51a0fe9c5595d9a4039e9ad0bbeccde7.ppt

- Количество слайдов: 49

Chapter 17 Foreign Exchange: Risk Identification and Management Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 1

Chapter 17 Foreign Exchange: Risk Identification and Management Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 1

Learning Objectives • Identify the different types of foreign exchange (FX) risk faced by firms • Formulate an FX policy document • Outline methods to identify a company’s FX exposures and assess their risks • Describe the implementation of market-based hedging techniques • Explain non-market based techniques for managing FX risk Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 2

Learning Objectives • Identify the different types of foreign exchange (FX) risk faced by firms • Formulate an FX policy document • Outline methods to identify a company’s FX exposures and assess their risks • Describe the implementation of market-based hedging techniques • Explain non-market based techniques for managing FX risk Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 2

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 3

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 3

17. 1 FX Risk Policy Formation • Foreign exchange risk exposures can be classified in terms of the impact on a firm’s cash flows, balance sheet, competitive position and value – – Transaction exposure Translation or accounting exposure Operational exposure Economic exposure Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 4

17. 1 FX Risk Policy Formation • Foreign exchange risk exposures can be classified in terms of the impact on a firm’s cash flows, balance sheet, competitive position and value – – Transaction exposure Translation or accounting exposure Operational exposure Economic exposure Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 4

17. 1 FX Risk Policy Formation (cont. ) • Transaction exposure – The risk that future foreign currency denominated cash flows will vary due to exchange rate movements § e. g. a contract to import goods from the US denominated in USD Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 5

17. 1 FX Risk Policy Formation (cont. ) • Transaction exposure – The risk that future foreign currency denominated cash flows will vary due to exchange rate movements § e. g. a contract to import goods from the US denominated in USD Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 5

17. 1 FX Risk Policy Formation (cont. ) • Translation or accounting exposure – The risk that conversion and consolidation of foreign currency assets or liabilities will adversely impact the balance sheet § e. g. a firm accumulates assets and liabilities overseas and at a future date translates their value onto its consolidated balance sheet Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 6

17. 1 FX Risk Policy Formation (cont. ) • Translation or accounting exposure – The risk that conversion and consolidation of foreign currency assets or liabilities will adversely impact the balance sheet § e. g. a firm accumulates assets and liabilities overseas and at a future date translates their value onto its consolidated balance sheet Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 6

17. 1 FX Risk Policy Formation (cont. ) • Operational exposure – The risk that day-to-day operating revenues and expenses will be affected by FX movements § E. g. foreign subsidiary operating expenses paid in the currency of the foreign country but sourced in another country such as the parent company Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 7

17. 1 FX Risk Policy Formation (cont. ) • Operational exposure – The risk that day-to-day operating revenues and expenses will be affected by FX movements § E. g. foreign subsidiary operating expenses paid in the currency of the foreign country but sourced in another country such as the parent company Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 7

17. 1 FX Risk Policy Formation (cont. ) • Economic exposure – The effect of exchange rate movements on the ongoing business operations of a firm (i. e. the net present value of its future cash flows) § It includes both transaction exposures and operating FX exposures and extends further to recognise the impact of FX risk on the value of a firm Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 8

17. 1 FX Risk Policy Formation (cont. ) • Economic exposure – The effect of exchange rate movements on the ongoing business operations of a firm (i. e. the net present value of its future cash flows) § It includes both transaction exposures and operating FX exposures and extends further to recognise the impact of FX risk on the value of a firm Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 8

17. 1 FX Risk Policy Formation (cont. ) • A company’s board of directors should document and circulate specific policies on FX risk management (i. e. policy document) including – – – – FX objectives Management structure Authorisations Exposure reporting systems Communications Performance evaluation Audit and review procedures Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 9

17. 1 FX Risk Policy Formation (cont. ) • A company’s board of directors should document and circulate specific policies on FX risk management (i. e. policy document) including – – – – FX objectives Management structure Authorisations Exposure reporting systems Communications Performance evaluation Audit and review procedures Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 9

17. 1 FX Risk Policy Formation (cont. ) • FX objectives – Consideration of what the company intends to achieve and how it will achieve it by specifying § The products and services that can be used to manage FX risk exposures, e. g. forward exchange contracts and currency swaps § The style of risk management • Active—hedging techniques continually adjusted in response to forecast changes in the exchange rate • Defensive—a defined percentage of identified risk exposure is automatically hedged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 10

17. 1 FX Risk Policy Formation (cont. ) • FX objectives – Consideration of what the company intends to achieve and how it will achieve it by specifying § The products and services that can be used to manage FX risk exposures, e. g. forward exchange contracts and currency swaps § The style of risk management • Active—hedging techniques continually adjusted in response to forecast changes in the exchange rate • Defensive—a defined percentage of identified risk exposure is automatically hedged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 10

17. 1 FX Risk Policy Formation (cont. ) • Management structure – Ensure appropriate organisational controls and reporting systems, skilled personnel and sufficient funding are in place § E. g. a company with a treasury division requires an FX dealing room, back office support, technical support and administration § The FX operation of a company may be • Centralised—a single FX function in one location from which all policy is developed and transactions occur • Decentralised—policy and trading is divested to each regional office Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 11

17. 1 FX Risk Policy Formation (cont. ) • Management structure – Ensure appropriate organisational controls and reporting systems, skilled personnel and sufficient funding are in place § E. g. a company with a treasury division requires an FX dealing room, back office support, technical support and administration § The FX operation of a company may be • Centralised—a single FX function in one location from which all policy is developed and transactions occur • Decentralised—policy and trading is divested to each regional office Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 11

17. 1 FX Risk Policy Formation (cont. ) • Authorisations – A description of who, in the organisation, has the authority to do what, ensuring task segregation – Limits can relate to § § § Single transactions Exposure to a particular client Each currency FX products used by the organisation Each individual FX dealer Maximum overnight exposures Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 12

17. 1 FX Risk Policy Formation (cont. ) • Authorisations – A description of who, in the organisation, has the authority to do what, ensuring task segregation – Limits can relate to § § § Single transactions Exposure to a particular client Each currency FX products used by the organisation Each individual FX dealer Maximum overnight exposures Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 12

17. 1 FX Risk Policy Formation (cont. ) • Exposure reporting systems – Determine which reports are required, how frequently they are required and who is responsible to act on them § e. g. exception reports—automatic computer-generated report when an FX authority is breached Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 13

17. 1 FX Risk Policy Formation (cont. ) • Exposure reporting systems – Determine which reports are required, how frequently they are required and who is responsible to act on them § e. g. exception reports—automatic computer-generated report when an FX authority is breached Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 13

17. 1 FX Risk Policy Formation (cont. ) • Communications – How communication should occur both horizontally and vertically within the treasury division and the overall organisation § e. g. Treasury must be advised of an import transaction so that it may arrange the payment of FX – Daily strategy meeting – Policy document should also outline communication system to apply in the event of a disaster, e. g. fire in the treasury and FX operations area Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 14

17. 1 FX Risk Policy Formation (cont. ) • Communications – How communication should occur both horizontally and vertically within the treasury division and the overall organisation § e. g. Treasury must be advised of an import transaction so that it may arrange the payment of FX – Daily strategy meeting – Policy document should also outline communication system to apply in the event of a disaster, e. g. fire in the treasury and FX operations area Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 14

17. 1 FX Risk Policy Formation (cont. ) • Performance evaluation – Evaluation of the performance of the FX operations, given the FX objectives § SMART—specific, measurable, achievable, realistic and timely • Audit and review procedures – A regular and structured process of carrying out internal and external audits of FX operations, including current objectives, policies and procedures, with appropriate lines of reporting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 15

17. 1 FX Risk Policy Formation (cont. ) • Performance evaluation – Evaluation of the performance of the FX operations, given the FX objectives § SMART—specific, measurable, achievable, realistic and timely • Audit and review procedures – A regular and structured process of carrying out internal and external audits of FX operations, including current objectives, policies and procedures, with appropriate lines of reporting Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 15

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 16

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 16

17. 2 Measuring Transaction Exposure • Transaction exposure – Is the risk faced by Australian firms that the AUD will change between the time an order is placed and the time of its payment – This risk is caused by the uncertainty as to the exact value of the transaction Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 17

17. 2 Measuring Transaction Exposure • Transaction exposure – Is the risk faced by Australian firms that the AUD will change between the time an order is placed and the time of its payment – This risk is caused by the uncertainty as to the exact value of the transaction Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 17

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure risk has two directional components – Downside exposure § Amount received (paid) in the future is less (more) than the current projected amount – Upside exposure § Amount received (paid) in the future is more (less) than the current projected amount Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 18

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure risk has two directional components – Downside exposure § Amount received (paid) in the future is less (more) than the current projected amount – Upside exposure § Amount received (paid) in the future is more (less) than the current projected amount Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 18

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure has two elements – Net cash flows § Collate all receivables and payables in each currency to determine net exposure – Risk associated with transaction exposure § Currency variability § Currency correlations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 19

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure has two elements – Net cash flows § Collate all receivables and payables in each currency to determine net exposure – Risk associated with transaction exposure § Currency variability § Currency correlations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 19

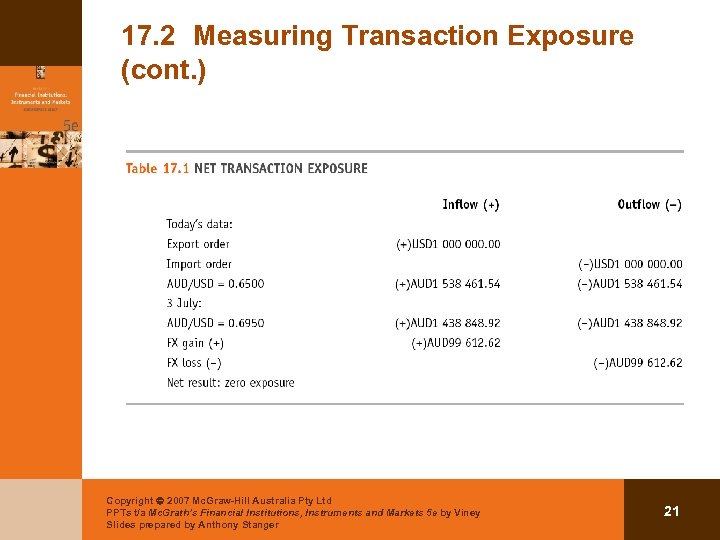

17. 2 Measuring Transaction Exposure (cont. ) • Net cash flows – Collate all receivables and payables in each foreign currency rather than considering each individual transaction – It is evident from Table 17. 1 that the § Company has a natural hedge • i. e. matching transactions have been used to offset a potential risk exposure § Net FX exposure is zero § Company had a perfect hedge because its receivables and payables were identical in size, currency and time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 20

17. 2 Measuring Transaction Exposure (cont. ) • Net cash flows – Collate all receivables and payables in each foreign currency rather than considering each individual transaction – It is evident from Table 17. 1 that the § Company has a natural hedge • i. e. matching transactions have been used to offset a potential risk exposure § Net FX exposure is zero § Company had a perfect hedge because its receivables and payables were identical in size, currency and time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 20

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 21

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 21

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposures: currency variability – Having determined the net FX exposure in each currency, the next step is to assess the extent of the risk (variability) of each exposure – Currency variability relates to the probability of the spot rate changing between contract date and payment date Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 22

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposures: currency variability – Having determined the net FX exposure in each currency, the next step is to assess the extent of the risk (variability) of each exposure – Currency variability relates to the probability of the spot rate changing between contract date and payment date Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 22

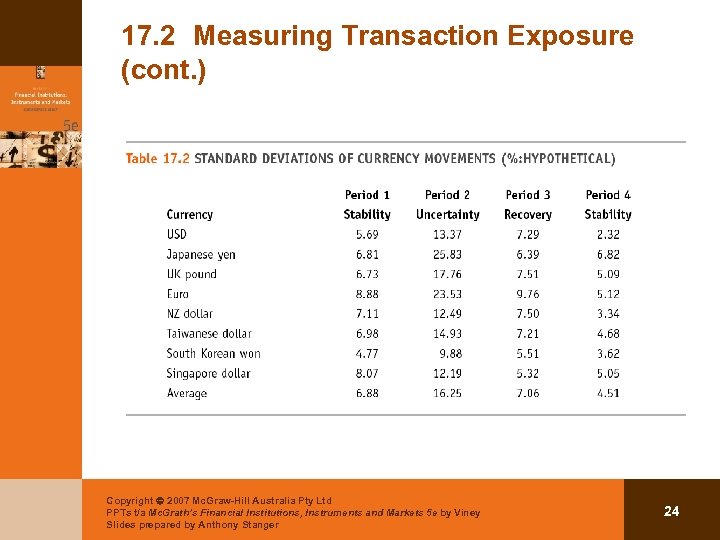

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposures: currency variability (cont. ) – Often measured by standard deviation – May need to examine trend in currency standard deviation over time as in Table 17. 2, which illustrates § Standard deviations vary between currencies in the same period § Standard deviations vary over time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 23

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposures: currency variability (cont. ) – Often measured by standard deviation – May need to examine trend in currency standard deviation over time as in Table 17. 2, which illustrates § Standard deviations vary between currencies in the same period § Standard deviations vary over time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 23

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 24

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 24

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations – In considering whether to hedge an FX exposure, the correlations between the currencies should also be considered – Correlation measures the degree to which two currencies move in relation to each other – Correlation ranges from + 1 (perfectly positively correlated) to – 1 (perfectly negatively correlated) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 25

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations – In considering whether to hedge an FX exposure, the correlations between the currencies should also be considered – Correlation measures the degree to which two currencies move in relation to each other – Correlation ranges from + 1 (perfectly positively correlated) to – 1 (perfectly negatively correlated) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 25

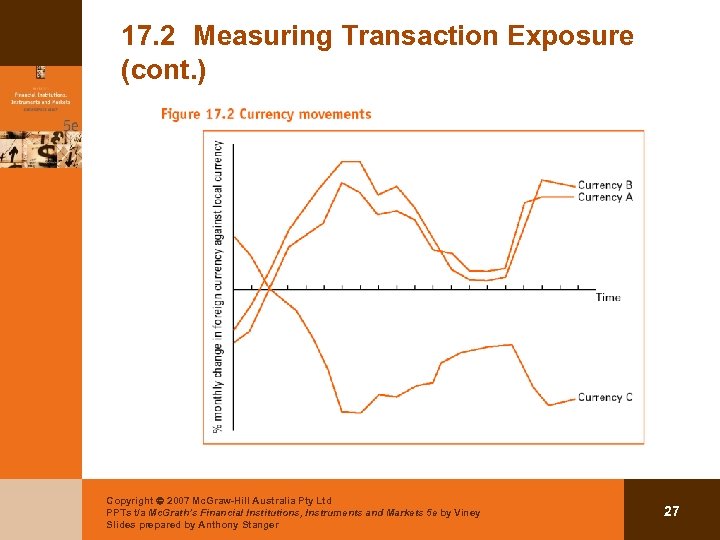

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) – Figure 17. 2 indicates § Currencies A and B are highly positively correlated § Currency C is highly negatively correlated with both currencies A and B Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 26

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) – Figure 17. 2 indicates § Currencies A and B are highly positively correlated § Currency C is highly negatively correlated with both currencies A and B Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 26

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 27

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 27

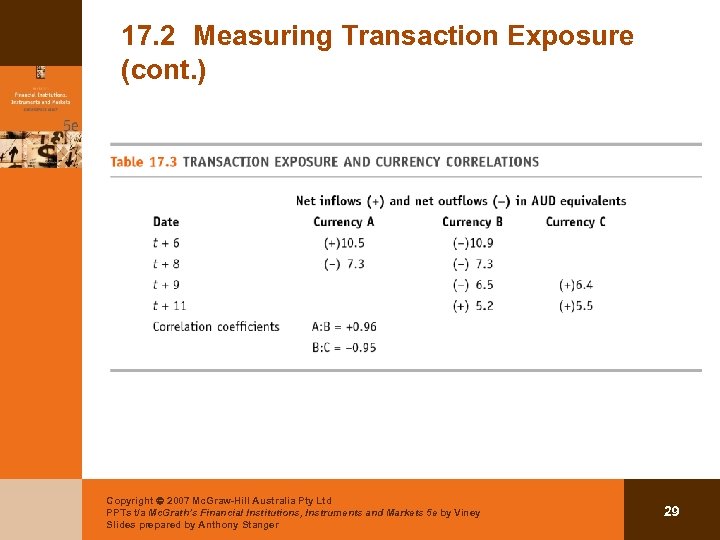

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) – Table 17. 3 demonstrates the use of correlation coefficients in assessing whether an FX exposure requires hedging § Date t+6 • A change in the AUD will result in a similar change in both inflows and outflows which offset each other – A natural hedge exists Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 28

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) – Table 17. 3 demonstrates the use of correlation coefficients in assessing whether an FX exposure requires hedging § Date t+6 • A change in the AUD will result in a similar change in both inflows and outflows which offset each other – A natural hedge exists Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 28

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 29

17. 2 Measuring Transaction Exposure (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 29

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) § Date t+8 • A change in the AUD will result in either a gain or a loss on both flows – The exposure should be hedged § Date t+9 • A change in the AUD will result in either a gain or a loss on both flows – The exposure should be hedged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 30

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) § Date t+8 • A change in the AUD will result in either a gain or a loss on both flows – The exposure should be hedged § Date t+9 • A change in the AUD will result in either a gain or a loss on both flows – The exposure should be hedged Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 30

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) § Date t+11 • A change in the AUD will result in a similar change in both inflows and outflows which offset each other – A natural hedge exists Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 31

17. 2 Measuring Transaction Exposure (cont. ) • Transaction exposure: currency correlations (cont. ) § Date t+11 • A change in the AUD will result in a similar change in both inflows and outflows which offset each other – A natural hedge exists Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 31

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 32

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 32

17. 3 Risk Management: Market-based Hedging Techniques • A firm may attempt to minimise FX risk (particularly downside exposure) through the use of hedging techniques/instruments • Hedging instruments include – Forward exchange contracts – Money-market hedge – Futures, options and swaps (discussed in Part 6 of text) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 33

17. 3 Risk Management: Market-based Hedging Techniques • A firm may attempt to minimise FX risk (particularly downside exposure) through the use of hedging techniques/instruments • Hedging instruments include – Forward exchange contracts – Money-market hedge – Futures, options and swaps (discussed in Part 6 of text) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 33

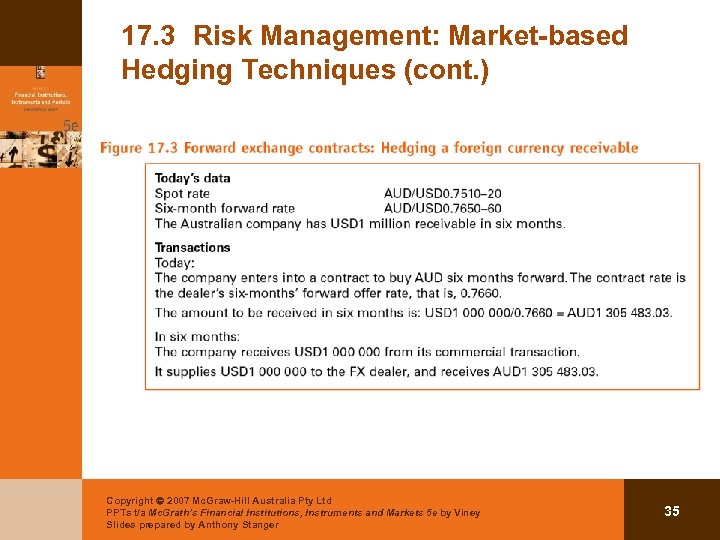

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) • Forward exchange contracts – Lock in an exchange rate today for delivery or receipt of a foreign currency at a specified future date – Figure 17. 3 provides an example of the use of a forward exchange contract to hedge a USD 1 million receivable in 6 months’ time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 34

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) • Forward exchange contracts – Lock in an exchange rate today for delivery or receipt of a foreign currency at a specified future date – Figure 17. 3 provides an example of the use of a forward exchange contract to hedge a USD 1 million receivable in 6 months’ time Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 34

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 35

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 35

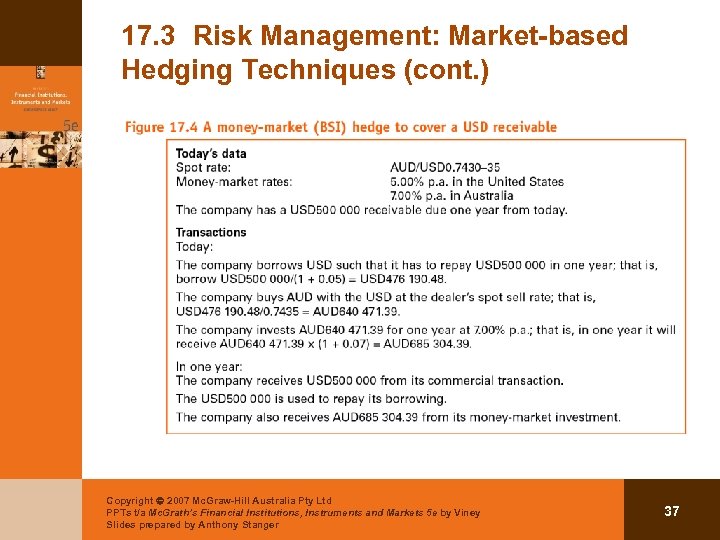

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) • Money-market hedging to cover FX risk – Also called ‘BSI hedge’—borrow, spot, invest – Example § A company has USD 1 million receivable in 6 months’ time § Money market hedging involves • STEP I: Borrow USD today • STEP II: Spot convert USD to AUD • STEP III: Invest the AUD today Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 36

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) • Money-market hedging to cover FX risk – Also called ‘BSI hedge’—borrow, spot, invest – Example § A company has USD 1 million receivable in 6 months’ time § Money market hedging involves • STEP I: Borrow USD today • STEP II: Spot convert USD to AUD • STEP III: Invest the AUD today Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 36

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 37

17. 3 Risk Management: Market-based Hedging Techniques (cont. ) Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 37

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 38

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 38

17. 4 Risk Management: Internal Hedging Techniques • Internal hedging minimises FX exposures and the need to use market-based hedging techniques • Main internal hedging techniques – – – Invoicing in the home currency Creating a natural hedge Currency diversification Leading and lagging FX transactions Mark-ups Counter-trades and currency offsets Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 39

17. 4 Risk Management: Internal Hedging Techniques • Internal hedging minimises FX exposures and the need to use market-based hedging techniques • Main internal hedging techniques – – – Invoicing in the home currency Creating a natural hedge Currency diversification Leading and lagging FX transactions Mark-ups Counter-trades and currency offsets Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 39

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Invoicing in the home currency – Avoids FX exposure – Effectively transfers all FX risk to the other party in the business transaction – The other party may charge a higher price to compensate for the extra risk Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 40

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Invoicing in the home currency – Avoids FX exposure – Effectively transfers all FX risk to the other party in the business transaction – The other party may charge a higher price to compensate for the extra risk Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 40

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Creating a natural hedge – Match foreign currency receivables and payables in terms of currency, timing and magnitude – Difficulties with this approach § Unlikely that an exact hedge can be achieved § Costs of hedge-motivated transactions • Extra costs associated with borrowing in markets where the business may not be well known • Are imported inputs or lease agreements superior in quality or price than another supplier in a non-matching currency? Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 41

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Creating a natural hedge – Match foreign currency receivables and payables in terms of currency, timing and magnitude – Difficulties with this approach § Unlikely that an exact hedge can be achieved § Costs of hedge-motivated transactions • Extra costs associated with borrowing in markets where the business may not be well known • Are imported inputs or lease agreements superior in quality or price than another supplier in a non-matching currency? Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 41

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Currency diversification – Limit impact of adverse exchange rate movements by spreading transactions over a large number of currencies – Chance of adverse movements in a large number of currencies is very small – Greatest diversification achieved where currencies are perfectly negatively correlated Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 42

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Currency diversification – Limit impact of adverse exchange rate movements by spreading transactions over a large number of currencies – Chance of adverse movements in a large number of currencies is very small – Greatest diversification achieved where currencies are perfectly negatively correlated Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 42

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Leading and lagging FX transactions – Leading § Changing the timing of a cash flow so that it takes place prior to the originally agreed date § e. g. pay a USD payable before an expected AUD depreciation – Lagging § Delaying the timing of an existing FX cash flow § e. g. delay a USD payable to coincide with a USD receivable – Need to assess costs/impact of strategies, e. g. unpredictable payment behaviour Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 43

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Leading and lagging FX transactions – Leading § Changing the timing of a cash flow so that it takes place prior to the originally agreed date § e. g. pay a USD payable before an expected AUD depreciation – Lagging § Delaying the timing of an existing FX cash flow § e. g. delay a USD payable to coincide with a USD receivable – Need to assess costs/impact of strategies, e. g. unpredictable payment behaviour Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 43

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Mark-ups – Increasing prices on exports or imports to cover worstcase scenario changes in an exchange rate § e. g. exporter marks-up export price of goods sold § e. g. importer marks-up the domestic price of imported goods – Competition is a constraint to this strategy Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 44

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Mark-ups – Increasing prices on exports or imports to cover worstcase scenario changes in an exchange rate § e. g. exporter marks-up export price of goods sold § e. g. importer marks-up the domestic price of imported goods – Competition is a constraint to this strategy Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 44

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Counter-trade and currency offsets – Counter-trade § The exchange of product for product, rather then currencybased buy or sell contracts § Limited to companies wishing to exchange products of equal value and at the same time – Currency offsets § Recognition of the timing and amount of cash inflows and outflows in the same currency § Applicable to both internal cash flows of a firm and FX cash flows between different firms Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 45

17. 4 Risk Management: Internal Hedging Techniques (cont. ) • Counter-trade and currency offsets – Counter-trade § The exchange of product for product, rather then currencybased buy or sell contracts § Limited to companies wishing to exchange products of equal value and at the same time – Currency offsets § Recognition of the timing and amount of cash inflows and outflows in the same currency § Applicable to both internal cash flows of a firm and FX cash flows between different firms Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 45

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 46

Chapter Organisation 17. 1 FX Risk Policy Formation 17. 2 Measuring Transaction Exposure 17. 3 Risk Management: Market-based Hedging Techniques 17. 4 Risk Management: Internal Hedging Techniques 17. 5 Summary Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 46

17. 5 Summary • Foreign exchange risk exposures can be classified as – – Transaction exposure Translation or accounting exposure Operational exposure Economic exposure Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 47

17. 5 Summary • Foreign exchange risk exposures can be classified as – – Transaction exposure Translation or accounting exposure Operational exposure Economic exposure Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 47

17. 5 Summary (cont. ) • FX risk policy formulation involves a number of aspects necessary to measure and manage FX risk including – FX objectives, authorisations, exposure reporting systems, communications, performance evaluation, audit and review procedures • Transaction exposures can be measured by – Net cash flows – Currency variability – Currency correlations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 48

17. 5 Summary (cont. ) • FX risk policy formulation involves a number of aspects necessary to measure and manage FX risk including – FX objectives, authorisations, exposure reporting systems, communications, performance evaluation, audit and review procedures • Transaction exposures can be measured by – Net cash flows – Currency variability – Currency correlations Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 48

17. 5 Summary (cont. ) • Risk management techniques include – Market-based hedging—forward exchange contracts and money market hedging – Internal hedging—invoicing in home currency, natural hedge, currency diversification, leading and lagging FX transactions, mark-ups, counter-trade and currency offsets Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 49

17. 5 Summary (cont. ) • Risk management techniques include – Market-based hedging—forward exchange contracts and money market hedging – Internal hedging—invoicing in home currency, natural hedge, currency diversification, leading and lagging FX transactions, mark-ups, counter-trade and currency offsets Copyright 2007 Mc. Graw-Hill Australia Pty Ltd PPTs t/a Mc. Grath’s Financial Institutions, Instruments and Markets 5 e by Viney Slides prepared by Anthony Stanger 49