722037b33263042db912f6ac7ebacfbb.ppt

- Количество слайдов: 19

Chapter 18 Lease Financing ® 2002 Prentice Hall Publishing 1

Chapter 18 Lease Financing ® 2002 Prentice Hall Publishing 1

Features of a Lease • • • Lessor/Lessee Advanced payment Maintenance lease Net lease Residual value ® 2002 Prentice Hall Publishing 2

Features of a Lease • • • Lessor/Lessee Advanced payment Maintenance lease Net lease Residual value ® 2002 Prentice Hall Publishing 2

Operating Versus Financial Leases • Operating lease – Relative short-term • < asset’s useful life – Cancellable with proper notice ® 2002 Prentice Hall Publishing • Financial lease – Longer term • Asset’s useful life – Noncancellable 3

Operating Versus Financial Leases • Operating lease – Relative short-term • < asset’s useful life – Cancellable with proper notice ® 2002 Prentice Hall Publishing • Financial lease – Longer term • Asset’s useful life – Noncancellable 3

Types of Lease Contracts • Sale and leaseback • Direct leasing • Leveraged involves 3 parties – Lessee – Lessor (Equity Participant) – Lender ® 2002 Prentice Hall Publishing 4

Types of Lease Contracts • Sale and leaseback • Direct leasing • Leveraged involves 3 parties – Lessee – Lessor (Equity Participant) – Lender ® 2002 Prentice Hall Publishing 4

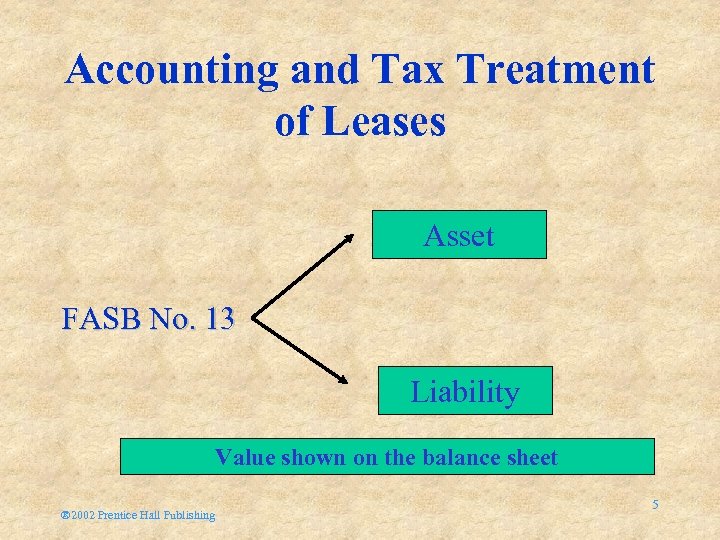

Accounting and Tax Treatment of Leases Asset FASB No. 13 Liability Value shown on the balance sheet ® 2002 Prentice Hall Publishing 5

Accounting and Tax Treatment of Leases Asset FASB No. 13 Liability Value shown on the balance sheet ® 2002 Prentice Hall Publishing 5

Capital Lease Conditions • • Title transfers to lessee Option to purchase Lease period 75% of economic life Present value (PV) of lease payments 90% of the fair value of the leased property ® 2002 Prentice Hall Publishing 6

Capital Lease Conditions • • Title transfers to lessee Option to purchase Lease period 75% of economic life Present value (PV) of lease payments 90% of the fair value of the leased property ® 2002 Prentice Hall Publishing 6

Recording the Value of a Capital Lease • Value appears on the balance sheet • Amount reflected – PV of the minimum lease payments over the lease period • Discount rate employed – Lessee’s incremental borrowing rate – Lessor’s implicit interest rate ® 2002 Prentice Hall Publishing 7

Recording the Value of a Capital Lease • Value appears on the balance sheet • Amount reflected – PV of the minimum lease payments over the lease period • Discount rate employed – Lessee’s incremental borrowing rate – Lessor’s implicit interest rate ® 2002 Prentice Hall Publishing 7

Disclosure of Operating Leases • • Total future minimum lease payments Schedule by year for next five years Total sublease rentals to be received Basis for contingent rental payments Existence and terms of purchase Renewal options and escalation clauses Lease agreement restrictions ® 2002 Prentice Hall Publishing 8

Disclosure of Operating Leases • • Total future minimum lease payments Schedule by year for next five years Total sublease rentals to be received Basis for contingent rental payments Existence and terms of purchase Renewal options and escalation clauses Lease agreement restrictions ® 2002 Prentice Hall Publishing 8

IRS Guidelines for the Tax Treatment of Lease Contracts • Lessor have a minimum “at risk” investment • Remaining life the longer of – One year – 20% of asset’s original estimated life • No bargain purchase option • No loan from lessee to lessor • Expected profit to lessor > tax benefits ® 2002 Prentice Hall Publishing 9

IRS Guidelines for the Tax Treatment of Lease Contracts • Lessor have a minimum “at risk” investment • Remaining life the longer of – One year – 20% of asset’s original estimated life • No bargain purchase option • No loan from lessee to lessor • Expected profit to lessor > tax benefits ® 2002 Prentice Hall Publishing 9

Lessor’s Return Depends on Three Things Length of the lease Beginning Periodic lease payments End Residual value assumption ® 2002 Prentice Hall Publishing 10

Lessor’s Return Depends on Three Things Length of the lease Beginning Periodic lease payments End Residual value assumption ® 2002 Prentice Hall Publishing 10

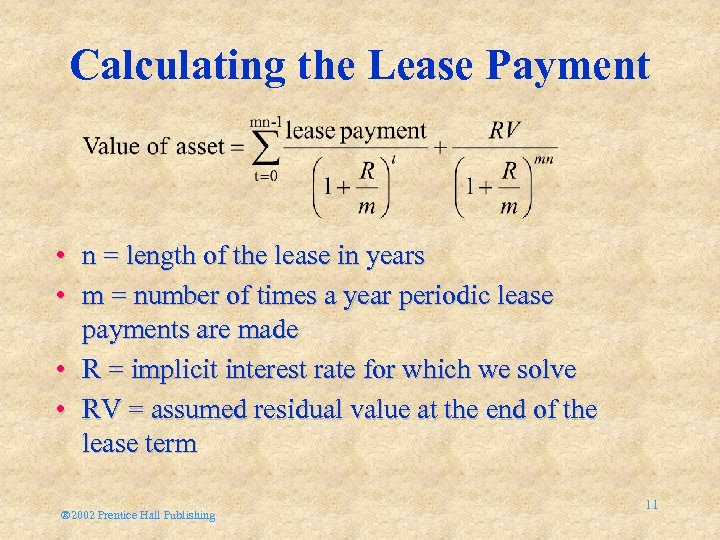

Calculating the Lease Payment • n = length of the lease in years • m = number of times a year periodic lease payments are made • R = implicit interest rate for which we solve • RV = assumed residual value at the end of the lease term ® 2002 Prentice Hall Publishing 11

Calculating the Lease Payment • n = length of the lease in years • m = number of times a year periodic lease payments are made • R = implicit interest rate for which we solve • RV = assumed residual value at the end of the lease term ® 2002 Prentice Hall Publishing 11

Analysis of Lease Versus Buy/Borrow • After tax • Discounted cash flows • Financial decision The investment decision is to acquire an asset Then a company decides how to finance it ® 2002 Prentice Hall Publishing 12

Analysis of Lease Versus Buy/Borrow • After tax • Discounted cash flows • Financial decision The investment decision is to acquire an asset Then a company decides how to finance it ® 2002 Prentice Hall Publishing 12

Methods of Analysis • Present value method (PV) – Compare PV’s of alternatives – Lowest PV is the most desirable • Internal rate of return (IRR) – Compare costs of lease/borrowing • After-tax – Select alternative with lowest rate ® 2002 Prentice Hall Publishing 13

Methods of Analysis • Present value method (PV) – Compare PV’s of alternatives – Lowest PV is the most desirable • Internal rate of return (IRR) – Compare costs of lease/borrowing • After-tax – Select alternative with lowest rate ® 2002 Prentice Hall Publishing 13

Favorable Factors for Buy/Borrow Alternative • • • Use of accelerated cost recovery depreciation Residual value at the end of the project Greater residual value Tax deductibility of interest payments High tax brackets ® 2002 Prentice Hall Publishing 14

Favorable Factors for Buy/Borrow Alternative • • • Use of accelerated cost recovery depreciation Residual value at the end of the project Greater residual value Tax deductibility of interest payments High tax brackets ® 2002 Prentice Hall Publishing 14

Residual Value • Usually subject to considerable uncertainty • Could require higher discount rate • Higher rate favors lease financing ® 2002 Prentice Hall Publishing 15

Residual Value • Usually subject to considerable uncertainty • Could require higher discount rate • Higher rate favors lease financing ® 2002 Prentice Hall Publishing 15

Sensitivity Analysis of Uncertain Borrowing Costs Interest rate change Change financing decision Speed of rate change How probable is the interest rate change? ® 2002 Prentice Hall Publishing 16

Sensitivity Analysis of Uncertain Borrowing Costs Interest rate change Change financing decision Speed of rate change How probable is the interest rate change? ® 2002 Prentice Hall Publishing 16

What if the Asset can Only be Leased? • Intertwined decisions – Investing – Financing • Lease if PV of cash benefits > the cashequivalent price • Reject lease if benefits < price ® 2002 Prentice Hall Publishing 17

What if the Asset can Only be Leased? • Intertwined decisions – Investing – Financing • Lease if PV of cash benefits > the cashequivalent price • Reject lease if benefits < price ® 2002 Prentice Hall Publishing 17

Sources of Value in Leasing • Perfect capital markets – Firm indifferent • Bankruptcy costs – Lessor’s position somewhat superior to lender • Effect of differing taxes – Low tax-bracket firms lease more and borrow less • Market equilibration process – Competition encourages sharing of tax benefits ® 2002 Prentice Hall Publishing 18

Sources of Value in Leasing • Perfect capital markets – Firm indifferent • Bankruptcy costs – Lessor’s position somewhat superior to lender • Effect of differing taxes – Low tax-bracket firms lease more and borrow less • Market equilibration process – Competition encourages sharing of tax benefits ® 2002 Prentice Hall Publishing 18

Alleged Lessor’s Benefits • Economies of scale • Different estimate – Life of the asset – Residual value – Discount rate • Face different borrowing costs • Provide expertise to customers – Equipment selection – Equipment maintenance ® 2002 Prentice Hall Publishing 19

Alleged Lessor’s Benefits • Economies of scale • Different estimate – Life of the asset – Residual value – Discount rate • Face different borrowing costs • Provide expertise to customers – Equipment selection – Equipment maintenance ® 2002 Prentice Hall Publishing 19