db6be01245585b02f58325347696a19c.ppt

- Количество слайдов: 36

Chapter 17 Monopoly Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Chapter 17 Monopoly Mc. Graw-Hill/Irwin Copyright © 2008 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Main Topics ¢Market power ¢Monopoly pricing ¢Welfare effects of monopoly pricing ¢Distinguishing monopoly from perfect competition ¢Nonprice effects of monopoly ¢Monopsony ¢Regulation of monopolies 17 -2

Main Topics ¢Market power ¢Monopoly pricing ¢Welfare effects of monopoly pricing ¢Distinguishing monopoly from perfect competition ¢Nonprice effects of monopoly ¢Monopsony ¢Regulation of monopolies 17 -2

Market Power ¢ In many situations, competition is not intense ¢ A firm has market power when it can profitably charge a price that is above its marginal cost ¢ Most firms have some market power, though it may be very slight ¢ Depends on whether their competitors’ products are close substitutes ¢ Two market structures in which firms have market power: ¢ A monopoly market has a single seller ¢ An oligopoly market has a few, but not many, producers ¢ Determining what is and is not a monopoly market can be trickier than simple definitions might suggest 17 -3

Market Power ¢ In many situations, competition is not intense ¢ A firm has market power when it can profitably charge a price that is above its marginal cost ¢ Most firms have some market power, though it may be very slight ¢ Depends on whether their competitors’ products are close substitutes ¢ Two market structures in which firms have market power: ¢ A monopoly market has a single seller ¢ An oligopoly market has a few, but not many, producers ¢ Determining what is and is not a monopoly market can be trickier than simple definitions might suggest 17 -3

How Do Firms Become Monopolists? ¢ Firms get to be monopolists in various ways: ¢Government grants a monopoly position to a firm (cable TV companies in local communities, drug patents) ¢Economies of scale (concrete supply in a small town) ¢Being first to produce a new product (i. Pod) ¢Owning all of an essential input (De Beers diamond producer) ¢ Many of these ways of initially capturing market power tend to erode over time 17 -4

How Do Firms Become Monopolists? ¢ Firms get to be monopolists in various ways: ¢Government grants a monopoly position to a firm (cable TV companies in local communities, drug patents) ¢Economies of scale (concrete supply in a small town) ¢Being first to produce a new product (i. Pod) ¢Owning all of an essential input (De Beers diamond producer) ¢ Many of these ways of initially capturing market power tend to erode over time 17 -4

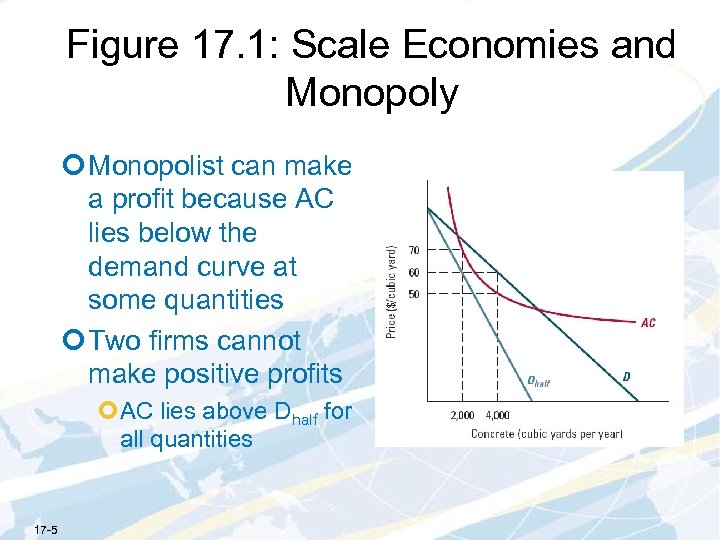

Figure 17. 1: Scale Economies and Monopoly ¢ Monopolist can make a profit because AC lies below the demand curve at some quantities ¢ Two firms cannot make positive profits ¢AC lies above Dhalf for all quantities 17 -5

Figure 17. 1: Scale Economies and Monopoly ¢ Monopolist can make a profit because AC lies below the demand curve at some quantities ¢ Two firms cannot make positive profits ¢AC lies above Dhalf for all quantities 17 -5

Monopoly Pricing ¢ Monopolist will choose the price that maximizes its profit, given the demand for its product ¢ Whenever the firm’s profit-maximizing sales quantity is positive, marginal revenue equals marginal cost at that sales quantity ¢ Marginal cost curve applies as usual ¢ Need to examine the shape of the marginal revenue curve ¢ Recall that a firm’s marginal revenue curve captures the additional revenue it gets from the marginal units it sells, measured on a per-unit basis 17 -6

Monopoly Pricing ¢ Monopolist will choose the price that maximizes its profit, given the demand for its product ¢ Whenever the firm’s profit-maximizing sales quantity is positive, marginal revenue equals marginal cost at that sales quantity ¢ Marginal cost curve applies as usual ¢ Need to examine the shape of the marginal revenue curve ¢ Recall that a firm’s marginal revenue curve captures the additional revenue it gets from the marginal units it sells, measured on a per-unit basis 17 -6

Marginal Revenue for a Monopolist ¢ An increase in sales quantity (DQ) changes revenue in two ways ¢ Firm sells DQ additional units of output, each at a price of P(Q), the output expansion effect ¢ Firm also has to lower price as dictated by the demand curve; reduces revenue earned from the original (Q-DQ) units of output, the price reduction effect ¢ The overall effect on marginal revenue is: ¢ So the price reduction effect makes the monopolist’s marginal revenue less than price 17 -7

Marginal Revenue for a Monopolist ¢ An increase in sales quantity (DQ) changes revenue in two ways ¢ Firm sells DQ additional units of output, each at a price of P(Q), the output expansion effect ¢ Firm also has to lower price as dictated by the demand curve; reduces revenue earned from the original (Q-DQ) units of output, the price reduction effect ¢ The overall effect on marginal revenue is: ¢ So the price reduction effect makes the monopolist’s marginal revenue less than price 17 -7

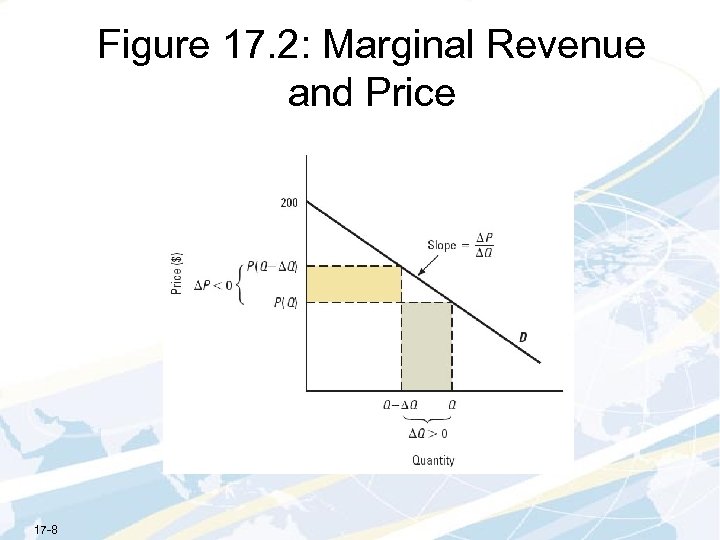

Figure 17. 2: Marginal Revenue and Price 17 -8

Figure 17. 2: Marginal Revenue and Price 17 -8

Sample Problem 1 (17. 2): Suppose that Noah and Naomi have a monopoly in the garden bench market. Their weekly demand is D(P) = 500 – 4 P. What is their marginal revenue when they sell 100 garden benches a week? Graph their inverse demand marginal revenue curves.

Sample Problem 1 (17. 2): Suppose that Noah and Naomi have a monopoly in the garden bench market. Their weekly demand is D(P) = 500 – 4 P. What is their marginal revenue when they sell 100 garden benches a week? Graph their inverse demand marginal revenue curves.

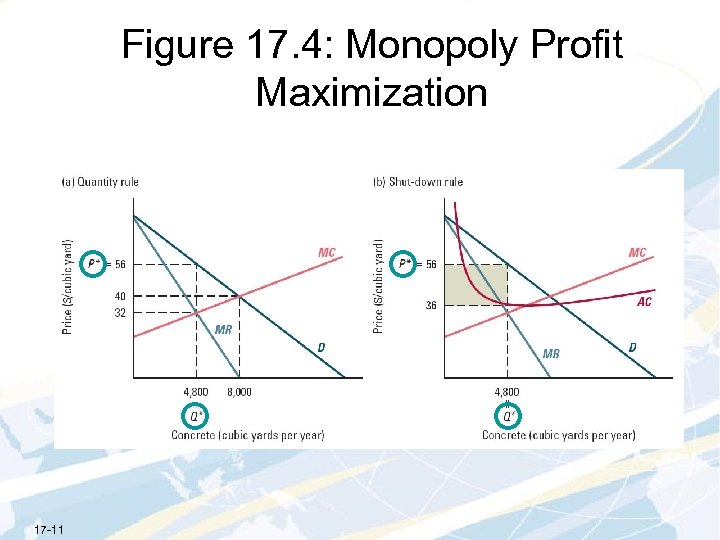

Monopoly Profit Maximization ¢ When a monopolist maximizes its profit by selling a positive amount, its marginal revenue must equal its marginal cost at that quantity ¢ If marginal revenue exceeded marginal cost the firm would be better off selling more ¢ If marginal revenue were less than marginal cost the firm would be better off selling less ¢ Two-step procedure for finding the profit-maximizing sales quantity ¢ Step 1: Quantity Rule ¢ Identify positive sales quantities at which MR=MC ¢ If more than one, find one with highest profit ¢ Step 2: Shut-Down Rule ¢ Check whether the quantity from Step 1 yields higher profit than shutting down 17 -10

Monopoly Profit Maximization ¢ When a monopolist maximizes its profit by selling a positive amount, its marginal revenue must equal its marginal cost at that quantity ¢ If marginal revenue exceeded marginal cost the firm would be better off selling more ¢ If marginal revenue were less than marginal cost the firm would be better off selling less ¢ Two-step procedure for finding the profit-maximizing sales quantity ¢ Step 1: Quantity Rule ¢ Identify positive sales quantities at which MR=MC ¢ If more than one, find one with highest profit ¢ Step 2: Shut-Down Rule ¢ Check whether the quantity from Step 1 yields higher profit than shutting down 17 -10

Figure 17. 4: Monopoly Profit Maximization 17 -11

Figure 17. 4: Monopoly Profit Maximization 17 -11

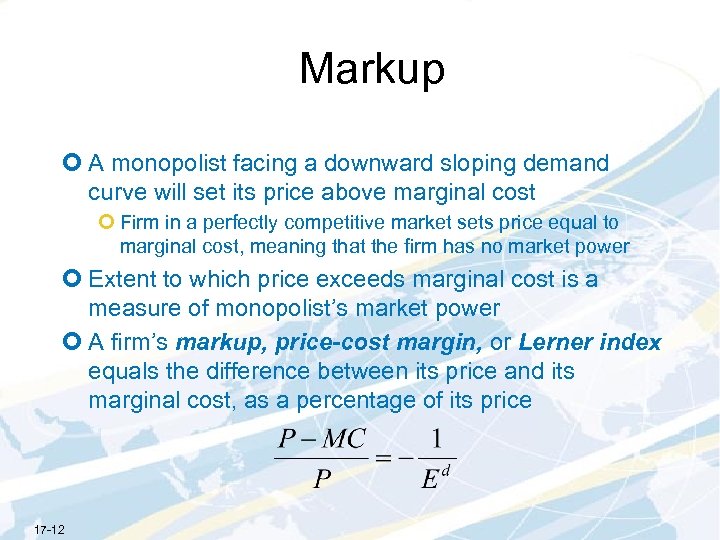

Markup ¢ A monopolist facing a downward sloping demand curve will set its price above marginal cost ¢ Firm in a perfectly competitive market sets price equal to marginal cost, meaning that the firm has no market power ¢ Extent to which price exceeds marginal cost is a measure of monopolist’s market power ¢ A firm’s markup, price-cost margin, or Lerner index equals the difference between its price and its marginal cost, as a percentage of its price 17 -12

Markup ¢ A monopolist facing a downward sloping demand curve will set its price above marginal cost ¢ Firm in a perfectly competitive market sets price equal to marginal cost, meaning that the firm has no market power ¢ Extent to which price exceeds marginal cost is a measure of monopolist’s market power ¢ A firm’s markup, price-cost margin, or Lerner index equals the difference between its price and its marginal cost, as a percentage of its price 17 -12

Markup ¢ A monopolist’s markup at its profit-maximizing price always equals the reciprocal of the elasticity of demand, times negative one ¢ The less elastic the demand curve, the greater the firm’s markup over its marginal cost ¢ When demand is less elastic, raising the price is more attractive because fewer sales are lost ¢ This also implies that demand must be elastic at the profit-maximizing price 17 -13

Markup ¢ A monopolist’s markup at its profit-maximizing price always equals the reciprocal of the elasticity of demand, times negative one ¢ The less elastic the demand curve, the greater the firm’s markup over its marginal cost ¢ When demand is less elastic, raising the price is more attractive because fewer sales are lost ¢ This also implies that demand must be elastic at the profit-maximizing price 17 -13

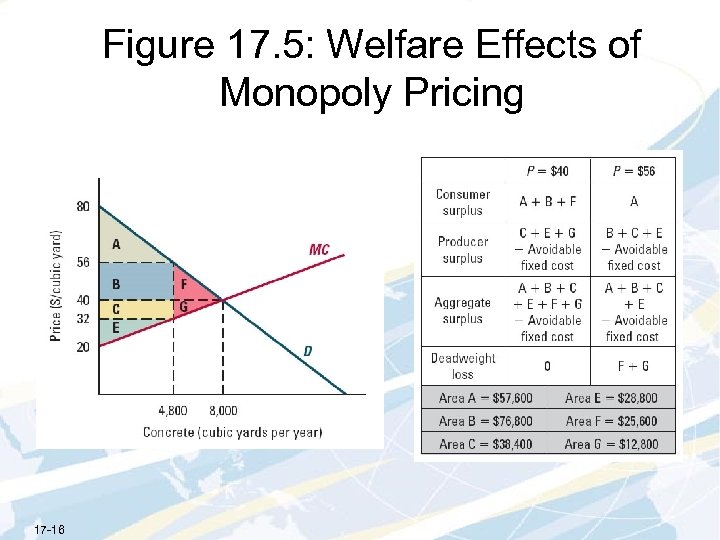

Sample Problem 2 (17. 4): Suppose KCC has faces an annual demand function Q = 16, 000 – 200 P, where P is the price, in dollars, of a cubic yard of concrete and Q is the number of cubic yards sold per year. Its marginal cost of $20 per cubic yard an avoidable fixed cost of $100, 000 per year. What is its profit-maximizing sales quantity and price?

Sample Problem 2 (17. 4): Suppose KCC has faces an annual demand function Q = 16, 000 – 200 P, where P is the price, in dollars, of a cubic yard of concrete and Q is the number of cubic yards sold per year. Its marginal cost of $20 per cubic yard an avoidable fixed cost of $100, 000 per year. What is its profit-maximizing sales quantity and price?

Welfare Effects of Monopoly Pricing ¢ By charging a price above marginal cost, the monopolist makes consumers worse off than under perfect competition ¢ Consumers who buy the product pay more for it ¢ Some who would have bought it under perfect competition will not buy it at the higher price ¢ Welfare effects of monopoly pricing: ¢ Firm gains ¢ Consumers lose ¢ Deadweight loss incurred ¢ Deadweight loss from monopoly pricing is the amount by which aggregate surplus falls short of its maximum possible level, which is attained in a competitive market 17 -15

Welfare Effects of Monopoly Pricing ¢ By charging a price above marginal cost, the monopolist makes consumers worse off than under perfect competition ¢ Consumers who buy the product pay more for it ¢ Some who would have bought it under perfect competition will not buy it at the higher price ¢ Welfare effects of monopoly pricing: ¢ Firm gains ¢ Consumers lose ¢ Deadweight loss incurred ¢ Deadweight loss from monopoly pricing is the amount by which aggregate surplus falls short of its maximum possible level, which is attained in a competitive market 17 -15

Figure 17. 5: Welfare Effects of Monopoly Pricing 17 -16

Figure 17. 5: Welfare Effects of Monopoly Pricing 17 -16

Distinguishing Monopoly from Perfect Competition ¢ Existence of more than one firm in a market does not guarantee perfect competition ¢ How can we tell whether multiple firms in a market are behaving like price takers or colluding and acting like a monopoly? ¢Easy to answer if we could observe marginal costs and compare to price ¢ Monopolists and perfectly competitive industries behave differently in responses to changes in demand changes in costs 17 -17

Distinguishing Monopoly from Perfect Competition ¢ Existence of more than one firm in a market does not guarantee perfect competition ¢ How can we tell whether multiple firms in a market are behaving like price takers or colluding and acting like a monopoly? ¢Easy to answer if we could observe marginal costs and compare to price ¢ Monopolists and perfectly competitive industries behave differently in responses to changes in demand changes in costs 17 -17

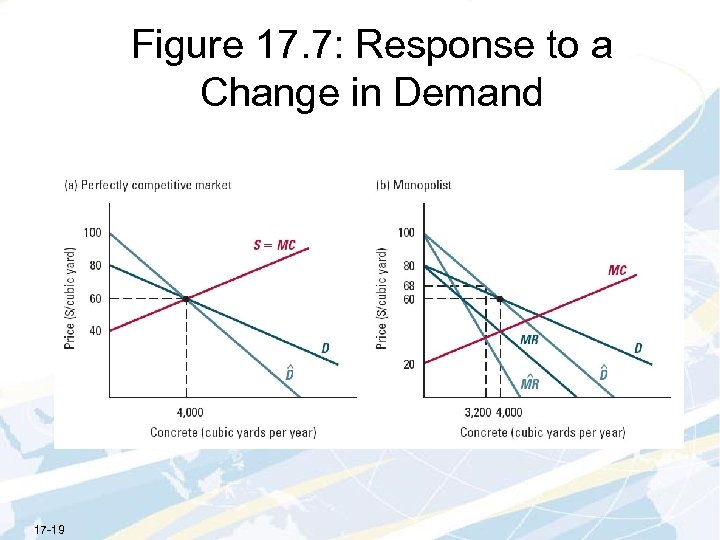

Response to Changes in Demand ¢ Monopolist’s profit-maximizing price depends on elasticity of demand ¢ Price in perfectly competitive market depends on level of demand ¢ If elasticity of demand changes but level of demand does not, provides a way to distinguish between market structures ¢ Can investigate this through data collection over time and statistical analysis 17 -18

Response to Changes in Demand ¢ Monopolist’s profit-maximizing price depends on elasticity of demand ¢ Price in perfectly competitive market depends on level of demand ¢ If elasticity of demand changes but level of demand does not, provides a way to distinguish between market structures ¢ Can investigate this through data collection over time and statistical analysis 17 -18

Figure 17. 7: Response to a Change in Demand 17 -19

Figure 17. 7: Response to a Change in Demand 17 -19

Response to Changes in Cost ¢ How do monopolies and perfectly competitive markets differ in their response to changes in costs? ¢ Consider the case of a marginal cost increase by a given amount at every level of output ¢ Example: a specific tax, T, on firms ¢ The pass-through rate is the increase in price that occurs in response to a small increase in marginal cost, measured per dollar of increase in marginal cost ¢ In a competitive market, the pass-through rate is never greater than one ¢ The monopolist’s pass-through rate depends on the shape of the demand curve ¢ Can be greater than one with a constant-elasticity demand curve 17 -20

Response to Changes in Cost ¢ How do monopolies and perfectly competitive markets differ in their response to changes in costs? ¢ Consider the case of a marginal cost increase by a given amount at every level of output ¢ Example: a specific tax, T, on firms ¢ The pass-through rate is the increase in price that occurs in response to a small increase in marginal cost, measured per dollar of increase in marginal cost ¢ In a competitive market, the pass-through rate is never greater than one ¢ The monopolist’s pass-through rate depends on the shape of the demand curve ¢ Can be greater than one with a constant-elasticity demand curve 17 -20

Nonprice Effects of Monopoly: Product Quality ¢ Product quality is a decision firms make ¢ Raising a product’s quality increases the consumer’s willingness to pay ¢ Producing a higher-quality product usually costs more ¢ The firm must decide whether the extra benefit is worth the extra cost ¢ How does the quality provided by a monopolist compare to the level that would maximize aggregate surplus? ¢ If different consumers value quality differently, the monopolist may not choose to offer the quality that maximizes aggregate surplus ¢ May over- or under-produce quality 17 -21

Nonprice Effects of Monopoly: Product Quality ¢ Product quality is a decision firms make ¢ Raising a product’s quality increases the consumer’s willingness to pay ¢ Producing a higher-quality product usually costs more ¢ The firm must decide whether the extra benefit is worth the extra cost ¢ How does the quality provided by a monopolist compare to the level that would maximize aggregate surplus? ¢ If different consumers value quality differently, the monopolist may not choose to offer the quality that maximizes aggregate surplus ¢ May over- or under-produce quality 17 -21

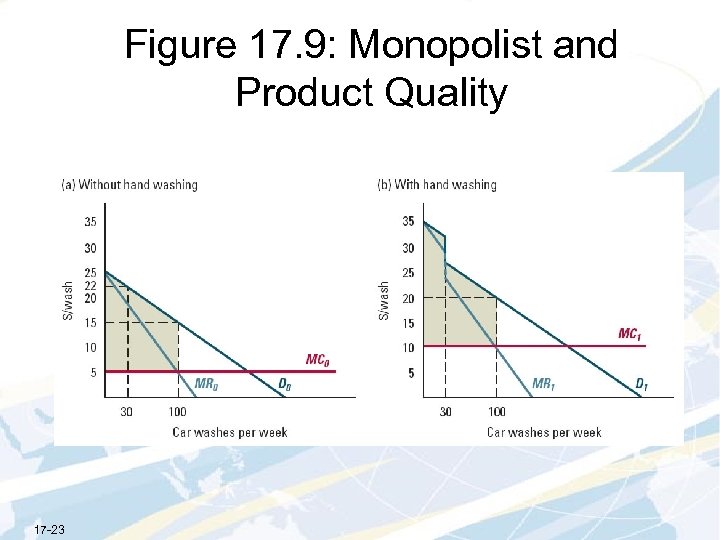

Product Quality: Car Wash Example ¢ Suppose the only car wash in town is deciding whether to provide hand washing ¢ Without hand washing the firm maximizes profit by selling 100 washes at $15 each, profit is $1, 000 ¢ Hand washing costs $5 more per wash ¢ Consumers whose willingness to pay is above $22 value a car wash $15 more if done by hand ¢ All other consumers value a hand wash $5 more ¢ With hand washes, firm’s profit-maximizing quantity is 100 washes at $20 each, with profit of $1, 000 ¢ Aggregate surplus: ¢ Without hand washes: $1, 500 ¢ With hand washes: $1, 800 ¢ Firm is indifferent between providing and not providing the higher quality product ¢ If cost of hand washing were $5. 01, monopolist would choose not to provide it even though aggregate surplus would be greater with it 17 -22

Product Quality: Car Wash Example ¢ Suppose the only car wash in town is deciding whether to provide hand washing ¢ Without hand washing the firm maximizes profit by selling 100 washes at $15 each, profit is $1, 000 ¢ Hand washing costs $5 more per wash ¢ Consumers whose willingness to pay is above $22 value a car wash $15 more if done by hand ¢ All other consumers value a hand wash $5 more ¢ With hand washes, firm’s profit-maximizing quantity is 100 washes at $20 each, with profit of $1, 000 ¢ Aggregate surplus: ¢ Without hand washes: $1, 500 ¢ With hand washes: $1, 800 ¢ Firm is indifferent between providing and not providing the higher quality product ¢ If cost of hand washing were $5. 01, monopolist would choose not to provide it even though aggregate surplus would be greater with it 17 -22

Figure 17. 9: Monopolist and Product Quality 17 -23

Figure 17. 9: Monopolist and Product Quality 17 -23

Sample Problem 3 (17. 20): The only gas station in a small town sells both regular and premium gasoline. The weekly demand functions for the two gasolines are: QReg = 10, 000 – 1, 000 PReg +50 PPrem and QPrem = 350 + 50 PReg – 100 PPrem where the quantities are measured in gallons and prices in dollars per gallon. Are these products substitutes or complements? If the price of regular gas is $3. 00 per gallon, its marginal cost is $2. 95, and the marginal cost of premium is $3. 05, what is the profit-maximizing price of premium gas?

Sample Problem 3 (17. 20): The only gas station in a small town sells both regular and premium gasoline. The weekly demand functions for the two gasolines are: QReg = 10, 000 – 1, 000 PReg +50 PPrem and QPrem = 350 + 50 PReg – 100 PPrem where the quantities are measured in gallons and prices in dollars per gallon. Are these products substitutes or complements? If the price of regular gas is $3. 00 per gallon, its marginal cost is $2. 95, and the marginal cost of premium is $3. 05, what is the profit-maximizing price of premium gas?

Nonprice Effects of Monopoly: Advertising ¢ Spending on advertising is another important decision for many firms ¢ Because the monopolist’s marginal cost is less than the price, each additional sale increases its profit ¢ Firms in perfectly competitive markets have no individual incentive to advertise ¢ Each firm perceives itself as capable of selling as much as its desires at the market price ¢ Marginal benefit of advertising equals the increase in sales times the firm’s profit on additional sales ¢ At the profit-maximizing level of advertising, this marginal benefit must equal the extra dollar expended ¢ For a monopolist, the ratio of the amount spend on advertising to the firm’s total sales revenue, the advertising-sales ratio, equals the advertising elasticity divided by the elasticity of demand, times negative one 17 -25

Nonprice Effects of Monopoly: Advertising ¢ Spending on advertising is another important decision for many firms ¢ Because the monopolist’s marginal cost is less than the price, each additional sale increases its profit ¢ Firms in perfectly competitive markets have no individual incentive to advertise ¢ Each firm perceives itself as capable of selling as much as its desires at the market price ¢ Marginal benefit of advertising equals the increase in sales times the firm’s profit on additional sales ¢ At the profit-maximizing level of advertising, this marginal benefit must equal the extra dollar expended ¢ For a monopolist, the ratio of the amount spend on advertising to the firm’s total sales revenue, the advertising-sales ratio, equals the advertising elasticity divided by the elasticity of demand, times negative one 17 -25

Nonprice Effects of Monopoly: Investments ¢ Firms can also make investments in an effort to become a monopolist ¢ Example: cable TV firms lobbying government officials to award them franchises ¢ If firms compete to become a monopolist, they will spend up to the full monopoly profit less avoidable fixed costs ¢ If spend on socially wasteful things (e. g. , golf outings for local officials) the loss from monopoly may be larger than deadweight loss and include all monopoly profit ¢ Rent seeking is socially useless effort devoted to securing a monopoly position ¢ Welfare effects of monopoly need not always be so bad ¢ Expenditures firms make to gain monopoly positions can be socially valuable (e. g. , R&D spending in the search for patentable drugs) 17 -26

Nonprice Effects of Monopoly: Investments ¢ Firms can also make investments in an effort to become a monopolist ¢ Example: cable TV firms lobbying government officials to award them franchises ¢ If firms compete to become a monopolist, they will spend up to the full monopoly profit less avoidable fixed costs ¢ If spend on socially wasteful things (e. g. , golf outings for local officials) the loss from monopoly may be larger than deadweight loss and include all monopoly profit ¢ Rent seeking is socially useless effort devoted to securing a monopoly position ¢ Welfare effects of monopoly need not always be so bad ¢ Expenditures firms make to gain monopoly positions can be socially valuable (e. g. , R&D spending in the search for patentable drugs) 17 -26

Monopsony ¢ Market power isn’t limited to the sellers of a product: it also can be held by buyers ¢ A monopsony market has a single buyer ¢ Analysis of monopsony parallels the analysis of monopoly ¢ A monopsonist faces an upward-sloping supply curve ¢ By lowering the quantity he buys, can pay less ¢ Monopsonist can think either in terms of what price to pay or in terms of how many units to employ 17 -27

Monopsony ¢ Market power isn’t limited to the sellers of a product: it also can be held by buyers ¢ A monopsony market has a single buyer ¢ Analysis of monopsony parallels the analysis of monopoly ¢ A monopsonist faces an upward-sloping supply curve ¢ By lowering the quantity he buys, can pay less ¢ Monopsonist can think either in terms of what price to pay or in terms of how many units to employ 17 -27

Marginal Expenditure ¢ A monopsonist’s marginal expenditure, ME, is the extra cost per marginal unit of an input ¢ Consider a small city in which the hospital is the only employer of nurses ¢ The hospital’s marginal expenditure has two parts ¢ The input expansion effect: the marginal nurse costs W ¢ Given the upward-sloping supply curve, the hospital must increase the wage by (DW/DQ) to hire another nurse ¢ Since the hospital must pay Q nurses this higher wage, the wage increase raises nursing costs by (DW/DQ) Q ¢ So ME is larger than W since the total effect is: 17 -28

Marginal Expenditure ¢ A monopsonist’s marginal expenditure, ME, is the extra cost per marginal unit of an input ¢ Consider a small city in which the hospital is the only employer of nurses ¢ The hospital’s marginal expenditure has two parts ¢ The input expansion effect: the marginal nurse costs W ¢ Given the upward-sloping supply curve, the hospital must increase the wage by (DW/DQ) to hire another nurse ¢ Since the hospital must pay Q nurses this higher wage, the wage increase raises nursing costs by (DW/DQ) Q ¢ So ME is larger than W since the total effect is: 17 -28

Monopsony Profit Maximization ¢ The monopsonist’s profit-maximizing choice equates its marginal benefit with its marginal cost ¢Maximizes its profit by choosing the quantity at which its demand ME curves cross ¢ Result is lower price and quantity than if the firm was a price taker ¢ Can solve for the equilibrium algebraically by setting marginal benefit equal to marginal expenditure and solving for quantity 17 -29

Monopsony Profit Maximization ¢ The monopsonist’s profit-maximizing choice equates its marginal benefit with its marginal cost ¢Maximizes its profit by choosing the quantity at which its demand ME curves cross ¢ Result is lower price and quantity than if the firm was a price taker ¢ Can solve for the equilibrium algebraically by setting marginal benefit equal to marginal expenditure and solving for quantity 17 -29

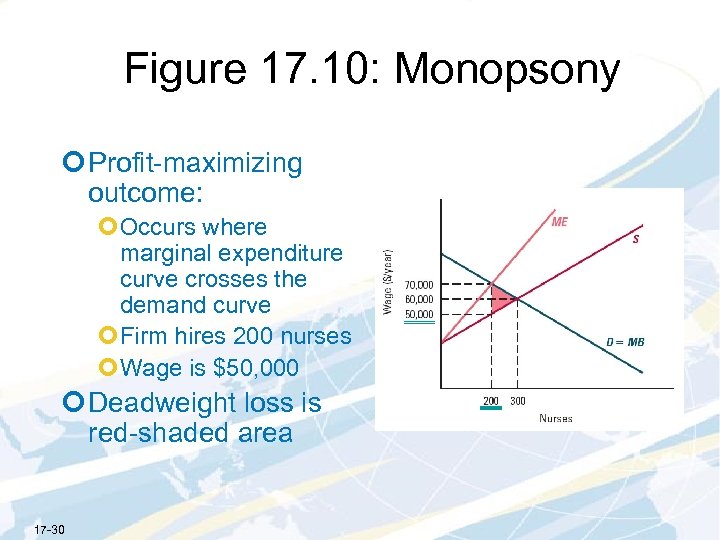

Figure 17. 10: Monopsony ¢ Profit-maximizing outcome: ¢Occurs where marginal expenditure curve crosses the demand curve ¢Firm hires 200 nurses ¢Wage is $50, 000 ¢ Deadweight loss is red-shaded area 17 -30

Figure 17. 10: Monopsony ¢ Profit-maximizing outcome: ¢Occurs where marginal expenditure curve crosses the demand curve ¢Firm hires 200 nurses ¢Wage is $50, 000 ¢ Deadweight loss is red-shaded area 17 -30

Welfare Effects of Monopsony Pricing ¢ Like with monopoly, monopsony price setting creates deadweight loss ¢ Monopsonist uses too little of the input ¢Potential net benefits from the input are lost ¢ Deadweight loss is created between the marginal benefit and market supply curves ¢See the red-shaded region in Figure 17. 10 ¢ Can compute the dollar value of the deadweight loss using algebra 17 -31

Welfare Effects of Monopsony Pricing ¢ Like with monopoly, monopsony price setting creates deadweight loss ¢ Monopsonist uses too little of the input ¢Potential net benefits from the input are lost ¢ Deadweight loss is created between the marginal benefit and market supply curves ¢See the red-shaded region in Figure 17. 10 ¢ Can compute the dollar value of the deadweight loss using algebra 17 -31

Sample Problem 4 (17. 15): The Happyland Hospital is a monopsonist employer of nurses in the small city of Happyland. The supply function of nurses is S(W) = 0. 1 W – 100, where W is the nurses’ weekly wage. What is the hospital’s marginal expenditure, ME? If the hospital’s marginal benefit is $2, 000 per week no matter how many nurses it hires, what is the profit-maximizing number of nurses for the hospital to hire? What will the nurses’ wage be? What is the deadweight loss?

Sample Problem 4 (17. 15): The Happyland Hospital is a monopsonist employer of nurses in the small city of Happyland. The supply function of nurses is S(W) = 0. 1 W – 100, where W is the nurses’ weekly wage. What is the hospital’s marginal expenditure, ME? If the hospital’s marginal benefit is $2, 000 per week no matter how many nurses it hires, what is the profit-maximizing number of nurses for the hospital to hire? What will the nurses’ wage be? What is the deadweight loss?

Regulation of Monopolies ¢ Deadweight loss from monopoly pricing provides a justification for government intervention ¢ Government actions that keep prices closer to marginal cost can protect consumers and increase economic efficiency ¢ Intervention can take many forms ¢ Antitrust legislation (see Chapter 19) ¢ Direct regulation of prices ¢ Price regulation not common in U. S. today ¢ More prevalent in the past ¢ Still used for electricity, natural gas, local telephone service ¢ More common in some other countries 17 -33

Regulation of Monopolies ¢ Deadweight loss from monopoly pricing provides a justification for government intervention ¢ Government actions that keep prices closer to marginal cost can protect consumers and increase economic efficiency ¢ Intervention can take many forms ¢ Antitrust legislation (see Chapter 19) ¢ Direct regulation of prices ¢ Price regulation not common in U. S. today ¢ More prevalent in the past ¢ Still used for electricity, natural gas, local telephone service ¢ More common in some other countries 17 -33

Why Are Some Monopolies Regulated? ¢ Regulation arises out of political pressure and economic concern about market dominance ¢ When governments create monopolies they may then regulate them to deal with the negative consequences ¢ May create a monopoly to ensure that goods are produced at least cost ¢ A market is a natural monopoly when a good is produced most economically through a single firm ¢ Average cost falls as quantity increases ¢ Second firm may enter but this would cause costs to rise ¢ Government can designate one firm to be the provider ¢ Institute price regulation to protect consumers 17 -34

Why Are Some Monopolies Regulated? ¢ Regulation arises out of political pressure and economic concern about market dominance ¢ When governments create monopolies they may then regulate them to deal with the negative consequences ¢ May create a monopoly to ensure that goods are produced at least cost ¢ A market is a natural monopoly when a good is produced most economically through a single firm ¢ Average cost falls as quantity increases ¢ Second firm may enter but this would cause costs to rise ¢ Government can designate one firm to be the provider ¢ Institute price regulation to protect consumers 17 -34

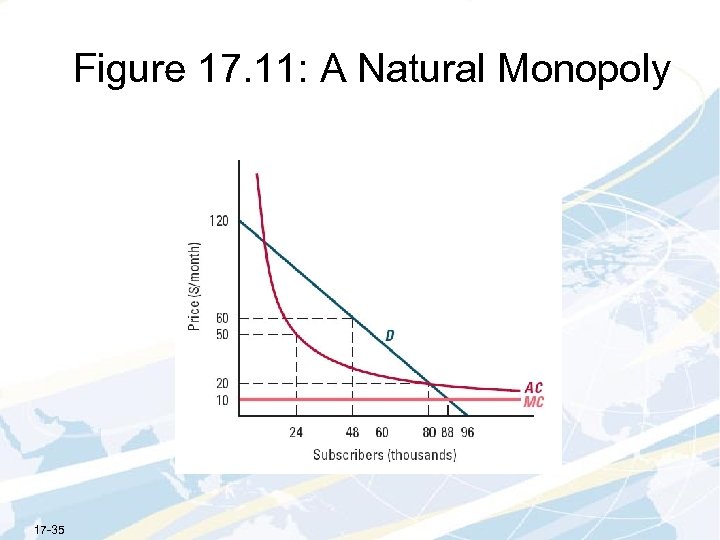

Figure 17. 11: A Natural Monopoly 17 -35

Figure 17. 11: A Natural Monopoly 17 -35

First-Best vs. Second-Best Price Regulation ¢ Under regulation, ideally prices will be set at the competitive price ¢ Price at which demand supply curves intersect ¢ Aggregate surplus will be maximized ¢ First-best solution to problem of price regulation ¢ Two problems with achieving this lead to second-best regulation ¢ Regulator may not know the firm’s marginal costs ¢ First-best solution would cause the monopolist to lose money ¢ If P < AC ¢ Best the regulator can do is set a price that makes aggregate surplus as large as possible, allow the firm to break even ¢ Set P = AC 17 -36

First-Best vs. Second-Best Price Regulation ¢ Under regulation, ideally prices will be set at the competitive price ¢ Price at which demand supply curves intersect ¢ Aggregate surplus will be maximized ¢ First-best solution to problem of price regulation ¢ Two problems with achieving this lead to second-best regulation ¢ Regulator may not know the firm’s marginal costs ¢ First-best solution would cause the monopolist to lose money ¢ If P < AC ¢ Best the regulator can do is set a price that makes aggregate surplus as large as possible, allow the firm to break even ¢ Set P = AC 17 -36