years of the 1930 s were characterized by international monetary warfare in the form of competitive devaluations and foreign exchange controls. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 12

Gold Exchange Standard: 1944– 1970 • An international conference in Bretton Woods, New Hampshire, in 1944 led to an agreement among participating countries to fix the values of their currencies to gold. • The U. S. dollar was the key currency, and $1 was defined as equal in value to 1/35 ounce of gold. All currencies were linked to the dollar and each other in a fixed exchange rate system. • If a country had difficulty maintaining its parity value, it could turn to the International Monetary Fund (IMF) for short-term loans (see Item 19. 1). Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 13

Gold Exchange Standard: 1944– 1970 • An international conference in Bretton Woods, New Hampshire, in 1944 led to an agreement among participating countries to fix the values of their currencies to gold. • The U. S. dollar was the key currency, and $1 was defined as equal in value to 1/35 ounce of gold. All currencies were linked to the dollar and each other in a fixed exchange rate system. • If a country had difficulty maintaining its parity value, it could turn to the International Monetary Fund (IMF) for short-term loans (see Item 19. 1). Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 13

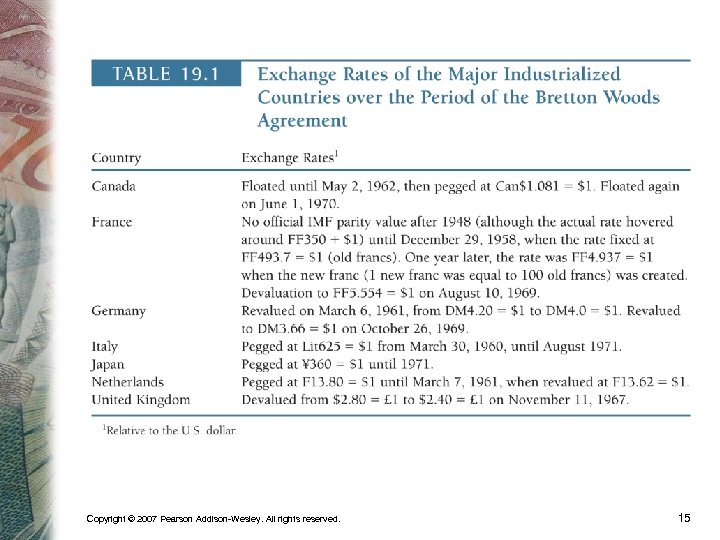

Gold Exchange Standard (cont. ) • In the case of more fundamental BOP problems, a country was allowed to devalue its currency (refer to Table 19. 1). • The gold exchange standard is also called an adjustable peg system. • Large U. S. balance of payments deficits and the consequent gold outflows as well as the unwillingness of major trading partners to realign currency values led to suspension of U. S. gold sales in 1971 and the end of fixed exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 14

Gold Exchange Standard (cont. ) • In the case of more fundamental BOP problems, a country was allowed to devalue its currency (refer to Table 19. 1). • The gold exchange standard is also called an adjustable peg system. • Large U. S. balance of payments deficits and the consequent gold outflows as well as the unwillingness of major trading partners to realign currency values led to suspension of U. S. gold sales in 1971 and the end of fixed exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 14

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 15

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 15

Transition Years: 1971– 1973 • In 1971, an international conference in Washington led to the Smithsonian agreement which raised the gold exchange value from $35 to $38 and also revalued the currencies of surplus countries. • In 1972 and early 1973, currency speculators sold large amounts of dollars leading to further dollar devaluation. • By March 1973, all major currencies were floating. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 16

Transition Years: 1971– 1973 • In 1971, an international conference in Washington led to the Smithsonian agreement which raised the gold exchange value from $35 to $38 and also revalued the currencies of surplus countries. • In 1972 and early 1973, currency speculators sold large amounts of dollars leading to further dollar devaluation. • By March 1973, all major currencies were floating. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 16

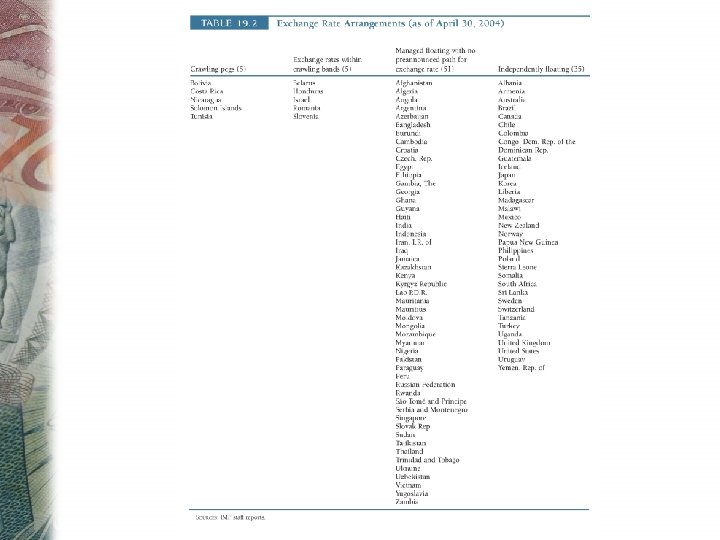

Floating Exchange Rates: Since 1973 • Although exchange rates since 1973 are described as floating (i. e. , determined by market forces of demand supply), the rates are effectively “managed float”, wherein central banks reserve the right to intervene at any time to obtain desirable rate levels. • Today, different countries follow different exchange rate arrangements. See Table 19. 2 for examples. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 17

Floating Exchange Rates: Since 1973 • Although exchange rates since 1973 are described as floating (i. e. , determined by market forces of demand supply), the rates are effectively “managed float”, wherein central banks reserve the right to intervene at any time to obtain desirable rate levels. • Today, different countries follow different exchange rate arrangements. See Table 19. 2 for examples. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 17

Types of Exchange Rate Arrangements • Crawling peg—the rate is adjusted periodically in small amounts. • Crawling band—the rate is maintained within fluctuation margins around a central rate which is adjusted periodically. • Managed floating—the central bank intervenes in the foreign exchange market with no pre-announced path for the exchange rate. • Independently floating—the rate is market-determined. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 20

Types of Exchange Rate Arrangements • Crawling peg—the rate is adjusted periodically in small amounts. • Crawling band—the rate is maintained within fluctuation margins around a central rate which is adjusted periodically. • Managed floating—the central bank intervenes in the foreign exchange market with no pre-announced path for the exchange rate. • Independently floating—the rate is market-determined. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 20

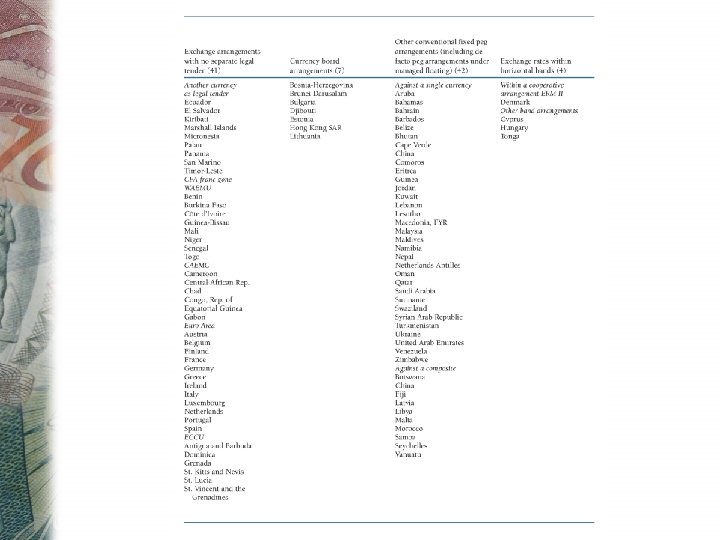

Types of XR Arrangements (cont. ) • No separate legal tender—either another country’s currency circulates as legal tender, or the country belongs to a monetary union with a shred legal tender. • Currency board—a fixed rate is established by legislative commitment to exchange domestic currency foreign currency at a fixed rate. • Fixed peg—the rate is fixed against a major currency or market basket of currencies. • Horizontal band—the rate fluctuates around a fixed central target rate. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 21

Types of XR Arrangements (cont. ) • No separate legal tender—either another country’s currency circulates as legal tender, or the country belongs to a monetary union with a shred legal tender. • Currency board—a fixed rate is established by legislative commitment to exchange domestic currency foreign currency at a fixed rate. • Fixed peg—the rate is fixed against a major currency or market basket of currencies. • Horizontal band—the rate fluctuates around a fixed central target rate. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 21

Floating vs. Fixed Exchange Rates • An argument in favor of flexible exchange rates is that a country can follow domestic macroeconomic policies independent from other countries. • An argument in favor of fixed exchange rates is that fixed rates impose international discipline on the inflationary policies of countries. • An argument against flexible rates is that such rates are subject to destabilizing speculation wherein speculators increase the variability or fluctuations of exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 22

Floating vs. Fixed Exchange Rates • An argument in favor of flexible exchange rates is that a country can follow domestic macroeconomic policies independent from other countries. • An argument in favor of fixed exchange rates is that fixed rates impose international discipline on the inflationary policies of countries. • An argument against flexible rates is that such rates are subject to destabilizing speculation wherein speculators increase the variability or fluctuations of exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 22

Country Factors and Choice of Exchange Rate System • Country size—Large countries tend to be less willing to subjugate own domestic policies to maintain a fixed rate system. • Openness—More open economies tend to follow a pegged exchange rate to minimize foreign shocks, while closed economies prefer the floating rate. • Trade pattern—A country that trades largely with one foreign country tends to peg its exchange rate to the other’s currency. A country with more diversified trade patterns might peg to a market basket of currencies. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 23

Country Factors and Choice of Exchange Rate System • Country size—Large countries tend to be less willing to subjugate own domestic policies to maintain a fixed rate system. • Openness—More open economies tend to follow a pegged exchange rate to minimize foreign shocks, while closed economies prefer the floating rate. • Trade pattern—A country that trades largely with one foreign country tends to peg its exchange rate to the other’s currency. A country with more diversified trade patterns might peg to a market basket of currencies. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 23

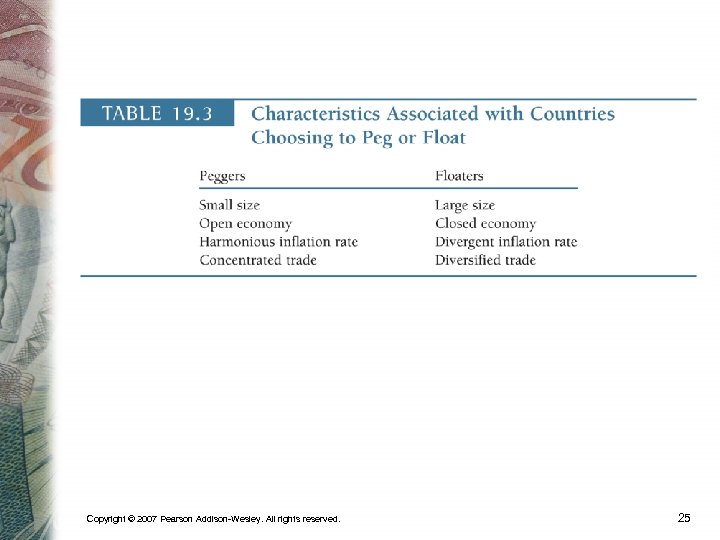

Country Factors (cont. ) • Inflation rate—Countries with more harmonious or stable inflation rates will prefer fixed exchange rates. • Money supply—The greater a country’s money supply fluctuations, the more likely the country will peg its exchange rate. See Table 19. 3 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 24

Country Factors (cont. ) • Inflation rate—Countries with more harmonious or stable inflation rates will prefer fixed exchange rates. • Money supply—The greater a country’s money supply fluctuations, the more likely the country will peg its exchange rate. See Table 19. 3 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 24

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 25

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 25

Optimum Currency Area • Currency Area—an area where exchange rates are fixed within the area and floating exchange rates exist against currencies outside the area. • The “optimum” currency area is the best grouping of countries to achieve some objective, such as ease of adjustment to real or nominal shocks. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 26

Optimum Currency Area • Currency Area—an area where exchange rates are fixed within the area and floating exchange rates exist against currencies outside the area. • The “optimum” currency area is the best grouping of countries to achieve some objective, such as ease of adjustment to real or nominal shocks. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 26

Optimum Currency Area (cont. ) • The optimum currency area is the region characterized by free and relatively costless mobility of resources such as labor and capital. • When factors are immobile, so that equilibrium is restored via changes in goods prices, then there is an advantage to flexible exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 27

Optimum Currency Area (cont. ) • The optimum currency area is the region characterized by free and relatively costless mobility of resources such as labor and capital. • When factors are immobile, so that equilibrium is restored via changes in goods prices, then there is an advantage to flexible exchange rates. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 27

European Monetary System and the Euro • The European Monetary System (EMS) was established in 1979 to maintain exchange rate stability in Western Europe. • The Exchange Rate Mechanism (ERM) required that each country maintain the value of its currency within a 2. 25 percent band. • The ERM broke down in 1992 as a result of the removal of capital controls and countries pursuing different domestic macroeconomic goals. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 28

European Monetary System and the Euro • The European Monetary System (EMS) was established in 1979 to maintain exchange rate stability in Western Europe. • The Exchange Rate Mechanism (ERM) required that each country maintain the value of its currency within a 2. 25 percent band. • The ERM broke down in 1992 as a result of the removal of capital controls and countries pursuing different domestic macroeconomic goals. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 28

Maastricht Treaty of 1991 • Called for a single European central bank and a single currency via the following: Removal of restrictions on European capital flows and greater coordination of monetary and fiscal policies. Creation of a European Monetary Institute (EMI) to prepare for a single monetary policy. Irrevocable fixing of exchange rates among member nations with a single currency (euro). Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 29

Maastricht Treaty of 1991 • Called for a single European central bank and a single currency via the following: Removal of restrictions on European capital flows and greater coordination of monetary and fiscal policies. Creation of a European Monetary Institute (EMI) to prepare for a single monetary policy. Irrevocable fixing of exchange rates among member nations with a single currency (euro). Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 29

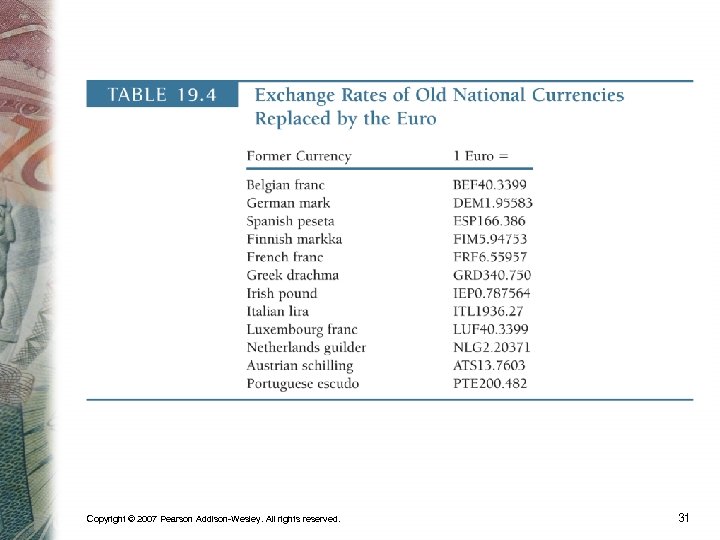

The Euro • The euro made its debut on January 1, 1999. • In the transition years of 1999– 2001, the euro was used as a unit of account. • Euro notes and coins began to circulate on January 1, 2002. • Currently, the United Kingdom, Denmark, and Sweden have not adopted the euro. • See Table 19. 4 for exchange rates of old European currencies. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 30

The Euro • The euro made its debut on January 1, 1999. • In the transition years of 1999– 2001, the euro was used as a unit of account. • Euro notes and coins began to circulate on January 1, 2002. • Currently, the United Kingdom, Denmark, and Sweden have not adopted the euro. • See Table 19. 4 for exchange rates of old European currencies. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 30

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 31

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 31

European Central Bank • The European Central Bank (ECB) began operations in 1998 in Frankfurt, Germany. • The Governing Council of the ECB determines the monetary policy for the euro-area. • The network of national central banks and the ECB is called the European System of Central Banks. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 32

European Central Bank • The European Central Bank (ECB) began operations in 1998 in Frankfurt, Germany. • The Governing Council of the ECB determines the monetary policy for the euro-area. • The network of national central banks and the ECB is called the European System of Central Banks. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 32

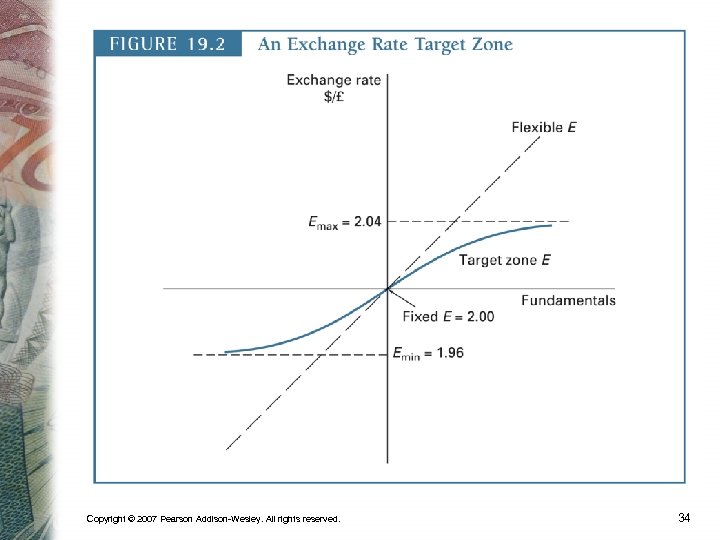

Target Zones • Target zones allow a country’s exchange rate to fluctuate within a limited range or band around some central fixed value. • The closer the exchange rate gets to the upper or lower limit, the greater the probability of central bank intervention (refer to Figure 19. 2). • A target zone backed by a credible government creates stability & confidence. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 33

Target Zones • Target zones allow a country’s exchange rate to fluctuate within a limited range or band around some central fixed value. • The closer the exchange rate gets to the upper or lower limit, the greater the probability of central bank intervention (refer to Figure 19. 2). • A target zone backed by a credible government creates stability & confidence. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 33

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 34

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 34

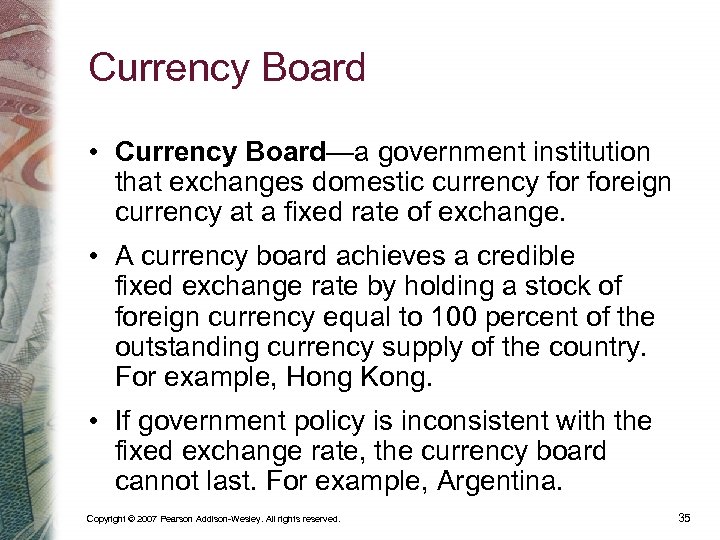

Currency Board • Currency Board—a government institution that exchanges domestic currency foreign currency at a fixed rate of exchange. • A currency board achieves a credible fixed exchange rate by holding a stock of foreign currency equal to 100 percent of the outstanding currency supply of the country. For example, Hong Kong. • If government policy is inconsistent with the fixed exchange rate, the currency board cannot last. For example, Argentina. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 35

Currency Board • Currency Board—a government institution that exchanges domestic currency foreign currency at a fixed rate of exchange. • A currency board achieves a credible fixed exchange rate by holding a stock of foreign currency equal to 100 percent of the outstanding currency supply of the country. For example, Hong Kong. • If government policy is inconsistent with the fixed exchange rate, the currency board cannot last. For example, Argentina. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 35

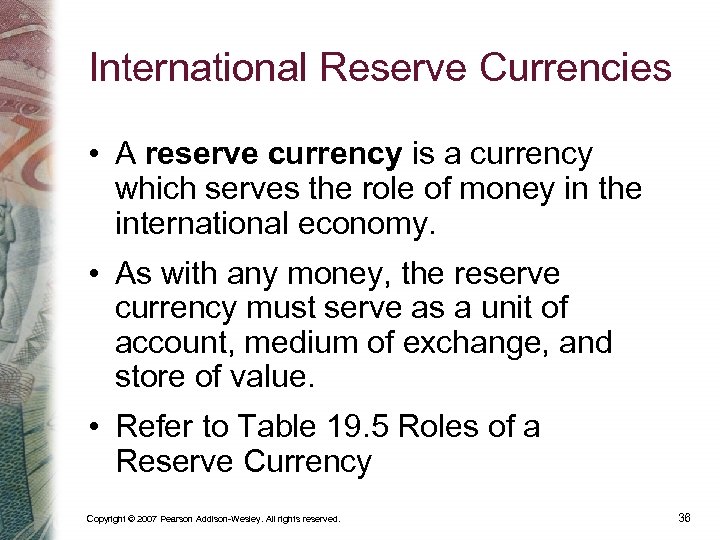

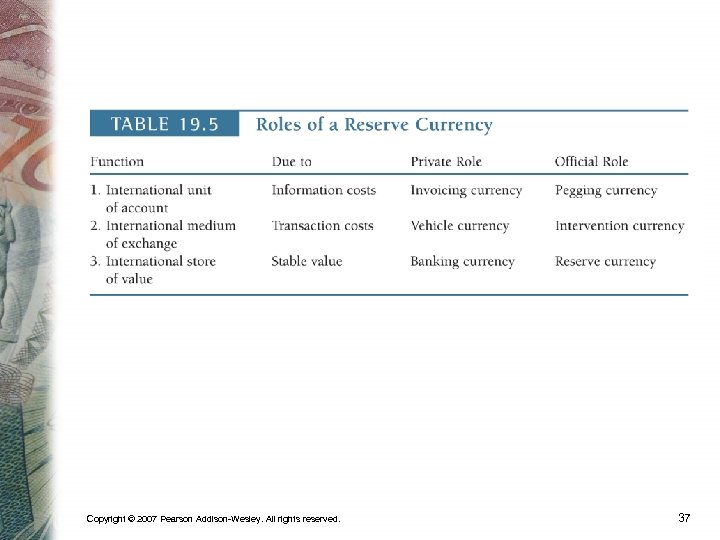

International Reserve Currencies • A reserve currency is a currency which serves the role of money in the international economy. • As with any money, the reserve currency must serve as a unit of account, medium of exchange, and store of value. • Refer to Table 19. 5 Roles of a Reserve Currency Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 36

International Reserve Currencies • A reserve currency is a currency which serves the role of money in the international economy. • As with any money, the reserve currency must serve as a unit of account, medium of exchange, and store of value. • Refer to Table 19. 5 Roles of a Reserve Currency Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 36

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 37

Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 37

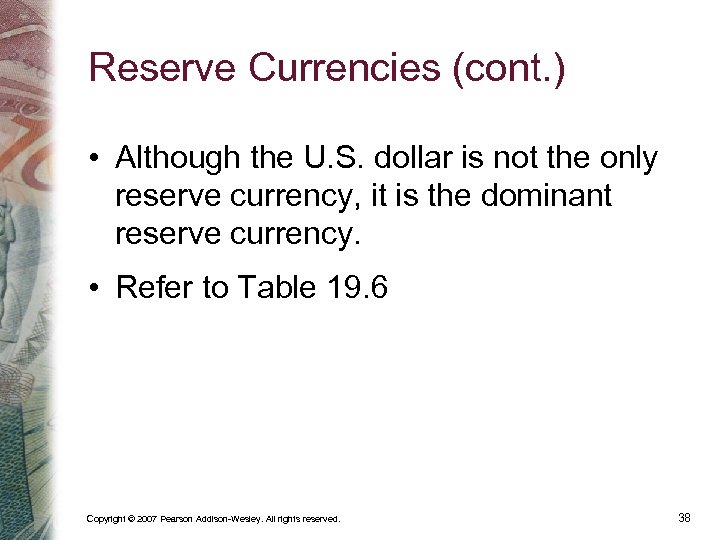

Reserve Currencies (cont. ) • Although the U. S. dollar is not the only reserve currency, it is the dominant reserve currency. • Refer to Table 19. 6 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 38

Reserve Currencies (cont. ) • Although the U. S. dollar is not the only reserve currency, it is the dominant reserve currency. • Refer to Table 19. 6 Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 38

Seigniorage • Seigniorage is the difference between the cost to the reserve country of creating new balances and the real resources the reserve country is able to acquire with the new balances. • It is a financial reward accruing to the reserve currency as a result of its being used as a world money. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 40

Seigniorage • Seigniorage is the difference between the cost to the reserve country of creating new balances and the real resources the reserve country is able to acquire with the new balances. • It is a financial reward accruing to the reserve currency as a result of its being used as a world money. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 40

Multiple Exchange Rates • Some countries maintain multiple exchange rates. • Arguments against multiple rates include: Multiple rates harm both the countries imposing them and other countries. They are costly in that people spend scarce resources to find ways to profit from the tiered exchange rates. Maintenance of multiple exchange rate system requires a costly administrative structure. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 41

Multiple Exchange Rates • Some countries maintain multiple exchange rates. • Arguments against multiple rates include: Multiple rates harm both the countries imposing them and other countries. They are costly in that people spend scarce resources to find ways to profit from the tiered exchange rates. Maintenance of multiple exchange rate system requires a costly administrative structure. Copyright © 2007 Pearson Addison-Wesley. All rights reserved. 41