91e1d90e02ce882e833235e24ea5206b.ppt

- Количество слайдов: 95

Chapter 17 Payout Policy

Chapter 17 Payout Policy

Chapter Outline 17. 1 Distributions to Shareholders 17. 2 Comparison of Dividends and Share Repurchases 17. 3 The Tax Disadvantage of Dividends 17. 4 Dividend Capture and Tax Clienteles 17. 5 Payout Versus Retention of Cash Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -2

Chapter Outline 17. 1 Distributions to Shareholders 17. 2 Comparison of Dividends and Share Repurchases 17. 3 The Tax Disadvantage of Dividends 17. 4 Dividend Capture and Tax Clienteles 17. 5 Payout Versus Retention of Cash Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -2

Chapter Outline 17. 6 Signaling with Payout Policy 17. 7 Stock Dividends, Splits and Spin-offs Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -3

Chapter Outline 17. 6 Signaling with Payout Policy 17. 7 Stock Dividends, Splits and Spin-offs Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -3

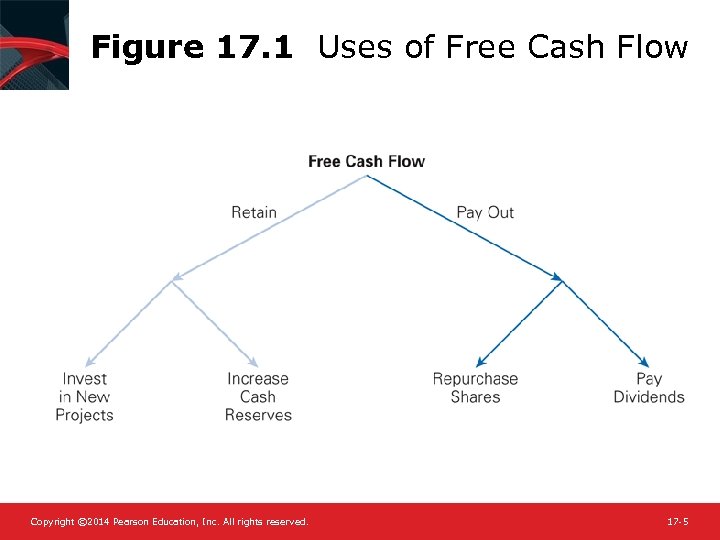

17. 1 Distribution to Shareholders • Payout Policy – The way a firm chooses between the alternative ways to distribute free cash flow to equity holders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -4

17. 1 Distribution to Shareholders • Payout Policy – The way a firm chooses between the alternative ways to distribute free cash flow to equity holders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -4

Figure 17. 1 Uses of Free Cash Flow Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -5

Figure 17. 1 Uses of Free Cash Flow Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -5

Dividends • Declaration Date – The date on which the board of directors authorizes the payment of a dividend • Record Date – When a firm pays a dividend, only shareholders on record on this date receive the dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -6

Dividends • Declaration Date – The date on which the board of directors authorizes the payment of a dividend • Record Date – When a firm pays a dividend, only shareholders on record on this date receive the dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -6

Dividends (cont'd) • Ex-dividend Date – A date, two days prior to a dividend’s record date, on or after which anyone buying the stock will not be eligible for the dividend • Payable Date (Distribution Date) – A date, generally within a month after the record date, on which a firm mails dividend checks to its registered stockholders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -7

Dividends (cont'd) • Ex-dividend Date – A date, two days prior to a dividend’s record date, on or after which anyone buying the stock will not be eligible for the dividend • Payable Date (Distribution Date) – A date, generally within a month after the record date, on which a firm mails dividend checks to its registered stockholders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -7

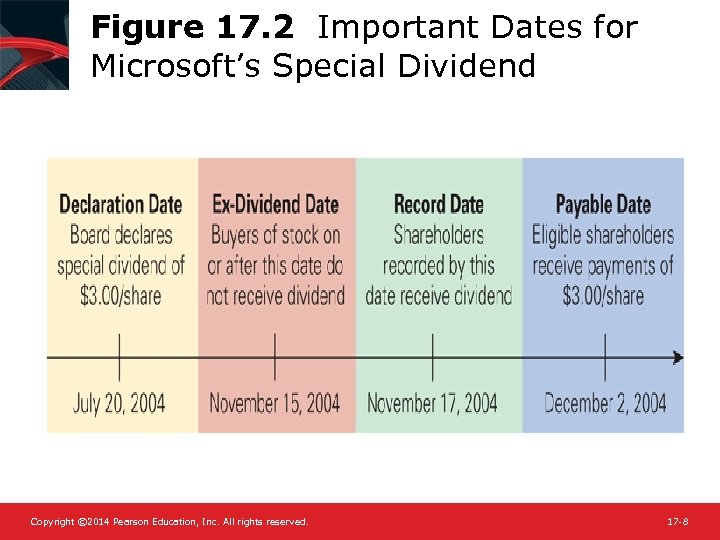

Figure 17. 2 Important Dates for Microsoft’s Special Dividend Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -8

Figure 17. 2 Important Dates for Microsoft’s Special Dividend Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -8

Dividends (cont'd) • Special Dividend – A one-time dividend payment a firm makes, which is usually much larger than a regular dividend • Stock Split (Stock Dividend) – When a company issues a dividend in shares of stock rather than cash to its shareholders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -9

Dividends (cont'd) • Special Dividend – A one-time dividend payment a firm makes, which is usually much larger than a regular dividend • Stock Split (Stock Dividend) – When a company issues a dividend in shares of stock rather than cash to its shareholders Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -9

Dividends (cont'd) • Return of Capital – When a firm, instead of paying dividends out of current earnings (or accumulated retained earnings), pays dividends from other sources, such as paid-in-capital or the liquidation of assets • Liquidating Dividend – A return of capital to shareholders from a business operation that is being terminated Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -10

Dividends (cont'd) • Return of Capital – When a firm, instead of paying dividends out of current earnings (or accumulated retained earnings), pays dividends from other sources, such as paid-in-capital or the liquidation of assets • Liquidating Dividend – A return of capital to shareholders from a business operation that is being terminated Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -10

Share Repurchases • An alternative way to pay cash to investors is through a share repurchase or buyback. – The firm uses cash to buy shares of its own outstanding stock. • In this kind of transaction, the firm uses cash to buy shares of its own outstanding stock. • These shares are generally held in the corporate treasury, and they can be resold if the company needs to raise money in the future. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -11

Share Repurchases • An alternative way to pay cash to investors is through a share repurchase or buyback. – The firm uses cash to buy shares of its own outstanding stock. • In this kind of transaction, the firm uses cash to buy shares of its own outstanding stock. • These shares are generally held in the corporate treasury, and they can be resold if the company needs to raise money in the future. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -11

Share Repurchases (cont'd) • Open Market Repurchase – A firm announces its intention to buy its own shares in the open market, and then proceeds to do so over time like any other investor. – Open market share repurchases represent about 95% of all repurchase transactions. The firm may take a year or more to buy the shares, and it is not obligated to repurchase the full amount it originally stated. Also, the firm must not buy its shares in a way that might appear to manipulate the price. For example, SEC guidelines recommend that the firm not purchase more than 25% of the average daily trading volume in its shares on a single day, nor make purchases at the market open or within 30 minutes of the close of trade Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -12

Share Repurchases (cont'd) • Open Market Repurchase – A firm announces its intention to buy its own shares in the open market, and then proceeds to do so over time like any other investor. – Open market share repurchases represent about 95% of all repurchase transactions. The firm may take a year or more to buy the shares, and it is not obligated to repurchase the full amount it originally stated. Also, the firm must not buy its shares in a way that might appear to manipulate the price. For example, SEC guidelines recommend that the firm not purchase more than 25% of the average daily trading volume in its shares on a single day, nor make purchases at the market open or within 30 minutes of the close of trade Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -12

Share Repurchases (cont'd) • Tender Offer – A public announcement of an offer to all existing security holders to buy back a specified amount of outstanding securities at a prespecified price (typically set at a 10%-20% premium to the current market price) over a prespecified period of time (usually about 20 days) – The offer often depends on shareholders tendering a sufficient number of shares. – If shareholders do not tender enough shares, the firm may cancel the offer and no buyback occurs. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -13

Share Repurchases (cont'd) • Tender Offer – A public announcement of an offer to all existing security holders to buy back a specified amount of outstanding securities at a prespecified price (typically set at a 10%-20% premium to the current market price) over a prespecified period of time (usually about 20 days) – The offer often depends on shareholders tendering a sufficient number of shares. – If shareholders do not tender enough shares, the firm may cancel the offer and no buyback occurs. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -13

Share Repurchases (cont'd) • Dutch Auction – A share repurchase method in which the firm lists different prices at which it is prepared to buy shares, and shareholders in turn indicate how many shares they are willing to sell at each price. – The firm then pays the lowest price at which it can buy back its desired number of shares Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -14

Share Repurchases (cont'd) • Dutch Auction – A share repurchase method in which the firm lists different prices at which it is prepared to buy shares, and shareholders in turn indicate how many shares they are willing to sell at each price. – The firm then pays the lowest price at which it can buy back its desired number of shares Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -14

Share Repurchases (cont'd) • Targeted Repurchase – When a firm purchases shares directly from a specific shareholder – In this case the purchase price is negotiated directly with the seller. – A targeted repurchase may occur if a major shareholder desires to sell a large number of shares but the market for the shares is not sufficiently liquid to sustain it • Greenmail – When a firm avoids a threat of takeover and removal of its management by a major shareholder by buying out the shareholder, often at a large premium over the current market price Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -15

Share Repurchases (cont'd) • Targeted Repurchase – When a firm purchases shares directly from a specific shareholder – In this case the purchase price is negotiated directly with the seller. – A targeted repurchase may occur if a major shareholder desires to sell a large number of shares but the market for the shares is not sufficiently liquid to sustain it • Greenmail – When a firm avoids a threat of takeover and removal of its management by a major shareholder by buying out the shareholder, often at a large premium over the current market price Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -15

17. 2 Comparison of Dividends and Share Repurchases • Consider Genron Corporation. • The firm’s board is meeting to decide how to pay out $20 million in excess cash to shareholders. • Genron has no debt, its equity cost of capital equals its unlevered cost of capital of 12%. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -16

17. 2 Comparison of Dividends and Share Repurchases • Consider Genron Corporation. • The firm’s board is meeting to decide how to pay out $20 million in excess cash to shareholders. • Genron has no debt, its equity cost of capital equals its unlevered cost of capital of 12%. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -16

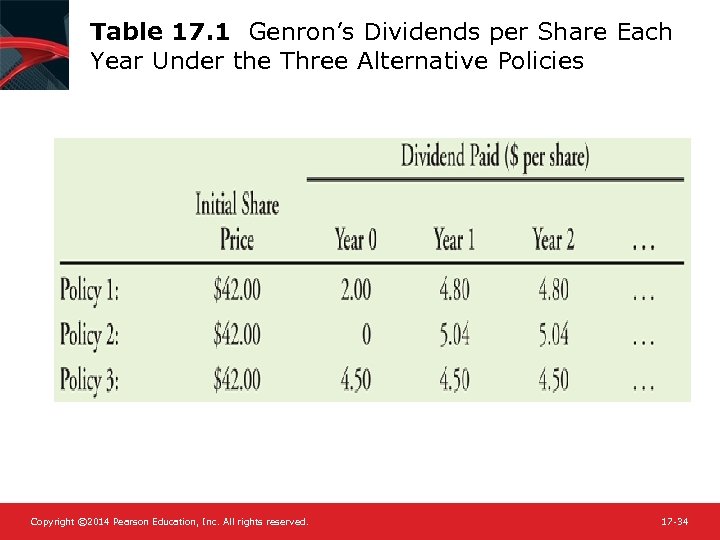

Alternative Policy 1: Pay Dividend with Excess Cash • With 10 million shares outstanding, Genron will be able to pay a $2 dividend immediately. • The firm expects to generate future free cash flows of $48 million per year, thus it anticipates paying a dividend of $4. 80 per share each year thereafter. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -17

Alternative Policy 1: Pay Dividend with Excess Cash • With 10 million shares outstanding, Genron will be able to pay a $2 dividend immediately. • The firm expects to generate future free cash flows of $48 million per year, thus it anticipates paying a dividend of $4. 80 per share each year thereafter. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -17

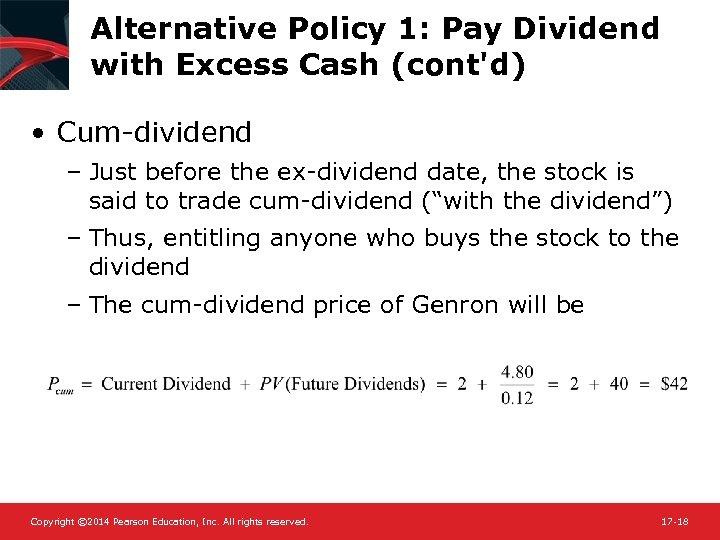

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • Cum-dividend – Just before the ex-dividend date, the stock is said to trade cum-dividend (“with the dividend”) – Thus, entitling anyone who buys the stock to the dividend – The cum-dividend price of Genron will be Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -18

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • Cum-dividend – Just before the ex-dividend date, the stock is said to trade cum-dividend (“with the dividend”) – Thus, entitling anyone who buys the stock to the dividend – The cum-dividend price of Genron will be Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -18

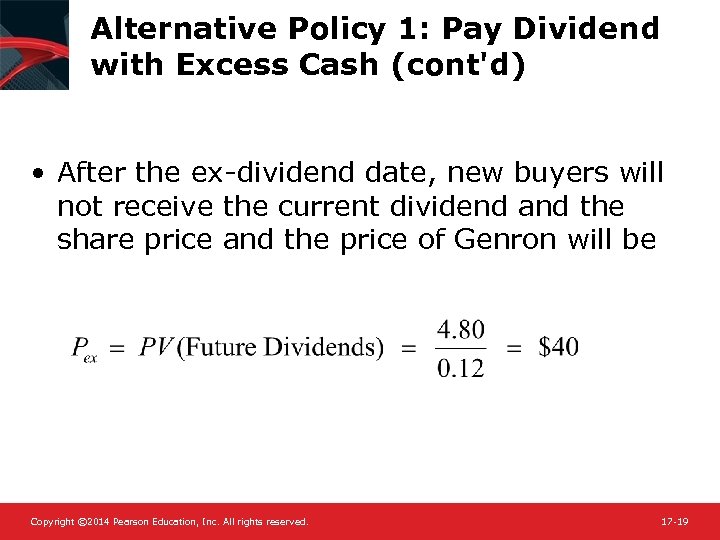

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • After the ex-dividend date, new buyers will not receive the current dividend and the share price and the price of Genron will be Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -19

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • After the ex-dividend date, new buyers will not receive the current dividend and the share price and the price of Genron will be Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -19

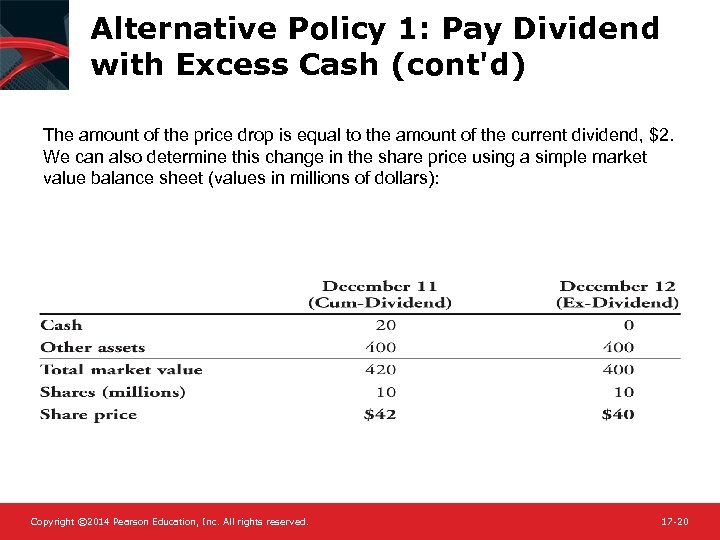

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) The amount of the price drop is equal to the amount of the current dividend, $2. We can also determine this change in the share price using a simple market value balance sheet (values in millions of dollars): Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -20

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) The amount of the price drop is equal to the amount of the current dividend, $2. We can also determine this change in the share price using a simple market value balance sheet (values in millions of dollars): Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -20

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • In a perfect capital market, when a dividend is paid, the share price drops by the amount of the dividend when the stock begins to trade ex-dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -21

Alternative Policy 1: Pay Dividend with Excess Cash (cont'd) • In a perfect capital market, when a dividend is paid, the share price drops by the amount of the dividend when the stock begins to trade ex-dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -21

Alternative Policy 2: Share Repurchase (No Dividend) • Suppose that instead of paying a dividend this year, Genron uses the $20 million to repurchase its shares on the open market. – With an initial share price of $42, Genron will repurchase 476, 000 shares. • $20 million ÷ $42 per share = 0. 476 million shares – This will leave only 9. 524 million shares outstanding. • 10 million − 0. 476 million = 9. 524 million Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -22

Alternative Policy 2: Share Repurchase (No Dividend) • Suppose that instead of paying a dividend this year, Genron uses the $20 million to repurchase its shares on the open market. – With an initial share price of $42, Genron will repurchase 476, 000 shares. • $20 million ÷ $42 per share = 0. 476 million shares – This will leave only 9. 524 million shares outstanding. • 10 million − 0. 476 million = 9. 524 million Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -22

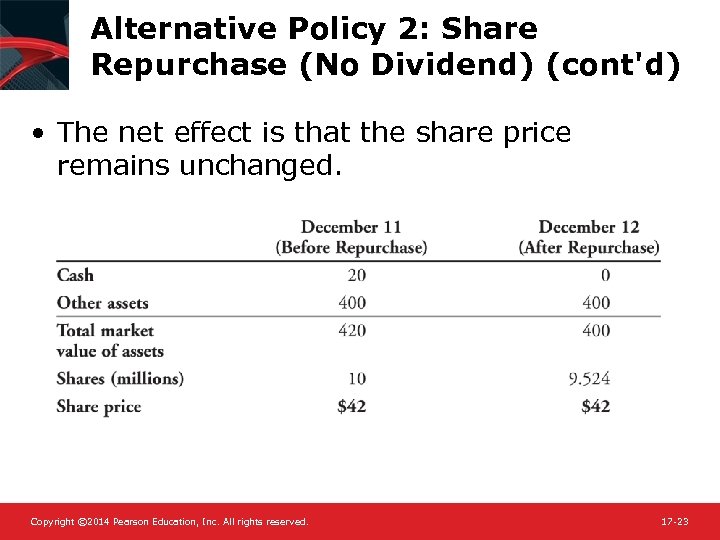

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • The net effect is that the share price remains unchanged. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -23

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • The net effect is that the share price remains unchanged. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -23

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Genron’s Future Dividends – It should not be surprising that the repurchase had not effect on the stock price. – After the repurchase, the future dividend would rise to $5. 04 per share. • $48 million ÷ 9. 524 million shares = $5. 04 per share • Genron’s share price is Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -24

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Genron’s Future Dividends – It should not be surprising that the repurchase had not effect on the stock price. – After the repurchase, the future dividend would rise to $5. 04 per share. • $48 million ÷ 9. 524 million shares = $5. 04 per share • Genron’s share price is Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -24

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Genron’s Future Dividends – In perfect capital markets, an open market share repurchase has no effect on the stock price, and the stock price is the same as the cum-dividend price if a dividend were paid instead. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -25

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Genron’s Future Dividends – In perfect capital markets, an open market share repurchase has no effect on the stock price, and the stock price is the same as the cum-dividend price if a dividend were paid instead. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -25

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Investor Preferences – In perfect capital markets, investors are indifferent between the firm distributing funds via dividends or share repurchases. – By reinvesting dividends or selling shares, they can replicate either payout method on their own. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -26

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Investor Preferences – In perfect capital markets, investors are indifferent between the firm distributing funds via dividends or share repurchases. – By reinvesting dividends or selling shares, they can replicate either payout method on their own. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -26

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Investor Preferences – In the case of Genron, if the firm repurchases shares and the investor wants cash, the investor can raise cash by selling shares. • This is called a homemade dividend. – If the firm pays a dividend and the investor would prefer stock, they can use the dividend to purchase additional shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -27

Alternative Policy 2: Share Repurchase (No Dividend) (cont'd) • Investor Preferences – In the case of Genron, if the firm repurchases shares and the investor wants cash, the investor can raise cash by selling shares. • This is called a homemade dividend. – If the firm pays a dividend and the investor would prefer stock, they can use the dividend to purchase additional shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -27

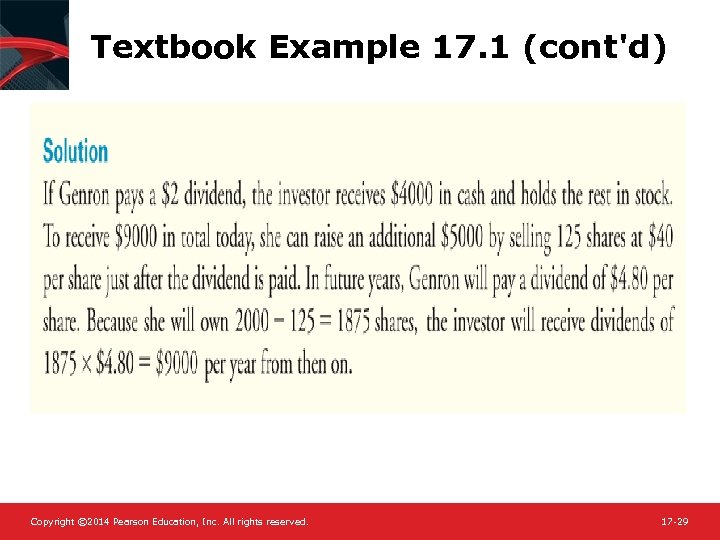

Textbook Example 17. 1 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -28

Textbook Example 17. 1 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -28

Textbook Example 17. 1 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -29

Textbook Example 17. 1 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -29

Alternative Policy 3: High Dividend (Equity Issue) • Suppose Genron wants to pay dividend larger than $2 per share right now, but it only has $20 million in cash today. – Thus, Genron needs an additional $28 million to pay the larger dividend now. – To do this, the firm decides to raise the cash by selling new shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -30

Alternative Policy 3: High Dividend (Equity Issue) • Suppose Genron wants to pay dividend larger than $2 per share right now, but it only has $20 million in cash today. – Thus, Genron needs an additional $28 million to pay the larger dividend now. – To do this, the firm decides to raise the cash by selling new shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -30

Alternative Policy 3: High Dividend (Equity Issue) (cont'd) • Given a current share price of $42, Genron could raise $28 million by selling 0. 67 million shares. – $28 million ÷ $42 per share = 0. 67 million shares • This will increase the total number of shares to 10. 67 million. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -31

Alternative Policy 3: High Dividend (Equity Issue) (cont'd) • Given a current share price of $42, Genron could raise $28 million by selling 0. 67 million shares. – $28 million ÷ $42 per share = 0. 67 million shares • This will increase the total number of shares to 10. 67 million. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -31

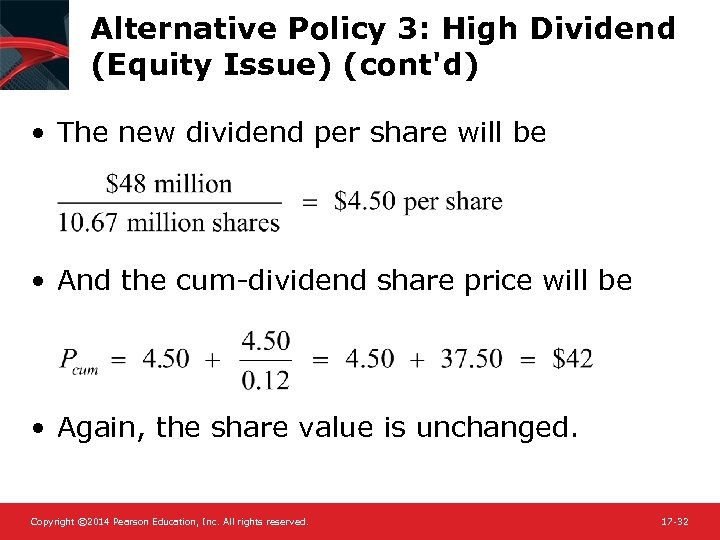

Alternative Policy 3: High Dividend (Equity Issue) (cont'd) • The new dividend per share will be • And the cum-dividend share price will be • Again, the share value is unchanged. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -32

Alternative Policy 3: High Dividend (Equity Issue) (cont'd) • The new dividend per share will be • And the cum-dividend share price will be • Again, the share value is unchanged. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -32

Modigliani–Miller and Dividend Policy Irrelevance • There is a trade-off between current and future dividends. – If Genron pays a higher current dividend, future dividends will be lower. – If Genron pays a lower current dividend, future dividends will be higher. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -33

Modigliani–Miller and Dividend Policy Irrelevance • There is a trade-off between current and future dividends. – If Genron pays a higher current dividend, future dividends will be lower. – If Genron pays a lower current dividend, future dividends will be higher. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -33

Table 17. 1 Genron’s Dividends per Share Each Year Under the Three Alternative Policies Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -34

Table 17. 1 Genron’s Dividends per Share Each Year Under the Three Alternative Policies Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -34

Modigliani–Miller and Dividend Policy Irrelevance (cont'd) • MM Dividend Irrelevance – In perfect capital markets, holding fixed the investment policy of a firm, the firm’s choice of dividend policy is irrelevant and does not affect the initial share price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -35

Modigliani–Miller and Dividend Policy Irrelevance (cont'd) • MM Dividend Irrelevance – In perfect capital markets, holding fixed the investment policy of a firm, the firm’s choice of dividend policy is irrelevant and does not affect the initial share price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -35

Dividend Policy with Perfect Capital Markets • A firm’s free cash flow determines the level of payouts that it can make to its investors. – In a perfect capital market, the type of payout is irrelevant. – In reality, capital markets are not perfect and it is these imperfections that should determine the firm’s payout policy. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -36

Dividend Policy with Perfect Capital Markets • A firm’s free cash flow determines the level of payouts that it can make to its investors. – In a perfect capital market, the type of payout is irrelevant. – In reality, capital markets are not perfect and it is these imperfections that should determine the firm’s payout policy. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -36

17. 3 The Tax Disadvantage of Dividends • Taxes on Dividends and Capital Gains – Shareholders must pay taxes on the dividends they receive and they must also pay capital gains taxes when they sell their shares. – Dividends are typically taxed at a higher rate than capital gains. – In fact, long-term investors can defer the capital gains tax forever by not selling. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -37

17. 3 The Tax Disadvantage of Dividends • Taxes on Dividends and Capital Gains – Shareholders must pay taxes on the dividends they receive and they must also pay capital gains taxes when they sell their shares. – Dividends are typically taxed at a higher rate than capital gains. – In fact, long-term investors can defer the capital gains tax forever by not selling. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -37

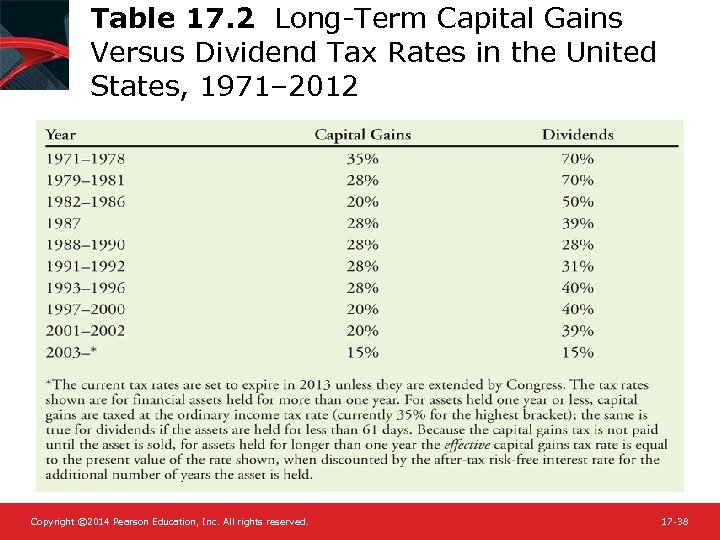

Table 17. 2 Long-Term Capital Gains Versus Dividend Tax Rates in the United States, 1971– 2012 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -38

Table 17. 2 Long-Term Capital Gains Versus Dividend Tax Rates in the United States, 1971– 2012 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -38

17. 3 The Tax Disadvantage of Dividends (cont'd) • Taxes on Dividends and Capital Gains – The higher tax rate on dividends makes it undesirable for a firm to raise funds to pay a dividend. • When dividends are taxed at a higher rate than capital gains, if a firm raises money by issuing shares and then gives that money back to shareholders as a dividend, shareholders are hurt because they will receive less than their initial investment. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -39

17. 3 The Tax Disadvantage of Dividends (cont'd) • Taxes on Dividends and Capital Gains – The higher tax rate on dividends makes it undesirable for a firm to raise funds to pay a dividend. • When dividends are taxed at a higher rate than capital gains, if a firm raises money by issuing shares and then gives that money back to shareholders as a dividend, shareholders are hurt because they will receive less than their initial investment. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -39

Textbook Example 17. 2 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -40

Textbook Example 17. 2 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -40

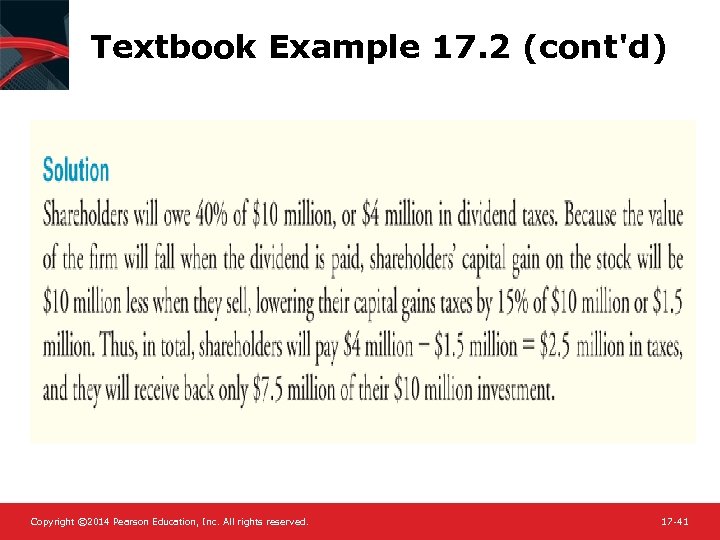

Textbook Example 17. 2 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -41

Textbook Example 17. 2 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -41

Optimal Dividend Policy with Taxes • When the tax rate on dividends is greater than the tax rate on capital gains, shareholders will pay lower taxes if a firm uses share repurchases rather than dividends. – This tax savings will increase the value of a firm that uses share repurchases rather than dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -42

Optimal Dividend Policy with Taxes • When the tax rate on dividends is greater than the tax rate on capital gains, shareholders will pay lower taxes if a firm uses share repurchases rather than dividends. – This tax savings will increase the value of a firm that uses share repurchases rather than dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -42

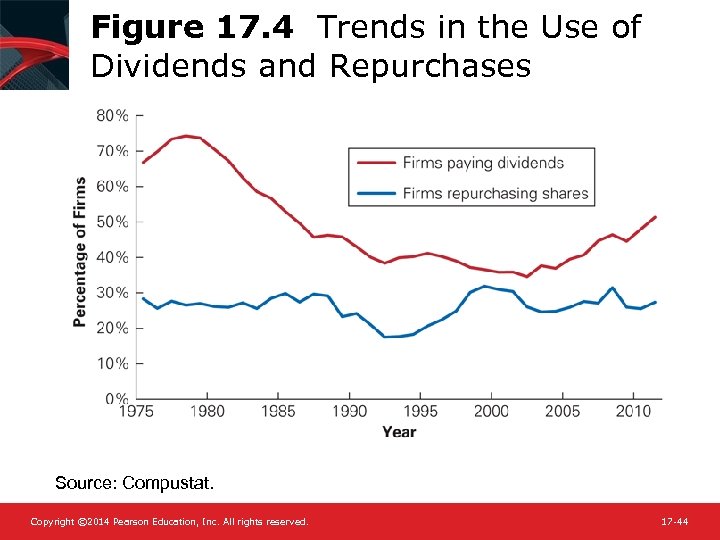

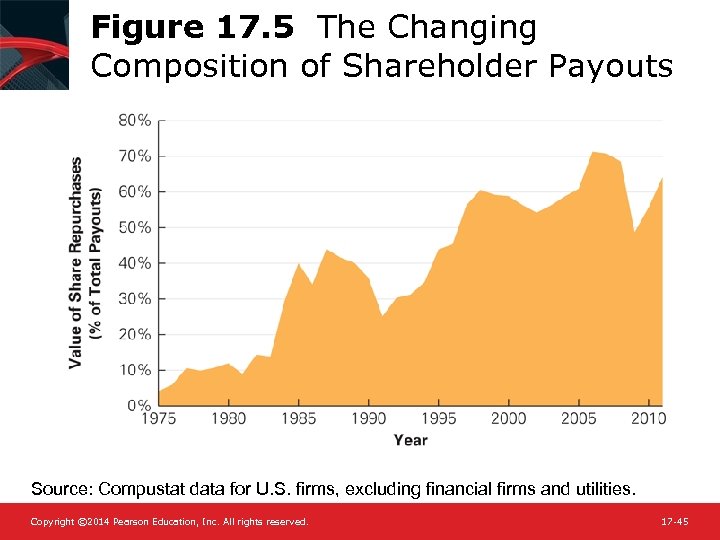

Optimal Dividend Policy with Taxes (cont'd) • The optimal dividend policy when the dividend tax rate exceeds the capital gain tax rate is to pay no dividends at all. – The payment of dividends has declined on average over the last 30 years while the use of repurchases has increased. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -43

Optimal Dividend Policy with Taxes (cont'd) • The optimal dividend policy when the dividend tax rate exceeds the capital gain tax rate is to pay no dividends at all. – The payment of dividends has declined on average over the last 30 years while the use of repurchases has increased. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -43

Figure 17. 4 Trends in the Use of Dividends and Repurchases Source: Compustat. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -44

Figure 17. 4 Trends in the Use of Dividends and Repurchases Source: Compustat. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -44

Figure 17. 5 The Changing Composition of Shareholder Payouts Source: Compustat data for U. S. firms, excluding financial firms and utilities. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -45

Figure 17. 5 The Changing Composition of Shareholder Payouts Source: Compustat data for U. S. firms, excluding financial firms and utilities. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -45

Optimal Dividend Policy with Taxes (cont'd) • Dividend Puzzle – When firms continue to issue dividends despite their tax disadvantage Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -46

Optimal Dividend Policy with Taxes (cont'd) • Dividend Puzzle – When firms continue to issue dividends despite their tax disadvantage Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -46

17. 4 Dividend Capture and Tax Clienteles • The preference for share repurchases rather than dividends depends on the difference between the dividend tax rate and the capital gains tax rate. – Tax rates vary by income, by jurisdiction, and by whether the stock is held in a retirement account. – Given these differences, firms may attract different groups of investors depending on their dividend policy. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -47

17. 4 Dividend Capture and Tax Clienteles • The preference for share repurchases rather than dividends depends on the difference between the dividend tax rate and the capital gains tax rate. – Tax rates vary by income, by jurisdiction, and by whether the stock is held in a retirement account. – Given these differences, firms may attract different groups of investors depending on their dividend policy. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -47

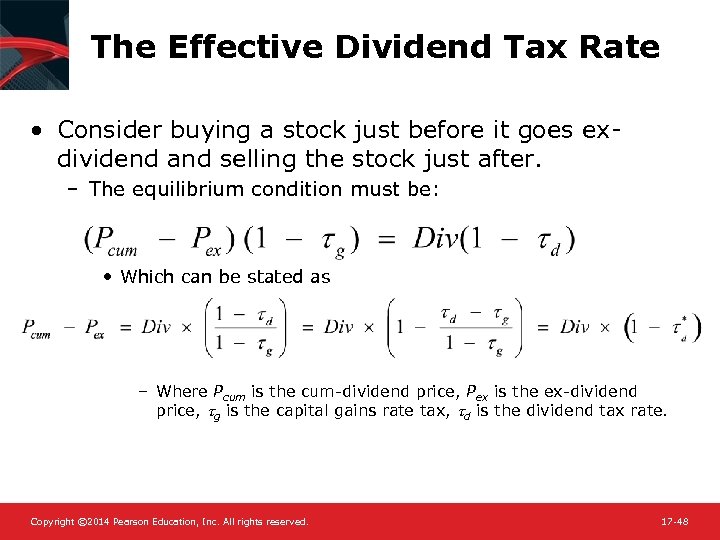

The Effective Dividend Tax Rate • Consider buying a stock just before it goes exdividend and selling the stock just after. – The equilibrium condition must be: • Which can be stated as – Where Pcum is the cum-dividend price, Pex is the ex-dividend price, g is the capital gains rate tax, d is the dividend tax rate. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -48

The Effective Dividend Tax Rate • Consider buying a stock just before it goes exdividend and selling the stock just after. – The equilibrium condition must be: • Which can be stated as – Where Pcum is the cum-dividend price, Pex is the ex-dividend price, g is the capital gains rate tax, d is the dividend tax rate. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -48

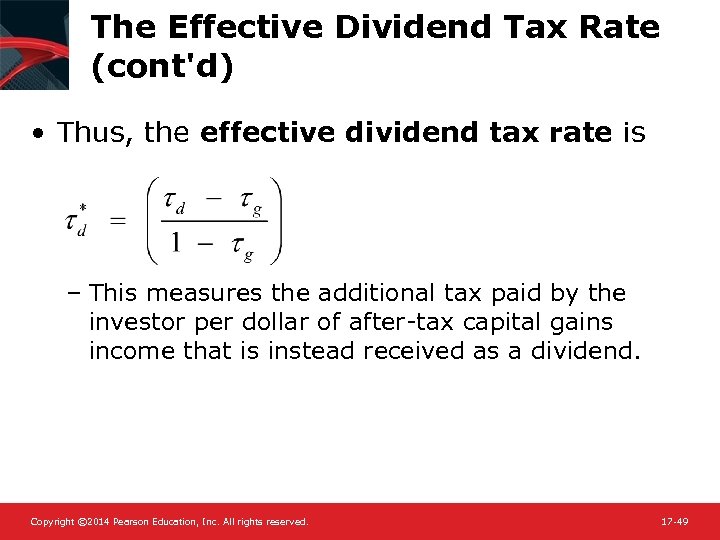

The Effective Dividend Tax Rate (cont'd) • Thus, the effective dividend tax rate is – This measures the additional tax paid by the investor per dollar of after-tax capital gains income that is instead received as a dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -49

The Effective Dividend Tax Rate (cont'd) • Thus, the effective dividend tax rate is – This measures the additional tax paid by the investor per dollar of after-tax capital gains income that is instead received as a dividend. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -49

Textbook Example 17. 3 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -50

Textbook Example 17. 3 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -50

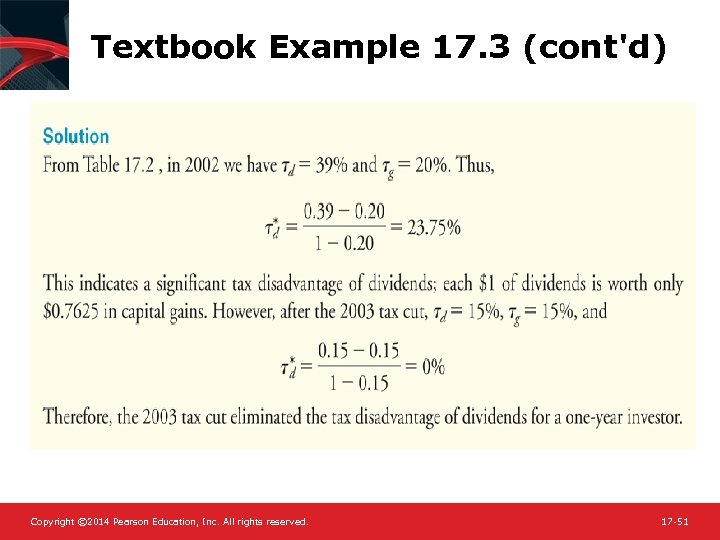

Textbook Example 17. 3 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -51

Textbook Example 17. 3 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -51

Tax Differences Across Investors • The effective dividend tax rate differs across investors for a variety of reasons. – Income Level – Investment Horizon – Tax Jurisdiction – Type of Investor or Investment Account • As a result of their different tax rates investors will have varying preferences regarding dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -52

Tax Differences Across Investors • The effective dividend tax rate differs across investors for a variety of reasons. – Income Level – Investment Horizon – Tax Jurisdiction – Type of Investor or Investment Account • As a result of their different tax rates investors will have varying preferences regarding dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -52

Clientele Effects • Clientele Effect – When the dividend policy of a firm reflects the tax preference of its investor clientele • Individuals in the highest tax brackets have a preference for stocks that pay no or low dividends, whereas tax-free investors and corporations have a preference for stocks with high dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -53

Clientele Effects • Clientele Effect – When the dividend policy of a firm reflects the tax preference of its investor clientele • Individuals in the highest tax brackets have a preference for stocks that pay no or low dividends, whereas tax-free investors and corporations have a preference for stocks with high dividends. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -53

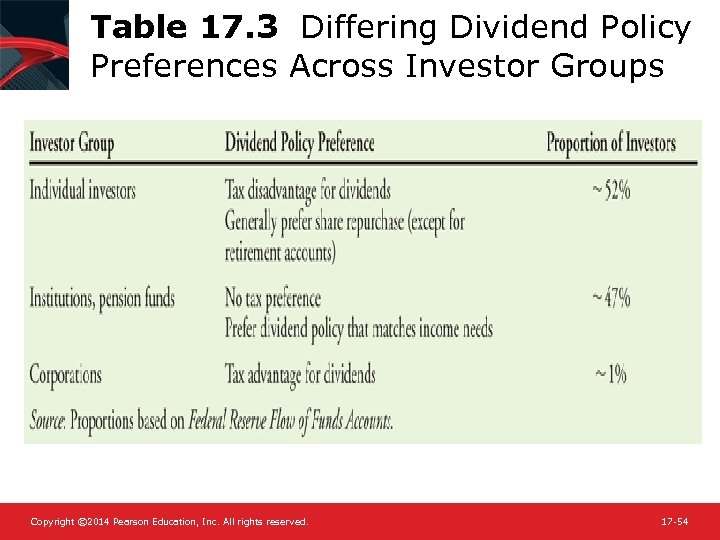

Table 17. 3 Differing Dividend Policy Preferences Across Investor Groups Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -54

Table 17. 3 Differing Dividend Policy Preferences Across Investor Groups Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -54

Clientele Effects (cont'd) • Dividend-Capture Theory – The theory that absent transaction costs, investors can trade shares at the time of the dividend so that non-taxed investors receive the dividend • An implication of this theory is that we should see large trading volume in a stock around the ex-dividend day, as high-tax investors sell and low-tax investors buy the stock in anticipation of the dividend, and then reverse those trades just after the ex-dividend date. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -55

Clientele Effects (cont'd) • Dividend-Capture Theory – The theory that absent transaction costs, investors can trade shares at the time of the dividend so that non-taxed investors receive the dividend • An implication of this theory is that we should see large trading volume in a stock around the ex-dividend day, as high-tax investors sell and low-tax investors buy the stock in anticipation of the dividend, and then reverse those trades just after the ex-dividend date. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -55

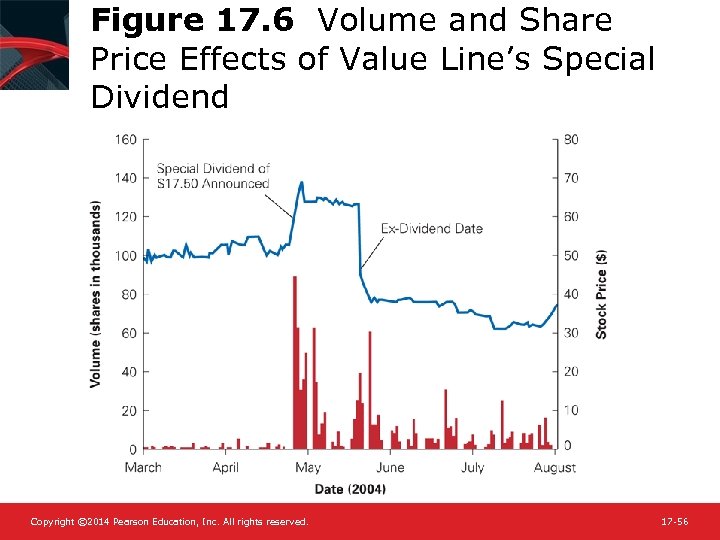

Figure 17. 6 Volume and Share Price Effects of Value Line’s Special Dividend Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -56

Figure 17. 6 Volume and Share Price Effects of Value Line’s Special Dividend Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -56

17. 5 Payout Versus Retention of Cash • In perfect capital markets, once a firm has taken all positive-NPV investments, it is indifferent between saving excess cash and paying it out. • With market imperfections, there is a tradeoff: Retaining cash can reduce the costs of raising capital in the future, but it can also increase taxes and agency costs. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -57

17. 5 Payout Versus Retention of Cash • In perfect capital markets, once a firm has taken all positive-NPV investments, it is indifferent between saving excess cash and paying it out. • With market imperfections, there is a tradeoff: Retaining cash can reduce the costs of raising capital in the future, but it can also increase taxes and agency costs. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -57

Retaining Cash with Perfect Capital Markets • If a firm has already taken all positive-NPV projects, any additional projects it takes on are zero or negative-NPV investments. – Rather than waste excess cash on negative-NPV projects, a firm can use the cash to purchase financial assets. – In perfect capital markets, buying and selling securities is a zero-NPV transaction, so it should not affect firm value. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -58

Retaining Cash with Perfect Capital Markets • If a firm has already taken all positive-NPV projects, any additional projects it takes on are zero or negative-NPV investments. – Rather than waste excess cash on negative-NPV projects, a firm can use the cash to purchase financial assets. – In perfect capital markets, buying and selling securities is a zero-NPV transaction, so it should not affect firm value. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -58

Retaining Cash with Perfect Capital Markets (cont'd) • Thus, with perfect capital markets, the retention versus payout decision is irrelevant. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -59

Retaining Cash with Perfect Capital Markets (cont'd) • Thus, with perfect capital markets, the retention versus payout decision is irrelevant. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -59

Textbook Example 17. 4 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -60

Textbook Example 17. 4 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -60

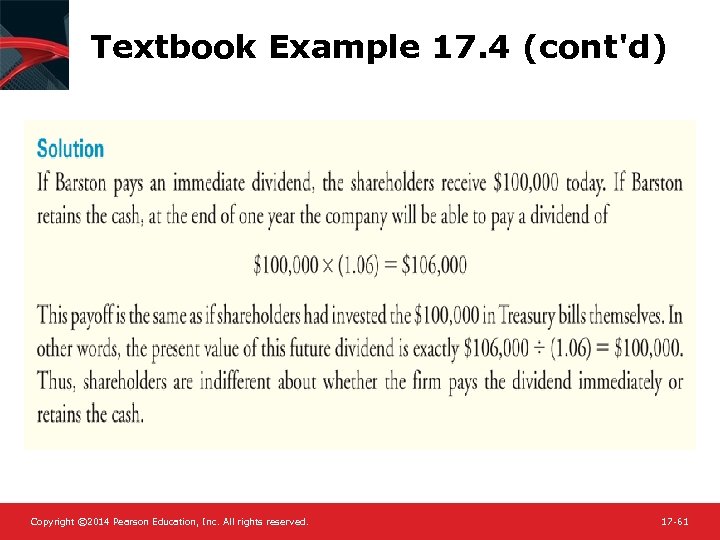

Textbook Example 17. 4 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -61

Textbook Example 17. 4 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -61

Retaining Cash with Perfect Capital Markets (cont'd) • MM Payout Irrelevance – In perfect capital markets, if a firm invests excess cash flows in financial securities, the firm’s choice of payout versus retention is irrelevant and does not affect the initial share price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -62

Retaining Cash with Perfect Capital Markets (cont'd) • MM Payout Irrelevance – In perfect capital markets, if a firm invests excess cash flows in financial securities, the firm’s choice of payout versus retention is irrelevant and does not affect the initial share price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -62

Taxes and Cash Retention • Corporate taxes make it costly for a firm to retain excess cash. – Cash is equivalent to negative leverage, so the tax advantage of leverage implies a tax disadvantage to holding cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -63

Taxes and Cash Retention • Corporate taxes make it costly for a firm to retain excess cash. – Cash is equivalent to negative leverage, so the tax advantage of leverage implies a tax disadvantage to holding cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -63

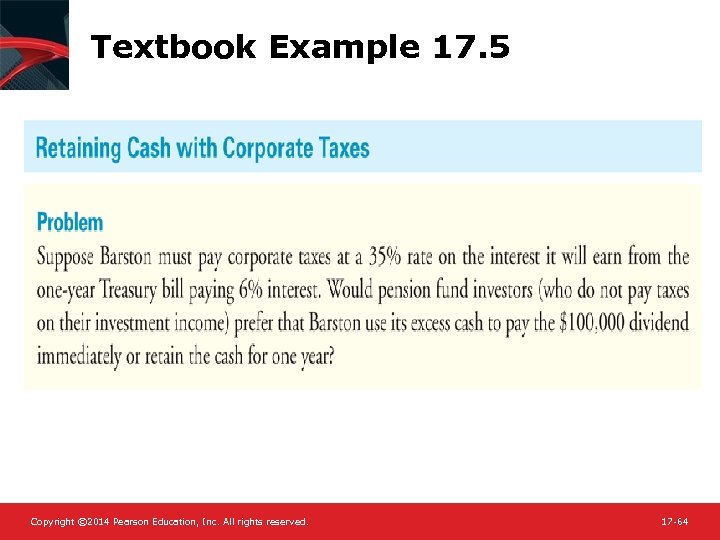

Textbook Example 17. 5 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -64

Textbook Example 17. 5 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -64

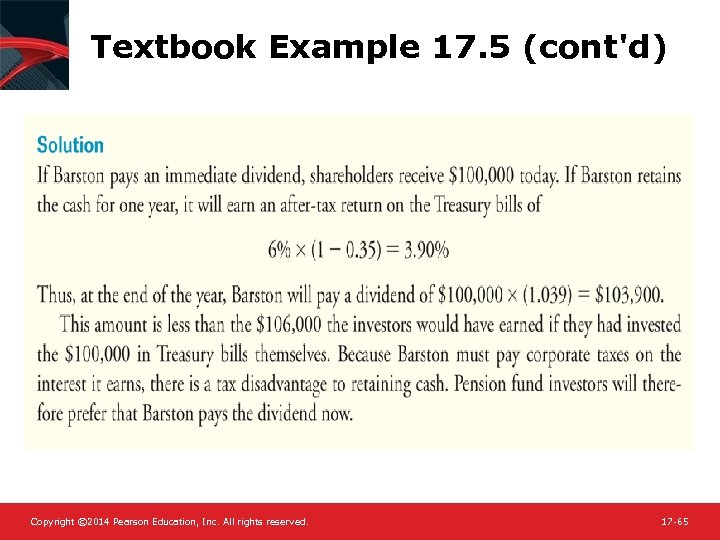

Textbook Example 17. 5 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -65

Textbook Example 17. 5 (cont'd) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -65

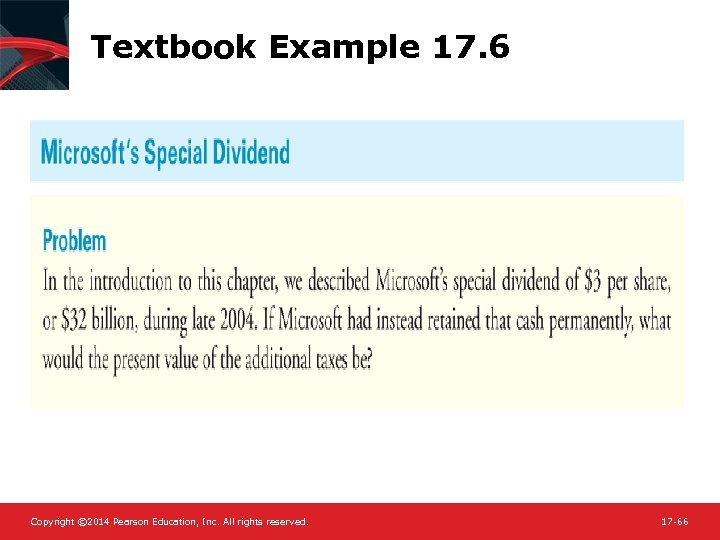

Textbook Example 17. 6 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -66

Textbook Example 17. 6 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -66

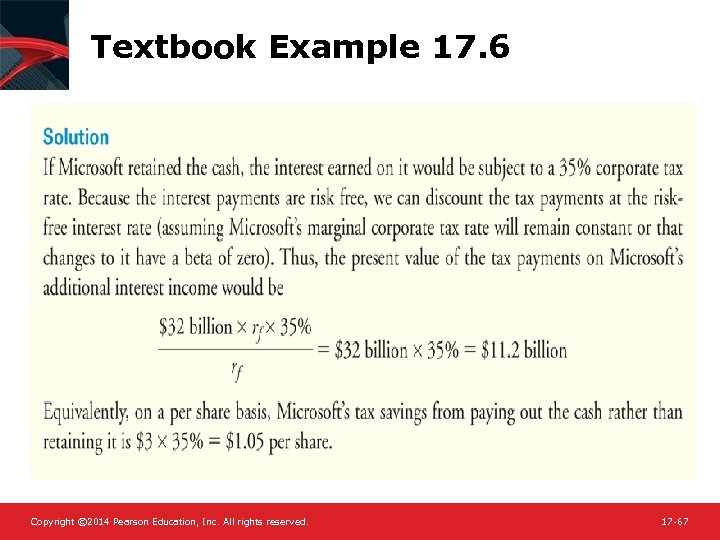

Textbook Example 17. 6 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -67

Textbook Example 17. 6 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -67

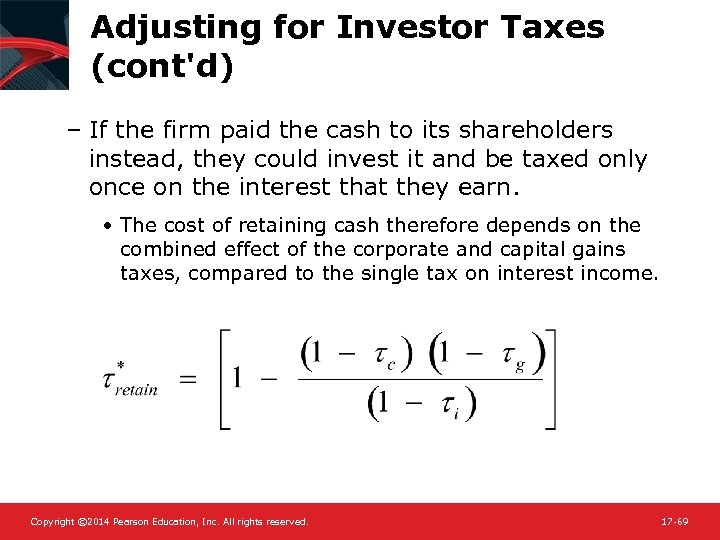

Adjusting for Investor Taxes • The decision to pay out versus retain cash may also affect the taxes paid by shareholders. – When a firm retains cash, it must pay corporate tax on the interest it earns. – In addition, the investor will owe capital gains tax on the increased value of the firm. – In essence, the interest on retained cash is taxed twice. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -68

Adjusting for Investor Taxes • The decision to pay out versus retain cash may also affect the taxes paid by shareholders. – When a firm retains cash, it must pay corporate tax on the interest it earns. – In addition, the investor will owe capital gains tax on the increased value of the firm. – In essence, the interest on retained cash is taxed twice. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -68

Adjusting for Investor Taxes (cont'd) – If the firm paid the cash to its shareholders instead, they could invest it and be taxed only once on the interest that they earn. • The cost of retaining cash therefore depends on the combined effect of the corporate and capital gains taxes, compared to the single tax on interest income. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -69

Adjusting for Investor Taxes (cont'd) – If the firm paid the cash to its shareholders instead, they could invest it and be taxed only once on the interest that they earn. • The cost of retaining cash therefore depends on the combined effect of the corporate and capital gains taxes, compared to the single tax on interest income. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -69

Issuance and Distress Costs • Generally, firms retain cash balances to cover potential future cash shortfalls, despite the tax disadvantage to retaining cash. – A firm might accumulate a large cash balance if there is a reasonable chance that future earnings will be insufficient to fund future positive-NPV investment opportunities. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -70

Issuance and Distress Costs • Generally, firms retain cash balances to cover potential future cash shortfalls, despite the tax disadvantage to retaining cash. – A firm might accumulate a large cash balance if there is a reasonable chance that future earnings will be insufficient to fund future positive-NPV investment opportunities. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -70

Issuance and Distress Costs (cont'd) • The cost of holding cash to cover future potential cash needs should be compared to the reduction in transaction, agency, and adverse selection costs of raising new capital through new debt or equity issues. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -71

Issuance and Distress Costs (cont'd) • The cost of holding cash to cover future potential cash needs should be compared to the reduction in transaction, agency, and adverse selection costs of raising new capital through new debt or equity issues. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -71

Agency Costs of Retaining Cash • When firms have excessive cash, managers may use the funds inefficiently by paying excessive executive perks, over-paying for acquisitions, etc. – Paying out excess cash through dividends or share repurchases, rather than retaining cash, can boost the stock price by reducing managers’ ability and temptation to waste resources. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -72

Agency Costs of Retaining Cash • When firms have excessive cash, managers may use the funds inefficiently by paying excessive executive perks, over-paying for acquisitions, etc. – Paying out excess cash through dividends or share repurchases, rather than retaining cash, can boost the stock price by reducing managers’ ability and temptation to waste resources. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -72

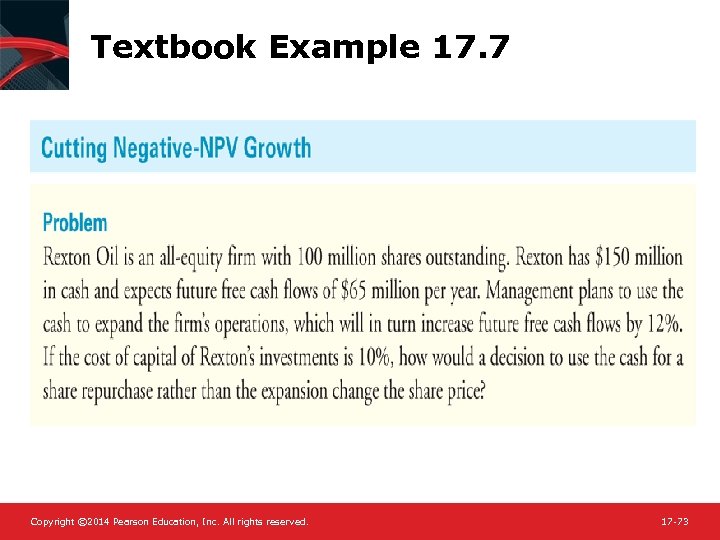

Textbook Example 17. 7 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -73

Textbook Example 17. 7 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -73

Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -74

Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -74

Agency Costs of Retaining Cash (cont'd) • Firms should choose to retain to help with future growth opportunities and to avoid financial distress costs. – It is not surprising that high-tech and biotechnology firms tend to retain and accumulate large amounts of cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -75

Agency Costs of Retaining Cash (cont'd) • Firms should choose to retain to help with future growth opportunities and to avoid financial distress costs. – It is not surprising that high-tech and biotechnology firms tend to retain and accumulate large amounts of cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -75

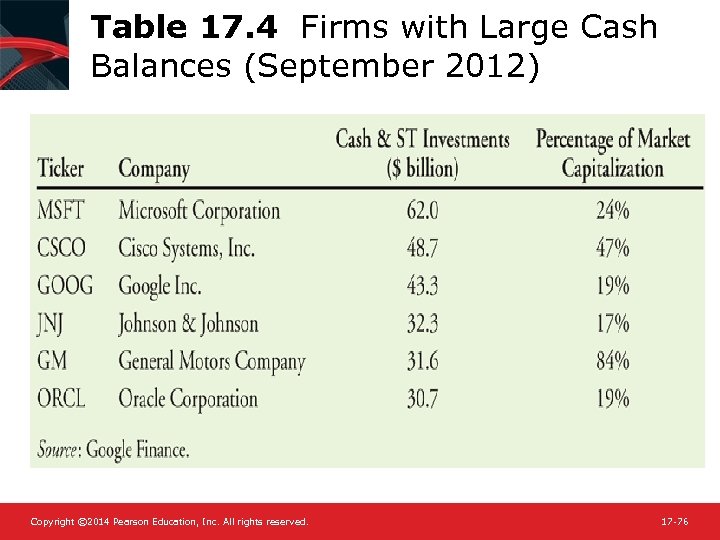

Table 17. 4 Firms with Large Cash Balances (September 2012) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -76

Table 17. 4 Firms with Large Cash Balances (September 2012) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -76

17. 6 Signaling with Payout Policy • Dividend Smoothing – The practice of maintaining relatively constant dividends • Firm change dividends infrequently and dividends are much less volatile than earnings. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -77

17. 6 Signaling with Payout Policy • Dividend Smoothing – The practice of maintaining relatively constant dividends • Firm change dividends infrequently and dividends are much less volatile than earnings. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -77

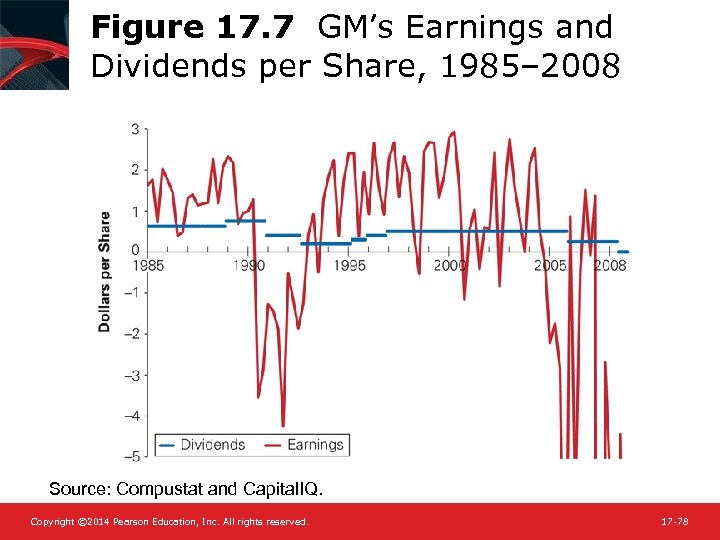

Figure 17. 7 GM’s Earnings and Dividends per Share, 1985– 2008 Source: Compustat and Capital. IQ. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -78

Figure 17. 7 GM’s Earnings and Dividends per Share, 1985– 2008 Source: Compustat and Capital. IQ. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -78

17. 6 Signaling with Payout Policy (cont'd) • Research has found that – Management believes that investors prefer stable dividends with sustained growth. – Management desires to maintain a long-term target level of dividends as a fraction of earnings. • Thus, firms raise their dividends only when they perceive a long-term sustainable increase in the expected level of future earnings, and cut them only as a last resort. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -79

17. 6 Signaling with Payout Policy (cont'd) • Research has found that – Management believes that investors prefer stable dividends with sustained growth. – Management desires to maintain a long-term target level of dividends as a fraction of earnings. • Thus, firms raise their dividends only when they perceive a long-term sustainable increase in the expected level of future earnings, and cut them only as a last resort. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -79

Dividend Signaling • Dividend Signaling Hypothesis – The idea that dividend changes reflect managers’ views about a firm’s future earning prospects • If firms smooth dividends, the firm’s dividend choice will contain information regarding management’s expectations of future earnings. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -80

Dividend Signaling • Dividend Signaling Hypothesis – The idea that dividend changes reflect managers’ views about a firm’s future earning prospects • If firms smooth dividends, the firm’s dividend choice will contain information regarding management’s expectations of future earnings. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -80

Dividend Signaling (cont'd) • When a firm increases its dividend, it sends a positive signal to investors that management expects to be able to afford the higher dividend for the foreseeable future. • When a firm decreases its dividend, it may signal that management has given up hope that earnings will rebound in the near term and so need to reduce the dividend to save cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -81

Dividend Signaling (cont'd) • When a firm increases its dividend, it sends a positive signal to investors that management expects to be able to afford the higher dividend for the foreseeable future. • When a firm decreases its dividend, it may signal that management has given up hope that earnings will rebound in the near term and so need to reduce the dividend to save cash. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -81

Dividend Signaling (cont'd) • While an increase of a firm’s dividend may signal management’s optimism regarding its future cash flows, it might also signal a lack of investment opportunities. • Conversely, a firm might cut its dividend to exploit new positive-NPV investment opportunities. – In this case, the dividend decrease might lead to a positive, rather than negative, stock price reaction. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -82

Dividend Signaling (cont'd) • While an increase of a firm’s dividend may signal management’s optimism regarding its future cash flows, it might also signal a lack of investment opportunities. • Conversely, a firm might cut its dividend to exploit new positive-NPV investment opportunities. – In this case, the dividend decrease might lead to a positive, rather than negative, stock price reaction. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -82

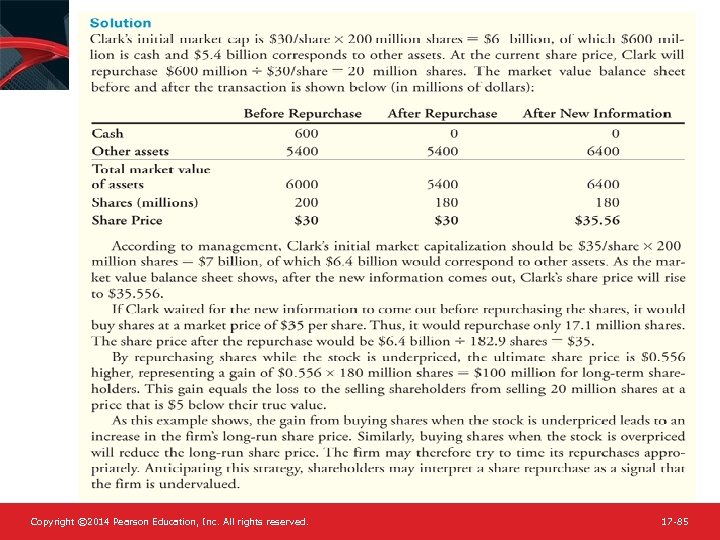

Signaling and Share Repurchases • Share repurchases are a credible signal that the shares are under-priced, because if they are over-priced a share repurchase is costly for current shareholders. – If investors believe that managers have better information regarding the firm’s prospects and act on behalf of current shareholders, then investors will react favorably to share repurchase announcements. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -83

Signaling and Share Repurchases • Share repurchases are a credible signal that the shares are under-priced, because if they are over-priced a share repurchase is costly for current shareholders. – If investors believe that managers have better information regarding the firm’s prospects and act on behalf of current shareholders, then investors will react favorably to share repurchase announcements. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -83

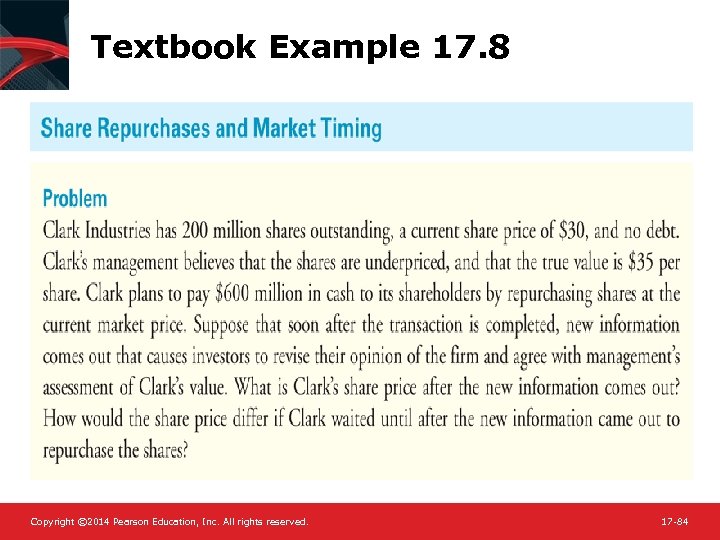

Textbook Example 17. 8 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -84

Textbook Example 17. 8 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -84

Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -85

Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -85

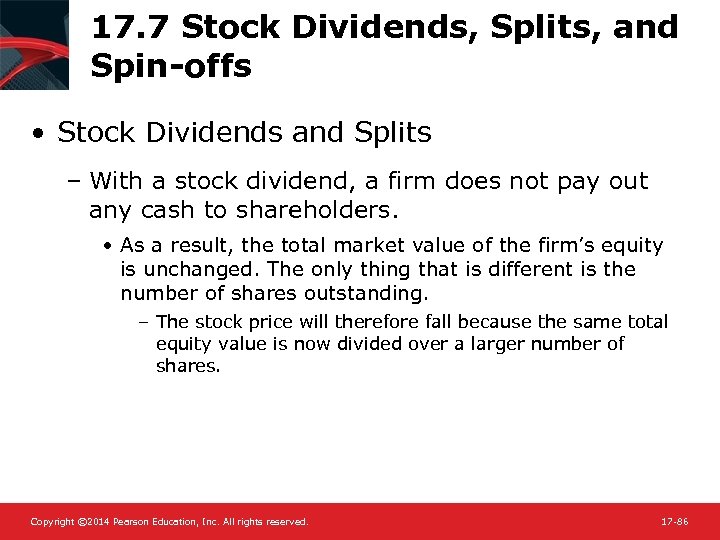

17. 7 Stock Dividends, Splits, and Spin-offs • Stock Dividends and Splits – With a stock dividend, a firm does not pay out any cash to shareholders. • As a result, the total market value of the firm’s equity is unchanged. The only thing that is different is the number of shares outstanding. – The stock price will therefore fall because the same total equity value is now divided over a larger number of shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -86

17. 7 Stock Dividends, Splits, and Spin-offs • Stock Dividends and Splits – With a stock dividend, a firm does not pay out any cash to shareholders. • As a result, the total market value of the firm’s equity is unchanged. The only thing that is different is the number of shares outstanding. – The stock price will therefore fall because the same total equity value is now divided over a larger number of shares. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -86

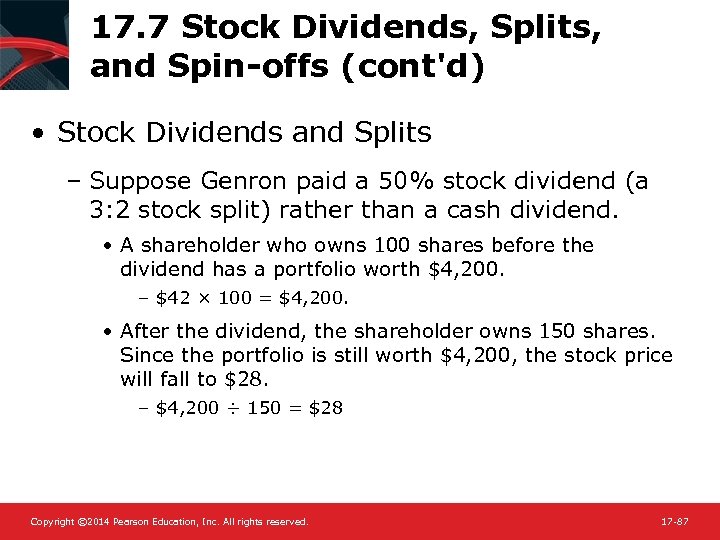

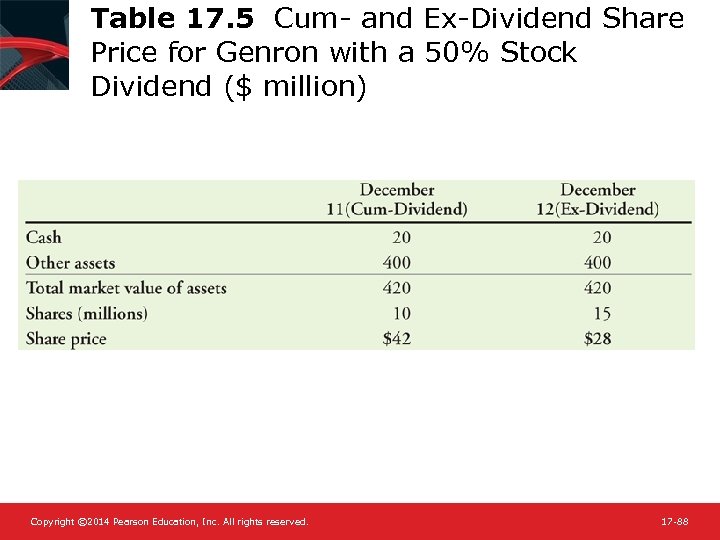

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Suppose Genron paid a 50% stock dividend (a 3: 2 stock split) rather than a cash dividend. • A shareholder who owns 100 shares before the dividend has a portfolio worth $4, 200. – $42 × 100 = $4, 200. • After the dividend, the shareholder owns 150 shares. Since the portfolio is still worth $4, 200, the stock price will fall to $28. – $4, 200 ÷ 150 = $28 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -87

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Suppose Genron paid a 50% stock dividend (a 3: 2 stock split) rather than a cash dividend. • A shareholder who owns 100 shares before the dividend has a portfolio worth $4, 200. – $42 × 100 = $4, 200. • After the dividend, the shareholder owns 150 shares. Since the portfolio is still worth $4, 200, the stock price will fall to $28. – $4, 200 ÷ 150 = $28 Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -87

Table 17. 5 Cum- and Ex-Dividend Share Price for Genron with a 50% Stock Dividend ($ million) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -88

Table 17. 5 Cum- and Ex-Dividend Share Price for Genron with a 50% Stock Dividend ($ million) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -88

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Stock dividends are not taxed, so from both the firm’s and shareholders’ perspectives, there is no real consequence to a stock dividend. • The number of shares is proportionally increased and the price per share is proportionally reduced so that there is no change in value. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -89

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Stock dividends are not taxed, so from both the firm’s and shareholders’ perspectives, there is no real consequence to a stock dividend. • The number of shares is proportionally increased and the price per share is proportionally reduced so that there is no change in value. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -89

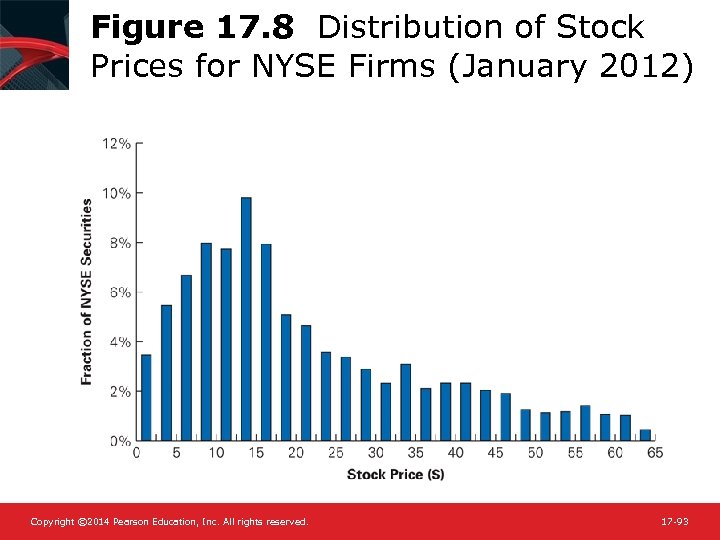

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – The typical motivation for a stock split is to keep the share price in a range thought to be attractive to small investors. – If the share price rises “too high, ” it might be difficult for small investors to invest in the stock. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -90

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – The typical motivation for a stock split is to keep the share price in a range thought to be attractive to small investors. – If the share price rises “too high, ” it might be difficult for small investors to invest in the stock. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -90

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Keeping the price “low” may make the stock more attractive to small investors and can increase the demand for and the liquidity of the stock, which may in turn boost the stock price. • On average, announcements of stock splits are associated with a 2% increase in the stock price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -91

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Keeping the price “low” may make the stock more attractive to small investors and can increase the demand for and the liquidity of the stock, which may in turn boost the stock price. • On average, announcements of stock splits are associated with a 2% increase in the stock price. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -91

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Reverse Split • When the price of a company’s stock falls too low and the company reduces the number of outstanding shares Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -92

17. 7 Stock Dividends, Splits, and Spin-offs (cont'd) • Stock Dividends and Splits – Reverse Split • When the price of a company’s stock falls too low and the company reduces the number of outstanding shares Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -92

Figure 17. 8 Distribution of Stock Prices for NYSE Firms (January 2012) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -93

Figure 17. 8 Distribution of Stock Prices for NYSE Firms (January 2012) Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -93

Spin-offs • Spin-off – When a firm sells a subsidiary by selling shares in the subsidiary alone • Non-cash special dividends are commonly used to spin off assets or a subsidiary as a separate company. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -94

Spin-offs • Spin-off – When a firm sells a subsidiary by selling shares in the subsidiary alone • Non-cash special dividends are commonly used to spin off assets or a subsidiary as a separate company. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -94

Spin-offs (cont'd) • Spin-offs offer two advantages – It avoids the transaction costs associated with a subsidiary sale. – The special dividend is not taxed as a cash distribution. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -95

Spin-offs (cont'd) • Spin-offs offer two advantages – It avoids the transaction costs associated with a subsidiary sale. – The special dividend is not taxed as a cash distribution. Copyright © 2014 Pearson Education, Inc. All rights reserved. 17 -95