6f76b23d55acab12236780726cf25900.ppt

- Количество слайдов: 51

Chapter 17 Domestic and International Dimensions of Monetary Policy

Chapter 17 Domestic and International Dimensions of Monetary Policy

Learning Objectives • Identify the key factors that influence the quantity of money that people desire to hold • Describe how the Federal Reserve’s tools of monetary policy influence market interest rates • Evaluate how expansionary and contractionary monetary policy actions affect equilibrium real GDP and the price level in the short run Copyright © 2008 Pearson Addison Wesley. All rights reserved. 2

Learning Objectives • Identify the key factors that influence the quantity of money that people desire to hold • Describe how the Federal Reserve’s tools of monetary policy influence market interest rates • Evaluate how expansionary and contractionary monetary policy actions affect equilibrium real GDP and the price level in the short run Copyright © 2008 Pearson Addison Wesley. All rights reserved. 2

Learning Objectives (cont'd) • Understand the equation of exchange and its importance in the quantity theory of money and prices • Discuss the interest-rate-based transmission mechanism of monetary policy • Explain why the Federal Reserve cannot stabilize both the money supply and interest rates simultaneously Copyright © 2008 Pearson Addison Wesley. All rights reserved. 3

Learning Objectives (cont'd) • Understand the equation of exchange and its importance in the quantity theory of money and prices • Discuss the interest-rate-based transmission mechanism of monetary policy • Explain why the Federal Reserve cannot stabilize both the money supply and interest rates simultaneously Copyright © 2008 Pearson Addison Wesley. All rights reserved. 3

Chapter Outline • What’s So Special About Money? • The Tools of Monetary Policy • Effects of an Increase in the Money Supply • Open Economy Transmission of Monetary Policy Copyright © 2008 Pearson Addison Wesley. All rights reserved. 4

Chapter Outline • What’s So Special About Money? • The Tools of Monetary Policy • Effects of an Increase in the Money Supply • Open Economy Transmission of Monetary Policy Copyright © 2008 Pearson Addison Wesley. All rights reserved. 4

Chapter Outline (cont'd) • Monetary Policy and Inflation • Monetary Policy in Action: The Transmission Mechanism • Fed Target Choice: Interest Rates or Money Supply? • The Way the Fed Policy is Currently Implemented Copyright © 2008 Pearson Addison Wesley. All rights reserved. 5

Chapter Outline (cont'd) • Monetary Policy and Inflation • Monetary Policy in Action: The Transmission Mechanism • Fed Target Choice: Interest Rates or Money Supply? • The Way the Fed Policy is Currently Implemented Copyright © 2008 Pearson Addison Wesley. All rights reserved. 5

What’s So Special About Money? • Something that changes the amount of money in circulation will have some affect on many transactions and thus on elements of GDP. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 6

What’s So Special About Money? • Something that changes the amount of money in circulation will have some affect on many transactions and thus on elements of GDP. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 6

What’s So Special About Money? (cont'd) • Recall…The demand for money § Transactions motive Ø Hold onto money for cash-based transactions § Speculative motive Ø Want to be prepared for cash-based investment opportunities § Precautionary motive Ø Hold onto money for unexpected cash expenses (i. e. medical bills or car repairs) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 7

What’s So Special About Money? (cont'd) • Recall…The demand for money § Transactions motive Ø Hold onto money for cash-based transactions § Speculative motive Ø Want to be prepared for cash-based investment opportunities § Precautionary motive Ø Hold onto money for unexpected cash expenses (i. e. medical bills or car repairs) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 7

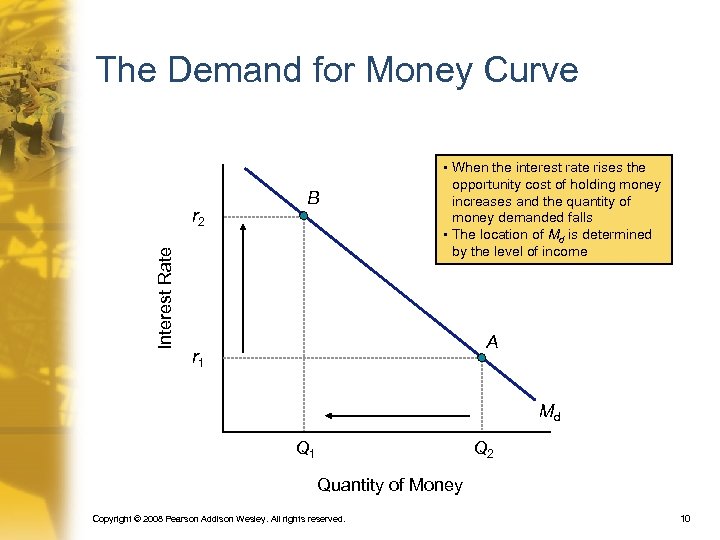

What’s So Special About Money? (cont'd) • The demand for money curve § Transactions demand for money is proportionate to income § Speculative and precautionary demand for money, on the other hand, are determined by the opportunity cost of holding money (i. e. the interest rate). Copyright © 2008 Pearson Addison Wesley. All rights reserved. 8

What’s So Special About Money? (cont'd) • The demand for money curve § Transactions demand for money is proportionate to income § Speculative and precautionary demand for money, on the other hand, are determined by the opportunity cost of holding money (i. e. the interest rate). Copyright © 2008 Pearson Addison Wesley. All rights reserved. 8

Figure 17 -1 The Demand for Money Curve Copyright © 2008 Pearson Addison Wesley. All rights reserved. 9

Figure 17 -1 The Demand for Money Curve Copyright © 2008 Pearson Addison Wesley. All rights reserved. 9

The Demand for Money Curve Interest Rate r 2 B • When the interest rate rises the opportunity cost of holding money increases and the quantity of money demanded falls • The location of Md is determined by the level of income A r 1 Md Q 1 Q 2 Quantity of Money Copyright © 2008 Pearson Addison Wesley. All rights reserved. 10

The Demand for Money Curve Interest Rate r 2 B • When the interest rate rises the opportunity cost of holding money increases and the quantity of money demanded falls • The location of Md is determined by the level of income A r 1 Md Q 1 Q 2 Quantity of Money Copyright © 2008 Pearson Addison Wesley. All rights reserved. 10

The Tools of Monetary Policy • The Fed seeks to alter consumption, investment, and aggregate demand as a whole by altering the rate of growth of the money supply. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 11

The Tools of Monetary Policy • The Fed seeks to alter consumption, investment, and aggregate demand as a whole by altering the rate of growth of the money supply. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 11

The Tools of Monetary Policy (cont'd) • Recall… • The Fed has three tools at its disposal as part of its policymaking action: 1. Reserve requirement changes 2. Open market operations 3. Discount rate changes Copyright © 2008 Pearson Addison Wesley. All rights reserved. 12

The Tools of Monetary Policy (cont'd) • Recall… • The Fed has three tools at its disposal as part of its policymaking action: 1. Reserve requirement changes 2. Open market operations 3. Discount rate changes Copyright © 2008 Pearson Addison Wesley. All rights reserved. 12

The Tools of Monetary Policy (cont'd) • Complete Activity 39: “The Federal Reserve System and Monetary Policy” Copyright © 2008 Pearson Addison Wesley. All rights reserved. 13

The Tools of Monetary Policy (cont'd) • Complete Activity 39: “The Federal Reserve System and Monetary Policy” Copyright © 2008 Pearson Addison Wesley. All rights reserved. 13

The Tools of Monetary Policy (cont'd) • Reserve Requirement Changes § An increase (decrease) in the required reserve ratio Ø Makes it more (less) expensive for banks to meet reserve requirements Ø Reduces (expands) bank lending Copyright © 2008 Pearson Addison Wesley. All rights reserved. 14

The Tools of Monetary Policy (cont'd) • Reserve Requirement Changes § An increase (decrease) in the required reserve ratio Ø Makes it more (less) expensive for banks to meet reserve requirements Ø Reduces (expands) bank lending Copyright © 2008 Pearson Addison Wesley. All rights reserved. 14

The Tools of Monetary Policy (cont'd) • Open market Operations § Fed purchases and sells government bonds issued by the U. S. Treasury Ø If Fed wants to buy bonds, it is going to have to offer to buy them at a higher price than exists in the marketplace Ø If the Fed wants to sell bonds, it is going to have to offer them at a lower price than exists in the marketplace § Thus, an open market operation must cause a change in the price of bonds. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 15

The Tools of Monetary Policy (cont'd) • Open market Operations § Fed purchases and sells government bonds issued by the U. S. Treasury Ø If Fed wants to buy bonds, it is going to have to offer to buy them at a higher price than exists in the marketplace Ø If the Fed wants to sell bonds, it is going to have to offer them at a lower price than exists in the marketplace § Thus, an open market operation must cause a change in the price of bonds. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 15

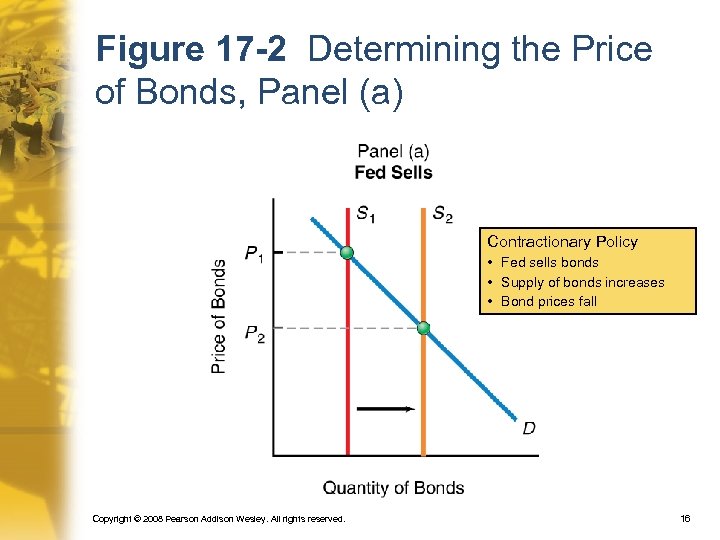

Figure 17 -2 Determining the Price of Bonds, Panel (a) Contractionary Policy • Fed sells bonds • Supply of bonds increases • Bond prices fall Copyright © 2008 Pearson Addison Wesley. All rights reserved. 16

Figure 17 -2 Determining the Price of Bonds, Panel (a) Contractionary Policy • Fed sells bonds • Supply of bonds increases • Bond prices fall Copyright © 2008 Pearson Addison Wesley. All rights reserved. 16

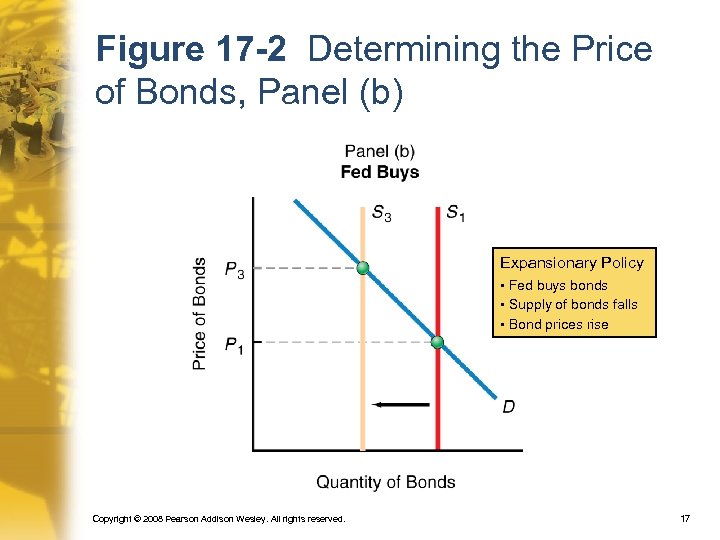

Figure 17 -2 Determining the Price of Bonds, Panel (b) Expansionary Policy • Fed buys bonds • Supply of bonds falls • Bond prices rise Copyright © 2008 Pearson Addison Wesley. All rights reserved. 17

Figure 17 -2 Determining the Price of Bonds, Panel (b) Expansionary Policy • Fed buys bonds • Supply of bonds falls • Bond prices rise Copyright © 2008 Pearson Addison Wesley. All rights reserved. 17

The Tools of Monetary Policy (cont'd) • Relationship between the price of existing bonds and the rate of interest § There is an inverse relationship between the price of existing bonds and the rate of interest. • Question § So what happens to the yield on a bond when the price of a bond increases (decreases)? Copyright © 2008 Pearson Addison Wesley. All rights reserved. 18

The Tools of Monetary Policy (cont'd) • Relationship between the price of existing bonds and the rate of interest § There is an inverse relationship between the price of existing bonds and the rate of interest. • Question § So what happens to the yield on a bond when the price of a bond increases (decreases)? Copyright © 2008 Pearson Addison Wesley. All rights reserved. 18

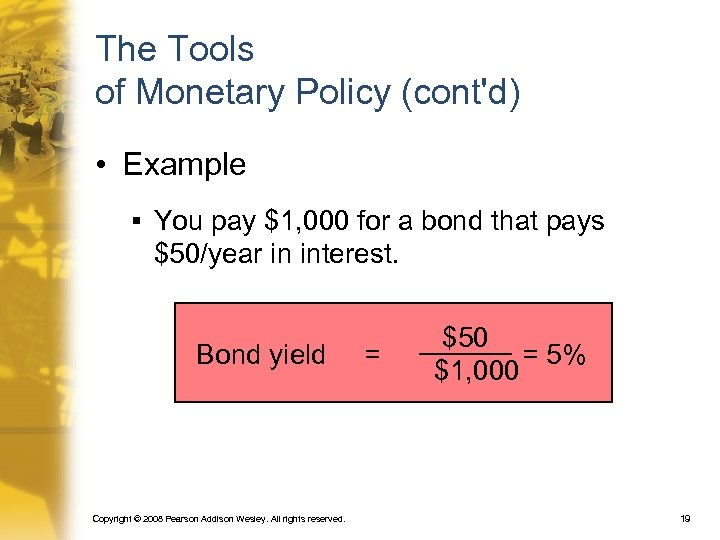

The Tools of Monetary Policy (cont'd) • Example § You pay $1, 000 for a bond that pays $50/year in interest. Bond yield Copyright © 2008 Pearson Addison Wesley. All rights reserved. = $50 = 5% $1, 000 19

The Tools of Monetary Policy (cont'd) • Example § You pay $1, 000 for a bond that pays $50/year in interest. Bond yield Copyright © 2008 Pearson Addison Wesley. All rights reserved. = $50 = 5% $1, 000 19

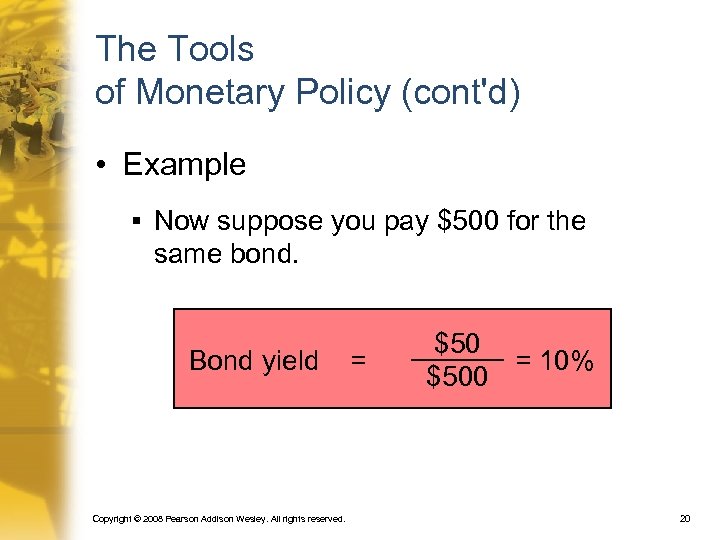

The Tools of Monetary Policy (cont'd) • Example § Now suppose you pay $500 for the same bond. Bond yield Copyright © 2008 Pearson Addison Wesley. All rights reserved. = $50 = 10% $500 20

The Tools of Monetary Policy (cont'd) • Example § Now suppose you pay $500 for the same bond. Bond yield Copyright © 2008 Pearson Addison Wesley. All rights reserved. = $50 = 10% $500 20

The Tools of Monetary Policy (cont'd) • The market price of existing bonds (and all fixed-income assets) is inversely related to the rate of interest prevailing in the economy. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 21

The Tools of Monetary Policy (cont'd) • The market price of existing bonds (and all fixed-income assets) is inversely related to the rate of interest prevailing in the economy. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 21

The Tools of Monetary Policy (cont'd) • Discount Rate Changes—changes in the difference between the discount rate and the federal funds rate § The discount rate is kept at 1 percentage point above the market-determined federal funds rate. § Increasing (decreasing) the discount rate increases (decreases) the cost of borrowed funds for depository institutions that borrow reserves. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 22

The Tools of Monetary Policy (cont'd) • Discount Rate Changes—changes in the difference between the discount rate and the federal funds rate § The discount rate is kept at 1 percentage point above the market-determined federal funds rate. § Increasing (decreasing) the discount rate increases (decreases) the cost of borrowed funds for depository institutions that borrow reserves. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 22

Effects of an Increase in The Money Supply • What if hundreds of millions of dollars in just-printed bills is dropped from a helicopter? • People pick up the money and put it in their pockets, but how do they dispose of the new money? Copyright © 2008 Pearson Addison Wesley. All rights reserved. 23

Effects of an Increase in The Money Supply • What if hundreds of millions of dollars in just-printed bills is dropped from a helicopter? • People pick up the money and put it in their pockets, but how do they dispose of the new money? Copyright © 2008 Pearson Addison Wesley. All rights reserved. 23

Effects of an Increase in The Money Supply (cont'd) • Direct effect § Aggregate demand rises because with an increase in the money supply § At any given price level people now want to purchase more output of real goods and services. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 24

Effects of an Increase in The Money Supply (cont'd) • Direct effect § Aggregate demand rises because with an increase in the money supply § At any given price level people now want to purchase more output of real goods and services. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 24

Effects of an Increase in The Money Supply (cont'd) • Indirect effect § Not everybody will necessarily spend the newfound money on goods and services. § Some of the money gets deposited, so banks have higher reserves (and they lend the excess out). § Increased loans generate an increase in aggregate demand. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 25

Effects of an Increase in The Money Supply (cont'd) • Indirect effect § Not everybody will necessarily spend the newfound money on goods and services. § Some of the money gets deposited, so banks have higher reserves (and they lend the excess out). § Increased loans generate an increase in aggregate demand. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 25

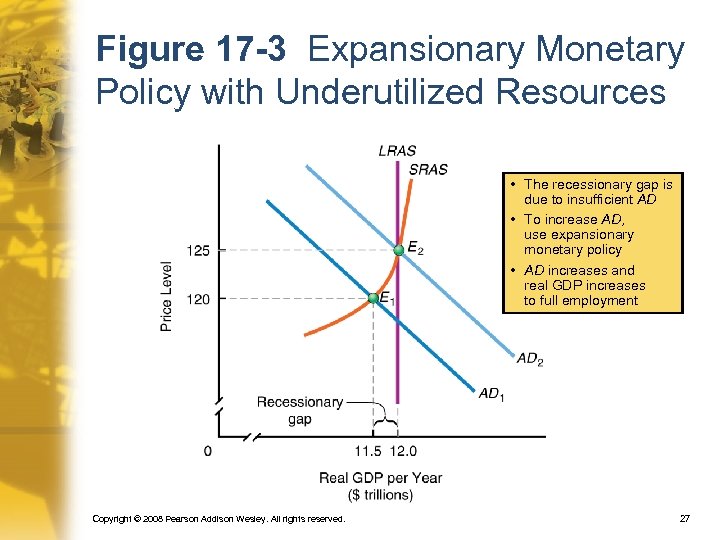

Graphing the Effects of an Expansionary Monetary Policy • Assume there is a recessionary gap § Expansionary monetary policy can close the recessionary gap. Ø Lower Ø Buy the required reserve ratio government securities on the open market Ø Lower the discount rate § Direct and indirect effects cause the aggregate demand curve to shift outward. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 26

Graphing the Effects of an Expansionary Monetary Policy • Assume there is a recessionary gap § Expansionary monetary policy can close the recessionary gap. Ø Lower Ø Buy the required reserve ratio government securities on the open market Ø Lower the discount rate § Direct and indirect effects cause the aggregate demand curve to shift outward. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 26

Figure 17 -3 Expansionary Monetary Policy with Underutilized Resources • The recessionary gap is due to insufficient AD • To increase AD, use expansionary monetary policy • AD increases and real GDP increases to full employment Copyright © 2008 Pearson Addison Wesley. All rights reserved. 27

Figure 17 -3 Expansionary Monetary Policy with Underutilized Resources • The recessionary gap is due to insufficient AD • To increase AD, use expansionary monetary policy • AD increases and real GDP increases to full employment Copyright © 2008 Pearson Addison Wesley. All rights reserved. 27

Graphing the Effects of Contractionary Monetary Policy • Assume there is an inflationary gap § Contractionary monetary policy can eliminate this inflationary gap. Ø Increase Ø Sell the required reserve ratio government securities on the open market Ø Increase the discount rate § Direct and indirect effects cause the aggregate demand curve to shift inward. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 28

Graphing the Effects of Contractionary Monetary Policy • Assume there is an inflationary gap § Contractionary monetary policy can eliminate this inflationary gap. Ø Increase Ø Sell the required reserve ratio government securities on the open market Ø Increase the discount rate § Direct and indirect effects cause the aggregate demand curve to shift inward. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 28

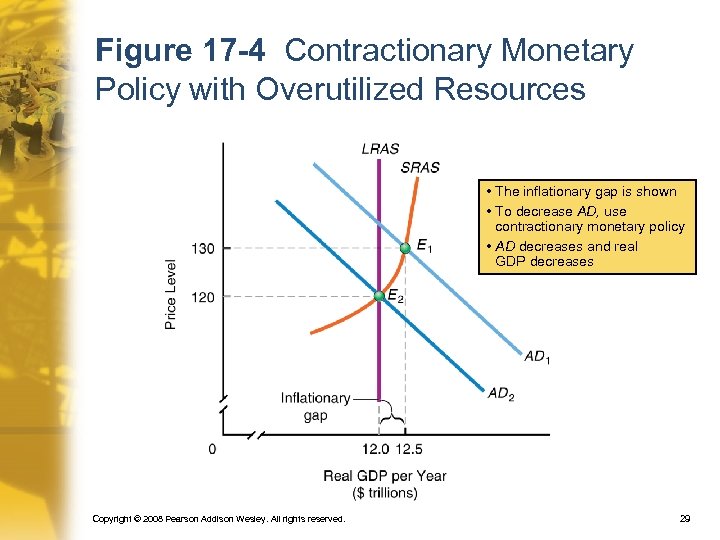

Figure 17 -4 Contractionary Monetary Policy with Overutilized Resources • The inflationary gap is shown • To decrease AD, use contractionary monetary policy • AD decreases and real GDP decreases Copyright © 2008 Pearson Addison Wesley. All rights reserved. 29

Figure 17 -4 Contractionary Monetary Policy with Overutilized Resources • The inflationary gap is shown • To decrease AD, use contractionary monetary policy • AD decreases and real GDP decreases Copyright © 2008 Pearson Addison Wesley. All rights reserved. 29

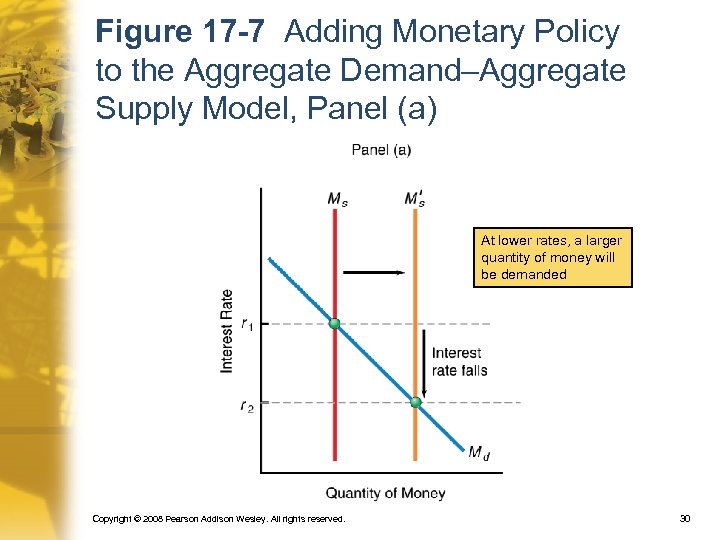

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (a) At lower rates, a larger quantity of money will be demanded Copyright © 2008 Pearson Addison Wesley. All rights reserved. 30

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (a) At lower rates, a larger quantity of money will be demanded Copyright © 2008 Pearson Addison Wesley. All rights reserved. 30

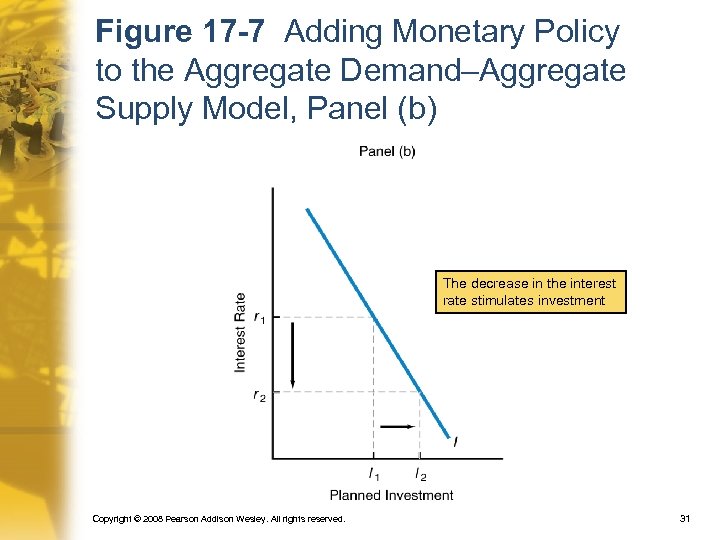

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (b) The decrease in the interest rate stimulates investment Copyright © 2008 Pearson Addison Wesley. All rights reserved. 31

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (b) The decrease in the interest rate stimulates investment Copyright © 2008 Pearson Addison Wesley. All rights reserved. 31

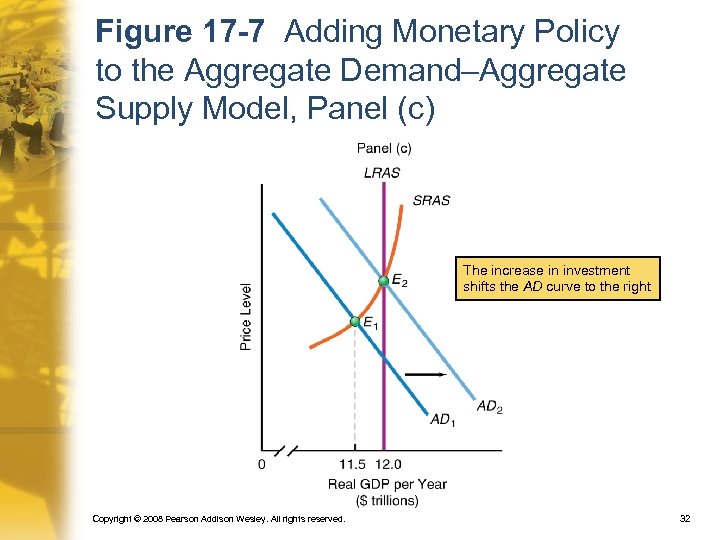

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (c) The increase in investment shifts the AD curve to the right Copyright © 2008 Pearson Addison Wesley. All rights reserved. 32

Figure 17 -7 Adding Monetary Policy to the Aggregate Demand–Aggregate Supply Model, Panel (c) The increase in investment shifts the AD curve to the right Copyright © 2008 Pearson Addison Wesley. All rights reserved. 32

Open Economy Transmission of Monetary Policy • So far we have discussed monetary policy in a closed economy. • When we move to an open economy, monetary policy becomes more complex. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 33

Open Economy Transmission of Monetary Policy • So far we have discussed monetary policy in a closed economy. • When we move to an open economy, monetary policy becomes more complex. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 33

Open Economy Transmission of Monetary Policy (cont'd) • The net export effect § Impact of contractionary monetary policy Ø Boosts the market interest rate Ø Higher rates attract foreign investment Ø International price of dollar rises Ø Appreciation of dollar reduces net exports Ø Negative net export effect Copyright © 2008 Pearson Addison Wesley. All rights reserved. 34

Open Economy Transmission of Monetary Policy (cont'd) • The net export effect § Impact of contractionary monetary policy Ø Boosts the market interest rate Ø Higher rates attract foreign investment Ø International price of dollar rises Ø Appreciation of dollar reduces net exports Ø Negative net export effect Copyright © 2008 Pearson Addison Wesley. All rights reserved. 34

Open Economy Transmission of Monetary Policy (cont'd) • The net export effect § Impact of expansionary monetary Ø Lower interest rates Ø Financial capital flows out of the United States Ø Demand for dollars will decrease Ø International price of dollar goes down Ø Foreign goods look more expensive in United States Ø Net exports increase (imports fall) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 35

Open Economy Transmission of Monetary Policy (cont'd) • The net export effect § Impact of expansionary monetary Ø Lower interest rates Ø Financial capital flows out of the United States Ø Demand for dollars will decrease Ø International price of dollar goes down Ø Foreign goods look more expensive in United States Ø Net exports increase (imports fall) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 35

Quantity Theory of Money • Monetarism § Neo-Classical approach; stands in contrast to the previously outlined Keynesian view; § Most major economic problems are caused by the Fed’s failure to manage the growth of the money supply appropriately Ø “Too large” increase will cause inflation Ø “Too small” increase will cause a recession Copyright © 2008 Pearson Addison Wesley. All rights reserved. 36

Quantity Theory of Money • Monetarism § Neo-Classical approach; stands in contrast to the previously outlined Keynesian view; § Most major economic problems are caused by the Fed’s failure to manage the growth of the money supply appropriately Ø “Too large” increase will cause inflation Ø “Too small” increase will cause a recession Copyright © 2008 Pearson Addison Wesley. All rights reserved. 36

Quantity Theory of Money • A simple way to show the relationship between money supply and price level… • The Equation of Exchange: Formula indicating that the number of monetary units times the number of times each unit is spent on final goods and services is identical to the price level times real GDP Ms. V = PQ Copyright © 2008 Pearson Addison Wesley. All rights reserved. 37

Quantity Theory of Money • A simple way to show the relationship between money supply and price level… • The Equation of Exchange: Formula indicating that the number of monetary units times the number of times each unit is spent on final goods and services is identical to the price level times real GDP Ms. V = PQ Copyright © 2008 Pearson Addison Wesley. All rights reserved. 37

Quantity Theory of Money • The equation of exchange and the quantity theory: MSV = PQ § MS = quantity of money § V = income velocity of money; the number of times a dollar becomes income to someone during a given period Copyright © 2008 Pearson Addison Wesley. All rights reserved. 38

Quantity Theory of Money • The equation of exchange and the quantity theory: MSV = PQ § MS = quantity of money § V = income velocity of money; the number of times a dollar becomes income to someone during a given period Copyright © 2008 Pearson Addison Wesley. All rights reserved. 38

Quantity Theory of Money • Income Velocity of Money § The number of times per year a dollar is spent on final goods and services; equal to the nominal GDP divided by the money supply. § V = GDP / M = PQ / M Copyright © 2008 Pearson Addison Wesley. All rights reserved. 39

Quantity Theory of Money • Income Velocity of Money § The number of times per year a dollar is spent on final goods and services; equal to the nominal GDP divided by the money supply. § V = GDP / M = PQ / M Copyright © 2008 Pearson Addison Wesley. All rights reserved. 39

Quantity Theory of Money • The equation of exchange and the quantity theory: MSV = PQ § P = price level or price index § Q = real GDP per year § PQ = the level of output Copyright © 2008 Pearson Addison Wesley. All rights reserved. 40

Quantity Theory of Money • The equation of exchange and the quantity theory: MSV = PQ § P = price level or price index § Q = real GDP per year § PQ = the level of output Copyright © 2008 Pearson Addison Wesley. All rights reserved. 40

Quantity Theory of Money • The equation of exchange as an identity § Total funds spent on final output Ms. V equals total funds received PQ § The value of goods purchased is equal to the value of goods sold § Ms. V = PQ = nominal GDP Copyright © 2008 Pearson Addison Wesley. All rights reserved. 41

Quantity Theory of Money • The equation of exchange as an identity § Total funds spent on final output Ms. V equals total funds received PQ § The value of goods purchased is equal to the value of goods sold § Ms. V = PQ = nominal GDP Copyright © 2008 Pearson Addison Wesley. All rights reserved. 41

Quantity Theory of Money • Quantity Theory of Money § The hypothesis that changes in the money supply lead to equiproportional changes in the price level Copyright © 2008 Pearson Addison Wesley. All rights reserved. 42

Quantity Theory of Money • Quantity Theory of Money § The hypothesis that changes in the money supply lead to equiproportional changes in the price level Copyright © 2008 Pearson Addison Wesley. All rights reserved. 42

Quantity Theory of Money • The quantity theory of money and prices § Assume: V is constant Q is stable Ms. V = PQ Copyright © 2008 Pearson Addison Wesley. All rights reserved. 43

Quantity Theory of Money • The quantity theory of money and prices § Assume: V is constant Q is stable Ms. V = PQ Copyright © 2008 Pearson Addison Wesley. All rights reserved. 43

Quantity Theory of Money • The quantity theory of money and prices § Increases in the money supply (Ms)must be matched by equal increases in the price level (P) Ms. V = PY Copyright © 2008 Pearson Addison Wesley. All rights reserved. 44

Quantity Theory of Money • The quantity theory of money and prices § Increases in the money supply (Ms)must be matched by equal increases in the price level (P) Ms. V = PY Copyright © 2008 Pearson Addison Wesley. All rights reserved. 44

Summary Discussion of Learning Objectives • Key factors that influence the quantity of money that people desire to hold § To make transactions § To hold for precautionary reasons § To hold as an asset (store of value) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 45

Summary Discussion of Learning Objectives • Key factors that influence the quantity of money that people desire to hold § To make transactions § To hold for precautionary reasons § To hold as an asset (store of value) Copyright © 2008 Pearson Addison Wesley. All rights reserved. 45

Summary Discussion of Learning Objectives (cont'd) • How the Federal Reserve’s monetary policy tools influence market interest rates § Open market purchases, reducing the discount rate, or reducing the required reserve ratio increases the money supply and lowers the interest rate. § Open market sales, raising the discount rate, or increasing the required reserve ratio decreases the money supply and raises the interest rate. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 46

Summary Discussion of Learning Objectives (cont'd) • How the Federal Reserve’s monetary policy tools influence market interest rates § Open market purchases, reducing the discount rate, or reducing the required reserve ratio increases the money supply and lowers the interest rate. § Open market sales, raising the discount rate, or increasing the required reserve ratio decreases the money supply and raises the interest rate. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 46

Summary Discussion of Learning Objectives (cont'd) • How expansionary and contractionary monetary policy affect equilibrium real GDP and the price level in the short run § Expansionary monetary policy Ø Pushing up money supply, inducing a fall in interest rates Ø Total planned expenditures rise, AD shifts rightward § Contractionary monetary policy Ø Reduces the money supply increasing interest rates Ø Total planned expenditures fall, AD shifts leftward Copyright © 2008 Pearson Addison Wesley. All rights reserved. 47

Summary Discussion of Learning Objectives (cont'd) • How expansionary and contractionary monetary policy affect equilibrium real GDP and the price level in the short run § Expansionary monetary policy Ø Pushing up money supply, inducing a fall in interest rates Ø Total planned expenditures rise, AD shifts rightward § Contractionary monetary policy Ø Reduces the money supply increasing interest rates Ø Total planned expenditures fall, AD shifts leftward Copyright © 2008 Pearson Addison Wesley. All rights reserved. 47

Summary Discussion of Learning Objectives (cont'd) • The equation of exchange and the quantity theory of money and prices § Equation of exchange Ø MV = PY § Quantity theory of money and prices ØV is constant and Y is stable Ø Increases in M lead to equiproportional increases in P Copyright © 2008 Pearson Addison Wesley. All rights reserved. 48

Summary Discussion of Learning Objectives (cont'd) • The equation of exchange and the quantity theory of money and prices § Equation of exchange Ø MV = PY § Quantity theory of money and prices ØV is constant and Y is stable Ø Increases in M lead to equiproportional increases in P Copyright © 2008 Pearson Addison Wesley. All rights reserved. 48

Summary Discussion of Learning Objectives (cont'd) • The interest-rate-based transmission mechanism of monetary policy § Operates through effects of monetary policy actions on market interest rates Ø Bring about changes in desired investment and thereby affect equilibrium GDP via the multiplier effect Copyright © 2008 Pearson Addison Wesley. All rights reserved. 49

Summary Discussion of Learning Objectives (cont'd) • The interest-rate-based transmission mechanism of monetary policy § Operates through effects of monetary policy actions on market interest rates Ø Bring about changes in desired investment and thereby affect equilibrium GDP via the multiplier effect Copyright © 2008 Pearson Addison Wesley. All rights reserved. 49

Summary Discussion of Learning Objectives (cont'd) • Why the Federal Reserve cannot stabilize the money supply and the interest rate simultaneously § To target the money supply the Fed must permit the interest rate to vary when the demand for money changes. § To target a market interest rate the Fed must adjust the money supply as necessary when the demand for money changes. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 50

Summary Discussion of Learning Objectives (cont'd) • Why the Federal Reserve cannot stabilize the money supply and the interest rate simultaneously § To target the money supply the Fed must permit the interest rate to vary when the demand for money changes. § To target a market interest rate the Fed must adjust the money supply as necessary when the demand for money changes. Copyright © 2008 Pearson Addison Wesley. All rights reserved. 50

End of Chapter 17 Domestic and International Dimensions of Monetary Policy

End of Chapter 17 Domestic and International Dimensions of Monetary Policy