798dfbd8f22db31108d03b527dfb00f2.ppt

- Количество слайдов: 34

Chapter 17: Public Goods and Common Resources Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia

Objectives After studying this chapter, you will be able to: § Distinguish among private goods, public goods, and common resources § Explain how the free-rider problem arises and how the quantity of public goods is determined § Explain the tragedy of the commons and its possible solutions Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -2

A Free Ride and a Tragedy § Why does government provide some goods and services such as the enforcement of law and national defence? § Is the quantity of government-provided services correct? § Why do common resources where everyone is free to use them result in overuse? § These are some of the questions raised in this chapter. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -3

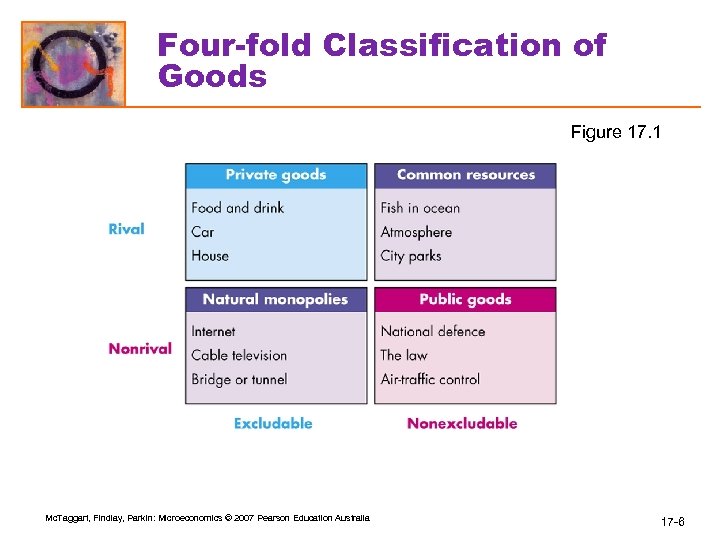

Classifying Goods and Resources § A good or service or a resource is: § Excludable if it is possible to prevent someone from enjoying its benefits. § Nonexcludable if it is impossible (or extremely costly) to prevent someone from benefiting from it § Rival if its use by one person decreases the quantity available for someone else § Nonrival if its use by one person does not decrease the quantity available for someone else Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -4

Classifying Goods and Resources § A Four-Fold Classification § A private good is both rival and excludable § A public good is both nonrival and nonexcludable § A common resource is rival and non-excludable. It can be used only once, but no one can be prevented from using what is available. Example: ocean fish § Marginal cost is zero when buyers can be excluded and are nonrival. Such a good or service is produced by a natural monopoly. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -5

Four-fold Classification of Goods Figure 17. 1 Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -6

Classifying Goods and Resources § Two Problems of Public goods § Public goods create a free-rider problem – the absence of an incentive for people to pay for what they consume § Common resource create the tragedy of the commons – the absence of an incentive to prevent the overuse and depletion of a resource Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -7

Public Goods and the Free-Rider Problem § The Benefit of a Public Good § The value of a private good is the maximum amount that a person would pay for one more unit, which is shown by the person’s demand curve. § The value of a public good is the maximum amount that all the people are willing to pay for one more unit of it. § The total benefit of a public good to an individual is the dollar value that a person places on a given level of provision of the good. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -8

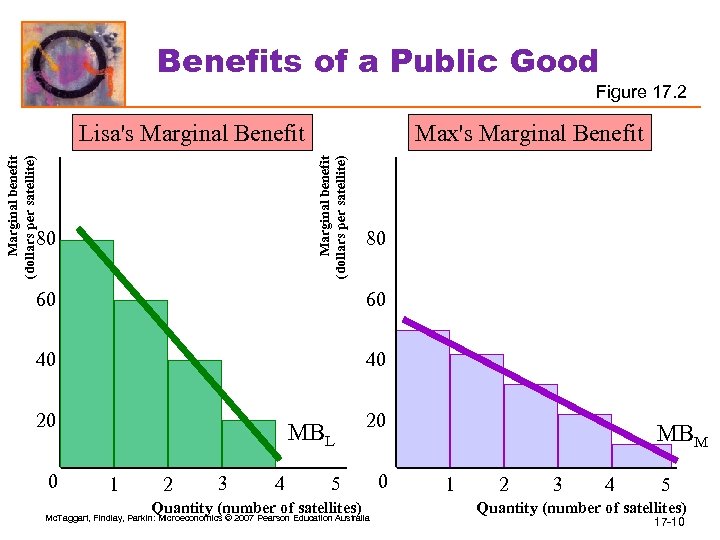

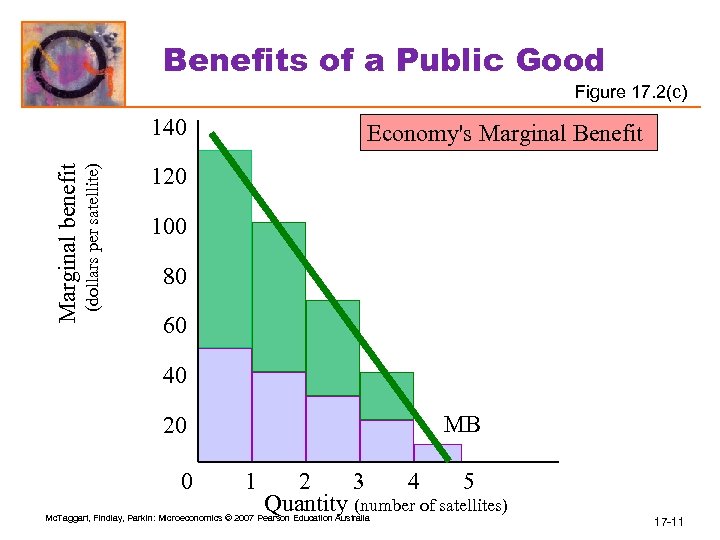

Public Goods and the Free-Rider Problem § The economy’s marginal benefit curve for a public good is the vertical sum of each individual’s marginal benefit curve. § The demand curve for a private good, is the horizontal sum of the individual demand curves at each price. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -9

Benefits of a Public Good Figure 17. 2 Max's Marginal Benefit Marginal benefit (dollars per satellite) Lisa's Marginal Benefit 80 80 60 60 40 40 20 0 MBL 1 2 3 4 20 5 Quantity (number of satellites) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 0 MBM 1 2 3 4 5 Quantity (number of satellites) 17 -10

Benefits of a Public Good Figure 17. 2(c) (dollars per satellite) Marginal benefit 140 Economy's Marginal Benefit 120 100 80 60 40 MB 20 0 1 2 3 4 5 Quantity (number of satellites) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -11

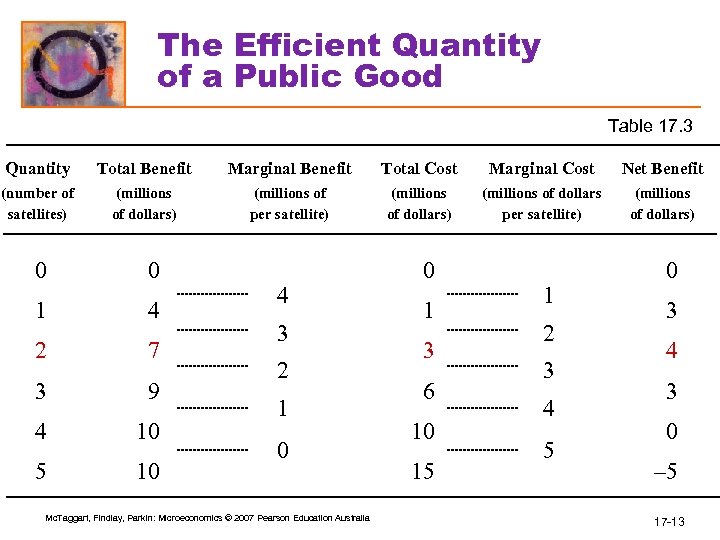

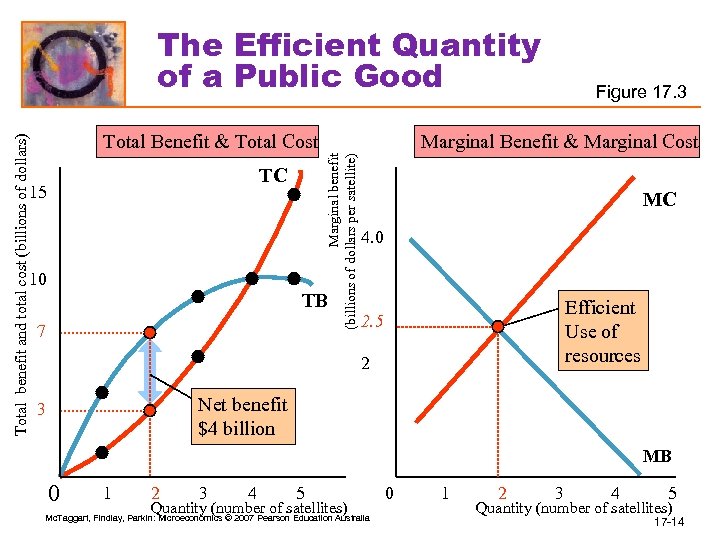

Public Goods and the Free-Rider Problem § The Efficient Quantity of a Public Good § The efficient quantity of a public good is the quantity that maximises net benefit—total benefit minus total cost—which is the same as the quantity at which marginal benefit equals marginal cost. § Figure 17. 3 illustrates the efficient quantity. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -12

The Efficient Quantity of a Public Good Table 17. 3 Quantity Total Benefit Marginal Benefit Total Cost Marginal Cost Net Benefit (number of satellites) (millions of dollars) (millions of per satellite) (millions of dollars) 0 0 1 4 2 7 3 9 4 10 5 10 4 3 2 1 0 Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 0 1 3 6 10 15 1 2 3 4 5 0 3 4 3 0 – 5 17 -13

Total Benefit & Total Cost TC 15 10 TB 7 Figure 17. 3 Marginal Benefit & Marginal Cost Marginal benefit (billions of dollars per satellite) Total benefit and total cost (billions of dollars) The Efficient Quantity of a Public Good MC 4. 0 Efficient Use of resources 2. 5 2 Net benefit $4 billion 3 MB 0 1 2 3 4 5 Quantity (number of satellites) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 0 1 2 3 4 5 Quantity (number of satellites) 17 -14

Public Goods and the Free-Rider Problem § Private Provision by Market § If a private firm tried to produce and sell a public good, almost no one would buy it. § The free-rider problem results in too little of the good being produced. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -15

Public Goods and the Free-Rider Problem § Public Provision § Government can tax all the consumers of the public good and force everyone to pay for its provision. Public provision overcomes the free-rider problem. § If two political parties compete, each is driven to propose the efficient quantity of a public good. § A party that proposes either too much or too little can be beaten by one that proposes the efficient amount, because more people vote for an increase in net benefit. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -16

Public Goods and the Free-Rider Problem § The Principle of Minimum Differentiation § The tendency for competitors to make themselves identical to appeal to the maximum number of clients or voters Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -17

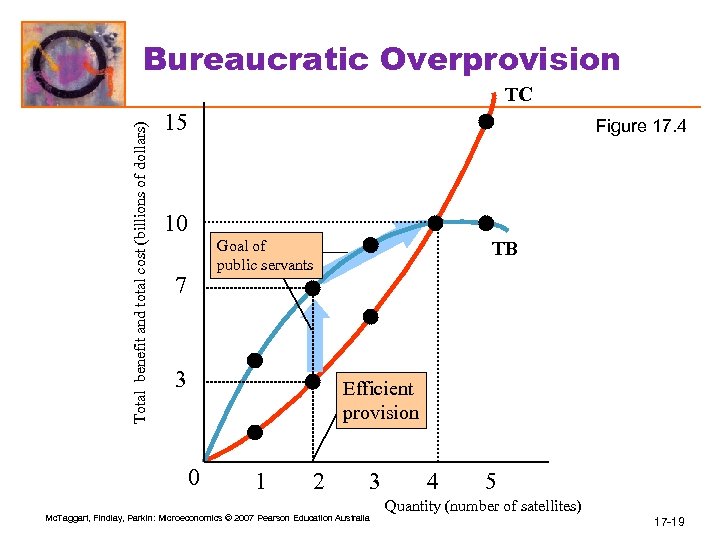

Public Goods and the Free-Rider Problem § The Role of Bureaucrats § Bureaucrats translate the choices of the politicians into programs and control the day-to-day activities that deliver public goods. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -18

Bureaucratic Overprovision Total benefit and total cost (billions of dollars) TC 15 Figure 17. 4 10 Goal of public servants 7 3 TB Efficient provision 0 1 2 3 Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 4 5 Quantity (number of satellites) 17 -19

Public Goods and the Free-Rider Problem § Rational Ignorance § The decision not to acquire information because the cost of doing so exceeds the expected benefit. § Voters usually are ignorant about an issue unless that issue perceptively effects the voter’s income. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -20

Public Goods and the Free-Rider Problem § Two Types of Political Equilibrium § Two types of political equilibrium—efficient and inefficient. These two types of equilibrium corresponds to two theories of government § Social interest theory. § Public choice theory Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -21

Public Goods and the Free-Rider Problem § Why Government is Large and Grows § Government grows because the demand for some public goods is income elastic. § Government might be too large because of inefficient over-provision. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -22

Public Goods and the Free-Rider Problem § Voters Strike Back § If government grows too large relative to the value voters place on public goods, there might be a voter backlash that leads politicians to propose smaller government. § Privatisation is one way of coping with overgrown government, and is based on distinguishing between public provision and public production of public goods. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -23

Common Resources § The Tragedy of the Commons § The tragedy of the commons is the absence of incentive to prevent the overuse and depletion of a commonly owned resource § The original tragedy of the commons has its origin in England from the 14 th century § A Tragedy of the Commons Today § Overfishing—several species of fish have seriously depleted in stock Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -24

Common Resources § Sustainable Production § Sustainable production is the rate that can be maintained indefinitely § Total Catch § The sustainable rate of production § Average Catch § This refers to the catch per boat which equals the total catch divided by the number of boats § Marginal Catch § The change in the total catch that occurs when one more boat joins the existing number Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -25

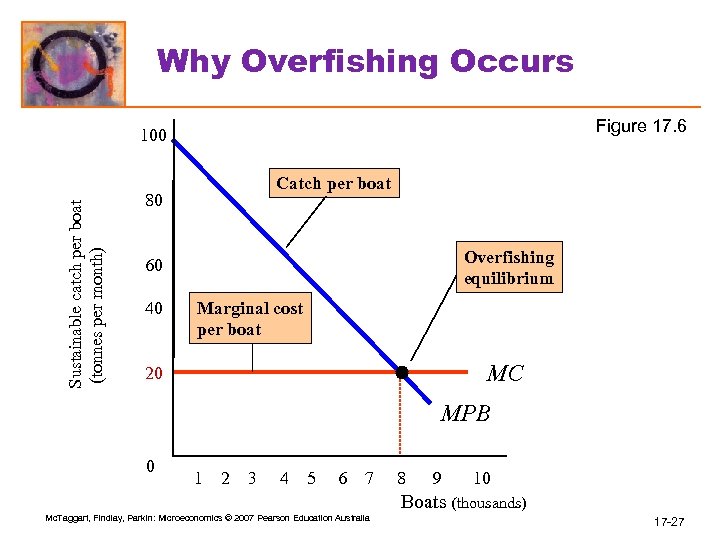

Common Resources § An Overfishing Equilibrium § Overfishing occurs because individuals boat owners consider their marginal benefit and cost, and ignore the social consequences. Figure 17. 6 illustrates. Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -26

Why Overfishing Occurs Figure 17. 6 Sustainable catch per boat (tonnes per month) 100 Catch per boat 80 Overfishing equilibrium 60 40 Marginal cost per boat MC 20 MPB 0 1 2 3 4 5 6 7 8 9 10 Boats (thousands) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -27

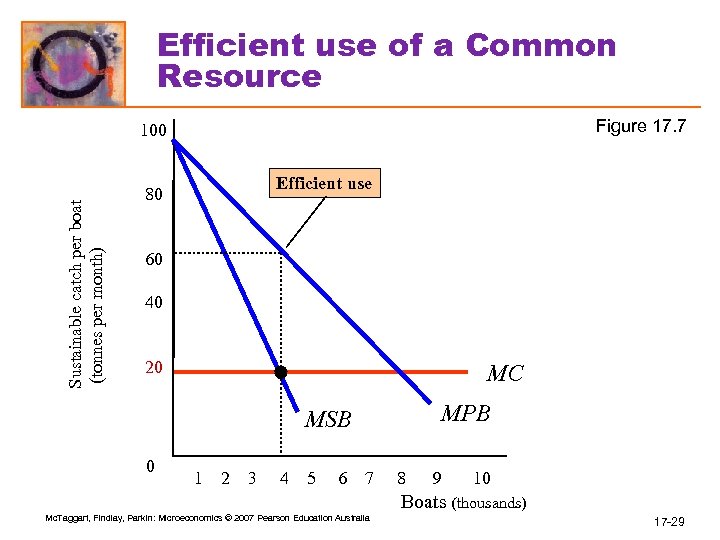

Common Resources § The Efficient Use of the Commons § Its is the use of the resource that maximises its sustainable value § The value of the resource is maximised when the marginal cost of using it equals the marginal social benefit from its use § Marginal Social Benefit § The MSB of a boat is the boat’s marginal catch – the increase in the total catch that results from an additional boat Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -28

Efficient use of a Common Resource Figure 17. 7 Sustainable catch per boat (tonnes per month) 100 Efficient use 80 60 40 20 MC MPB MSB 0 1 2 3 4 5 6 7 8 9 10 Boats (thousands) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -29

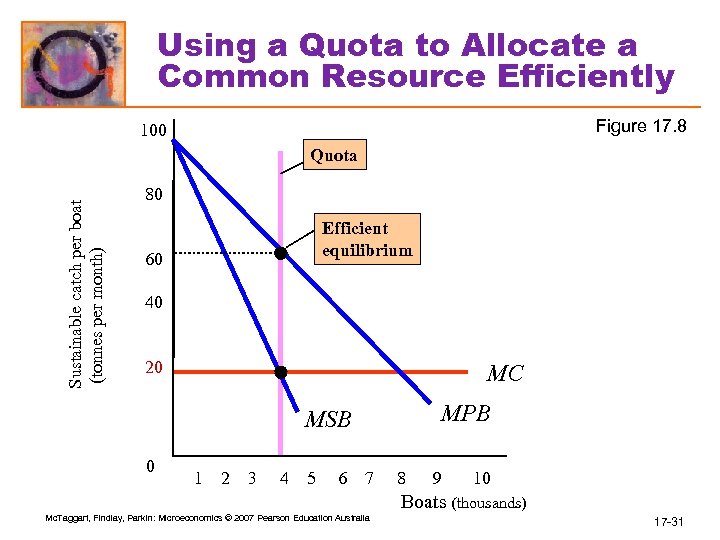

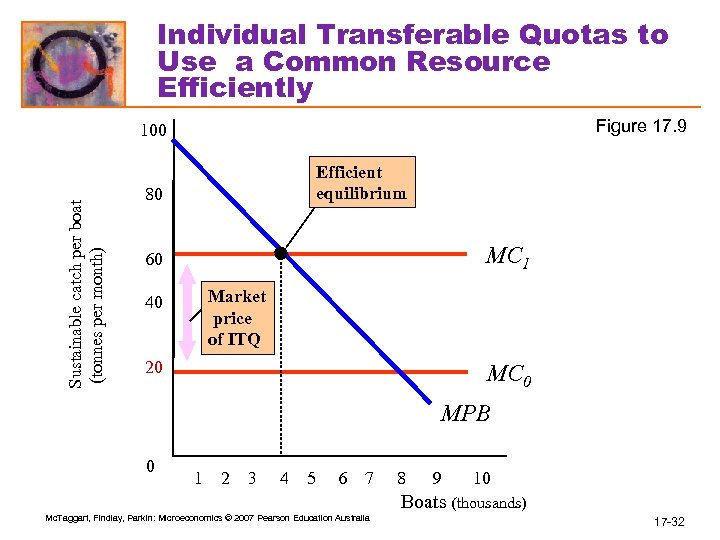

Common Resources § Achieving an Efficient Outcome § Three main methods might be used to achieve the efficient use of a common resource § Property rights § Quotas § Individual transferable quotas § An individual transferable quota (ITQ) is a production limit that is assigned to an individual who is free to transfer the quota to someone else Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -30

Using a Quota to Allocate a Common Resource Efficiently Figure 17. 8 100 Sustainable catch per boat (tonnes per month) Quota 80 Efficient equilibrium 60 40 20 MC MPB MSB 0 1 2 3 4 5 6 7 8 9 10 Boats (thousands) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -31

Individual Transferable Quotas to Use a Common Resource Efficiently Figure 17. 9 Sustainable catch per boat (tonnes per month) 100 Efficient equilibrium 80 MC 1 60 Market price of ITQ 40 20 MC 0 MPB 0 1 2 3 4 5 6 7 8 9 10 Boats (thousands) Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -32

Common Resources § Public Choice and the Political Equilibrium § The method a society chooses for coping with a tragedy of the commons is necessarily a public choice and the outcome of a political process § Efficient Political Outcome § ITQs are examples of efficient political outcome as used by Australia and New Zealand to conserve Southern Bluefin tuna in the South Pacific Ocean § Inefficient Political Outcome § The fishing industries in other countries like the USA and Canada has successfully opposed the introduction of ITQs Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -33

END CHAPTER 17 Mc. Taggart, Findlay, Parkin: Microeconomics © 2007 Pearson Education Australia 17 -34

798dfbd8f22db31108d03b527dfb00f2.ppt