97699055f1acafc7e0b8b3f7ea2bf99c.ppt

- Количество слайдов: 26

Chapter 17 International Portfolio Theory and Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. Copyright © 2010 Pearson Hall. All rights reserved.

Chapter 17 International Portfolio Theory and Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. Copyright © 2010 Pearson Hall. All rights reserved.

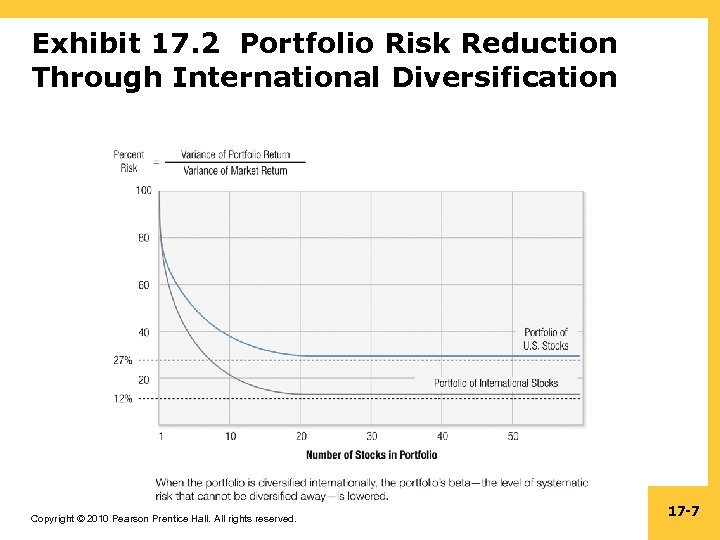

17. 1 International Diversification and Risk • international diversification of portfolios, ====risk reduction of holding international securities. • As an investor increases the number of securities in a portfolio, the portfolio’s risk declines rapidly at first, then asymptotically approaches the level of systematic risk of the market. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -2

17. 1 International Diversification and Risk • international diversification of portfolios, ====risk reduction of holding international securities. • As an investor increases the number of securities in a portfolio, the portfolio’s risk declines rapidly at first, then asymptotically approaches the level of systematic risk of the market. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -2

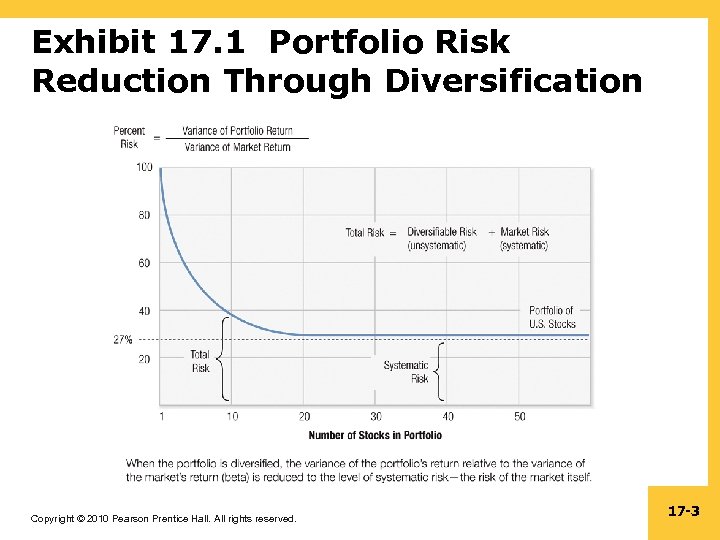

Exhibit 17. 1 Portfolio Risk Reduction Through Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -3

Exhibit 17. 1 Portfolio Risk Reduction Through Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -3

Portfolio Risk Reduction (P. 432) • The total risk of any portfolio is therefore composed of systematic risk (the market) and unsystematic risk (the individual securities). • Increasing the number of securities in the portfolio reduces the unsystematic risk component leaving the systematic risk component unchanged. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -4

Portfolio Risk Reduction (P. 432) • The total risk of any portfolio is therefore composed of systematic risk (the market) and unsystematic risk (the individual securities). • Increasing the number of securities in the portfolio reduces the unsystematic risk component leaving the systematic risk component unchanged. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -4

Foreign Exchange Risk (P. 433) • The second component of the case for international diversification addresses foreign exchange risk. • Purchasing assets in foreign markets, in foreign currencies may alter the correlations associated with securities in different countries (and currencies). • The risk associated with international diversification, when it includes currency risk, is very complicated when compared to domestic investments. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -5

Foreign Exchange Risk (P. 433) • The second component of the case for international diversification addresses foreign exchange risk. • Purchasing assets in foreign markets, in foreign currencies may alter the correlations associated with securities in different countries (and currencies). • The risk associated with international diversification, when it includes currency risk, is very complicated when compared to domestic investments. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -5

International Diversification and Risk • International diversification benefits induce investors to demand foreign securities (the so called buy-side). • If the addition of a foreign security to the portfolio of the investor aids in the reduction of risk for a given level of return, or if it increases the expected return for a given level of risk, then the security adds value to the portfolio. • A security that adds value will be demanded by investors, bidding up the price of that security, resulting in a lower cost of capital for the issuing firm. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -6

International Diversification and Risk • International diversification benefits induce investors to demand foreign securities (the so called buy-side). • If the addition of a foreign security to the portfolio of the investor aids in the reduction of risk for a given level of return, or if it increases the expected return for a given level of risk, then the security adds value to the portfolio. • A security that adds value will be demanded by investors, bidding up the price of that security, resulting in a lower cost of capital for the issuing firm. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -6

Exhibit 17. 2 Portfolio Risk Reduction Through International Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -7

Exhibit 17. 2 Portfolio Risk Reduction Through International Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -7

17. 2 Internationalizing the Domestic Portfolio • Classic portfolio theory assumes a typical investor is risk-averse. • This means an investor is willing to accept some risk but is not willing to bear unnecessary risk. • The typical investor is therefore in search of a portfolio that maximizes expected portfolio return per unit of expected portfolio risk. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -8

17. 2 Internationalizing the Domestic Portfolio • Classic portfolio theory assumes a typical investor is risk-averse. • This means an investor is willing to accept some risk but is not willing to bear unnecessary risk. • The typical investor is therefore in search of a portfolio that maximizes expected portfolio return per unit of expected portfolio risk. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -8

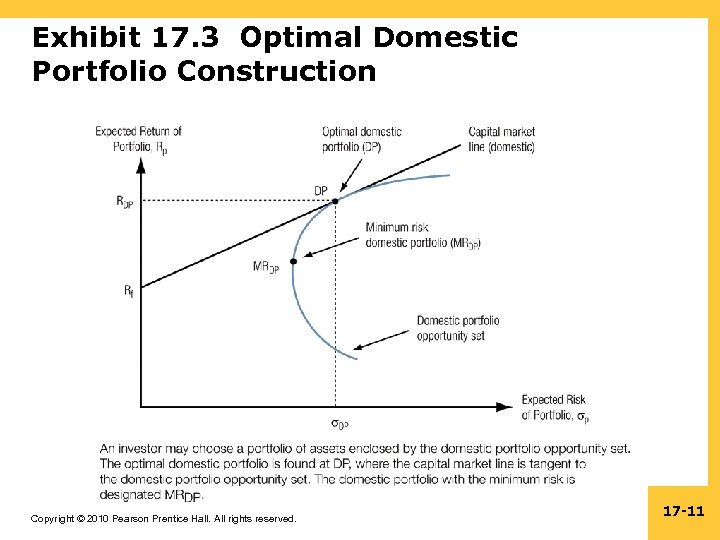

The Optimal Domestic Portfolio(P. 435) • The domestic investor may choose among a set of individual securities in the domestic market. • The near-infinite set of portfolio combinations of domestic securities form the domestic portfolio opportunity set (next exhibit). • The set of portfolios along the extreme left edge of the set is termed the efficient frontier. • This efficient frontier represents the optimal portfolios of securities that possess the minimum expected risk for each level of expected portfolio return. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -9

The Optimal Domestic Portfolio(P. 435) • The domestic investor may choose among a set of individual securities in the domestic market. • The near-infinite set of portfolio combinations of domestic securities form the domestic portfolio opportunity set (next exhibit). • The set of portfolios along the extreme left edge of the set is termed the efficient frontier. • This efficient frontier represents the optimal portfolios of securities that possess the minimum expected risk for each level of expected portfolio return. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -9

Internationalizing the Domestic Portfolio • The portfolio with the minimum risk along all those possible is the minimum risk domestic portfolio (MRDP). • The individual investor will search out the optimal domestic portfolio (DP), which combines the risk-free asset and a portfolio of domestic securities found on the efficient frontier. • He or she begins with the risk-free asset (Rf) and moves out along the security market line until reaching portfolio DP. • This portfolio is defined as the optimal domestic portfolio because it moves out into risky space at the steepest slope. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -10

Internationalizing the Domestic Portfolio • The portfolio with the minimum risk along all those possible is the minimum risk domestic portfolio (MRDP). • The individual investor will search out the optimal domestic portfolio (DP), which combines the risk-free asset and a portfolio of domestic securities found on the efficient frontier. • He or she begins with the risk-free asset (Rf) and moves out along the security market line until reaching portfolio DP. • This portfolio is defined as the optimal domestic portfolio because it moves out into risky space at the steepest slope. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -10

Exhibit 17. 3 Optimal Domestic Portfolio Construction Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -11

Exhibit 17. 3 Optimal Domestic Portfolio Construction Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -11

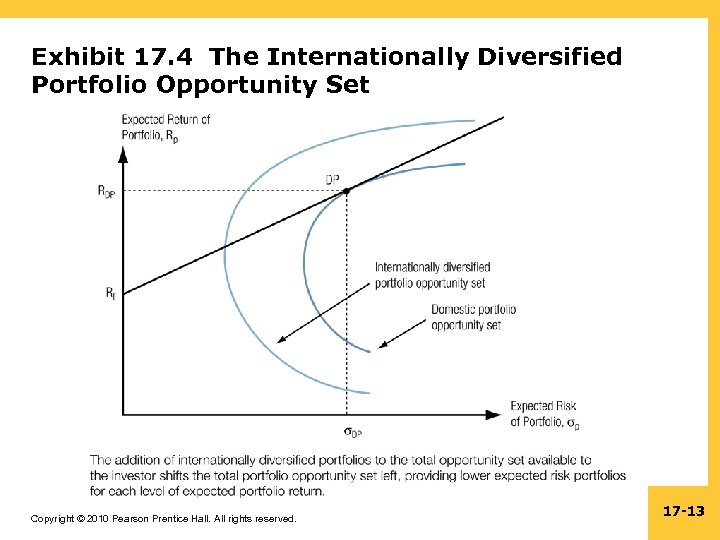

International Diversification (P. 436) • The internationally diversified portfolio opportunity set shifts leftward of the purely domestic opportunity set. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -12

International Diversification (P. 436) • The internationally diversified portfolio opportunity set shifts leftward of the purely domestic opportunity set. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -12

Exhibit 17. 4 The Internationally Diversified Portfolio Opportunity Set Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -13

Exhibit 17. 4 The Internationally Diversified Portfolio Opportunity Set Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -13

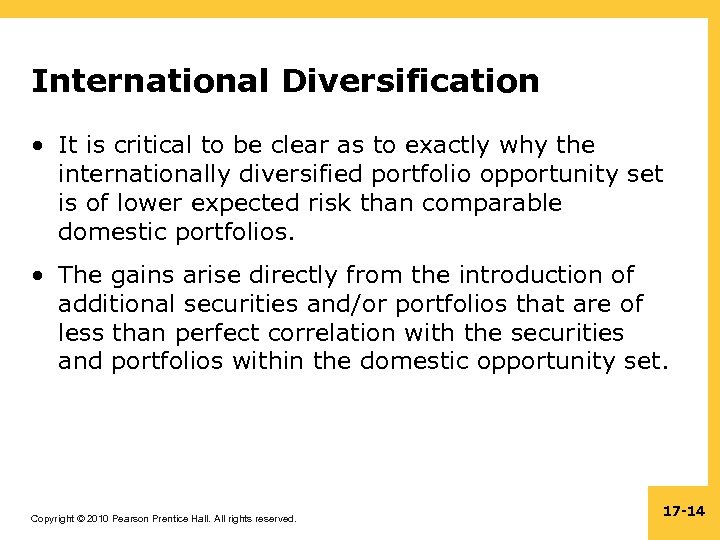

International Diversification • It is critical to be clear as to exactly why the internationally diversified portfolio opportunity set is of lower expected risk than comparable domestic portfolios. • The gains arise directly from the introduction of additional securities and/or portfolios that are of less than perfect correlation with the securities and portfolios within the domestic opportunity set. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -14

International Diversification • It is critical to be clear as to exactly why the internationally diversified portfolio opportunity set is of lower expected risk than comparable domestic portfolios. • The gains arise directly from the introduction of additional securities and/or portfolios that are of less than perfect correlation with the securities and portfolios within the domestic opportunity set. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -14

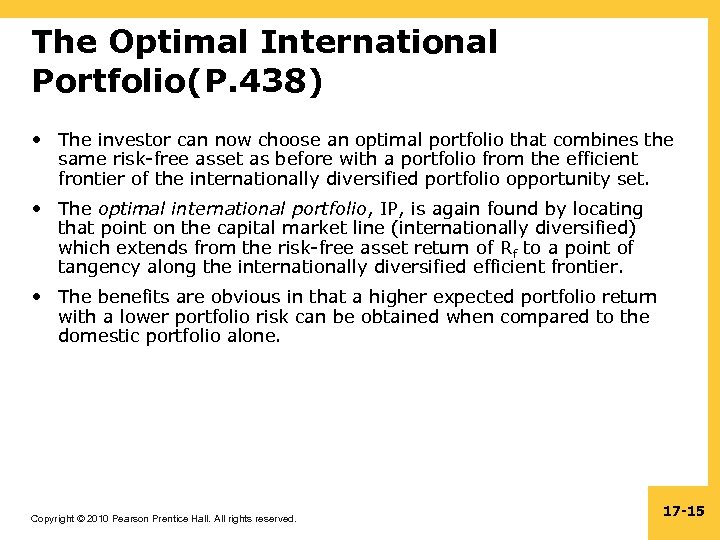

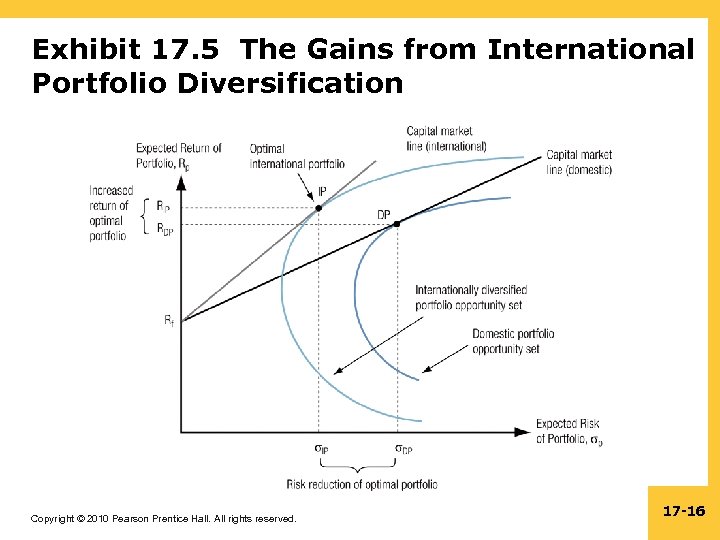

The Optimal International Portfolio(P. 438) • The investor can now choose an optimal portfolio that combines the same risk-free asset as before with a portfolio from the efficient frontier of the internationally diversified portfolio opportunity set. • The optimal international portfolio, IP, is again found by locating that point on the capital market line (internationally diversified) which extends from the risk-free asset return of R f to a point of tangency along the internationally diversified efficient frontier. • The benefits are obvious in that a higher expected portfolio return with a lower portfolio risk can be obtained when compared to the domestic portfolio alone. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -15

The Optimal International Portfolio(P. 438) • The investor can now choose an optimal portfolio that combines the same risk-free asset as before with a portfolio from the efficient frontier of the internationally diversified portfolio opportunity set. • The optimal international portfolio, IP, is again found by locating that point on the capital market line (internationally diversified) which extends from the risk-free asset return of R f to a point of tangency along the internationally diversified efficient frontier. • The benefits are obvious in that a higher expected portfolio return with a lower portfolio risk can be obtained when compared to the domestic portfolio alone. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -15

Exhibit 17. 5 The Gains from International Portfolio Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -16

Exhibit 17. 5 The Gains from International Portfolio Diversification Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -16

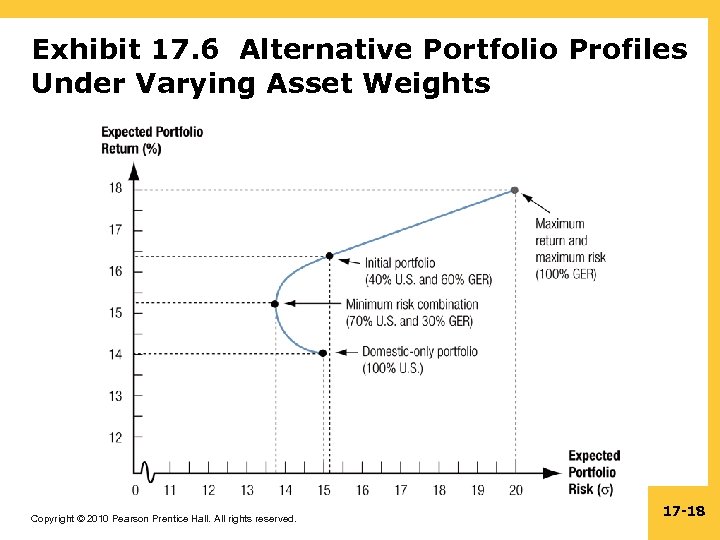

Altering the Weights(P. 440) • An investor can reduce investment risk by holding risky assets in a portfolio. • As long as the asset returns are not perfectly positively correlated, the investor can reduce risk, because some of the fluctuations of the asset returns will offset each other. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -17

Altering the Weights(P. 440) • An investor can reduce investment risk by holding risky assets in a portfolio. • As long as the asset returns are not perfectly positively correlated, the investor can reduce risk, because some of the fluctuations of the asset returns will offset each other. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -17

Exhibit 17. 6 Alternative Portfolio Profiles Under Varying Asset Weights Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -18

Exhibit 17. 6 Alternative Portfolio Profiles Under Varying Asset Weights Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -18

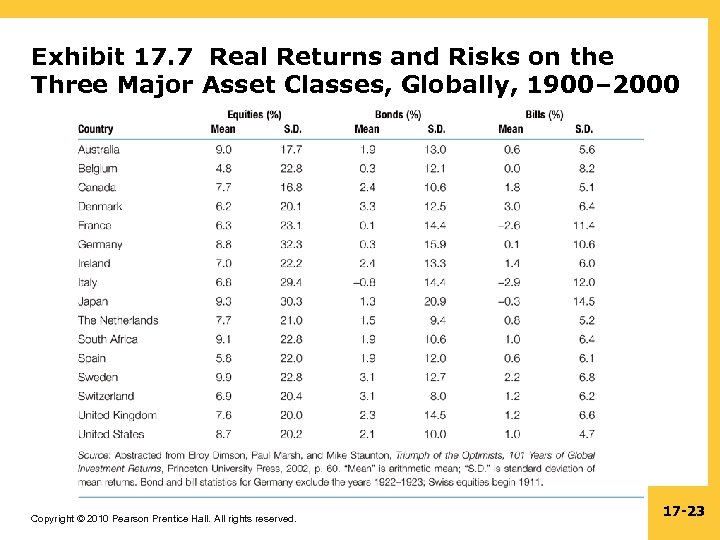

17. 3 National Markets and Asset Performance • For the 100 year period ending in 2000, the risk of investing in equity assets has been rewarded with substantial returns. • The true benefits of global diversification=== the returns of different stock markets around the world are not perfectly positively correlated. • This is because the are different industrial structures in different countries, and because different economies do not exactly follow the same business cycle. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -19

17. 3 National Markets and Asset Performance • For the 100 year period ending in 2000, the risk of investing in equity assets has been rewarded with substantial returns. • The true benefits of global diversification=== the returns of different stock markets around the world are not perfectly positively correlated. • This is because the are different industrial structures in different countries, and because different economies do not exactly follow the same business cycle. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -19

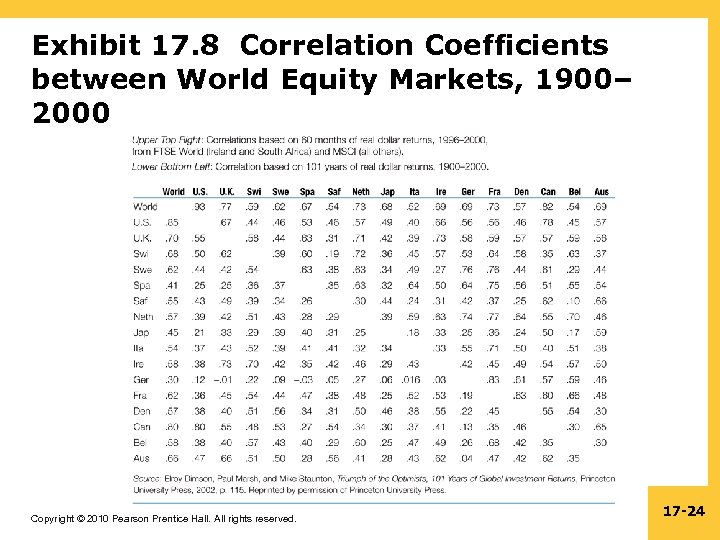

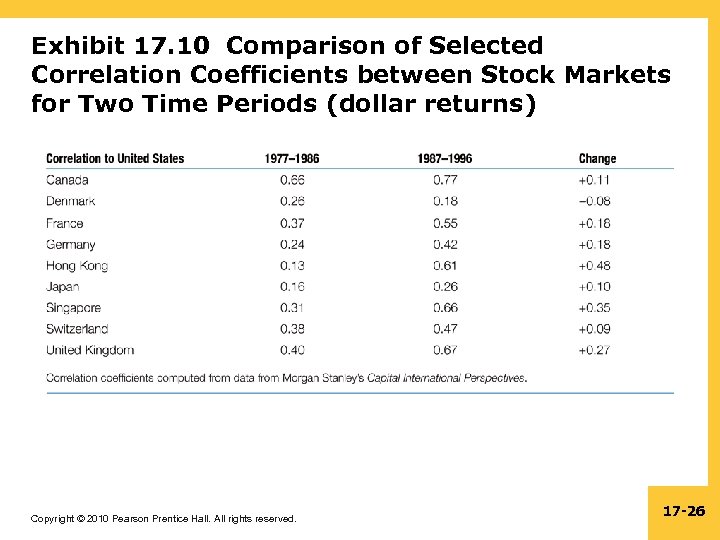

National Markets and Asset Performance • Interestingly, markets that are contiguous or nearcontiguous (geographically) seemingly demonstrate the higher correlation coefficients for the past century. • It is often said that as capital markets around the world become more and more integrated over time, the benefits of diversification will be reduced. • Analysis of market data supports this Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -20

National Markets and Asset Performance • Interestingly, markets that are contiguous or nearcontiguous (geographically) seemingly demonstrate the higher correlation coefficients for the past century. • It is often said that as capital markets around the world become more and more integrated over time, the benefits of diversification will be reduced. • Analysis of market data supports this Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -20

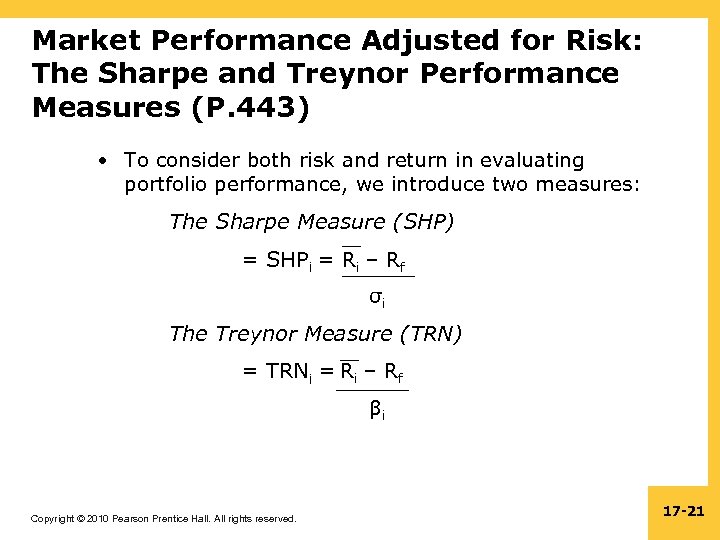

Market Performance Adjusted for Risk: The Sharpe and Treynor Performance Measures (P. 443) • To consider both risk and return in evaluating portfolio performance, we introduce two measures: The Sharpe Measure (SHP) = SHPi = Ri – Rf σi The Treynor Measure (TRN) = TRNi = Ri – Rf βi Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -21

Market Performance Adjusted for Risk: The Sharpe and Treynor Performance Measures (P. 443) • To consider both risk and return in evaluating portfolio performance, we introduce two measures: The Sharpe Measure (SHP) = SHPi = Ri – Rf σi The Treynor Measure (TRN) = TRNi = Ri – Rf βi Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -21

the Sharpe and Treynor measures • Though the equations of look similar, the difference between them is important. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -22

the Sharpe and Treynor measures • Though the equations of look similar, the difference between them is important. Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -22

Exhibit 17. 7 Real Returns and Risks on the Three Major Asset Classes, Globally, 1900– 2000 Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -23

Exhibit 17. 7 Real Returns and Risks on the Three Major Asset Classes, Globally, 1900– 2000 Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -23

Exhibit 17. 8 Correlation Coefficients between World Equity Markets, 1900– 2000 Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -24

Exhibit 17. 8 Correlation Coefficients between World Equity Markets, 1900– 2000 Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -24

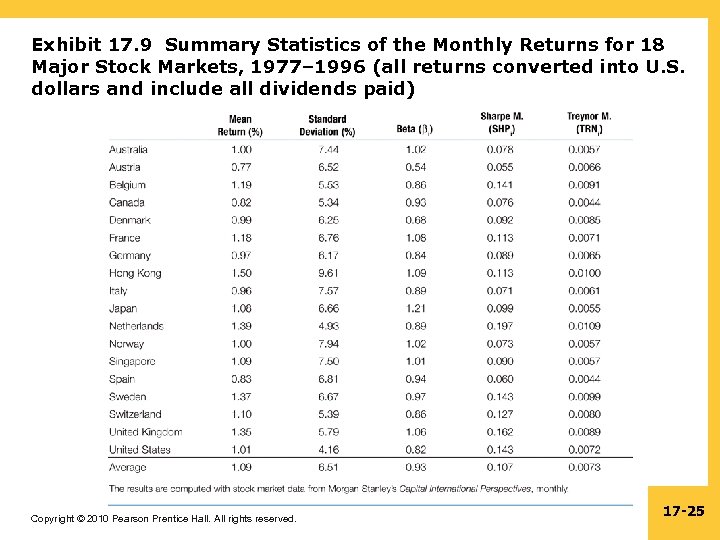

Exhibit 17. 9 Summary Statistics of the Monthly Returns for 18 Major Stock Markets, 1977– 1996 (all returns converted into U. S. dollars and include all dividends paid) Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -25

Exhibit 17. 9 Summary Statistics of the Monthly Returns for 18 Major Stock Markets, 1977– 1996 (all returns converted into U. S. dollars and include all dividends paid) Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -25

Exhibit 17. 10 Comparison of Selected Correlation Coefficients between Stock Markets for Two Time Periods (dollar returns) Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -26

Exhibit 17. 10 Comparison of Selected Correlation Coefficients between Stock Markets for Two Time Periods (dollar returns) Copyright © 2010 Pearson Prentice Hall. All rights reserved. 17 -26