702e3f619606fdfb437794e27a634408.ppt

- Количество слайдов: 31

Chapter 18 Price Setting in the Business World

How are prices set by business people? • Costs provide a price floor. • See what substitute products are priced at • Can you offer something of additional value that people will pay a price premium for? • Use this information and market responses to set your prices. • Remember, price increases & decreases have a direct impact on unit profits

Markup Pricing • Markup - a dollar amount added to the cost of products to get a selling price (638) • Many retailers apply a standard markup to everything they sell. • However, with modern data information price setting is changing to more of a market response method for many firms.

Markup Formulas • Markup On Selling Price = – (Selling Price - Cost) / Selling Price • Markup on Cost = – (Selling Price - Cost)/ Cost

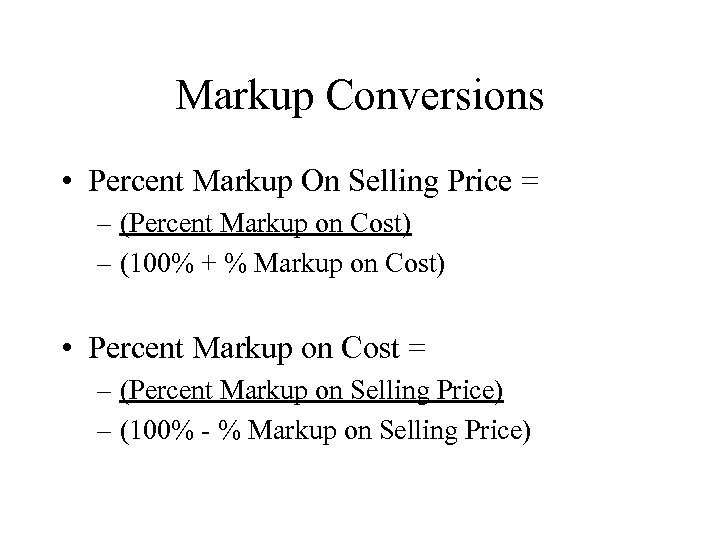

Markup Conversions • Percent Markup On Selling Price = – (Percent Markup on Cost) – (100% + % Markup on Cost) • Percent Markup on Cost = – (Percent Markup on Selling Price) – (100% - % Markup on Selling Price)

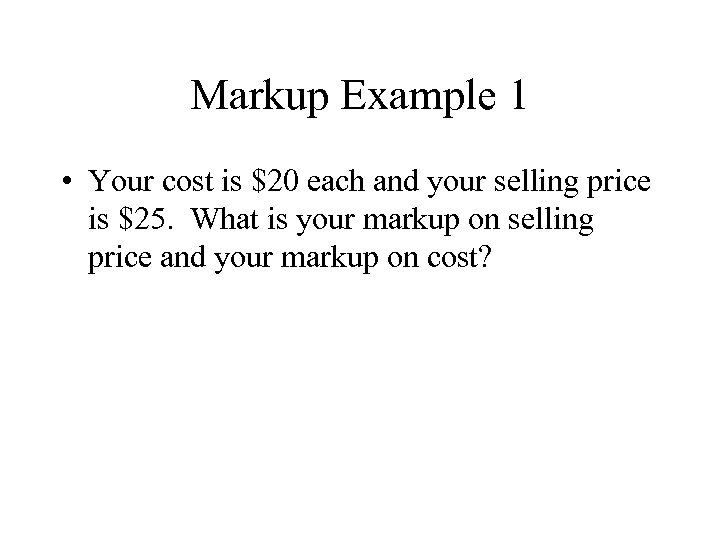

Markup Example 1 • Your cost is $20 each and your selling price is $25. What is your markup on selling price and your markup on cost?

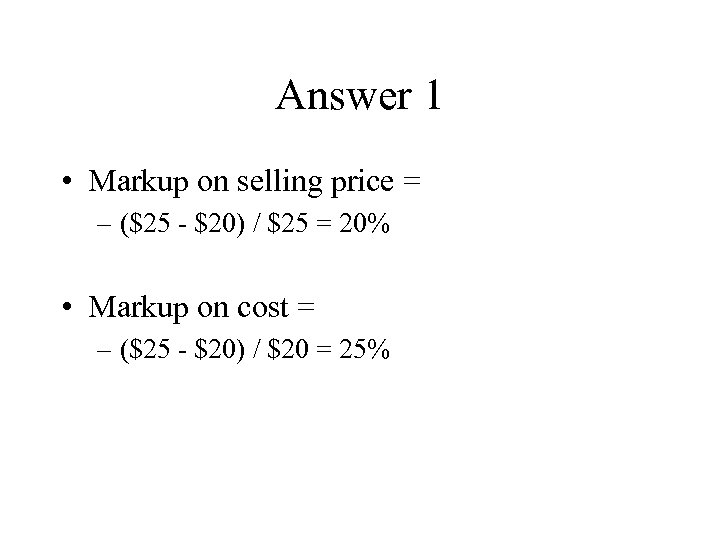

Answer 1 • Markup on selling price = – ($25 - $20) / $25 = 20% • Markup on cost = – ($25 - $20) / $20 = 25%

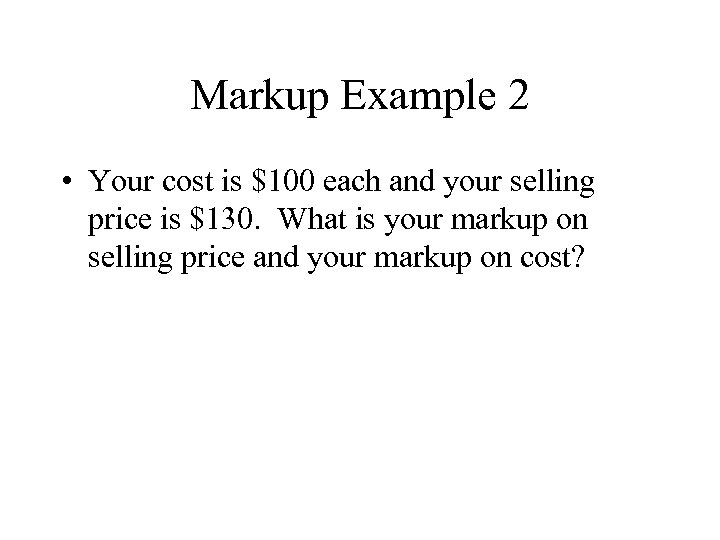

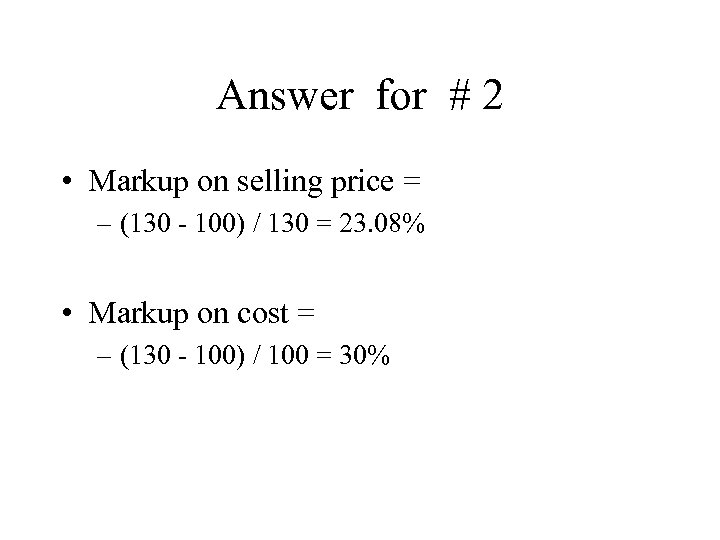

Markup Example 2 • Your cost is $100 each and your selling price is $130. What is your markup on selling price and your markup on cost?

Answer for # 2 • Markup on selling price = – (130 - 100) / 130 = 23. 08% • Markup on cost = – (130 - 100) / 100 = 30%

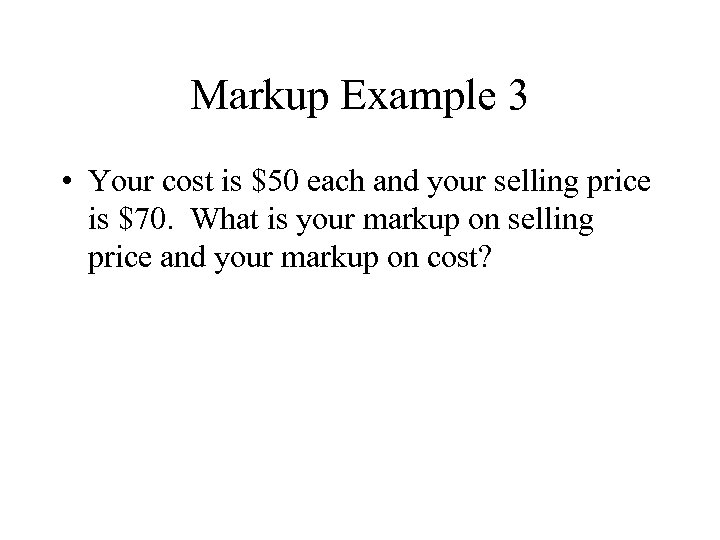

Markup Example 3 • Your cost is $50 each and your selling price is $70. What is your markup on selling price and your markup on cost?

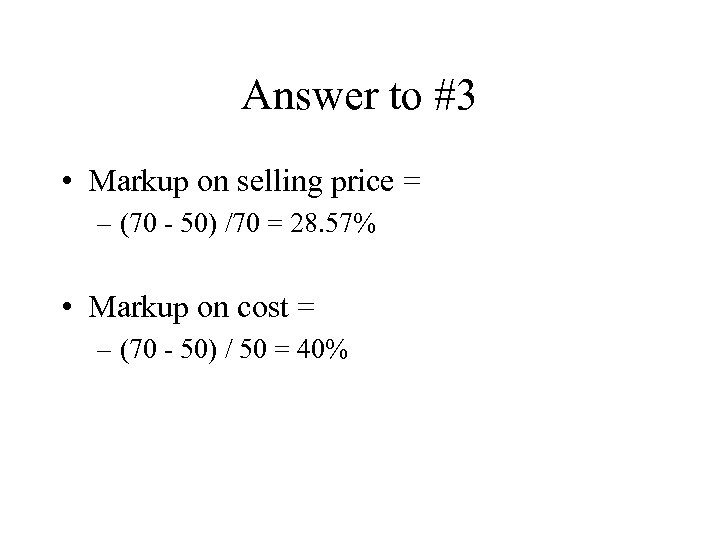

Answer to #3 • Markup on selling price = – (70 - 50) /70 = 28. 57% • Markup on cost = – (70 - 50) / 50 = 40%

![Markup Example #4 • A] You have a 30% markup on selling price. What Markup Example #4 • A] You have a 30% markup on selling price. What](https://present5.com/presentation/702e3f619606fdfb437794e27a634408/image-12.jpg)

Markup Example #4 • A] You have a 30% markup on selling price. What would this be if it was a markup on cost? • B] You have a 20% markup on cost. What would this be if it was a markup on selling price?

![Answer # 4 • A] 30 / (100 - 30) = 42. 86% • Answer # 4 • A] 30 / (100 - 30) = 42. 86% •](https://present5.com/presentation/702e3f619606fdfb437794e27a634408/image-13.jpg)

Answer # 4 • A] 30 / (100 - 30) = 42. 86% • B] 20 / (100 + 20) = 16. 67%

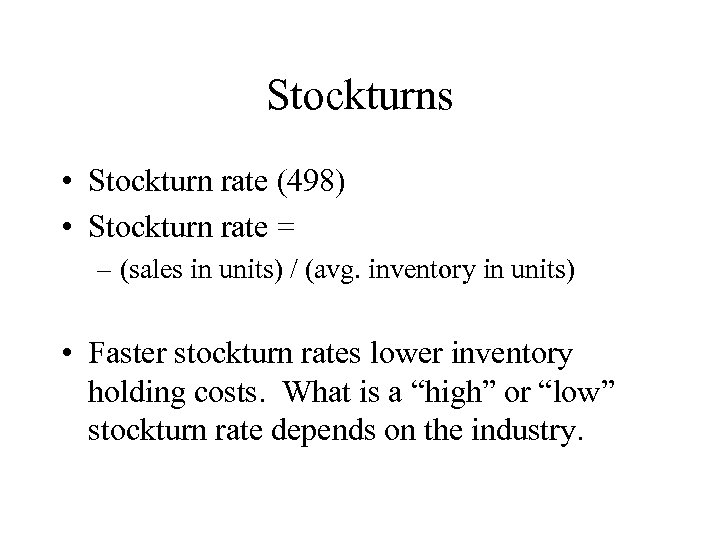

Stockturns • Stockturn rate (498) • Stockturn rate = – (sales in units) / (avg. inventory in units) • Faster stockturn rates lower inventory holding costs. What is a “high” or “low” stockturn rate depends on the industry.

Average Cost Pricing • Average Cost Pricing (490) • Problems: – does not consider cost changes at different output levels. – Does not consider the impact price has on quantity demanded

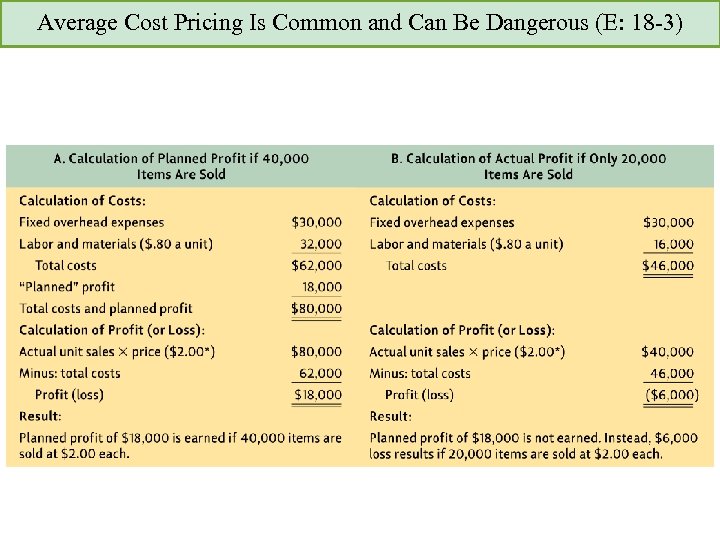

Average Cost Pricing Is Common and Can Be Dangerous (E: 18 -3)

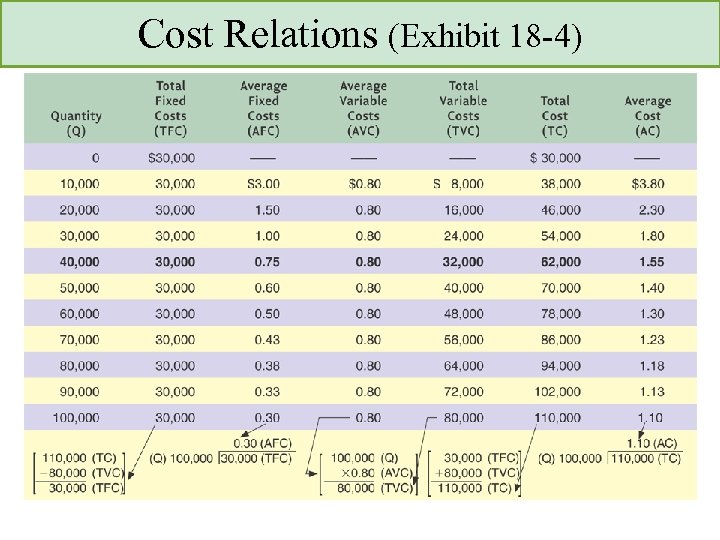

Cost Relations (Exhibit 18 -4)

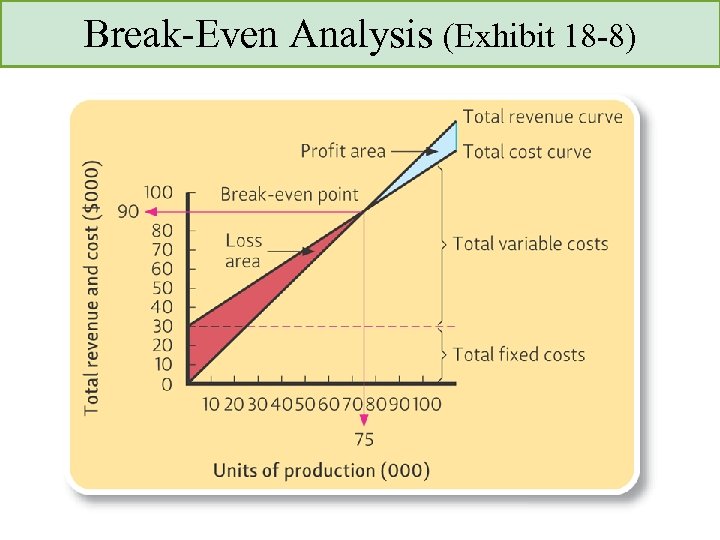

Break Even Analysis • Break - even analysis (505) • Break - even point (505) • BEP (in units) = – (Total Fixed Cost) / (Fixed Cost Contribution per Unit)

Break-Even Analysis (Exhibit 18 -8)

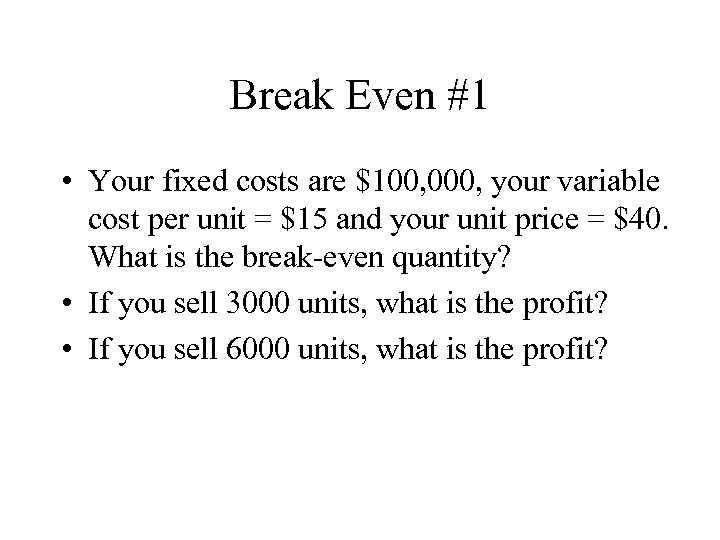

Break Even #1 • Your fixed costs are $100, 000, your variable cost per unit = $15 and your unit price = $40. What is the break-even quantity? • If you sell 3000 units, what is the profit? • If you sell 6000 units, what is the profit?

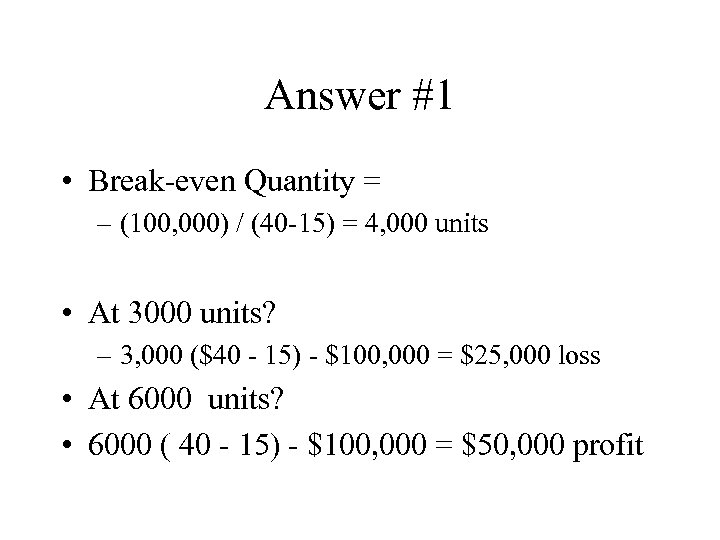

Answer #1 • Break-even Quantity = – (100, 000) / (40 -15) = 4, 000 units • At 3000 units? – 3, 000 ($40 - 15) - $100, 000 = $25, 000 loss • At 6000 units? • 6000 ( 40 - 15) - $100, 000 = $50, 000 profit

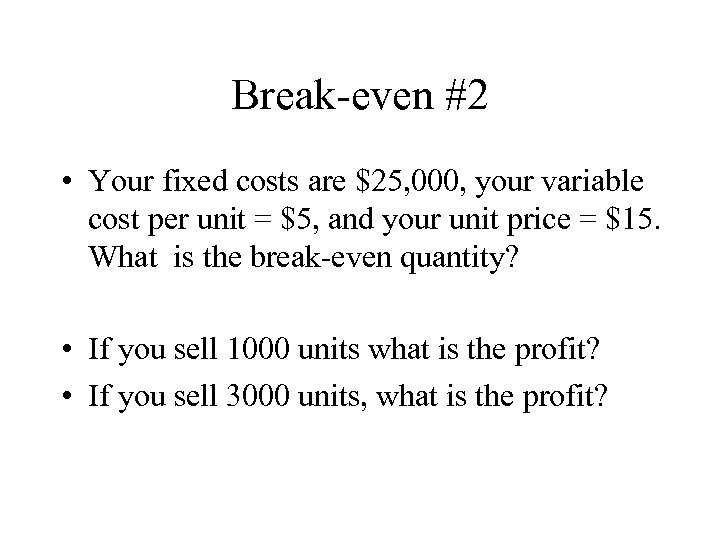

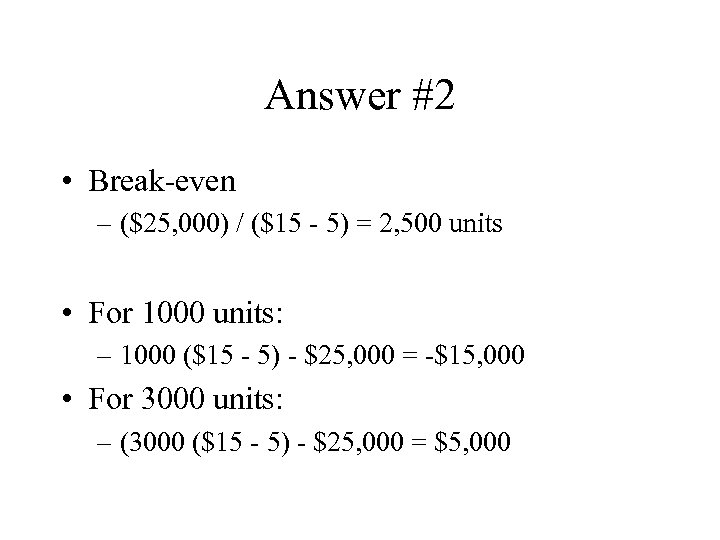

Break-even #2 • Your fixed costs are $25, 000, your variable cost per unit = $5, and your unit price = $15. What is the break-even quantity? • If you sell 1000 units what is the profit? • If you sell 3000 units, what is the profit?

Answer #2 • Break-even – ($25, 000) / ($15 - 5) = 2, 500 units • For 1000 units: – 1000 ($15 - 5) - $25, 000 = -$15, 000 • For 3000 units: – (3000 ($15 - 5) - $25, 000 = $5, 000

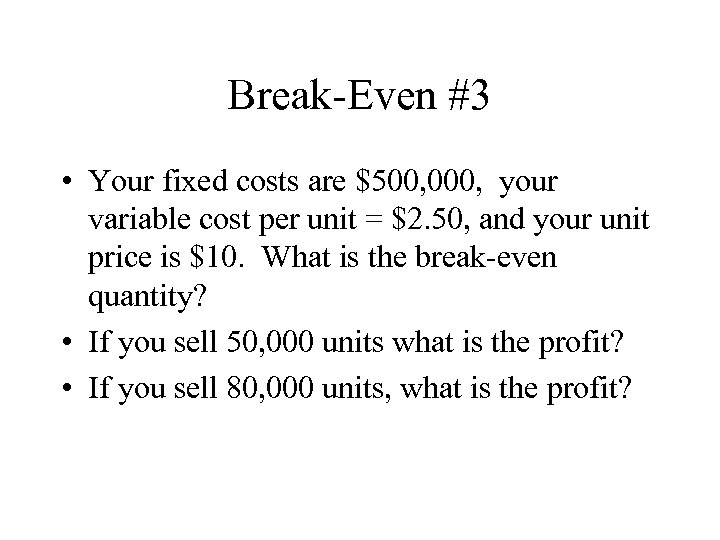

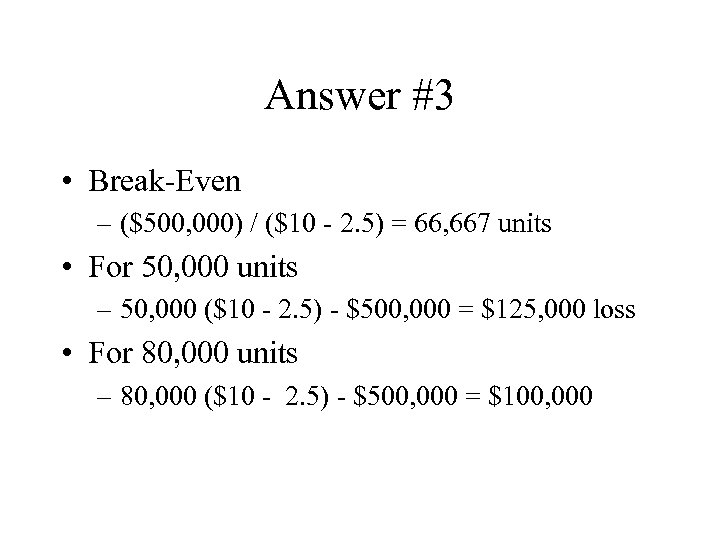

Break-Even #3 • Your fixed costs are $500, 000, your variable cost per unit = $2. 50, and your unit price is $10. What is the break-even quantity? • If you sell 50, 000 units what is the profit? • If you sell 80, 000 units, what is the profit?

Answer #3 • Break-Even – ($500, 000) / ($10 - 2. 5) = 66, 667 units • For 50, 000 units – 50, 000 ($10 - 2. 5) - $500, 000 = $125, 000 loss • For 80, 000 units – 80, 000 ($10 - 2. 5) - $500, 000 = $100, 000

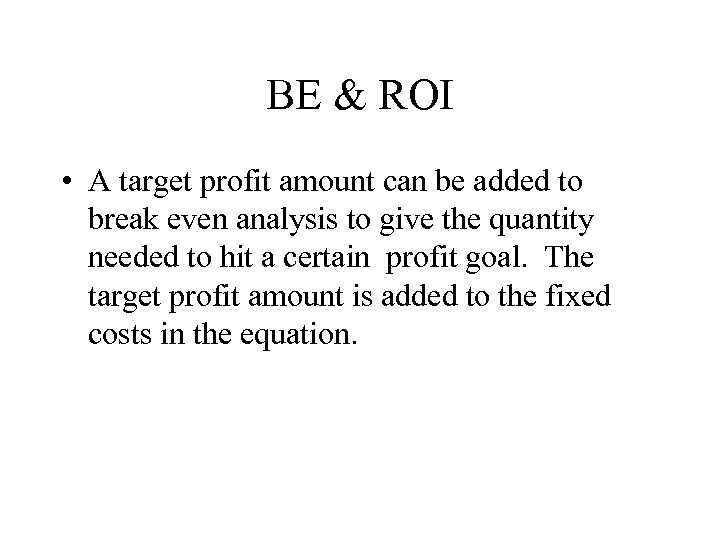

BE & ROI • A target profit amount can be added to break even analysis to give the quantity needed to hit a certain profit goal. The target profit amount is added to the fixed costs in the equation.

BE & ROI Problem • Take the last example. Our goal is now a 10% ROI. What is the quantity needed to hit this ROI target?

BE ROI Answer • Our new “fixed costs” are • $500, 000 & the profit goal. – $500, 000 + (500, 000 x 0. 1) = $550, 000 • Break even for this ROI level is • $550, 000 / ($10 - 2. 50) = 73, 334 units

Break Even • Calculating BEP at several possible prices and forecasting the probable demand at those price points can be helpful. • BE Analysis is also a good illustration of why managers constantly look for ways to cut costs. Cost cuts means you can achieve profitability at much lower sales levels.

![Problems with BE Analysis • Break-even analysis has two big assumptions • 1] There Problems with BE Analysis • Break-even analysis has two big assumptions • 1] There](https://present5.com/presentation/702e3f619606fdfb437794e27a634408/image-30.jpg)

Problems with BE Analysis • Break-even analysis has two big assumptions • 1] There is a horizontal demand curve • 2] Cost curves do not change over the production horizon

![Competitive Bidding • Six steps a firm should use: • 1] Decide if the Competitive Bidding • Six steps a firm should use: • 1] Decide if the](https://present5.com/presentation/702e3f619606fdfb437794e27a634408/image-31.jpg)

Competitive Bidding • Six steps a firm should use: • 1] Decide if the bid is worth the bid preparation costs • 2] Calculate the direct & indirect costs of the contract • 3] Estimate the probabilities of acceptance at each of several bid levels • 4] Calculate the expected profits at each bid level • 5] Evaluate the process after submission

702e3f619606fdfb437794e27a634408.ppt