420b55c9fbb4c3bf74ec5b25065cb769.ppt

- Количество слайдов: 83

Chapter 17 Mc. Graw-Hill/Irwin Accounting Systems For Measuring Costs © The Mc. Graw-Hill Companies, Inc. , 2002

Chapter 17 Mc. Graw-Hill/Irwin Accounting Systems For Measuring Costs © The Mc. Graw-Hill Companies, Inc. , 2002

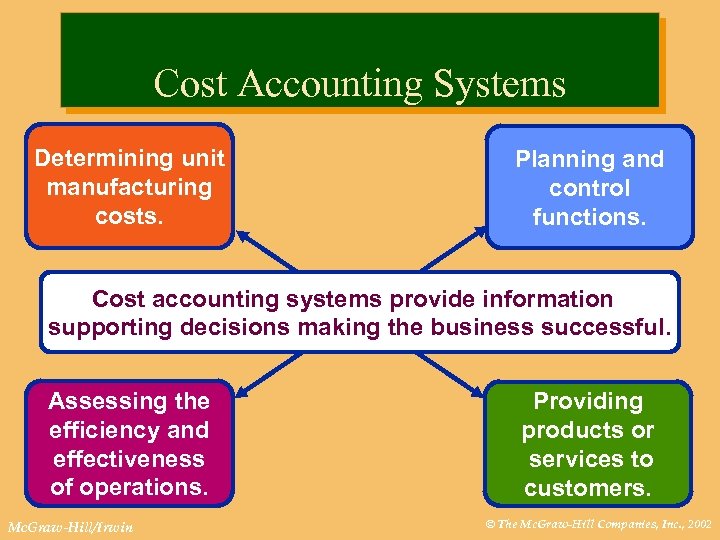

Cost Accounting Systems Determining unit manufacturing costs. Planning and control functions. Cost accounting systems provide information supporting decisions making the business successful. Assessing the efficiency and effectiveness of operations. Mc. Graw-Hill/Irwin Providing products or services to customers. © The Mc. Graw-Hill Companies, Inc. , 2002

Cost Accounting Systems Determining unit manufacturing costs. Planning and control functions. Cost accounting systems provide information supporting decisions making the business successful. Assessing the efficiency and effectiveness of operations. Mc. Graw-Hill/Irwin Providing products or services to customers. © The Mc. Graw-Hill Companies, Inc. , 2002

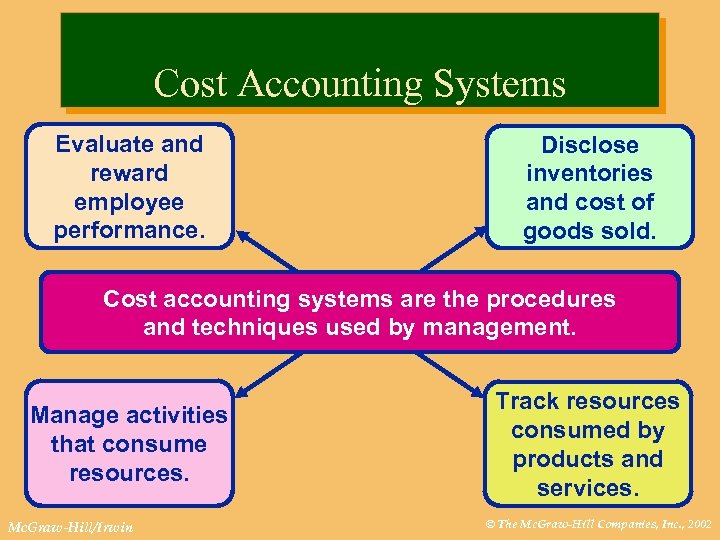

Cost Accounting Systems Evaluate and reward employee performance. Disclose inventories and cost of goods sold. Cost accounting systems are the procedures and techniques used by management. Manage activities that consume resources. Mc. Graw-Hill/Irwin Track resources consumed by products and services. © The Mc. Graw-Hill Companies, Inc. , 2002

Cost Accounting Systems Evaluate and reward employee performance. Disclose inventories and cost of goods sold. Cost accounting systems are the procedures and techniques used by management. Manage activities that consume resources. Mc. Graw-Hill/Irwin Track resources consumed by products and services. © The Mc. Graw-Hill Companies, Inc. , 2002

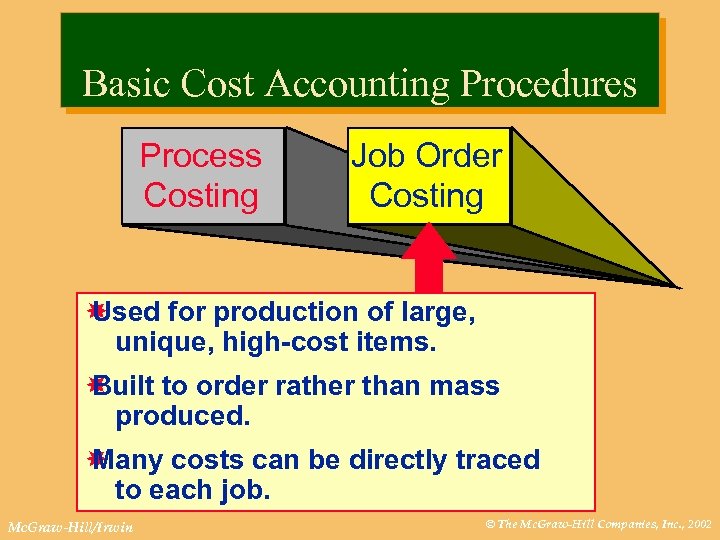

Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of large, unique, high-cost items. Built to order rather than mass produced. Many costs can be directly traced to each job. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of large, unique, high-cost items. Built to order rather than mass produced. Many costs can be directly traced to each job. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

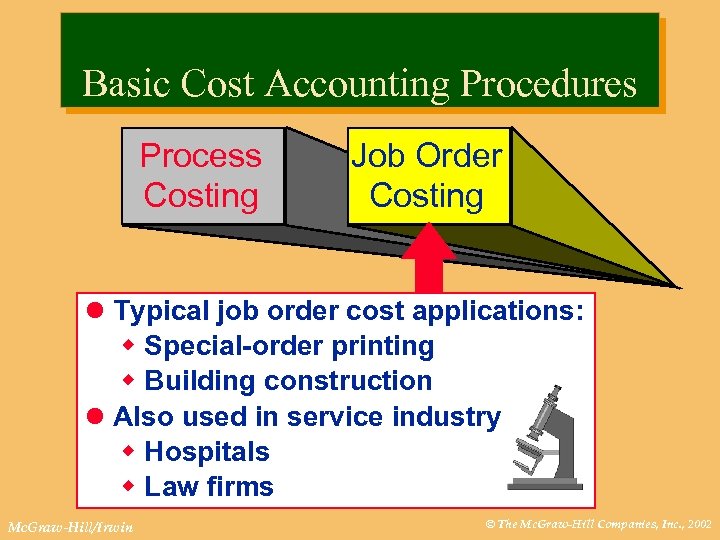

Basic Cost Accounting Procedures Process Costing Job Order Costing l Typical job order cost applications: w Special-order printing w Building construction l Also used in service industry w Hospitals w Law firms Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Basic Cost Accounting Procedures Process Costing Job Order Costing l Typical job order cost applications: w Special-order printing w Building construction l Also used in service industry w Hospitals w Law firms Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

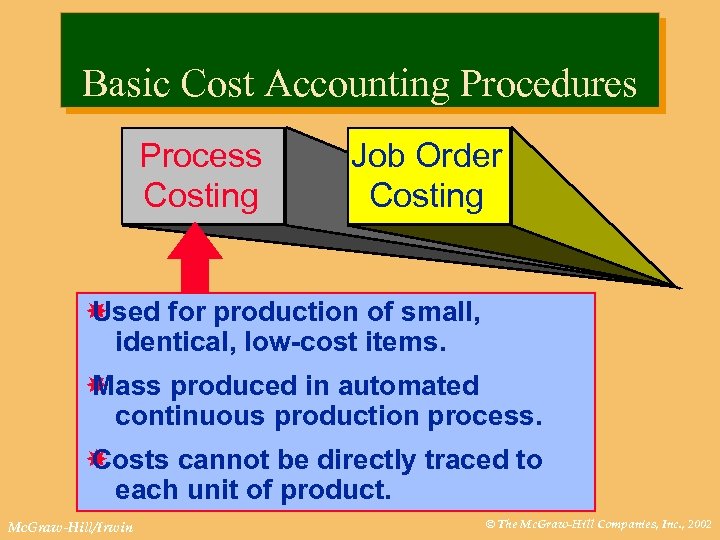

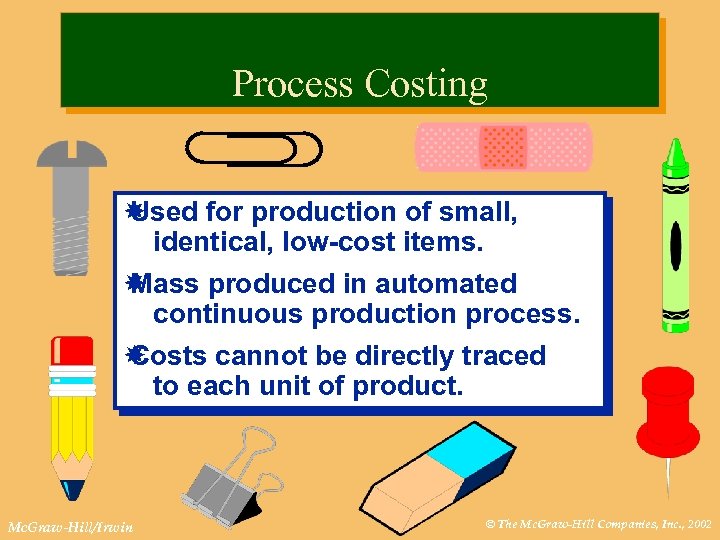

Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of small, identical, low-cost items. Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Basic Cost Accounting Procedures Process Costing Job Order Costing Used for production of small, identical, low-cost items. Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

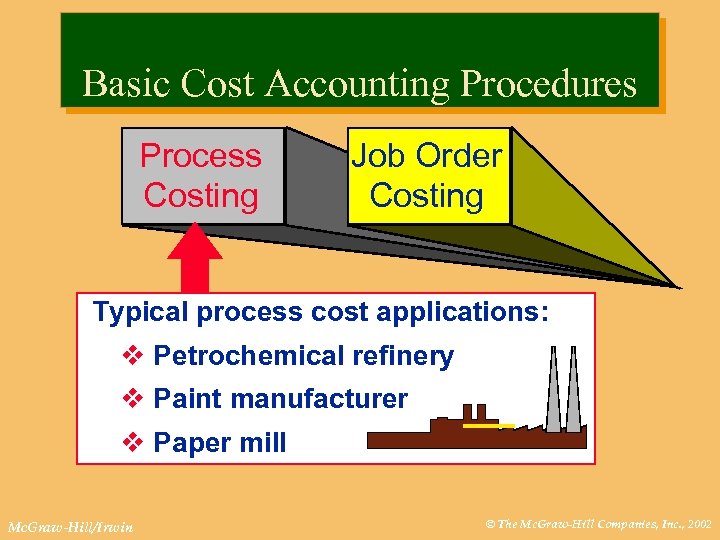

Basic Cost Accounting Procedures Process Costing Job Order Costing Typical process cost applications: v Petrochemical refinery v Paint manufacturer v Paper mill Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Basic Cost Accounting Procedures Process Costing Job Order Costing Typical process cost applications: v Petrochemical refinery v Paint manufacturer v Paper mill Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

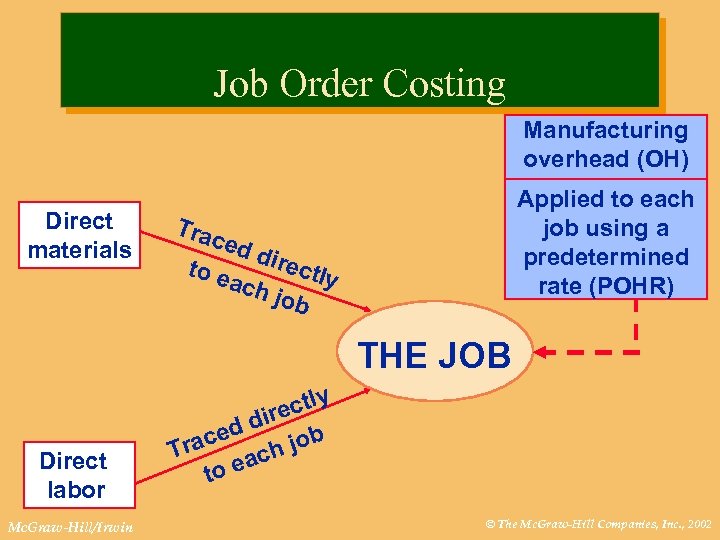

Job Order Costing Manufacturing overhead (OH) Direct materials Applied to each job using a predetermined rate (POHR) Tra ced dire to e ctly ach job THE JOB Direct labor Mc. Graw-Hill/Irwin y ectl dir d b ace Tr h jo eac to © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Manufacturing overhead (OH) Direct materials Applied to each job using a predetermined rate (POHR) Tra ced dire to e ctly ach job THE JOB Direct labor Mc. Graw-Hill/Irwin y ectl dir d b ace Tr h jo eac to © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing The primary document for tracking the costs associated with a given job is the job cost sheet. Let’s investigate Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing The primary document for tracking the costs associated with a given job is the job cost sheet. Let’s investigate Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

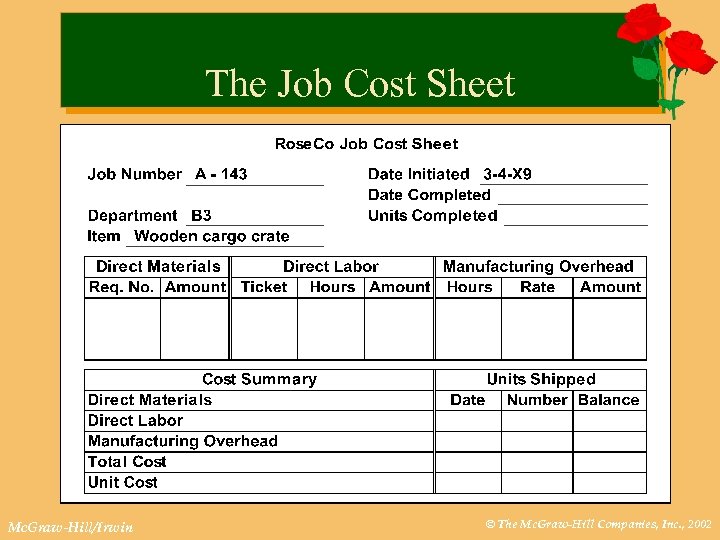

The Job Cost Sheet Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

The Job Cost Sheet Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

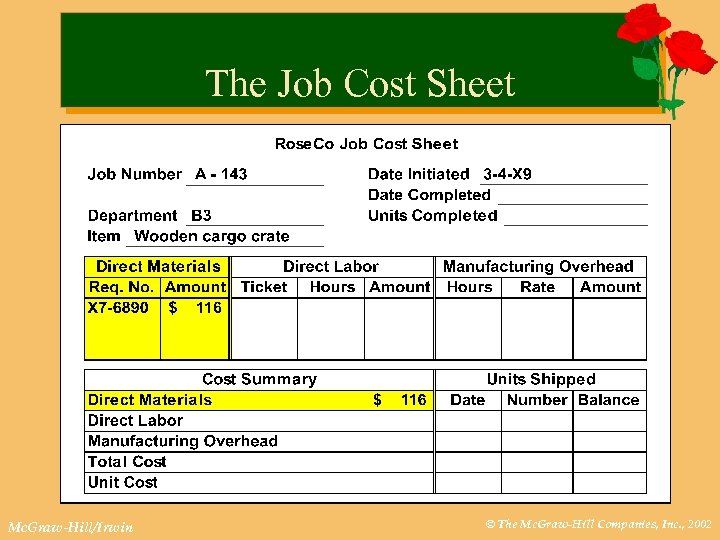

The Job Cost Sheet Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

The Job Cost Sheet Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

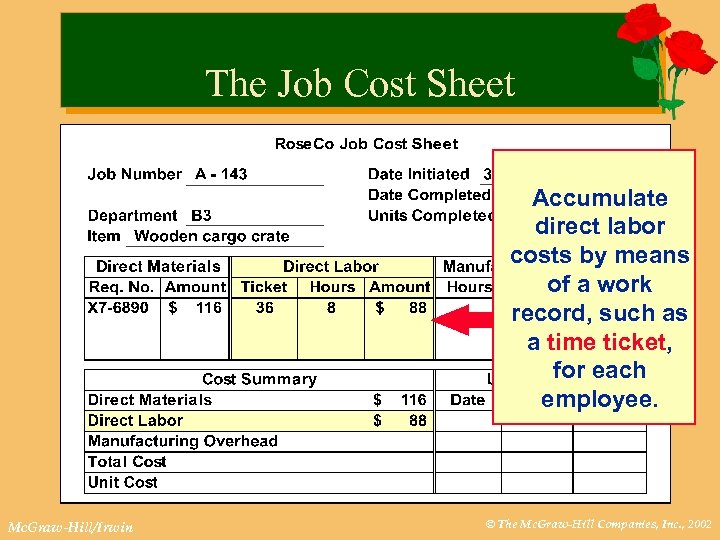

The Job Cost Sheet Accumulate direct labor costs by means of a work record, such as a time ticket, for each employee. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

The Job Cost Sheet Accumulate direct labor costs by means of a work record, such as a time ticket, for each employee. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

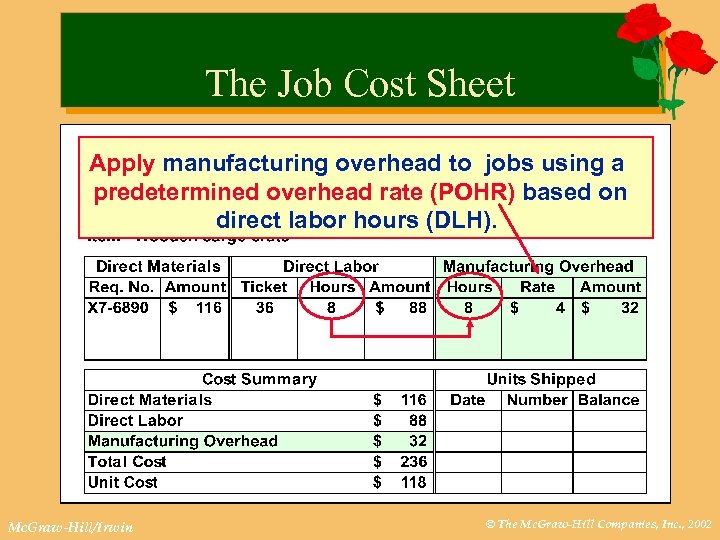

The Job Cost Sheet Apply manufacturing overhead to jobs using a predetermined overhead rate (POHR) based on direct labor hours (DLH). Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

The Job Cost Sheet Apply manufacturing overhead to jobs using a predetermined overhead rate (POHR) based on direct labor hours (DLH). Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Document Flow Summary Let’s summarize the document flow we have been discussing in a job order costing system. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Document Flow Summary Let’s summarize the document flow we have been discussing in a job order costing system. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

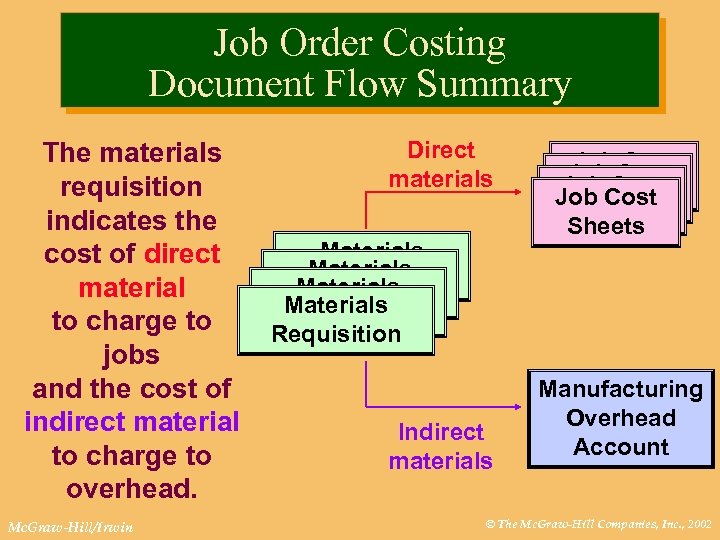

Job Order Costing Document Flow Summary The materials requisition indicates the cost of direct material to charge to jobs and the cost of indirect material to charge to overhead. Mc. Graw-Hill/Irwin Direct materials Materials Ledger Cards Requisition Indirect materials Job. Cost Job Sheets Job Cost Sheets Manufacturing Overhead Account © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Document Flow Summary The materials requisition indicates the cost of direct material to charge to jobs and the cost of indirect material to charge to overhead. Mc. Graw-Hill/Irwin Direct materials Materials Ledger Cards Requisition Indirect materials Job. Cost Job Sheets Job Cost Sheets Manufacturing Overhead Account © The Mc. Graw-Hill Companies, Inc. , 2002

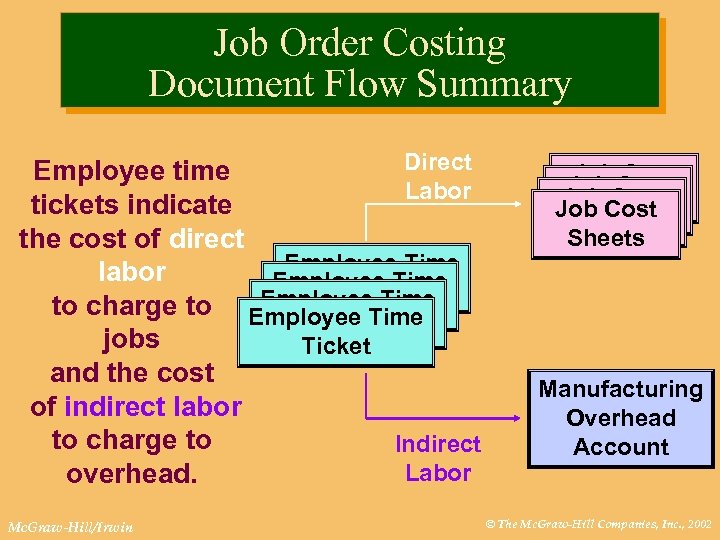

Job Order Costing Document Flow Summary Direct Employee time Labor tickets indicate the cost of direct Employee Time labor Employee Time Ticket Employee Time to charge to Employee Time Ticket jobs Ticket and the cost of indirect labor to charge to Indirect Labor overhead. Mc. Graw-Hill/Irwin Job. Cost Job Sheets Job Cost Sheets Manufacturing Overhead Account © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Document Flow Summary Direct Employee time Labor tickets indicate the cost of direct Employee Time labor Employee Time Ticket Employee Time to charge to Employee Time Ticket jobs Ticket and the cost of indirect labor to charge to Indirect Labor overhead. Mc. Graw-Hill/Irwin Job. Cost Job Sheets Job Cost Sheets Manufacturing Overhead Account © The Mc. Graw-Hill Companies, Inc. , 2002

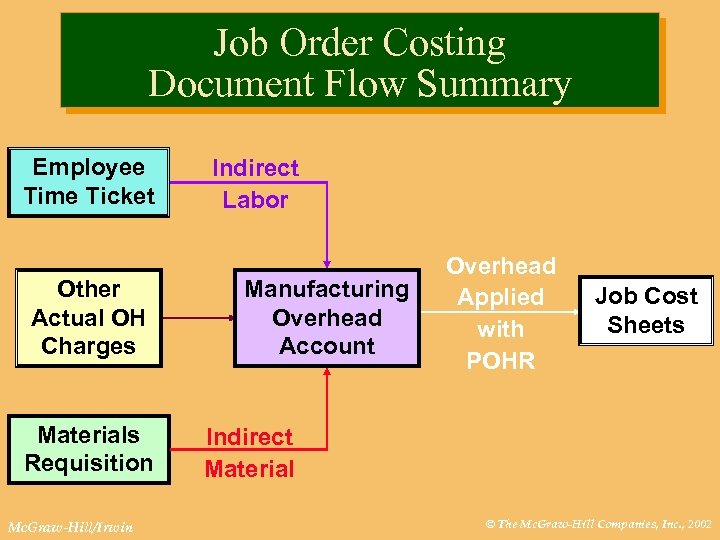

Job Order Costing Document Flow Summary Employee Time Ticket Other Actual OH Charges Materials Requisition Mc. Graw-Hill/Irwin Indirect Labor Manufacturing Overhead Account Overhead Applied with POHR Job Cost Sheets Indirect Material © The Mc. Graw-Hill Companies, Inc. , 2002

Job Order Costing Document Flow Summary Employee Time Ticket Other Actual OH Charges Materials Requisition Mc. Graw-Hill/Irwin Indirect Labor Manufacturing Overhead Account Overhead Applied with POHR Job Cost Sheets Indirect Material © The Mc. Graw-Hill Companies, Inc. , 2002

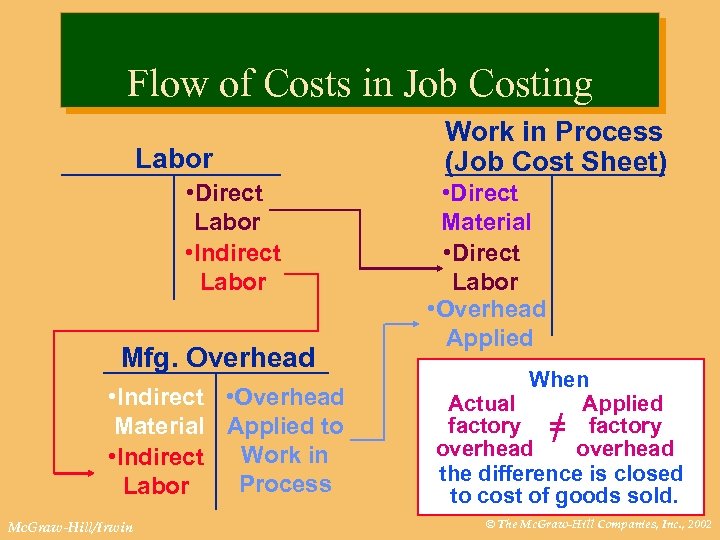

Flow of Costs in Job Costing Let’s examine the cost flows in a job order costing system. We will use T-accounts and start with materials. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Let’s examine the cost flows in a job order costing system. We will use T-accounts and start with materials. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

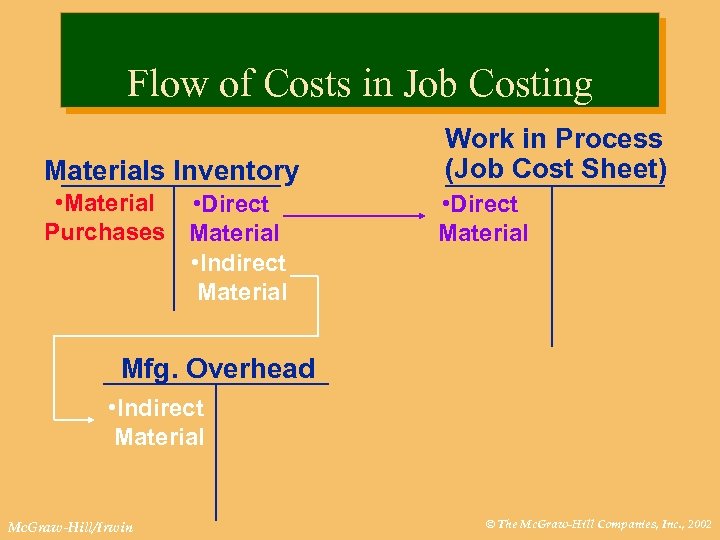

Flow of Costs in Job Costing Materials Inventory • Material • Direct Purchases Material • Indirect Material Work in Process (Job Cost Sheet) • Direct Material Mfg. Overhead • Indirect Material Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Materials Inventory • Material • Direct Purchases Material • Indirect Material Work in Process (Job Cost Sheet) • Direct Material Mfg. Overhead • Indirect Material Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Next let’s add labor costs and applied manufacturing overhead to the job order cost flows. Are you with me? Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Next let’s add labor costs and applied manufacturing overhead to the job order cost flows. Are you with me? Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Labor • Direct Labor • Indirect Labor Mfg. Overhead • Indirect • Overhead Material Applied to Work in • Indirect Process Labor Mc. Graw-Hill/Irwin Work in Process (Job Cost Sheet) • Direct Material • Direct Labor • Overhead Applied When Actual Applied factory = factory overhead the difference is closed to cost of goods sold. / © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Labor • Direct Labor • Indirect Labor Mfg. Overhead • Indirect • Overhead Material Applied to Work in • Indirect Process Labor Mc. Graw-Hill/Irwin Work in Process (Job Cost Sheet) • Direct Material • Direct Labor • Overhead Applied When Actual Applied factory = factory overhead the difference is closed to cost of goods sold. / © The Mc. Graw-Hill Companies, Inc. , 2002

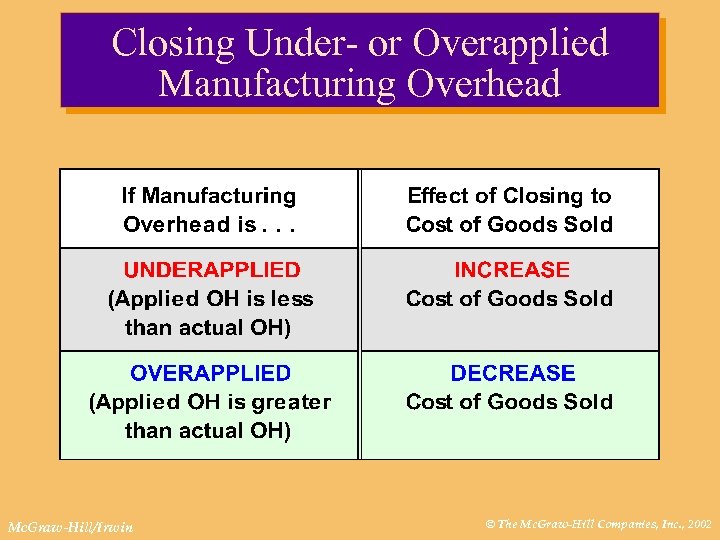

Closing Under- or Overapplied Manufacturing Overhead Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Closing Under- or Overapplied Manufacturing Overhead Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

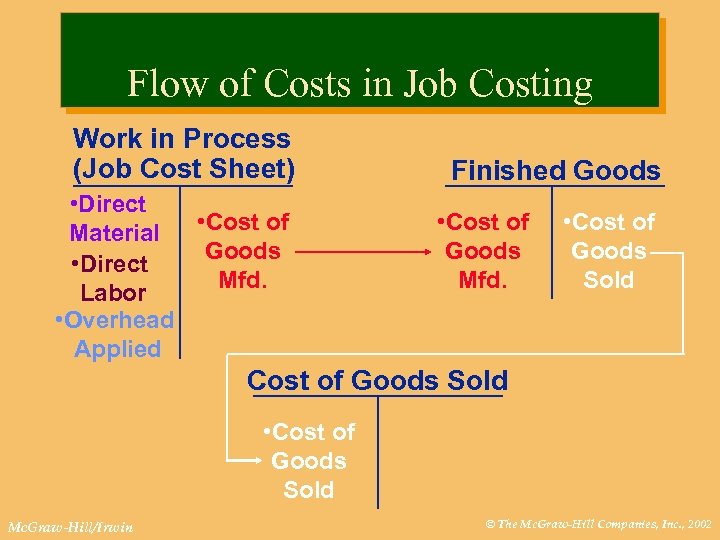

Flow of Costs in Job Costing Now let’s complete the goods and sell them. Still with me? Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Now let’s complete the goods and sell them. Still with me? Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Work in Process (Job Cost Sheet) • Direct • Cost of Material Goods • Direct Mfd. Labor • Overhead Applied Finished Goods • Cost of Goods Mfd. • Cost of Goods Sold Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Flow of Costs in Job Costing Work in Process (Job Cost Sheet) • Direct • Cost of Material Goods • Direct Mfd. Labor • Overhead Applied Finished Goods • Cost of Goods Mfd. • Cost of Goods Sold Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing Used for production of small, identical, low-cost items. Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing Used for production of small, identical, low-cost items. Mass produced in automated continuous production process. Costs cannot be directly traced to each unit of product. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

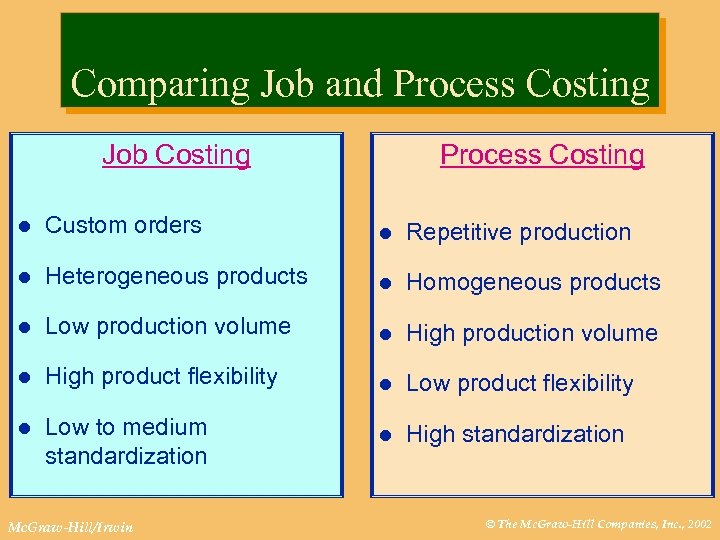

Comparing Job and Process Costing Job Costing Process Costing l Custom orders l Repetitive production l Heterogeneous products l Homogeneous products l Low production volume l High product flexibility l Low to medium standardization l High standardization Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Comparing Job and Process Costing Job Costing Process Costing l Custom orders l Repetitive production l Heterogeneous products l Homogeneous products l Low production volume l High product flexibility l Low to medium standardization l High standardization Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

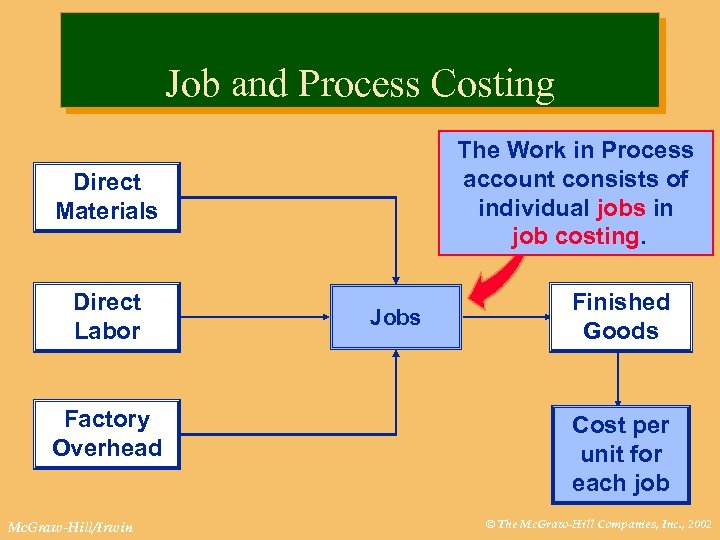

Job and Process Costing The Work in Process account consists of individual jobs in job costing. Direct Materials Direct Labor Factory Overhead Mc. Graw-Hill/Irwin Jobs Finished Goods Cost per unit for each job © The Mc. Graw-Hill Companies, Inc. , 2002

Job and Process Costing The Work in Process account consists of individual jobs in job costing. Direct Materials Direct Labor Factory Overhead Mc. Graw-Hill/Irwin Jobs Finished Goods Cost per unit for each job © The Mc. Graw-Hill Companies, Inc. , 2002

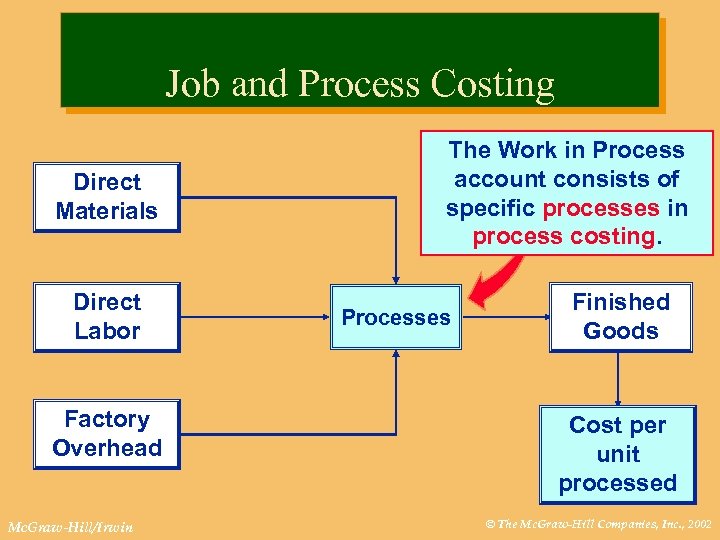

Job and Process Costing Direct Materials Direct Labor Factory Overhead Mc. Graw-Hill/Irwin The Work in Process account consists of specific processes in process costing. Processes Finished Goods Cost per unit processed © The Mc. Graw-Hill Companies, Inc. , 2002

Job and Process Costing Direct Materials Direct Labor Factory Overhead Mc. Graw-Hill/Irwin The Work in Process account consists of specific processes in process costing. Processes Finished Goods Cost per unit processed © The Mc. Graw-Hill Companies, Inc. , 2002

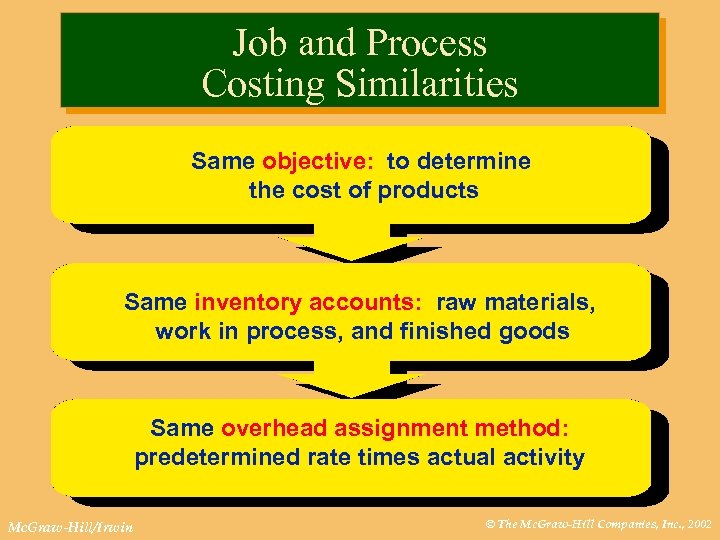

Job and Process Costing Similarities Same objective: to determine the cost of products Same inventory accounts: raw materials, work in process, and finished goods Same overhead assignment method: predetermined rate times actual activity Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Job and Process Costing Similarities Same objective: to determine the cost of products Same inventory accounts: raw materials, work in process, and finished goods Same overhead assignment method: predetermined rate times actual activity Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

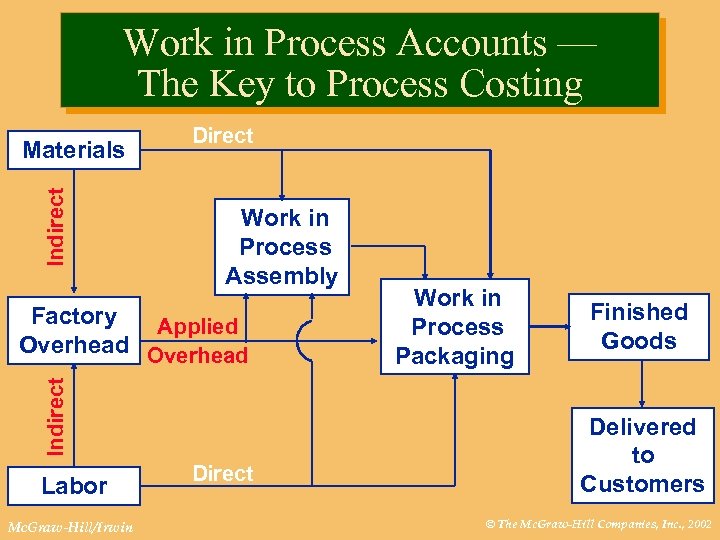

Work in Process Accounts — The Key to Process Costing Indirect Materials Direct Work in Process Assembly Indirect Factory Applied Overhead Labor Mc. Graw-Hill/Irwin Direct Work in Process Packaging Finished Goods Delivered to Customers © The Mc. Graw-Hill Companies, Inc. , 2002

Work in Process Accounts — The Key to Process Costing Indirect Materials Direct Work in Process Assembly Indirect Factory Applied Overhead Labor Mc. Graw-Hill/Irwin Direct Work in Process Packaging Finished Goods Delivered to Customers © The Mc. Graw-Hill Companies, Inc. , 2002

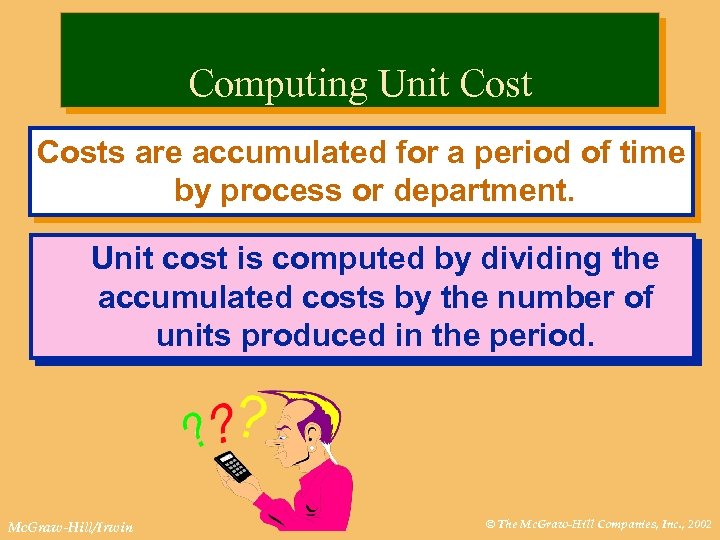

Computing Unit Costs are accumulated for a period of time by process or department. Unit cost is computed by dividing the accumulated costs by the number of units produced in the period. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Unit Costs are accumulated for a period of time by process or department. Unit cost is computed by dividing the accumulated costs by the number of units produced in the period. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

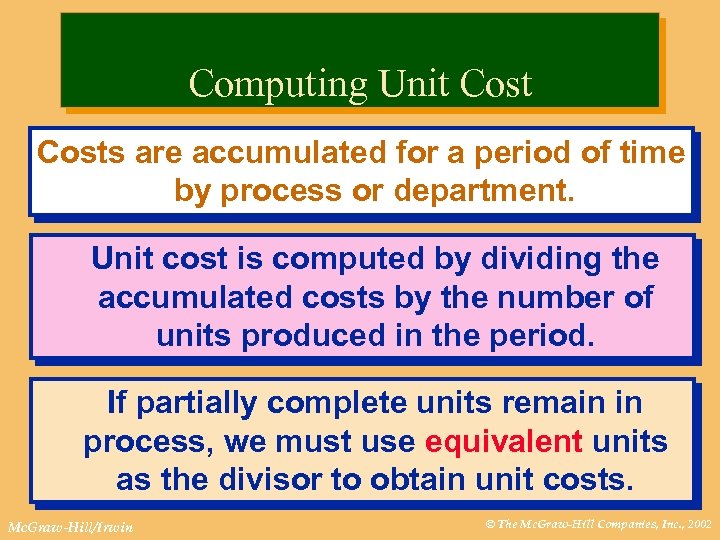

Computing Unit Costs are accumulated for a period of time by process or department. Unit cost is computed by dividing the accumulated costs by the number of units produced in the period. If partially complete units remain in process, we must use equivalent units as the divisor to obtain unit costs. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Unit Costs are accumulated for a period of time by process or department. Unit cost is computed by dividing the accumulated costs by the number of units produced in the period. If partially complete units remain in process, we must use equivalent units as the divisor to obtain unit costs. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

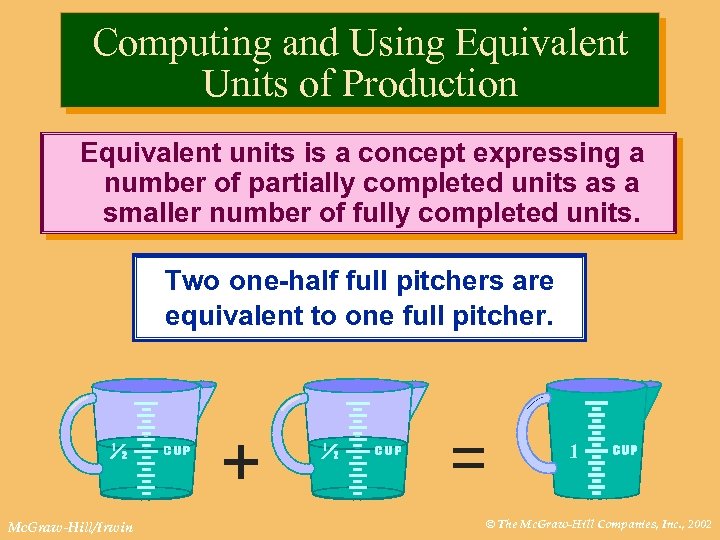

Computing and Using Equivalent Units of Production Equivalent units is a concept expressing a number of partially completed units as a smaller number of fully completed units. Two one-half full pitchers are equivalent to one full pitcher. + Mc. Graw-Hill/Irwin = 1 © The Mc. Graw-Hill Companies, Inc. , 2002

Computing and Using Equivalent Units of Production Equivalent units is a concept expressing a number of partially completed units as a smaller number of fully completed units. Two one-half full pitchers are equivalent to one full pitcher. + Mc. Graw-Hill/Irwin = 1 © The Mc. Graw-Hill Companies, Inc. , 2002

Question For the current period, Pencil. Co started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Pencil. Co have for the period? a. 10, 000 b. 11, 500 c. 1, 500 d. 15, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Question For the current period, Pencil. Co started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Pencil. Co have for the period? a. 10, 000 b. 11, 500 c. 1, 500 d. 15, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

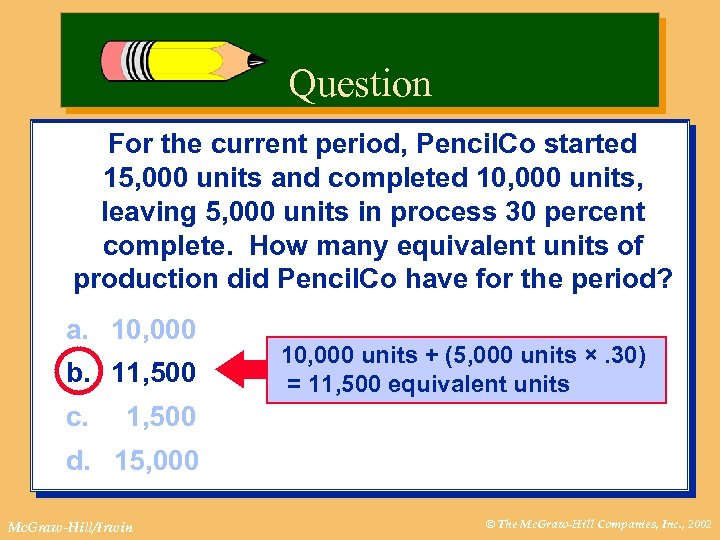

Question For the current period, Pencil. Co started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Pencil. Co have for the period? a. 10, 000 b. 11, 500 c. 10, 000 units + (5, 000 units ×. 30) = 11, 500 equivalent units 1, 500 d. 15, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Question For the current period, Pencil. Co started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Pencil. Co have for the period? a. 10, 000 b. 11, 500 c. 10, 000 units + (5, 000 units ×. 30) = 11, 500 equivalent units 1, 500 d. 15, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Cost Per Equivalent Unit Cost per equivalent unit Mc. Graw-Hill/Irwin Product costs for the period = Equivalent units for the period © The Mc. Graw-Hill Companies, Inc. , 2002

Cost Per Equivalent Unit Cost per equivalent unit Mc. Graw-Hill/Irwin Product costs for the period = Equivalent units for the period © The Mc. Graw-Hill Companies, Inc. , 2002

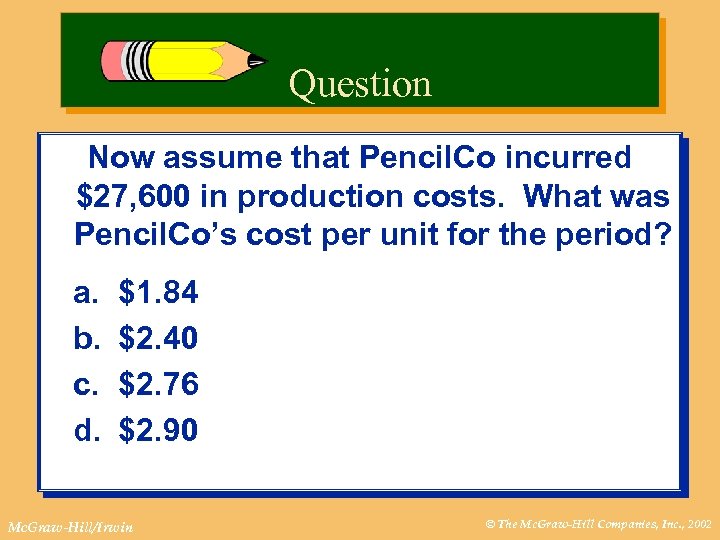

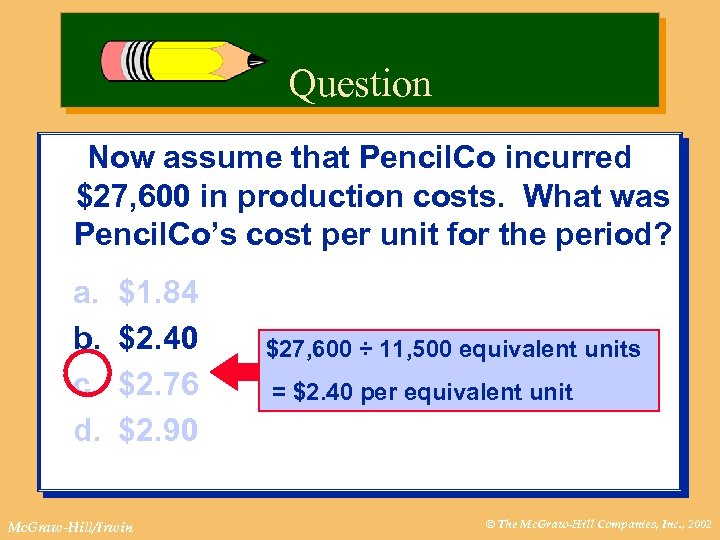

Question Now assume that Pencil. Co incurred $27, 600 in production costs. What was Pencil. Co’s cost per unit for the period? a. b. c. d. $1. 84 $2. 40 $2. 76 $2. 90 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Question Now assume that Pencil. Co incurred $27, 600 in production costs. What was Pencil. Co’s cost per unit for the period? a. b. c. d. $1. 84 $2. 40 $2. 76 $2. 90 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Question Now assume that Pencil. Co incurred $27, 600 in production costs. What was Pencil. Co’s cost per unit for the period? a. b. c. d. $1. 84 $2. 40 $2. 76 $2. 90 Mc. Graw-Hill/Irwin $27, 600 ÷ 11, 500 equivalent units = $2. 40 per equivalent unit © The Mc. Graw-Hill Companies, Inc. , 2002

Question Now assume that Pencil. Co incurred $27, 600 in production costs. What was Pencil. Co’s cost per unit for the period? a. b. c. d. $1. 84 $2. 40 $2. 76 $2. 90 Mc. Graw-Hill/Irwin $27, 600 ÷ 11, 500 equivalent units = $2. 40 per equivalent unit © The Mc. Graw-Hill Companies, Inc. , 2002

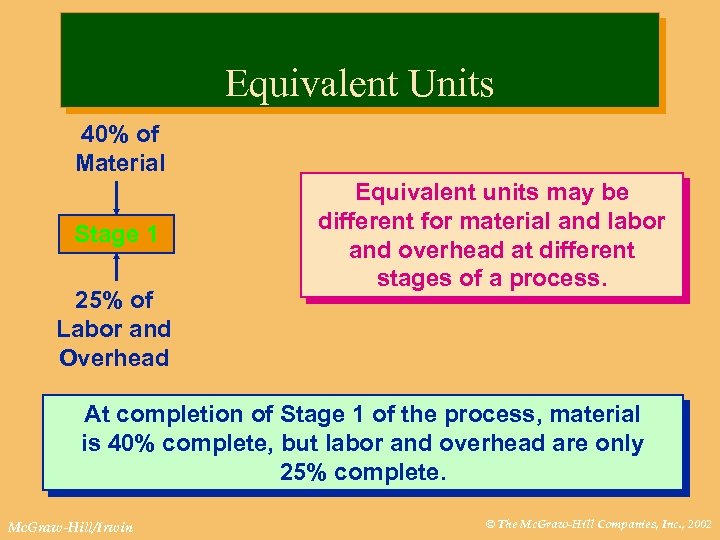

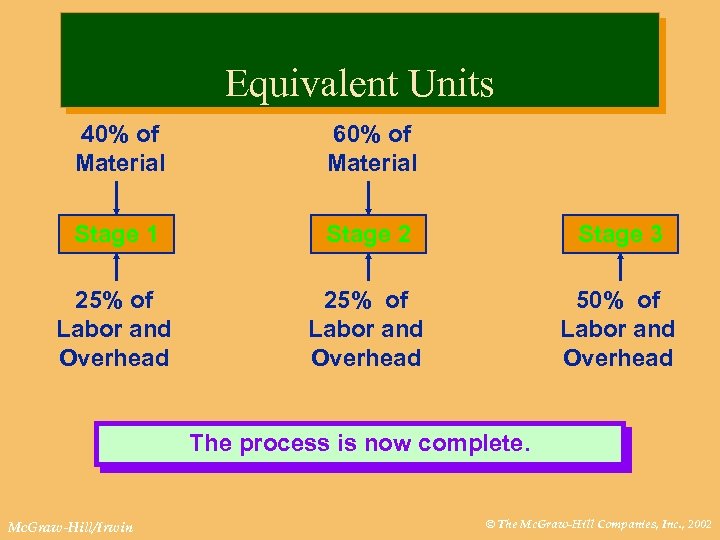

Equivalent Units 40% of Material Stage 1 25% of Labor and Overhead Equivalent units may be different for material and labor and overhead at different stages of a process. At completion of Stage 1 of the process, material is 40% complete, but labor and overhead are only 25% complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Equivalent Units 40% of Material Stage 1 25% of Labor and Overhead Equivalent units may be different for material and labor and overhead at different stages of a process. At completion of Stage 1 of the process, material is 40% complete, but labor and overhead are only 25% complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

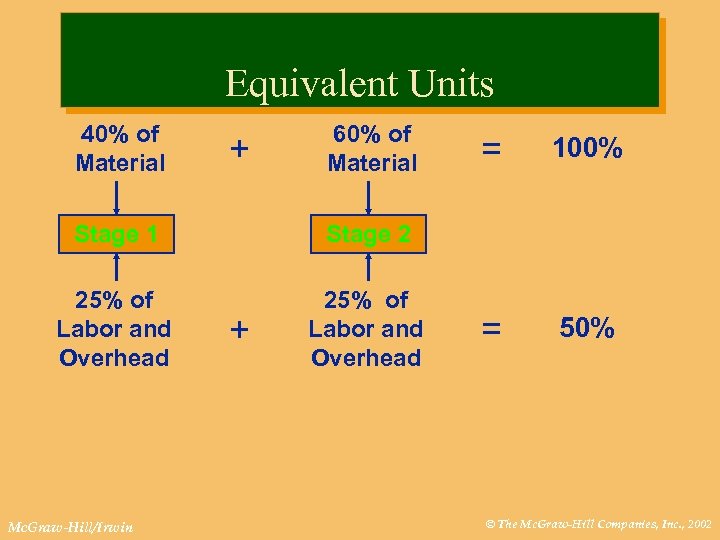

Equivalent Units 40% of Material + 60% of Material Stage 1 25% of Labor and Overhead 100% = 50% Stage 2 25% of Labor and Overhead = Mc. Graw-Hill/Irwin + © The Mc. Graw-Hill Companies, Inc. , 2002

Equivalent Units 40% of Material + 60% of Material Stage 1 25% of Labor and Overhead 100% = 50% Stage 2 25% of Labor and Overhead = Mc. Graw-Hill/Irwin + © The Mc. Graw-Hill Companies, Inc. , 2002

Equivalent Units 40% of Material 60% of Material Stage 1 Stage 2 Stage 3 25% of Labor and Overhead 50% of Labor and Overhead The process is now complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Equivalent Units 40% of Material 60% of Material Stage 1 Stage 2 Stage 3 25% of Labor and Overhead 50% of Labor and Overhead The process is now complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

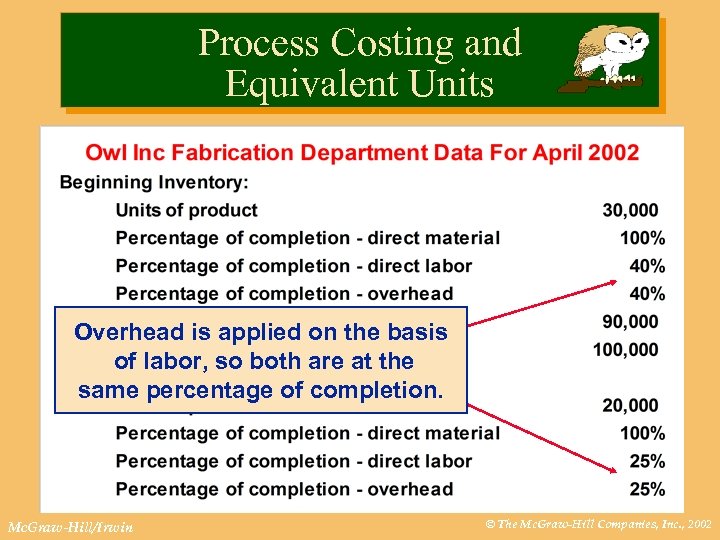

Process Costing and Equivalent Units Owl Inc uses FIFO process costing in its Fabrication Department where a product called Strata is made. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Owl Inc uses FIFO process costing in its Fabrication Department where a product called Strata is made. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

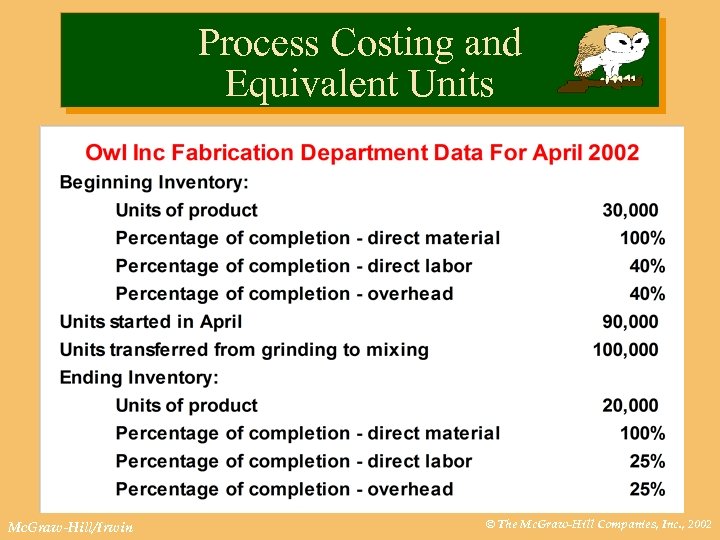

Process Costing and Equivalent Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

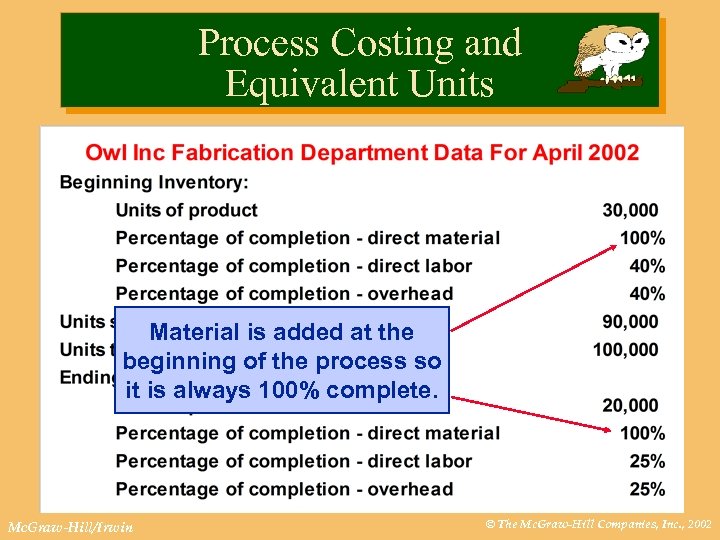

Process Costing and Equivalent Units Material is added at the beginning of the process so it is always 100% complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Material is added at the beginning of the process so it is always 100% complete. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Overhead is applied on the basis of labor, so both are at the same percentage of completion. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Overhead is applied on the basis of labor, so both are at the same percentage of completion. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

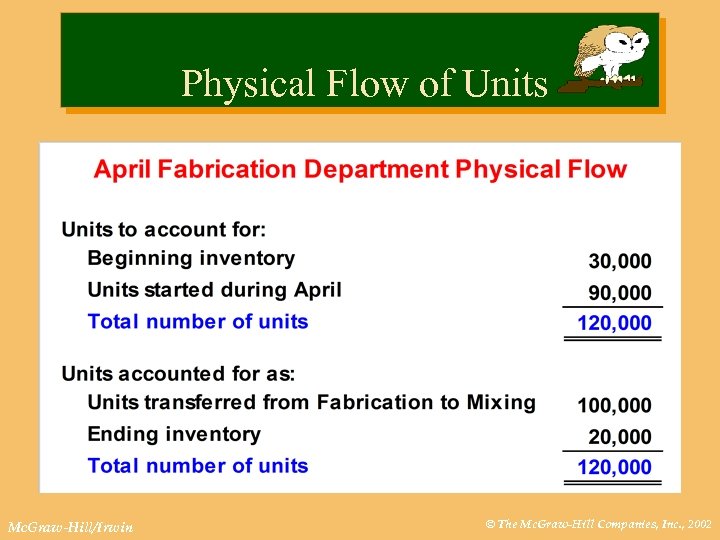

Physical Flow of Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Physical Flow of Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

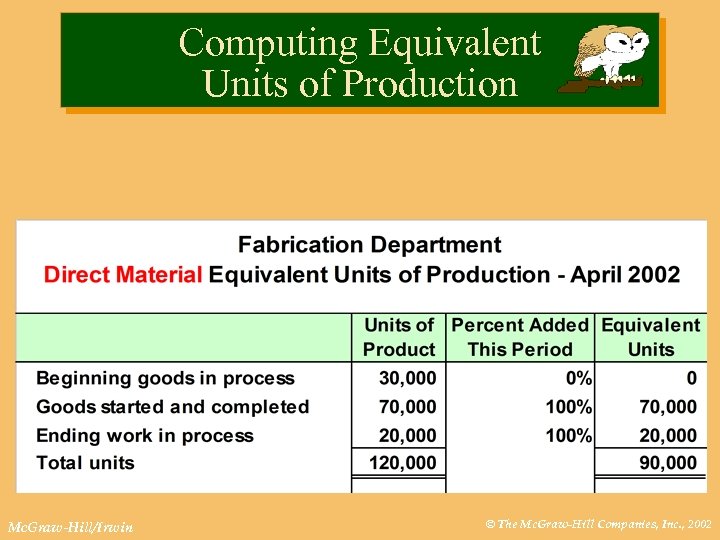

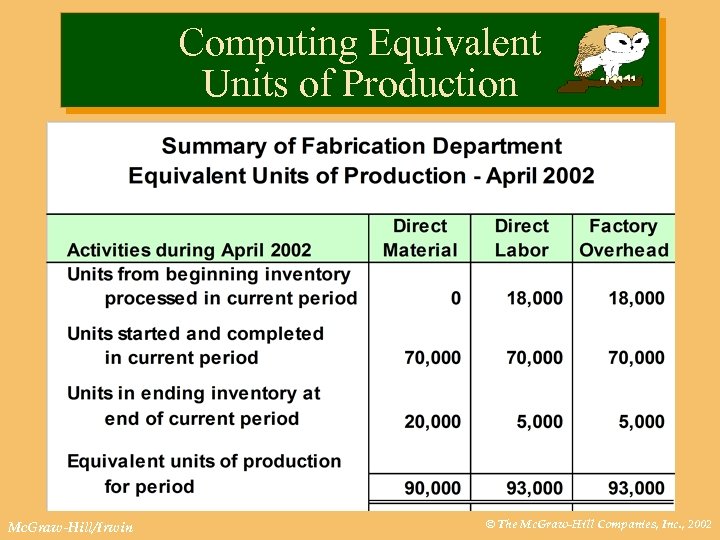

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

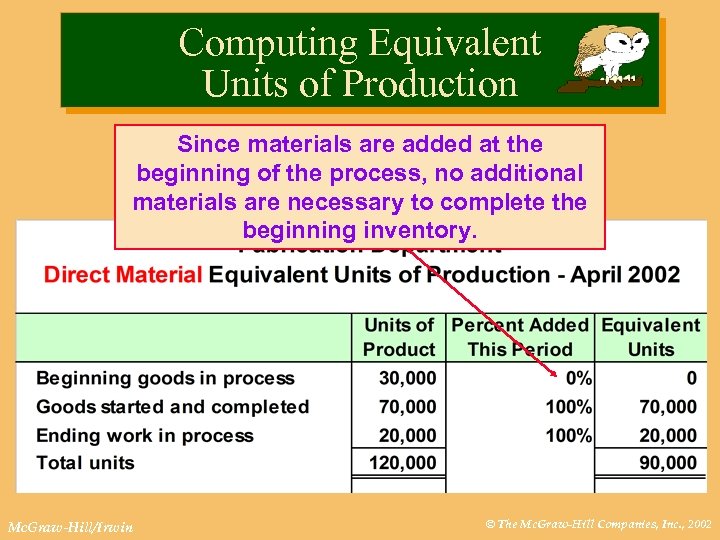

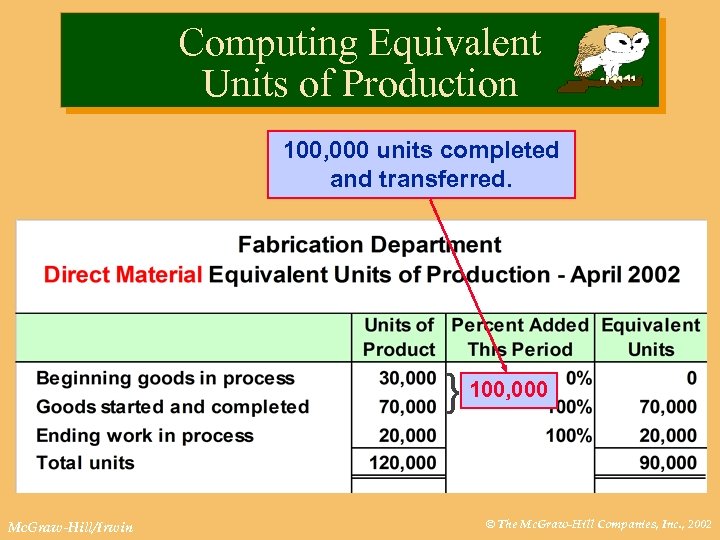

Computing Equivalent Units of Production Since materials are added at the beginning of the process, no additional materials are necessary to complete the beginning inventory. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Since materials are added at the beginning of the process, no additional materials are necessary to complete the beginning inventory. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production 100, 000 units completed and transferred. } 100, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production 100, 000 units completed and transferred. } 100, 000 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

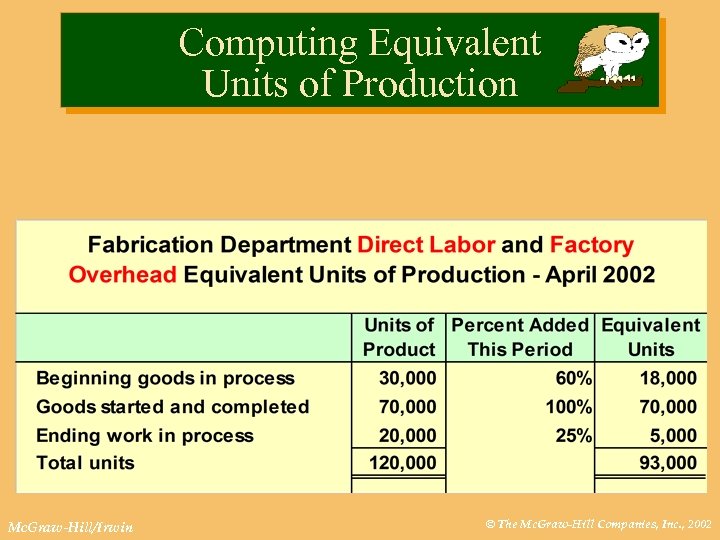

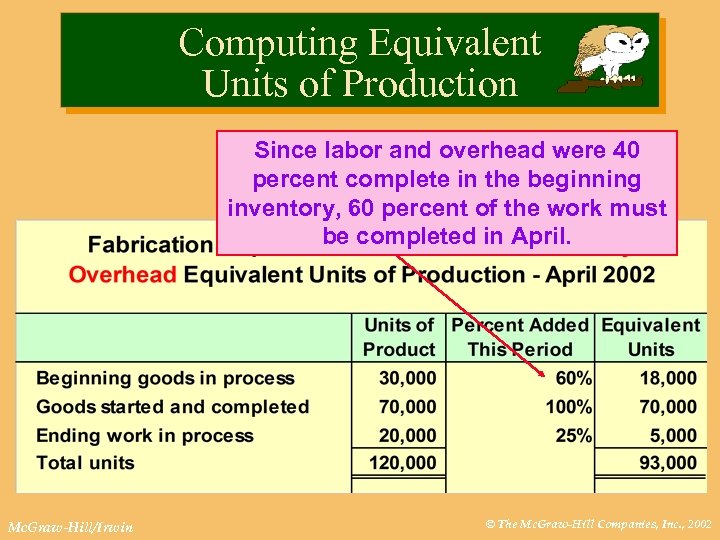

Computing Equivalent Units of Production Since labor and overhead were 40 percent complete in the beginning inventory, 60 percent of the work must be completed in April. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Since labor and overhead were 40 percent complete in the beginning inventory, 60 percent of the work must be completed in April. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

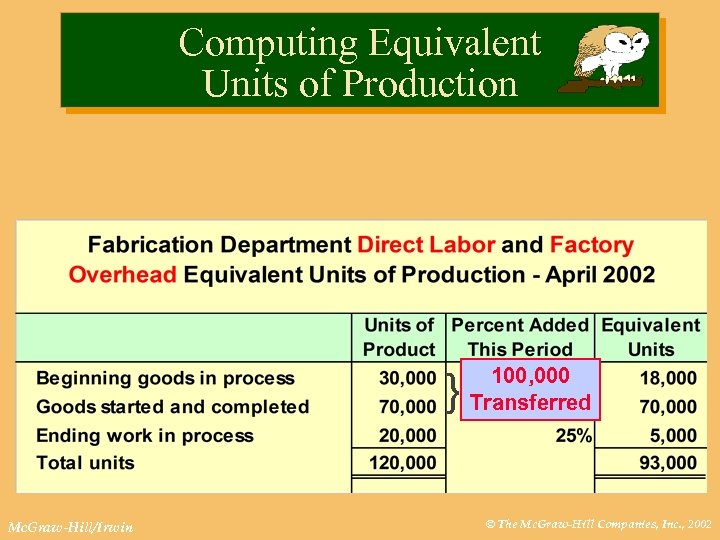

Computing Equivalent Units of Production } Mc. Graw-Hill/Irwin 100, 000 Transferred © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production } Mc. Graw-Hill/Irwin 100, 000 Transferred © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Computing Equivalent Units of Production Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

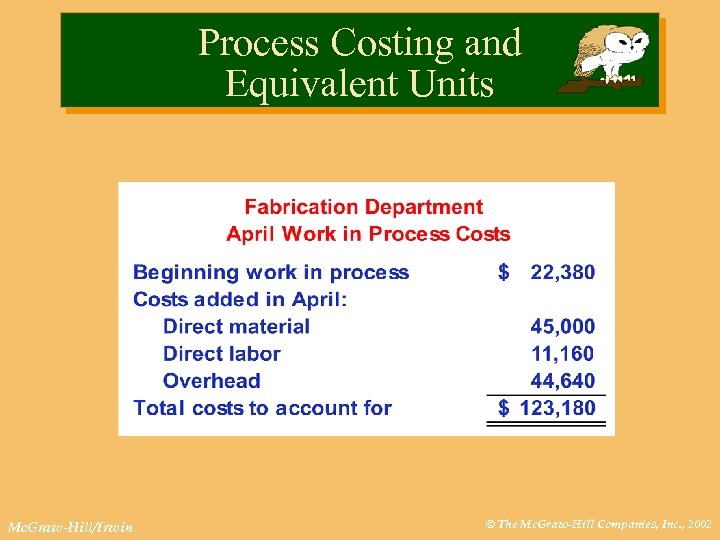

Process Costing and Equivalent Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Process Costing and Equivalent Units Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

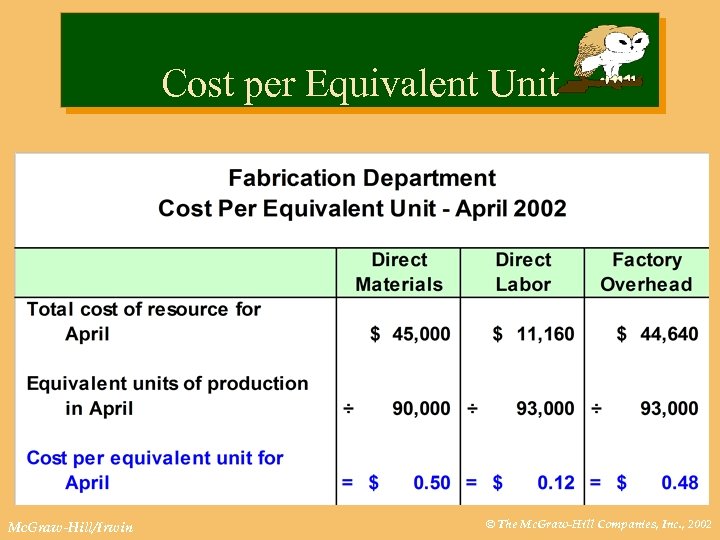

Cost per Equivalent Unit Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Cost per Equivalent Unit Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

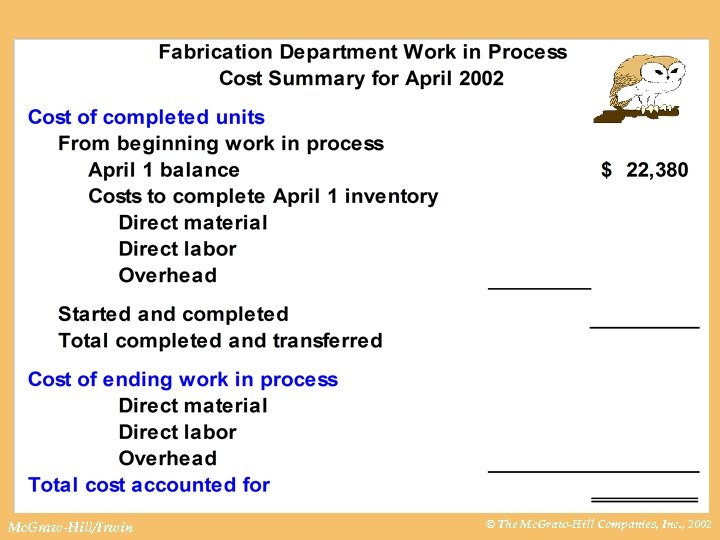

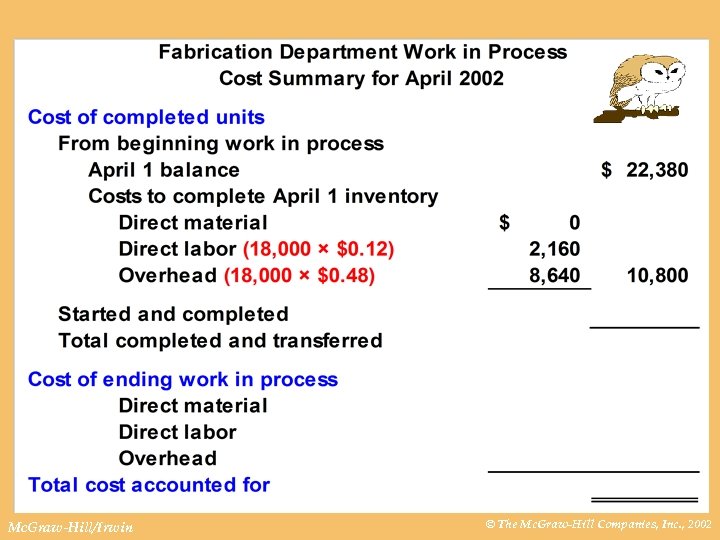

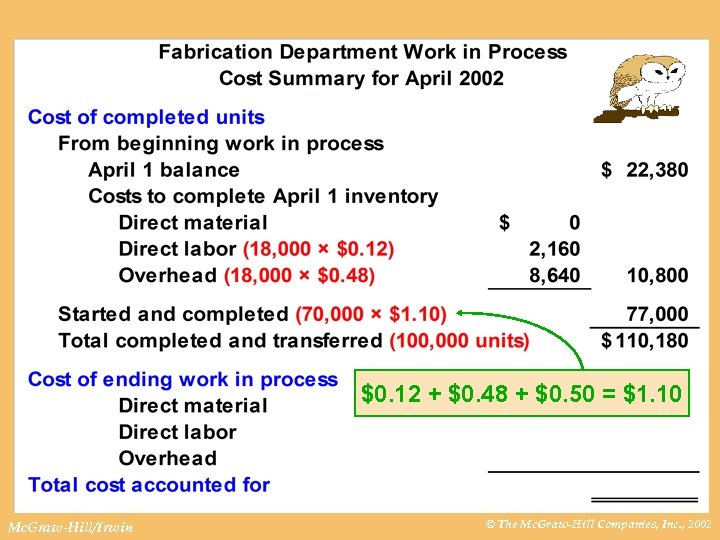

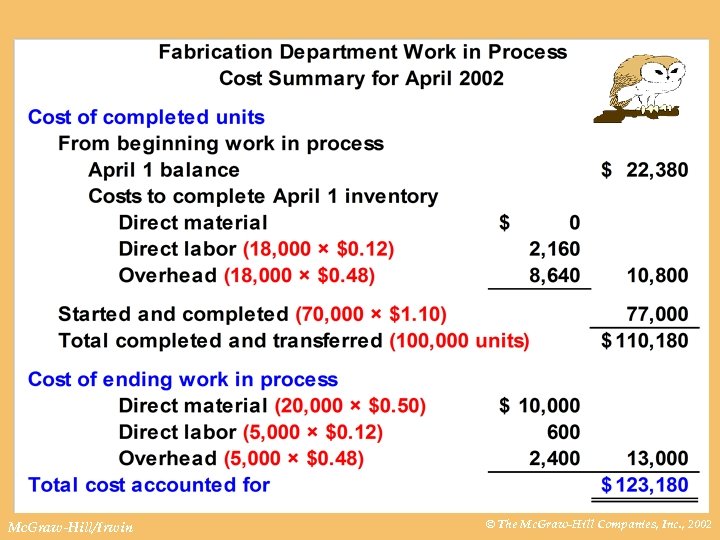

Cost Reconciliation We will account for all costs incurred by assigning unit costs to the: A. 100, 000 units completed and transferred. B. 20, 000 units remaining in ending work in process inventory. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Cost Reconciliation We will account for all costs incurred by assigning unit costs to the: A. 100, 000 units completed and transferred. B. 20, 000 units remaining in ending work in process inventory. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

$0. 12 + $0. 48 + $0. 50 = $1. 10 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

$0. 12 + $0. 48 + $0. 50 = $1. 10 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) A B C Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) A B C Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) One of the most difficult tasks in computing accurate unit costs lies in determining the proper amount of overhead cost to assign to each job. Mc. Graw-Hill/Irwin Assigning overhead is difficult. I agree! © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) One of the most difficult tasks in computing accurate unit costs lies in determining the proper amount of overhead cost to assign to each job. Mc. Graw-Hill/Irwin Assigning overhead is difficult. I agree! © The Mc. Graw-Hill Companies, Inc. , 2002

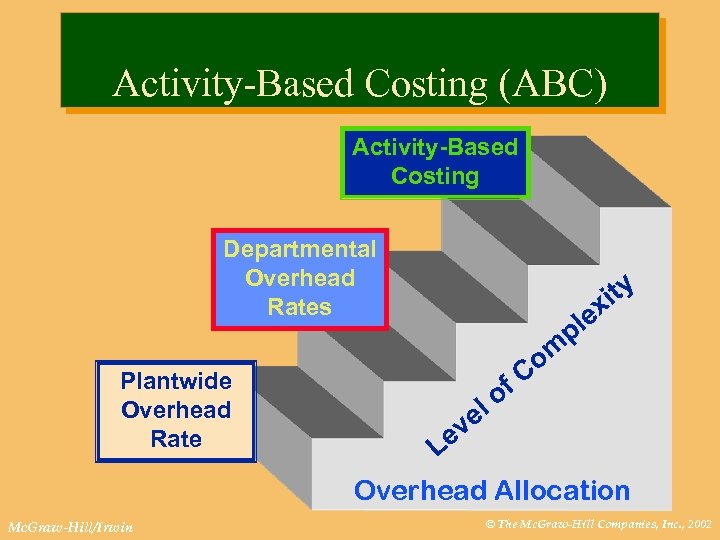

Activity-Based Costing (ABC) Activity-Based Costing Departmental Overhead Rates Plantwide Overhead Rate Mc. Graw-Hill/Irwin ity ex pl om el v f. C o Le Overhead Allocation © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) Activity-Based Costing Departmental Overhead Rates Plantwide Overhead Rate Mc. Graw-Hill/Irwin ity ex pl om el v f. C o Le Overhead Allocation © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) A B C Mc. Graw-Hill/Irwin In the ABC method, we recognize that many activities within a department drive overhead costs. © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) A B C Mc. Graw-Hill/Irwin In the ABC method, we recognize that many activities within a department drive overhead costs. © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) Identify activities and assign indirect costs to those activities. Central idea. . . l Products require activities. l Activities consume resources. Mc. Graw-Hill/Irwin A B C © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing (ABC) Identify activities and assign indirect costs to those activities. Central idea. . . l Products require activities. l Activities consume resources. Mc. Graw-Hill/Irwin A B C © The Mc. Graw-Hill Companies, Inc. , 2002

The Benefits of ABC More detailed measures of costs. l Better understanding of activities. l More accurate product costs for. . . l Pricing decisions. v Product elimination decisions. v Managing activities that cause costs. v l Benefits should always be compared to costs of implementation. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

The Benefits of ABC More detailed measures of costs. l Better understanding of activities. l More accurate product costs for. . . l Pricing decisions. v Product elimination decisions. v Managing activities that cause costs. v l Benefits should always be compared to costs of implementation. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Identifying Cost Drivers Most cost drivers are related to either volume or complexity of production. v Examples: machine time, machine setups, purchase orders, production orders. Three factors are considered in choosing a cost driver: v Causal relationship. v Benefits received. v Reasonableness. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Identifying Cost Drivers Most cost drivers are related to either volume or complexity of production. v Examples: machine time, machine setups, purchase orders, production orders. Three factors are considered in choosing a cost driver: v Causal relationship. v Benefits received. v Reasonableness. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

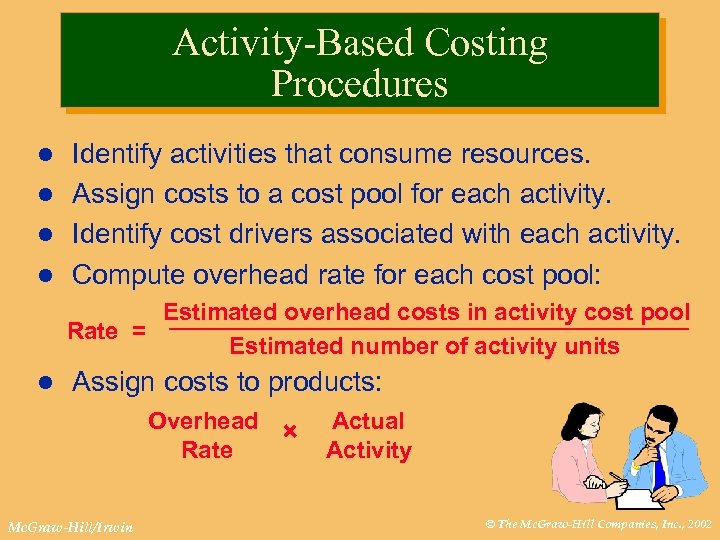

Activity-Based Costing Procedures Identify activities that consume resources. l Assign costs to a cost pool for each activity. l Identify cost drivers associated with each activity. l Compute overhead rate for each cost pool: l Estimated overhead costs in activity cost pool Rate = Estimated number of activity units l Assign costs to products: Overhead × Rate Mc. Graw-Hill/Irwin Actual Activity © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Procedures Identify activities that consume resources. l Assign costs to a cost pool for each activity. l Identify cost drivers associated with each activity. l Compute overhead rate for each cost pool: l Estimated overhead costs in activity cost pool Rate = Estimated number of activity units l Assign costs to products: Overhead × Rate Mc. Graw-Hill/Irwin Actual Activity © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Let’s look at an example comparing traditional costing with ABC. We will start with traditional costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Let’s look at an example comparing traditional costing with ABC. We will start with traditional costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

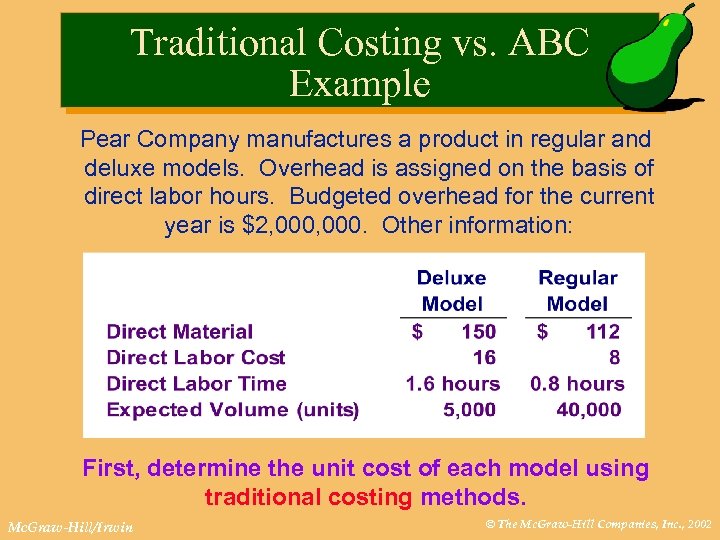

Traditional Costing vs. ABC Example Pear Company manufactures a product in regular and deluxe models. Overhead is assigned on the basis of direct labor hours. Budgeted overhead for the current year is $2, 000. Other information: First, determine the unit cost of each model using traditional costing methods. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Traditional Costing vs. ABC Example Pear Company manufactures a product in regular and deluxe models. Overhead is assigned on the basis of direct labor hours. Budgeted overhead for the current year is $2, 000. Other information: First, determine the unit cost of each model using traditional costing methods. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

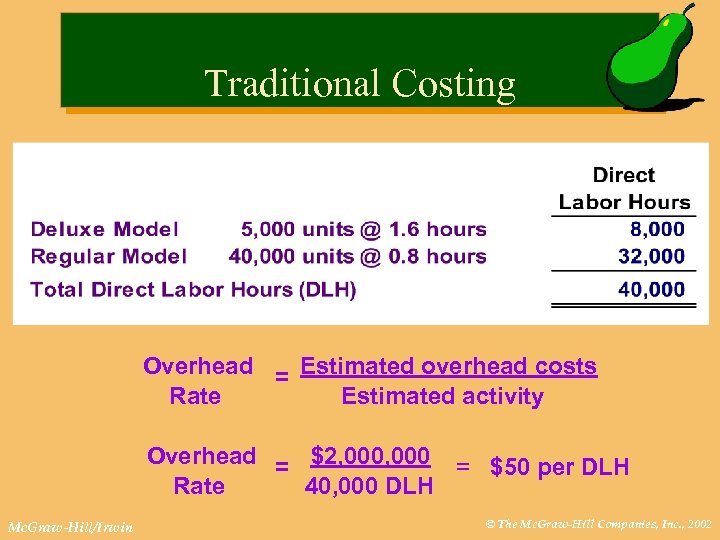

Traditional Costing Overhead = Estimated overhead costs Rate Estimated activity Overhead = $2, 000 = $50 per DLH Rate 40, 000 DLH Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Traditional Costing Overhead = Estimated overhead costs Rate Estimated activity Overhead = $2, 000 = $50 per DLH Rate 40, 000 DLH Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

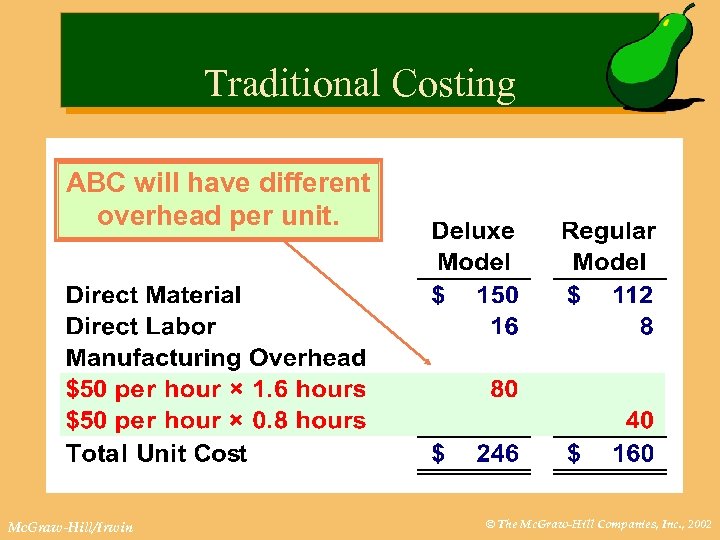

Traditional Costing ABC will have different overhead per unit. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Traditional Costing ABC will have different overhead per unit. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

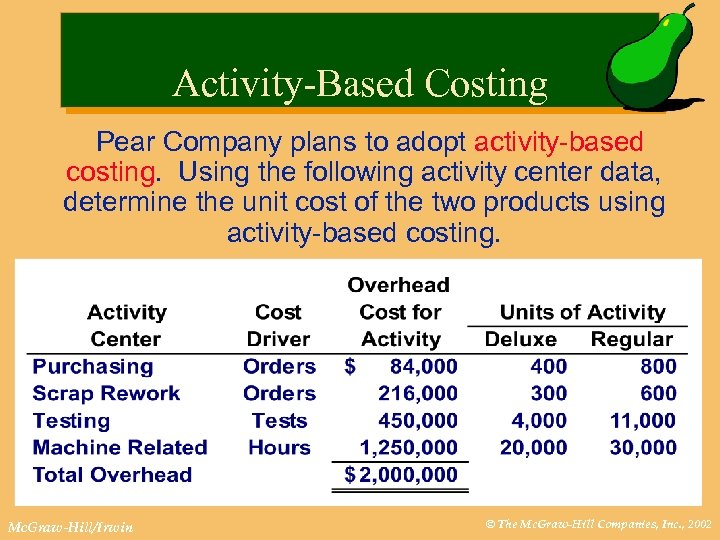

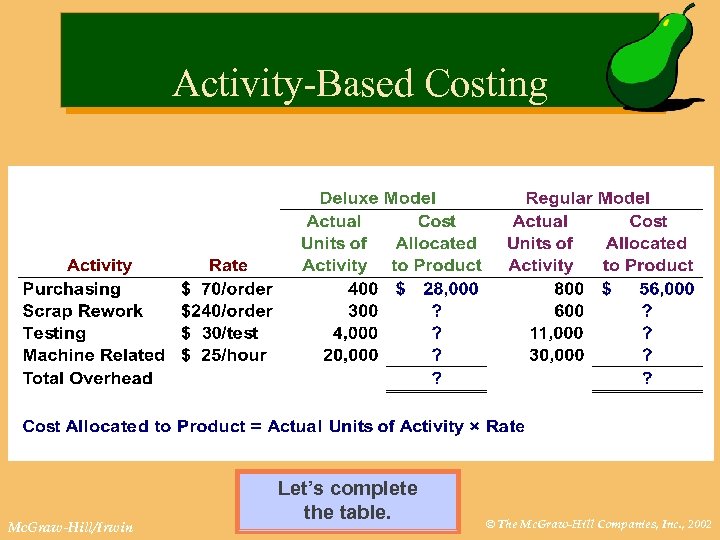

Activity-Based Costing Pear Company plans to adopt activity-based costing. Using the following activity center data, determine the unit cost of the two products using activity-based costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Pear Company plans to adopt activity-based costing. Using the following activity center data, determine the unit cost of the two products using activity-based costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

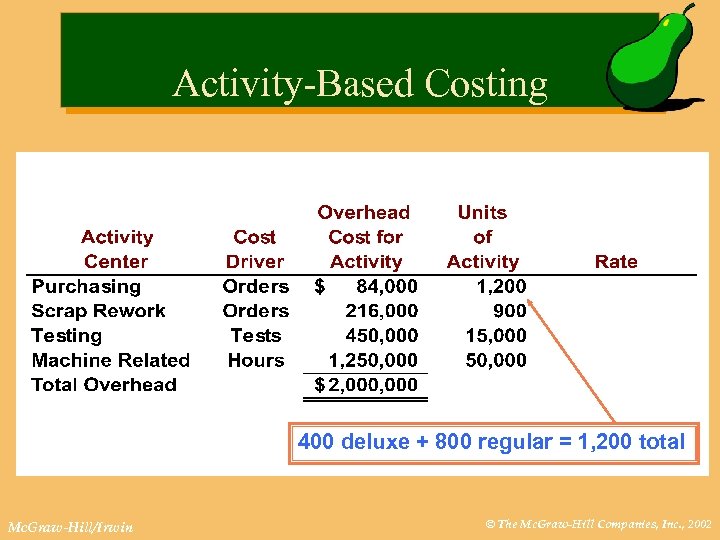

Activity-Based Costing 400 deluxe + 800 regular = 1, 200 total Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing 400 deluxe + 800 regular = 1, 200 total Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

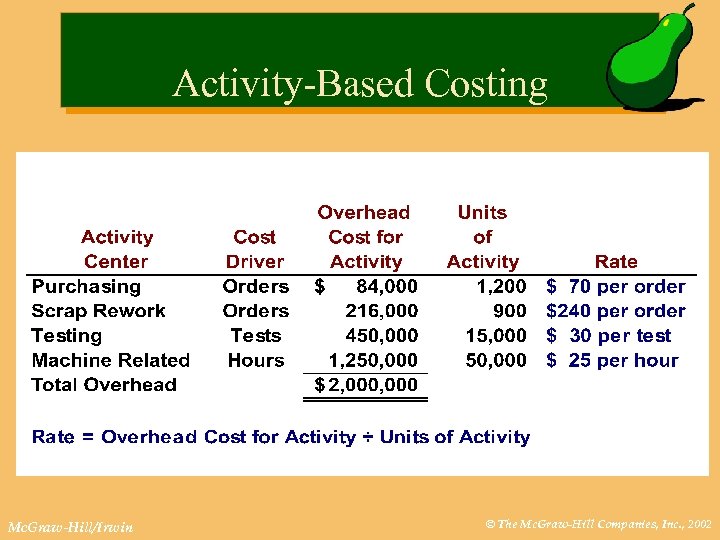

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

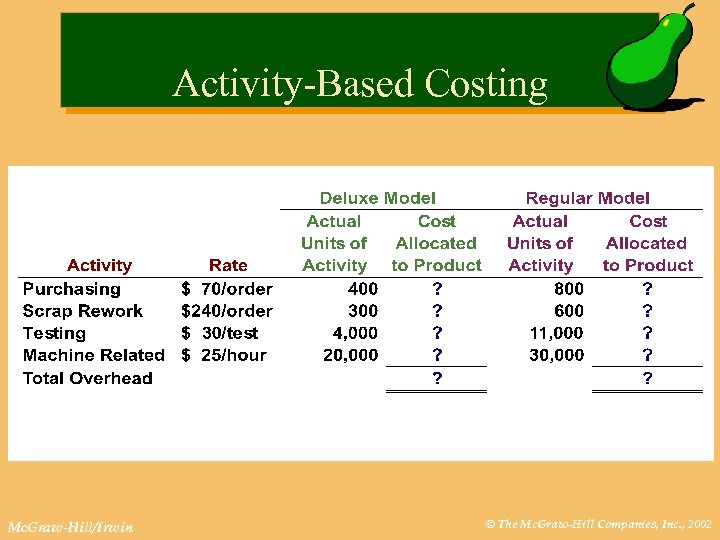

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin Let’s complete the table. © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin Let’s complete the table. © The Mc. Graw-Hill Companies, Inc. , 2002

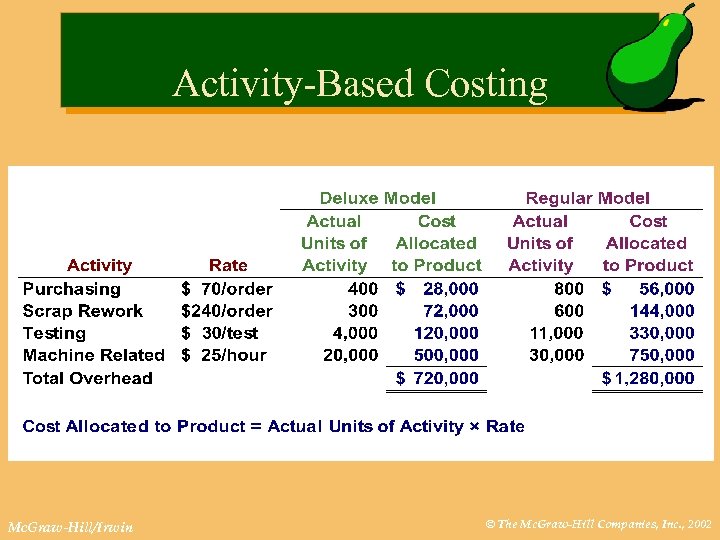

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

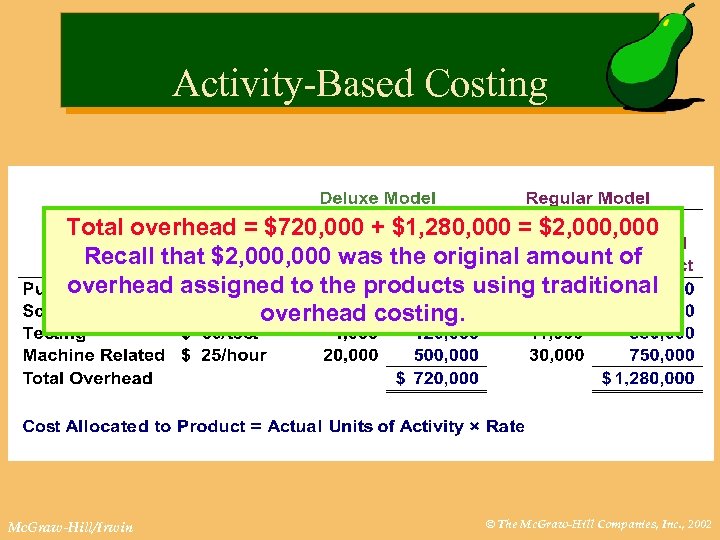

Activity-Based Costing Total overhead = $720, 000 + $1, 280, 000 = $2, 000 Recall that $2, 000 was the original amount of overhead assigned to the products using traditional overhead costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Total overhead = $720, 000 + $1, 280, 000 = $2, 000 Recall that $2, 000 was the original amount of overhead assigned to the products using traditional overhead costing. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

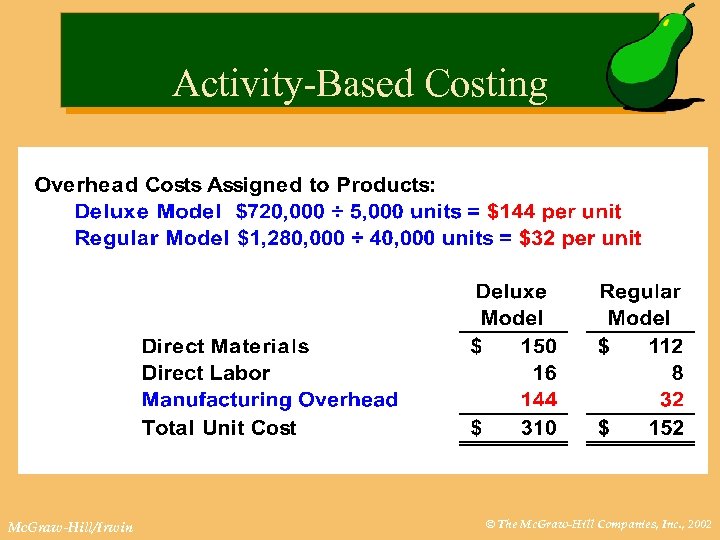

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

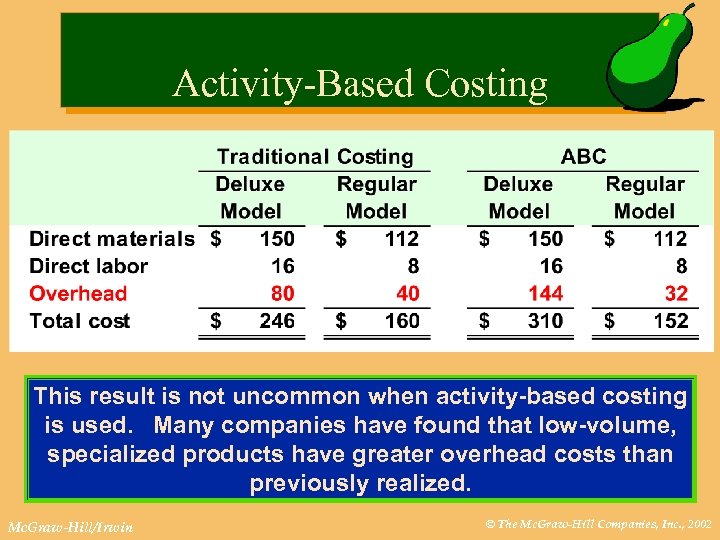

Activity-Based Costing This result is not uncommon when activity-based costing is used. Many companies have found that low-volume, specialized products have greater overhead costs than previously realized. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Activity-Based Costing This result is not uncommon when activity-based costing is used. Many companies have found that low-volume, specialized products have greater overhead costs than previously realized. Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

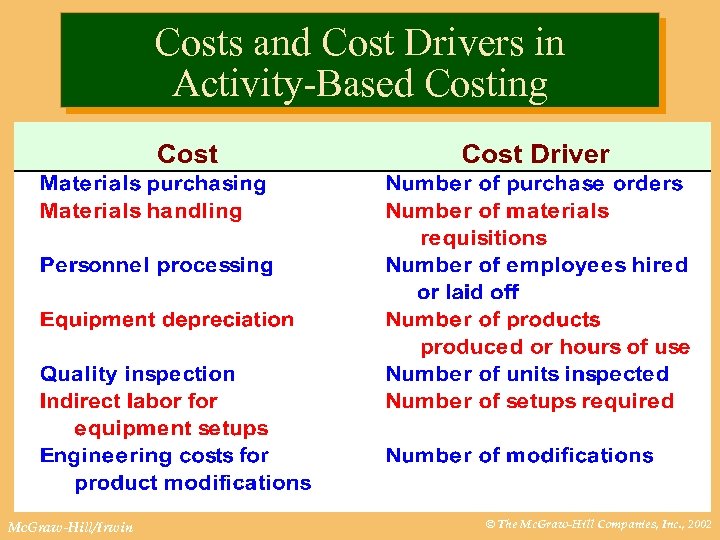

Costs and Cost Drivers in Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

Costs and Cost Drivers in Activity-Based Costing Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

End of Chapter 17 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002

End of Chapter 17 Mc. Graw-Hill/Irwin © The Mc. Graw-Hill Companies, Inc. , 2002