5604744a4f295ae0b2654e8d686bb204.ppt

- Количество слайдов: 46

CHAPTER 19 1 CHAPTER 19 Savings and Investment Strategies 19 -1 Saving and Investment Planning 19 -2 Stock Investments 19 -3 Bonds and Mutual Funds 19 -4 Real Estate Investments 19 -5 Other Investments © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 1 CHAPTER 19 Savings and Investment Strategies 19 -1 Saving and Investment Planning 19 -2 Stock Investments 19 -3 Bonds and Mutual Funds 19 -4 Real Estate Investments 19 -5 Other Investments © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

19 -1 Saving and Investment Planning Goal 1 Explain the basics of saving and investing. Goal 2 Identify types of savings and investments. Goal 3 Discuss factors to consider when evaluating savings and investment alternatives. © 2012 Cengage Learning. All Rights Reserved. SLIDE 2

19 -1 Saving and Investment Planning Goal 1 Explain the basics of saving and investing. Goal 2 Identify types of savings and investments. Goal 3 Discuss factors to consider when evaluating savings and investment alternatives. © 2012 Cengage Learning. All Rights Reserved. SLIDE 2

CHAPTER KEY TERMS 19 3 ● saving ● investing ● yield ● liquidity © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER KEY TERMS 19 3 ● saving ● investing ● yield ● liquidity © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

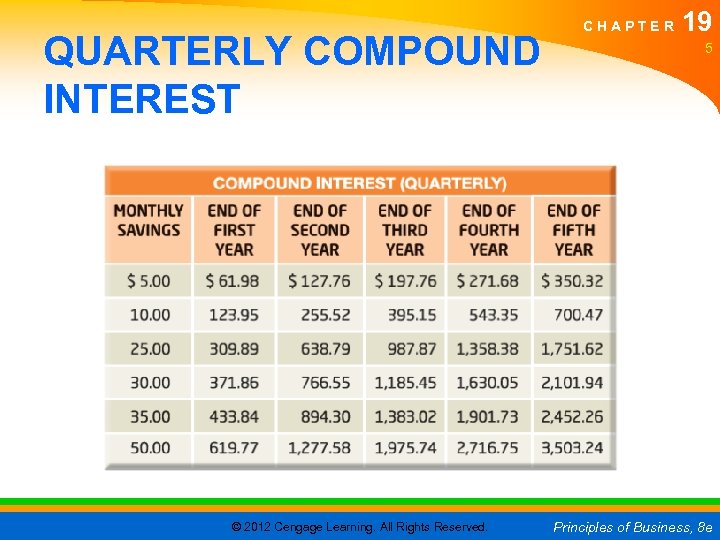

SAVING AND INVESTMENT BASICS CHAPTER 19 4 ● Savings and investment activities ● Determine investment goals ● The growth of savings ● Interest ● Compound interest © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

SAVING AND INVESTMENT BASICS CHAPTER 19 4 ● Savings and investment activities ● Determine investment goals ● The growth of savings ● Interest ● Compound interest © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

QUARTERLY COMPOUND INTEREST © 2012 Cengage Learning. All Rights Reserved. CHAPTER 19 5 Principles of Business, 8 e

QUARTERLY COMPOUND INTEREST © 2012 Cengage Learning. All Rights Reserved. CHAPTER 19 5 Principles of Business, 8 e

CHAPTER 19 6 Checkpoint ● How does saving influence economic activity? ● Saving benefits the economy by making more money available for borrowing by individuals, businesses, and governments. ● When this money is spent, demand for goods and services increases, resulting in more jobs and more spending by workers. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 6 Checkpoint ● How does saving influence economic activity? ● Saving benefits the economy by making more money available for borrowing by individuals, businesses, and governments. ● When this money is spent, demand for goods and services increases, resulting in more jobs and more spending by workers. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER SAVING AND INVESTMENT CHOICES ● Savings plans ● Savings account ● Certificate of deposit ● Money market account 19 7 ● Alternative investments ● Real estate ● Commodities ● Collectibles ● Securities ● Stock investments ● Bond investments ● Mutual funds © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER SAVING AND INVESTMENT CHOICES ● Savings plans ● Savings account ● Certificate of deposit ● Money market account 19 7 ● Alternative investments ● Real estate ● Commodities ● Collectibles ● Securities ● Stock investments ● Bond investments ● Mutual funds © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 8 Checkpoint ● What are the nine main categories of saving and investment alternatives? ● ● ● ● ● Savings accounts Certificates of deposit Money market accounts Stock investments Bond investments Mutual funds Real estate Commodities Collectibles © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 8 Checkpoint ● What are the nine main categories of saving and investment alternatives? ● ● ● ● ● Savings accounts Certificates of deposit Money market accounts Stock investments Bond investments Mutual funds Real estate Commodities Collectibles © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

EVALUATING SAVINGS AND INVESTMENTS CHAPTER 19 9 ● Safety and risk ● Potential return ● Liquidity ● Taxes © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

EVALUATING SAVINGS AND INVESTMENTS CHAPTER 19 9 ● Safety and risk ● Potential return ● Liquidity ● Taxes © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

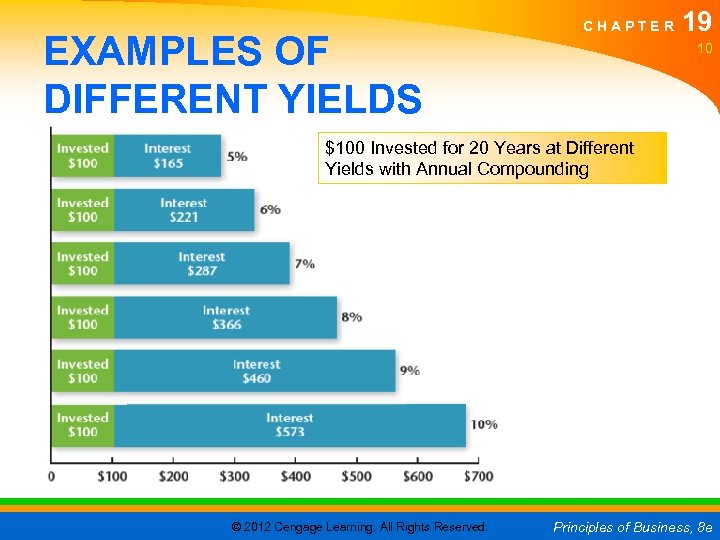

EXAMPLES OF DIFFERENT YIELDS CHAPTER 19 10 $100 Invested for 20 Years at Different Yields with Annual Compounding © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

EXAMPLES OF DIFFERENT YIELDS CHAPTER 19 10 $100 Invested for 20 Years at Different Yields with Annual Compounding © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

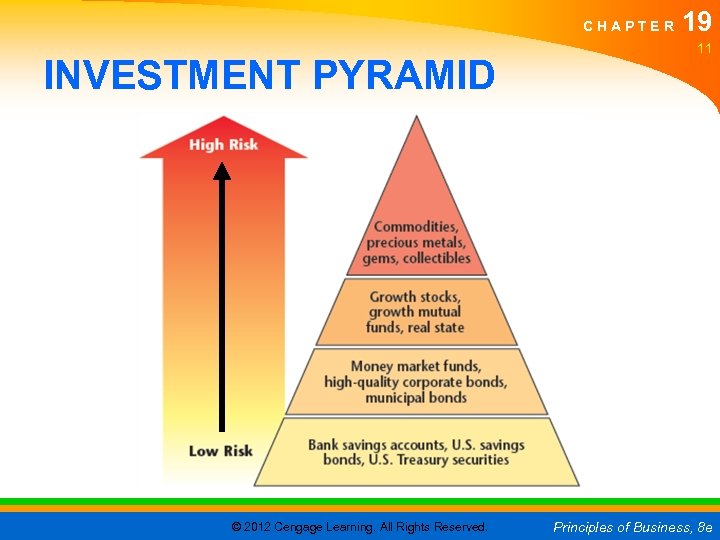

CHAPTER INVESTMENT PYRAMID © 2012 Cengage Learning. All Rights Reserved. 19 11 Principles of Business, 8 e

CHAPTER INVESTMENT PYRAMID © 2012 Cengage Learning. All Rights Reserved. 19 11 Principles of Business, 8 e

CHAPTER 19 12 Checkpoint ● What are four factors to consider when selecting an investment? ● Safety ● Return ● Liquidity ● Taxes © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 12 Checkpoint ● What are four factors to consider when selecting an investment? ● Safety ● Return ● Liquidity ● Taxes © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

19 -2 Stock Investments Goal 1 Compare the two major types of stock. Goal 2 Describe the activities involved with buying or selling stock. Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. SLIDE 13

19 -2 Stock Investments Goal 1 Compare the two major types of stock. Goal 2 Describe the activities involved with buying or selling stock. Goal 3 Identify factors that affect the value of a stock. © 2012 Cengage Learning. All Rights Reserved. SLIDE 13

CHAPTER KEY TERMS 19 14 ● preferred stock ● common stock ● stockbroker ● stock exchange ● market value © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER KEY TERMS 19 14 ● preferred stock ● common stock ● stockbroker ● stock exchange ● market value © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER TYPES OF STOCK 19 15 ● Preferred stock ● Common stock © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER TYPES OF STOCK 19 15 ● Preferred stock ● Common stock © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 16 Checkpoint ● How does preferred stock differ from common stock? ● Preferred stock has priority over common stock in the payment of dividends. ● Investing in preferred stock is less risky than common stock, but preferred stockholders generally have no voting rights within the corporation. ● Common stock represents general ownership in a corporation and a right to share in its profits. ● Common stockholders are entitled to one vote per share. ● Although preferred stockholders are paid first, their dividends usually are limited to a set rate. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 16 Checkpoint ● How does preferred stock differ from common stock? ● Preferred stock has priority over common stock in the payment of dividends. ● Investing in preferred stock is less risky than common stock, but preferred stockholders generally have no voting rights within the corporation. ● Common stock represents general ownership in a corporation and a right to share in its profits. ● Common stockholders are entitled to one vote per share. ● Although preferred stockholders are paid first, their dividends usually are limited to a set rate. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER STOCK TRANSACTIONS 19 17 ● Using a stockbroker ● Online investing ● Stock exchanges ● Changing stock values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER STOCK TRANSACTIONS 19 17 ● Using a stockbroker ● Online investing ● Stock exchanges ● Changing stock values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

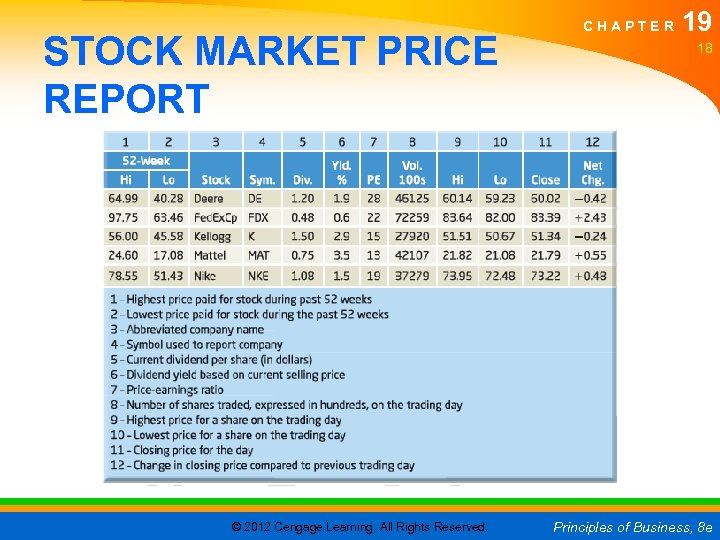

STOCK MARKET PRICE REPORT © 2012 Cengage Learning. All Rights Reserved. CHAPTER 19 18 Principles of Business, 8 e

STOCK MARKET PRICE REPORT © 2012 Cengage Learning. All Rights Reserved. CHAPTER 19 18 Principles of Business, 8 e

CHAPTER 19 19 Checkpoint ● What is the purpose of a stock exchange? ● The purpose of a stock exchange is to accommodate the buying and selling of securities. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 19 Checkpoint ● What is the purpose of a stock exchange? ● The purpose of a stock exchange is to accommodate the buying and selling of securities. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER STOCK SELECTION 19 20 ● Stock information sources ● Economic factors ● Inflation ● Interest rates ● Consumer spending ● Employment ● Company factors © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER STOCK SELECTION 19 20 ● Stock information sources ● Economic factors ● Inflation ● Interest rates ● Consumer spending ● Employment ● Company factors © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

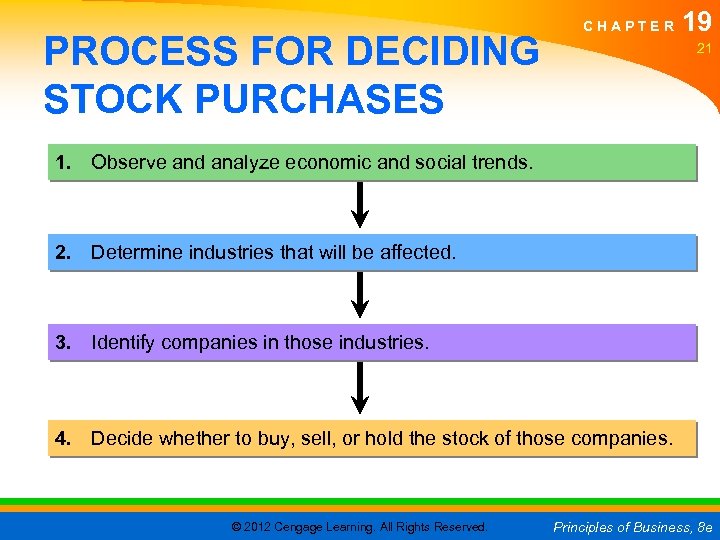

PROCESS FOR DECIDING STOCK PURCHASES CHAPTER 19 21 1. Observe and analyze economic and social trends. 2. Determine industries that will be affected. 3. Identify companies in those industries. 4. Decide whether to buy, sell, or hold the stock of those companies. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

PROCESS FOR DECIDING STOCK PURCHASES CHAPTER 19 21 1. Observe and analyze economic and social trends. 2. Determine industries that will be affected. 3. Identify companies in those industries. 4. Decide whether to buy, sell, or hold the stock of those companies. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 22 Checkpoint ● How do various economic factors affect stock prices? ● Inflation affects stock prices by causing lower spending by consumers, reducing company profits out of which dividends are paid. ● Falling or rising interest rates can also increase or decrease company profits as the cost of money changes. ● The employment rate also affects stock prices; when more people are employed, they spend more money on a company’s products and stock prices rise. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 22 Checkpoint ● How do various economic factors affect stock prices? ● Inflation affects stock prices by causing lower spending by consumers, reducing company profits out of which dividends are paid. ● Falling or rising interest rates can also increase or decrease company profits as the cost of money changes. ● The employment rate also affects stock prices; when more people are employed, they spend more money on a company’s products and stock prices rise. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

19 -3 Bonds and Mutual Funds Goal 1 List types of government bonds. Goal 2 Describe features of corporate bonds. Goal 3 Describe various types of mutual funds. © 2012 Cengage Learning. All Rights Reserved. SLIDE 23

19 -3 Bonds and Mutual Funds Goal 1 List types of government bonds. Goal 2 Describe features of corporate bonds. Goal 3 Describe various types of mutual funds. © 2012 Cengage Learning. All Rights Reserved. SLIDE 23

CHAPTER KEY TERMS 19 24 ● municipal bond ● corporate bond ● mutual fund © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER KEY TERMS 19 24 ● municipal bond ● corporate bond ● mutual fund © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER GOVERNMENT BONDS 19 25 ● Municipal bonds ● U. S. savings bonds ● Other federal securities ● Federal notes (T-notes) ● Treasury bills (T-bills) ● Treasury bonds (T-bonds) © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER GOVERNMENT BONDS 19 25 ● Municipal bonds ● U. S. savings bonds ● Other federal securities ● Federal notes (T-notes) ● Treasury bills (T-bills) ● Treasury bonds (T-bonds) © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 26 Checkpoint ● List the types of bonds issued by the federal government of the United States. ● The types of U. S. savings bonds issued by the federal government are Series EE bonds, Series HH bonds, and I bonds. ● The federal government also issues Treasury bills and Treasury notes. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 26 Checkpoint ● List the types of bonds issued by the federal government of the United States. ● The types of U. S. savings bonds issued by the federal government are Series EE bonds, Series HH bonds, and I bonds. ● The federal government also issues Treasury bills and Treasury notes. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER CORPORATE BONDS 19 27 ● Bond components ● Bond values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER CORPORATE BONDS 19 27 ● Bond components ● Bond values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 28 Checkpoint ● What affects the value of a bond? ● The value of a bond is affected by changing interest rates. ● If the bond’s stated rate is lower than interest rates on similar bonds, investors will want to buy the bond for less than its face value. ● If the bond’s stated interest rate is higher than interest rates on similar bonds, the seller of the bond will want to receive more than its face value. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 28 Checkpoint ● What affects the value of a bond? ● The value of a bond is affected by changing interest rates. ● If the bond’s stated rate is lower than interest rates on similar bonds, investors will want to buy the bond for less than its face value. ● If the bond’s stated interest rate is higher than interest rates on similar bonds, the seller of the bond will want to receive more than its face value. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 29 MUTUAL FUNDS ● A mutual fund is an investment fund set up and managed by companies that receive money from many investors. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 29 MUTUAL FUNDS ● A mutual fund is an investment fund set up and managed by companies that receive money from many investors. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER TYPES OF MUTUAL FUNDS 19 30 ● Aggressive-growth stock funds ● Income funds ● International funds ● Sector funds ● Bond funds ● Balanced funds © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER TYPES OF MUTUAL FUNDS 19 30 ● Aggressive-growth stock funds ● Income funds ● International funds ● Sector funds ● Bond funds ● Balanced funds © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER MUTUAL FUND VALUES 19 31 ● Shares of the mutual fund ● Value of each share ● Net asset value (NAV) ● Operating expenses ● Earnings © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER MUTUAL FUND VALUES 19 31 ● Shares of the mutual fund ● Value of each share ● Net asset value (NAV) ● Operating expenses ● Earnings © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 32 Checkpoint ● What are the main types of mutual funds? ● The main types of mutual funds are aggressive-growth stock funds, income funds, international funds, sector funds, bond funds, and balanced funds. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 32 Checkpoint ● What are the main types of mutual funds? ● The main types of mutual funds are aggressive-growth stock funds, income funds, international funds, sector funds, bond funds, and balanced funds. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

19 -4 Real Estate Investments Goal 1 Describe home buying activities. Goal 2 Explain the benefits of home ownership. Goal 3 Discuss the costs of home ownership. © 2012 Cengage Learning. All Rights Reserved. SLIDE 33

19 -4 Real Estate Investments Goal 1 Describe home buying activities. Goal 2 Explain the benefits of home ownership. Goal 3 Discuss the costs of home ownership. © 2012 Cengage Learning. All Rights Reserved. SLIDE 33

CHAPTER KEY TERMS 19 34 ● real estate ● mortgage ● equity ● assessed value © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER KEY TERMS 19 34 ● real estate ● mortgage ● equity ● assessed value © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER SELECTING HOUSING 19 35 ● Renting your residence ● Owning a mobile home ● Buying a home ● Services of real estate agents ● Other real estate professionals ● Buying a condominium © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER SELECTING HOUSING 19 35 ● Renting your residence ● Owning a mobile home ● Buying a home ● Services of real estate agents ● Other real estate professionals ● Buying a condominium © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER Checkpoint 19 36 ● What are four available housing alternatives? ● Renting ● Owning a mobile home ● Buying a traditional home ● Buying a condominium © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER Checkpoint 19 36 ● What are four available housing alternatives? ● Renting ● Owning a mobile home ● Buying a traditional home ● Buying a condominium © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

BENEFITS OF HOME OWNERSHIP CHAPTER 19 37 ● Tax benefits ● Increased equity ● Pride of ownership © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

BENEFITS OF HOME OWNERSHIP CHAPTER 19 37 ● Tax benefits ● Increased equity ● Pride of ownership © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 38 Checkpoint ● What are the main benefits of home ownership? ● Tax benefits ● Increased equity ● Pride of ownership © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 38 Checkpoint ● What are the main benefits of home ownership? ● Tax benefits ● Increased equity ● Pride of ownership © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

COSTS OF HOME OWNERSHIP CHAPTER 19 39 ● Property taxes ● Interest payments ● Property insurance ● Maintenance © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

COSTS OF HOME OWNERSHIP CHAPTER 19 39 ● Property taxes ● Interest payments ● Property insurance ● Maintenance © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 40 Checkpoint ● What are common costs of home ownership? ● Common costs of home ownership are property taxes, interest payments, property insurance, and maintenance. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 40 Checkpoint ● What are common costs of home ownership? ● Common costs of home ownership are property taxes, interest payments, property insurance, and maintenance. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

19 -5 Other Investments Goal 1 Discuss types of commodity investments. Goal 2 Explain the use of collectibles as an investment. © 2012 Cengage Learning. All Rights Reserved. SLIDE 41

19 -5 Other Investments Goal 1 Discuss types of commodity investments. Goal 2 Explain the use of collectibles as an investment. © 2012 Cengage Learning. All Rights Reserved. SLIDE 41

CHAPTER KEY TERMS 19 42 ● commodities ● futures contract ● collectibles © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER KEY TERMS 19 42 ● commodities ● futures contract ● collectibles © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER COMMODITIES AND FUTURES 19 43 ● Commodity exchanges ● Agricultural commodities ● Gold, silver, and precious metals ● Currency and financial instruments © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER COMMODITIES AND FUTURES 19 43 ● Commodity exchanges ● Agricultural commodities ● Gold, silver, and precious metals ● Currency and financial instruments © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 44 Checkpoint ● What types of commodities are commonly used with futures contracts? ● Types of commodities commonly used with futures contracts are agricultural commodities, such as grain and livestock, and precious metals. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 44 Checkpoint ● What types of commodities are commonly used with futures contracts? ● Types of commodities commonly used with futures contracts are agricultural commodities, such as grain and livestock, and precious metals. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER COLLECTIBLES 19 45 ● Types of collectibles ● Collectible values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER COLLECTIBLES 19 45 ● Types of collectibles ● Collectible values © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 46 Checkpoint ● What are common types of collectibles? ● Common types of collectibles are stamps, coins, sport trading cards, and antiques, as well as unusual items purchased as investments. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e

CHAPTER 19 46 Checkpoint ● What are common types of collectibles? ● Common types of collectibles are stamps, coins, sport trading cards, and antiques, as well as unusual items purchased as investments. © 2012 Cengage Learning. All Rights Reserved. Principles of Business, 8 e