941d220a1a8bbfa8c59137228d3b88eb.ppt

- Количество слайдов: 14

Chapter 18 18 -0 Pricing for International Markets Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Chapter 18 18 -0 Pricing for International Markets Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

International Pricing Approach 18 -1 Full Cost vs Variable Cost Skimming vs Penetration Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

International Pricing Approach 18 -1 Full Cost vs Variable Cost Skimming vs Penetration Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Costs of Exporting 18 -2 Taxes Tariffs Administrative Costs Inflation Exchange Rate Fluctuations Varying Currency Values Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Costs of Exporting 18 -2 Taxes Tariffs Administrative Costs Inflation Exchange Rate Fluctuations Varying Currency Values Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

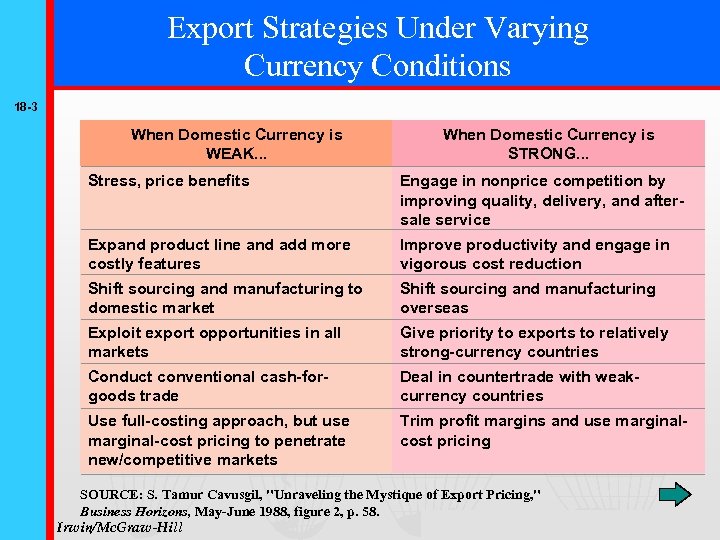

Export Strategies Under Varying Currency Conditions 18 -3 When Domestic Currency is WEAK. . . When Domestic Currency is STRONG. . . Stress, price benefits Engage in nonprice competition by improving quality, delivery, and aftersale service Expand product line and add more costly features Improve productivity and engage in vigorous cost reduction Shift sourcing and manufacturing to domestic market Shift sourcing and manufacturing overseas Exploit export opportunities in all markets Give priority to exports to relatively strong-currency countries Conduct conventional cash-forgoods trade Deal in countertrade with weakcurrency countries Use full-costing approach, but use marginal-cost pricing to penetrate new/competitive markets Trim profit margins and use marginalcost pricing SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing, " Business Horizons, May-June 1988, figure 2, p. 58. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Export Strategies Under Varying Currency Conditions 18 -3 When Domestic Currency is WEAK. . . When Domestic Currency is STRONG. . . Stress, price benefits Engage in nonprice competition by improving quality, delivery, and aftersale service Expand product line and add more costly features Improve productivity and engage in vigorous cost reduction Shift sourcing and manufacturing to domestic market Shift sourcing and manufacturing overseas Exploit export opportunities in all markets Give priority to exports to relatively strong-currency countries Conduct conventional cash-forgoods trade Deal in countertrade with weakcurrency countries Use full-costing approach, but use marginal-cost pricing to penetrate new/competitive markets Trim profit margins and use marginalcost pricing SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing, " Business Horizons, May-June 1988, figure 2, p. 58. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Export Strategies Under Varying Currency Conditions 18 -4 When Domestic Currency is WEAK. . . When Domestic Currency is STRONG. . . Speed repatriation of foreign-earned income and collections Keep the foreign-earned income in host country, slow collections Minimize expenditures in local, host country currency Maximize expenditures in local, host country currency Buy needed services (advertising, insurance, transportation, etc. ) in domestic market Buy needed services abroad and pay for them in local currencies Minimize local borrowing Borrow money needed for expansion in local market Bill foreign customers in domestic currency Bill foreign customers in their own currency SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing, " Business Horizons, May-June 1988, figure 2, p. 58. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Export Strategies Under Varying Currency Conditions 18 -4 When Domestic Currency is WEAK. . . When Domestic Currency is STRONG. . . Speed repatriation of foreign-earned income and collections Keep the foreign-earned income in host country, slow collections Minimize expenditures in local, host country currency Maximize expenditures in local, host country currency Buy needed services (advertising, insurance, transportation, etc. ) in domestic market Buy needed services abroad and pay for them in local currencies Minimize local borrowing Borrow money needed for expansion in local market Bill foreign customers in domestic currency Bill foreign customers in their own currency SOURCE: S. Tamur Cavusgil, "Unraveling the Mystique of Export Pricing, " Business Horizons, May-June 1988, figure 2, p. 58. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

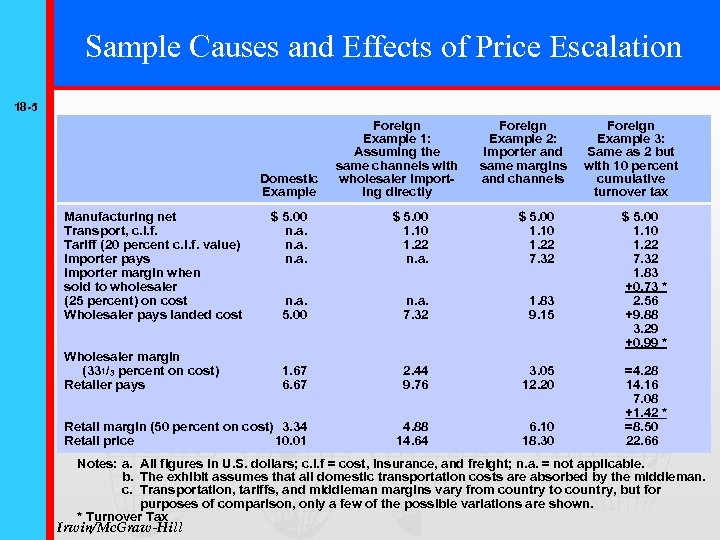

Sample Causes and Effects of Price Escalation 18 -5 Domestic Example Manufacturing net Transport, c. i. f. Tariff (20 percent c. i. f. value) Importer pays Importer margin when sold to wholesaler (25 percent) on cost Wholesaler pays landed cost Foreign Example 1: Assuming the same channels with wholesaler importing directly Foreign Example 2: Importer and same margins and channels $ 5. 00 n. a. $ 5. 00 1. 10 1. 22 7. 32 n. a. 5. 00 n. a. 7. 32 1. 83 9. 15 1. 67 6. 67 2. 44 9. 76 3. 05 12. 20 Retail margin (50 percent on cost) 3. 34 Retail price 10. 01 4. 88 14. 64 6. 10 18. 30 Wholesaler margin (331/3 percent on cost) Retailer pays Foreign Example 3: Same as 2 but with 10 percent cumulative turnover tax $ 5. 00 1. 10 1. 22 7. 32 1. 83 +0. 73 * 2. 56 +9. 88 3. 29 +0. 99 * =4. 28 14. 16 7. 08 +1. 42 * =8. 50 22. 66 Notes: a. All figures in U. S. dollars; c. i. f = cost, insurance, and freight; n. a. = not applicable. b. The exhibit assumes that all domestic transportation costs are absorbed by the middleman. c. Transportation, tariffs, and middleman margins vary from country to country, but for purposes of comparison, only a few of the possible variations are shown. * Turnover Tax Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Sample Causes and Effects of Price Escalation 18 -5 Domestic Example Manufacturing net Transport, c. i. f. Tariff (20 percent c. i. f. value) Importer pays Importer margin when sold to wholesaler (25 percent) on cost Wholesaler pays landed cost Foreign Example 1: Assuming the same channels with wholesaler importing directly Foreign Example 2: Importer and same margins and channels $ 5. 00 n. a. $ 5. 00 1. 10 1. 22 7. 32 n. a. 5. 00 n. a. 7. 32 1. 83 9. 15 1. 67 6. 67 2. 44 9. 76 3. 05 12. 20 Retail margin (50 percent on cost) 3. 34 Retail price 10. 01 4. 88 14. 64 6. 10 18. 30 Wholesaler margin (331/3 percent on cost) Retailer pays Foreign Example 3: Same as 2 but with 10 percent cumulative turnover tax $ 5. 00 1. 10 1. 22 7. 32 1. 83 +0. 73 * 2. 56 +9. 88 3. 29 +0. 99 * =4. 28 14. 16 7. 08 +1. 42 * =8. 50 22. 66 Notes: a. All figures in U. S. dollars; c. i. f = cost, insurance, and freight; n. a. = not applicable. b. The exhibit assumes that all domestic transportation costs are absorbed by the middleman. c. Transportation, tariffs, and middleman margins vary from country to country, but for purposes of comparison, only a few of the possible variations are shown. * Turnover Tax Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

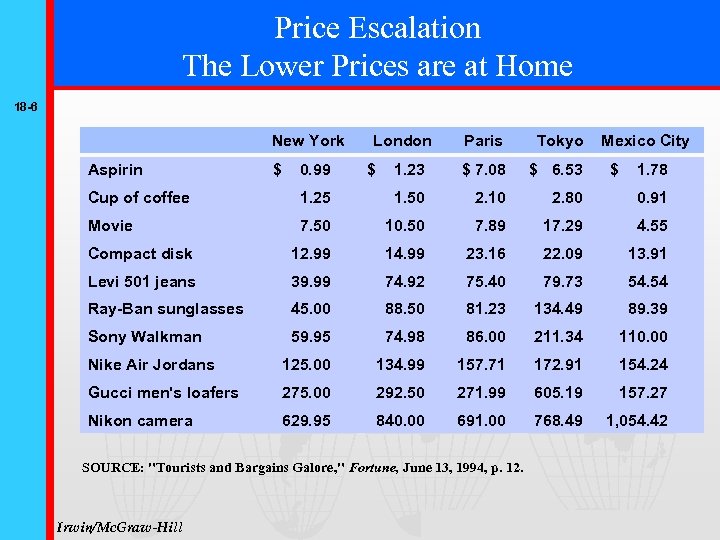

Price Escalation The Lower Prices are at Home 18 -6 New York Aspirin $ 0. 99 London $ Paris Tokyo 1. 23 $ 7. 08 $ 6. 53 Mexico City $ 1. 78 Cup of coffee 1. 25 1. 50 2. 10 2. 80 0. 91 Movie 7. 50 10. 50 7. 89 17. 29 4. 55 Compact disk 12. 99 14. 99 23. 16 22. 09 13. 91 Levi 501 jeans 39. 99 74. 92 75. 40 79. 73 54. 54 Ray-Ban sunglasses 45. 00 88. 50 81. 23 134. 49 89. 39 Sony Walkman 59. 95 74. 98 86. 00 211. 34 110. 00 Nike Air Jordans 125. 00 134. 99 157. 71 172. 91 154. 24 Gucci men's loafers 275. 00 292. 50 271. 99 605. 19 157. 27 Nikon camera 629. 95 840. 00 691. 00 768. 49 1, 054. 42 SOURCE: "Tourists and Bargains Galore, " Fortune, June 13, 1994, p. 12. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Price Escalation The Lower Prices are at Home 18 -6 New York Aspirin $ 0. 99 London $ Paris Tokyo 1. 23 $ 7. 08 $ 6. 53 Mexico City $ 1. 78 Cup of coffee 1. 25 1. 50 2. 10 2. 80 0. 91 Movie 7. 50 10. 50 7. 89 17. 29 4. 55 Compact disk 12. 99 14. 99 23. 16 22. 09 13. 91 Levi 501 jeans 39. 99 74. 92 75. 40 79. 73 54. 54 Ray-Ban sunglasses 45. 00 88. 50 81. 23 134. 49 89. 39 Sony Walkman 59. 95 74. 98 86. 00 211. 34 110. 00 Nike Air Jordans 125. 00 134. 99 157. 71 172. 91 154. 24 Gucci men's loafers 275. 00 292. 50 271. 99 605. 19 157. 27 Nikon camera 629. 95 840. 00 691. 00 768. 49 1, 054. 42 SOURCE: "Tourists and Bargains Galore, " Fortune, June 13, 1994, p. 12. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

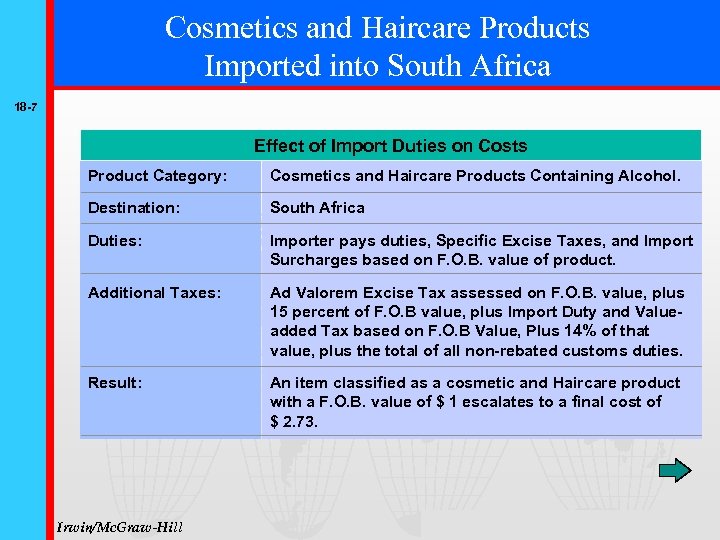

Cosmetics and Haircare Products Imported into South Africa 18 -7 Effect of Import Duties on Costs Product Category: Cosmetics and Haircare Products Containing Alcohol. Destination: South Africa Duties: Importer pays duties, Specific Excise Taxes, and Import Surcharges based on F. O. B. value of product. Additional Taxes: Ad Valorem Excise Tax assessed on F. O. B. value, plus 15 percent of F. O. B value, plus Import Duty and Valueadded Tax based on F. O. B Value, Plus 14% of that value, plus the total of all non-rebated customs duties. Result: An item classified as a cosmetic and Haircare product with a F. O. B. value of $ 1 escalates to a final cost of $ 2. 73. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Cosmetics and Haircare Products Imported into South Africa 18 -7 Effect of Import Duties on Costs Product Category: Cosmetics and Haircare Products Containing Alcohol. Destination: South Africa Duties: Importer pays duties, Specific Excise Taxes, and Import Surcharges based on F. O. B. value of product. Additional Taxes: Ad Valorem Excise Tax assessed on F. O. B. value, plus 15 percent of F. O. B value, plus Import Duty and Valueadded Tax based on F. O. B Value, Plus 14% of that value, plus the total of all non-rebated customs duties. Result: An item classified as a cosmetic and Haircare product with a F. O. B. value of $ 1 escalates to a final cost of $ 2. 73. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

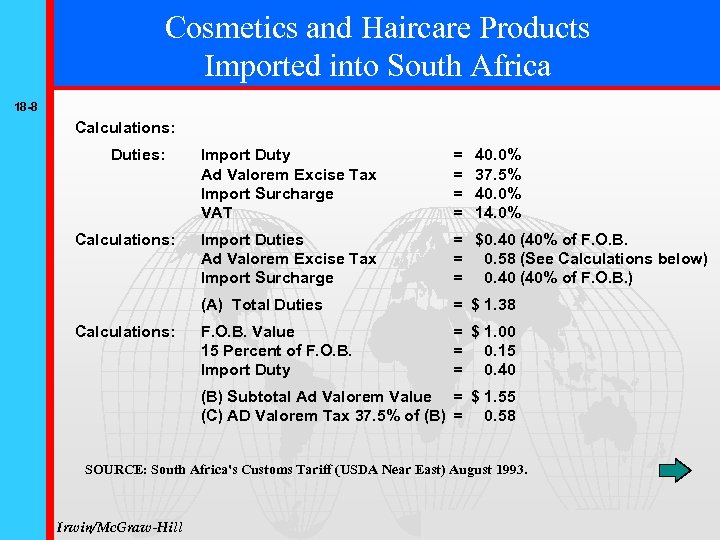

Cosmetics and Haircare Products Imported into South Africa 18 -8 Calculations: Duties: Calculations: = = Import Duties Ad Valorem Excise Tax Import Surcharge = $0. 40 (40% of F. O. B. = 0. 58 (See Calculations below) = 0. 40 (40% of F. O. B. ) (A) Total Duties Calculations: Import Duty Ad Valorem Excise Tax Import Surcharge VAT 40. 0% 37. 5% 40. 0% 14. 0% = $ 1. 38 F. O. B. Value 15 Percent of F. O. B. Import Duty = $ 1. 00 = 0. 15 = 0. 40 (B) Subtotal Ad Valorem Value = $ 1. 55 (C) AD Valorem Tax 37. 5% of (B) = 0. 58 SOURCE: South Africa's Customs Tariff (USDA Near East) August 1993. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Cosmetics and Haircare Products Imported into South Africa 18 -8 Calculations: Duties: Calculations: = = Import Duties Ad Valorem Excise Tax Import Surcharge = $0. 40 (40% of F. O. B. = 0. 58 (See Calculations below) = 0. 40 (40% of F. O. B. ) (A) Total Duties Calculations: Import Duty Ad Valorem Excise Tax Import Surcharge VAT 40. 0% 37. 5% 40. 0% 14. 0% = $ 1. 38 F. O. B. Value 15 Percent of F. O. B. Import Duty = $ 1. 00 = 0. 15 = 0. 40 (B) Subtotal Ad Valorem Value = $ 1. 55 (C) AD Valorem Tax 37. 5% of (B) = 0. 58 SOURCE: South Africa's Customs Tariff (USDA Near East) August 1993. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

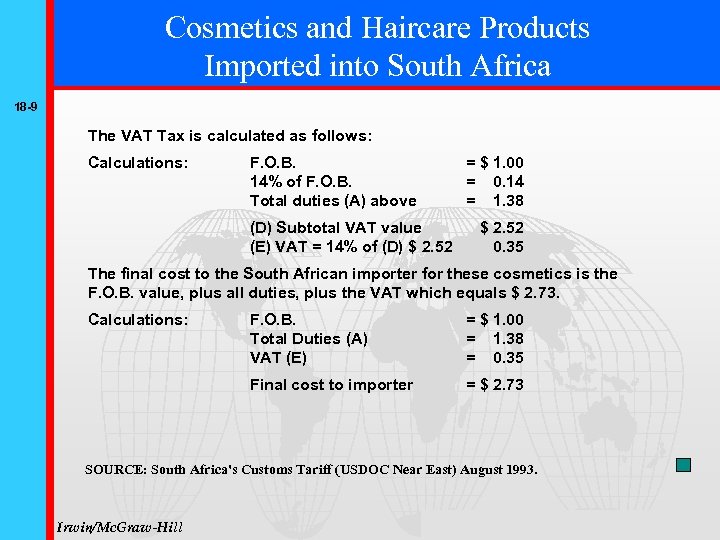

Cosmetics and Haircare Products Imported into South Africa 18 -9 The VAT Tax is calculated as follows: Calculations: F. O. B. 14% of F. O. B. Total duties (A) above (D) Subtotal VAT value (E) VAT = 14% of (D) $ 2. 52 = $ 1. 00 = 0. 14 = 1. 38 $ 2. 52 0. 35 The final cost to the South African importer for these cosmetics is the F. O. B. value, plus all duties, plus the VAT which equals $ 2. 73. Calculations: F. O. B. Total Duties (A) VAT (E) = $ 1. 00 = 1. 38 = 0. 35 Final cost to importer = $ 2. 73 SOURCE: South Africa's Customs Tariff (USDOC Near East) August 1993. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Cosmetics and Haircare Products Imported into South Africa 18 -9 The VAT Tax is calculated as follows: Calculations: F. O. B. 14% of F. O. B. Total duties (A) above (D) Subtotal VAT value (E) VAT = 14% of (D) $ 2. 52 = $ 1. 00 = 0. 14 = 1. 38 $ 2. 52 0. 35 The final cost to the South African importer for these cosmetics is the F. O. B. value, plus all duties, plus the VAT which equals $ 2. 73. Calculations: F. O. B. Total Duties (A) VAT (E) = $ 1. 00 = 1. 38 = 0. 35 Final cost to importer = $ 2. 73 SOURCE: South Africa's Customs Tariff (USDOC Near East) August 1993. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Lessening Price Escalation 18 -10 Lower Cost of Goods ¨ Lower Manufacturing Costs ¨ Eliminate Functional Features ¨ Lower Quality Lower Tariffs ¨ Tariff Reclassification ¨ Product Modification ¨ Partial Assembly ¨ Repack aging Lower Distribution Costs ¨ Shorten Channels of Distribution ¨ Lower Shipping Costs Foreign Trade Zones Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Lessening Price Escalation 18 -10 Lower Cost of Goods ¨ Lower Manufacturing Costs ¨ Eliminate Functional Features ¨ Lower Quality Lower Tariffs ¨ Tariff Reclassification ¨ Product Modification ¨ Partial Assembly ¨ Repack aging Lower Distribution Costs ¨ Shorten Channels of Distribution ¨ Lower Shipping Costs Foreign Trade Zones Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Lessening in International Markets 18 -11 Leasing opens the door to a large segment of nominally financed foreign firms that can be sold on a lease option but might be unable to buy for cash. Leasing can ease the problems of selling new, experimental equipment, since less risk is involved for users. Leasing helps guarantee better maintenance and service on overseas equipment. Equipment leased and in use helps to sell other companies in that country. Lease revenue tends to be more stable over a period of time than direct sales would be. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Lessening in International Markets 18 -11 Leasing opens the door to a large segment of nominally financed foreign firms that can be sold on a lease option but might be unable to buy for cash. Leasing can ease the problems of selling new, experimental equipment, since less risk is involved for users. Leasing helps guarantee better maintenance and service on overseas equipment. Equipment leased and in use helps to sell other companies in that country. Lease revenue tends to be more stable over a period of time than direct sales would be. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Countertrades 18 -12 Barter Compensation Deals Counterpurchase or Offset Trade Product Buy-Back Agreement Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Countertrades 18 -12 Barter Compensation Deals Counterpurchase or Offset Trade Product Buy-Back Agreement Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Why Purchasers Impose Countertrade Obligations 18 -13 To Preserve Hard Currency To Improve Balance of Trade To Gain Access to New Markets To Upgrade Manufacturing Capabilities To Maintain Prices of Export Goods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999

Why Purchasers Impose Countertrade Obligations 18 -13 To Preserve Hard Currency To Improve Balance of Trade To Gain Access to New Markets To Upgrade Manufacturing Capabilities To Maintain Prices of Export Goods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 1999